FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February, 2011

Commission File Number: 1-33659

COSAN LIMITED

(Translation of registrant’s name into English)

Av. Juscelino Kubitschek, 1726 – 6th floor

São Paulo, SP 04543-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

COSAN LIMITED

| |

| 1. | Communication regarding 3rd Quarter Fiscal Year 2011 earnings release |

CCL, Rumo and Cogen reach 45% of the

total EBITDA in the quarter

São Paulo, February 09, 2011 - COSAN LIMITED (NYSE: CZZ; Bovespa: CZLT11) and COSAN S.A. INDÚSTRIA E COMÉRCIO (Bovespa: CSAN3) are announcing today their results for the third quarter of fiscal year 2011 (3Q’11), ended on December 31, 2010. The results for 3Q’11 are shown in consolidated form, according to Brazilian corporate legislation.

Marcelo Martins | ● | Record Revenues of R$3.1billion from CCL |

| | ● | EBITDA of R$ 98.1 million from CCL |

| ● | Transportation Revenues of R$80.9 million from Rumo |

| | ● | Rumo’s EBITDA of R$37.7 million |

| ● | Revenues of R$53.7 million from Cogeneration |

| | ● | Record Revenues of R$ 1.37 billion from CAA |

| | | Summary of Financial and Operating Information (R$MM) | | |

| 3Q'10 | 3Q'11 | | YTD'10 | YTD'11 |

| 3,800.5 | 4,738.4 | Net sales | 10,941.9 | 13,454.1 |

| 460.0 | 577.9 | l | Gross profit | 1,351.5 | 1,812.9 |

| 12.1% | 12.2% | | Gross Margin | 12.4% | 13.5% |

| 253.0 | 75.2 | l | Operating income (loss) | 1,016.4 | 691.0 |

| 6.7% | 1.6% | | Operating margin | 9.3% | 5.1% |

| 490.4 | 410.5 | l | EBITDA | 1,157.2 | 1,565.3 |

| 12.9% | 8.7% | | EBITDA Margin | 10.6% | 11.6% |

| 167.8 | 35.5 | l | Income (loss) before minority interest | 669.4 | 505.7 |

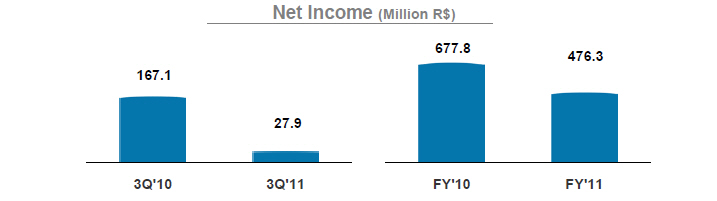

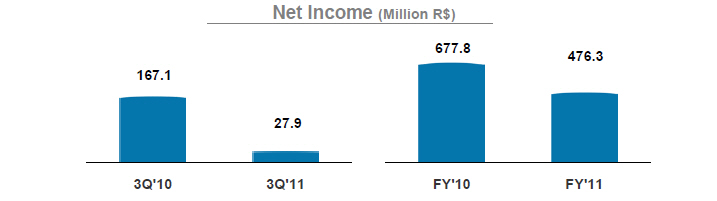

| 167.1 | 27.9 | l | Net income (loss) | 677.8 | 476.3 |

| 4.4% | 0.6% | | Profit (loss) Margin | 6.2% | 3.5% |

| 401.0 | 548.7 | Capex | 1,182.5 | 1,543.5 |

| 4,300.8 | 5,301.1 | Net Debt | 4,300.8 | 5,301.1 |

| 4,963.9 | 5,496.9 | Shareholders' & Minorities Equity | 4,963.9 | 5,496.9 |

A. Market Overview

According to data from UNICA, the 2010/11 crop of the Center -South region of Brazil (CS) was already almost concluded at the end of December 2010, totaling 555.0 million tons of sugar, 2.4% higher than the same period of the previous crop. The production mix maximized the sugar production, including the entry into operation of about 10 new sugar plants. This product accounted for 44.79% of processed cane, compared to 42.59% of the previous crop, resulting in the production of 33.5 million tons of sugar and 25.3 billion of liters of ethanol, 16.8% and 6 71% higher, respectively, the previous crop. This production increase was mainly due to higher amount of TSR (total sugar recoverable) per ton of cane, which totaled 141.3 kg / ton, compared to 130.2 kg / ton in 2009/10.

Despite the above-mentioned significant production growth, the 2010/11 crop has suffered the impacts of the drought in the period that affected the CS and showed a lower yield per hectare, which reduced the availability of cane. A drop of nearly 7.0% on UNICA’ s first harvest estimate (595.9 million tons of cane), partially offset by a 1.9% higher TSR and the mix of sugar above expected, resulted in a production of 0.6 million tons of sugar and 2.1 billion liters of ethanol lower than expected.

The sugar production growth in the CS was accompanied by the strong pace of exports. In the period between April and December 2010, 23.5 million tons of sugar were exported by Brazil, a volume 19.9% higher than the previous year's harvest. Raw sugar accounted for 75.2% of total exports, mainly intended to UAE, Russia, Malaysia and India. White sugar exports totaled 5.8 million tons, mainly to Yemen, Ghana, Mauritania and Ivory Coast.

The high sugar prices in international markets reflected the reversal of the global production and consumption balance for the 2009/10 crop. Earlier this year, market estimates foresaw a surplus of more than 5 million tons. Due to lower production in countries like Brazil, Russia, Australia and others, new estimates range from an equilibrated supply and demand to a deficit of 3 million tons for the 2010/11 crop.

In India, the current crop already presented a production 15% higher than the same period last year, with 8.5 million tons of sugar, indicating that the total output should be close to market consensus of 25.0 million tons. Due to the evolution of this crop and high food prices, the

government of that country adopted a more cautious export policy, postponing the decision to issue the licenses (OGLS).

In Australia, the 2010/11 harvest was significantly affected by the rains, with floods hitting the main producing regions. As a result, almost 20.0% of the cane was left for the next harvest (called "cana bisada") and difficulties were faced in the application of fertilizers and pest control, which should impact the productivity of the next crop.

In the EU, due to news on a shortage of sugar in retail and aiming to contain inflation of agricultural products prices, the European Commission signaled that it may approve additional “out-of-quota" sugar imports, which indicates that this year's volume available for exports will be significantly below the previous year, when the exports were 500,000 tons above the volume allowed by the WTO.

In China, during the quarter ended December, the local government held several auctions to sell the product in the domestic market and contain prices in the local market, which was also affected by lower product availability. Consequently, China has become one of the main Brazilian destinations, importing about 1 million tons.

In Russia, traditionally Brazil's main sugar importer, the local government started discussions on the reduction of the import tax due to the reduced inventory levels.

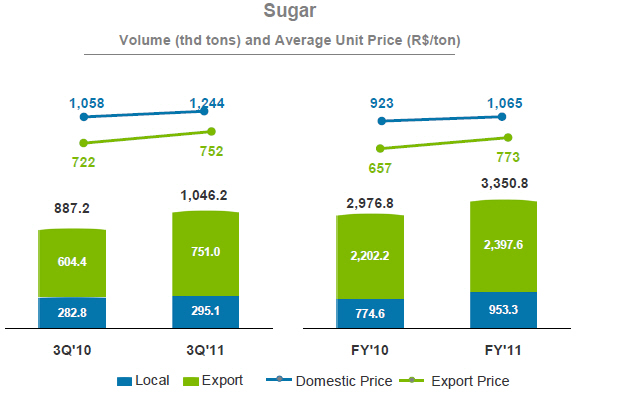

As a result of this scenario, the raw sugar price strongly recovered in the 3Q’11, with an average of ¢US$29.07/lb, 44.4% above the 2Q’11 and 22.8% above the average of the 3Q’10, reaching ¢US$32.12/lb at the end of December. The refined sugar in international market had an average price of US$731.08/ton in the period, which represents a 19.1% increase in comparison with the 3Q’10 and 25.7% above the 2Q’11.

In the 3Q’11, the average price of the Brazilian real in relation to the US dollar was R$ 1.70/US$, 3.0% below the average of the previous quarter and 2.4% lower than the 3Q’10. The exchange rate at the end of the period was R$1.67/US$, compared with R$1.69/US$ in September 2010 and R$1.74/US$ in December 2009.

In the domestic market, the average refined sugar price for the 3Q’11 (based on data of the Luiz de Queiroz School of Agriculture - ESALQ) was R$74.2 per 50Kg bag, which is equivalent to ¢US$39.67/lb, 54.7% higher than the previous quarter and 28.7% above the 3Q’10, mainly due to the crop shortfall in Brazil.

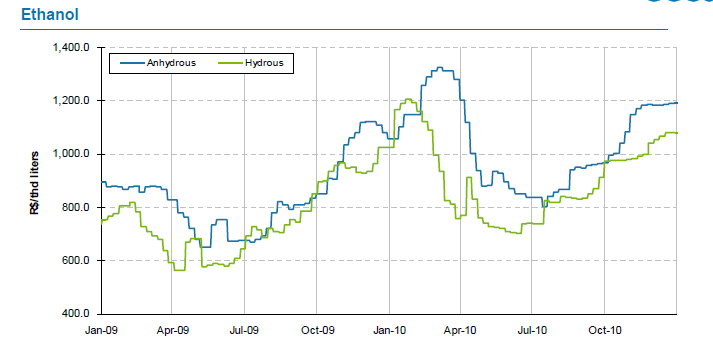

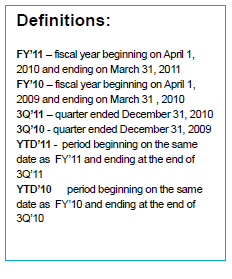

In the ethanol domestic ethanol market, the anhydrous and hydrous ethanol prices strongly recovered due to the start of the interharvest season and lower carryover stocks, due to (i) crop shortfall in Brazil, (ii) maximization of sugar production and (iii) increased demand for anhydrous and hydrous ethanol due to growing demand, reflecting the increased vehicle fleet. The average hydrous ethanol price (ESALQ’s base) was R $ 1,015.2 / cbm in the 3Q’11, 22.9% higher than the previous quarter and 6.9% above the 3Q’10. The average anhydrous ethanol price was R $ 1,187.1 / cbm, representing an increase of 23.1% compared to the 2Q’11 and 8.5% compared to the same quarter of last year.

The average parity (weighted by the fleet) of the hydrous ethanol price compared to gasoline in Brazil, according to the National Petroleum Agency (ANP), was approximately 72.5% at the end of the 3Q11, leaving only four states within the 70% parity, which together represent approximately 41.0% of the country's flex-fuel fleet.

Fuel

According to ANP, the volume of diesel sold in October and November 2010 (December data not yet available) was 6.9% higher than the same period of last year, reaching 8.7 billion liters. With higher prices throughout 2010, hydrous ethanol had unfavorable parity in relation to gasoline in many states, hence the volume of product sold decreased by 5.2%, totaling 2.6 billion liters. In contrast, the volume sold of gasoline C (with a blend of 25% anhydrous ethanol) rose by 12.7%, reaching 3.7 billion liters in that period.

| B. Production Figures | | |

| 3Q'10 | 3Q'11 | Production Highlights | YTD'10 | YTD'11 |

| 14,228 | 11,299 | Sugarcane Crushed (thd tons) | 50,133 | 54,238 |

| 5,778 | 6,092 | Own Cane (thd tons) | 23,443 | 27,400 |

| 8,450 | 5,207 | Suppliers (thd tons) | 26,690 | 26,838 |

| | | Production | - | |

| 662 | 485 | Raw Sugar (thd tons) | 2,520 | 2,515 |

| 274 | 324 | White Sugar (thd tons) | 993 | 1,405 |

| 228 | 174 | Anhydrous Ethanol (thd cbm) | 623 | 686 |

| 303 | 280 | Hydrous Ethanol (thd cbm) | 1,203 | 1,513 |

| 126.6 | 138.5 | Sugarcane TSR (kg/ton) | 131.1 | 139.9 |

| 68.4% | 78.1% | Mechanization (%) | 68.4% | 78.1% |

This year’s crop was affected by severe drought which impacted the Center-South region of Brazil, reducing the availability of sugarcane. Consequently, the mills ended their harvest in the beginning of December with a total crushed volume of 11.3 million tons of sugarcane in the quarter, 20.1% lower than the 3Q’10. During this quarter the own cane represented 53.9% of total processed cane, with a mechanization rate of 78.1%.

The 11.9 kg /ton increase in the ATR, compared with the same quarter of last year, was insufficient to offset the smaller amount of cane processed. Therefore, this quarter sugar and ethanol production was 16.0% and 17.0%, respectively lower than that of the 3Q’10. The good sugar prices, especially in the domestic market, allowed a strategy to prioritize the production of white sugar with higher added value, which reached 324 thousand tons or an increase of 50 thousand tons in relation to the 3Q’10.

C. Operating Performance

As of the 2011 fiscal year, the Company adopted the hedge accounting criteria with the goal of providing greater transparency regarding hedges and their results. All of its effects will be described in detail in the section "Hedge Accounting Impacts.”

EBITDA by Business Unit

| EBITDA (R$ MM) - 3Q'11 | CAA | Rumo | CCL | Total* |

| Net Revenues | 1,683.0 | 113.7 | 3,084.8 | 4,738.4 |

| (-) Cost of Product Sold / Services Rendered | (1,369.1) | (75.3) | (2,863.3) | (4,160.5) |

| (=) Gross Profit | 313.9 | 38.3 | 221.5 | 577.9 |

| Gross Margin | 18.7% | 33.7% | 7.2% | 12.2% |

| (-) Selling Expenses | (153.4) | - | (113.4) | (271.0) |

| (-) General and Administrative Expenses | (101.8) | (5.8) | (24.4) | (132.0) |

| (-) Other Operating Revenues | (7.5) | (0.3) | 4.2 | (3.6) |

| (+) Depreciation and Amortization | 223.6 | 5.5 | 10.2 | 239.2 |

| (=) EBITDA | 274.8 | 37.7 | 98.1 | 410.5 |

| EBITDA Margin | 16.3% | 33.2% | 3.2% | 8.7% |

| * Total contemplates the effects of consolidation elimination | | | | |

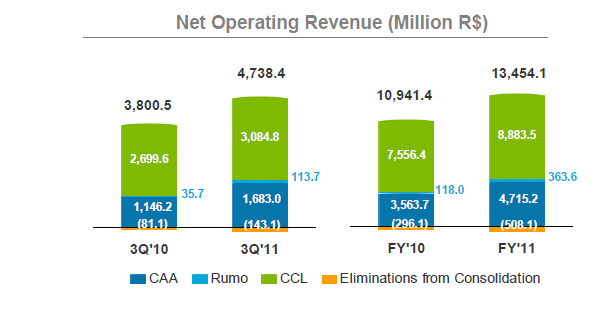

| Net Revenue |

| 3Q'10 | 3Q'11 | Sales Composition (R$MM) | YTD'10 | YTD'11 |

| 3,800.5 | 4,738.4 | Net Operating Revenue | 10,941.9 | 13,454.1 |

| 1,146.2 | 1,683.0 | CAA | | 3,563.7 | 4,715.2 |

| 735.6 | 931.9 | l | Sugar Revenue - CAA | 2,162.3 | 2,868.3 |

| 299.2 | 367.0 | | Local | 714.6 | 1,015.3 |

| 436.5 | 564.9 | | Export | 1,447.7 | 1,853.0 |

| 338.3 | 647.7 | l | Ethanol Revenue - CAA | 1,145.5 | 1,537.0 |

| 249.3 | 557.9 | | Local | 776.2 | 1,318.0 |

| 89.0 | 89.9 | | Export | 369.3 | 219.0 |

| 19.4 | 53.7 | l | Energy Cogeneration - CAA | 87.9 | 190.5 |

| 52.8 | 49.7 | l | Other Revenue - CAA | 168.0 | 119.4 |

| 35.7 | 113.7 | Rumo | | 118.0 | 363.6 |

| 35.7 | 32.7 | l | Loading | 115.3 | 114.2 |

| - | 80.9 | l | Transportation | 2.7 | 249.5 |

| 2,699.6 | 3,084.8 | CCL | | 7,556.4 | 8,883.5 |

| 2,537.0 | 2,865.7 | l | Fuels Revenue - CCL | 7,035.7 | 8,220.4 |

| 240.7 | 238.5 | | Ethanol | 586.5 | 611.5 |

| 1,102.4 | 1,213.5 | | Gasoline | 2,902.3 | 3,391.1 |

| 1,166.5 | 1,381.2 | | Diesel | 3,339.3 | 4,139.7 |

| 27.4 | 32.5 | | Other | 207.6 | 78.2 |

| 143.9 | 207.4 | l | Lubes Revenue - CCL | 465.1 | 613.6 |

| 18.7 | 11.8 | l | Other Revenue - CCL | 55.6 | 49.4 |

| (81.1) | (143.1) | Eliminations from Consolidation | (296.1) | (508.1) |

Cosan’s net revenue amounted to R$4.7 billion in the 3Q11, compared with R$3.8 billion in the same quarter of the previous year. This increase of 24.7% reflects the growth in all business units through the increase in the production capacity and volume sold and services provided. At CAA, the growth was due to (i) the increase in the use of the installed capacity of two greenfield projects (Jataí and Caarapó) and (ii) the entry into operation of other co-generation projects which, aligned with the best sugar and ethanol prices, increased CAA’s revenues by 46.8%, changing to R$1.68 billion. CCL’s net revenues increased by 14.3%, totaling R$3.1 billion, mainly due to a 18.4% increase in diesel revenues, a 44.1 % increase in lubricants revenues and 10.1% increase in gasoline revenues. At Rumo, the beginning of transport operations, which is primarily based on the partnership agreement with ALL – America Latina Logística S.A., was the main responsible for the 218.1% increase in its net revenues, which totaled R$113.7 million, of which R$80.9 million resulted from services and transport and R$32.7 million from loading services.

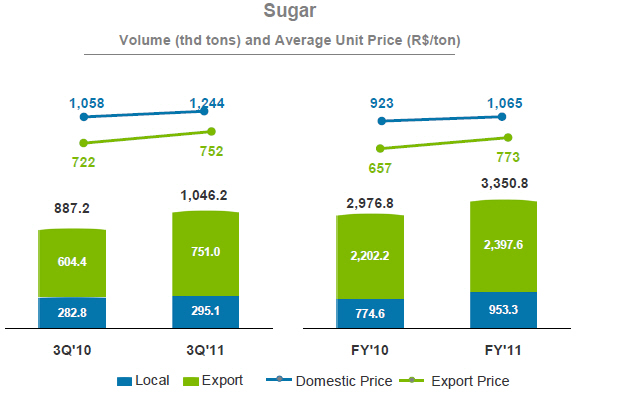

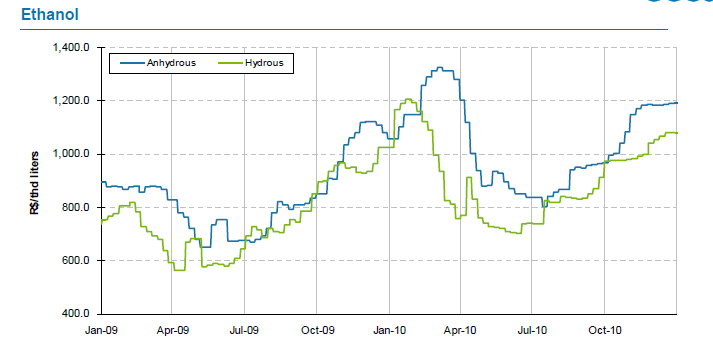

Sugar Sales - CAA

Sugar sales in the quarter totaled R $ 931.9 million, an increase of 26.7% over the same quarter last year. The main effects that contributed to the increase of R $ 196.3 million were:

| | Þ | Increase of R $ 131.8 million from the higher sales volume, 17.9% above the same quarter of last year. Domestic sales increased 4.4%, totaling 295.1 thousand tons, while exports amounted to 751.0 thousand tons, an increase of 24.2%; |

| | Þ | Increase of R $ 55.0 million due to prices 7.4% higher, while domestic prices were 17.5% higher, prices in international markets increased of only 4.2% compared with the same period of last year due to the hedge accounting effects. |

| | Þ | In contrast, the domestic market accounted for 28.2% of sales in comparison with 31.9% in the 3Q10. This mix reduction offset part of the gains of higher volumes and prices |

The amount of sugar in stock at the end of this quarter, of 998 thousand tons, fell by 18.8% compared to the 3Q10 and reflected the impacts of the sugar production lower than expected.

Sugar Inventories

| Inventories: Sugar | |

| | 3Q'10 | 3Q'11 |

| '000 ton | 1,229.3 | 998.3 |

| R$'MM | 614.0 | 582.7 |

| R$/ton | 499 | 584 |

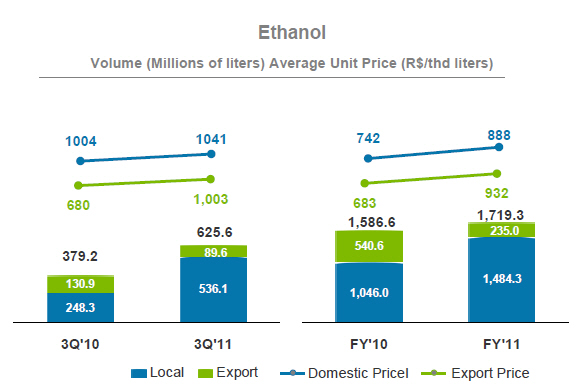

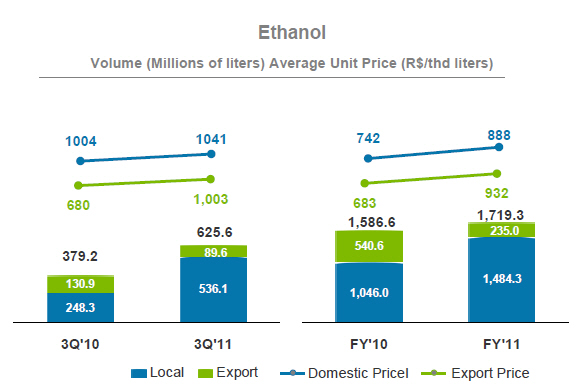

Ethanol Sales - CAA

Ethanol revenues in the 3Q11 totaled R$647.7 million, showing a strong increase of 91.5% compared to the 3Q10. It is important to stress the main factors that increased the revenues by R$ 309.5 million:

| | Þ | Increase of R$ 219.7 million due to higher sales volume, 65.0% higher than the 3Q10, resulting from the increase of 115.8% in volume sold in the domestic market, partially offset by a decrease of 31.6% in exports. It is worth mentioning that the sales volume in 3Q11 was impacted: |

| | o | In the domestic market, by the commercial decision to take the high prices of the product at the end of the harvest and reduce the risk of carrying a high inventory to sell it during the offseason; and |

| | o | In international markets, the export opportunity windows remain closed and thus the sales volume just follows the previously established trade agreements. Moreover, competition from ethanol produced in the U.S. has caused major difficulties for the sale of Brazilian ethanol in the European market. |

| | Þ | the increment of R$54.3 million from 3.7% higher prices in the domestic market and 47.6% higher in international markets; |

| | Þ | In addition, 3Q11 revenues increased by R$ 4.7 million due to the sales mix more focused on the domestic market, which showed slightly higher prices and represented 85.6% of the sales for the period, compared to 65.5% in the 3Q10. |

Throughout this year, the Company opted to keep a steady pace for their ethanol sales as evidenced in previous quarters.

The level of inventories in the 3Q11 showed a decrease of 12.6% compared to the 3Q10, even with production 20.5% higher than last year. This level is mainly a result of an increase of 65.0% in sales volume compared to the same quarter of last year.

| Inventories: Ethanol | |

| | 3Q'10 | 3Q'11 |

| '000 cbm | 645.0 | 563.9 |

| R$'MM | 569.6 | 492.5 |

| R$/cbm | 883 | 873 |

Cogeneration of Energy - CAA

The energy revenues totaled R$ 53.7 million through the sale of R$ 2.7 million in steam and 380,8 thousand MWh of energy at an average price of R$134.0 / MWh. The growth of 114.3% in the sales volume results from the startup of new cogeneration units (totaling 10 units this year, compared to 6 last year) and the ramp-up of the others.

Other Products and Services - CAA

CAA’s revenues from other products and services decreased by 5.9%, or R$3.1 million compared to the 3Q10, mainly due to: (i) the decrease in retail sales of DaBarra Alimentos products, such as breakfast foods, as a result of a strategic repositioning of Cosan Alimentos, and (ii) reduction in diesel sales mainly to service providers in the agriculture area, due to increased purchase of agricultural machinery and equipment which increased the Company's mechanization level.

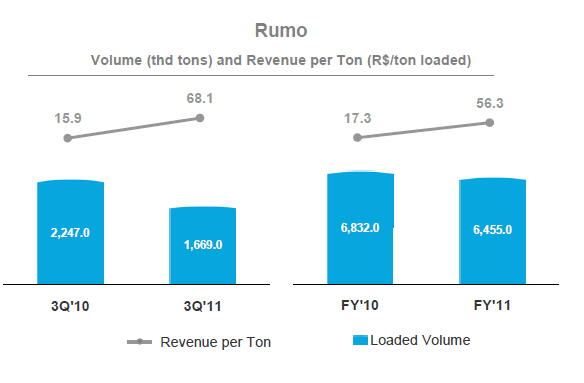

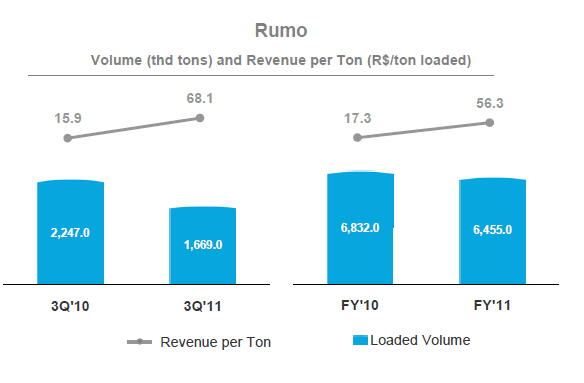

Rumo

Rumo’s net revenues of R$ 113.7 million in the 3Q11 was 218.1% higher than the 3Q10, reflecting the startup of transport operations in January 2010, which accounted for revenues of R$80.9 million. By reviewing Rumo’s operations separately, one can note a decrease of 8.4% in the revenues from loading services, of R$ 32.7 million, due to a reduction of 25.7% in the volume loaded, partially offset by the increase of 23.3% in the average price of this service.

The lower volume in this quarter reflected the crop shortfall, which reduced the availability of sugar to be exported. Of the total sugar loaded by Rumo in this quarter, CAA represented 35.0% or 589 thousand tons in the period. On the other hand, the increase of the average price of the port services was due to renegotiation of existing commercial contracts and the mix of the loading services with higher participation of white sugar (with margin and prices higher), from 6.5% on 3Q’10 to 10% on 3Q’11.

As a result of higher value added to the shipped product, mainly by the increase in transport operations, revenues per ton loaded this quarter was 4.3 times higher than in the 3Q10.

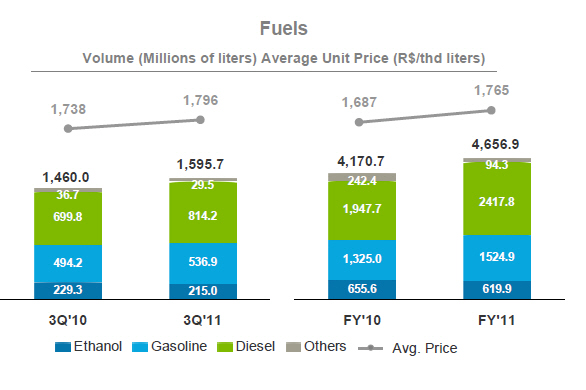

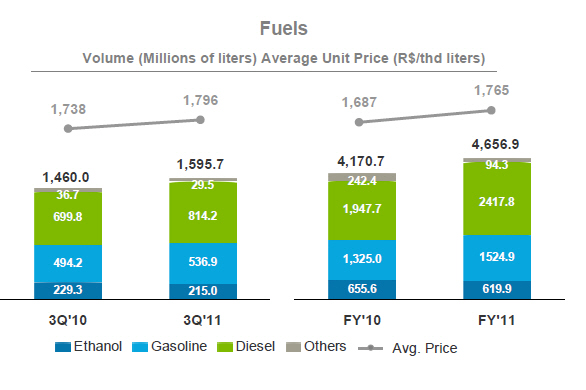

Fuel Sales - CCL

CCL’s net revenues amounted to R$3.1 billion in the 3Q11, 14.3% higher to that of the same quarter of the previous year, and the fuel revenues increased 13.0%, reaching R$2.7 billion. The main factors that affected the fuel revenues in this quarter were:

| | Þ | Increase of 16.4% in the volume of diesel sold in comparison with the 3Q10. This increase is due to the following factors: |

| | o | Increase of 6.9% in the diesel national consumption, according to ANP, in October and November 2010 (December data are not yet available) due to an increase in the industrial customers and transport demand in view of the recovery of the economic activity in Brazil. |

| | o | Market share gains in retail, mainly in the manufacturing industry. |

| | Þ | Increase of 8.7% in the gasoline C sales volume in relation to the 3Q10 due to an increase in the percentage of flex fuel car users, who are now opting for this fuel in substitution for the hydrated ethanol; |

| | Þ | Increase in the average unit prices of ethanol, gasoline and diesel and higher diesel market share in the sales mix, whose prices are higher than the ethanol. |

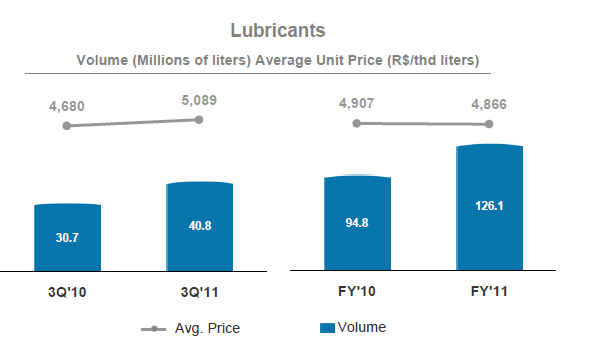

Lubricant Sales - CCL

The 44.1% increase in lubricant revenues, which totaled R$ 207.4 million in the quarter, results from the mix with a higher share of premium products with higher added value and the strong sales volume of 40.8 million liters due to the increase of the national consumption and market share gains, which was 11,1% on the accumulated data from April /09 to December/09 and increased to 13,5% on the same period of 2010 . It should be noted that, compared to the 2Q11, the lubricant sales volume decreased 4.1% due to the typical year-end seasonality, while the volume sold by the Sindicom associated companies decreased by approximately 9.0 %.

CCL’s inventories increased by 15.9%, aligned with the growth in the fuel sales volume. Analysing the inventory in days of sales, no significant change was found, remaining at about 9 days.

CCL Inventories

(Includes Fuels and Lubricants)

| Inventories: CCL | |

| | 3Q'10 | 3Q'11 |

| '000 cbm | 145.1 | 168.2 |

| R$'MM | 290.1 | 335.3 |

| R$/cbm | 1,999 | 1,994 |

Cost of Goods Sold

Cost of Products Sold totaled R$4.2 billion, in comparison with R$3.3 billion in the same quarter of the previous year. At CAA, the increase of 54.3%, or R$482.0 million, results mainly from the higher volume sold, increase in the activity that purchase the sugar for sale in the domestic market and increase in depreciation. At Rumo, the startup of transport activities was the main responsible for the 147.7% increase in the cost of the products sold. At CCL, the 14.2% in the cost of products sold, which amounted to R$2,863.3 million, is due mainly to the higher volume sold, higher diesel and gasoline share in the mix of products sold, in addition to the increase in the acquisition cost of ethanol.

| 3Q'10 | 3Q'11 | COGS per Product | YTD'10 | YTD'11 |

| (3,340.5) | (4,160.5) | Cost of Good Sold (R$MM) | (9,590.4) | (11,641.2) |

| (887.1) | (1,369.1) | CAA | (2,799.5) | (3,658.3) |

| (498.3) | (707.2) | Sugar | (1,429.0) | (1,947.8) |

| (314.2) | (576.8) | Ethanol | (1,178.5) | (1,492.2) |

| (74.6) | (85.1) | Others CAA + Cogeneration | (191.9) | (218.4) |

| (30.4) | (75.3) | Rumo | (88.9) | (248.0) |

| (2,506.8) | (2,863.3) | CCL | (6,992.8) | (8,250.5) |

| 83.7 | 147.2 | Eliminations from Consolidation | 290.8 | 515.7 |

| | | Average Unit Cost | | |

| | | CAA | | |

| 496 | 589 | Unit Cash COGS of Sugar (R$/ton) | 419 | 500 |

| 656 | 757 | Unit Cash COGS of Ethanol (R$/thd lit | 327 | 355 |

| 1,682 | 1,750 | CCL (R$/thousand liters) | 1,639 | 1,725 |

* the cash-cost of sugar and ethanol does not include depreciation and amortization of planted areas, agricultural depreciation (machinery and equipment), industrial depreciation and inter-harvest maintenance.

CAA

Since the beginning of this fiscal year we have presented the unit cost of sugar and ethanol excluding amortization and depreciation (cost-cash) effects aiming to better analyze their behavior over the quarters.

The depreciation and amortization effects on the unit costs reflected the investments made in the sugar cane planting, maintenance of our industrial units, harvest mechanization, the greenfield projects (Jataí and Caarapó), which entered into operation at the end of the former harvest, and the improvement of safety and sustainability of our operations.

Cost of products sold and services provided by CAA totaled R$1.4 billion, representing an increase of 54.3% or R$ 482.0 million compared to the same period of last year. The main factors behind this increase are:

| | Þ | higher volume of sugar and ethanol sold, which was responsible for the increase of R$293.5 million, |

| | Þ | R$ 152.2 million for sugar origination, characterized by the purchase of raw material for refining and finished product and subsequent sale and distribution in domestic market. |

| | Þ | Increase of approximately R$88.8 million due to an increase in the ATR according to Consecana formula (which defines suppliers’ remuneration and land lease), which changed from R$0.3524/kg of ATR to R$0.3766/kg of ATR. It is worth highlight that the |

ATR price increase impact is not only on the sugar cane harvested this quarter but on all previous quarters of this fiscal year, therefore with negative effects on the unit cost of this quarter;

| | Þ | the increase of R$32 million in depreciation due to the investments made over the years |

| | Þ | R$16.6 million due to take-or-pay contracts with service providers due to crop shortfall; |

| | Þ | All these factors were partially offset by the increase of the amount of ATR, which increased from 126.6kg / ton of cane to 138.5kg / ton due to more appropriate climatic conditions, improving the cost at R$82.9 million in the 3Q11. |

Rumo

The cost of products sold by Rumo in the 3Q11 was R$75.3 million and includes costs of port loading, transshipment, storage services and contracting of rail and road freights. In addition, the participation of the loading of the white sugar (bagged) increased over the total volume of sugar loaded, with higher costs and margin, reflecting an increase of Rumo´s COGS.

CCL

The cost of products sold by CCL increased by 14.2% compared to the 3Q10. Excluding the volume factor the unit cost of R$1,750m3 in the 3Q11 was 4.0% higher than the same quarter of the previous year. This results from the following factors:

| | Þ | Cost of ethanol 7.6% higher than the 3Q10; |

| | Þ | Sales mix with higher share of gasoline and diesel, which have unit costs higher than the ethanol; |

| | Þ | Increase in the unit cost of lubricants, however offset by the increase in revenues resulting from the sales mix with more share of products with higher added value. |

Gross Profit

With these results, the 3Q11 presented gross profit of R $ 577.9 million, 25.6% higher than the same period of the previous year, a margin of 12.2%. CAA has contributed with gross profits of R$313.9 million, a gross cash margin of 26.9% for ethanol and 33.9% for sugar, also benefited by the higher share of cogeneration results. Rumo, in turn, contributed with gross profits of R$38.3 million, with consolidated margin of 33.7%. At CCL, the gross margin remained constant at 7.2% but with a 4.7% increase in gross margin in Reais per thousand liters, which changed from R$129/thousand liters to R$135/thousand liters, benefited mainly by the lubricants business and the mix of products with a higher share of diesel and gasoline.

| 3Q'10 | 3Q'11 | Gross Margin per Product | YTD'10 | YTD'11 |

| | | Unitary Gross Margin | | |

| | | CAA | | |

| 333 | 302 | Gross Margin (Cash) Sugar (R$/ton) | 308 | 356 |

| 235 | 278 | Gross Margin (Cash) Ethanol (R$/thd liters) | 395 | 539 |

| 129 | 135 | CCL (R$/thousand liters) | 132 | 132 |

| | | % Gross Margin/Net Revenues | | |

| | | CAA | | |

| 40.1% | 33.9% | Gross Margin (Cash) Sugar | 42.4% | 41.6% |

| 26.4% | 26.9% | Gross Margin (Cash) Ethanol | 54.7% | 60.3% |

| 15.0% | 33.7% | Rumo | 24.6% | 31.8% |

| 7.1% | 7.2% | CCL | 7.5% | 7.1% |

Selling Expenses

Selling expenses increased by 24.1%, or R$52.6 million in relation to the 3Q10 mainly due to the increase in the volume sold by CAA and CCL, which resulted in more freight costs.

| 3Q'10 | 3Q'11 | Selling Expenses | YTD'10 | YTD'11 |

| (218.4) | (271.0) | Selling Expenses (R$MM) | (639.3) | (750.8) |

| (108.4) | (153.4) | CAA | (349.2) | (434.1) |

| - | - | Rumo | - | 0.1 |

| (107.3) | (113.4) | CCL | (295.4) | (319.7) |

| (2.6) | (4.1) | Elimination | 5.3 | 2.9 |

CAA

CAA’s selling expenses in the 3Q11 had a significant increase of 41.5%, reaching R$153.4 million, mainly due to the increase in the sugar sales volume both in the domestic and international markets. In addition, during this quarter the ethanol sales to domestic market under CIF modality increased, which includes logistics costs.

Rumo

Due to the nature of its business, Rumo does not have selling expenses.

CCL

CCL’s selling expenses increased by 5.7% or R$6.1 million, changing from R$113.4 million, mainly due to the increase in the volume sold. Accordingly, by analyzing the selling expenses in unit terms we can note a decrease of 3.7%, changing from R$72.0/m3 in the 3Q10 to R$69.3/ m3 in the 3Q11, benefited by the higher dilution of fixed costs as a result of a 9.8% increase in the volume sold.

General and Administrative Expenses

General and administrative expenses of R$132 million represented an increase of 12% in relation to the amount of R$117.9 million for the 3Q10. This increase refers to CAA and Rumo and reflects the efforts and investments, most of them not recurring, that have been made to improve the controls and management, but mainly aiming at a better operating efficiency for the time the

investments are concluded. On the other hand, CCL had a reduction of 7.6%. The main factors that caused impact on general and administrative expenses are described below.

| 3Q'10 | 3Q'11 | General & Administrative Expenses | YTD'10 | YTD'11 |

| (117.9) | (132.0) | G&A Expenses (R$MM) | (323.4) | (389.7) |

| (87.3) | (101.8) | CAA | (254.9) | (285.9) |

| (4.2) | (5.8) | Rumo | (12.3) | (20.8) |

| (26.4) | (24.4) | CCL | (56.2) | (83.0) |

CAA

General and administrative expenses of R$101.8 million in the 3Q11 increased by 16.6% when compared to the same quarter of last year. This increase of R$14.5 million is due mainly to nonrecurring expenses relating to the Shell Joint Venture process and costs for the areas of Safety, Environment and Sustainability.

Rumo

Rumo’s general and administrative expenses totaled R$5.8 million in the 3Q11, presenting an increase of 37.3%, as already expected due to the hiring of new executives. This results from the hiring of:

| | Þ | New executives to strength the Company’s management team and middle management; |

| | Þ | Consulting to review and renegotiate contracts of Rumo’s suppliers; |

| | Þ | Assistance to start and monitor the transport operations. |

CCL

CCL’s general and administrative expenses totaled R$24.4 million in the 3Q11, representing a decrease of 7.6%. It is worth noting that due to the phase of investments in improvements for the Company, CCL’s expenses are still being negatively impacted by nonrecurring expenses of approximately R$ 5.0 million related to adjustments to the transition to CAN and expenses with the transition team for the beginning of the Joint Venture with Shell.

EBITDA

With these results, Cosan reached EBITDA of R$410.5 million in the 3Q11, 16.9% lower than the EBITDA of the 3Q10, of R$490.4 million. Of this total CAA accounted for R$274.8 million, 33.9% lower than its EBITDA for the 3Q10. CCL accounted for R$98.1 million and Rumo R$37.7 million.

| 3Q'10 | 3Q'11 | EBITDA | YTD'10 | YTD'11 |

| 490.4 | 410.5 | EBITDA (R$MM) | 1,157.2 | 1,565.3 |

| 12.9% | 8.7% | | Margin | 10.6% | 11.6% |

| 415.8 | 274.8 | l | CAA | 881.5 | 1,164.7 |

| 35.2% | 16.3% | | Margin | 23.9% | 24.7% |

| 5.9 | 37.7 | l | Rumo | 34.8 | 117.9 |

| 16.4% | 33.2% | | Margin | 29.5% | 32.4% |

| 68.7 | 98.1 | l | CCL | 241.0 | 282.4 |

| 2.5% | 3.2% | | Margin | 3.2% | 3.2% |

CAA

Depreciation and amortization of R$223.6 million, 62.7% higher than those recorded in the 3Q10 (R$137.4 million), result from (i) higher sales volume in the period and (ii) the strong investment plan that is being implemented with the goal of increasing efficiencies of production through mechanization, cogeneration and industrial improvements, in addition to investments to expand sugar production capacity and milling capacity at new units (greenfields). Thus, CAA reported EBITDA of R$ 274.8 million, with a margin of 16.3%.

Rumo

Benefited by the entry into operation of the transportation activities, Rumo’s EBITDA in the 3Q11 reached R$37.7 million, with a margin of 33.2%, amount 6.4 times higher than in that of the 3Q10. Reflecting its investment program, depreciation and amortization showed an increase of 58.4%, reaching R$5.5 million in the period.

CCL

In the quarter, CCL had an EBITDA of R$98.1 million, with a margin of R$59.9 per thousand liters, or 3.2% of the net revenues, reflecting improved product mix of both fuel and lubricants. It is noteworthy that this EBITDA was negatively impacted by extraordinary expenses related to adjustments for the transition to CAN and the transition period for Shell Joint Venture, totaling R$5.0 million, partially offset by other nonrecurring revenues of R$4.2 million, related mostly to the sale of non-operating assets.

The depreciation and amortization of CCL increased by 15.6% compared to the 3Q10, to R$10.2 million, mainly due to (i) the start of the amortization of certain intangible assets, and (ii) amortization of investments in maintenance and repairs of gas stations, aimed at improving their images, and terminal expansion and reforms, such investments are higher than on previous years.

Financial Result

The Company reported net financial expense in the 3Q11 of R$97.8 million compared with a net financial expenses of R$78.3 million in the same quarter of the previous year.

Debt charges expenses increased 13.9% mainly due to higher average indebtedness of the Company, when compared with the same period of last year.

| 3Q'10 | 3Q'11 | Financial Expenses, Net (R$MM) | YTD'10 | YTD'11 |

| (111.3) | (126.8) | Interest on Financial Debt | (312.8) | (349.0) |

| 14.1 | 22.2 | Financial Investments Income | 41.7 | 58.4 |

| (97.2) | (104.6) | (=) Sub-total: Interest on Net Financial | (271.1) | (290.6) |

| (47.2) | (33.2) | Other charges and monetary variation | (85.5) | (83.9) |

| 50.1 | 59.3 | Exchange Variation | 628.9 | 214.8 |

| 18.0 | (17.0) | Gains (losses) with Derivatives | 162.2 | 6.3 |

| (2.0) | (2.3) | Others | (0.4) | (3.7) |

| (78.3) | (97.8) | (=) | Net Financial Expenses | 434.0 | (157.0) |

The net effect of exchange rate changes showed a gain of R$59.3 million in the 3Q11 compared to R$50.1 million in the 3Q10. The positive effect of the exchange variation is due to the impacts on assets and liabilities denominated in US dollars by the appreciation of local currency (real) against the US currency (dollar), which has appreciated by 1.7% this quarter compared with an appreciation of 2.1% in the same quarter of last year.

The result of derivatives in the quarter was negative at R$17.0 million compared with a positive result of R$18.0 million in the same quarter of last year, already net of the hedge accounting impacts discussed below.

The result of foreign exchange derivatives was positive in R$14.8 million in this quarter compared to R$46.9 million in the 3Q’10 and reflects the impact on the Company's short position, given its export profile, seeking coverage for its future sales denominated in US dollars in a scenario where the exchange rate depreciated 1.7% this quarter compared to 2.1% in the 3Q10.

In the context of commodity derivatives, mainly sugar, the Company had a negative effect of R$31.8 million in the 3Q11, net of the hedge accounting effects, compared with losses of R$28.9 million in the same quarter of last year due to the Company’s short position in sugar derivatives. It is worth noting that in the 3Q10 the Company did not apply the hedge accounting method.

The position of sugar volumes and prices set forth based on trading or financial instruments as of December 31, 2010, as well as foreign exchange derivative contracts aiming to hedge the Company’s future cash flows are summarized as follows:

| Summary of Hedge* as of December 31, 2010: | Fiscal Year | |

| | 2010/11 | 2011/12 |

| Sugar | | |

| NY#11 | | |

| Volume (thd tons) | 658.9 | 1,545.7 |

| Average Price (¢US$/lb) | 22.8 | 20.6 |

| London #5 | | |

| Volume (thd tons) | 19.1 | - |

| Average Price (US$/ton) | 779.3 | - |

| Ethanol | | |

| BM&F | | |

| Volume (cubic meters) | 1,200.0 | - |

| Average Price (R$/cbm) | 1,053.8 | - |

| US$ | | |

| Volume (US$ million) | 216.8 | 371.3 |

| Average Price (R$/US$) | 1.777 | 2.011 |

Gross debt charges totaled R$126.8 million, an increase of 13.9% compared with the 3Q10, resulting from the higher average indebtedness balance of the Company mainly due to the ongoing projects of investment both in CAA and Rumo, which demanded new credit facilities.

Impacts of Hedge Accounting

As of April 1, 2010, the Company adopted the cash flow hedge accounting method for certain derivative financial instruments designated to cover risks of price and exchange variations on revenues from sugar exports. In the quarter ended December 31, 2010, the Company recorded a deferral (reclassification between financial income (expenses) and the reserve account in the shareholders’ equity) of R$277.5 million of net losses on such derivatives. In the 3Q11 there was the allocation of loss on the variation of fair value of derivatives in the amount of R$84.9 million,

classified as net operating revenues. The table below shows the expectation of transfer of the balances reclassified from shareholders’ equity to net operating revenues, according to the coverage period of each instrument.

| | | Expected period to affect P&L | Total |

| Derivative | Market | Risk 2010/11 | 2011/12 |

| Future | OTC/NYBOT | #11 | (378.5) | (480.6) |

| NDF | OTC/CETIP | USD | 93.7 | 104.4 |

| (=) Hedge Accounting impact | | (284.8) | (376.2) |

| (-) Deferred income taxes | | 96.8 | 127.9 |

| (=) Other comprehensive income | | (188.0) | (248.3) |

Cosan closed the 3Q11 with net profits of R$27.9 million, compared with net profits of R$167.1 million in the 3Q10. The result of the 3Q11 was favored by higher volumes of CAA and CCL, better prices, mainly of sugar and ethanol, and the ramp-up of the transportation activities of Rumo and the cogeneration projects. However, this quarter was negatively impacted by the effects of the increase in the costs of CAA, mainly resulting from the effects of the shortfall and the cumulative effects of the ATR prices, in addition to more offer of sugar for resale with lower margins. Net profits for the same quarter of last year (3Q10) were also favored by the nonrecurring effect on Other operating revenues from the net gain obtained from the adhesion to the Tax Debt Installment Payment Program (REFIS IV).

D. Indebtedness

The gross financial debt, excluding Resolution 24711, totaled R$6.4 billion in the 3Q11, an increase of 12% in relation to R$5.7 billion in the 2Q11 and 24.7% higher than the indebtedness of R$5.1 billion existing at the end of the 3Q10.

In the 3Q11 the following fund amounts were raised: (i) R$514.0 million referring to the Perpetual Bond (equivalent to USD 300 million) used to settle short-term debts (ii) release of R$543.3 million in credit facilities from the National Bank for Economic and Social Development (BNDES) and the Government Agency for Machinery and Equipment Financing (Finame), mainly for energy cogeneration projects, greenfields, sugar farming mechanization and locomotive investments by Rumo; (iii) R$40 million from the Sugar-Alcohol Support Program (PASS). In addition, over the quarter there was amortization of R$458.2 million of principal and interests paid.

| Debt per Type (R$MM) | 3Q'10 | 2Q'11 | 3Q'11 | % ST | Var. |

| Foreign Currency | 3,415.8 | 3,460.3 | 3,666.4 | | 206.0 |

| Perpetual Notes | 792.8 | 771.4 | 1,264.9 | 1.2% | 493.5 |

| Senior Notes 2017 | 716.7 | 685.5 | 685.8 | 0.3% | 0.3 |

| Senior Notes 2014 | 632.3 | 601.1 | 605.3 | 3.7% | 4.2 |

| IFC | 90.9 | - | - | | - |

| FX Advances | 223.2 | 382.6 | 210.4 | 100.0% | (172.2) |

| Pre-Export Contracts | 960.0 | 845.8 | 731.5 | 37.9% | (114.4) |

| Export Credit Notes | - | 173.9 | 168.4 | 1.1% | (5.5) |

| Local Currency | 1,749.0 | 2,269.1 | 2,771.6 | | 502.5 |

| BNDES | 844.8 | 1,342.9 | 1,623.0 | 8.8% | 280.1 |

| Finame (BNDES) | 156.1 | 456.9 | 682.5 | 10.9% | 225.5 |

| Working Capital | 20.0 | 18.3 | 17.6 | 28.2% | (0.7) |

| Overdraft | 42.0 | 20.2 | 19.0 | 100.0% | (1.2) |

| Credit Banking Notes | 121.1 | - | - | 0.0% | - |

| Credit Notes | 510.5 | 314.8 | 305.8 | 50.9% | (9.1) |

| CDCA | 60.2 | 61.8 | 30.1 | 100.0% | (31.7) |

| PROINFA | 42.2 | - | - | 0.0% | - |

| Rural credit | - | 89.4 | 90.9 | 100.0% | 1.5 |

| PASS | - | - | 40.2 | 100.0% | 40.2 |

| Expenses with Placement of Debt | (47.7) | (35.3) | (37.4) | 26.5% | (2.1) |

| Gross Debt | 5,164.9 | 5,729.4 | 6,438.0 | 35.3% | 708.6 |

| Cash and Marketable Securities | 864.1 | 988.4 | 1,136.9 | | 148.5 |

| Net Debt | 4,300.8 | 4,741.0 | 5,301.1 | | 560.0 |

At the end of the 3Q11 Cosan's cash resources totaled R$1.1 billion, leading its indebtedness to R$5.3 billion, which is equivalent to 2.48 times the EBITDA for the past twelve months.

1 As disclosed in Note 13 to the financial statements, this debt of Resolution 2471 is secured by National Treasury certificates acquired by the Company and recorded in noncurrent assets. For this reason, we did not include this debt in the indebtedness analysis.

E. Investments

The capital expenditures with investments in the 3Q11 totaled R$ 548.7 million, 36% above the same period of last year. This change is due to: (i) investments of R$123.6 million made by Rumo mainly on its new business of rail transportation, (ii) planting, totaling R$72.9 million and (iii) investments of R$66.4 million in mechanization and projects related to the Safety, Health and Environment areas. A summary of the investments in the main areas can be found below:

| 3Q'10 | 3Q'11 | Capex (R$MM) | YTD'10 | YTD'11 |

| 146.7 | 265.9 | CAA - Operating Capex | 410.1 | 731.5 |

| 48.2 | 72.9 | l | Sugar Cane Planting Costs | 164.7 | 261.3 |

| 36.7 | 55.7 | l | Inter-harvest Maintenance Costs | 63.3 | 111.4 |

| 7.8 | 31.0 | l | SSMA & Sustaining | 14.6 | 83.1 |

| - | 35.4 | l | Mecanização | - | 122.6 |

| 54.0 | 70.9 | l | Projects CAA | 167.5 | 153.0 |

| 231.3 | 110.2 | CAA - Expansion Capex | 728.7 | 341.4 |

| 93.5 | 84.9 | l | Co-generation Projects | 264.5 | 198.8 |

| 97.5 | 17.4 | l | Greenfield | 416.1 | 60.0 |

| 40.4 | 7.9 | l | Expansion | 48.1 | 82.6 |

| 378.0 | 376.1 | CAA - Total | 1,138.8 | 1,072.8 |

| 20.5 | 49.0 | CCL | | 39.7 | 96.3 |

| 2.5 | 123.6 | Rumo | | 4.0 | 374.4 |

| 401.0 | 548.7 | (=) | Consolidated Capex | 1,182.5 | 1,543.5 |

| 14.7 | - | l | Investments | (14.6) | 21.0 |

| (1.8) | (2.2) | l | Cash received on Sale of Fixed Assets | (121.0) | (20.1) |

| 413.9 | 546.5 | (=) | Investment Cash Flow | 1,046.9 | 1,544.4 |

| * mechanization during 3Q10 is under CAA Projects | | |

CAA

In the 3Q11 the Company maintained the high level of investments in planting and interharvest maintenance, which showed an increase of 51.2% and 52.1%, respectively, when compared with the same period of last year, totaling R$128.6 million. In the first three quarters of this year 56.6 thousand hectares were planted, an increase of 47% compared to 38.5 thousand hectares in the same period of last year. With regard to soil tillage in areas not yet planted the growth was also relevant, being approximately 43% higher compared to the same period of last year.

Investments in Safety, Health and Environment (SSMA) were significant in the 3Q11, an increase of 297.5% compared to the same quarter of the previous year. Of the total investment amount in the year, approximately 93% was allocated to investments in projects of vignasse (a liquid byproduct resulting from the processing of ethanol and reused as fertilizer), aiming to reduce its exposure from the mill to the agriculture areas.

Investments in agricultural mechanization remained significant for the quarter, totaling R$35.4 million, composed primarily of agricultural machinery and equipment and fitness of its units to receive the sugarcane from the mechanical harvesting.

CAA projects accounted for R$70.9 million of the total investments in the third quarter, amount 25.5% higher than the amount of R$56.5 million for the same period of last year. Such growth shows that the Company continues to maintain substantial investments in its production units in the processing and agricultural areas.

Cogeneration investments totaled R$84.9 million, of which 84.5% were for Ipaussu and Univalem units. Other units have far less significant realizations, since their projects are already in the final stage of implementation.

The greenfield projects of Cosan, Jataí (GO) and Caarapó (MS) accounted for investments of R$17.4 million in this quarter, of which R$13.9 million in Jataí and R$3.5 million in Caarapó. Of the total investments in Jataí for this period, approximately 69% were allocated to the industrial area.

Investments in expanding sugar plant capacity totaled R$ 7.9 million, 80.4% lower than the investments of the same period of last year. This reduction is due to the completion of the projects of the Gasa, Ipaussu, Bonfim, Junqueira, Tamoio and Costa Pinto units. Construction works remain only at Barra unit, in connection with the processing, logistics and bagging areas.

Rumo

In the 3Q11 Rumo had investments of R$ 123.6 million, in line with the amount invested in the last two quarters of this year. Of this amount, approximately 32% were allocated for the purchase of locomotives and 61% for investments in construction of permanent way.

CCL

In the 3Q11, CCL's capital expenditure for investment in productive capital totaled R$49.0 million, representing an increase of 139% when compared to the same quarter of last year, and 104.8% for the year, when compared to the same period of last year. The main investments in this period focused on the line of supply and distribution and in the fuels distribution bases.

| | Þ | On November 22, Cosan S.A. approved the Buyback Program relating to its common shares for maintenance in treasure, cancelation or sale, with a 365 term. As of December 31, 2010, the Company had purchased 591,400 of its own shares. |

| | Þ | On November 23, Cosan S.A. informed that it entered into an Association Commitment with Camargo Correa Óleo e Gás S.A., Copersucar S.A., Odebrecht Transport Participações S.A., Petróleo Brasileiro S.A. and Uniduto Logística S.A. aiming to establish a joint venture to construct and operate a multimodal logistics system for transportation and storage of liquids, mainly ethanol. |

| | Þ | On January 4, 2011 the Company announced the receipt of unconditional release from the European Committee to form the previously announced Joint Venture with Shell International Petroleum Company Limited involving certain of their assets, and it may now focus on the conclusion of the conditions precedent of the agreement and the business unit integration process for launching the new company. |

| | Þ | On January 7, Cosan entered into a Binding Memorandum of Understandings with the partners of Usina Zanin Açúcar e Álcool Ltda., with exclusivity period of 45 days, aiming the purchase of the total outstanding equity interests of Zanin at the amount of R$142.0 million. In addition, the Company will assume financial debts in the amount of R$236.6 million. This transaction will involve Zanin industrial and agricultural assets with annual crushing capacity of approximately 2.6 million tons of cane, and a greenfield project located in the City of Prata, State of Minas Gerais. |

| | Þ | On January 17, Cosan Combustíveis e Lubrificantes, holder of the license to use the trademarks Esso and Mobil in Brazil, and Banco Santander announced the launching, in the first quarter 2011, of the Esso Santander credit card aiming to strengthen the relationship with consumers of the Esso network. |

| | Þ | On January 18, Rumo Logística and São Martinho announced the 2nd phase of the agreement for logistics projects and services of storage, transshipment and rail transportation of sugar. This phase estimates investments of approximately R$30.0 million in Usina São Martinho for the construction of a sugar warehouse and modernization of the plant’s extension access to the Pradópolis yard. These investments will increase the transshipment capacity to up to 2,000,000 tons of sugar per year. Any rail transportation adjustments to accomplish the transportation and transshipment obligations shall be responsibility of Rumo, as already provided for in its investment plan. |

G. Guidance

This section contains guidance ranges for selected key parameters of the Company for the fiscal year 2011, which began on April 1st, 2010 and will end on March 31st, 2011. Note that statements in other sections of this letter may also contain projections. These projections and guidance are merely estimates and indicative, and should not be construed as a guarantee of future performance. This guidance takes into consideration the operations held by the Cosan group today, which includes CAA, CCL, and Rumo Logística.

A new update of this fiscal year guidance is shown below due to the shortfall of sugar in the Brazilian Center- South region impacting Rumo´s loaded volume and reducing the estimates for sugar exports on the second half of this fiscal year.

On the other hand, due to market share gains and the growth of the Brazilian economy, the lubricants volume should be higher than previously estimated.

Due to the proximity of the end of fiscal year and consequent better visibility of the year-end results, the range of the guidance for the expected EBITDA was narrowed.

| Guidance | 2009FY | 2010FY | 2011FY - New |

| Crushed Sugarcane Volume (thousand tons) | 43,127 | 50,314 | 54,000 | ≤ ∆ ≤ 58,000 |

| Sugar Volume Sold (thousand tons) | 3,187 | 4,135 | 4,100 | ≤ ∆ ≤ 4,500 |

| Ethanol Volume Sold (million liters) | 1,671 | 2,148 | 2,000 | ≤ ∆ ≤ 2,200 |

| Volume of Energy Sold (thousand MW) | - | 596 | 1,000 | ≤ ∆ ≤ 1,300 |

| Loading Volume (thousand tons) | 3,479 | 8,124 | 7,500 | ≤ ∆ ≤ 8,500 |

| Transportation Volume (thousand tons) | - | - | 5,000 | ≤ ∆ ≤ 6,000 |

| Volume of Fuels Sold (million liters) | 1,681 | 5,491 | 5,700 | ≤ ∆ ≤ 6,200 |

| Volume of Lubes Sold (million liters) | 34 | 131 | 150 | ≤ ∆ ≤ 170 |

| Net Revenues (R$ MM) | 6,270 | 15,336 | 16,500 ≤ ∆ ≤ 18,500 |

| EBITDA (R$ MM) | 718 | 1,733 | 2,000 | ≤ ∆ ≤ 2,200 |

| Net Profit/Loss (R$ MM) | (474) | 986 | | * |

| Capex (R$ MM) | 1,346 | 1,926 | 1,900 | ≤ ∆ ≤ 2,300 |

H. Financial Statements of Cosan S.A. - BRGAAP

| Income Statement | Apr'08 | Mar'09 | Mar'10 | Dec'09 | Mar'10 | Jun'10 | Sep'10 | Dec'10 |

| (In million of reais) | FY'08 | FY'09 | FY'10 | 3Q'10 | 4T'10 | 1T'11 | 2T'11 | 3T'11 |

| Gross Operating Revenue | 2,978.6 | 6,732.8 | 16,685.9 | 4,145.1 | 4,790.0 | 4,369.4 | 5,199.8 | 5,192.9 |

| (-) | Sales Taxes and Deductions | (242.5) | (462.7) | (1,349.8) | (344.6) | (395.9) | (369.8) | (483.7) | (454.5) |

| (=) Net Operating Revenue | 2,736.2 | 6,270.1 | 15,336.1 | 3,800.5 | 4,394.1 | 3,999.6 | 4,716.1 | 4,738.4 |

| (-) | Cost of Goods Sold and Services Rendered | (2,387.1) | (5,470.7) | (13,210.7) | (3,340.5) | (3,620.3) | (3,493.1) | (3,987.6) | (4,160.5) |

| (=) Gross Profit | 349.0 | 799.4 | 2,125.4 | 460.0 | 773.9 | 506.6 | 728.5 | 577.9 |

| | Margin | 12.8% | 12.7% | 13.9% | 12.1% | 17.6% | 12.7% | 15.4% | 12.2% |

| (-) | Operating Income (Expenses): | (418.0) | (1,508.5) | (712.5) | (206.9) | (377.4) | (477.4) | (141.8) | (502.7) |

| (-) | Selling | (301.3) | (432.6) | (864.6) | (218.4) | (225.3) | (215.2) | (264.6) | (271.0) |

| (-) | General and Administrative | (210.2) | (275.9) | (497.2) | (117.9) | (173.7) | (120.2) | (137.5) | (132.0) |

| (-) | Financial Income (Expenses), Net | 284.3 | (817.4) | 420.4 | (78.3) | (13.7) | (139.3) | 80.2 | (97.8) |

| (±) Earnings (Losses) on Equity Investments | 6.6 | 14.0 | (18.6) | (9.4) | (5.8) | (0.4) | (3.8) | 1.7 |

| (-) | Goodwill Amortization | (201.4) | (196.5) | (85.6) | - | - | - | - | - |

| (±) Other Operating Income (Expenses), Net | 4.0 | 199.9 | 333.1 | 217.0 | 41.1 | (2.3) | 183.9 | (3.6) |

| (=) Operating Income (Loss) | (69.0) | (709.1) | 1,412.9 | 253.0 | 396.5 | 29.1 | 586.7 | 75.2 |

| | Margin | -2.5% | -11.3% | 9.2% | 6.7% | 9.0% | 0.7% | 12.4% | 1.6% |

| (±) Income and Social Contribution Taxes | 18.7 | 234.7 | (433.8) | (85.3) | (86.9) | (18.5) | (127.2) | (39.7) |

| (±) | Minority Interest | 2.5 | 0.6 | 7.5 | (0.7) | (0.9) | (1.9) | (19.8) | (7.6) |

| (=) Net Income (Loss) for the Year | (48.0) | (474.0) | 986.5 | 167.0 | 309.0 | 9.0 | 440.0 | 28.0 |

| | Margin | -1.8% | -7.6% | 6.4% | 4.4% | 7.0% | 0.2% | 9.3% | 0.6% |

l EBITDA | 182.9 | 718.0 | 1,733.1 | 490.4 | 575.9 | 358.0 | 796.7 | 410.5 |

| | Margin | 6.7% | 11.5% | 11.3% | 12.9% | 13.1% | 9.0% | 16.9% | 8.7% |

l Depreciation & Amortization | 341.3 | 427.2 | 636.3 | 149.7 | 160.0 | 189.2 | 286.4 | 239.2 |

| | | | | | | | | |

| Balance Sheet | Apr'08 | Mar'09 | Mar'10 | Dec'09 | Mar'10 | Jun'10 | Sep'10 | Dec'10 |

| (In million of reais) | FY'08 | FY'09 | FY'10 | 3Q'10 | 4T'10 | 1T'11 | 2T'11 | 3T'11 |

| Cash and Cash Equivalents | 1,010.1 | 719.4 | 1,078.4 | 864.1 | 1,078.4 | 1,054.9 | 988.4 | 1,136.9 |

| Restricted Cash | 79.6 | 11.8 | 45.0 | 172.1 | 45.0 | 51.3 | 76.0 | 276.2 |

| Derivative Financial Instruments | 6.9 | 17.0 | 230.6 | 72.0 | 230.6 | 144.5 | 166.0 | 180.0 |

| Trade Accounts Receivable | 215.2 | 599.2 | 766.4 | 511.1 | 766.4 | 619.1 | 760.0 | 657.5 |

| Inventories | 570.5 | 1,106.2 | 1,046.7 | 1,936.8 | 1,046.7 | 1,433.7 | 1,938.8 | 2,010.0 |

| Advances to Suppliers | 226.1 | 206.0 | 235.6 | 241.2 | 235.6 | 323.5 | 293.9 | 268.6 |

| Related Parties | 16.3 | 57.2 | 24.9 | 24.6 | 24.9 | 49.9 | 21.2 | 20.3 |

| Deferred Income and Social Contribution Taxes | - | 42.5 | 76.3 | 29.2 | 76.3 | 94.6 | 94.5 | 100.9 |

| Recoverable Taxes | 129.8 | 265.4 | 327.9 | 307.8 | 327.9 | 355.4 | 396.4 | 401.1 |

| Other Assets | 17.9 | 50.3 | 61.2 | 54.0 | 61.2 | 68.3 | 71.9 | 102.8 |

| | Current Assets | 2,272.4 | 3,074.9 | 3,892.8 | 4,212.8 | 3,892.8 | 4,195.1 | 4,807.1 | 5,154.3 |

| Accounts Receivable from Federal Government | 342.2 | 323.4 | 333.7 | 331.4 | 333.7 | 336.3 | 339.2 | 342.1 |

| CTN's-Restricted Brazilian Treasury Bills | 151.7 | 177.6 | 205.7 | 194.6 | 205.7 | 217.6 | 228.5 | 242.6 |

| Deferred Income and Social Contribution Taxes | 357.0 | 700.0 | 560.1 | 334.2 | 560.1 | 521.5 | 576.1 | 645.0 |

| Advances to Suppliers | 77.3 | 48.0 | 63.7 | 132.5 | 63.7 | 52.5 | 65.1 | 85.5 |

| Related Parties | - | - | 81.4 | 149.9 | 81.4 | 79.6 | 77.8 | 76.0 |

| Other Assets | 94.4 | 132.4 | 211.8 | 210.8 | 211.8 | 216.7 | 225.2 | 262.8 |

| Investments | 120.3 | 278.2 | 193.1 | 194.0 | 193.1 | 193.6 | 207.6 | 208.7 |

| Property, Plant and Equipment | 2,776.3 | 3,465.2 | 5,561.1 | 4,871.5 | 5,561.1 | 5,836.0 | 5,878.4 | 6,173.9 |

| Intangible | 1,160.7 | 2,447.5 | 2,901.3 | 2,765.5 | 2,901.3 | 2,921.2 | 2,931.8 | 2,938.1 |

| | Noncurrent Assets | 5,079.9 | 7,572.5 | 10,112.0 | 9,184.4 | 10,112.0 | 10,375.0 | 10,529.8 | 10,974.7 |

| (=) Total Assets | 7,352.4 | 10,647.4 | 14,004.8 | 13,397.2 | 14,004.8 | 14,570.1 | 15,336.9 | 16,129.0 |

| Loans and Financings | 78.2 | 1,449.5 | 800.9 | 892.6 | 800.9 | 860.3 | 1,058.6 | 1,129.1 |

| Derivatives Financial Instruments | 50.7 | 66.9 | 76.7 | 232.9 | 76.7 | 37.4 | 96.1 | 379.0 |

| Trade Accounts Payable | 191.0 | 456.1 | 569.4 | 712.1 | 569.4 | 716.3 | 832.1 | 754.4 |

| Salaries Payable | 80.7 | 93.2 | 141.6 | 133.0 | 141.6 | 219.9 | 225.5 | 175.6 |

| Taxes and Social Contributions Payable | 116.1 | 168.6 | 215.9 | 201.0 | 215.9 | 197.4 | 239.2 | 218.8 |

| Related Parties | - | 5.2 | 14.4 | 50.5 | 14.4 | 120.1 | 66.0 | 74.6 |

| Dividendos a pagar | - | - | 116.6 | - | 116.6 | 116.6 | 7.0 | 7.0 |

| Other Liabilities | 49.9 | 85.8 | 182.4 | 123.4 | 182.4 | 189.4 | 198.4 | 180.3 |

| | Current Liabilities | 566.5 | 2,325.2 | 2,117.9 | 2,345.5 | 2,117.9 | 2,457.3 | 2,722.8 | 2,918.9 |

| Loans and Financing | 2,106.2 | 2,885.5 | 5,136.5 | 4,859.1 | 5,136.5 | 5,322.7 | 5,310.8 | 5,961.7 |

| Taxes and Social Contributions Payable | 359.3 | 328.8 | 593.5 | 255.7 | 593.5 | 597.9 | 606.3 | 618.7 |

| Provision for Legal Proceedings | 832.4 | 1,105.9 | 444.4 | 755.7 | 444.4 | 456.1 | 469.3 | 469.2 |

| Related Parties | - | 405.2 | - | - | - | - | - | - |

| Pension Fund | - | 60.4 | 61.8 | 61.6 | 61.8 | 59.8 | 57.8 | 53.6 |

| Other Liabilities | 144.4 | 139.9 | 493.1 | 155.8 | 493.1 | 487.8 | 575.8 | 610.0 |

| | Noncurrent Liabilities | 3,442.3 | 4,925.5 | 6,729.3 | 6,087.8 | 6,729.3 | 6,924.2 | 7,020.0 | 7,713.2 |

| | Minority Shareholders' Interest | 17.7 | 30.9 | 47.8 | 47.0 | 47.8 | 49.7 | 246.5 | 253.6 |

| Capital | 2,935.3 | 3,819.8 | 4,687.8 | 4,687.7 | 4,687.8 | 4,687.8 | 4,691.1 | 4,691.1 |

| Capital Reserve | - | 41.7 | 50.6 | 50.1 | 50.6 | 51.1 | 51.5 | 36.1 |

| Profits Reserve | 180.2 | - | 374.2 | - | 374.2 | 374.2 | 290.8 | 290.8 |

| Legal Reserve | 16.0 | - | - | - | - | - | - | - |

| Revaluation Reserves | 194.4 | - | - | - | - | - | - | - |

| Ajuste de Avaliação Patrimonial | - | - | (2.9) | - | (2.9) | 17.0 | (134.3) | (251.1) |

| Accumulated losses | - | (495.7) | - | 179.1 | - | 8.7 | 448.4 | 476.3 |

| | Shareholders' Equity | 3,325.8 | 3,365.7 | 5,109.8 | 4,917.0 | 5,109.8 | 5,138.9 | 5,347.6 | 5,243.3 |

| (=) Total Liabilities & Shareholders' Equity | 7,352.4 | 10,647.4 | 14,004.8 | 13,397.2 | 14,004.8 | 14,570.1 | 15,336.9 | 16,129.0 |

| Cash Flow Statement | Apr'08 | Mar'09 | Mar'10 | Dec'09 | Mar'10 | Jun'10 | Sep'10 | Dec'10 |

| (In millions of reais) | FY'08 | FY'09 | FY'10 | 3Q'10 | 4T'10 | 1T'11 | 2T'11 | 3T'11 |

| Net Income (Loss) for the Year | (47.8) | (473.8) | 986.5 | 167.1 | 308.7 | 8.7 | 439.7 | 27.9 |

| Non-cash Adjustments: | | | | | | | | |

| Earnings (Losses) from Equity Investments | (6.6) | (14.0) | 18.6 | 9.4 | 5.8 | 0.4 | 3.8 | (1.7) |

| Depreciation & Amortization | 341.3 | 427.2 | 636.3 | 149.7 | 160.0 | 189.2 | 286.4 | 239.2 |

| Losses (Gains) in Fixed Assets Disposals | (1.2) | (208.9) | (80.5) | 1.1 | 20.8 | 3.1 | (11.8) | 2.1 |

| Goodwill Amortization | 201.4 | 196.5 | 85.6 | - | - | - | - | - |

| Accrued Financial Expenses | (116.0) | 932.5 | (150.5) | (60.5) | 281.9 | 162.6 | (56.0) | 61.6 |

| Other Non-cash Items | (42.4) | (197.9) | 104.2 | (154.1) | 51.2 | 38.8 | (90.5) | 24.5 |

| (=) Adjusted Net Profit (Loss) | 328.8 | 661.5 | 1,600.3 | 112.6 | 828.3 | 402.7 | 571.6 | 353.6 |

| (±) Variation on Assets and Liabilities | (360.1) | (234.5) | (42.5) | (142.7) | 217.3 | 96.6 | (725.2) | (286.3) |

| (=) Cash Flow from Operating Activities | (31.3) | 427.0 | 1,557.8 | (30.1) | 1,045.7 | 499.3 | (153.7) | 67.3 |

| Additions on Investments, Net of Cash Received | (160.5) | (1,823.6) | (16.0) | (14.7) | (30.7) | (8.2) | (12.7) | - |

| Additions on Property, Plant and Equipment | (1,053.1) | (1,346.1) | (1,926.1) | (401.0) | (745.4) | (595.9) | (398.9) | (548.8) |

| Cash Received on Sale of Fixed Asset | 12.2 | 372.1 | 126.2 | 1.8 | 5.3 | 0.7 | 17.2 | 2.2 |

| (=) Cash Flow from Investment Activities | (1,201.4) | (2,797.6) | (1,816.0) | (413.9) | (770.9) | (603.5) | (394.4) | (546.6) |

| Additions of Debt | 198.3 | 1,478.0 | 3,427.9 | 1,665.5 | 543.8 | 642.4 | 495.9 | 1,101.2 |

| Payments of Principal and Interest on Debt | (839.4) | (257.2) | (2,846.6) | (1,838.4) | (563.1) | (561.6) | (224.7) | (458.2) |

| Capital Increase | 1,742.6 | 884.5 | 533.9 | 532.4 | 0.1 | - | - | - |

| Treasury Stock | - | (4.2) | - | - | - | - | - | (15.2) |

| Capital Increase by noncontrolling | - | 15.4 | - | - | - | - | 403.3 | - |

| Dividends | (75.8) | - | - | - | - | - | (193.0) | - |

| Other | - | (36.6) | (498.0) | - | (41.3) | - | - | - |

| (=) Cash Flows from Financing Activities | 1,025.7 | 2,079.9 | 617.1 | 359.5 | (60.5) | 80.7 | 481.5 | 627.8 |

| (=) Total Cash Flow | (207.0) | (290.7) | 359.0 | (84.6) | 214.3 | (23.5) | (66.5) | 148.5 |

| (+) Cash & Equivalents, Beginning | 1,217.1 | 1,010.1 | 719.4 | 948.6 | 864.1 | 1,078.4 | 1,054.9 | 988.4 |

| (=) Cash & Equivalents, Closing | 1,010.1 | 719.4 | 1,078.4 | 864.1 | 1,078.4 | 1,054.9 | 988.4 | 1,136.9 |

| | | | | | | | | |

| Credit Statistics (LTM) | Apr'08 | Mar'09 | Mar'10 | Dec'09 | Mar'10 | Jun'10 | Sep'10 | Dec'10 |

| (In million of reais) | FY'08 | FY'09 | FY'10 | 3Q'10 | 4T'10 | 1T'11 | 2T'11 | 3T'11 |

| Net Operating Revenues | 2,736.2 | 6,270.1 | 15,336.1 | 13,291.7 | 15,336.1 | 15,769.6 | 16,910.3 | 17,848.3 |

l Gross Profit | 349.0 | 799.4 | 2,125.4 | 1,591.4 | 2,125.4 | 2,264.2 | 2,468.9 | 2,586.8 |

l EBITDA | 182.9 | 718.0 | 1,733.1 | 1,323.1 | 1,733.1 | 1,779.9 | 2,220.9 | 2,141.1 |

l EBIT | (158.4) | 290.8 | 1,096.8 | 824.7 | 1,096.8 | 1,124.3 | 1,435.7 | 1,266.3 |

l Net Financial Expenses | 106.2 | 179.9 | 361.8 | 329.8 | 361.8 | 367.7 | 373.9 | 381.2 |

l Net Profit | (47.8) | (473.8) | 986.5 | 637.5 | 986.5 | 657.9 | 924.3 | 785.1 |

| Liquid Funds | | | | | | | | |

l Cash and Cash Equivalents | 1,010.1 | 719.4 | 1,078.4 | 864.1 | 1,078.4 | 1,054.9 | 988.4 | 1,136.9 |

| Short-Term Debt | | | | | | | | |

l Loans and Financings | 69.3 | 1,442.7 | 793.8 | 886.5 | 793.8 | 848.5 | 1,044.7 | 1,122.4 |

| Long-Term Debt | | | | | | | | |

l Loans and Financings | 1,562.5 | 2,312.3 | 4,540.0 | 4,278.4 | 4,540.0 | 4,709.3 | 4,684.7 | 5,315.5 |

| Total Debt | 1,631.8 | 3,755.0 | 5,333.8 | 5,164.9 | 5,333.8 | 5,557.8 | 5,729.4 | 6,438.0 |

| Net Debt | 621.7 | 3,035.6 | 4,255.4 | 4,300.8 | 4,255.4 | 4,502.9 | 4,741.0 | 5,301.1 |

| Current Assets | 2,272.4 | 3,074.9 | 3,892.8 | 4,212.8 | 3,892.8 | 4,195.1 | 4,807.1 | 5,154.3 |

| Current Liabilities | 566.5 | 2,325.2 | 2,117.9 | 2,345.5 | 2,117.9 | 2,457.3 | 2,722.8 | 2,918.9 |

| Shareholders' Equity | 3,325.8 | 3,365.7 | 5,109.8 | 4,917.0 | 5,109.8 | 5,138.9 | 5,347.6 | 5,243.3 |

| Capex - Property, Plant and Equipment | 1,053.1 | 1,346.1 | 1,180.7 | 1,515.3 | 1,180.7 | 2,101.4 | 2,141.2 | 2,289.0 |

| EBITDA Margin | 6.7% | 11.5% | 11.3% | 10.0% | 11.3% | 11.3% | 13.1% | 12.0% |

l Gross Profit Margin | 12.8% | 12.7% | 13.9% | 12.0% | 13.9% | 14.4% | 14.6% | 14.5% |

l EBIT Margin | -5.8% | 4.6% | 7.2% | 6.2% | 7.2% | 7.1% | 8.5% | 7.1% |

l Net Profit Margin | -1.7% | -7.6% | 6.4% | 4.8% | 6.4% | 4.2% | 5.5% | 4.4% |

| Net Debt ÷ Shareholders' Equity | | | | | | | | |

l Net Debt % | 15.8% | 47.4% | 45.4% | 46.7% | 45.4% | 46.7% | 47.0% | 50.3% |

l Shareholders' Equity % | 84.2% | 52.6% | 54.6% | 53.3% | 54.6% | 53.3% | 53.0% | 49.7% |

| Long-Term Payable Debt to Equity Ratio | 0.5x | 0.7x | 0.9x | 0.9x | 0.9x | 0.9x | 0.2x | 0.2x |

| Liquidity Ratio (Current Assets ÷ Current Liabilities) | 4.0x | 1.3x | 1.8x | 1.8x | 1.8x | 1.7x | 1.8x | 1.8x |

| Net Debt ÷ EBITDA | 3.4x | 4.2x | 2.5x | 3.3x | 2.5x | 2.5x | 2.1x | 2.5x |

l Short-Term Net Debt ÷ EBITDA | 0.4x | 2.0x | 0.5x | 0.7x | 0.5x | 0.5x | 0.5x | 0.5x |

| Net Debt ÷ (EBITDA - Capex) | -0.7x | -4.8x | 7.7x | -22.4x | 7.7x | -14.0x | 59.5x | -35.8x |

| Interest Cover (EBITDA ÷ Net Financial Exp.) | 1.7x | 4.0x | 4.8x | 4.0x | 4.8x | 4.8x | 5.9x | 5.6x |

l Interest Cover (EBITDA - Op.Capes)÷Net Fin.) | -5.6x | 0.9x | 3.4x | 2.0x | 3.4x | 4.8x | 5.9x | 5.6x |

| Avg. Debt Cost (Net.Fin.Exp. ÷ Net Debt) | 17.1% | 5.9% | 8.5% | 7.7% | 8.5% | 8.2% | 7.9% | 7.2% |

| I. | Financial Statements of Cosan Limited– USGAAP |

| | | | | | | | | | | |

| | | | | | | | | | |

| Income Statement | Apr'08 | Apr'09 | Mar'10 | Dec'09 | Mar'10 | Jun'10 | Sep'10 | Dec'10 | |

| (In millions of U.S. dollars) | FY'08 | FY'09 | FY'10 | 3Q'10 | 4T'10 | 1T'11 | 2T'11 | | 3T'11 |

| Net sales | | 1,491.2 | 2,926.5 | 8,283.2 | 2,209.5 | 2,437.7 | 2,233.8 | 2,695.5 | 2,800.6 | |

| (-) | Cost of goods sold | (1,345.6) | (2,621.9) | (7,223.3) | (1,965.3) | (2,041.1) | (1,994.5) | (2,305.7) | (2,484.9) | |

| (=) Gross profit | 145.6 | 304.6 | 1,059.9 | 244.3 | 396.6 | 239.4 | 389.8 | | 315.7 | |

| (-) | Selling expenses | (168.6) | (213.3) | (470.3) | (128.0) | (125.2) | (122.7) | (151.2) | | (167.7) | |

| (-) | General and administrative expenses | (115.1) | (140.1) | (271.3) | (106.7) | (93.9) | (68.3) | (79.9) | | (81.1) | |

| (=) Operating income (loss) | (138.1) | (48.8) | 318.3 | 9.6 | 177.6 | 48.4 | 158.7 | | 66.9 | |

| | Operating margin | -9.3% | -1.7% | 3.8% | 0.4% | 7.3% | 2.2% | 5.9% | | 2.4% | |

| (-) Other income (expense): | | | | | | | | | | |

| | Financial | 116.8 | (370.8) | 203.7 | (80.4) | 4.2 | (62.3) | 61.8 | | (48.0) | |

| | Other | | (3.7) | (2.3) | 178.9 | 155.5 | 30.5 | (0.1) | (21.4) | | 4.2 | |

| (=) Income (loss) before income taxes | (25.0) | (421.9) | 700.9 | 84.7 | 212.3 | (14.0) | 199.1 | | 23.1 | |

| (-) | Income taxes expense (benefit) | 19.8 | 144.7 | (184.8) | (52.3) | (6.5) | (1.2) | (69.9) | | (15.3) | |

| (=) Income (loss) before equity | (5.2) | (277.2) | 516.2 | 32.4 | 205.8 | (15.3) | 129.2 | | 7.8 | |

| (±) Equity in income of affiliates | (0.2) | 6.1 | (10.3) | (3.8) | (4.8) | 0.6 | (2.1) | | 0.3 | |

| (±) Minority interest in net (income) loss | 22.0 | 83.0 | (174.0) | (7.3) | (77.0) | 2.8 | (50.4) | | (3.9) | |

| (=) Net income (loss) | 16.6 | (188.1) | 331.9 | 21.3 | 124.0 | (11.9) | 76.7 | | 4.2 | |

| | Margin | | 1.1% | -6.4% | 4.0% | 1.0% | 5.1% | -0.5% | 2.8% | | 0.2% | |

l EBITDA | 94.3 | 239.6 | 985.8 | 338.8 | 315.8 | 193.5 | 342.0 | | 242.5 | |

| | Margin | | 6.3% | 8.2% | 11.9% | 15.3% | 13.0% | 8.7% | 12.7% | | 8.7% | |

l EBIT | | (141.8) | (51.1) | 497.3 | 165.1 | 208.1 | 48.2 | 137.3 | | 71.1 | |

| | Margin | | -9.5% | -1.7% | 6.0% | 7.5% | 8.5% | 2.2% | 5.1% | | 2.5% | |

l Depreciation and amortization | 236.1 | 290.7 | 488.5 | 173.7 | 107.7 | 145.3 | 204.8 | | 171.4 | |

| Balance Sheet | Apr'08 | Mar'09 | Mar'10 | Dec'09 | Mar'10 | Jun'10 | Sep'10 | Dec'10 |

| (In millions of U.S. dollars) | FY'08 | FY'09 | FY'10 | 3Q'10 | 4T'10 | 1T'11 | 2T'11 | 3T'11 |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | 68.4 | 508.8 | 623.7 | 516.7 | 623.7 | 601.4 | 595.5 | 693.6 |

| Restricted cash | 47.2 | 5.1 | 25.3 | 98.8 | 25.3 | 28.5 | 44.8 | 165.8 |

| Marketable securities | 1,014.5 | - | - | - | - | - | - | - |

| Derivative financial instruments | 31.5 | 7.4 | 129.5 | 41.4 | 129.5 | 80.2 | 98.0 | 108.0 |

| Trade accounts receivable, net | 126.9 | 258.9 | 430.3 | 293.5 | 430.3 | 343.7 | 448.6 | 394.6 |

| Inventories | 337.7 | 477.8 | 587.7 | 1,112.3 | 587.7 | 795.8 | 1,144.4 | 1,206.3 |

| Advances to suppliers | 133.7 | 89.0 | 132.3 | 138.6 | 132.3 | 179.6 | 173.5 | 161.2 |

| Deferred income taxes | - | 114.6 | 184.1 | 176.8 | 184.1 | 197.3 | 255.6 | 240.7 |

| Other current assets | 103.2 | 66.0 | 49.2 | 54.1 | 49.2 | 66.6 | 33.5 | 74.3 |

| | 1,863.0 | 1,527.5 | 2,161.9 | 2,432.2 | 2,161.9 | 2,292.9 | 2,793.9 | 3,044.5 |

| Noncurrent assets: | | | | | | | | |

| Property, plant and equipment, net | 2,018.1 | 2,259.4 | 4,146.5 | 3,737.0 | 4,146.5 | 4,205.3 | 4,473.6 | 4,725.5 |

| Goodwill | 772.6 | 888.8 | 1,362.1 | 1,624.4 | 1,362.1 | 1,361.8 | 1,479.7 | 1,492.6 |

| Intangible assets, net | 106.1 | 243.1 | 602.3 | 255.3 | 602.3 | 582.2 | 592.8 | 592.1 |

| Accounts Receivable from Federal Government | 202.8 | 139.7 | 187.4 | 190.3 | 187.4 | 186.7 | 200.2 | 205.3 |

| Other non-current assets | 306.4 | 362.6 | 534.8 | 635.0 | 534.8 | 561.2 | 624.2 | 681.8 |

| | 3,406.1 | 3,893.6 | 6,833.0 | 6,442.0 | 6,833.0 | 6,897.2 | 7,370.5 | 7,697.3 |

| (=) Total assets | 5,269.1 | 5,421.1 | 8,994.9 | 8,874.2 | 8,994.9 | 9,190.2 | 10,164.4 | 10,741.9 |

| Liabilities and shareholders' equity | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Trade accounts payable | 114.4 | 197.2 | 320.0 | 409.3 | 320.0 | 397.9 | 491.6 | 453.2 |

| Taxes payable | 62.9 | 69.0 | 121.2 | 115.4 | 121.2 | 109.5 | 141.2 | 131.3 |

| Salaries payable | 47.8 | 40.2 | 79.5 | 76.4 | 79.5 | 122.1 | 133.1 | 105.4 |

| Current portion of long-term debt | 38.2 | 781.7 | 471.1 | 542.9 | 471.1 | 498.6 | 645.4 | 698.0 |

| Derivative financial instruments | 55.0 | 28.9 | 43.1 | 133.8 | 43.1 | 20.8 | 56.7 | 227.5 |

| Dividends payable | - | - | 24.7 | - | 24.7 | 24.4 | 1.3 | 1.2 |

| Deferred income taxes | - | - | - | - | - | - | - | - |

| Other liabilities | 40.8 | 47.6 | 112.0 | 111.0 | 112.0 | 173.5 | 157.9 | 155.1 |

| | 359.1 | 1,164.7 | 1,171.5 | 1,388.8 | 1,171.5 | 1,346.8 | 1,627.2 | 1,771.7 |

| Long-term liabilities: | | | | | | | | |

| Long-term debt | 1,249.3 | 1,251.1 | 2,845.7 | 2,802.2 | 2,845.7 | 2,917.6 | 3,096.3 | 3,540.0 |

| Estimated liability for legal proceedings | 494.1 | 497.6 | 294.6 | 464.8 | 294.6 | 297.7 | 326.7 | 336.0 |

| Taxes payable | 170.4 | 151.5 | 381.8 | 220.6 | 381.8 | 380.7 | 410.3 | 425.2 |

| Advances from customers | - | - | - | - | - | - | - | - |

| Deferred income taxes | 101.8 | 40.4 | 408.8 | 245.4 | 408.8 | 403.2 | 443.1 | 416.7 |

| Pension Fund | - | - | - | - | - | - | - | - |

| Other long-term liabilities | 101.7 | 175.0 | 209.4 | 219.5 | 209.4 | 205.3 | 215.2 | 213.7 |

| | 2,117.4 | 2,115.6 | 4,140.3 | 3,952.4 | 4,140.3 | 4,204.5 | 4,491.7 | 4,931.6 |

| Minority interest in consolidated subsidiaries | 796.8 | 544.5 | 1,338.9 | 1,296.7 | 1,338.9 | 1,324.1 | 1,570.9 | 1,569.4 |

| Shareholders' equity: | | | | | | | | |

| Common stock | 2.3 | 2.7 | 2.7 | 2.7 | 2.7 | 2.7 | 2.7 | 2.7 |

| Additional paid-in capital | 1,723.1 | 1,926.7 | 1,932.1 | 1,927.3 | 1,932.1 | 1,932.3 | 2,004.0 | 1,997.1 |

| Accumulated other comprehensive income | 171.8 | (243.6) | 167.1 | 188.1 | 167.1 | 149.4 | 231.2 | 228.5 |

| Retained earnings (losses) | 98.5 | (89.6) | 242.3 | 118.3 | 242.3 | 230.3 | 236.6 | 240.9 |

| Total shareholders' equity | 1,995.7 | 1,596.2 | 2,344.2 | 2,236.3 | 2,344.2 | 2,314.7 | 2,474.6 | 2,469.1 |

| (=) Total liabilities and shareholders' equity | 5,269.1 | 5,421.1 | 8,994.9 | 8,874.2 | 8,994.9 | 9,190.2 | 10,164.4 | 10,741.9 |

| Cash Flow Statement | Apr'08 | Mar'09 | Mar'10 | Dec'09 | Mar'10 | Jun'10 | Sep'10 | Dec'10 |

| (In millions of U.S. dollars) | FY'08 | FY'09 | FY'10 | 3Q'10 | 4T'10 | 1T'11 | 2T'11 | 3T'11 |

| l | Cash flow from operating activities: | | | | | | | | |

| Net income (loss) for the year/quarter | 16.6 | (188.1) | 331.9 | 21.3 | 124.0 | (11.9) | 76.7 | 4.2 |

| Adjustments to reconcile net income (loss) to cash provided by operating activities: | | | | | | |

| | Depreciation and amortization | 236.1 | 290.7 | 488.5 | 173.7 | 107.7 | 145.3 | 204.8 | 171.4 |

| | Deferred income and social contribution taxes | (52.4) | (145.3) | 143.3 | 52.3 | (35.0) | (5.3) | 42.9 | 14.8 |

| | Interest, monetary and exchange variation | (43.7) | 497.3 | (131.4) | (57.8) | 130.6 | 72.3 | (5.6) | (16.7) |

| | Minority interest in net income of subsidiaries | (22.0) | (83.0) | 174.0 | 7.3 | 77.0 | 1.1 | 46.5 | 3.9 |

| | Others | 15.2 | 14.5 | (137.3) | (99.0) | (2.7) | 11.5 | 25.5 | (25.7) |

| | | 149.8 | 386.1 | 869.0 | 97.8 | 401.6 | 213.0 | 390.7 | 152.0 |

| Decrease/increase in operating assets and liabilities: | | | | | | | | |

| | Trade accounts receivable, net | (57.1) | (23.7) | 1.4 | 46.9 | (93.6) | 85.1 | (85.1) | 81.3 |

| | Inventories | (31.7) | (85.9) | 126.2 | (198.8) | 415.1 | (158.0) | (261.3) | (41.5) |

| | Advances to suppliers | (8.4) | 21.1 | 37.4 | 27.0 | 41.9 | (42.6) | 7.3 | 2.4 |

| | Trade accounts payable | 33.7 | 33.4 | (26.1) | 0.9 | (81.4) | 81.5 | 73.5 | (44.0) |

| | Derivative financial instruments | 90.4 | 4.4 | (111.1) | 25.5 | (178.2) | 67.7 | (107.8) | 54.5 |

| | Taxes payable | (19.6) | (17.1) | 192.5 | (0.6) | 252.1 | (16.1) | 19.2 | (13.9) |

| | Other assets and liabilities, net | (99.4) | (61.8) | (278.2) | 11.2 | (310.3) | 64.7 | (54.0) | (96.1) |

| | | (92.2) | (129.6) | (58.1) | (88.0) | 45.6 | 82.4 | (408.2) | (57.3) |

| (=) Net cash provided by operating actitivities | 57.6 | 256.6 | 811.0 | 9.8 | 447.2 | 295.3 | (17.5) | 94.7 |

| l | Cash flow from investing activities: | | | | | | | | |

| | Restricted cash | (25.9) | 29.3 | (18.7) | (14.6) | 73.4 | (28.5) | (16.4) | (121.0) |

| | Marketable securities | (671.0) | 558.8 | - | - | - | - | - | - |

| | Acquisition of property, plant and equipment | (642.9) | (606.2) | (1,081.5) | (239.6) | (403.4) | (333.3) | (256.6) | (339.3) |

| | Acquisitions, net of cash acquired | (102.0) | (930.4) | (9.0) | (239.7) | 230.7 | (2.1) | (7.6) | (0.2) |

| | Other | - | 160.7 | 6.0 | (14.1) | (63.5) | 0.4 | 80.9 | 2.7 |

| (=) Net cash used in investing actitivities | (1,441.7) | (787.8) | (1,103.2) | (507.9) | (162.8) | (363.4) | (199.6) | (457.7) |

| l | Cash flow from financing activities: | | | | | | | | |

| | Proceeds from issuance of common stock | 1,118.4 | 200.0 | - | 303.7 | (304.4) | - | 227.8 | - |

| | Capital increase on subsidiary from minority | 324.4 | 11.2 | 57.4 | (1.3) | 121.3 | - | - | - |

| | Dividends Paid | (44.9) | - | - | - | - | - | (184.3) | (3.1) |

| | Additions of financial debt | 117.5 | 789.5 | 2,020.7 | 996.1 | 339.2 | 356.6 | 315.3 | 676.4 |

| | Payments of financial debt | (492.1) | (111.1) | (1,839.5) | (1,064.4) | (354.5) | (311.8) | (152.4) | (282.8) |

| | Other | - | (17.8) | (85.6) | - | (85.6) | - | - | (9.0) |

| (=) Net cash provided by financing actitivities | 1,023.3 | 871.9 | 153.0 | 234.0 | (284.0) | 44.8 | 206.4 | 381.5 |

| | Effect of exchange rate changes on cash and cash | 112.6 | 99.7 | 195.7 | (46.8) | 48.2 | 1.0 | 4.9 | 79.5 |

| (=) Variation in cash & equivalents | (248.2) | 440.4 | 56.5 | (310.9) | 48.5 | (22.3) | (5.9) | 98.0 |

| (+) Cash and cash equivalents at beginning of year | 316.5 | 68.4 | 508.8 | 827.6 | 508.8 | 623.7 | 601.4 | 595.5 |

| (=) Cash and cash equivalents at end of year | 68.4 | 508.8 | 565.2 | 516.7 | 557.3 | 601.4 | 595.5 | 693.6 |

Cosan Limited

Condensed Consolidated Financial Statements

For the nine-month periods ended December 31, 2010 and 2009

COSAN LIMITED

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CONTENTS

| Report of independent registered public accounting firm | 1 |

| | |

| Condensed consolidated balance sheets | 2 |

| Condensed consolidated statements of operations | 4 |

| Condensed consolidated statement of shareholders’ equity and comprehensive income | 5 |

| Condensed consolidated statements of cash flows | 6 |

| Notes to the condensed consolidated financial statements | 7 |

Report of independent registered public accounting firm

To the Board of Directors and Shareholders of

Cosan Limited

We have reviewed the condensed consolidated balance sheet of Cosan Limited and subsidiaries as of December 31, 2010, the related condensed consolidated statements of operations and cash flows for the nine-month periods ended December 31, 2010 and 2009 and the condensed consolidated statement of shareholders’ equity and comprehensive income for the nine-month period ended December 31, 2010. These financial statements are the responsibility of the Company's management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board, the objective of which is the expression of an opinion regarding the financial statements taken as whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the condensed consolidated financial statements referred to above for them to be in conformity with U.S. generally accepted accounting principles.