UNITED STATES

SECURITIES AND ECHANGE COMMISSION

Washington, C.D. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

[X] Preliminary Information Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)2))

[ ] Definitive Information Statement

MANTRA VENTURE GROUP LTD.

(Name of Registrant as Specified in Charter)

| Payment of Filing Fee (Check the appropriate box): |

| |

| [X] | No fee required |

| | |

| [ ] | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| 1. | Title of each class of securities to which transaction applies: |

| | |

| 2. | Aggregate number of securities to which transaction applies: |

| | |

| 3. | Per unit price or other underlying value of transaction, computed pursuant to Exchange Act Rule O- 11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| 4. | Proposed maximum aggregate value of transaction: |

| | |

| 5. | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| | |

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | Amount Previously Paid: |

| | |

| 2. | Form Schedule or Registration Statement No.: |

| | |

| 3. | Filing Party: |

| | |

| 4. | Date Filed: |

2

SCHEDULE 14C INFORMATION STATEMENT

Pursuant to Regulation 14C of the Securities Exchange Act of 1934 as amended

MANTRA VENTURE GROUP LTD.

1562 128th Street

Surrey, BC V4A 3T7

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is furnished by the Board of Directors of Mantra Venture Group Ltd., a British Columbia corporation (“we”, “our”, “us”, the “corporation"), to the holders of record at the close of business on the record date, November 6, 2015 of our outstanding common stock, $0.0001 par value per share, pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended. This Information Statement is being furnished to such stockholders for the purpose of informing the stockholders in regards to:

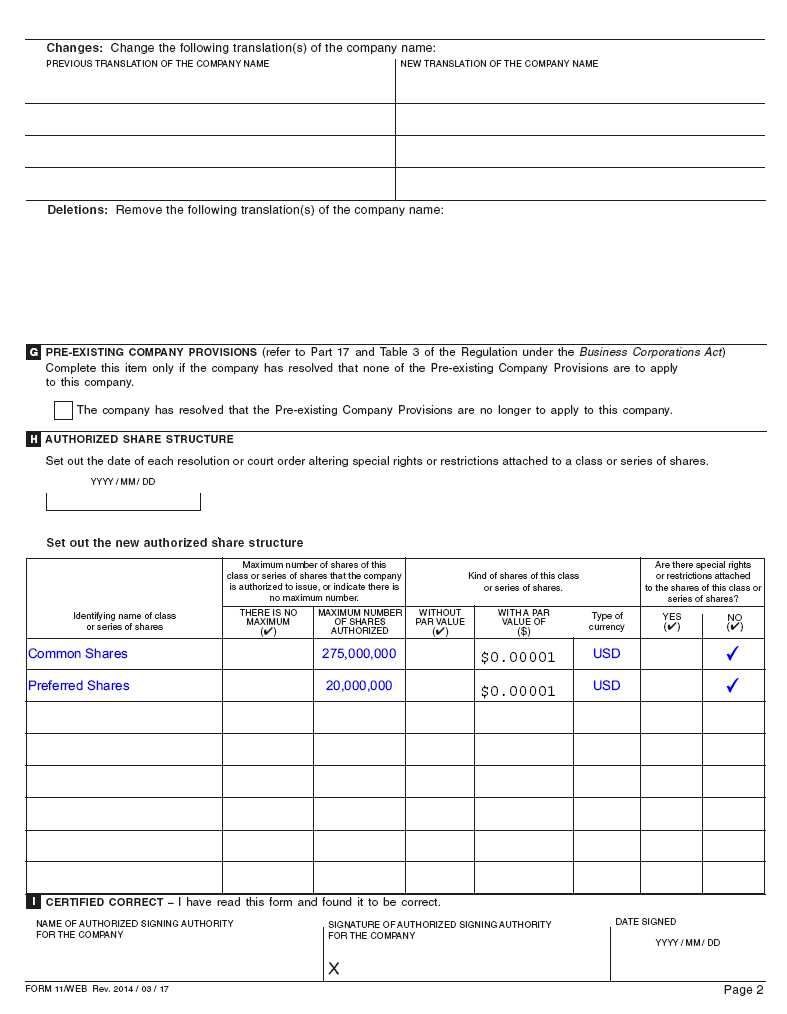

- an amendment (the “Amendment”) to our Notice of Articles to increase the authorized number of shares of our common stock from 100,000,000 shares of common stock, par value $0.00001 to 275,000,000 shares of common stock, par value of $0.00001 per share.

Our Board of Directors approved the Amendment on November 3, 2015.

On November 4, 2015, subsequent to the approval by our Board of Directors of the, the holder of the majority of the outstanding shares of our corporation entitled to vote gave us written consent for the Amendment.

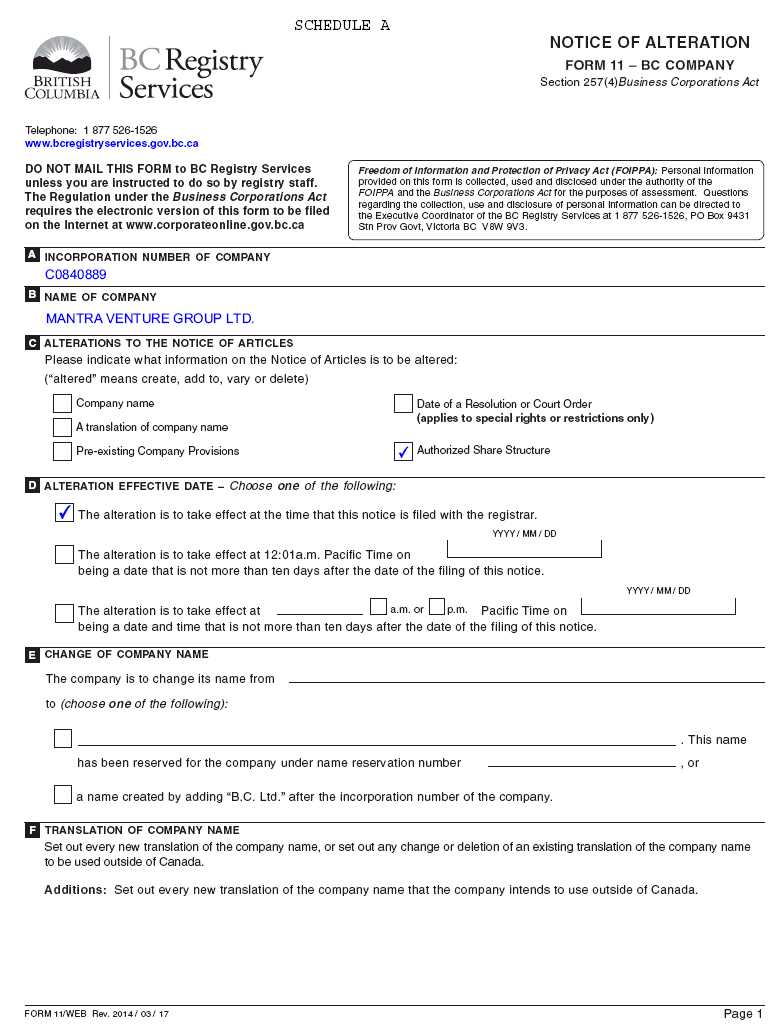

Following the expiration of the twenty-day (20) period mandated by Rule 14c, our corporation will file a Notice of Alteration to amend our Notice of Articles to give effect to the Amendment. We will not file the Notice of Alteration to our Notice of Articles until at least twenty (20) days after the filing and mailing of this Information Statement. The proposed Certificate of Amendment to our Notice of Articles is attached hereto as Schedule A. The Certificate of Amendment will become effective when it is filed with the British Columbia Register of Companies. We anticipate that such filing will occur twenty (20) days after this Information Statement is first mailed to our shareholders.

Record Date and Expenses

The entire cost of furnishing this Information Statement will be borne by our corporation. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of our common stock held of record by them.

Our Board of Directors has fixed the close of business on November 6, 2015 as the record date for the determination of shareholders who are entitled to receive this Information Statement. There were 74,641,113 shares of our common stock and no shares of preferred stock issued and outstanding on November 6, 2015. We anticipate that a definitive copy of this Information Statement will be mailed on or about December 29, 2015 to all shareholders of record as of the record date.

PLEASE NOTE THAT THIS IS NOT A REQUEST FOR YOUR VOTE OR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE AMENDMENT TO OUR ARTICLES OF INCORPORATION.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THIS IS NOT AN OFFER TO PURCHASE YOUR SHARES.

3

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

Except as disclosed elsewhere in this Information Statement, since June 30, 2015, being the commencement of our last financial year, none of the following persons has any substantial interest, direct or indirect, by security holdings or otherwise in any matter to be acted upon:

| 1. | any director or officer of our corporation; |

| | |

| 2. | any proposed nominee for election as a director of our corporation; and |

| | |

| 3. | any associate or affiliate of any of the foregoing persons. |

The shareholdings of our directors and officers are listed below in the section entitled "Principal Shareholders and Security Ownership of Management". To our knowledge, no director has advised that he intends to oppose the Amendment, as more particularly described herein.

PRINCIPAL SHAREHOLDERS AND SECURITY OWNERSHIP OF MANAGEMENT

As of November 6, 2015, we had a total of 74,641,113 shares of common stock ($0.00001 par value per share) and no shares of preferred stock issued and outstanding.

The following table sets forth, as of November 6, 2015, certain information with respect to the beneficial ownership of our voting securities by each stockholder known by us to be the beneficial owner of more than 5% of our voting securities and by each of our current directors and executive officers. Each person has sole voting and investment power with respect to voting securities, except as otherwise indicated. Beneficial ownership consists of a direct interest in the voting securities, except as otherwise indicated.

Unless otherwise indicated in the footnotes to the following table, each person named in the table has sole voting and investment power and that person’s address is c/o Mantra Venture Group Ltd., #562 – 800 15355 24th Avenue, Surrey, British Columbia, Canada V4A 2H9.

| NAME OF OWNER | | TITLE OF CLASS | | NUMBER OF | | PERCENTAGE OF |

| | | | | SHARES OWNED (1) | | COMMON STOCK (2) |

| Larry Kristof | | Common Stock | | 13,300,000(3) | | 18.36 % |

| Jonathan Michael Boughen | | Common Stock | | 162,500 (4) | | * |

| Patrick Dodd | | Common Stock | | 200,000(5) | | * |

| W. Glenn Parker | | Common Stock | | 150,000 (6) | | * |

| Officers and Directors as a | | Common Stock | | 13,812,500(7) | | 18.99 % |

| Group (4 persons) 0770987 BC Ltd. | | Common Stock | | 13,250,000 | | 18.31 % |

___________________________________________

* Denotes less than 1%

| (1) | Beneficial Ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock subject to options or warrants currently exercisable or convertible, or exercisable or convertible within 60 days of November 6, 2015 are deemed outstanding for computing the percentage of the person holding such option or warrant but are not deemed outstanding for computing the percentage of any other person. |

| (2) | Percentage based upon 74,641,113 shares of common stock issued and outstanding as of November 6, 2015. |

| (3) | Includes 50,000 shares of common stock underlying options which are currently exercisable or become exercisable within 60 days and 13,250,000 shares of common stock owned by 0770987 BC Ltd. Larry Kristof, as the President of 0770987 BC Ltd. has investment and voting control over the shares held by this entity. |

| (4) | Includes 100,000 shares of common stock underlying options which are currently exercisable or become exercisable within 60 days. |

| (5) | Includes 50,000 shares of common stock underlying options which are currently exercisable or become exercisable within 60 days. |

| (6) | Represents shares of common stock underlying options which are currently exercisable or become exercisable within 60 days. |

| (7) | Includes 350,000 shares of common stock underlying options which are currently exercisable or become exercisable within 60 days. |

4

INCREASE OF AUTHORIZED CAPITAL

Action and Effect

Our Board of Directors approved the Amendment to increase our authorized capital so that we will have a sufficient number of common shares available to fulfill our contractual obligations in relation to outstanding convertible promissory notes and stock purchase warrants issued by our corporation and to accommodate any future equity financings which we may undertake.

Subsequent to our Board of Directors' approval of the Amendment, the holder of the majority of the outstanding shares of our corporation entitled to vote gave us their written consent to the Amendment on November 4, 2015. Therefore, following the expiration of the twenty-day (20) period mandated by Rule 14c, our corporation will file a Notice of Alteration to amend our Notice of Articles to give effect to the Amendment. We will not file the Notice of Alteration to our Notice of Articles until at least twenty (20) days after the filing and mailing of this Information Statement.

The proposed Notice of Alteration to our Notice of Articles is attached hereto as Schedule A. The Notice of Alteration will become effective when it is filed with the British Columbia Registrar of Companies. We anticipate that such filing will occur twenty (20) days after this Information Statement is first mailed to our shareholders.

DISSENTERS RIGHTS

Under the law British Columbia, shareholders of our common stock are not entitled to dissenter's rights of appraisal with respect to our proposed Amendment.

ADDITIONAL INFORMATION

We are subject to the informational requirements of the Exchange Act, and in accordance therewith file reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q with the Securities and Exchange Commission (the “Commission”). Reports and other information filed by us can be inspected and copied at the public reference facilities maintained at the Commission at 100 F Street NW, Washington, D.C. 20549. Copies of such material can also be obtained upon written request addressed to the Commission, Public Reference Section, 100 F Street NW, Washington D.C. 20549, at prescribed rates. The Commission maintains a website on the Internet (http://www.sec.gov) that contains the filings of issuers that file electronically with the Commission through the EDGAR system.

Signature

Dated: December 3, 2015

By Order of the Board of Directors

MANTRA VENTURE GROUP LTD.

By:/s/ Larry Kristof

Larry Kristof

President, Chief Executive Officer and Director

5

SCHEDULE A