KBH Topco, LLC

Consolidated Financial Statements and

Independent Auditor’s Report

December 31, 2024 and 2023

KBH TOPCO, LLC

TABLE OF CONTENTS

Page

INDEPENDENT AUDITOR’S REPORT 1 - 2

CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Balance Sheets 3

Consolidated Statements of Comprehensive Income 4

Consolidated Statements of Members’ Equity 5

Consolidated Statements of Cash Flows 6

Notes to the Consolidated Financial Statements 7 - 19

INDEPENDENT AUDITOR’S REPORT

To the Management of

KBH Topco, LLC

Opinion

We have audited the accompanying consolidated financial statements of KBH Topco, LLC, which comprise the consolidated balance sheets as of December 31, 2024 and 2023, and the related consolidated statements of comprehensive income, members’ equity, and cash flows for the years then ended, and the related notes to the consolidated financial statements.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of KBH Topco, LLC as of December 31, 2024 and 2023, and the results of its operations and its cash flows for the years then ended, in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are required to be independent of KBH Topco, LLC and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events considered in the aggregate, that raise substantial doubt about KBH Topco, LLC’s ability to continue as a going concern within one year after the date that the consolidated financial statements are available to be issued.

Auditor's Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with generally accepted auditing standards will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements.

In performing an audit in accordance with generally accepted auditing standards, we:

oExercise professional judgment and maintain professional skepticism throughout the audit.

oIdentify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements.

oObtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of KBH Topco, LLC’s internal control. Accordingly, no such opinion is expressed.

oEvaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements.

oConclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about KBH Topco, LLC’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

/s/ FGMK, LLC

Bannockburn, Illinois

February 21, 2025

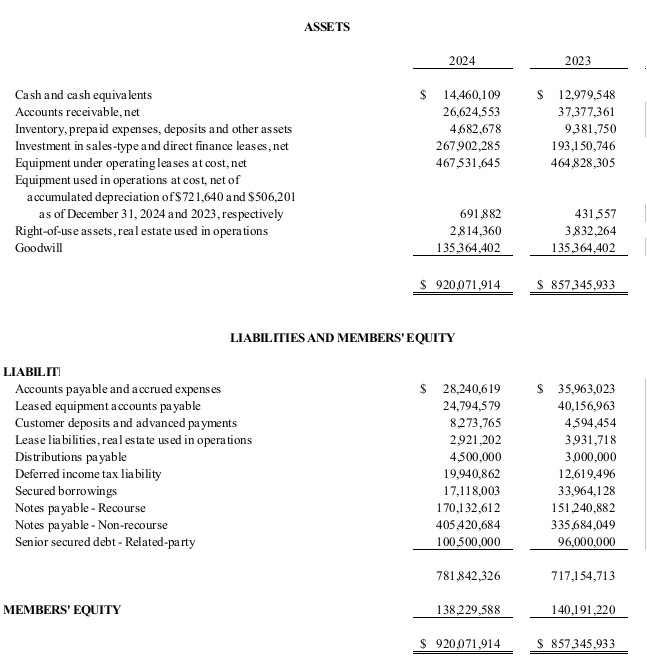

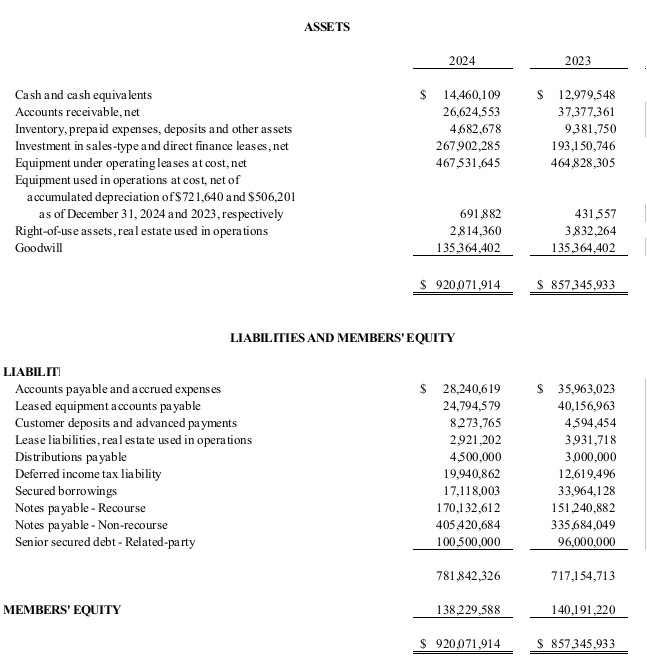

Page 3

KBH TOPCO, LLC

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2024 AND 2023

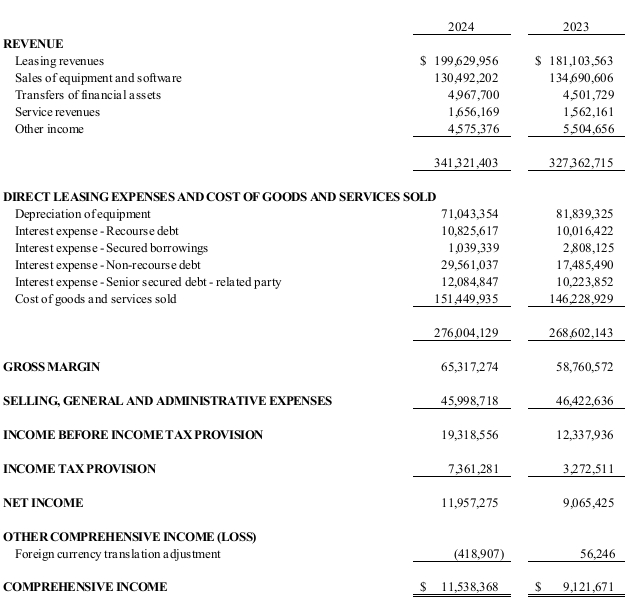

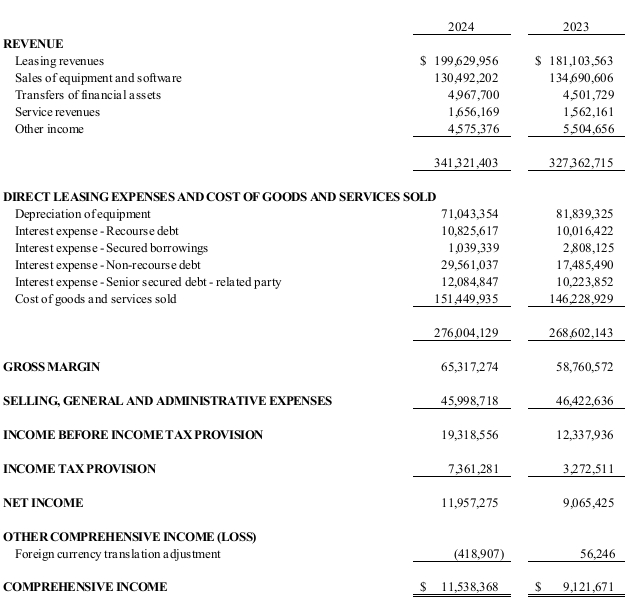

Page 4

KBH TOPCO, LLC

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

YEARS ENDED DECEMBER 31, 2024 AND 2023

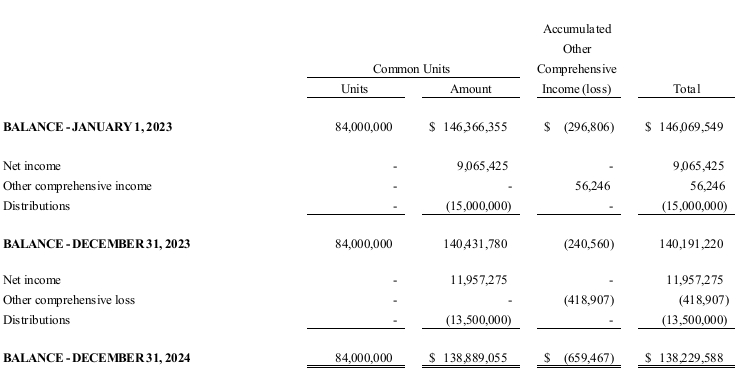

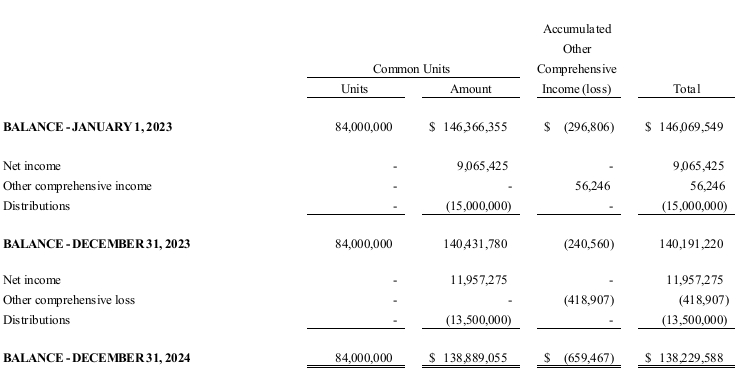

Page 5

KBH TOPCO, LLC

CONSOLIDATED STATEMENTS OF MEMBERS’ EQUITY

YEARS ENDED DECEMBER 31, 2024 AND 2023

Page 6

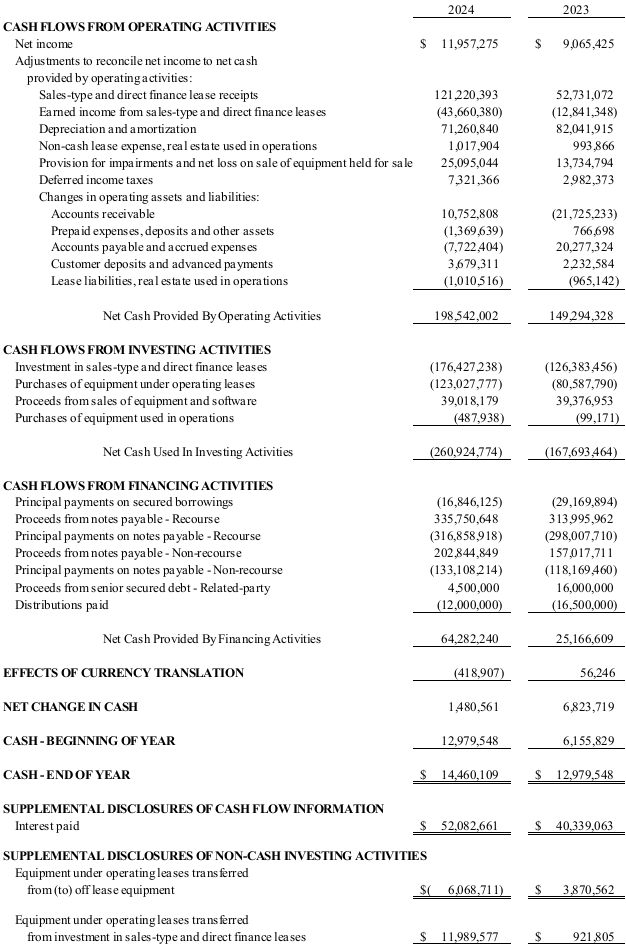

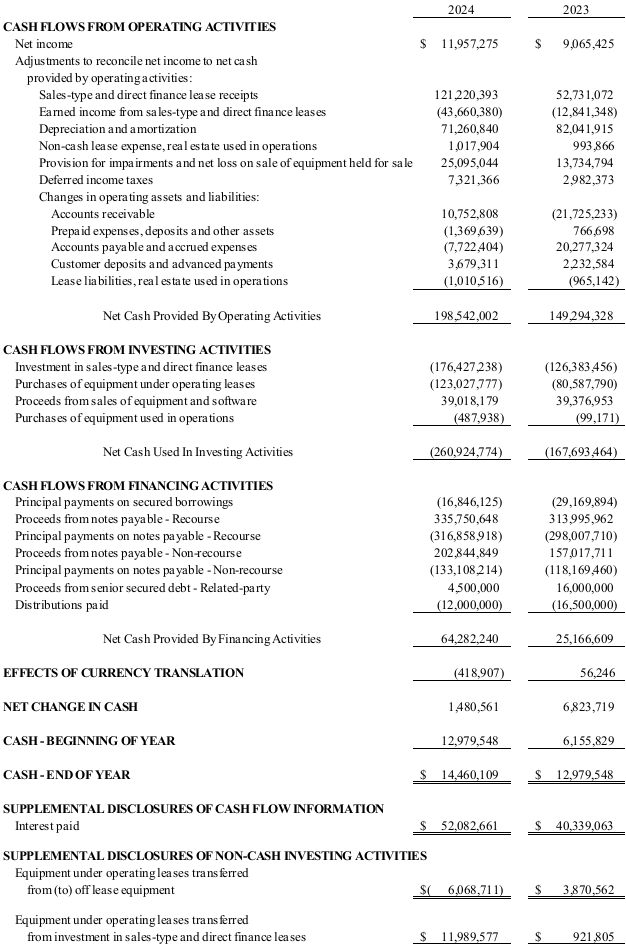

KBH TOPCO, LLC

CONSOLIDATED STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2024 AND 2023

Page 7

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation and Financial Reporting. The accompanying consolidated financial statements include the accounts of KBH Topco, LLC, a Delaware limited liability company (“KBHT”) formed on October 29, 2020, and its wholly-owned subsidiaries (each organized as either a Nevada limited liability company or a Delaware limited liability company), collectively referred to as the “Company.” All significant intercompany accounts and transactions have been eliminated in consolidation. In November 2020, 87.50% of the Company was acquired by SLR Investment Corp. f/k/a Solar Capital Ltd. (“SLR”). In March 2024, as per the terms of the original purchase agreement, SLR acquired an additional 3.125% of the Company. As of December 31, 2024, SLR owns 90.63% of the Company.

Description of Business. The Company leases, rents, sells, manages, and remarkets technology, industrial, healthcare, and other general equipment and software. Their customers are located throughout the United States, Canada, France, Spain, and Italy.

Management Estimates and Assumptions. The preparation of these consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could materially differ from those estimates. Significant estimates and assumptions are used for, but not limited to: (1) estimated useful lives and residual values of equipment under operating, sales-type and direct finance leases; (2) classification of leases; (3) impairment of equipment under operating leases; (4) impairment of goodwill; (5) revenue recognition; (6) allowance for credit losses; and (7) valuation of net deferred income tax assets or liabilities. Future events and their effects cannot be predicted with certainty; accordingly, accounting estimates require the exercise of judgment. Accounting estimates used in the preparation of these consolidated financial statements change as new events occur, as more experience is acquired, as additional information is obtained, and as the operating environment changes.

Cash and Cash Equivalents. The Company considers all liquid investments with original maturities of three months or less to be cash equivalents. Cash and cash equivalents are deposited at banking institutions which management believes have strong credit ratings. The Company regularly maintains cash balances that exceed the Federal Deposit Insurance Corporation regulatory insurance limits.

Leases – Lessor. Leases not classified as a sales-type or direct finance lease are classified as operating leases. If a lease meets one or more of the following five criteria at lease commencement, the lease is classified as a sales-type lease:

•The lease transfers ownership of the underlying asset to the lessee by the end of the lease term;

•The lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise;

•The lease term is for a major part of the remaining estimated economic life of the underlying asset;

•The present value of the sum of the lease payments and any residual value guaranteed by the lessee that is not already reflected in the lease payments equals or exceeds substantially all of the fair value of the underlying asset; or

•The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease.

When none of the sales-type lease criteria have been met, leases are classified as operating leases unless both of the following criteria are met, in which case the lessor shall classify the leases as direct finance leases: (1) the present value of the sum of the lease payments and any residual value guaranteed by the lessee and/or third party unrelated to the lessor equals or exceeds substantially all of the fair value of the underlying asset and (2) it is probable that the lessor will collect the lease payments plus any amount necessary to satisfy a residual value guarantee.

(Continued)

Page 8

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Leases – Lessor (Concluded). Residual Values – The estimated residual values of equipment at the end of the useful life are recorded at the inception of each lease. The estimated residual values vary as a percentage of the original equipment cost and depend upon the equipment type. Residual values for sales-type and direct finance leases are recorded at their net present value and the unearned income is amortized over the life of the lease using the effective interest method. The residual values for operating leases are included in the leased equipment’s net book value. The Company manages and evaluates residual value risk by performing periodic reviews and any impairment, other than temporary, is recorded in the period in which the impairment is determined. No upward revision of residual values is made subsequent to lease inception.

Property taxes paid by the lessor which are reimbursed by the lessee are considered to be lessor costs of owning the asset and are recorded gross with revenue in other income and expense in selling, general and administrative expenses. The Company elected a lessor accounting policy to exclude sales taxes and other similar taxes on lease revenue-producing transactions collected from the lessee from revenue and expenses.

Leases – Lessee. Operating lease right-of-use assets and operating lease liabilities are recognized at the present value of the future lease payments, generally for the base non-cancelable lease term, at the lease commencement date for each lease. The Company has elected a policy to use a risk-free rate as the discount rate used to determine the present value of the future lease payments because the interest rate implicit in most of the Company’s leases is not readily determinable. The Company’s lease agreements may contain lease and non-lease components. Variable lease payments are not included in the measurement of the right-of-use asset and lease liability, and they are recognized as lease expense is incurred.

Leases may contain options to renew or terminate lease terms. The exercise of these lease options is generally at the Company’s sole discretion and included in the right-of-use asset and lease liability. The Company elected to apply the short-term lease measurement and recognition exemption to its leases where applicable.

Variable lease payments predominantly relate to variable operating expenses including common area maintenance, property taxes and other operating expenses. The Company records the amortization of the right-of-use asset and the interest accretion on the lease liability for operating leases as a component of selling, general, and administrative expenses in the statement of comprehensive income.

When lease agreements provide allowances for leasehold improvements, the Company assesses whether it is the owner of the leasehold improvements for accounting purposes. When the Company concludes that it is the owner, it capitalizes the leasehold improvement assets and recognizes the related amortization expense on a straight-line basis over the lesser of the related lease term, including renewals that are reasonably assured of being exercised, or the estimated useful life of the asset. Additionally, the Company recognizes the amounts of allowances to be received from the lessor as a reduction of the lease liability and the associated right-of-use asset. When the Company concludes that it is not the owner, the payments that the Company makes towards the leasehold improvements are accounted for as a component of the lease payments.

Revenue Recognition. The Company recognizes revenue in accordance with the following accounting standards: (1) FASB ASC 842, Leases, (2) FASB ASC 860, Transfers and Servicing, and (3) FASB ASC 606, Revenue from Contracts with Customers.

Revenue from Leasing Transactions under FASB ASC 842 – The Company accounts for certain leasing revenues in accordance with FASB ASC 842. The accounting for revenue is different depending on the type of lease.

For sales-type and direct finance leases, the Company records the net investment in leases, which consists of the sum of the minimum lease payments, initial direct costs, and unguaranteed residual value for sales-type leases and guaranteed residual value for direct finance leases (gross investment) less the unearned income. Revenue for sales-type and direct finance leases is recognized as the unearned income is amortized over the life of the lease using the effective interest method. For operating leases, rental amounts are accrued on a straight-line basis over the lease term and are recognized as leasing revenue.

Page 9

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

NOTE 1 – DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Revenue Recognition (Continued). Leasing revenues consist of rentals due under operating leases and the amortization of unearned income on sales-type and direct finance leases. Equipment under operating leases is recorded at cost and depreciated on a straight-line basis over the useful life.

Revenue from the Transfer of Financial Assets under FASB ASC 860 - The Company enters into arrangements to transfer the contractual payments due under sales-type and direct finance leases, which are accounted for in accordance with FASB ASC 860. These transfers are accounted for as either a pledge of collateral in a secured borrowing or a sale. For transfers accounted for as a secured borrowing, the corresponding investments serve as collateral for recourse and non-recourse notes payable. For transfers accounted for as sales, the Company derecognizes the carrying value of the asset transferred plus any liability and recognizes a net gain or loss on the sale, which are presented as transfers of financial assets in the consolidated statements of comprehensive income.

Revenue from Sales of Equipment, Software and Services under FASB ASC 606 - Under FASB ASC 606, revenue is recognized when the Company satisfies its performance obligations, in an amount that reflects the consideration the Company expects to be entitled to in exchange for those goods or services.

Revenue from contracts with customers is measured based on the consideration specified in the contract with the customer, and excludes any sales incentives and amounts collected on behalf of third parties. Contracts with customers may include multiple promises that are distinct performance obligations. For such arrangements, the Company allocates the transaction price to each performance obligation based on its relative standalone selling price. A performance obligation is a promise in a contract to transfer a distinct good or service to a customer. The Company recognizes revenue when it satisfies a performance obligation by transferring control over a product or service to a customer. The amount of revenue recognized reflects the consideration the Company expects to be entitled to in exchange for such goods or services. After completion of the performance obligation, the Company has an unconditional right to consideration as outlined in the contract.

Service Revenues - The Company maintains service contracts for maintenance and repair services to customers for the customer owned equipment. The Company’s arrangement is typically a single performance obligation comprised of a series of distinct services that are substantially the same and that have the same pattern of transfer. The Company typically recognizes sales from these services on a straight-line basis over the period services are provided. Payments are typically due within 30 days after an invoice is sent to the customer. Invoices for services are typically sent in advance.

Equipment and Software Sales - The Company sells equipment and software to both current lessees and third parties for leased equipment, brokerage of equipment, and lease transaction sales. Sales revenue is recorded at the amount of gross consideration received. Revenue is recognized at a point in time when the Company satisfies its performance obligations. Payments are typically due upon receipt of the invoice. Invoices for equipment and software sales are typically sent in advance.

The Company has adopted certain practical expedients under FASB ASC 606 with significant items disclosed herein. The Company has elected to apply the portfolio approach practical expedient allowed under FASB ASC 606 to evaluate contracts with customers that share the same revenue recognition patterns as the result of evaluating them as a group will have substantially the same result as evaluating them individually.

(Continued)

NOTE 1 – DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Page 10

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Revenue Recognition (Concluded). Disaggregation of Revenue - The table below summarizes the Company’s revenues as presented in the consolidated statement of comprehensive income for the year ended December 31, 2024 by revenue type and by the applicable accounting standard:

| | | | | | | | |

| | Year Ended December 31, 2024 |

| | FASB ASC 842 | | FASB ASC 860 | | FASB ASC 606 | | Total |

| | | | | | | | |

Operating lease revenues | | $ 155,969,576 | | $ - | | $ - | | $ 155,969,576 |

Sales-type and direct finance lease revenues | | 43,660,380 | | - | | - | | 43,660,380 |

Sales of equipment and software | | - | | - | | 130,492,202 | | 130,492,202 |

Transfers of financial assets | | - | | 4,967,700 | | - | | 4,967,700 |

Service revenues | | - | | - | | 1,656,169 | | 1,656,169 |

Other income | | 3,977,021 | | - | | 598,355 | | 4,575,376 |

| | | | | | | | |

Total revenue | | $ 203,606,977 | | $ 4,967,700 | | $ 132,746,726 | | $ 341,321,403 |

Total revenue subject to FASB ASC 606 recognized at a point in time and over time was $ 131,090,557 and $ 1,656,169, respectively, for the year ended December 31, 2024.

The table below summarizes the Company’s revenues as presented in the consolidated statement of comprehensive income for the year ended December 31, 2023 by revenue type and by the applicable accounting standard:

| | | | | | | | |

| | Year Ended December 31, 2023 |

| | FASB ASC 842 | | FASB ASC 860 | | FASB ASC 606 | | Total |

| | | | | | | | |

Operating lease revenues | | $ 168,262,215 | | $ - | | $ - | | $ 168,262,215 |

Sales-type and direct finance lease revenues | | 12,841,348 | | - | | - | | 12,841,348 |

Sales of equipment and software | | - | | - | | 134,690,606 | | 134,690,606 |

Transfers of financial assets | | - | | 4,501,729 | | - | | 4,501,729 |

Service revenues | | - | | - | | 1,562,161 | | 1,562,161 |

Other income | | 5,060,610 | | - | | 444,046 | | 5,504,656 |

| | | | | | | | |

Total revenue | | $ 186,164,173 | | $ 4,501,729 | | $ 136,696,813 | | $ 327,362,715 |

Total revenue subject to FASB ASC 606 recognized at a point in time and over time was $ 135,134,652 and $ 1,562,161, respectively, for the year ended December 31, 2023.

Accounts Receivable. Accounts receivable represent customer obligations, which include base monthly, quarterly, and annual rentals due under the terms of each respective customer’s lease and equipment sales. The carrying amount of accounts receivable is reduced by an allowance for credit losses. Gross accounts receivable were $27,067,325, $37,812,925 and $15,814,867 as of December 31, 2024, December 31, 2023 and January 1, 2023, respectively.

(Continued)

Page 11

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Allowance for Credit Losses. The Company’s allowance for credit losses represents the estimate of expected credit losses related to accounts receivable and investment in sales-type and direct finance leases. The Company pools its accounts receivable and investment in sales-type and direct finance leases based on similar risk characteristics, such as geographic location, business channel, and other account data. To estimate the allowance for credit losses, the Company leverages information on historical losses, asset-specific risk characteristics, current conditions, overall credit quality of the lessees, and reasonable and supportable forecasts of future conditions. Account balances are written off against the allowance when the Company deems the amount is uncollectible. The allowance for credit losses related to accounts receivable was $ 442,772, $ 435,564 and $ 162,739 as of December 31, 2024, December 31, 2023 and January 1, 2023, respectively. There was no allowance for credit losses related to investment in sales-type and direct finance leases.

Depreciation and Amortization. Depreciation provisions for revenue-producing equipment are computed using the straight-line method over the related useful life of the equipment, after giving effect to an estimated residual value. The estimated useful lives and residual values determined by the Company may have a material effect on the gain or loss of equipment held for sale in the year of disposition due to the uncertainty of future market conditions. For other equipment used in operations, depreciation and amortization is computed using the straight-line method over the estimated useful lives of the assets, ranging from approximately three to eight years and was $ 217,486 and $ 202,590 for the years ended December 31, 2024 and 2023, respectively, and included in selling, general and administrative expenses.

Goodwill. Goodwill represents the excess of the consideration paid over the estimated fair value of the net assets acquired in a business combination. The Company performs an annual impairment test for goodwill at the entity level. There were no impairment charges or triggering events for the years ended December 31, 2024 or 2023.

Foreign Operations. The functional currencies for the consolidated foreign operations are the Canadian dollar and Euro. The translation of the applicable foreign currencies into U.S. dollars is performed for monetary balance sheet accounts using current exchange rates in effect at the balance sheet date and for revenue and expense accounts using a weighted average exchange rate during the period. Nonmonetary balance sheet accounts and related revenue, expense, gain and loss accounts are remeasured using historical rates to produce the same results as if the items had been initially recorded in U.S. dollars. The gains or losses resulting from such translation of the Canadian dollar and Euro are included as a component of accumulated other comprehensive income in members’ equity. Assets located outside the United States and subject to foreign currency denominated transactions totaled $13,135,782 and $9,821,459 as of December 31, 2024 and 2023, respectively.

Income Taxes. The Company was formed as a limited liability company and elected to be taxed as a C-Corporation. Deferred income taxes are provided using the liability method whereby deferred income tax assets are recognized for deductible temporary differences and operating loss and tax credit carryforwards and deferred income tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred income tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred income tax assets will not be realized. Deferred income tax assets and liabilities are adjusted for the effects of the changes in tax laws and rates at the date of enactment. Income tax expense is the tax payable or refundable for the period plus or minus the change during the period in deferred income tax assets and liabilities.

KBHT’s wholly-owned subsidiaries are disregarded entities for income tax purposes. Their operations are combined with the operations of KBHT and reported together in one income tax return.

Fair Value Measurements. Fair value accounting guidance defines fair value, establishes a framework for measuring fair value under GAAP, and expands disclosures about fair value measurements for both financial and non-financial assets. It also provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy

Page 12

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurements) and the lowest priority to unobservable inputs (level 3 measurements).

(Continued)

NOTE 1 – DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Concluded)

Fair Value Measurements (Concluded). The three levels of the fair value hierarchy are described as follows:

Level 1. Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Company has the ability to access.

Level 2. Inputs to the valuation methodology include the following:

•Quoted prices for similar assets or liabilities in active markets;

•Quoted prices for identical or similar assets or liabilities in inactive markets;

•Inputs other than quoted prices that are observable for the asset or liability;

•Inputs that are derived principally from, or corroborated by, observable market data by correlation or other means.

If the asset or liability has a specified (contractual) term, the level 2 input must be observable for substantially the full term of the asset or liability.

Level 3. Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

Certain assets are measured at fair value on a nonrecurring basis subsequent to initial recognition. These assets are not measured at fair value on an ongoing basis but are subject to fair value adjustments only under certain circumstances, as GAAP does not permit the recording of unrealized appreciation of equipment held for sale and leased equipment.

In certain circumstances, these assets were written down to estimated fair value when it is determined that net realizable value is below cost. Adjustments to write down certain equipment held for sale and leased equipment to their net realizable value totaled approximately $11,155,000 and $10,121,000 for the years ended December 31, 2024 and 2023, respectively, and are included within cost of goods and services sold on the consolidated statements of comprehensive income. Equipment held for sale totaled approximately $7,300,000 as December 31, 2024 and 2023, respectively, and is included within inventory, prepaid expenses, deposits and other assets on the consolidated balance sheets.

Recent Accounting Pronouncements. In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740), to enhance disclosures related to income taxes, including specific thresholds for inclusion within the tabular disclosure of income tax rate reconciliation and specified information about income taxes paid. This update is effective for fiscal years beginning after December 15, 2025, with early adoption permitted. Management is currently evaluating this standard.

NOTE 2 – INVESTMENT IN SALES-TYPE AND DIRECT FINANCE LEASES, NET

The investment in sales-type and direct finance leases consisted of the following as of December 31:

| | | | |

| | 2024 | | 2023 |

| | | | |

Minimum lease payments | | $ 257,675,874 | | $ 207,187,336 |

Estimated residual value | | 77,031,450 | | 40,196,048 |

| | | | |

Subtotal | | 334,707,324 | | 247,383,384 |

Less: Unearned lease income | | 66,805,039 | | 54,232,638 |

Page 13

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

| | | | |

| | | | |

Investment in sales-type and direct finance leases, net | | $267,902,285 | | $193,150,746 |

As of December 31, 2024 and 2023, there were $16,367,737 and $28,493,846 of investment in sales-type and direct finance leases in leased equipment accounts payable, respectively.

Page 14

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 3 – EQUIPMENT UNDER OPERATING LEASES

Approximate equipment under operating leases consisted of the following as of December 31:

| | | | | | | | |

| | 2024 | | 2023 | | Estimated Useful Life (months) | | Estimate Residual Value |

| | | | | | | | |

Industrial | | $ 438,018,000 | | $ 396,115,000 | | 120 | | 10% |

Technology | | 163,826,000 | | 197,611,000 | | 72 | | 3% |

Healthcare | | 70,872,000 | | 55,466,000 | | 96 | | 10% |

| | | | | | | | |

| | 672,716,000 | | 649,192,000 | | | | |

Less: Accumulated depreciation | | 205,185,000 | | 184,363,000 | | | | |

| | | | | | | | |

| | $ 467,531,000 | | $ 464,829,000 | | | | |

NOTE 4 – FUTURE MINIMUM LEASE PAYMENTS TO BE RECEIVED

Approximate future minimum lease payments to be received under the terms of the non-cancelable operating, sales-type and direct finance leases as of December 31, 2024 were as follows:

| | | | | | |

Year Ending December 31 | | Sales-type and direct finance | | Operating | | Total |

| | | | | | |

2025 | | $136,555,000 | | $ 92,556,000 | | $229,111,000 |

2026 | | 50,990,000 | | 70,447,000 | | 121,437,000 |

2027 | | 30,264,000 | | 49,728,000 | | 79,992,000 |

2028 | | 20,068,000 | | 31,535,000 | | 51,603,000 |

2029 | | 10,986,000 | | 15,806,000 | | 26,792,000 |

Thereafter | | 8,813,000 | | 566,000 | | 9,379,000 |

| | | | | | |

Total minimum lease payments | | 257,676,000 | | $260,638,000 | | $518,314,000 |

| | | | | | |

Less: Unearned Income | | 66,805,000 | | | | |

| | | | | | |

Sales-type and direct finance lease receivable, at present value | | $ 190,871,000 | | | | |

NOTE 5 – DEBT

Secured Borrowings. The Company enters into arrangements to transfer the contractual payments due under sales-type, direct finance and operating leases. Due to the rights retained on certain lease participations sold, the Company is deemed to have retained effective control over these leases and therefore these transfers are accounted for as secured borrowings. As of December 31, 2024, the Company has secured borrowing agreements totaling $ 17,118,003 of which $951,673 was recourse and $ 16,166,330 was non-recourse. As of December 31, 2023, secured borrowing agreements totaled $ 33,964,128 of which $ 2,565,988 was recourse and $ 31,398,140 was non-recourse. These secured borrowing agreements have various maturity dates through 2026 and interest rates ranging from 3.20% and 5.28%. The investment in sales-type and direct finance leases and the equipment under operating leases pledged under these secured borrowing agreements were $287,035 and $37,117,695, respectively, as of December 31, 2024 and $599,204 and $55,555,542, respectively, as of December 31, 2023.

Page 15

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

Page 16

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – DEBT (Continued)

Secured Borrowings (Concluded). Principal payments on secured borrowings as of December 31, 2024 were due as follows:

| | |

Year Ending December 31 | | Amount |

| | |

2025 | | $ 14,237,435 |

2026 | | 2,880,568 |

| | |

| | $ 17,118,003 |

Notes Payable - Recourse. The Company has recourse borrowing arrangements with various financial institutions with $ 170,132,612 and $ 151,240,882 of recourse debt outstanding as of December 31, 2024 and 2023, respectively. Various rate structures for each line pricing exist, based upon either the U.S. prime rate (7.50% at December 31, 2024, “Prime”) plus a spread, or based upon 30-day Secured Overnight Financing Rate (“SOFR”) plus a spread, or the like term swap rate for the investment period, plus 2.50% to 4.50%. Borrowings are collateralized by either a first lien on the equipment and assignment of rent or a second lien on the equipment representing the leased equipment’s residual values.

Under a $30,000,000 facility, maturing in August 2025, principal payments are determined by the maturities of the underlying equipment leases, of which $24,830,729 and $19,351,128 was outstanding as ofDecember 31, 2024 and 2023, respectively. Balances are priced at Prime plus 1.50%, with a floor of 5.00%. Outstanding balances as of December 31, 2024 were due between January 2025 and September 2029. The debt agreement includes covenants for minimum tangible net worth and leverage. Additionally, there is a $2,000,000 guidance facility available for lease equipment residual values, where the financial institution has been assigned rents under notes payable non-recourse, of which $551,903 and $663,456 was outstanding as of December 31, 2024 and 2023, respectively.

Under a $65,000,000 facility maturing in October 2026, secured by a first lien on the equipment, with principal payments due based on the following schedule: the first two months of borrowing are interest only, after which 1.00% of the original principal is due on the first of each month, and then at six months from the date of the individual borrowing for the purchase of the equipment, the remaining principal balance is due. On this facility, $ 57,747,216 and $ 36,268,984 was outstanding as of December 31, 2024 and 2023, respectively. The debt agreement includes covenants for minimum tangible net worth.

Under a $50,000,000 facility maturing in November 2027, principal payments are due based on the following schedule: the first two months of borrowing are interest only, after which 1.00% of the original principal is due on the first of each month, and then at six months from the date of the individual borrowing for the purchase of the equipment, the remaining principal balance is due. On this facility, $36,223,469 and $35,075,304 was outstanding as of December 31, 2024 and 2023, respectively. Additionally, $10,000,000 of this facility is able to be used for borrowings on a term basis, secured by a second lien on the equipment representing the leased equipment’s residual values, of which $4,260,951 and $4,553,140 was outstanding as of December 31, 2024 and 2023, respectively. The debt agreement includes covenants for minimum tangible net worth.

Under a $27,000,000 facility, subject to annual review, borrowings are collateralized by either a first lien on the equipment and assignment of rents or a second lien on the equipment representing the leased equipment’s residual values subject to a cap on residuals of $8,000,000. On this facility, $1,554,456 and $1,887,946 was outstanding as of December 31, 2024 and 2023, respectively. Outstanding balances as of December 31, 2024 were due between January 2025 and June 2028.

Under an additional facility, borrowings are collateralized by a combination of first lien on the equipment and assignment of rents and a second lien on the equipment representing the leased equipment’s residual values. On this facility, $ 327,532 and $ 362,743 was outstanding as of December 31, 2024 and 2023, respectively. Outstanding balances as of December 31, 2024 were due between January 2025 and May 2027.

(Continued)

Page 17

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – DEBT (Continued)

Notes Payable - Recourse (Continued). Under a $10,000,000 facility, subject to annual review, borrowings are collateralized by a combination of first lien on the equipment and assignment of rents and a second lien on the equipment representing the leased equipment’s residual values. Rates are determined at the time of discounting based on the underlying lease term. On this facility, $ 2,670,753 and $ 3,483,057 was outstanding as of December 31, 2024 and 2023, respectively. Outstanding balances as of December 31, 2024 were due between January 2025 and May 2028.

Under a $15,000,000 facility, subject to annual review, borrowings are collateralized by a combination of first lien on the equipment and assignment of rents and a second lien on the equipment representing the leased equipment’s residual values. On this facility, $6,968,779 and $7,140,817 was outstanding as of December 31, 2024 and 2023, respectively. Additionally, $9,000,000 of this facility is able to be used for borrowings collateralized by the Company’s equipment leases with a subsidiary, secured by both the rental stream and equipment residual values. On this portion of the facility, $ 3,958,712 and $ 3,974,649 was outstanding as of December 31, 2024 and 2023, respectively. Outstanding balances as of December 31, 2024 were due between January 2025 and December 2028. The facility includes covenants for minimum net worth.

Under a $4,000,000 facility, subject to annual review, borrowings are collateralized by a combination of first lien on the equipment and assignment of rents and a second lien on the equipment representing the leased equipment’s residual values. On this facility, $2,707,138 and $2,365,787 was outstanding as of December 31, 2024 and 2023, respectively. Outstanding balances as of December 31, 2024 were due between January 2025 and December 2028.

Under an additional facility, the Company has borrowed either funding against lease stream payments or equity residual in equipment. The periodic payments are determined by the underlying equipment lease streams and/or residual values of equipment, with both interest rate and principal payments being determined at the time of line draw by the financial institution. Rates on borrowings from this facility range from 200 to 450 basis points over the like term swap rate at the time of borrowing, with $3,048,517 and $5,368,251 outstanding as of December 31, 2024 and 2023, respectively. Borrowings for equity residuals are priced at 2.00% over the corresponding non-recourse stream rate for the underlying transaction. Outstanding balances as of December 31, 2024 were due between January 2025 and March 2028. There are additional loans with this financial institution of which $281,580 and $308,397 was outstanding as of December 31, 2024 and 2023, respectively.

Under a $1,500,000 guidance facility, subject to annual review, $190,321 and $-0- was outstanding as of December 31, 2024 and 2023, respectively. Outstanding balances as of December 31, 2024 were due in November 2027.

The Company has a borrowing arrangement collateralized by a first lien on the equipment and assignment of rents on a pool of lease transactions totaling $135,219,647 and $110,782,280 outstanding as of December 31, 2024 and 2023, respectively, at a borrowing rate ranging from 3.25% to 7.13%. Of the total transactions, $18,467,801 and $21,362,208 as of December 31, 2024 and 2023, respectively, is secured on a recourse basis for a portion of the equipment’s residual values. The recourse portion of this transaction will amortize with cash flow from residual values. Management estimates that this obligation will fully amortize by March 2031. An additional $13,000,000 was provided on a recourse basis at 5.52% of which $6,342,755 and $9,075,015 was outstanding as of December 31, 2024 and 2023, respectively.

(Continued)

Page 18

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – DEBT (Concluded)

Notes Payable - Recourse (Concluded). Principal payments on recourse notes payable as of December 31, 2024 were due as follows:

| | |

Year Ending December 31 | | Amount |

| | |

2025 | | $125,201,788 |

2026 | | 15,376,088 |

2027 | | 9,062,461 |

2028 | | 8,344,402 |

2029 | | 9,112,640 |

Thereafter | | 3,035,233 |

| | |

| | $170,132,612 |

Notes Payable - Non-Recourse. Non-recourse notes payable are collateralized by the assignment of rent and the equipment value under lease. The financial institutions and a related party have a first lien on the underlying leased equipment with no further recourse against the Company in the event of default by lessee. Interest rates range from 1.5% to 12.0%. Under these arrangements, each lease is financed under a separate borrowing. Non-recourse debt and related interest expense is paid by funds from assigned committed term lease payments with various financial institutions. The outstanding balance was $ 405,420,684 and $ 335,684,049 as of December 31, 2024 and 2023, respectively, of which $ 18,083,413 and $ 21,976,624 with an average interest rate of 9.00% was due to a related party under common control as of December 31, 2024 and 2023, respectively.

Principal payments on non-recourse notes payable as of December 31, 2024 were due as follows:

| | |

Year Ending December 31 | | Amount |

| | |

2025 | | $144,334,336 |

2026 | | 100,139,372 |

2027 | | 70,594,854 |

2028 | | 50,067,560 |

2029 | | 29,015,010 |

Thereafter | | 11,269,552 |

| | |

| | $405,420,684 |

Senior Secured Debt - Related-Party. The Company has a recourse senior secured debt facility with SLR. The facility was amended in 2024 to allow the Company to borrow up to $100,500,000. The interest rate on the facility is SOFR plus 7.00%. Interest payments are due quarterly until maturity in December 2027. The debt is collateralized by a subordinated lien on the Company’s leased assets and the Company’s outstanding rollover equity interests. The debt agreement includes covenants for minimum tangible net worth and leverage. The outstanding balance including accrued interest was $ 100,500,000 and $ 96,000,000 as of December 31, 2024 and 2023, respectively. Related-party interest expense was approximately $ 12,085,000 and $ 10,224,000 for the years ended December 31, 2024 and 2023, respectively.

Page 19

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 6 – MEMBERS’ EQUITY

All members of the Company have the same rights, preferences, and privileges. Profits, losses, and distributions are allocated in accordance with the Operating Agreement.

The Company has two classes of units: Common units and Preferred units. There were no Preferred units issued and outstanding as of December 31, 2024 and 2023.

NOTE 7 – OPERATING LEASES

The Company leases various facilities under the terms of non-cancelable operating leases which expire from February 2025 through July 2028 which call for monthly rental payments ranging from approximately $2,000 to $30,000 per month. The Company does not believe it will exercise the options to extend the leases. The office leases generally require the Company to pay taxes, insurance, utilities, and maintenance costs in addition to base rent.

The components of lease expense were as follows for the years ended December 31:

| | | | |

| | 2024 | | 2023 |

| | | | |

Fixed operating lease cost | | $ 1,132,135 | | $ 1,130,177 |

Variable and short-term lease costs | | 388,328 | | 300,922 |

| | | | |

Total lease expense | | $ 1,520,463 | | $ 1,431,099 |

Other information related to lease was as follows for the years ended December 31:

| | | | |

| | 2024 | | 2023 |

| | | | |

Weighted-average remaining lease term (in years) | | 3.12 | | 3.96 |

| | | | |

Weighted-average discount rate | | 3.34% | | 3.26% |

Cash flows related to leases were as follows for the years ended December 31:

| | | | |

| | 2024 | | 2023 |

Cash flows from operating activities: | | | | |

| | | | |

Cash paid for amounts included in the measurement of operating lease liabilities | | $ 1,124,746 | | $ 1,101,453 |

| | | | |

Supplemental disclosure of cash flow information: | | | | |

| | | | |

Right-of-use assets obtained in exchange for operating lease obligations | | $ - | | $ 1,101,349 |

(Continued)

Page 20

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 7 – OPERATING LEASES (Concluded)

Approximate future maturities of lease liabilities under non-cancelable operating leases were as follows as of December 31, 2024:

| | |

Year Ending December 31 | | Amount |

| | |

2025 | | $ 1,014,000 |

2026 | | 947,000 |

2027 | | 879,000 |

2028 | | 241,000 |

| | |

| | 3,081,000 |

Less: Imputed interest | | 160,000 |

| | |

| | $ 2,921,000 |

NOTE 8 – INCOME TAXES

A reconciliation of the statutory federal income tax rate and effective rate of the provision for income taxes is as follows:

| | | | |

| | December 31, 2024 | | December 31, 2023 |

| | | | |

Federal statutory rate | | 21.00% | | 21.00% |

State income taxes, net of federal benefit | | 1.07 | | 5.05 |

Deferred true up | | 14.25 | | (0.05) |

Permanent items | | 0.24 | | 0.52 |

| | | | |

Effective tax rate | | 36.56% | | 26.52% |

The income tax provision consisted of the following components for the years ended December 31:

| | | | |

| | 2024 | | 2023 |

| | | | |

Deferred | | $ 7,321,366 | | $ 2,982,373 |

Current | | 39,915 | | 290,138 |

| | | | |

| | $ 7,361,281 | | $ 3,272,511 |

The Company’s deferred income tax assets and liabilities consisted of the following components as of December 31:

| | | | |

| | 2024 | | 2023 |

Deferred income tax asset (liability) | | | | |

Depreciation and amortization | | $(131,244,171) | | $(23,416,416) |

Intangible assets | | 37,261,670 | | (10,812,995) |

Allowance for credit losses | | 117,939 | | 112,407 |

Interest expense carryforward | | 23,511,683 | | 3,372,581 |

Net operating loss | | 50,412,017 | | 18,124,927 |

| | | | |

Net deferred income tax liability | | $19,940,862) | | $(12,619,496) |

(Continued)

Page 21

KBH TOPCO, LLC

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 8 – INCOME TAXES (Concluded)

The Company has a pre-tax net operating loss (“NOL”) carryforward of $182,158,885 for Federal tax purposes as of December 31, 2024. The Company has apportioned after-tax state NOLs of up to $83,949,287 as of December 31, 2024 with the earliest expiration date in 2040.

In the normal course of business, the Company is subject to examinations by federal, foreign, and state and local jurisdictions, where applicable. There are currently no pending tax examinations. The Company’s tax years are currently open under statute are from 2021 to the present.

NOTE 9 – MAJOR CUSTOMERS

Two customers of which are either investment grade rated or a large corporate company comprised of approximately 25% of revenue for the year ended December 31, 2024. One large corporate customer is the lessee under sales-type, direct finance and operating leases of approximately 12% of total assets as of December 31, 2024. One large corporate customer is the lessee under sales-type, direct finance and operating leases of approximately 14% of total assets as of December 31, 2023.

One customer has a subsidiary that is also a co-lessee that is undergoing bankruptcy proceedings, and as a result, is in default for breach of a master lease agreement and numerous equipment subleases. There is approximately $25,517,000 and $50,255,000 of investment in sales-type and direct finance leases, net and equipment under operating leases, net relating to leases with the subsidiary as of December 31, 2024, respectively. There is approximately $55,329,000 and $8,910,000 of non-recourse and recourse debt outstanding related to these leases as of December 31, 2024, respectively. Management believes the Company will be successful in recovering the full amounts due from the customer under these leases.

NOTE 10 – LITIGATION

From time to time, the Company is subject to litigation arising in the ordinary course of business. It is the opinion of the Company’s management that any claims pending are either covered by insurance or that there is no material exposure to the Company in connection with any proceedings.

NOTE 11 – SUBSEQUENT EVENTS

Management has evaluated all known subsequent events from December 31, 2024 through February 21, 2025, the date the accompanying consolidated financial statements were available to be issued and is not aware of any material subsequent events occurring during this period.