UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

(Amendment No. 1)

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of The Securities Exchange Act of 1934

TECHMEDIA ADVERTISING, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0540833 |

| (State or other Jurisdiction of Incorporation or organization) | (I.R.S. Employer Identification No.) |

| 6, Shenton Way #21-08 OUE Downtown | |

| Singapore | 068809 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, including area code: +65-65572516

Securities registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Shares, $0.001 par value

(Title of class)

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (do not check if a smaller reporting company) | Smaller reporting company [X] |

| | |

| | Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

1

2

REFERENCES

As used in this registration statement on Form 10 (the “Registration Statement”): (i) the terms the “Registrant”, “we”, “us”, “our”, “TechMedia” and the “Company” mean TechMedia Advertising, Inc.; (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the United States Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

NOTE ABOUT FORWARD-LOOKING STATEMENTS

Certain statements contained in this Registration Statement on Form 10 constitute “forward-looking statements.” These statements appear in a number of places in this Registration Statement and documents included herein and include statements regarding the Registrant’s intent, belief or current expectation and that of the Registrant’s officers and directors. These forward-looking statements involve known and unknown risks and uncertainties that may cause the Registrant’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as “believe”, “intend”, “may”, “will”, “should”, “plans”, “anticipates”, “believes”, “potential”, “intends”, “expects” and other similar expressions. These statements are based on the Registrant’s current plans and are subject to risks and uncertainties, and as such the Registrant’s actual future activities and results of operations may be materially different from those set forth in the forward-looking statements. Any or all of the forward-looking statements in this Registration Statement may turn out to be inaccurate and as such, you should not place undue reliance on these forward-looking statements. The Registrant has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. The forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and assumptions due to a number of factors, including, dependence on key personnel, competitive factors, the operation of the Registrant’s intended business, and general economic conditions in the United States and Singapore. These forward-looking statements speak only as of the date on which they are made. The Registrant assumes no obligation to update or to publicly announce the results of any change to any of the forward-looking statements contained or included herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements, other than where a duty to update such information or provide further disclosure is imposed by applicable law, including applicable United States federal securities laws. In addition, the Registrant cannot assess the impact of each factor on its intended business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. All subsequent written and oral forward-looking statements attributable to the Registrant or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained in this Registration Statement. Important factors that you should also consider, include, but are not limited to, the factors discussed under “Risk Factors” in this Registration Statement.

ITEM 1. BUSINESS

General

We were incorporated in the State of Nevada under the name “Ultra Care, Inc.” on January 30, 2007. Effective February 17, 2009, we completed a merger with our wholly-owned subsidiary, TechMedia Advertising, Inc. As a result, we have changed our name from “Ultra Care, Inc.” to “TechMedia Advertising, Inc.”

In addition, effective February 17, 2009, we effected a forward stock split or our authorized, issued and outstanding common stock on a basis of one (1) old share for twenty-two (22) new shares. As a result, our authorized capital increased from 50,000,000 shares of common stock to 1,100,000,000 shares of common stock.

3

Our head and principal office is located at 6, Shenton Way #21-08 OUE Downtown, Singapore 068809. Our registered agent in the State of Nevada is Nevada Agency and Transfer Company located at 50 West Liberty Street, Suite 880, Reno, Nevada 89501.

Our original business plan was to service the healthcare industry and provide prospective employers with reliable recruitment, screening, and placement services by developing an innovative web-based service to match foreign-based nurses who are looking to work in the United States and Canada with healthcare employers located in the United States and Canada. However, in 2009, we adopted a new business plan that entailed entering into the streaming digital media advertising business in India through a joint venture company to be formed in India as well as through our indirectly owned subsidiary, TechMedia Advertising (India) Private Limited (“TM India”). In the fall of 2009, we, through our wholly owned subsidiary, TechMedia Advertising Mauritius (“TM Mauritius”) entered into a Joint Venture Development and Operating Agreement (the “JV Agreement”) with Peacock Media Ltd. (“PML”), a company incorporated under the laws of India, to form a new private Indian joint venture company where we would indirectly own 85% and PML would own 15%. We intended for the joint venture company to operate the business of displaying mobile digital advertising platforms in public transportation vehicles such as long-distance buses and trains in India where such transportation vehicles would display third-party commercial content and advertisements for a fee. However, in early 2011, we decided to discontinue the operations with respect to the JV Agreement and TM India. Our subsidiary TM Mauritius was struck from the corporate register in Mauritius on December 1, 2013. In addition, our subsidiary TM India was dissolved on January 7, 2014.

Under SEC Rule 12b-2 under the Securities Act, we qualify as a “shell company,” because we have no or nominal assets (other than cash) and no or nominal operations at this time.

On December 16, 2016, we entered into a binding and definitive share exchange agreement (the “Share Exchange Agreement”) with IBASE Technology Private Limited (“IBASE”), a company organized under the laws of Singapore, and all of the shareholders of IBASE, whereby we have agreed to acquire 100% of the issued and outstanding shares in the capital of IBASE in exchange for the issuance of an aggregate of 18,998,211 post-reverse stock split shares of our common stock to the shareholders of IBASE on a pro rata basis in accordance with each IBASE shareholders’ percentage of ownership in IBASE. Our reverse stock split required as a condition precedent to closing the Share Exchange Agreement shall be on a basis of one (1) new share for each five (5) old shares, which is to be completed prior to the closing of the Share Exchange Agreement. Among other closing conditions, the Share Exchange Agreement is subject to the following material conditions precedent:

| | (a) | the Company having filed a Form 10 registration statement with the SEC to have its shares of common stock registered pursuant to Section 12(g) of the Exchange Act and the Company being subject to the reporting requirements of Section 13(a) of the Exchange Act; |

| | | |

| | (b) | Mr. Alan Goh having resigned from the position of Secretary and a Director of the Company to be effective upon closing; |

| | | |

| | (c) | Mr. William Goh having resigned from the positions of President, CEO, CFO and Treasurer of the Company to be effective upon closing; |

| | | |

| | (d) | the Company appointing Ernest Kok-Yong Ong as the President and CEO of the Company and Willie Lian as the CFO, Treasurer and Secretary of the Company to be effective upon closing; and |

| | | |

| | (e) | on or prior to closing, the Company shall take all action necessary to: |

| | (i) | cause the number of directors that will comprise the full board of directors of the Company effective as of immediately following the closing to be fixed at three; |

| | | |

| | (ii) | cause the board of directors of the Company effective immediately following the closing to consist of Ernest Kok-Yong Ong, Willie Lian and William Goh, and |

4

| | (iii) | cause the individuals identified or designated pursuant to the preceding clause (ii) to be appointed to the Board of Directors of the Company effective immediately following the closing. |

Pending satisfaction of the closing conditions of the Share Exchange Agreement, IBASE will become a wholly owned subsidiary of the Company and the shareholders of IBASE will become our shareholders. This transaction is commonly referred to as a Reverse Take-Over (“RTO”) and effectively upon closing, IBASE shareholders will hold more than 50% of our post-closing outstanding shares, not including the shares to be issued by us pursuant to any financing for working capital purposes prior to the closing of the Share Exchange Agreement. With respect to our shares of common stock to be issued to the shareholders of IBASE, we intend to rely on the exemption from registration under the Securities Act provided by Rule 903 of Regulation S based on the representations and warranties of the shareholders of IBASE contained in the Share Exchange Agreement.

On March 31, 2017, we entered into an extension agreement (the “Extension Agreement”) to the Share Exchange Agreement with IBASE and all of the shareholders of IBASE, whereby the parties agreed to extend the Closing Date (as defined in the Share Exchange Agreement) to March 31, 2018 and the Latest Closing Date (also as defined in the Share Exchange Agreement) to April 30, 2018.

On March 31, 2018, we entered into an amended share exchange agreement (the “Amended Share Exchange Agreement”) with IBASE and all of the shareholders of IBASE, whereby the parties agreed further amend the Closing Date to be on or before December 15, 2018 and the Latest Closing Date to be December 31, 2018, subject to any extensions of 15 days per extension as mutually agreed to by the parties, as well as to reflect the convertible note financing (the “Convertible Notes”) of IBASE of up to US$3,500,000, which upon closing of the Amended Share Exchange Agreement the Convertible Notes will automatically convert into shares of our common stock at a price of US$0.90 per share (up to a maximum of 3,888,889 shares of our common stock).

On September 22, 2017, we effected a reverse stock split of our authorized and outstanding shares of common stock on a basis of one (1) new share of common stock for each five (5) old shares of common stock. As a result of the reverse stock split, our authorized capital decreased from 1,100,000,000 shares of common stock with a par value of $0.001 per share to 220,000,000 shares of common stock with a par value of $0.001 per share, and correspondingly our issued and outstanding capital decreased from 48,327,371 shares of common stock to approximately 9,665,474 shares of common stock.

Our independent auditors’ report accompanying our July 31, 2018 and 2017 financial statements contains an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. Our financial statements have been prepared assuming that we will continue as a going concern, which contemplates that we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business.

Intercorporate Relationships

We currently do not have any subsidiaries, however, upon closing of the Share Exchange Agreement, IBASE Technology Private Limited will become our wholly-owned subsidiary.

Business Operations

At this time we do not have any current business operations other than completing due diligence on IBASE and working on satisfying the conditions precedent in order to close the Share Exchange Agreement to acquire 100% of the issued and outstanding shares in the capital of IBASE. Upon completion of the acquisition of IBASE, the business of IBASE will become our business. The following information in this Form 10 registration statement about IBASE has been provided by management of IBASE and prepared pursuant to consultation between us and the management of IBASE.

5

IBASE

IBASE was incorporated on May 13, 1999, pursuant to the laws of Singapore. The current directors of IBASE are Ernest Kok-Yong Ong (managing director) and Willie Lian. Mr. Foot Hin Wong is the Secretary of IBASE. The authorized capital stock of IBASE consists of 1,000,000 ordinary shares each with a par value of SGD$1.00, of which 325,000 shares are issued and outstanding.

IBASE ‘s head office is in Singapore located at No. 19, Kallang Ave, #04-151, Singapore 339410.

Description of Business

IBASE is in the business of being a solution provider of cloud-enabled real estate and facility management, financial management, security and enterprise turn-key systems/solutions for business-to-government, business-to-business and business-to-consumer. IBASE’s web-based management solution UBERIQTM has been adopted by multiple enterprises internationally. The IBASE software technology is comprehensive and represents cutting edge technology made simple to use.

IBASE’s solutions help generate positive gains and returns in the following areas:

| | • | Financial & Tax management |

| | • | Property management |

| | • | Lease, rental and MCST* management |

| | • | Facility and asset management |

| | • | MyTenantWorld Web Portal |

| | • | Mobile applications |

*MCST – stands for Management Corporation Strata Title. It is a company or individual appointed to manage a real estate property that a company or individual owns. Manage of real estate property involves the maintaining good security, upkeeping commercial facilities, regulating rules, etc. IBASE’s solution aims to improve the operation challenges.

Principal Products and Services

IBASE’s main product offerings are UBERIQTM and MyTenantWorld.

UBERIQTM

UBERIQTM is a state-of-art web-enabled business management system that readily delivers the latest and smartest features to empower a customer’s employees to operate multiple management activities such as billing, leasing, documentation, financial management, customer relationship and facilities management at optimum efficiency and effectiveness. UBERIQTM has led the industry by responding quickly to industry changes and constant innovation, becoming the premier application for the property and facilities management industry.

UBERIQTM features modular solutions, true web solutions, simplified solutions and globalization support. UBERIQTM comprises of more than 1,000 in-house developed applications that are intelligently designed and developed to operate in modularly. Each module can function as a standalone or efficiently integrate with other modules. IBASE’s customers only purchase the modules they require resulting in cost savings for the customer. UBERIQTM is 100% web-enabled. An entry level computer with internet connectivity is able to access our suite of powerful applications efficiently, which eliminates the need to acquire expensive equipment and complex multi-location deployments. UBERIQTM is intuitive and easy to use, which was a result of investing a massive amount of man-day efforts in researching how IBASE customers interact with its solutions and development an intuitive user experience and interface, which eliminates intensive system training programs and re-training to held IBASE clients achieve time and cost savings. The ability to extend a customer’s businesses globally is simplified by using UBERIQTM Solution as the business management platform. The system supports multiple languages, currencies and is customizable to quickly adapt to different business conditions in foreign markets. UBERIQTM is a truly comprehensive solution that uniquely provides critical local market functionalities to help businesses expand across borders easily.

6

UBERIQTM Online Facility & Property Asset Management System

UBERIQTM Online Facility & Property Asset Management System provides the customer with fast, reliable and comprehensive facility and asset lifecycle planning, utilization monitoring, expense control, vendor contract management and real-time analysis capabilities. In addition, it enables the customer to extend the appropriate information and business workflow so that the customer can improve the efficiency of its existing facility and asset management processes.

The advantages of the UBERIQTM Online Facility & Asset Management System are as follows:

| | • | Allows a service request module to be easily implemented as a helpdesk system for the recording of complaints, viewing of historical information and dissemination of work orders; |

| | • | Provides comprehensive vendor contract management tools that stores all contracted information of appointed vendors. The collective information such as tender details, award details, schedule-of-rates, service types, and related documents are stored securely to form a powerful knowledge based system for business decisions; and |

| | • | Allows property manages to pre-define the service provider, criticality, personnel involved and contact number, etc. for every problem code that is created in the system. The availability of such information enables the system to establish an automated problem escalation workflow to issue a works order (and SMS alerts) based on a specific fault reported. |

The key benefits of the UBERIQTM Online Facility & Asset Management System are as follows:

| | • | Centralized monitoring of the customer’s facilities and asset maintenance plans for multiple properties; |

| | • | Detailed tracking of facilities and asset locations, historical utilization rate and maintenance status to enable optimal lifecycle planning activities; |

| | • | Systematic control of procurement process with tight control on schedule-of-rates; |

| | • | Accurate budget control of expenses that can be integrated with UBERIQTM Financial Management Solutions; and |

| | • | Ability to make the right decisions at the shortest time to maximize proper utilization of available resources. |

UBERIQTM Online Property Leasing Management System

UBERIQ™ Online Property Leasing Management System is the most intuitive and comprehensive lease administration system available in the market to provide the customer with fast and reliable lease management capabilities such as tenancy contracting, operation workflows, utility tracking, rental tabulation and real-time data analysis, etc. As a result, the customer will be able to achieve a highly automated leasing management process regardless of the number of properties, size or locations.

The advantages of the UBERIQTM Online Property Leasing Management System are as follows:

| | • | Keeps track of fine details of each tenancy transactions and activities. The efficient centralized data storage helps establish the backbone knowledge base that is mandatory for the call centre support function. With accurate and quick retrieval of a relevant tenancy record, it is easier to achieve optimal customer service- level; |

7

| | • | Designed to manage more than the usual lease management accounting processes alone, the customer receives integrated tenant operation functions as a standard feature to access a comprehensive suite of tenant relations management functions; and |

| | • | Seamlessly integrated with the MyTenantWorld web portal. All lease billing, tenant operations information and payment transaction details are published on the securely encrypted property web portal. |

The key benefits of the UBERIQTM Online Property Leasing Management System are as follows:

| | • | Allows the customer to obtain a holistic view of its property lease management process; |

| | • | Real-time tracking of rental income, lease expiry and arrears, etc.; |

| | • | Streamline and automation of lease management processes; |

| | • | Integrated tenant relations management workflows; and |

| | • | Provides accurate insight of your average rental rates per work space. |

UBERIQTM Online Strata Manager System

UBERIQTM Online Strata Manager System provides the customer (and its valued residents/tenants) with fast, reliable and comprehensive range of innovative e-Services that empower the customer (the property manager) to extend the most appropriate information and automated online services, to achieve enhanced customer experience.

The advantages of the UBERIQTM Online Strata Manager System are as follows:

| | • | With the UBERIQ™ Strata Management Tools the property manager is able to mass disseminate official announcements and publish property-related information onto the web portal; |

| | • | UBERIQ™ is a modular but tightly integrated management system that offers unmatched enterprise efficiency; and |

| | • | Billing functions to assist property manager to efficiently generate electronic payment statements so that tenants achieve paperless operation. |

The key benefits of the UBERIQTM Online Strata Manager System are as follows:

| | • | Allows the customer to obtain a holistic view of its property activities and status; |

| | • | Tracking of tenant and resident requests and feedback actively; |

| | • | Provides greater insight of the customer’s facilities utilization per week accurately thereby improving the management ability to make the right decisions at the shortest time; |

| | • | Dashboard alerts; |

| | • | Web content management; |

| | • | Online feedback and applications; |

| | • | Facility/Event booking; |

| | • | View invoices and statements; |

| | • | Payments/Refunds/Receipts. |

UBERIQTM Online Financial & Tax Management System

UBERIQTM Online Financial & Tax Management System provides the customer with fast, reliable and comprehensive accounting, financial reporting and real-time analysis capabilities, enabling the customer to extend the appropriate information and business workflows so that it is able to improve the overall efficiency of its existing accounting management processes.

The advantages of the UBERIQTM Online Financial & Tax Management System are as follows:

8

| | • | The dashboard information serves as an important tool to trigger alerts and deliver the latest relevant information to designated users for immediate response and decision-making; |

| | • | Intuitive and user-friendly system design utilizing integrated form wizards and data validation functions to intelligently guide users through step-by-step instructions in creating documents allowing the end-users to eliminate the need to refer to user-manuals when using the system; and |

| | • | Supports multiple currencies and languages to establish an effective centralized accounting management system critical in managing multi-geographical business deployments. |

The key benefits of the UBERIQTM Online Financial & Tax Management System are as follows:

| | • | Accuracy and clarity of the customer’s finances at its fingertips; |

| | • | Improve the efficiency of the client’s financial operations to enable optimal strategic planning; |

| | • | Ability to manage cash flow accurately in real-time; |

| | • | Ensure regulatory compliance with our approved system; |

| | • | Fast data mining capabilities to provides greater insight of the customer’s financial performance; and |

| | • | Improve management’s ability to make the right decisions in a shorter period of time. |

MyTenantWorld

What is MyTenantWorld?

MyTenantWorld is Asia’s leading condominium application and IBASE is reinventing the way residents live and how property managers manage their condos through innovative design and IoT [NTD: What is IoT?]and mobile technology. With MyTenantWorld, residents need only their smartphone and our mobile application to manage all aspects of their condo living.

Why MyTenantWorld?

The modern conveniences provided through innovation is now a must rather than a need. As our world develops with technological advances and as our society becomes ever more tech-savvy, there is a need to rethink and reimagine future condo living.

Imagine the convenience of booking your facilities or making your maintenance fee payments through your smartphone without the need to call or walking to the management office. Imagine the peace of mind through having your condo’s news and information at your fingertips or never missing out on an important update or event.

MyTenantWorld provides convenience, peace of mind, comforts, security and services that condo residents have grown to love and expect. MyTenantWorld is designed to enhance the prestige of your condo and redefine condo living with MyTenantWorld.

What does MyTenantWorld provide?

MyTenantWorld condominium portal allows residents to manage their condo living through their smartphones. The application has two distinct sections – one for residents and one for condo managers, both equipped with easy tools that make condo living and management hassle free.

MyTenantWorld provides residents with the following features:

| | • | Up-to-date condo announcements |

| | • | Facility bookings |

| | • | Online payments of booking and maintenance fees |

| | • | Important alerts and payment reminders |

9

| | • | A community events calendar |

| | • | Concierge services |

For condo managers, MyTenantWorld provides them with the following features:

| | • | Management Dashboard with alerts and statistics |

| | • | Announcement management and push notifications |

| | • | Tenant and owner management |

| | • | Facility and booking management |

| | • | Payment management |

| | • | Event management |

Competitive Business Conditions and IBASE Position in the Industry

IBASE is operating and competing in two market segments for business both of which are billion dollar industries, namely FinTech (Finance Technologies) and PropTech (Property Technologies).

FinTech

In the FinTech Market, IBASE is offering both Enterprise-based and Software-as-a-Service-based financial management system to Singapore Small and Medium Enterprises (“SMEs”). This market segment comprises of greater than 200,000 SMEs. However, this is a very challenging market space due to a huge number of service providers, easily greater than 50 companies, competing for the market share.

To differentiate IBASE from competition, it pioneered the development of a first-of-its-kind cloud-based XBRL & Tax Management Engine through close consultation with multiple professionals and government entities. The engine encompasses complex algorithms based on the latest Inland Revenue tax policies, rules and standards.

This powerful engine allows end-users to quickly and accurately generate the XBRL financial reports and tax computation for annual filing to the tax authorities.

The XBRL/Tax computation engine has enabled IBASE to move up the value chain through the offering of an expert system for management decision-making; rather than just a data entry platform for business accounting purposes.

Also, IBASE has successfully created a unique selling point for IBASE’s financial management system by offering XBRL/Tax computation engine as a standard product functionality.

IBASE has established a dedicated team to constantly enhance the engine to include compatibility with multiple brands of accounting systems, integrating artificial intelligence and big data analytics capabilities, etc.

With the XBRL/Tax computation engine, IBASE’s management believes that it sits in a very niche market position by offering solutions to help clients easily achieve regulatory compliance in a very efficient manner. IBASE offers the products indirectly to the 200,000 SMEs through the professional firms network, i.e. corporate secretary, accounting & audit firms, etc. based on a monthly subscription fee.

PropTech

In the PropTech Market, IBASE is offering both Enterprise-based and Software-as-a-Service-based property and facility management systems to both local and overseas markets.

10

The market potential is very large due to the strong growth in the region’s real estate development projects that resulted in demand of computerized solutions for,

| | • | Facility Operations & Security Management |

| | • | Emergency & Incident Management |

| | • | Lease Accounting Management |

| | • | Contract Management |

| | • | Asset Maintenance Management |

| | • | Tenant/Resident Management and more |

This market potential is further expanded by the demand to the introduce the smart-nation and smart-building initiatives. It is no longer a good-to-have but rather a must-have for new building developments.

Based on an independent report by PR Newswire titled “Facility Management Market – Global Forecast to 2023”, dated June 4, 2018, located at https://www.prnewswire.com/news-releases/facility-management-market---global-forecast-to-2023-300658085.html, it was reported that the global market size for this industry is set to grow from US$34.65 billion to US$59.33 billion by 2023 driven by needs for sustainable infrastructure, Internet-of-Things, building automation, regulatory compliance and demand for integrated facilities management, etc.

There is only a handful of specialized service providers in the market and IBASE sees the following companies as its key competitors in similar PropTech space and market segment:

| | • | Anacle Systems Limited (www.anacle.com) |

| | • | Yardi Systems Inc. (www.yardi.com) |

| | • | MRI Software LLC (www.mrisoftware.com) |

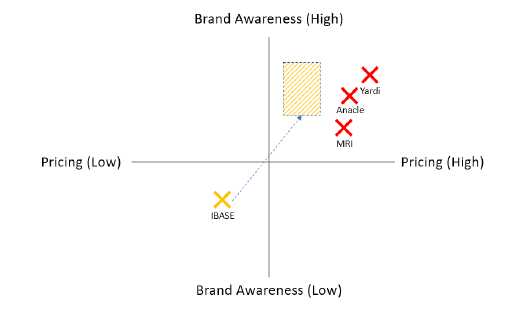

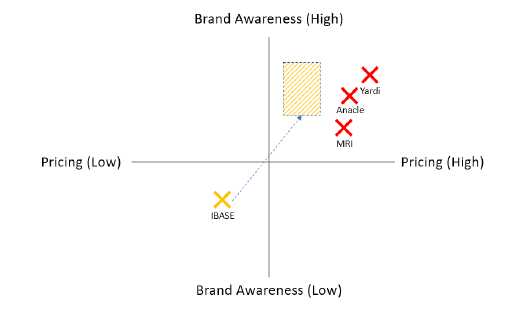

Vis-à-vis that the companies are offering similar technology capabilities and products to the industry, IBASE’s management believes that the market positioning chart below shows where IBASE sits in the market at the moment.

-Market Positioning Chart-

11

IBASE currently offers a low-cost solution to the industry but its brand awareness is lower. As such, IBASE’s initial plan is to embark on aggressive branding and marketing initiatives to increase IBASE’s brand profile in the market for both Singapore and overseas markets such as Malaysia, Indonesia, Thailand, Hong Kong, China, Australia, etc.

To further differentiate IBASE’s products from the competition, IBASE intends to integrate in-house FinTech capabilities into its PropTech solutions to help real estate owners and managers easily meet the regulatory compliance for the real-estate industry. IBASE’s target is to move IBASE into a positioning that is within the shaded box in the market positioning chart above.

Generally, IBASE’s management strongly believes that IBASE is well positioned to capitalize on two very large and potential markets due to the following positive factors:

| | • | Mature Management Team - IBASE has been established for 18 years and successfully acquired high- profile clientele such as Singapore Government ministries and agencies, multi-national companies and large property developers and managing agencies. |

| | • | Tested Business Model – UBERIQ and MyTenantWorld are dynamic and scalable software solutions that have proven its effectiveness to the market. UBERIQ is a web-enabled business operation and management software and MyTenantWorld e-Portal serves the needs of both condominium residents/building tenants (front-end) and property managers (back-end). |

| | • | Business Growth – IBASE expects to complete a reverse takeover of TechMedia in order to position it to be able to access capital markets for business growth and expansion. |

| | • | Strategic Alliance – IBASE’s strong partnerships with industry-leading property management firms will provide a launch pad for MyTenantWorld’s South East Asia expansion plans. |

| | • | Smart Nation Enabler – MyTenanWorld is an enabling platform to support government’s Smart Nation/Smart Cities vision and initiatives. This can be achieved through data aggregation, business intelligence and Internet-of-Things connectivity, etc. |

| | • | Competitive Pricing – IBASE is known for providing cost-effective solutions as referenced in the market positioning chart above. |

| | • | High Service Levels – IBASE has consistently delivered high service levels and provide impressive after- sales support, which has let to repeat business. |

IBASE’s management team identified the following negative factors but intends to invest in resources to eradicate or reduce the weaknesses/risks to its businesses, which are:

| | • | Weak Corporate & Product Branding - IBASE is weaker in corporate and product branding as IBASE and its products are still relatively unknown in the market, especially in overseas markets. With proper branding, IBASE products are expected to contribute to increased market share to achieve revenue growth. |

| | • | No Sales & Marketing Team – There is no well-organized sales and marketing team within IBASE. IBASE’s initial plans are to invest in an experienced sales and marketing team to help increase IBASE’s presence in the market and to grow revenues. |

| | • | Expansion in Technical Capabilities – To become a market leader in the technology field, IBASE intends to continuously push its technical capabilities to be one of the best in the market. As such, IBASE intends to aggressively compete to recruit the best talents to help IBASE create the best products and services for the industry. |

Patents, Trademarks and Licenses

IBASE has registered the trademark “UBERIQ” with the Intellectual Property Office of Singapore under the provision of the Trade Mark Act 1998 on the 14th day of February 2013 in Class 42 in respect of the following:

Computer software advisory services; computer software consultancy; computer software design; computer software development; computer software programming; computer support services (programming and software installation, repair and maintenance services); design and development of computer software (for others); design of computer software; development of computer software application solutions; information technology (IT) services (computer hardware, software and peripherals design and technical consultancy); providing information, including online, about design and development of computer hardware and software.

12

Also, IBASE is in the process of submitting a Trade Mark application for MyTenantWorld with the Intellectual Property Office of Singapore.

Key Customers

IBASE’s key customers are comprised of the Singapore Government Ministries & Agencies, and large multinational corporations as follows:

| S/N | Customer | Logo | Service | Product | Terms | Estimated

Revenue SGD | Estimated Revenue% |

| Financial Year Ending June 30, 2018 (Total Revenue @ approximately SGD1,440,000.00) |

| 1 | SMECEN Pte Ltd |  | Supply of SaaS-based ERP Solutions and Regulatory Compliance Systems | Turnkey | One-Time Project Fees billed on job completion | $334,800.00 | 23% |

| 2 | Agri-Food & Veterinary Authority of Singapore (AVA) |  | Supply of Enterprise Property Management System | UBERIQ | One-Time Project Fees billed on job completion | $160,000.00 | 11% |

| 3 | Ministry of Foreign Affairs |  | Enhancement & Maintenance of Enterprise Integrated Financial System | UBERIQ | One-Time Project Fees billed on job completion | $90,000.00 | 6% |

| 4 | Knight Frank Property Asset Pte Ltd |  | Enhancement of Asset & Facilities Management System | UBERIQ | One-Time Project Fees billed on job completion | $40,000.00 | 2% |

| 5 | Singapore Police Force |  | Enhancement & Maintenance of Asset & Facilities Management System | UBERIQ | One-Time Project Fees billed on job completion | $88,660.00 | 6% |

13

Financial Year Ending June 30, 2017 (Total Revenue @ approximately SGD1,420,000.00) |

| 1 | Ministry of Foreign Affairs |  | Enhancement of Enterprise Integrated Financial System | UBERIQ | One-Time Project Fees billed on job completion | $268,000.00 | 19% |

| 2 | Knight Frank Property Asset Pte Ltd |  | Supply of Enterprise Leasing, Asset& Facilities Management System | UBERIQ | One -Time Project Fees billed on job completion | $43,000.00 | 3% |

| 3.1 | Singapore Police Force |  | Supply of Enterprise Financial& Inventory System | UBERIQ | One -Time Project Fees billed on job completion | $20,000.00 | 1% |

| 3.2 | Singapore Police Force |  | Annual Maintenance Fees | UBERIQ | Recurring Fees | $75,000.00 | 5% |

| 4 | YR Industries Pte Ltd |  | Annual Maintenance Feefor Enterprise Human Resource Information System | UBERIQ | Recurring Fees | $12,000.00 | 1% |

| 5.1 | Singapore Corporative Rehabilitative Enterprises |  | Enhancement of Enterprise Human Resource Information System | UBERIQ | One -Time Project Fees billed on job completion | $28,750.00 | 2% |

| 5.2 | Singapore Corporative Rehabilitative Enterprises |  | Annual Maintenance Fee for Enterprise Human Resource Information System | UBERIQ | Recurring Fees | $14,000.00 | 1% |

Research and Development

During the fiscal year ended June 30, 2018, IBASE spent $130,788 on research and development. During the fiscal years ended June 30, 2017 and 2016, IBASE spent nil on research and development.

Moving forward, IBASE plans to embark on research and development work on developing innovative products and run pilot projects for the industry, which is expected to cost approximately $300,000 over the next twelve months

14

Employees

IBASE currently has about 25 employees in its Singapore office.

Material Contracts

| S/N | Parties | Logo | Subject of Agreement | Dateof

Agreement | Terms of Contract | Duration | Termination Provisions |

| 1 | Association of Small Medium Enterprises (ASME) |  | Memorandum of Understandingfor partnership of IT Related Initiatives for Inland Revenue Authority (IRAS)and Accountingand Corporate Regulatory Authority(ACRA) of Singapore | June1st2016 | Memorandum of understanding to express interest to jointly embark on an IT initiative. | No fixed date. | This MOU shall be terminated by either party in writing. |

| 2 | Knight Frank Property Asset Pte Ltd |  | Application Services Collaboration Agreementfor Propertye Portal Solutions | December 28th2016 | Supply pf Property e -Portal Solutions to Knight Frank & its clients based on fees shown in Schedule1 | Commenced from effective datefora period of 5 years. | Without affecting any other rights or remedy available,either party may terminate this Agreement with immediate effect by giving written notice based on conditions stated in Clause13.2of Agreement. |

ITEM 1A. RISK FACTORS

In addition to the factors discussed elsewhere in this Registration Statement, the following are certain material risks and uncertainties that are specific to the IBASE business and industry that could materially adversely affect our business, financial condition and results of operations.

Risks related to the IBASE Business

The loss of one or more of IBASE’s key customers, or a failure to renew its service agreements with one or more of its key customers, could negatively affect its ability to market its applications.

IBASE relies on its reputation and recommendations from key customers in order to promote services to its product applications. The loss of any of its key customers, or a failure of some of them to renew, could have a significant impact on its revenues, reputation and our ability to obtain new customers. In addition, acquisitions of its customers could lead to cancellation of its contracts with those customers or by the acquiring companies, thereby reducing the number of its existing and potential customers.

IBASE faces competition in its markets, and if it does not compete effectively, its operating results may be harmed.

The market for cloud-based property management software solutions is highly competitive and rapidly changing and fragmented, with increasingly and relatively low barriers to entry.

With the introduction of new technologies and market entrants, IBASE expects competition to intensify in the future. In addition, pricing pressures and increased competition generally could result in reduced sales, reduced margin or the failure of its products and services to achieve or maintain more widespread market acceptance.

Many of IBASE’s actual and potential competitors have competitive advantages, such as Anacle Systems Limited (www.anacle.com), Yardi Systems Inc. (www.yardi.com) and MRI Software LLC (www.mrisoftware.com). They have greater brand name recognition, larger sales and marketing budgets and resources, broader distribution networks and more established relationships with distributors and customers, greater resources to develop and introduce solutions that compete with its products and substantially greater financial, technical and other resources. As a result, IBASE competitors may be able to respond more quickly and effectively than it can to new or changing opportunities, technologies, standards or customer requirements. If IBASE is not able to compete effectively, its operating results will be harmed.

15

If IBASE fails to manage its technical operations infrastructure, its existing customers may experience service outages and its new customers may experience delays in the deployment of its applications.

IBASE has experienced growth in the number of users, transactions and data that its operations infrastructure supports. IBASE seeks to maintain sufficient excess capacity in its operations infrastructure to meet the needs of all of its customers. It also seeks to maintain excess capacity to facilitate the rapid provision of new customer deployments and the expansion of existing customer deployments. In addition, IBASE needs to properly manage its technological operations infrastructure in order to support version control, changes in hardware and software parameters and the evolution of its applications. However, the provision of new hosting infrastructure requires significant lead time. It may in the future experience website disruptions, outages and other performance problems. These problems may be caused by a variety of factors, including infrastructure changes, human or software errors, viruses, security attacks, fraud, spikes in customer usage and denial of service issues. In some instances, IBASE may not be able to identify the cause or causes of these performance problems within an acceptable period of time. If it does not accurately predict its infrastructure requirements, its existing customers may experience service outages that may subject it to financial penalties, financial liabilities and customer losses. If its operations infrastructure fails to keep pace with increased sales, customers may experience delays as we seek to obtain additional capacity, which could adversely affect its reputation and adversely affect its revenues.

Assertions by third parties of infringement or other violations by IBASE of their intellectual property rights could result in significant costs and harm its business and operating results.

Patent and other intellectual property disputes are common in the software and technology industries. Third parties may in the future assert claims of infringement, misappropriation or other violations of intellectual property rights against IBASE. They may also assert such claims against its customers or channel partners whom it typically indemnify against claims that its solutions infringe, misappropriate or otherwise violate the intellectual property rights of third parties. As the numbers of products and competitors in our market increase and overlaps occur, claims of infringement, misappropriation and other violations of intellectual property rights may increase. Any claim of infringement, misappropriation or other violation of intellectual property rights by a third party, even those without merit, could cause IBASE to incur substantial costs defending against the claim and could distract its management from its business.

IBASE is dependent on the continued services and performance of its senior management and other key employees, the loss of any of whom could adversely affect its business, operating results and financial condition.

IBASE’s future performance depends on the continued services and continuing contributions of its senior management, particularly Mr. Ernest Kok Yong Ong (Co-Founder and CEO), Mr. Willie Lian (Co-Founder & CFO), Mr. Hui Bon Tay (Co-Founder & Senior Manager), Mr. William Goh (Company Director) and other key employees to execute on its business plan and strategies. Although its executive officers are currently covered by employment agreements, other members of its senior management team are generally employed on an at-will basis, which means that they could terminate their employment with it at any time. The loss of the services of its senior management, particularly Mr. Ernest Kok Yong Ong, Mr. Willie Lian, Mr. Hui Bon Tay, Mr. William Goh, or other key employees for any reason could significantly delay or prevent the achievement of its strategic objectives and harm its business, financial condition and results of operations.

16

IBASE may acquire other businesses, products or technologies, which divert its management’s attention and otherwise disrupt its operations and harm its business and results of operations.

As part of IBASE’s growth strategy, it may pursue business and technology acquisitions in the future. The environment for acquisitions in its industry is very competitive and acquisition purchase prices may exceed what it would prefer to pay. Moreover, it may not realize the anticipated benefits of its acquisitions to the extent that it anticipates, or at all, because acquisitions involve many risks, including:

| | • | difficulties integrating the acquired operations, personnel, technologies, products or infrastructure; |

| | • | diversion of management’s attention or other resources from other critical business operations and strategic priorities; and |

| | • | unexpected difficulties encountered when it enters new markets in which it has little or no experience, or where competitors may have stronger market positions. |

Failure to address these risks or other problems encountered in connection with IBASE’s past or future acquisitions and strategic transactions could cause it to fail to realize the anticipated benefits of such acquisitions or transactions, incur unanticipated liabilities, and harm its business generally.

IBASE’s growth could suffer if the markets into which it sells its products and services decline, do not grow as anticipated or experience cyclicality.

IBASE’s growth depends in part on the growth of the markets which it serves, and visibility into its markets is limited. IBASE’s quarterly sales and profits depend substantially on the volume and timing of orders received during the fiscal quarter, which are difficult to forecast. Any decline or lower than expected growth in its served markets could diminish demand for its products and services, which could adversely affect its financial statements. IBASE’s business operate in industries that may experience periodic, cyclical downturns. In addition, if its business demand depends on customers’ capital spending budgets, product and economic cycles can affect the spending decisions of these entities. Demand for its products and services is also sensitive to changes in customer order patterns, which may be affected by announced price changes, changes in incentive programs, new product introductions and customer inventory levels. Any of these factors could adversely affect its growth and results of operations in any given period.

Risks Related to Technology Industry

If the market for cloud solutions for workplace applications does not evolve as IBASE anticipates, its revenues may not grow and its operating results would be harmed.

IBASE’s success will depend, to a large extent, on the willingness of prospective customers to increase their use of cloud solutions for their workplace applications. However, the market for cloud solutions for workplace applications is at an early stage and it is difficult to predict important trends, if any, of the market for cloud-based workplace applications. Many companies may be reluctant or unwilling to migrate to cloud solutions. Other factors that may affect market acceptance of our cloud-based workplace applications include:

| | • | its ability to maintain high levels of customer satisfaction; |

| | • | the level of customization of configuration we offer; and the price, |

| | • | performance and availability of competing products and services. |

If the market for cloud solutions for workplace applications does not evolve in the way IBASE anticipates or customers do not recognize the benefits of cloud solutions, and as a result it is unable to increase sales of subscriptions for its products, then its revenues may not grow or may decline and its operating results would be harmed.

17

If IBASE fails to develop or acquire new products or enhance its existing products, its revenue growth will be harmed and it may not be able to maintain profitability.

IBASE’s ability to attract new customers and increase revenue from existing customers will depend in large part on its ability to enhance and improve its existing products and to introduce new products in a timely manner. The success of any enhancement or new product depends on several factors, including the timely completion, introduction and market acceptance of the enhancement or new product. Any new product IBASE develops or acquires may not be introduced in a timely or cost-effective manner and may not achieve the broad customer acceptance necessary to generate significant revenue. If it is unable to successfully develop or acquire new products or enhance its existing products to meet customer requirements and keep pace with technological developments, IBASE’s revenue will not grow as expected and it may not be able to maintain profitability.

Adverse economic conditions or reduced investments in cloud-based applications and information technology spending may adversely impact IBASE’s business.

IBASE’s business depends on the overall demand for cloud-based applications and information technology spending and on the economic health of its current and prospective customers. If the state of the economy and employment rate deteriorates in the future, many customers may reduce their number of employees and delay or reduce technology purchases. This could also result in reductions in its revenues and sales of its products, longer sales cycles, increased price competition and customers’ purchasing fewer solutions than they have in the past. Any of these events would likely harm its business, results of operations, financial condition and cash flows from operations.

IBASE’s business depends substantially on retaining its current customers, and any decline in its customer renewals could harm its future operating results.

IBASE offers its products primarily pursuant to a cloud-based or software-as-a-service model, and its customers purchase subscriptions and pay professional and maintenance fees (“Contracts”) which are for a period of two years generally. IBASE’s customers have no obligation to renew their Contracts after its expiry, and they may not renew their Contracts at the same or higher levels or at all. As a result, IBASE’s ability to grow depends in part on its current customers renewing their existing Contracts and purchasing additional applications from it. IBASE has limited historical data with respect to rates of customer Contract renewals, upgrades and expansions, so it may not accurately predict future trends in customer renewals. Its customers’ renewal rates may decline or fluctuate due to number of factors, including the level of customer satisfaction, the prices of its solutions, the prices of competing products or services, reduced hiring by its customers, and reductions in its customers’ spending levels. If its customers do not renew their Contracts to its products, renew on less favorable terms or do not purchase additional applications, its revenues may grow more slowly than expected or decline and its results of operations or financial condition may be harmed.

If IBASE is unable to continue to attract new customers, its growth could be slower than it expects.

We believe that IBASE’s future growth depends in part upon increasing its customer base. The ability to achieve significant growth in revenues in the future will depend, in large part, upon continually attracting new customers and obtaining Contract renewals to IBASE’s products from those customers. If it fails to attract new customers, its revenues may grow more slowly than expected and its business may be harmed.

Software defects or errors in IBASE’s products could harm its reputation, result in significant costs to it and impair its ability to sell its products, which would harm operating results.

IBASE’s products may contain undetected defects or errors when first introduced or as new versions are released, which could materially and adversely affect its reputation, result in significant costs to it and impair its ability to sell its products in the future. The costs incurred in correcting any defects or errors may be substantial and could adversely affect operating results.

Any defects that cause interruptions in the availability or functionality of IBASE’s products could result in:

18

| | • | lost or delayed customer acceptance and sales of its products; loss of customers; |

| | • | product liability and breach of warranty claims against it; |

| | • | diversion of development and support resources; |

| | • | harm to its reputation; and |

| | • | increased billing disputes and customer claims for fee credits. |

If IBASE’s security measures are breached or unauthorized access to customer data is otherwise obtained, customers may perceive its applications as not being secure and may reduce the use of or stop using our applications and it may incur significant liabilities.

IBASE’s applications involve the storage and transmission of its customers’ and their employees’ confidential and proprietary information as well as their financial data. As a result, unauthorized access or security breaches could result in the loss of confidential information, litigation, indemnity obligations and other significant liabilities. While IBASE has security measures in place to protect customer information and prevent data loss and other security breaches, if these measures are breached, its business may suffer and it could incur significant liability. Because the techniques used to obtain unauthorized access or sabotage systems change frequently and generally are not identified until they are launched against a target, IBASE may be unable to anticipate these techniques or to implement adequate preventative measures. Any or all of these issues could negatively affect its ability to attract new customers, cause existing customers to elect to not renew their Contracts, result in reputational damage or subject it to third-party lawsuits, regulatory fines or other actions or liabilities or increase its costs, any of which could adversely affect operating results.

IBASE depends on data centers operated by third parties and any disruption in the operation of these facilities could adversely affect its business.

While IBASE controls and has access to its servers and all of the components of its network that are located in its external data centers, it does not control the operation of these facilities. The owners of IBASE data center facilities have no obligation to renew their agreements with it on commercially reasonable terms, or at all. If IBASE is unable to renew these agreements on commercially reasonable terms, or if one of its data center operators is acquired, it may be required to transfer its servers and other infrastructure to new data center facilities, and it may incur significant costs and possible service interruption in connection with doing so.

Problems faced by IBASE’s third-party data center locations, with the telecommunications network providers with whom it or they contract or with the systems by which IBASE’s telecommunications providers allocate capacity among their customers, including IBASE, could adversely affect the experience of its customers. IBASE’s third-party data centers operators could decide to close their facilities without adequate notice. In addition, any financial difficulties, such as bankruptcy, faced by its third-party data centers operators or any of the service providers with whom it or they contract may have negative effects on its business, the nature and extent of which are difficult to predict. Additionally, if its data centers are unable to keep up with its growing needs for capacity, this could have an adverse effect on IBASE’s business. Any changes in third-party service levels at its data centers or any errors, defects, disruptions or other performance problems with its applications could adversely affect its reputation and may damage its customers’ stored files or result in lengthy interruptions in its services. Interruptions in its services might reduce its revenues, cause it to issue refunds to customers for prepaid and unused subscription services, subject it to potential liability or adversely affect its renewal rates.

Any interruption in its service may affect the availability, accuracy or timeliness of these programs and could damage its reputation, cause its customers to terminate their use of its application, require it to indemnify its customers against certain losses and prevent it from gaining additional business from current or future customers.

Privacy concerns and laws or other regulations may reduce the effectiveness of IBASE’s applications and adversely affect its business.

IBASE’s customers can use its applications to collect, use and store personal or identifying information regarding their employees, customers and suppliers. Federal, state and foreign government bodies and agencies have adopted, are considering adopting, or may adopt laws and regulations regarding the collection, use, storage and disclosure of personal information obtained from consumers and individuals. The costs of compliance with, and other burdens imposed by, such laws and regulations that are applicable to the businesses of IBASE’s customers may limit the use and adoption of its applications and reduce overall demand, or lead to significant fines, penalties or liabilities for any noncompliance with such privacy laws. Furthermore, privacy concerns may cause its customers' workers to resist providing the personal data necessary to allow its customers to use its applications effectively. Even the perception of privacy concerns, whether or not valid, may inhibit market adoption of its applications in certain industries.

19

In addition to government regulation, privacy advocates and industry groups may propose new and different self-regulatory standards. Because the interpretation and application of privacy and data protection laws are still uncertain, it is possible that these laws may be interpreted and applied in a manner that is inconsistent with IBASE’s existing data management practices or the features of its solution. Any failure to comply with government regulations that apply to its applications, including privacy and data protection laws, could subject it to liability. In addition to the possibility of fines, lawsuits and other claims, it could be required to fundamentally change its business activities and practices or modify its solution, which could have an adverse effect on its business, operating results or financial condition. Any inability to adequately address privacy concerns, even if unfounded, or comply with applicable privacy or data protection laws, regulations and policies, could result in additional cost and liability to IBASE, damage its reputation, inhibit sales and adversely affect its business, operating results or financial condition.

All of these legislative and regulatory initiatives may adversely affect the ability of IBASE’s clients to process, handle, store, use and transmit demographic and personal information from their employees, which could reduce demand for its applications.

Changes in laws or regulations related to the Internet or changes in the Internet infrastructure may diminish the demand for IBASE’s products and could have a negative impact on its business.

The future success of IBASE’s business depends upon the continued use of the Internet as a primary medium for commerce, communication and business applications. Federal, state or foreign government bodies or agencies have in the past adopted, and may in the future adopt, laws or regulations affecting the use of the Internet. Changes in these laws or regulations could require IBASE to modify its applications in order to comply with these changes. In addition, government agencies or private organizations may begin to impose taxes, fees or other charges for accessing the Internet or on commerce conducted via the Internet. These laws or charges could limit the growth of Internet-related commerce or communications generally, resulting in reductions in the demand for Internet-based applications such as IBASE’s products.

In addition, the use of the Internet as a business tool could be adversely affected due to delays in the development or adoption of new standards and protocols to handle increased demands of Internet activity, security, reliability, cost, ease of use, accessibility, and quality of service. The performance of the Internet and its acceptance as a business tool has been adversely affected by "viruses," "worms" and similar malicious programs, and the Internet has experienced a variety of outages and other delays as a result of damage to portions of its infrastructure. If the use of the Internet is adversely affected by these issues, demand for IBASE’s applications could suffer.

Defects and unanticipated use or inadequate disclosure with respect to IBASE’s products (including software) or services could adversely affect its business, reputation and financial statements.

Manufacturing or design defects or “bugs” in, unanticipated use of, safety or quality issues (or the perception of such issues) with respect to, or inadequate disclosure of risks relating to the use of products and services that IBASE makes or sells (including items that it sources from third parties) can lead to personal injury, death, property damage or other liability. These events could lead to recalls or safety alerts, result in the removal of a product or service from the market and result in product liability or similar claims being brought against IBASE. Recalls, removals and product liability and similar claims (regardless of their validity or ultimate outcome) can result in significant costs, as well as negative publicity and damage to its reputation that could reduce demand for its products and services.

20

Risks Related to Real Estate Industry

The market for on demand software solutions in the real estate industry is new and continues to develop, and if it does not develop further or develops more slowly than IBASE expects, its business will be harmed.

The market for on demand software solutions in the real estate industry delivered via the Internet is growing. It is uncertain whether the on demand delivery model will achieve and sustain high levels of demand and market acceptance, making IBASE’s business and future prospects difficult to evaluate and predict. While IBASE’s existing customer base has widely accepted this new model, its future success will depend, to a large extent, on the willingness of its potential customers to choose on demand software solutions for business processes that they view as critical. Many of its potential customers have invested substantial effort and financial resources to integrate traditional enterprise software into their businesses and may be reluctant or unwilling to switch to on demand software solutions. Some businesses may be reluctant or unwilling to use on demand software solutions because they have concerns regarding the risks associated with security capabilities, reliability and availability, among other things, of the on demand delivery model. If potential customers do not consider on demand software solutions to be beneficial, then the market for these solutions may not further develop, or it may develop more slowly than IBASE expects, either of which would adversely affect its operating results.

Government regulation of the Real Estate industry, including background screening services and utility billing, the Internet and e-commerce is evolving, and changes in regulations or IBASE’s failure to comply with regulations could harm its operating results.

The real estate industry is subject to extensive and complex federal, state and local regulations. IBASE’s services and solutions must work within the extensive and evolving regulatory requirements applicable to its customers and third-party service providers, including, but not limited to, those under Singapore’s Personal Data Protection Act 26 of 2012 (the “PDPA”) and complex and divergent state/provincial and local laws and regulations related to data privacy and security, credit and consumer reporting, deceptive trade practices, discrimination in housing, utility billing and energy and gas consumption. These regulations are complex, change frequently and may become more stringent over time. Although IBASE attempts to structure and adapt its solutions and service offerings to comply with these complex and evolving laws and regulations, it may be found to be in violation. If IBASE is found to be in violation of any applicable laws or regulations, it could be subject to administrative and other enforcement actions as well as class action lawsuits. Additionally, many applicable laws and regulations provide for penalties or assessments on a per occurrence basis.

IBASE delivers its on demand software solutions over the Internet and sells and markets certain of its solutions over the Internet. As Internet commerce continues to evolve, increasing regulation by federal, state or foreign agencies becomes more likely. Taxation of products or services provided over the Internet or other charges imposed by government agencies or by private organizations for accessing the Internet may also be imposed. Any regulation imposing greater fees for Internet use or restricting information exchange over the Internet could result in a decline in the use of the Internet and the viability of on demand software solutions, which could harm IBASE’s business and operating results.

Risks Related to Our Securities

Because there is no public trading market for our common stock, you may not be able to resell your shares.

There is currently no public trading market for our common stock. Therefore, there is no central place, such as stock exchange or electronic trading system, to resell your shares. If you do wish to resell your shares, you will have to locate a buyer and negotiate your own sale. As a result, you may be unable to sell your shares, or you may be forced to sell them at a loss.

We cannot assure you that there will be a market in the future for our common stock. We intend to apply to have our common stock quoted on the OTC Pink, and subsequently the OTCQB, after we become subject to the reporting requirements under Section 13(a) of the Exchange Act and we have cleared any and all comments that the SEC may have with respect to this Form 10 registration statement, but if for any reason our common stock is not quoted on the OTC Pink or OTCQB or a public trading market does not otherwise develop, purchasers of our securities may have difficulty selling their shares. Even if our common stock is quoted on the OTC Pink or OTCQB, the trading of securities on the OTC Markets is often sporadic and investors may have difficulty buying and selling our shares or obtaining market quotations for them, which may have a negative effect on the market price for our common stock. You may not be able to sell your shares at their purchase price or at any price at all. Accordingly, you may have difficulty reselling any shares you purchase from the selling security holders.

21

The prior registration of our common stock under section 12(g) of the Exchange Act was revoked pursuant to section 12(j) of that Exchange Act due to our failure to comply with our reporting obligations. If, in the future, we fail to comply with the reporting requirements of the Exchange Act, the SEC could initiate proceedings to once again revoke our registration, and broker-dealers in the United States would thereafter be unable to effect transactions in our Company’s common shares.

On January 25, 2013, the SEC initiated proceedings under section 12(j) of the Securities Exchange Act of 1934 for our Company’s failure to comply with section 13(a) of the Exchange Act because we had not filed any periodic reports with the Commission since the interim period ended April 30, 2010. As a result, broker-dealers in the United States will continue to be unable to effect transactions in our Company’s common shares until this registration statement becomes effective to register our common shares under section 12(g) of the Exchange Act, the requirements of Rule 15c2-11 under the Exchange Act have been satisfied, and a broker-dealer has completed a Form 211 filing with the Financial Industry Regulatory Authority, Inc. (commonly called “FINRA”) pursuant to FINRA Rule 6432. This registration statement is expected to become effective by lapse of time on November 1, 2018 (being the 60th day following the date of its original filing with the SEC), and we will then become subject to the reporting requirements of section 13(a) of the Exchange Act. If, in the future, we fail to comply with such reporting requirements, the SEC could initiate proceedings to once again revoke our registration under section 12(j) of the Exchange Act, and broker-dealers in the United States would thereafter be unable to effect transactions in our Company’s common shares.

Our common stock is subject to risks arising from restrictions on reliance on Rule 144 by shell companies or former shell companies.

Under Rule 144 under the Securities Act, a person who beneficially owns restricted securities of an issuer may sell them without registration under the Securities Act provided that certain conditions have been met and depending on whether the shareholder is an affiliate or non-affiliate of the issuer. One of these conditions is that such person has held the restricted securities for a prescribed period, which will be 6 months for shares of common stock of an issuer that has been subject to the reporting requirements under Section 13 or 15(d) of the Exchange Act for a period of at least 90 days. However, Rule 144 is unavailable for the resale of securities issued by an issuer that is a shell company (other than a business combination related shell company) or, unless certain conditions are met, that has been at any time previously a shell company. The SEC defines a shell company as a company that has (a) no or nominal operations and (b) either (i) no or nominal assets, (ii) assets consisting solely of cash and cash equivalents; or (iii) assets consisting of any amount of cash and cash equivalents and nominal other assets. Upon the anticipated closing of the Share Exchange Agreement, the Company will cease to be a shell company as such term is defined in Rule 12b-2 under the Exchange Act. While we believe that as a result of the closing of the Share Exchange Agreement, the Company will cease to be a shell company, the SEC and others whose approval may be required in order for shares to be sold under Rule 144 might take a different view. Rule 144 is available for the resale of restricted securities of former shell companies if and for as long as the following conditions are met: (i) the issuer of the securities that was formerly a shell company has ceased to be a shell company, (ii) the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act, (iii) the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Current Reports on Form 8-K; and (iv) at least one year has elapsed from the time that the issuer filed current comprehensive disclosure with the SEC reflecting its status as an entity that is not a shell company known as “Form 10 Information.” Shareholders who receive the Company’s restricted securities will not be able to sell them pursuant to Rule 144 without registration until the Company has met the conditions above and then for only as long as the Company continues to meet the condition described in subparagraph (iii), above, and is not a shell company. No assurance can be given that the Company will meet these conditions or that, if it has met them, it will continue to do so, or that it will not again be a shell company.

22

As a result, it may be harder for us to fund our operations and pay our consultants with our securities instead of cash. Further, it will be more difficult for us to raise funding through the sale of debt or equity securities unless we agree to register such securities under the Securities Act, which could cause us to expend significant time and cash resources. The lack of liquidity of our securities as a result of the inability to sell under Rule 144 for a longer period of time than a non-former shell company could negatively affect the value of our securities. Our status as a “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions (although none are currently planned other than the Share Exchange Agreement).

Another implication of us being a shell company is that we cannot file registration statements under Section 5 of the Securities Act using a Form S-8, a short form registration to register securities issued to employees and consultants under an employee benefit plan until we have not been a shell company for at least 60 calendar days after filing “Form 10 Information” and we have filed all reports and other materials required to be filed pursuant to Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the we were required to file such reports and materials).

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make a gain on your investment.

We do not anticipate paying any cash dividends on our common stock in the foreseeable future and we may not have sufficient funds legally available to pay dividends. To the extent that we require additional funding currently not provided for in our financing plans, our funding sources may prohibit the payment of any dividends. Because we do not intend to declare dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

Our stock is a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations which may limit a stockholder's ability to buy and sell our stock.