As filed with the Securities and Exchange Commission on March 31, 2010

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| Covenant Group of China Inc. |

| (Name of Registrant as specified in its charter) |

| Nevada | | 000-53463 | | 27-051555191 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

Two Bala Plaza, Suite 300

Bala Cynwyd, PA 19004

(610) 660-7828

(Address and telephone number of principal executive offices and principal place of business)

Mr. Kenneth Wong

President

Covenant Group of China Inc.

Two Bala Plaza, Suite 300

Bala Cynwyd, PA 19004

(610) 660-7828

(Name, address and telephone number of agent for service)

Copies to:

William Uchimoto, Esq. Stevens & Lee, PC 1818 Market St. Philadelphia, PA 19103 (215) 751-2876 | Wesley R. Kelso, Esq. Stevens & Lee, PC 51 South Duke St. Lancaster, PA 17602 (717) 399-6632 |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: S

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated Filer | o |

Non-accelerated filer (Do not check if a smaller reporting company) | o | Smaller reporting company | x |

Calculation of Registration Fee

Title of Each Class of Securities To Be Registered | | Amount To Be Registered | | | Proposed Maximum Offering Price Per Unit | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee | |

| | | | | | | | | | | | | |

| Common Stock ($0.00001 par value) (1) | | | | | | | | $ | 74,400,000 | | | $ | 5,305 | |

| | | | | | | | | | | | | | | |

| Common Stock Underlying Warrants (2) | | | 300,000 | | | $ | 2.00 | | | $ | 600,000 | | | $ ____43 | |

| | | | | | | | | | | | | | | | | |

| Total | | $ | 75,000,000 | | | | -- | | | $ | 75,000,000 | (3) | | $ | 5,348 | (6) |

| (1) | Subject to note 3 below, there are being registered an indeterminate number of shares of common stock as may, from time to time, be issued by Covenant Group of China Inc. at indeterminate prices or upon the exercise of the common stock warrants being registered hereunder, as the case may be. Pursuant to Rule 416 under the Securities Act, the shares being registered hereunder include such indeterminate number of shares of common stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or other similar transactions. Pursuant to Rule 457(i) under the Securities Act, the shares being registered hereunder include such indeterminate number of shares of common stock as may be issuable upon conversion of any warrants issued under this registration statement. |

| (2) | There is currently being registered a warrant to purchase 300,000 shares of common stock of Covenant Group of China Inc. An indeterminate number of further warrants to purchase shares of common stock of Covenant Group of China Inc. may be sold, from time to time, by Covenant Group of China Inc. Warrants may be sold separately or with the common stock. |

| (3) | The aggregate maximum public offering price of all offered securities issued pursuant to this registration statement will not exceed $75,000,000. |

| (4) | Calculated in accordance with Rule 457(o) under the Securities Act of 1933, as amended, at the statutory rate of $71.30 per $1,000,000 of securities registered, pursuant to which a registration fee of $5,348 is being paid with respect to $75,000,000 of the registrant’s securities. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the United States Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting offers to buy, these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED MARCH 31, 2010

COVENANT GROUP OF CHINA INC.

$75,000,000

of Common Stock and Warrants

We may, from time to time, offer and sell shares, and warrants to purchase shares, of our common stock, par value $0.00001 per share.

On January 31, 2010 we entered into an equity credit agreement with Southridge Partners II, LP, or Southridge, pursuant to which we may from time to time sell to Southridge shares of our common stock for aggregate gross proceeds of up to $20,000,000 under this registration statement (the “Equity Credit Agreement”). Any shares of our common stock sold under the Equity Credit Agreement will be covered by a prospectus supplement specifying, among other things, the number of shares sold and the price per share.

In connection with the Equity Credit Agreement, we are issuing to Southridge a warrant to purchase 300,000 shares of common stock for a five year period at an initial purchase price of $2.00 per share, subject to adjustment.

You should carefully read this prospectus and the applicable prospectus supplement before deciding to buy any of these securities.

THIS PROSPECTUS MAY NOT BE USED TO OFFER OR SELL ANY SECURITIES UNLESS ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

The maximum aggregate offering price for the securities registered pursuant to this registration statement will not exceed $75,000,000. We will describe the terms of any such offering in a supplement to this prospectus. Any prospectus supplement may also add, update, or change information contained in this prospectus. Such prospectus supplement will contain the following information about the offered securities:

· | offering price, any underwriting discounts and commissions or agency fees, and our net proceeds; |

· | any market listing and trading symbol; |

· | names of lead or managing underwriters or agents and description of underwriting or agency arrangements; and |

· | the specific terms of the offered securities. |

Our shares of common stock trade on the Over-the-Counter Bulletin Board (“OTC.BB”) under the symbol “CVGC.” On March 22, 2010, the last reported sale price for our common stock was $2.45 per share. You are urged to obtain current market quotations for our common stock.

You should consider carefully the risk factors beginning on page 10 of this prospectus. You should carefully review the risks and uncertainties described under the heading “Risk Factors” contained in the applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this preliminary prospectus is March 31, 2010.

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any time after its date.

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this shelf registration process, we may, from time to time, sell common stock or warrants to purchase common stock in one or more series of offerings for total gross proceeds of up to $75,000,000.

Each time we offer securities under this prospectus, we will provide a prospectus supplement that will contain specific information about the terms of that offering and securities offered. We may also add, update, or change in the prospectus supplement any of the information contained in this prospectus. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement. We urge you to carefully read this prospectus and any applicable prospectus supplement before deciding to buy any of these securities.

We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock. The rules of the SEC may require us to update this prospectus in the future.

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. Before investing in the securities offered hereby, you should read the entire prospectus, including our financial statements and related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In this prospectus, the terms “Covenant,” “the Company,” “we,” “us,” and “our” refer to Covenant Group of China, Inc.

Our Company

We are a holding company engaged in the business of acquiring equity interests in private companies based and operating in the People’s Republic of China (“PRC” or “China”) and providing these companies with support, including administrative, legal, accounting and marketing assistance, and an infusion of capital with the long term goal of preparing them to become public companies in their own right. We believe that equity investments in China present one of the most attractive global investment opportunities available in the coming four to seven years. We plan to focus on growth company acquisitions located in China. The local Chinese equity markets are highly concentrated, serving only a small fraction of the local corporate market. This fact, taken together wi th the current international economic uncertainty, presents a unique opportunity to acquire small, growing and profitable Chinese companies at historically realistic valuations.

We were incorporated in the State of Nevada on November 8, 2006 under the name Everest Resources Corp. (“Everest”) as an exploration stage corporation that intended to engage in the exploration of gold. On December 24, 2009 we changed our name to Covenant Group of China Inc. and acquired all of the equity interests in Covenant Group Holdings Inc. (“Covenant Holdings”), a privately held company incorporated under the laws of the State of Delaware and engaged in the business of acquiring equity interests in private Chinese operating companies and providing these companies with strategic support. The acquisition of the equity interests of Covenant Holdings was accomplished on December 24, 2009 pursuant to the terms of a Share Exchange Agreement by and among the Company, Covenant Hol dings and all of the shareholders of Covenant Holdings. Upon the closing of the share exchange, each of the Covenant Holdings shareholders exchanged their respective shares of Covenant Holdings, on a one-for-one basis, for 9,380,909 shares of the Company’s common stock. As a result of the share exchange, Covenant Holdings became a wholly owned subsidiary of the Company.

Prior to our acquisition of Covenant Holdings, we were in the development stage and had minimal business operations. We had no interest in any property, but had the right to conduct mineral exploration activities on 471 acres located in southern British Columbia, Canada pursuant to an agreement with the former majority shareholder of the Company, Gary Sidhu. In connection with the acquisition of Covenant Holdings, Mr. Sidhu terminated the Company’s mineral exploration rights, and he agreed to surrender 5,000,000 shares of the Company’s common stock in exchange for $100,000 and a promissory note from the Company in the principal amount of $190,000, $90,000 of which the Company has prepaid. Mr. Sidhu has surrendered 4,500,000 shares of our common stock and has agreed to surrender his remaining 500,000 shares upon full payment of the promissory note by the Company. On March 25, 2010, Mr. Sidhu and the Company entered into an agreement pursuant to which Mr. Sidhu agreed to cancel the promissory note and surrender his remaining 500,000 shares in exchange for the Company issuing to him 300,000 shares of common stock of the Company.

There was no significant activity from June 10, 2009 through December 31, 2009 except for the acquisitions of our two operating subsidiaries, Hainan Jien and Chongqing Sysway. On June 24, 2009, Covenant Holdings entered into a stock acquisition and reorganization agreement with the Hainan Jien and its stockholders. Pursuant to the terms of this agreement, Covenant Holdings acquired 100% of the capital stock of Jien, representing 100% of the company’s outstanding equity interests, in exchange for 1,350,000 shares of a public shell's common stock. For purposes of this acquisition, the common stock of the shell company that would acquire all of the rights and obligations of Covenant Holdings was valued at $1.76 per share, which was determined by the volume weighted average stock price for the first day of trad ing of the Company’s common stock plus all private sales of Covenant Holdings’ common stock prior to the completion of the reverse merger with the Company. Jien was incorporated in Hainan Province, People’s Republic of China in 1999. Jien specializes in the design and installation of security and surveillance infrastructure to protect financial institutions and government agencies, and it also implements IC projects for commercial customers.

On June 24, 2009, Covenant Holdings entered into a stock acquisition and reorganization agreement with the Chongqing Sysway and its stockholders. Pursuant to the terms of this agreement, Covenant Holdings acquired 100% of the capital stock of Sysway, representing 100% of the company’s outstanding equity interests, in exchange for 1,400,000 shares of a public shell's common stock. For purposes of this acquisition, the common stock of the shell company that would acquire all of the rights and obligations of Covenant Holdings was valued at $1.76 per share, which was determined by the volume weighted average stock price for the first day of trading of the Company’s common stock plus all private sales of Covenant Holdings’ common stock prior to the completion of the reverse merger with the Company. & #160;Chongqing Sysway was incorporated in the Chongqing City, Sichuan Province, PRC, in 1999 as a State Owned Enterprise (“SOE”). In 2005, the two SOE shareholders sold their ownership shares among other original minority shareholders, and since then, Chongqing Sysway began to operate as a private enterprise mainly engaged in systems integration services, including computer systems installation, website design, and system firewall setup, particularly for the tobacco industry.

Our principal offices are located at Two Bala Plaza, Suite 300, Bala Cynwyd, Pennsylvania 19004. Our telephone number is (610) 660-7828.

The Offering

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission utilizing a shelf registration process. Under this shelf registration statement, we may, from time to time, sell any combination of common stock or warrants to purchase common stock in one or more offerings for total gross proceeds of up to $75,000,000. This prospectus provides you with a general description of the securities we may offer.

Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of the securities being offered. The prospectus supplement may add, update or change information contained in this prospectus and may include a discussion of any risk factors or other special considerations that apply to the offered securities. If there is any inconsistency between the information in this prospectus and a prospectus supplement, you should rely on the information in that prospectus supplement. Before making an investment decision, it is important for you to read and consider the information contained in this prospectus and any prospectus supplement, together with the additional information described under the heading “Available Information.”

Equity Credit Agreement

On January 31, 2010, we entered into the Equity Credit Agreement with Southridge. We may sell shares of our common stock to Southridge from time to time under the Equity Credit Agreement for aggregate gross proceeds of up to $20,000,000. We have no obligation to sell any shares under the equity credit agreement. Any shares of our common stock we do sell under the Equity Credit Agreement will be covered by a prospectus supplement specifying, among other things, the number of shares sold and the price per share.

We agreed in the Equity Credit Agreement to issue to Southbridge a warrant to purchase up to 300,000 shares of our common stock for a five year period at a purchase price of $2.00 per share (the “Southridge Warrant”). This prospectus supplement covers those warrants and the shares of common stock issuable upon exercise of those warrants.

The following is a brief summary of certain provisions of the Equity Credit Agreement, does not purport to be complete, and is qualified by reference in its entirety to the Equity Credit Agreement which is filed as an exhibit to the registration statement on Form S-1 of which this prospectus is a part.

Terms of Sale

We may require Southridge to purchase shares of our common stock from time to time under the equity credit agreement by delivering a put notice specifying the total purchase price for the shares to be purchased (the “Investment Amount”). The Investment Amount may not be greater than the lesser of (a) $1,000,000 or (b) 300% of the average dollar volume (closing bid price times the volume on the OTC.BB for a trading day) for the 20 trading days preceding the put notice.

The purchase price per share for the shares to be purchased for the Investment Amount will be 94% of the lowest closing bid price on the OTC.BB during the five trading days following the put notice (the “Valuation Period”).

If within 15 trading days after the closing of any purchase and sale of shares under the equity credit agreement (a “Closing”) the Company delivers a notice (a “Blackout Notice”) to Southridge that the Company’s Board of Directors has determined in good faith that (a) either (i) the Company possesses material information not ripe for disclosure in a registration statement or (ii) the Company is engaged in a material activity that would be adversely affected by disclosure in a registration statement and (b) the registration statement of which this prospectus is a part would be materially misleading absent the inclusion of such information and Southridge still holds shares of common stock purchased at such Closing and the Company suspends the right of Southridge to sell the common s tock for a period (a “Blackout Period”), the Company may be required to issue additional shares of common stock to Southridge if the closing bid price for the common stock on the first trading day following the Blackout Period (the “New Bid Price”) is less than the closing bid price for the common stock on the trading day immediately preceding the Blackout Period (the “Old Bid Price”). The number of additional shares to be issued, if any, will be equal to the difference between (a) the number of shares purchased at such Closing still held by Southridge (the “Remaining Shares”) multiplied by the Old Bid Price, divided by the New Bid Price and (b) the Remaining Shares.

Conditions to Obligation to Purchase Stock

The obligation of the Southridge to purchase shares of common stock at any Closing is subject to the satisfaction of the following conditions:

| · | a registration statement must be in effect; |

| · | the representations and warranties made by the Company must be true and correct in all material respects; |

| · | the Company must have performed all covenants, agreements and conditions required by the equity credit agreement and by a registration rights agreement entered into by the Company in connection with the equity credit agreement; |

| · | no statute, rule, regulation, executive order, decree, ruling, or injunction has been entered that prohibits or has a direct material adverse effect on the transactions under the equity credit agreement; |

| · | no material adverse development with respect to the business, operations, properties, or financial condition of the Company has occurred; |

| · | the Company must have delivered an opinion of the Company’s legal counsel prior to the first Closing; |

| · | the shares to be purchased by Southridge must not result in Southridge owning more than 4.99% of the Company’s outstanding common stock; |

| · | the shares to be purchased by Southridge must not exceed the amount that may be issued by the Company under the rules of the principal market in which the shares of common stock are traded; |

| · | the Company must have no knowledge of any event more likely than not to cause the registration statement pursuant to which the applicable prospectus supplement is delivered to be suspended or otherwise ineffective; and |

| · | since the date of the put notice for such Closing, there shall not have occurred a subdivision or combination of the Company’s common stock, a common stock dividend or distribution, the issuance of options or rights to purchase shares of common stock for a purchase price less than the closing bid price immediately prior to such issuance, the issuance of securities convertible into or exchangeable for shares of common stock for consideration less than the closing bid price in effect immediately prior to such issuance, any other issuance of shares of common stock for consideration lower than the closing bid price in effect immediately prior to such issuance, or certain distributions of assets or indebtedness or distributions in respect of the sale of all or substantially all of the Company’s assets. |

In addition, we may not deliver a put notice at any time during the continuance of any of the following events:

| · | the receipt of any request for additional information by the SEC or any other federal or state governmental authority for additional information or amendments or supplements to the registration statement or related prospectus; |

| · | the issuance of a stop order or the initiation of any proceedings for that purpose; |

| · | receipt of any notification with respect to the suspension of the qualification or exemption from qualification of the securities covered by this prospectus supplement for sale in any jurisdiction or the initiation or threatening of any proceedings for that purpose; |

| · | the occurrence of any event that makes any statement made in the registration statement or related prospectus or document incorporated by reference therein untrue in any material respect or that requires changes to such registration statement, prospectus, or document so that, in the case of the registration statement or prospectus it will not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading, in light of the circumstances under which they were made; and |

| · | the Company determines that a post-effective amendment to the registration statement would be appropriate. |

Our business and an investment in our securities are subject to a variety of risks. The following risk factors describe the most significant events, facts or circumstances that could have a material adverse effect upon our business, financial condition, results of operations, ability to implement our business plan, and the market price for our securities. Many of these events are outside of our control. The risks described below are not the only ones facing our company.

Risks Related to Our Business.

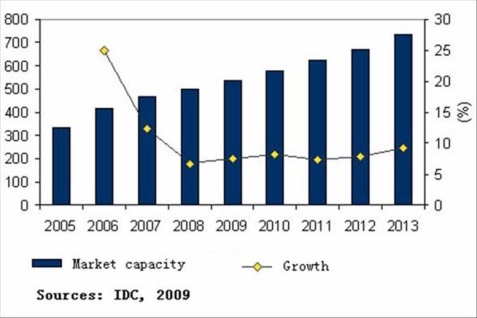

Our operating subsidiaries may not be able to adapt to rapid changes in the dynamic Chinese IT industry, thereby losing market share and revenue opportunities. The Chinese IT industry is extremely dynamic, characterized by rapid changes in technology and the frequent introduction of new and more advanced equipment and software applications. Our subsidiaries and the growth companies that we may acquire will be subject to the general risks, uncertainties and problems frequently encountered by similar companies operating in the Chinese IT industry. These include, among others, the following:

· the failure to anticipate and adapt to developing market trends;

· the failure to identify, develop and market services and products that respond to changing client needs and changing technological standards;

· the inability to maintain, upgrade and improve our current services and products;

· the inability to attract and retain skilled personnel, relevant to our companies' service and product offerings; and

· the failure to manage our currently rapidly expanding operations.

If our subsidiaries are unable to meet these challenges and any others that they may encounter, it is possible that they will lose market share and revenue opportunities and that our growth will be slowed.

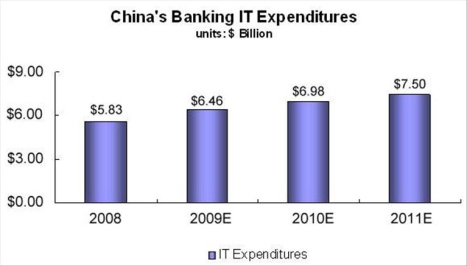

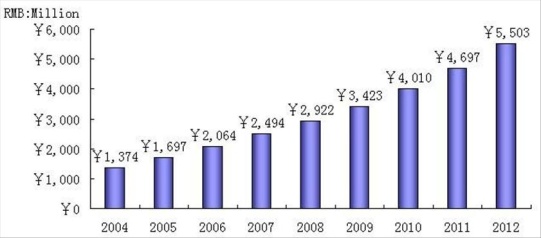

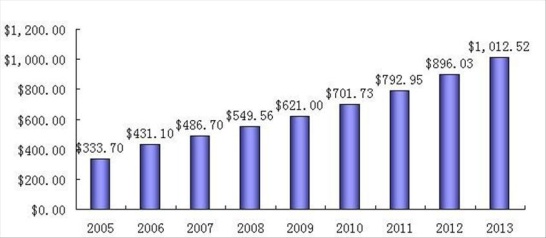

We depend on the financial services industry, and changes within that industry could reduce demand for products and services. Unfavorable economic conditions adversely impacting the financial services industry could have a material adverse effect on our business, financial condition and results of operations. For example, depository financial institutions have experienced, and may continue to experience, cyclical fluctuations in profitability as well as increasing challenges to improve their operating efficiencies. Due to the entrance of foreign global players, non-traditional competitors and the global financial crises, the profit margins of depository financial institutions have narrowed. As a result, some financia l institutions have slowed, and may continue to slow, their capital spending, including spending on web-based products and solutions, which can negatively impact sales to new and existing clients. Decreases in, or reallocation of, capital expenditures by our current and potential clients, unfavorable economic conditions and new or persisting competitive pressures affecting the financial services industry could adversely affect our business, financial condition and results of operations.

Our customer base includes commercial banks and financial institutions in the PRC. Any economic downturn or regional financial upheavals disrupting growth and developments in the PRC banking and the financial services sector would presumably result in the reduction of IT expenditures or the postponement of major IT upgrading projects. If that should occur, there would be a detrimental impact on our growth opportunities if banks and financial institutions in the PRC are less prepared to incur expenditures to purchase or upgrade IT infrastructure and security surveillance systems. Our financial performance and overall investor value may therefore be adversely affected.

There exists substantial and increasing competition with which our businesses must compete in service offerings and pricing, and if our subsidiaries are not successful in addressing those issues, they may lose market share and revenue potential. In general, the level of competition in the PRC market for IT services and solutions to the financial services sector is intense. We face competition from both local and international companies. Some of our competitors have longer operating histories, larger clientele, more varied service and product offerings and more extensive personnel and financial resources which place them in a better position than our subsidiaries to develop and expand their range of s ervices and market share. It is also expected that there will be competition from new entrants into the industry. Current or future competitors may develop or offer services that are comparable or superior to ours at a lower price. In addition, only some of the products and services of our companies are protected by intellectual property rights, therefore competitors would not be prevented from copying our business techniques. If we fail to successfully compete against our current and future competitors, our business, financial condition and operating results will be adversely affected.

In some service areas of the IT business, prices are decreasing and is adversely affecting margins in those areas; if our subsidiaries do not meet the resulting pricing structure or shift away from those areas of business to more profitable services, they may lose business opportunities and may experience losses. There has been increasing competition in some areas of IT consulting services, resulting in more competitive pricing and falling margins. Customers may elect to engage competitors who offer better pricing rather than use our subsidiaries. If our subsidiaries do not successfully manage their businesses and compete in these areas for engagements, they will suffer financial losses. Our subsidia ries may also address the competitive situation by shifting to other service areas where margins are better or they may provide extra services or enhancements that result in different pricing. If they are not successful in implementing new or differentiating services, they may suffer losses in particular segments of their businesses.

The failure to retain existing customers or changes in their continued use of our services will adversely affect operating results. Our subsidiaries, in part, compete using service and product fee structures designed to establish solid, long term client relationships and recurring revenues through ongoing usage by customers. Some of their revenues are dependent on recurring revenues and the continued acceptance of their services by customers in areas such as account presentation, payments and other financial services. The failure to retain the existing customers or a change in spending patterns and budgetary aspects of competing products would adversely affect our companies’ business model. Als o, competitors may compete directly with our businesses by adopting a similar business model or through the acquisition of companies, such as resellers, who provide complementary products or services.

As a holding company, our business plan calls for cross selling, development of new offerings and expanded marketing by our subsidiaries; if they are unable to achieve these goals, our subsidiaries will not grow as expected and the future value of our stock to investors may be less than expected. The expansion of our subsidiaries' businesses is dependent, in part, on developing, marketing, selling and supporting new financial products and services to the financial industry and cross selling to expand their customer base. If any new products developed prove defective or if the companies fail to properly market these products to the financial industry or sell these products to their customers, the busi nesses of our subsidiaries may not expand and grow. In such a circumstance, the value of these companies may remain stagnant or decline, which would adversely affect our financial condition and results of operations.

IT infrastructure components are obtained from selected suppliers; if the ability to obtain needed items is disrupted, our subsidiaries' businesses would be adversely affected. Many of the IT consulting services and system infrastructure installations conducted by our subsidiaries depend on the availability of the necessary hardware equipment and software applications from third parties. Our subsidiaries have established relations with selected suppliers. There is no assurance that these vendors/distributors will continue to offer needed items or not terminate their relationship with our subsidiaries. Although there are alternative suppliers for most of the needs, if our subsidiaries are unable to ob tain the necessary IT infrastructure components from these or comparable vendors/distributors on a timely basis, our business, financial condition and results of operation would be adversely affected.

If the senior management team and critical staff are not retained, our subsidiaries would suffer a loss of reputation and an inability to manage their commitments and expand their operations as planned. In a service-oriented business, personal relationships, goodwill and networks are critical in obtaining and maintaining customer engagements. The ability to successfully complete engagements depends on a trained, knowledgeable and stable staff. The success of our subsidiaries depends on the continued efforts of the senior management teams in building good relationships with existing and potential customers and in the implementation of their growth and business strategy and their company’s abilit y to retain and replace its staff. Each senior management team has substantial experience in the services offered by the company and has been instrumental in their past growth and expansion. The loss of any member of the senior management team and critical staff could, without adequate replacement, result in an adverse impact on their businesses, financial conditions and results of operations.

If our subsidiaries are unable to protect their proprietary technology and other rights, they may be unable to effectively compete. Our subsidiaries rely on a combination of patent, copyright, trademark and anti-competition laws, as well as licensing agreements, third-party nondisclosure agreements, internal confidentiality policies and other contractual provisions and technical measures to protect their intellectual property rights. There can be no assurance that these protections will be adequate to prevent competitors from copying or reverse-engineering our subsidiaries’ products, or that competitors will not independently develop technologies that are substantially equivalent or superior to our technology. To protect our subsidiaries’ trade secrets and other proprietary information, employees, consultants, advisors and collaborators are required to enter into non-disclosure confidentiality agreements. There can be no assurance that these agreements will provide meaningful protection for the trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. Although our subsidiaries hold registered rights covering certain aspects of their technology, there can be no assurance of the level of protection that these registrations will provide. Our subsidiaries may have to resort to litigation to enforce the intellectual property rights, to protect the trade secrets or know-how, or to determine their scope, validity or enforceability. Enforcing or defending intellectual property rights is expensive, could cause diversion of our resources and may not prove successful.

If our subsidiaries' proprietary rights infringe on those of other persons, they could be required to redesign those products, pay royalties or enter into license agreements with third parties or cease offering the infringing products or services, any of which could have an adverse impact on the business and revenues and profits of our subsidiaries and us. There can be no assurance that a third party will not assert that the intellectual property rights and services of our subsidiaries violates such third party’s intellectual property rights. To some extent, the law of the PRC is not extensively developed in the area of enforcement. As the number of products offered by our subsidiaries and comp etitors increases and the functionality of these products further overlap, the provision of web-based financial services technology may become increasingly subject to infringement claims. Any claims, whether with or without merit, could:

· be expensive and time consuming to defend or prosecute;

· cause our companies to cease making, licensing or using products that incorporate the challenged intellectual property;

· require our companies to redesign our products, if feasible;

· divert management's attention and resources; and

· require our companies to pay royalties or enter into licensing agreements in order to obtain the right to use necessary technologies.

System failures could hurt our business reputation, and our subsidiaries could be liable for some types of failures, the extent or amount of which cannot be predicted. The operations of our subsidiaries depend on their ability to protect their systems from interruption caused by damage from fire, earthquake, power loss, telecommunications failure, unauthorized entry or other events beyond our control. Our subsidiaries, in the future, plan to maintain their own offsite disaster recovery facility if it is necessary to their business strategies. In the event of major disasters, both primary and backup locations could be adversely impacted. Our subsidiaries do not currently have sufficient backup facilit ies to provide full Internet services if their primary facility is not functioning. They could also experience system interruptions due to the failure of their systems to function as intended or the failure of the systems relied upon to deliver services such as the Internet, certain services specific to the financial industry, processors that integrate with other systems and networks, and systems of third parties. Loss of all or part of the systems for a period of time could have a material adverse effect on our subsidiaries’ businesses and reputation. Our subsidiaries may be liable to their clients for breach of contract for interruptions in service. Due to the numerous variables surrounding system disruptions, the extent or amount of any potential liability cannot be predicted.

Security breaches could have a material adverse effect on our business and the business reputations of our subsidiaries. Computer systems may be vulnerable to computer viruses, hackers, and other disruptive problems caused by unauthorized access to, or improper use of, systems by third parties or employees. Although our subsidiaries intend to continue to implement state-of-the-art security measures, computer attacks or disruptions may jeopardize the security of information stored in and transmitted through computer systems of the clients and their end-users. Actual or perceived concerns that company systems may be vulnerable to such attacks or disruptions may deter financial services providers and co nsumers from using the company's services.

Data networks are also vulnerable to attacks, unauthorized access and disruptions. For example, in a number of public networks, hackers have bypassed firewalls and misappropriated confidential information. It is possible that, despite existing safeguards, an employee could divert end-user funds while these funds are in company control, exposing the subsidiaries to a risk of loss or litigation and possible liability. In dealing with numerous end-users, it is possible that some level of fraud or error will occur, which may result in erroneous external payments. Losses or liabilities that are incurred as a result of any of the foregoing could have a material adverse effect on the business of our subsidiaries.

The potential obsolescence of our subsidiaries' technology or the offering of new, more efficient means of conducting business could negatively impact our business. The industry for account presentation and payments services is relatively new and subject to rapid change. Success will depend substantially upon an ability to enhance existing products and to develop and introduce, on a timely and cost-effective basis, new products and features that meet the changing financial industry requirements and incorporate technological advancements. If our individual subsidiaries are unable to develop new products and enhanced functionalities or technologies to adapt to these changes, or if they cannot offset a decline in revenues of existing products by sales of new products, their business would suffer.

Our subsidiaries' businesses use internally developed software and systems as well as third-party products, any of which may contain errors and bugs, the effect of which could cause our subsidiaries to spend additional money and time to correct, cause a breach of services agreements and/or pay damages. Our subsidiaries' products may contain undetected errors, defects or bugs that may or may not be correctable. The products involve integration with products and systems developed by third parties. Complex software programs of third parties may contain undetected errors or bugs when they are first introduced or as new versi ons are released. There can be no assurance that errors will not be found in existing or future products or third-party products upon which our subsidiaries' products are dependent, which could result in delays, loss of market acceptance of their products, diversion of resources, injury to their reputation, and increased expenses and potentially the payment of damages.

Our subsidiaries could be sued for contract or product liability claims, and those lawsuits may disrupt our business, divert management's attention or have an adverse effect on our financial results. The financial industry uses our products and services to provide web-based account presentation, customer service and other financial services to their end-users. Failures in a client's system could result in an increase in service and warranty costs or a claim for substantial damages. There can be no assurance that the limitations of liability set forth in company contracts would be enforceable or would otherwise protect us from liability for damages. The successful assertion of one or more large claims could result in substantial cost to the company and divert management's attention from operations. Any contract liability claim or litigation against the company could, therefore, have a material adverse effect on the business, financial condition and results of operations. In addition, because many of our subsidiaries projects are business-critical projects for financial services providers, a failure or inability to meet a client's expectations could seriously damage the company's reputation and affect its ability to attract new business.

Part of the business plan in the future is to seek additional services and clients and business opportunities through the acquisition of related service and product providers; in such acquisitions, we will have to manage the integration of the acquired business operations, systems and personnel, which may be disruptive to ongoing business, not successful, or more costly than estimated. Part of our business plan for our individual subsidiaries is to acquire additional businesses. To achieve the anticipated benefits of these acquisitions, our subsidiaries will need to successfully integrate the acquired employees, products and services, data and business methods of operations. In addition, o ur subsidiaries may also have to consolidate certain functions and integrate procedures, personnel, product lines and operations in an efficient and effective manner. The integration process may be disruptive to, and may cause an interruption of, business as a result of a number of potential obstacles, such as:

· the loss of key employees or customers;

· the need to coordinate diverse organizations;

· difficulties in integrating administrative and other functions;

· the loss of key members of management following the acquisition; and

· the diversion of management's attention from our day-to-day operations.

We have not entered into definitive negotiations with any other target Chinese operating companies at this time, and therefore we cannot provide further specific information to you. In this regard, we are not dissimilar from a blank check company whereby the success of the Company will be predicated upon finding suitable acquisition target companies, successfully purchasing them at a fair and economical price, and integrating them into the business culture of the Company.

If our subsidiaries are not successful in integrating these businesses or if the integrations take longer than expected, there could be significant costs and our businesses could be adversely affected.

We will incur costs as a result of being a public company, and the requirements of being a public company may divert management’s attention from our business and adversely affect our financial results. As a public company, we will be subject to a number of requirements, including the reporting requirements of the Exchange Act, Sarbanes-Oxley and eventually the listing standards of the NASDAQ Capital Market. These requirements will cause us to incur costs and might place a strain on our systems and resources. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and financial condition. Sarbanes-Oxley requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight will be required. As a result, our management’s attention might be diverted from other business concerns, which could have a material adverse effect on our business, results of operations and financial condition. Furthermore, we might not be able to retain our independent directors or attract new independent directors for our committees.

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our business and adversely impact the trading price of our common stock. We are required to establish and maintain internal control over financial reporting, disclosure controls, and to comply with other requirements of Sarbanes-Oxley and the rules promulgated by the SEC thereunder. Our management, including our President, cannot guarantee that our internal controls and disclosure controls will prevent all possible errors or all fraud . A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. In addition, the design of a control system must reflect the fact that there are resource constraints and the benefit of controls must be relative to their costs. Because of the inherent limitations in all control systems, no system of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake. Further, controls can be circumvented by individual acts of some persons, by collusion of two or more persons, or by management override of the controls. The design of any system of controls also is based in part upon certain assumptions about the likeliho od of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, a control may become inadequate because of changes in conditions or the degree of compliance with policies or procedures may deteriorate. Because of inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not be detected.

All of Covenant Holdings' liabilities survived its acquisition by the Company and there may be undisclosed liabilities that could have a negative impact on our financial condition. Before the share exchange, certain due diligence activities on the Company and Covenant Holdings were performed. The due diligence process may not have revealed all liabilities (actual or contingent) of the Company and Covenant Holdings that existed or which may arise in the future relating to the Company's activities before the consummation of the acquisition. Notwithstanding that Mr. Sidhu agreed to release and indemnify the Company of all liability related to the Company’s ownership interest in the mineral exploration rights in Canada, it is possible that claims for such liabilities may still be made against us, which we will be required to defend or otherwise resolve. The provisions and terms of the termination agreement may not be sufficient to protect us from claims and liabilities and any breaches of related representations and warranties. Any liabilities remaining from the Company's pre-closing activities could harm our financial condition and results of operations.

New accounting standards could result in changes to our methods of quantifying and recording accounting transactions, and could affect our financial results and financial position. Changes to United States generally accepted accounting principles, or GAAP, arise from new and revised standards, interpretations, and other guidance issued by the Financial Accounting Standards Board, or FASB, the SEC, and others. The effects of such changes may include prescribing an accounting method where none had been previously specified, prescribing a single acceptable method of accounting from among several acceptable methods that currently exist, or revoking the acceptability of a current method and rep lacing it with an entirely different method, among others. Such changes could result in unanticipated effects on our results of operations, financial position, and other financial measures.

Risks Related to Doing Business in China.

We may have difficulty establishing adequate management, legal and financial controls in China. Historically, China has not adopted a Western style of management and financial reporting concepts and practices, as well as modern banking, computer and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in China. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

In December 2009, the board of directors of Chongqing Sysway, one of our wholly owned Chinese subsidiaries, declared and paid a $322,061 dividend to the original shareholders and management of the company without the authorization of Covenant’s board of directors. In a December 2009 meeting of the Chongqing Sysway board, the board resolved to declare a dividend payment to the original shareholders and management of the company based on 2007 earnings on the assumption that it was permissible. Upon our receipt of a report from our independent accountants, we determined that this payment was outside the parameters of our acquisition agreement with Chongqing Sysway and had to be reversed. Moreover, in the event the management and original shareholders of Chongqing Sysway fail to repay the dividend, C hongqing Sysway will have a continuing obligation under PRC law to repay that portion of the dividend attributable to prior years losses carried forward in retained earnings (1,528,642 RMB ($223,793) at December 31, 2009), plus applicable surplus reserves. Consequently, the original shareholders and management of Chongqing Sysway have executed a promissory note to repay the full $322,061 dividend to Chongqing Sysway by April 15, 2010 as recourse for the unauthorized payment. However, the Company provides no assurances that it can enforce a judgment in its or Chongqing Sysway’s favor in the event the original shareholders and management of Chongqing Sysway default under the promissory note and fail to repay the funds by April 15, 2010. See Our Business—History.

Recent Chinese regulations relating to the establishment of offshore special purpose companies by Chinese residents and registration requirements for employee stock ownership plans or share option plans may subject our Chinese resident shareholders to personal liability and limit our ability to acquire companies in China or to inject capital into our subsidiaries in China, limit our Chinese subsidiaries' ability to distribute profits to us, or otherwise materially and adversely affect us. The Chinese State Administration of Foreign Exchange ("SAFE") issued a public notice in October 2005, requiring Chinese residents, including both legal persons and natural persons, to register with the competent local SAFE branch before establishing or controlling any company outside of China established for the purpose of acquiring any assets of or equity interest in companies in China and raising funds from overseas (referred to as an “offshore special purpose company”). In addition, any Chinese resident that is a shareholder of an offshore special purpose company is required to amend his or her SAFE registration with the local SAFE branch in the event of any increase or decrease of capital, transfer of shares, merger, division, equity investment or creation of any security interest over any assets located in China with respect to that offshore special purpose company. To further clarify the implementation of Circular 75, the SAFE issued Circular 124 and Circular 106 on November 24, 2005 and May 29, 2007, respectively. Under Circular 106, PRC subsidiaries of an offshore special purpose company are required to coordinate and supervise the filing of SAFE registrations by the offshore holding company’s shareholders who are Chines e residents in a timely manner. If these shareholders fail to comply, the Chinese subsidiaries are required to report to the local SAFE authorities. If the Chinese subsidiaries of the offshore parent company do not report to the local SAFE authorities, they may be prohibited from distributing their profits and proceeds from any reduction in capital, share transfer or liquidation to their offshore parent company, and the offshore parent company may be restricted in its ability to contribute additional capital into its Chinese subsidiaries. Moreover, failure to comply with the above SAFE registration requirements could result in liabilities under China law for evasion of foreign exchange restrictions. The failure or inability of these Chinese resident beneficial owners to comply with the applicable SAFE registration requirements may subject these beneficial owners or us to the fines, legal sanctions and restrictions described above.

On March 28, 2007, SAFE released detailed registration procedures for employee stock ownership plans or share option plans to be established by overseas listed companies and for individual plan participants. Any failure to comply with the relevant registration procedures may affect the effectiveness of our employee stock ownership plans or share option plans and subject the plan participants, the companies offering the plans or the relevant intermediaries, as the case may be, to penalties under PRC foreign exchange regime. These penalties may subject us to fines and legal sanctions, prevent us from being able to make distributions or pay dividends, as a result of which our business operations and our ability to distribute profits to our shareholders could be materially and adversely affected.

In addition, the National Development and Reform Commission ("NDRC") promulgated a rule in October 2004, or the NDRC Rule, which requires NDRC approvals for overseas investment projects made by PRC entities. The NDRC Rule also provides that approval procedures for overseas investment projects of PRC individuals must be implemented with reference to this rule. However, there exist extensive uncertainties in terms of interpretation of the NDRC Rule with respect to its application to a PRC individual’s overseas investment, and in practice, we are not aware of any precedents that a PRC individual’s overseas investment has been approved by the NDRC or challenged by the NDRC based on the absence of NDRC approval. Our current beneficial owners who are PRC individuals did not apply for NDRC approval for investment in us. We cannot predict how and to what extent this will affect our business operations or future strategy. For example, the failure of our shareholders who are PRC individuals to comply with the NDRC Rule may subject these persons or our PRC subsidiary to certain liabilities under PRC laws, which could adversely affect our business.

Chinese regulation of loans and direct investment by offshore holding companies to Chinese entities may delay or prevent us from using the proceeds of this offering to make loans or additional capital contributions to our operating subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business. We may make loans to our subsidiaries, or we may make additional capital contributions to our subsidiaries. Any loans to our subsidiaries are subject to Chinese regulations. For example, loans by us to our subsidiaries in China, which are foreign-invested enterprises, to finance their activities cannot exceed statutory limits and must be registered with the SAFE.

We may also decide to finance our subsidiaries by means of capital contributions. These capital contributions must be approved by the Ministry of Commerce or its local counterpart. We cannot assure you that we will be able to obtain these government approvals on a timely basis, or if at all, with respect to future capital contributions by us to our subsidiaries. If we fail to receive such approvals, our ability to capitalize our Chinese operations may be negatively affected, which could adversely affect our liquidity and our ability to fund and expand our business.

A return to profit repatriation controls may limit the ability to expand business and reduce the attractiveness of investing in Chinese business opportunities. PRC law allows enterprises owned by foreign investors to remit their profits, dividends and bonuses earned in the PRC to other countries, and the remittance does not require prior approval by SAFE. SAFE regulations required extensive documentation and reporting, some of which was burdensome and slowed payments. If there is a return to payment restrictions and reporting, the ability of a Chinese company to attract investors will be reduced. Also, current investors may not be able to obtain the profits of the business in which they own for other reasons. Relevant PRC law and regulation permit payment of dividends only from retained earnings, if any, determined in accordance with PRC accounting standards and regulations. It is possible that the PRC tax authorities may require changes in the income of the company that may limit its ability to pay dividends and other distributions to shareholders. PRC law requires companies to set aside a portion of net income to fund certain reserves, which amounts are not distributable as dividends. These rules and possible changes could restrict our companies from repatriating funds to us, and ultimately, our shareholders as dividends.

The economy of China has been experiencing unprecedented growth and this has resulted in some inflation. If the Chinese government tries to control inflation by traditional means of monetary policy or returns to planned economic techniques, our business will suffer a reduction in sales growth and expansion opportunities. The rapid growth of the Chinese economy has resulted in higher levels of inflation. If the government tries to control inflation, it may have an adverse effect on the business climate and growth of private enterprise in the PRC. An economic slow down will have an adverse effect on our sales and may increase costs. On the other hand, if inflation is allowed to proceed unch ecked, our companies' costs would likely increase, and there can be no assurance that they would be able to increase their prices to an extent that would offset the increase in their expenses.

We are subject to international economic and political risks over which we have little or no control and may be unable to alter our business practice in time to avoid the possibility of reduced revenues. Our business is conducted in China. Doing business outside the United States, particularly in China, subjects us to various risks, including changing economic and political conditions, major work stoppages, exchange controls, currency fluctuations, armed conflicts and unexpected changes in United States and foreign laws relating to tariffs, trade restrictions, transportation regulations, foreign investments and taxation. We have no control over most of these risks and may be una ble to anticipate changes in international economic and political conditions and, therefore, unable to alter our business practice in time to avoid the possibility of reduced revenues.

China's economic policies could affect our business. Substantially all of our assets are located in China and all of our revenue is derived from our operations in China. Accordingly, our results of operations and prospects are subject, to a significant extent, to the economic, political and legal developments in China.

While China's economy has experienced significant growth in the past twenty years, such growth has been uneven, both geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall economy of China, but they may also have a negative effect on us. For example, operating results and financial condition may be adversely affected by government control over capital investments or changes in tax regulations. The economy of China has been changing from a planned economy to a more market-oriented economy. In recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform and the reduction of state ownership of productive assets, and the establishment of corporate governance in business enterprises; however, a substantial portion of productive assets in China are still owned by the Chinese government. In addition, the Chinese government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over China's economic growth through the allocation of resources, the control of payment of foreign currency-denominated obligations, the setting of monetary policy and the provision of preferential treatment to particular industries or companies.

China could change its policies toward private enterprise or even nationalize or expropriate private enterprises. Our business is subject to significant political and economic uncertainties and may be affected by political, economic and social developments in China. Over the past several years, the Chinese government has pursued economic reform policies including the encouragement of private economic activity and greater economic decentralization. The Chinese government may not continue to pursue these policies or may significantly alter them to our detriment from time to time with little, if any, prior notice.

Changes in policies, laws and regulations or in their interpretation or the imposition of confiscatory taxation, restrictions on currency conversion, restrictions or prohibitions on dividend payments to stockholders, or devaluations of currency could cause a decline in the price of our common stock. Nationalization or expropriation could even result in the total loss of an investment in our stock.

The nature and application of many laws of China create an uncertain environment for business operations and they could have a negative effect on us. The legal system in China is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, China began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in China and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corpo rate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could cause a decline in the price of our common stock. In addition, as these laws, regulations and legal requirements are relatively recent, their interpretation and enforcement involve significant uncertainty.

If certain exemptions within the PRC regarding withholding taxes are removed, our subsidiaries may be required to deduct Chinese corporate withholding taxes from any dividends that are paid to us, which will reduce the return on our investment. Under current PRC tax laws, regulations and rulings, Chinese companies are exempt from paying withholding taxes with respect to dividends paid to stockholders outside the PRC. If the foregoing exemption is eliminated, in the future our Chinese subsidiaries may be required to withhold such taxes on dividends paid to the Company.

The PRC legal system has inherent uncertainties that could limit the legal protections available to you. Most of the Company assets and all of our operations are in the PRC. The Chinese legal system is based on written statutes. Prior court decisions may be cited for reference but are not binding on subsequent cases and have limited precedential value. Since 1979, the Chinese legislative bodies have promulgated laws and regulations dealing with such economic matters as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their non-binding nature, the interpretation and enforcement of these l aws and regulations involve uncertainties. The laws in the PRC differ from the laws in the United States and may afford less protection to our shareholders. Unlike laws in the United States, the applicable laws of China do not specifically allow shareholders to sue the directors, supervisors, officers or other shareholders on behalf of the company to enforce a claim against these parties that the company has failed to enforce itself. Therefore, any action brought against the company or its officers and directors or its assets may be very difficult to pursue if not impossible. It is unlikely that any suit in the PRC would be able to be based on theories common in the United States or based on United States securities laws.

It will be extremely difficult to acquire jurisdiction and enforce liabilities against any officers, directors, advisory board members and assets based in China. As our executive officers, advisory board members and directors may be Chinese citizens, it may be difficult, if not impossible, to acquire jurisdiction over these persons in the event a lawsuit is initiated against us and/or our officers and directors by a shareholder or group of shareholders in the United States. Also, because our operating subsidiaries and assets are located in China, it may be extremely difficult or impossible for you to access those assets to enforce judgments rendered against us or our executive officers, advisory board members or directors by U.S. courts.& #160; In addition, the courts in China may not permit the enforcement of judgments arising out of U.S. federal and state corporate, securities or similar laws. Accordingly, U.S. investors may not be able to enforce judgments against us for violation of U.S. securities laws.

We may face judicial corruption in China. Another obstacle to foreign investment in China is corruption. There is no assurance that we will be able to obtain recourse in any legal disputes with suppliers, customers or other parties with whom we conduct business, if desired, through China's poorly developed and sometimes corrupt judicial systems.

If relations between the United States and China worsen, investors may be unwilling to hold or buy our stock and our stock price may decrease. At various times during recent years, the United States and China have had significant disagreements over political and economic issues. Controversies may arise in the future between these two countries. Any political or trade controversies between the United States and China, whether or not directly related to our business, could reduce the price of our common stock.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively. The Renminbi Yuan (“RMB” or “Renminbi”) is currently convertible under the “current account,” which includes dividends, trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, our Chinese subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of SAFE. However, the relevant Chinese government authorities may limit or eliminate their ability to purchase foreign currencies in the future. Since a significant amount of our future revenues will be denominated in Renminbi, any existing and future restrictions on currency exchange may limit our ability to utilize revenues generated in Renminbi to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by our Chinese subsidiaries under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with Chinese governmental authorities, including SAFE. In particular, if our Chinese subsidiaries borrow foreign currency loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance our Chinese subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the NDRC, the Ministry of Commerce, or MOFCOM, or their respective local counterparts. These limitations could affect the ability of our Chinese subsidiaries to obtain foreign exchange through debt or equity financing.

Fluctuation in the value of the RMB may reduce the value of your investment. The change in value of the RMB against the U.S. dollar, Euro and other currencies is affected by, among other things, changes in China’s political and economic conditions. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the current policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in a greater fluctuation range between RMB and the U.S. dollar. There remains significant international pressure on China to a dopt a more flexible and more market-oriented currency policy that allows a greater fluctuation in the exchange rate between the RMB and the U.S. dollar. Accordingly, we expect that there will be increasing fluctuations in the RMB exchange rate against the U.S. dollar in the near future. Any significant revaluation of the RMB may have a material adverse effect on the value of, and any dividends paid on, our common stock in U.S. dollar terms.

We face risks associated with currency exchange rate fluctuations; any adverse fluctuation may adversely affect our operating margins. Almost all of our revenues are denominated in Renminbi. Conducting business in currencies other than US dollars subjects us to fluctuations in currency exchange rates that could have a negative impact on our reported operating results. Fluctuations in the value of the US dollar relative to other currencies impact our revenues, cost of revenues and operating margins and result in foreign currency translation gains and losses. If the exchange rate of the Renminbi is affected by lowering its value as against the US dollar, our reported profitability when stated in US dollars will decrease. Historically, we have not enga ged in exchange rate hedging activities and have no current intention of doing so.

Risks Related to Our Securities

We may need additional capital to execute our business plan and fund operations and may not be able to obtain such capital on acceptable terms or at all. Capital requirements are difficult to plan in our rapidly changing industry. We expect that we will need additional capital to fund our future growth.

Our ability to obtain additional capital on acceptable terms or at all is subject to a variety of uncertainties, including:

| · | Investors' perceptions of, and demand for, companies in our industries; |

| · | Investors' perceptions of, and demand for, companies operating in the PRC |

| · | Conditions of the U.S. and other capital markets in which we may seek to raise funds; |

| · | Our future results of operations, financial condition and cash flows; |

| · | Governmental regulation of foreign investment in companies in particular countries; |

| · | Economic, political and other conditions in the United States, the PRC, and other countries; and |

| · | Governmental policies relating to foreign currency borrowings. |

We may be required to pursue sources of additional capital through various means, including joint venture projects and debt or equity financings. There is no assurance that we will be successful in locating a suitable financing transaction in a timely fashion or at all. In addition, there is no assurance that we will be successful in obtaining the capital we require by any other means. Future financings through equity investments are likely to be dilutive to our existing shareholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights, the issuance of warrants or other derivative securities, and the issuances of incentive awards under equity employee incentive plans, which may have additional dilu tive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our results of operations or financial condition.

If we cannot raise additional funds on favorable terms or at all, we may not be able to carry out all or parts of our strategy to maintain our growth and competitiveness or to fund our operations. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

The market price of our common stock may be volatile, which could cause the value of your investment to decline or could subject us to securities class action litigation. Many factors could cause the market price of our common stock to rise and fall, including the following:

| · | variations in our or our competitors’ actual or anticipated operating results; |

| · | variations in our or our competitors’ growth rates; |

| · | recruitment or departure of key personnel; |

| · | changes in the estimates of our operating performance or changes in recommendations by any securities analyst that follows our stock; |

| · | substantial sales of our common stock; or |

| · | changes in accounting principles. |