UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 ESCO Global Realty Corp. |

| (Exact name of registrant as specified in its charter) |

| Colorado | | 6531 | | 98-0564647 |

| | | | | |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

594 Dagall Road Mill Bay, BC Canada V0R 2P4 (250) 813-0337 |

| (Address and telephone number of registrant’s principal executive offices) |

Devlin Jensen, Barristers & Solicitors 2550 - 555 West Hastings, Vancouver British Columbia, Canada V6B 4N5 Attention: Michael Shannon (604) 684-2550 |

| (Name, address and telephone number of agent for service) |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer ¨ |

| | |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered(1) | | Amount to be registered | | | Proposed maximum offering price per share | | | Proposed maximum aggregate offering price (US$) | | | Amount of registration fee(3) | |

| Common stock | | | 6,000,000 | | | $ | 1.00 | (2) | | $ | 6,000,000.00 | | | $ | 235.80 | |

| | | | | | | | | | | | | | | | | |

| Share Purchase Rights | | | 4,000,000 | | | $ | 1.00 | (2) | | $ | 4,000,000.00 | | | $ | 157.20 | |

| | | | | | | | | | | | | | | | | |

| Total Registration Fee | | | | | $ | 393.00 | |

(1) In the event of a stock split, stock dividend, or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) There is no public market for the securities of ESCO Global Realty Corp. Our common stock is not traded on any national exchange and in accordance with Rule 457, the offering price was determined by the board of directors.

(3) Fee calculated in accordance with Rule 457(c) of the Securities Act. Estimated solely for purposes of calculating the registration fee under Rule 457(a).

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON THE DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON THE DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

Subject to Completion: February __, 2009

PROSPECTUS

ESCO GLOBAL REALTY CORP.

A COLORADO CORPORATION

UP TO 6,000,000 SHARES OF COMMON STOCK AT $1.00 PER SHARE AND

SHARE PURCHASE RIGHTS TO ACQUIRE UP TO 4,000,000 SHARES AT

AN EXERCISE PRICE OF $1.00 PER SHARE

This prospectus relates to the sale of up to 6,000,000 new shares of our common stock at an offering price of $1.00 per share and the issuance of share purchase rights to acquire up to 4,000,000 new shares of our common stock at $1.00 per share. The offering will commence promptly after the date of this prospectus and close no later than 180 days after the date of this prospectus. We may extend the offering for up to 90 days following the 180-day offering period. However, we intend to keep this prospectus continuously effective and to file post effective amendments as and when required in order continue our Own Your Future® plan. We will pay all expenses incurred in this offering. The common shares are being offered to members of the public that become members of the ESCO Global Realty Corp. franchise structure. Sales Agents are required to purchase shares annually such that the aggregate total value of the shares purchased annually equals at a minimum 2% of the respective Sales Agent’s annual gross commission. Franchisees are required to purchase shares annually such that the aggregate total value of the shares purchased annually equals at a minimum 0.2% of the annual gross commissions of Sales Agents in their respective offices. Regional Owners and support staff at all levels of the franchise structure have no minimum or maximum purchase requirements. To the extent that we receive funds in this offering from members of the ESCO Global Realty Corp. franchise structure, they will be immediately available for our use since we have no arrangements to place funds in escrow, trust or similar account.

Our common stock is not presently traded on any market or securities exchange. The Company intends to sell its shares at $1.00 per share until our shares are quoted on the Over-The-Counter Bulletin Board (the “OTCBB”), and thereafter at prevailing market prices or privately negotiated prices. We have arbitrarily determined the offering price of $1.00 per share offered hereby. We do not intend to apply for our shares of common stock to be quoted on the OTCBB for another two to three years. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria.

The offering is a self-underwritten offering; there will be no underwriter involved in the sale of these securities. We intend to offer the securities through our officers and directors, who will not be paid any commission for such sales.

Our business is subject to many risks and an investment in our common stock will also involve a high degree of risk. You should invest in our common stock only if you can afford to lose your entire investment. You should carefully consider the various Risk Factors described beginning on page 5 before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE AMENDED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

The date of this prospectus is February ___, 2009

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

TABLE OF CONTENTS

| PROSPECTUS SUMMARY | 3 |

| Corporate Background | 3 |

| Our Business | 3 |

| Number of Securities Being Offered | 3 |

| Number of Shares Outstanding | 3 |

| Market for Common Shares | 4 |

| Use of Proceeds | 4 |

| Summary of Financial Data | 4 |

| RISK FACTORS | 5 |

| FORWARD-LOOKING STATEMENTS | 15 |

| USE OF PROCEEDS | 16 |

| DETERMINATION OF OFFERING PRICE | 16 |

| DILUTION | 17 |

| SELLING SECURITY HOLDERS | 17 |

| PLAN OF DISTRIBUTION | 17 |

| DESCRIPTION OF SECURITIES TO BE REGISTERED | 20 |

| INTEREST OF NAMED EXPERTS AND COUNSEL | 20 |

| INFORMATION WITH RESPECT TO THE REGISTRANT | 21 |

| Description of Business | 21 |

| Description of Property | 31 |

| Legal Proceedings | 31 |

| Market Price of and Dividends on the Registrant's Common Equity and Related Stockholder Matters | 32 |

| Market Information | 32 |

| Holders | 32 |

| Dividends | 32 |

| Section 15(g) of the Exchange Act | 32 |

| Equity Compensation Plan Information | 32 |

| Management’s Discussion and Analysis | 32 |

| Changes in and Disagreements with Accountants | 36 |

| Quantitative and Qualitative Disclosure About Market Risk | 36 |

| Directors, Executive Officers, Promoters and Control Persons | 36 |

| Executive Compensation | 38 |

| Security Ownership of Certain Beneficial Owners and Management | 39 |

| Transactions with related persons, promoters and certain control persons | 41 |

| Corporate Governance | 42 |

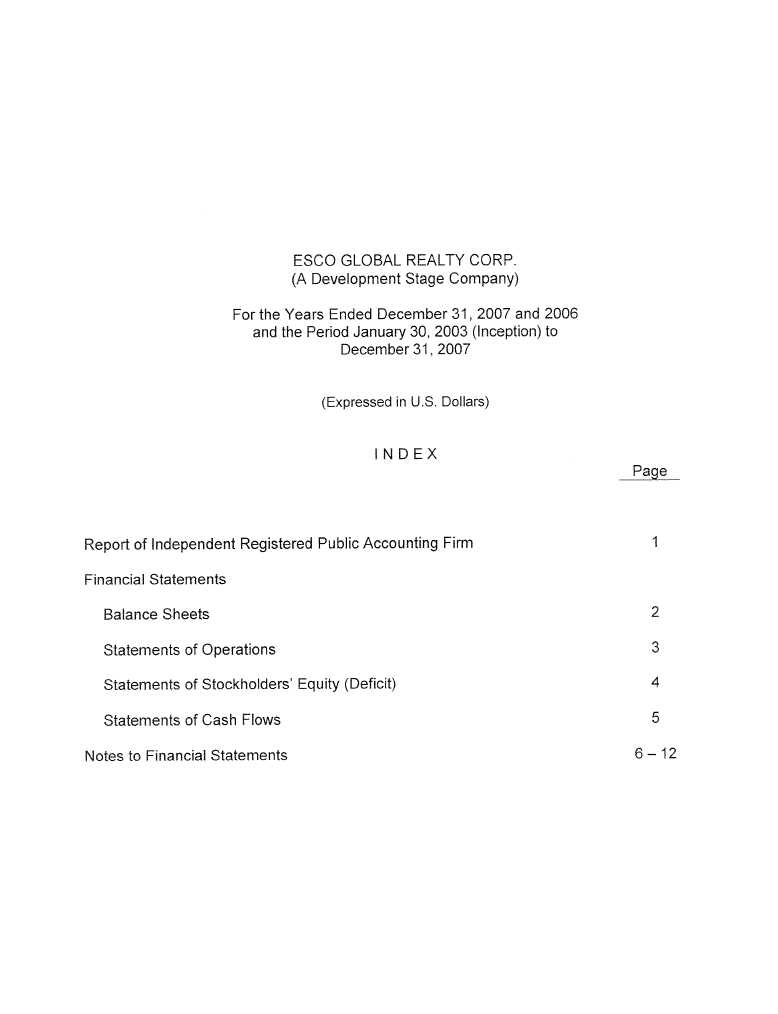

| Financial Statements | 42 |

| MATERIAL CHANGES | 44 |

| INCORPORATION OF CERTAIN MATERIAL BY REFERENCE | 44 |

| Where You Can Find More Information | 44 |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 44 |

As used in this prospectus, the terms “we”, “us”, “our”, and “ESCO” mean ESCO Global Realty Corp. unless otherwise indicated.

All dollar amounts refer to US dollars unless otherwise indicated.

PROSPECTUS SUMMARY

Corporate Background

We were incorporated in the State of Colorado, United States, on January 30, 2003 under the name Trans-Group International Inc. and have a December 31 fiscal year end. On June 2, 2003, we amended our articles of incorporation to change our name from Trans-Group International Inc. to Trans Globus Realty Corporation and on October 24, 2004, we amended our articles of incorporation to change our name from Trans Globus Realty Corporation to ESCO Global Realty Corp. (“ESCO”). ESCO® has been considered a development stage enterprise since its formation.

We maintain our registered agent’s office at Corporation Service Company of 1560 Broadway, Suite 2090 Denver, Colorado, U.S.A 80202, and our principal executive office is located at 594 Dagall Road, Mill Bay, BC Canada V0R 2P4 (250) 813-0337.

Our Business

ESCO® is a real estate franchisor whose mission is to provide a marketing identity and operations model for an international real estate network through the application of the “Own Your Future®” plan, a business model that incorporates ownership at each level of the organization. We hold trademark protection relating to our name. We license the right to market the ESCO® franchise system in predefined geographic areas. We intend to conduct our business through a projected network of 40 to 50 Regional Owners in the U.S. and Canada. Our franchise system generates income for us through franchise fees and transaction fees. Additional income is expected to be generated through ancillary programs developed after the ESCO® franchise system is established.

Number of Securities Being Offered

This prospectus relates to the initial public offering by ESCO Global Realty Corp. of up to 6,000,000 shares of our common stock at $1.00 per share and share purchase rights to acquire up to 4,000,000 shares of our common stock exercisable at $1.00 per share. These securities are being offered for a period not to exceed 180 days, unless extended by our board of directors for an additional 90 days. The Company will sell these shares of common stock through its directors and officer, or through any other means described in the section entitled “PLAN OF DISTRIBUTION.”

Number of Shares Outstanding

There were 15,479,380 shares of our common stock issued and outstanding as at February 10, 2009 There will be 25,479,380 shares of our common stock issued and outstanding after this offering if all the shares being offered are sold and all the share purchase rights being offered are exercised.

Market for Common Shares

There is no public market for our common shares. Within two to three years after the effective date of the registration statement, we intend to have a market maker file an application on our behalf with FINRA to have our common stock quoted on the OTCBB. We currently have no market maker who is willing to list quotations for our common stock. There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale.

Use of Proceeds

The net proceeds from the sale of the shares of our common stock and from the exercise of share purchase rights being offered for sale by the Company will be used to execute our business plan and for general corporate purposes, including working capital. We may also use a portion of the net proceeds to acquire complementary businesses, technologies or other assets. See the section entitled “USE OF PROCEEDS” for further details.

Summary of Financial Data

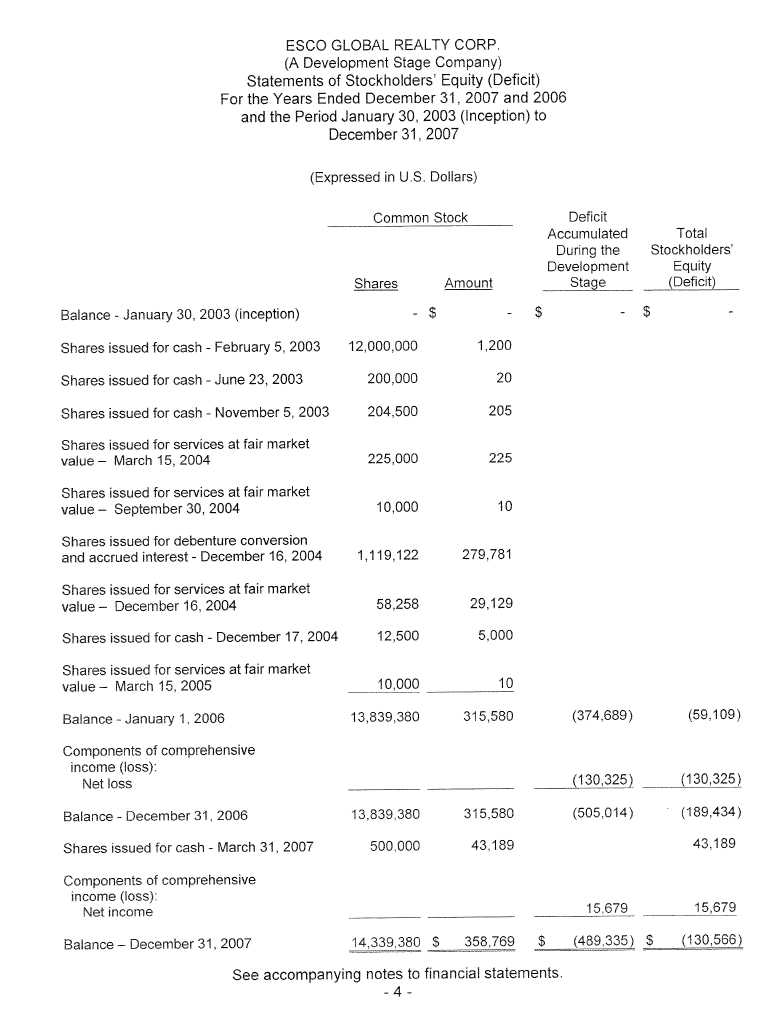

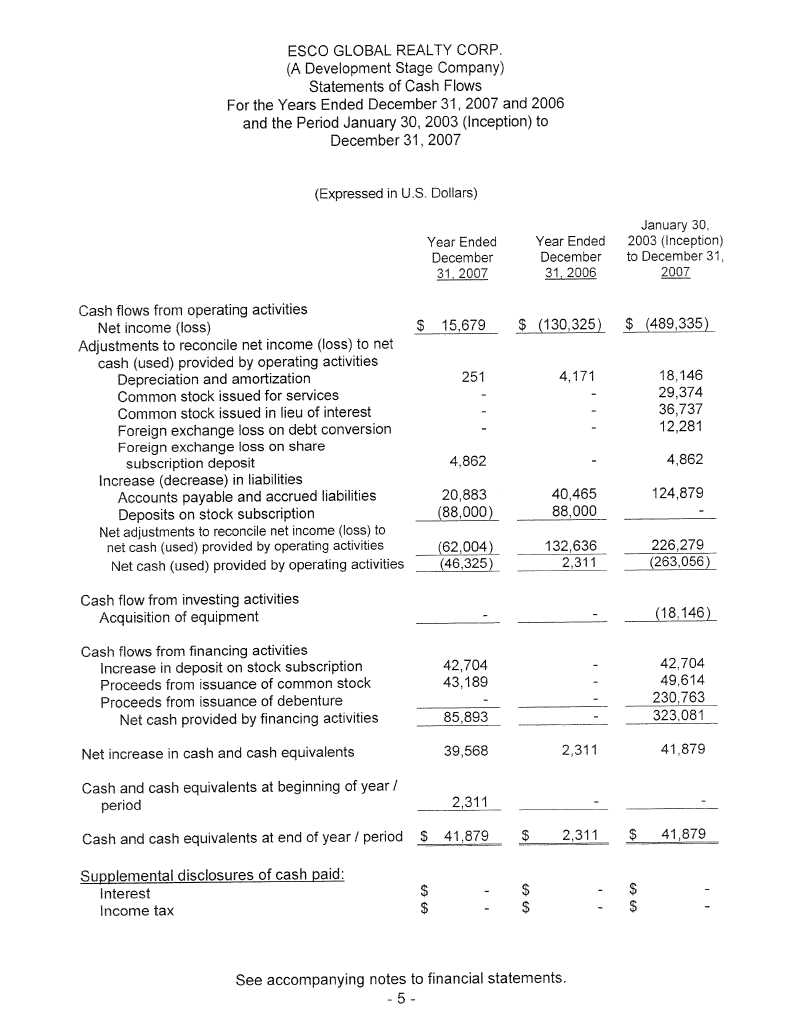

The summarized consolidated financial data presented below is derived from and should be read in conjunction with our audited consolidated financial statements for the year ended December 31, 2007 and the nine month period ended September 30, 2008, including the notes to those financial statements, which are included elsewhere in this prospectus along with the section entitled “MANAGEMENT’S DISCUSSION AND ANALYSIS.”

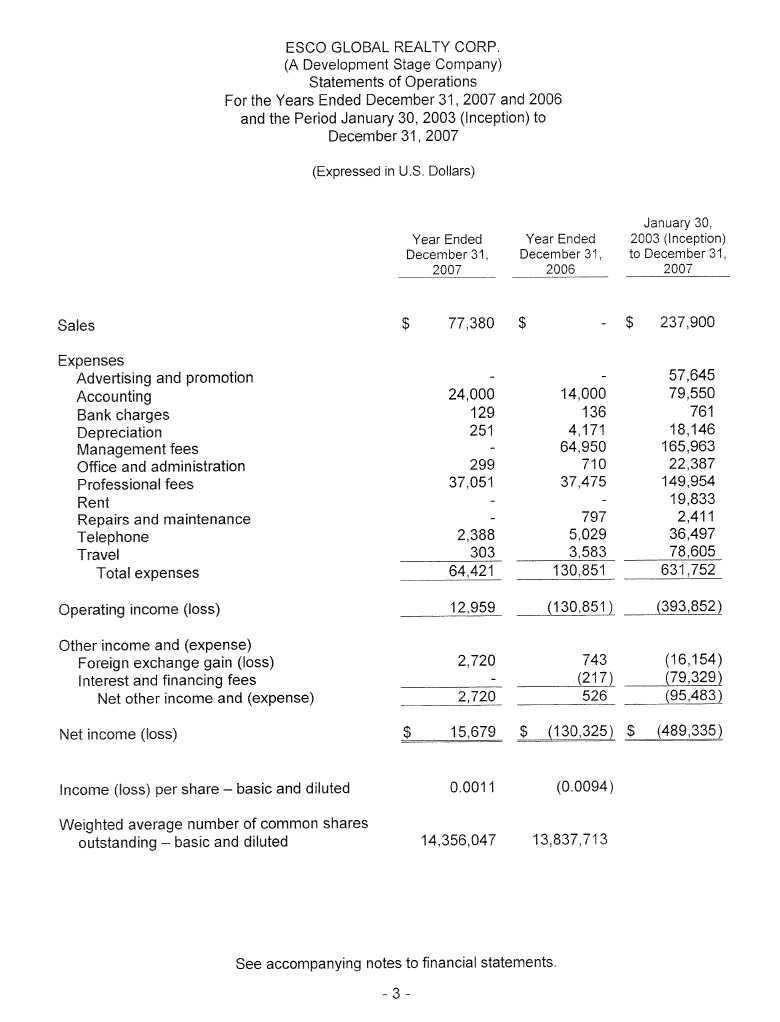

| Statement of Operations | |

| | | Years ended December 31 | | | Nine months ended September 30 | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2008 | | | 2007 | |

| Revenue | | $ | 77,380 | | | | - | | | $ | 160,520 | | | | - | | | $ | (299,700 | ) | | $ | 77,380 | |

| Net Income (Loss) | | $ | 15,679 | | | $ | (130,325 | ) | | $ | (9,301 | ) | | $ | (155,972 | ) | | $ | (577,707 | ) | | $ | 49,305 | |

| Income (Loss) per share – basic and diluted | | $ | 0.0011 | | | $ | (0.0094 | ) | | $ | (0. 0007 | ) | | $ | (0.01 | ) | | $ | (0.0387 | ) | | $ | 0.0034 | |

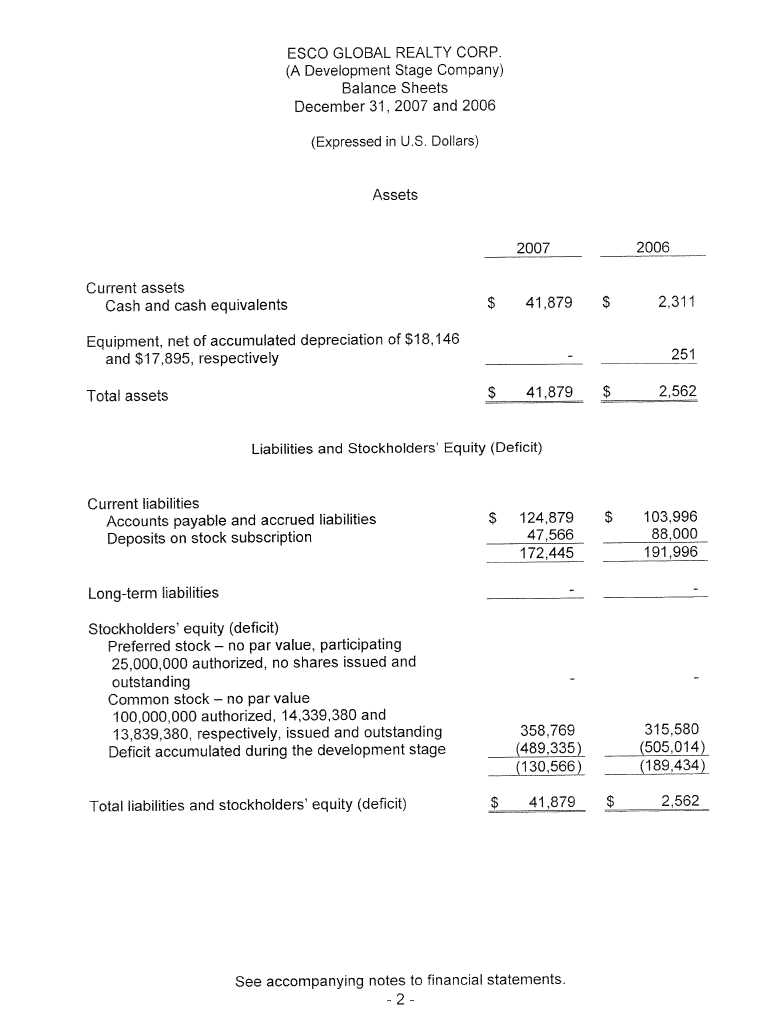

| Balance Sheet | |

| | | Years ended December 31 | | | Nine months ended Sept. 30, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2008 | |

| Current Assets | | $ | 41,879 | | | | 2,311 | | | | - | | | $ | 114,082 | | | $ | 31,929 | |

| Total Assets | | $ | 41,879 | | | $ | 2,562 | | | $ | 4,422 | | | $ | 121,977 | | | $ | 31,929 | |

| Current Liabilities | | $ | 172,445 | | | $ | 191,996 | | | $ | 63,531 | | | $ | 172,020 | | | $ | 374,246 | |

| Total Liabilities | | $ | 172,445 | | | $ | 191,996 | | | $ | 63,531 | | | $ | 172,020 | | | $ | 252,031 | |

| Shareholders’ Equity (Deficit) | | $ | 41,879 | | | $ | 2,562 | | | $ | (59,109 | ) | | $ | (50,043 | ) | | $ | (1,067,042 | ) |

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this prospectus in evaluating our Company and its business before purchasing shares of our Company’s common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are all of the material risks that we are currently aware of that are facing our Company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

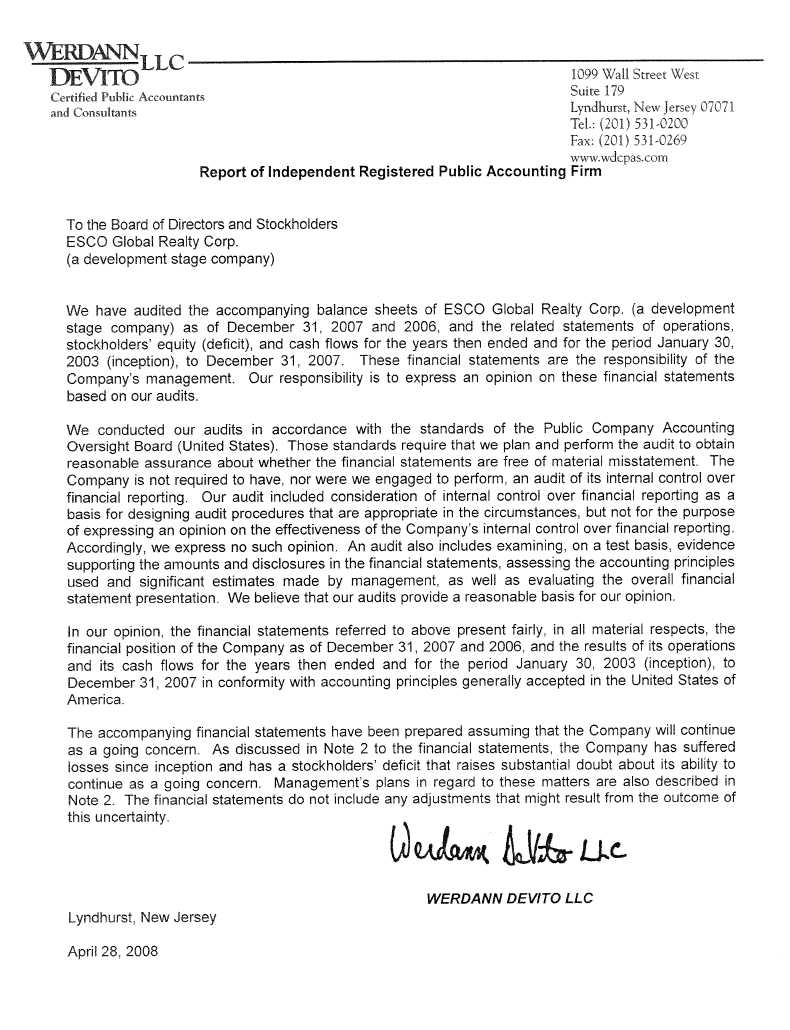

We have incurred losses and substantial doubt exists about our ability to continue as a going concern.

We have incurred net income/(losses) of $15,679 and ($577,707) for the year ended December 31, 2007 and nine months ended September 30, 2008, respectively. We had a working capital deficiency of ($342,317) and a shareholders’ deficiency of ($594,349) as of September 30, 2008. These factors raise substantial doubt about our ability to continue as a going concern. The auditors’ report in our financial statements as at December 31, 2007 includes an explanatory paragraph that states that we have generated net losses and have a working capital deficiency, factors which raise substantial doubt about our ability to continue as a going concern.

We may need to seek capital by way of an offering of our equity securities, an offering of debt securities, or by obtaining financing through a bank or other entity. We have not established a limit as to the amount of debt we may incur nor have we adopted a ratio of our equity to debt allowance. If we need to obtain additional financing, there is no assurance that financing will be available from any source, that it will be available on terms acceptable to us, or that any future offering of securities will be successful. If additional funds are raised through the issuance of equity securities, there may be a significant dilution in the value of our outstanding common stock. We could suffer adverse consequences if we are unable to obtain additional capital which would cast substantial doubt on our ability to continue our operations and growth.

We are a Development Stage Company and may never be able to execute our Business Plan

We currently have no products, customers or revenues. Although we have begun initial planning for the development of our business, we may not be able to execute our business plan unless and until we are successful in raising funds in this offering. In addition, our auditors’ report in our financial statements as at December 31, 2007 includes an explanatory paragraph that states that we have generated net losses and have a working capital deficiency, factors which raise substantial doubt about our ability to continue as a going concern.

There can be no assurances that we will ever achieve any revenues or profitability. The revenue and income potential of our proposed business and operations is unproven, and the lack of operating history makes it difficult to evaluate the future prospects of our business.

Our business model is new and unproven, and we cannot guarantee our future success.

Our business model is relatively new and unproven. Our business model differs significantly from that of a traditional real estate brokerage firm in several ways. For example, traditional real estate brokerage firms may implement one of several compensation plans that have been developed in the real estate industry, each attempting to provide consistent profitability for the office owner and sufficient incentive for the sales agent. We believe that each of these compensation plans fails to successfully address the issue of sales agent retention - there is no vested interest to hold a sales agent to the office or franchise they have helped to build. As independent contractors, agents lack long-term security and consequently have no incentive to stay with one company. The Own Your Future® plan is similar to a broad-based employee stock ownership plan which is designed to provide stock ownership to all Region Owners, Franchisees, Sales Agents, and all support staff. However, in our business model the Regional Owners, Franchisees, Sales Agents and support staff are our independent contractors and not employees. Through its application of the Own Your Future® plan ESCO® envisions a high recruitment and retention rate of personnel at each level of the ESCO® franchise. Every Regional Owner, Franchisee, Sales Agent and employee in the ESCO® franchise system will have a vested interest in its success, and ultimately in the success of ESCO®. The success of our business model depends on several factors including, (a) our ability to meet funding requirements prior to active operations, (b) lengthy implementations resulting from regulatory compliance, (c) unknown market response from other franchises, and (d) economic climate. If we are unable to efficiently acquire clients and maintain agent productivity, we may close fewer transactions and our net revenues could suffer as a result. If we are unsuccessful in providing our agents with more opportunities to close transactions than under the traditional model, our ability to hire and retain qualified real estate agents would be harmed, which would in turn significantly harm our business.

Our business model requires access to real estate listing services provided by third parties that we do not control, and the demand for our services may be reduced if our ability to display listings on our web site is restricted.

A key component of our business model is that through our website we offer clients access to, and the ability to search, real estate listings posted on the Multiple Listing Services (MLSs) in the markets we serve. Most large metropolitan areas in the United States have at least one MLS, though there is no national MLS. The homes in each MLS are listed voluntarily by its members, who are licensed real estate brokers. The information distributed in an MLS allows brokers to cooperate in the identification of buyers for listed properties.

If our access to one or more MLS databases were restricted or terminated, our service could be adversely affected and our business may be harmed. Because participation in an MLS is voluntary, a broker or group of brokers may decline to post their listings to the existing MLS and instead create a new proprietary real estate listing service. If a broker or group of brokers created a separate real estate listing database, we may be unable to obtain access to that private listing service on commercially reasonable terms, if at all. As a result, the percentage of available real estate listings that our clients would be able to search using our web site would be reduced, perhaps significantly, thereby making our services less attractive to potential clients.

If we fail to recruit, hire and retain qualified agents, we may be unable to service our clients and our growth could be impaired.

Our business requires us to contract with licensed real estate agents, and our strategy is based on consistently and rapidly growing our team of Regional Owners, Franchisees and Sales Agents. Competition for qualified agents is intense, particularly in the markets in which we compete. While there are many licensed real estate agents in our markets and throughout the country we may have difficulties in recruiting and retaining properly qualified licensed agents due to the highly competitive nature of the business. If we are unable to recruit, train and retain a sufficient number of qualified licensed real estate agents, we may be unable to service our clients properly and grow our business.

Furthermore, we rely on federal and state exemptions from minimum wage and fair labour standards laws for our Sales Agents, who are compensated solely through commissions. Such exemptions may not continue to be available, or we may not qualify for such exemptions, which could subject us to penalties and damages for non-compliance. If similar exemptions are not available in states where we desire to expand our operations or if they cease to be available in the states where we currently operate, we may need to modify our agent compensation structure in such states.

Our failure to effectively manage the growth of our Regional Owners, Franchisees and Sales Agents, and our information and control systems could adversely affect our ability to service our clients.

As we grow, our success will depend on our ability to continue to implement and improve our operational, financial and management information and control systems on a timely basis, together with maintaining effective cost controls. This ability will be particularly critical as we implement new systems and controls to help us comply with the more stringent requirements of being a public company, including the requirements of the Sarbanes-Oxley Act of 2002, which require management to evaluate and assess the effectiveness of our internal controls and our disclosure controls and procedures. Effective internal controls are required by law and are necessary for us to provide reliable financial reports and effectively prevent fraud. Effective disclosure controls and procedures will be required by law and are necessary for us to file complete, accurate and timely reports under the Securities Exchange Act of 1934 (the “Exchange Act”). Any inability to provide reliable financial reports or prevent fraud or to file complete, accurate and timely reports under the Exchange Act could harm our business, harm our reputation or result in a decline in our stock price. We are continuing to evaluate and, where appropriate, enhance our systems, procedures and internal controls. We are in the process of establishing our disclosure controls and procedures. If our systems, procedures or controls are not adequate to support our operations and reliable, accurate and timely financial and other reporting, we may not be able to successfully satisfy regulatory and investor scrutiny, offer our services and implement our business plan.

Our operating results are subject to seasonality and vary significantly among quarters during each calendar year, making meaningful comparisons of successive quarters difficult.

The residential real estate market traditionally has experienced seasonality, with a peak in the spring and summer seasons and a decrease in activity during the fall and winter seasons. Revenues in each quarter are significantly affected by activity during the prior quarter, given the typical 30- to 45-day time lag between contract execution and closing. This seasonality can cause revenue, operating income, net income and cash flow from operating activities to be lower in the first and fourth quarters and higher in the second and third quarters of each year.

Factors affecting the timing of real estate transactions that can cause our quarterly results to fluctuate include:

| | 1. | timing of widely observed holidays and vacation periods and availability of real estate agents and related service providers during these periods; |

| | 2. | a desire to relocate prior to the start of the school year; |

| | 3. | timing of employment compensation changes, such as raises and bonuses; and |

| | 4. | the time between entry into a purchase contract for real estate and closing of the transaction. |

We expect our revenues to be subject to these seasonal fluctuations, which, combined with growth, can make it difficult to compare successive quarters.

Interest rates have been at historic lows for the past several years, and increases in interest rates have the potential to negatively impact the housing market.

When interest rates rise, all other things being equal, housing becomes less affordable, since at a given income level people cannot qualify to borrow as much principal, or given a fixed principal amount they will be faced with higher monthly payments. This result may mean that fewer people will be able to afford homes at prevailing prices, potentially leading to fewer transactions or reductions in house prices in certain regions, depending also on the relevant supply-demand dynamics of those markets. Since it is likely that we will, at least in our initial years of development, be operating in only higher density population areas around the country, it is possible that we could experience a more pronounced impact than we would experience if our operations were more diversified. Should we experience softening in our markets and not be able to offset the potential negative market influences on price and volume by increasing our transaction volume through market share growth, our financial results could be negatively impacted.

Our success depends in part on our ability to successfully expand into additional real estate markets.

We plan on operating in the most populous U.S. metropolitan statistical areas. A part of our business strategy is to grow our business by entering into additional real estate markets. Key elements of this expansion include our ability to identify strategically attractive real estate markets and to successfully establish our brand in those markets. We consider many factors when selecting a new market to enter, including:

| | 1. | the economic conditions and demographics of a market; |

| | 2. | the general prices of real estate in a market; |

| | 3. | competition within a market from local and national brokerage firms; |

| | 4. | rules and regulations governing a market; |

| | 5. | the ability and capacity of our organization to manage expansion into additional geographic areas, additional headcount and increased organizational complexity; |

| | 6. | the existence of local MLSs; and |

| | 7. | state laws governing cash rebates and other regulatory restrictions. |

We have limited experience expanding into and operating in multiple markets, managing multiple sales regions or addressing the factors described above. In addition, this expansion could involve significant initial start-up costs. We expect that significant revenues from new markets will be achieved, if ever, only after we have been operating in that market for some time and begun to build market awareness of our services. As a result, geographic expansion is likely to significantly increase our expenses and cause fluctuations in our operating results. In addition, if we are unable to successfully penetrate these new markets, we may continue to incur costs without achieving the expected revenues, which would harm our financial condition and results of operations.

Unless we develop, maintain and protect a strong brand identity, our business may not grow and our financial results may suffer.

We believe a strong brand is a competitive advantage in the residential real estate industry because of the fragmentation of the market and the large number of agents and brokers available to the consumer. Because our brand is new, we currently do not have strong brand identity. We believe that establishing and maintaining brand identity and brand loyalty is critical to attracting new clients. In order to attract and retain clients, and respond to competitive pressures, we expect to increase our marketing and business development expenditures to maintain and enhance our brand in the future.

We plan to advertise by developing the ESCO® brand and visual identity program. We will produce the ESCO® Brand Book which is a comprehensive manual containing brand usage guidelines for anticipated franchise applications: stationery, listing and selling presentations, proposals, ad layouts, websites, trade show displays, signage, merchandise and apparel. The Brand Book will be provided to Regional Owners and Franchisees, who are responsible for protecting the ESCO® brand by ensuring strict compliance with the program among their Sales Agents.

We plan to increase our advertising expenditures substantially in the future. While we intend to enhance our marketing and advertising activities in order to promote our brand, our activities may not have a material positive impact on our brand identity. In addition, maintaining our brand will depend on our ability to provide a high-quality consumer experience and high quality service, which we may not do successfully. If we are unable to maintain and enhance our brand, our ability to attract new clients or successfully expand our operations will be harmed.

We have numerous competitors, many of whom have valuable industry relationships and access to greater resources than we do.

The residential real estate market is highly fragmented, and we have numerous competitors, many of whom have greater name recognition, longer operating histories, larger client bases, and significantly greater financial, technical and marketing resources than we do. Some of those competitors are large national brokerage firms or franchisors, such as Prudential Financial, Inc., RE/MAX International Inc. and Realogy, which owns the Century 21®, Coldwell Banker®, ERA®, Better Homes and Gardens Real Estate®, and Sotheby’s International Realty® franchise brands. We are also subject to competition from local or regional firms, as well as individual real estate agents. We also compete or may in the future compete with various online services that look to attract and monetize home buyers and sellers using the Internet. Some of these companies, either directly or through their affiliates, may have preferred access to listing information and other competitive advantages. In addition, our Own Your Future® business model is a relatively new approach to the residential real estate market and many consumers may be hesitant to choose us over more established brokerage firms employing traditional techniques.

Some of our competitors are able to undertake more extensive marketing campaigns, make more attractive offers to potential agents and clients and respond more quickly to new or emerging technologies. Over the past several years there has been a slow but steady decline in average commissions charged in the real estate brokerage industry, with the average commission percentage decreasing from 6.1% in 1991 to 4.9% in 2006 according to the National Association of REALTORS®. Some of our competitors with greater resources may be able to better withstand the short- or long-term financial effects of this trend. We may not be able to compete successfully for clients and agents, and increased competition could result in price reductions, reduced margins or loss of market share, any of which would harm our business, operating results and financial condition.

Changes in federal and state real estate laws and regulations, and rules of industry organizations such as the National Association of REALTORS®, could adversely affect our business.

The real estate industry is heavily regulated in the United States, including regulation under the Fair Housing Act, the Real Estate Settlement Procedures Act, state and local licensing laws and regulations and federal and state advertising laws. In addition to existing laws and regulations, states and industry participants and regulatory organizations could enact legislation, regulatory or other policies in the future, which could restrict our activities or significantly increase our compliance costs. If existing laws or regulations are amended or new laws or regulations are adopted, we may need to comply with additional legal requirements and incur significant compliance costs, or we could be precluded from certain activities. Any significant lobbying or related activities, either of governmental bodies or industry organizations, required to respond to current or new initiatives in connection with our business could substantially increase our operating costs and harm our business.

Our business could be harmed by economic events that are out of our control and may be difficult to predict.

The success of our business depends in part on the health of the residential real estate market, which traditionally has been subject to cyclical economic swings. The purchase of residential real estate is a significant transaction for most consumers, and one which can be delayed or terminated based on the availability of discretionary income. Economic slowdown or recession, rising interest rates, adverse tax policies, lower availability of credit, increased unemployment, lower consumer confidence, lower wage and salary levels, war or terrorist attacks, or the public perception that any of these events may occur, could adversely affect the demand for residential real estate and would harm our business. Also, if interest rates increase significantly, homeowners’ ability to purchase a new home or a higher priced home may be reduced as higher monthly payments would make housing less affordable. In addition, these conditions could lead to a decline in new listings, transaction volume and sales prices, any of which would harm our operating results.

If our future Franchisees and Sales Agents fail to comply with real estate brokerage laws and regulations, they may incur significant financial penalties or lose licenses to operate.

Due to the geographic scope of our operations and the nature of the real estate services we perform, our Franchisees are subject to numerous federal, state and local laws and regulations. For example, our Franchisees are required to maintain real estate brokerage licenses in each state in which they operate and to designate individual licensed brokers of record. If they fail to maintain licenses, lose the services of their designated broker of record or conduct brokerage activities without a license, the Franchisees and possibly us may be required to pay fines or return commissions received, our Franchisees’ licenses may be suspended or they and possibly us may be subject to other civil and/or criminal penalties. As we expand into new markets, our Franchisees and their individual brokers of record will need to obtain and maintain the required brokerage licenses and comply with the applicable laws and regulations of these markets, which may be different from those to which they and we are accustomed, may be difficult to obtain and will increase our compliance costs. In addition, both the difficulty and cost of compliance with the numerous state licensing regimes and possible losses resulting from non-compliance have increased. Our failure to comply with applicable laws and regulations, the possible loss of our Franchisees and designated brokers of record real estate brokerage licenses or litigation by government agencies or affected clients may have a material adverse effect on our business, financial condition and operating results, and may limit our ability to expand into new markets.

We may have liabilities in connection with real estate brokerage activities.

We and our Franchisees and Sales Agents are subject to statutory due diligence, disclosure and standard-of-care obligations. In the ordinary course of business we and our employees are subject to litigation from parties involved in transactions for alleged violations of these obligations. In addition, we may be required to indemnify our employees who become subject to litigation arising out of our business activities, including for claims related to the negligence of those employees. An adverse outcome in any such litigation could negatively impact our reputation and harm our business.

We may be subject to liability for the Internet content that we publish.

As a publisher of online content, we face potential liability for negligence, copyright, patent or trademark infringement, or other claims based on the nature and content of the material that we publish or distribute. Such claims may include the posting of confidential data, erroneous listings or listing information and the erroneous removal of listings. These types of claims have been brought successfully against the providers of online services in the past and could be brought against us or others in our industry. These claims, whether or not successful, could harm our reputation, business and financial condition. General liability insurance may not cover claims of these types or may be inadequate to protect us for all liability that we may incur.

Our intellectual property rights are valuable and our failure to protect those rights could adversely affect our business.

Our intellectual property rights, including existing and future patents, trademarks, trade secrets, and copyrights, are and will continue to be valuable and important assets of our business. We believe that our technologies and business practices are competitive advantages and that any duplication by competitors would harm our business. We have taken measures to protect our intellectual property, but these measures may not be sufficient or effective. For example, we seek to avoid disclosure of our intellectual property by requiring employees and consultants with access to our proprietary information to execute confidentiality agreements. We also seek to maintain certain intellectual property as trade secrets. Intellectual property laws and contractual restrictions may not prevent misappropriation of our intellectual property or deter others from developing similar technologies. In addition, others may develop technologies that are similar or superior to our technology, including our patented technology. Any significant impairment of our intellectual property rights could harm our business.

We may in the future be subject to intellectual property rights disputes, which could divert management attention, be costly to defend and require us to limit our service offerings.

Our business depends on the protection and utilization of our intellectual property. Other companies may develop or acquire intellectual property rights that could prevent, limit or interfere with our ability to provide our products and services. One or more of these companies, which could include our competitors, could make claims alleging infringement of their intellectual property rights. Any intellectual property claims, with or without merit, could be time-consuming and expensive to litigate or settle and could significantly divert management resources and attention.

Our technologies may not be able to withstand any third-party claims or rights against their use. If we were unable to successfully defend against such claims, we may have to:

| | 2. | stop using the technology found to be in violation of a third party’s rights; |

| | 3. | seek a license for the infringing technology; or |

| | 4. | develop alternative non-infringing technology. |

If we have to obtain a license for the infringing technology, it may not be available on reasonable terms, if at all. Developing alternative non-infringing technology could require significant effort and expense. If we cannot license or develop alternative technology for the infringing aspects of our business, we may be forced to limit our product and service offerings. Any of these results could reduce our ability to compete effectively, and harm our business and results of operations.

If we fail to attract and retain our key personnel, our ability to meet our business goals will be impaired and our financial condition and results of operations will suffer.

The loss of the services of one or more of our key personnel could seriously harm our business. In particular, our success depends on the continued contributions of senior level sales, operations, marketing, technology and financial officers. Our business plan was developed in large part by our senior level officers and its implementation requires their skills and knowledge. None of our officers or key employees has an employment agreement, see “Certain Relationships and Related Transactions”. We do not have “key person” life insurance policies covering any of our executives.

Without a public market there is no liquidity for our shares and our shareholders may never be able to sell their shares which would result in a total loss of their investment.

Our common shares are not listed on any exchange or quotation system and do not have a market maker which results in no market for our shares. Therefore, our shareholders will not be able to sell their shares in an organized market place unless they sell their shares privately. If this happens, our shareholders might not receive a price per share which they might have received had there been a public market for our shares.

Once this registration statement becomes effective, it is our intention to apply for a quotation on the OTCBB within three years whereby:

| | · | We will have to be sponsored by a participating market maker who will file a Form 211 on our behalf since we will not have direct access to the FINRA personnel; and |

| | · | We will not be quoted on the OTCBB unless we are current in our periodic reports; being at a minimum Forms 10-K and 10-Q; filed with the SEC or other regulatory authorities. |

We do not plan on applying to have our common stock listed on the OTCBB for another two to three years. However, we cannot be sure we will be able to obtain a participating market maker or be approved for a quotation on the OTCBB. If this is the case, there will be no liquidity for the shares of our shareholders.

If for any reason our common stock is not listed on the OTCBB or a public trading market does not otherwise develop, purchasers of the shares may have difficulty selling their common stock should they desire to do so. No market makers have committed to becoming market makers for our common stock and it is possible that none will do so.

Our stock price may be volatile, and you may not be able to resell your shares at or above the initial public offering price.

The trading price of our common stock after this offering may fluctuate widely, depending upon many factors, some of which are beyond our control. These factors include, among others, the risks identified above and the following:

| | 1. | variations in our quarterly results of operations; |

| | 2. | announcements by us or our competitors or lead source providers; |

| | 3. | changes in estimates of our performance or recommendations, or termination of coverage by securities analysts; |

| | 4. | inability to meet quarterly or yearly estimates or targets of our performance; |

| | 5. | the hiring or departure of key personnel, including agents or groups of agents or key executives; |

| | 6. | changes in our reputation; |

| | 7. | acquisitions or strategic alliances involving us or our competitors; |

| | 8. | changes in the legal and regulatory environment affecting our business; and |

| | 9. | market conditions in our industry and the economy as a whole. |

In addition, if our shares are traded on the OTCBB, our share price may be impacted by factors that are unrelated or disproportionate to our operating performance. Our share price might be affected by general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations. In addition, even if our stock is approved for quotation by a market maker through the OTCBB, stocks traded over this quotation system are usually thinly traded, highly volatile and not followed by analysts. These factors, which are not under our control, may have a material effect on our share price.

Our share price could decline due to the large number of outstanding shares of our common stock eligible for future sale.

The market price of our common stock could decline as a result of sales of substantial amounts of our common stock in the public market after this offering, or from the perception that these sales could occur. These sales could also make it more difficult for us to sell our equity or equity-related securities in the future at a time and price that we deem appropriate.

Immediately after this offering is completed, we may have 25,479,380 shares of common stock outstanding.

Our principal stockholders, executive officers and directors own a significant percentage of our stock, and as a result, the trading price for our shares may be depressed and these stockholders can take actions that may be adverse to your interests.

Our executive officers and directors and entities affiliated with them will, in the aggregate, beneficially own 36.97% of our common stock before this offering and up to 22.46% following this offering. This significant concentration of share ownership may adversely affect the trading price for our common stock because investors often perceive disadvantages in owning stock in companies with controlling stockholders. These stockholders, acting together, will have the ability to exert control over all matters requiring approval by our stockholders, including the election and removal of directors and any proposed merger, consolidation or sale of all or substantially all of our assets. In addition, these stockholders who are executive officers or directors, or who have representatives on our board of directors, could dictate the management of our business and affairs. This concentration of ownership could have the effect of delaying, deferring or preventing a change in control, or impeding a merger or consolidation, takeover or other business combination that could be favorable to you.

We anticipate the need to sell additional treasury shares in the future, meaning there will be a dilution to our existing shareholders resulting in their percentage ownership in the Company being reduced accordingly.

We expect that the only way we will be able to acquire additional funds is through the sale of our common stock. This will result in a dilution effect to our shareholders whereby their percentage ownership interest in the Company is reduced. The magnitude of this dilution effect will be determined by the number of shares we will have to issue in the future to obtain the funds required.

Because our common stock is subject to penny stock rules, the liquidity of your investment may be restricted.

Our common stock is now, and may continue to be in the future, subject to the penny stock rules under the Exchange Act. These rules regulate broker/dealer practices for transactions in “penny stocks”. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker/dealers to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker/dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker/dealer and its salesperson and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations and the broker/dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction, the broker and/or dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These additional penny stock disclosure requirements are burdensome and may reduce the trading activity in the market for our common stock. As long as the common stock is subject to the penny stock rules, holders of our common stock may find it more difficult to sell their securities.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our shares of common stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our shares of common stock, which may limit your ability to buy and sell our shares of common stock and have an adverse effect on the market for its shares.

If we are unable to gain commercial acceptance of our business model by various real estate industry members targeted by our business model, then we may be unable to implement our business plan which will affect our ability to continue operations.

Our success is dependent on the commercial acceptance of our business model by the various real estate industry members targeted by our business model. Broad market acceptance of our business model will depend upon our ability to demonstrate to potential customers that our products are superior to or can compete favorably with alternatives. There can be no assurance that any of the targeted markets will result in a significant commercial opportunity for us, that unforeseen problems will not develop with respect to the plans, or that we will be successful in completing the commercial implementation of the plan.

If we are unable to manage our growth effectively by continuing to implement and improve our management, operational and financial systems and to expand, train and manage our employees and franchise licensees, then we may fail to effectively manage growth which could have an adverse effect on results of operations.

Future growth may challenge our management, operational and financial resources. We may experience problems associated with the roll-out of our plan, both foreseen and unforeseen. Our ability to manage growth effectively will require us to continue to implement and improve our management, operational and financial systems and to expand, train and manage our employees and franchise licensees. Management of growth is especially challenging for an organization with a relatively short operating history and limited financial resources and the failure to effectively manage growth could have a material adverse effect on our results of operations.

Exchange rate fluctuations may negatively impact our business.

Our reporting currency is the United States Dollar but our financial currency is the Canadian Dollar. As such, exchange rate fluctuation may have a material impact on our consolidated financial reporting and make realistic revenue projections difficult.

If we issue additional shares of common stock in the future this may result in dilution to our existing stockholders.

Our articles of incorporation, as amended, authorize the issuance of 125,000,000 shares of which 100,000,000 are shares of common stock and 25,000,000 are preferred shares. Our board of directors has the authority to issue additional shares of common stock up to the authorized capital stated in the articles of incorporation. Our board of directors may choose to issue some or all of such shares to acquire one or more businesses or to provide additional financing in the future. The issuance of any such shares may result in a reduction of the book value or market price of the outstanding shares of our common stock. It will also cause a reduction in the proportionate ownership and voting power of all other stockholders.

The shares available for sale immediately along with shares available pursuant to Rule 144 could significantly reduce the market price of our common stock, if a market should develop.

If a market should develop for the shares of our common stock, the market price could drop if a substantial amount of shares available for public sale without any increase to our capitalization are sold in the public market or if the market perceives that such sales could occur. After a one-year holding period our restricted shares of common stock are eligible for trading, pursuant to Rule 144, without any additional payment to us or any increase to our capitalization. Our affiliates will be subject to the limitations of Rule 144, including its volume limitations in the sale of their shares. An aggregate of 13,010,000 of the outstanding shares of our common stock are held by officers, directors, affiliates and entities controlled by them and are subject to the limitations of Rule 144. In addition, there is no limit on the amount of restricted securities that may be sold by a non-affiliate after the restricted securities have been held by the owner for a period of two years or more. A drop in the market price could adversely affect holders of our common stock and could also harm our ability to raise additional capital by selling equity securities.

Our Bylaws do not contain anti-takeover provisions, which could result in a change of our management and directors if there is a take-over of our company.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our Bylaws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and directors.

As a result of a majority of our directors and officers being residents of countries other than the United States, investors may find it difficult to enforce, within the United States, any judgments obtained against our directors and officers.

We do not currently maintain a permanent place of business within the United States. In addition, a majority of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Please read this prospectus carefully. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. You should not assume that the information provided by the prospectus is accurate as of any date other than the date on the front of this prospectus.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “RISK FACTORS”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. The safe harbor for forward-looking statements provided in the Private Securities Litigation Reform Act of 1995 does not apply to the offering made in this prospectus.

USE OF PROCEEDS

The net proceeds to us from the sale of up to 6,000,000 shares of our common stock at $1.00 per share, and from the payment of the exercise price of the share purchase rights to acquire up to 4,000,000 shares of our common stock, will vary depending upon the number of shares sold and the number of share purchase rights exercised. Regardless of the number of shares sold and the number of share purchase rights exercised, we expect to incur offering expenses estimated at approximately $55,000 for legal, accounting, printing and other costs connected with this offering.

The table below shows the net proceeds from this offering we expect to receive for scenarios where we sell various amounts of the shares. Since we are making this offering without any minimum requirement, there is no guarantee that we will be successful at selling any of the securities being offered in this prospectus. Accordingly, the actual amount of proceeds we will raise in this offering, if any, may differ.

| | | % of total shares offered (including share purchase rights) | |

| | | | 20% | | | | 60% | | | | 100% | |

| Shares sold and share purchase rights exercised | | | 2,000,000 | | | | 6,000,000 | | | | 10,000,000 | |

| Gross proceeds | | $ | 2,000,000 | | | $ | 6,000,000 | | | $ | 10,000,000 | |

| Less offering expenses | | $ | 55,000 | | | $ | 55,000 | | | $ | 55,000 | |

| Net offering proceeds | | $ | 1,945,000 | | | $ | 5,945,000 | | | $ | 9,945,000 | |

The principal purposes of this offering are to obtain additional capital, to create a public market for our common stock and to facilitate our future access to the public equity markets.

We currently estimate that we will use the net proceeds of this offering to execute our business plan and for general corporate purposes, including working capital. We have not assigned specific portions of the net proceeds of this offering for any particular uses, and we will retain broad discretion in the allocation of these proceeds.

Pending such uses, we intend to invest the funds in short-term, investment-grade securities. We cannot predict whether the proceeds invested will yield a favorable return.

DETERMINATION OF OFFERING PRICE

We will sell our shares at $1.00 per share until our shares are quoted for trading on the OTCBB, and thereafter at prevailing market prices or privately negotiated prices. The exercise price of the share purchase rights offered in this prospectus will be $1.00 per share until our shares are quoted for trading on the OTCBB, and thereafter the exercise price will be the prevailing market price of our shares on the date of grant of the share purchase right. The exercise price of $1.00 was arbitrarily determined by us and bears no relationship whatsoever to, our assets, earnings, book value or any other criteria of value. Among the factors considered were:

| | · | our lack of operating history |

| | · | the proceeds to be raised by the offering |

| | · | the amount of capital to be contributed by purchasers in this offering in proportion to the amount of stock to be retained by our existing stockholders, and |

| | · | our relative cash requirements. |

We intend to apply for a listing of our common stock on the OTCBB (or other specified market) within two to three years of becoming a reporting company under the Exchange Act, as amended (the “Exchange Act”). If a market for our stock develops as a result of becoming listed on the OTCBB (or other specified market), we anticipate the actual price of sale will vary according to the market for our stock at the time of resale.

DILUTION

If you invest in our common stock, your interest will be diluted to the extent of the difference between the offering price per share of our common stock and net tangible book value per share of our common stock immediately after this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing shareholders. As of September 30, 2008, the net tangible book value of our shares of common stock was a deficit of ($594,349) or approximately ($0.039) per share based upon 14,939,380 shares outstanding. Upon completion of this offering, in the event that all of the shares are sold and assuming that all of the share purchase warrants are exercised, the net tangible book value of the 25,479,380 shares to be outstanding will be $10,617,529, or approximately $0.42 per share. The net tangible book value of the shares held by our existing stockholders will be increased by $0.42 per share without any additional investment on their part. You will incur an immediate dilution from $1.00 per share to $0.42 per share.

The following table summarizes, as of February 10, 2009, the differences between the number of shares of common stock purchased from us, the total cash consideration paid and the average price per share paid by the existing stockholders and by the new investors purchasing stock in this offering at an assumed initial offering price of $1.00 per share, before deducting any estimated offering expenses payable by us:

| | | Shares purchased | | | Total cash consideration | | | Average price | |

| | | Number | | | Percentage | | | Amount | | | Percentage | | | per share | |

| Existing stockholders | | | 15,479,380 | | | | 60.75 | % | | $ | 617,529 | | | | 5.82 | % | | $ | 0.03989 | |

| New investors | | | 10,000,000 | | | | 39.25 | % | | $ | 10,000,000 | | | | 96.18 | % | | $ | 1.00 | |

| Total: | | | 25,479,380 | | | | 100 | % | | | 10,617,529 | | | | 100 | % | | | | |

SELLING SECURITY HOLDERS

Our current stockholders are not selling any of the shares being offered in this prospectus.

PLAN OF DISTRIBUTION

There is no current market for our shares

There is currently no market for our shares. We cannot give you any assurance that the shares you purchase will ever have a market value or that if a market for our shares ever develops, that you will be able to sell your shares. In addition, even if a public market for our shares develops, there is no assurance that a secondary public market will be sustained.

The shares you purchase are not traded or listed on any exchange. Within three years after the effective date of the registration statement, we intend to have a market maker file an application with FINRA to have our common stock quoted on the OTCBB. We currently have no market maker who is willing to list quotations for our stock. Further, even assuming we do locate such a market maker, it could take several months before the market maker’s listing application for our shares is approved.

The OTCBB is maintained by FINRA. The securities traded on the OTCBB are not listed or traded on the floor of an organized national or regional stock exchange. Instead, these securities transactions are conducted through a telephone and computer network connecting dealers in stocks. Over-the-counter stocks are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

Even if our shares are quoted on the OTCBB, a purchaser of our shares may not be able to resell the shares. Broker-dealers may be discouraged from effecting transactions in our shares because they will be considered penny stocks and will be subject to the penny stock rules. Rules 15g-1 through 15g-9 promulgated under the Exchange Act, as amended, impose sales practice and disclosure requirements on FINRA brokers-dealers who make a market in a “penny stock”. A penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transactions is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

The additional sales practice and disclosure requirements imposed upon brokers-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market, assuming one develops.

The offering will be sold by our officers and directors

We are offering up to a total of 6,000,000 shares of our common stock at $1.00 per share and share purchase rights to acquire up to 4,000,000 shares of our common stock at an exercise price of $1.00 per share. The offering will be for a period of 180 days from the effective date and may be extended for an additional 90 days if we choose to do so, however, we intend to keep this registration statement continuously effective and to file post effective amendments as and when required in order continue our Own Your Future® plan. In our sole discretion, we have the right to terminate the offering at any time, even before we have sold all of the 6,000,000 shares or distributed all of the 4,000,000 share purchase rights pursuant to this offering. There are no specific events which might trigger our decision to terminate the offering.

We have not established a minimum amount of proceeds that we must receive in the offering before any proceeds may be accepted. We cannot assure you that all or any of the shares offered under this prospectus will be sold. No one has committed to purchase any of the shares offered. Therefore, we may sell only a nominal amount of shares and receive minimal proceeds from the offering. We reserve the right to withdraw or cancel this offering and to accept or reject any subscription in whole or in part, for any reason or for no reason.

Subscriptions will be accepted or rejected promptly. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions.

Any accepted subscriptions will be made on a rolling basis. Once accepted, the funds will be deposited into an account maintained by us and be immediately available to us. Subscription funds will not be placed into escrow, trust or any other similar arrangement. There is no investor protection for the return of subscription funds once accepted. Once we receive the purchase price for the shares, we will be able to use the funds. Certificates for shares purchased will be issued and distributed by our transfer agent promptly after a subscription is accepted and “good funds” are received in our account.

If it turns out that we have not raised enough money to effectuate our business plan, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and are not successful, we may have to suspend or cease operations.

We will sell the shares in this offering through our officers and directors. The officers and directors engaged in the sale of the securities will receive no commission from the sale of the shares nor will they register as a broker-dealer pursuant to Section 15 of the Exchange Act in reliance upon Rule 3(a)4-1. Rule 3(a)4-1 sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer’s securities and not be deemed to be a broker-dealer. Our officers and directors satisfy the requirements of Rule 3(a)4-1 in that:

| | 1. | None of such persons is subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Act, at the time of his participation; and, |

| | 2. | None of such persons is compensated in connection with his or her participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and |

| | 3. | None of such persons is, at the time of his participation, an associated person of a broker- dealer; and |

| | 4. | All of such persons meet the conditions of Paragraph (a)(4)(ii) of Rule 3(a)4-1 of the Exchange Act, in that they (A) primarily perform, or are intended primarily to perform at the end of the offering, substantial duties for or on behalf of the issuer otherwise than in connection with transactions in securities; and (B) are not a broker or dealer, or an associated person of a broker or dealer, within the preceding twelve (12) months; and (C) do not participate in selling and offering of securities for any issuer more than once every twelve (12) months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii). |

As long as we satisfy all of these conditions, we are comfortable that we will be able to satisfy the requirements of Rule 3a4-1 of the Exchange Act notwithstanding that a portion of the proceeds from this offering will be used to pay the salaries of our officers.

As our officers and directors will sell the shares being offered pursuant to this offering, Regulation M prohibits the Company and its officers and directors from certain types of trading activities during the time of distribution of our securities. Specifically, Regulation M prohibits our officers and directors from bidding for or purchasing any common stock or attempting to induce any other person to purchase any common stock, until the distribution of our securities pursuant to this offering has ended.

We have no intention of inviting broker-dealer participation in this offering.

Offering period and expiration date

This offering will commence on the effective date of this prospectus, as determined by the Securities and Exchange Commission and continue for a period of 180 days. We may extend the offering for an additional 90 days unless the offering is completed or otherwise terminated by us. However, we intend to keep this registration statement continuously effective and to file post effective amendments as and when required in order continue our Own Your Future® plan.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you must deliver a bank draft or certified funds for acceptance or rejection. The Sales Agents under the ESCO® franchise structure (See “Description of Business – Franchise Structure”) are required to purchase a minimum of 2% of their gross annual sales commissions each year up to a maximum of 5%. Franchisees are required to purchase a minimum of 0.2% of the gross annual sales commissions each year of the Sales Agents in their offices up to a maximum of 0.5%. There are no minimum or maximum share purchase requirements for Regional Owners or Support Staff under the ESCO® franchise structure (See “Description of Business – Franchise Structure”). All checks for subscriptions must be made payable to “ESCO Global Realty Corp.”

Upon receipt, all funds provided as subscriptions will be immediately deposited into our account and be available for our use to further the development and business of the Company.

Right to reject subscriptions

We maintain the right to accept or reject subscriptions in whole or in part, for any reason or for no reason, except for the mandatory subscriptions by Sales Agents as mentioned above. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours of our having received them.

DESCRIPTION OF SECURITIES TO BE REGISTERED

Common Stock

Our Articles of Incorporation authorize the issuance of 100,000,000 shares of common stock without par value. The holders of our common stock are entitled to one vote per share for each share held on all matters to be voted on by shareholders, including election of directors. The holders of our common stock are entitled to receive dividends when, as and if declared by our board of directors out of legally available funds. In the event our company is liquidated, dissolved or wound up, the holders of our common stock are entitled, subject to the rights of the shares of preferred stock as established by the Board of Directors of ESCO® in accordance with our articles of incorporation and the Colorado Business Corporation Act, to share pro-rata in all assets remaining available for distribution to them after payment of all liabilities. The holders of our common stock do not have any pre-emptive rights. To the extent that additional shares of our common stock are issued, the relative interest of then existing stockholders may be diluted.

Share Purchase Rights

Our offering of share purchase rights will enable acquisition of up to 4,000,000 of our common shares. All share purchase rights will be exercisable at a price of $1.00 per share unless our common shares are listed on an exchange. If our common shares are listed on an exchange, the exercise price per share will be the market price in effect on the date that the share purchase right was issued. Share purchase rights will expire on the earlier of (i) the date the holder leaves the ESCO® Regional Owner or Franchisee or (ii) the expiration of three years from the date of issue, at which time they may be open for renewal or replacement depending upon the requests of Regional Owners or Franchisees.

INTEREST OF NAMED EXPERTS AND COUNSEL