A free translation from Portuguese into English of Independent Auditor’s Review Report

We have reviewed the accompanying consolidated interim financial information, contained in the Quarterly Financial Information (ITR) of Cosan Limited, as of September 30, 2011, comprising the statement of financial position and the related statements of income, comprehensive income for the three-month and nine-month periods then ended, changes in equity and cash flows for the nine-month period then ended, including the explanatory notes.

Management is responsible for the consolidated interim financial information in accordance with IAS 34 – Interim Financial Reporting, issued by the International Accounting Standards Board (IASB), as well as for the fair presentation of this information in conformity with specific rules issued by the Brazilian Securities Commission (CVM) applicable to the preparation of Quarterly Financial Information (ITR). Our responsibility is to express a conclusion on this interim financial information based on our review.

Auditores Independentes S.S.

See accompanying notes to consolited quarterly financial information.

Cosan Limited

Consolidated Statements of Comprehensive Income

Period ended September 30, 2011 and 2010

(In Thousands of Reais)

| | | 07.01.2011 to

09.30.2011 | | | 04.01.2011 to

09.30.2011 | | | 07.01.2010 to

09.30.2010 | | | 04.01.2010 to

09.30.2010 | |

| | | | | | | | | | | | | |

| Net income of the period | | | 84,581 | | | | 1,942,742 | | | | 238,635 | | | | 235,795 | |

| | | | | | | | | | | | | | | | | |

| Other Comprehensive Income (Loss): | | | | | | | | | | | | | | | | |

| Cummulative Translation Adjustment - CTA | | | 18,232 | | | | 13,100 | | | | (3,374 | ) | | | (3,644 | ) |

| Net movement on cash flow hedges | | | (42,268 | ) | | | 15,794 | | | | (229,394 | ) | | | (199,177 | ) |

| Actuarial gains and losses on defined benefit plans | | | - | | | | - | | | | (3,641 | ) | | | (3,639 | ) |

| Income tax effects | | | 14,371 | | | | (5,369 | ) | | | 79,232 | | | | 68,958 | |

| | | | | | | | | | | | | | | | | |

| Other Comprehensive Income (Loss) for the period, net of tax | | | (9,665 | ) | | | 23,525 | | | | (157,177 | ) | | | (137,502 | ) |

| | | | | | | | | | | | | | | | | |

| Total Comprehensive Income for the period, net of tax | | | 74,916 | | | | 1,966,267 | | | | 81,458 | | | | 98,293 | |

| | | | | | | | | | | | | | | | | |

| Attributable to: | | | | | | | | | | | | | | | | |

| Owners of the Company | | | 38,045 | | | | 1,041,937 | | | | 54,142 | | | | 61,743 | |

| Non-controlling interests | | | 36,871 | | | | 924,330 | | | | 27,316 | | | | 36,550 | |

See accompanying notes to consolidated quartely financial information.

Cosan Limited

Consolidated Statements of Cash Flows

Period ended September 30, 2011 and 2010

(In Thousands of Reais)

| | | | 09.30.2011 | | | | 09.30.2010 | |

| Operating activities | | | | | | | | |

| Net income of the period attributable to Cosan | | | 1,022,364 | | | | 148,669 | |

| Non-cash adjustments to reconcile profit before tax to net cash flows from operating activities: | | | | | | | | |

| Depreciation and amortization | | | 669,205 | | | | 690,927 | |

| Biological assets | | | 17,856 | | | | 70,829 | |

| Income from equity investments | | | (658 | ) | | | (8,116 | ) |

| Loss (gain) from disposal of property, plant and equipment | | | 5,542 | | | | (8,718 | ) |

| Deferred income taxes | | | 920,054 | | | | 103,714 | |

| Non-controlling interests | | | 920,378 | | | | 87,126 | |

| Interest, monetary variations and foreign exchange variation, net | | | 542,028 | | | | 102,582 | |

| Joint Ventures formation effects | | | (2,853,057 | ) | | | - | |

| Others | | | 16,845 | | | | 32,722 | |

| | | | 1,260,557 | | | | 1,219,735 | |

| Changes in assets and liabilities | | | | | | | | |

| Accounts receivable | | | (228,808 | ) | | | (121 | ) |

| Restricted cash | | | 121,179 | | | | - | |

| Inventories | | | (638,444 | ) | | | (752,596 | ) |

| Related parties | | | (1,604,806 | ) | | | - | |

| Advances to suppliers | | | (103,922 | ) | | | (59,728 | ) |

| Suppliers | | | 366,203 | | | | 262,688 | |

| Salaries payable | | | 116,062 | | | | 83,905 | |

| Legal proceedings | | | 68,074 | | | | 4,770 | |

| Derivatives | | | (141,242 | ) | | | (143,865 | ) |

| Taxes and Contributions Payable | | | 924,273 | | | | 5,209 | |

| Other assets and liabilities, net | | | 343,691 | | | | (63,179 | ) |

| | | | | | | | | |

| Net cash flows from operating activities | | | 482,817 | | | | 556,818 | |

| Investing activities | | | | | | | | |

| Acquisitions, net cash of cash acquired | | | (26,270 | ) | | | (16,467 | ) |

| Acquisition of sugar retail business | | | (72,780 | ) | | | - | |

| Dividends received | | | 100,639 | | | | - | |

| Purchase of property, plant and equipment, software and other intangible assets | | | (729,096 | ) | | | (826,505 | ) |

| Sugarcane planting and growing costs | | | (340,784 | ) | | | (392,620 | ) |

| Cash contributed in the formation of Raízen | | | (173,116 | ) | | | - | |

| Proceeds from the sale of other investments and property, plant and equipment | | | 42,282 | | | | 17,906 | |

| | | | | | | | | |

| Net cash flows used in investing activities | | | (1,199,125 | ) | | | (1,217,686 | ) |

| Financing activities | | | | | | | | |

| Proceeds from long-term debt | | | (1,199,125 | ) | | | (1,138,273 | ) |

| Repayment of long-term debt | | | (613,524 | ) | | | (786,368 | ) |

| Capital increase | | | - | | | | 403,309 | |

| Capital increase in subsidiaries by non-controlling interests in subsidiaries | | | 139,925 | | | | - | |

| Acquisition of treasury shares | | | (49,847 | ) | | | - | |

| Acquisition of shares of subsidiary | | | (4,579 | ) | | | - | |

| Dividends paid | | | (328,805 | ) | | | (192,413 | ) |

| | | | | | | | | |

| Net cash flows from financing activities | | | 908,057 | | | | 562,801 | |

| | | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | | 19,343 | | | | (3,746 | ) |

| Net increase in cash and cash equivalents | | | 211,092 | | | | (101,813 | ) |

| Cash and cash equivalents at the beginning of the period | | | 1,271,780 | | | | 1,110,766 | |

| Cash and cash equivalents at the end of the period | | | 1,482,872 | | | | 1,008,953 | |

| Supplemental disclosure of cash flow information | | | | | | | | |

| Financial interest expenses paid | | | 151,823 | | | | 211,456 | |

| Income taxes paid | | | 98,836 | | | | 18,369 | |

See accompanying notes to consolidated quarterly financial information.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

Cosan Limited (“Cosan” and “the Company”) was incorporated in Bermuda on April 30, 2007. Its shares are traded on the New York Stock Exchange (NYSE – CZZ) and in the São Paulo Stock Exchange (Bovespa – CZLT11). Mr. Rubens Ometto Silveira Mello is the ultimate controlling shareholder of the Company. Cosan Limited controls Cosan S.A. Indústria e Comércio and its subsidiaries (“Cosan S.A.”) with a 62.47% interest.

Cosan S.A. is a Brazilian Company with its shares traded on Novo Mercado of São Paulo Stock Exchange (“Bovespa”) under the ticker CSAN 3. Its registered office is located in the city of São Paulo, Brazil.

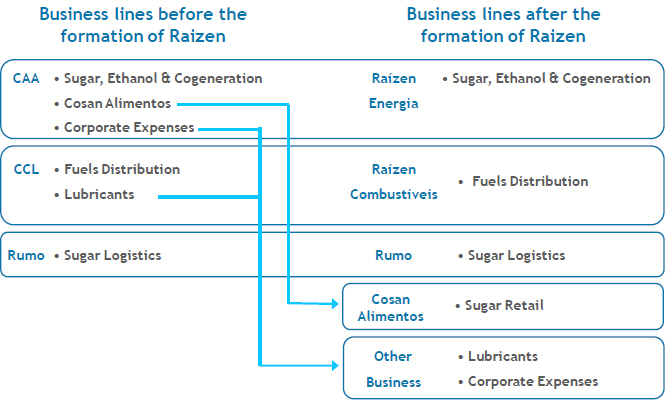

Cosan S.A., through its subsidiaries and jointly controlled subsidiaries, primary activities are in the following business segments (i) Sugar & Ethanol: the production of sugar and ethanol, as well as the energy cogeneration produced from sugar cane bagasse, through its joint venture named Raízen Energia Participações S.A. (“Raízen Energia”) (ii) Fuel Distribution through its joint venture named Raízen Combustíveis S.A. (“Raízen Combustíveis”) (iii) Logistics services including transportation, port lifting and storage of sugar (iv) Production and distribution of lubricants licensed by Mobil trademark and, (v) since July 1, 2011, the purchase and sale of sugar in the retail segment, activity that was previously developed by its joint venture Raízen Energia, now under the name of a business segment “Cosan Alimentos”.

On June 1st 2011, the Company completed, jointly with Royal Dutch Shell ("Shell"), the establishment of two controlling companies ("joint ventures"): (i) Raizen Combustíveis S.A. ("Raízen Combustíveis"), in the fuel distribution segment, and (ii) Raizen Energia Participações SA ("Raízen Energia"), in the segment of sugar and ethanol. Cosan and Shell share control of the two entities, with each company holding 50% of the economic control. Cosan recorded its investments in the joint ventures using the equity method of accounting for the purposes of its individual financial information, and through proportionate consolidation in the consolidated financial information.

Cosan contributed with their business of sugar, ethanol, cogeneration and fuel distribution in the formation of joint ventures. Shell contributed its business of distributing fuel in Brazil and participation in business research and development of second generation ethanol (Iogen and Codexis), the license to use the Shell brand in the amount of R$ 530,498 and a contribution of money determined valued at approximately R$ 1.8 billion over a period of 2 years. The accounting effects arising from the formation of Raizen Combustíveis and Raizen Energia are presented in Note 21.

The logistics of sugar and lubricants business, together with investment in Radar Propriedades Agrícolas S.A. ("Radar") were not contributed to the joint ventures.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| 2. | Presentation of quarterly financial information and accounting policies |

The quarterly financial information have been prepared and presented in accordance with IAS 34 International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

Information in the notes to the financial information that have not had any significant changes or present immaterial information in comparison to those included in the annual report dated March 31, 2011, have not been included in this financial information

As of April 1, 2011, the following pronouncements and interpretations took effect: IAS 24 - Disclosure Requirements for State Entities and Definition of Related Party (Revised), IFRIC 14 - Prepayments of a Minimum Funding Requirement, and IFRIC 19 - Extinguishment of Financial Liabilities to Equity Instruments. The adoption of these pronouncements and interpretations did not impact the financial information for September 30, 2011.

This quartely financial information were authorized for issued by the Audit Committee on November 2, 2011.

Certain reclassifications have been made for a fair presentation of quarterly financial information.

The consolidated financial statements are presented in Brazilian reais. However, the functional currency of Cosan is the U.S. dollar. The Brazilian real is the currency of the primary economic environment in which Cosan S.A. and its subsidiaries, located in Brazil, operate and generate and expend cash and is the functional currency, except for the foreign subsidiaries in which U.S. dollar is the functional currency. The conversion effects are registered in the shareholder’s equity of those subsidiaries.

The exchange rate of the Brazilian real (R$) to the U.S. dollar (US$) was R$1.8544=US$1.00 at September 30, 2011, R$1,6287=US$1.00 at March 31, 2011.

On November 3, 2011, the Company's Board of Directors approved this financial information and authorized its issuance.

Company’s jointly controlled subsidiaries

Cosan holds stakes in two joint ventures (Raizen Combustíveis and Raizen Energia), which, together with Shell, have a contractual arrangement that establishes joint control of the company’s activities. Cosan recognizes their participation in these joint ventures through proportionate consolidation of the consolidated information and through the equity method applied in the individual information.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

Consolidation of quarterly financial information

The consolidated quarterly financial information include information from Cosan, its subsidiaries and jointly controlled subsidiaries for the quarter ended September 30, 2011 and year ended March 31, 2011. The Subsidiaries and jointly controlled subsidiaries are listed below:

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Subsidiaries (direct interest) | | | | | | | | |

| Cosan S.A. Indústria e Comercio | | | 62.47 | % | | | 62.20 | % |

| | | | | | | | | |

| Indirect interest | | | | | | | | |

| Administração de Participações Aguassanta Ltda. | | | 57.16 | % | | | 56.91 | % |

| Bioinvestments Negócios e Participações S.A. | | | 57.16 | % | | | 56.91 | % |

| Vale da Ponte Alta S.A. | | | 57.16 | % | | | 56.91 | % |

| Águas da Ponte Alta S.A. | | | 57.16 | % | | | 56.91 | % |

| Proud Participações S.A. | | | 62.47 | % | | | 62.14 | % |

| Cosan Distribuidora de Combustíveis Ltda. | | | 62.47 | % | | | 62.14 | % |

| Cosan Overseas Limited | | | 62.47 | % | | | 62.20 | % |

| Pasadena Empreendimentos e Participações S.A. | | | 62.47 | % | | | 62.20 | % |

| Cosan Cayman Finance Limited | | | 62.47 | % | | | 62.20 | % |

| Cosan Lubrificantes e Especialidades S.A. (anteriormente denominada Cosan Combustíveis e Lubrificantes S.A.) | | | 62.47 | % | | | 62.20 | % |

| CCL Cayman Finance Limited | | | 62.47 | % | | | 62.20 | % |

| Copsapar Participações S.A. | | | 56.22 | % | | | 55.98 | % |

| Novo Rumo Logística S.A. | | | 58.03 | % | | | 57.78 | % |

| Rumo Logística S.A. | | | - | | | | 43.35 | % |

| Docelar Alimentos e Bebidas S.A. | | | 62.41 | % | | | 62.14 | % |

| Cosan Operadora Portuária S.A. | | | 43.54 | % | | | 43.35 | % |

| Teaçú Armazéns Gerais S.A. | | | 43.54 | % | | | 43.35 | % |

| Logispot Armazéns Gerais S.A. | | | 22.18 | % | | | 22.08 | % |

| | | | | | | | | |

| Jointly-controlled subsidiaries (indirect) | | | | | | | | |

| Raízen S.A. (1) | | | 31.24 | % | | | - | |

| Raízen Energia Participações S.A. (1) | | | 31.24 | % | | | - | |

| Raízen Combustíveis S.A. (1) | | | 31.24 | % | | | - | |

(1) Jointly-controlled subsidiares with Shell

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

The subsidiaries are fully consolidated from the date of acquisition of control, and continue to be consolidated until the date that control ceases to exist. The jointly controlled subsidiaries are consolidated proportionally from the date of acquisition of joint control until the date that joint control ceases to exist.

The quarterly financial information of subsidiaries and jointly controlled subsidiaries are prepared for the same disclosure period as that of the parent company, using consistent accounting policies. All balances held between the subsidiary companies and jointly controlled subsidiaries, income and expenses and unrealized gains and losses derived from intercompany transactions are eliminated in their entirety.

Any change in the ownership interest of a subsidiary that does not result in loss of control is accounted for as an equity transaction.

| 2. | New IFRS and IFRIC Interpretations Committee (Financial Reporting Interpretations of IASB) applicable to the consolidated financial statements |

New accounting pronouncements from the IASB and IFRIC interpretations have been published and / or reviewed and have the optional adoption for the current year. These new accounting pronouncements and interpretations are described below:

• IFRS 9 Financial Instruments – Classification and measurement - It reflects the first phase of the IASBs work on the replacement of IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 uses a simplified approach to determine whether a financial asset is measured at amortized cost or fair value, based on the manner in which an entity manages its financial instruments (business model) and the typical contractual cash flow of financial assets. The standard also requires the adoption of only one method for determining losses in recoverable value of assets. The standard is effective for annual periods beginning on or after 1 January 2013. Early adoption is permitted. Management is still evaluating the impact on its financial position or performance in relation to IFRS 9.

• IFRS 10 Consolidated Financial Statements - IFRS 10 as issued establishes principles for the presentation and preparation of consolidated financial statements when an entity controls one or more other entities. IFRS 10 replaces the consolidation requirements in SIC-12 Consolidation—Special Purpose Entities and IAS 27 Consolidated and Separate Financial Statements and is effective for annual periods beginning on or after January 1, 2013. Early adoption is permitted. Management is still evaluating the impact on its financial position or performancefrom the adoption of IFRS 10.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| 3. | New IFRS and IFRIC Interpretations Committee (Financial Reporting Interpretations of IASB) applicable to the consolidated financial statements --Continued |

• IFRS 11 Joint Arrangements – IFRS 11 provides for a more realistic reflection of joint arrangements by focusing on the rights and obligations of the arrangement, rather than its legal form. The standard addresses inconsistencies in the reporting of joint arrangements by requiring a single method to account for interests in jointly controlled entities. IFRS 13 supersedes IAS 31 Interests in Joint Ventures and SIC-13 Jointly Controlled Entities - Non-Monetary Contributionsby Ventures, and is effective for annual periods beginning on or after 1 January 2013. Early adoption is permitted. The main effect of this adoption of IFRS 11 will the end of the option of proportional consolidation. Equity method will be the only option to account for interest in joint ventures entities in the consolidated financial statements.

• IFRS 12 Disclosures of Interests in Other Entities – IFRS 12 is a new and comprehensive standard on disclosure requirements for all forms of interests in other entities, including subsidiaries, joint arrangements, associates and unconsolidated structured entities. IFRS 12 is effective for annual periods beginning on or after 1 January 2013. Early adoption is permitted. Management is still evaluating the impact on its financial position or performance from the adoption of IFRS 12.

• IFRS 13 Fair Value Measurement - IFRS 13 establishes new requirements on how to measure fair value and the related disclosures for IFRS and US generally accepted accounting principles. The standard is effective for annual periods beginning on or after 1 January 2013. Early adoption is permitted. Management is still evaluating the impact on its financial position or performance from the adoption of IFRS 13.

There are no other issued pronuncement and interpretation not yet adopted which may, in the management’s opinion, have significant impact in the income statement or in the shareholder’s equity disclosed by the Company.

| 4. | Cash and cash equivalents |

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Cash | | | - | | | | 289 | |

| Bank accounts | | | 91,032 | | | | 142,790 | |

| Amounts pending foreign exchange closing | | | 133,605 | | | | - | |

| Highly liquid investments | | | 1,258,235 | | | | 1,128,701 | |

| | | | 1,482,872 | | | | 1,271,780 | |

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| | | | 09.30.2011 | | | | 03.31.2011 | |

Restricted Financial Investments | | | 25,383 | | | | 61,072 | |

| Deposits in connection with Derivative Transactions | | | 27,157 | | | | 126,872 | |

| | | | 52,540 | | | | 187,944 | |

Deposits in connection with derivative transactions relate to margin calls by counterparties in derivative transactions.

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Fair value of Radar option (1) | | | 142,589 | | | | 162,961 | |

| Treasury certificates – CTN (2) | | | 276,058 | | | | 257,456 | |

| | | | 418,647 | | | | 420,417 | |

(1) Cosan S.A. holds warrants on Radar, exercisable at any time up to maturity (August 2018). Such warrants will allow Cosan to purchase additional shares at R$41.67 per share adjusted for inflation (IPCA), equivalent to 20% of the total shares issued by Radar as of the date of exercise. The exercise of warrants will not change the classification of this investment as an equity investment. The fair value of these warrants was calculated based on observable market data.

(2) Represented by bonds issued by the Brazilian National Treasury under the Special Program for Agricultural Securitization - "PESA" with original maturity of 20 years in connection with the long-term debt denominated PESA (note 16). These bonds yield inflation (IGPM) plus 12% p.a.. The value of these securities at maturity is expected to be equal to the amount due to the PESA at that date. If the PESA debt is paid in advance, the Company may still keep this investment until maturity.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Domestic | | | 978,923 | | | | 678,498 | |

| Foreign | | | 104,647 | | | | 7,556 | |

| Allowance for doubtful accounts | | | (99,846 | ) | | | (91,197 | ) |

| | | | 983,724 | | | | 594,857 | |

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Finished goods: | | | | | | | | |

| Sugar | | | 368,031 | | | | 77,673 | |

| Ethanol | | | 280,670 | | | | 42,840 | |

| Fuel and Lubricants | | | 537,180 | | | | 326,634 | |

| Raw material | | | 36,412 | | | | 51,598 | |

| Work in process | | | 11,464 | | | | 5,121 | |

| Spare parts and other | | | 134,614 | | | | 186,032 | |

| Provision for inventory realization and obsolescence and other | | | (6,562 | ) | | | (19,567 | ) |

| | | | 1,361,809 | | | | 670,331 | |

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Withholding income tax | | | 5,043 | | | | - | |

| Income tax and social contribution | | | 104,289 | | | | 66,274 | |

| COFINS | | | 115,304 | | | | 121,474 | |

| PIS | | | 32,430 | | | | 27,338 | |

| State VAT - ICMS | | | 191,781 | | | | 151,161 | |

| IPI | | | 39,142 | | | | 47,741 | |

| Other | | | 51,691 | | | | 16,069 | |

| | | | 539,680 | | | | 430,057 | |

| Current | | | (416,032 | ) | | | (374,991 | ) |

| Non Current | | | 123,648 | | | | 55,066 | |

In the normal course of business the Company has operational and financing transactions with several related parties. The significant related party balances and transactions are summarized below:

· Aguassanta:

The jointly-controlled subsidiary Raízen Energia has land leased from entities controlled by Group Aguassanta (“Aguassanta”). The lease costs are paid considering the ATR price published by CONSECANA and contracts having terms expiring between 2026 and 2027.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

· Radar

The jointly-controlled subsidiary Raízen Energia has land leased with investee Radar Propriedades Agrícolas S.A. (“Radar”). These lease costs are paid also considering the ATR price published by CONSECANA and most of the lease contracts have terms expiring in 2027.

· Rezende Barbosa

Cosan S.A. has receivable from Rezende Barbosa which are ultimately guaranteed by shares issued by the Cosan.

The jointly-controlled subsidiary Raízen Energia executed a long-term agreement with Rezende Barbosa to supply sugar-cane prior related parts. Prices paid to them are based on ATR price published by CONSECANA.

· Vertical

The jointly-controlled subsidiary Raízen Energia sell and buy ethanol from Vertical UK LLP (“Vertical”) in the normal course of business. Vertical is a Trading Company headquartered in Switzerland for which Cosan S.A. has a indirect interest of 50% without exercising control over it.

· Raízen Energia and Raízen Combustíveis

The jointly-controlled subsidiaries Raizen Energia and Raizen Combustíveis, in sequence to the contract signed upon its formation (note 21), assumed rights and obligations of certain transactions with Cosan S.A., seeking refunds or reimbursements related to certain operations prior to the formation of the joint venture.

Cosan S.A. has right to a financial compensation from Raizen Energia for the tax benefit obtained by Raízen Energia due to the use of tax losses by Raizen Energia and Raizen Combustíveis for the tax benefit obtained by Raízen Combustíveis due to tax amortization of goodwill contributed by Cosan S.A..

· Shell Group

The jointly-controlled Raízen Combustíveis has fuel sale operations for use on foreign aircrafts that have contracts with Shell Aviation Limited. Payments take place every fifteen days.

The jointly-controlled Raízen Combustíveis, in sequence to the contract signed of the formation of the joint venture, assumed the rights to reimbursement of certain litigation from the period prior to the joint venture with Shell Brazil Holding BV.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

The jointly-controlled subsidiary Raizen Energia, in response to the contract signed of the formation of the joint venture, has an accounts receivable related to the Shell's cash contribution in the amount of R$ 1,774,082, being presented here only for the portion equivalent to Cosan S.A., in the amount of R$ 887,041, distributed between short and long term. This amount is indexed in U.S. dollars and has been corrected in LIBOR.

| | a. | Summarized balances with related parties |

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Current assets | | | | | | | | |

| Shell Brazil Holding B.V. | | | 577,373 | | | | - | |

| Raízen Energia | | | 7,795 | | | | - | |

| Rezende Barbosa | | | 8,958 | | | | 7,298 | |

| Vertical UK LLP | | | 2,526 | | | | 6,430 | |

| Raízen Combustíveis | | | 547 | | | | - | |

| Other Related parties | | | 2,480 | | | | 941 | |

| Total Current assets | | | 599,679 | | | | 14,669 | |

| | | | | | | | | |

| | | | | | | | | |

| Non-current assets | | | | | | | | |

| Shell Brazil Holding B.V. | | | 766,856 | | | | - | |

| Raízen Energia | | | 217,419 | | | | - | |

| Raízen Combustíveis | | | 98,220 | | | | - | |

| Rezende Barbosa | | | 88,358 | | | | 91,954 | |

| CTC - Centro de Tecnologia Canavieira | | | 3,985 | | | | - | |

| Other Related parties | | | 1,768 | | | | - | |

| Total Non Current assets | | | 1,176,606 | | | | 91,954 | |

| Total Assets | | | 1,776,285 | | | | 106,623 | |

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Current Liabilities | | | | | | | | |

| Raízen Energia | | | 75,911 | | | | - | |

| Grupo Rezende Barbosa | | | 56,750 | | | | 37,664 | |

| Shell Brazil Holding B.V. | | | 28,782 | | | | - | |

| Other | | | 1,724 | | | | 3,499 | |

Total Current Liabilities | | | 163,167 | | | | 41,163 | |

| | | | | | | | | |

| Non-current liabilities | | | | | | | | |

| Shell Brazil Holding B.V. | | | 444,785 | | | | - | |

| Raízen Energia | | | 86,207 | | | | - | |

| Others | | | 15,303 | | | | 4,444 | |

Total non Current Liabilities | | | 546,295 | | | | 4,444 | |

Total Liabilities | | | 709,462 | | | | 45,607 | |

| | b. | Summarized transactions with related parties |

| | | | 09.30.2011 | | | | 09.30.2010 | |

| Sale | | | | | | | | |

| Vertical UK LLP | | | 118,722 | | | | 87,930 | |

| Other | | | 120 | | | | 34,576 | |

| | | | 118,842 | | | | 122,506 | |

| Purchase of goods/ services | | | | | | | | |

| Grupo Rezende Barbosa | | | 222,579 | | | | 245,709 | |

| | | | | | | | | |

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| Leased land | | | | | | | | |

| Aguassanta | | | 10,678 | | | | 13,261 | |

| Radar | | | 17,508 | | | | 12,803 | |

| | | | 28,186 | | | | 26,064 | |

| Financial income/ (expense) | | | | | | | | |

| | | | | | | | | |

| Grupo Rezende Barbosa | | | 1,343 | | | | - | |

| Shell Brazil Holding B.V. | | | 100,330 | | | | - | |

| Other | | | 68 | | | | - | |

| | | | 101,741 | | | | - | |

c. Officers and director compensation

At the Annual General and Extraordinary Meeting of July 29, 2011, the total annual compensation of the directors of the Cosan S.A for the fiscal year ending on March 31, 2012 was approved in the maximum amount of R$ 32,000 (including salaries and bonuses).

| 11. | Business combinations and acquisitions of non-controlling interest |

On July 1, 20011, the subsidiary Cosan S.A., through its indirect subsidiary Docelar Alimentos S.A. (“Docelar”), purchased the retail sugar business of Raízen Energia. The preliminary estimated fair value of assets at the date of acquisition of the consideration transferred amounted R$ 175,000, as follows:

| Cash | | | 145,560 | |

| Consideration considered | | | 29,140 | |

| Total | | | 175,000 | |

The estimated preliminary fair value of assets acquired and liabilities assumed at the date of acquisition of the retail sugar business were as follows:

| Description | | | |

| Accounts receivable | | | 105,894 | |

| Inventories | | | 33,398 | |

| Taxes recoverable | | | 3,413 | |

| Deffered taxes | | | 12,956 | |

| Property, plant and equipment | | | 37,114 | |

| Suppliers | | | (21,709 | ) |

| Others | | | (6,360 | ) |

| Net assets acquired | | | 164,706 | |

| Consideration transferred, net cash acquired | | | 175,000 | |

| Preliminary goodwill | | | 10,294 | |

The purchase price for the acquisition of the retail sugar was allocated on a preliminary basis based on the estimated fair value of assets acquired and liabilities assumed. The preliminary goodwill was allocated to the primary segment "Cosan Alimentos".

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

The assets represented by retail brands, such as "União" and "DaBarra" which had not been contributed to the Raízen Energia, being from that quarter, considered as assets of the "Cosan Alimentos".

| 12. | Equity method investments |

| | | Investiments | | | Equity income (loss) of

subsidiaries and associates | |

| | | | 09.30.2011 | | | | 03.31.2011 | | | | 09.30.2011 | | | | 09.30.2010 | |

| Radar Propriedades Agrícolas S.A. | | | 263,989 | | | | 260,756 | | | | 658 | | | | 14,450 | |

| Codexis Inc | | | 43,974 | | | | - | | | | - | | | | - | |

| Outros investimentos | | | 50,089 | | | | 43,836 | | | | - | | | | (6,334 | ) |

| | | | 358,052 | | | | 304,592 | | | | 658 | | | | 8,116 | |

Changes in investments

| Balance at March 31, 2011 | | | 304,142 | |

| | | | | |

| Equity income | | | 658 | |

| Capital increase Tellus and Logum | | | 26,270 | |

| Net effect of the formation of Raízen | | | 30,043 | |

| Other | | | (3,061 | ) |

| | | | | |

| Balance at September 30, 2011 | | | 358,052 | |

Changes in biological assets (sugarcane plants) are described below:

| Balances at March 31, 2011 | | | 1,561,132 | |

| Changes in fair value less estimated cost to sell | | | (17,856 | ) |

| Increase due to planting and growing costs | | | 340,784 | |

| Harvest cane transferred to inventory (*) | | | (363,510 | ) |

| Proportional consolidation effect due to the formation of JVs (50%) | | | (803,584 | ) |

| Balances at September 30, 2011 | | | 716,966 | |

(*) R$109,364 of this amount was allocated in sugar and ethanol’s inventory as of September 30, 2011.

Sugarcane plants

Areas cultivated represent only sugarcane, without considering the land where these crops are found. The following assumptions were used to determine fair value using the discounted cash flow (consolidated):

| | | | 09.30.2011 | | | | 03.31.2011 | |

Crop area (hectares) (1) | | | 367,265 | | | | 340,386 | |

| Expect productivity (tons of cane per hectare) | | | 84.74 | | | | 85 | |

| Total amount of recoverable sugar – ATR (kg) | | | 138.54 | | | | 138.54 | |

| Price kg ATR projected average (R$/kg) | | | 0.4228 | | | | 0.4228 | |

| | (1) | The biogical assets are proportionally consolidated in 50.0% in the Company. |

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

Sugar production depends on the volume and sucrose content of sugarcane grown or supplied by farmers located near the plants. The yield of the crop and the sucrose content in sugarcane mainly depend on weather conditions such as rainfall rate and temperature, which may vary.

Historically, weather conditions have caused volatility in ethanol and sugar production, and consequently in our operating results because it cause demage to the annual harvest. Future climate conditions may reduce the amount of sugar and sugarcane that the Company will obtain in a particular season or in the sucrose content of sugarcane. Additionally, our business is subject to seasonality according to the growth cycle of sugarcane in the south-central region of Brazil.

The period of annual harvest of sugarcane in the south-central region of Brazil begins in April / May and ends in November / December. This creates variations in stock, usually high in November to cover sales between harvests (i.e. from December to April) and a degree of seasonality in gross profit as sales of ethanol and sugar are significantly lower in the last quarter of fiscal year. The seasonality and any reduction in the volume of sugar recovered could have a material adverse effect on our operating results and financial condition.

| 14. | Property, plant and equipment |

| | | | 03.31.2011 | | | Addition | | | Write-off | | | Transfer | | | Effect of Formation Joint Venture

and Docelar | | | | 09.30.2011 | |

| Cost | | | | | | | | | | | | | | | | | | | | |

| Land and rural properties | | | 1,263,240 | | | | - | | | | (14,880 | ) | | | (2,514 | ) | | | 398,852 | | | | 1,644,698 | |

| Buildings and improvements | | | 1,122,256 | | | | 1,432 | | | | (14,051 | ) | | | 140,823 | | | | (282,416 | ) | | | 968,044 | |

| Machinery, equipments and installations | | | 4,980,432 | | | | 34,484 | | | | (16,184 | ) | | | 554,816 | | | | (342,410 | ) | | | 5,211,138 | |

| Aircraft | | | 30,903 | | | | - | | | | (4,691 | ) | | | (0 | ) | | | - | | | | 26,212 | |

| Rail cars and locomotives | | | 341,647 | | | | - | | | | - | | | | 50,000 | | | | - | | | | 391,647 | |

| Boats and vehicles | | | 323,042 | | | | 2,741 | | | | (604 | ) | | | 18,598 | | | | (46,283 | ) | | | 297,494 | |

| Furniture, fixtures and computer equipment | | | 137,206 | | | | 174 | | | | (4,143 | ) | | | 16,236 | | | | (22,821 | ) | | | 126,652 | |

| Construction in progress | | | 1,218,765 | | | | 502,071 | | | | (4,013 | ) | | | (394,259 | ) | | | (512,056 | ) | | | 810,508 | |

| Advances for purchase of property, plant and equipment | | | 148,947 | | | | 16,632 | | | | (2,009 | ) | | | (33,570 | ) | | | (36,482 | ) | | | 93,518 | |

| Parts and components to be periodically replaced | | | 1,043,342 | | | | 124,283 | | | | - | | | | (117,292 | ) | | | (277,221 | ) | | | 773,112 | |

| Other | | | 4,782 | | | | 12,994 | | | | (9,596 | ) | | | 30,421 | | | | 134,526 | | | | 173,127 | |

| Total | | | 10,614,562 | | | | 694,811 | | | | (70,171 | ) | | | 263,259 | | | | (986,311 | ) | | | 10,516,150 | |

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| | | | 03.31.2011 | | | Addition | | | Write-off | | | Transfer | | | Effect of Formation Joint Venture

and Docelar | | | | 09.30.2011 | |

| Depreciation: | | | | | | | | | | | | | | | | | | | | |

| Land and rural properties | | | (3,118 | ) | | | - | | | | - | | | | 3,118 | | | | - | | | | - | |

| Buildings and improvements | | | (287,620 | ) | | | (24,375 | ) | | | 4,540 | | | | (50,983 | ) | | | 107,891 | | | | (250,547 | ) |

| Machinery, equipments and installations | | | (1,472,512 | ) | | | (202,994 | ) | | | 10,454 | | | | (289,090 | ) | | | 662,003 | | | | (1,292,139 | ) |

| Aircraft | | | (15,195 | ) | | | (876 | ) | | | 860 | | | | (0 | ) | | | - | | | | (15,211 | ) |

| Rail cars and locomotives | | | (6,128 | ) | | | (6,079 | ) | | | - | | | | (0 | ) | | | - | | | | (12,207 | ) |

| Boats and vehicles | | | (150,146 | ) | | | (16,034 | ) | | | 460 | | | | (8,552 | ) | | | 60,555 | | | | (113,717 | ) |

| Furniture, fixtures and computer equipment | �� | | (87,460 | ) | | | (6,015 | ) | | | 3,303 | | | | (12,440 | ) | | | 11,165 | | | | (91,447 | ) |

| Construction in progress | | | - | | | | 49 | | | | - | | | | - | | | | - | | | | 49 | |

| Parts and components to be periodically replaced | | | (611,859 | ) | | | (260,280 | ) | | | - | | | | 129,322 | | | | 37,728 | | | | (705,089 | ) |

| Other | | | - | | | | (2,875 | ) | | | 2,974 | | | | (21,503 | ) | | | (85,664 | ) | | | (107,068 | ) |

| Total | | | (2,634,038 | ) | | | (519,479 | ) | | | 22,591 | | | | (250,128 | ) | | | 793,678 | | | | (2,587,376 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net salvage value: | | | 7,980,524 | | | | 175,331 | | | | (47,580 | ) | | | 13,132 | | | | (192,633 | ) | | | 7,928,774 | |

Capitalization of borrowing costs

During the period ended September 30, 2011, borrowing costs capitalized amounted to R$ 33,153 (R$ 70,543 during the year ended March 31, 2011). The weighted average interest rate, used for capitalization of interest on the balance of construction in progress, was 8.6% per year during the period ended September 30, 2011 (9.13% per year during the year ended March 31, 2011).

| Cost | | At March 31, 2011 | | | Additions | | | Write offs | | | Transfers | | | Effects of formation

of Raízen

and Docelar | | | At September 30, 2011 | |

| Software | | | 98,063 | | | | 570 | | | | (1 | ) | | | (75,593 | ) | | | 28,065 | | | | 51,104 | |

| Trademarks and patents | | | 429,671 | | | | - | | | | (9,513 | ) | | | (40,375 | ) | | | 230,401 | | | | 610,184 | |

| Goodwill | | | 2,697,221 | | | | - | | | | (639,154 | ) | | | 10,292 | | | | 751,098 | | | | 2,819,458 | |

| Customer base | | | 583,420 | | | | - | | | | - | | | | (57,701 | ) | | | 317,986 | | | | 843,705 | |

| Leases | | | 155,505 | | | | - | | | | (232 | ) | | | (14,253 | ) | | | (61,333 | ) | | | 79,687 | |

| Distribution rights | | | 170,291 | | | | 2,531 | | | | - | | | | 206,289 | | | | (53,952 | ) | | | 325,159 | |

| Others | | | 43,263 | | | | 7,863 | | | | (8,645 | ) | | | 36,754 | | | | 103,458 | | | | 182,693 | |

| Total | | | 4,177,434 | | | | 10,964 | | | | (657,545 | ) | | | 65,414 | | | | 1,315,723 | | | | 4,911,990 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation | | | | | | | | | | | | | | | | | | | | | | | | |

| Software | | | (66,111 | ) | | | (4,760 | ) | | | 1 | | | | 68,433 | | | | (34,254 | ) | | | (36,691 | ) |

| Trademarks and patents | | | (98,710 | ) | | | (12,911 | ) | | | - | | | | 39,359 | | | | (2,335 | ) | | | (74,597 | ) |

| Customer base | | | (41,038 | ) | | | (18,579 | ) | | | - | | | | 41,086 | | | | (16,587 | ) | | | (35,118 | ) |

| Favorable operating leases | | | (15,118 | ) | | | (1,389 | ) | | | 232 | | | | 13,817 | | | | (7,559 | ) | | | (10,017 | ) |

| Distribution rights | | | (62,387 | ) | | | (3,397 | ) | | | - | | | | (34,641 | ) | | | - | | | | (100,425 | ) |

| Others | | | (4,495 | ) | | | (13,790 | ) | | | (224 | ) | | | (12,217 | ) | | | (93,312 | ) | | | (124,037 | ) |

| | | | (287,859 | ) | | | (54,826 | ) | | | 9 | | | | 115,837 | | | | (154,047 | ) | | | (380,885 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net salvage value | | | 3,889,575 | | | | (43,862 | ) | | | (657,536 | ) | | | 181,251 | | | | 1,161,678 | | | | 4,531,105 | |

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| | | Anual

amortization | | | | | | | |

| Intangible assets (except Goodwill) | | Rate | | | | 09.30.2011 | | | | 03.31.2011 | |

| | | | | | | | | | | | |

| Software | | | 20 | % | | | 14,413 | | | | 31,952 | |

| Trademarks and patents (a) | | | 20 | % | | | 283,848 | | | | 68,696 | |

| Trademark Mobil (b) | | | 10 | % | | | 165,496 | | | | 176,911 | |

| Trademark União (c) | | | 2 | % | | | 86,243 | | | | 85,354 | |

| Customer base (d) | | | 3 | % | | | 519,982 | | | | 247,907 | |

| Operation license and customer base(e) | | | 4 | % | | | 288,604 | | | | 294,475 | |

| Favorable operating leases (f) | | | 6 | % | | | 69,670 | | | | 140,387 | |

| Distribution rights | | Straight line

over contract

term | | | | 224,734 | | | | 107,904 | |

| Other | | | | | | | 58,657 | | | | 38,768 | |

| Total | | | | | | | 1,711,647 | | | | 1,192,354 | |

(a) refers to the right to use the trademark of fuel distribution through its joint venture Raízen Combustíveis

(b) refers to the right to use the trademark of Mobil lubricants

(c) refers to the right to use the trademark sugar União arising from business combination

(d) refers to the relationship between Raízen Combustívies and the gas station that maintain its flags

(e) Operation license and customer relations of Rumo, arising from business combination

(f) Intangible assets related to existing contracts of lease of land from business combination

Impairment testing of goodwill

The Company tests annually (on March 31) the recoverable amounts of intangible assets with indefinite useful lives, consisting primarily of a portion of goodwill from expected future income resulting from business combination processes and establishment of joint ventures. The assets property, plant and equipments and intangible assets subject to amortization are reviewed whenever there are indications that the carrying amount is not recoverable.

During the quarted ended September 30, 2011, the Company did not identify any indicators of impairment that would required another impairment test.

The combined accounting values of goodwill allocated to each unit are as follows:

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| Accounting value of Goodwill | | | 09.30.2011 | | | | 03.31.2011 | |

| | | | | | | | | |

| Cash-generating unit Raízen Energia | | | 1,420,234 | | | | 1,877.883 | |

| Cash-generating unit Raízen Combustíveis | | | 753,148 | | | | 755,524 | |

| Cash-generating unit Cosan Alimentos | | | 10,294 | | | | - | |

| Cash-generating unit Rumo | | | 63,812 | | | | 63,814 | |

| Cash-generating unit Others | | | 571,110 | | | | - | |

| Total goodwill | | | 2,819,458 | | | | 2,697,221 | |

| 16. | Loans and long-term debt |

| | Financial charges (1) | | | | |

| Description | Index | Average Annual

interest rate | | 09.30.2011 | | 03.31.2011 | | Maturity date |

| | | | | | | | | |

| Senior Notes Due 2014 | Dollar (USD) | 9.5% | | 328,374 | | 576,814 | | July/2014 |

| Senior Notes Due 2017 | Dollar (USD) | 7.0% | | 375,135 | | 658,954 | | February/2017 |

| BNDES | URTJLP | 2.75% | | 659,390 | | 1,308,034 | | October/2025 |

| | Pre fixed | 4.5% | | 156,011 | | 242,508 | | July/2020 |

| | UMBND | 6.74% | | 20,075 | | 38,947 | | July/2019 |

| | Dollar (USD) | 7.09% | | 19 | | - | | November/2012 |

| Bank Credit Notes | CDCA | 0.55%+CDI | | 15,755 | | 31,378 | | December/2011 |

| ACC | Dollar (USD) | 1.54% | | 364,775 | | 228,229 | | May/2012 |

| Perpetual Notes | Dollar (USD) | 8.3% | | 939,099 | | 1,236,209 | | November/2015 |

| Resolution 2471 (PESA) | IGP-M | 3.95% | | 312,594 | | 674,392 | | April/2023 |

| | Pre fixed | 3.0% | | 57 | | 114 | | October/2025 |

| Rural Credits | Pre fixed | 6.75% | | 47,735 | | 92,352 | | October/2011 |

| Working capital | Dollar (USD) + Libor | 2.15% | | 417,240 | | - | | April/2013 |

| | IGP-M | 11% | | 141 | | - | | December/2012 |

| | Pre fixed | 13.64% | | 5,881 | | - | | March/2015 |

| Pre payments | Dollar (USD) + Libor | 6.0% | | 368,904 | | 736,472 | | April/2016 |

| Credit Notes | 110,0% CDI | - | | 322,736 | | 303,719 | | Februay/2014 |

| | Dollar (USD) | 2.35% | | 174,645 | | 314,105 | | February/2013 |

| | Pre fixed | 6.25% | | - | | 10,142 | | October/2012 |

| Finame | Pre fixed | 4.85% | | 420,176 | | 517,842 | | July/2020 |

| | URTJLP | 2.42% | | 252,338 | | 187,336 | | January/2022 |

| | UMBND | 8.59% | | 29 | | - | | October/2012 |

| Others | Diverse | Diverse | | 31,795 | | 74,482 | | Diverse |

| | | | | 5,212,904 | | 7,232,029 | | |

| Current | | | | (805,119) | | (957,134) | | |

| Non-current | | | | 4,407,785 | | 6,274,895 | | |

| | (1) | Financial charges as of September 30, 2011, except as indicated otherwise. |

All loans and long-term debt are guaranteed by promissory notes and endorsements of the Company and its jointly-controlled subsidiaries and controlling shareholders, besides other guarantees, such as: i) Credit rights originated from energy contracts (BNDES); ii) CTN and land mortgages; and iii) underlying assets being financed (Finame).

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

Long-term debt has the following scheduled maturities:

| | | | 09.30.2011 | | | | 03.31.2011 | |

| 13 to 24 months | | | 815,962 | | | | 745,454 | |

| 25 to 36 months | | | 975,619 | | | | 762,649 | |

| 37 to 48 months | | | 209,959 | | | | 1,010,797 | |

| 49 to 60 months | | | 1,124,149 | | | | 777,963 | |

| 61 to 72 months | | | 527,544 | | | | 878,092 | |

| 73 to 84 months | | | 191,092 | | | | 222,289 | |

| 85 to 96 months | | | 280,257 | | | | 453,711 | |

| Thereafter | | | 283,203 | | | | 1,423,940 | |

| | | | 4,407,785 | | | | 6,274,895 | |

PESA - Resolution 2471

From 1998 to 2000, Cosan S.A. and currenty the jointly-controlled Raízen Energia renegotiated their debts related to financing for agricultural costs with several financial institutions, reducing it to annual interest rates below 10%, ensuring the repayment of debt’s principal with assignment and transfer of Treasury Certificates, redeemable at the debt clearing, using the incentives promoted by Central Bank resolution No. 2471 of February 26, 1998. That debt is self-cleared by CTN, as mentioned in explanoty note 6.

Senior Notes due on 2014

On August 4, 2009, the indirect subsidiary CCL Finance Limited issued Senior Notes in the international market in accordance with “Regulation S” and “Rule 144A” in the amount of US$350 million, which are subject to interest of 9.5% per year payable semiannually in February and August each year, beginning in February 2010.

Senior Notes due on 2017

On January 26, 2007, the wholly-owned indirect controlled Cosan Finance Limited issued Senior Notes in the international market in accordance with the “Regulation S” and “Rule 144A” in the amount of US$ 400 million, which are subject to interest at 7% per annum, payable semiannually in February and August of each year.

BNDES

Refers to the financing of cogenation projects, greenfields (sugar and ethanol mills) and expansion of the logistics segment.

Perpetual Notes

On January 24 and February 10, 2006, Cosan S.A. issued Perpetual Notes in the international market in accordance with “Regulation S” and “Rule 144A” in the amount of US$450 million for qualified institutional investors. The Perpetual Notes

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

were repurchased on May 2011 as part of the financial restructuring for the formation of the joint venture. In order to repurchase these notes, working capital was raised, as decribed below.

On November 5, 2010, the subsidiary Cosan Overseas Limited issue Perpetual Notes in the international market, in accordance with “Regulation S” in the amount of US$300 thousand, which are subject to interest at 8.25% per year, payable quarterly. On July 2011, complementary Perpetual Notes of US$ 200 millions were issued, which are subject to the same conditions of the previous operation.

Export Prepayment

Between 2009 and 2011, Cosan S.A. and its jointly-controlled Raízen Energia signed export prepayment with several institutions. These export prepayment will be for funding of future sugar exports which will be settled between 2013 and 2016.

Working Capital

On May 16, 2011, a bank debt of US$ 450 million was issued in favour of the jointly-controlled subsidiary Raízen Energia in order to replace the perpetual notes issued in 2006. This bank debt has a maturity up to two years, payable quarterly and subject to Libor + interest of 2.15% per annum.

Advances on Foreign Exchange Contracts (“ACC”) and Credit Notes

ACC contracts and credit notes have been signed with several financial institutions and will be cleared thourgh exports made from 2011 and 2014. These transactions are subject to interest payable semiannually and on maturity.

Finame

Finame borrowings are financing related to financing of machinery and equipment. These loans are subject to interest payable monthly and are secured by underlying financed assets.

Covenants

The Company, its subsidiaries and jointly-controlled subsidiaries are annualy (March 31) subject to certain restrictive financial covenants set forth in existing loans and financing agreements based on certain financial indicators, which are monthly assessed by management. For the quarter ended September 30, 2011, the Company, its subsidiaries and jointly-controlled subsidiaries were in compliance with tis debt covenants.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

Cosan Limited is incorporated in Bermuda which has no income taxes. The following relates to Brazilian taxes of Cosan S.A. and its subsidiaries.

| | | | 09.30.2011 | | | | 03.31.2011 | |

| | | | | | | | | |

| ICMS | | | 45,809 | | | | 72,265 | |

| IPI | | | 5,961 | | | | 30,661 | |

| INSS | | | 15,991 | | | | 25,309 | |

| PIS | | | 15,547 | | | | 7,229 | |

| COFINS | | | 82,883 | | | | 33,721 | |

| Recovery program – Refis IV (a) | | | 1,219,763 | | | | 670,645 | |

| Others | | | 122,878 | | | | 44,525 | |

| | | | 1,508,832 | | | | 884,355 | |

| Current | | | (328,874 | ) | | | (245,284 | ) |

| Non-current | | | 1,179,958 | | | | 639,071 | |

| | a) | On July 2011 the subsidiary Cosan Lubrificantes e Especialides S.A., current name of Cosan Combustíveis e Lubrificantes S.A., successor entity of Esso Brasileira de Petróleio Ltda. (“Essobrás”), consolidated the current tax liabilities included the special program of federal tax recovery (“Refis IV”) in the amount of 537,703, as determined by ExxonMobil Brasil Holdings BV., former owner of Essobrás and contractualy responsible for these liabilities. As a result, the Company recognized an obligation and a corresponding accounts receivable of ExxonMobil Brasil Holdings BV in the same amount, under the caption “other credits”, of which R$40,080 in the short term and the remaining balance in the long term. |

Maturities of long-term taxes payable are as follows:

| | | | 09.30.2011 | | | | 03.30.2011 | |

| | | | | | | | | |

| 13 to 24 months | | | 99,158 | | | | 67,848 | |

| 25 to 36 months | | | 95,760 | | | | 61,205 | |

| 37 to 48 months | | | 95,601 | | | | 60,396 | |

| 49 to 60 months | | | 94,906 | | | | 60,008 | |

| 61 to 72 months | | | 94,654 | | | | 52,243 | |

| 73 to 84 months | | | 92,589 | | | | 46,707 | |

| 85 to 96 months | | | 92,065 | | | | 45,799 | |

| Thereafter | | | 515,225 | | | | 244,865 | |

| | | | 1,179,958 | | | | 639,071 | |

| 18. | Income taxes and social contribution |

Cosan Limited is incorporated in Bermuda which has no income taxes. The following relates to Brazilian taxes of Cosan S.A. and its subsidiaries.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| | a) | Reconciliation of income and social contribution tax expenses: |

| | | | 09.30.2011 | | | | 09.30.2010 | |

| Income before income tax and social contribution | | | 2,979,185 | | | | 373,044 | |

| Income tax and social contribution at nominal rate (34%) | | | (1,012,923 | ) | | | (126,835 | ) |

Adjustments made for determining the effective rate: | | | | | | | | |

| Equity pick-up | | | 223 | | | | 2,759 | |

| Release of Provision for non-realization of fiscal credits | | | 36,169 | | | | - | |

| Income not taxable of foreign subsidiary | | | (59,936 | ) | | | (2.448 | ) |

| Other | | | 24 | | | | (10.725 | ) |

| Total of deferred and current income taxes and social contributions | | | (1,036,443 | ) | | | (137,249 | ) |

| Effective rate | | | 34.79 | % | | | 36.79 | % |

b) Deferred income and social contribution tax assets and liabilities:

| | | 09.30.2011 | | | 03.31.2011 | |

| Assets | | Basis | | | IRPJ 25% | | | CSLL 9% | | | Total | | | | |

| Tax losses: | | | | | | | | | | | | | | | | | |

| Tax losses | | | 1,865,178 | | | | 466,295 | | | | - | | | | 466,295 | | | | 273,555 | |

| Negative social contribution | | | 1,844,243 | | | | - | | | | 165,982 | | | | 165,982 | | | | 99,609 | |

| Temporary differences: | | | | | | | | | | | | | | | | | | | | |

| Provision for judicial demands and other temporary differences | | | 963,140 | | | | 240,785 | | | | 86,682 | | | | 327,467 | | | | 342,169 | |

| | | | 4,672,561 | | | | 707,080 | | | | 252,664 | | | | 959,744 | | �� | | 715,333 | |

| Liabilities | | | | | | | | | | | | | | | | | | | | |

| Temporary differences: | | | | | | | | | | | | | | | | | | | | |

| Exchange variaton | | | (361,112 | ) | | | (90,278 | ) | | | (32,500 | ) | | | (122,778 | ) | | | (274,189 | ) |

| Depreciation | | | (36,622 | ) | | | (9,156 | ) | | | - | | | | (9,156 | ) | | | (4,596 | ) |

| Goodwill | | | (625,075 | ) | | | (156,269 | ) | | | (56,257 | ) | | | (212,526 | ) | | | (252,323 | ) |

| Other provisions and other temporary differences: | | | | | | | | | | | | | | | | | | | | |

| Business Combinations | | | | | | | | | | | | | | | | | | | | |

| Property, plant and equipment | | | (3,129,578 | ) | | | (782,394 | ) | | | (281,662 | ) | | | (1,064,056 | ) | | | (344,686 | ) |

| Intangible assets | | | (1,371,473 | ) | | | (342,868 | ) | | | (123,433 | ) | | | (466,301 | ) | | | (381,558 | ) |

| Other net assets | | | 46,699 | | | | 11,675 | | | | 4,203 | | | | 15,877 | | | | 99,331 | |

| Gain of formation of Joint Venture | | | (3,296,959 | ) | | | (824,240 | ) | | | (296,726 | ) | | | (1,120,966 | ) | | | - | |

| Deemed cost | | | (366,151 | ) | | | (91,538 | ) | | | (32,954 | ) | | | (124,491 | ) | | | (124,490 | ) |

| Others | | | (160,994 | ) | | | (40,248 | ) | | | (14,489 | ) | | | (54,737 | ) | | | (228,454 | ) |

| | | | (9,301,265 | ) | | | (2,325,316 | ) | | | (833,818 | ) | | | (3,159,134 | ) | | | (1,510,965 | ) |

| Total deferred taxes, net | | | (4,628,704 | ) | | | (1,618,237 | ) | | | (581,153 | ) | | | (2,199,390 | ) | | | (795,632 | ) |

The assets of deferred income taxes should be realized within 10 years, according to the future profitability of the Company, its subsidiaries and joint-controlled entities.

Income tax losses carryforward and social contribution tax losses may be offset against a maximum of 30% of annual taxable income earned, with no statutory limitation period. Income tax losses carryforward and social contribution tax losses do not expire.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| 19. | Provision for judicial demands |

| | | | 09.30.2011 | | | | 03.31.2011 | |

| | | | | | | | | |

| Tax | | | 584,986 | | | | 418,744 | |

| Civil | | | 180,266 | | | | 82,599 | |

| Labor | | | 210,539 | | | | 164,939 | |

| | | | 975,791 | | | | 666,282 | |

Changes in provision for judicial demands:

| | | Tax | | | Civil | | | Labor | | | Total | |

| Balance at March 31, 2011 | | | 418,744 | | | | 82,599 | | | | 164,939 | | | | 666,282 | |

| Provision | | | 35,984 | | | | 20,882 | | | | 51,075 | | | | 107,941 | |

| Settlements | | | (2,175 | ) | | | (3,309 | ) | | | (6,607 | ) | | | (12,091 | ) |

| Write off | | | (908 | ) | | | (16,092 | ) | | | (31,228 | ) | | | (48,228 | ) |

| Reclassification | | | - | | | | 988 | | | | - | | | | 988 | |

| Effect of proportional consolidation of Raízen | | | 118,824 | | | | 91,020 | | | | 22,768 | | | | 232,612 | |

| Monetary variation | | | 14,517 | | | | 4,178 | | | | 9,592 | | | | 28,287 | |

| Balance at Setembro 30, 2011 | | | 584,986 | | | | 180,266 | | | | 210,539 | | | | 975,791 | |

The existing judicial demands and contingencies until the formation of the joint venture will be under the responsability of their shareholders (Cosan and Shell). Any disbursement incurred by the jointly-controlled subsidiaries will be subject to refund.

The judicial demands and contingencies which may take place after the date of the formation of the joint ventures will be under the responsibility of the jointly-controlled subsidiaries.

Judicial demands deemed as probable loss

The major tax legal proceeding as of September 30,2011 and March 31, 2011 are described as follows:

| | | | 09.30.2011 | | | | 03.31.2011 | |

| IPC – 89 (i) | | | 81,225 | | | | 80,273 | |

| Compensation with finsocial (ii) | | | 189,918 | | | | 183,706 | |

| CIDE (iii) | | | 93,842 | | | | - | |

| ICMS credits (iv) | | | 67,085 | | | | 56,880 | |

| PIS and COFINS | | | 25,228 | | | | - | |

| IPI | | | 21,779 | | | | - | |

| IRPJ and CSLL | | | 4,073 | | | | - | |

| Others | | | 101,836 | | | | 97,885 | |

| | | | 584,986 | | | | 418,744 | |

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

(i) Since 1993, the subsidiary Cosan Lubrificantes e Especialidades (“Cosan CLE”) filed a suit to challenge the balance sheet restatement índex (IPC) established by the federal government in 1989, considering the such index did not reflect the actual inflation back then. The use of this index led the Company to supposedly overstate and overpay the income and social contribution taxes. Cosan CLE obtained a favorable preliminary court ruling that allowed it to recalculate the financial position, using indexes that accurately measured the inflation over the period. In doing so the company adjusted the amounts of income and social contribution taxes payable and identified that overpayments for both taxes were offset in subsequent years until 1997. Despite the favorable court rulings, tax authorities issued a notice of infringement to the Company challenging all tax offsets performed in 1993 and some offsets in 1994 and 1997. Due to this contingent scenario involving those compensations, these amounts were recorded as a provision for judicial demands. These amounts have been updated according to the SELIC variation.

(ii) From September to March 1994, the subsidiary Cosan CLE did the compensation of COFINS and other taxes with the FINSOCIAL previous paid from that period, based on a favorable court ruling which were discussed the constitutionality of FINSOCIAL.

In 1995, Cosan CLE was declared exempt from COFINS levies. Thus, Cosan CLE understood that the compensations done between COFINS and FINSOCIAL did not occur and, in 2003, based on a favorable final courd decision to the Company related to FINSOCIAL, the Company concluded that the credits of these taxes compensated with COFINS were once again available to compensate with another taxes. Due to this contingent scenario of this compensation, Cosan CLE maintained all the amount compensated recorded as a provision for judicial demands until the Federal Revenue Service ratify this compensation.

In 2009 the Federal Revenue Service dismissed this aforementioned compensation, under the allegation that Cosan CLE had alrealy utilized these credits to compensate with COFINS in 1994. In view of this understanding, the management decided to challenge the administrative decisions, which is pending judgement at the Taxpayers’ Council. The amount of the provision for judicial demands recorded has been updated according to the SELIC variation.

(iii) The jointly-controlled subsidiary Raízen Combustíveis, while named Shell Brasil Limitada, made provisions of CIDE over services provided by operations not contributed in the process of formation of joint ventures such as exploration and production of oil and natural gas. If the jointly-controlled subsidiary is not successful in the litigation, the shareholder Shell will reimburse the jointly-controlled subsidiary. The reimbursement which the jointly-controlled subsidiary Raízen Combustíveis is entitled to receive from Shell Group is recorded as a accounts receivable in related parties.

(iv) The amount accrued related to ICMS credits is represented by: (a) notices of violations received, despite the fact that we are defending our position in an

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

administrative or judicial shere, our legal advisors believe that the chance of loss are probable; (b) use of credit and financial charges on issues whose understanting of the management of the Company and their tax advisors differs from the interpretations of the tax authorities.

The Company, its subsidiaries and jointly-controlled subsidiaries are parties to a number of civil claims related to (i) indemnity for physical and moral damages; (ii) public civil claims related to sugarcane stubble burning; and (iii) environmental matters.

The Company, its subsidiaries and jointly-controlled subsidiaries are also parties to a number of labor claims filed by former employees and service providers challenging, among other factors, the payment of additional hours, night shift premium and risk premium, employment inclusion, reimbursement of discounts from payroll, such as social contribution, trade union charges, among others.

Judicial demands deemed as possible loss

The main tax claims for which the unfavorable outcome is deemed possible and, therefore, no provision for legal claims was recorded, are as follows:

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Tax assessment - Withholding income taxes (i) | | | 199,845 | | | | 194,498 | |

| ICMS - State VAT (ii) | | | 596,146 | | | | 490,896 | |

| IRPJ / CSSL | | | 138,015 | | | | - | |

| ICMS Tax Replacement (ii) | | | 619,171 | | | | - | |

| IPI - Federal VAT (iii) | | | 204,891 | | | | 270,817 | |

| Compensation with IPI – IN 67/98 (iv) | | | 93,210 | | | | 181,292 | |

| Contribution to IAA - sugar & ethanol institute | | | 1,307 | | | | - | |

| INSS - Social security contribution (v) | | | 66,247 | | | | 72,616 | |

| PIS and Cofins (vi) | | | 422,045 | | | | 163,129 | |

| Others | | | 208,094 | | | | 197,884 | |

| | | | 2,548,971 | | | | 1,571,132 | |

| | (i) | Tax assessment – withholding income tax |

In September 2006 the Federal Revenue Service served another notice of infringement on the Company, this time for failure to withhold and pay income tax at source on capital gains derived from the acquisition of a subsidiary. This tax assessment originated administrative demand, which loss probability is considered possible in the opinion of legal advisors of the Company and, therefore, no provision for legal claims was recorded.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

Refers mainly to (i) Tax Assessment filed in view of the alleged lack of payment of ICMS and non-compliance with accessory obligation, in connection with the partnership and manufacturing upon demand, with Central Paulista Açúcar e Álcool Ltda., between May to December 2006 and May to December 2007; and (ii) ICMS levied on the remittances of crystallized sugar for export purposes. In accordance with the tax agent, such product is classified as semi-finished product and that, in accordance with the ICMS regulation, would be subject to taxation, (iii) ICMS levied on possible differences in terms of sugar and alcohol inventories, arising from magnetic tax files and Inventory Registry Books and (iv) ICMS concerning rate difference due to ethanol sales to companies located in other states, which, subsequently, had their registrations revoked and (v) disallowance of credit resulting from the acquisition of diesel used in the production process.

(iii) IPI – Federal VAT

SRF Normative Instruction n° 67/98 approved the procedure adopted by the industrial establishments which performed remittances without registries and payment of the IPI rate, in regard to transfers of sugarcane carried out between July 6, 1995 and November 16, 1997 and refined sugar between January 14, 1992 and November 16, 1997. Such rule was considered in proceedings filed by the Federal Revenue Secretariat against the Company, the unfavorable outcome of which is deemed as possible, in accordance with the opinion of the Company’s legal advisors.

(iv) Offsets against IPI credits – IN 67/98

SRF Normative Instruction No. 67/98 made it possible to obtain refund of IPI tax payments for sales of refined sugar from January 14, 1992 through November 16, 1997. In view of this rule, the Company applied for offsetting amounts paid during the relevant periods against other tax liabilities. However, the Federal Revenue Service denied its application for both reimbursement and offsetting of such amounts. The Company challenged this ruling in an administrative proceeding.

Upon being notified to pay tax debts resulting from offset transactions in light of certain changes introduced by IN SRF No. 210/02, the Company filed a writ of mandamus and applied for a preliminary injunction seeking to stay enforceability of offset taxes, in an attempt to prevent the tax authorities from demanding the relevant tax debts in court. The preliminary injunction was granted by court. A liminar foi deferida pelo juízo competente. The legal advisor of the Company, who sponsor this demand, considered the loss probability of this demand as possible.

(v) INSS - Social Security Contribution

Refers mainly to tax assessment received and defended by the legal counsel, concerning social security contribution on: (i) stock option plan and (ii) export sales and (iii) resale of materials for companies under common control and suppliers.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

(vi) PIS e COFINS

Refers mainly to the reversal of PIS and COFINS credits, provided by Laws 10.637/2002 and 10.833/2003, respectively. Those reversals arise from a differing interpretation of the laws by the Internal Revenue Service in regard to raw materials. Such discussions are still at the administrative level.

The compensated and updated amount until September 30, 2011 is R$184,439 (R$182,624 as of March 31, 2011). In addition, the Company has the same litigation with the Internal Revenue Service, which the compensated and updated amount totalized R$12,479 until September 30, 2011 (R$12,360 as of March 31, 2011). This demand is supported by the legal advisors and the Company considers that there is no need to accrue any provision for this aforementioned demand.

The main civil and labor claims for which the unfavorable outcome is deemed possible and, therefore, no provision for legal claims was recorded, are as follows::

| | | | 09.30.2011 | | | | 03.31.2011 | |

| Civil | | | 1,410,169 | | | | 377,608 | |

| Labour | | | 385,662 | | | | 302,289 | |

| | | | 1,795,831 | | | | 679,897 | |

The Labor public prosecution office of the 15th Region (Campinas) and two non-governmental organizations filed a public civil action (ACP) against Shell Brazil Ltda ("Shell Brazil") today the jointly controlled subsidiary Raizen Combustíveis, in March 2007. The applications are based on, at the preliminary injunction, (i) lifelong health care for all former employees of the Paulínia plant and their families and as a definite application, (i) confirmation of the application, in case it has not been granted as writ of prevention (ii) collective moral damages worth of R$622,200 and (iii) failure to explore economic activity in that region due to environmental degradation caused by chemical contamination of soil and water. The parties attempted to negotiate an agreement between 2007 and 2009 and during this period the lawsuit was suspended.

On August 19, 2010, the ruling was published, which granted the former employees of the claim, Shell, the payment of R$20 per year of service or fraction greater than six months, as individual moral damages, plus a consistent compensation for material damages for the cost of medical treatment to each former employee and their dependents, and also R$ 64.5 to each former employee and each dependent as a compulsory substitute indemnification of affirmative covenant, which refers to the period between the filing of action until September 30, 2010, as well as collective moral damages, which was be revised from R$ 622,200 to R$762,000.

Finally, the judge ruled that the total amount the cause was R$1,100,000. In August, Shell Brazil filed an ordinary appeal.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

On April 8, 2011 the decision of the Regional Labor Court - TRT was published, which did not grant the ordinary appeals lodged by Shell and BASF and fully maintained the convictions set as published on August 19, 2010. The two companies requested further clarification on the decision in order to submit applicable appeals to the Superior Labor Court - TST." The Company believes that, on a possible ultimate conviction, the amount set by the decision will be significantly lower than those decided by the TST.

The Shell Group believes that, on a possible ultimate conviction, the amount set by the decision will be significantly lower than those decided by the TST.

It is import to mention that, according to a agreement entered into at the establishment of the joint venture, any convictions in litigation arising from events prior to the establishment of the joint venture, are the sole responsibility of the jointly controlling shareholders, in this case, the Shell Group.

a) Common stock

As of March 31, 2011 and March 31, 2010, Cosan Limited’s share capital consists of:

Shareholder | | Class A shares and/or BDRs | | | % | | | Class B shares | | | % | |

| Queluz Holding Limited | | | 11,111,111 | | | | 6.37 | | | | 66,321,766 | | | | 68.85 | |

| Usina Costa Pinto S.A. Açúcar e Álcool | | | - | | | | - | | | | 30,010,278 | | | | 31.15 | |

| Aguassanta Participações S.A. | | | 5,000,000 | | | | 2.87 | | | | - | | | | - | |

| Gávea Funds | | | 33,333,333 | | | | 19.12 | | | | - | | | | - | |

| Others | | | 124,910,897 | | | | 71.64 | | | | - | | | | - | |

| Total | | | 174,355,341 | | | | 100.00 | | | | 96,332,044 | | | | 100.00 | |

Class B1 shares are entitle their holders to 10 votes per share and Class A shares entitle holders to 1 vote per share.

b) Repurchase of shares

On September 16, 2011, the Board of Directors approved a stock repurchase plan for the purpose of maintenance in treasury, cancellation or disposal. The repurchase of shares is due to 365 days and the maximum amount of repurchase is US$100 million.

During the quarter ended September 30, 2011, the Company acquired 230,500 shares for R$4,579, including expenses. The average unit stock value acquired during the period was R$18.88, which the maximum and minimum value was R$21.16 and R$ 16.12, respectively.

As of September 30, 2011, the Company has 230,500 treasury shares, which market value, that date, was R$18.47.

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

c) Dividends

On August 12, 2011 was approved at a meeting of the Board of Directors, the distribution of the entire dividend to be received by Cosan S,A, Indústria e Comércio on August 31, 2011, The dividends will be paid to shareholders for the fiscal year 2011, ended March 31, 2011 totaling US$ 76,907, corresponding to US$ 0.28 per share and class A/B or the equivalent in dollars to holders of share deposit certificate (BDR), without withholding income tax at source.

d) Earnings per share

According to the IAS 33 – Earnings per share, the tables below present the reconciliation of the net income and the weighted average value per share used to the calculation of the basic and diluted earnings per share.

Cosan Limited does not present any dilutive potential shares outstanding, therefore the table below presents the calculation of basic and diluted earnings per share:

Basic and diluted:

| | | | 09.30.2011 | | | | 09.30.2010 | |

| Numerator: | | | | | | | | |

| Net income – attributable to Cosan | | | 1,022,364 | | | | 148,669 | |

| Denominator: | | | | | | | | |

| Weighted average shares outstanding | | | 270,687,385 | | | | 270,687,385 | |

| Basic earnings per share | | R$ | 3.78 | | | R$ | 0.55 | |

| 21. | Result of the formation of Joint Ventures (Raízen Energia e Raízen Combustíveis) |

As mentioned in note 1, on July 1st, 2011, the Company concluded, together with Royal Dutch Shell (“Shell”), the formation of two joint ventures: (1) Raízen Combustíveis, in the fuel distribution segment, and (ii) Raízen Energia, in the sugar and ethanol segment. The Company and Shell share the control of the two entities, each one has 50% of the economic control.

The formation of Raízen Energia and Raízen Combustíveis has the objective to create one of the world’s largest producers of sugar, ethanol and bioenergy produced through sugarcane and one of the largest fuel distributors in the Brazilian market.

Due to the formation of Raízen Energia and Raízen Combustíveis, the Company contributed its sugar and ethanol and fuel distribution businesses. Disconsolidating the related assets and liabilities and recording the remaining interest at fair value.

The process of disconsolidating do the contributed business, on June 1st, 2011, and the recognition of the new interest at fair value produced a gain of R$2,853,057 recorded during the period and shown below:

Cosan Limited

Notes to consolidated quarterly financial information

September 30, 2011

(in thousands of Reais, unless otherwise stated)

| Fair value of the remaining interest in the joint ventures (a) | 8,059,870 | |

| Book value of the contributed businesses (assets and liabilities) | (4,207,173 | ) |

| Gain on the formation of joint ventures | | 3,852,697 | |

| | | | |

| Other effects: | | - | |

| | | | |

| Write-off of recoverable taxes not realizable (b) | | (83,465 | ) |

| Write-off of goodwill not contributed | | (637,535 | ) |

| Write-off of other comprehensive income related to hedge acccounting | | (98,858 | ) |

| Accrual of provisions according to the joint venture’s contract | | (80,000 | ) |

| Other expenses and write-off incurred during the formation of joint ventures | | (99,782 | ) |

| Net result on the formation of joint ventures | | 2,853,057 | |