As filed with the Securities and Exchange Commission on January 30, 2025

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

High Wire Networks, Inc.

(Exact name of Registrant as specified in its charter)

| Nevada | | 3690 | | 81-5055489 |

| (State or other jurisdiction of | | (Primary Standard Industrial | | (IRS Employer |

| incorporation or organization) | | Classification Code Number) | | Identification No.) |

30 North Lincoln

Batavia, IL 60510

(952) 974-4000

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Mark W. Porter

Chief Executive Officer

30 North Lincoln

Batavia, IL 60510

(952) 974-4000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

| M. Ali Panjwani, Esq. | | Joseph M. Lucosky, Esq. |

| Pryor Cashman LLP | | Scott E. Linsky, Esq. |

| 7 Times Square | | Lucosky Brookman LLP |

| New York, New York 10036 | | 101 Wood Avenue South, 5th Floor |

| (212) 421-4100 | | Woodbridge, NJ 08830 |

| | | (732) 395-4400 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the public offering of 750,000 shares of High Wire Networks, Inc. (the “Company”) common stock (the “Public Offering Prospectus”) through the underwriter named on the cover page of the Public Offering Prospectus. |

| ● | Resale Prospectus. A prospectus to be used for the resale by the selling stockholders (the “Selling Stockholder”) set forth therein of 583,296 shares of the Company’s common stock (the “Resale Prospectus”). |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | it contains different outside and inside front covers and back covers; |

| ● | it contains different About This Offering sections in the Prospectus Summary section beginning on page Alt-1; |

| ● | it contains different Use of Proceeds sections on page Alt-2; |

| ● | a Private Placement section is included in the Resale Prospectus; |

| ● | a Selling Stockholder section is included in the Resale Prospectus; |

| ● | the Dilution section from the Public Offering Prospectus on page 30 is deleted from the Resale Prospectus; |

| ● | the Capitalization section from the Public Offering Prospectus on page 29 is deleted from the Resale Prospectus; |

| ● | the Underwriting section from the Public Offering Prospectus on page 78 is deleted from the Resale Prospectus and a Selling Shareholders Plan of Distribution is inserted in its place; and |

| ● | the Legal Matters section in the Resale Prospectus on page Alt-9 deletes the reference to counsel for the underwriter. |

The Company has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the Registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages, as well as the deletion of certain sections and disclosures in the Public Offering Prospectus and will be used for the resale offering by the Selling Shareholders.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED JANUARY 30, 2025

High Wire Networks, Inc.

750,000 Shares of Common Stock

We are offering up to 750,000 shares of our common stock, par value $0.00001 per share (the “common stock”) assuming a per share price of $7.50. We currently expect the public offering price will be between $7.00 and $9.00 per share.

Our common stock is currently listed on the OTCQB® Venture Market (“OTCQB”) under the symbol “HWNI”. We have applied to list our common stock listed on the Nasdaq Capital Markets (“Nasdaq”) under the symbol “HWNI”. If shares of our common stock are not approved for listing on the Nasdaq, we will not consummate this offering. No assurance can be given that our application will be approved.

We expect to effect a 1-for-250 reverse stock split of our outstanding common stock prior to the completion of this offering (the “Reverse Split”). Unless otherwise noted and other than in our financial statements incorporated by reference herein, the share and per share information in this prospectus reflects a proposed reverse stock split of the outstanding common stock and preferred stock at an assumed 1-for-250 ratio expected to occur prior to the effective date of the registration statement of which this prospectus forms a part.

Our common stock is quoted on the OTCQB under the symbol “HWNI.” On January 28, 2025 the last reported sale price for our common stock was $0.0249 per share, before giving effect to the Reverse Split.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. BEFORE MAKING ANY INVESTMENT DECISION, YOU SHOULD CAREFULLY REVIEW AND CONSIDER ALL THE INFORMATION IN THIS PROSPECTUS AND THE DOCUMENTS INCORPORATED BY REFERENCE HEREIN, INCLUDING THE RISKS AND UNCERTAINTIES DESCRIBED UNDER “RISK FACTORS” BEGINNING ON PAGE 12.

We have not registered the sale of the shares under the securities laws of any state. Brokers or dealers effecting transactions in the shares of common stock offered hereby should confirm that the shares have been registered under the securities laws of the state or states in which sales of the shares occur as of the time of such sales, or that there is an available exemption from the registration requirements of the securities laws of such states.

We have not authorized anyone, including any salesperson or broker, to give oral or written information about this offering, High Wire Networks, Inc., or the shares of common stock offered hereby that is different from the information included in this prospectus. You should not assume that the information in this prospectus, or any supplement to this prospectus, is accurate at any date other than the date indicated on the cover page of this prospectus or any supplement to it.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Share | | | Total | |

| Initial public offering price (assumed) | | $ | 7.50 | | | $ | 5,625,000 | |

| Underwriting discounts and commissions (1) | | | (1.07 | ) | | $ | (803,000 | ) |

| Proceeds before expenses, to us(2) | | $ | 6.43 | | | $ | 4,822,000 | |

| (1) | The underwriters will receive compensation in addition to the discounts and commissions. We have also agreed to issue warrants to the representative of the underwriters exercisable in the aggregate for up to such number of shares as is equal to 5% of the number of shares sold in this offering, at an exercise price equal to 100% of the public offering price (the “Representative’s Warrants”), the amount above does not include offering expenses. We refer you to “Underwriting” beginning on page 78 for additional information regarding the underwriters’ compensation. |

| (2) | The amount of offering proceeds to us presented in this table does not give effect to the exercise of (i) the over-allotment option issued to the underwriters or (ii) the Representative’s Warrants. |

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and purchase all of the shares of common stock offered by us under this prospectus if any such shares are taken. We have granted a 45-day option to the underwriters to purchase up to 112,500 additional shares of common stock, representing 15% of the shares of common stock sold in this offering, solely to cover over-allotments, if any. If the underwriters exercise the option in full, the total proceeds to us, less underwriting discounts and commissions, will be $5,545,300, based on a public offering price of $7.50 per share.

Delivery of the shares of common stock is expected to be made on or about , 2025.

Joseph Gunnar & Co., LLC

The date of this prospectus is , 2025.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are not making an offer of these securities in any state or other jurisdiction where the offer is not permitted. The information in this prospectus may only be accurate as of the date on the front of this prospectus regardless of the time of delivery of this prospectus or any sale of our securities.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, our common stock hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy our securities in any circumstance under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of our securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the jurisdiction of the United States who come into possession of this prospectus are required to inform themselves about, and to observe any restrictions relating to this offering and the distribution of this prospectus applicable to that jurisdiction.

If required, we will provide you with, in addition to this prospectus, a prospectus supplement that will contain specific information about the terms of that offering. We may also use a prospectus supplement and any related free writing prospectus to add, update or change any of the information contained in this prospectus or in documents we have incorporated by reference. This prospectus, together with any applicable prospectus supplements, any related free writing prospectuses and the documents incorporated by reference into this prospectus, includes all material information relating to this offering. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement. Please carefully read both this prospectus and any prospectus supplement together with the additional information described below under the section entitled “Incorporation of Certain Documents by Reference” before buying any of the securities offered.

Unless otherwise indicated, information in this prospectus concerning economic conditions, our industries, and our markets is based on a variety of sources, including information from third-party industry analysts and publications and our estimates and research. This information involves a number of assumptions, estimates, and limitations. The industry publications, surveys and forecasts, and other public information generally indicate or suggest that their information has been obtained from sources believed to be reliable. None of the third-party industry publications used in this prospectus were prepared on our behalf. The industries in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in this prospectus. These and other factors could cause results to differ materially from those expressed in these publications.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. Forward-looking statements include all statements that do not directly or exclusively relate to historical facts. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “forecasts,” “predicts,” “potential,” or the negative of those terms, and similar expressions and comparable terminology. These include, but are not limited to, statements relating to future events or our future financial and operating results, plans, objectives, expectations and intentions. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these expectations may not be achieved. Forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to known and unknown risks, uncertainties and other factors outside of our control that could cause our actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. Actual results may differ materially from those anticipated or implied in the forward-looking statements.

You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. You should also consider carefully the statements under the section titled “Risk Factors” and elsewhere in this prospectus, which address additional factors that could cause our actual results to differ from those set forth in the forward-looking statements. Such risks and uncertainties include:

| ● | our ability to successfully execute our business strategies, including the acquisition of other businesses to grow our company and integration of recent and future acquisitions; |

| ● | changes in aggregate capital spending, cyclicality and other economic conditions, and domestic and international demand in the industries we serve; |

| ● | our ability to adopt and master new technologies and adjust certain fixed costs and expenses to adapt to our industry’s and customers’ evolving demands; |

| ● | our ability to obtain additional financing in sufficient amounts or on acceptable terms when required; |

| ● | our ability to adequately expand our sales force and attract and retain key personnel and skilled labor; |

| ● | shifts in geographic concentration of our customers, supplies and labor pools and seasonal fluctuations in demand for our services; |

| ● | our dependence on third-party subcontractors to perform some of the work on our contracts; |

| ● | our ability to comply with certain financial covenants of our debt obligations |

| ● | the impact of new or changed laws, regulations or other industry standards that could adversely affect our ability to conduct our business; and changes in general market, economic and political conditions in the United States and global economies or financial markets, including those resulting from natural or man-made disasters. |

These risks also should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. All written and oral forward-looking statements made in connection with this prospectus that are attributable to our company or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given these uncertainties, you are cautioned not to place undue reliance on any forward-looking statements and you should carefully review this prospectus and the information incorporated by reference herein in its entirety. These forward-looking statements speak only as of the date of this prospectus, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

Except for our ongoing obligations to disclose material information under federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. We do not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events, except as required by applicable law or regulation.

MARKET DATA

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, governmental publications, reports by market research firms or other independent sources that we believe to be reliable sources. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We are responsible for all of the disclosures contained in this prospectus, and we believe these industry publications and third-party research, surveys and studies are reliable. While we are not aware of any misstatements regarding any third-party information presented in this prospectus, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties, and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” and elsewhere in this prospectus. Some data are also based on our good faith estimates.

TRADEMARKS

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks and trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by, us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, ™ symbols, but the omission of such references is not intended to indicate, in any way, that we do not own such trademarks, service marks or trade names and will not assert, to the fullest extent under applicable law, our rights or the right of the applicable owner of these trademarks, service marks and trade names.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and may not contain all of the information that you should consider before investing in our common stock. You are urged to read this prospectus in its entirety, including the information under “Risk Factors”, “Cautionary Statement Regarding Forward-Looking Statements”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this Prospectus.

Unless otherwise noted, the share and per share information in this prospectus reflects a 1-for-250 reverse stock split of our outstanding common stock that we expect to complete prior to the completion of this offering (the “Reverse Split”).

Our Company

Overview

We provide award winning managed cyber security solutions, managed services, and wholesale telecommunications exclusively through our channel partners around the world. We leverage state of the art cyber security tools to deliver these services. We have built out extensive hyper-automation capabilities and leverage Artificial Intelligence based toolsets to create a competitive advantage, scalability, and better outcomes for our clients. Our 100% U.S. based Security Operations Center (“SOC”) provides SOC as a Service (“SOCaaS”) to manage all of the tools, 24x7x365. Our Overwatch Managed Cybersecurity (“Overwatch”) solution has been globally recognized by Frost & Sullivan on their Global Frost Cybersecurity Radar for 2024 as one of the top 12 Managed and Professional Cybersecurity Companies based on growth and innovation.

In addition to Overwatch, we offer wholesale voice transport as an Federal Communications Commission (“FCC”) registered Interexchange Carrier (“IXC”) through our wholly-owned subsidiary, Secure Voice Corporation (“SVC”). SVC works with other industry service providers to route traffic to its final destination. Leveraging a highly resilient virtual infrastructure, the Company runs millions of minutes of calls per day.

We provide the following to our customers:

| ● | Managed Cybersecurity: Recognized by Frost and Sullivan as one of the “Top 12 Managed and Professional Cybersecurity Companies in the Americas” in February 2023 and again in 2024, High Wire’s award-winning Overwatch solution offers organizations end-to-end protection for networks, data, endpoints and users via multiyear, recurring revenue contracts. Managed cybersecurity is a fast-growing technology segment, and it provides nearly 100% recurring revenue through long-term contracts with our average contract length being more than two years. Overwatch delivers services through managed service providers (“MSPs”), strategic partnerships and alliances, Value Added Resellers (“VARs”), distributors, and network service providers. |

| ● | Secure Voice Corp. Offering wholesale session integration protocols (“SIP”) only network transport as an FCC registered IXC and partnering with providers around the country to deliver voice traffic to its end destination SVC provides attractive rates and voice products, running millions of minutes of calls per day. |

Our Industry

The pace of technological evolution continues to accelerate and shows no sign of slowing down. As technology evolves, the demand for more robust networks, faster speeds, better experiences and protection from cyber threats continues to grow. This demand was compounded by the COVID-19 pandemic and the rapid transition to “work from home” for large swaths of the global workforce. Remote learning, virtual meetings, collaboration software and increased email volume, have all transformed and strained the way we do business and share information. Networks can no longer be secured with firewalls and other network centric cybersecurity controls. As a result of these developments, cybersecurity strategy will continue to evolve and create opportunities for companies to innovate and thrive.

With the rapid proliferation of device connectivity and the transition of the workforce to remote or hybrid, cyber security risks have grown significantly. Cyber security challenges have thus increased the demands on enterprise networks and all traditional networks. According to Grandview Research, the Global Cybersecurity market was $222.66 Billion in 2023 and expected to grow at a CAGR of 12.3% through 2030. According to Chainalysis, in 2023, Ransomware payments reached a record $1.1 billion. Cyber risk is now something that every business is forced to address around the globe. Closer to home, a patchwork of legislation has emerged in the United States with various states enacting different requirements for the protection of sensitive data, networks. These requirements often include the imposition of a duty to disclose cyber security incidents. Congress has yet to enact federal laws mandating cyber security protections thus far, but there have been many discussions on the subject. Federal agencies have already issued regulations with cyber risk in mind. For example, the Department of Defense has updated standards for private sector companies doing business with them.

Global Cyber Security spending is expected to exceed $1.75 trillion from 2021 to 2025 according to Cybersecurity Ventures. Enterprises, Service Providers, Wireless Providers, and Managed Service Providers are all working at a feverish pace to keep up with emerging threats. There are over 2,000 different “point” solutions on the market today. Most are focused on a single part of the problem or “attack surface.” Traditional solutions require a lot of work to deploy, constant monitoring, and well-trained personnel to interpret the massive amounts of data they produce. This sets the stage for a company which combines best-in-breed tools with a comprehensive solution.

All of these trends come together at the network level. As networks improve from the carrier to the enterprise, demand for building, managing, and protecting these networks will rise. The amount of money that the industry is predicted to spend on cyber security will increase as well. The contracts to perform these services and provide human capital for them will last years.

Industry Trends and Opportunities

| ● | Cybersecurity Managed Service |

| ● | IOT creating deployment and cybersecurity opportunities |

| ● | International growth, developing and emerging markets |

| ● | Monetize our existing telecom network (SVC) in new ways |

Competitors

Managed Services is a very competitive market and as such, our strategy is to continue to work through distribution channels with existing customer bases and robust sales organizations as well as selectively work with very large Enterprise in markets our channel partners do not serve. We believe that this strategy can provide rapid growth. Many of our competitors are wed to their own software, which makes it challenging to pivot as threats change. We have chosen to avoid this trap, allowing us to pivot quickly as needs change, and not spend tens or hundreds of millions in R&D, risking missing a single tech cycle and burning shareholder capital. Some of our significant competitors would be Arctic Wolf, Cydera, SecureWorks and numerous smaller competitors. This space is rapidly evolving, thus hiring and retaining talent can be challenging. Companies that leverage automation technologies to scale will have a significant advantage. In a crowded and evolving landscape, there will be a continued need to spend on marketing and sales to acquire partners and help them convert and acquire new customers. We believe that with the combination of businesses we have and the extensive investments we have made in hyper-automation and extensive experimentation with Generative Artificial Intelligence products, we will be able to differentiate our services and compete aggressively in this market, capitalizing on and monetizing trends ahead of the competition.

Our Competitive Strengths

We believe our market advantage is our positioning as a trusted authority in the space, our highly experienced management team with long-term relationships, proven track record of growth, and industry reputation for high-quality service. High Wire’s investments in automation technologies, scalable and open architecture, help our partners and our clients create a competitive advantage in the war against cybercriminals.

We believe our additional strengths described below will enable us to continue to compete effectively and to take advantage of anticipated growth opportunities:

| ● | Recognition by Frost and Sullivan in February of 2023 and again in 2024 as one of the “Top 12 Managed and Professional Cybersecurity Solution Providers”, selected from over 120 companies considered. |

| ● | Extensive sales distribution in cybersecurity and managed services with over 250 established MSP channel partners and over 1,300 paying end clients. |

| ● | Established operational expertise and channel partnerships with the largest technology resellers and channel partners in the world. |

| ● | Proven ability to recruit, manage and retain high-quality personnel. Our ability to recruit, manage and retain skilled labor is a critical advantage in an industry where the supply of highly skilled and experienced personnel is limited. This is often a key factor in our customers selecting High Wire Networks over our competitors. We believe that our highly skilled team members with professional certifications give us a competitive edge over other companies as we continue to expand and meet our clients’ needs. |

| ● | Expansion of our recurring revenue streams through increased focus on managed services, cyber security services, and professional services programs. These multi-year engagements will increase client retention and grow margins and make the business more predictable through uncertain economic cycles. |

| ● | Our sales organization has extensive expertise and deep industry relationships. Paired with an effective and efficient marketing message that drives new client acquisition, we believe they position us to compete at a high level. |

| ● | Our highly experienced management team has deep industry knowledge and brings extensive experience across a broad range of disciplines. We believe our senior management team is a key driver of our success and is well-positioned to execute our strategy. |

Sample Customers

| ● | Technology Resellers: Exclusive Networks, Tech Data/Synnex, Worldwide Technologies, NWN Carousel, CDW/Sirius, Myriad 360 and many more. |

| ● | Original Equipment Manufacturers: HPE Enterprise and Nile Networks. |

| ● | Unified Communications Providers and Carriers: RingCentral, Lumen, Call One, Peerless and XTel. |

Key Aspects

| ● | Proven management team in place |

| ● | Competing in high growth markets |

| ● | Global operational capabilities |

| ● | Effective marketing and strong brand awareness in the industry |

| ● | Vast expertise in technology domains |

| ● | Top customers in the industry in every segment |

| ● | Diverse customer base of nearly 300 channel partners across two different sales channels |

Our Growth Strategy

| ● | Under our current management team, we have developed a growth strategy based on a combination of organic growth and acquisition targets. Our strategy is focused on building the business using high margin recurring revenue streams to drive long term sustainability. We have a consolidated sales and management team to leverage the strength of our clients and sell across the existing base. We will continue to focus on existing offerings while adding robust new capabilities. |

| ● | We will continue to grow and expand our award winning, channel focused Overwatch platform. This service leverages our extensive expertise to prevent, detect, and respond to cyber threats 24x7x365. These services are in high demand around the world, and our platform is cutting edge. |

| ● | We intend to expand our relationships with new service partners. We plan to capture and expand new relationships. We believe that the business model for the expansion of these relationships, leveraging our core strengths, experience and broad array of service solutions, will support our business model for organic growth. |

| ● | We plan to increase operating margins by continuing to leverage advanced automation technologies as well as generative artificial intelligence technology to supplement our cybersecurity analysts and scale the business. |

| ● | We expect growth in our cybersecurity business driven by multi-year contracts with recurring revenue. Overwatch’s contractual relationships with our nearly 250 channel partners are driven by “Evergreen” master services agreements (“MSA”), and High Wire has a 24-year history of partner retention that spans years and decades. Typical customer engagement agreements are three-year contracts. As such, our monthly recurring revenue (“MRR”) growth is predictable as it compounds with new partner and new end customer acquisition. |

| ● | In our Managed Cybersecurity segment, our strategy is considered “marketing driven” rather than “sales driven.” A marketing driven strategy drives new partner acquisition faster and more cost effectively. By acquiring partners this way, we typically migrate their entire customer base for at least one service, then move them into additional services once that is completed. This allows us to grow with incremental sales within their existing base, as well as new customers as they add to their base. This creates a “network multiplying effect” to our strategy. Our marketing strategy consists of attending trade shows geared to partners for brand awareness, speaking engagements, thought leadership events, search engine optimization campaigns and building our organic “domain relevance” with search engines by constantly providing expert content, which brings searchers to our site for expertise, not just sales. Behind our marketing, we focus on an efficient capture by our sales organization, which can be kept lean and focused on larger strategic initiatives to enable partners to bring us larger deals. Sales also focuses on the larger enterprise-oriented partners where relationships already exist from our technology services segment. |

| ● | We plan to acquire new partners and help them grow their business. Once partners are acquired and we onboard their customer base, we focus on enablement with them to help them upsell the more complex and high value solutions. This is done with webinars, on-site training, and infotainment events that we co-sponsor with the partners using funds they earn as a percentage of their overall annual sales. |

| ● | We expect to add contractual services in the SVC segment. These services include fully managed and hosted contact center services and voice call origination. Our updated and upgraded infrastructure positions us to grow and scale our traffic, and we believe adding more contractual recurring revenue in this segment will grow enterprise value. 2024 results have validated the scalability and profitability of this model. |

| ● | We intend to grow revenues and market share through selective acquisitions. We plan to acquire companies that enhance our earnings and offer complementary recurring revenue services plus expand our geographic reach and client base. We believe such acquisitions will help us to accelerate our revenue growth, leverage our existing strengths, and capture and retain market share. We intend to target companies where we can take advantage of our investments in automation to maximize profitability immediately by significant reductions in headcount. |

Customers

The majority of our revenue is from partners, as opposed to end customers. This enables us to leverage a smaller sales, sales support and customer service team.

A substantial portion of our revenue is derived from work performed under an MSA and multi-year service contracts with clients subject to the MSA terms. We have entered into MSAs with numerous service providers, VARS, stocking distributors and OEMs. MSAs are generally the contracting vehicle used to render our services for their clients, and we work with many clients under a single MSA with a partner. Customer specific Statements of Work (“SOWs”) generally contain customer-specified service requirements, including among others discrete pricing, specific security services to be managed, duration of the agreement, Service Level Agreements (“SLAs”) or service credits. Most of our MSAs may be cancelled by our customers upon minimum notice (typically 60 days), regardless of whether we are or are not in default, however specific customer SOWs may not be canceled without breach or specific causes of action. They are typically multi-year engagements, up to three years in duration, with our average across all end customers being more than two years. For the nine months ended September 30, 2024, three customers accounted for 6%, 5% and 5%, respectively, of consolidated revenues for the period. These customer relationships are driven by MSAs and relationships that have spanned for several years to over a decade. In addition, amounts due from these customers represented 15%, 1% and 0%, respectively, of trade accounts receivable as of September 30, 2024. For the nine months ended September 30, 2023, three customers accounted for 5%, 5% and 4%, respectively, of consolidated revenues for the period. In addition, amounts due from these customers represented 2%, 0% and 0%, respectively, of trade accounts receivable as of September 30, 2023.

Suppliers and Vendors

We have supply agreements with major technology vendors and other IXCs. However, for a majority of the managed services we perform, the most significant cost is the personnel in our SOC. We expect to continue to further develop our relationships with our technology vendors and to broaden our scope of work with each of our partners. In many cases, our relationships with our partners have spanned more than three years which we attribute to the relative importance of our solution set to their business, and our commitment to excellence. It is our objective to selectively expand our partnerships moving forward in order to expand our service offerings.

Corporate History

High Wire Networks, Inc. (f/k/a Spectrum Global Solutions, Inc.) (“High Wire”) was incorporated in the State of Nevada on January 22, 2007 to acquire and commercially exploit various new energy related technologies through licenses and purchases. On December 8, 2008, High Wire reincorporated in the province of British Columbia, Canada.

HWN, Inc., (d/b/a High Wire Network Solutions, Inc.) (“HWN”) was incorporated in Delaware on January 20, 2017. HWN is a global provider of managed cybersecurity, and professional cybersecurity services delivered primarily through a channel sales model. HWN’s Overwatch platform-as-a-service offers organizations end-to-end protection for networks, data, endpoints and users via multiyear recurring revenue contracts in this fast-growing technology segment. HWN has continuously operated under the High Wire Networks brand for 24 years.

On April 25, 2017, High Wire entered into and closed on an asset purchase agreement with InterCloud Systems, Inc. (“InterCloud”). Pursuant to the terms of the asset purchase agreement, High Wire purchased 80.1% of the assets associated with InterCloud’s AW Solutions, Inc. (“AWS”), AW Solutions Puerto Rico, LLC (“AWS PR”), and Tropical Communications, Inc. (“Tropical” and collectively with AWS and AWS PR, the “AWS Entities”).

On November 15, 2017, High Wire changed its name to “High Wire Enterprises, Inc.” and reincorporated in the state of Nevada.

On February 6, 2018, High Wire entered into and closed on a stock purchase agreement with InterCloud. Pursuant to the terms of the stock purchase agreement, High Wire purchased all of the issued and outstanding capital stock and membership interests of ADEX Corporation, ADEX Puerto Rico LLC, ADEX Towers, Inc. and ADEX Telecom, Inc. and formed ADEX Canada LLC in September 2019 (collectively “ADEX” or the “ADEX Entities”). High Wire completed the acquisition on February 27, 2018.

On February 14, 2018, High Wire entered into an agreement with InterCloud providing for the sale, transfer, conveyance and delivery to High Wire of the remaining 19.9% of the assets associated with InterCloud’s AWS business not already purchased by High Wire.

On May 18, 2018, High Wire transferred all of its ownership interests in and to its subsidiaries Carbon Commodity Corporation, Mantra China Limited, Mantra Media Corp., Mantra NextGen Power Inc., Mantra Wind Inc., Climate ESCO Ltd. and Mantra Energy Alternatives Ltd., (collectively “Mantra”) to an entity controlled by Mantra’s former Chief Executive Officer, Larry Kristof. The new owner of the aforementioned entities assumed all liabilities and obligations with respect to such entities.

On January 4, 2019, High Wire entered into a stock purchase agreement with InterCloud. Pursuant to the terms of the stock purchase agreement, InterCloud agreed to sell, and High Wire agreed to purchase, all of the issued and outstanding capital stock of TNS, Inc. (“TNS”), an Illinois corporation.

On February 7, 2019, HWN and JTM Electrical Contractors, Inc. (“JTM”), an Illinois corporation, entered into an operating agreement through which HWN owned 50% of JTM. HWN sold its interest in JTM effective December 31, 2021.

On September 30, 2020, High Wire sold TNS. On December 31, 2020, High Wire sold AWS.

On June 16, 2021, HWN completed a reverse merger with Spectrum Global Solutions, Inc. (the “Merger”). The Merger was accounted for as a reverse merger. At the time of the Merger, High Wire’s subsidiaries included HWN, the ADEX Entities, AWS PR and Tropical. On March 6, 2023, High Wire divested the ADEX Entities.

On November 4, 2021, High Wire closed on its acquisition of SVC. The closing of the acquisition was facilitated by a senior secured promissory note.

On January 7, 2022, Spectrum Global Solutions, Inc. legally changed its name to High Wire Networks, Inc. For accounting purposes, HWN is the operating entity and is referred to throughout as “HWN”. The parent entity, High Wire Networks, Inc. is referred to as “High Wire” or the “Company.”

On March 6, 2023, the Company entered into a stock purchase agreement, by and among ADEX Corporation, ADEX Canada LTD., ADEX Puerto Rico, LLC and ADEXCOMM, and ADEX Acquisition Corp., pursuant to which the Company sold to ADEX Acquisition Corp. its legacy staffing business in a transaction valued at approximately $11,500,000, comprised primarily of the elimination of approximately $10,000,000 of debt, representing monthly debt payments of approximately $325,000, and the cancellation of 140 shares of the Company’s Series D preferred stock. The sale of ADEX Corporation closed simultaneously with the signing of the agreement.

On July 31, 2023, the Company entered into and closed an asset purchase agreement with Tower Tech Engineering, PSC, (“TowerTech”), a Puerto Rico Professional Services Corporation. In the transaction, the Company sold to TowerTech its Puerto Rico-based professional and field services business and certain assets in the amount of $200,000, less a customer prepayment of $40,000. As of the closing, the Company ceased operations in Puerto Rico.

On August 4, 2023, the Company formed Overwatch Cyberlabs, Inc. (“Cyberlabs”).

On November 3, 2023, the Company paused the operations of Tropical.

On June 27, 2024, High Wire entered into an asset purchase agreement with INNO4, LLC to sell the assets of its technical services business unit of HWN, Inc. for $11.2 million in cash consideration less certain adjustments for net working capital, 50% post sale performance, and 50% of the cost of representations and warranties insurance coverage. Proceeds from the sale were used to reduce the Company’s liabilities by over $8,000,000 with the remaining proceeds used to support the Company’s operations.

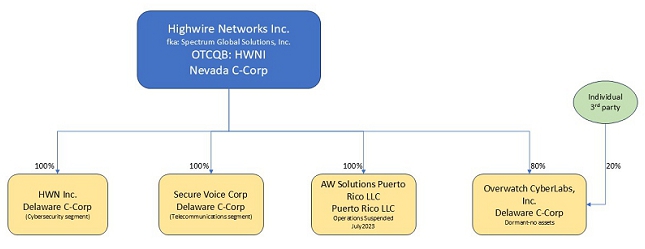

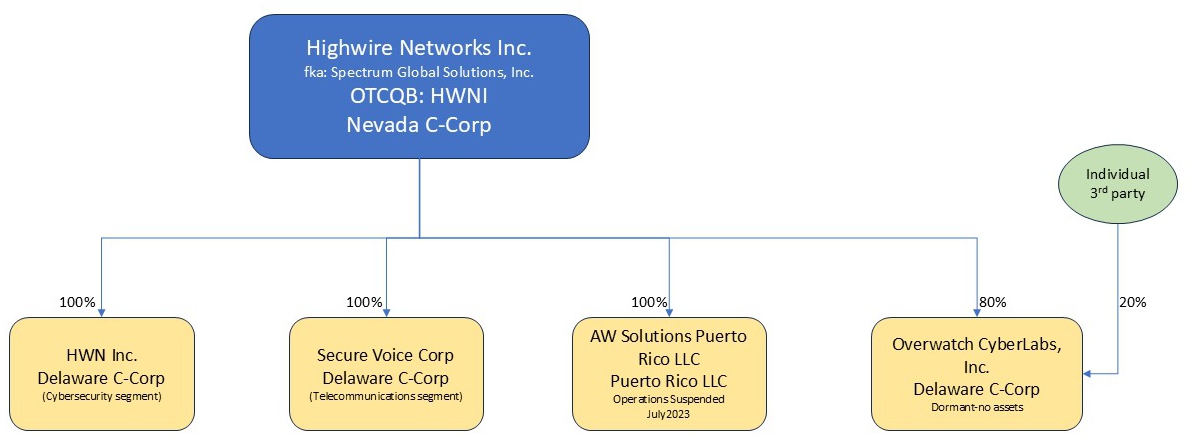

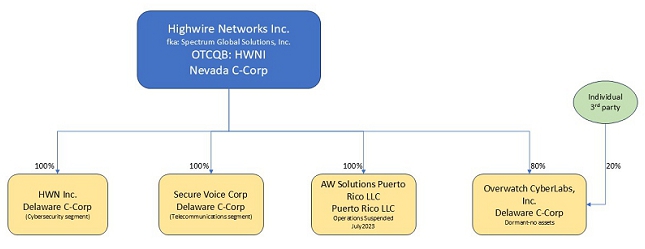

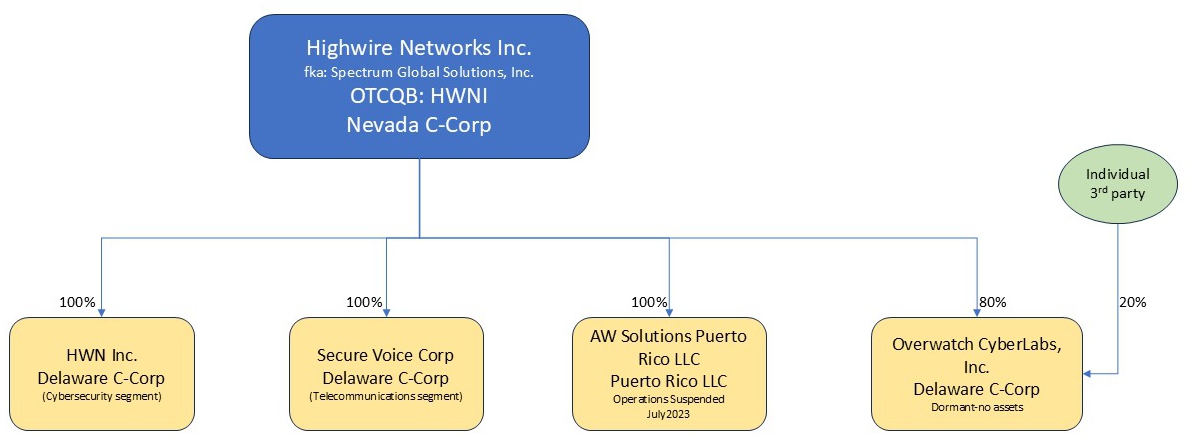

Entity Organizational Chart

Safety and Risk Management

As a cybersecurity provider we take extensive precautions to defend and protect our systems from cyber risk. We have extensive internal procedures and practice to prevent cyber breaches and educate our personnel on cyber risk. We currently have no claims related to: workers’ compensation claims, general liability and damage claims, errors and omissions claims, cyber-related claims nor claims related to vehicle accidents, including personal injury and property damage. We insure against the risk of loss arising from our operations up to certain deductible limits in all of the states in which we operate. We evaluate our insurance requirements on an ongoing basis to help ensure we maintain adequate levels of coverage internally and externally for our clients.

Our internal policy is to carefully monitor claims and actively participate with our insurers in determining claims estimates and adjustments. The estimated costs of claims are accrued as liabilities and include estimates for claims incurred but not reported. If we experience future insurance claims in excess of our umbrella coverage limit, our business could be materially and adversely affected.

Additionally, we require all employees to pass background checks prior to hiring as a standard human resources practice.

Employees

As of December 2, 2024, we had 38 full-time employees and three part-time employees, of whom five were in administration and corporate management, three were accounting personnel, seven were sales personnel and 26 are engaged in professional engineering, operations, project managerial and technical roles.

We maintain a core of professional, technical and managerial personnel and add employees as deemed appropriate to address operational and scale requirement related to growth.

Regulation

Our operations are subject to various federal, state, local and international laws and regulations, including, but not limited to, licensing, permitting and inspection requirements applicable to electricians and engineers; building codes; permitting and inspection requirements applicable to construction and installation projects; regulations relating to worker safety and environmental protection; telecommunication regulations affecting our wireless, wireline and fiber optic business; labor and employment laws; laws governing advertising, and laws governing our public business.

Our Corporate Information

Our principal offices are located at 30 N. Lincoln St, Batavia, IL 60510. Our telephone number is (952) 974-4000.

Risk Factors Summary

Risks Related to Our Financial Results and Financing Plans

| ● | Our revenue growth rate and financial performance in recent years may not be indicative of future performance and such growth may slow over time. |

| ● | Our substantial indebtedness could adversely affect our business, financial condition and results of operations and our ability to meet our payment obligations. |

Risks Relating To Our Business

| ● | Our future success is substantially dependent on third-party relationships. |

| ● | Claims by others that we infringed their proprietary technology or other intellectual property rights could harm our business. |

| ● | Our trademarks, copyrights, and other intellectual property could be unenforceable or ineffective. |

| ● | The cost of enforcing our trademarks and copyrights could prevent us from enforcing them. |

| ● | We are making substantial investments in new product offerings and technologies and expect to increase such investments in the future. These efforts are inherently risky, and we may never realize any expected benefits from them. |

| ● | Our new products could fail to achieve the sales projections we expected. |

| ● | The development and commercialization of our products and services are highly competitive. |

| ● | We must correctly predict, identify, and interpret changes in consumer preferences and demand, offer new products to meet those changes, and respond to competitive innovation. |

| ● | We depend on relationships with our MSPs, and any adverse changes in their financial strength, tightening of the technical standards required by their end-customers would adversely affect our business, financial condition, and results of operations. |

| ● | Our financial performance is partially dependent on our ability to successfully engage with MSP’s and other technology partners, and these MSP’s and partners are not precluded from offering products and services outside of our offerings. |

| ● | MSP’s and technology partners on our marketplaces may not provide competitive levels of service to end customers, which could materially and adversely affect our operating results. |

| ● | Data breaches or incidents involving our technology or products could damage its business, reputation and brand and substantially harm its business and results of operations. |

| ● | Security incidents or real or perceived errors, failures or bugs in our systems and platform could impair our operations, compromise our confidential information or our users’ personal information, damage our reputation and brand, and harm our business and operating results. |

| ● | Computer malware, viruses, ransomware, hacking, phishing attacks and similar disruptions could result in security and privacy breaches and interruptions and delays in services and operations, which could harm our business. |

| ● | Changes in government regulation could adversely impact our business. |

| ● | Failure to obtain proper business licenses or other documentation or to otherwise comply with local laws and requirements regarding marketing or matching commercial property and business borrowers with financial services providers may result in civil or criminal penalties and restrictions on our ability to conduct business in that jurisdiction. |

| ● | We rely on confidentiality agreements with our suppliers, employees, consultants and other parties; the breach of such agreements could adversely affect our business and results of operations. |

Risks Relating to Our Industry

| ● | Our industry is highly competitive, with a variety of larger companies with greater resources competing with us, and our failure to compete effectively could reduce the number of new contracts awarded to us or adversely affect our market share and harm our financial performance. |

| ● | Many of the industries we serve are subject to consolidation and rapid technological and regulatory change, and our inability or failure to adjust to our customers’ changing needs could reduce demand for our services. |

| ● | Economic downturns could cause capital expenditures in the industries we serve to decrease, which may adversely affect our business, financial condition, results of operations and prospects. |

Risks Related to our Common Stock and this Offering

| ● | The sale or availability for sale of substantial amounts of our common stock could adversely affect the market price of our common stock. |

| ● | If we do not meet the listing standards of a national securities exchange our investors’ ability to make transactions in our securities will be limited and we will be subject to additional trading restrictions. |

| ● | You will experience immediate and substantial dilution as a result of this offering. |

| ● | Future sales of our securities may affect the market price of our securities. |

| ● | A large number of shares of our capital stock eligible for public sale could depress the market price of our common stock. |

| ● | You may be diluted by the future issuance of additional common stock in connection with our equity incentive plans, acquisitions or otherwise. |

| ● | We may issue additional debt and equity securities, which are senior to our common stock as to distributions and in liquidation, which could materially adversely affect the market price of our securities. |

| About This Offering |

| | | |

| Shares offered: | | 750,000 shares of common stock (862,500 shares of common stock, if the underwriters exercise their over-allotment option in full. |

| | | |

| Offering price: | | $7.50 per share of our common stock, the bottom of the range of $7.00 to $9.00 per share. |

| | | |

| Over-Allotment option: | | We have granted a 45-day option to the underwriters to purchase up to 112,500 additional shares of common stock, representing 15% of the shares sold in this offering. |

| | | |

Shares of common stock

Outstanding before the offering (1): | | 1,004,604 |

| | | |

Shares of common stock

Outstanding after the offering (1): | | 1,754,604, or 1,867,104 assuming the underwriters exercise their over-allotment option in full. |

| | | |

Series B Preferred Stock; Disparate

voting control: | | 1,000 shares of our Series B Preferred Stock, all of which are owned by Mark W. Porter, our Chief Executive Officer and Chairman of the Board of Directors (the “Board”), and which has a 51% super-majority voting control of our outstanding voting capital stock. |

| | | |

Automatic Conversion of

Outstanding Series D Preferred

Stock and Series E Preferred Stock: | | Upon the consummation of this offering, 943 shares of our outstanding Series D Preferred Stock will automatically convert into an aggregate of 167,556 shares of common stock and 311 shares of our outstanding Series E Preferred Stock will automatically convert into an aggregate of 53,828 shares of common stock. |

| | | |

| Use of proceeds: | | We estimate that the net proceeds from the sale of the shares in the offering, at an assumed public offering price per share of $7.50, will be approximately $4,446,000 after deducting the underwriting discounts and commissions and estimated offering expenses, or $5,161,000 if the underwriters exercise their overallotment option in full. We currently expect to use approximately $2,500,000 of the net proceeds of this offering primarily to expand aggregation of cybersecurity contracts and the remaining proceeds of the approximately $1,946,000 for general corporate purposes, including working capital. |

| | | |

Proposed Nasdaq listing

and symbol: | | We have applied to list our common stock on the Nasdaq under the symbol “HWNI.” No assurance can be given that our listing will be approved by Nasdaq or that a trading market will develop for the common stock. We will not proceed with this offering in the event the common stock is not approved for listing on Nasdaq. |

| | |

| Representative’s Warrants: | | We have agreed to issue to the representatives of the underwriters or their designees at the closing of this offering, warrants to purchase the number of shares of our common stock equal to five percent (5%) of the aggregate number of shares sold in this offering (the “Representative’s Warrants”). The Representative’s Warrants will be non-exercisable for six (6) months from the effective date of this offering and are otherwise exercisable at any time thereafter and from time to time, in whole or in part, during the five year period commencing six (6) months from the effective date of this offering. The exercise price of the Representative’s Warrants will equal 100% of the initial public offering price per share, subject to adjustments. |

| Lockup: | | We and our directors, officers, certain stockholders who are holders of 3% or more of the outstanding shares of common stock and any holder of promissory notes convertible into the shares of our common stock at a discount to the initial public offering price per share as of the effective date of the registration statement, have agreed with the underwriters that we will not, without the prior written consent of the Representative, for a period of six (6) months after the date of this prospectus offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any securities of the Company. The Company and any successors of the Company have agreed with the underwriters that each will not, without the prior written consent of the Representative for a period of three (3) months from the closing of this offering: (i) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any classes of our stocks or any securities convertible into or exercisable or exchangeable for any classes of our stocks except that the Company may grant awards under its Equity Incentive Plan in the ordinary course of business as long as the Company does not file a Form S-8 or other registration statement covering common stock underlying the awards or otherwise issued as awards during the three (3) month period; (ii) file or caused to be filed any registration statement with the SEC, relating to the offering of any classes of our stocks or any securities convertible into or exercisable or exchangeable for any classes of our stocks; (iii) complete any offering of debt securities, other than entering into a line of credit with a traditional bank; or (iv) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of any classes of our stocks, whether any such transaction described in clause (i), (ii), (iii) or (iv) above is to be settled by delivery of any classes of our stocks or such other securities, in cash or otherwise. |

| | | |

| Dividend Policy: | | We currently intend to retain all available funds and future earnings, if any, for use in the operation of our business and do not anticipate paying any cash dividends on our common stock in the foreseeable future. Investors should not purchase our common stock with the expectation of receiving cash dividends. |

| | | |

| Transfer Agent: | | Equiniti Trust Company, LLC. |

| | | |

| Risk Factors: | | Investing in our securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth under the heading “Risk Factors.” |

| (1) | The number of shares of common stock that are and will be outstanding immediately before and after this offering as shown above is based on 1,004,604 shares outstanding as of January 28, 2025, after giving effect to the Reverse Split and excluding (i) 37,500 shares of common stock issuable upon the exercise of the Representative’s Warrants, (ii) 167,556 shares of common stock issuable upon conversion of our Series D Preferred Stock, (iii) 53,828 shares of common stock issuable upon conversion of our Series E Preferred Stock, (iv) 90,453 shares of common stock issuable upon conversion of our Series F Preferred Stock, (v) 120,140 shares underlying stock options with an average weighted price of $24.78 per share, (vi) 166,444 underlying outstanding warrants at a weighted-average exercise price of $25.81 per share, and assumes no exercise of over-allotment option by the underwriters. |

RISK FACTORS

An investment in our common stock involves a high degree of risk. The risks described below include all material risks to our company or to investors in this offering that are known to our company. You should carefully consider such risks before participating in this offering. If any of the following risks actually occur, our business, financial condition and results of operations could be materially harmed. As a result, the trading price of our common stock could decline, and you might lose all or part of your investment. When determining whether to buy our common stock, you should also refer to the other information in this prospectus, including our financial statements and the related notes included elsewhere in this prospectus.

Risks Related to Our Financial Results and Financing Plans

Our revenue growth rate and financial performance in recent years may not be indicative of future performance and such growth may slow over time.

We have grown rapidly over the last three years, and our recent revenue growth rate and financial performance may not be indicative of our future performance. You should not rely on our revenue for any previous quarterly or annual period as an indication of our revenue or revenue growth in future periods. As we grow our business, our revenue growth rates may slow, or our revenue may decline, in future periods for a number of reasons, which may include slowing demand for our platform offerings and services, increasing competition, a decrease in the growth of our overall credit market, increasing regulatory costs and challenges and our failure to capitalize on growth opportunities. Further, we believe our growth over the last several years has been driven in large part by our platform, lender partnerships and current lack of competitors with a similar business model. Future incremental improvements in the financial capabilities of lenders, primarily our partners, may impact this substantially, and such developments may lead to varying levels of growth from past periods. As a result of these factors, our revenue growth rates may slow, and our financial performance may be adversely affected.

Our indebtedness could adversely affect our business, financial condition and results of operations and our ability to meet our payment obligations.

As of September 30, 2024, we had total indebtedness of $2,422,701, consisting of $742,860 of convertible debentures, $1,321,567 of loans payable and $358,274 of loans payable to related parties. Of the indebtedness, $2,132,150 is due within the twelve months ending September 30, 2025. Our indebtedness could have important consequences to our stockholders. For example, it could:

| ● | increase our vulnerability to and limit our flexibility in planning for, or reacting to, changes in our business; |

| ● | place us at a competitive disadvantage compared to our competitors that have less debt; |

| ● | limit our ability to borrow additional funds, dispose of assets, pay dividends and make certain investments; and |

| ● | make us more vulnerable to a general economic downturn than a company that is less leveraged. |

A high level of indebtedness would increase the risk that we may default on our debt obligations. Our ability to meet our debt obligations and to reduce our level of indebtedness will depend on our future performance. General economic conditions and financial, business and other factors affect our operations and our future performance. Many of these factors are beyond our control. We may not be able to generate sufficient cash flows to pay the interest on our debt and future working capital, borrowings or equity financing may not be available to pay or refinance such debt. Factors that will affect our ability to raise cash through an offering of our capital stock or a refinancing of our debt include our ability to access the public equity and debt markets, financial market conditions, the value of our assets and our performance at the time we need capital.

Risks Relating To Our Business

Our future success is substantially dependent on third-party relationships.

An element of our strategy is to establish and maintain alliances with other companies, such as suppliers of products and services as well as third-party software. These relationships enhance our status in the marketplace, which generates new business opportunities and marketing channels and, in certain cases, additional revenue and profitability. To effectively generate revenue out of these relationships, each party must coordinate and support required hence the sales and marketing efforts of the other, often including making a sizable investment in such sales and marketing activity. Our inability to establish and maintain effective alliances with other companies could impact our success in the marketplace, which could materially and adversely impact our results of operations. In addition, as we cannot control the actions of these third-party alliances, if these companies suffer business downturns or fail to meet their objectives, we may experience a resulting diminished revenue and decline in results of operations.

We license third-party software and other intellectual property for use in connection with our platform, including for various third-party product integrations with our platform. Our third-party licenses typically limit our use of intellectual property to specific uses and include other contractual obligations with which we must comply. These licenses may need to be renegotiated or renewed from time to time, or we may need to obtain new licenses in the future. Third parties may stop adequately supporting or maintaining their offerings or they or their technology may be acquired by our competitors. If we are unable to obtain licenses to third-party software and intellectual property on reasonable terms or at all, the functionalities available through our platform may be adversely impacted, which could in turn harm our business. Further, if we or our third-party licensors were to breach any material term of a license, such a breach could, among other things, prompt costly litigation, result in the license being invalidated and/or result in fines and other damages. If any of the following were to occur, it could harm our business, financial results, and our reputation. We also cannot be certain that our licensors are not infringing the intellectual property rights of others or that our licensors have sufficient rights to the intellectual property to grant us the applicable licenses. Although we seek to mitigate this risk contractually, we may not be able to sufficiently limit our potential liability. If we are unable to obtain or maintain rights to any of this intellectual property because of intellectual property infringement claims brought by third parties against our licensors or against us, our ability to provide functionalities through our platform using such intellectual property could be severely limited and our business could be harmed. Furthermore, regardless of the outcome, infringement claims may require us to use significant resources and may divert management’s attention.

Claims by others that we infringed their proprietary technology or other intellectual property rights could harm our business.

Companies in the internet security and technology industries are frequently subject to litigation based on allegations of infringement, misappropriation or other violations of intellectual property rights. In addition, certain companies and rights holders seek to enforce and monetize patents or other intellectual property rights they own, have purchased, or have otherwise obtained. As we gain an increasingly high public profile, the possibility of intellectual property rights claims against us grows. Although we may have meritorious defenses, there can be no assurance that we will be successful in defending against these allegations or in reaching a business resolution that is satisfactory to us. Our competitors and others may now and in the future have patent portfolios that are used against us. In addition, future litigation may involve patent holding companies or other adverse patent owners who have no relevant product or service revenue and against whom our patents may therefore provide little or no deterrence or protection. Many potential litigants, including some of our competitors and patent-holding companies, have the ability to dedicate substantial resources to the assertion of their intellectual property rights. Any claim of infringement by a third-party, even those without merit, could cause us to incur substantial costs defending against the claim, could distract our management from our business and could require us to cease use of such intellectual property.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, we risk compromising our confidential information during this type of litigation. We may be required to pay substantial damages, royalties or other fees in connection with a claimant securing a judgment against us, we may be subject to an injunction or other restrictions that prevent us from using or distributing our intellectual property, or from operating under our brand, or we may agree to a settlement that prevents us from distributing our offerings or a portion thereof, which could adversely affect our business, results of operations and financial condition.

With respect to any intellectual property rights claim, we may have to seek out a license to continue operations found or alleged to violate such rights, which may not be available on favorable or commercially reasonable terms and may significantly increase our operating expenses. Some licenses may be non-exclusive, and therefore our competitors may have access to the same technology licensed to us. If a third party does not offer us a license to its intellectual property on reasonable terms, or at all, we may be required to develop alternative, non-infringing technology, which could require significant time (during which we would be unable to continue to offer our affected offerings), effort and expense and may ultimately not be successful. Any of these events could adversely affect our business, results of operations and financial condition.

Our trademarks, copyrights, and other intellectual property could be unenforceable or ineffective.

Intellectual property is a complex field of law in which few things are certain. Competitors may be able to design around our intellectual property, find prior art to invalidate it, or render the patents unenforceable through some other mechanism. If competitors can bypass our patent, trademark and copyright protection without obtaining a sub-license, the Company’s value will likely be materially and adversely impacted. This could also impair the Company’s ability to compete in the marketplace. Moreover, if our patent, trademarks and copyrights are deemed unenforceable, the Company will almost certainly lose any potential revenue it might be able to raise by entering into sub-licenses. This would cut off a significant potential revenue stream for the Company.

The cost of enforcing our trademarks and copyrights could prevent us from enforcing them.

Patent, trademark and copyright litigation has become extremely expensive. Even if we believe that a competitor is infringing on one or more of our patent, trademarks or copyrights, we might choose not to file suit because we lack the cash to successfully prosecute a multi-year litigation with an uncertain outcome, or because we believe that the cost of enforcing our patent(s), trademark(s) or copyright(s) outweighs the value of winning the suit in light of the risks and consequences of losing it, or for some other reason. Choosing not to enforce our patent(s), trademark(s) or copyright(s) could have adverse consequences for the Company, including undermining the credibility of our intellectual property, reducing our ability to enter into sublicenses, and weakening our attempts to prevent competitors from entering the market. As a result, if we are unable to enforce our patent(s), trademark(s) or copyright(s) because of the cost of enforcement, your investment in the Company could be significantly and adversely affected.

We are making substantial investments in new product offerings and technologies and expect to increase such investments in the future. These efforts are inherently risky, and we may never realize any expected benefits from them.

We have made substantial investments to develop new product offerings and technologies, including our data infrastructure and our secure browser module software, and we intend to continue investing significant resources in developing new technologies, tools, features, services, products, and product offerings. We expect to increase our investments in these new initiatives in the near term, which may result in lower margins. We also expect to spend substantial amounts as we seek to grow the verticals in which we operate our platform and increase our scale and expand our offerings to additional geographic markets. If we do not spend our development budget efficiently or effectively on commercially successful and innovative technologies, we may not realize the expected benefits of our strategy. Our new initiatives also have a high degree of risk, as each involves strategies, technologies, and regulatory requirements with which we have limited or no prior development or operating experience. There can be no assurance that demand for such initiatives will exist or be sustained at the levels that we anticipate, or that any of these initiatives will gain sufficient traction or market acceptance to generate sufficient revenue to offset any new expenses or liabilities associated with these new investments. It is also possible that product offerings developed by others will render our product offerings non-competitive or obsolete. Further, our development efforts for new product offerings and technologies could distract management from current operations and will divert capital and other resources from our more established product offerings and technologies. Even if we are successful in developing new product offerings or technologies, regulatory authorities may subject us to new rules or restrictions in response to our innovations that could increase our expenses or prevent us from successfully commercializing new product offerings or technologies. If we do not realize the expected benefits of our investments, our business, financial condition and operating results may be harmed.

Our new products could fail to achieve the sales projections we expected.

Our growth projections assume that with an increased advertising and marketing budget, our products will be able to gain traction in the marketplace at a faster rate than our current products. Our new products may fail to gain market acceptance for any number of reasons. If the new products fail to achieve significant sales and acceptance in the marketplace, this could materially and adversely impact the value of your investment.

The development and commercialization of our products and services are highly competitive.

We face competition with respect to any products and services that we may seek to develop or commercialize in the future. Our competitors include major companies, some publicly listed, in the United States. Many of our competitors have significantly greater financial, technical, and human resources than we have and superior expertise in research and development and MSP/partner relationships and thus may be better equipped than us to provide requisite technical service and to develop and commercialize products. These competitors also compete with us in recruiting and retaining qualified personnel and acquiring technologies. Smaller or early-stage companies may also prove to be significant competitors or disruptors, particularly through collaborative arrangements with large and established companies and/or some of our competitors. Accordingly, our competitors may commercialize products more rapidly or effectively than we can, which would adversely affect our competitive position, the likelihood that our products and services will achieve initial market acceptance and our ability to generate meaningful additional revenues from our products and services.

We must correctly predict, identify, and interpret changes in consumer preferences and demand, offer new products to meet those changes, and respond to competitive innovation.