FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of June, 2011

Commission File Number: 1-33659

COSAN LIMITED

(Translation of registrant’s name into English)

Av. Juscelino Kubitschek, 1327 – 4th floor

Vila Olímpia,

São Paulo, SP 04543-000 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

COSAN LIMITED

| | |

| 1. | | Communication regarding 4th Quarter Fiscal Year 2010 earnings release |

Item 1

In first year of IFRS, Cosan presents

record EBITDA of R$2.7 billion

São Paulo, June 06, 2011 - COSAN LIMITED (NYSE: CZZ; BM&FBovespa: CZLT11) and COSAN S.A. INDÚSTRIA E COMÉRCIO (BM&FBovespa: CSAN3) are announcing today their results for the fiscal year 2011, ended on March 31, 2011. The results for FY’11 are shown in consolidated form, according to the new Brazilian corporate legislation and aligned with international accounting principles (IFRS).

| | |

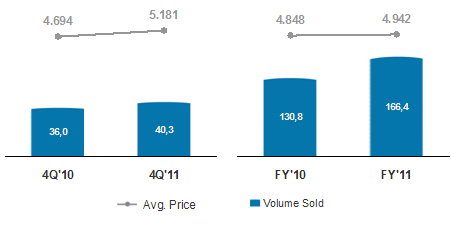

Marcelo Martins CFO & IRO Luiz Felipe Jansen de Mello Head of IR ri@cosan.com.br www.cosan.com.br | ● Implementation of new accounting principles according to international standards (IFRS) ● Record net revenues in all business units (CAA, Cogeneration, CCL and Rumo) ● Record volume sold of lubricants, totaling 166.4 million liters ● EBITDA of R$146.2 million at Rumo, benefited by the beginning of transportation operations ● Net income of R$771.6 million |

| Summary of Financial and Operating Information (R$MM) | | |

| 4Q'10 | 4Q'11 | | | FY10 | FY'11 |

| 4,394.1 | 4,609.3 | | Net sales | 15,336.1 | 18,063.5 |

| 710.6 | 1,137.1 | | l | Gross profit | 2,064.7 | 2,913.4 |

| 16.2% | 24.7% | | | Gross Margin | 13.5% | 16.1% |

| 370.9 | 721.8 | | l | Operating income (loss) | 1,472.9 | 1,191.1 |

| 8.4% | 15.7% | | | Operating margin | 9.6% | 6.6% |

| 646.1 | 1,057.5 | | l | EBITDA | 2,227.1 | 2,671.0 |

| 14.7% | 22.9% | | | EBITDA Margin | 14.5% | 14.8% |

| 14.7% | 22.9% | | | EBITDA Margin | 14.5% | 14.8% |

| 294.7 | 486.8 | | l | Income (loss) before minority interest | 1,049.6 | 776.6 |

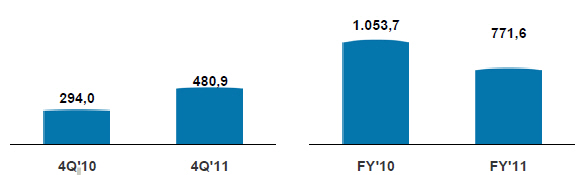

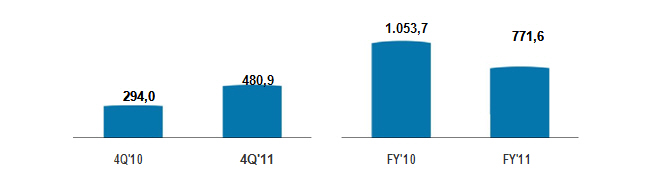

| 294.0 | 480.9 | | l | Net income (loss) | 1,053.7 | 771.6 |

| 6.7% | 10.4% | | | Profit (loss) Margin | 6.9% | 4.3% |

| 745.3 | 531.9 | | Capex | 2,545.5 | 3,037.2 |

| 4,249.5 | 5,262.7 | | Net Debt | 4,249.5 | 5,262.7 |

| 5,982.2 | 6,784.3 | | Shareholders' & Minorities Equity | 5,982.2 | 6,784.3 |

Definitions: FY’11 – fiscal year beginning on April 1, 2010 and ending on March 31, 2011 FY’10 – fiscal year beginning on April 1, 2009 and ending on March 31 , 2010 4Q’11 – quarter ended March 31, 2011 4Q’10 - quarter ended March 31, 2010 |

A. Main IFRS impacts

| Þ | Biological Assets, CPC 29 (IAS 41): the biological assets of the Company are now measured at their fair value, applying the future discounted cash flow method, the impact of which in the variation of fair value for the year ended March 31 , 2011 was R$ 381.9 million (R$44.9 million in 2010). |

| Þ | Business combination, CPC 15 (IFRS 3): the assets and liabilities of acquired business are evaluated at their fair value at the date of each transaction, increasing, mostly, the basis of the Company fixed assets and, accordingly, the depreciation (therefore no impact in EBITDA). As result, we had higher costs with amortization and depreciation of assets related to the acquisitions of Cosan Alimentos, Teaçu and Esso Brasileira (current CCL), impacting all of the Company’s business units. |

| Þ | Crop Treatment: Positive impact of R$370.9 million in the year (R$292.4 million in the prior year) due to consideration of crop treatment made in the fields (after planting) as being Capex and as a consequence its amortization being considered for purposes of EBITDA calculation, which improved the cash cost and as a consequence the EBITDA of CAA; |

| Þ | Alienation of participation: reversal of R$ 223.0 million (when compared to the old BRGAAP) related to the disposal of participation in Rumo, since, in the IFRS, transactions between controlling shareholders and non controlling do not impact on the result, being directly recognized in net assets. |

B. Market Overview

Crushing in Center-South (CS) region of Brazil reached 556.8 million tons of sugarcane in the 2010/11 harvest, an amount 2.75% higher than the previous harvest according to data provided by UNICA. Sugarcane production increased by 16.9%, reaching 33.5 million tons, while ethanol production reached 25.4 billion liters, 7.1% higher than the previous harvest, 18.0 billion liters of which of hydrous ethanol and 7.4 billion liters of anhydrous ethanol. The lower sugarcane availability when compared to the initial projections made by UNICA, resulted from an extremely dry weather which, in spite of maximizing the amount of sugar equivalent in the sugarcane (TSR), has reduced its productivity rate by planted area. TSR per ton of sugarcane in the 2010/11 harvest totaled 141.20 kg, while during the 2009/10 harvest the TSR totaled 130,23 kg/ton. With the elevated prices in the international market, the production mix for sugar increased from 42.6% in the previous harvest to 44.71% in this harvest.

Crushing estimate for 2011/12 harvest is of 568.5 million of sugarcane, which represents an increase of 2.1% when compared to the previous harvest. This low increase for the second year in a row is a result of scarcity of raw materials, mainly impacted by the aging of the reeds due to the lack of investments in the sector, combined with an unfavorable weather condition in the previous harvest, as mentioned above. It is expected that 2011/12 harvest has an even more sugar profile, due to the investments made in sugar production driven by the elevated prices in the global market. The estimate of sugarcane production is of 34.6 million tons, while ethanol estimate is of 25.51 billion liters, with a higher share of anhydrous ethanol in the total amount.

Most recent numbers from UNICA indicate a decrease of sugarcane crushing in the beginning of 2011/12 harvest until May 16, 2011, totaling in 56.7 million tons, 39.5% lower than the same period in the previous harvest. The main reasons for this decrease are: (i) the delay in the beginning of the production units, due to the lowest availability of sugarcane, (ii) sugarcane quality inferior to the previous harvest with 8.51kg less of TSR per ton of sugarcane and (iii) anticipation in the previous harvest when some production units operated even during the slump period. The production mix began to prioritize ethanol due to the elevated prices in the domestic market, in which 59.87% of sugarcane was destined to this product and 40.13% destined to sugar. Sugar production reached 2.4 million tons, a decrease of 46.7% in comparison to the previous harvest, while ethanol production reached 2.2 billion liters, 1.3 billion liters of hydrous ethanol and 843,0 million of anhydrous ethanol, representing a decrease of 55.1% and an increase of 4.2%, respectively.

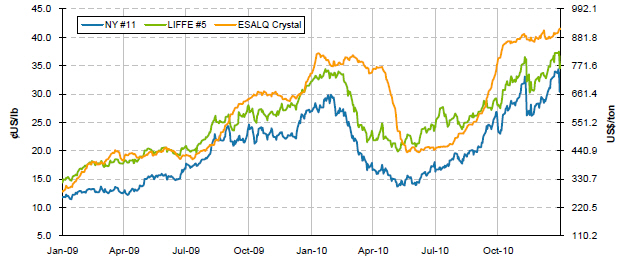

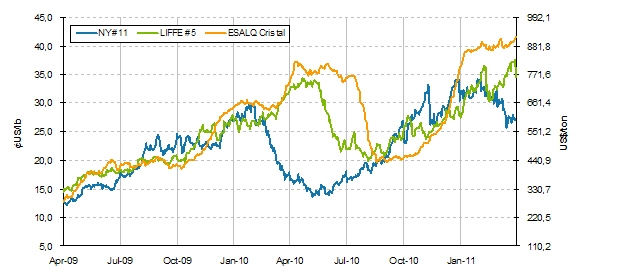

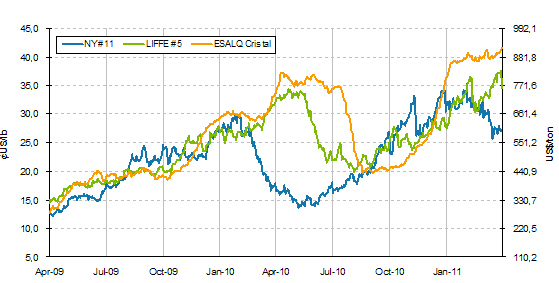

Sugar

In the domestic market, the price of sugar remained elevated, with the bag of sugar of 50kg, based on ESALQ, traded in the quarterly average at R$74.0. Maintenance of high prices of sugar occurred due to the production encouragement of VHP to export, which resulted in a low availability of the product in the internal market once sugar production in the 2010/11 harvest increased by 16.94% or 5 million tons.

In Russia, the planted area expansion wasn’t enough to compensate the agricultural income losses related to the dryness due to high temperatures. For this reason, the development potential of beet was restrict and sugar production reached 3 million tons, which represents a decrease of 1 million tons in relation the initial expectations. Because of low availability there was a strong prices increase, which caused the Russian government to anticipate the reduction in import rates.

In India, the high availability of sugarcane resulted in a production Record in the region of Maharashtra of 9 million tons, which compensated the production decrease in Uttar Pradesh at the end of the harvest. Generally, the production in India must reach 26.1 million tons, only 400,000 tons lower to the market expectations. The government has authorized an export license of 500 thousand tons of sugar through OGL regimen until June 17.

Harvest in Thailand exceeded the expectations of the market reaching approximately 95 million tons of processed sugarcane, which represents a growth of 35% in annual comparison. The decision to prioritize the production of raw sugar instead of white sugar due to high premiums in the commodity market spot impacted the global balance of raw sugar, causing a low price of the product in the international market.

As a result, raw sugar price in this 4Q11 was of an average of ¢US$30,54/lb, 5,1% higher than the 3Q11 and 24.6% higher than the 4Q10 average, reaching

¢US$24,52/lb in the end of December. Refined sugar present an average price of US$751,43/ton for the period in the international market, 14.0% higher than in the 4Q10 and 2.8% higher than in the 3Q11.

In the 4Q11, Real currency presented an average quotation of R$1.67/US$, 1,8% lower than the average of the previous quarter and 7.5% lower than the 4Q10. The exchange rate at the end of the period was of R$1.6 3/US$, compared to R$ 1.67/US$ as of December 2010 and R$ 1.78/US$ as of March 2010.

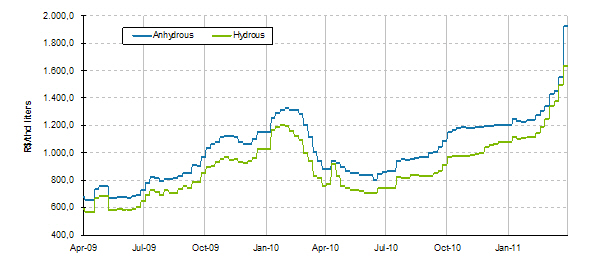

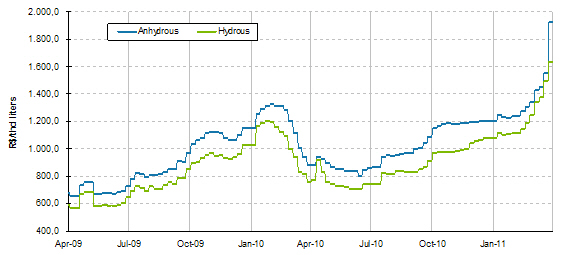

Ethanol

In the ethanol domestic market, the prices reached elevated level due to a very tight offer and demand balance, mainly due to (i) a shortfall of harvest in Brazil; (ii) a sugar production maximization and (iii) an increase of 6% in the light vehicles fleet. The average price for hydrous ethanol, based in ESALQ, was of R$ 1.237,3/cbm in the 4Q11, 21.9% higher than the previous quarter and 18.8 higher than the 4Q10. The average price of anhydrous ethanol was of R$ 1.361,1/cbm, an increase of 14.7% in comparison to the 3Q11 and of 14.5% in comparison to the same quarter of the previous year.

In this quarter there have also been important changes in the sector, with ANP (Brazilian National Oil Agency) being the official institution which shall regulate the ethanol market, which shall now be referred to as a fuel and no longer as an agricultural product, due to its strategic importance to Brazil. In addition, changes also have occurred to the mandatory blend of anhydrous ethanol to gasoline, which previously could vary from 2% to 25% and the lowest limit of which was reduced to 18%.

The average parity (weighted by fleet) of the price of hydrous ethanol in relation to gasoline in Brazil, calculated according to data provided by the ANP, was of approximately 80% at the end of the 4Q11, and only one Brazilian state, Mato Grosso, which represents 1.8% of the national fleet, with a parity of 70%.

Pursuant to ANFAVEA, during the 4Q11, 658.9 thousand flex-fuel vehicles were licensed throughout Brazil, which means 85% of the total new vehicles and a growth of 1.0% in relation to the 4Q10.

Fuel

Pursuant to ANP, the volume of Diesel sold in the first quarter of 2011was 3.9% higher than the same period of the previous year, reaching 11.6 billion liters. In spite of the elevated prices of hydrous ethanol, which caused ethanol to be less competitive than gasoline, its consumption increased by 2.4% in the period, with a volume o f 2.9 billion liters as result of the growth in the Brazilian flex fuel fleet. The volume traded of gasoline A increased by 2.9%, with 6.0 billion liters sold in the quarter, which caused the volume of anhydrous ethanol (25% blended with gasoline A) traded in the quarter to reach 2.1 billion liters.

C. Production Data

| 4Q'10 | 4Q'11 | | Production Highlights | FY10 | FY'11 |

| 181 | 77 | | Sugarcane Crushed (thd tons) | 50,314 | 54,315 |

| 16 | - | | Own Cane (thd tons) | 23,443 | 27,400 |

| 164 | 77 | | Suppliers (thd tons) | 26,690 | 26,838 |

| | | | Production | - | |

| - | 2 | | Raw Sugar (thd tons) | 2,520 | 2,517 |

| - | 1 | | White Sugar (thd tons) | 993 | 1,406 |

| - | - | | Anhydrous Ethanol (thd cbm) | 623 | 686 |

| 9 | 3 | | Hydrous Ethanol (thd cbm) | 1,212 | 1,516 |

| 115.0 | 136.1 | | Sugarcane TSR (kg/ton) | 129.8 | 139.0 |

| 99.5% | 0.0% | | Mechanization (%) | 64.5% | 79.5% |

This year harvest was strongly affected by the drought in the Center South region of the country, decreasing the availability of sugarcane. Despite this adverse weather effect, Cosan presented an increase of 8.0% in sugarcane crushed, totaling 54.3 million tons, mainly due to the beginning of operation of Jataí and Caarapó greenfields . Own sugarcane represented, in this harvest, 50.4% of overall processed sugarcane, with mechanization index of 79.5%.

On the other hand, the dry weather favored the TSR concentration that reached 139.0 kg/tons of sugarcane in this harvest. The 12 month consolidation of Cosan Alimentos and better prices of sugar, mainly in the domestic market, enabled the strategy of prioritizing the white sugar production with more value added, which reached 1.4 million tons, 41.6% higher than the previous year

D. Operating Performance

As from this year we are reporting the financial information in accordance with the new accounting rules effective in Brazil (“BR GAAP”), which are aligned with the international accounting principles (“IFRS”). This adoption has the date of April 1, 2009 as transition date (time in which we convert the opening balances in accordance with the old rules for the new accounting rules). Further details on these differences and main impacts from this change to the IFRS may be obtained and are detailed in explanatory note 3 of the financial statements.

In addition, as from the fiscal year 2011, the Company adopts the accounting criterion of hedge accounting, in order to provide more transparency to the hedging effects in its results. As well as in the prior Quarterly Letters for this fiscal year, all the effects from this accounting criterion adopted will be detailed in the section “Impacts from Hedge Accounting”.

EBITDA per Business Unit

| EBITDA (R$ MM) - FY11 | CAA | Rumo | CCL | Total* |

| Net Revenues | 6,389.2 | 448.1 | 11,795.3 | 18,063.5 |

| (-) Cost of Product Sold / Services Rendered | (4,400.5) | (316.5) | (11,014.1) | (15,150.1) |

| (=) Gross Profit | 1,988.7 | 131.6 | 781.2 | 2,913.4 |

| Gross Margin | 31.1% | 29.4% | 6.6% | 16.1% |

| (-) Selling Expenses | (568.4) | 0.1 | (456.1) | (1,026.0) |

| (-) General and Administrative Expenses | (393.0) | (29.1) | (118.9) | (541.0) |

| (-) Other Operating Revenues | (64.9) | 9.9 | 31.8 | (33.8) |

| (+) Depreciation and Amortization | 1,168.2 | 33.7 | 156.6 | 1,358.5 |

| (=) EBITDA | 2,130.6 | 146.2 | 394.5 | 2,671.0 |

| EBITDA Margin | 33.3% | 32.6% | 3.3% | 14.8% |

* Total considers the effects from consolidation eliminations

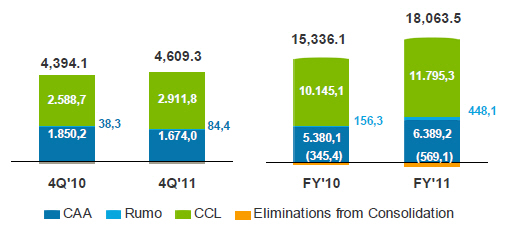

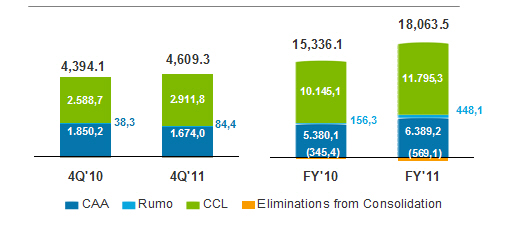

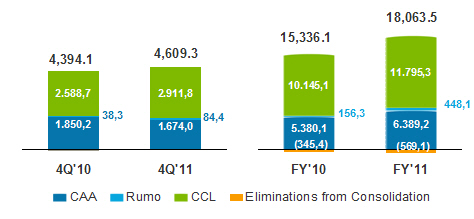

Net Revenue

| 4Q'10 | 4Q'11 | | Sales Composition (R$MM) | FY10 | FY'11 |

| 4,394.1 | 4,609.3 | | Net Operating Revenue | 15,336.1 | 18,063.5 |

| 1,850.2 | 1,674.0 | | CAA | | 5,380.1 | 6,389.2 |

| 1,215.5 | 985.1 | | l | Sugar Revenue - CAA | 3,377.8 | 3,853.4 |

| 347.7 | 372.0 | | | Local | 1,062.3 | 1,387.3 |

| 867.8 | 613.2 | | | Export | 2,315.5 | 2,466.2 |

| 602.1 | 666.7 | | l | Ethanol Revenue - CAA | 1,747.6 | 2,203.7 |

| 549.7 | 641.0 | | | Local | 1,325.9 | 1,958.9 |

| 52.4 | 25.8 | | | Export | 421.8 | 244.8 |

| 5.7 | 4.4 | | l | Energy Cogeneration - CAA | 93.6 | 194.9 |

| 26.8 | 17.8 | | l | Other Revenue - CAA | 161.0 | 137.1 |

| 38.3 | 84.4 | | Rumo | 156.3 | 448.1 |

| 24.9 | 28.1 | | l | Loading | 140.1 | 142.2 |

| 13.4 | 56.3 | | l | Transportation | 16.1 | 305.9 |

| 2,588.7 | 2,911.8 | | CCL | | 10,145.1 | 11,795.3 |

| 2,401.6 | 2,681.8 | | l | Fuels Revenue - CCL | 9,437.3 | 10,902.3 |

| 170.4 | 203.1 | | | Ethanol | 757.0 | 814.6 |

| 1,208.6 | 1,265.9 | | | Gasoline | 4,111.0 | 4,656.9 |

| 999.3 | 1,185.6 | | | Diesel | 4,338.5 | 5,325.3 |

| 23.3 | 27.2 | | | Other | 230.9 | 105.4 |

| 168.9 | 208.8 | | l | Lubes Revenue - CCL | 634.0 | 822.4 |

| 18.1 | 21.2 | | l | Other Revenue - CCL | 73.7 | 70.6 |

| (83.0) | (60.9) | | Eliminations from Consolidation | (345.4) | (569.1) |

Cosan net revenue in FY’11 reached R$18.1 billion, compared to R$15.3 billion in FY’10. This increase of 17.8% reflects another year of growth in all the business units, through the increase in production capacity and volume sold and services rendered. In CAA, even with a difficult harvest due to unfavorable weather conditions that affected the sugarcane, productivity we obtained a production increase due to (i) the increase in the use of the installed capacity of 2 greenfields (Jataí and Caarapó), (ii) expansion of the sugar plants (iii) and beginning of operation of other co-generation projects, coupled with better prices of sugar and ethanol, increasing CAA revenue at 18.0%, to R$6.4 billion. The net revenue of CCL presented increase of 16.3%, totaling R$11.8 billion, particularly due to the increase of 22.7% in the revenue of Diesel, 29.7% in the lubricants and 13.3% of gasoline. In Rumo, the transportation operation primarily based on the partnership agreement with ALL – America Latina Logística S.A. was the main responsible for the increase of 186.8% in its net revenue, which totaled R$448.1 million, of which R$305.9 million arising from the transportation service and R$142.2 million from loading

Net operating income (R$ MM)

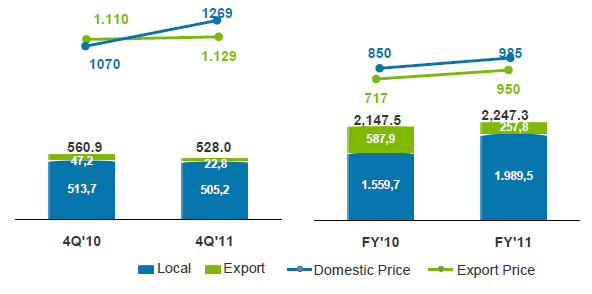

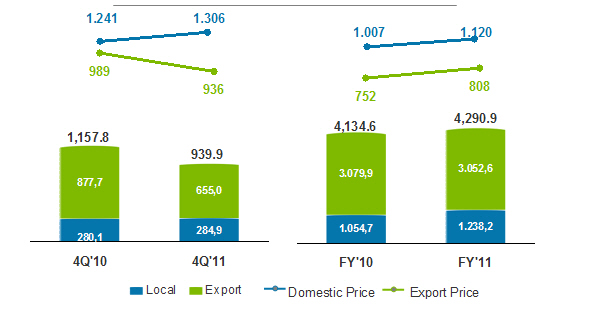

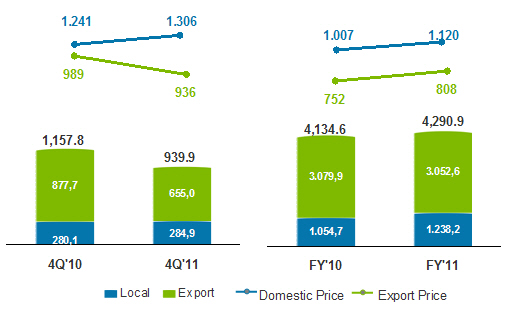

Sugar Sales - CAA

The sugar sales totaled in this fiscal year R$3.9 billion, an increase of 14.1% in relation to the prior year. The main factors contributing for the increase of R$ 475.6 million were:

| Þ | Increase of R$128 million arising from the higher volume sold, 3.8% higher than the prior year. The sales in the domestic market increased 17.4%, with 1,238.2 thousand tons reflecting the effect of 12 months of sales against 10 months in the year prior to the purchase of Cosan Alimentos and the greater concentration of TSR in the sugarcane (139.0 kg / ton of sugarcane compared to 129.8 kg / ton of sugarcane in 2009/10 crop). However, the lower than expected harvest affected the sugar production and the exports of this product decreased 1% in comparison to the previous year amounting to 3,052.6 thousand tons; |

| Þ | Increase of R$335 million due to prices 10% higher, with the prices in the domestic market 11.2% higher and the prices in the foreign market presenting an increase of only 7.5% when compared to the same prior year period, due to the effect of the hedge accounting, which had a negative impact of R$160.3 million. |

The effect from the mix of products contributed with R$ 13 million, with a higher mix of sugar sold in the domestic market that reached 29% against 25.5% in the prior fiscal year.

Sugar

Volume (Thousand tons) and Average unit price (R$/ton)

The sugar stocks ended this fiscal year 28.1% below the previous year, reflecting the commercial strategy adopted to better use the high prices of the product in the last quarter.

Sugar Inventories

| Inventories: Sugar |

| | 4Q'10 | 4Q'11 |

| '000 ton | 135.8 | 97.7 |

| R$'MM | 93.6 | 77.6 |

| R$/ton | 689 | 794 |

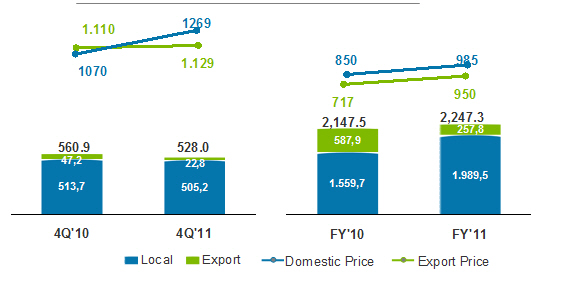

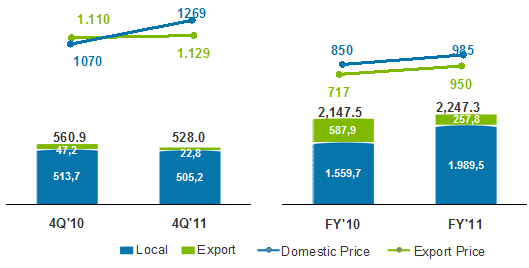

Ethanol Sales - CAA

The revenue from ethanol in FY’11 totaled R$2.2 billion, presenting an increase of 26.1% when compared to the previous year. We highlight, below, the main factors that increased the revenue at R$ 456.1 million:

| Þ | Gains of R$81.2 million arising from the increase in the volume of ethanol sold due to the: (i) incorporation of Cosan Alimentos plants in June 2009 which increased our crushing capacity; (ii) greater concentration of TSR and (iii) ramp-up of the greenfields Jataí and Caarapó. |

| Þ | Gains of R$358.3 million, due to the increase of 20.5% in the average price of ethanol in the domestic and international markets; |

| Þ | Gains of R$16,6 million due to the effect of mix of products with less participation of sales in the foreign market, which presented lower average prices than the domestic market. |

Ethanol

Volume (Million liters) and Average unit price (R$/thd liters)

Throughout this year, the Company opted for keeping a regular pace in its ethanol sales as evidenced in the prior quarters reflex of the commercial strategy of the Company.

The inventories levels in 4Q11 presented a drop of 27.3% compared to the 4Q10, even with a production 20% higher than the previous year, due to the stronger demand and higher prices in the inter-harvest period.

Ethanol Inventories

| Inventories: Ethanol |

| | 4Q'10 | 4Q'11 |

| '000 cbm | 68.2 | 49.6 |

| R$'MM | 56.2 | 42.8 |

| R$/cbm | 824 | 864 |

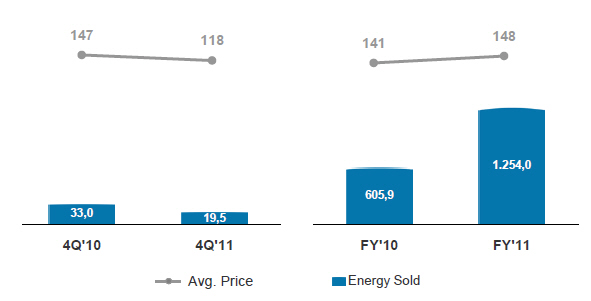

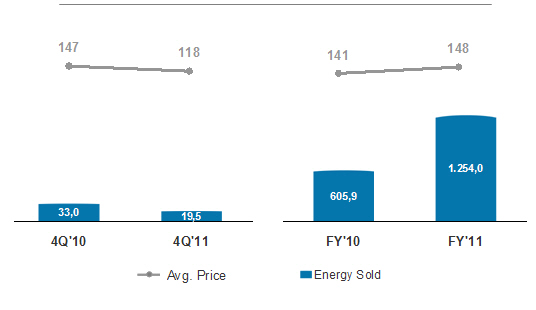

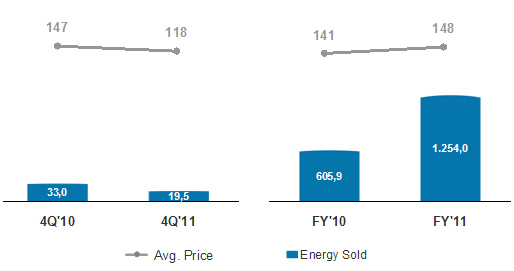

Energy cogeneration - CAA

The energy revenue totaled R$194.9 million through the sale of R$8.9 million in steem and 1,254.0 thousand MWh of energy at an average price of R$148.3/MWh. The growth of 107.0% in the volume sold results from the beginning of operation of new cogeneration units (totaling 10 this year, compared to 6 in the prior year) and to the ramp-up of the others.

Cogeneration of Energy

Volume (‘000 MWh) and Average Unit price (R$/MWh)

Other Products and Services - CAA

The revenue from other products and services of CAA decreased 14.8%, or R$23.9 million in relation to FY’10, mainly due to Cosan’s strategic repositioning with the reduction in sales of products DaBarra Alimentos in the retail market which was alienated in February 2011 (except for the sugar brand).

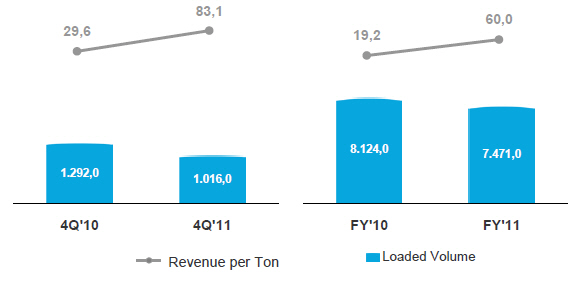

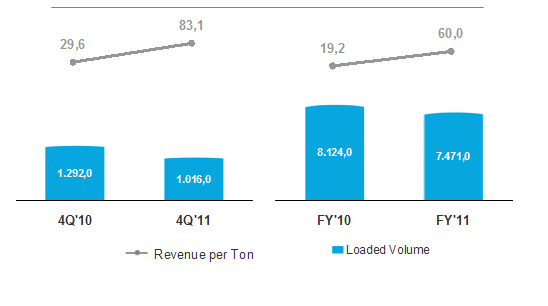

Rumo

The net revenue of Rumo of R$448.1 million in the FY’11 was 186.7% higher than the FY’10, reflex from the beginning of transportation operations in January 2010, which presented revenue of R$305.9 million.

Loading revenue was in line with the prior year, totaling R$ 142.2 million in the year, despite the 8.0% volume lower, benefitted from the increase of 10.4% in the loading price.

The lower loaded volume in the year arises from the concentration of the volume exported in the peak months, above loading capacity, and the lower than expected harvest, which reduced the sugar available to be exported at the end of the harvest. This effect was partially offset by the increase in prices.

As a result of the higher value added to the loaded product, mainly for the increase of the transportation operations, which exceed the initial expectation for the first year of operations, the revenue per loaded ton in this quarter was 3.1 times higher than the FY’10.

Rumo

Volume (Thousand tons) and Revenue per Ton (R$/ton loaded)

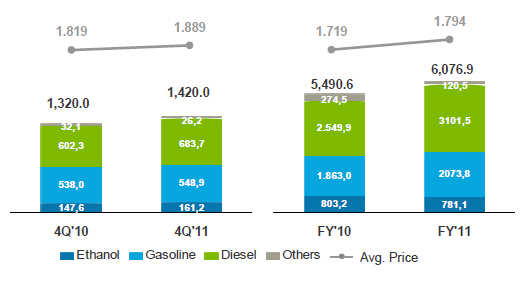

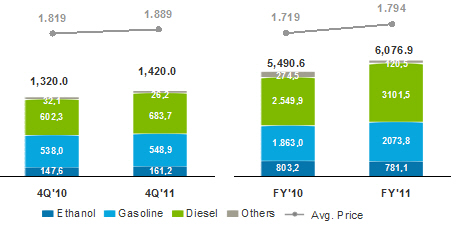

Fuels Sales - CCL

CCL net revenue amounted to R$11.8 billion in the FY’11, 16.3% higher than the prior year, and the fuels revenue increased 15.5%, reaching R$10.9 billions. The main factors affecting the fuels revenue in this quarter were:

| Þ | Increase of 21.6% in the sold volume of Diesel when compared to the FY’10. This increase occurred due to the following factors: |

| o | Increase of 9.0% in the domestic consumption of Diesel, according to ANP, due to the increase in the demand from industrial clients and transportation due to the recovery of the economic activity in the country. |

| o | Gains of market-share in the retail market, and mainly in the industrial segment. |

| Þ | Increase of 11.3% in gasoline C volume sold in relation to the FY’10, partially compensated by the lower ethanol sold, due to the increase of percentage of flex fuel cars users that opted for this fuel replacing the hydrous ethanol; |

| Þ | Increase in the average unit prices of ethanol, gasoline and Diesel, and of the greater participation of Diesel and gasoline in the mix of sales, which present higher prices than ethanol. |

Fuels

Volume (Million of liters) and Average Unit price (R$/thousand liters)

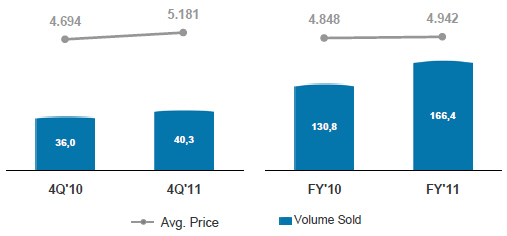

Lubricants Sales – CCL

The increase of 29.7% in the revenue of lubricants, which totaled R$822.4 million in the quarter, results from the mix with greater participation from premium products, which have higher value added, and the strong increase in the sales volume, which reached 166.4 million of liters due to the increase of approximately 9.0% in the domestic consumption and gains of market share, a result from the marketing effort in the period.

Lubricants

Volume (Million of liters) and Average Unit price (R$/thousand liters)

The volume in stocks of CCL presented an increase of 10.7%, following the growth in the volume sold of fuels and lubricants. Upon analyzing the stocks in days of Sales, there was no significant change, maintaining in approximately 9 days.

CCL Inventories

(Includes Fuels and Lubricants)

| Inventories: CCL |

| | 4Q'10 | 4Q'11 |

| '000 cbm | 137.5 | 152.2 |

| R$'MM | 266.5 | 326.6 |

| R$/cbm | 1,938 | 2,146 |

Cost of Products Sold

The Cost of products sold (COGS) totaled R$15.1 billion, in comparison to R$13.3 billion in the previous year. In CAA, before IFRS adjustments, we had an increase of 20.4%, or R$828.9 million is mainly reflex from (i) the higher volume of equivalent sugar sold, (ii) increase in the refined sugar activity for sale in the domestic market and (iii) increase in depreciation/amortization. In Rumo, the beginning of transportation activities was the main responsible for the increase of 147.6% of COGS. In CCL, the growth of 16.5% in COGS, which totaled R$11.014,1 million, is a reflex, mainly from the higher volume sold, higher participation of Diesel and gasoline in the mix of products sold, in addition to the increase in the acquisition cost of ethanol.

In addition, the Company COGS had the following adjustments relating to the adoption of IFRS:

| Þ | Biological Assets, CPC 29 (IAS 41): the biological assets of the Company are now measured at their fair value, applying the future discounted cash flow method, the impact of which in the variation of fair value for the year ended March 31 , 2011 was R$ 381.9 million (R$44.9 million in 2010). |

| Þ | Business combination, CPC 15 (IFRS 3): the assets and liabilities of acquired business are evaluated at their fair value at the date of each transaction, increasing, mostly, the basis of the Company fixed assets and, accordingly, the depreciation (therefore no impact in EBITDA). As result, we had higher costs with amortization and depreciation of assets related to the acquisitions of Cosan Alimentos, Teaçu and Esso Brasileira (current CCL), impacting all of the Company’s business units. |

| 4Q'10 | 4Q'11 | | COGS per Product | FY10 | FY'11 |

| (3,683.5) | (3,472.2) | | Cost of Good Sold (R$MM) | (13,271.3) | (15,150.1) |

| (1,338.0) | (768.7) | | CAA | (4,038.5) | (4,400.5) |

| (687.1) | (657.1) | | Sugar | (2,116.2) | (2,604.9) |

| (567.0) | (523.7) | | Ethanol | (1,745.5) | (2,015.9) |

| (42.8) | (57.8) | | Others CAA + Cogeneration | (206.4) | (276.2) |

| (27.0) | 464.3 | | Biological Assets - IFRS Adjustment | 44.9 | 381.9 |

| (14.2) | 5.6 | | Other IFRS Adjustments | (15.4) | 114.5 |

| (28.0) | (58.4) | | Rumo | (127.8) | (316.5) |

| (3.4) | (3.4) | | Other IFRS Adjustments | (12.3) | (13.5) |

| (2,400.6) | (2,710.6) | | CCL | (9,452.3) | (11,014.1) |

| (18.8) | (20.1) | | Other IFRS Adjustments | (77.8) | (73.1) |

| 83.0 | 65.4 | | Eliminations from Consolidation | 347.4 | 581.1 |

| | | | Average Unit Cost | | |

| 508 | 578 | | Unit Cash COGS of Sugar (R$/ton) | 415 | 494 |

| 789 | 725 | | Unit Cash COGS of Ethanol (R$/thd liters) | 609 | 664 |

| 1,770 | 1,856 | | CCL (R$/thousand liters) | 1,681 | 1,764 |

* In the cash-cost of sugar and ethanol, the plantation, crop treatment, agricultural depreciation (machinery and equipment), industrial depreciation and maintenance of inter harvest, are not considered.

CAA

As mentioned in prior quarterly letters, since the beginning of this fiscal year, we presented the unit cost of sugar and ethanol excluding the amortization and depreciation effects (cash-cost), in order to better analyze their behavior throughout the quarters.

The depreciation and amortization effects on the unit costs reflected investments made in the sugarcane plantation, maintenance of our industrial facilities, mechanization of harvest

in the greenfields projects (Jataí and Caarapó) that started operations at the end of the past harvest, in the cogeneration units and in the improvement of security and sustainability of our operations.

The cost of products sold and services rendered of CAA amounted to R$4.4 billion, presenting an increase of 9%, or R$362 million, compared to the previous year. The mains factors that explain this increase, in addition to the adjustments related to the adoption of IFRS mentioned above, are:

| Þ | The higher volume of sugar and ethanol sold, which was responsible for the increase of R$161.1 million; |

| Þ | R$360.0 million from sugar origination, characterized by the purchase of raw materials for refining and finished products for later resale and distribution in the domestic market; |

| Þ | R$54.2 million of ethanol origination in order to benefit of market opportunities; |

| Þ | Increase of approximately R$234.9 million due to the increase in TSR price according to Consecana formula, which defines the compensation to suppliers and land leasing, that increased from R$0.3492/kg of TSR to R$0.4022/kg of TSR; |

| Þ | These effects were partially offset by the increase in the amount of TSR, from 131.1kg/ton of sugarcane to 139.9kg/ton due to more adequate weather conditions improving the cost at R$187.9 million in the FY’11. |

Rumo

The COGS of Rumo in the FY’11 of R$316.5 million presented an increase of 147.6% in comparison to the prior year, due to the beginning of transportation, transfer, storage operations in the interior and contracting of railway freights. On the other hand, loading cost, which already occurred in the previous year, presented a slight reduction due to the lower loaded volume of bulk and bagged sugar, the latest presenting higher costs.

CCL

The COGS of CCL presented an increase of 16.5% compared to the FY’10. Excluding the volume factor, the unit cost of R$1,764/cbm in the FY’11 was 4.9% higher than the prior year. This effect results from the following factors:

| Þ | Increase in the cost of ethanol, which impacts not only the hydrous ethanol that will be used in the flex fuel vehicles, but also the anhydrous that is blended into gasoline C (25% mandatory blend); |

| Þ | Increase of 1.7% in the unit cost of Diesel; |

| Þ | Mix of sales with more participation of gasoline and Diesel, which present higher unit costs than ethanol. |

Gross Profit

With these results, the FY’11 presented gross profit of R$2,913.4 million, 41.1% higher than the prior year, presenting a margin of 16.1%. CAA contributed with a gross profit of R$1,988.7 million, presenting gross margin (cash) of ethanol of 32.3%, and 45.0% of sugar,

also benefited from the higher participation of results from cogeneration. Rumo, on its turn, contributed with a gross profit of R$131.5 million, presenting consolidated margin of 29.4%. In CCL, the gross margin decreased slightly from 6.8% to 6.6%. However, when we analyse the gross margin in Brazilian Reais per cubic meter, it is noted a small increase to R$125.1/ thousand liters. This was due to:

| Þ | Increase in the volume sold of lubricants, that despite the increase in the petroleum price presented a stability of margin due to the Company strategy of increasing the participation of higher value added products; |

| Þ | Higher participation of gasoline in the mix of products sold, which presents better margins than ethanol and Diesel. |

| Þ | Both effects above were partially offset by: |

| o | Worse margins of ethanol in the first quarters of the year, which were not fully offset by the recovery in the interharvest period; |

| o | Mix with more participation of Diesel than, in the accumulated for the year, presented margins lower than the prior year, due to the Company strategy of increasing its participation of sales for industrial clients. Despite the lower unit margin, the higher volume sold of this products helps to dilute the fixed expenses for all the others; |

| 4Q'10 | 4Q'11 | | Gross Margin per Product | FY10 | FY'11 |

| | | | Unitary Gross Margin | | |

| | | | CAA | | |

| 542 | 470 | | Gross Margin (Cash) Sugar (R$/ton) | 402 | 404 |

| 284 | 537 | | Gross Margin (Cash) Ethanol (R$/thd liters) | 204 | 317 |

| 153 | 152 | | CCL (R$/thousand liters) | 137 | 137 |

| | | | % Gross Margin/Net Revenues | | |

| | | | CAA | | |

| 51.6% | 44.9% | | Gross Margin (Cash) Sugar | 49.2% | 45.0% |

| 26.5% | 42.5% | | Gross Margin (Cash) Ethanol | 25.1% | 32.3% |

| 27.0% | 30.8% | | Rumo | 18.2% | 29.4% |

| 8.0% | 7.6% | | CCL | 7.6% | 7.2% |

Selling Expenses

Selling Expenses presented an increase of 18.9%, or R$163,3 million compared to the same period in the previous year, mainly due to the increase in the volume sold by CAA and by CCL, which imply in higher expenditures with freight.

| 4Q'10 | 4Q'11 | | Selling Expenses | FY10 | FY'11 |

| (224.9) | (272.5) | | Selling Expenses (R$MM) | (862.7) | (1,026.0) |

| (120.6) | (134.2) | | CAA | (469.8) | (568.4) |

| (0.0) | (0.0) | | Rumo | (0.0) | 0.1 |

| (104.3) | (133.8) | | CCL | (398.2) | (456.1) |

| (0.0) | (4.6) | | Elimination | 5.3 | (1.6) |

CAA

The Selling Expenses of CAA totaled R$568.4 million in comparison to the R$469.8 million for the same prior year period. The increase of 21.0%, or R$98.5 million, reflects some factors:

| Þ | Increase of 30% in the volume of sugar bagged for export, which presents a higher cost than sugar in bulk; |

| Þ | Significant increase in the volume of sugar in the retail of the domestic market; |

| Þ | Expenses with marketing of União brand; |

| Þ | Increase in the volume of ethanol in the domestic market in the modality CIF, which implies in increase in the expenditures with freight, more than offset by its higher price. |

Rumo

Due to the nature of its business, Rumo does not present Selling Expenses.

CCL

The Selling Expenses of CCL presented an increase of 14.5% or R$57.9 million, to R$456.1 million, mainly due to the higher volume sold. Accordingly, upon analyzing the Selling Expenses in unit terms, it may be noted that the unit expenses were in line (R$73.0/cbm) in the comparison between the periods, benefitted by the higher dilution of fixed expenditures due to the increase of 13.2% in the volume sold.

General and Administrative Expenses

The general and administrative expenses of R$541.0 million represented an increase of 9.0% in relation to R$496.3 million of FY’10. This increase reflects the efforts and investments, many of which are non recurring events, which are being conducted to improve the controls and management, but mainly aiming to increase operating efficiency for when the investments are concluded, in addition to the expenditures incurred for the Association with Shell. The main factors that impacted the general and administrative expenses are described below.

| 4Q'10 | 4Q'11 | | General & Administrative Expenses | FY10 | FY'11 |

| (173.5) | (150.0) | | G&A Expenses (R$MM) | (496.3) | (541.0) |

| (131.4) | (107.0) | | CAA | (386.3) | (393.0) |

| (5.8) | (8.3) | | Rumo | (18.1) | (29.1) |

| (36.3) | (34.7) | | CCL | (91.9) | (118.9) |

CAA

The general and administrative expenses of R$393.0 million in FY’11 had an increase of 1.7% when compared to the same prior year period. Excluding non recurring expenses related to process of Association with Shell, which amounted to approximately R$30 million, general and administrative expenses of CAA would have presented an improvement of 6.0% in the compared period.

Rumo

The general and administrative expenses of Rumo amounted to R$29.1 million in the FY’11, presenting an increase of 60.8% in comparison to the prior year. Excluding the extraordinary expenses of approximately R$ 6.0 million related to the constitution of provisions and to the process of private placement of the company, the increase of 27.6% in the general and administrative expenses was already expected due to the contracting of:

| Þ | New officers to strengthen the management team and composition of the company middle management; |

| Þ | Advisory for review and renegotiation of the suppliers contracts of Rumo; |

| Þ | Advisory for beginning and monitoring of the transportation operations |

CCL

The general and administrative expenses of CCL amounted to R$118.9 million in the FY’11, an increase of 29.4% when compared to FY’10. Part of this increase is explained by provisions and amortizations in the approximate amount of R$8.0 million which were not carried out in the 1Q’10 and 2Q’10 (as described in the Letter of 1Q’11) and were carried out in the 3Q’10. In addition, it should be emphasized that, due to the investments in the Company improvement, CCL expenses are still being negatively affected by non-recurring expenses of approximately R$16.0 million related to adjustments for the transition for the Shared Services Center (CSC) and expenditures with the transition team for the Joint Venture with Shell.

EBITDA

With these results, Cosan reached an EBITDA of R$2,671.0 million in the FY’11, 22.4% higher than the EBITDA of FY’10, both already adjusted by IFRS effects. Of this amount, CAA contributed with R$2,130.3 million, CCL with R$394.5 million and Rumo with R$146.2 million.

| 4Q'10 | 4Q'11 | | EBITDA | FY10 | FY'11 |

| 646.3 | 1,057.0 | | EBITDA (R$MM) | 2,182.8 | 2,671.0 |

| 14.7% | 22.9% | | | Margin | 14.2% | 14.8% |

| 534.3 | 940.1 | | l | CAA | 1,756.2 | 2,130.3 |

| 28.9% | 56.2% | | | Margin | 32.6% | 33.3% |

| 13.5 | 28.3 | | l | Rumo | 73.0 | 146.2 |

| 35.3% | 33.5% | | | Margin | 46.7% | 32.6% |

| 98.4 | 89.0 | | l | CCL | 353.6 | 394.5 |

| 3.8% | 3.1% | | | Margin | 3.5% | 3.3% |

CAA

The EBITDA of CAA totaled R$2,130.3 million in the FY’11, benefitted by the following IFRS adjustments:

| Þ | Positive impact of R$381.9 million related to the evaluation at fair value of its Biological assets; |

| Þ | Positive impact of R$370.9 million in the year (R$292.4 million in the prior year) due to consideration of crop treatment made in the fields (after planting) as being Capex and as a consequence its amortization being considered for purposes of EBITDA calculation, which improved the cash cost and as a consequence the EBITDA of CAA; |

Excluding the effects from IFRS mentioned above, and non recurring expenses of R$ 30.0 million related to the JV with Shell (Raízen), the EBITDA of CAA would have totaled R$1,407.5 million this year, 22.6% higher than the adjusted EBITDA of the prior year, also excluding the non recurring gains of R$272.3 million from Refis.

Rumo

Benefited by the beginning of operation of the transportation activities, the EBITDA of Rumo in the FY’11 reached R$146.2 million, with margin of 32.6%, amount 2.0 times higher than the FY’10.

CCL

In thus year, CCL presented an EBITDA of R$394.5 million, with margin of R$63.2/thousand liters, or 3.3% of its net revenue. This EBITDA, as well as FY’10 EBITDA reported in IFRS, had a positive impact of R$ 35.8 million related to the adoption of IFRS, due to reclassification of investments in long term contracts with clients, treated before as prepaid expenses, as intangible assets, which affected both the reported Capex and the amortization considered for EBITDA purposes. In addition, CCL presented other operating revenues of R$31.8 million from the sale of assets. Excluding these IFRS adjustments and non recurring revenues/expenses, CCL EBITDA was R$343.0 million, 6.1% higher than the previous year EBITDA, due to the increase in volume sold, better mix and higher dilution of fixed expenses.

Financial Results

The financial results in the year was a net expense of R$146.7 million compared to a net revenue of R$455.2 million in the prior year.

| 4Q'10 | 4Q'11 | | Financial Expenses, Net (R$MM) | FY10 | FY'11 |

| (101.5) | (123.8) | | Interest on Financial Debt | (414.3) | (472.8) |

| 10.8 | 31.9 | | Financial Investments Income | 52.5 | 90.3 |

| (90.7) | (91.9) | | (=) | Sub-total: Interest on Net Financial Debt | (361.8) | (382.4) |

| (20.9) | (36.8) | | Other charges and monetary variation | (103.0) | (97.6) |

| (69.9) | 67.9 | | Exchange Variation | 559.0 | 282.7 |

| 192.6 | 48.4 | | Gains (losses) with Derivatives | 354.8 | 54.8 |

| 6.6 | (0.8) | | Others | 6.2 | (4.1) |

| 17.8 | (13.2) | | (=) | Net Financial Expenses | 455.2 | (146.7) |

The expenses with debt charges, net of financial investments yields, presented an increase of 5.7%, when compared to the prior year, mainly due to the greater average indebtedness. This increase of net debt, mostly financed by BNDES, was mainly due to new investment projects in Rumo (with acquisition of locomotives, railcars and investment in permanent ways) as well as in the projects of energy cogeneration. In addition, as a result from the adoption of IFRS, we capitalized financial charges to fixed assets, which benefitted/reduced the financial expenses at R$ 70.5 million in the current year and R$ 43.3 million in the prior year.

The net effects of exchange variation was a revenue of R$282.7 million in the year, compared to a net revenue of R$559 million in the prior year. These positive effects from exchange variation occurred due to the impacts on assets and liabilities denominated in foreign currency, mainly from the indebtedness in US dollar, due to the appreciation of local currency (Real), which appreciated 8.6% in this year and 23.1% in the prior year before the American currency. The gross indebtedness denominated in US dollars was R$ 3,622 million and R$ 3,502 million at March 31, 2010 and March 31, 2011, respectively.

The result from derivatives in the year was positive at R$54.8 million compared to an also positive result of R$354.8 million in the prior year, net of the hedge accounting impacts. It should be pointed out that, in the prior year we did not adopt the hedge accounting and as a consequence the results from derivatives in both years are not comparable, since the gains/losses with derivatives in the current year financial results refer only to the derivative instruments not designed for hedge accounting and the non effective portion of the designed hedge.

In addition, as a result from the adoption of IFRS, measured at fair value the financial instruments known as warrants, which Cosan has in its investee RADAR, and the positive result in the year for the appreciation of this instrument was recognized as derivative gain and totaled R$ 13.0 million in the year, compared to R$24,0 million in the prior year.

The position of volumes and prices of sugar fixed as tradings or via derivative financial instruments at March 31, 2011, as well as the Exchange derivative contracts, contracted to protect the Company future cash flows are summarized below:

| Summary of Hedge* as of March 31, 2011 | Fiscal Year |

| | 2011/12 |

| Sugar | |

| NY#11 | |

| Volume (thd tons) | 1,828.4 |

| Average Price (¢US$/lb) | 21.9 |

| London #5 | |

| Volume (thd tons) | 54.5 |

| Average Price (US$/ton) | 748.9 |

| US$ | |

| Volume (US$ million) | 451.1 |

| Average Price (R$/US$) | 1.730 |

| To be sold / crop (thousand tons) | 3153,6 |

| % sales of sugar hedged | 60% |

Hedge Accounting Impacts

As from April 1, 2010, the Company adopted the hedge accounting in the modality of cash flow, for certain derivative financial instruments designated to cover the sugar price risk and risk of exchange variation on revenues of sugar export. In the year ended March 31, 2011, we had the deferral (reclassification between financial results and the “reserve” account, in net assets) of R$393.0 million in net losses with these derivatives, and R$160.3 million was transferred to net operating income for the year. The table below shows the expectation of transfer of the balance of gains/ losses of net assets at 3/31/11 to net operating income in future years in accordance with the coverage period of the designated hedge instruments.

| | | | | | | Expected period to affect P&L | |

| Derivative | Market | | Risk | | | | 2011/12 | | | | 2012/13 | | | Total | |

| Future | OTC/NYBOT | | #11 | | | | (353.9 | ) | | | 2.8 | | | | (351.1 | ) |

| NDF | OTC/CETIP | | USD | | | | 134.0 | | | | - | | | | 134.0 | |

| (=) Hedge Accounting impact | | | | | | | (219.9 | ) | | | 2.8 | | | | (217.1 | ) |

| (-) Deferred income taxes | | | | | | | 74.8 | | | | (1.0 | ) | | | 73.8 | |

| (=) Other comprehensive income | | | | | | | (145.1 | ) | | | 1.8 | | | | (143.3 | ) |

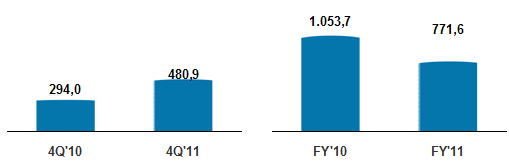

Net Income

Net income (R$ MM)

Cosan ended FY’11 with net income of R$771.6 million, compared to a net income of R$1,053.7 million of FY’10.

The result for FY’11 was benefited from larger volumes in CAA and CCL, better prices, specially, in sugar and ethanol, and the ramp-up of transportation activities of Rumo and of cogeneration projects, which justified an increase of 30% in the profit before the equity method, of the financial results and taxes on income, which increased from R$ 1,013.5 million in the prior year to R$ 1,312.6 million in the current year. It should also be pointed out that in the prior year we had a positive effect of R$ 270.3 million related to gains with the adhesion to the REFIS program, which did not occur this year.

The net financial income of the prior year which was R$ 455.1 million (compared to a net expense of R$ 146.7 million this year), also had an important participation in the result for that year, being significantly impacted by the gains with derivative transactions (of R$ 354.8 million) and gains with the effects from Real appreciation before the US dollar, which was less representative this year.

In terms of effective rate of taxes on income, compared to the nominal rate of 34%, this year we had an average rate of 35% compared to 29% in the prior year, considering that some gains in the scope of REFIS recognized that year, were not taxable.

E. Financial Condition

The financial gross debt, excluding Resolution 24711, totaled R$6.5 billion in the year ended March 31, 2011, an increase of 22.6% in relation to R$5.3 billion in the year ended March 31, 2010.

During the year, there was the funding of (i) R$514.8 million related to Perpetual Bonus (equivalent to USD 300 million) mainly used to settle the short term debts (ii) R$1,186.9 million in lines contracted from BNDES, Finame and Finem, mainly related to projects of energy cogeneration, greenfields, mechanization and investments in rail assets and terminals by Rumo; and (iii) R$138.5 million in the Program for Support of the Sugar Alcohol Sector (PASS) and rural credits ; (iv) acquisition of Zanin mill, in which Cosan assumed financial debts of R$ 235.0 million and (v) amortization of R$1,967.9 million of principal and interest paid

| Debt per Type (R$MM) | | 4Q'10 | | | 4Q'11 | | | % ST | | | Var. | |

| Foreign Currency | | | 3.622,5 | | | | 4.054,5 | | | | | | | 388,7 | |

| Perpetual Notes | | | 810,9 | | | | 1.236,2 | | | | 1,2 | % | | | (28,7 | ) |

| Senior Notes 2017 | | | 720,6 | | | | 659,0 | | | | 0,3 | % | | | (26,8 | ) |

| Senior Notes 2014 | | | 631,2 | | | | 576,8 | | | | 3,7 | % | | | (28,5 | ) |

| FX Advances | | | 296,4 | | | | 228,2 | | | | 100,0 | % | | | 17,8 | |

| Pre-Export Contracts | | | 980,6 | | | | 736,5 | | | | 38,0 | % | | | 6,5 | |

| Export Credit Notes | | | 182,8 | | | | 617,8 | | | | 1,1 | % | | | 448,4 | |

| Local Currency | | | 1.711,7 | | | | 2.462,3 | | | | | | | | (304,7 | ) |

| BNDES | | | 1.055,3 | | | | 1.589,5 | | | | 8,8 | % | | | (29,4 | ) |

| Finame (BNDES) | | | 199,1 | | | | 705,2 | | | | 10,9 | % | | | 23,7 | |

| Overdraft | | | 58,7 | | | | 62,3 | | | | 100,0 | % | | | 25,6 | |

| Credit Banking Notes | | | 62,5 | | | | 31,4 | | | | 0,0 | % | | | 31,4 | |

| Credit Notes | | | 380,1 | | | | 10,1 | | | | 50,9 | % | | | (295,6 | ) |

| Rural credit | | | - | | | | 92,4 | | | | 100,0 | % | | | 1,5 | |

| Expenses with Placement of Debt | | | (44,0 | ) | | | (28,5 | ) | | | 26,5 | % | | | 8,9 | |

| Gross Debt | | | 5.334,2 | | | | 6.516,8 | | | | 35,4 | % | | | 83,9 | |

| Cash and Marketable Securities | | | 1.078,4 | | | | 1.254,1 | | | | | | | | 117,2 | |

| Net Debt | | | 4.255,8 | | | | 5.262,7 | | | | | | | | (33,2 | ) |

| PESA debt | | | 603,6 | | | | 674,5 | | | | 0,0 | % | | | 21,7 | |

| CTNs | | | 205,7 | | | | 257,5 | | | | 0,0 | % | | | 14,8 | |

In the year ended March 31, 2011, the resources in cash of Cosan totaled R$1.3 billion, with its net debt amounting to R$5.3 billion, equivalent to 1.9 times the EBITDA.

1 As disclosed in the explanatory note 13 of the financial statements, this debt from Resolution2471 is backed by the National Treasury certificates, acquired by the Company and recorded in non-current assets. For this reason, we did not consider this debt in the indebtedness analysis

F. Investments

The capital expenditures (Capex) amounted to R$3,037.2 million in the FY’11, 19.3% higher than the same prior year period, mainly influenced by investments (i) higher investment by Rumo, (ii) higher operating capex for CAA, from R$ 1,229.6 million to R$ 1,756.8 million specially from the increase in investments in biological assets, interharvest maintenance mechanization and SSMA and (iii) significative reduction in expansion capex specially for greenfield and cogeneration due to the completion of such projects. Below a summary of the investments in each of the main groups/ categories:

| | Capex (R$MM) | FY10 | FY'11 |

| CAA - Capex operacional | 1,229.6 | 1,756.8 |

| l | Biological assets | 647.5 | 745.0 |

| l | Inter-harvest Maintenance Costs | 332.4 | 514.2 |

| l | SSMA & Sustaining | 45.0 | 121.9 |

| l | Mecanização | 30.5 | 124.1 |

| l | Projects CAA | 174.2 | 251.6 |

| CAA - Capex de expansão | 972.0 | 441.7 |

| l | Co-generation Projects | 376.4 | 287.6 |

| l | Greenfield | 462.2 | 66.9 |

| l | Expansão | 133.4 | 87.2 |

| CAA - Total | 2,201.6 | 2,198.6 |

| CCL | | 130.5 | 191.6 |

| Rumo | 143.8 | 427.9 |

| IFRS reclassification | 69.6 | 219.1 |

| (=) | Capex Consolidado | 2,545.5 | 3,037.2 |

| l | Investments | 16.0 | 159.9 |

| l | Cash received on Sale of Fixed Assets | (126.2) | (47.5) |

| (=) | Investment Cash Flow | 2,435.3 | 3,149.6 |

CAA

In FY’11 the Company maintained the high level of investments in plantation and crop treatment that with the IFRS began to be treated as addition to the biological assets which increased 15% compared to the previous year. The expenses with inter harvest maintenance, which presented an increase of 54.9% when compared to the prior year, totaled R$514.2 million.

The investments related to Safety, Health and Environment (SSMA), presented an increase of 171.1% when compared to the prior period. Most of these investments were focused on vignasse, projects, which is a byproduct reused as fertilizer in the sugarcane crops, aiming to create less exposure in its transportation from the plant to the agricultural areas.

Investments in agricultural mechanization totaled R$124.1 million, 4 times what was invested in the prior year, basically composed of agricultural equipment and machinery and adjustment of its units to receive sugarcane from mechanized crop.

The CAA projects consumed R$251.6 million of total investments in the fiscal year, amount 44.4% higher than the prior year. Such growth shows that the Company continues to maintain substantial investments in its production units in the processing and agricultural areas.

The investments in cogeneration amounted to R$ 287.6 million, mainly for the units of Ipaussu, Univalem and Bonfim. Other units received small investments, less relevant due to the final phase of investments.

The investments in greenfield projects of Cosan, Jataí (GO) and Caarapó (MS), decreased 85.5%, compatible with the final stage of investments.

Investments in expansion of capacity of sugar plants totaled R$87.2 million, 35.7% lower than the investments in the same prior year period. This decrease was due to the conclusion of most of the projects in the units Gasa, Ipaussu, Bonfim, Junqueira, Tamoio, Costa Pinto and Barra.

In line with its growth plan and always alert for market opportunities, Cosan concluded, on February, the acquisition of Zanin mill, totaling R$90.0 million plus debts previously mentioned.

Rumo

Of the total of R$427.9 million invested by Rumo, in line with its business plan, approximately 55% was addressed to the acquisition of locomotives and 45% for investments in construction of permanent road, terminals in the countryside of São Paulo and in the Santos Port. In line with its business plan to become a multimodal logistics alternative, Rumo acquired, on March 2011, control of Logispot Armazéns Gerais for R$ 48.9 million.

CCL

In FY’11, the capex of CCL amounted to R$191.6million, representing an increase of 46.9% when compared to the prior year. Out of this total, R$68.3 million refer to the purchase of intangible assets related to long term contracts with clients, which were not treated as Capex before the IFRS. The remaining R$123.3 million are concentrated in the supply and distribution in the terminals of fuels distribution, implementation of new programs and system, especially in the tax area and the updating if the storage system of lubricants.

G. Relevant Facts

| Þ | On June 16, Cosan informed that through its controlled subsidiary Barra Bioenergia S.A. it obtained approval by the BNDES of financial support in the amount of R$711.4 million, intended for the cogeneration projects of the Univalem, Ipaussu, Barra and Bonfim units, located in the State of São Paulo. The financial support is split into three financing facilities, which reflect the current conditions of the BNDES and the Company’s risk: (i) cogeneration line, with an average term of 13 years TJLP (Long-Term Interest Rate) + 1.92% p.a.; (ii) Finame line PSI (local acronym for Investment Sustainability Program), with a term of 10 years, with a total cost of 4.5% p.a., provided that it is contracted by no later than June 30, 2010; and (iii) the social projects facility, with a term of 8 years with TJLP cost. |

| Þ | On July 30, Cosan S.A. announced the approval, in an Annual and Special Shareholders’ Meeting held on July 30, 2010, of distribution of dividends in a total amount of two hundred million Reais (R$200,000,000), corresponding to R$0.491388181 per share, without withholding Tax. The mentioned divides will be paid on August 30, 2010 and will have as a calculation base the shareholding position on July 30, 2010, whereby as from August 2, 2010, the Company’s shares would be traded ex-dividends. |

| Þ | On August 25, Cosan S.A. and Cosan Limited successfully concluded the negotiations with Shell International Petroleum Company Limited and have entered into definitive agreements providing for the creation of a proposed joint venture involving certain of their respective assets, resulting in an estimated amount of US$12 billion. |

| Þ | On August 30, Cosan S.A. paid dividends in the amount of R$200,000,000, equivalent to R$0.491388181 per share. |

| Þ | On September 2, Rumo Logística S.A. received capitalization in a total amount of R$400,000,000.00 of investment vehicles managed by TPG Capital and Gávea Investimentos, which afterwards proceeded to detain 12.5% of Rumo each. These funds, added to the financing secured with the BNDES, assure the totality of the funds required for Rumo’s investments plan. Such capitalization, added to the R$986.5 million in financial support from BNDES – Brazilian National Development, Economic and Social Bank – secure the totality of the funds required for accomplishment of Rumo’s investments program of approximately R$1.2 billion. |

| Þ | On September 10, Cosan Limited distributed dividends relative to fiscal year 2010, amounting US$70,413,337.75, corresponding to US$0.260127888 per class A and/or B share. Payment in Brazil to the holders of BDRs occurred on September 17, 2010, for an amount of R$0.446561545 per BDR, based on a foreign exchange rate defined on September 10, 2010. |

| Þ | On October 29 Cosan Overseas Limited, a subsidiary of Cosan S.A., priced its Perpetual Senior Notes, amounting to US$300 million, with an interest rate of 8.25% per annum, paid quarterly. The Notes are guaranteed by Cosan S.A. and, with the conclusion of the proposed joint venture between Cosan and Shell, by Cosan Combustíveis e Lubrificantes S.A. (CCL), which will then proceed to detain exclusively the lubricants business. |

| Þ | On November 22, Cosan S.A. approved the Buyback Program relating to its common shares for maintenance in treasure, cancelation or sale, with a 365 term. As of December 31, 2010, the Company had purchased 591,400 of its own shares. |

| Þ | On November 23, Cosan S.A. informed that it entered into an Association Commitment with Camargo Correa Óleo e Gás S.A., Copersucar S.A., Odebrecht Transport Participações S.A., Petróleo Brasileiro S.A. and Uniduto Logística S.A. aiming to establish a joint venture to construct and operate a multimodal logistics system for transportation and storage of liquids, mainly ethanol. |

| Þ | On January 4, 2011 the Company announced the receipt of unconditional release from the European Committee to form the previously announced Joint Venture with Shell International Petroleum Company Limited involving certain of their assets, and it may now focus on the conclusion of the conditions precedent of the agreement and the business unit integration process for launching the new company. |

| Þ | On January 17, Cosan Combustíveis e Lubrificantes, holder of the license to use the trademarks Esso and Mobil in Brazil, and Banco Santander announced the launching, in the first quarter 2011, of the Esso Santander credit card aiming to strengthen the relationship with consumers of the Esso network. |

| Þ | On January 18, Rumo Logística and São Martinho announced the 2nd phase of the agreement for logistics projects and services of storage, transshipment and rail transportation of sugar. This phase estimates investments of approximately R$30.0 million in Usina São Martinho for the construction of a sugar warehouse and modernization of the plant’s extension access to the Pradópolis yard. These investments will increase the transshipment capacity to up to 2,000,000 tons of sugar per year. Any rail transportation adjustments to accomplish the transportation and transshipment obligations shall be responsibility of Rumo, as already provided for in its investment plan. |

| Þ | On February 22, Cosan S.A. informed that its subsidiary Cosan S.A. Açúcar e Álcool concluded negotiation with the shareholders of Usina Zanin Açúcar e Álcool Ltda., entering into an agreement involving the purchase of the equity interests of Zanin. This transaction amounted R$90.0 million and debts amounting approximately R$235.0 million. This Transaction will include Zanin assets related to the industrial and agricultural activities with annual crushing capacity of approximately 2.6 million tons of sugarcane and a greenfield project in the city of Prata, State of Minas Gerais. |

| Þ | On April 7, Cosan S.A. and Cosan Limited announced to their shareholders and to the market that successfully concluded negotiations of the pending matters under the Framework Agreement executed with Shell Brazil Holdings B.V. and signed an amendment to such agreement. It has been agreed that the retail sugar business will be retained by Cosan and the average foreign exchange rate to be used for the |

first installment of the cash to be contributed by Shell and for the net debt contribution from Cosan will be of R$ 1.6287 / US$ (PTAX of March 31st, 2011).

| Þ | On May 16, Cosan S.A. concluded the call of the totality of its 8.25% Perpetual Notes issued in 2006 in the amount of US$ 450 million. These Perpetual Notes were replaced by a syndicated bank loan in the amount of US$ 450 million of up to 2 (two) years with provision for quarterly pre-payment and cost of Libor + 2.15% p.a.. This lower cost debt will be contributed to Raízen. |

| Þ | On June 2, Cosan S.A. and Cosan Limited announced the conclusion of the corporate reorganization as set forth in the Framework Agreement executed with Shell Brazil Holdings B.V., giving rise to Raízen Energia Participações S.A. and Raízen Combustíveis S.A., the world´s largest sugar, ethanol and cogeneration producer out of sugarcane and one of the largest fuels distributors in the Brazilian market. The net debt contributed by Cosan to the joint venture shall be R$4.94 billion plus certain adjustments. |

H. Guidance

This section contains guidance ranges for selected key parameters of the Company for the fiscal year 2012, which began on April 1st, 2011 and will end on March 31st, 2012. Note that statements in other sections of this letter may also contain projections. These projections and guidance are merely estimates and indicative, and should not be construed as a guarantee of future performance. This guidance takes into consideration the operations held by the Cosan group today, which includes Raízen Energia, Raízen COmbustíveis, Cosan Alimentos, Cosan Lubrificantes and Specialties and Rumo Logística.

| Guidance Raízen Energia | 2010FY | 2011FY | 2012FY |

| Crushed Sugarcane Volume (thousand tons) | 50.314 | 54.238 | 56.000 | ≤ ∆ ≤ 60.000 |

| Sugar Volume Sold (thousand tons) | 4.135 | 4.291 | 4.200 | ≤ ∆ ≤ 4.600 |

| Ethanol Volume Sold (million liters) | 2.148 | 2.247 | 2.100 | ≤ ∆ ≤ 2.300 |

| Volume of Energy Sold (thousand MW) | 596 | 1.254 | 1.400 | ≤ ∆ ≤ 1.600 |

| EBITDA (R$ MM) | 1.711 | 2.130 | 1.900 | ≤ ∆ ≤ 2.300 |

| | | | |

| Guidance Raízen Combustíveis | 2010FY | 2011FY | 2012FY |

| Fuels Volume Sold million liters) | | | 21.000 | ≤ ∆ ≤ 23.000 |

| EBITDA (R$ MM) | | | 850 ≤ ∆ ≤ 1050 |

| | | | |

| | | | |

| Guidance Cosan Consolidated * | 2010FY | 2011FY | 2012FY |

| Net Revenues (R$ MM) | 15.336 | 18.063 | 25.500 | ≤ ∆ ≤ 27.500 |

| Loading Volume (thousand tons) | 8.124 | 7.481 | 9.000 ≤ ∆ ≤ 11.000 |

| Transportation Volume (thousand tons) | - | 5,000 ≤ ∆ ≤ 6,000 | 6.000 | ≤ ∆ ≤ 8.000 |

| Volume of Lubes Sold (million liters) | 131 | 166 | 170 | ≤ ∆ ≤ 190 |

| Sugar Volume Sold - Retail (thousand tons) | | | 600 | ≤ ∆ ≤ 700 |

| EBITDA (R$ MM) | 2.141 | 2.671 | 1.800 | ≤ ∆ ≤ 2.200 |

| Net Profit/Loss (R$ MM) | 986 | 772 | | - |

| Capex (R$ MM) | 1.926 | 2.500 | 2.000 | ≤ ∆ ≤ 2.300 |

*Refers to partial consolidation of 50% of Raízen businesses and 100% of the other businesses controlled by Cosan

Consolidated Financial Statements

Cosan S.A. Indústria e Comércio

March 31, 2011 and 2010

COSAN S.A. INDÚSTRIA E COMÉRCIO

Consolidated Financial Statements

March 31, 2011 and 2010

Contents

| Report of Independent Auditors | 1 |

| | |

| | |

| Consolidated Statements of Financial Position | 3 |

| Consolidated Income Statements | 5 |

| Consolidated Statements of Changes in Equity | 6 |

| Consolidated Statements of Comprehensive Income | 7 |

| Consolidated Statements of Cash Flows | 8 |

| Notes to the Consolidated Financial Statements | 9 |

Report of Independent Auditors to the Shareholders of Cosan S.A. Indústria e Comércio

We have audited the accompanying consolidated financial statements of Cosan S.A. Indústria e Comércio, which comprise the consolidated statement of financial position as at March 31, 2011, and the consolidated income statement, consolidated statement of comprehensive income, consolidated statement of changes in equity and consolidated statement of cash flows for the year then ended, and a summary of significant accounting policies and other explanatory information.

Management’s responsibility for the consolidated financial statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditors’ responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of Cosan S.A. Indústria e Comércio as at March 31, 2011, and of its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards.

São Paulo, June 6, 2011

ERNST & YOUNG TERCO

Auditores Independentes S.S.

Luiz Carlos Nannini

Partner

COSAN S.A INDÚSTRIA E COMÉRCIO

Consolidated Statements of Financial Position

March 31, 2011, 2010 and April 1, 2009

(In Thousands of Reais)

| | | Note | | | March 31, 2011 | | | March 31, 2010 | | | April 1, 2009 | |

| Assets | | | | | | | | | | | | |

| Current | | | | | | | | | | | | |

| Cash and cash equivalents | | | 4 | | | | 1,254,070 | | | | 1,078,366 | | | | 719,356 | |

| Restricted cash | | | 5 | | | | 187,944 | | | | 44,972 | | | | 11,757 | |

| Accounts receivable | | | 7 | | | | 594,857 | | | | 766,415 | | | | 599,163 | |

| Derivatives | | | 26 | | | | 55,682 | | | | 230,561 | | | | 17,022 | |

| Inventories | | | 8 | | | | 670,331 | | | | 612,683 | | | | 719,656 | |

| Advances to suppliers | | | | | | | 229,325 | | | | 201,573 | | | | 206,032 | |

| Related parties | | | 10 | | | | 14,669 | | | | 27,246 | | | | 57,232 | |

| Recoverable taxes | | | 9 | | | | 374,991 | | | | 327,864 | | | | 265,417 | |

| Other current assets | | | | | | | 80,385 | | | | 75,157 | | | | 69,508 | |

| | | | | | | | 3,462,254 | | | | 3,364,837 | | | | 2,665,143 | |

| | | | | | | | | | | | | | | | | |

| Non-current | | | | | | | | | | | | | | | | |

| Deferred income taxes | | | 18 | | | | 715,333 | | | | 686,139 | | | | 809,218 | |

| Advances to suppliers | | | | | | | 46,037 | | | | 63,741 | | | | 48,035 | |

| Related parties | | | 10 | | | | 91,954 | | | | 81,411 | | | | - | |

| Recoverable taxes | | | 9 | | | | 55,066 | | | | 45,018 | | | | 21,374 | |

| Judicial deposits | | | | | | | 218,371 | | | | 167,562 | | | | 171,266 | |

| Other financial assets | | | 6 | | | | 420,417 | | | | 355,370 | | | | 303,467 | |

| Other non-current assets | | | | | | | 443,752 | | | | 450,819 | | | | 392,023 | |

| Equity method investments | | | 12 | | | | 304,142 | | | | 260,814 | | | | 323,077 | |

| Biological assets | | | 13 | | | | 1,561,132 | | | | 963,244 | | | | 754,231 | |

| Property, plant and equipment | | | 14 | | | | 7,980,524 | | | | 6,114,531 | | | | 3,923,623 | |

| Intangible assets | | | 15 | | | | 3,445,674 | | | | 3,381,466 | | | | 2,465,955 | |

| | | | | | | | 15,282,402 | | | | 12,570,115 | | | | 9,212,269 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total Assets | | | | | | | 18,744,656 | | | | 15,934,952 | | | | 11,877,412 | |

COSAN S.A INDÚSTRIA E COMÉRCIO

Consolidated Statements of Financial Position

March 31, 2011, 2010 and April 1.2009

(In Thousands of Reais)

| | | Nota | | | March 31, 2011 | | | March 31, 2010 | | | April 1, 2009 | |

| Liabilities | | | | | | | | | | | | |

| Current | | | | | | | | | | | | |

| Current portion of long-term debt | | | 16 | | | | 916,400 | | | | 795,001 | | | | 1,449,504 | |

| Derivatives | | | 26 | | | | 132,289 | | | | 76,703 | | | | 66,895 | |

| Trade accounts payable | | | | | | | 558,766 | | | | 569,399 | | | | 456,116 | |

| Salaries payable | | | | | | | 183,560 | | | | 141,584 | | | | 93,156 | |

| Taxes payable | | | 17 | | | | 245,284 | | | | 215,862 | | | | 168,596 | |

| Dividends payable | | | 21 | | | | 190,285 | | | | 116,569 | | | | - | |

| Related parties | | | 10 | | | | 41,163 | | | | 16,105 | | | | 4,458 | |

| Other current liabilities | | | | | | | 189,629 | | | | 182,434 | | | | 85,794 | |

| | | | | | | | 2,457,376 | | | | 2,113,657 | | | | 2,324,519 | |

| Non-current | | | | | | | | | | | | | | | | |

| Long-term debt | | | 16 | | | | 6,274,895 | | | | 5,136,529 | | | | 2,885,456 | |

| Taxes payable | | | 17 | | | | 639,071 | | | | 592,854 | | | | 328,760 | |

| Legal proceedings | | | 19 | | | | 666,282 | | | | 611,983 | | | | 1,277,165 | |

| Related parties | | | 10 | | | | 4,444 | | | | - | | | | 405,871 | |

| Pension | | | 27 | | | | 24,380 | | | | - | | | | 65,108 | |

| Deferred income taxes | | | 18 | | | | 1,510,965 | | | | 1,122,408 | | | | 528,969 | |

| Other non-current liabilities | | | | | | | 382,897 | | | | 375,344 | | | | 362,393 | |

| | | | | | | | 9,502,934 | | | | 7,839,118 | | | | 5,853,722 | |

| | | | | | | | | | | | | | | | | |

| Equity | | | | | | | | | | | | | | | | |

| Common stock | | | 21 | | | | 4,691,822 | | | | 4,687,826 | | | | 3,819,770 | |

| Treasury shares | | | | | | | (19,405 | ) | | | (4,186 | ) | | | (4,186 | ) |

| Capital reserve | | | | | | | 537,468 | | | | 491,329 | | | | 45,841 | |

| Profit reserves | | | | | | | 1,248,976 | | | | 744,089 | | | | - | |

| Accumulated losses | | | | | | | - | | | | - | | | | (193,075 | ) |

| Equity attributable to owners of the Company | | | | | | | 6,458,861 | | | | 5,919,058 | | | | 3,668,350 | |

| Equity attributable to non-controlling interests | | | | | | | 325,485 | | | | 63,119 | | | | 30,821 | |

| Total Equity | | | | | | | 6,784,346 | | | | 5,982,177 | | | | 3,699,171 | |

| Total Liabilities and Equity | | | | | | | 18,744,656 | | | | 15,934,952 | | | | 11,877,412 | |

See accompanying notes to consolidated financial statements.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Consolidated Income Statements

Years ended March 31, 2011 and 2010

(In thousands of Reais, except otherwise stated)

| | | Note | | | 2011 | | | 2010 | |

| Net sales | | | 22 | | | | 18,063,480 | | | | 15,336,055 | |

| Cost of goods sold | | | 23 | | | | (15,150,079 | ) | | | (13,271,331 | ) |

| Gross profit | | | | | | | 2,913,401 | | | | 2,064,724 | |

| | | | | | | | | | | | | |

| Operational income /(expenses) | | | | | | | | | | | | |

| Selling | | | 23 | | | | (1,026,000 | ) | | | (862,726 | ) |

| General and administrative | | | 23 | | | | (541,002 | ) | | | (496,346 | ) |

| Other, net | | | 25 | | | | (33,828 | ) | | | 37,523 | |

| Gain on tax recovery program | | | 17 | | | | - | | | | 270,333 | |

| | | | | | | | (1,600,830 | ) | | | (1,051,216 | ) |

| Income before financial results, equity income of associates and income taxes | | | | | | | 1,312,571 | | | | 1,013,508 | |

| | | | | | | | | | | | | |

| Equity income of associates | | | 12 | | | | 25,187 | | | | 4,178 | |

| Financial results, net | | | 24 | | | | (146,688 | ) | | | 455,168 | |

| | | | | | | | (121,501 | ) | | | 459,346 | |

| Income before income taxes | | | | | | | 1,191,070 | | | | 1,472,854 | |

| Income Taxes | | | | | | | | | | | | |

| Current | | | 18 | | | | (85,437 | ) | | | (78,381 | ) |

| Deferred | | | 18 | | | | (329,071 | ) | | | (344,923 | ) |

| | | | | | | | | | | | | |

| Net income for the year | | | | | | | 776,562 | | | | 1,049,550 | |

| | | | | | | | | | | | | |

| Net income attributable to non-controlling interests | | | | | | | (4,997 | ) | | | 4,183 | |

| Net income attributable to Cosan | | | | | | | 771,565 | | | | 1,053,733 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Earnings per share (in Reais) | | | 21 | | | | | | | | | |

| Basic | | | | | | | 1.90 | | | | 2.81 | |

| Diluted | | | | | | | 1.90 | | | | 2.72 | |

See accompanying notes to consolidated financial statements.

COSAN S.A. INDÚSTRIA E COMÉRCIO

Consolidated Statements of Changes in Equity

Years ended March 31, 2011 and 2010

(In Thousands of Reais)

| | | | | | | | | Capital Reserve | | | Profit Reserves | | | | | | | | | | | | | |

| | | Common Stock | | | Treasury shares | | | Additional paid-in capital | | | Other Components of equity | | | Legal reserve | | | Retained earnings | | | Accumulated earnings (losses) | | | Total | | | Non-controlling interests | | | Total ´ Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| April 1. 2009 | | | 3,819,770 | | | | (4,186 | ) | | | 45,841 | | | | - | | | | - | | | | - | | | | (193,075 | ) | | | 3,668,350 | | | | 30,821 | | | | 3,699,171 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisition of Teaçu | | | - | | | | - | | | | 164,976 | | | | - | | | | - | | | | - | | | | - | | | | 164,976 | | | | 142,535 | | | | 307,511 | |

| Acquisition of Curupay | | | 334,172 | | | | - | | | | 232,429 | | | | - | | | | - | | | | - | | | | - | | | | 566,601 | | | | (121,927 | ) | | | 444,674 | |

| Exercise of stock option | | | 6,003 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 6,003 | | | | - | | | | 6,003 | |

| Exercise of common stock warrants | | | 527,881 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 527,881 | | | | - | | | | 527,881 | |

| Acquisition of TEAS | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 15,873 | | | | 15,873 | |

| Cumulative translation adjustment - CTA | | | - | | | | - | | | | - | | | | (2,944 | ) | | | - | | | | - | | | | - | | | | (2,944 | ) | | | - | | | | (2,944 | ) |

| Pension | | | - | | | | - | | | | - | | | | 42,056 | | | | | | | | - | | | | - | | | | 42,056 | | | | - | | | | 42,056 | |

| Share based compensation | | | - | | | | - | | | | 8,971 | | | | - | | | | - | | | | - | | | | - | | | | 8,971 | | | | - | | | | 8,971 | |

| Net Income | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,053,733 | | | | 1,053,733 | | | | (4,183 | ) | | | 1,049,550 | |

| Destination: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Legal reserve | | | - | | | | - | | | | - | | | | - | | | | 24,541 | | | | - | | | | (24,541 | ) | | | - | | | | - | | | | - | |

| Proposed Dividends (Note 21) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (116,569 | ) | | | (116,569 | ) | | | - | | | | (116,569 | ) |

| Reserves | | | | | | | | | | | | | | | | | | | | | | | 719,548 | | | | (719,548 | ) | | | - | | | | - | | | | - | |

| March 31, 2010 | | | 4,687,826 | | | | (4,186 | ) | | | 452,217 | | | | 39,112 | | | | 24,541 | | | | 719,548 | | | | - | | | | 5,919,058 | | | | 63,119 | | | | 5,982,177 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock option | | | 3,995 | | | | - | | | | - | | | | | | | | - | | | | - | | | | - | | | | 3,995 | | | | - | | | | 3,995 | |

| Exercise of common stock warrants | | | 1 | | | | - | | | | - | | | | | | | | - | | | | - | | | | - | | | | 1 | | | | - | | | | 1 | |