Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| DANVERS BANCORP, INC. |

(Name of Registrant as Specified In Its Charter) |

Not Applicable |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

April 19, 2010

Dear Stockholder:

I am pleased to invite you to the Danvers Bancorp, Inc. 2010 Annual Meeting of Stockholders. The meeting will be held at 10:00 a.m., Eastern Time, on May 21, 2010, at the Peabody Marriott Hotel, 8A Centennial Drive, Peabody, Massachusetts 01960.

Enclosed are a notice of matters to be voted on at the meeting, our proxy statement, a proxy card and our 2009 Annual Report. In addition to the formal items of business, we will report on the operations of Danvers Bancorp, Inc. and Danversbank. Directors and officers of the Company will be present to respond to any questions that you may have.

Whether or not you plan to attend and regardless of the number of shares you own, it is important that your shares be represented. Please mark, sign and date the proxy card and return it in the enclosed postage-paid envelope. You may revoke your proxy at any time before it is exercised as explained in the proxy statement.

If you plan to attend the Annual Meeting, please bring the admission ticket attached to your proxy card and photo identification. Also, if your shares are held in the name of a broker or other nominee, please bring with you a proxy or letter from the broker or nominee confirming your ownership as of the record date.

On behalf of the Board of Directors and the employees of Danvers Bancorp, Inc. and Danversbank, we thank you for your continued support and look forward to seeing you at the Annual Meeting.

| | |

| | | Sincerely, |

|

|

|

| | | Kevin T. Bottomley

Chairman of the Board, President and

Chief Executive Officer |

Table of Contents

One Conant Street

Danvers, Massachusetts 01923

(978) 777-2200

NOTICE OF 2010 ANNUAL MEETING OF STOCKHOLDERS

May 21, 2010

10:00 a.m. Eastern Standard Time

To Holders of Common Stock of Danvers Bancorp, Inc.:

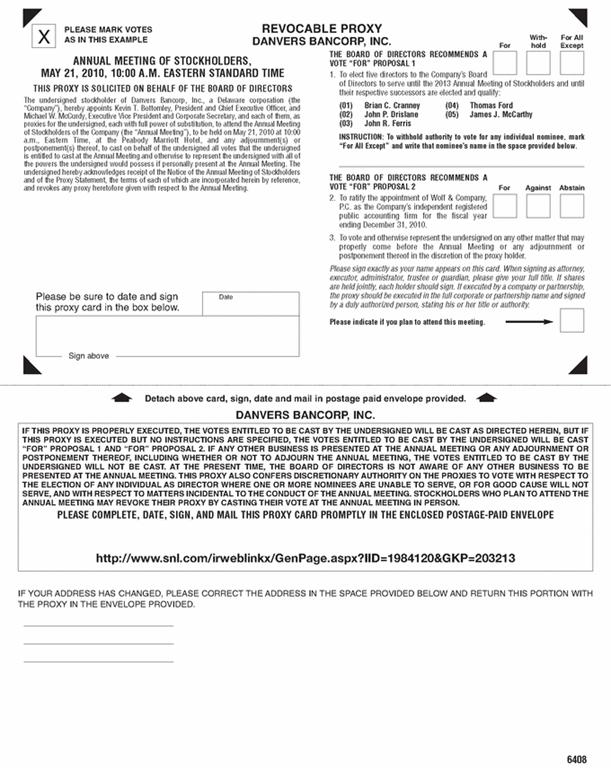

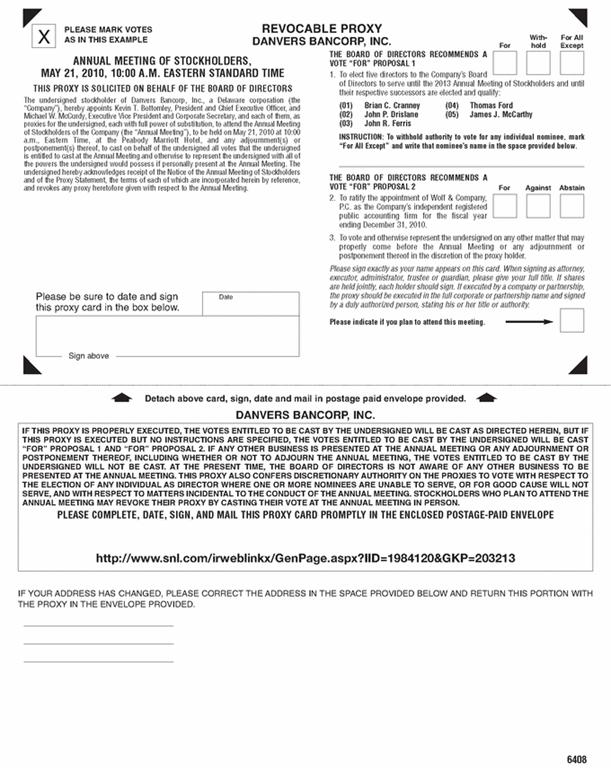

Notice is hereby given that the 2010 Annual Meeting of Stockholders of Danvers Bancorp, Inc. (the "Company"), will be held on Friday, May 21, 2010 at 10:00 a.m., Eastern Time, at the Peabody Marriott Hotel, 8A Centennial Drive, Peabody, Massachusetts 01960, for the following, as more fully described in the accompanying proxy statement (the "Proxy Statement"):

- 1.

- To elect five directors to the Company's Board of Directors (the "Board"). The Board has nominated the following five nominees, all of whom are current directors of the Company: Brian C. Cranney; John P. Drislane; John R. Ferris; Thomas Ford; and James J. McCarthy;

- 2.

- To ratify the appointment of Wolf & Company, P.C. as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2010; and

- 3.

- To transact such further business as may properly come before the Annual Meeting, or any adjournment or postponement thereof. Please note that at this time we are not aware of any such business.

Only stockholders of record as of the close of business on March 26, 2010 are entitled to receive notice of, to attend and to vote at the Annual Meeting. In accordance with Delaware law, for 10 days prior to the Annual Meeting, a list of those registered stockholders entitled to vote at the Annual Meeting will be available for inspection in the office of the Corporate Secretary, Danvers Bancorp, Inc., One Conant Street, Danvers, Massachusetts. The list will also be available at the Annual Meeting.

Your vote is important. Please submit your proxy as soon as possible. Even if you plan to attend the Annual Meeting in person, please complete, sign, and date the enclosed proxy card and return it in the enclosed postage-paid envelope. You may revoke your proxy at any time before it is exercised as explained in the proxy statement.

| | |

| | | Sincerely, |

|

|

Michael W. McCurdy

Executive Vice President

General Counsel and Secretary |

Danvers, Massachusetts

April 19, 2010

Table of Contents

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to be Held on May 21, 2010:

The Proxy Statement and Annual Report to Stockholders are available at

https://www.snl.com/irweblinkx/GenPage.aspx?IID=1984120&GKP=203213

Table of Contents

TABLE OF CONTENTS

| | |

| | Page |

|---|

General Information | | 1 |

Proposal 1: Election of Directors | |

3 |

Role of the Board; Corporate Governance Matters | |

8 |

Security Ownership of Certain Beneficial Owners, Directors and Management | |

13 |

Director Compensation | |

16 |

Executive Officers | |

19 |

Executive Compensation | |

21 |

Compensation Discussion and Analysis | |

21 |

Compensation Committee Report | |

29 |

Audit Committee Report | |

37 |

Proposal 2: Ratification of the Appointment of Independent Registered Public Accounting Firm | |

38 |

Stockholder Proposals for 2011 Annual Meeting | |

39 |

Other Matters | |

39 |

Miscellaneous | |

39 |

Table of Contents

One Conant Street

Danvers, Massachusetts 01923

(978) 777-2200

PROXY STATEMENT

FOR

2010 ANNUAL MEETING OF STOCKHOLDERS

General Information

Why am I receiving this Proxy Statement?

The Company has made this Proxy Statement and the Company's Annual Report and Form 10-K for the fiscal year ended December 31, 2009 available to you in connection with the Company's solicitation of proxies for use at the Annual Meeting, to be held on Friday, May 21, 2010 at 10:00 a.m., Eastern Time, and at any postponement(s) or adjournment(s) thereof. These materials were first sent or given to the stockholders on or about April 19, 2010. You are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement. The Annual Meeting will be held at the Peabody Marriott Hotel, 8A Centennial Drive, Peabody, Massachusetts 01960.

What items will be voted on at the Annual Meeting?

You are being asked to vote on the following items at the Annual Meeting:

- 1.

- The election to the Board of Directors of the five nominees named in this Proxy Statement;

- 2.

- The ratification of the appointment of Wolf & Company, P.C. as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2010; and

- 3.

- The transaction of such further business as may properly come before the Annual Meeting. Please note that at this time we are not aware of any such business.

What are the Board's voting recommendations?

The Board recommends that you vote your shares "FOR" each of the nominees to the Board and "FOR" the ratification of the appointment of Wolf & Company, P.C. as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2010.

Where are the Company's principal executive offices located and what is the Company's main telephone number?

The Company's principal executive offices are located at One Conant Street, Danvers, Massachusetts 01923 and the Company's main telephone number is (978) 777-2200.

How can I view the Company's proxy materials for the Annual Meeting on the Internet?

The Company's proxy materials are available on the Company's website at:https://www.snl.com/irweblinkx/GenPage.aspx?IID=1984120&GKP=203213

1

Table of Contents

Who may vote at the Annual Meeting?

Each share of the Company's common stock has one vote on each matter. As of March 26, 2010, there were 21,680,907 shares of the Company's common stock issued and outstanding. Only stockholders of record as of the close of business on March 26, 2010 (the "Record Date") are entitled to receive notice of and to vote at the Annual Meeting.

What is the quorum requirement for the Annual Meeting?

The holders of a majority of all of the shares of the stock entitled to vote at the Annual Meeting, present in person or by proxy, constitute a quorum for the purpose of considering each proposal. Abstentions and broker non-votes will be treated as present at the Annual Meeting for purposes of determining the presence or absence of a quorum for the transaction of all business. A broker non-vote occurs when a broker indicates on the proxy card that it does not have discretionary authority as to certain shares to vote on a particular matter. In the event that a quorum is not present at the Annual Meeting, it is expected that the meeting will be adjourned or postponed to solicit additional proxies.

What is the voting requirement to approve each of the Proposals?

For Proposal 1, the nominees must receive a plurality of the votes cast at the Annual Meeting to be elected as directors and to serve until the expiration of their term and until their successors are duly elected and qualified. You may not vote your shares cumulatively for the election of directors.

For Proposal 2, the affirmative vote of the holders of a majority of the shares present in person or by proxy at the annual meeting and entitled to vote on Proposal 2 is required to pass the proposal. This vote is non-binding and in the event that it is not approved by a majority of shares voted at the Annual Meeting, the Audit Committee would reconsider its selection of Wolf & Company, P.C. as the Company's independent registered public accounting firm, but is not obligated to change its selection.

How are abstentions treated?

Abstentions and broker non-votes are counted for purposes of determining whether a quorum is present. If you do not vote for a nominee set forth in Proposal 1, or you indicate "withhold authority" for any nominee on your proxy card, your vote will not count "for" or "against" the nominee and will have no effect on the outcome. If you "abstain" from voting for Proposal 2, it will have the same effect as if your vote was not cast with respect to this proposal, and this will have no effect on the outcome. A broker non-vote will have no effect on the outcome of Proposal 1 or Proposal 2.

How are proxies voted?

All valid proxies received prior to the Annual Meeting will be voted. All shares represented by a proxy will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted by the proxyholders in accordance with the stockholder's instructions.

What happens if I do not give specific voting instructions?

If you are a stockholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, or sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

2

Table of Contents

Can I revoke my proxy card and change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date via the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), by signing and returning a new proxy card or vote instruction form with a later date, or by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request that your prior proxy be revoked by delivering a written notice of revocation to the Company's Corporate Secretary at One Conant Street, Danvers, Massachusetts 01923 prior to the Annual Meeting.

Is my vote confidential?

Proxy instructions, ballots, voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties except as necessary to meet applicable legal requirements, to allow for the tabulation and certification of votes, and to facilitate a successful proxy solicitation.

Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to management and the Board.

Where can I find the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. The final voting results will be tallied by a representative from Registrar and Transfer Company, who will serve as inspector of election, and published and filed with the Securities Exchange Commission (the "SEC") on a Form 8-K within four business days following the completion of the Annual Meeting.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company's Board currently consists of 19 directors, each of whom is elected to a term of three years. All of the Company's directors are independent under the current listing standards of the NASDAQ Stock Market LLC, except for Messrs. Bottomley, McCarthy and O'Neil, who currently serve as officers of the Company. Five directors will be elected at the Annual Meeting to serve for a three-year term until the 2013 Annual Meeting of Stockholders and until their respective successors have been duly elected. Proxies cannot be voted for a greater number of persons than the number of nominees named in the proxy.

The Board has nominated Brian C. Cranney, John P. Drislane, John R. Ferris, Thomas Ford, and James J. McCarthy for election as directors, each of whom has agreed to serve if so elected. Please refer to the sections entitled "Nominees for Director" and "Stock Ownership of Directors and Management" for additional information regarding the nominees.

The following includes a discussion of the business experience for the past five years for each of our nominees and continuing directors. The indicated period for service as a director includes service as a director of Danversbank.

The biographical description below for each nominee includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Corporate Governance Committee and the Board of Directors that such person should serve as a director of the Company. The biographical description below for each director who is not standing for election includes the specific experience, qualifications, attributes and skills that the Corporate Governance Committee and the Board of Directors would expect to consider if it were making a conclusion currently as to whether such person should serve as a director. The Corporate Governance Committee and the Board of

3

Table of Contents

Directors did not currently evaluate whether these directors should serve as directors, as the terms for which they have been previously elected continue beyond the Annual Meeting.

In addition to the information presented below regarding each person's specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director, we also believe all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the Company and its shareholders.

Nominees for Director

Term to Expire in 2013

Brian C. Cranney. Mr. Cranney is President of the Cranney Companies in Danvers, Massachusetts, a diversified line of companies providing electrical, communications, HVAC and fabrication services for retail and commercial customers, which he founded in 1985. As president of the Cranney Companies, Mr. Cranney oversees the budget of a $16 million dollar company, determines costs for jobs and works on contract negotiations. He is an active member of the community, serving on several local, private company and non-profit Boards. As a member of the Board of Directors, he serves on the Company's Governance and Executive Committees. We believe Mr. Cranney's many years of hands-on business experience combined with his proven leadership skills make him an excellent candidate for the Board.

John P. Drislane. Mr. Drislane has been an independent commercial real estate developer since 2000 and is the former owner of Essex Bituminous Corp. Essex Bituminous Corp. was a manufacturer and supplier of construction materials to the heavy and highway construction industries. As head of the company, Mr. Drislane was involved the day-to-day running of the company including public relations, contract negotiations and labor relations, banking relations, and financial management. Mr. Drislane earned his B.A. in Finance from Babson College in 1970. He serves as the Chair of the Company's Audit Committee. With his many years of management experience and service to the community, we believe Mr. Drislane is well qualified to serve on the Board.

John R. Ferris. Mr. Ferris has served as the President and principal of Copley Capital, LLC, a management consulting firm in Newburyport, Massachusetts since 2004. From 1995 to 2004, he served as President and COO of Mobility Services International. Prior to his tenure at Mobility Services, he was CEO of BioQuest and a Vice President of Freudenberg USA. He earned his B.A. in Economics from Boston College in 1979. He serves as Chair of the Company's Compensation Committee and as a member of the Governance Committee. Mr. Ferris brings his skills in the areas of strategic planning and marketing to the Board.

Thomas Ford. Mr. Ford has served as President of T Ford Company, Inc., a civil and environmental contracting company since 1987. In addition, he is principal in a number of real estate developments that include residential and commercial land development, new home construction and commercial rental property. Mr. Ford earned his B.S. in Civil Engineering at Northeastern University in 1978 and his M.S. in Civil Engineering at the Georgia Institute of Technology in 1982. He also earned his M.S. in Real Estate Development at the Massachusetts Institute of Technology in 1985. In addition to serving on the Board at Danversbank, Mr. Ford is also on the Board of Hospice of the North Shore. He is active in the community, contributing to charitable and civic events. He serves on the Company's Audit Committee. Mr. Ford brings business, management, and customer-based experience to the Board. With his many years as head of T Ford Company, he also brings extensive leadership experience.

4

Table of Contents

James J. McCarthy, Executive Vice President/Chief Operating Officer. Mr. McCarthy was the President and Chief Executive Officer of Revere Federal Savings Bank and joined Danversbank as Executive Vice President when the merger of the two institutions took place in September 2001. Mr. McCarthy worked at Revere Federal Savings Bank for 16 years prior to the merger and became the Chief Operating Officer of Danversbank in 2003. Prior to Revere Federal, Mr. McCarthy worked at Ernst & Young LLP for five years. Mr. McCarthy received a B.S. in Accounting from Northeastern University and became a CPA in 1983. Mr. McCarthy currently oversees the Finance, Retail Banking, Risk Management, Compliance, Facilities, Information Technology and Investment Departments of Danversbank. Mr. McCarthy brings business management, finance and accounting, along with industry knowledge, leadership, and strategic planning experience to the Board.

Continuing Directors

Term to Expire in 2011

Neal H. Goldman. Mr. Goldman has served as Vice President for Industry Relations at Iron Mountain Group in Boston, Massachusetts since 1999. He earned his B.S. in Business from Boston University in 1973 and his M.B.A. from Babson College in 1979. Mr. Goldman serves as the President of the Iron Mountain Charitable Foundation, and on the Board of Directors for the Jewish Rehab Center in Swampscott, MA. Mr. Goldman serves on the Board of Directors for the Danversbank Charitable Foundation. He is a member of the Company's Compensation Committee. We believe Mr. Goldman's qualifications to serve on the Board of Directors include his demonstrated experience in executive leadership, strategic planning, and governance of a public company.

J. Michael O'Brien. Mr. O'Brien is Chief Executive Officer and President of Eagle Air Freight, Inc. and Trustee of O'Brien Realty Trust of Chelsea, Massachusetts. He has held both positions since 1981. Mr. O'Brien serves as the Company's Lead Director and is a member of its Compensation and Executive Committees. Mr. O'Brien brings his experience and expertise in business management, company leadership, and corporate governance to the Board.

John J. O'Neil, Executive Vice President/Chief Lending Officer. Mr. O'Neil joined Danversbank as Executive Vice President, Senior Lending Officer in November of 2001. As a member of senior management, Mr. O'Neil is directly responsible for managing Danversbank's commercial and residential loan portfolios and developing new loan products. Mr. O'Neil joined Danversbank from MetroWest Bank, where he was Executive Vice President, Senior Lender. He was previously employed by Boston Private Bank & Trust Company, where he was Senior Vice President, Commercial Lending, and USTrust and Patriot Bank, where he was Senior Vice President, Commercial Lending. Mr. O'Neil also serves as President of One Conant Capital, a subsidiary of Danversbank. Mr. O'Neil's extensive commercial lending, management and leadership experience provides value to the Board's deliberations and decision-making.

John M. Pereira. Mr. Pereira has served as President of Combined Properties, Inc. since 1991, where he is currently Chief Executive Officer. Prior to joining Combined Properties Mr. Pereira was a partner at the law firm of Sherin and Lodgen. He earned his B.S. from the University of Massachusetts at Dartmouth and his J.D. from Boston College Law School in 1981. In addition to his work with the Board, he serves on the Board of Directors for the Malden YMCA, South Shore YMCA, and the Malden-based non-profit, Triangle. In addition to his position at Combined Properties, Mr. Pereira is a registered Real Estate Broker. As an attorney, Mr. Pereira brings his extensive legal and commercial real estate experience to the Board, along with his work in the business and non-profit communities.

Diane T. Stringer. Ms. Stringer has served as the President and Chief Executive Officer of Hospice of the North Shore since 1989. She earned her B.S. in Nursing from Case Western Reserve University in 1976 and her M.S. in Health Policy from Harvard University in 1982. Ms. Stringer brings

5

Table of Contents

business and management experience, along with her extensive background in customer relations and care to the Board.

Term to Expire in 2012

Kevin T. Bottomley, President and Chief Executive Officer. Mr. Bottomley became Chief Executive Officer and President of Danversbank in 1996. He became Chairman of the Board of Directors in 2003. Prior to arriving at Danversbank, he was the Chief Lending Officer and Executive Vice President at Boston Private Bank & Trust Company. Mr. Bottomley began his career at Bankers Trust in 1976 in the Asia Pacific division and also worked for many years at The First National Bank of Boston as a Vice President in its Asia Pacific Division in the Reverse Multinational Group and in its London Branch. Mr. Bottomley earned his undergraduate degree from Harvard College in 1974 and earned his M.B.A. from the University of Virginia in 1976. Mr. Bottomley's qualifications to serve on the Board include his demonstrated experience in executive leadership, strategic planning and governance of a public company.

Diane C. Brinkley. Ms. Brinkley served as the President and owner of Murphy's Fruit Mart, Inc. in Danvers, Massachusetts from 1980 until her retirement in 2005. She has been a member of the Board of Directors of Danversbank since 1988. Ms. Brinkley brings to the Board many years of business, management and customer based experience, along with a knowledge of crisis and risk management.

Robert J. Broudo. Mr. Broudo has served as Headmaster of the Landmark School in Beverly, Massachusetts, a private school for students with learning disabilities, since 1990. He has been a member of the faculty holding various positions at Landmark for over 40 years and throughout that time has been an active member of the North Shore community. Mr. Broudo serves on the Board of Trustees for the Waring, Glen Urquhart, and Brookwood Schools. In addition to being a director at Danversbank since 1998, he is also on the Board of Directors of Creative Soul of Children, Inc. Mr. Broudo is a member of the Company's Governance and Compensation Committees. We believe Mr. Broudo's many years of service to the community and managerial experience at Landmark School have provided him with the qualifications to serve on the Board.

Craig S. Cerretani. Mr. Cerretani is a founding principal of Longfellow Financial, LLC and currently manages the company's Executive Benefit Practice in Boston, Massachusetts. Mr. Cerretani works extensively in the areas of executive and employee benefits planning as well as in wealth transfer techniques for closely held and/or family owned businesses. Mr. Cerretani earned his B.A. from The College of the Holy Cross in 1979. Additionally, Mr. Cerretani serves on a number of local community boards and provides leadership to a local community groups. Mr. Cerretani serves as the Chair of the Company's Governance Committee. Mr. Cerretani brings leadership, management and executive compensation skills to the Company's Board.

Mark B. Glovsky. Mr. Glovsky is the Managing Member of Glovsky & Glovsky LLC, a general practice law firm located in Beverly, Massachusetts. He has been with the firm since 1973. Mr. Glovsky earned his undergraduate degree from Dartmouth College in 1970 and his law degree from Boston College Law School in 1973. Mr. Glovsky has been involved in many community and non-profit organizations throughout his career, including serving as Chairman of the Board of Directors of the North Shore Chamber of Commerce and Chairman of the Board of Trustees of Montserrat College of Art. We believe Mr. Glovsky's qualifications to serve on the Board include his extensive legal and business experience along with his involvement in the North Shore community.

Eleanor M. Hersey. Ms. Hersey is a retired treasurer of The Wakefield Corporation, a position she held from 1975 to 1989. As treasurer, she was responsible for the Corporation's financials. Since 2001, she has been a partner and treasurer of Sunset Acres LLC, a real estate and investment

6

Table of Contents

company. In addition to her professional accomplishments, Ms. Hersey is actively involved in the community. She has been on the Board of Directors of the Danvers Community Council since 1994. As part of her work with the Community Council, she co-founded the Danvers People to People Food Pantry later in 1994. These organizations provide valuable services to the Danvers community. Ms. Hersey serves on the Audit committee of Danversbank. She brings experience in accounting, finance, and business management to the Board.

Mary Coffey Moran, CPA. Ms. Moran has served as the CFO of St. John's Preparatory School in Danvers, Massachusetts since February 1, 2010. Prior to joining St. John's Preparatory School, Ms. Moran managed her own financial consulting business, MCM Consulting. She founded the company in 2001. Ms. Moran earned her B.A. in Economics from The College of the Holy Cross in 1977 and an M.B.A. and M.S. in Accounting from Northeastern University in 1979. She currently serves as a Trustee at The College of the Holy Cross. Ms. Moran presently serves on the Company's Audit Committee. With her background in finance and accounting, Ms. Moran brings a valuable skill set to the Board.

Pamela C. Scott. Ms. Scott is President and CEO of LVCC, Inc., a corporate and non-profit business development and organizational consulting firm, founded in 2003. Ms. Scott has over 30 years of sales and management experience in financial and investment services. Previously, Ms. Scott managed client investments as a Senior Vice President at State Street Corporation and also led State Street Global Advisors' Charitable Asset Management department, serving non-profit organizations. Ms. Scott earned a B.A. in Economics from Rice University in 1973 and an MBA in Finance from the Tuck School of Business at Dartmouth College in 1975. Ms. Scott brings investment management and non-profit organizational experience to the Company's Board.

Michael F. Tripoli. Mr. Tripoli was a founding partner in the firm Grandmaison & Tripoli, LLP, a CPA firm located in Danvers, Massachusetts and founded in 1985. He earned his undergraduate degree from Merrimack College in 1980 and a Master of Science in Taxation from Bentley College in 1990. Mr. Tripoli is actively involved in several local community organizations, including the American Institute of CPA's, the Massachusetts' Society of CPA's, and the North Shore Chamber of Commerce. He is also a past member of the Board of Advisors of Bishop Fenwick High School and the Past-Treasurer and Member of the Board of Trustees of North Shore Music Theater. Mr. Tripoli's experience and background in accounting and finance provides value to the Board.

THE BOARD RECOMMENDS A VOTE "FOR" EACH OF THE NOMINEES

TO THE BOARD OF DIRECTORS LISTED ABOVE

7

Table of Contents

ROLE OF THE BOARD; CORPORATE GOVERNANCE MATTERS

It is the critical function of the Board to oversee the Company's executive management in the competent and ethical operation of the Company on a day-to-day basis and to assure that the long-term interests of the stockholders are being served. To satisfy this duty, the directors take a proactive approach to their position, and establish appropriate policy to ensure that the Company is committed to success through maintenance of high standards of responsibility and ethics.

Members of the Board bring to the Company a wide range of experience and knowledge. These varied skills provide for strong leadership and effective corporate governance. The Board works closely with senior management to provide for effective decision-making, compliance with Company policy and regulations, and strong leadership. The Company's corporate governance policy is available for review atwww.danversbank.com/investor_relations.

Board Leadership Structure

Mr. Bottomley has served as a member of our Board of Directors since becoming Chief Executive Officer and President of Danversbank in 1996. Mr. Bottomley became Chairman of the Company in 2008. Mr. O'Brien has served as our Lead Director since 2008. The Lead Director's role is to work with the Chairman to determine Board agenda items and foster contributions of other directors during the Board's deliberations.

Our Board of Directors encourages strong communication among all of our independent directors and the Lead Director. Our Board of Directors also believes that it is able to effectively provide independent oversight of the Company's business and affairs, including risks facing the Company, through the composition of our Board of Directors, the Lead Director, the strong leadership of the independent directors and the independent committees of our Board of Directors, and the other corporate governance structures and processes already in place. Sixteen of the nineteen members of our Board of Directors are non-management directors, and all of these non-management directors are independent under the independence rules of the NASDAQ Stock Market LLC. All of our directors are free to suggest the inclusion of items on the agenda for meetings of our Board of Directors or raise subjects that are not on the agenda for that meeting. In addition, our Board of Directors and each committee has complete and open access to any member of management and the authority to retain independent legal, financial and other advisors as they deem appropriate without consulting or obtaining the approval of any member of management. Our Board of Directors also holds regularly scheduled executive sessions of non-management directors in order to promote discussion among the non-management directors and assure independent oversight of management. Moreover, our Audit Committee and our Governance Committee, each of which are comprised entirely of independent directors, also perform oversight functions independent of management.

Risk Oversight

The Board of Directors plays an important role in the risk oversight of the Company. Although the Board recognizes that it is not possible to identify all risks that may affect the Company and its subsidiaries or to develop processes and controls to completely eliminate or mitigate their occurrence or effects, the Board is involved in risk oversight through direct decision-making authority with respect to significant matters and the oversight of management by the Board of Directors and its committees. The Board of Directors and its committees also are each directly responsible for considering risks and the oversight of risks relating to decisions that each is responsible for making.

In particular, the Board of Directors administers its risk oversight function through (1) the review and discussion of regular periodic reports to the Board of Directors and its committees on topics relating to the risks that the Company faces, including, among others, market risk, interest rate risk, credit risk, regulatory risk and various other matters relating to the Company's business, (2) the

8

Table of Contents

required approval by the Board of Directors (or a committee thereof) of significant transactions and other decisions, including, among others, new hires and promotions to the Company's senior management positions, (3) the direct oversight of specific areas of the Company's business by the Audit Committee and the Governance Committee, and (4) regular periodic reports from the Company's internal and external auditors and other outside consultants regarding various areas of potential risk, including, among others, those relating to the Company's internal control over financial reporting. The Board of Directors also relies on management to bring significant matters impacting the Company and its subsidiaries to the Board's attention.

Pursuant to the Audit Committee's charter, the Audit Committee is specifically responsible for reviewing and discussing with management and the Company's external and internal auditors matters and activities relating to financial reporting and internal controls of the Company, and the guidelines and policies that govern the process by which the Company's exposure to risk is assessed and managed by management.

Board Committees

During 2009, the Board met 10 times. Each director attended at least 75% of the combined total number of meetings of the Board and Board Committees of which he or she was a member. Consistent with the Company's corporate governance policy, the independent directors meet at least twice each year in executive session. In addition, the Company strongly encourages all directors and nominees to attend each Annual Meeting. Fifteen of the directors attended the Annual Meeting held on May 8, 2009 and the Company anticipates that all of the directors will attend the 2010 Annual Meeting.

The Board has four standing committees: Executive, Governance, Audit and Compensation. The Board has adopted a written charter for each of the standing committees, which are available on the Company's website atwww.danversbank.com/investor_relations.

Executive Committee. The Executive Committee consists of J. Michael O'Brien, Robert J. Broudo and Brian C. Cranney. The Executive Committee is responsible for directing and transacting any business of the Company which properly might come before the Board of Directors, except such as by law, only the full Board is authorized to perform. The Executive Committee documents its proceedings and reports on any actions taken at the next meeting of the Board of Directors. The Executive Committee did not meet in 2009.

Governance Committee. The Governance Committee consists of Craig S. Cerretani (Chair), Robert J. Broudo, Brian C. Cranney and John R. Ferris. The Governance Committee is responsible for the annual selection of the Board's nominees for election as directors and developing and implementing policies and practices relating to corporate governance, including implementing and monitoring the adherence to Danvers Bancorp's corporate governance policy. Each member of the Governance Committee is independent under the definition contained in the listing standards of the NASDAQ Stock Market LLC. The Governance Committee met a total of three times during 2009.

Audit Committee. The Audit Committee currently consists of John P. Drislane (Chair), Thomas Ford, Eleanor M. Hersey and Mary Coffey Moran. Duties of the Audit Committee include the following: reviewing annually the scope of the proposed internal audit and external audit activities, as well as the actual coverage of those activities; discussing the contents of our annual and quarterly consolidated financial statements with management, the independent registered public accounting firm and the chief auditor; appointing or terminating, determining the compensation of, and evaluating the quality and independence of, the independent registered public accounting firm; pre-approving the scope of services provided by and fees paid to the independent registered public accounting firm for audit, audit-related and permitted non-audit-related services; overseeing the internal audit function; reviewing the scope and content of examinations of the Company by banking and other regulatory

9

Table of Contents

agencies and reporting their conclusions to the Board; and reviewing with management and the Company's General Counsel the nature and status of significant legal matters. The Board has determined that Ms. Moran qualifies as an "audit committee financial expert" as defined by the SEC and that all members of the Audit Committee are independent and financially sophisticated in accordance with the listing standards of the NASDAQ Stock Market LLC. The report of the Audit Committee is included in this Proxy Statement. The Audit Committee met a total of eight times during 2009.

Compensation Committee. The Compensation Committee consists of John R. Ferris (Chair), Robert J. Broudo, Neal H. Goldman and J. Michael O'Brien. The Compensation Committee is responsible for determining annual grade and salary levels for employees and establishing personnel policies. Each member of the Compensation Committee is independent under the listing standards of the NASDAQ Stock Market LLC. The report of the Compensation Committee is included in this Proxy Statement. The Compensation Committee met a total of seven times during 2009.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics that set forth standards of ethical business conduct for all directors, officers and employees of the Company. Additionally, the Code of Business Conduct and Ethics is in conformity with the requirements of the Sarbanes-Oxley Act of 2002 and the NASDAQ Stock Market LLC listing standards. A copy of the Code and any amendments to or waivers of the requirements under the Code, are available on the Company's website atwww.danversbank.com/investor_relations.

The Board has established a means for employees, customers, suppliers, stockholders and other interested parties to submit confidential and anonymous reports of suspected or actual violations of our Code of Business Conduct and Ethics relating, among other things, to:

- •

- Accounting practices, internal accounting controls or auditing matters and procedures;

- •

- Theft or fraud of any amount;

- •

- Insider trading;

- •

- Performance and execution of contracts;

- •

- Conflicts of interest; and

- •

- Violations of securities and antitrust laws.

Any employee, stockholder or other interested party can submit a report to the Audit Committee either in writing to: Internal Audit Services, P.O. Box 161, Danvers, Massachusetts 01923; or by calling the Ethics Reporting Program at (800) 765-3277. Such reports may be submitted confidentially or anonymously. In addition, a report may be submitted by email toaudit.services@danversbank.com. (Please note, however, thatanonymity cannot be maintained for email.)

Board Nominations

The Governance Committee identifies nominees by evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are first considered for renomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service, or if the Governance Committee or the Board decides not to renominate a member for reelection, or if the size of the Board is increased, the Governance Committee would seek to identify appropriate director

10

Table of Contents

candidates. In addition, the Governance Committee is authorized by its charter, subject to prior approval from the Board, to engage a third party to assist in the identification of director nominees.

Neither the Governance Committee nor the Board has a policy with regard to the consideration of diversity in identifying director nominees, although both may consider diversity when identifying and evaluating nominees. The Governance Committee may consider whether a nominee, if elected, would have the necessary qualifications, professional background and core competencies to discharge his or her duties as well as the ability to add something unique and valuable to our Board of Directors as a whole. The Governance Committee would seek to identify a candidate who at a minimum satisfies the following criteria:

- •

- Has the highest personal and professional ethics and integrity and whose values are compatible with those of the Company;

- •

- Has experience and achievements demonstrating the ability to exercise and develop good business judgment;

- •

- Is willing to make the necessary time commitment to the Board and its committees, which includes being available for Board and Committee meetings;

- •

- Is familiar with the communities in which the Company operates and/or is actively engaged in community activities;

- •

- Is involved in other activities or interests that do not create a conflict with Board responsibilities or the Company's stockholders; and

- •

- Has the capacity and desire to represent the best interests of our stockholders as a group and not a special interest group or constituency.

The Governance Committee will also take into account whether a candidate satisfies the criteria for "independence" under the NASDAQ Stock Market LLC listing standards, and if a candidate with financial and accounting experience is sought for service on the Audit Committee, whether the individual qualifies as an Audit Committee financial expert.

Stockholder Nominations

The Governance Committee has adopted procedures for the consideration of Board candidates submitted by stockholders. Any stockholder can submit the names of candidates for director by writing to the Governance Committee, care of the Corporate Secretary, at Danvers Bancorp, Inc., One Conant Street, Danvers, Massachusetts 01923. The Governance Committee must receive a submission not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the anniversary of the preceding year's Annual Meeting; provided, however, that in the event that the date of the Annual Meeting is advanced by more than 30 days before or delayed by more than 60 days after such anniversary date, notice by the stockholder to be timely must be so delivered not later than the close of business on the later of the 90th day prior to such Annual Meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. The submission should include the following information:

- •

- The name and address of record of the stockholder;

- •

- A representation that the stockholder is a record holder of the Company's securities, or if the security holder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Securities Exchange Act of 1934, as amended (the "Exchange Act");

- •

- The name, age, business and residential address, educational background, current principal occupation or employment and principal occupation or employment for the preceding five full fiscal years of the proposed director candidate;

11

Table of Contents

- •

- A description of the qualifications and background of the proposed director candidate which addresses the minimum qualifications and other criteria for Board membership approved by the Board from time to time and set forth in the Governance Committee Charter and which are discussed in further detail below in the section above;

- •

- A description of all arrangements or understandings between the stockholder and proposed director candidate;

- •

- The consent of the proposed director candidate (i) to be named in the proxy statement relating to the Company's Annual Meeting of Stockholders and (ii) to serve as a director if elected as such Annual Meeting; and

- •

- Any other information regarding the proposed director candidate that is required to be included in a proxy statement filed pursuant to the rules of the Securities and Exchange Commission.

A nomination for Board candidates submitted by a stockholder for presentation at an Annual Meeting must comply with the procedural and informational requirements in "Advance Notice of Business to be Conducted at an Annual Meeting." There were no submissions by stockholders of Board nominees for our Annual Meeting.

Communications with the Board

Stockholders who wish to communicate with our Board or with any director can write to the Governance Committee, care of the Corporate Secretary, at Danvers Bancorp, Inc., One Conant Street, Danvers, Massachusetts 01923. This letter should indicate that the author is a stockholder and if shares are not held of record, should include appropriate evidence of stock ownership. Depending on the subject matter, the Corporate Secretary will forward the communication to the director(s) to whom it is addressed, or, if the inquiry is a request for information about the Company or a stock-related matter for example, the Corporate Secretary will respond directly. The Corporate Secretary will not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate.

At each Board meeting, the Corporate Secretary shall present a summary of all communication received since the last meeting and make those communications available to the directors upon request.

Transactions with Related Parties

The Company's Code of Business Conduct and Ethics sets forth standards applicable to contracts with, and the retention of services of, any director or officer (or his or her related interest) in an amount exceeding $120,000, as required by the rules of the NASDAQ Stock Market, LLC. In general, the Code of Business Conduct and Ethics requires that such contracts or services shall be entered into only on substantially the same terms and conditions as those prevailing for comparable market transactions. The Code of Business Conduct and Ethics further requires that an insider who is a director who has an interest in a covered contract or service is required to formally abstain from negotiating, entering into, reviewing or approving any such contract or service. Moreover, the Code of Business Conduct and Ethics provides any covered contract or service with an insider requires the formal approval of a majority of the Board of Directors, excluding any individual interested in such transaction. Although the foregoing written policy applies only with respect to transactions in excess of banking regulations, the Company generally follows the guidelines of such policy in connection with smaller transactions as well.

In the ordinary course of business, the Company does business or receives services from entities that members of the Board of Directors of the Company have a financial interest. During the year ended December 31, 2009, the Company contracted electrical and HVAC services with an entity owned by a member of the Board of Directors in the amount of $161,000 and paid premiums on life insurance policies amounting to $146,000 brokered by a Board member.

12

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS,

DIRECTORS AND MANAGEMENT

Persons and groups who beneficially own in excess of five percent of the Common Stock are required to file certain reports with the SEC regarding ownership. The following table sets forth, as of the Record Date, the shares of Common Stock beneficially owned by each person who was the beneficial owner of more than five percent of the Company's Common Stock, including shares owned by its directors and executive officers.

| | | | | | | | |

Name and Address of Owner | | Shares of

Common

Stock | | Percent of

Class of

Ownership | |

|---|

| BlackRock, Inc.(1) | | | 1,293,281 | | | 5.8 | % |

| | 40 East 52nd Street

New York, NY 10022 | | | | | | | |

First Bankers Trust Services, Inc. |

|

|

1,427,102 |

|

|

6.4 |

% |

| | as Trustee for the Danvers Bancorp, Inc. Employee

Stock Ownership Plan(2)

One Conant Street

Danvers, MA 01923 | | | | | | | |

Lord, Abbett & Co., LLC and Lord Abbett Research Fund, Inc.—Small-Cap Value Series(3) |

|

|

1,680,926 |

|

|

7.5 |

% |

| | 90 Hudson Street

Jersey City, NJ 07302 | | | | | | | |

Vaughan Nelson Investment Management, Inc. and Vaughan Nelson Investment Management, L.P.(4) |

|

|

1,250,930 |

|

|

5.6 |

% |

| | 600 Travis Street, Suite 6300

Houston, TX 77002 | | | | | | | |

Wellington Management Company, LLP(5) |

|

|

1,434,701 |

|

|

6.4 |

% |

| | 75 State Street

Boston, MA 02109 | | | | | | | |

- (1)

- Based exclusively on a Schedule 13G filed by BlackRock, Inc. on January 20, 2010.

- (2)

- Reflects shares held in ESOP for the benefit of employees of the Company based exclusively on a Schedule 13G filed by First Bankers Trust Services, Inc. on February 3, 2010. Under the terms of the ESOP, the ESOP Trustee will vote shares allocated to participants' accounts in the manner directed by the ESOP Committee. The Trustee is subject to fiduciary duties under ERISA. The Trustee disclaims beneficial ownership of the shares of common stock held in the ESOP.

- (3)

- Based exclusively on Schedule 13G's filed by Lord, Abbett & Co. LLC and Lord Abbett Research Fund, Inc.—Small-Cap Value Series on February 12, 2010.

- (4)

- Based exclusively on a Schedule 13G filed by Vaughan Nelson Investment Management, Inc. and Vaughan Nelson Investment Management, L.P. on February 9, 2010. The filer claimed shared power to dispose or to direct the disposition of 156,930 shares.

- (5)

- Based exclusively on a Schedule 13G filed by Wellington Management Company, LLP on February 12, 2010. The filer claimed shared power to vote or direct the vote of 1,327,963 shares and shared power to dispose or to direct the disposition of 1,434,701 shares.

13

Table of Contents

The following table details, as of the Record Date, information concerning the beneficial ownership of our Common Stock by:

- •

- Each director;

- •

- Our principal executive officer, principal financial officer and principal operating officer in 2009; and

- •

- All directors and named executive officers as a group.

In general, beneficial ownership includes those shares that can be voted or transferred.

| | | | | | | | | | | | | | | | | | |

Director | | Age | | Position | | Director

Since | | Term

Expires | | Amount and

Nature of

Beneficial

Ownership

(1)(2) | | Percent of

Class(3) | |

|---|

NOMINEES | |

Brian C. Cranney | | |

53 | | Director | | |

2002 | | |

2013 | | |

63,742 | | |

* | |

John P. Drislane | | | 66 | | Director | | | 1996 | | | 2013 | | | 69,742 | (4) | | * | |

John R. Ferris | | | 53 | | Director | | | 1993 | | | 2013 | | | 57,672 | (5) | | * | |

Thomas Ford | | | 54 | | Director | | | 1999 | | | 2013 | | | 82,242 | (6) | | * | |

James J. McCarthy | | | 49 | | Executive Vice President, Chief Operating Officer | | | 2001 | | | 2013 | | | 237,113 | | | * | |

DIRECTORS CONTINUING IN OFFICE

|

|

Kevin T. Bottomley | | |

57 | | Chairman, President and Chief Executive Officer | | |

1996 | | |

2012 | | |

544,214 |

(7) | |

* | |

Diane C. Brinkley | | | 60 | | Director | | | 1988 | | | 2012 | | | 50,742 | | | * | |

Robert J. Broudo | | | 61 | | Director | | | 1998 | | | 2012 | | | 51,742 | | | * | |

Craig S. Cerretani | | | 56 | | Director | | | 2003 | | | 2012 | | | 69,742 | (8) | | * | |

Mark B. Glovsky | | | 62 | | Director | | | 2009 | | | 2012 | | | 25,619 | | | * | |

Neal H. Goldman | | | 58 | | Director | | | 2004 | | | 2011 | | | 89,842 | (9) | | * | |

Eleanor M. Hersey | | | 74 | | Director | | | 1988 | | | 2012 | | | 52,742 | | | * | |

Mary Coffey Moran | | | 54 | | Director | | | 2007 | | | 2012 | | | 64,742 | | | * | |

J. Michael O'Brien | | | 56 | | Director | | | 2001 | | | 2011 | | | 75,442 | (10) | | * | |

John J. O'Neil | | | 56 | | Executive Vice President, Chief Lending Officer | | | 2001 | | | 2011 | | | 236,520 | (11) | | * | |

John M. Pereira | | | 54 | | Director | | | 2007 | | | 2011 | | | 89,742 | | | * | |

Diane T. Stringer | | | 56 | | Director | | | 1999 | | | 2011 | | | 57,242 | | | * | |

Pamela C. Scott | | | 58 | | Director | | | 2009 | | | 2012 | | | 12,626 | | | * | |

Michael F. Tripoli | | | 52 | | Director | | | 2009 | | | 2012 | | | 18,486 | | | * | |

NAMED EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS | |

L. Mark Panella | | |

54 | | Executive Vice President, Chief Financial Officer | | |

N/A | | |

N/A | | |

126,982 | | |

* | |

Michael W. McCurdy | | | 41 | | Executive Vice President, General Counsel and Secretary and Director of Retail Banking | | | N/A | | | N/A | | | 46,241 | (12) | | * | |

Directors and Officers as a group (21) persons | | | | | | | | | | | | | | 2,110,551 | | | 10.02 | % |

14

Table of Contents

- (1)

- Except as otherwise noted, each person has sole, or shared with spouse, voting and dispositive power as to the shares reported.

- (2)

- Does not include 615,900 shares owned by the Danversbank Charitable Foundation, Inc. The directors of the foundation are Messrs. Goldman, Pereira, O'Brien, O'Neil, Ardiff and Dawley, Ms. Hersey, Ms. Stringer and Ms. Brinkley. The President, Treasurer and Clerk are Messrs. Bottomley, McCarthy and Ford, respectively.

- (3)

- Calculated based on outstanding shares of Danvers Bancorp, Inc. common stock as of the Record Date.

- (4)

- Includes 10,000 shares owned by Mr. Drislane's spouse.

- (5)

- Includes 440 shares held in an IRA owned by Mr. Ferris's spouse and 350 shares held in a trust of which Mr. Ferris's spouse is trustee.

- (6)

- Includes 15,000 shares held in an IRA owned by Mr. Ford's spouse and 15,000 shares owned by a corporation of which Mr. Ford is President.

- (7)

- Includes 6,000 shares owned by Mr. Bottomley's spouse.

- (8)

- Includes 10,000 shares held in a trust of which Mr. Cerretani is trustee.

- (9)

- Includes 20,000 shares held in a trust of which Mr. Goldman is trustee, 20,000 shares owned by a corporation of which Mr. Goldman is President and 100 shares held in a trust of which Mr. Goldman and his spouse are trustees.

- (10)

- Includes 20,000 shares owned by a trust of which Mr. O'Brien is trustee, 5,500 shares held by Mr. O'Brien's sons and 200 shares owned jointly with a family member.

- (11)

- Includes 1,600 shares held in an IRA owned by Mr. O'Neil's spouse.

- (12)

- Includes 2,426 shares owned jointly with Mr. McCurdy's spouse.

Section 16(a) Beneficial Ownership Reporting Compliance

The Company's common stock is registered with the SEC pursuant to Section 12 of the Exchange Act. Accordingly, our directors, senior management and beneficial owners of more than 10% the Company's common stock are required to disclose beneficial ownership and changes in beneficial ownership on Forms 3, 4 and 5, which are filed with the SEC. At the present time, the Company has no knowledge of any individual, group or entity with beneficial ownership of more than 10% of the Company's common stock. In addition, based on the Company's review of ownership reports, the Company believes its directors and senior management timely complied with the reporting requirements of Section 16(a) for the period ended December 31, 2009.

15

Table of Contents

DIRECTOR COMPENSATION

The Company's primary goal is to provide competitive and reasonable compensation to independent directors in order to attract and retain qualified candidates to serve on the Company's Board. Directors who are also officers of the Company are not eligible to receive board fees. All fees earned are paid in cash and are eligible for deferral under the Non Qualified Deferred Compensation Plan, as defined below.

The following table sets forth certain information as to the total remuneration paid to our directors other than Messrs. Bottomley, McCarthy and O'Neil for the year ended December 31, 2009. No compensation was paid to Messrs. Bottomley, McCarthy or O'Neil for their services as director.

| | | | | | | | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid

in Cash

($)(1) | | Stock

Awards

($)(2) | | Option

Awards

($)(3) | | Non-Equity

Incentive

Compensation ($) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($) | | All Other

Compensation

($)(4) | | Total ($) | |

|---|

Brinkley, Diane C. | | | 23,600 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 9,453 | | | 356,710 | |

Broudo, Robert J. | | | 42,100 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 15,205 | | | 380,962 | |

Cerretani, Craig S. | | | 31,600 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 14,537 | | | 369,794 | |

Cranney, Brian C. | | | 35,700 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 15,441 | | | 374,798 | |

Drislane, John P. | | | 34,900 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 15,561 | | | 374,118 | |

Ferris, John R. | | | 49,167 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 15,004 | | | 387,828 | |

Ford, Thomas | | | 29,300 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 14,650 | | | 367,607 | |

Glovsky, Mark B.(5) | | | 3,300 | | | — | | | — | | N/A | | N/A | | | — | | | 3,300 | |

Goldman, Neal H. | | | 35,000 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 14,912 | | | 373,569 | |

Hersey, Eleanor M.(6) | | | 26,400 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 2,674 | | | 352,731 | |

Moran, Mary C. | | | 33,200 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 10,932 | | | 367,789 | |

O'Brien, J. Michael | | | 40,700 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 14,537 | | | 378,894 | |

Pereira, John M. | | | 21,400 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 15,007 | | | 360,064 | |

Scott, Pamela C.(5) | | | 4,800 | | | — | | | — | | N/A | | N/A | | | — | | | 4,800 | |

Stringer, Diane T. | | | 37,100 | | | 198,367 | | | 125,290 | | N/A | | N/A | | | 14,401 | | | 375,158 | |

Tripoli, Michael F.(5) | | | 4,100 | | | — | | | — | | N/A | | N/A | | | — | | | 4,100 | |

- (1)

- Reflects all fees earned or paid for services as a director of Danvers Bancorp, Inc. and Danversbank ($800 per Board Meeting attended, $700 per Committee Meeting attended, and $1,250 monthly for the Danversbank Board of Investment Committee) and annual retainer paid in 2009 ($10,000) for services as a director earned during 2008. Also includes amounts which have been deferred at the election of the non-employee directors and compensation for serving on committees of the Board of Directors. Mr. O'Brien received $15,000 for services as Lead Director; Mr. Drislane received $10,000 for services as Chairman of the Audit Committee; Mr. Ferris received $10,000 for services as Chairman of the Compensation Committee; and Mr. Cerretani received $8,000 for services as Chairman of the Governance Committee.

- (2)

- Stock awards vest 20% per year over a five-year period. The dollar value is grant date fair value of the awards. For the assumptions used in calculating the grant date fair value under ASC 718, see Note 19 to the financial statements contained in our Form 10-K for the year ended December 31, 2009.

- (3)

- Option awards vest 20% per year from the date of the grant and are fully vested in year five. The maximum term of each option is ten years (five years for a 10% owner). The dollar value is grant date fair value of the awards. For the assumptions used in calculating the grant date fair value

16

Table of Contents

under ASC 718, see Note 19 to the financial statements contained in our Form 10-K for the year ended December 31, 2009.

- (4)

- Represents the long-term care insurance paid by the Company for each board member. Mr. Glovsky, Ms. Scott and Mr. Tripoli were not eligible for long-term care insurance in 2009.

- (5)

- Former Beverly National Corporation board director. As a result of the Beverly National Corporation acquisition, on October 30, 2009, Mr. Glovsky, Ms. Scott and Mr. Tripoli became directors of the Company in November 2009.

- (6)

- Ms. Hersey voluntarily terminated her long-term care insurance effective October 31, 2009.

Outstanding Equity Awards

The following table itemizes outstanding option awards and stock awards held by the Company's Directors as of December 31, 2009:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | Option Awards | | Stock Awards | |

|---|

Name | | Grant

Date | | Number of

Securities

Underlying

Unexercised

Options

Exercisable

(#)(1) | | Number of

Securities

Underlying

Unexercised

Options

Unexercisable

(#)(1) | | Equity

Incentive

Plan Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#) | | Option

Exercise

Price

($) | | Options

Expiration

Date

(2) | | Number of

Shares or

Units of

Stock that

Have Not

Vested

(#)(3) | | Market

Value of

Shares or

Units of

Stock that

Have Not

Vested

($)(4) | |

|---|

Brinkley, Diane C. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Broudo, Robert J. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Cerretani, Craig S. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Cranney, Brian C. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Drislane, John P. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Ferris, John R. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Ford, Thomas | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Glovsky, Mark B. | | | N/A | | | — | | | — | | | — | | | — | | | N/A | | | — | | | — | |

Goldman, Neal H. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Hersey, Eleanor M. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Moran, Mary C. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

O'Brien, J. Michael | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Pereira, John M. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Scott, Pamela C. | | | N/A | | | — | | | — | | | — | | | — | | | N/A | | | — | | | — | |

Stringer, Diane T. | | | 02/09/09 | | | — | | | 33,500 | | | 33,500 | | | 13.00 | | | 02/09/19 | | | 15,259 | | | 198,214 | |

Tripoli, Michael F. | | | N/A | | | — | | | — | | | — | | | — | | | N/A | | | — | | | — | |

- (1)

- Option awards vest 20% per year from the date of the grant and are fully vested in year five.

- (2)

- Options expire ten years from the grant date (five years for a 10% owner).

- (3)

- Stock awards vest 20% per year over a five-year period.

- (4)

- The amount shown represents the number of stock awards that have not vested multiplied by the closing price of the Company's common stock on December 31, 2009, which was $12.99.

17

Table of Contents

Cash Retainer and Meeting Fees for Non-Employee Directors

The following table sets forth the applicable retainers and fees paid to our non-employee directors for their service on the Board of Directors of Danvers Bancorp, Inc. and Danversbank during 2009:

| | |

Fee per board meeting attended | | $ 800 |

Fee per committee meeting attended | | $ 700 |

Annual retainer | | $10,000 / year(1) |

Danversbank Board of Investment Committee member fee | | $15,000 / year |

- (1)

- Employee directors do not receive an annual retainer.

Nonqualified Deferred Compensation Plan

The Company offers a nonqualified deferred compensation plan to provide directors with the opportunity to defer all or a portion of their fees. Deferrals are credited quarterly with interest at a rate equal to the average yield on the Company's loan portfolio for the preceding calendar year. Participants are 100 percent vested in their voluntary deferrals. Participants receive distributions from the plan upon separation from service or death, or on a fixed date selected by the participants. Plan benefits are paid in a lump sum or annual installments over a period not exceeding ten years, in accordance with participants' elections. Upon the death of the participant, the designated beneficiary receives any remaining payments due under the plan.

Other Benefits

The Company provides individual long term care insurance to its directors.

18

Table of Contents

EXECUTIVE OFFICERS

The following sets forth certain information regarding executive officers of the Company. Information pertaining to Messrs. Bottomley, McCarthy and O'Neil, who are both directors and executive officers of the Company, may be found in the section entitled "Proposal 1: Election of Directors."

| | | | | | |

Name | | Position with Company | | Age | |

|---|

Donat A. Fournier | | Executive Vice President/Wealth Management | | | 62 | |

David A. Lahive | | Senior Vice President/Chief Credit Officer | | | 45 | |

Michael W. McCurdy | | Executive Vice President/General Counsel and Secretary/

Director of Retail Banking | | | 41 | |

Mary C. McGovern | | Senior Vice President/Chief Accounting Officer | | | 45 | |

Jack M. Murray, Jr. | | Senior Vice President/Chief Auditor | | | 58 | |

L. Mark Panella | | Executive Vice President/Chief Financial Officer | | | 54 | |

Peter Z. Shabowich | | Senior Vice President/Chief Investment Officer | | | 47 | |

Donat A. Fournier, Executive Vice President/Wealth Management. Mr. Fournier was President and Chief Executive Officer of Beverly National Bank from 2002 until the acquisition by Danvers Bancorp, Inc., which occurred in October 2009. Prior to joining Beverly National, he was Senior Vice President and Director of Small Business Banking for Webster Bank. Mr. Fournier worked for New England Community Bancorp as Senior Lender from 1993 until 1999. He also worked many years for Eastland Financial Corporation. Mr. Fournier began his career at Chase Manhattan, London in 1973. He earned his undergraduate degree from Husson College in 1970.

David A. Lahive, Senior Vice President/Chief Credit Officer. Mr. Lahive is primarily responsible for the Company's credit quality administration, risk oversight, management of the loan review process and lending policies. Mr. Lahive joined Danversbank in May of 2002 as the Senior Vice President of Commercial Real Estate Lending and he was appointed Senior Credit Officer in October of 2007. He joined Danversbank from MetroWest Bank where he was the Senior Vice President of Commercial Real Estate Lending. Prior to MetroWest Bank, he was employed by The Boston Five Cents Savings Bank as a Commercial & Construction Lending Officer.

Michael W. McCurdy, Executive Vice President/General Counsel and Secretary/Director of Retail Banking. Mr. McCurdy was the President and Chief Executive Officer of BankMalden and joined Danversbank as a Senior Vice President for Legal and Corporate Operations when the merger of the two institutions took place in February, 2007. Mr. McCurdy currently serves as the Company's General Counsel and Director of Retail Banking. Prior to his tenure at BankMalden, Mr. McCurdy worked as an associate with a Boston law firm. Mr. McCurdy earned his B.A. in Political Science from University of California at Santa Barbara in 1990 and his J.D. from Suffolk Law School in 1996.

Mary C. McGovern, Senior Vice President/Chief Accounting Officer. Ms. McGovern joined Danversbank in May of 1999 as an Assistant Treasurer in the Finance Department. She has 20 years of banking experience having worked as a Financial Officer at Boston Private Bank & Trust Company for seven years and for four years as Assistant Controller at Capital Crossing Bank in Boston. Ms. McGovern was promoted to Assistant Vice President and Controller in January 2000 and to Vice President in March of 2002. She was promoted to First Vice President in November 2004, Chief Accounting Officer in December 2006, and to Senior Vice President in September of 2008. She manages the Finance Department, which is responsible for all financial reporting, wire transfer processing, budgeting, account reconciliations as well as maintaining all aspects of the general ledger. Ms. McGovern received her Bachelor of Arts degree in Mathematics from Emmanuel College and her M.B.A. in Finance at Babson College.

19

Table of Contents

Jack M. Murray, Jr., Senior Vice President/Chief Auditor. Mr. Murray joined Danversbank in 2002 as Vice President, Risk Management. He previously held positions with MetroWest Bank as Senior Vice President—Director of Internal Audit from 1998 to 2001, and as Senior Manager at KPMG LLP from 1994 to 1998. Mr. Murray oversees the Internal Audit function. He reports directly to the Audit Committee of the Board of Directors and administratively to James J. McCarthy, Executive Vice President & Chief Operating Officer.

L. Mark Panella, Executive Vice President/Chief Financial Officer. Mr. Panella joined the Danversbank in July of 1995 as Senior Vice President and Chief Financial Officer. He previously worked at Boston Private Bank & Trust Company as the Chief Financial Officer, Senior Operations Officer and Treasurer. He has also worked for two companies that provided software solutions to the banking industry. Mr. Panella is primarily responsible for the Company's financial reporting, investor relations, budgeting, insurance contract negotiations and overall accounting and regulatory compliance. He earned his B.A. in Economics from Dartmouth College in 1978.

Peter Z. Shabowich, Senior Vice President/Chief Investment Officer. Mr. Shabowich joined Danversbank in June of 1983. Mr. Shabowich manages the Company's investment portfolio, is responsible for external borrowings, and formulates ALCO strategies. Mr. Shabowich works with the loan department on interest rate swaps and derivative products. In addition, Mr. Shabowich serves as the Company's Director of Security. Mr. Shabowich earned a B.A. from Merrimack College in 1986, his M.B.A. from Salem State College in 1993 and his M.S. in Criminal Justice Administration from Western New England College in 1995.

20

Table of Contents

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This section provides a description of the roles and responsibilities of the Compensation Committee of the Company's Board of Directors. Additionally, this section details the Company's executive compensation philosophy and contains a discussion of each material element of the Company's executive officer compensation program as it relates to the following "named executive officers" (the "Named Officers") whose compensation information is detailed more completely in the tables contained in the following section:

| | |

| Kevin T. Bottomley | | President & Chief Executive Officer |

| James J. McCarthy | | Executive Vice President/Chief Operating Officer |

| John J. O'Neil | | Executive Vice President/Chief Lending Officer |

| L. Mark Panella | | Executive Vice President/Chief Financial Officer |

| Michael W. McCurdy | | Executive Vice President/General Counsel and Secretary/

Director of Retail Banking |

Executive Summary

The Company's success depends on our ability to hire and retain highly qualified executives that have the potential to influence our performance and enhance shareholder value over time. The Company seeks to accomplish this goal in a way that is aligned with the long-term interests of the Company's shareholders. The Compensation Committee oversees the executive compensation program and determines the compensation for the Company's executive officers. The Committee believes that the Named Officers were instrumental in helping the Company achieve strong financial performance in the challenging economic environment in 2009.

In 2009, the Company reported relatively strong financial results and completed the acquisition of Beverly National Corporation and its subsidiary Beverly National Bank. At year end, the Company recorded net income of $5.3 million and assets of $2.5 billion. The Company's total deposit balances increased by $647 million, or 57.9% for the year ended December 31, 2009, and the Company opened new branch locations in Cambridge and Waltham. In 2009, the Company reported loan growth of $547 million and its asset quality metrics remained relatively stable. (The Company's deposit and loan growth figures for 2009 include its acquisition of Beverly National Corporation).

The Company believes that the executive compensation program has served the Company well, as evidenced by the Company's performance in 2009.

Role of the Compensation Committee