UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2021

CYTONICS CORPORATION

(Exact name of registrant as specified in its charter)

| Commission file number: | | 024-11196 |

| | | |

| Florida | | 20-8883869 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

658 West Indiantown Road, Suite 214 Jupiter, Florida | | 33458 |

| (Address of principal executive office) | | (Zip Code) |

(561) 406-2864

(Registrant’s telephone number, including area code)

Series C Preferred Stock

(Title of each class of securities issued pursuant to Regulation A)

PART II

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward looking statements that are subject to various risk and uncertainties and that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, in contrast with statements that reflect historical facts. Many of these statements are contained under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Forward-looking statements are generally identifiable by use of forward-looking terminology such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project” or “expect,” “may,” “will,” “would,” “could” or “should,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to, those described under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this annual report. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this annual report, whether as a result of new information, future events or otherwise.

You should read thoroughly this annual report and the documents that we refer to herein with the understanding that our actual future results may be materially different from and/or worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements including those made in Risk Factors appearing elsewhere in this annual report. Other sections of this annual report include additional factors which could adversely impact our business and financial performance. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this annual report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

Overview

CYTONICS CORPORATION, a Florida corporation (“we,” “us,” “ours” or the “Company”) was formed on July 19, 2006 as a Florida corporation, under the name Gamma Spine, Inc. and was renamed Cytonics Corporation on April 17, 2007. The Company was formed for the purpose of researching and developing, marketing and distributing analytic tools used to detect biomarkers associated with certain diseases referred to as “assays,” therapeutic drugs, and related instruments and disposables related to musculoskeletal diseases. We are a development stage research company dedicated to developing therapeutics based on the naturally-occurring protease inhibitor alpha-2-macroglobulin (A2M), a blood serum protein that has known cartilage-protecting effects and could potentially serve as a treatment for osteoarthritis. To this end, we have developed a number of diagnostic and therapeutic products aimed at treating joint pain and inflammation.

Our mission is to improve people’s lives by limiting the progression of chondral pathology, which is bone and cartilage degeneration, which leads to disabling pain, inflammation, and the development of arthritis. Our strategy has been to leverage the unique molecular characteristics of A2M to develop autologous (“self-derived”) and synthetic (manufactured in a laboratory) therapeutics. We have developed two autologous A2M therapies and have out-licensed the drugs to medical device distributors in the human and veterinary orthopedic markets. Our current focus is on the development of a synthetic A2M variant (“CYT-108”) that can be synthesized in a laboratory and purchased “off-the-shelf,” and can be delivered in high concentrations to damaged and inflamed joints by an orthopedist. We seek to maximize the value of the drugs we discover by putting them in the hands of leading pharmaceutical companies with late-stage development, commercialization and marketing expertise.

The Osteoarthritis (“OA”) market represents a $180 billion annual opportunity, which is currently attributable to treating pain symptoms and invasive surgery. According to the Centers for Disease Control and Prevention (the “CDC”), in the U.S., over 27 million people are treated for back pain every year, and osteoarthritis (OA) affects nearly 30 million people. Back pain is the #1 cause of missed work and the #1 healthcare expense in our country. Joint pain and OA account for millions of doctor office visits each year, and are rapidly rising as the average life expectancy increases. In all, musculoskeletal disease burdens our nation with human suffering, lost productivity, missed work, and excessive medical expenses.

Our Company has developed protein-based diagnostics and therapeutics for chronic orthopedic diseases. In 2010, our Company launched our flagship product, a first-in-kind biomarker assay that detects byproducts of cartilage degradation in joint fluid, called “FACT” (Fibronectin-Aggrecan Complex Test). The FACT diagnostic product is currently sold to physicians nationwide, and is used to assess the extent of cartilage damage in patients and determine the appropriate course of treatment. Samples of patient’s joint (synovial) fluid are delivered to Cytonics’ laboratory for testing, and the results are uploaded to a secure database accessible only to physicians. Over 900 kits were distributed to physicians in 2019, with roughly 934 kits distributed in 2020 and roughly 785 kits distributed in 2021. The decline in sales is related to the shutdown of many medical offices during COVID-19, and the hurdle of re-establishing relationships with this customer base upon re-opening.

We have developed a range of therapeutic products for the treatment of painful osteoarthritis, back, and joint pain based upon our understanding of Fibronectin-Aggrecan Complex formation and the role that A2M plays in regulating cartilage degradation. The Company’s first therapeutic product, APIC-PRP was cleared for sale via the 510(k) regulatory process in January 2014. This technology is predicated on Platelet Rich Plasma (PRP), a concentration of the plasma cells found in blood that is injected into joints that are painful and inflamed. The APIC-PRP system differs from PRP in that it selectively concentrates A2M while removing other blood proteins. The final preparation is a highly-concentrated, A2M-rich solution that can be injected into damaged, painful, and inflamed joints.

The Company has entered into licensing agreements with certain distributors of medical devices whereby the Company has granted sales, marketing manufacturing, and distribution licenses in the human and veterinary markets with exclusive rights to sell both domestically and internationally in the human and veterinary markets the APIC-PRP products and FACT products of the Company.

Our current focus is on the development of a synthetic A2M variant (“CYT-108”), based upon the protein structure of the naturally-occurring A2M molecule that has been shown to inhibit the enzymes that degrade cartilage in disease models of osteoarthritis. This synthetic variant, “CYT-108,” has been shown to inhibit cartilage degradation more than 2-fold over that of the naturally-occurring A2M molecule in small animal models of osteoarthritis (Zhang, Y., Wei, X., Browning, S., Scuderi, G., Hanna, L. S., & Wei, L. (2017)). Targeted designed variants of alpha-2-macroglobulin (A2M) attenuate cartilage degeneration in a rat model of osteoarthritis induced by anterior cruciate ligament transection. (Arthritis Research & Therapy, 19(1). doi: 10.1186/s13075-017-1363-4). Cytonics has contracted a Collaborative Manufacturing Organization and Collaborative Research Organization (Sinclair Research, Auxvasse, MO) to synthesize CYT-108 and perform pre-clinical tests ahead of human clinical trials. In 2019 we successfully purified CYT-108 for pre-clinical trials, which were initiated in October 2019 in an animal model of post-traumatic osteoarthritis. If CYT-108 is approved for sale by the FDA and if CYT-108 is successfully commercialized, we anticipate that CYT-108 will substantially reduce APIC sales as we believe that CYT-108 is a superior treatment option to APIC. We are currently working toward FDA approval by preparing for Phase 1 human clinical trials starting in Q1 of 2023.

For the fiscal years ended December 31, 2021 and 2020, we generated revenues of $307,500 and $591,056, respectively, and reported net losses of $2,544,189 and $995,850, respectively, and negative cash flow from operating activities of $2,784,503 and $585,103, respectively. As noted in our financial statements, we had an accumulated stockholders’ deficit of approximately $19,907,507 and recurring losses from operations as of December 31, 2021. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. Please refer to Note 3 of our audited financial statements included elsewhere in this Annual Report on Form 1-K.

FACT DIAGNOSTIC PRODUCT

Cytonics’ first product was “FACT” (Fibronectin-Aggrecan Complex Test), a pilot-launched lab developed test diagnostic assay that can identify pain generators associated with degenerating cartilage such as in OA or degenerative disc disease. Cytonics demonstrated in top peer-review journals (ID of a Novel Fibronectin-Aggrecan Complex in Synovial Fluid of Knees w/Painful Meniscal Injury; JBJS, Feb 2011; Clinically Significant Improvement in Functional Outcome After Lumbar Epidural Steroid Injection for Radiculopathy is Predicted by Assay for Novel Fibronectin-Aggrecan Complex; Golish SR et al SPINE, August 2011) that “FAC” (Fibronectin-Aggrecan complex) is present in joints exhibiting pain from cartilage degeneration but not in asymptomatic joints. We believe FACT will become an important tool to improve joint and especially spine surgery results currently compromised by poor diagnostics.

FACT™ is an enzyme linked immunosorbent sandwich assay (ELISA) that measures the presence of a FAC in a fluid specimen taken from patients with spine or joint related pain. The presence of the Fibronectin-Aggrecan Complex (FAC) and other related biomarkers has been shown in clinical studies to be associated with inflammation due to tissue damage or degeneration. FACT™ is a Laboratory Developed Test that was developed, and its performance characteristics determined by Cytonics Corporation. The test has not been cleared or approved by the U.S. Food and Drug Administration. Federal law restricts the FACT diagnostic test to sale only by or on the order of a physician. FACT may be protected by U.S. Patent 8,338,572, which was issued to the Company on December 25, 2012 and other pending U.S. and foreign patent applications made by the Company as further described below.

The FACT™ diagnostic product was debuted at the North American Spine Society (NASS) Annual Meeting in October 2010 in Orlando, FL. We received a very positive response from physicians and were awarded “Best New Technology for Spine Care in 2010” and “Best New Technology in Diagnostics and Imaging in 2010.”

Following NASS, we initiated a pilot launch of the FACT testing service with a limited number of physicians, the majority of which were Cytonics’ investors.

In February 2011, Synthes Corporation, a leading orthopedic implant company, purchased 400,000 shares of our Series B Preferred Stock at $2.50 per share, along with the option to purchase additional equity of the Company. In June 2011, Synthes exercised the option to purchase additional equity and also purchased an additional 1,600,000 shares of Series B Preferred Stock at $2.50 per share. On April 2013, Johnson and Johnson (“J&J”), who purchased Synthes in 2012, purchased an additional 87,500 shares of Series B Preferred Stock at $4.00 per share.

In June 2011, Synthes also entered into an Exclusive Global Marketing and Distribution Agreement (“Agreement”) with the Company. In the Agreement, Synthes received an exclusive worldwide license to sell and market certain of the Company’s diagnostic products. As part of this Agreement, Synthes also received the option to negotiate for the purchase of an exclusive worldwide license to sell and market the Company’s autologous and non-autologous therapeutic products. The Synthes option to negotiate for the Company’s autologous therapeutic products expired in 2012. In April of 2013, the marketing and distribution agreement was terminated upon mutual agreement (with J&J). All options expired upon termination of the Agreement.

The FACT diagnostic product is currently sold to physicians nationwide, and is used to assess the extent of cartilage damage in patients and determine the appropriate course of treatment. Samples of patient’s joint (synovial) fluid are delivered to Cytonics’ laboratory for testing, and the results are uploaded to a secure database accessible only to physicians. Over 900 kits were distributed to physicians in 2019, with roughly 900 kits distributed in 2020 and roughly 785 kits distributed in 2021. The decline in sales is related to the shutdown of many medical offices during COVID-19, and the hurdle of re-establishing relationships with the customer base upon re-opening.

FACT REGULATORY STRATEGY

Cytonics testing service for FACT is regulated under the Clinical Laboratories Improvement Amendments of 1988. The FACT is considered a Lab Developed Test (LDT) and has not been cleared or approved by the U.S. Food and Drug Administration (FDA). The FDA does have enforcement authority over LDT's, but until now has not exercised its authority, except on a very limited basis.

The current FDA regulatory landscape of In Vitro Diagnostic (IVD) and LDTs remains unclear. However, based on the publicly available information, as well as our current regulatory experience, the FDA appears to be considering its authority of LDTs marketed without FDA clearance or approval at this point in time. Given that the FACT™ assay meets the definition of an LDT (i.e., IVD test created and used by the same CLIA-certified laboratory; “CLIA” means clinical laboratory improvement amendments), it is our understanding that FDA likely would allow our strategic partner to market the FACT™ assay without premarket clearance or approval under the agency’s enforcement discretion pending forthcoming guidance from FDA regarding the future regulation of LDTs. Thus, it is our view that until such time that FDA provides further guidance on its strategy for regulation of LDTs, we may offer the FACT™ assay as an LDT through our CLIA-certified laboratory without receiving FDA clearance or approval. However, there can be no assurance that our understanding of the foregoing is correct.

The FDA has detailed a potential risk-based classification scheme for the future regulation of LDTs. Based on our experience with currently regulated IVDs, it is our understanding that the agency’s proposed risk-based classification scheme, if pursued by FDA, likely will correlate to well-defined regulatory pathways. For example, makers of an LDT that could result in serious injury or death, result in difficulty detecting a false result, or have a high public health risk likely will be required to submit an FDA approval mechanism that requires randomized prospective data (“PMA”). Next, makers of an LDT that could result in a non-serious injury, result in a relatively easy to detect false result, or are an adjunctive test likely will be required to submit a 510(k) notice. Lastly, makers of an LDT that could result in little potential for injury, result in an easy to detect false result, or are a highly adjunctive test likely will be 510(k) exempt. However, the agency has acknowledged that there are a number of issues that remain undecided including, whether some tests will remain subject to enforcement discretion and the timeline for phasing in a new LDT regulatory scheme. It is our view that, similar to previous guidance issued by FDA where the agency seeks regulatory oversight regarding LDTs, there very likely will be a reasonable grace period for companies to comply with any new regulatory requirements.

It is our further view that our FACT™ assay will be considered by FDA to represent a moderate risk device. Moderate risk devices are often regulated through the 510(k) process if an appropriate “predicate” class I or class II device can be identified. In the event that our assay is subject to FDA regulations sometime in the future, we will implement a strategy that has the greatest chance that the FACT™ assay will be found to be subject to the lowest level of regulation. We will identify the appropriate class I or class II predicates but we will have to work with FDA through the pre-submission process to determine whether FDA will accept the company’s 510(k) substantial equivalence arguments.

In summary, while the FDA continues to consider implementation of enforcement over LDTs, we can currently offer the FACT™ assay through a CLIA-certified laboratory. Should our assay become subject to new FDA regulation, our strategy will be to request FDA oversight of the FACT™ assay at the lowest level of regulation. Finally, even with future FDA regulation of LDTs, it is likely that the agency will provide a grace period for LDTs currently offered through CLIA laboratories to comply with any new regulatory requirements. Accordingly, we believe that we are likely to have a period of time while offering the FACT™ assay as an LDT in which to seek FDA premarket clearance or approval, if required. However, there can be no assurance that the foregoing will occur as expected, and if the FDA decides to take different action that we expect, it could have a material adverse effect on the Company.

ORTHOPEDIC THERAPIES

Cytonics exploited its unique understanding of the cartilage degenerative/pain cascade to create therapeutic products for the treatment of painful osteoarthritic joint and spine disease. Its key scientific discovery is that Alpha-2-Macroglobulin (“A2M”), a protein that can be concentrated from a patient’s blood, inhibits catabolic proteases that have long been known to be implicated in cartilage breakdown secondary to OA. According to the CDC, OA affects over 30 million U.S. patients each year and while clinicians offer various injections to treat the associated pain, there is no definitive treatment except for expensive joint replacement. Cytonics’ development and clinical- regulatory projects have already brought two autologous A2M versions to the clinic to treat the disease as well as its painful symptoms and we believe will culminate in already-optimized recombinant off-the-shelf versions.

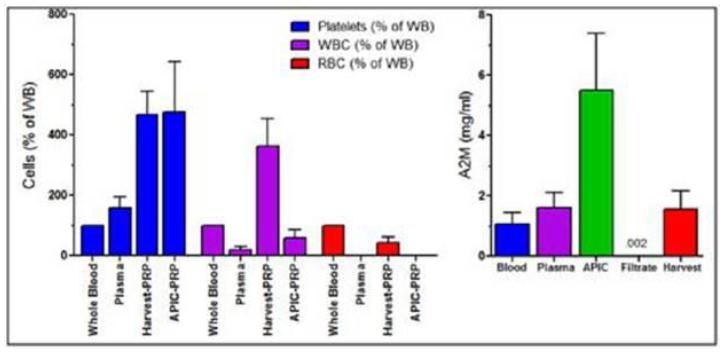

The Company’s first therapeutic product, Autologous Platelet Integrated Concentrate (“APIC”) received 510(k) clearance (FDA approval for medical devices) as platelet rich plasma (PRP) in January 2014 (BK-130060-0). Unlike other PRP products which proved only modest clinical benefit, APIC’s novel two-stage process follows traditional centrifugation with a second, filtration step, resulting in a plasma concentrate that is low in WBCs (which are harmful to intra-articular healing (Platelet-Rich Plasma Increases Matrix Metalloproteases in Cultures of Human Synovial Fibroblasts; Browning SR, Weiser Am, Scuderi GI, Carballo C, Hanna LS; JBJS Am 2012; 94(23); e1721-e1727) and which concentrates not just platelets but also alpha-2-macroglobulin, (A2M) a potent and broad-based protease inhibitor. The Company has entered into licensing agreements with certain distributors of medical devices whereby the Company has granted sales, marketing manufacturing, and distribution licenses in the human and veterinary markets with exclusive rights to sell both domestically and internationally in the human and veterinary markets the APIC-PRP products of the Company.

Inspired by Cytonics’ 2013 Orthopedic Research Society presentation of its pilot work with A2M, (Is There a Chondroprotective effect of Autologous Protease Inhibitor Concentrate on an Osteoarthritis Rabbit Model? A Pilot Study; Cuellar J and V, Browning S, Scuderi G, Golish R, Hanna L; presented 2013 ORS, San Antonio) independent investigators from Brown University supported by NIH and its Chinese counterpart published in July 2014 a seminal paper validating Cytonics’ work and concluding that “…. supplemental A2M provides chondral protection in post-traumatic OA.”(Identification of a2-Macroglobulin as a Master Inhibitor of Cartilage-Degrading Factors That Attenuates the Progression of Posttraumatic Osteoarthritis.; Wei et al; Arthritis and Rheumatology Vol 66 No. 7, July 2014). This team continues to pursue independent animal research demonstrating that A2M protects joints from chronic osteoarthritic degradation.

RECOMBINANT

Cytonics’ ultimate goal is to expand upon the therapeutic potential of the naturally-occurring (“wild-type”) A2M molecule by engineering a synthetic (“recombinant”) version of the wild-type A2M. We believe that this will allow us to create an off-the-shelf biologic drug that can be produced in high concentrations and in mass quantities. The creation of a recombinant A2M molecule involves three distinct steps: (1) Obtaining the DNA sequence that encodes for the A2M protein found in the body, (2) Engineering that DNA sequence to give the A2M variant improved functionality, and (3) Expressing the A2M variant DNA to create an A2M variant protein product (the final drug that has therapeutic function). This is accomplished using high speed screening and discovery techniques. Cytonics screened thousands of A2M variants and identified multiple optimized recombinant forms whose protease inhibition exceeds that of the naturally occurring, wild-type A2M. These select variants have been synthesized, validated in vitro, secured by an international patent portfolio, and have demonstrated cartilage-protective activity and tolerability in preclinical work in a small animal model at Brown University. We believe that these research efforts confirm Cytonics’ ability to engineer biologic variants of naturally-occurring molecules for therapeutic purposes. We have contracted with Goodwin Laboratory (Plantation, FL) for GLP/GMP production of our A2M variants and to move forward with pre-clinical trials. A pilot pre-clinical study was initiated in October 2019 at Sinclair Research (Auxvasse, MO) and concluded in December 2019.We concluded the study in Q1 2020 and it was determined that CYT-108 showed signs of activity in preserving cartilage and other joint tissues, as measured by an independent pathologist, and safety in an animal model of osteoarthritis.

APIC THERAPEUTIC PRODUCTS

Cytonics has developed autologous treatments for osteoarthritis, back, and joint pain. Based on Cytonics’ in depth knowledge of the pain cascade and our discovery of FAC, we have developed a method to concentrate proteins that are known to inhibit cartilage degeneration and potentially prevent the formation of FAC. We have developed the APIC PRP and APIC Mini Systems, which utilize a unique and proprietary process to concentrate platelets, growth factors, and/or protease inhibitors from a patient’s own blood for a range of orthopedic applications. The resulting concentrated formulas have been shown to slow the breakdown of cartilage in vitro and in vivo studies. To-date, over 8,000 patients suffering from joint pain and inflammation have been treated with Cytonics’ APIC system.

APIC REGULATORY STRATEGY

In January 2014, we received FDA 510k clearance for our APIC PRP System. This was a major milestone for the Company and allows us to sell and market the APIC System in the U.S. In 2020 we entered into an agreement with Christie Medical Holdings, the holding company of CareStream America, an international manufacturer and distributor of medical devices, for the exclusive manufacturing and sales right of the APIC system in the international human market. The agreement also included the first rights to develop our second autologous technology, the APIC Mini, a more cost efficient version of the APIC PRP System that is appropriate for treating small joints. CareStream America has completed the comparable system testing in preparation for a 510k submission in the first half of 2023.

We have received CE (“Conformité Européenne” which means European Conformity) mark approval for use of the APIC Systems in Europe. We have no plans currently to pursue sales and marketing of the APIC Systems for use in Europe.

We are supported in all FDA submissions by our regulatory affairs counsel.

ADDITIONAL PRODUCTS

The Company plans to develop additional products that include therapeutics that we plan to manufacture, outsource to contract manufacturing, or license to strategic partners. Products currently in development or envisioned include the following:

| | 1. | Recombinant Protein Therapeutic – A recombinant protein therapy delivered locally to the source of pain to reduce inflammation, eliminate pain, and to promote healing. |

| | 2. | APIC PRP for the treatment of chronic wounds. |

| | 3. | APIC Mini for the treatment of small joints in humans and animals. |

CHRONIC WOUNDS

A further development is that the same MMP and other proteases that are implicated in OA – and inhibited by A2M – are elevated in many chronic wounds, thus prevent their healing, (Analysis of the acute and chronic wound environments: the role of protease and their inhibitors; Trengove N, Schultz G et al; Wound Repair and Regenerative Medicine 1999 Nov-Dec; 7 (6); 442-451 and Protease Activity Levels Associated with Healing Status of Chronic Wounds; Serena, T et al; Poster 429, European Wound Management Association (EWMA) meeting Vienna, 2012) and that APIC has been shown to significantly decrease the protease levels that are upregulated in Elevated Protease Activity (“EPA”) wounds (Communications, Drs. Serena, Kirsner, Hanft). While this represents an enormous clinical need and market, Cytonics has elected to prioritize and pursue other clinical indications, such inflammatory joint disease, for their technologies.

LICENSING AGREEMENTS

A2MCyte, LLC

In October 2015, the Company entered into an Exclusive Sales, Marketing, Manufacturing and Distribution Agreement with A2MCyte, LLC, whereby the Company granted to A2MCyte an exclusive manufacturing, marketing and sales license of the Company’s APIC-PRP products during a 5-year period with an exclusive right to sell such products in the United States. In April 2020, prior to the expiration of the term of the agreement in October 2020, the Company exercised its option to terminate the agreement due to A2MCyte’ s continued failure to achieve aggregate product sales milestones since the effectiveness of the agreement. The total amount of payments made by A2MCyte to the Company under the agreement was $1,290,000 consisting of $500,000 of upfront payments and $790,000 minimum royalty payments. There are no more royalty obligations or other payment obligations of A2MCyte under this agreement since the termination of the agreement in April 2020.

Christie Medical Holdings, LLC

On October 8, 2019, the Company entered into a letter of intent, effective January 1, 2020, with Christie Medical Holdings, LLC (“Christie Medical Holdings”) for a grant of an exclusive manufacturing, marketing and sales license in the human markets with exclusive rights to sell both domestically and internationally in the human markets the Company’s APIC-PRP and FACT products. The terms and conditions of the letter of intent were superseded by that certain definitive Exclusive Sales, Marketing, Manufacturing and Distribution Agreement for Human Market, dated as of April 27, 2020, between the Company and Christie Medical Holdings. As of December 31, 2021, the total amount of payments made by Christie Medical Holdings to the Company was $430,000, consisting of $130,000 in upfront payments and $300,000 in royalty payments. To date, the total amount of payments made by Christie Medical Holdings to the Company is $690,000, consisting of $210,000 of upfront payments and $480,000 royalty payments.

Term and Termination Provisions

The term of the agreement is a 10-year term immediately following the effective date of the agreement (April 27, 2020), subject to automatic renewal for an additional successive 5-year term. Either party of the agreement has the right to terminate the agreement upon written notice to the other party in the event of the other party (i) materially breaches or fails to perform any of its obligations, representations or undertakings under the agreement or (ii) becomes insolvent, adjudged bankrupt, liquidates, dissolves or there is an assignment of the other party’s business for the benefit of creditors. The agreement may also be terminated at any time during the term of the agreement by written mutual agreement between the parties.

Upfront Payments

As to upfront payments, pursuant to the terms of the agreement, Christie Medical Holdings is to pay the Company a non-refundable payment in the amount of $450,000, of which (i) Christie Medical Holdings has already paid $210,000 to the Company and (ii) $240,000 is to be paid by Christie Medical Holdings to the Company in three equal payments ($80,000 per payment) at the beginning of each calendar year following the effectiveness of the agreement. As of December 31, 2021, the total amount of upfront payments made by Christie Medical Holdings was $130,000.

Royalty Payments

As to royalty payments, pursuant to the terms of the agreement, Christie Medical Holdings will pay the Company a portion of the revenue generated from sales and distribution of APIC-PRP and FACT products equal to 10% of the aggregate products sales per quarter, payable within 30 days after the end of each calendar quarter during a calendar year. Notwithstanding the foregoing, Christie Medical Holdings is required to pay the Company royalty guaranteed quarterly minimum payments as to APIC-PRP products as follows:

| Royalty Payment Period | | Minimum Due Per Quarter | |

| 3rd Quarter of 2020 through 2021 | | $ | 50,000 | |

| 2022 through 2023 | | $ | 60,000 | |

| 2024 | | $ | 65,000 | |

| 2025 | | $ | 70,000 | |

| 2026 through 2029 | | $ | 75,000 | |

Sales Milestones

There are no sales milestone requirements under this agreement.

Astaria Global, LLC

On June 30, 2019, the Company entered into an Exclusive License Agreement for Manufacturing, Sales, Marketing, and Distributing in the Veterinary Market with Astaria Global, LLC, a device distributor in the veterinary market, whereby the Company granted to Astaria Global, LLC an exclusive manufacturing, marketing and sales license of the Company’s APIC-PRP products in the veterinary markets with an exclusive right to sell such products in the veterinary markets both domestically and internationally. As of December 31, 2021, the total amount of payments made by Astaria Global, LLC to the Company was $290,000, $250,000 of which were upfront payments. To date, the total amount of payments made by Astaria Global, LLC to the Company is $372,500, consisting of $287,500 of upfront payments and $85,000 royalty payments.

Term and Termination Provisions

The term of the agreement is in perpetuity following the effectiveness of the agreement (June 30, 2019). Either party of the agreement has the right to terminate the agreement upon written notice to the other party in the event of the other party (i) materially breaches or fails to perform any of its obligations, representations or undertakings under the agreement or (ii) becomes insolvent, adjudged bankrupt, liquidates, dissolves or there is an assignment of the other party’s business for the benefit of creditors. The agreement may also be terminated at any time during the term of the agreement by written mutual agreement between the parties.

Upfront Payments

As to upfront payments, pursuant to the terms of the agreement, Astaria Global, LLC agreed to pay the Company a non-refundable licensing fee in the amount of $400,000, of which (i) Astaria Global, LLC has already paid $287,500 to the Company to date and (ii) the remainder is to be paid by Astaria Global, LLC to the Company in three equal payments ($37,500 per payment) payable within 15 days of the beginning of each of the third and second quarters of calendar years 2021, 2022, and 2023. As of December 31, 2021, the total amount received was $290,000, $250,000 of which were upfront payments.

Royalty Payments

As to royalty payments, pursuant to the terms of the agreement, Astaria Global, LLC will pay the Company a portion of the revenue generated from sales and distribution of APIC-PRP products equal to 2%, 3%, and 4% of the aggregate products sales per quarter for calendar year 2021, calendar year 2022, and calendar years 2023 and thereafter, respectively, payable within 15 days after the end of each calendar quarter during a calendar year. To date, $40,000 (including royalty guaranteed quarterly minimum payments) as to APIC-PRP products have been paid by Astaria Global, LLC to the Company.

Sales Milestones

There are no sales milestone requirements under the agreement.

COMPANY AND TECHNOLOGY

Cytonics is a research-driven company that has published 14 peer-review papers. We currently have seven U.S. patents (US 10,265,388, US 11,040,092, US 10,940,189, US 9,352,021, US 9,498,514, US 10,400,028, US 10,889,631), three U.K. patents (GB2501611, GB2503131 and GB2522561), two European patents (EP 2827882 and EP 3221341; each of which are validated in FR, DE, and GB), one Canadian patent (CA 2865170), two Australian patents (AU 2013222414, AU 2015349782), and one Japanese patent (JP 6861152). The Company also has five additional related pending patents applications. The Company has also achieved early revenue through the out-licensing of its autologous APIC-PRP technology to a US-based distributor of medical devices. It maintains its laboratory and office in Jupiter, Florida. Its first therapeutic product, APIC-PRP was cleared for sale via the 510(k) regulatory process in January 2014. Unlike traditional PRP or other injectable products that have been recently directed at orthopedic indications, Cytonics APIC products were conceived specifically for use in osteoarthritis (OA) joints, and, while not required by FDA, were validated in the lab prior to pilot launch. The Company has entered into certain licensing agreements with to certain distributors of medical devices whereby the Company has granted sales, marketing manufacturing, and distribution licenses in the human and veterinary markets with exclusive rights to sell both domestically and internationally in the human and veterinary markets the APIC-PRP and FACT products of the Company.

THE SCIENCE OF OSTEOARTHRITIS AND CYTONICS A2M

The cause and progression of osteoarthritis (OA) is complex. It is known that there are biomechanical and biochemical contributors as well as consequences to the disease but because this is still not fully understood there are no treatments that prevent or significantly slow its progression.

Currently available non-surgical therapies are nonsteroidal anti-inflammatory drugs (NSAIDs), corticosteroid injections and visco-supplementation which all treat pain and functional symptoms, temporarily. Joint replacement surgery and physical therapy following injury can address the biomechanical aspects of OA, but there are as yet no effective therapies to address the biochemical contributors. Any treatment that will delay and reduce the necessity of expensive joint replacement will be very beneficial for the patient and reduce the economic burden.

PROTEASES AND PROTEASE INHIBITORS

Cartilage degradation is the hallmark of OA and while it has been researched for years, inhibition of its progression has proven elusive. Many metabolic and physiologic processes in animals are regulated by an interactive balance between proteases and their inhibitors. Homeostasis (a healthy, steady state) is achieved by this carefully regulated balance and imbalance – such as that observed when cartilage cell physiology changes - can result in a disease state. A growing body of evidence agrees that cartilage catabolism (the breakdown of molecules and thus tissue) follows changes in the normal physiology of cartilage cells, leading to upregulation (and consequent “overbalance”) of metalloproteases (a large family of catabolic protein enzymes that break down cartilage).

Cytonics’ First Cartilage Degradation Discovery

A spine surgeon, Dr. Scuderi, in his initial Cytonics research program, sought to enable definitive identification of the pain generator in Degenerative Disc Disease (DDD). The current imperfect diagnosis techniques for DDD lead to suboptimal surgical results for debilitating procedures that cost patients and payers $40 billion per year. Cytonics demonstrated that Aggrecan fragments from degraded cartilage form complexes with Fibronectin from the synovial or disc fluid in vivo and that the complex can be assayed as a biomarker for pain associated with the degenerating cartilage. They named the complex “FAC” (Fibronectin-Aggrecan complex” and the assay for it “FACT”.)

They then reasoned that perhaps FAC was not just a byproduct of cartilage degeneration but was a mediator in the degenerative cascade. By this hypothesis, preventing its formation could stop the degenerative process or the associated pain and so this guided the next phase of Cytonics’ research.

Cartilage degradation in OA has been associated with increased activity of several classes of proteases, including A Disintegrin-like and Metalloproteinase with ThromboSpondin (ADAMTS)-4 and ADAMTS-5, matrix metalloproteinase’s (MMPs) 1, 5-7 and inflammatory proteases (elastase and cathepsin-G) 8-10. Proteases break down molecules (and thus tissues) by cleaving protein bonds. The cleaving of an Aggrecan fragment, which then forms a complex with fibronectin, is an example of such catabolism.

Alpha-2 Macroglobulin, a broad-based protease inhibitor

Cytonics’ next key understandings and discoveries relate to findings that Alpha-2-Macroglobulin (A2M) functions as a highly potent serine protease inhibitor throughout different tissues and extracellular spaces. A2M is a glycoprotein in blood plasma that can inhibit a broad range of MMPs and ADAMTSs, as well as other serine proteases such as elastases and cathepsins. It could thus inhibit OA progression.

While not the current focus of Cytonics’ clinical research, the use of A2M to also inhibit the pain and progression of disc degeneration via local delivery – which some believe to be the “holy grail” of DDD treatment, is another key clinical opportunity for Cytonics. The spine clinic has shown great interest in such a treatment, but multiple high visibility, high-cost programs to treat DDD pain via injection have all failed. Sixteen of the leading spine surgeons and interventionalists have expressed an interest in treating DDD with Cytonics’ products.

It has also been demonstrated in experimental models, and in pilot clinical experience, that A2M is capable of in inhibiting the proteases implicated in non-healing wounds with Elevated protease Activity (EPA), recently determined to represent as much as a third of chronic wounds.

How does A2M inhibit proteases that cause OA?

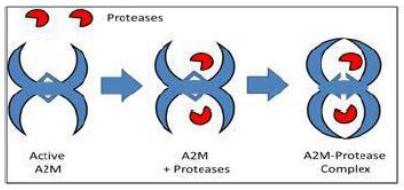

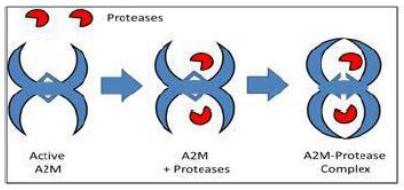

A2M is a “suicide inhibitor” that uses a highly potent ‘bait and trap’ approach to protease inhibition. A2M is a cage-like protein with a central “bait region” which is particularly subject to proteolytic cleavage (Figure 2.2 F1).

Fig 3.1: Diagram of A2M entrapment of proteases.

Once a protease enters the A2M “trap” and cleaves the “bait region” A2M undergoes a conformational change that closes the trap and prevents the protease from escaping {Feldman, 1985}. Additionally, the conformational change reveals a binding region to the LRP-1 receptor, which helps facilitate the removal of A2M-protease complexes.

A2M IS A POTENTIAL THERAPEUTIC AGENT

A2M is thus an appealing candidate to inhibit the proteases that break down cartilage in OA (and, it turns out, in some other disease states as well). Cytonics first demonstrated that the concentration of A2M in synovial fluid of a healthy person is less than 30 ug/ml, whereas in OA joints A2M is found to be 80 - 120 ug/ml. This is consistent with the idea that under natural conditions A2M in synovial fluid is not sufficient to stop the early initiation of OA. Thus, increases in A2M (for example, by addition of additional A2M) may be therapeutic.

Validation of A2M and APIC as Therapeutic Agents

Cytonics next conducted a series of experiments to demonstrate that A2M inhibits OA progression. It then repeated the experiments with the “product version” of A2M, Autologous Platelet Integrated Concentrate or APIC, which is now marketed in the U.S. Several of these studies were integral components of Cytonics’ 700-page Investigational New Drug Application to FDA, which was approved in 30 days with no questions, a highly unusual result and a tribute to the submission’s quality.

This series of experiments and their findings are summarized below.

| | 1. | A2M inhibits OA in ex vivo cartilage models. |

Cytonics first employed a series of traditional ex-vivo experiments. In these experiments, explanted specimens of bovine cartilage explants (“BCE”) were degraded by addition of a series of known OA-associated matrix metalloproteinases: (ADAMTS-4, ADAMTS-5, MMP-3, MMP-7, MMP-12, or MMP-13).

The experiment first quantified the degradation of the BCE by each protease, then repeated with the addition of A2M to demonstrate, in compelling and unambiguous results, that it greatly inhibits the degradation of bovine cartilage explants by each of the proteinases.

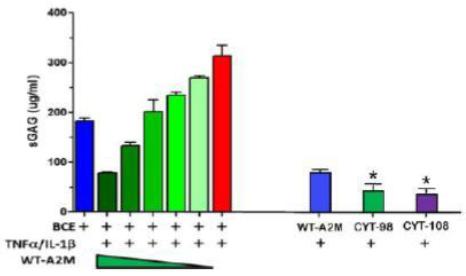

| | 2. | A2M inhibits indirect cartilage catabolism by pro inflammatory cytokines |

To further confirm and clarify its findings, Cytonics then tested in the same model, the impact of A2M on pro-inflammatory cytokines TNF-α and IL-1β, which act upon endogenous chondrocytes in the cartilage to produce proteases, also and “indirectly” breaking down cartilage resulting in increased sGAG in the media. A2M was shown to similarly inhibit these cytokines and their downstream proteases.

| | 3. | APIC inhibits OA in ex vivo cartilage models. |

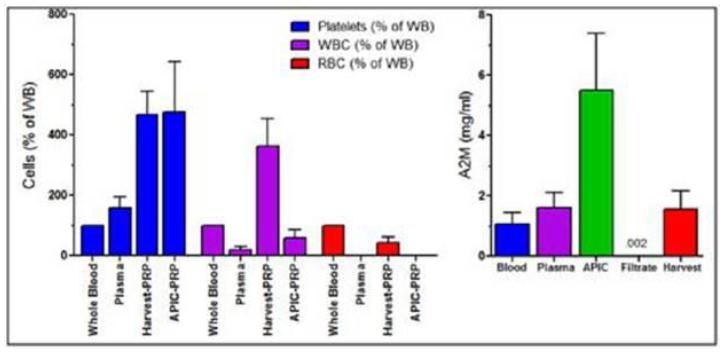

Cytonics’ next series of experiments were created to evaluate not purified A2M as in earlier experiments, but a “product version” of A2M in the same models. Autologous Protease Inhibitor Concentrate (APIC) is Cytonics’ autologous biologic treatment obtained from the patient’s own blood and processed at point-of-service. The APIC process concentrates A2M from the patient’s plasma to 5-7 mg/ml and permits it to be used as treatment for mild to moderate OA. It similarly inhibited cartilage degradation.

| | 4. | APIC inhibits Post-Traumatic Osteoarthritis (PTOA) in a rabbit OA model |

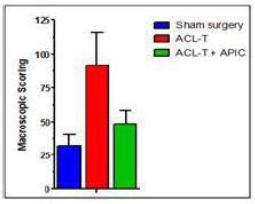

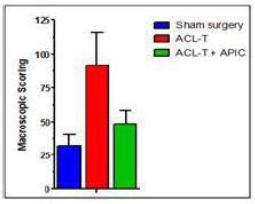

Cytonics next progressed to a well-validated animal model, which mimics the development of early post-traumatic and/or established Osteoarthritis depending on the time point after surgically created ACL injury (“ACL-T”). These studies were key in proving A2M performance and were carried out by AccelLab (Montreal, Canada). AccelLab’s Institutional Animal Care and Use Committee (IACUC) approved all studies, which meet or exceeds all U.S. standards.

| |

| |

| In this experiment, animals were allocated in 2 study groups and results summarized below: |

| · In treatment Group 1, 6 rabbits received ACL-T surgery and A2M treatment on the right knee, (green) and sham surgery on the left knee. |

| · In control Group 2, 6 rabbits received ACL-T surgery and saline treatment on the right knee, (red) and no sham surgery on the left knee. |

| |

| |

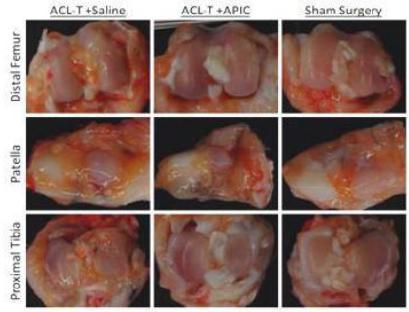

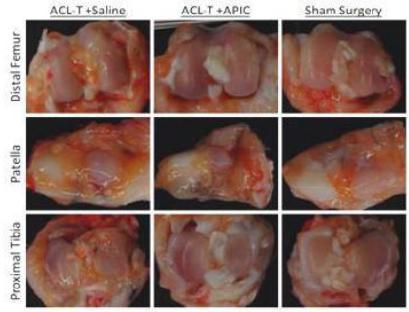

Macroscopic evaluation of the total femur, tibia and patella (below) using the Osteoarthritis Research Society International (OARSI) grading system demonstrated that A2M reduced cartilage degradation by 53 ±20% compared to untreated controls (p = 0.0086).

| | Fig 3.3 Macroscopic Images of rabbit knees 6 weeks after ACL Injury and treatment with Saline or APIC. Sham surgeries without ACL-T were performed as a control. |

| | 5. | A2M Confirmed as the Principle OA Therapeutic in APIC |

Despite this exciting conclusion in an animal model, Cytonics continued its characterization of the APIC formulation to confirm that among its multiple plasma components A2M is the active compound.

APIC, as an autologous blood products designed to inhibit cartilage catabolism, consists of all the constituents of plasma at some concentration. Therefore, other common blood protease inhibitors a1-anti-trypsin (AT), a1-anti-chymotrypsin, (ACT) and anti-thrombin III (ATIII) are present in APIC and were tested for their ability to inhibit cartilage catabolism in the Bovine Cartilage Explant (BCE) model. In summary, these experiments confirmed that while A2M is able to completely inhibit the pro-inflammatory cytokine-induced catabolism of cartilage (A, below) equal molar amounts of purified human AT, ACT, and heparinized ATIII did not. Further, the chondroprotective abilities of purified AT, ACT, and ATIII at the concentrations present in APIC were tested (B, below) with similar conclusion.

| | 6. | A2M inhibits FAC formation |

Coming full circle, Cytonics then ran novel experiments that used the culture media from BCE experiments (test series 1) to confirm that A2M does in fact inhibit the formation of FAC, the cartilage breakdown product that is the subject of its diagnostic product. It was demonstrated that treatment of the cartilage with A2M prevented cartilage catabolism and subsequently inhibited FAC formation. This finding inspired the compelling clinical project that won for Cytonics the Best Paper Award at 2015 ISIS, wherein Cytonics found that patients who are “FAC+” within the disc are more likely to demonstrate clinical improvement following intradiscal autologous A2M injection. The results of this investigation suggest that autologous A2M may be an efficacious biologic treatment in discogenic pain and that FAC may be an important biomarker in patient selection for this treatment.

Together, these studies demonstrate that A2M and autologous APIC are capable of treating OA with little to no side effects. Several of these studies were vital components of Cytonics’ 700-page IND submission to FDA, which can be reviewed in its entirety upon request and execution of a Non-Disclosure Agreement.

APIC-PRP AS A THERAPEUTIC FOR CHRONIC WOUNDS

Cytonics is fully focused on the treatment of OA but has previously established that other disease states can be treated with its existing APIC products.

An understanding in the treatment of chronic wounds is that many of those that are most resistant to healing are characterized by Elevated Protease Activity (EPA) (Treatment of Osteoarthritis of the Knee; Evidence-Based Guideline, 2nd Edition; AAOS, May 18, 2013). This has led to a growing interest in specialized methods to treat these wounds, and in new point-of-care diagnostics (Systematic Review for Effectiveness of Hyaluronic Acid in the Treatment of Severe Degenerative Joint Disease (DJD) of the Knee; AHRQ, Dec 14, 2014), that can identify these wounds in a matter of minutes so as to offer them special treatment. Elevated Protease Activity (EPA) contributes to non-healing wounds by digesting growth factors that assist in the healing process, degrading Extracellular Matrix (ECM) proteins, and disrupting cell-cell and cell-matrix communication. MMP-2, MMP-8, and Neutrophil Elastase have been identified as important factors in EPA non-healing wounds.

Currently there are no therapies that we are aware of that seek to treat these wounds by inhibiting the elevated proteases that characterize them. Rather, companies offer re-purposed collagen wound dressings, which have been a staple of wound care for decades. As the target proteases attack collagen binding sites as well as ECM and other wound healing factors, it is proposed that these aged collagen products compete for protease binding sites and thus lessen the impact of EPA.

As the proteinases implicated in EPA are closely related to those that APIC products inhibit in orthopedic joints, Cytonics sought to determine if they would be similarly inhibited in these wounds. In experiments carried out in conjunction with University of Florida-Gainesville, Cytonics demonstrated that both APIC and A2M inhibited protein digestion by Chronic Wound Fluid (WF) from a patient with a DFU, in a dose-dependent manner. This exciting result suggests a new treatment in heretofore hard-to-heal chronic wounds, and several leading wound care clinicians successfully treated difficult, long term non-healing wounds with APIC, and expressed interest in treating more of their chronic wound patients with APIC.

Cytonics is not pursuing this program at this time and believes that with the anticipated U.S. release of the first point-of-care EPA diagnostic, this first and only treatment that inhibits EPA proteases will be a valuable out licensing opportunity for the $6 billion Advanced Wound Care segment. It has been estimated that a third of the chronic wounds treated in this hard-to-heal segment are EPA wounds.

CYTONICS THERAPEUTIC PRODUCTS

1. APIC PRP

Cytonics’ first therapeutic product APIC PRP received FDA permission to market via the 510(k) process in January 2014. Like all other PRP systems and despite its distinguishing technology and performance, Cytonics APIC-PRP is indicated by its FDA-approved labeling for:

The Cytonics Autologous Platelet Integrated Concentrate (APIC) is indicated for the rapid preparation of autologous platelet rich plasma from a small sample of blood at the patient's point of care. The platelet rich plasma is mixed with autograft and/or allograft bone prior to application to a bony defect for improving bone graft handling characteristics.

This means that the single indication for which PRP products are approved is one that is rarely practiced and is irrelevant to current PRP or APIC use. While Cytonics’ goal is to create products to treat OA, and not necessarily to “be in the PRP business,” a strategic decision was made to gain quick APIC access to the clinic via this method, before pursuing the more time consuming Investigational New Drug process for its biologic drug candidate, “CYT-108”. Following pilot launch in 2014, Cytonics has seen increasing success and interest in its APIC system.

Like earlier PRP systems it incorporates a centrifuge to concentrate platelets, but APIC PRP (below) is distinguished from all other systems primarily by a second step that further concentrates the platelets as well as the protease inhibitor A2M.

Fig 4.1. Pictures of APIC PRP system hardware and disposable (below)

Because APIC products are conceived specifically to treat degenerating cartilage in joints and other inflammatory pathology related to protease activity, they have specific features that differentiate them from other systems. Key to all APIC products are features that concentrate A2M. After centrifugation, the APIC PRP System utilizes a hollow fiber Tangential Flow Filter (TFF, schematic in Fig 2.) to further concentrate platelets and concentrate A2M.

Fig. 4.2 Tangential Flow Filter

The resultant concentrate has a low RBC content, low WBC and a very high A2M concentration. Because it has been demonstrated that WBCs – often concentrated along with platelets – are actually harmful in the treatment of joint pain (Misharin, A. V., Cuda, C. M., Saber, R., Turner, J. D., Gierut, A. K., Haines, G. K., … Perlman, H. (2014). Nonclassical Ly6C− Monocytes Drive the Development of Inflammatory Arthritis in Mice. Cell Reports, 9(2), 591–604. doi: 10.1016/j.celrep.2014.09.032), Cytonics configured its system to have a WBC content barely higher than physiologic, unlike most other systems. (Figure 3.3)

Fig. 4.3 Characterization of WBC, RBC, Platelet and A2M content of Cytonics and Harvest PRP Systems

2. APIC MINI

| | The APIC Mini system was designed to provide an A2M concentration in smaller volumes for applications such as spinal discs and facet joints, small joints (i.e. wrist, hand), and podiatry. The APIC Mini System will provide the market with the only low cost A2M concentration System. This system requires a lower volume of blood and yields approximately 2cc’s of concentrated APIC. This product will not require a separate pump, as in APIC-PRP. There will be a 2-step process with centrifugation only utilizing a filter in the centrifugation step. Christie Medical Holdings has finished testing with our predicate device and are awaiting biocompatibility-testing results. They anticipate filing with 510k application for this product in the first half of 2023. We anticipate a similar labeling to APIC-PRP. |

Fig 4.4. Picture of APIC Mini system disposable kit

“The Cytonics Autologous Platelet Integrated Concentrate (APIC-Mini) is indicated for the rapid preparation of autologous platelet rich plasma from a small sample of blood at the patient's point of care. The platelet rich plasma is mixed with autograft and/or allograft bone prior to application to a bony defect for improving bone graft handling characteristics.”

3. Recombinant A2M Program

Cytonics’ ultimate goal with its A2M program is to bring recombinant, off-the-shelf products to the various clinics, bypassing the need to prepare APIC products onsite. Recombinant products offer multiple advantages including the ability to have variants that are more effective than “wild-type” and are the obvious culmination of this program.

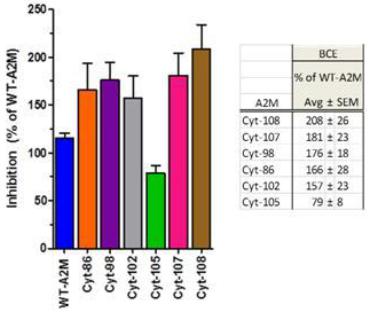

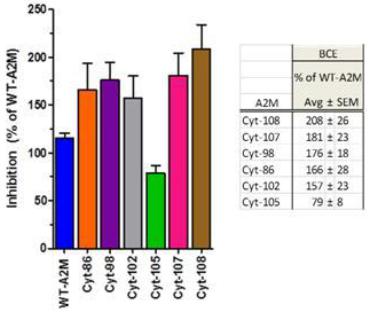

Cytonics’ efforts to identify optimal recombinant variants began in 2011, where intense, targeted design and production of A2M variants were screened against “wild type” A2M using both in vitro protease digestion assays and ex vivo cartilage models of OA. As indicated below, several of the variants have demonstrated considerably more inhibitory effect than human “wild type” (also recombinantly produced) A2M. We have achieved success in a small animal model of OA at Brown University (REF). Our recombinant variant CYT-108 performed better than Wild Type A2M and showed evidence of cartilage upregulation in RT-PCR. This is an important accomplishment as it represents an IND enabling study for an eventual Biologic License Application (BLA). Our next step is protein development and scale to accomplish a large animal study, and toxicity study.

Fig. 4.7 Comparison of Candidate Inhibition Compared to Wild Type A2M. Fig. 4.8 Summary of animal data (N=77) CYT-108 statistically better then WT in preventing PTOA in ACL-T rat model |  |

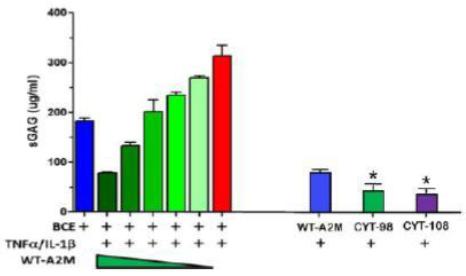

Fig. 4.9 Wild-type alpha-2-macroglobulin (WT-A2M) (left) and A2M variants CYT-98 and CYT-108 (right) inhibit cartilage catabolism induced by TNFα and IL-1β. *Compared with wt-A2M, P < 0.05. BCE, bovine articular cartilage explants, SGAG sulfated glycosaminoglycan |  |

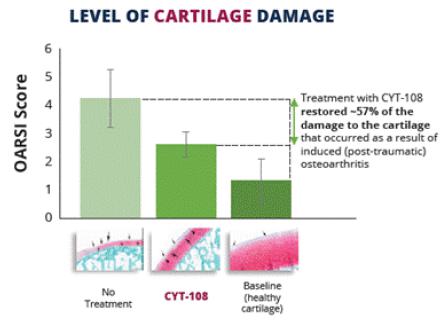

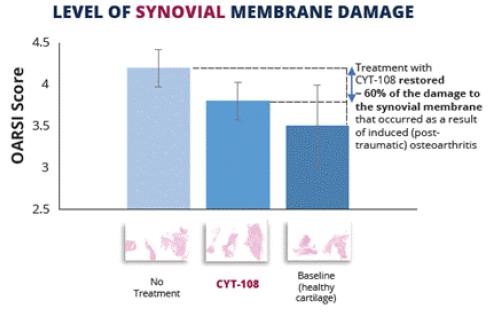

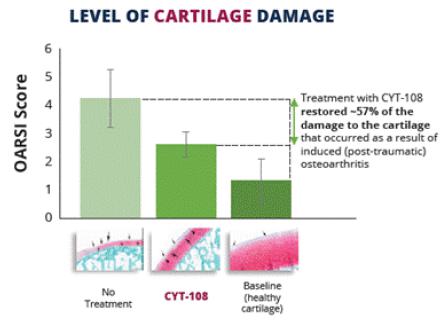

In 2020, we concluded a plot preclinical study to examine the effects of CYT-108 when administered subcutaneously and intra-articularly (in the joint). When injected subcutaneously at a 10x proposed dose (5mg per kg of body weight), we observed no adverse effects nor organ damage as determined by an independent pathologist. We also observed some signs of efficacy, although the data was not statistically significant due to the small sample size.

Figure 5.0. Intra-articular injection of CYT-108 at a dose of 0.5mg/kg (proposed effective dose) appears to prevent up to 57% of the damage to the cartilage tissue on the articular surface of the femur and tibia in the knee joint. Note: data is not statistically significant.

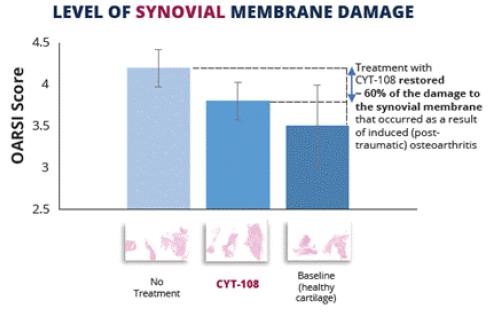

Figure 5.1. Intra-articular injection of CYT-108 at a dose of 0.5mg/kg (proposed effective dose) appears to prevent up to 60% of the damage to the synovial membrane encapsulating the joint. Note: data is not statistically significant.

Note: The data represented in Figures 5 and 5.1 (and the next slide) is from a preclinical experiment conducted by Sinclair Research Center LLC ("Sinclair"), a Contract Research Organization located in Auxvasse, MO. Sinclair was contracted by Cytonics to perform the preclinical studies measuring the effect of CYT-108 on cartilage integrity and other joint tissues. Data was analyzed by an independent pathologist.

Moreover, in 2016 we were issued the first patents in both the UK and US for our machined variants. We currently have seven U.S. patents (US 10,265,388, US 11,040,092, US 10,940,189, US 9,352,021, US 9,498,514, US 10,400,028, US 10,889,631), three U.K. patents (GB2501611, GB2503131 and GB2522561), two European patents (EP 2827882 and EP 3221341; each of which are validated in FR, DE, and GB), one Canadian patent (CA 2865170), two Australian patents (AU 2013222414, AU 2015349782), and one Japanese patent (JP 6861152). The Company also has five additional related pending patents applications.

THE MARKET FOR OA TREATMENT

Cytonics has focused its efforts on the treatment of osteoporosis, one of the largest, rapidly growing, and underserved global clinical markets.

Centers for Disease Control (CDC) define Osteoarthritis (OA) as “…a disease of the entire joint involving the cartilage, joint lining, ligaments, and underlying bone. The breakdown of these tissues eventually leads to pain and joint stiffness. The joints most commonly affected are the knees, hips, and those in the hands and spine. …. There is currently no cure for OA. Treatment for OA focuses on relieving symptoms and improving function, and can include a combination of patient education, physical therapy, weight control, use of medications, and eventually total joint replacement.”

Dramatically Rising Incidence and Cost

According to the CDC, OA is estimated to affect 72 million US adults in 2030. An aging US population and an increasing incidence of obesity has greatly increased the occurrence of OA, but the increasing desire of aging baby boomers to remain active, combined with improved techniques, has caused the number of joint replacement surgeries (virtually all of which are to treat OA) to rise at substantially faster rates. In its recent report, “Health, 2014, United States,” HHS reported that the incidence per 10,000 patients ages 45-64 of total knee and total hip replacements increased dramatically from 6.3 to 37.1, and from 6.2 to 18.2 (Health, United States, 2014; HHS, Library of Congress Catalog Number 76–641496). The American Academy of Orthopaedic Surgeons (AAOS) reported 680,150 total knee replacements and 370,770 total hip replacements in 2014 during their 2018 annual meeting, and the AOOS anticipates total knee replacements and total hip replacements to grow by 142% and 190%, respectively, by 2030.The estimated cost of treating all orthopedic pain conditions is more than $54 billion according to Blue Cross Blue Shield (2019) (Blue Cross Blue Shield, The Health of America Report 2019).

Current Non-Surgical OA Treatments

Prior to resorting to joint replacement for the treatment of knee and hip OA, clinicians had few options. They recommend weight loss, and exercise and treat the pain, but not the disease, with periodic injections of corticosteroids or hyaluronic acid (HA). Injection therapy represents a $1B a year market. The treatment of joint OA thus lacks any alternatives between a simple injection to temporarily relieve pain and a major joint replacement surgery.

Hyaluronic Acid (HA)

The CDC reports that in the US, HA is the pre-surgical treatment of choice and is approaching $1 billion annually in sales, with research showing that the global HA market is reported to exceed $15B by 2026.

While the average selling price for HA products is around $250-$300, corticosteroid injections are far less expensive. Almost all injections take place in the clinician’s office where the practice is allowed to charge (by CMS) a 6% premium over the cost of the HA injectate, but also bills for ancillary codes including office, diagnosis and injecting, making their total reimbursement $400-$500. In all cases, private payers reimburse considerably more than CMS.

Table 1. Hyaluronic Acid Injection Products and Competitors

| Product | | Seller/Manufacturer | | Est. Current Market Share | |

| Synvisc, Synvisc One | | Genzyme/Sanofi | | | 41.3 | % |

| Monovisc | | JNJ DePuy-Synthes/Anika | | | 20.5 | % |

| Euflexxa | | Ferring | | | 18.5 | % |

| Supartz | | Supartz/Sekagaku | | | 9.6 | % |

| Hyalgan | | Fidia Pharmaceuticals | | | 6.3 | % |

| Gel-One | | Zimmer/Sekagaku | | | 3.9 | % |

(Joint Fluid, US; SmarTRAK; July 2015; BioMed GPS).

Payer/Reimbursement Pressure on HA

The large full-line orthopedic biotech firms field large direct sales organizations to promote their offerings. Pain clinicians also treat joint pain with injections and have demonstrated more willingness to try new injection products; they are more likely to offer multiple corticosteroid injections and to rely on injections as the major revenue driver in their practices.

Very few medical drugs or devices are successful without reimbursement from public CMS and private payers. Starting in 2013, the use of HA has come under pressure. In May 2013, following years of recommending its use in OA knees, the American Academy of Orthopedic Surgeons (AAOS) reversed its position and recommended against such use, citing the lack of compelling evidence in a meta-analysis of the published data (Treatment of Osteoarthritis of the Knee; Evidence-Based Guideline, 2nd Edition; AAOS, May 18, 2013). In December 2014, CMS issued its own critical report, a Technology Assessment” (Systematic Review for Effectiveness of Hyaluronic Acid in the Treatment of Severe Degenerative Joint Disease (DJD) of the Knee; AHRQ, Dec 14, 2014) from sister Agency for Healthcare Research and Quality (AHRQ) in which it reported that, in its (Medicare/Medicaid) patient population the “…average effects (of HA) do not meet the minimum clinically important difference…”. This is seen as the first step in a CMS coverage decision to restrict/reduce or even end coverage for HA and indeed several private payers have already ended or restricted coverage as a result of these reports.

Many orthopedic surgeons still believe, despite their society’s recommendation and rationale, that HA works to temporarily relieve pain for at least some of their patients and continue to offer it to those patients (the majority) whose payers still cover it. Indeed, some payers who immediately suspended coverage of HA following the AAOS recommendation have returned to some level of coverage, because they have seen a resultant increase in total joint surgeries when HA was not offered. Orthopedists generally believe – and some publications support – that HA generally offers some pain relief at 4 weeks, peaks at 8 weeks, and then declines to show some residual effect even out to 24 weeks. The AAOS recommendation timing is fortuitous for Cytonics, as clinicians have begun to seek effective alternatives to HA.

New Non-Surgical OA Treatments

We believe that there is clearly an opportunity for new products and players who can deliver what payers are seeking. In its report, AHRQ/CMS clearly indicated their disappointment that no HA offerings demonstrated in their PMA (FDA approval mechanism that requires randomized prospective data) applications and clinical studies the ability to reduce or delay the incidence of joint replacement surgery, despite such claims by manufacturers. The strong implication (and common sense economic conclusion) is that such results would not warrant coverage.

Many new technologies are offered in this segment with relatively little market penetration – and no compelling randomized data – to date. They fall primarily into three categories: (1) Platelet Rich Plasma or “PRP” (without concentrated A2M) (2) “stem-cell” offerings derived from autologous adipose (fat) tissue or bone marrow and (3) placental-derived allograft products. Notably, the large orthopedic players have declined to participate in these segments because they would prefer to wait until a new technology is clinically proven in Level One studies, has specific FDA-cleared labeling claims and has gained reimbursement before acquiring at a premium. To date, none of the firms with autologous or allograft treatments have shown any indication that they will pursue this route, so Cytonics will remain as players in the niche cash-pay market for knee pain treatments.

Platelet-Rich-Plasma (PRP)

PRP has been offered for years by orthopedists for extra-articular (ligament, tendon) pain. Despite a complete lack of compelling clinical evidence, this treatment is safe and profitable for clinicians. As many clinicians have begun to get pushback from payers for HA treatments, they have begun to offer traditional PRP products for intra-articular (inside the joint, as a treatment for OA) use. There is little to no evidence that supports its clinical efficacy and in fact most PRPs have been shown to cause more pain due to high WBC content. Unlike HA, the majority of PRP sales today are NOT directed at intra-articular (OA pain relief) indications and the Company estimates the current U.S. market for OA-directed PRP at well under $50 million.

Stem Cell Treatments Directed at OA

Like PRP, so-called “stem cell treatments” have been offered largely for extra-articular soft-tissue orthopedic injuries (and many unrelated indications) but recently have begun to be used intra-articularly to treat OA pain. Clinicians and patients are enamored of the appeal of stem cells, which in theory can impact healing and other physiologic functions in many ways, or can differentiate into specific types of cells that are especially useful in the location into which they are injected. However, no studies have indicated that they can do either in any orthopedic indication, or that the cells are either alive, active or replicating once injected. Stem cells are typically derived in an office setting from the patient’s adipose (fat tissue) or from bone marrow. The ensuing preparation is time-consuming and labor intensive. Some firms offer “externally expanded” stem cells, typically mesenchymal stem cells (MSC’s that are capable of differentiating into skin, bone, cartilage, muscle) to vastly increase the number of cells; these clearly are heavily regulated by FDA and unavailable for sale in the U.S.

Because stem cell, PRP, and placental tissue injections are all unreimbursed and minimally regulated, clinicians are free to charge patients cash at whatever rate they desire; these treatments can thus be enormously profitable is some practices in wealthy areas. They tend to be offered more frequently by pain clinicians and “regenerative clinicians” than by practicing orthopedists and are sometimes accompanied by claims of “regenerating cartilage” to treat OA. The Company believes that, while it will in some cases compete with such treatments, they will never be able to demonstrate disease (or even pain) treatment and thus will not achieve reimbursement.

Placental-Derived products Directed at OA

In recent years allograft amniotic membranes, sourced from consenting C-Section mothers, have been found to be very effective in treating certain chronic wounds and, in certain surgeries to prevent post-surgical adhesions. (Ilic, D., Vicovac, L., Nikolic, M., & Ilic, E. L. (2016). Human amniotic membrane grafts in therapy of chronic non-healing wounds: Table 1. British Medical Bulletin, 117(1), 59–67. doi: 10.1093/bmb/ldv053). Some allograft tissues, like bone, skin and many of these amniotic membrane tissues have been classified by FDA as “361 Human Cellular and Tissue products” which, by virtue of minimal manipulation”, “for homologous use” and “non-reliance on cellular activity” are deemed inherently safe and exempted from pre-market approval and can thus be brought quickly to market. As a result of the recent criticisms of HA, many of these firms are promoting placental-derived tissue products as treatments for soft tissue and for OA orthopedic pathologies.

Changing FDA Rules for Amniotic and Other Allografts

FDA has indicated, and provided controversial guidance, for a much more limiting definition of “minimal manipulation” and promises new interpretation for “homologous use” as well. The clear intent, and possible outcome despite industry resistance, is the greatly reduce the number of new, lightly-regulated, “361 HCT/P” products. The products are, in order of frequency of use, (1) amniotic membrane, ground to minute particles and suspended in saline (2) stem cells derived from amniotic fluid suspended in saline or (3) processed amniotic fluid.

Ground Amnion in Suspension

Several firms offer ground up or “micronized” amniotic tissues in suspension. As claimed 361 HCT/P allograft tissues they are essentially unregulated by FDA but have no labeling claims and are always intended for “homologous use.” The market leader overall in placental tissues is Mimedx (NASDAQ, MDXG) by virtue of the commanding success in demonstrating intact membrane efficacy in chronic wounds. Their ground up (“micronized’) amnion injectable product was challenged by FDA in 2013 as not qualifying as a “361” allograft because the grinding was “more than minimal manipulation.” This product thus needs to go through an FDA pre-market approval process (like Cell-Free APIC) and MiMedx has continued to lobby the FDA for continued marketing of the injectable product while they pursue an Investigational New Drug (IND) application, the prospective randomized study in plantar fasciitis for which is underway. This will be the first “FDA study” for any placental tissue but expected, unlike Cytonics A2M products to treat just the pain associated with knee OA, thus competing with traditional HA.

Amniotic Fluid Stem Cells in Suspension

BioD and NuCel offer amniotic fluid claimed to have live stem cells, suspended in fluid for injection and BioD is the reported market leader in placental derived injectables with sales estimated between $20-30 million. No evidence of efficacy has been offered and there are many small emerging players in the segment as the technology (and currently, regulatory) bars are relatively low. Changing FDA perspectives on these allograft products may have a major impact on this segment will begin to be clarified following the three –day September workshop with FDA and industry representatives.

Processed Amniotic Fluid

Several firms offer injections made solely from processed amniotic fluid that seems to offer better pain reduction than other placental-derived injections, with perhaps somewhat longer durability; it has thus attracted new emerging competitors. As 361 HCT/P products, these offerings also have no specific labeling claim.

Unless they proceed like Cytonics through the rigorous IND or BLA regulatory process, we believe that all of these allograft products will continue to have no labeling claims and no pathway to reimbursement. It is unclear that any of the firms have an interest in that pathway, and most do not have the funding or capability.

Cytonics A2M products Strategy vs. Competition

AAOS and payers have made it clear that they are not impressed with HA and that they desire a treatment that can actually delay or preferably, reduce the need for total joint surgery. Like HA, all of the reviewed product types are intended to reduce the pain, and thus improve patient’s function, in OA joints, but none are targeting the disease itself, and all are just additional palliative treatments for a chronic progressive disease. We believe that none have a scientific rationale, tested and proven, to demonstrate a method of action, and physiologic effect, like APIC. Some of them, and APIC, will take a share from HA by virtue of offering increased cartilage-protecting abilities and longevity of use than that of the short-lived HA injections. Others may take a share because, as unreimbursed treatments, they enable the clinician to promote aggressively and charge unlimited amounts for such injections. We believe that only Cytonics’ APIC line of products treats the disease itself at a molecular level and is generating Level One, prospective randomized data, in an FDA-approved study with OA labeling claims to demonstrate long term relief of symptoms and attenuation of disease process. We believe that this pathway will in turn enable Cytonics to seek reimbursement and compete directly for the $1 billion U.S. hyaluronic acid market.

Summary of Current Status of Cytonics’ Products

Status of Cytonics Products and Programs:

Product

/Project | | Description | | Status | | Value |

| Recombinant A2M (“CYT-108”) | | Optimized | | GMP drug tested in IND-enabling toxicology and demonstrated an acceptable safety profile. The IND application for CYT-108 as a treatment for osteoarthritis of the knee is under construction and is anticipated to be submitted in 1Q23. | | Intended Vehicle for Cytonics Investor Exit Plan: Submit IND application for Phase 1a study of CYT-108 as a treatment for primary osteoarthritis of the knee in 1Q23. Begin Phase 1a study in the second half of 2023, with preliminary data expected in the first half of 2024. |

| APIC first generation | | PRP kit and hardware which concentrates platelets and A2M | | 510k cleared; sales $625k in 2017 with very small distribution footprint; Licensed to multi-national distributor for $2.97M (upfront fee plus royalty payments through 2029), with minimum $300,000 in annual royalties (human market) starting in 2020 through 2029. Recently licensed to veterinary distributor for $660,000 (upfront fee plus royalty payments through 2025). | | Active, Entered into agreement with Christie Medical Holdings for a 10-year license beginning in 2020 for an additional $450,000 and 10% royalties on in-market sales (total deal value ~$3M). Entered into a 6 year licensing deal with Astaria Global for exclusive manufacturing and sales rights in the veterinary market (total deal value ~$700,000. Plan: help grow revenue establish A2M/APIC brand |

| APIC MINI second generation | | Low cost PRP kit | | Application for 510(k) 2020 | | Proposed Active Licensed development, manufacturing, and sales rights to Christie Medical Holdings. CMH anticipates 510k filing by The first half of 2023. |

| APIC for Spine | | Same products directed at DDD | | On hold; should be paired with FACT. Needs clinical data | | Inactive. Minimal current clinical use. License opportunity |

| APIC for EPA wounds | | Same products directed at EPA wounds | | On hold. Small pilot demonstrated cartilage-protective activity and generated clinician advocates | | Inactive License opportunity |

| APIC for Veterinary Applications | | Same products directed animals | | Out-licensed to distributor in the equine veterinary industry, royalties on in-market sales starting in 2021 | | Active. Licensed to veterinary medical device manufacturer and distributor in Q2 2019 for $400,000 (the first tranche of which in the amount of $152,500 has been received by the Company and the remaining balance will be amortized over 2 years) and royalties on in-market sales. Plan: help grow the market for equine applications, then expand to companion animals. Currently negotiating a development, manufacturing, and sales license for CYT-108 for veterinary applications. |

| FACT | | Biomarker assay for the detection of cartilage damage | | Sold to physicians nationwide, often accompanying the sale of an APIC-PRP kit | | Provides physicians with a quantitative method to determine the extent of cartilage damage and promotes APIC-PRP treatment. Assisted Christie Medical Holdings (CMH) with setting up a CLIA-certified lab. All FACT tests are conducted in CMH’s lab. |