UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33657

Abraxis BioScience, Inc.

(Exact name of registrant as specified in its charter)

| | |

Delaware | | 30-0431735 |

(State of incorporation) | | (I.R.S. Employer Identification No.) |

| |

11755 Wilshire Boulevard, Suite 2000 Los Angeles, CA 90025 | | (310) 883-1300 |

| (Address of principal executive offices, including zip code) | | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Common Stock, par value $0.001 per share | | The NASDAQ Stock Market LLC |

| (Title of Class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| ¨ Large accelerated filer | | x Accelerated filer | | ¨ Non-accelerated filer | | ¨ Smaller reporting company |

| | | | (Do not check if a smaller

reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as determined by rule 12b-2 of the Exchange Act). Yes¨ Nox

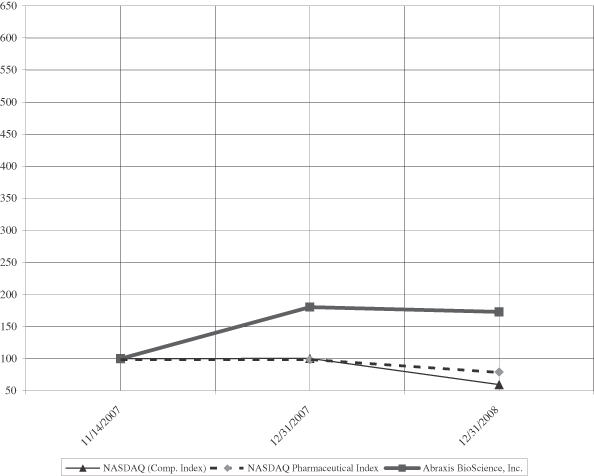

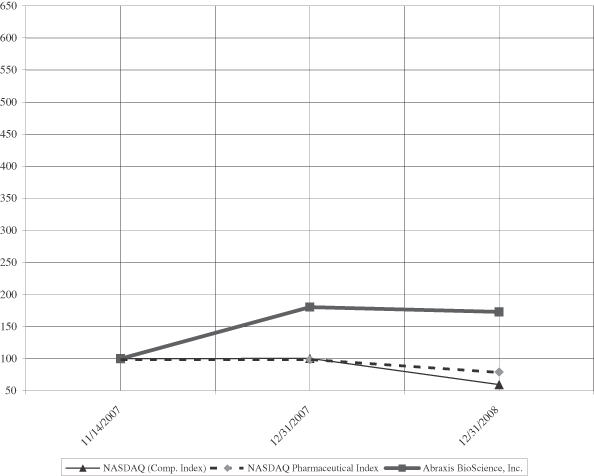

Shares of the registrant’s common stock was first distributed to the stockholders of APP Pharmaceuticals, Inc. on November 13, 2007 and commenced trading on November 14, 2007. Prior to that date, there was no public market for the registrant’s common stock.

The approximate aggregate market value of voting and non-voting stock held by non-affiliates of the registrant was $438 million as of June 30, 2008. All executive officers and directors of the registrant have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

The number of shares of common stock outstanding as of February 24, 2009 was 40,070,846

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the registrant’s 2009 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

Abraxis BioScience, Inc.

FORM 10-K

For the Year Ended December 31, 2008

TABLE OF CONTENTS

2

PART I

Item 1. BUSINESS

Unless the context otherwise requires, references to “New Abraxis,” “Abraxis BioScience,” “Abraxis,” “we,” “us” and “our” refer to Abraxis BioScience, Inc. (formerly New Abraxis, Inc.) and its subsidiaries, including our operating subsidiary Abraxis BioScience, LLC; references to “Old Abraxis” refer to Abraxis BioScience, Inc. (formerly American Pharmaceuticals, Inc.) prior to the 2007 separation; references to “APP” refer to APP Pharmaceuticals, Inc. and its subsidiaries, including its operating subsidiary APP Pharmaceuticals Partners, LLC (which we sometimes refer to as APP LLC); and references to the “distribution,” “separation,” “2007 separation” or “spin-off” refer to the transactions in which we separated from Old Abraxis and became an independent publicly-traded company in 2007.

Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K and other materials filed or to be filed by us with the Securities and Exchange Commission, or the SEC, as well as information included in oral statements or other written statements made or to be made by us, contain forward-looking statements within the meaning of federal securities laws. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the federal securities laws. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections about our industry, our beliefs and assumptions. These risks and uncertainties include those described in “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Forward-looking statements, whether express or implied, are not guarantees of future performance and are subject to risks and uncertainties, which can cause actual results to differ materially from those currently anticipated, due to a number of factors, which include, but are not limited to:

| | • | | the amount and timing of costs associated with the continuing launch of Abraxane®; |

| | • | | our ability to maintain and/or improve sales and earnings performance; |

| | • | | the actual results achieved in further clinical trials of Abraxane® may or may not be consistent with the results achieved to date; |

| | • | | the market adoption of any new pharmaceutical products; |

| | • | | the difficulty in predicting the timing or outcome of product development efforts and regulatory approvals; |

| | • | | our ability and that of our suppliers to comply with laws, regulations and standards, and the application and interpretation of those laws, regulations and standards, that govern or affect the pharmaceutical industry, the non-compliance with which may delay or prevent the sale of their products; |

| | • | | the availability and price of acceptable raw materials and components from third-party suppliers; |

| | • | | any adverse outcome in litigation; |

| | • | | general economic, political and business conditions that adversely affect our company or our suppliers, distributors or customers; |

| | • | | changes in costs, including changes in labor costs, raw material prices or advertising and marketing expenses; |

| | • | | inventory reductions or fluctuations in buying patterns by wholesalers or distributors; |

| | • | | the impact on our products and revenues of patents and other proprietary rights licensed or owned by us, our competitors and other third parties; |

| | • | | the ability to successfully manufacture our products in an efficient, time-sensitive and cost effective manner; and |

| | • | | the impact of recent legislative changes to the governmental reimbursement system. |

3

You should read this Annual Report on Form 10-K with the understanding that actual future results may be materially different from expectations. Readers should carefully review the factors described in“Item 1A: Risk Factors”below and other documents we file from time to time with the SEC for a more detailed description of these risks and other factors that may affect the forward-looking statements. All forward-looking statements made in this Annual Report on Form 10-K are qualified by these cautionary statements. These forward-looking statements are made only as of the date of this Annual Report on Form 10-K, and we do not undertake any obligation (and we expressly disclaim any such obligation), other than as may be required by law, to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events or changes in future operating results over time or otherwise. We use words such as “should,” “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate” and variations of these words and similar expressions to identify forward-looking statements, but these are not the exclusive means of identifying forward-looking statements.

Available Information

Our Internet address is www.abraxisbio.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and other information are available free of charge on our website as soon as reasonably practical after they are electronically filed or furnished to the SEC. The information found on our website shall not be deemed incorporated by reference by any general statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent we specifically incorporate the information found on our website by reference, and shall not be deemed filed under such Acts.

The SEC also maintains an Internet site that contains reports, proxy and information statements, and other information about issuers that file reports electronically with the SEC. The address of that site is www.sec.gov.

2007 Separation

On November 13, 2007, Abraxis BioScience, Inc. (formerly “American Pharmaceutical Partners, Inc.”) (“Old Abraxis”) was separated into two independent publicly-traded companies: one holding the former Abraxis Pharmaceutical Products business (which is referred to as the “hospital-based business”); and the other holding the former Abraxis Oncology and Abraxis Research businesses (which is referred to as the “proprietary business”). Following the separation, the proprietary business changed its name from New Abraxis, Inc. to Abraxis BioScience, Inc. and the hospital-based business was operated under the name APP Pharmaceuticals, Inc.

In connection with the separation, stockholders of Old Abraxis as of November 13, 2007 received one share of our company for every four shares of Old Abraxis held as of that date. In addition, in connection with the separation, we entered into a separation and distribution agreement that provides for, among other things, the principal corporate transactions required to effect the separation and other specified terms governing our relationship with APP after the spin-off. We also entered into various agreements with APP, including (i) a transition services agreement pursuant to which we and APP agreed to continue to provide each other with various services on an interim, transitional basis, for periods up to 24 months depending on the particular service; (ii) a manufacturing agreement whereby we and APP agreed to manufacture Abraxane® and certain other products and to provide other manufacturing-related services for a period of four or five years; (iii) an employees matters agreement providing for each company’s respective obligations to employees and former employees who are or were associated with their respective businesses, and for other employment and employee benefit matters; (iv) various real estate leases; and (v) a tax allocation agreement. Also, in connection with the separation, APP contributed $700 million in cash to us.

4

Proposed 2009 Spin-Off

In January 2009, we announced that our board of directors approved a plan to spin-off a newly-formed subsidiary Abraxis Health, Inc. as a new independent, stand-alone company holding our drug discovery, pilot manufacturing and development business. If the spin-off occurs, our stockholders would own (i) shares of Abraxis Health and (ii) shares of our common stock, and we would continue to operate our existing business, excluding the drug discovery, pilot manufacturing and development business to be held by Abraxis Health. In connection with the proposed spin-off, Abraxis Health would enter into several agreements with us related to, among other things, manufacturing, transition services, product development and research, tax allocations, clinical development and a number of ongoing commercial relationships.

The proposed spin-off is subject to a number of closing conditions, including final approval by our board of directors and the effectiveness of the registration statement registering the common stock of Abraxis Health to be distributed to our stockholders in connection with the spin-off. Approval by our stockholders is not required as a condition to the consummation of the proposed spin-off. In connection with the proposed spin-off, Abraxis Health filed a registration statement on Form 10 with the SEC. Stockholders are urged to read Abraxis Health’s Form 10 registration statement carefully because it contains important information about the proposed spin-off. SeeItem 8—Financial Statements and Supplementary Data, Note 15—Subsequent Events for further discussion.

Overview

We are a Delaware corporation that was formed in June 2007. Our business was conducted as part of Old Abraxis prior to the separation. References in this Annual Report on Form 10-K to the historical assets, liabilities, products, businesses or activities of our company are generally intended to refer to the historical assets, liabilities, products, businesses or activities of the business as it was conducted as part of Old Abraxis prior to the separation.

We are one of the few fully integrated biotechnology companies, with a breakthrough marketed product (Abraxane®), global ownership of our proprietary technology platform and clinical pipeline, dedicated nanoparticle manufacturing capabilities for worldwide supply integrated with seasoned in-house capabilities, including discovery, clinical drug development, regulatory and sales and marketing.

We are dedicated to the discovery, development and delivery of next-generation therapeutics and core technologies that offer patients safer and more effective treatments for cancer and other critical illnesses. Our portfolio includes the world’s first and only protein-based nanoparticle chemotherapeutic compound (Abraxane®) which is based on our proprietary tumor targeting technology known as thenab® technology platform. Thisnab® technology platform is the first to exploit the tumor’s biology against itself, taking advantage of an albumin-specific, receptor-mediated transport system and allowing the delivery of a drug from the vascular space across the blood vessel wall to the underlying tumor tissue. Abraxane® is the first clinical and commercial validation of ournab® technology platform. From the discovery and research phase to development and commercialization, we are committed to rapidly enhancing our product pipeline and accelerating the delivery of breakthrough therapies that will transform the lives of patients who need them.

We own the worldwide rights to Abraxane®, a next-generation, nanometer-sized, solvent-free taxane that was approved by the U.S. Food and Drug Administration, or the FDA, in January 2005 for its initial indication in the treatment of metastatic breast cancer and launched in February 2005. We believe the successful launch of Abraxane® validates ournab® tumor targeting technology, a novel biologically interactive (receptor-mediated) system to deliver chemotherapeutic agents in high concentrations preferentially to all tumors secreting a protein called SPARC, which attracts and binds to albumin. Abraxane® revenue for the year ended December 31, 2008 and 2007 was $ 335.6 million and $324.7 million, respectively, which included the recognition of previously deferred revenue related to our June 2006 co-promotion agreement with AstraZeneca UK Limited. In January 2009, we re-acquired from AstraZeneca the exclusive rights to market Abraxane® in the United States, thereby ending the co-promotion agreement.

5

Our research and development approach is based on the integration of ournab® tumor targeting technology, our natural product drug discovery platform, our multi-functional chemistry capabilities with our in-house clinical trial and regulatory strengths, combined with our unique nanoparticle manufacturing capabilities. Our product pipeline includes over five clinical oncology and cardiovascular product candidates in various stages of testing and development, including Abraxane® and Coroxane™ for various indications. We also have over 45 discovery product candidates and novel chemical entities for various diseases, including cancer, multiple sclerosis and Alzheimer’s. We believe the application of ournab® technology will serve as the platform for the development of numerous drugs for the treatment of cancer and other critical illnesses. To leverage in-house manufacturing, clinical trial and regulatory expertise, we will continue to supplement our discovery efforts through technology acquisitions and external collaborations with academia and start-up biotechnology companies.

Abraxane®, A Proprietary Injectable Oncology Product

Overview

Abraxane® is a next-generation, nanometer-sized, solvent-free taxane that was approved by the FDA in January 2005 for its initial indication in the treatment of metastatic breast cancer and launched in February 2005. As of December 2008, Abraxane was approved for marketing in 36 countries. Taxanes are one of the most widely used chemotherapy agents. We believe the successful launch of Abraxane® validates ournab® tumor targeting technology described below. Effective January 1, 2006, we received a unique reimbursement “J” code for Abraxane®, which facilitates reimbursement from Medicare and Medicaid as well as private payors.

First clinical and commercial validation of our nab® tumor targeting technology

Abraxane® represents the first in a new class of protein-bound drug particles that takes advantage of albumin, a natural carrier of water insoluble molecules (e.g., various nutrients, vitamins and hormones) found in humans. Because tumors have an increased need for nutrients to support rapid malignant growth, albumin complexes accumulate preferentially in tumors. Recent molecular analyses have identified receptor-mediated pathways (gp60) facilitating active transport of albumin complexes from the blood into tissues and resulting in preferential accumulation in tumors by tumor-secreted proteins (SPARC), which attract albumin. Abraxane® consists only of paclitaxel nanometer-sized albumin-bound particles and, in a pivotal 460 patient Phase III clinical trial, demonstrated an almost doubling of the response rate, a longer time to tumor progression in metastatic breast cancer as well as an increased survival in patients previously treated for metastatic disease when compared to Taxol®. We believe that ournab® tumor targeting technology and these albumin pathways allow more rapid delivery of paclitaxel to the cancer cells, with preferential accumulation while at the same time allowing less drug indiscriminately into normal, healthy cells. This is supported by the clinical findings demonstrated by Abraxane®.

Overcoming the obstacles and toxicity of solvents

Many oncology drugs are water insoluble and thus require solvents to formulate the drugs for injection. Taxol® and its generic solvent-based equivalents contain the active ingredient paclitaxel dissolved in the solvent Cremophor. The toxicity of Cremophor limits the dose of Taxol® that can be administered, potentially limiting the efficacy of the drug. Furthermore, patients receiving Taxol® require pre-medication with steroids and antihistamines to prevent the toxic side effects associated with Cremophor and, in some cases, require a growth factor such as G-CSF to overcome low white blood cell levels resulting from chemotherapy.

Abraxane® utilizes ournab® tumor targeting technology to encapsulate an amorphous form of paclitaxel in albumin, a human protein found in blood and avoids the need for Cremophor. Because it contains no Cremophor solvent, this next-generation taxane product enables the administration of 50% more chemotherapy with a well- tolerated safety profile, requires no routine premedication to prevent hypersensitivity reactions, can be given over a shorter infusion time using standard IV tubing and reduces the need for G-CSF support.

6

Abraxane® clinical development, label expansion and global commercialization plans

We will continue to pursue an aggressive and comprehensive clinical development plan to maximize the commercial potential and clinical knowledge of Abraxane®. As of December 31, 2008, approximately 25 company-sponsored Abraxane® clinical studies and approximately 62 investigator-initiated Abraxane® clinical studies were planned or underway for various indications, of which more than 42 had patient participation. The investigator-initiated studies generally are intended to advance the clinical knowledge of Abraxane® and support our clinical development program.

Results from five company-sponsored studies of Abraxane® were presented at the 31st Annual San Antonio Breast Cancer Symposium in December 2008. Preliminary results from a single-arm, open-label, Phase II clinical trial evaluating Abraxane® in combination with gemcitabine and epirubicin for the treatment of patients with locally advanced breast cancer (neoadjuvant treatment) indicated that 18 percent of patients (n=23) given a regimen of Abraxane®, gemcitabine and epirubicin achieved a complete pathologic response (the disappearance of all target lesions), and 68 percent (n=84) achieved a partial response (a 30 percent or greater decrease in size of target lesions). The company also presented pre-clinical data evaluating the potential antitumor activity of nab®-paclitaxel given in combination with two investigational therapies that utilize our proprietary nanoparticle technology, nab®-rapamycin and nab®-IDN5404.

We will continue to study the use of Abraxane® in a variety of oncology settings and intend to focus our Phase III trials in first-line non-small cell lung cancer (NSCLC), melanoma and pancreatic cancer, all of which are expected to be superiority trials utilizing weekly dosing schedules of Abraxane®. The Phase III NSCLC pivotal trial is a randomized, open-label trial comparing weekly 100 mg/m2 Abraxane® (days 1, 8 and 15 of each cycle) and 200 mg/m2 Taxol® (paclitaxel) injection every three weeks. Carboplatin will be administered at AUC=6 on day 1 of each cycle repeated every three weeks in both treatment arms. The study will enroll over 1,000 patients with Stage IIIb and IV non-small cell lung cancer. The primary endpoint of the study is overall response rate and the detection of meaningful differences in progression-free survival (PFS). Patient enrollment of this trial began in the fourth quarter of 2007 and is presently 60% enrolled. The Phase III melanoma trial is expected to begin in the first half of 2009. Based on encouraging Phase I/II clinical trial data of Abraxane®in combination with gemcitabine in the treatment of metastatic pancreatic cancer, we filed with the FDA a Phase III randomized trial of Abraxane®for use in both first and second line pancreatic cancer. A presentation of the Phase I/II study on use of Abraxane®in treatment of pancreatic cancer was presented at the American Society of Clinical Oncology Annual Meeting in May 2008. We continue to expand our clinical experience with Abraxane® and its potential in treating multiple tumor types as a single agent and in combination.

With regard to the global commercialization, Abraxane® is presently approved in 36 countries worldwide. Subsequent to the FDA approval of Abraxane® in the US in January 2005, Abraxis received regulatory approval from the Therapeutic Products Directorate of Health Canada to market Abraxane® for the treatment of metastatic breast cancer in Canada in June 2006. In October 2007, Abraxis received regulatory approval from India’s Drug Controller General to market Abraxane® for the treatment of breast cancer after failure of combination chemotherapy for metastatic disease or relapse within 6 months of adjuvant chemotherapy. In January 2008, the European Commission granted marketing approval in 30 European countries (via the centralized procedure) for Abraxane® in patients who have failed first-line treatment for metastatic disease and for whom standard, anthracycline containing therapy is not indicated. In March 2008, we received regulatory approval with the Korean FDA to market Abraxane® in South Korea for the treatment of breast cancer after failure of combination chemotherapy for metastatic disease. In June 2008, we received regulatory approval with the State Food and Drug Administration of the People’s Republic of China to market Abraxane® for the treatment of breast cancer after failure of combination chemotherapy for metastatic disease or relapse within 6 months of adjuvant chemotherapy. Prior therapy should have included an anthracycline unless clinically contraindicated. In September 2008, we received regulatory approval from the Therapeutic Goods Administration, Australia to market Abraxane® powder for injection (suspension) for the treatment of metastatic carcinoma of the breast after failure of anthracycline therapy. We launched Abraxane® in India (through our partner Biocon) in July 2008, in

7

the United Arab Emirates with partner Neobiocon in October 2008, in the United Kingdom in December 2008, in Germany in February 2009 and in Australia in collaboration with Specialised Therapeutics Australia Pty Ltd. in February 2009. Additionally, in 2009, we expect to launch Abraxane® in South Korea with partner Green Cross Corporation.

Marketing authorization applications have been submitted to several countries including Russia in June 2006, Japan in February 2008, and via the centralized procedure, in the Gulf Corporation Council countries (Saudi Arabia, Bahrain, Sultanate of Oman and Kuwait) in December 2008. In 2009, we further plan to submit marketing authorization applications for regulatory approval of Abraxane® (for the metastatic breast cancer indication) in New Zealand, Bhutan, Sri Lanka, Brazil and Taiwan.

nab® Tumor Targeting Technology Platform

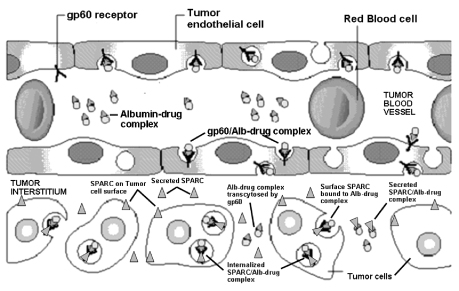

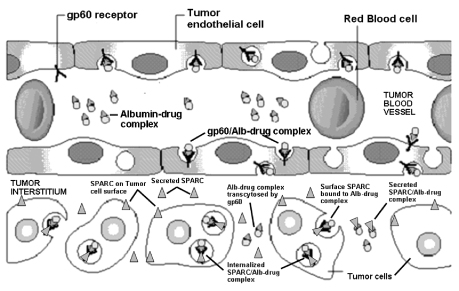

We have identified a biological pathway specific to tumors through which tumors preferentially accumulate albumin-bound complexes. This preferential accumulation of albumin appears to be facilitated through a tumor’s secretion of a protein called SPARC, which binds to and accumulates albumin. A body of research has suggested that the secretion of SPARC occurs in most solid tumors that are difficult to treat, including in breast, lung, ovarian, head and neck, melanoma, gastric, esophageal, glioma and cervical tumors. Exploiting these tumors’ attraction for albumin, we have developed a novel mechanism to deliver chemotherapy agents in high concentrations preferentially to all tumors secreting SPARC. This is accomplished through ournab® tumor targeting technology, which encapsulates chemotherapy agents in nanometer-sized particles of albumin that is approximately 1/100th the size of a single red blood cell. Millions of these particles can be injected in a single dose of medication. This albumin-bound medication enters the bloodstream where it is transported across the blood vessel wall through a specific albumin receptor (gp60) on the blood vessel wall and targeted by SPARC secreted from the tumor cell.

The following diagram depicts ournab® tumor targeting technology and the proposed mechanism by which high concentrations of chemotherapy agents are delivered preferentially to tumors through the biological gp60 receptor pathway and through albumin binding to SPARC.

In April 2007, at the 98th Annual Meeting of the American Association for Cancer Research (AACR), we announced results from various pre-clinical studies that support the role of SPARC and ournab® tumor targeting

8

technology. The results from one pre-clinical study demonstrated that SPARC is an albumin-binding protein and that the level of the SPARC expression could be correlated with the response of tumors to Abraxane®. This provides concrete support for the earlier hypothesis that higher levels of SPARC protein may lead to enhanced anti-tumor effect of Abraxane®. The pre-clinical study results also provided evidence for chemotherapy induced angiogenesis and a rationale for combining Abraxane® with VEGF inhibitor drugs like Avastin® . We continue to explore the role of ournab® technology for targeting SPARC and other biological pathways, as well as for the development of new therapeutic candidates, including our clinical product candidates described below.

We believe we can apply ournab® tumor targeting technology to numerous chemotherapy agents. By exploiting the abnormal vascular growth (angiogenesis) and the overexpression of albumin-binding proteins (gp60 and SPARC) in advanced tumor cells and by overcoming water insolubility of many active chemotherapy agents, we believe that our technology may revolutionize the delivery of chemotherapy agents to cancer patients. As shown below, Abraxane® represents the first clinical and commercial validation of ournab® technology that takes advantage of albumin, a natural carrier of water insoluble molecules (e.g., various nutrients, vitamins and hormones) found in humans. Because tumors have an increased need for nutrients to support rapid malignant growth, albumin complexes accumulate preferentially in tumors.

We believe that ournab® tumor targeting technology will serve as the platform for the development of numerous other drugs for the treatment of cancer and other critical illnesses. We are committed to maximizing the potential application of our technology.

9

Select Clinical Product Candidates

We intend to continue to leverage ournab® tumor targeting technology and our internal clinical development and regulatory expertise to develop numerous drug candidates for the treatment of cancer and other critical illnesses. The following table is a selection of certain of our clinical product candidates and shows the status of these clinical product candidates.

| | | | |

Compound | | Critical Illness | | Status |

| | |

Abraxane® | | First-Line Non-Small Cell Lung Cancer | | Phase III began in the fourth quarter of 2007 and is 60% enrolled. |

| | |

Abraxane® | | Malignant Melanoma | | Phase III planned to begin in the first half of 2009. |

| | |

ABI-008 (nab®-docetaxel) | | Solid Tumors | | Phase I completed in hormone-refractory prostate cancer (HRPC). Phase II started in 2008. |

| | |

ABI-009 (nab®-rapamycin) | | Solid Tumors | | Phase I in progress. |

| | |

ABI-010 (nab®-17AAG) | | Solid Tumors | | IND filed in the first quarter of 2008. Phase I planned to begin in the first half of 2009. |

| | |

ABI-011 (nab®-thiocolchicine dimer) | |

Solid Tumors | | IND filing planned for 2009. |

| | |

Coroxane™ | | Coronary Artery Restenosis | | Phase II. Seeking strategic partner. |

| | |

Coroxane™ | | Peripheral Artery Restenosis | | Phase II. Seeking strategic partner. |

ABI-008 (nab®-docetaxel). ABI-008 is a solvent-free, Tween®-free nanometer-sized form of docetaxel. Docetaxel is the active ingredient in the currently largest selling taxane, Taxotere®. An investigational new drug application, or IND, was filed for ABI-008 in the fourth quarter of 2006. ABI-008 is currently in development for the first-line treatment of hormone-refractory prostate cancer (HRPC). Phase I studies have been completed and Phase II studies started in the second half of 2008. A Phase I/II trial in metastatic breast cancer is expected to begin later in 2009. Additionally, two Phase III ABI-008 trials, in HRPC and 2nd line non-small cell lung cancer (NSCLC), are planned to be filed with the FDA in 2009.

ABI-009 (nab®-rapamycin). Rapamycin, a protein kinase inhibitor, inhibits downstream signals from mTOR, a pathway that promotes tumor growth. Currently, it is marketed as an orally bioavailable immunosuppresive drug and no intravenous form is available because of the water insolubility of this molecule. The anti-cancer effects of rapamycin are limited by the immunosuppression associated with chronic oral administration. ABI-009 is a nanometer-sized, albumin-bound form of rapamycin able to be administered intravenously or by inhalation. At the 98th Annual Meeting of the AACR in April 2007, first-time data were presented from a pre-clinical study evaluating the toxicity and anti-tumor effect of ABI-009. These results demonstrated that ABI-009 was well-tolerated, showed linear pharmacokinetics, and was highly effective against a number of tumor models in vivo. The Phase I study is currently ongoing with ABI-009 in patients with solid tumors.

ABI-010 (nab®-17AAG). 17AAG is a polyketide inhibitor of Hsp90 (heat shock protein 90) and interrupts several biological processes implicated in cancer cell growth and survival. Hsp90 is a protein chaperone that

10

binds to several sets of signaling proteins, known as “client proteins.” 17AAG binds to Hsp90 and causes its dissociation from, and consequent degradation of, the client proteins. Because the Hsp90 client proteins are so important in signal transduction and in transcription (processes critical to the growth and survival of cancer cells), 17AAG may serve as a chemotherapy agent in the treatment of multiple cancers. Current formulations of 17AAG require solvents such as Cremophor and DMSO. ABI-010 is a solvent-free albumin-bound form of this drug The IND fornab®-17AAG and the clinical development plan was approved by the FDA in May 2008.

ABI-011 (nab® -thiocolchicine dimer).Thiocolchicine dimers are novel thiocolchicines with dual mechanisms of action showing both microtubule destabilization and the disruption of topoisomerase-1 activity.nab®-thiocolchicine dimer is a nanoparticle, albumin-bound form of the water insoluble dimer. ABI-011 was selected for its cytotoxic activity in nanomole range concentrations on several human tumor cell lines and, in particular, on a tumor cell line resistant to cisplatin and topotecan. This particular behavior was related to a dual mechanism of action. ABI-011 has the additional oncotherapeutic property of inhibiting topoisomerase-1 nuclear enzymes in a different manner than the classic topo-1 inhibitors, camptothecins. Pre-clinical studies of ABI-011 have shown that it also possesses anti-angiogenic and vascular disrupting activity. We anticipate that an IND fornab® thiocolchicine dimer will be filed in 2009.

Coroxane™ (nanometer-sized paclitaxel, Abraxane®, under the trade name Coroxane™).Coroxane™ is currently closing its Phase II clinical studies for coronary restenosis as well as peripheral artery (superficial femoral artery) restenosis. The SNAPIST series of studies examines the use of Coroxane™ in the treatment of coronary artery restenosis, including the use of Coroxane™ in patients receiving bare metal stents. Coroxane™ administered with bare metal stents may address the issue of incomplete re-endothelialization and acute thrombosis associated with drug-eluting stents. Coroxane™ administered following balloon angioplasty in the superficial femoral artery may help reduce the incidence of restenosis in these patients. We currently intend to seek a strategic partner for the further development and marketing of Coraxane™.

Research and Development

Our research and development efforts are based on the tight integration and rapid translation of discovery from the bench to the clinic among its chemistry, biology, pharmaceutical, regulatory and clinical development groups. We have recruited seasoned discovery scientists, medicinal chemists, formulation scientists and integrated these talents with a team of clinical development and regulatory experts. Our approach is based on the integration of various capabilities and resources, including:

| | • | | ournab® tumor targeting technology; |

| | • | | our proprietary natural product drug discovery platform; |

| | • | | our multi-functional chemistry capabilities; and |

| | • | | internal clinical trial and regulatory competencies. |

Natural Product Drug Discovery Platform

Almost half of today’s best-selling drugs originate from natural products or their derivatives. A key feature of natural products is their enormous structural and chemical diversity that is not represented in combinatorial libraries of synthetic compounds. This makes natural products a fertile resource for finding novel compounds that interact with new targets for drug discovery. In addition, we believe ournab® tumor targeting technology platform is ideally suited to the formulation and delivery of natural products, which tend to be more water insoluble, larger and more complex than typical synthetic drugs.

We have established a proprietary natural product library of large chemical diversity for drug discovery. The library currently represents approximately 100,000 semi-purified screening samples derived from microorganisms (over 65,000 strains of actinomycetes, fungi and bacteria) retrieved from over 38,000 soil

11

samples representing geographic, habitat and genetic diversity from all over the world. New strains of microorganisms are continuously being added from our soil sample collection, and we believe the millions of microorganisms in each soil sample provide us with an almost limitless resource for continuing to create new and targeted libraries of natural product chemical diversity for drug discovery. For example,nab®-17AAG was developed based on extracts from our natural product library.

Natural products are an important component of our drug discovery strategy and, with the capability to overcoming water insolubility through the use of ournab® technology, we believe we have the unique opportunity to translate water insoluble compounds discovered from our natural product libraries into clinical applications.

Multi-functional Chemistry Capabilities. We possess a full range of chemistry capabilities, including organic and medicinal chemistry, analytical chemistry, formulation, process development and natural product isolation chemistry. Our approach, which involves chemistry-driven discovery combined with biology-driven validation and integration with ournab® technology, has been applied successfully on many drug discovery programs.

Internal Clinical Trial and Regulatory Competencies. We have established key internal clinical development and regulatory competencies to execute rapid clinical translation of our technology in the most cost-efficient manner. Clinical Operations, Safety Reporting, Data Management and Biostatistics are located in our Durham, North Carolina office. Clinical Operations manages all of our company-sponsored clinical trials by overseeing the study conduct at each site and verifying data integrity. Data Management enters all clinical trial data into an in-house database, which is then analyzed by our biostatistics team who produce reports for FDA submissions. Safety reporting and post-marketing safety surveillance are carried out using a Drug Safety Reporting System. The regulatory operations team is responsible for making submissions to the FDA and global regulatory authorities. This seasoned team accomplished the first electronic submission of an NDA with the FDA of an oncology product, resulting in FDA approval of Abraxane®. An important strategy underway is the development of informatics and electronic systems to streamline our clinical trial management processes, including establishing alliances to enhance patient accrual and provide efficient methods to capture data.

Drug Discovery Strategies

Our drug discovery strategies are based upon the following:

| | • | | our nab® tumor targeting technology; |

| | • | | our natural product drug discovery platform; |

| | • | | biomarkers and molecular profiling; |

| | • | | cyclodextrin-based delivery technology; |

| | • | | nucleic acid complementation technology; |

| | • | | pluripotent adult stem cells; |

| | • | | our cancer drug discovery targeting the tumor suppressor p53; |

| | • | | immunotherapeutics and related assay systems; |

| | • | | Abraxis translational molecular bioscience at California NanoSystems Institute; |

| | • | | central nervous system therapies. |

12

SPARC

SPARC (Secreted Protein Acidic Rich in Cysteine) appears to be the intratumoral target of ournab® technology platform due to its secretion by a variety of tumors and the affinity of albumin for SPARC. In addition, it has been discovered that the SPARC protein, when administered systemically in combination with chemotherapy, can greatly sensitize a chemotherapy resistant tumor in xenograft tumor models. Our scientists, in collaboration with university scientists, are exploring the therapeutic potential of SPARC in the treatment of chemo-resistant tumors. We will continue to explore the role of ournab® technology for targeting SPARC and other biological pathways, as well as for the development of new therapeutic candidates.

Biomarkers and Molecular Profiling

In May 2007, we entered into a license agreement with the University of Southern California (USC) under which we licensed the exclusive worldwide development and commercialization rights for an intellectual property portfolio of diagnostic protein biomarkers for therapy response, therapy toxicity and disease recurrence in colorectal cancers. The intellectual property licensed is based on USC research by Associate Professor of Medicine Heinz-Joseph Lenz and colleagues. We believe these licensed biomarkers are consistent with our strategy to identify compounds with specific activity linked to specific biological markers related to particular disease states and may be useful predictors of response to treatments (evaluated through clinical response, toxicity and time to disease progression) and prognostic markers which are important in determining the aggressiveness of cancers as well as other diseases.

Cyclodextrin-Based Delivery Technology

Through our wholly-owned subsidiary Shimoda Biotech (Pty) Limited (Shimoda), we are developing cyclodextrin-based formulations of existing therapeutics to improve their bioavailability characteristics. Shimoda has used cyclodextrin formulations to improve the dissolution rate and bioavailability of orally-deliverable drugs, such as diclofenac sodium, to increase aqueous solubility of poorly water-soluble drugs, to increase the chemical and physical stability of injectable drugs and to mask the unpleasant taste of oral drugs. Cyclodextrin is a water-soluble complex oligosaccharide that structurally forms a unique nanoparticle capable of delivering hydrophobic compounds via multiple routes, including oral ingestion and intravenous injection.

Shimoda’s first cyclodextrin-based product, Dyloject® (diclofenac sodium solution for injection), is an injectable painkiller for the treatment of post-surgical pain. Dyloject® is the world’s first solubilized intravenous formulation of diclofenac. Diclofenac is a non-steroidal anti-inflammatory drug (NSAID). Dyloject® was launched in December 2007 in the United Kingdom by Javelin Pharmaceuticals under an exclusive worldwide license agreement pursuant to which Shimoda will receive milestone payments and royalties.

Nucleic Acid Complementation Technology

We are pursuing the development of an engineered split-toxin platform which leads to the functional reconstitution of a cytotoxin from multiple parts under very specific conditions (for example, in cancer cells arising from known genetic anomalies or in virus-infected cells). This strategy does not require traditional high-throughput drug screening methodologies and has the added capability of being further modified to serve as a diagnostic tool for monitoring patients’ responses to therapy. This research is being pursued through Dithera, Inc. (Dithera). In December 2008, we purchased preferred stock of Dithera representing 50% of Dithera’s outstanding capital stock and were required under GAAP to consolidate Dithera in our 2008 financial statements.

Pluripotent Adult Stem Cells

In September of 2006, we entered into a license with the University of Maryland under which we exclusively licensed the worldwide intellectual property rights to the CD34+ non-adherent adult bone marrow stem cell technology. This technology may present an opportunity to reverse the effects of neurodegenerative

13

diseases such as macular degeneration, Alzheimer’s and Parkinson’s diseases, and multiple sclerosis, as well as to rehabilitate non-CNS diseased organs such as the pancreas for autologous production of insulin in diabetic patients.

Cancer Drug Discovery Targeting the Tumor Suppressor p53

In July 2007, we entered into a license agreement with the Buck Institute for Age Research under which we exclusively licensed the worldwide intellectual property rights for technologies designed to generate novel therapeutics and identify new drug discovery targets. There are no up-front or milestone payments required by us under the license agreement. If products are successfully developed incorporating any of the licensed technologies, we will pay the Buck Institute royalties based on a percentage of net sales. The term of the agreement will continue until the last patent claiming a licensed product under the agreement expires. However, the license agreement may be terminated earlier by either party upon the other party’s failure to timely cure a material breach under the agreement or upon the other party’s bankruptcy or insolvency.

Through this license agreement, we own the rights to a proprietary discovery platform designed to discover new chemical entities that remediate the signaling activities of the tumor suppressor p53 in p53-dysfunctional cancer cells. Loss of p53 activity is associated with one-half of all human tumors, often rendering these cancer cells resistant to conventional therapies. The licensed technologies have made the discovery of reactivators of appropriate p53 signaling behavior possible. Inherent in the design of the technologies is a strategy to develop therapeutics that selectively stimulate programmed cell death in p53-dysfunctional cancer cells and that would leave healthy cells expressing normal p53 unaffected.

The therapies developed in this program will target a specific population of aberrant (tumor) cells and forge a novel class of chemotherapeutics which have the potential to be much more potent than general inhibitors of cell proliferation or inducers of cell death. In the era of personalized medicine, and in combination with our emerging diagnostic methodologies, we believe this program will generate a novel pipeline of drugs that promise cancer patients greater proficiency with fewer side effects.

Immunotherapeutics and Related Assay Systems

The technologies licensed from the Buck Institute also included a novel immunotherapeutic/anti-cancer compound (T9) and highly sensitive cell-based assay systems for the discovery of additional immune-modulating drugs. Immune-modulating drugs represent an emerging class of therapies with broad clinical application in the treatment of cancer, allergies, inflammation, autoimmunity and tissue transplantation. T9 is a highly potent bi-functional molecule with the ability to kill cancer cells and to activate the immune response to recognize cancer cells in a manner analogous to childhood vaccination.

T9 was originally discovered using robust ultra-sensitive cell-based assay systems which respond to minute amounts of potential immune-modulating drugs. Over time, these systems were further modified to allow for their use in high throughput screens for the identification of compounds that can control the magnitude and quality of the immune response. The immune-modulating high throughput screening systems (IMHTSS) technologies are important tools for the discovery of novel agents which modulate the immune response through controlling the type and degree of inflammation. “Hits” resulting from the screening of synthetic and natural product libraries using the IMHTSS technologies are anticipated to be further developed to act as immune adjuvants in improving existing vaccination platforms or to inhibit the immune response in the context of allergies (such as asthma) or autoimmune diseases (such as type I diabetes, multiple sclerosis and lupus erythematosus).

Translational Molecular Bioscience at CNSI

The California NanoSystems Institute (CNSI) is a multidisciplinary research center at UCLA whose mission is to encourage university-industry collaboration and to enable the rapid commercialization of discoveries in

14

nanosystems. CNSI members include some of the world’s preeminent scientists, and the work conducted at the institute represents world-class expertise in five targeted areas of nanosystems-related research: renewable energy, environmental nanotechnology and nanotoxicology, nanobiotechnology and biomaterials, nanomechanical and nanofluidic systems, and nanoelectronics, photonics and architectonics.

In July 2007, we entered into a research collaboration agreement with CNSI under which the parties agreed to collaborate on early research in nanobiotechnology for the advancement of new technologies in medicine. Under the agreement, we committed to fund up to $10 million over ten years in two tranches of $5 million for research projects selected by a committee comprised equally of our and CNSI representatives. Any intellectual property resulting from the projects will be owned by CNSI. However, we have first right to negotiate an option or license to all of such intellectual property on commercially reasonable terms, including royalties. In addition, if the parties are unable to successfully negotiate a license, CNSI may not license the intellectual property to another party at a lower rate than offered to us for a specified period of time. The term of the agreement is ten years, but either party can terminate on 30 days notice and the funding commitment for the second $5 million is subject to mutual agreement within 30 days of the end of the fifth year of the agreement.

This partnership provides CNSI and our researchers the opportunity to jointly pursue innovative approaches to the diagnosis and treatment of life-threatening diseases, leveraging the complementary resources and skills of both organizations. Working side by side with CNSI researchers, our scientists will focus on rapidly and seamlessly translating early scientific discovery into practical application. The Abraxis/CNSI Research Collaboration Lab has been designed to integrate and support multidisciplinary science, including cellular and molecular biology (including high-throughput discovery), nanodetection methodologies and tools for diagnostic discoveries, medicinal and synthetic chemistry, computational structural biology (including rational approaches to drug discovery) and bioengineering of nanodevices and nanomaterials.

Biosimilars

In June 2007, we entered into a license agreement with Biocon Limited under which we licensed the right to develop and commercialize a biosimilar version of G-CSF (granulocyte-colony stimulating factor) in North America and the European Union. G-CSF is an haematopoietic growth factor that works by encouraging the bone marrow to produce more white blood cells. Therapeutic G-CSF is primarily used for the treatment of neutropenia, the lowering of the white blood cells that fight infections. Biocon has received regulatory approval of its G-CSF from the Drugs Controller General of India (DCGI) for the treatment of neutropenia in cancer patients. The biological activity of Biocon’s G-CSF used in clinical trials was evaluated by the National Institute of Biological Standards and Control (NIBSC), UK, which provides independent testing of biological medicines. The NIBSC found that the potency of Biocon’s drug met the necessary requirements of a biosimilar G-CSF.

In November 2007, we entered into a license agreement with Green Cross Corporation under which we licensed the right to develop and commercialize five biosimilars for the United States and Canada on an exclusive basis: Enbrel® (etanercept), pegylated G-CSF, recombinant Factor VIII, Interferon-Alpha and Erythropoietin. Etanercept is a chimeric protein designed to neutralize tumor necrosis factor (TNF), an important regulator of local inflammatory response. Pegylated G-CSF, like G-CSF, is primarily used for the treatment of neutropenia, but its half-life is greatly increased compared to G-CSF because of the polyethylene glycol treatment (a process also commonly referred to as “pegylating”), thereby reducing the frequency and dose of the injections required to sustain a patient’s neutrophil levels. Recombinant Factor VIII is a clotting factor that is essential for reestablishing hemostasis in hemophiliac patients. Interferon-Alpha is a powerful, multifunctional protein produced by innate cells of the immune system to combat viral infections. Erythropoietin is a protein produced mainly by cells of the kidneys to maintain red blood cell levels by inhibiting their ability to commit cellular “suicide” and stimulate their production from precursors and is approved for patients experiencing anemia due to a variety of mechanisms including chronic renal failure and certain anti-cancer chemotherapies.

15

Central Nervous System Therapies

In April 2007, we formed a joint venture with Cenomed, Inc. (Cenomed) to create Cenomed BioSciences, LLC. This venture is designed to further the research and development of novel drugs that interact with the central nervous system focused on psychiatric and neurological diseases. Substantially all of the assets of Cenomed were contributed to this joint venture. The previous focus of the research by Cenomed included the development of drugs for the treatment of schizophrenia, neuroprotection, mild cognitive impairment and memory and attention impairments associated with aging, attention deficit hyperactivity disorder and pain. We hold a 70% membership interest in this joint venture, which is consolidated in our financial results of operations.

Sales and Marketing

We have a dedicated sales and marketing group in North America which targets key segments of the oncology market: specifically, leading oncologists, cancer centers and the oncology distribution channel. This group is comprised of approximately 136 sales, marketing and medical professionals and support staff members. With respect to sales and marketing of Abraxane® in countries outside of North America, we are continuing to establish our infrastructure and are evaluating developing our own sales and marketing expertise as well as exploring possible strategic relationships for other jurisdictions. Sales force and commercial services in our European market will be provided by Innovex, a unit of Quintiles Transnational Corp., which is the leading global commercial solutions provider to the pharmaceutical, biotech, and medical device industries.

Strategic Relationships

Taiho Pharmaceutical Co., Ltd.

In May 2005, we entered into a license agreement with Taiho Pharmaceutical Co., Ltd. under which we granted to Taiho the exclusive rights to market and sell Abraxane® in Japan. In March 2008, Taiho filed a Japanese New Drug Application (J-NDA) with the Ministry of Health, Labour and Welfare to market Abraxane® for the treatment of breast cancer in Japan. We established a joint steering committee with Taiho to oversee the development of Abraxane® in Japan for the treatment of breast, lung and gastric cancer and other solid tumors. Under this license agreement, Taiho paid us a non-refundable, upfront payment and will make additional payments to us upon achievement of various clinical, regulatory and sales milestones, with total potential payments in excess of $50 million. In addition, we will receive royalties from Taiho based on net sales under the license agreement. The agreement will remain in effect until terminated by one of the parties in accordance with its terms. The agreement may be terminated: (a) at any time by mutual agreement of the parties; (b) by either party if the other party fails to timely cure a material breach under the agreement or the other party is bankrupt or insolvent; (c) by Taiho upon nine months notice if Taiho determines, for safety, legal or other reasons, not to continue pursuing the development and commercialization of Abraxane® in Japan; (d) by Taiho if we fail to timely remedy certain manufacturing deficiencies; and (e) at any time by us if Taiho sells (i) Abraxane® while concurrently selling Abraxane® in a generic form or (ii) an injectable formulation of a taxane compound, including paclitaxel and docetaxel.

Biocon Limited

In June 2007, we entered into a license agreement with Biocon Limited under which we granted Biocon the right to market and sell Abraxane® in India, Pakistan, Bangladesh, Sri Lanka, United Arab Emirates, Saudi Arabia, Kuwait and certain other South Asian and Persian Gulf countries. Biocon’s rights are exclusive with respect to India, Pakistan, Bangladesh, Nepal, Bhutan, Sri Lanka and the Maldive Islands and are co-exclusive with us and our licensees with respect to all other countries. If Biocon fails to achieve a specified target market share by a specified time in any exclusive country, then we have the right to make Biocon’s license in that country non-exclusive unless Biocon makes a payment to us equal approximately to the royalty that would have been payable had Biocon achieved the target market share. If Biocon fails to achieve a minimum market share by

16

a specified time in any exclusive country for two consecutive calendar years, then we also have the right to terminate Biocon’s rights with respect to such country. The agreement will remain in effect until terminated by one of the parties in accordance its terms. We may terminate the agreement if Biocon (a) fails to timely cure a material breach; (b) becomes bankrupt; or (c) sells Abraxane® while concurrently selling a generic form of Abraxane®. Biocon may terminate the agreement if we fail to timely cure a material breach. We will receive payments from Biocon based on the higher of a percentage net sales or a specified profit split under the license agreement. In October 2007, we received regulatory approval from India’s Drug Controller General to market Abraxane® for the treatment of metastatic breast cancer in India. In July 2008, we launched Abraxane in India for the treatment of metastatic breast cancer.

ProMetic Life Sciences Inc

In September 2008, we entered into agreements with ProMetic Life Sciences Inc. (ProMetic) to develop and commercialize four biopharmaceutical products targeting underserved medical conditions. We entered into the following agreements: (i) a securities purchase agreement, (ii) a license agreement, (iii) a supply and license agreement (iv) an exclusive manufacturing agreement and (v) a services agreement. The transaction included an initial investment in ProMetic of $7 million and optional future investment rights of up to $25 million. Of the $7 million initial investment, $5.2 million was allocated to the purchase of ProMetic’s common stock and $1.8 million was allocated to the future investment rights option. We will have access to ProMetic’s proprietary protein technologies to commercialize the biopharmaceuticals and will fund all development costs to regulatory approval. In consideration, we will pay potential milestone and royalty payments to ProMetic and royalties on the net sales of the four products. Additionally, ProMetic will perform product development activities on behalf of Abraxis under the service agreement.

Competition

Competition among biotechnology, pharmaceutical and other companies that research, develop, manufacture or market proprietary pharmaceuticals is intense and is expected to increase. We compete with these entities in all areas of business, including competing to attract and retain qualified scientific and technical personnel.

Our products’ and product candidates’ competitive position among other pharmaceutical products may be based on, among other things, patent position, product efficacy, safety, reliability, availability, patient convenience/delivery devices and price, as well as, the development and marketing of new competitive products. Certain of our products and product candidates may face substantial competition from products marketed by large pharmaceutical companies, many of which have greater clinical, research, regulatory, manufacturing, marketing, financial and human resources, and experience than we do. In addition, the introduction of new products or the development of new processes by competitors or new information about existing products may result in product replacements or price reductions, even for products protected by patents.

Some of our competitors are actively engaged in research and development in areas where we are developing product candidates. The competitive marketplace for our product candidates is significantly dependent upon the timing of entry into the market. Early entry may have important advantages in gaining product acceptance and market share and, as a result, may contribute significantly to the product’s eventual success and profitability. Accordingly, in some cases, the relative speed with which we can develop products, complete the testing, receive approval, and supply commercial quantities of the product to the market is expected to be important to our competitive position.

In addition, we compete with large pharmaceutical and biotechnology companies when entering into cooperative arrangements with smaller companies and research organizations in the biotechnology industry for the development and commercialization of products and product candidates. Small companies, academic institutions, governmental agencies and other public and private research organizations conduct a significant

17

amount of research and development in the biotechnology industry. These entities may seek to enter into licensing arrangements to collect royalties for use of technology or for the sale of products they have discovered or developed. We may face competition in licensing or acquisition activities from pharmaceutical companies and large biotechnology companies that also seek to acquire technologies or product candidates from these entities.

We believe that Abraxane® competes, directly or indirectly, with the primary taxanes in the market place, including Bristol-Myers Squibb’s Taxol® and its generic equivalents, Sanofi-Aventis’ Taxotere® and other cancer therapies. Many pharmaceutical companies have developed and are marketing, or are developing, alternative formulations of paclitaxel and other cancer therapies that may compete directly or indirectly with Abraxane®.

Regulatory Considerations

Proprietary pharmaceutical products are subject to extensive pre- and post-market regulation by the FDA, including regulations that govern the testing, manufacturing, safety, efficacy, labeling, storage, record keeping, advertising and promotion of the products under the Federal Food Drug and Cosmetic Act and the Public Health Services Act, and by comparable agencies in foreign countries. FDA approval is required before any dosage form of any drug can be marketed in the United States. All applications for FDA approval of drugs must contain information relating to pharmaceutical formulation, stability, manufacturing, processing, packaging, labeling and quality control.

The process required by the FDA before a new drug may be marketed in the United States generally involves:

| | • | | completion of pre-clinical laboratory and animal testing; |

| | • | | submission of an investigational new drug application, or IND, which must become effective before trials may begin; |

| | • | | performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug product’s intended use; and |

| | • | | submission to and approval by the FDA of a new drug application, or NDA. |

Clinical trials are typically conducted in three sequential phases that may overlap. These phases generally include:

| | • | | Phase I during which the drug is introduced into healthy human subjects or, on occasion, patients, and generally is tested for safety, stability, dose tolerance and metabolism; |

| | • | | Phase II during which the drug is introduced into a limited patient population to determine the efficacy of the product in specific targeted diseases, to determine dosage tolerance and optimal dosage and to identify possible adverse effects and safety risks; and |

| | • | | Phase III during which the clinical trial is expanded to a more diverse patient group in geographically dispersed trial sites to further evaluate clinical efficacy, optimal dosage and safety. |

The drug sponsor, the FDA or the Institutional Review Board at each institution at which a clinical trial is being performed may suspend a clinical trial at any time for various reasons, including a belief that the subjects are being exposed to an unacceptable health risk.

The results of product development, preclinical animal studies and human studies are submitted to the FDA as part of the NDA. The NDA also must contain extensive manufacturing information. The FDA may approve on the basis of the submission made or disapprove the NDA if applicable FDA regulatory criteria are not satisfied. The FDA may also require additional clinical data. Under certain circumstances, drug sponsors may obtain approval pursuant to Section 505(b)(2) of the Federal Food, Drug & Cosmetic Act based in part upon literature or

18

an FDA finding and/or effectiveness for another approved product, even where the products are not duplicates in terms of formulation and bioequivalence. Once approved, the FDA may withdraw the product approval if compliance with pre- and post-market regulatory standards is not maintained or if problems occur after the product reaches the marketplace. In addition, the FDA may require post-marketing studies to monitor the effect of approved products and may limit further marketing of the product based on the results of these post-marketing studies. The FDA has broad post-market regulatory and enforcement powers, including the ability to levy fines and civil penalties, suspend or delay issuance of approvals, seize or recall products, and withdraw approvals.

Satisfaction of FDA pre-market approval requirements typically takes several years and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease. Government regulation may delay or prevent marketing of potential products for a considerable period of time and impose costly procedures upon a manufacturer’s activities. Success in early stage clinical trials does not assure success in later stage clinical trials. Data obtained from clinical activities is not always conclusive and may be susceptible to varying interpretations that could delay, limit or prevent regulatory approval. Even if a product receives regulatory approval, later discovery of previously unknown problems with a product may result in restrictions on the product or even complete withdrawal of the product from the market.

In addition to regulating and auditing human clinical trials, the FDA regulates and inspects equipment, facilities, laboratories and processes used in the manufacturing and testing of such products prior to providing approval to market a product. If after receiving clearance from the FDA, a material change is made in manufacturing equipment, location or process, additional regulatory review may be required. We and our suppliers also must adhere to current good manufacturing practice and product-specific regulations enforced by the FDA through its facilities inspection program. The FDA also conducts regular, periodic visits to re-inspect equipment, facilities, laboratories and processes following the initial approval. If, as a result of these inspections, the FDA determines that the equipment, facilities, laboratories or processes do not comply with applicable FDA regulations and conditions of product approval, the FDA may seek civil, criminal or administrative sanctions and/or remedies against our manufacturers, including the suspension of manufacturing operations.

While the above process describes the regulatory process in the United States, similar processes for drug development and approval to market generally apply internationally.

We are also subject to various federal and state laws pertaining to health care “fraud and abuse,” including anti-kickback laws and false claims laws. Anti-kickback laws make it illegal to solicit, offer, receive or pay any remuneration in exchange for, or to induce, the referral of business, including the purchase or prescription of a particular drug. The federal government has published regulations that identify “safe harbors” or exemptions for certain arrangements that do not violate the anti-kickback statutes. Due to the breadth of the statutory provisions and the absence of guidance in the form of regulations or court decisions addressing some practices, it is possible that our practices might be challenged under anti-kickback or similar laws. False claims laws prohibit anyone from knowingly and willingly presenting, or causing to be presented for payment to third-party payers (including Medicare and Medicaid), claims for reimbursed drugs or services that are false or fraudulent, claims for items or services not provided as claimed or claims for medically unnecessary items or services. The activities of our strategic partners relating to the sale and marketing of our products may be subject to scrutiny under these laws. Violations of fraud and abuse laws may be punishable by criminal and/or civil sanctions, including fines and civil monetary penalties, as well as the possibility of exclusion from federal health care programs (including Medicare and Medicaid). If the government were to allege against or convict us of violating these laws, there could be a material adverse effect on us. Our activities could be subject to challenge for the reasons discussed above and due to the broad scope of these laws and the increasing attention being given to them by law enforcement authorities.

We are also subject to regulation under the Occupational Safety and Health Act, the Toxic Substances Control Act, the Resource Conservation and Recovery Act, and other current and potential future federal, state, or local laws, rules and/or regulations. Our research and development activities involve the controlled use of

19

chemicals, biological materials and other hazardous materials. We believe that our procedures comply with the standards prescribed by federal, state and local laws, rules and/or regulations; however, the risk of injury or accidental contamination cannot be completely eliminated.

Manufacturing

We have manufacturing facilities in Melrose Park, Illinois, Phoenix, Arizona and Barbengo, Switzerland. For the length of the applicable lease, our manufacturing facility in Melrose Park has been leased to APP and APP has agreed to provide certain contract manufacturing services to us in accordance with the terms of the manufacturing agreement. In addition, we leased from APP a portion of APP’s Grand Island, New York manufacturing facility to enable us to perform our responsibilities under the manufacturing agreement with APP for its term. The initial term of the manufacturing agreement will expire on December 31, 2011, but the term of the manufacturing agreement will be automatically extended for one year if either APP exercises its option to extend the lease for our Melrose Park manufacturing facility for an additional year or we exercise our option to extend the lease for APP’s Grand Island manufacturing facility for an additional year.

In addition, as part of the separation agreement, APP’s Puerto Rico facility was divided into two separate facilities and we took ownership of one part of the facility. The portion of the Puerto Rico facility that is owned by us following the separation is the 90,000 square foot active pharmaceutical ingredients manufacturing plant currently leased to Pfizer for a term expiring in February 2012. Pfizer has notified us that it intends to vacate the premises in May 2009. Pfizer will not incur any penalty for the early termination of the lease.

We are required to comply with the applicable FDA manufacturing requirements contained in the FDA’s current Good Manufacturing Practice, or cGMP, regulations. cGMP regulations require quality control and quality assurance as well as the corresponding maintenance of records and documentation. Our manufacturing facilities must meet cGMP requirements to permit us to manufacture our products. We are subject to the periodic inspection of our facilities, procedures and operations and/or the testing of our products by the FDA, the Drug Enforcement Administration and other authorities to assess our compliance with applicable regulations.

Failure to comply with the statutory and regulatory requirements subjects the manufacturer to possible legal or regulatory action, including the seizure or recall of products, injunctions, consent decrees placing significant restrictions on or suspending manufacturing operations, and civil and criminal penalties. Adverse experiences with a product must be reported to the FDA and could result in the imposition of market restriction through labeling changes or in product removal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following approval.

Raw Materials

The manufacture of our products requires raw materials and other components that must meet stringent FDA requirements. Some of these raw materials and other components currently are available only from a limited number of sources. Additionally, regulatory approvals for a particular product denote the raw materials and components, and the suppliers for such materials that may be used for that product. Even when more than one supplier exists, we may elect to list, and in some cases have only listed, one supplier in our applications with the FDA. Any change in or addition of a supplier not previously approved must then be submitted through a formal approval process with the FDA. From time to time, it is necessary to maintain increased levels of certain raw materials due to the anticipation of raw material shortages or in response to market opportunities.

Intellectual Property

We rely on trade secrets, unpatented proprietary know-how, continuing technological innovation and patent protection to preserve our competitive position. We have over 100 issued U.S. and foreign patents, including patents relating to Abraxane® and the technology surrounding Abraxane®. The issued patents covering

20

Abraxane®, and methods of use and preparation of Abraxane®, currently expire through 2018, but we have additional pending U.S. and foreign patent applications covering Abraxane® that could extend the expiration dates.

Our success depends on our ability to operate without infringing the patents and proprietary rights of third parties. We cannot determine with certainty whether patents or patent applications of other parties will materially affect our ability to make, use, offer to sell or sell any products. A number of pharmaceutical companies, biotechnology companies, universities and research institutions may have filed patent applications or may have been granted patents that cover aspects of our or our licensors’ products, product candidates or other technologies.

Intellectual property protection is highly uncertain and involves complex legal and factual questions. Our patents and those for which we have or will have licensed rights may be challenged, invalidated, infringed or circumvented, and the rights granted in those patents may not provide proprietary protection or competitive advantages to us. We and our licensors may not be able to develop patentable products. Even if patent claims are allowed, the claims may not issue, or in the event of issuance, may not be sufficient to protect the technology owned by or licensed to us.

Third-party patent applications and patents could reduce the coverage of the patents licensed, or that may be licensed to or owned by us. If patents containing competitive or conflicting claims are issued to third parties, we may be enjoined from commercialization of products or be required to obtain licenses to these patents or to develop or obtain alternative technology. In addition, other parties may duplicate, design around or independently develop similar or alternative technologies to our licensors or our technologies.

Litigation may be necessary to enforce patents issued or licensed to us or to determine the scope or validity of another party’s proprietary rights. U.S. Patent and Trademark Office interference proceedings may be necessary if we and another party both claim to have invented the same subject matter. Similarly, our patents and patent applications, or those of our licensors, could face other challenges, such as opposition proceedings and reexamination proceedings. Any such challenge, if successful, could result in the invalidation of, or a narrowing of scope of, any such patents and patent applications. We could incur substantial costs and our management’s attention would be diverted if:

| | • | | patent litigation is brought by third parties; |

| | • | | we are a party to or participate in patent suits brought against or initiated by us or our licensors; |

| | • | | we are a party to or participate in an interference proceeding; or |

| | • | | we are a party to an opposition or reexamination proceeding. |

In addition, we may not prevail in any of these actions or proceedings.

We are currently involved in a patent infringement lawsuit with Élan Pharmaceutical Int’l Ltd. See “Item 3—Legal Proceedings” below.

Employees