This report contains forward-looking statements that involve future events, our future performance and our expected future operations and actions. In some cases you can identify forward-looking statements by the use of words such as “may,” “will,” “should,” “anticipate,” “believe,” “expect,” “plan,” “future,” “intend,” “could,” “estimate,” “predict,” “hope,” “potential,” “continue,” or the negative of these terms or other similar expressions. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to, those business risks and factors described elsewhere in this report, in our other Securities and Exchange Commission filings, as well as those listed below.

| | |

| • | Our inability to obtain financing to complete construction of our plant; |

| | |

| • | Overcapacity within the biodiesel industry; |

| | |

| • | The ability of any company we may invest in or merge with to effectively operate its plant and manage its business; |

| | |

| • | Changes in our business strategy, capital improvements or development plans; |

| | |

| • | Lack of member approval to merge with or invest in another company that owns a constructed biodiesel plant; |

| | |

| • | Lack of definitive documents to merge with or invest in another company that owns a constructed biodiesel plant; |

| | |

| • | Availability and costs of feedstock, particularly soy oil, animal fats andcorn oil; |

| | |

| • | Changes in the price and market for biodiesel and glycerin; |

| | |

| • | Our ability to successfully complete a merger with or investment in a plant which owns a completed biodiesel plant; |

| | |

| • | Actual biodiesel and glycerin production varying from expectations; |

| | |

| • | Changes in or elimination of governmental laws, tariffs, trade or other controls or enforcement practices such as national, state or local energy policy; federal biodiesel tax incentives; or environmental laws and regulations that apply to the plant operations of any company we may invest in or merge with and their enforcement; |

| | |

| • | Changes in the weather or general economic conditions impacting the availability and price of vegetable oils and animal fats; |

| | |

| • | Total U.S. consumption of diesel; |

| | |

| • | Weather changes, strikes, transportation or production problems causing supply interruptions or shortages affecting the availability and price of feedstock; |

| | |

| • | Changes in plant production capacity or technical difficulties in operating any plant which we may invest in or merge with; |

| | |

| • | Changes in interest rates or the availability of credit; |

| | |

| • | Our ability to generate free cash flow to invest in our business; |

| | |

| • | Our potential liability resulting from future litigation; |

| | |

| • | General economic conditions; |

| | |

| • | Changes and advances in biodiesel production technology; |

| | |

| • | Competition from other alternative fuels; and |

| | |

| • | Other factors described elsewhere in this report. |

We undertake no duty to update these forward looking statements, even though our situation may change in the future. Furthermore, we cannot guarantee future results, events, levels of activity, performance or achievements. We caution you not to put undue reliance on any forward-looking statements which speak only as of the date of this

Table of Contents

report. You should read this report completely and with the understanding that our actual future results may be materially different from what we currently expect. We qualify all of our forward looking statements by these cautionary statements.

Overview

Soy Energy, LLC was organized as an Iowa limited liability company by filing articles of organization with the Iowa Secretary of State on December 15, 2005. We anticipated constructing a biodiesel plant with a production capacity of 15 million gallons per year using technology provided by Best Energies, Inc. (“Best Energies”) in Marcus, Iowa, however, given the current downturn in economic and market conditions combined with Best Energies inability to make a $5,000,000 equity contribution, Management determined in October 2008 that obtaining the financing to construct our plant would not likely be feasible. Management is now exploring its options to negotiate a plan to invest in or merge with a company that already owns a biodiesel plant. Currently, our principal place of business is located at P.O. Box 663, 222 N. Main St., Marcus, Iowa 51035.

We previously entered into a Phase 2 Agreement and an Agreement for Pre-Construction Services with Renewable Energy Group, Inc. of Ames, Iowa (“REG”). Our board of directors determined it was in the best interest of the company to change our design-builder to Bratney. We paid REG $2,500,000 under our Phase 2 and Pre-Construction Services Agreements. We requested that REG immediately refund $2,200,000 and provide us an itemized list of performed services for the remaining $300,000. We immediately received $2,200,000 and subsequently received $250,000 back from REG. We paid $1,500,000 of the refunded amount to Bratney Companies, as a deposit, under our Phase I Design Services Agreement.

In June 2007, we signed a design-build agreement with Bratney for the design and construction of a 30 million gallon per year biodiesel facility. We agreed to a guaranteed maximum price of $48,855,000 to construct the plant. On March 6, 2008, we gave notice to Bratney that we were terminating our design-build agreement with them as Management believed that the biodiesel plant as designed would not be profitable to operate due to the high cost of soybean oil and increasing costs of animal fats. Management decided to pursue a different biodiesel plant design utilizing Best Energies technology in order to reduce construction and future operating costs of our biodiesel plant. We paid Bratney approximately $13,659,000 for design and construction related services associated with the biodiesel plant. On July 25, 2008, we executed a termination agreement which settled certain issues we had with Bratney regarding the termination of the design-build agreement. In the termination agreement, Bratney agreed to refund $4,500,000, including amounts for construction assets returned, previously paid under the design-build agreement and to provide certain documents and information necessary for us to continue developing our project. We received the $4,500,000 from Bratney on July 25, 2008. Additionally, we executed a redemption agreement with Bratney pursuant to which Bratney agreed to return its 750 membership units for a non-cash settlement of approximately $750,000 of construction-in-progress as part of the termination agreement.

On April 10, 2008, we held our annual member meeting, where our members approved pursuing the use of Best Energies technology for the biodiesel plant and reducing the initial production capacity of the biodiesel plant to 15 million gallons per year from 30 million gallons per year. We anticipated that the proposed Best Energies design would allow us to expand the biodiesel plant to a 25 million gallon per year capacity in the future. We believed that the cost to construct the Best Energies biodiesel plant would be approximately $32,334,000. We do not, however, have a definitive agreement with Best Energies, and we no longer intent to construct our own biodiesel plant.

Because we no longer plan to construct our plant, any funds we have expended in our construction and plant development efforts will be deemed a loss. From our fiscal year ended October 31, 2008, we have incurred accumulated losses of approximately $7,046,000. Since we have not yet executed a business plan or commenced any operations, we do not yet have comparable income, production or sales data.

Liquidity and Capital Resources

We expect to spend the next 12 months focused primarily on negotiating, obtaining member approval, filing the necessary reports with the SEC and closing on a merger or investment in a company that owns a constructed biodiesel plant. If we are able to complete a merger or investment in an existing biodiesel plant, then we will proceed with the execution of the chosen business plan. Until we have a more definitive plan to merge with or invest in another company, we do not have an estimate of the costs for this new business plan.

32

Table of Contents

We raised $1,300,000 of equity in our private placement offerings to fund our development, organizational and offering expenses. This includes $500,000 we raised in our founders offering and $800,000 we raised in our seed capital offering. In our Iowa intrastate offering, we raised $30,668,000 in equity.

On June 7, 2007, we received a contingent loan commitment from AgStar Financial Services agreeing to provide us with approximately $33,487,000 in financing to capitalize the biodiesel plant. The AgStar loan commitment was contingent on AgStar securing the participating lenders required to fund the loan commitment and other to be determined conditions required by AgStar’s legal counsel and conditions that may be required by any participating lenders. Based on this contingent loan commitment, we satisfied all of the requirements of our escrow agreement to release the equity funds from escrow.

AgStar did not secure the participating lenders to fund the debt financing we required for our biodiesel plant. Given the current global economic conditions and notification from Best Energies that it will not be able to contribute a $5,000,000 equity investment, Management determined in October 2008 it will not likely be able to obtain the necessary financing to construct a biodiesel plant. We are now in the process of exploring our options to invest in or merge with a constructed biodiesel plant and may present a plan to our members for approval in the event we are able to negotiate a viable option in this regard.

Of the $31,968,000 we raised in equity, we have total assets remaining of approximately $24,436,000 as of October 31, 2008. Not all of these assets are liquid and we are uncertain as to whether we will be able to transfer our non-liquid assets as a part of any merger or investment plan we may negotiate. If we do not transfer these non-liquid assets, we may not be able to sell them at all, or may not be able to sell them at a profit. Because we do not have any definitive agreements and are currently still exploring our options to enter into a merger or investment with a company that owns an existing biodiesel plant, we are uncertain of what amount of resources we will need to go forward with this business plan. We do anticipate, however, that any merger or investment we may enter into will result in transferring the large majority of assets as a result of such transaction.

Sources and Uses of Proceeds

Below is a table showing our sources of funds and our estimated use of proceeds on our attempts to construct our own plant. We anticipate that any remaining funds will be used to invest in our merge with a company that owns any existing biodiesel plant, although we do not have member approval and have not executed definitive documents regarding such a transaction.

ESTIMATED USE OF PROCEEDS

Use of Proceeds | | Amount | |

Equity Proceeds Raised | | $ | 31,782,000 | (1) |

Estimated Proceeds Used in Development and Construction of biodiesel facility in Marcus, Iowa | | | 10,473,686 | (2) |

Estimated Proceeds Remaining to Invest in or Merge with another company | | $ | 21,308,314 | |

(1) This amount is our total equity proceeds less the redemption agreement for 750 units we executed with Bratney and our offering costs of approximately $186,000. The primary costs we incurred in raising capital included legal fees, accounting fees, printing and distribution costs, and meeting costs.

(2) This amount is the current impairment we have recorded and the amount of assets we have reclassified as assets held for sale, based on our determination that constructing a biodiesel facility in Marcus, Iowa is not presently feasible. We believe these amounts represent a reasonable estimate of the proceeds we used on construction, building and facilities, purchase and installation of machinery and equipment and purchases of real estate related to our attempt to construct a biodiesel facility in Marcus, Iowa.

Site Acquisition and Development

We purchased approximately 35 acres for our plant site near Marcus, Iowa in Cherokee County. In August 2007, we commenced construction of our biodiesel plant. In November 2007, we suspended all construction related activities on our plant while we sought the debt financing we need to complete construction of the plant. To date, we have completed approximately 10% of the construction of our biodiesel plant. In October 2008, Management determined that it would not likely be feasible to complete construction of the biodiesel plant. We may be unable to sell the site and the construction completed at a profit or at all and we may be unable to transfer such equipment and land as a part of any investment or merger we may complete. Due to the significant changes we made to our project, we have recorded an impairment charge in the value of constructed and construction in process assets of approximately $6,923,000 as of October 31, 2008 and a portion of this is from the site we purchased.

Plant Construction and Start-Up of Plant Operations

Plant Construction Activity

Construction of the plant in Marcus, Iowa was approximately 10% complete when Management determined completion of the construction was no longer feasible. We have suspended construction of our biodiesel plant. In October 2008 we terminated our agreement with Best Energies because it notified us it was no longer able to commit a $5,000,000 equity contribution to the project. As a result of this and the current economic downturn, Management determined that obtaining financing to complete construction was not likely feasible and began exploring its options to invest in or merge with a company that owns a constructed biodiesel plant. Due to the significant changes we made to our project, we have recorded an impairment charge related to the carrying value of constructed and construction in process assets of approximately $6,923,000 as of October 31, 2008.

Permitting and Costs and Effects of Compliance with Environmental Laws

Stanley Consultants, Inc. has assisted us in obtaining our required permits. We previously obtained or were in the process of obtaining all of the required air, water, construction and other permits necessary to construct the

33

Table of Contents

plant and to operate the plant. Because we no longer anticipate completing the plant, we will likely lose any resources we have invested in applying for such permits.

Trends and Uncertainties Impacting the Biodiesel Industry and Our Future Operations

Any company we may invest in or merge with will be subject to industry-wide factors that affect its operation of its biodiesel plant and financial performance. These factors include, but are not limited to, the available supply and cost of feedstock from which the biodiesel and glycerin will be processed; dependence on its biodiesel marketer and glycerin marketer to market and distribute its products, in the event such company utilizes outside marketers; the competitive nature of the biodiesel industry; possible legislation at the federal, state and/or local level; changes in federal tax incentives; and the cost of complying with extensive environmental laws that regulate the biodiesel industry.

We anticipate the revenues of any company we may merge with or invest in will consist of sales of biodiesel and glycerin. We expect biodiesel sales to constitute the bulk of its revenues. Although the price of diesel fuel has increased over the last several years and continues to rise, diesel fuel prices per gallon remain at levels below or equal to the price of biodiesel. In addition, other more cost-efficient domestic alternative fuels may be developed and displace biodiesel as an environmentally-friendly alternative. If diesel prices do not continue to increase or a new fuel is developed to compete with biodiesel, it may be difficult to market biodiesel, which could result in the loss of some or all of the value of our units. Further, due to the increase in the supply of biodiesel from the number of new biodiesel plants scheduled to begin production and the expansion of current plants, we do not expect current biodiesel prices to be sustainable in the long term and the industry will need to continue to grow demand to offset the increased supply brought to the market place by additional production.

We also expect to benefit from federal and state biodiesel supports and tax incentives, however, these benefits may be subject to the structure of any company we may invest in or merge with and the applicability of such supports and tax incentives to the company with which we may merge with or invest in. The applicability of such supports and incentives may also be dependent upon how any merger or investment we may enter into is structured and may not result in our members receiving direct benefits. Changes to these supports or incentives could significantly impact demand for biodiesel. See “DESCRIPTION OF BUSINESS –Governmental approval and regulations.”

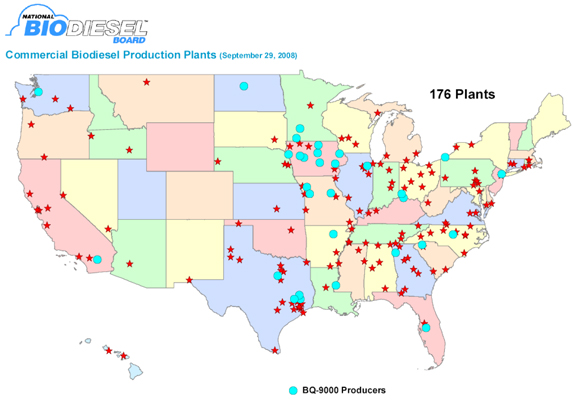

Biodiesel production continues to grow as additional plants become operational. In 2005, approximately 75 million gallons of biodiesel were produced in the United States, a three fold increase from 2004 biodiesel production according to the National Biodiesel Board. Further, in 2006 biodiesel production increased to 250 million gallons, a further significant increase from 2005. The National Biodiesel Board estimates that in 2007, biodiesel production reached 450 million gallons. In September 2008, the most recently reported data, the National Biodiesel Board estimated there were 176 active plants with an annual production capacity of 2.61 billion gallons annually, with another 39 plants and 1 expansion in construction. The biodiesel industry is becoming more competitive nationally as a result of the substantial construction and expansion that is occurring in the industry. We believe this increase in biodiesel supply as well as high soybean oil prices have forced some biodiesel producers to cut back production or cease production altogether. The combination of additional supply and stagnant or reduced demand may damage our ability to secure the debt financing we require and hurt our ability to generate revenue and maintain positive cash flows should our biodiesel plant become operational.

In recent months the global equity markets have been disrupted and have experienced significant volatility. The U.S. stock markets have tumbled since September 2008 upon the collapse of multiple major financial institutions, the federal government’s takeover of two major mortgage companies, Freddie Mac and Fannie Mae, and the President’s enactment of a $700 billion bailout plan pursuant to which the federal government will directly invest in troubled financial institutions. Financial institutions across the country have lost billions of dollars due to the extension of credit for the purchase and refinance of over-valued real property. The collapse of these financial institutions and the continued volatility in the credit market may significantly decrease the availability of credit needed to fund our project. The U.S. economy is also in the midst of a recession, with increasing unemployment rates and decreasing retail sales. A recession is expected to decrease availability of equity investment monies for our company as well.

34

Table of Contents

Financial Results

At October 31, 2008, we had total assets of approximately $24,436,000 consisting primarily of cash and equivalents and assets held for sale. At October 31, 2008, we had current liabilities of approximately $451,000 consisting of our accounts payable and other accrued expenses. Total members’ equity at October 31, 2008, was approximately $23,985,000. Since our inception, we have generated no revenue from operations. For the fiscal year ended October 31, 2008, we have a net loss of approximately $7,073,000 primarily due to an impairment charge of approximately $6,923,000.

Based upon our recent determination that building the plant would not likely be feasible, we have begun to explore our options for using our funds to invest in or merge with a plant that owns a completed biodiesel plant. We have not yet entered into any definitive documents and are therefore unable to determine what the total cost of this new business plan will be and we do not currently have a capitalization plan in place for any merger or investment. We anticipate as we begin to negotiate definitive documents and narrow our options for an investment or merger we will be able to develop a budget and estimated project cost for this new option.

Sources of Funds

In December 2005, we sold a total of 1,500 units to our founding members at a price of $333.33 per unit and received aggregate proceeds of $500,000. In addition, in April 2006 we issued 1,600 units to our seed capital members at a price of $500 per unit and received aggregate proceeds of $800,000. We sold 30,668 units at a price of $1,000 per unit in our Iowa registered offering and received aggregate proceeds of $30,668,000. We broke escrow on our Iowa registered offering in June 2007. We incurred costs of raising capital of approximately $186,000 related to the equity proceeds raised. These costs primarily consisted of legal fees, professional fees and printing costs. We executed a redemption agreement with Bratney pursuant to which Bratney agreed to return its 750 membership units.

We determined the offering price for our founding members, seed capital and general offering units based upon the capitalization requirements necessary to fund our development, organization and financing activities as a development-stage company. We did not rely upon any independent valuation, book value or other valuation criteria in determining the founding member, seed capital and general offering sales price per unit.

Debt Financing

During May 2006, we obtained loans with Farmers State Bank in Marcus, Iowa, totaling $1,999,000, a portion of which we used to pay REG under our pre-construction services agreement. Upon termination of our relationship with REG, we received a refund of a portion of the funds paid to REG under our Phase 2 and pre-construction services agreement. We paid Bratney $1,500,000 under our Phase I Design Services Agreement and we paid an additional deposit in June 2007 of $3,950,000. When we broke escrow on our Iowa registered intrastate offering in June 2007, we repaid the entire amount of our loans with Farmers State Bank.

On June 7, 2007, we received a contingent loan commitment from AgStar Financial Services agreeing to provide us with approximately $33,487,000 in financing to capitalize the biodiesel plant. The AgStar loan commitment was contingent on AgStar securing the participating lenders required to fund the loan commitment and other to be determined conditions required by AgStar’s legal counsel and conditions that may be required by any participating lenders. Based on this contingent loan commitment, we satisfied all of the requirements of our escrow agreement to release the equity funds from escrow. AgStar failed to secure the participating lenders to fund the debt financing we require for our biodiesel plant.

In July 2008, we entered into an agreement with Piper Jaffray to act as our debt placement agent to structure and market senior debt participations in a total amount of approximately $9,000,000. In exchange for these services, we would pay Piper Jaffray 1.5% of the aggregate amount of senior debt participations raised by Piper Jaffray at financial close. We have not, however, taken further action on this agreement and it is unlikely that Piper Jaffray will be able to obtain senior debt participants for us. Therefore, we will not likely make any payments to Piper Jaffray under this agreement.

In October 2008, Management determined it would not likely be feasible to obtain the necessary debt financing to complete construction of our biodiesel plant. We have therefore began to explore opportunities to

35

Table of Contents

invest in or merge with a company that owns a completed biodiesel plant. We are still exploring our options and have not entered into any definitive agreements and therefore are uncertain what debt financing, if any, will be necessary to complete a merger or investment in a company that owns a biodiesel plant.

Grants and Government Programs

Currently, there are limited numbers of grants, loans and forgivable loan programs available to biodiesel producers. We are uncertain what grants, loans and forgivable loan programs, if any, will be available and utilized by any company we may invest in or merge with. Some combinations of programs are mutually exclusive. Funds that we have expended in applying for grants, loans and forgivable loan programs will likely be a loss, unless we can transfer those benefits as a result of any merger or investment we enter into, which is not likely. Any benefits we may have already received may have to be repaid because we no longer plan to complete construction of our plant.

Employees

We currently have two full-time employees and no part-time employees. Our employment needs in the future will be dependent upon the terms and conditions of any merger or investment we may enter into with a company that owns a completed biodiesel plant.

Critical Accounting Estimates

Management uses estimates and assumptions in preparing financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and reported revenues and expenses. Significant estimates include long-lived asset impairment analysis and amounts expended for assets held for sale.

The Company noted certain construction-in-progress assets, construction related amounts, and other long-lived assets were impaired as result of the Company terminating all construction contracts as a result of determining that it is currently not feasible to build a biodiesel facility. The Company recorded an impairment charge of approximately $6,923,000 for the year ended October 31, 2008. As a result of the change in the project, the Company has transferred nearly all its remaining property and equipment assets as held for sale as of October 31, 2008. The property and equipment assets held for sale are carried at their estimated fair value, less estimated selling costs. There was no impairment charge for the year ended October 31, 2007.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

The Company is not required to provide the information required by this item because it is a smaller reporting company.

36

Table of Contents

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors

Soy Energy, LLC

Marcus, Iowa

We have audited the balance sheets of Soy Energy, LLC (a development stage company) as of October 31, 2008 and 2007, and the related statements of operations, changes in members’ equity and cash flows for the years then ended and the period from inception (December 15, 2005) to October 31, 2008. Soy Energy, LLC’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, and audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s interal control over financial reporting. Accordingly, we express no such opinion. The audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Soy Energy, LLC as of October 31, 2008 and 2007, and the results of its operations and its cash flows for the years then ended and for the period from inception (December 15, 2005) to October 31, 2008 in conformity with accounting principals generally accepted in the United States of America.

/s/ Boulay, Heutmaker, Zibell & Co. P.L.L.P.

Certified Public Accountants

Minneapolis, Minnesota

January 29, 2009

37

Table of Contents

|

SOY ENERGY, LLC |

(A Development Stage Company) |

|

Balance Sheets |

| | | | | | | |

| | October 31,

2008 | | October 31,

2007 | |

|

ASSETS | | | | | | | |

| | | | | | | |

Current Assets | | | | | | | |

Cash and equivalents | | $ | 20,803,450 | | $ | 16,244,811 | |

Certificates of deposit | | | — | | | 1,850,000 | |

Accrued interest receivable | | | 30,575 | | | 12,507 | |

Prepaid expenses | | | 38,545 | | | 2,250 | |

Total current assets | | | 20,872,570 | | | 18,109,568 | |

| | | | | | | |

Property, Plant and Equipment | | | | | | | |

Land | | | — | | | 250,012 | |

Equipment | | | 8,873 | | | 8,873 | |

Total | | | 8,873 | | | 258,885 | |

Accumulated depreciation | | | (2,492 | ) | | (718 | ) |

Total | | | 6,381 | | | 258,167 | |

Construction-in-progress | | | — | | | 11,093,267 | |

Net property, plant and equipment | | | 6,381 | | | 11,351,434 | |

| | | | | | | |

Other Assets | | | | | | | |

Design services deposit - related party | | | — | | | 4,535,000 | |

Loan commitment fee | | | — | | | 25,000 | |

Assets held for sale | | | 3,557,061 | | | — | |

Total other assets | | | 3,557,061 | | | 4,560,000 | |

| | | | | | | |

Total Assets | | $ | 24,436,012 | | $ | 34,021,002 | |

| | | | | | | |

LIABILITIES AND MEMBERS’ EQUITY | | | | | | | |

| | | | | | | |

Current Liabilities | | | | | | | |

Accounts payable | | $ | 442,825 | | $ | 499,379 | |

Accounts payable - related party | | | — | | | 1,711,363 | |

Accrued expenses | | | 7,909 | | | 1,708 | |

Total current liabilities | | | 450,734 | | | 2,212,450 | |

| | | | | | | |

Members’ Equity | | | | | | | |

Member contributions, 33,018 and 33,768 units outstanding at October 31, 2008 and 2007, respectively | | | 31,031,572 | | | 31,781,572 | |

(Deficit) income accumulated during development stage | | | (7,046,294 | ) | | 26,980 | |

Total members’ equity | | | 23,985,278 | | | 31,808,552 | |

| | | | | | | |

Total Liabilities and Members’ Equity | | $ | 24,436,012 | | $ | 34,021,002 | |

Notes to Financial Statements are an integral part of this Statement.

38

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Statements of Operations

| | | | | | | | | | |

| | Year Ended

October 31,

2008 | | Year Ended

October 31,

2007 | | From Inception

(December 15,

2005) to

October 31, 2008 | |

| | | | | | | | | | |

Revenues | | $ | — | | $ | — | | $ | — | |

| | | | | | | | | | |

Operating Expenses | | | | | | | | | | |

General and administrative | | | 404,448 | | | 171,668 | | | 667,677 | |

Professional fees | | | 372,812 | | | 139,301 | | | 667,066 | |

Impairment expense | | | 6,922,625 | | | — | | | 6,922,625 | |

Total operating expenses | | | 7,699,885 | | | 310,969 | | | 8,257,368 | |

| | | | | | | | | | |

Operating Loss | | | (7,699,885 | ) | | (310,969 | ) | | (8,257,368 | ) |

| | | | | | | | | | |

Other Income | | | | | | | | | | |

Interest income | | | 626,611 | | | 571,439 | | | 1,198,050 | |

Other income | | | — | | | 4,500 | | | 13,024 | |

Total other income | | | 626,611 | | | 575,939 | | | 1,211,074 | |

| | | | | | | | | | |

Net (Loss) Income | | $ | (7,073,274 | ) | $ | 264,970 | | $ | (7,046,294 | ) |

| | | | | | | | | | |

Weighted Average Units Outstanding - Basic and Diluted | | | 33,565 | | | 13,776 | | | 17,224 | |

| | | | | | | | | | |

Net (Loss) Income Per Unit - Basic and Diluted | | $ | (210.73 | ) | $ | 19.23 | | $ | (409.10 | ) |

Notes to Financial Statements are an integral part of this Statement.

39

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Statements of Changes in Members’ Equity

| | | | | | | |

| | Member

Contributions | | Income (Deficit)

Accumulated

During

Development

Stage | |

| | | | | | | |

Balance at Inception (December 15, 2005) | | $ | — | | $ | — | |

| | | | | | | |

Capital contributions - 1,500 units, $333.33 per unit - December 2005 | | | 500,000 | | | — | |

| | | | | | | |

Capital contributions - 1,600 units, $500 per unit - April 2006 | | | 800,000 | | | — | |

| | | | | | | |

Costs of raising capital | | | (13,212 | ) | | — | |

| | | | | | | |

Net loss for the period ended October 31, 2006 | | | — | | | (237,990 | ) |

| | | | | | | |

Balance at October 31, 2006 | | $ | 1,286,788 | | $ | (237,990 | ) |

| | | | | | | |

Capital contributions - 30,668 units, $1,000 per unit June - October 2007 | | | 30,668,000 | | | — | |

| | | | | | | |

Costs of raising capital | | | (173,216 | ) | | — | |

| | | | | | | |

Net income for the year ended October 31, 2007 | | | — | | | 264,970 | |

| | | | | | | |

Balance at October 31, 2007 | | $ | 31,781,572 | | $ | 26,980 | |

| | | | | | | |

Redemption of 750 units - July 2008 | | | (750,000 | ) | | — | |

| | | | | | | |

Net loss for the year ended October 31, 2008 | | | — | | | (7,073,274 | ) |

| | | | | | | |

Balance at October 31, 2008 | | $ | 31,031,572 | | $ | (7,046,294 | ) |

Notes to Financial Statements are an integral part of this Statement.

40

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Statements of Cash Flows

| | | | | | | | | | |

| | Year Ended

October 31, 2008 | | Year Ended

October 31, 2007 | | From Inception

(December 15,

2005) to

October 31, 2008 | |

| | | | | | | | | | |

Cash Flows from Operating Activities | | | | | | | | | | |

Net income (loss) | | $ | (7,073,274 | ) | $ | 264,970 | | $ | (7,046,294 | ) |

Adjustments to reconcile net income loss income to net cash provided by operating activities: | | | | | | | | | | |

Depreciation | | | 1,774 | | | 703 | | | 2,492 | |

Impairment of long-lived assets | | | 6,922,625 | | | — | | | 6,922,625 | |

Write off of construction services related to terminated agreement | | | — | | | — | | | 50,000 | |

Write off of loan commitment fees | | | 25,000 | | | — | | | 25,000 | |

Non-cash interest income | | | (30,000 | ) | | — | | | (30,000 | ) |

Changes in operating assets and liabilities: | | | | | | | | | | |

Accrued interest receivable | | | (18,068 | ) | | (12,507 | ) | | (30,575 | ) |

Prepaid expenses | | | (36,295 | ) | | — | | | (38,545 | ) |

Accounts payable | | | 222,402 | | | (37,835 | ) | | 247,714 | |

Accrued expenses | | | 6,201 | | | 1,231 | | | 7,909 | |

Net cash provided by operating activities | | | 20,365 | | | 216,562 | | | 110,326 | |

| | | | | | | | | | |

Cash Flows from Investing Activities | | | | | | | | | | |

Capital expenditures | | | (2,330,397 | ) | | (7,686,614 | ) | | (10,588,448 | ) |

Proceeds from disposal of property and equipment | | | 1,725,000 | | | — | | | 1,725,000 | |

Payments for design services deposit | | | — | | | (3,950,000 | ) | | (5,450,000 | ) |

Refund of design services deposit | | | 3,300,000 | | | — | | | 3,300,000 | |

Payments for construction deposit | | | — | | | — | | | (2,500,000 | ) |

Refund of construction deposit | | | — | | | — | | | 2,450,000 | |

Payments for certificates of deposit | | | (100,000 | ) | | (1,850,000 | ) | | (1,950,000 | ) |

Proceeds from maturing certificates of deposit | | | 1,950,000 | | | — | | | 1,950,000 | |

Net cash provided by (used for) investing activities | | | 4,544,603 | | | (13,486,614 | ) | | (11,063,448 | ) |

| | | | | | | | | | |

Cash Flows from Financing Activities | | | | | | | | | | |

Payments on revolving notes payable | | | — | | | (1,201,000 | ) | | — | |

Loan commitment fees | | | — | | | (25,000 | ) | | (25,000 | ) |

Members’ contributed capital | | | — | | | 30,668,000 | | | 31,968,000 | |

Payments for offering costs | | | (6,329 | ) | | (136,674 | ) | | (186,428 | ) |

Net cash (used for) provided by financing activities | | | (6,329 | ) | | 29,305,326 | | | 31,756,572 | |

| | | | | | | | | | |

Net Increase in Cash and Equivalents | | | 4,558,639 | | | 16,035,274 | | | 20,803,450 | |

| | | | | | | | | | |

Cash and Equivalents at Beginning of Period | | | 16,244,811 | | | 209,537 | | | — | |

| | | | | | | | | | |

Cash and Equivalents at End of Period | | $ | 20,803,450 | | $ | 16,244,811 | | $ | 20,803,450 | |

| | | | | | | | | | |

Supplemental Cash Flow Information | | | | | | | | | | |

Capitalized interest paid | | $ | — | | $ | 133,556 | | $ | 133,556 | |

|

Supplemental Schedule of Noncash Investing and Financing Activities | | | | | | | | | | |

Assets held for sale included in accounts payable | | $ | 195,111 | | $ | 2,179,101 | | $ | 195,111 | |

Construction-in-progress applied against design services deposit | | $ | 48,675 | | $ | 915,000 | | $ | 963,675 | |

Offering costs included in accounts payable | | $ | — | | $ | 6,329 | | $ | — | |

Design services deposit applied against accounts payable to related party | | $ | 431,696 | | $ | — | | $ | 431,696 | |

Property and equipment returned for member units | | $ | 750,000 | | $ | — | | $ | 750,000 | |

Property and equipment reclassified to assets held for sale | | $ | 3,557,061 | | $ | — | | $ | 3,557,061 | |

Notes to Financial Statements are an integral part of this Statement.

41

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Notes to Financial Statements

October 31, 2008 and 2007

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

Soy Energy, LLC (a development stage Iowa limited liability company) was organized to develop, own and operate a 30 million gallon per year (MGY) production biodiesel facility between Cleghorn and Marcus, Iowa in Cherokee County. The Company was formed December 15, 2005 to have a perpetual life. As of October 31, 2008, Soy Energy is in the development stage with its efforts being principally devoted to organizational, financing, and project development activities.

Construction of a biodiesel facility began in June 2007 with completion originally expected in the first calendar quarter of 2009. In November 2007, the Company suspended construction on the project subject to securing debt financing. In April 2008, the Company’s members voted to reduce the project from a 30 MGY to a 15 MGY production biodiesel facility.

As of October 31, 2008 the Company determined a biodiesel facility near Marcus, Iowa is not currently feasible, terminated all design/build construction contracts, and recorded impairment charges totaling approximately $6,923,000, which includes estimates for assets held for sale. There was no impairment charge for the year ended October 31, 2007. The Company will continue to monitor and evaluate the value of long-lived assets to determine if additional impairment is necessary.

As of October 31, 2008 the Company was considering the purchase of or investment in an existing biodiesel facility. As a result of the change in the project, the Company has transferred nearly all its remaining property and equipment assets as held for sale as of October 31, 2008.

Fiscal Reporting Period

The Company adopted a fiscal year ending October 31 for financial operations.

Accounting Estimates

Management uses estimates and assumptions in preparing financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and reported revenues and expenses. Significant estimates include long-lived asset impairment analysis and amounts expended for assets held for sale.

The Company noted certain construction-in-progress assets, construction related amounts, and other long-lived assets were impaired as result of the Company terminating all construction contracts as a result of determining that it is currently not feasible to build a biodiesel facility. The Company recorded an impairment charge of approximately $6,923,000 for the year ended October 31, 2008. As a result of the change in the project, the Company has transferred nearly all its remaining property and equipment assets as held for sale as of October 31, 2008. The property and equipment assets held for sale are carried at their estimated fair value, less estimated selling costs. There was no impairment charge for the year ended October 31, 2007.

Cash and Equivalents

The Company considers all highly liquid debt instruments purchased with an original maturity of three months or less to be cash and equivalents.

The Company maintains its accounts primarily at one financial institution. At times throughout the period, cash and equivalents balances exceeded amounts insured by the Federal Deposit Insurance Corporation. The Company has not experienced losses relative to cash and equivalents, and does not believe such accounts are at significant risk of loss.

42

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Notes to Financial Statements

October 31, 2008 and 2007

Certificates of Deposit

Certificates of deposit with maturities greater than three months are classified as “available for sale.” Certificates of deposit are carried at their estimated fair market value based on quoted market prices, which approximates cost. Interest is accrued as earned on the certificates of deposit. Because fair market value approximates cost, there are neither realized gains nor losses upon automatic renewal or liquidation at maturity nor unrealized gains or losses at October 31, 2008 and 2007. Automatic renewals upon maturity are considered neither sales nor new purchases of available for sale securities.

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Equipment is depreciated over estimated service lives of related assets, five years, using the straight-line method of accounting. Property, plant and equipment undergoing development that is not in service is shown in the balance sheet as construction-in-progress and is not depreciated. The Company determined a biodiesel facility is currently not feasible and; accordingly, recognized an impairment charge of approximately $6,923,000 on construction-in-progress, construction related amounts, and other long-lived assets for the year ended October 31, 2008. There was no impairment charge for the year ended October 31, 2007. As a result of the change in the project, the Company has transferred nearly all its remaining property and equipment assets as held for sale as of October 31, 2008.

Ordinary maintenance and repairs are expensed as incurred. Cost of renewals and betterments are capitalized in appropriate property and equipment accounts and depreciated as discussed above.

Capitalization of Interest

The Company capitalizes interest costs on construction-in-progress and capitalized development costs in accordance with the requirements of Statements of Financial Accounting Standards No. 34 (SFAS No. 34),Capitalization of Interest Cost. This standard requires a certain portion of interest cost be capitalized as part of the historical cost of developing or constructing an asset.

Long-Lived Assets

The Company reviews property and equipment and other long-lived assets for impairment in accordance with Statement of Financial Accounting Standards No. 144 (SFAS No. 144),Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed of.

Long-lived assets, such as property, plant, and equipment, and purchased intangible assets subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. If circumstances require a long-lived asset be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by an asset to the carrying value of the asset. If the carrying value of the long-lived asset is not recoverable on an undiscounted cash flow basis, impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values and third-party independent appraisals, as considered necessary.

As of October 31, 2008, the Company determined it is not currently feasible to build a biodiesel facility, recording an impairment charge totaling approximately $6,923,000 on construction-in-progress, construction related amounts, and other long-lived assets for the year ended October 31, 2008, related to these long-lived assets. There was no impairment charge for the year ended October 31, 2007.

43

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Notes to Financial Statements

October 31, 2008 and 2007

Deferred Offering Costs

The Company defers costs incurred to raise equity financing until that financing occurs, at which time costs are netted against proceeds received. During the year ended October 31, 2007, approximately $173,000 of offering costs were netted against the proceeds received. There were no offering costs for the year ended October 31, 2008.

Grants

The Company recognizes grant income for reimbursement of expenses incurred upon complying with the conditions of the grant. For reimbursements of incremental expenses (expenses the Company otherwise would not have incurred had it not been for the grant), grant proceeds are recognized as a reduction of the related expense. Grants for reimbursement of capital expenditures are recognized as a reduction of the basis of the asset upon complying with conditions of the grant.

Organization and Start-up Costs

The Company expenses organizational and start-up costs as they are incurred.

Income Taxes

The Company is treated as a partnership for federal and state income tax purposes and; accordingly, members report their proportionate share of the Company’s income, gains, losses, tax credits, etc. in their income tax returns. No benefit from or provision for federal or state income taxes is included in accompanying financial statements.

In June 2006, the FASB issued Interpretation No. 48,Accounting for Uncertainty in Income Taxes (FIN 48). FIN 48 clarifies the requirements of SFAS 109,Accounting for Income Taxes, relating to the recognition of income tax benefits. FIN 48 provides a two-step approach to recognizing and measuring tax benefits when realization of the benefits is uncertain. The first step is to determine whether the benefit meets the more-likely-than-not condition for recognition and the second step is to determine the amount to be recognized based on the cumulative probability that exceeds 50%. Primarily due to the Company’s tax status as a partnership, the adoption of FIN 48 on November 1, 2008, had no material impact on the Company’s financial condition or results of operations.

Net (Loss) Income per Unit

Basic net (loss) income per unit is computed by dividing net (loss) income by the weighted average number of members’ units outstanding during the period. Diluted net (loss) income per unit is computed by dividing net (loss) income by the weighted average number of members’ units and members’ unit equivalents outstanding during the period. There were no member unit equivalents outstanding during the 2008 and 2007 periods; accordingly, the Company’s basic and diluted net (loss) income per unit are the same for all periods presented.

Recently Issued Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 157 (SFAS 157),Fair Value Measurements. SFAS 157 defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. The statement is effective for

44

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Notes to Financial Statements

October 31, 2008 and 2007

(1) financial assets and liabilities in financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years; and, (2) certain non-financial assets and liabilities in financial statements issued for fiscal years beginning after November 15, 2008, and interim periods within those fiscal years. The Company is evaluating the effect, if any, adoption of SFAS 157 will have on its results of operations, financial position, and the related disclosures.

In February 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 159 (SFAS 159),The Fair Value Option for Financial Assets and Financial Liabilities - Including an amendment of FASB Statement No. 115 (Accounting for Certain Investments in Debt and Equity Securities). SFAS 159 provides companies with an option to report selected financial assets and liabilities at fair value and is effective for fiscal years beginning after November 15, 2007 with early adoption permitted. The Company is evaluating the effect, if any, adoption of SFAS 159 will have on its results of operations, financial position, and the related disclosures.

In December 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 160 (SFAS 160), Noncontrolling Interests in Consolidated Financial Statements - an amendment of ARB No. 51 (Consolidated Financial Statements). SFAS 160 establishes accounting and reporting standards for a noncontrolling interest in a subsidiary and for deconsolidation of a subsidiary. In addition, SFAS 160 requires certain consolidation procedures for consistency with requirements of SFAS 141, Business Combinations. SFAS 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008 with earlier adoption prohibited. SFAS 160 must be adopted concurrently with the effective date of SFAS 141(R). The Company is evaluating the effect, if any, adoption of SFAS 160 will have on its results of operations, financial position, and related disclosures.

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB Statement No. 133. SFAS 161 applies to all derivative instruments and nonderivative instruments that are designated and qualify as hedging instruments pursuant to paragraphs 37 and 42 of SFAS 133 and related hedged items accounted for under SFAS 133. SFAS 161 requires entities to provide greater transparency through additional disclosures about how and why an entity uses derivative instruments, how derivative instruments and related hedged items are accounted for under SFAS 133 and its related interpretations, and how derivative instruments and related hedged items affect an entity’s financial position, results of operations, and cash flows. SFAS 161 is effective for an entity’s first fiscal year beginning after November 15, 2008. The Company currently plans to adopt SFAS 161 during its 2010 fiscal year.

In September 2008, the FASB issued “Clarification of the Effective Date of FASB Statement No. 161.” This FASB Staff Position (FSP) clarifies the effective date in SFAS No. 161. The disclosures required by SFAS No. 161 should be provided for any reporting period (annual or quarterly interim) beginning in the Company’s fiscal year ending October 31, 2010.

2. LIQUIDITY

The Company is a developmental stage company and has no operating revenues. The Company has determined it is not currently feasible to build a biodiesel facility. The Company is currently considering purchasing or investing in an existing biodiesel facility. The Company’s current equity reserves are sufficient to fund operations without additional financing through October 2009 if it does not build or purchase a biodiesel plant.

The Company may return a portion of the equity proceeds, net of any outstanding obligation to its members if it does not build or invest in an existing biodiesel facility, which amount would be less than members’ original investment.

3. CONSTRUCTION-IN-PROGRESS

The Company originally projected construction of a 30 MGY biodiesel facility to cost approximately $53,112,000 of which approximately $11,093,000 had been expended as of October 31, 2007. During 2008, the project subsequently changed, as the Company determined it was not currently feasible to build a plant. The Company recorded an impairment charge of approximately $6,923,000 during fiscal year 2008. There was no impairment charge for fiscal year 2007. As a result of the change in the project, the Company has transferred nearly all its remaining property and equipment assets as held for sale as of October 31, 2008.

45

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Notes to Financial Statements

October 31, 2008 and 2007

Amounts included in construction-in-progress are as follows:

| | | | |

| | October 31,

2007 | |

Construction costs | | $ | 10,944,264 | |

Capitalized interest | | | 133,556 | |

Insurance and other costs | | | 15,447 | |

|

| | $ | 11,093,267 | |

The Company capitalized interest of approximately $84,000 for the year ended October 31, 2007.

4. ASSETS HELD FOR SALE

As of October 31, 2008 the Company determined construction of a biodiesel facility near Marcus, Iowa was not currently feasible, terminated all design/build construction contracts, and is currently considering the purchase of or investment in an existing biodiesel facility. As a result of the change in the project, the Company has reclassified nearly all its remaining property and equipment assets as held for sale as of October 31, 2008. The Company is actively working to sell the assets held for sale. These assets have been recorded at their estimated net realized value, less estimated selling costs. The fair value of these assets was determined based on recent sales of similar equipment.

| | | | |

Land | | $ | 250,262 | |

Equipment | | | 3,306,799 | |

| | $ | 3,557,061 | |

5. DEBT FINANCING

Iowa Department of Economic Development Loan

In September 2006, the Company was awarded a $400,000 loan from the Iowa Department of Economic Development under the Value-Added Agricultural Products and Processes Financial Assistance Program. The arrangement provides $100,000 of the loan to be forgiven upon the Company fulfilling certain employment obligations and production of 30 MGY of biodiesel. The Company’s failure to meet employment obligations requires it to pay the $100,000 forgivable portion of the $400,000 loan, subject to proration based on the deficiency in the employment obligation, with interest at 6%. The remaining $300,000 will be payable without interest in sixty monthly installments beginning the first day of the fourth month from the date funds are disbursed. No funds have been drawn on the Iowa Department of Economic Development loan as of October 31, 2008 and 2007.

6. MEMBERS’ EQUITY

In December 2005, the Company was initially capitalized by members investing an aggregate $500,000 for 1,500 units. The Company issued an additional 1,600 units for $800,000 pursuant to an April 2006 private placement memorandum. Proceeds from the two offerings were used to pay organizational, permitting, and other development costs.

The Company raised additional equity through an Iowa intrastate offering of a minimum of 25,000 units and a maximum of 39,000 units at $1,000 per unit. As of October 31, 2007, the Company raised $30,668,000 by issuing 30,668 units in the Iowa intrastate offering, which equity proceeds were held in escrow until June 2007. During July 2008, the Company redeemed, at fair value, 750 units for approximately $750,000 upon settlement of the construction contract with the general contractor as described in Note 8.

The Company’s operating agreement authorizes the Board of Directors to issue up to 48,750 units without consent of a majority of its membership voting interests. The Company has one class of membership unit which, under its

46

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Notes to Financial Statements

October 31, 2008 and 2007

operating agreement, gives a member one vote for each unit owned, provided no member, related party and/or affiliate of a member may vote more than five percent of the Company’s outstanding membership interests. The Company’s operating agreement restricts transfer of membership units generally to operation of law, such as upon death, without approval of a majority of its Directors.

Income, losses, and distributions are allocated to members based upon their respective percentage of units owned.

7. INCOME TAXES

The Company adopted an October 31 fiscal year end for financial and income tax reportings. Subsequent to year end, the Company adopted a December 31 fiscal year end for income tax reportings. Differences in total assets for financial and income tax reportings are as follows:

| | | | | | | | |

| | | October 31,

2008 | | October 31,

2007 | |

| Financial statement basis of total assets | | $ | 24,436,012 | | $ | 34,021,002 | |

| Add - Start up and organizational costs | | | 1,168 | | | 456,192 | |

| - Impairment of long lived assets expensed for financial and not for income tax reportings | | | 701,915 | | | — | |

| Subtract - Interest capitalized for financial and not for income tax reportings | | | — | | | (83,691 | ) |

| - Equipment depreciated using straight-line for financial and accelerated methods for income tax reportings | | | 2,492 | | | — | |

|

| Taxable income basis of total assets | | $ | 25,141,587 | | $ | 34,393,503 | |

There are no differences in liabilities for financial and income tax reportings at October 31, 2008 and 2007, respectively.

8. COMMITMENTS AND CONTINGENCIES

Construction Contracts

The Company terminated all in force and negotiations relative to pending construction contracts when it decided not to build a biodiesel plant. Upon termination of the construction contract with the general contractor during fiscal year 2008, the Company received $4,500,000 in cash consideration for the design services deposit and construction services paid in excess of those earned to date by the general contractor plus estimated interest on these excess deposits. As part of the termination and settlement of the construction contract, the Company redeemed at fair value the 750 units for approximately $750,000 initially invested by the general contractor.

In May 2008, the Company signed a letter of intent with a general contractor, an unrelated party, to construct a 15 MGY biodiesel facility for approximately $33,530,000, which was contingent upon obtaining adequate financing, and feedstock supplies. As of October 31, 2008 the Company determined it is not currently feasible to build a biodiesel facility near Marcus, Iowa, and has no intent of entering into a definitive agreement with the general contractor.

Legal Proceedings

The Company is subject to legal proceedings and claims which arise in the ordinary course of business. Accordingly, management recorded a liability relating to the probable future settlement of a claim as of October 31, 2008. In the opinion of management, the remaining matters are adequately covered by insurance, or if not covered,

47

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Notes to Financial Statements

October 31, 2008 and 2007

are without merit, are of such a nature, or involve such amounts, as would not materially affect the financial position or results of operations of the Company. Nevertheless, due to uncertainties in the settlement process, it is at least reasonably possible that management’s view of the outcomes will change in the near term.

Debt Placement Agent

In July 2008, the Company entered into an agreement with an unrelated investment banker to act as participating debt placement agent to structure and market senior debt participations in a total amount of approximately $9,000,000. The Company will pay a placement fee of 1.5% of the aggregate amount of senior debt participations raised by the investment banker at financial close. The agreement is subject to termination by either party with 30 days written notice, and the Company’s payment of reasonable out-of-pocket expenses incurred by the investment banker. The Company did not close on a credit facility through October 31, 2008 and the agreement has been terminated.

Sales Agreement

In August 2006, the Company entered into an agreement with an unrelated party to market and purchase all the Company’s production for three years beginning the first day of production. The Company will pay a fee for the services provided of 1.0% of the net purchase price per gallon of biodiesel purchased. The contract provides for automatic renewal for three years unless terminated by either party with 120 days notice.

The Company did not produce biodiesel or related products through October 31, 2008 and the agreement has been terminated.

Energy Supply Contract

In June 2007, the Company entered into a contract for an unrelated party to provide process engineered fuel pellets to fuel the Company’s boiler system for ten years commencing the first day of operations unless the Company is not operating by June 1, 2009. The agreement provides for the Company to pay $3.00 per MMBTU for Process Engineered Fuel (PEF) pellets delivered to the Company.

The Company did not purchase engineered fuel pellets through October 31, 2008.

9. RELATED PARTY TRANSACTIONS

In January 2006, the Company entered into an agreement with a related party to serve as temporary project manager, providing organizational and development services. The agreement, subject to termination upon the Company employing a permanent project manager or with 14 days notice, obligates the Company to pay $150 for each service day not to exceed $750 a calendar week, reimbursement for expenses, and $15,000 upon the Company employing a permanent project manager and phasing out its temporary manager. Services totaling approximately $1,000 and $41,000 were provided during the years ended October 31, 2008 and 2007, respectively. The related party is an investor and serves on the Company’s Board of Directors.

In May 2006, the Company entered into a consulting agreement with a related party to assist its temporary project manager. The agreement, subject to termination upon 14 days notice, obligates the Company to pay an initial $4,000, $150 for each service day not to exceed $750 a calendar week, and $16,000 upon the Company obtaining debt and equity capital to fund its business plan. Services totaling approximately $36,000 were provided during the year ended October 31, 2007. There were no services provided during the year ended October 31, 2008. The related party is an investor and serves on the Company’s Board of Directors.

The general contractor invested $750,000 in the Company as part of the Company’s Iowa Intrastate offering. The general contractor’s units were redeemed for $750,000 as part of the termination agreement described in Note 8. Accordingly, Bratney is no longer a member of the Company.

48

Table of Contents

SOY ENERGY, LLC

(A Development Stage Company)

Notes to Financial Statements

October 31, 2008 and 2007

Certain members of the Company’s Board of Directors are also members of the Board of Directors of Farmers State Bank, which Bank lent money to the Company during the year ended October 31, 2007. There were no amounts loaned to the Company or outstanding during the year ended October 31, 2008.

49

Table of Contents

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE.

King, Reinsch, Prosser & Co., L.L.P., Certified Public Accountants (“KRP”), has been the company’s accountants since its inception. KRP’s accountants reports on the company’s March 31, 2007 compiled financial statements did not contain an adverse disclaimer or modification. Soy Energy LLC’s decision to use Boulay, Heutmaker, Zibell & Co., P.L.L.P. to audit Soy Energy, LLC’s October 31, 2007 and October 31, 2008 financial statements and the statement of operations since inception (December 15, 2005) to October 31, 2008 were approved by the company’s board of directors. There are no disagreements with KRP on any matter of accounting principles or practices, financial statement disclosure, auditing scope or procedure, which, if not resolved to KRP’s satisfaction, would have caused it to make reference to the subject matter of the disagreement(s) in connection with its report. A copy of this disclosure has been provided to KRP and we have not received a response disagreeing with the terms of this disclosure. Boulay, Heutmaker, Zibell & Co., P.L.L.P., Certified Public Accountants, has been the company’s independent registered public accounting firm since December 10, 2007.

ITEM 9A(T). CONTROLS AND PROCEDURES.

Our management, including our Chief Executive Officer (the principal executive officer), along with our Chief Financial Officer (the principal financial officer), have reviewed and evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended) as of October 31, 2008. Based upon this review and evaluation, these officers have concluded that our disclosure controls and procedures were not effective due to the material weaknesses discussed below.

Due to the current operations and size of the Company, there is a lack of segregation of duties in certain functions. In addition, there were adjustments to our financial statements and other factors during the course of fiscal year 2008. To address these weaknesses, the Company performed additional analysis and other post-closing procedures to ensure that our financial statements are prepared in accordance with generally accepted accounting principles. Accordingly, our executive officers and management believe that the financial statements included in this report present fairly in all material respects our financial condition, results of operations and cash flows for the periods presented. The Company is in the process of strengthening internal controls including enhancing our internal control systems and procedures to assure that these weaknesses are corrected and remediated.

Our management, including our principal executive officer and principal financial officer, have reviewed and evaluated any changes in our internal control over financial reporting that occurred during the period covered by this report and there has been no change, other than in regard to the material weakness discussed above, that has materially affected or is reasonably likely to materially affect our internal control over financial reporting.

This annual report does not include a report of management’s assessment regarding internal control over financial reporting or an attestation report of the Company’s registered public accounting firm due to a transition period established by the rules of the Securities and Exchange Commission for newly public companies.

ITEM 9B. OTHER INFORMATION.

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CORPORATE GOVERNANCE.

The information required by this Item is incorporated by reference to the definitive proxy statement for our 2009 annual Meeting of Members to be filed with the Securities and Exchange Commission within 120 days after the end of our 2008 fiscal year. This proxy statement is referred to in this report as the 2009 Proxy Statement.

ITEM 11. EXECUTIVE COMPENSATION.

The information required by this Item is incorporated by reference to the 2009 Proxy Statement.

50

Table of Contents

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED MEMBER MATTERS.

The information required by this Item is incorporated by reference to the 2009 Proxy Statement.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR

INDEPENDENCE.

The information required by this Item is incorporated by reference to the 2009 Proxy Statement.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

The information required by this Item is incorporated by reference to the 2009 Proxy Statement.

PART IV

ITEM 15. EXHIBITS.

The following exhibits are filed as part of, or are incorporated by reference into, this report:

| | | | |

Exhibit

No. | | Description | | Method of Filing |

| | | | |

31.1 | | Certificate pursuant to 17 CFR 240 13a-14(a) | | * |

| | | | |

31.2 | | Certificate pursuant to 17 CFR 240 13a-14(a) | | * |

| | | | |

32.1 | | Certificate pursuant to 18 U.S.C. Section 1350 | | * |

| | | | |

32.2 | | Certificate pursuant to 18 U.S.C. Section 1350 | | * |

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | | SOY ENERGY, LLC |

| | | | |

Date: | January 29, 2009 | | | /s/ Charles Sand |

| | | | Charles Sand

Chairman |

| | | | |

Date: | January 29, 2009 | | | /s/ Dallas Thompson |

| | | | Dallas Thompson

Treasurer and Chief Financial Officer |

51

Table of Contents

In accordance with the Exchange Act, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | | | |

Date: | January 29, 2009 | | | /s/ Charles Sand |

| | | | Charles Sand

Chairman |

| | | | |

Date: | January 29, 2009 | | | /s/ Dallas Thompson |

| | | | Dallas Thompson

Treasurer and Chief Financial Officer |

| | | | |

Date: | January 29, 2009 | | | /s/ Ronald Wetherell |

| | | | Vice Chairman |

| | | | |

Date: | January 29, 2009 | | | /s/ Douglas Lansink |

| | | | Douglas Lansink

Secretary |

| | | | |

Date: | January 29, 2009 | | | /s/ Darrell Downs |

| | | | Darrell Downs, Director |

| | | | |

Date: | January 29, 2009 | | | /s/ Daryl Haack |

| | | | Daryl Haack, Director |

| | | | |

Date: | January 29, 2009 | | | /s/ Steven Leavitt |

| | | | Steven Leavitt, Director |

| | | | |

Date: | January 29, 2009 | | | /s/ Carol Reuter |

| | | | Carol Reuter, Director |

| | | | |

Date: | January 29, 2009 | | | /s/ David Langel |

| | | | David Langel, Director |

52