Exhibit 99.1

BEZEQ Q 3 2019 INVESTOR PRESENTATION November 18 , 2019

Forward - Looking Information and Statement This presentation contains general data and information as well as forward looking statements about Bezeq The Israel Telecommunications Corp . , Ltd ( “ Bezeq ” ) . Such statements, along with explanations and clarifications presented by Bezeq ’ s representatives, include expressions of management ’ s expectations about new and existing programs, opportunities, technology and market conditions . Although Bezeq believes its expectations are based on reasonable assumptions, these statements are subject to numerous risks and uncertainties . These statements should not be regarded as a representation that anticipated events will occur or that expected objectives will be achieved . In addition, the realization and/or otherwise of the forward looking information will be affected by factors that cannot be assessed in advance, and which are not within the control of Bezeq, including the risk factors that are characteristic of its operations, developments in the general environment, external factors, and the regulation that affects Bezeq ’ s operations . This presentation includes revenue and other figures that are based on external sources and various surveys and studies . Bezeq is not responsible for the content thereof . The information included in this presentation is based on information included in Bezeq ’ s public filings . However, some of the information may be presented in a different manner and/or breakdown and/or is differently edited . In any event of inconsistency between Bezeq ’ s public filings and the information contained in this presentation - the information included in the public filings shall prevail . The information contained in this presentation or which will be provided orally during the presentation thereof, does not constitute or form part of any invitation or offer to sell, or any solicitation of any invitation or offer to purchase or subscribe for, any securities of Bezeq or any other entity, nor shall the information or any part of it or the fact of its distribution form the basis of, or be relied on in connection with or relating to any action, contract, commitment or to the securities of Bezeq . The presentation does not constitute a recommendation or opinion or substitute for the discretion of any investor . Ϯ

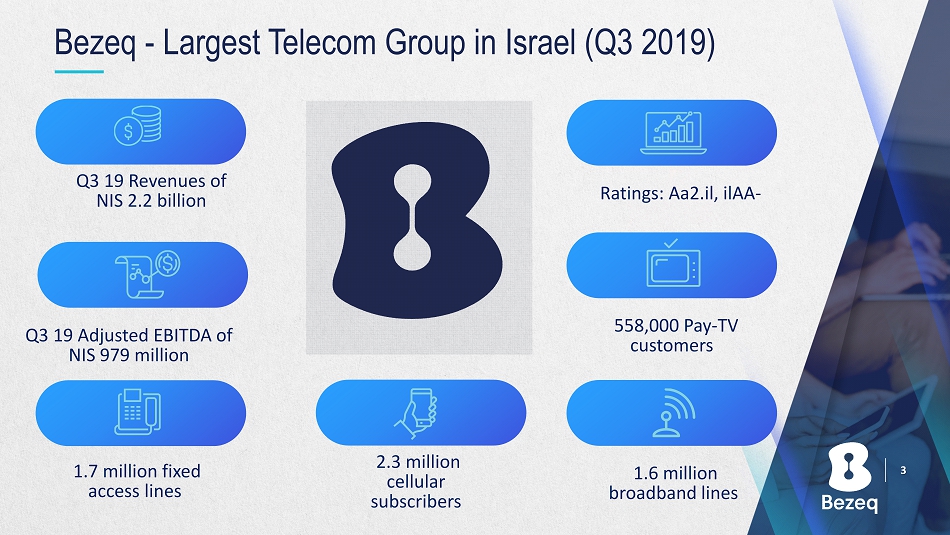

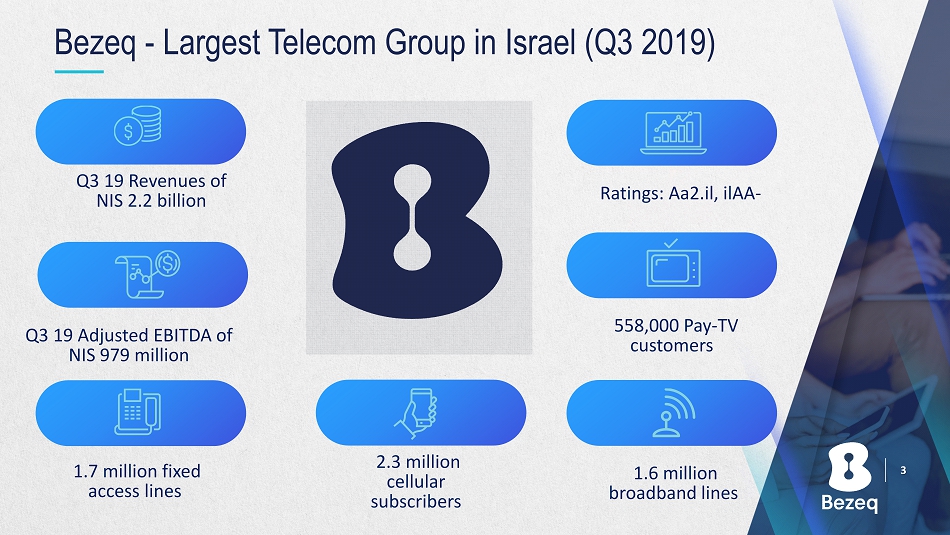

Bezeq - Largest Telecom Group in Israel (Q 3 2019 ) Q 3 19 Revenues of NIS 2.2 billion Q 3 19 Adjusted EBITDA of NIS 979 million ϭ͘ϳ � million fixed access lines �� Ϯ͘ϯ � million cellular subscribers ϱϱϴ͕ϬϬϬ �� Pay - TV customers �� ϭ͘ϲ � million broadband lines Ratings: Aa 2 .il, ilAA - ϯ

ϰ Bezeq Group Vision and Strategy Group Vision To � lead � the � tele communications � market � in � Israel , � provid ing � a � full � range � of � tele communications � products and services � for � the � private � and � business � market s � and � striv ing � for � continuous � improvement � in � its � operating � results � Group Strategy Lead � the � telecommunications � market � through � the � ownership � and � operation � of � quality � and � advanced � infrastructure s � and � provid e � the � best � service � while � fully � complying � with � regulatory � restrictions � To meet the technology, business and service - oriented needs for all telecommunications requirements of the Company ’ s customers To focus exclusively on Israel ’ s domestic market Emphasis on the Group ’ s profitability in the medium term, rather than market share, as a strategic goal Strive for financial � stability � and � improv ement in � aggregate � results � with � ongoing � efficiency � and � controlled � risk � taking � Until the removal of structural separation is complete, the G roup � will operate in � two business units �

Bezeq Fixed - Line ϱ

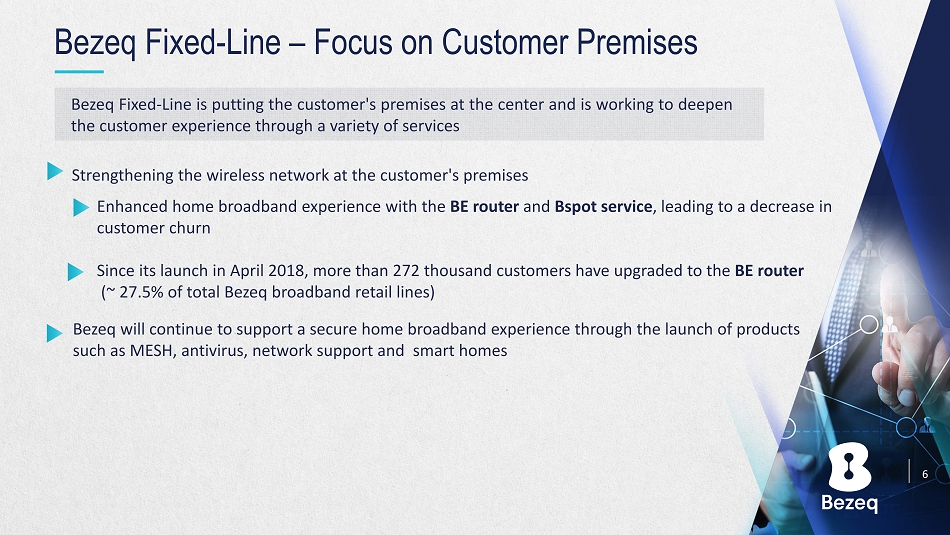

Bezeq Fixed - Line – Focus on Customer Premises Strengthening the wireless network at the customer's premises Enhanced home broadband experience with the BE router and Bspot service , leading to a decrease in customer churn Since its launch in April 2018 , more than 272 thousand customers have upgraded to the BE router (~ 27.5 % of total Bezeq broadband retail lines) Bezeq will continue to support a secure home broadband experience through the launch of products such as MESH, antivirus , network support and smart homes Bezeq Fixed - Line is putting the customer's premises at the center and is working to deepen the customer experience through a variety of services ϲ

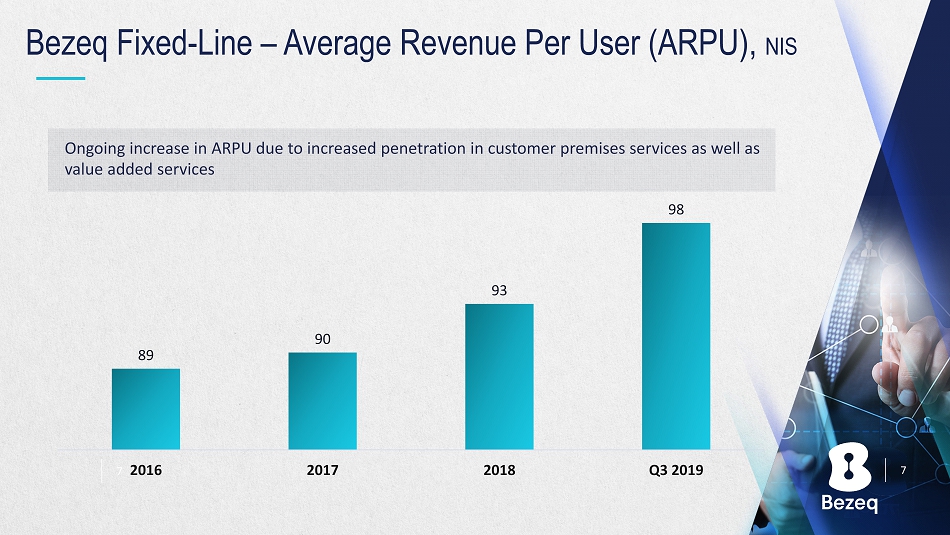

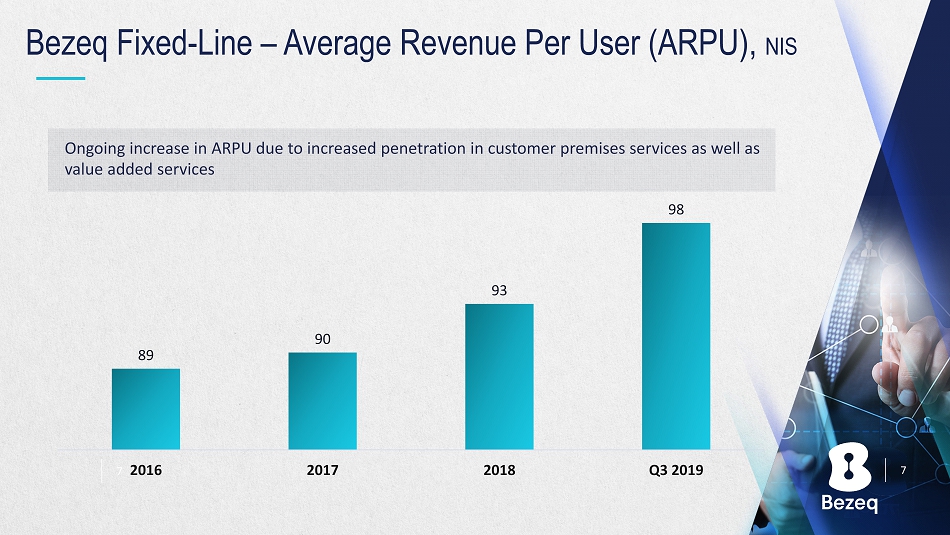

ϳ Ongoing increase in ARPU due to increased penetration in customer premises services as well as value added services Bezeq Fixed - Line – Average Revenue Per User (ARPU), NIS ϳ 89 90 93 98 2016 2017 2018 Q3 2019

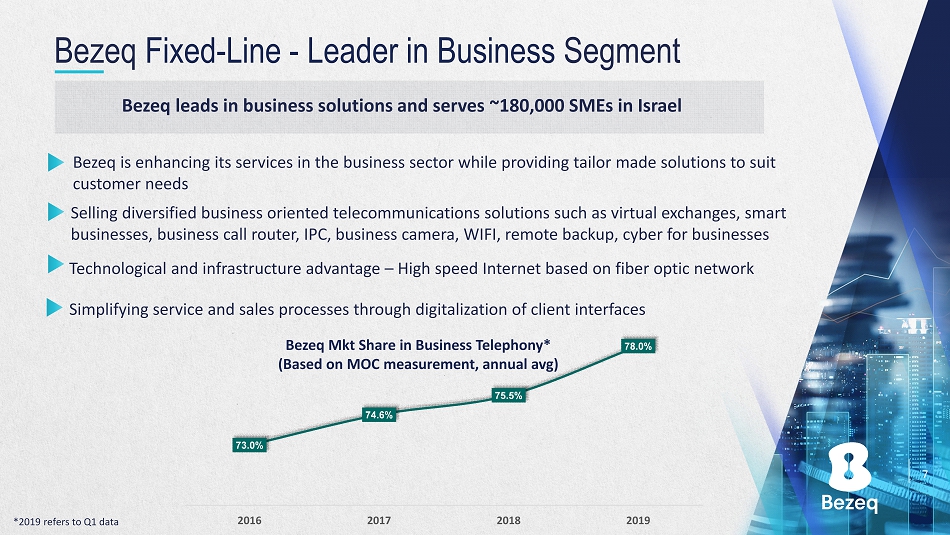

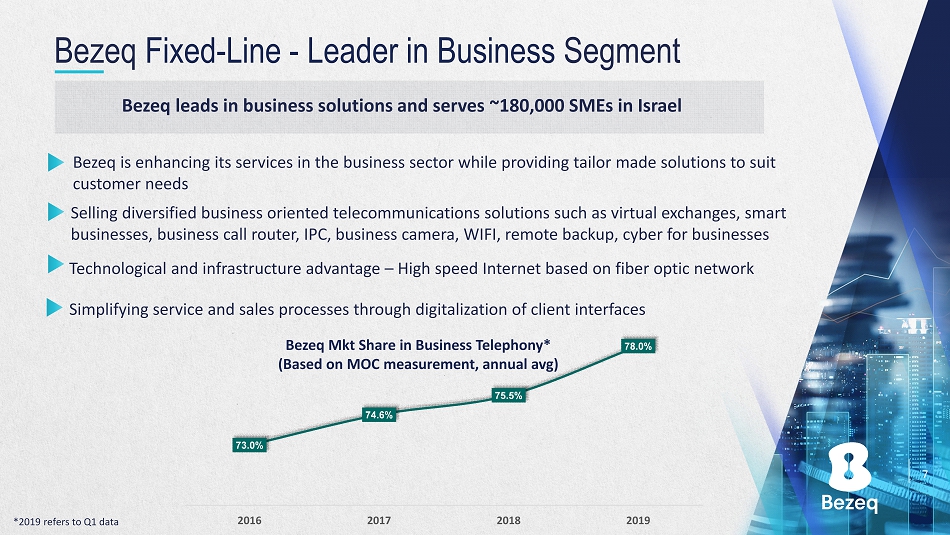

Bezeq Fixed - Line - Leader in Business Segment Bezeq is enhancing its services in the business sector while providing tailor made solutions to suit customer needs Bezeq leads in business solutions and serves ~ 180,000 SMEs in Israel ϳ Selling � diversified business oriented tele communications � solutions � such as virtual exchanges, smart businesses, business call router, IPC, business camera, WIFI, remote backup, cyber for businesses Technological and infrastructure advantage – High speed Internet based on fiber optic network Simplif ying � service � and � sales � processes � through � digitalization � of � client � interfaces � 73.0 % 74.6 % 75.5 % 78.0 % 2016 2017 2018 2019 Bezeq Mkt Share in Business Telephony* ( Based on MOC measurement, annual avg ) * 2019 refers to Q 1 data

In 2019 Bezeq Fixed - Line entered the terminal equipment market - in the first stage through the sale of smartphones and televisions and in the future, the offering will expand to additional end - user equipment ϵ Bezeq Fixed - Line – Retail Market 22.9 й Advanced and diversified services in business customer premises Creating a wide variety of integration solutions over the Bezeq cloud • Managed switches • Call Center • Data security • Vcloud Other revenues in Q 3 2019 increased 22.9 % y - o - y due to increased sales of terminal equipment 59 48 Q3 2019 Q3 2018 Other Revenues ( NIS millions)

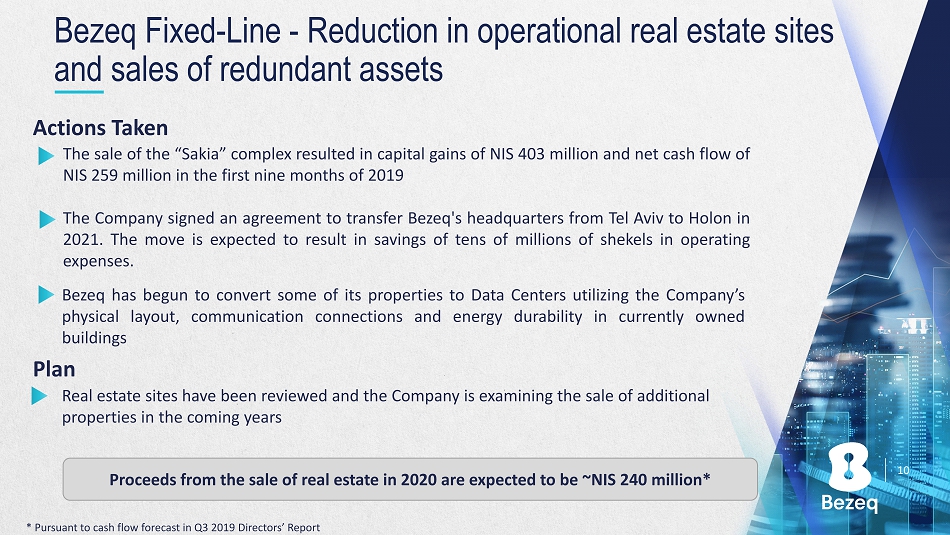

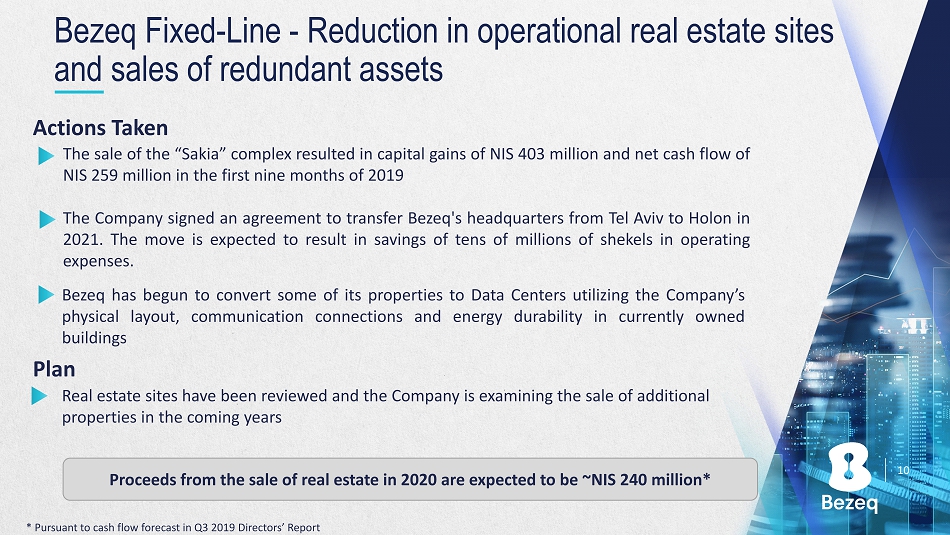

Plan Actions Taken The sale of the “ Sakia ” complex resulted in capital gains of NIS 403 million and net cash flow of NIS 259 million in the first nine months of 2019 The Company signed an agreement to transfer Bezeq's headquarters from Tel Aviv to Holon in 2021 . The move is expected to result in savings of tens of millions of shekels in operating expenses . Real estate sites have been reviewed and the Company is examining the sale of additional properties in the coming years ϭϬ Bezeq Fixed - Line - Reduction in operational real estate sites and sales of redundant assets Bezeq has begun to convert some of its properties to Data Centers utilizing the Company ’ s physical layout, communication connections and energy durability in currently owned buildings Proceeds from the sale of real estate in 2020 are expected to be ~NIS 240 million* * Pursuant to cash flow forecast in Q 3 2019 Directors ’ Report

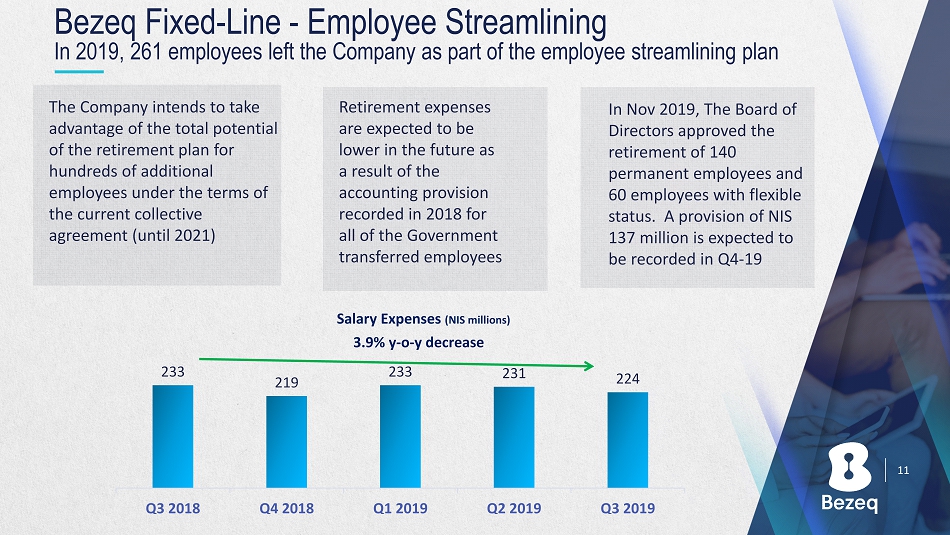

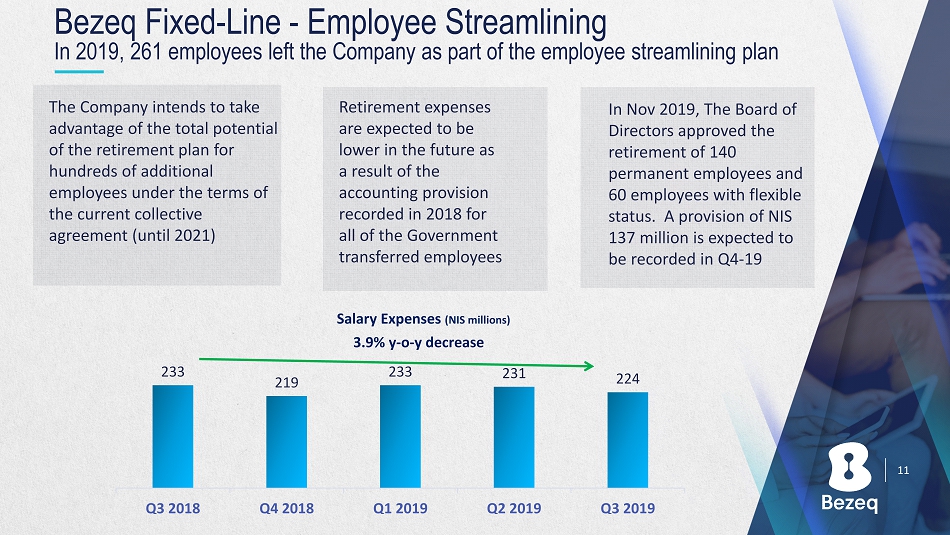

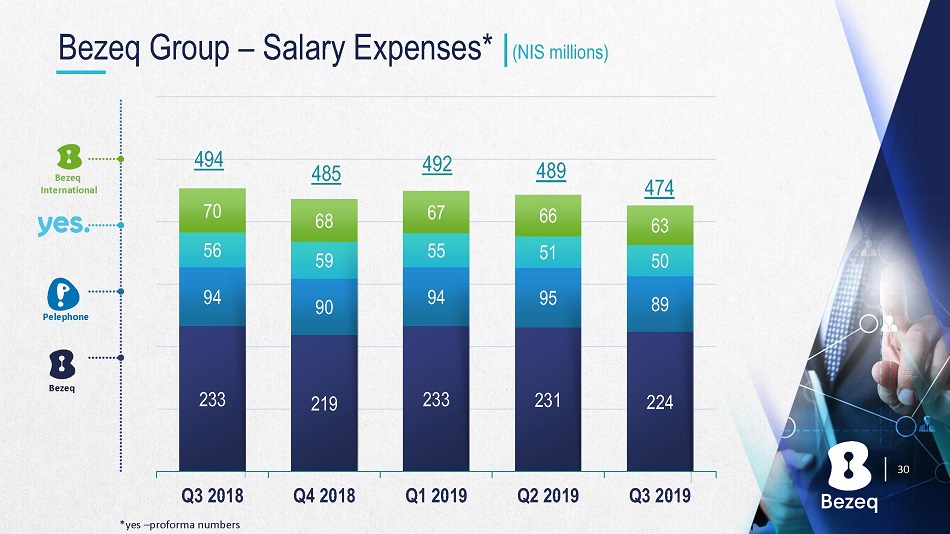

The Company intends to take advantage of the total potential of the retirement plan for hundreds of additional employees under the terms of the current collective agreement (until 2021 ) Retirement expenses are expected to be lower in the future as a result of the accounting provision recorded in 2018 for all of the Government transferred employees ϭϭ Bezeq Fixed - Line - Employee Streamlining In 2019 , 261 employees left the Company as part of the employee streamlining plan 224 231 233 219 233 Q3 2019 Q2 2019 Q1 2019 Q4 2018 Q3 2018 Salary Expenses (NIS millions) ϯ͘ϵй y - o - y decrease In Nov 2019 , The Board of Directors approved the retirement of 140 permanent employees and 60 employees with flexible status. A provision of NIS 137 million is expected to be recorded in Q 4 - 19

ϭϮ Bezeq Fixed - Line – Decrease in Operating Expenses (NIS m) ϭϮ Operating expenses ( excluding terminal equipment and materials) decreased y - o - y 134 127 9M 2018 9M 2019 * Excluding terminal equipment & materials Total Operating Expenses* ( NIS millions) Ϳ ϱ͘Ϯй ;

Subsidiaries The image part with relationship ID rId4 was not found in the file. The image part with relationship ID rId7 was not found in the file. Bezeq International Pelephone ϭϯ

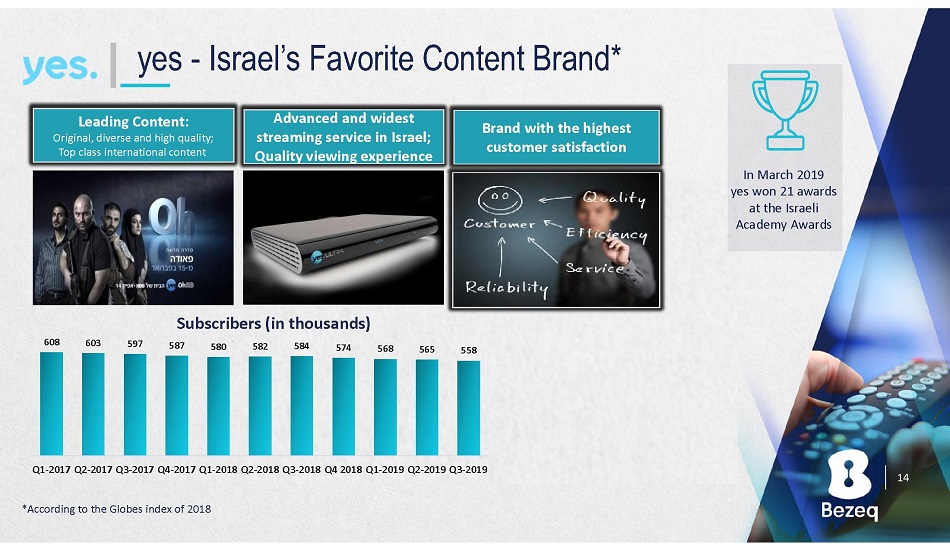

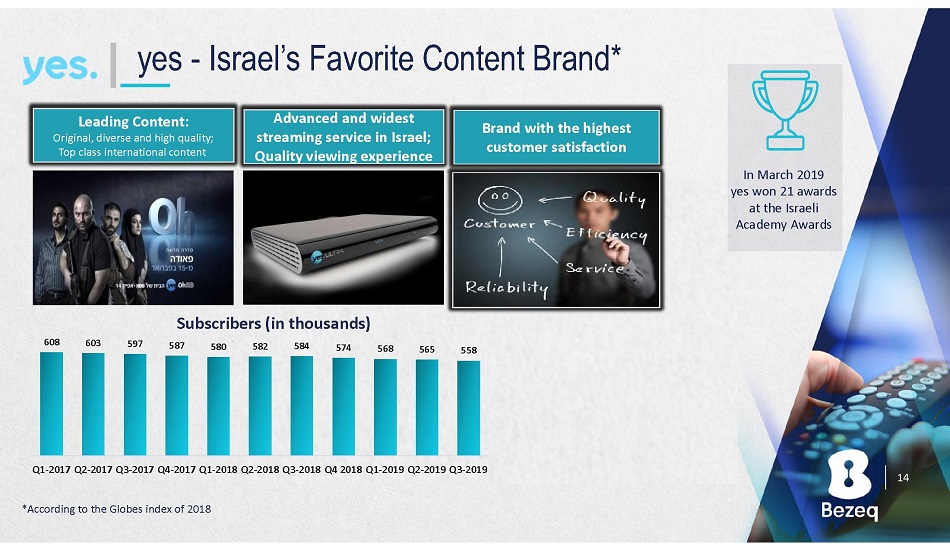

*According to the Globes index of 2018 yes - Israel ’ s Favorite Content Brand* In March 2019 yes won 21 awards at the Israeli Academy Awards Subscribers (in thousands) ϭϰ Advanced and widest streaming service in Israel; Quality viewing experience Leading Content: Original , diverse and high quality; Top class international content Brand with the highest customer satisfaction 608 603 597 587 580 582 584 574 568 565 558 Q1-2017 Q2-2017 Q3-2017 Q4-2017 Q1-2018 Q2-2018 Q3-2018 Q4 2018 Q1-2019 Q2-2019 Q3-2019

ϭϱ yes is gradually migrating from satellite to IP broadcasting in order to significantly upgrade the viewing experience as well as allow for the transfer of operations over the Group's infrastructure Transition to IP Broadcasting to Enhance Viewing Experience and Reduce Costs Over the next few years, yes will gradually replace set top boxes until full transition to IP service The fixed cost for satellite infrastructure will be replaced by the use of the Group's infrastructures Logistical flexibility and decrease in expenses such as: acquisition of set top boxes, installation and service costs Shelf STBs to replace tailor made – provides flexibility yes offers diversified and customized plans in IP: yes+ for premium and StingTV for low cost ϭϱ In Q 4 2019 yes began migrating customers through the launch of the yes+ service

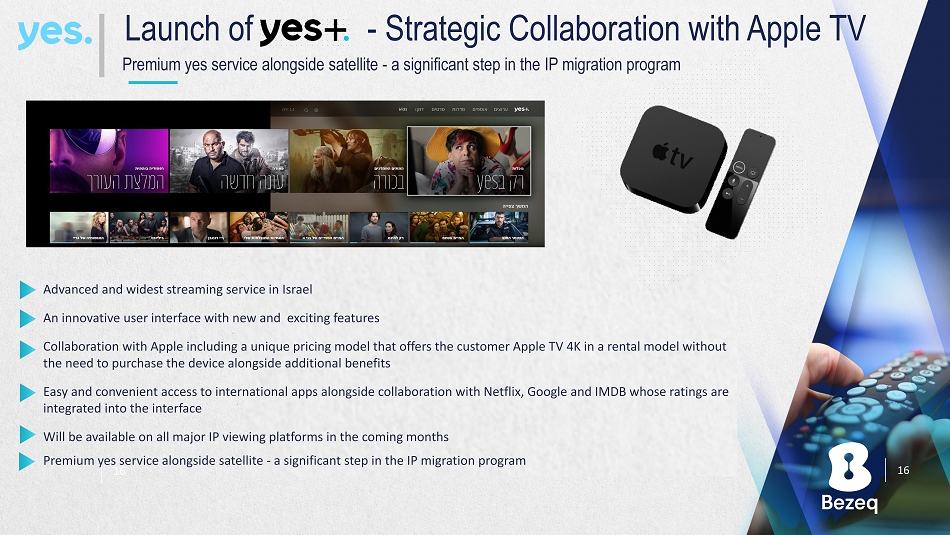

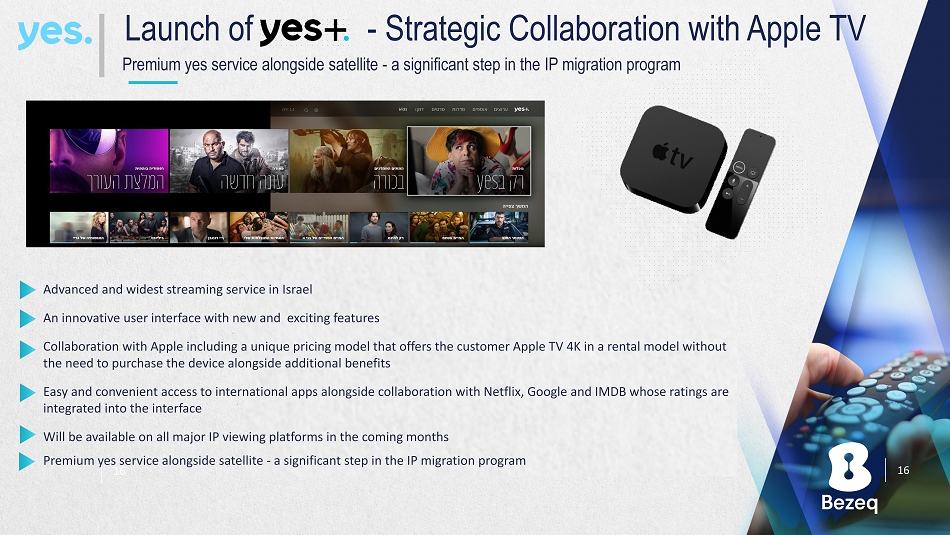

ϭϲ Advanced and widest streaming service in Israel An innovative � user interface � with � new � and �� exciting � features Collaboration with � Apple � including a unique � pricing � model � that � offers the customer � Apple TV ϰ K in a rental � model � without the need � to � purchase the device � alongside � additional � benefits Easy and convenient access � to � international � apps � alongside � collaboration � with � Netflix ͕� Google � and IMDB whose � ratings � are � integrated � into the interface Will be available on all major IP viewing platforms in the coming months P remium � yes service � alongside � satellite - a significant � step � in � the � IP migration � program � Launch of - Strategic Collaboration with Apple TV P remium � yes service � alongside � satellite - a significant � step � in � the � IP migration � program � ϭϲ

ϭϳ Play Launch x Adapting the offering to customer needs including Internet services, TV and home phone of Bezeq International and yes x The triple play, which combines the company ’ s services, will result in operating efficiencies in sales and services ϭϳ

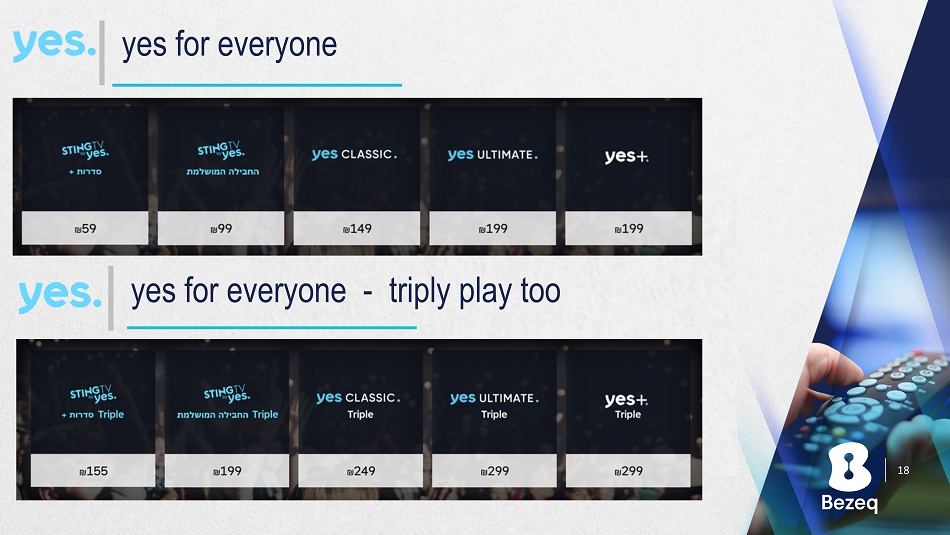

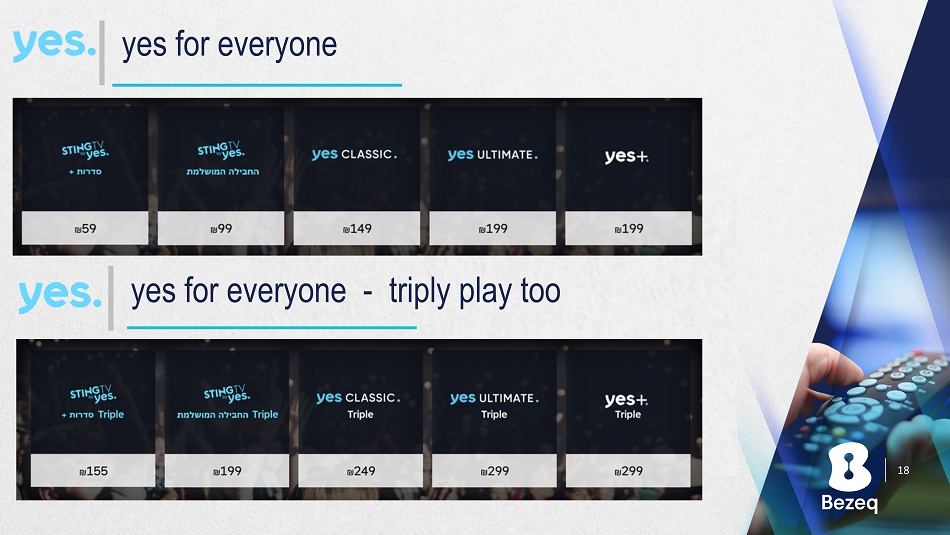

ϭϴ yes for everyone yes for everyone - triply play too ϭϴ

Bezeq International - Wide Range of Services Bezeq International x Leading ISP in Israel x Advanced value - added services for Internet customers x Operates high quality infrastructure including ownership of submarine cable Wide Range of Business Solutions x ICT solutions for business sector x Growth engines and diversified solutions: cyber; cloud for businesses; DR, storage and backup x Wide distribution of data centers x Professional services in the areas of installation; service and project management in cyber security networking and systems Bezeq International is a significant player in a growing market ϭϵ

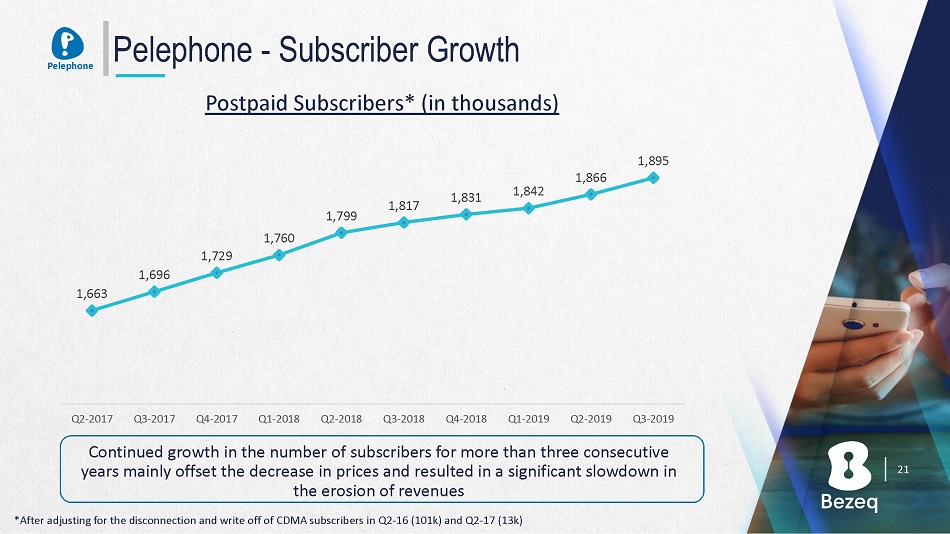

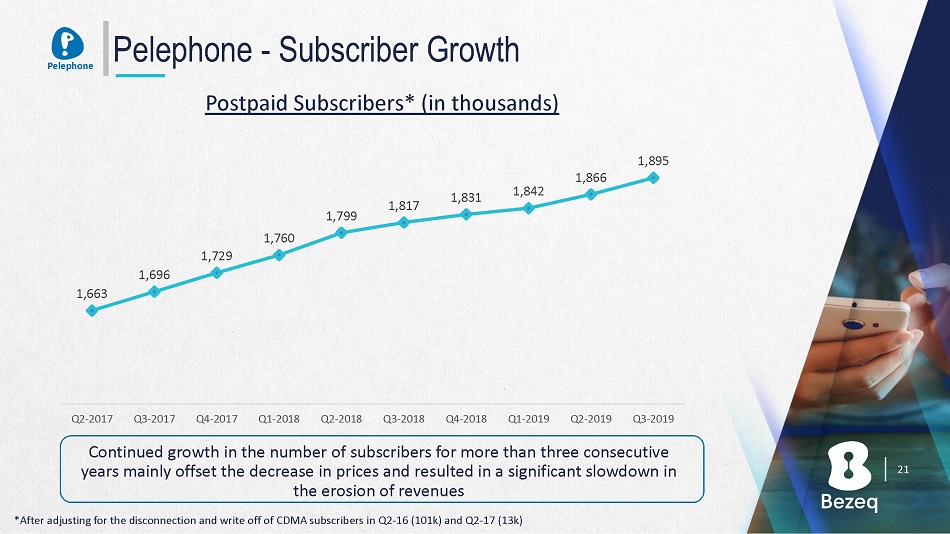

Pelephone – Growth alongside Innovation Subscriber Growth • Subscriber growth for over 3 consecutive years • Wide retail distribution • Advanced cellular network in Israel • Leading operator in business sector and cellular provider for Government offices Innovation Connected cars, PTT, IOT, Big Data, Cyber, Cloud, ESIM Frequency Tender Pelephone is preparing for the frequency tender published by the MOC. The frequencies will also be used for 5 G ϮϬ The image part with relationship ID rId6 was not found in the file. Pelephone

Pelephone - Subscriber Growth Postpaid Subscribers* (in thousands) Continued growth in the number of subscribers for more than three consecutive years mainly offset the decrease in prices and resulted in a significant slowdown in the erosion of revenues Ύ After adjusting for the disconnection and write off of CDMA subscribers in Q 2 - 16 ( 101 k) and Q 2 - 17 ( 13 k) Ϯϭ 1,663 1,696 1,729 1,760 1,799 1,817 1,831 1,842 1,866 1,895 Q2-2017 Q3-2017 Q4-2017 Q1-2018 Q2-2018 Q3-2018 Q4-2018 Q1-2019 Q2-2019 Q3-2019 The image part with relationship ID rId6 was not found in the file. Pelephone

Key Processes - Synergies and Streamlining ϮϮ ϮϮ The image part with relationship ID rId5 was not found in the file. The image part with relationship ID rId8 was not found in the file. Bezeq International Pelephone

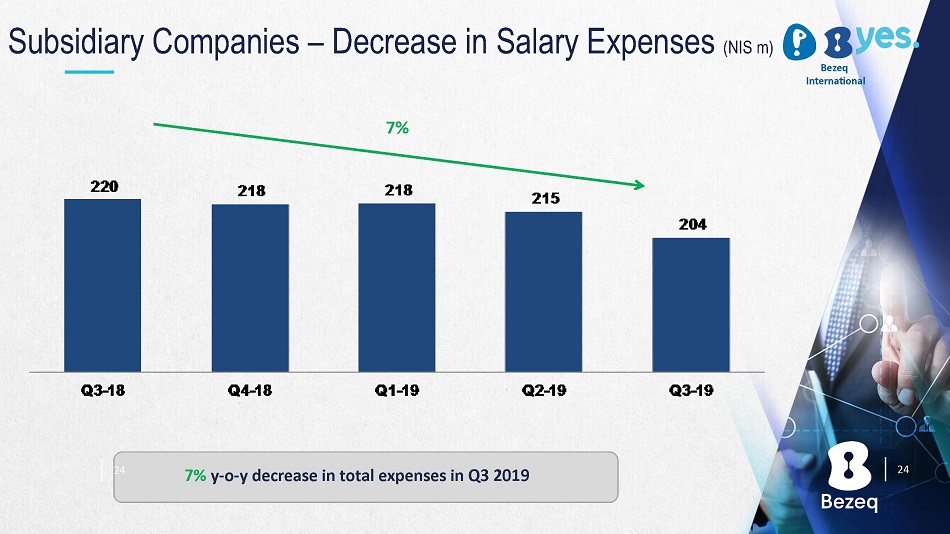

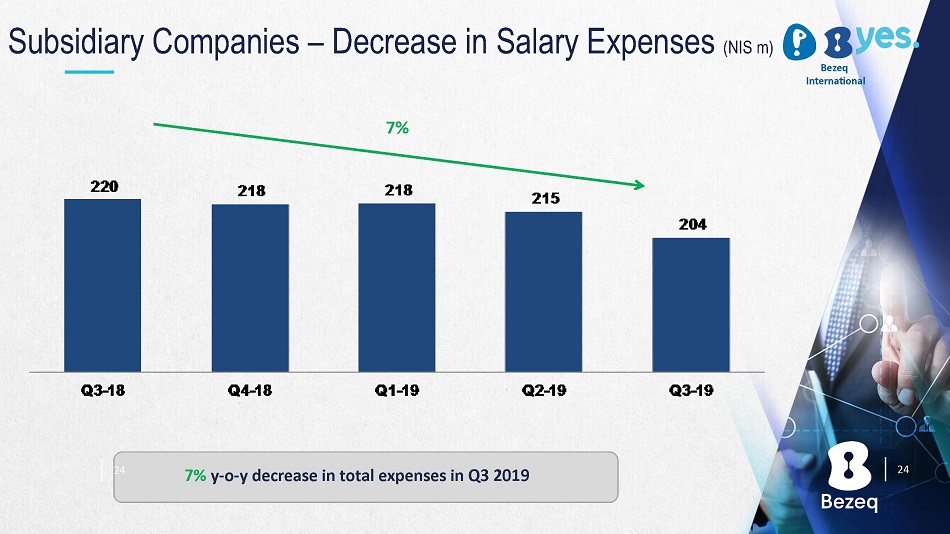

Ϯϯ Maximizing Synergies in Subsidiaries – Employees and Labor Relations x In 2019 , agreements were signed in the three subsidiaries that allow the companies to realize synergies and streamline, thus reducing our workforce by a total of over 1,000 employees in the next two years in addition to the non - recruitment of additional employees x Regulating labor relations and reaching agreements that allow for synergies and streamlining are a key element in the implementation of the subsidiaries' business plans x The subsidiaries have begun to implement the efficiency plans in accordance with the agreements x The agreements include the renewal of collective labor agreements until the end of 2021 Ϯϯ The image part with relationship ID rId5 was not found in the file. Pelephone Bezeq International

Subsidiary Companies – Decrease in Salary Expenses (NIS m) Ϯϰ 7 % y - o - y decrease in total expenses in Q 3 2019 Ϯϰ ϳй The image part with relationship ID rId8 was not found in the file. The image part with relationship ID rId11 was not found in the file. Bezeq International

Subsidiary Companies – Decrease in Total Expenses (excluding Salaries) * (NIS m) Ϯϱ 5 % y - o - y decrease in total expenses in Q 3 2019 Ϯϱ 4 % � *Bezeq International and yes – excluding Other Expenses The image part with relationship ID rId6 was not found in the file. The image part with relationship ID rId9 was not found in the file. Bezeq International 1 , 212 1 , 251 1 , 240 1 , 351 1 , 266 Q3-19 Q2-19 Q1-19 Q4-18 Q3-18

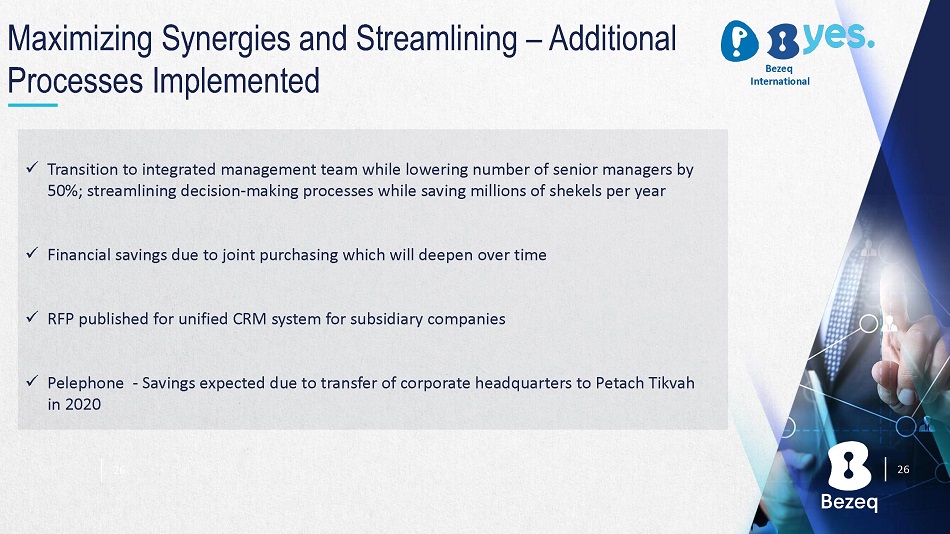

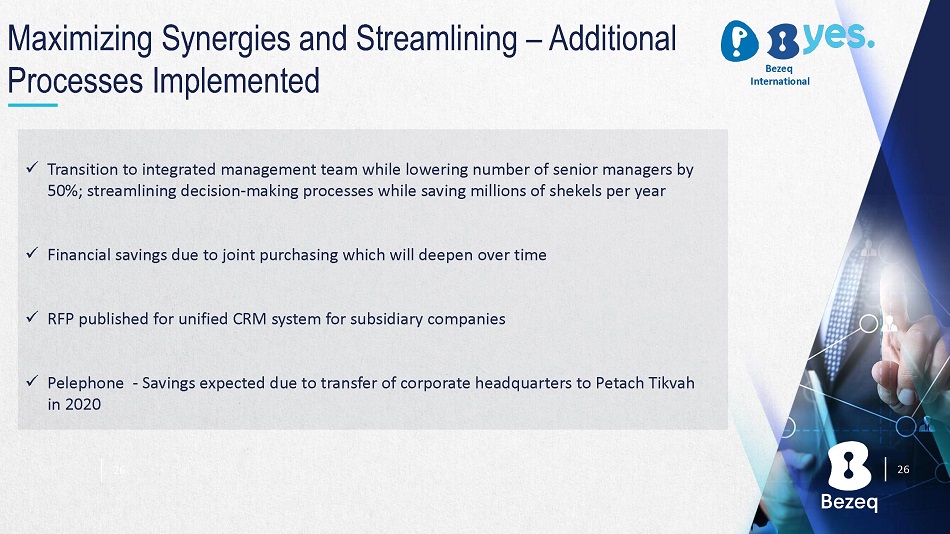

Ϯϲ Maximizing Synergies and Streamlining – Additional Processes Implemented x Transition to integrated management team while lowering number of senior managers by 50 %; streamlining decision - making processes while saving millions of shekels per year x Financial savings due to joint purchasing which will deepen over time x RFP published for unified CRM system for subsidiary companies x Pelephone - Savings expected due to transfer of corporate headquarters to Petach Tikvah in 2020 Ϯϲ The image part with relationship ID rId5 was not found in the file. The image part with relationship ID rId9 was not found in the file. Bezeq International

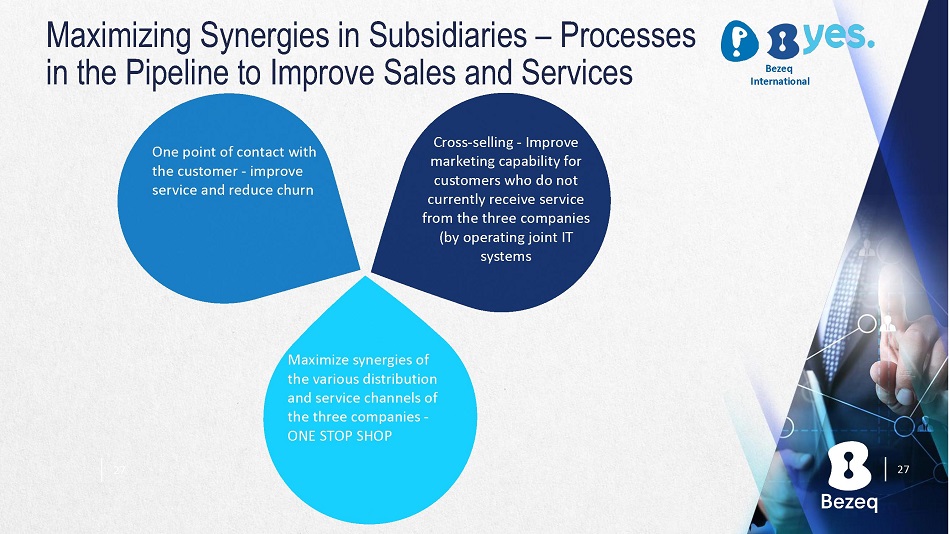

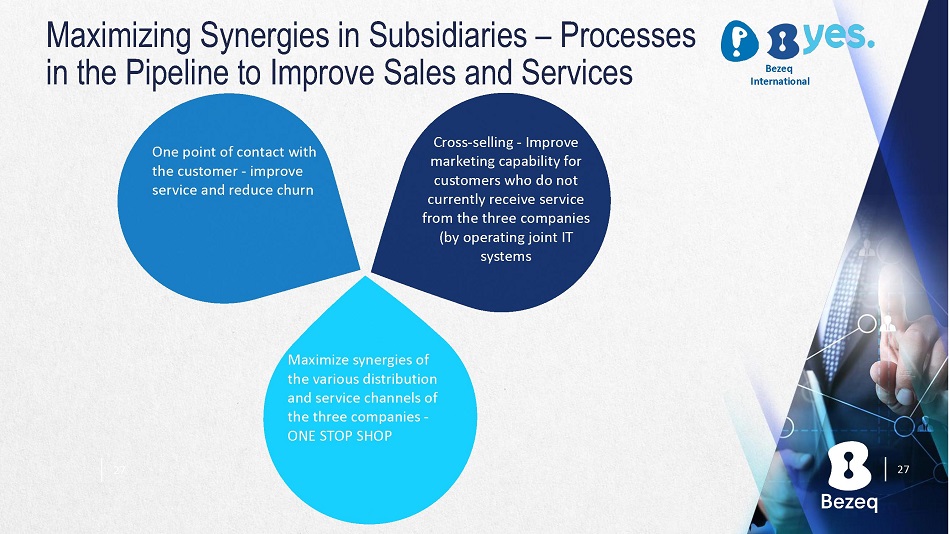

Maximizing Synergies in Subsidiaries – Processes in the Pipeline to Improve Sales and Services Ϯϳ One point of contact with the customer - improve service and reduce churn Cross - selling - Improve marketing capability for customers who do not currently receive service from the three companies ( by operating joint IT systems Maximize synergies of the various distribution and service channels of the three companies - ONE STOP SHOP Ϯϳ The image part with relationship ID rId5 was not found in the file. The image part with relationship ID rId9 was not found in the file. Bezeq International

Q 3 2019 Financial Results Ϯϴ

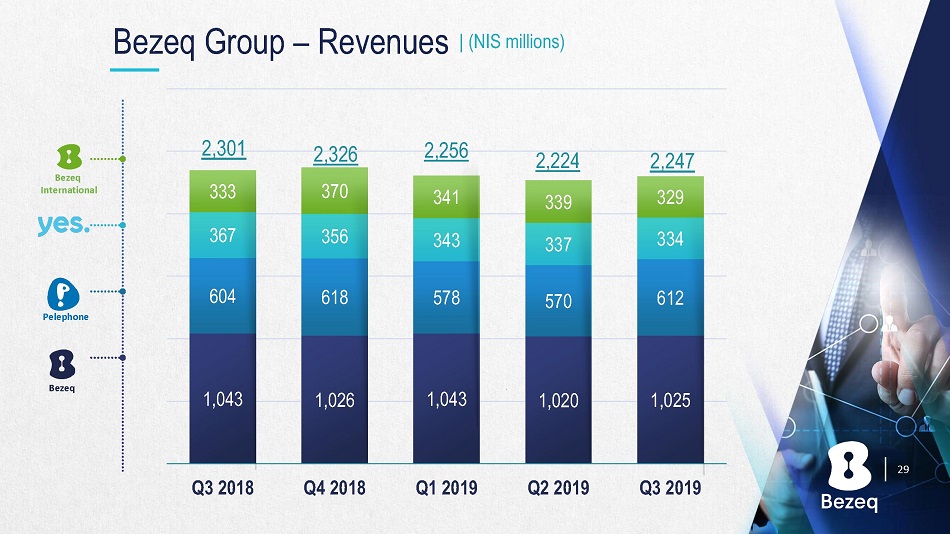

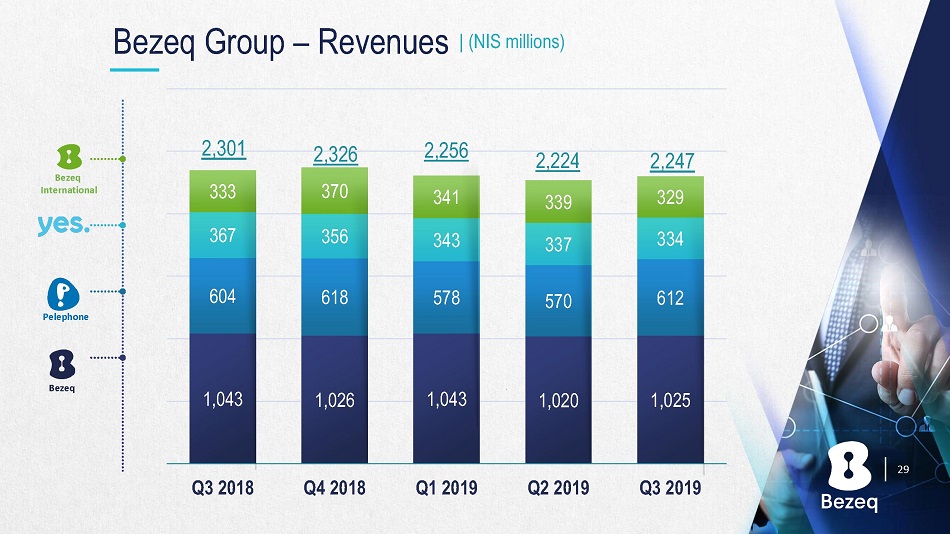

Ϯϵ Bezeq Group – Revenues _ (NIS millions) Bezeq International The image part with relationship ID rId6 was not found in the file. Pelephone Bezeq 1,043 1,026 1,043 1,020 1,025 604 618 578 570 612 367 356 343 337 334 333 370 341 339 329 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 2,247 2,301 2,326 2,256 2,224

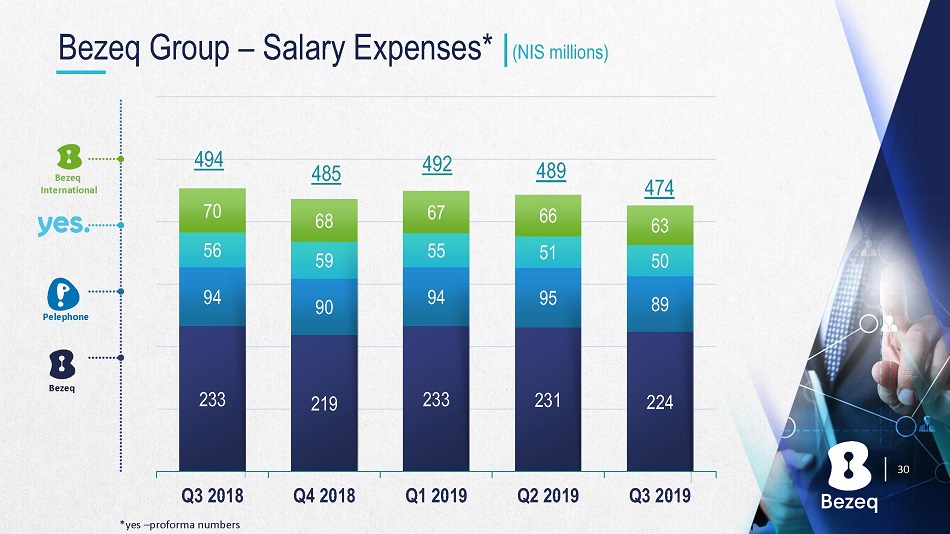

ϯϬ Bezeq Group – Salary Expenses* _ (NIS millions) Bezeq International The image part with relationship ID rId6 was not found in the file. Pelephone Bezeq 233 219 233 231 224 94 90 94 95 89 56 59 55 51 50 70 68 67 66 63 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 474 494 485 492 489 * yes – proforma numbers

ϯϭ Bezeq Group – Operating & General Expenses* _ (NIS millions) Bezeq International The image part with relationship ID rId6 was not found in the file. Pelephone Bezeq 143 168 141 133 144 344 354 337 324 348 229 244 226 222 219 184 216 194 194 194 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 794 815 885 812 814 * yes – proforma numbers

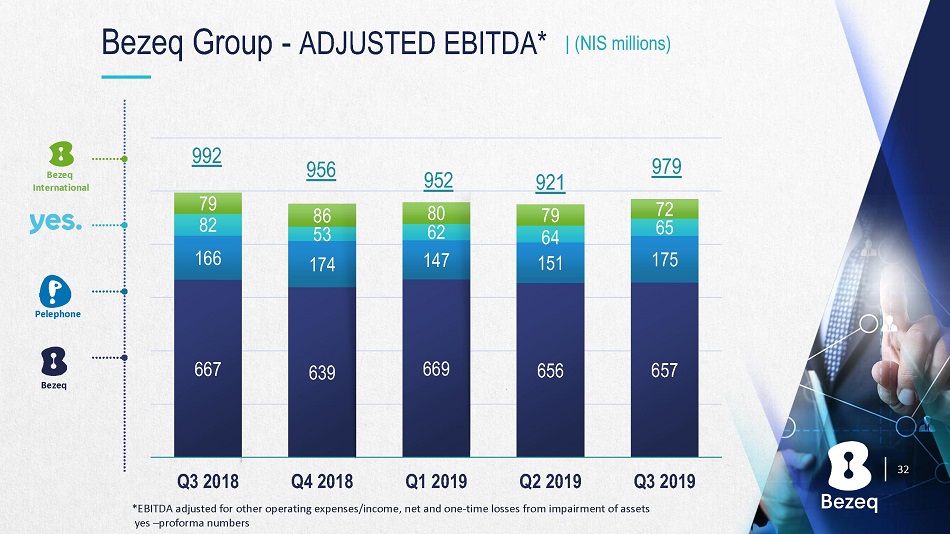

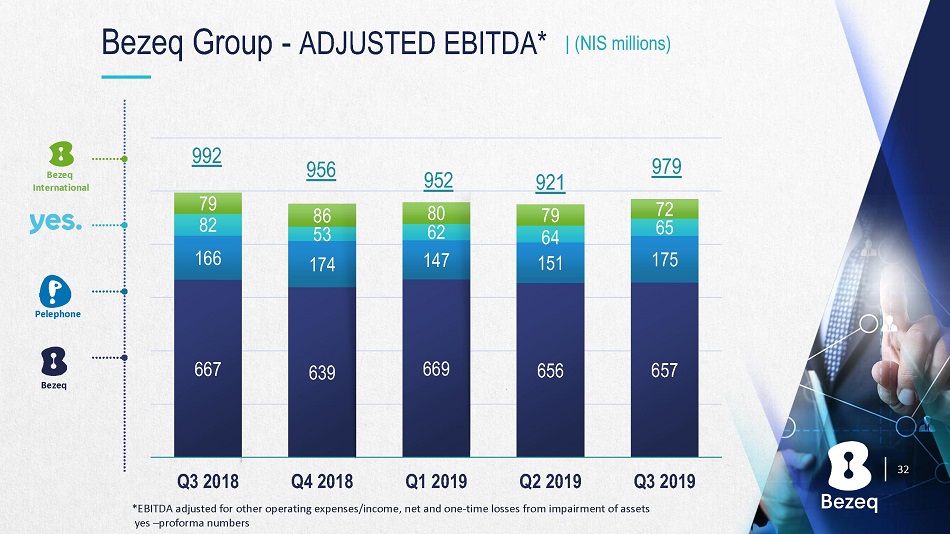

ϯϮ Bezeq Group - ADJUSTED EBITDA* _ (NIS millions) * EBITDA adjusted for other operating expenses/ income, net and one - time losses from impairment of assets yes – proforma numbers Bezeq International The image part with relationship ID rId6 was not found in the file. Pelephone Bezeq 667 639 669 656 657 166 174 147 151 175 82 53 62 64 65 79 86 80 79 72 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 979 992 956 921 952

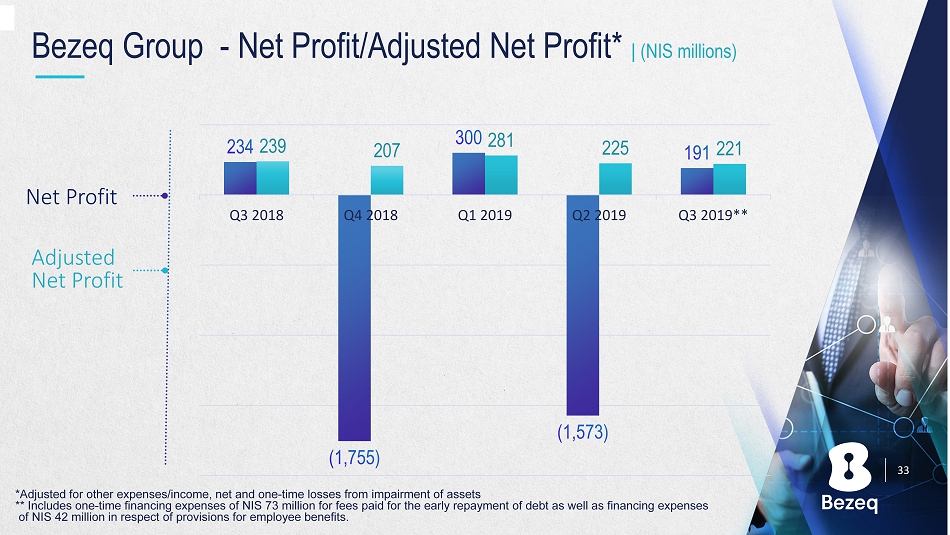

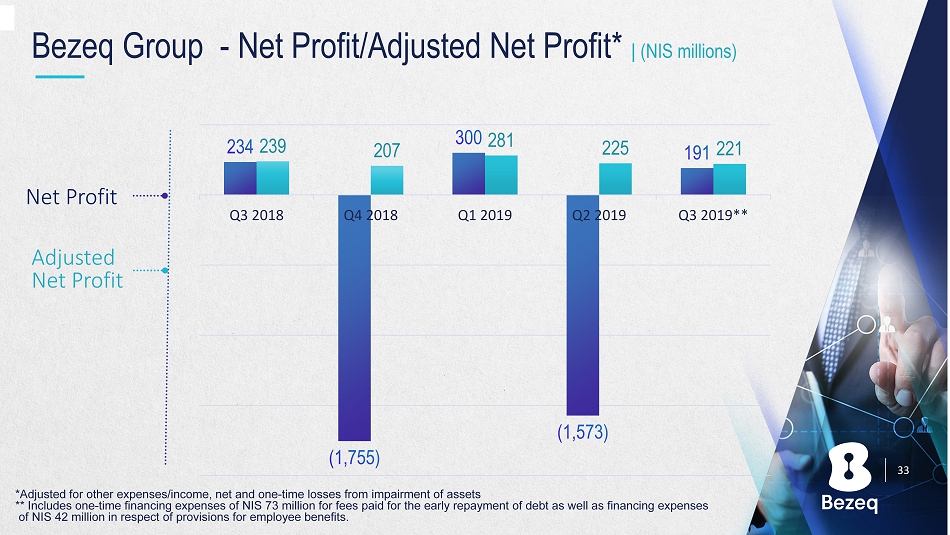

ϯϯ *Adjusted for other expenses/income, net and one - time losses from impairment of assets ** Includes one - time financing expenses of NIS 73 million for fees paid for the early repayment of debt as well as financing expenses of NIS 42 million in respect of provisions for employee benefits. ������� Bezeq Group - Net Profit/Adjusted Net Profit* _ (NIS millions) Net Profit Adjusted Net Profit 239 207 281 225 221 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019**

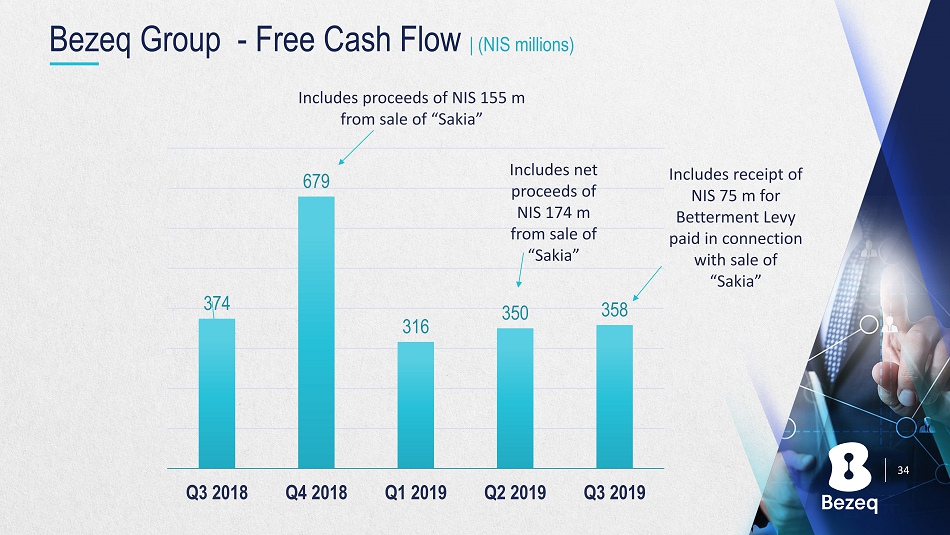

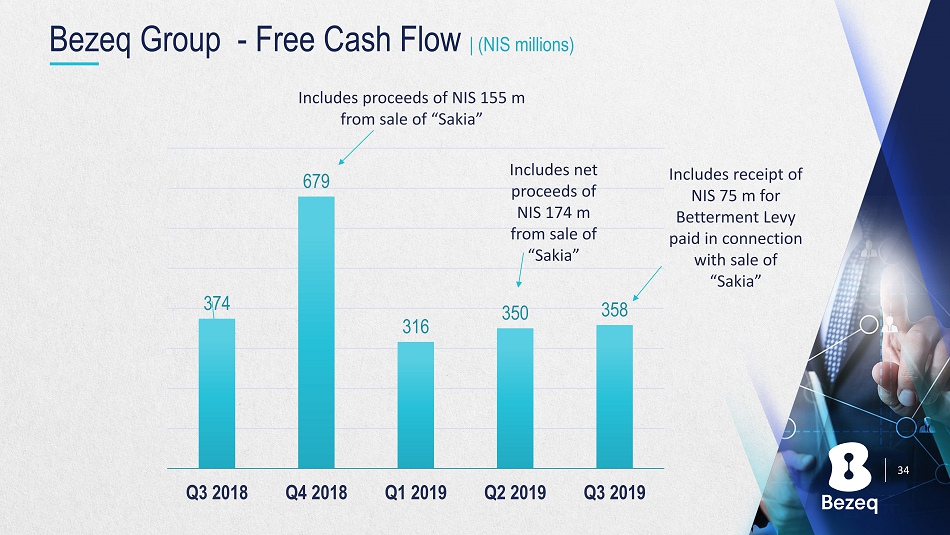

ϯϰ Bezeq Group - Free Cash Flow | (NIS millions) 374 679 316 350 358 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Includes proceeds of NIS 155 m from sale of “ Sakia ” Includes net proceeds of NIS 174 m from sale of “ Sakia ” Includes receipt of NIS 75 m for Betterment Levy paid in connection with sale of “ Sakia ”

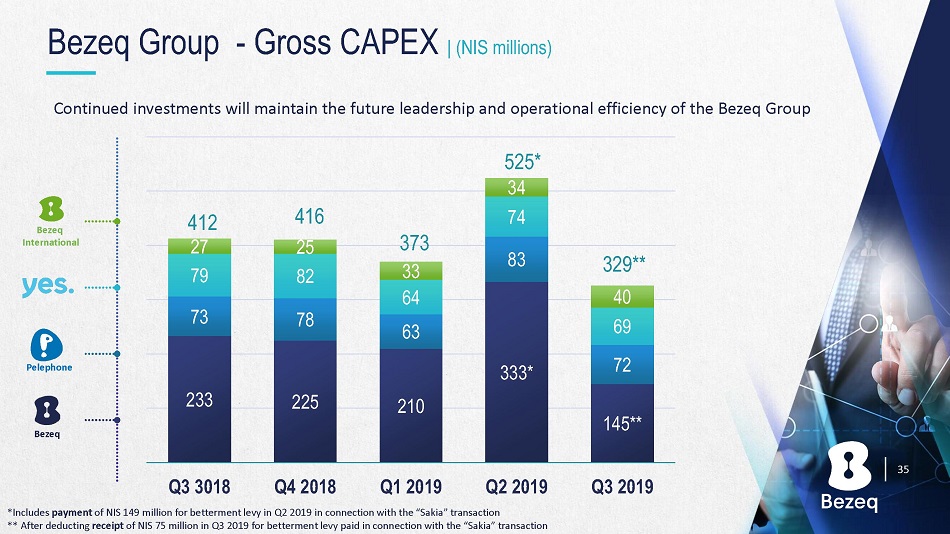

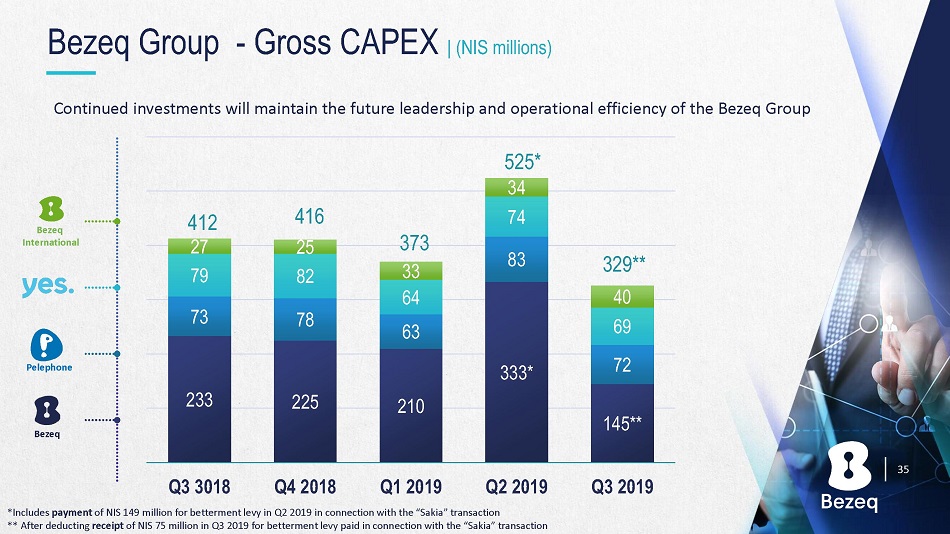

ϯϱ Continued investments will maintain the future leadership and operational efficiency of the Bezeq Group Bezeq Group - Gross CAPEX | (NIS millions) �� * Includes payment of NIS 149 million for betterment levy in Q 2 2019 in connection with the “ Sakia ” transaction ** After deducting receipt of NIS 75 million in Q 3 2019 for betterment levy paid in connection with the “ Sakia ” transaction Bezeq International The image part with relationship ID rId6 was not found in the file. Pelephone Bezeq 233 225 210 333 * 145 ** 73 78 63 83 72 79 82 64 74 69 27 25 33 34 40 Q3 3018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 416 373 412 329 ** 525 *

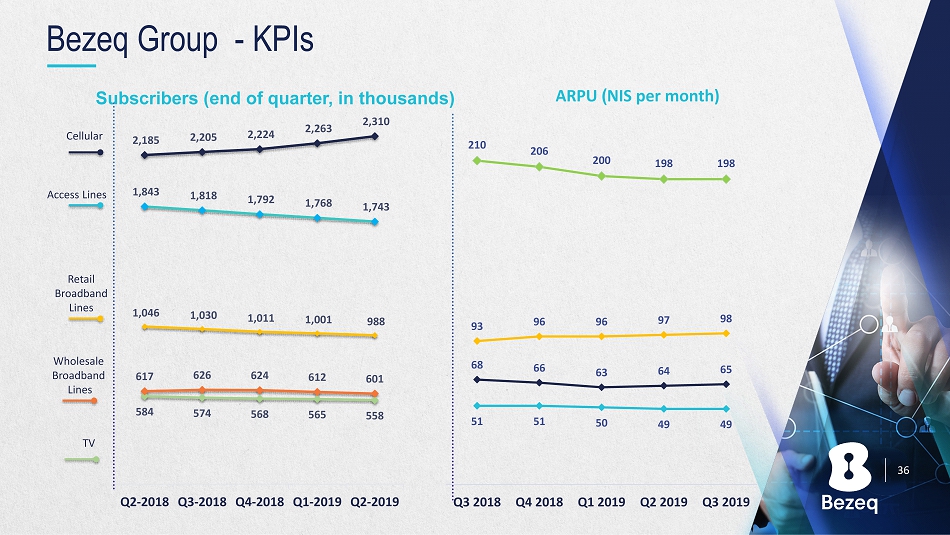

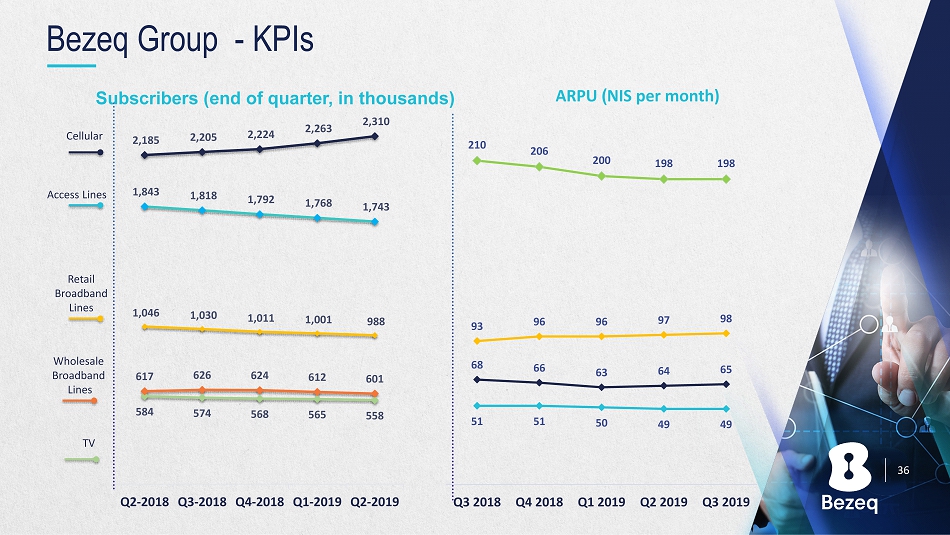

ϯϲ Subscribers (end of quarter, in thousands) Bezeq Group - KPIs Wholesale Broadband Lines TV Retail Broadband Lines Access Lines Cellular ARPU ( NIS per month) 51 51 50 49 49 68 66 63 64 65 93 96 96 97 98 210 206 200 198 198 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 584 574 568 565 558 617 626 624 612 601 1,046 1,030 1,011 1,001 988 1,843 1,818 1,792 1,768 1,743 2,185 2,205 2,224 2,263 2,310 Q2-2018 Q3-2018 Q4-2018 Q1-2019 Q2-2019

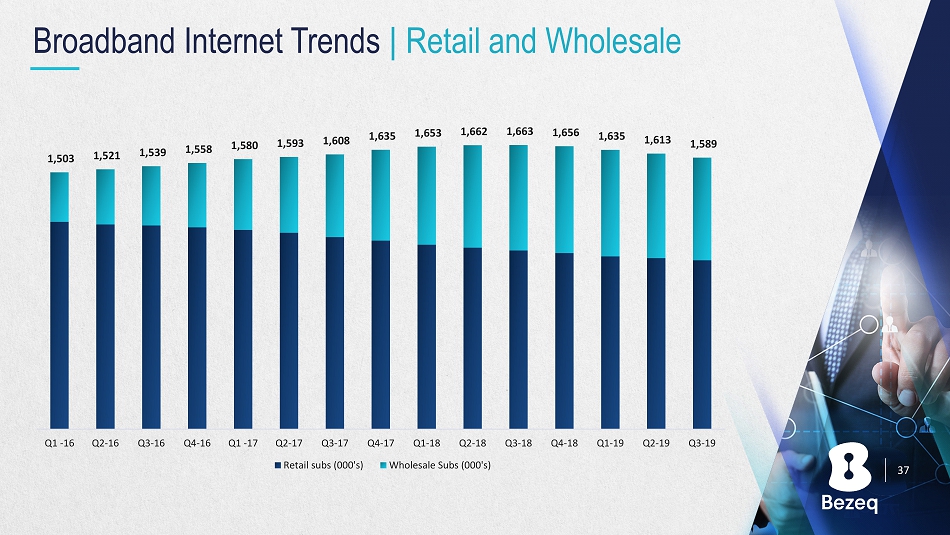

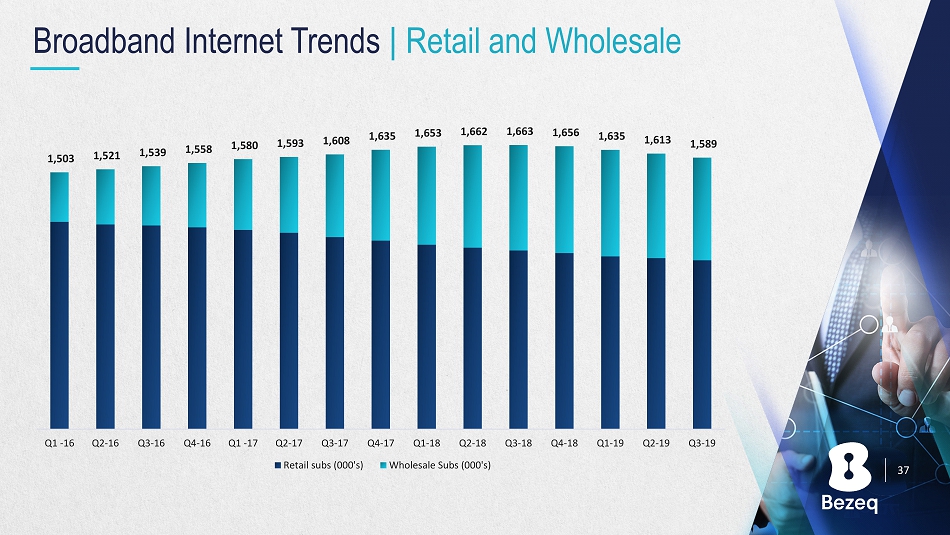

ϯϳ Broadband Internet Trends _ Retail and Wholesale 1,503 1,521 1,539 1,558 1,580 1,593 1,608 1,635 1,653 1,662 1,663 1,656 1,635 1,613 1,589 Q1 -16 Q2-16 Q3-16 Q4-16 Q1 -17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 Q2-19 Q3-19 Retail subs (000's) Wholesale Subs (000's)

ϯϴ Bezeq Group – Net Debt | (NIS millions) Debt continues to decrease over time Gross Debt Net Debt 9,401 9,022 8,885 8,544 8,419 8,130 12,000 11,947 11,179 11,156 11,334 10,519 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 y - o - y decrease of NIS 1.4 billion in gross debt y - o - y decrease of NIS 900 million in net debt

Bezeq ’ s responsible and prudent management of all financial aspects of the Company will provide financial flexibility and ensure its long - term financial strength Principles of financial debt management: I. Continue to adapt the Company ’ s debt structure to its needs II. Seek to maintain prudent debt coverage ratios and AA credit rating range III. Operate with high cash balances Actions taken in 2019 : I. The Company raised NIS 1.69 billion and made early repayments of debt of NIS 1.97 billion I. The average duration of debt increased from 3.5 to 4.0 with the raising of long - term debt and repayment of short - term debt Financial Debt ϯϵ

Bezeq Group - 2019 Outlook *CAPEX - payments (gross) for investments in fixed and intangible assets Net loss : Approximately NIS 1.1 billion (compared to net profit of NIS 900 million - NIS 1.0 billion in the Original Outlook) EBITDA : Approximately NIS 2.9 billion (compared to NIS 3.9 in the Original Outlook) CAPEX *: Approximately NIS 1.7 billion (unchanged) The Company shall report, as required, deviations of more/less than 10 % of the amounts stated in the Outlook . Due to extraordinary items in the second quarter of 2019 (write - off of the tax asset, impairment loss in Pelephone assets and the recording of capital gains from the sale of the "Sakia" complex) as well as the inclusion of estimated costs for early retirement in the Outlook, on August 29 , 2019 the Bezeq Group updated its Outlook for 2019 , as originally published in the Company's periodic report as of December 31 , 2018 ("Original Outlook “ ) . There is no change to the Outlook since the Q 2 2019 update . We continue to expect : ϰϬ

Bezeq Group - 2019 Guidance (cont ’ d) The Group's updated Outlook includes the write - off of the balance of the tax asset in respect of losses from yes of NIS 1 . 166 billion, an impairment loss in Pelephone assets of NIS 951 million, capital gains of NIS 403 million from the sale of the "Sakia" complex and provisions for the early retirement of employees in Bezeq Fixed - Line, Pelephone, Bezeq International and yes . It is noted that NIS 213 million of the total forecasted provisions for early retirement have not yet been recorded as actual provisions in the financial statements and represents an estimate that may not be realized . The Company's forecasts in this section are forward - looking information, as defined in the Securities Law . The forecasts are based on the Company's estimates, assumptions and expectations and do not include the effects, if any, of the cancellation of the Group ’ s structural separation and the merger with the subsidiary companies and everything involved therein in 2019 . The Group's forecasts are based, inter alia , on its estimates regarding the structure of competition in the telecommunications market and regulation in this sector, the economic situation and accordingly, the Group's ability to implement its plans in 2019 . Actual results may differ from these estimates taking note of changes which may occur in the foregoing, in business conditions, and the effects of regulatory decisions, technology changes and developments in the structure of the telecommunications market, and so forth, or the realization of one or more of the risk factors listed in sections 2 . 20 , 3 . 19 , 4 . 14 and 5 . 19 of the Periodic Report of 2018 , and specifically the risk factor detailed in section 2 . 20 . 12 of the Periodic Report of Q 3 2019 regarding the impairment of assets in the subsidiary companies . . ϰϭ

ϰϮ Thank You For more information please visit ir.bezeq.co.il