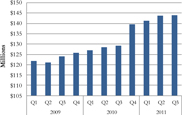

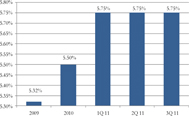

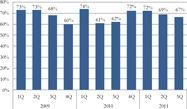

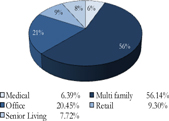

Letter to Investors Dear Investors: INREIT Real Estate Investment Trust (“INREIT”) achieved a significant milestone in the third quarter of 2011, as the United State Securities and Exchange Commission completed its review of the Trust’s Form 10 Registration Statement. As a result of this process, INREIT is now a publicly-reporting non-traded REIT. We are grateful to everyone involved in this thoughtful and comprehensive evaluation. In keeping with our pubic company status, we filed our third quarter report on Form 10-Q on November 14, 2011. This report contains a full description and discussion of INREIT’s third quarter 2011 financial and operational results. A copy of INREIT’s third quarter 10-Q is available on our website (www.INREIT.com) and the SEC’s website (www.sec.gov). We encourage you to page through this current report of our performance and operations. Highlights from the quarter ended September 30, 2011 include: • Rental Income increased 12.4% over the same nine-month period in 2010. • Interest Expense, as percent of total revenue, decreased from 26.6% in 2010 to 24.5% in the same nine-month period of 2011. • Total liabilities decreased more than $2.2 million in the third quarter 2011, due primarily to mortgage pay offs. • Investor equity increased $4.3 million since December 31, 2010 from $139.7 million to $143.9 million. • Shares and units outstanding increased 14.1% and 9.8% respectively, over the same nine-month period in 2010. • Cumulative dividends and distributions paid in 2011 exceeded $8.6 million. During the third quarter of 2011, INREIT successfully closed on the sale of its Colonial Plaza retail property in Norfolk, Nebraska. The sale was significant, in that, we eliminated our highest vacancy, and most underperforming property. As part of this sale, INREIT took in trade a nearly new, Class A, fully-leased office building in Norfolk’s business district valued at over $600,000. INREIT is a registered, but unincorporated business trust organized in North Dakota. INREIT elected to be taxed as a Real Estate Investment Trust (“REIT”) under Sections 856-860 of the Internal Revenue Code, which requires that 75 percent of the assets of a REIT must consist of real estate and that 75 percent of its gross income must be derived from real estate. INREIT Declares 3Q 2011 Dividend INREIT’s Board of Trustees authorized a dividend of $0.2012 per share (equates to an annualized rate of 5.75%), based on the offering price of $14.00 per share for stockholders of record as of September 30, 2011. The payment date for the distribution for the period commencing on July 1 and ending on September 30, 2011 was paid in October 15. Cautionary Language Concerning Forward-Looking Statements Certain statements in this update are “forward looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties, and other factors including, but are not limited to: fluctuations in interest rates, the effect of government regulations, the availability of capital, changes in general and local economic and real estate market conditions, competition, our ability to attract and retain skilled personnel, intentions and expectations regarding future dividends and those risks and uncertainties detailed from time to time in our filings with the Securities & Exchange Commission, including our Form 10. We assume no obligation to update or supplement forward looking statements that become untrue because of subsequent events. |