SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K /A

(Amendment No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 28, 2009

Waste2Energy Holdings, Inc.

(Formerly known as Maven Media Holdings, Inc.)

(Exact name of registrant as specified in its charter)

| Delaware | 333-151108 | 26-2255797 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| | | |

1185 Avenue of the Americas, 20 th Floor

New York, NY 10036

(Address of principal executive offices) (zip code)

(646) 723-4000

(Registrant's telephone number, including area code)

Marc Ross, Esq.

Thomas A. Rose, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway

New York, New York 10006

Phone: (212) 930-9700

Fax: (212) 930-9725

1649 Dartmouth Street

Chula Vista, CA 91913

(Former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On May 6, 2009, Maven Media Holdings, Inc., a Delaware corporation (“Maven” or the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Waste2Energy Acquisition Co., a Delaware corporation and wholly-owned subsidiary of the Company (the “Subsidiary”) and Waste2Energy, Inc., a Delaware corporation (“Waste2Energy”). On May 28, 2009, Maven, Subsidiary and Waste2Energy entered into Amendment No. 1, dated as of May 28, 2009, to the Merger Agreement (“Amendment No.1”). Pursuant to Amendment No. 1, the definition of Acquisition Shares was revised to mean 45,981,770 shares of Waste2Energy and Section 5.19(e) of the Merger Agreement was revised to note that the issued and outstanding share capital of Waste2Energy consists of 45,981,770 issued and outstanding shares. (The Merger Agreement as amended by Amendment No. 1 is hereinafter referred to as the “Merger Agreement”).

Pursuant to the Merger Agreement, on May 28, 2009 (the “Closing Date”), the Subsidiary merged with and into Waste2Energy resulting in Waste2Energy becoming a wholly-owned subsidiary of the Company (the “Merger”). Pursuant to the Merger Agreement, the Company issued 45,981,770 shares of common stock (the “Common Stock”) of the Company (the “Acquisition Shares”) to the shareholders of Waste2Energy, representing approximately 96% of the issued and outstanding shares of Common Stock following the closing of the Merger and the Private Placement (as defined below), and warrants to purchase 18,760,000 shares of Common Stock (the “Acquisition Warrants”) to the warrant holders of Waste2Energy at exercise prices ranging from $.10 to $.75. Pursuant to the Merger Agreement, the outstanding shares of common stock and warrants to purchase shares of common stock of Waste2Energy were cancelled.

On the Closing Date, and in connection with and pursuant to the terms of the Confidential Private Offering Memorandum dated May 7, 2009, as amended by Amendment No. 1 dated May 26, 2009 (the “Private Placement Memorandum”) of the Company, the Company sold in a private placement (the “Private Placement”) 254,500 units (the “Units”) to investors (the “Investors”), each Unit consisting of (i) three (3) shares of Common Stock and (ii) a three-year warrant (the “Warrants”) to purchase three (3) additional shares of Common Stock at an exercise price of $1.25 per share, at a purchase price of $2.00 per Unit and, as a result, the Company received gross proceeds of approximately $509,000 and is issuing the Investors an aggregate of 763,500 shares of Common Stock and Warrants to purchase 763,500 shares of Common Stock (the “Warrant Shares”). The Warrants may not be exercised to the extent such exercise would cause the holder of the Warrant, together with its affiliates, to beneficially own a number of shares of Common Stock which would exceed 4.99% of the Company’s then outstanding shares of Common Stock following such exercise.

The Company agreed to file a registration statement registering the Common Stock and the Warrant Shares, subject to Securities and Exchange Commission (“SEC”) limitations, within the later of (i) 50 days after the Closing Date, and (ii) 10 days after the offering under the Private Placement is completed or otherwise terminated.

A registered broker-dealer and a member of the Financial Industry Regulatory Authority (“FINRA”) was retained as the exclusive placement agent for the Private Placement and received a commission of $50,898 (ten (10%) percent of the gross proceeds) and a non-accountable expense allowance of $15,269.40 (three (3%) percent of the gross proceeds). The broker-dealer is to receive an investment banking fee of $400,000, payable from the gross proceeds of the Private Placement (the “IB Fee”). Such IB Fee shall be due and payable as follows: $25,000, upon the closing of at least $500,000 of Units ( the “Minimum Offering”), which was paid on the closing of the Private Placement; $75,000 upon the closing of aggregate gross proceeds of at least $2,000,000 of Units; $100,000 upon the closing of aggregate gross proceeds of at least $4,000,000 of Units; $100,000 upon the closing of aggregate gross proceeds of at least $6,000,000 of Units; and $100,000 upon the closing of aggregate gross proceeds of at least $8,000,000 of Units. As of the closing of the Minimum Offering, the broker-dealer has the right to have a representative attend all meetings of the Company’s Board of Directors as an observer for a period beginning on the Closing of the Minimum Offering and ending two (2) years from the final closing of Units Pursuant to the Private Placement Memorandum.

Upon each exercise of the Warrants, the broker-dealer will receive a ten (10%) percent commission and a three (3%) percent non-accountable expense allowance, and will also be issued a three-year warrant exercisable to purchase such number of shares of Common Stock, at $1.25 per share, equal to 4.5% of the number of shares issued pursuant to the exercise of the Warrants. In addition, the broker-dealer was issued 3,304,670 shares of Common Stock all of which shares are being held in escrow by the Company. Such shares shall be equal to the 4.5% of the fully diluted outstanding shares of Common Stock of the Company then outstanding assuming the sale of $8,000,000 of Units (the “Maximum Offering”). Such shares shall be delivered to the broker-dealer as follows: 164,614 shares upon the closing of the sale of the Minimum Offering, 164,615 shares upon the closing of the sale of an aggregate of $1,000,000 of Units, 329,230 shares upon the closing of the sale of an aggregate of $2,000,000 of Units, 658,459 shares upon the closing of the sale of each $2,000,000 of Units thereafter. If less than the $1,000,000 increment of Units is sold (i.e. $1.7mm of Units) or less than the subsequent $2,000,000 of increments of Units are sold (i.e. $3.7mm of Units), the broker –dealer shall be issued pro-rata shares based upon the number of Units sold in increments in the Offering. Upon the expiration or termination of the Offering, prior to the sale of $10,000,000 of Units, any shares not then released to the broker-dealer as described herein shall be cancelled and the Company shall have no further obligation to issue such shares to the broker-dealer.

In connection with the Private Placement, the Company relied upon the exemption from securities registration afforded by Rule 506 of Regulation D as promulgated by the SEC under the Securities Act of 1933, as amended (the “Securities Act”) and/or Section 4(2) of the Securities Act. No advertising or general solicitation was employed in offering the securities. The offerings and sales were made to a limited number of persons, all of whom were “accredited investors,” and transfer was restricted by the Company in accordance with the requirements of the Securities Act.

In connection with the Merger and the Private Placement and in addition to the foregoing:

(i) The Company entered into a Separation Agreement with Waste2Energy and Adrienne Humphreys, the Company’s sole officer and director and principal shareholder, pursuant to which, on the Closing Date, the Company paid Adrienne Humphreys $210,000 and Adrienne Humphreys returned for cancellation 2,000,000 shares of Common Stock.

(ii) Effective on the Closing Date, Adrienne Humphreys resigned as the sole officer and director of the Company and the following executive officers and directors of Waste2Energy were appointed as executive officers and directors of the Company:

| Name | Title |

| Christopher d’Arnuad-Taylor | Chief Executive Officer and Chairman of the Board of Directors |

| Peter Bohan | President and Chief Operating Officer |

| Friðfinnur (Finni) Einarsson | Chief Technology Officer |

| | |

(iii) The Company intends to change its name to Waste2Energy Holdings, Inc., or a similar derivation, as soon as practicable. Following the final closing of the Company’s offering pursuant to the Private Placement Memorandum (the “Final Closing”), the Company intends to relocate its corporate offices to Greenville, South Carolina. Simultaneously with the Final Closing, Peter Bohan will become Chief Executive Officer of the Company and of Waste2Energy and Christopher d’Arnaud-Taylor will resign as the Chairman and Chief Executive Officer of the Company and Waste2Energy. Mr. d’ Arnaud-Taylor will become a consultant to Waste2Energy Group Holdings, PLC (“Group Holdings”), the Company’s wholly-owned European Subsidiary. He will also serve as Chairman of the Board of Group Holdings. Mr. d’Arnaud-Taylor will continue to serve on the board of the Company and Waste2Energy but will not in the future hold any other executive position with either the Company or Waste2Energy.

Item 2.01 Completion of Acquisition or Disposition of Assets

Information in response to this Item 2.01 is keyed to the Item numbers of Form 10.

Item 1. Description of Business

Effective on the Closing Date, pursuant to the Merger Agreement, Waste2Energy became a wholly-owned subsidiary of the Company. The acquisition of Waste2Energy is treated as a reverse acquisition, and the business of Waste2Energy became the business of the Company. At the time of the reverse acquisition, Maven was not engaged in any active business.

References to “Waste2Energy”, “W2E”, “we”, “us”, “our” and similar words refer to the Company and its wholly-owned subsidiary, Waste2Energy, unless the context otherwise requires, and prior to the effectiveness of the reverse acquisition, these terms refer to Waste2Energy. References to “Maven” refer to the Company and its business prior to the reverse acquisition.

Summary

Waste2Energy is a Delaware corporation formed on April 10, 2007. Maven is a Delaware corporation organized in March 2008.

Waste2Energy designs, builds, installs and sells waste-to-energy plants that generate “Renewable Green Power” converting biomass or other solid waste streams traditionally destined for landfill into clean renewable energy. In November 2007, we acquired EnerWaste International Corporation and in May 2008 we acquired Enerwaste Europe in Iceland. Pursuant to these acquisitions, we acquired what we believe to be two state-of-the-art technologies based on gasification and subsequent clean oxidation of waste.

Our executive offices are located at 1185 Avenue of the Americas, 20th Floor, New York, NY 10036 and our telephone number at such address is 646-723-4000.

RISK FACTORS

An investment in the Common Stock involves a high degree of risk. In determining whether to purchase the Common Stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this report before making a decision to purchase the Company’s securities. An investor should only purchase the Company’s securities if he or she can afford to suffer the loss of his or her entire investment.

Risks Related to our Business

We are not currently profitable and may never become profitable.

We have a history of losses (approximately $17,440,535 from continuing operations for the year ended March 31, 2009), have an aggregate accumulated deficit (approximately $18,732,349, through March 31, 2009), expect to incur additional substantial operating losses for the foreseeable future and we may never achieve or maintain profitability. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our Common Stock and investors would in all likelihood lose their entire investment.

Our independent registered auditors have expressed substantial doubt about our ability to continue as a going concern.

Our audited financial statements for the fiscal year ended March 31, 2009 included an explanatory paragraph that such financial statements were prepared assuming that we would continue as a going concern. As discussed in Note 2 to the consolidated financial statements included with this Report, we have incurred a significant operating loss of $17,440,535 and used cash of $941,832 for continuing operations which resulted in an accumulated deficit of $18,732,349 and a working capital deficiency of $6,305,611 as of March 31, 2009. These conditions raise substantial doubt about our ability to continue as a going concern. Management's plans regarding these matters also are described in Note 2 to the financial statements. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

To date we have had significant operating losses, an accumulated deficit and have had limited revenues and do not expect to be profitable for at least the foreseeable future, and cannot predict when we might become profitable, if ever.

As discussed elsewhere herein, we have been operating at a substantial operating loss each year since our inception, have a substantial accumulated deficit and we expect to continue to incur substantial losses for the foreseeable future. Although to date we have minimal revenues for the nine months ended December 31, 2008, our revenues were approximately $2,678,556. Further, we may not be able to generate significant revenues in the future. In addition, we expect to incur substantial operating expenses in order to fund the expansion of our business. As a result, we expect to continue to experience substantial negative cash flow for the foreseeable future and cannot predict when, or if, we might become profitable. We will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate sufficient revenue to fund our operations or achieve profitability in the future. Even if we do achieve profitability, we may not be able to sustain profitability. If we are not able to generate revenues sufficient to fund our operations through product sales or if we are not able to raise sufficient funds through investments by third parties, it would result in our inability to continue as a going concern and, as a result, our investors would lose their entire investment.

We have a limited operating history upon which an evaluation of our prospects can be made. We may never achieve profitability.

We were organized on April 10, 2007 and have had only limited operations since our inception upon which to evaluate our business prospects. As a result, investors do not have access to the same type of information in assessing their proposed investment as would be available to purchasers in a company with a history of prior substantial operations. We face all the risks inherent in a new business, including the expenses, lack of adequate capital and other resources, difficulties, complications and delays frequently encountered in connection with conducting operations, including capital requirements and management’s potential underestimation of initial and ongoing costs. We also face the risk that we may not be able to effectively implement our business plan. If we are not effective in addressing these risks, we will not operate profitably and we may not have adequate working capital to meet our obligations as they become due.

We will need significant additional capital, which we may be unable to obtain.

As of May 28, 2009, we had cash available of approximately $194,369, which we anticipate is likely to be sufficient to allow the Company to fund its proposed operations for an estimated approximately one month. However, should, among other items, our business plan not be realized for whatever reason, we will need additional capital in the future. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. If we are unable to raise substantial capital, investors will lose their entire investment.

If our strategy is unsuccessful, we will not be profitable and our stockholders could lose their investment.

We do not believe there are track records for companies pursuing our strategy, and there is no guarantee that our strategy will be successful or profitable. If our strategy is unsuccessful, we will fail to meet our objectives and not realize the revenues or profits from the business we pursue, which would cause the value of the Company to decrease, thereby potentially causing in all likelihood, our stockholders to lose their investment.

We may not be able to effectively control and manage our proposed growth business plan, which would negatively impact our operations.

If our business and markets grow and develop, of which there are no assurances, it will be necessary for us to finance and manage expansion in an orderly fashion. We may face challenges in managing expanding service offerings and in integrating any acquired businesses with our own. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy increased demands could interrupt or adversely affect our operations and cause administrative inefficiencies.

We may be unable to successfully execute any of our identified business opportunities or other business opportunities that we determine to pursue.

We currently have a limited corporate infrastructure. In order to pursue business opportunities, we will need to continue to build our infrastructure and operational capabilities. Our ability to do any of these successfully could be affected by any one or more of the following factors:

| · | our ability to raise substantial additional capital to fund the implementation of our business plan; |

| · | our ability to execute our business strategy; |

| · | the ability of our products to achieve market acceptance; |

| · | our ability to manage the expansion of our operations and any acquisitions we may make, which could result in increased costs, high employee turnover or damage to customer relationships; |

| · | our ability to attract and retain qualified personnel; |

| · | our ability to manage our third party relationships effectively; |

| · | our ability to accurately predict and respond to the rapid technological changes in our industry and the evolving demands of the markets we serve; |

| · | challenges and issues related to the proprietary technology of the Company; |

| · | delays in obtaining, or conditions imposed by, regulatory approvals; |

| · | breakdown or failure of equipment or processes; and |

| · | major incidents and/or catastrophic events such as fires, explosions, earthquakes or storms. |

Our failure to adequately address any one or more of the above factors could have a significant impact on our ability to implement our business plan and our ability to pursue other opportunities that arise, which could result in investors losing their entire investments.

Our business depends on the development of strong brands, and if we do not develop and enhance our brands, our ability to attract and retain customers may be impaired and our business and operating results may be harmed.

We believe that our “Batch Oxidation System™,” or “BOS™,” Standard BOS TM or sBOS TM “Continuous Batch Oxidation System TM ” or “cBOS TM ” and “Continuous Oxidation Reactor™,” or “COR™,” brands will be a critical part of our business. Developing and enhancing these brands may require us to make substantial investments with no assurance that these investments will be successful. If we fail to promote and develop our brands, or if we incur significant expenses (or significantly greater expenses than allocable) in this effort, our business, prospects, operating results and financial condition will be harmed. We anticipate that developing, maintaining and enhancing our brands will become increasingly important, difficult and expensive .

Our operations may be negatively affected by currency exchange rate fluctuations.

Our assets, earnings and cash flows are influenced by a wide variety of currencies due to the geographic diversity of the countries in which we currently operate or plan on operating in. Fluctuations in the exchange rates of those currencies, if we are able to commence operation in different countries, may have a significant impact on our financial results. Given the dominant role of the US currency in our affairs, the US dollar is the currency in which we present financial performance. It is also the natural currency for borrowing and holding surplus cash. We do not generally believe that active currency hedging provides long-term benefits to our shareholders. We may consider currency protection measures appropriate in specific commercial circumstances, subject to strict limits established by our Board. Therefore, in any particular year, currency fluctuations may have a significant and material adverse impact on our financial results.

Economic, political and other risks associated with international sales and operations could adversely affect our proposed business.

Because we currently intend to sell our products worldwide, our proposed business is subject to risks associated with doing business internationally. In addition, our employees, contract manufacturers, suppliers and job functions may be located outside the U.S. Accordingly, our future results could be harmed by a variety of factors, including, but not limited to:

| · | interruption to transportation flows for delivery of parts to us and finished goods to our customers; |

| · | changes in foreign currency exchange rates; |

| · | changes in a specific country's or region's political, economic or other conditions; |

| · | trade protection measures and import or export licensing requirements; |

| · | negative consequences from changes in tax laws; |

| · | difficulty in staffing and managing widespread operations; |

| · | differing labor regulations; |

| · | differing protection of intellectual property; |

| · | unexpected changes in regulatory requirements; and |

| · | geopolitical turmoil, including terrorism and war. |

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products and brands.

Our intellectual property rights are important assets for us. We have patents pending on the control mechanisms and proprietary processes of our Batch Oxidation System™, or BOS™, continuous-batch process thermal gasification technology in Iceland and under the Patent Cooperation Treaty (which includes nearly all of the major industrialized countries). In addition, as a result of being “first-to-market” we have gained a significant amount of know-how and expertise related to the design and operation of these plants. Various events outside of our control pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in every country in which our products are distributed. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights is costly and time consuming. Any increase in the unauthorized use of our intellectual property could make it more expensive to do business and harm our operating results.

We may be unable to protect our intellectual property from infringement by third parties.

Our business plan is significantly dependent upon exploiting our intellectual property. There can be no assurance that we will be able to control all of the rights for all of our intellectual property. We may not have the resources necessary to assert infringement claims against third parties who may infringe upon our intellectual property rights. Litigation can be costly and time consuming and divert the attention and resources of management and key personnel.

In providing our products we could infringe on the intellectual property rights of others, which may cause us to engage in costly litigation and, if we do not prevail, could also cause us to pay substantial damages and prohibit us from selling our services.

Third parties may assert infringement or other intellectual property claims against us. We may have to pay substantial damages, if it is ultimately determined that our services infringe a third party’s proprietary rights. Even if claims are without merit, defending a lawsuit takes significant time, may be expensive and may divert management’s attention from our other business concerns.

We are subject to a number of foreign and domestic laws, rules, regulations and guidelines, including laws, rules, and regulations relating to health and safety, the conduct of operations, the protection of the environment and the manufacture, management, transportation, storage and disposal of certain materials used in the Company’s operations. Management believes that the Company is in compliance with such laws, regulations and guidelines; however, changes to such laws, regulations and guidelines due to environmental changes, unforeseen environmental effects, general economic conditions and other matters beyond our control may cause adverse effects to our operations. We have invested financial and managerial resources to ensure compliance with applicable laws, regulations and guidelines and will continue to do so in the future. Although such expenditures have not, historically, been material to the Company, such laws regulations and guidelines are subject to change. Accordingly, it is impossible for the Company to predict the cost or impact of such laws, regulations or guidelines on its future operations. It is not expected that any changes to these laws, regulations or guidelines would affect our operations in a manner materially different than they would affect other gasification companies of a similar size.

We may become liable for damages for violations of environmental laws and regulations.

We are subject to various environmental laws and regulations enacted in the jurisdictions in which we operate which govern the manufacture, importation, handling and disposal of certain materials used in our operations. We are in the process of establishing procedures to address compliance with current environmental laws and regulations and we monitor our practices concerning the handling of environmentally hazardous materials. However, there can be no assurance that our procedures will prevent environmental damage occurring from spills of materials handled by the Company or that such damage has not already occurred. On occasion, substantial liabilities to third parties may be incurred. We may have the benefit of insurance maintained by the Company or the operator; however, the Company may become liable for damages against which it cannot adequately insure or against which it may elect not to insure because of high costs or other reasons.

Our customers are subject to similar environmental laws and regulations, as well as limits on emissions to the air and discharges into surface and sub-surface waters. While regulatory developments that may follow in subsequent years could have the effect of reducing industry activity, we cannot predict the nature of the restrictions that may be imposed. We may be required to increase operating expenses or capital expenditures in order to comply with any new restrictions or regulations.

We may become subject to liabilities relating to risks inherent in the gasification industry, for which we may not be adequately insured.

Our operations are subject to risks inherent in the gasification industry, such as equipment defects, malfunction, failures and natural disasters. These risks and hazards could expose the Company to substantial liability for personal injury, loss of life, business interruption, property damage or destruction, pollution and other environmental damages.

While we believe our insurance coverage addresses all material risks to which we are exposed and is adequate and customary in our current state of operations, such insurance is subject to coverage limits and exclusions and may not be available for the risks and hazards to which the Company is exposed. In addition, no assurance can be given that such insurance will be adequate to cover our liabilities or will be generally available in the future or, if available, that premiums will be commercially justifiable. If we were to incur substantial liability and such damages were not incurred by insurance or were in excess of policy limits, or if we were to incur such liability at a time when we are not able to obtain liability insurance, our business, results of operations and financial condition could be materially adversely affected.

We face intense competition and may not be able to successfully compete.

The Company currently has few competitors in the capacity range we target. However, there can be no assurance that such competitors will not substantially increase the resources devoted to the development and marketing of products and services that compete with those of the Company or that new or existing competitors will not enter the market in which the Company is active.

Our ability to compete and grow is dependent on access to adequate supplies of labor, equipment, parts and components.

Our ability to compete and grow will be dependent on our having access, at a reasonable cost and in a timely manner, to skilled labor, equipment, parts and components. Failure of suppliers to deliver such skilled labor, equipment, parts and components at a reasonable cost and in a timely manner would be detrimental to our ability to compete and grow. No assurances can be given we will be successful in maintaining our required supply of skilled labor, equipment and components. It is possible that the final costs of the major equipment contemplated by our capital expenditure program may be greater than the funds available to the Company, in which circumstances we may curtail, or extend the timeframes for completing, our capital expenditure plans. This could have a material adverse effect on our financial results.

The prices we will receive for our end products are uncertain.

The prices we receive for our end products will be dependent on demand for them, the computed internal rate of return of the project and supporting legislation. There is no proven market for gasification products, and there can be no assurance that the pricing of these products will be at levels anticipated by the Company. All such estimates for the pricing of our end products are currently uncertain.

We rely on key personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our success depends in large part upon the abilities and continued service of our executive officers and other key employees, particularly Mr. Peter Bohan, President and Chief Operating Officer and Mr. Friðfinnur (Finni) Einarsson, Chief Technology Officer. There can be no assurance that we will be able to retain the services of such officers and employees. Our failure to retain the services of our key personnel could have a material adverse effect on the Company. In order to support our projected growth, we will be required to effectively recruit, hire, train and retain additional qualified management personnel. Our inability to attract and retain the necessary personnel could have a material adverse effect on the Company. We have no “key man” insurance on any of our key employees.

We are dependent on one (1) customer, the loss of which would substantially impact our operations.

Our current business operations are dependent on generating substantial revenues from one (1) customers ASCOT Environmental Ltd. This subjects us to significant financial and other risks in the operation of our business if a major customer were to terminate or materially reduce, for any reason, its business relationship with us.

Our Chief Executive Officer was a defendant in prior litigation arising alleging violation of the Federal Securities laws, which may prevent or make more difficult listing on a national exchange and/or NASDAQ.

Christopher d’Arnaud-Taylor, our Chief Executive Officer and Chairman, formerly served as a member of the Board of Directors and Chairman of Global Energy Holdings Corp (formerly Xethanol, Inc.), a publicly traded company. In October 2006, Mr. d’Arnaud-Taylor was named with others as a defendant in a class action lawsuit alleging various violations of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder. The matter was subsequently settled and Mr. d’Arnaud-Taylor and the other defendants expressly denied liability. Although settled without any admission of guilt, an application made by the Company to list its securities on a national stock exchange may be viewed unfavorably as a result of the prior legal action. There can be no assurance that Mr. d’Arnaud-Taylor’s actions and/or involvement in the prior litigation will not negatively impact and/or prevent the Company’s ability to be listed on an exchange and/or NASDAQ, even if the Company were to meet such listing qualifications, which it will not for the foreseeable future.

Risks Related to the Common Stock

There is no trading market for the Common Stock.

The Common Stock is eligible for quotation on the Over-the-Counter Bulletin Board. However, to date there has been limited trading market for the Common Stock, and we cannot give an assurance that a trading market will develop. The lack of an active, or any, trading market will impair a stockholder’s ability to sell his shares at the time he wishes to sell them or at a price that he considers reasonable. An inactive market will also impair our ability to raise capital by selling shares of capital stock and will impair our ability to acquire other companies or assets by using common stock as consideration.

Stockholders may have difficulty trading and obtaining quotations for our common stock.

Our Common Stock does not trade, and the bid and asked prices for our Common Stock on the Over-the-Counter Bulletin Board may fluctuate widely in the future. As a result, investors may find it difficult to dispose of, or to obtain accurate quotations of the price of, our securities. This severely limits the liquidity of our Common Stock, and would likely reduce the market price of our Common Stock and hamper our ability to raise additional capital.

The market price of our Common Stock is likely to be highly volatile and subject to wide fluctuations.

Dramatic fluctuations in the price of our Common Stock may make it difficult to sell our Common Stock. The market price of our Common Stock is likely to be highly volatile and could be subject to wide fluctuations in response to a number of factors that are beyond our control, including:

| · | dilution caused by our issuance of additional shares of common stock and other forms of equity securities, in connection with future capital financings to fund our operations and growth, to attract and retain valuable personnel and in connection with future strategic partnerships with other companies; |

| · | variations in our quarterly operating results; |

| · | announcements that our revenue or income are below or that costs or losses are greater than analysts’ expectations; |

| · | the general economic slowdown; |

| · | sales of large blocks of our common stock; |

| · | announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; and |

| · | fluctuations in stock market prices and volumes; |

These and other factors are largely beyond our control, and the impact of these risks, singly or in the aggregate, may result in material adverse changes to the market price of our Common Stock and/or our results of operations and financial condition.

The ownership of our Common Stock is highly concentrated in our officers and directors.

Based on the 47,745,270 shares of Common Stock outstanding as of May 28, 2009, our executive officers and directors beneficially own approximately 44% of our outstanding Common Stock. As a result, they have the ability to exercise control over our business by, among other items, their voting power with respect to the election of directors and all other matters requiring action by stockholders. Such concentration of share ownership may have the effect of discouraging, delaying or preventing, among other items, a change in control of the Company. Our officers and directors acquired their securities in the Company at no or nominal cost.

Our issuance of Common Stock upon exercise of outstanding warrants may depress the price of the Common Stock and make it more difficult to raise additional financing.

As of May 28, 2009, we have 47,745,270 shares of Common Stock outstanding and warrants to purchase an additional 18,760,000 shares of Common Stock outstanding which are exercisable at prices ranging from $.10 to $1.25 per share. Additionally, in connection with the Private Placement, we also issued warrants to purchase 763,500 shares of Common stock at an exercise price of $1.25 per share. The issuance of shares of Common Stock upon exercise of outstanding warrants (including the Warrants) and options could result in substantial dilution to our stockholders, which may have a negative effect on the price of our Common Stock and make it more difficult to raise additional financing.

Over 21,000,000 shares of our outstanding Common Stock were purchased by our founders at a price of $.01 per share.

At the time we were formed, we issued an aggregate of 21,112,500 shares of Common Stock at a price of $.01 per share to 31 individuals and entities including 6,000,000 shares to our current officers and directors. In addition, pursuant to a Private Placement Memorandum dated August 15, 2007, we issued 11,867,080 shares to 123 accredited investors at a price of $.50 per share. In connection with such sale, we also issued the placement agent 1,500,000 shares and a six-year warrant to purchase 1,000,000 additional shares at an exercise price of $0.50 per share. The low purchase price for such shares may make it more likely that the shares will be sold at lower trading prices. The sale of such shares into the market could have a depressive effect on the trading price of our Common Stock, if then traded.

The Common Stock will be subject to the “penny stock” rules of the SEC, which may make it more difficult for stockholders to sell the Common Stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| · | that a broker or dealer approve a person's account for transactions in penny stocks; and |

| · | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

| · | obtain financial information and investment experience objectives of the person; and |

| · | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

| · | sets forth the basis on which the broker or dealer made the suitability determination; and |

| · | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The regulations applicable to penny stocks may severely affect the market liquidity for the Common Stock and could limit an investor’s ability to sell the Common Stock in the secondary market.

As an issuer of “penny stock,” the protection provided by the federal securities laws relating to forward looking statements does not apply to the Company.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, the Company will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by the Company contained a material misstatement of fact or was misleading in any material respect because of the Company’s failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

The Company has not paid dividends in the past and does not expect to pay dividends for the foreseeable future. Any return on investment may be limited to the value of the Common Stock.

No cash dividends have been paid on the Common Stock. We expect that any income received from operations will be devoted to our future operations and growth. The Company does not expect to pay cash dividends in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as the Company’s board of directors may consider relevant. If the Company does not pay dividends, the Common Stock may be less valuable because a return on an investor’s investment will only occur if the Company’s stock price appreciates.

FORWARD-LOOKING STATEMENTS

Statements in this current report on Form 8-K may be “forward-looking statements.” Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this prospectus, including the risks described under “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this current report and in other documents which we file with the Securities and Exchange Commission. In addition, such statements could be affected by risks and uncertainties related to our ability to raise any financing which we may require for our operations, competition, government regulations and requirements, pricing and development difficulties, our ability to make acquisitions and successfully integrate those acquisitions with our business, as well as general industry and market conditions and growth rates, and general economic conditions. Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this current report.

BUSINESS

Overview

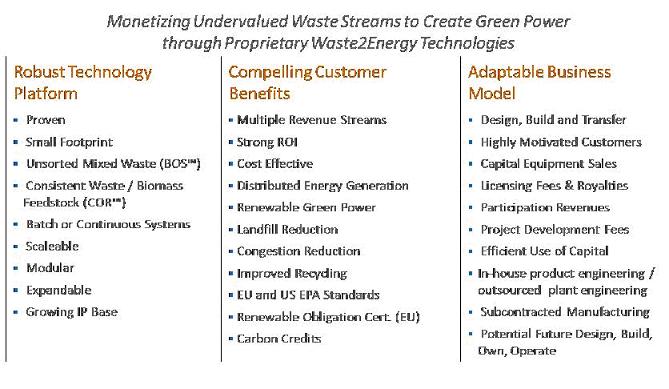

We intend to compete in the growing worldwide market for waste-to-energy systems that simultaneously destroy waste and generate green energy. Our business plan calls for us to design, manufacture and install small footprint, simple, cost-effective gasification technologies that are scalable, modular, environment friendly and robust enough to operate in harsh and remote environments. We provide customized engineering solutions that will enable our current and future customers to convert solid waste streams traditionally destined for landfill or incineration into clean, renewable energy.

We intend to target the local waste-to-energy sector in the small to mid-range market – from one ton batch systems all the way up to the continuous 500 metric ton per day (TPD) range – not large centralized plants such as those operated by waste-to-energy companies like Covanta or Wheelabrator who typically develop major facilities in the 1,000+ TPD range. We intend to focus on providing any customers we obtain with the technologies to recover the energy trapped in municipal solid waste, construction and demolition debris, industrial and commercial waste, and biomass.

To date we have financed our developmental stage activities and acquisitions through private placements of our securities. To date we have generated limited revenues, have substantial operating losses and accumulated deficit since our inception in April 2007.

Basis of Business Model

Our current proposed business model and strategic focus will be on sales of plant and equipment incorporating our technology to: (i) facility based waste generators (e.g., hospitals, mining camps, military) with simultaneous waste disposal and energy requirements, (ii) dedicated waste management and alternative energy companies with the resources to advance integrated waste-2-energy projects, and (iii) municipalities and their contractors. We believe we can generate revenues from the sale of plant and equipment.

We also believe we have near term revenue generating potential in operations, service and maintenance contracts. Over the longer term, we will seek to obtain carried interest participation in selected customer projects and, as and if we develop a proposed licensing program, we believe we will be able to generate licensing and royalty income.

Recent History

Since our incorporation in April, 2007, the Company has focused time and resources in five main areas:

| i. | Acquiring EnerWaste International and EnerWaste Europe, |

| ii. | Executing on the DARGAVEL Project in Dumfries, Scotland, as described below, |

| iii. | Attempting to deal with the consequences of the collapse of the Icelandic banking system and the subsequent closure of our operations in Iceland, |

| iv. | Replicating, on an outsourced basis in close proximity to Dumfries, the design, engineering and manufacturing capability that we previously had in Iceland, and |

| v. | Developing our intellectual property. |

Items (i) (iii) and (iv) have been progressing and DARGAVEL is entering into cold commissioning prior to hand over to our customer ASCOT Environmental Ltd. After that the plant will go through hot commissioning before commencing commercial processing of waste. Item (v) is a work-in-process with the acquisition of patents pending and codification of subsequent “know-how” and “trade secrets” into one dedicated technology subsidiary that will support our planned licensing strategy. During the same period we have been marketing our technologies and product lines to potentially interested parties and developing the foundations for a global sales organization. To date we have not, however, generated significant revenues.

The Global Waste Management Market

We believe waste presents a large challenge to our civilization. The Company believes discarded materials need to be efficiently collected, treated, recycled or disposed. The Company believes, whether located in urban or rural areas, every sector of the economy needs to address the challenge of waste management. The Company believes our advanced thermal processes permit various types of waste to be safely and efficiently handled at a state-of-the-art facility, which we believe provides major benefits for the waste producer, the local community and the environment.

As we will be subject to intense competition with, among others, landfill and recycling/composting and other waste-to-energy technologies in the global waste management market.

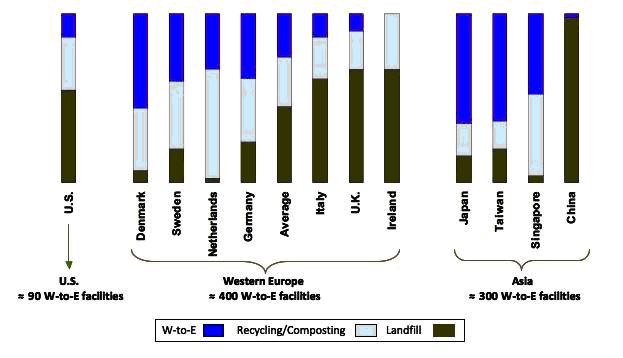

The chart below (Source: Covanta) identifies certain global waste management markets by primary management approach.

While many countries that we believe represent opportunities for W2e™ systems are not depicted, we believe the chart demonstrates the overall magnitude of the waste market. Clearly certain regions with high landfill and low waste-to-energy management approaches represent primary markets for W2e™. Globally, landfills account for 1.2 billion tons annually, recycling for 0.5 billion tons, and conversion of waste into energy only 0.2 billion tons (Source: Covanta).

In developing our growth strategy and marketing plans, we took into consideration that landfill space is increasingly at a premium and, in Europe, is being phased out. We also believe that island economies (the Caribbean etc.), being based on garbage-averse tourism with expensive electricity, will be natural markets. and that the global economic drivers of higher waste disposal costs, higher electricity costs, higher congestion costs and higher energy costs will make waste-to-energy a more competitive solution.

Waste is a local feedstock that does not gain value when transported distances. This means that plant size has to be both scalable down and up and modular to satisfy feedstock supply considerations and allow for future expansion.

Technology

Gasification Process in General

Gasification is a process that converts carbon-containing materials, such as coal, petroleum coke, municipal solid waste, or biomass, into a synthesis gas (syngas) and ash. Gasification occurs when a carbon-containing feedstock is exposed to elevated temperatures and/or pressures in the presence of controlled, limited amounts of oxygen.

The heart of a gasification-based system is the gasifier. Gasification technologies differ in many respects but share certain general production characteristics. The feedstock reacts in the gasifier with oxygen (and/or steam) at high temperature and pressure in an oxygen starved atmosphere to produce a syngas and ash. Syngas is primarily hydrogen, carbon monoxide and other gaseous constituents, the proportions of which can vary depending upon the conditions in the gasifier and the type of feedstock. It can be used as a basic chemical building block in the production of high value energy products such as diesel or electricity.

Waste2Energy’s Process

We believe W2e TM ’s gasification process follows the same basic principles as described above but is differentiated by the following features:

| · | Most gasifiers require feedstock that has been through a process of pretreatment - either drying, sorting, shredding or sizing. Our BOS™ technologies require no such pretreatment as all waste goes straight into the primary chamber. The COR TM system is optimized for biomass and will function more efficiently with MSW feed stocks if glass, masonry and metals are pre-sorted. |

| · | In W2e TM ’s systems, the syngas is oxidized at very high temperatures in a secondary combustion chamber to ensure complete destruction of all remaining hydrocarbon compounds. The result is a stream of very hot (> 1000Deg C) waste flue gas. The thermal power of this waste stream can be captured in a waste heat recovery boiler and be used in a simple steam cycle or Organic Rankine Cycle (ORC), utilizing a refrigerant gas to drive a turbine coupled to an electric generator. Alternatively, or in conjunction with power recovery, steam may be used for district heating or in other industrial processes. |

| · | Typically, the waste flue gas is treated as an integral part of the BOS™ process train. W2e TM ’s treatment utilizes commercially available systems that add sodium bicarbonate for acid neutralization; activated carbon to remove trace dioxins, furans, and heavy metals; and a filter bag house to collect scrubber consumables and any residual fly ash. |

| · | A Continuous Emission Monitoring (CEM) system monitors and logs air emissions. The cBOS TM plant in Husavik, Iceland, currently meets and exceeds the stringent EU regulations covering emissions (EU regulations are currently more onerous than US EPA standards). |

Waste2Energy Products

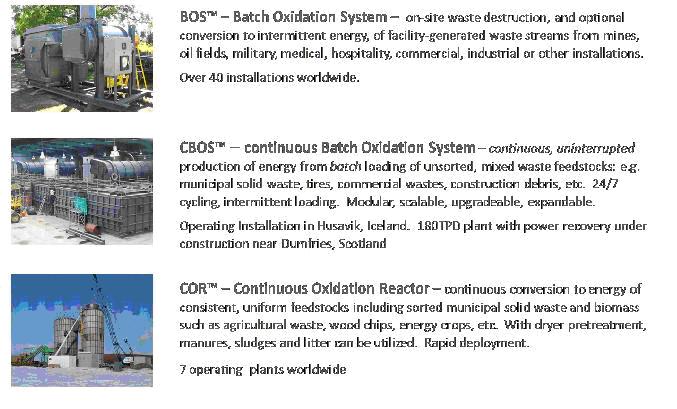

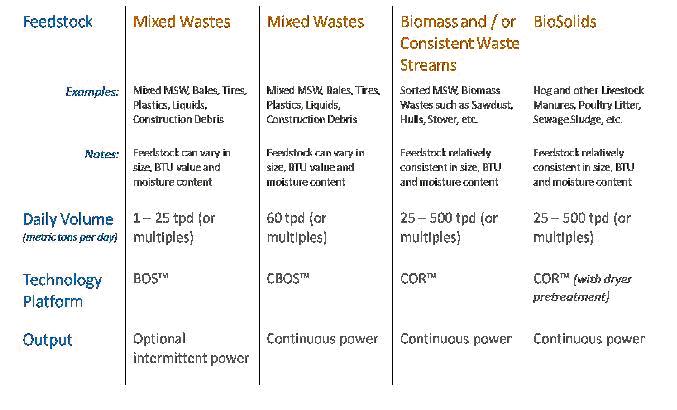

Our business plan calls for us to build small footprint, simple, cost-effective technologies that are scalable, modular, environment friendly and robust enough to operate in harsh and remote environments. Although we have limited revenues, we have developed three technology platforms which are owned by us:

We neither own any interest nor receive any revenues and/or other income from the above plants/installations.

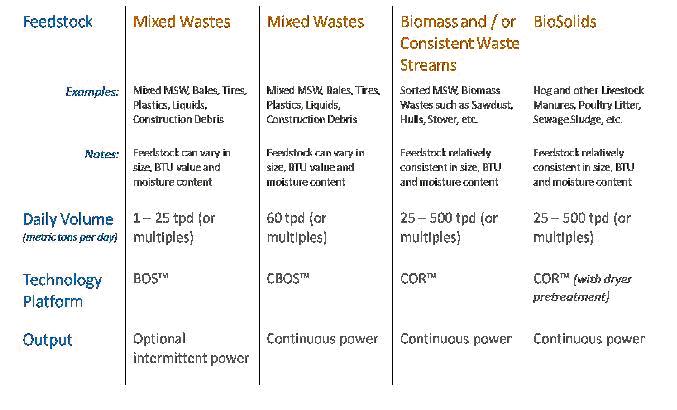

The technology platform best suited to a particular application is selected primarily on the basis of the feedstock specifications as shown in the tabulation below.

BOS™ Products

We believe the Batch Oxidation System™ will be our primary catalyst for growth in the global waste-to-energy industry due to a wide range of benefits and several first-to-market advantages. The Standard BOS (sBOS™) was originally developed in the US as a modular approach to small scale facility based waste disposal, with the added benefit that it is able to recover energy in the form of hot water, steam and/or electricity. The inability of the sBOS TM to provide a continuous production of energy over a 24 hour period of operation lead to the development of the Continuous Batch Oxidation System (cBOS TM ).

The sBOS™ accepts solid or liquid (in small quantities) waste or other forms of waste and is distinguished by its ability to accept untreated waste. No preparation is required in the form of separation, shredding etc. Even large motor tires and animal carcasses can be fed directly into the primary cells. Gasification is done at a controlled temperature above 600 Deg C with minimum airflow, which facilitates a complete gasification of the mixed waste, allows metals to be ejected in solid form with the ash (from whence they can be removed and recycled), sterilizes any medical waste and minimizes the production of airborne particulates. The bottom ash, which is the solid residue left in the primary cells, is also non-toxic/hazardous and can safely be sent as inert landfill, or be used for drainage fill or as aggregate in concrete, cement block, and asphalt road surfacing. The reduction in volume of bottom ash is between 90% and 95% of the initial waste.

The syngas generated in the primary gasification chamber is oxidized in a secondary combustion chamber to completely destroy remaining hydrocarbons. The hot flue gases are released with or without further treatment depending on the nature of the feedstock and the emission regulations at the site.

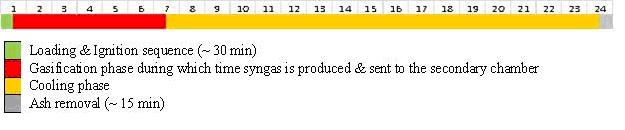

A basic sBOS™ unit goes through the following cycle during a 24 hour period:

With this sequence we believe it is possible to recover reasonable amount of thermal energy for only 6+ hours of operation in any 24 hour period. Full power recovery is unlikely to be economically justifiable but steam production for heating or laundry may be very attractive to a hospital or hotel.

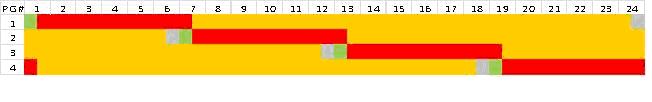

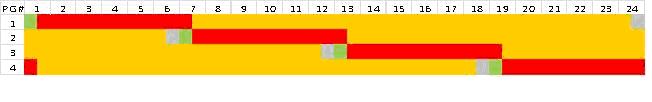

By combining four BOS™ primary gasifier chambers it is possible to obtain continuous power output by staggering the operational sequence by six hours as shown below:

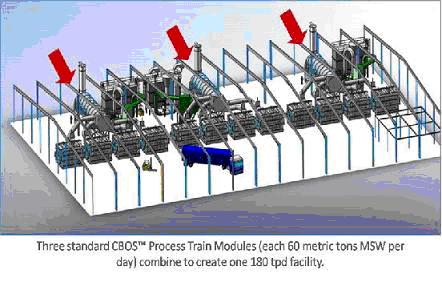

This is the basis of our Continuous Batch Oxidation System (cBOS TM ) technology. The basic cBOS TM system has a nominal capacity of 60 Tonnes Per day and consists of four primary gasification chambers feeding one secondary oxidation chamber. For larger requirements the basic four-primary module can be replicated on the same site to produce a much larger plant, the ultimate size being limited only by the logistics of transporting and handling the waste. With its modular design, continuous power output and ability to meet current stringent emission standards, the cBOS™ is well suited to process Municipal Solid Waste (“MSW”) from residential communities of 20,000 to 100,000 in Europe or North America (larger in Africa, Asia & Latin America) or to tackle industrial waste piles of tires etc. At present we believe there is very little industrial scale gasification of biomass or MSW and we see this as a significant opportunity as we believe there are few systems, if any, that are as versatile as the BOS™ that meet or exceed both EU and EPA emission standards.

cBOS TM plant designed, built and sold by the Company. and operating in Husavik, Iceland. However, the Company does not receive any revenues from nor have any ownership interest in the plant. |  |

| | |

Layout of the 180 TPD cBOS TM plant under construction at Dargavel, Scotland. The first phase of the plant is the installation of 2 – 60 TPD cBOS TM trains followed by a third train to be ordered in 2009. The plant is entering the cold commissioning phase with handover to our customer, Ascot Environmental Ltd., anticipated to follow shortly. The plant powers a SIEMENS turbine and generator. At full capacity, the plant will generate 7MW of electricity. | |

| | |

| cBOS TM being installed in Dargaval, Scotland |

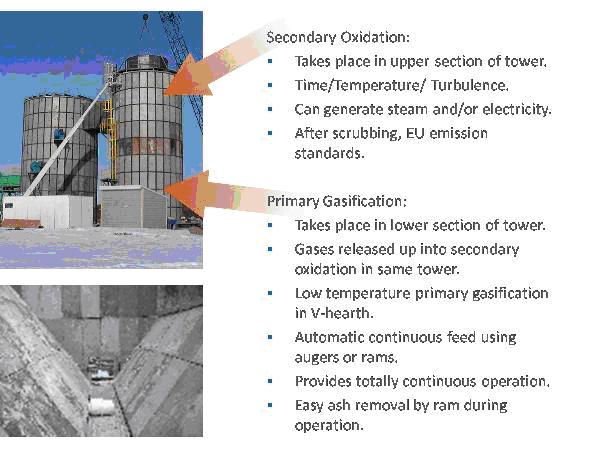

Continuous Oxidation Reactor (COR™)

We believe the COR™ is a low-cost gasification and oxidation system in which both processes are carried out in the same vertical chamber. Like the BOS™, the COR™ gasifies at low temperature and then oxidizes at high temperature thus giving extremely clean emissions. It has a mechanical feed system and is optimized for large quantities of biomass or other consistent waste feedstock from 50 to 500 tons per day and is also modular. This system can be supplied with or without energy capture for the production of steam or electricity. Biomass feedstocks include wood chips from forestry operations; construction leftovers such as sawdust and wood debris; agricultural residues like corn stalks, rice and wheat straw as well as much of the content of MSW (if properly pre-treated).

We believe the advantages of the COR™ are:

| · | Low capital costs as a result of simple modular construction; |

| · | Short lead time and rapid deployment (basic system); |

| · | Gasification and oxidation occur in the same vertical chamber, with the upper oxidation section reacting at high temperature to minimize emission issues; |

| · | Ease of repair and maintenance. |

We believe the COR™ is essentially the same process as the BOS™, except that the COR™ does gasification and oxidation in the same reactor. This requires continuous feed as opposed to batch operation and dictates that the feed material must be relatively consistent in chemistry and physical composition. There are MSW and industrial waste streams that have such properties, particularly if some pretreatment such as sorting, densification or dewatering is done. De-ashing is also carried out on a continuous basis as the tower does not cool down.

Market Size

We believe the municipal solid waste (MSW) market is the largest addressable market for our technologies. The following chart derived from the US Energy Information Agency shows the energy potential trapped in various components of MSW:

| Renewable | | Million BTU/ton | | Non-Renewable | | Million BTU/ton | |

| Textiles | | | 13.8 | | Plastics | | | |

| Wood | | | 10.0 | | PET | | | 20.5 | |

| Food | | | 5.2 | | HDPE | | | 19.0 | |

| Yard trimmings | | | 6.0 | | PVC | | | 16.5 | |

| Newspaper | | | 16.0 | | LDPE/LLDPE | | | 24.1 | |

| Corrugated Cardboard | | | 16.5 | | PP | | | 38.0 | |

| Mixed paper | | | 6.7 | | PS | | | 35.6 | |

| Leather | | | 14.4 | | Other | | | 20.5 | |

| | | | | | Rubber | | | 26.9 | |

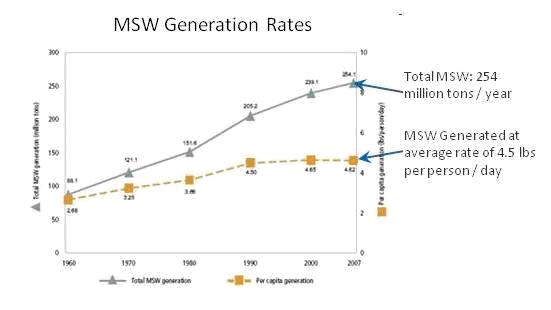

The market potential we believe is therefore significant. The chart opposite shows that the US alone generates in excess of 250 million tons of MSW per year. We believe that the percentage of this that is processed in a waste-to-energy faculty will increase with the availability of smaller scale processing technologies, such as our BOS™ and COR™.

Chart from US Environmental Protection Agency (http://www.epa.gov/epawaste/basic-solid.htm)

Based on the rates above, a single 60 TPD cBOS TM could potentially handle the waste generated by a town of 25,000 inhabitants and in the process produce approximately 2MW of electricity (depending on the actual composition of the MSW).

In addition to MSW, we intend to target construction and demolition waste (sometimes referred to as “debris”) which generally includes a mix of wood, cardboard, metal, plastics, asphalt, brick and concrete. According to Waste Management, Inc., a large waste processing company in the US, there is more than 130 million tons of this mixed waste stream generated each year in the US alone. Of this, they report that only one fifth is currently recycled. We believe our BOS can be used for handling this waste stream and recovering recyclable elements.

Target Markets and Customer Profile

Our target markets and potential customers for each product are tabulated below.

Competition

We will face extremely intense competition from known and unforeseen competitors in different industries. Moreover, as we have limited assets, personnel and other related items, most, if not all, of our competitors will have more financial resources, experience and personnel.

We currently believe our primary competition comes from landfill and recycling facilities as well as suppliers of incineration equipment designed to handle MSW. Because incinerators employ single-stage oxidation, carried out at much lower temperatures than used by our BOS™ technology, they face a greater challenge with emissions control and cleaning. This raises the initial capital cost of the equipment. Additionally, incineration systems are not usually suited to smaller applications.

We are aware of several gasification technologies that are potential competitors. There are also plasma technologies that are being marketed for MSW processing, including by AlterNRG a Canadian company formed to acquire and commercialize Westinghouse’s plasma technology which is an expensive process.

We believe the BOS™ has the following competitive advantages over these technologies - and other continuous systems that require pre-treatment of waste:

| · | Capital & Operating Costs. In continuous processes, the waste needs to be sorted and shredded. The sorting removes solid metals and pieces of unshreddable material such as bricks. In the W2e™ BOS™ no shredding or sorting is needed as everything goes straight into the primary chamber. This means the capital and operational costs of a BOS™ are both significantly lower for an equivalent size of plant. |

| · | Complexity. The mechanism for feeding continuous systems is automatic and mechanical thus adding considerable complexity than that of the BOS™ which is loaded through a simple hydraulically operated lid. |

| · | Operational Flexibility. The BOS™ normally runs with four primaries to each secondary. During maintenance, however, it is possible to continue to run on three primaries while the fourth is being serviced. Furthermore, our primaries cool off daily as part of their normal cycle, thus allowing minor maintenance to be carried out without any disruption to the normal operation. In contrast, a traditionally designed continuous system has to be completely shut down and cooled off before any maintenance is done. |

| · | Consistency of Feed. Unlike the BOS™, other continuous systems require that the feedstock must be consistent in order for the mechanical handling to work effectively. |

| · | Fly-ash and other Particulates. The BOS™ has no turbulence in the primary chamber and thus creates almost no fly-ash or other particulates. Additional filtering systems have to be used in continuous systems in order to cope with the particulates in the flue gas emissions. |

In addition to AlterNRG, there are other emerging technologies such as waste2tricity but, to the best of our knowledge, these technologies are unproven with no commercial references. We believe that the “first mover” advantages of the fully permitted plant in Husavik, Iceland and proven technology in multi-applications gives Waste2Energy a head start over emerging competitors.

Government Regulation

We are subject to a number of foreign and domestic laws, regulations and guidelines, including laws and regulations relating to health and safety, the conduct of operations, the protection of the environment and the manufacture, management, transportation, storage and disposal of certain materials used in the Company’s operations. Management believes that the Company is in compliance with such laws, regulations and guidelines; however, changes to such laws, regulations and guidelines due to environmental changes, unforeseen environmental effects, general economic conditions and other matters beyond our control may cause adverse effects to our operations. We have invested financial and managerial resources to ensure compliance with applicable laws, regulations and guidelines and will continue to do so in the future. Although such expenditures have not, historically, been material to the Company, such laws regulations and guidelines are subject to change. Accordingly, it is impossible for the Company to predict the cost or impact of such laws, regulations or guidelines on its future operations. It is not expected that any changes to these laws, regulations or guidelines would affect our operations in a manner materially different than they would affect other gasification companies of a similar size.

We are subject to various environmental laws and regulations enacted in the jurisdictions in which we operate which govern the manufacture, importation, handling and disposal of certain materials used in our operations. We are in the process of establishing procedures to address compliance with current environmental laws and regulations and we monitor our practices concerning the handling of environmentally hazardous materials. However, there can be no assurance that our procedures will prevent environmental damage occurring from spills of materials handled by the Company or that such damage has not already occurred. On occasion, substantial liabilities to third parties may be incurred. We may have the benefit of insurance maintained by the Company or the operator; however, the Company may become liable for damages against which it cannot adequately insure or against which it may elect not to insure because of high costs or other reasons.

Our customers are subject to similar environmental laws and regulations, as well as limits on emissions to the air and discharges into surface and sub-surface waters. While regulatory developments that may follow in subsequent years could have the effect of reducing industry activity, we cannot predict the nature of the restrictions that may be imposed. We may be required to increase operating expenses or capital expenditures in order to comply with any new restrictions or regulations.

Iceland and Europe

We previously maintained a technology center and manufacturing plant in Keflavik, Iceland. In September, 2008, the economic system of Iceland collapsed under the stresses of the emerging global financial crisis which resulted in the take-over of various industries by the government and the cessation of certain cross-border business and financial activities. As a result, operating conditions in Iceland became strained. To protect its currency, the Government of Iceland created a situation where there was no foreign exchange entering or leaving the country.

We believe the financial crisis in Iceland had a serious impact on EnerWaste Europe because it was unable to pay its sub-contractors in the United Kingdom which in turn was having an impact on the Dargavel Project. At that time, most of the plant and equipment for the Dargavel Project that had been manufactured in Iceland had been shipped to Scotland for installation and commissioning utilizing United Kingdom subcontractors and other outsourced systems.

In October 2008, the Icelandic banks, including Glitnir Bank, the lender to EnerWaste Europe, were nationalized and placed into receivership. Enerwaste Europe was placed in involuntary receivership in early 2009 and the company is currently in administration under the supervision of the local courts. The supply contract for the Dargavel Project between EnerWaste Europe and Ascot was terminated and, on November 10, 2008, a new agreement was entered into between a W2E subsidiary in the United Kingdom and Ascot for completion of the cBOS™ installation at Dargavel.

Intellectual Property

We have patents pending in Iceland on certain aspects of our Batch Oxidation System, and plan to develop further patents in the near future. Originally filed in Iceland, we are extending our patent options internationally through the Patent Cooperation Treaty (PCT) mechanism, which includes all the major industrialized countries. The PCT is the international treaty which allows patents initially filed in one country to begin the process of filing for that a patent internationally. After the initial period of PCT filing, the patent filings must then go through a nationalization period where the patent filing process goes through the specific country's patent office for approval. It is more expeditious and common practice to file a PCT filing before the nationalization process in the various other countries.

In addition to future engineering development and patent filings, we have a significant IP portfolio in the form of trade secrets and know-how for the operation, management and control of gasification processes, especially related to unsorted municipal waste streams. This is further enhanced by the technical documentation and support necessary not only to operationalize these systems, but also to bring them successfully through the local and regional permitting processes and the appropriate regulatory oversight agencies. We are in an ongoing process of further codifying this knowledge base for the future benefit of licensees we are able to obtain, if any.

We also intend, subject to available funds among other factors, to pursue not only the development of additional IP but also its proactive acquisition when we identify opportunities to strengthen our proprietary position.

Employees

As of the date of the filing of this report, we have eight (8) employees, all of whom are full-time, three (3) of which are executive officers. We consider our employee relations to be good.

Research and Development

For the period from April 10, 2007 (date of inception) to March 31, 2009 , we expended no funds on research and development.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward Looking Statements

Some of the statements contained in this Form 8- K/A that are not historical facts are "forward-looking statements" which can be identified by the use of terminology such as "estimates," "projects," "plans," "believes," "expects," "anticipates," "intends," or the negative or other variations, or by discussions of strategy that involve risks and uncertainties. We urge you to be cautious of the forward-looking statements, that such statements, which are contained in this Form 8- K/A , reflect our current beliefs with respect to future events and involve known and unknown risks, uncertainties and other factors affecting our operations, market growth, services, products and licenses. No assurances can be given regarding the achievement of future results, as actual results may differ materially as a result of the risks we face, and actual events may differ from the assumptions underlying the statements that have been made regarding anticipated events. Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include without limitation:

| · | Our ability to attract and retain management; |

| · | Our ability to raise capital when needed and on acceptable terms and conditions; |

| · | The intensity of competition; and |

| · | General economic conditions. |

All written and oral forward-looking statements made in connection with this Form 8- K/A that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given the uncertainties that surround such statements, you are cautioned not to place undue reliance on such forward-looking statements.

Plan of Operation

We intend to compete in the growing worldwide market for waste-to-energy systems that simultaneously destroy waste and generate green energy. Our business plan calls for us to design, manufacture and install small footprint, simple, cost-effective gasification technologies that are scalable, modular, environment friendly and robust enough to operate in harsh and remote environments. We intend to provide customized engineering solutions that we believe will enable our current and future customers to convert solid waste streams traditionally destined for landfill or incineration into clean, renewable energy.

We intend to target the local waste-to-energy sector in the small to mid-range market – from one ton batch systems all the way up to the continuous 500 metric ton per day (TPD) range – not large centralized plants such as those operated by waste-to-energy companies like Covanta or Wheelabrator who typically develop major facilities in the 1,000+ TPD range. We intend to focus on providing any customers we obtain with the technologies to recover the energy trapped in municipal solid waste, construction and demolition debris, industrial and commercial waste, and biomass.

To date we have financed our activities and acquisitions through private placements of our securities, including the Private Placement. To date we have generated limited revenues, have substantial operating losses and an accumulated deficit since our inception in April 2007.

Major Contract to Date

To date our primary project has been the DARGAVEL, project, which consists of a cBOS™ system with power recovery. Equipment for the Dargavel project was being manufactured at our technology center and manufacturing plant in Keflavik, Iceland. In September, 2008, Iceland was the first country to collapse under the stresses of the emerging global economic downturn . Operating conditions in Iceland became impossible. To protect its currency, the Government of Iceland suspended foreign exchange transactions such that there was no money coming in or leaving the country.

This financial freeze in Iceland had a serious impact on our subsidiary EWE because it was unable to pay its sub-contractors in the UK. This, in turn, had a negative impact on the DARGAVEL project to the extent that EWE was unable to complete the project. Then, in October 2008, Icelandic banks, including Glitner Bank the lender to EWE, were nationalized and placed in receivership and the Icelandic banking system collapsed. By that time however, most of the plant and equipment for DARGAVEL that EWE had manufactured in Iceland had been shipped to Scotland for installation and commissioning. The supply contract for the Dargavel Project between EnerWaste Europe and our customer was terminated and, on November 10, 2008 a new agreement was entered into between a Waste2Energy subsidiary in the United Kingdom and our customer for completion of the cBOS™ installation at Dargavel.