The Auburn Bancorp, Inc. stock offering closed at 12:00 Noon, Eastern Standard Time (EST), on [Date 1], 2008. The results of the offering are as follows:

____________________________________________________.

Interest and refund [if applicable] checks will be mailed out on ________________ by regular mail. No special mailing instructions will be accepted.

Allocations will be made available beginning at ______ on ________________. [If applicable]

Notice to Subscribers not receiving all shares: Please be aware that while we believe this to be a final allocation, we reserve the right to amend this amount up to the time of trading and recommend you verify such on your certificate prior to trading your shares. [if applicable]

The transfer agent for Auburn Bancorp, Inc. will be Registrar and Transfer Company, Cranford, New Jersey and the phone number for their Investor Relations Department is 1-800-368-5948.

We anticipate trading to begin on ____________, 2008 on the OTC Bulletin Board under the symbol “____.”

Allen T. Sterling

President and CEO

FACTSABOUT THEREORGANIZATION

The Board of Directors of Auburn Savings Bank, FSB unanimously adopted a Plan of Reorganization From a Mutual Savings Bank to a Mutual Holding Company and Stock Issuance Plan to reorganize into a mutual holding company structure. As a result of the reorganization, Auburn Bancorp, Inc. will become the federally chartered mid-tier stock holding company of Auburn Savings Bank, FSB (“Auburn Savings”), and Auburn Bancorp, Inc. will be 55% owned by Auburn Bancorp, MHC. In connection with the reorganization, Auburn Bancorp, Inc. is offering a minority of its common stock in a subscription offering to the public pursuant to the Plan of Reorganization and Stock Issuance. Auburn Bancorp, MHC will be the majority stockholder of the common stock of Auburn Bancorp, Inc. after the reorganization. Auburn Bancorp, MHC will have as its members the depositors and certain borrowers of Auburn Savings.

This brochure answers some of the most frequently asked questions about the stock issuance and about your opportunity to invest in Auburn Bancorp, Inc.

Investment in the stock of Auburn Bancorp, Inc. involves certain risks. For a discussion of these risks and other factors, including a complete description of the offering, investors are urged to read the accompanying Prospectus, especially the discussion under the heading “Risk Factors.”

|

WHAT IS THE PURPOSE OF THEREORGANIZATION? |

|

The primary reasons for the reorganization and our decision to conduct the offering are to:

- Increase our capital in order to increase our profitability and support asset growth;

- Allow our directors, officers and employees the opportunity to become stockholders, which we see as an effective performance incentive and an effective means of attracting and retaining qualified personnel; and

- Retain the characteristics of a mutual organization. The mutual holding company structure will allow our mutual holding company to retain voting control over most decisions to be made by Auburn Bancorp, Inc. shareholders.

|

WILL THE REORGANIZATION AFFECT ANY OF MY DEPOSIT ACCOUNTS OR LOANS? |

|

No. The reorganization will not affect the balance or terms of any deposit account or loan. Your deposits will continue to be federally insured by the Federal Deposit Insurance Corporation (“FDIC”) to the maximum legal limit.Your deposit account is not being converted to stock.

Yes. Your “YES” vote is very important! PLEASE SIGN AND RETURN ALL PROXY CARDS AT YOUR EARLIEST CONVENIENCE!

|

MAYIVOTE IN PERSON AT THE SPECIAL MEETING OF MEMBERS? |

|

Yes, but we would still like you to sign and mail your proxy today. If you decide to revoke your proxy, you may do so by giving notice at the special meeting.

|

DO DEPOSITORS HAVE TO BUY STOCK? |

|

No. However, the reorganization will allow Auburn Savings’ depositors and certain borrowers an opportunity to buy stock and become stockholders of Auburn Bancorp, Inc.

|

WHO IS ELIGIBLE TO PURCHASE STOCK IN THE SUBSCRIPTION OFFERING AND COMMUNITY OFFERING? |

|

Certain depositors and borrowers of Auburn Savings as of certain dates and the Auburn Savings employee stock ownership plan can purchase stock in the subscription offering. We may elect to conduct a community offering that could commence at the same time as, during, or after the subscription offering that would allow certain members of the general public to purchase stock and give a preference to residents of Androscoggin County.

|

HOW MANY SHARES OF STOCK ARE BEING OFFERED AND AT WHAT PRICE? |

|

Auburn Bancorp, Inc. is offering through the Prospectus between 225,675 and 305,325 shares of common stock at a price of $10.00 per share. The maximum number of shares that we may sell in the stock offering may increase by 15% to 351,124 shares as a result of regulatory considerations or changes in financial markets.

The minimum order is 25 shares or $250. No person may purchase more than 10,000 shares or $100,000 of common stock in the subscription offering, and no person, together with associates of and persons acting in concert with such persons may purchase more than 15,000 shares (or $150,000) of common stock, or more than 5% of the common stock sold in the stock offering (which in certain circumstances is fewer than 15,000 shares).

You must complete the enclosed Stock Order and Certification Form. Instructions for completing your Stock Order and Certification Form are contained in this packet. Your ordermustbereceivedby Auburn Savings prior to 12:00 Noon, Eastern Standard Time (EST), on _____, 2008.

|

HOW MAYIPAY FOR MY SHARES OF STOCK? |

|

First, you may pay for stock by check or money order. Interest will be paid by Auburn Savings on these funds at our passbook savings rate from the day the funds are received until the reorganization is completed or terminated. Second, you may authorize us to withdraw funds from your Auburn Savings savings account or certificate of deposit for the amount of funds you specify for payment. You will not have access to these funds from the day we receive your order until the reorganization is completed or terminated. Auburn Savings will waive any early withdrawal penalties on certificate of deposit accounts used to purchase stock.

|

CAN IPURCHASE SHARES USING FUNDS IN MY AUBURN SAVINGS IRA? |

|

Potentially. However, you must establish a self-directed IRA account at a brokerage firm or trust department to which you can transfer a portion or all of your IRA account at Auburn Savings that will enable such purchase. Please contact your broker or self-directed IRA provider as soon as possible if you want to explore this option, as such transactions take time, typically several weeks.

|

MAYIOBTAIN A LOAN FROM AUBURN SAVINGS TO PAY FOR THE STOCK? |

|

No. Regulations do not allow Auburn Savings to make loans for this purpose, nor may you use an Auburn Savings line of credit to pay for shares. However, you are not precluded from obtaining financing from another financial institution.

|

DOES PLACING AN ORDER GUARANTEE THAT IWILL RECEIVE ALL,OR A PORTION, OF THE SHARESIORDERED? |

|

No. It is possible that orders received during the stock offering will exceed the number of shares offered for sale. In this case, referred to as an “oversubscription,” regulations require that orders be filled using a predetermined allocation procedure. Please refer to the section of the Prospectus titled, “The Reorganization and Stock Offering” for a detailed description of allocation procedures.

If we are not able to fill an order (either wholly or in part), excess funds will be refunded by check, including interest earned at Auburn Savings’ passbook savings rate. If payment is to be made by withdrawal from an Auburn Savings deposit account, excess funds will remain in that account.

|

WILL THE STOCK BE INSURED? |

|

No. Like any other common stock, Auburn Bancorp, Inc.’s stock will not be insured.

|

WILL DIVIDENDS BE PAID ON THE STOCK? |

|

The board of directors does not currently intend to pay cash dividends. The board may decide to pay cash dividends in the future. For a further discussion, see the section entitled “Dividend Policy” on page __ of the Prospectus.

|

HOW WILL THE STOCK BE TRADED? |

|

Upon completion of the offering, we anticipate that our common stock will be quoted on the OTC Bulletin Board.

|

ARE OFFICERS AND DIRECTORS OF AUBURNSAVINGS PLANNING TO PURCHASE STOCK? |

|

Yes! Auburn Savings’ executive officers and directors plan to purchase, in the aggregate, $____ worth of stock or approximately ___% at the maximum of the offering range.

No. You will not be charged a commission or fee on the purchase of shares in the reorganization.

|

Stock Information Center

(207) xxx-xxxx

Auburn Bancorp, Inc.

325 Sabattus Street

Lewiston, ME 04240

Hours

Monday - Friday 9:00 a.m. to 5:00 p.m.

Excluding Bank Holidays |

The Plan of

Reorganization and

Stock Issuance

QUESTIONS

&

ANSWERS

The proposed mid-tier stock holding company for Auburn Savings Bank, FSB

|

The shares of common stock being offered are not deposits or savings accounts and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency. |

|

This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the Prospectus. |

| Auburn Bancorp, Inc.

Community Meeting

_____ __, 2008

The shares of common stock being offered are not deposits or savings accounts and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency. This is not an offer to sell or a solicitation of an offer to buy common stock. The offer is made only by the Prospectus. |

| FORWARD-LOOKING STATEMENTS

The Prospectus contains a number of forward-looking statements regarding the financial condition, results of operations, earnings outlook, and business prospects of Auburn Bancorp, Inc. You can find may of these statements by looking for words such as “expects,” “projects,” “anticipates,” “believes,” “intends,” “estimates,” “strategy,” “plan,” “potential,” “possible” and other similar expressions. Forward-looking statements include: statements of our goals, intentions, and expectations; statements regarding our business plans, prospectus, growth and operating strategies; statements regarding the quality of our loan and investment portfolios; and estimates of our risks and future costs and benefits.

The forward-looking statements involve significant risks and uncertainties. Actual results may differ materially from those expressed in, or implied by, the forward-looking statements due to, among others, the factors discussed under “Risk Factors” in the Prospectus as well as the following: changes in the interest rate environment that reduce our interest margins or reduce the fair value of financial instruments; competitive pressures among financial services companies in our market area; general economic conditions, either nationally or in our market area, that are worse than expected; increased lending risks associated with increased commercial and construction lending; legislative or regulatory changes that adversely affect our business; changes in consumer spending, borrowing and savings habits; adverse changes in the securities markets; and changes in accounting policies and practices, as may be adopted by Auburn Savings Bank, regulatory agencies, the Financial Accounting Standards Board or the Public Company Accounting Oversight Board.

Any of the forward-looking statements that we make in the Prospectus and in other public statements we make may later prove incorrect because of the inaccurate assumptions, the factors illustrated above or other factors that we cannot foresee. Because of these and other uncertainties, no forward-looking statements can be guaranteed, and you should not rely on such statement. Except to the extent required by applicable law or regulation, Auburn Bancorp, Inc. undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events. |

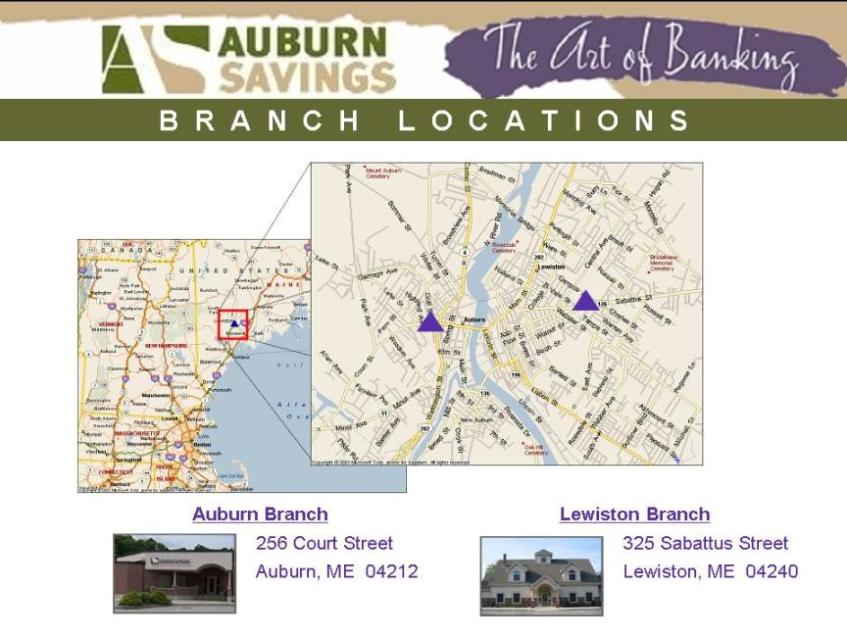

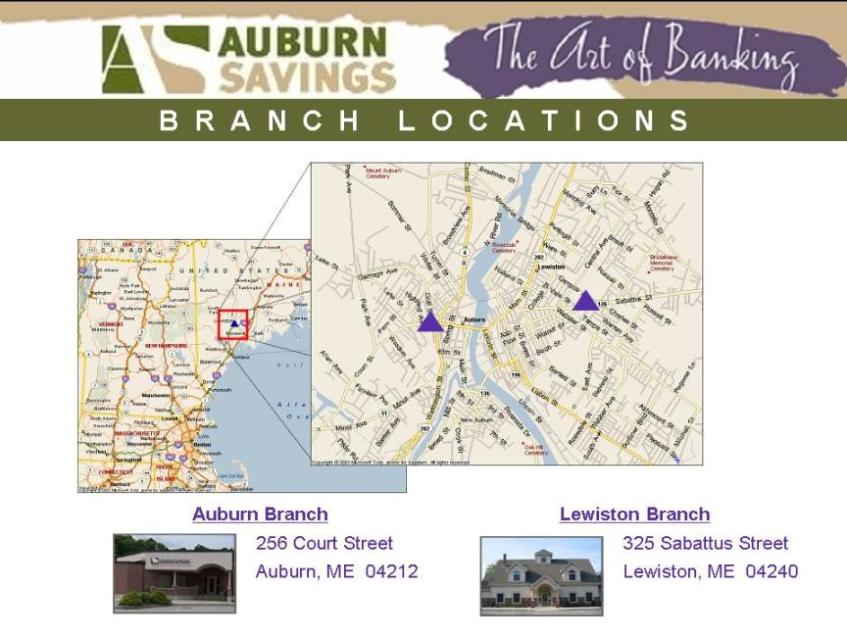

| BRANCH LOCATIONS

Auburn Branch

256 Court Street

Auburn, ME 04212

Lewiston Branch

325 Sabattus Street

Lewiston, ME 04240 |

| MANAGEMENT TEAM

Allen T. Sterling, President & Chief Executive Officer

Bruce M. Ray, Senior Vice President & Senior Loan Officer

Rachel A. Haines, Senior Vice President & Treasurer

Martha L. Adams, Senior Vice President & Operations Officer

Jason M. Longley, Vice President & Commercial Loan Officer |

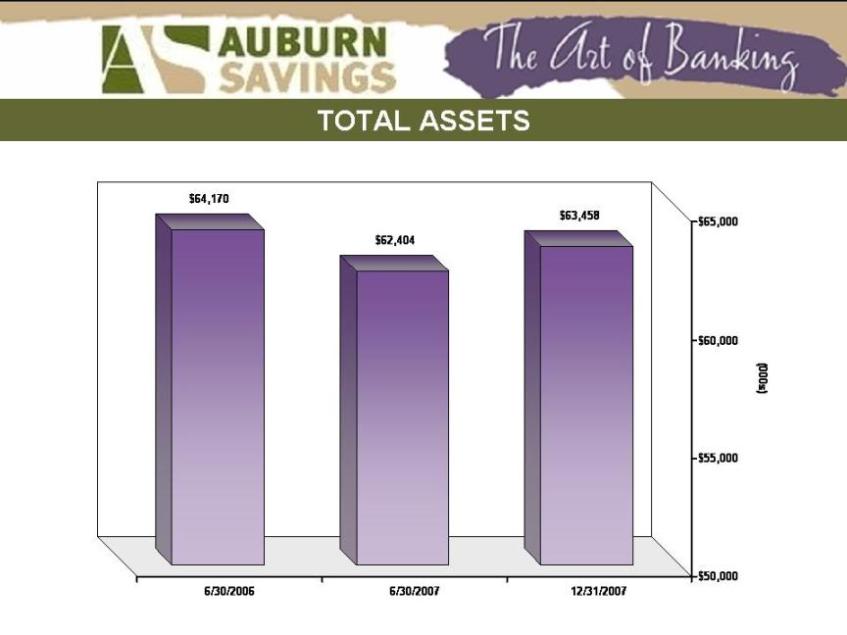

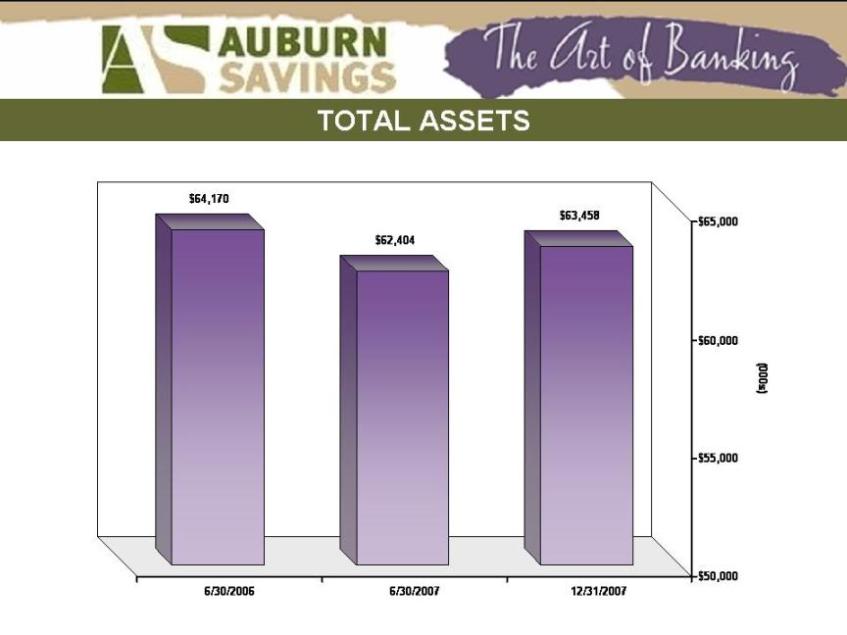

| TOTAL ASSETS

$64,170

6/30/2006

$62,404

6/30/2007

$63,458

12/31/2007 |

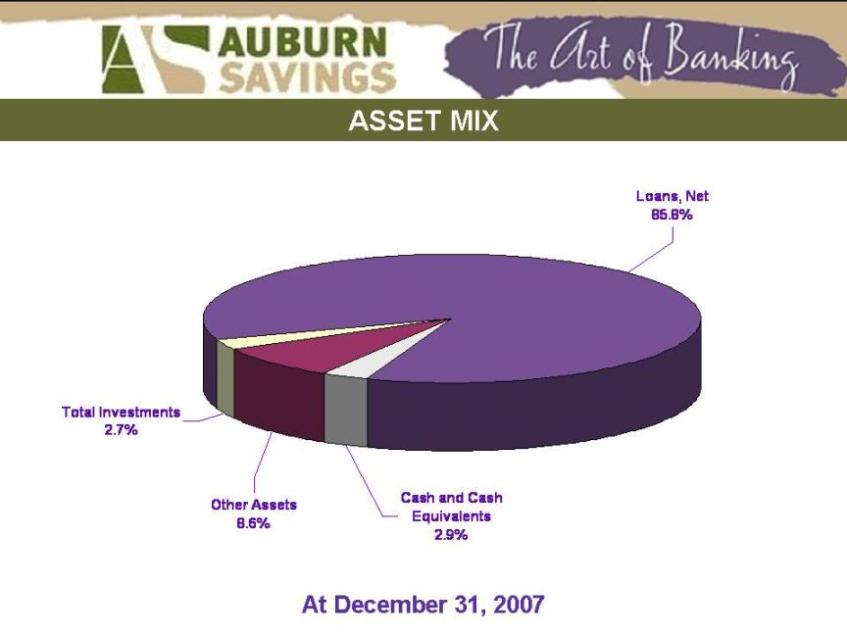

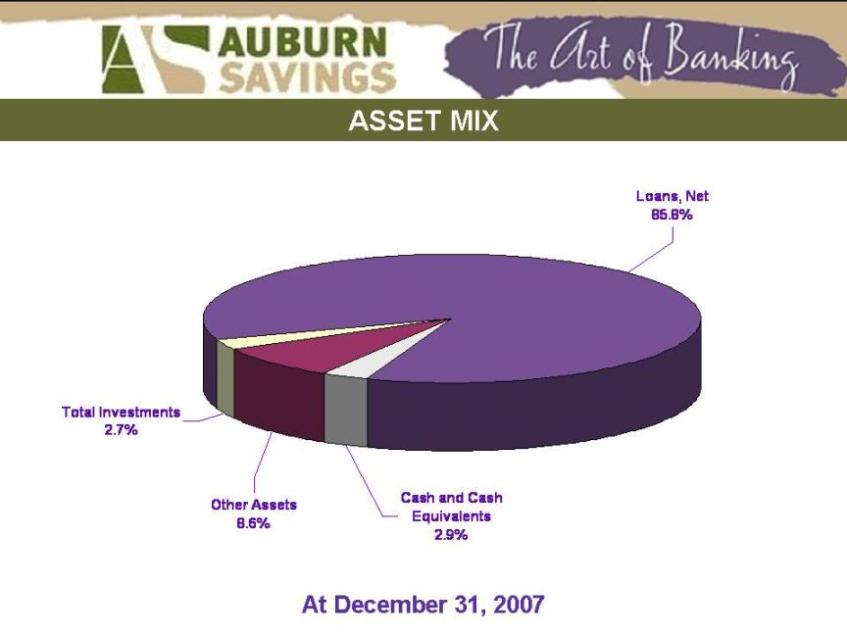

| ASSET MIX

Total Investments 2.7%

Other Assets 8.6%

Cash and Cash Equivalents 2.9%

Loans, Net 85.8% |

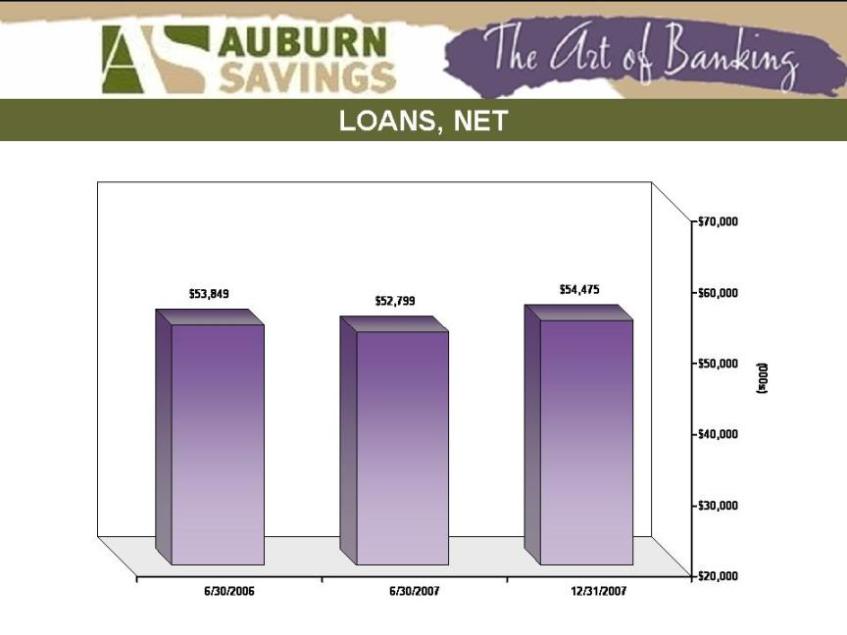

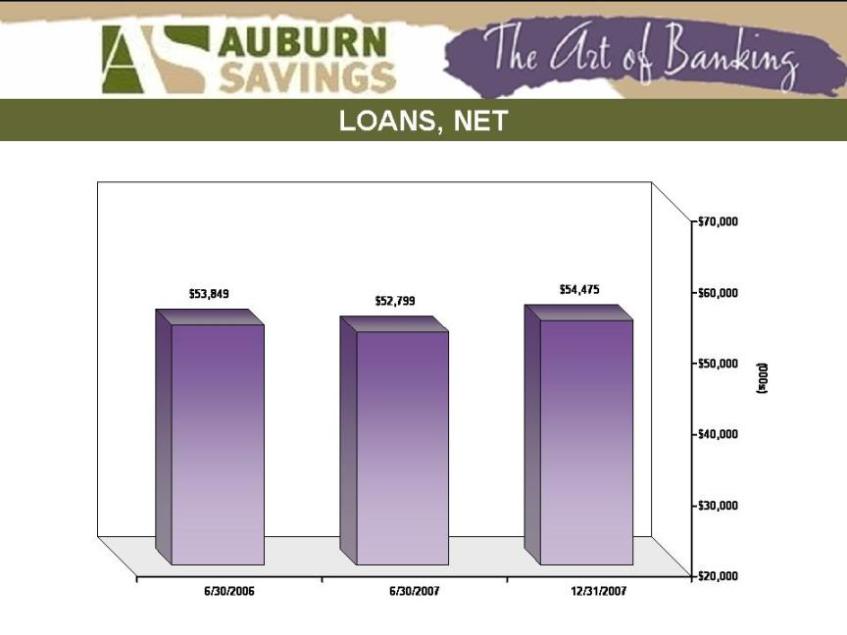

| LOANS, NET

$53,849

6/30/2006 $52,799

6/30/2007 $54,475

12/31/2007 |

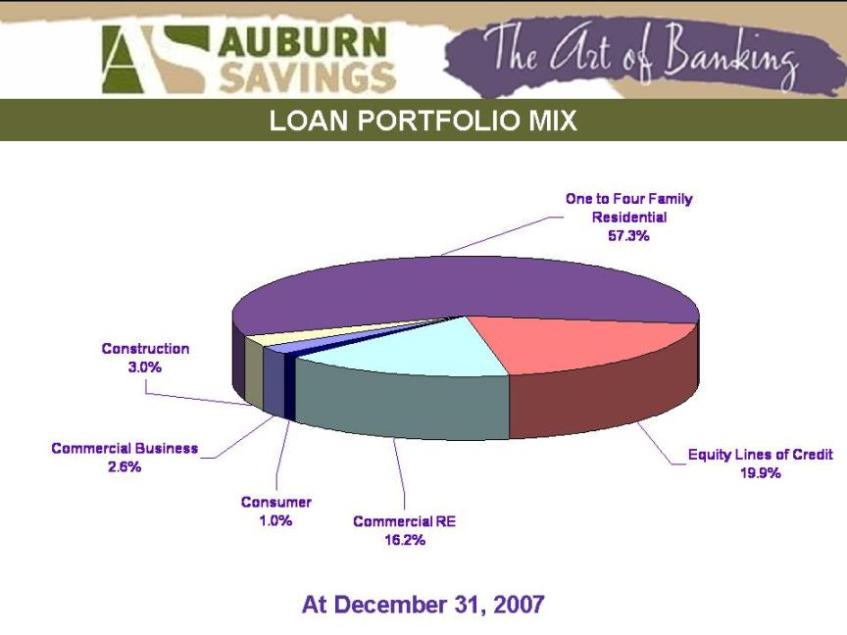

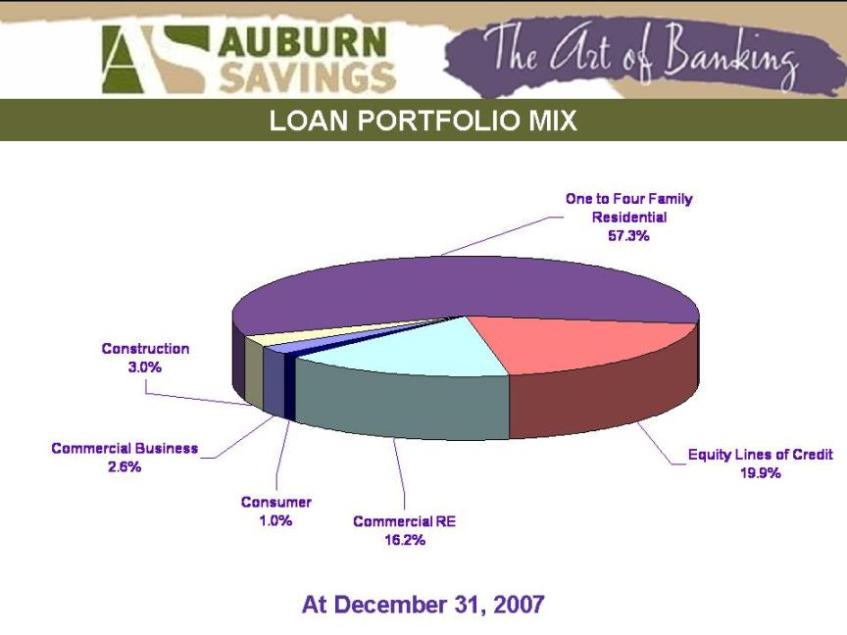

| LOAN PORTFOLIO MIX

Construction 3.0%

Commercial Business 2.6%

Consumer 1.0%

Commercial RE 16.2%

Equity Lines of Credit 19.9%

One to Four Family Residential 57.3% |

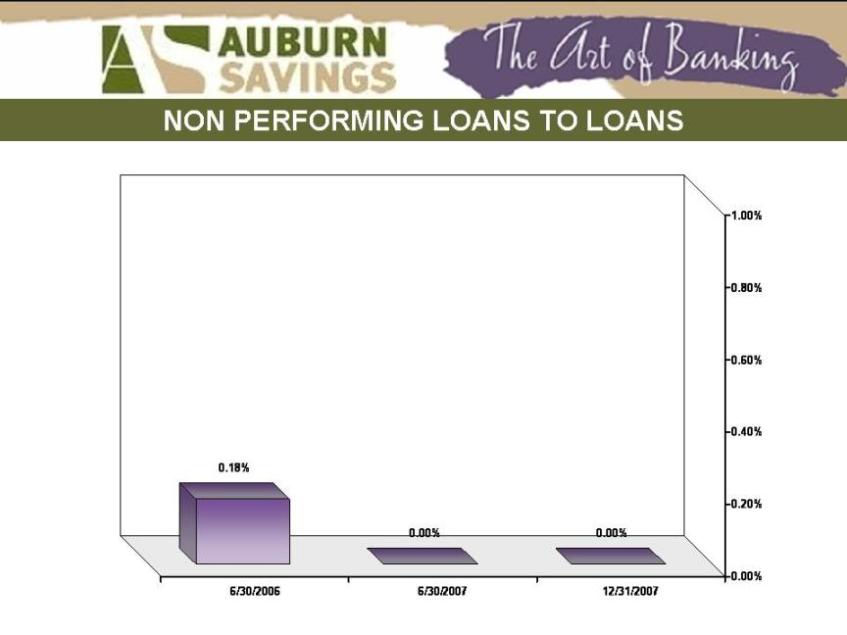

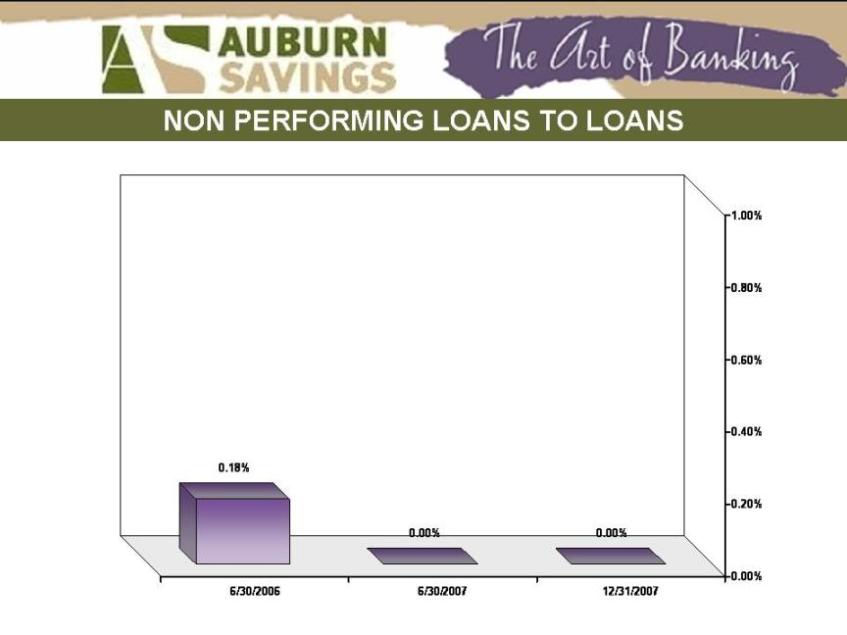

| NON PERFORMING LOANS TO LOANS

0.18% 6/30/2006

0.00% 6/30/2007

0.00% 12/31/2007 |

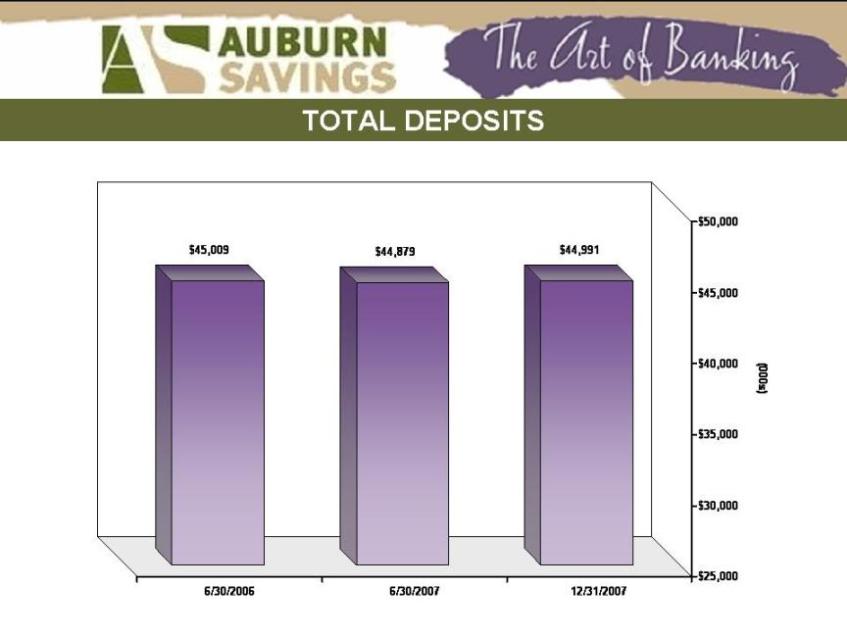

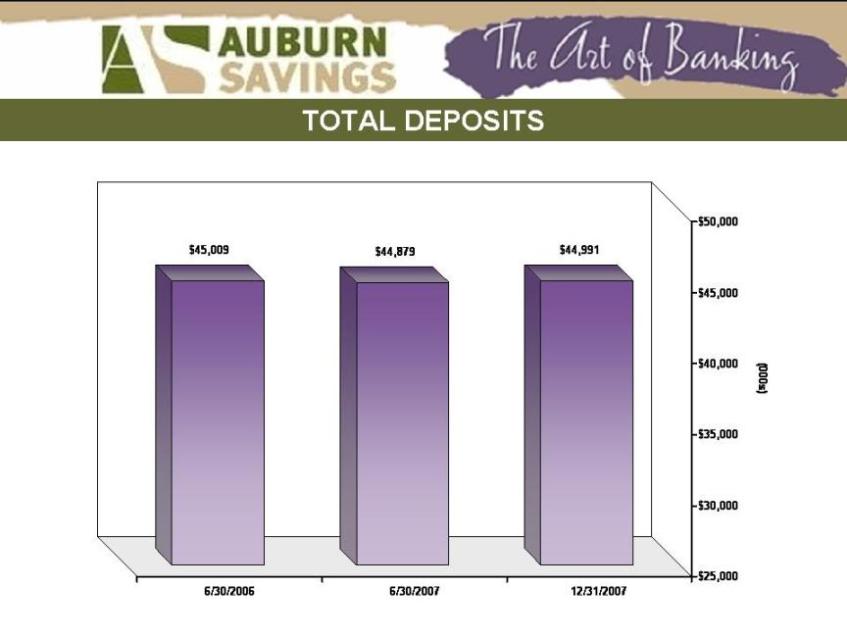

| TOTAL DEPOSITS $45,009 6/30/2006

$44,879 6/30/2007

$44,991 12/31/2007 |

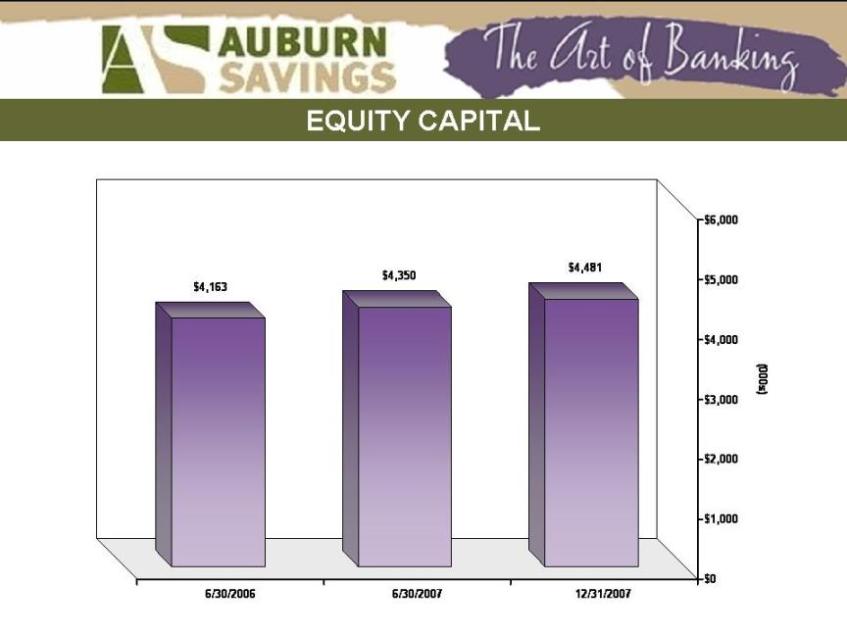

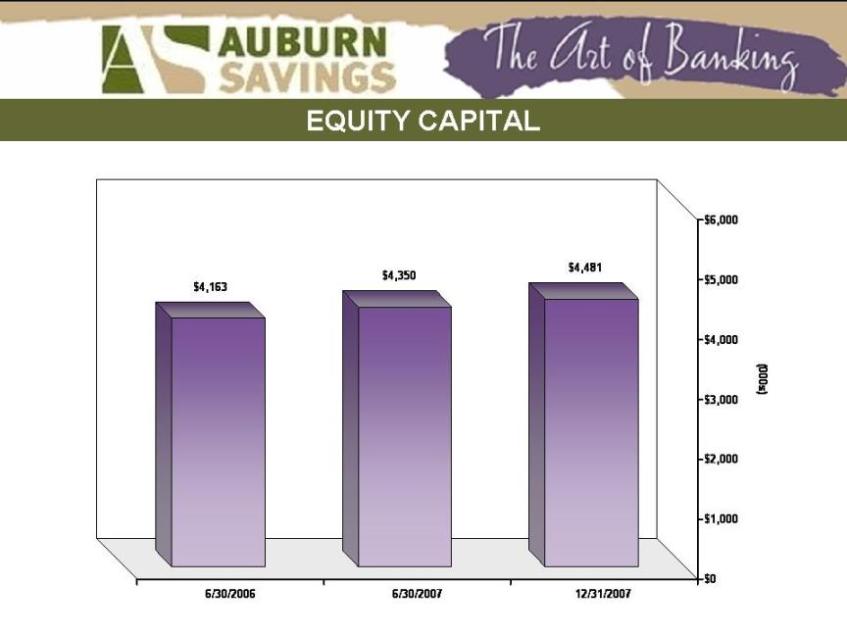

| EQUITY CAPITAL

$4,163 6/30/2006

$4,350 6/30/2007

$4,481 12/31/2007 |

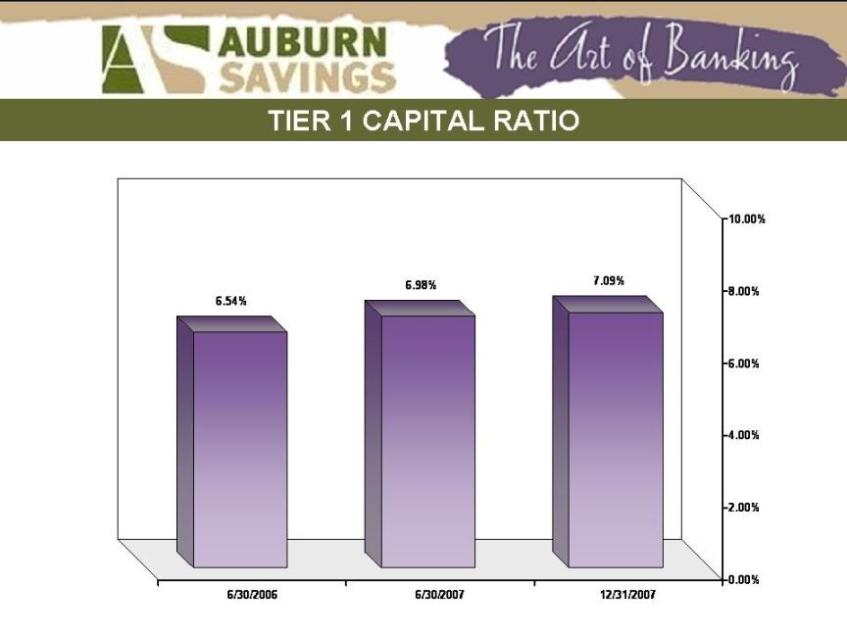

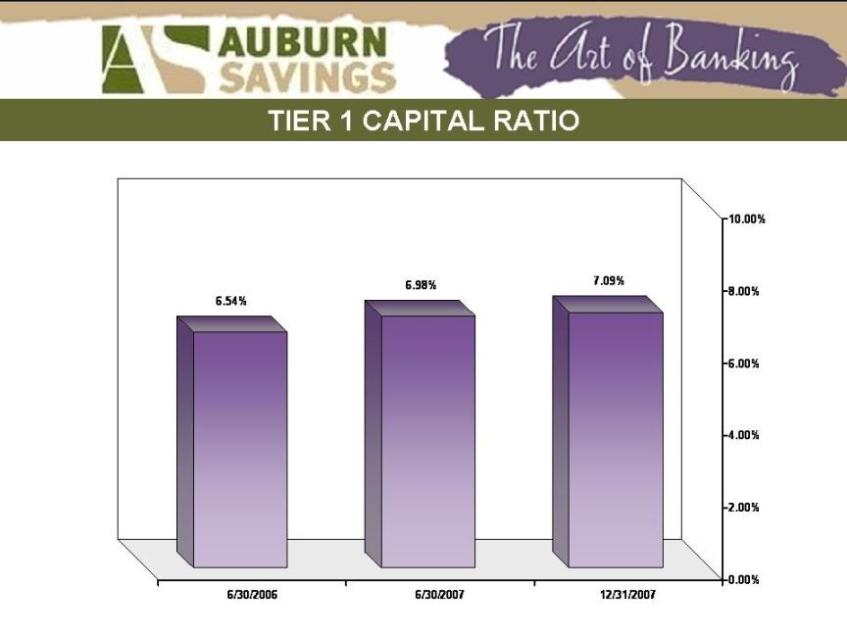

| TIER 1 CAPITAL RATIO

6.54% 6/30/2006

6.98% 6/30/2007

7.09% 12/31/2007 |

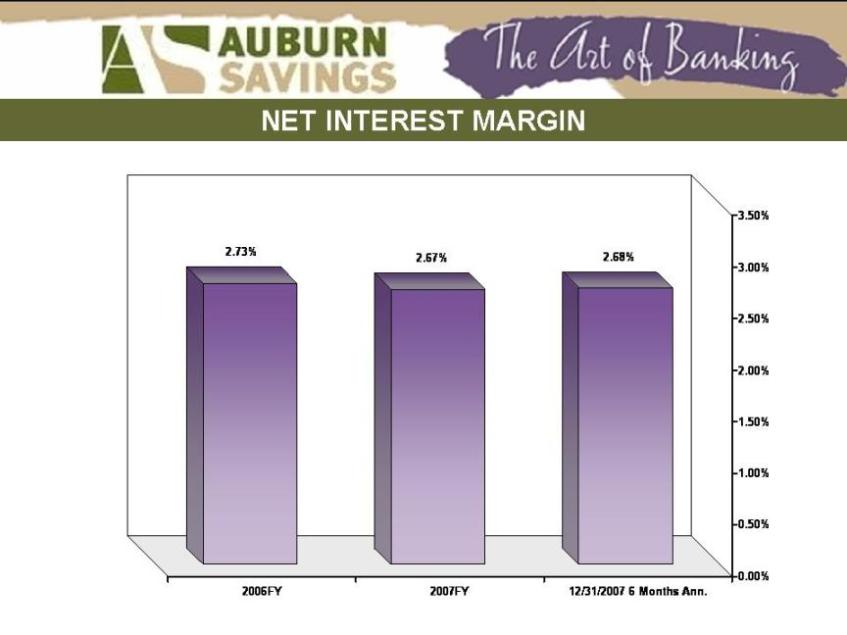

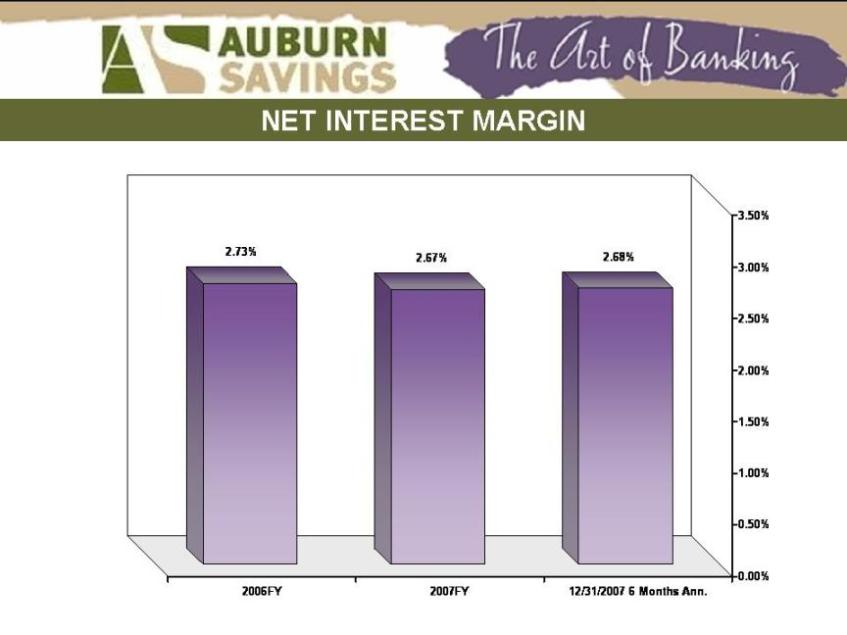

| NET INTEREST MARGIN

2.73% 2006FY

2.67% 2007FY

2.68% 12/31/2007 6 Months Ann. |

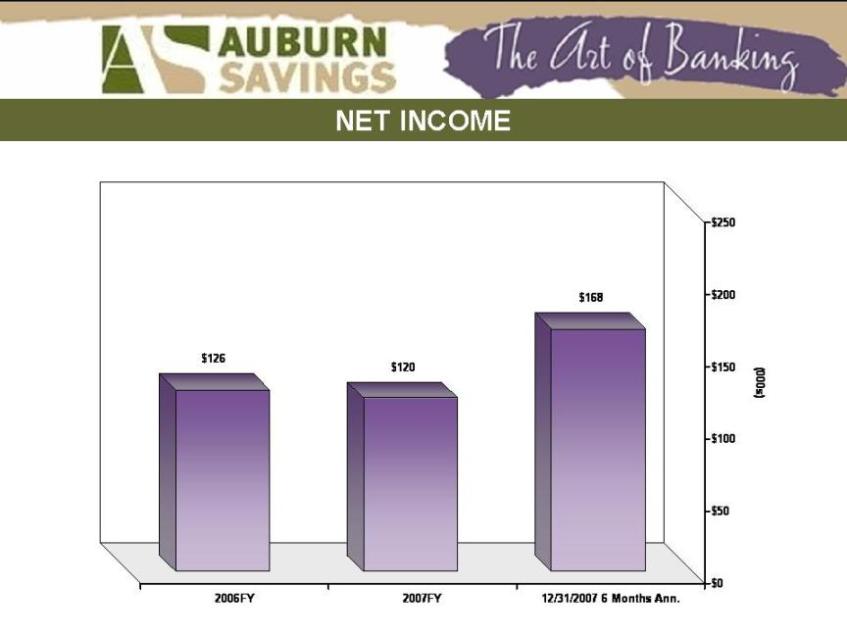

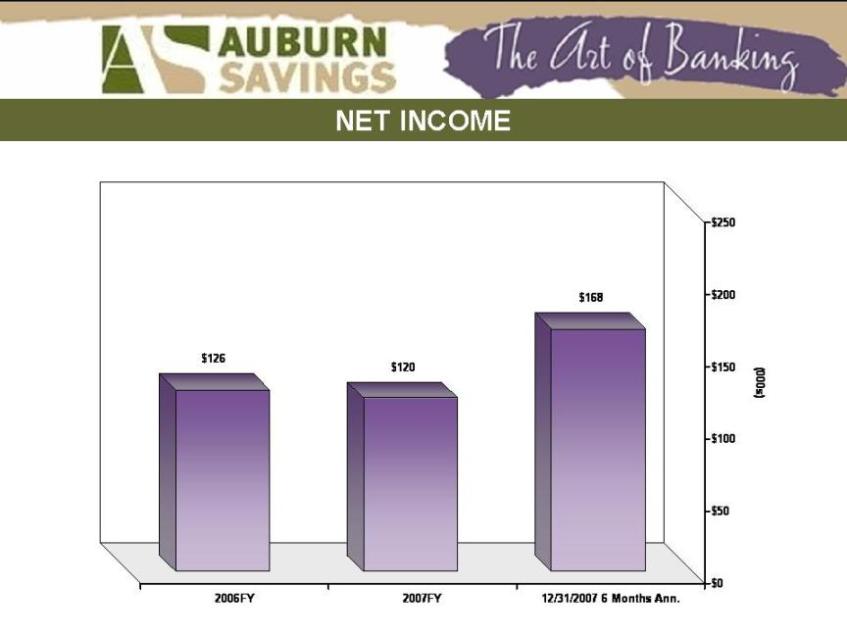

| NET INCOME

$126 2006FY

$120 2007FY

$168 12/31/2007 6 Months Ann. |

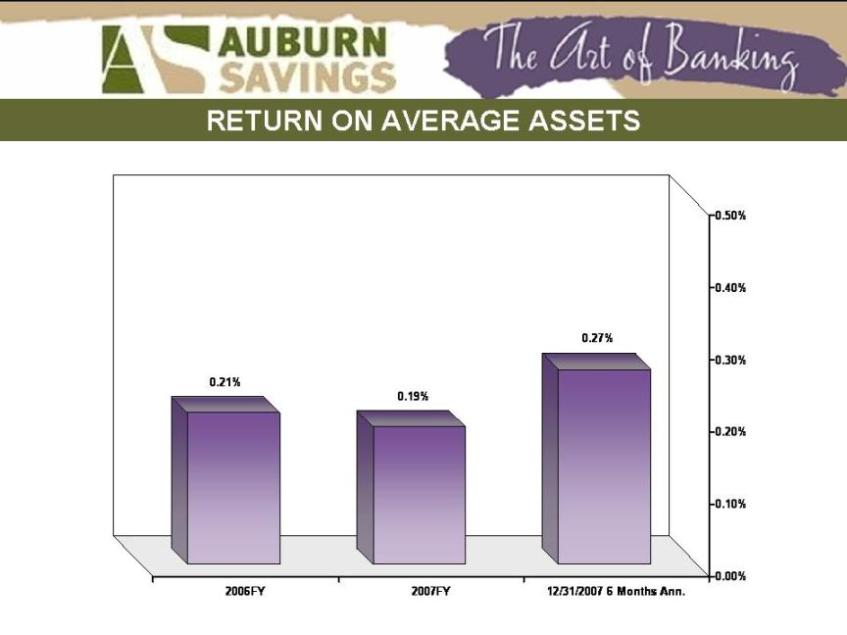

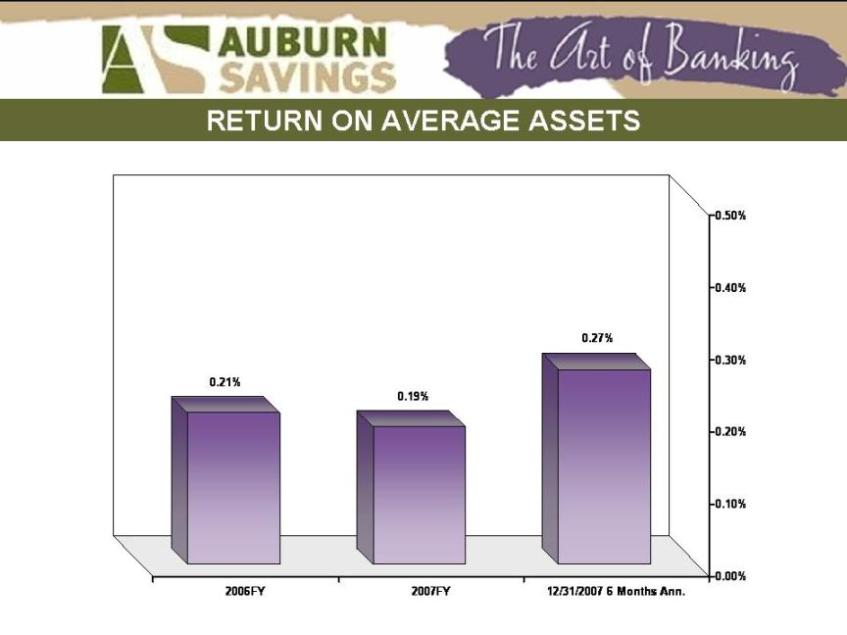

| RETURN ON AVERAGE ASSETS

0.21% 2006FY

0.19% 2007FY

0.27% 12/31/2007 6 Months Ann. |

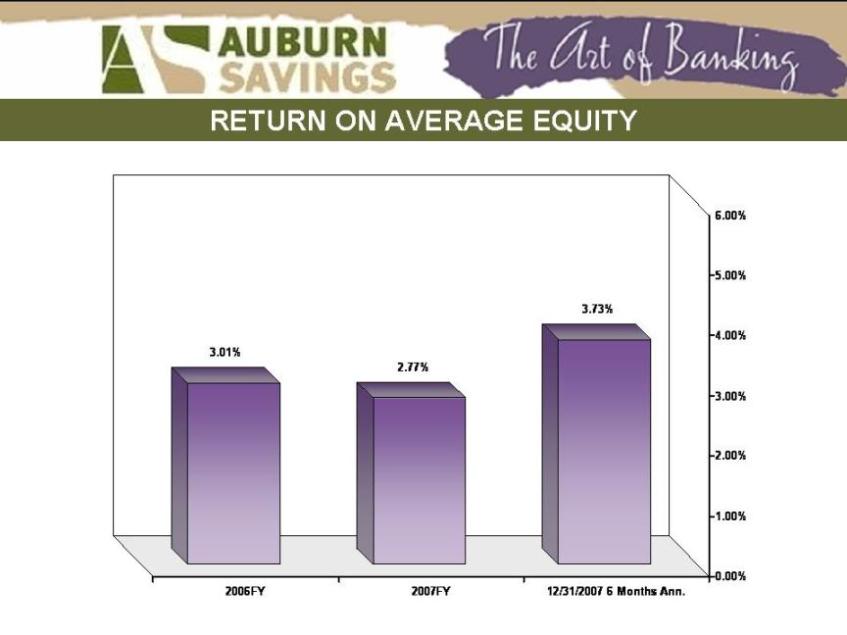

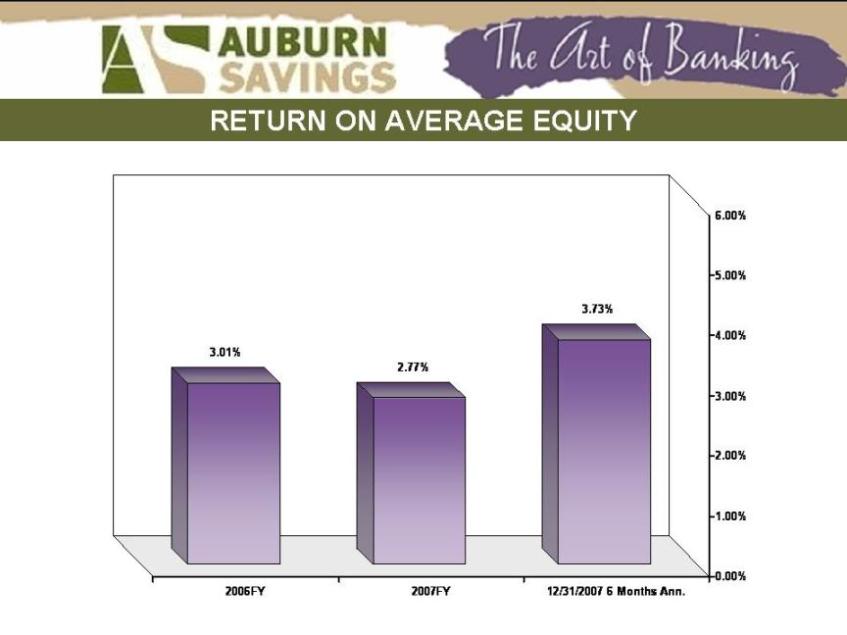

| RETURN ON AVERAGE EQUITY

3.01% 2006FY

2.77% 2007FY

3.73% 12/31/2007 6 Months Ann. |

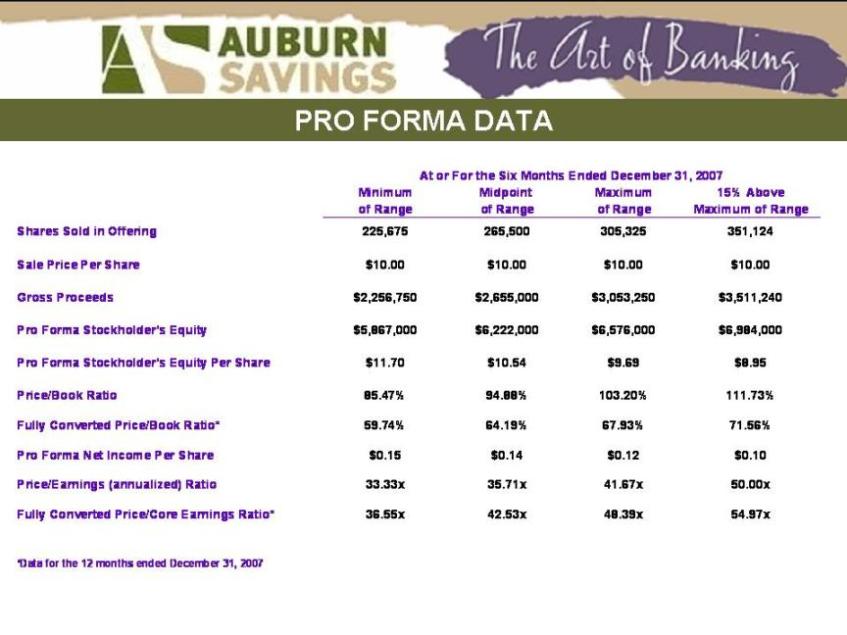

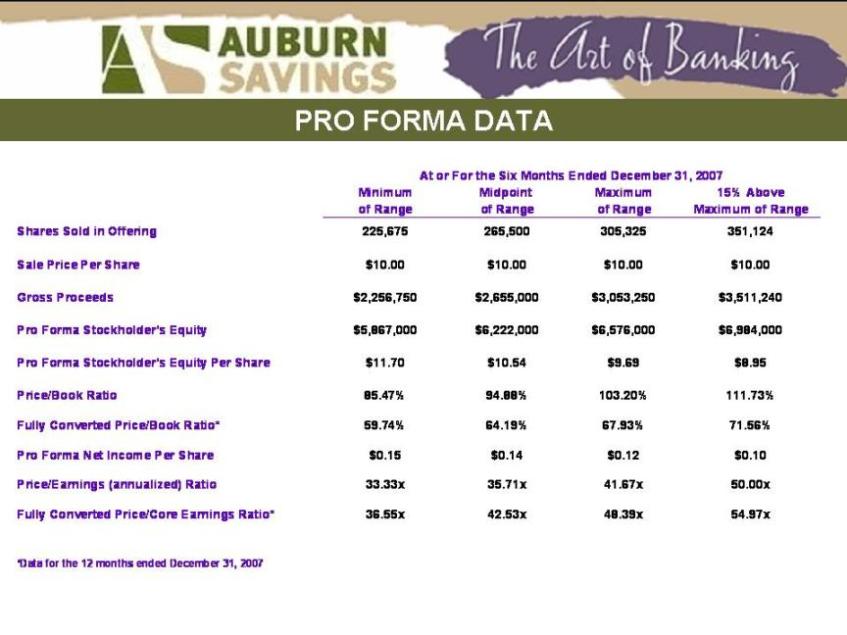

| PRO FORMA DATA

|

| PREFERENCE CATEGORIES

1. Eligible Account Holders

Depositors with $50 or more on deposit as of September 30, 2006.

2. Employee Stock Ownership Plan (ESOP)

3 Supplemental Eligible Account Holders

Depositors with $50 or more on deposit as of March 31, 2008.

4 Other Members

Depositors of Auburn Savings Bank as of [Voting Record Date], 2008, or borrowers as of July 1, 2006 whose loans continue to be outstanding on [Voting Record Date].

5 Local Community

Residents of Androscoggin County, ME.

6. General Community |

| We thank you for your interest in Auburn Bancorp, Inc. |