Preliminary Offering Circular Dated October 23, 2015

An offering statement pursuant to Regulation A relating to these securities has been filed with the Commission, which we refer to as the Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

APERION BIOLOGICS, INC.

2,500,000 Shares of Common Stock

This is our initial public offering. No public market currently exists for our shares. We are selling 2,500,000 shares of our common stock. We expect that the initial public offering price will be between $7.00 and $9.00 per share. We have applied to list our common stock on The NASDAQ Capital Market under the symbol “ZLIG.”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and, as such, may elect to comply with certain reduced reporting requirements for this Offering Circular and future filings after this offering.

| THE OFFERING | | PER SHARE | | TOTAL

OFFERING | |

| Initial Public Offering Price | | | | | |

| Underwriting Discounts and Commissions | | | | | |

| Proceeds to us | | | | | |

(1) We refer you to “Underwriting” beginning on page 25 of this Offering Circular for additional information regarding total underwriter compensation.

See “Risk Factors” on page 9 to read about factors you should consider before buying shares of our common stock.

The underwriter has agreed to use its best efforts to procure potential purchasers for the shares of common stock offered pursuant to this Offering Circular.

The shares are being offered on an all or none basis. The offering will commence on the date of this Offering Circular. All investor funds received from the date of this Offering Circular to the closing date of this offering, which shall take place on , 2015, will be deposited into an escrow account until closing. The closing date is also the termination date of this offering. If, on the closing date, investor funds are not received for the full amount of shares to be sold in this offering, the offering will terminate and any funds received will be returned promptly, without interest.

The date of this Offering Circular is , 2015

This Offering Circular follows the disclosure format of Part I of Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

THE UNITED STATES COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

THE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) OR APPLICABLE STATE SECURITIES LAWS, AND THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION. HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

THIS OFFERING CIRCULAR CONTAINS ALL OF THE REPRESENTATIONS BY THE COMPANY CONCERNING THIS OFFERING, AND NO PERSON SHALL MAKE DIFFERENT OR BROADER STATEMENTS THAN THOSE CONTAINED HEREIN. INVESTORS ARE CAUTIONED NOT TO RELY UPON ANY INFORMATION NOT EXPRESSLY SET FORTH IN THIS OFFERING CIRCULAR.

TABLE OF CONTENTS

OFFERING CIRCULAR SUMMARY

This summary highlights information contained elsewhere in this Offering Circular and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire Offering Circular, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case included elsewhere in this Offering Circular. Unless otherwise stated, all references to “us,” “our,” “we,” the “Company” and similar designations refer to Aperion Biologics, Inc.

Overview

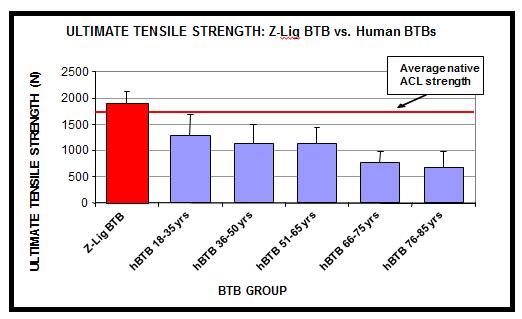

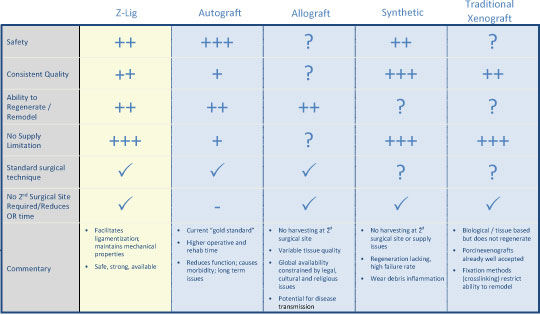

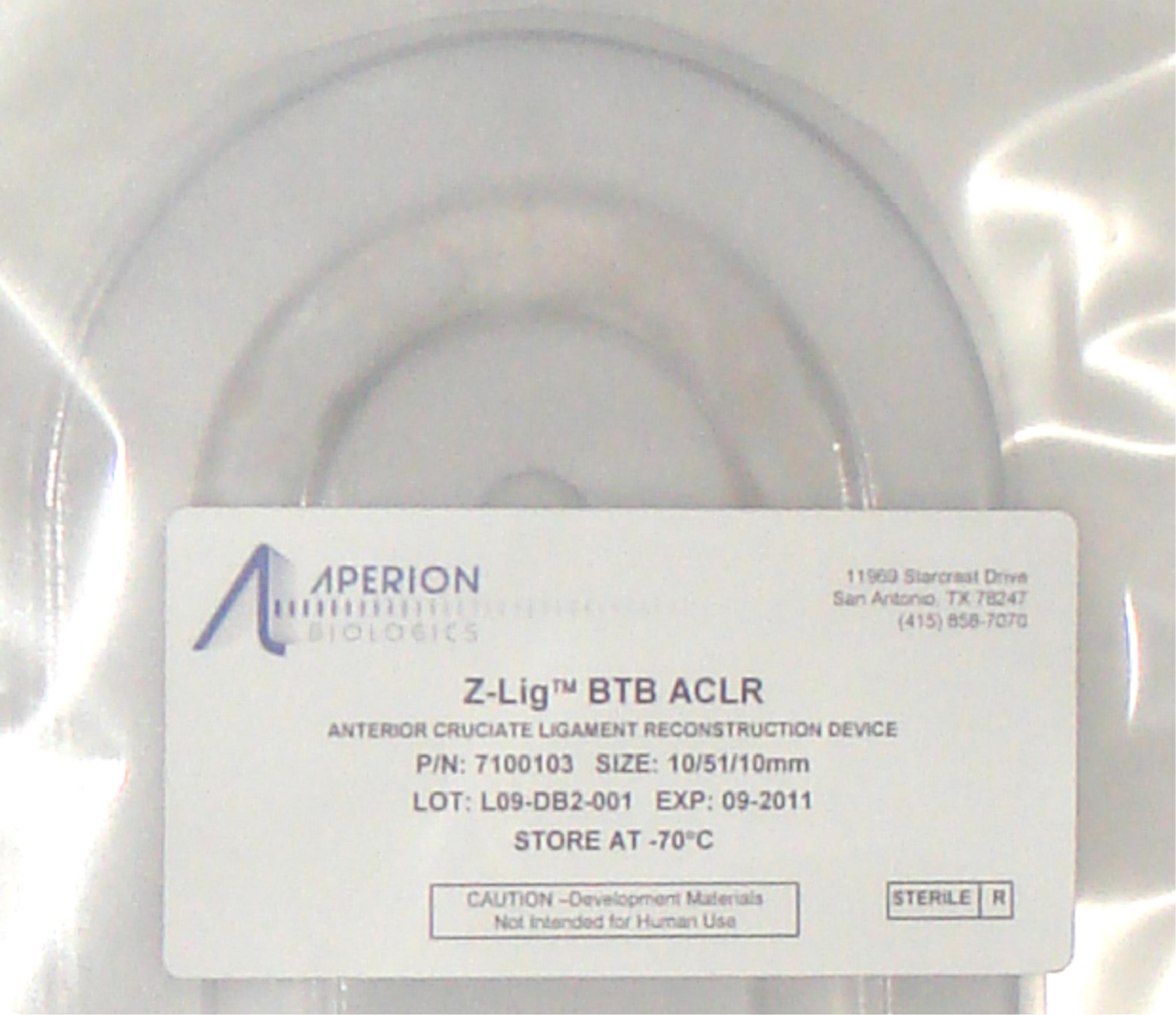

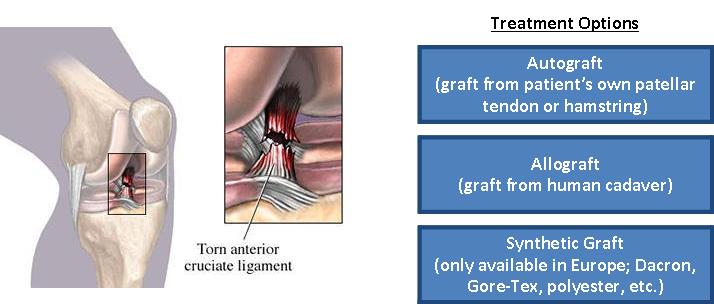

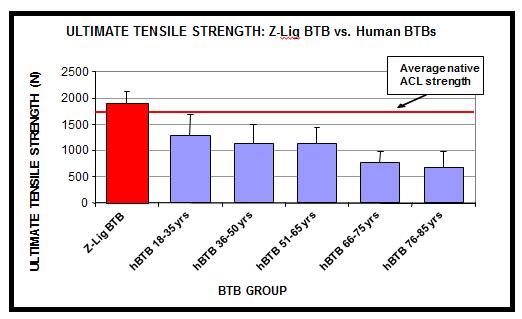

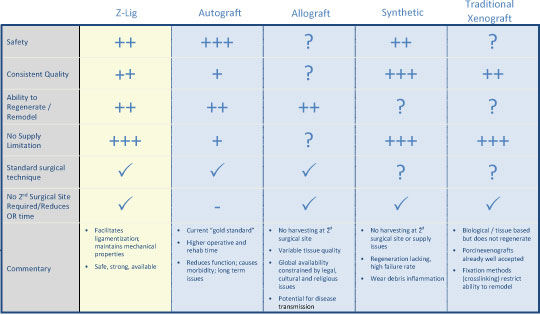

We are a commercial-stage medical device company addressing the significant need for an alternative to human-based sources of tissues to be used in surgical procedures. Our lead product, the Z-Lig ®, is produced by a patent-protected process for porcine tendons and its safety and performance was demonstrated in multicenter, prospective randomized trials in Europe and South Africa. In 2014, we received the CE Mark (the regulatory permission to market the product in Europe) for use initially as a knee joint anterior cruciate ligament (“ACL”) replacement in revision and multiligament procedures, which allows us to distribute the Z-Lig in any market that recognizes this approval. We have been building the appropriate distribution channels, primarily focusing on establishing a network of distributors that have strong relationships with sports medicine doctors.

Z-Lig is the only known biological alternative to human tissue for ACL replacement. Since Z-Lig is a biological implant that maintains a scaffold, it can become populated and remodeled with the patient’s own cells (similar to human-sourced tissue), referred to in the industry as “ligamentization”. This ligamentization is one of the keys to Z-Lig’s proven ability to be highly functional in patients many years post-implantation. Our propriety process is protected by an extensive portfolio of patents and patent applications, including 23 issued patents in the U.S. and internationally.

Our Solution

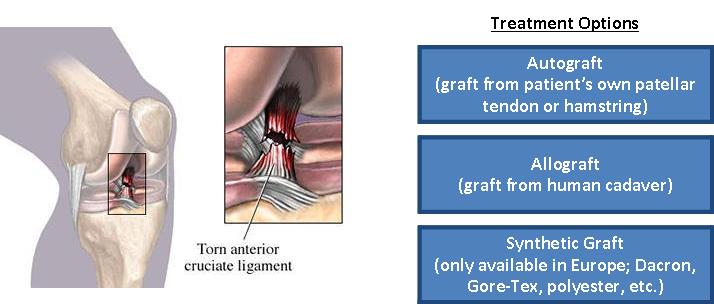

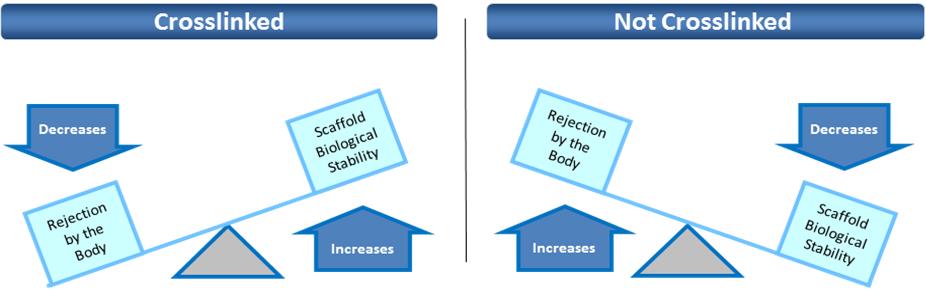

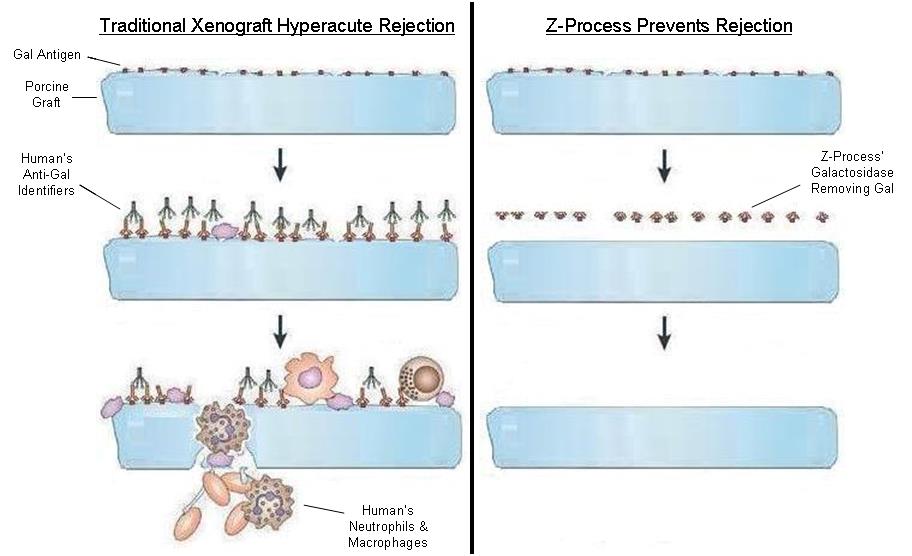

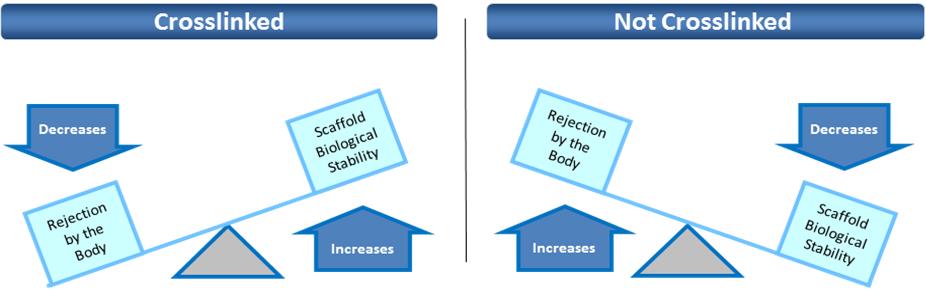

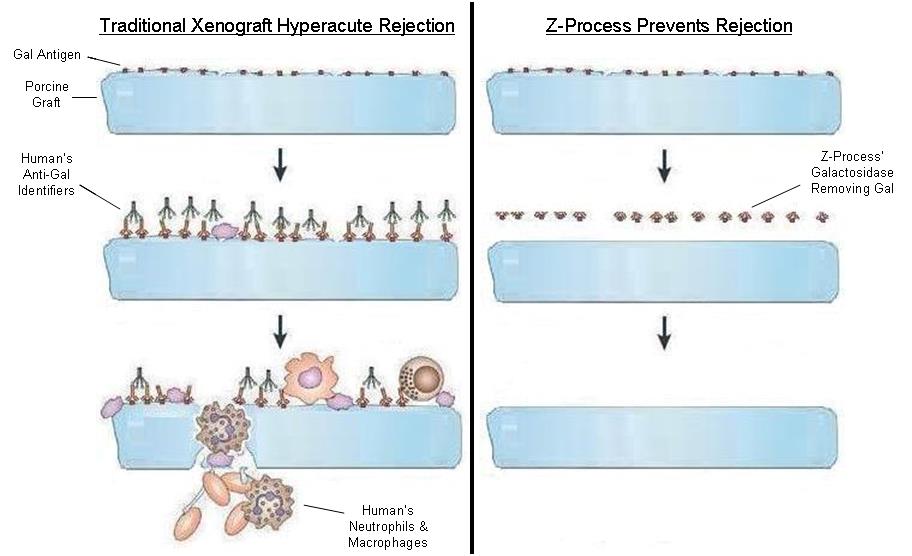

To solve for xenotransplant (transplants between the two different species) rejection problems, we developed the Z-Process, which is a proprietary process that immunochemically modifies animal tissue so that it is compatible with the human immune system. The Z-Process addresses both α-gal (galactose) and non-gal antigens on the xenograft (graft from another species) to create porcine tendons that can be safely used in humans while still maintaining their biological scaffold activity. Using the Z-Process, we developed the Z-Lig ® device as an immunocompatible, porcine-derived ACL reconstruction alternative that provides a readily available, off-the-shelf solution and is strong, sterile, cost-effective and consistent.

Our Product Candidate Pipeline

In addition to the ACL, our processing technology represents a platform that can also potentially be applied to opportunities involving cartilage, soft tissue patches (extracellular matrices), bone, heart valves, vascular grafts, collagen and other tissues throughout the body.

The Company has several product families in clinical and preclinical development and research stages that fall into four general groupings:

| | · | Z-Lig - family of devices designed for use in a range of ligament reconstruction procedures, in addition to the initial application for the ACL. |

| | · | Z-Patch - an extracellular matrix product used in soft tissue repair and augmentation procedures. |

| | · | Z-Fix - a bone-based product for biologic fixation in ACL reconstruction procedures which would be complementary to the Z-Lig device permitting an all-biologic ACL reconstruction. |

| | · | Z-Meniscus - a meniscus device which can be used in the repair or reconstruction of meniscal injuries and defects. |

Our Strategies

Our contact with clinicians confirmed that the initial market need for the Z-Lig is comprised of those revision and multiligament knee joint cases where a graft option is required to achieve the desired clinical result. The first phase of our European roll-out calls for the targeting of a select number of markets where human or synthetic graft options are accepted; in particular those markets whose sites participated in our European and South African (EUSA) clinical trials. Thus, the initial target markets for Z-Lig distribution include Italy, South Africa, Poland, Spain, UK, and the Benelux countries (Netherlands, Belgium, Luxembourg). We have identified and signed with a select group of distributors that have met our selection criteria, which include existing complementary product lines, market share, financial stability, and willingness to invest in the product line. In these markets, we are introducing the product through a targeted approach by focusing on clinicians chosen by our investigative surgeons and our distribution partners.

Supporting our indirect distribution efforts will be Aperion direct personnel specifically tasked with sales management and also clinical marketing specialists for training and technical/scientific field education.

The next distribution phase is expected to expand our application of use to include all ACL indications and furthermore to add European and Asian markets that accept the CE Mark, with a specific focus on high-volume clinical centers or those specializing in knee injuries. The third and final phase would include pan-European expansion into markets in the EU and continued introduction in markets outside the United States that accept the CE Mark and potential distribution into non-European nations whose regulatory bodies require additional regulatory approval.

We intend to build a sizable revenue base with the Z-Lig in overseas (outside U.S.) markets over the next several years. Our marketing efforts in the U.S. are contingent on obtaining FDA approval for the Z-Lig and other devices. The FDA has granted us an unconditional approval for a clinical trial of the Z-Lig in the United States. We plan to market our products in the U.S. after the trial is completed and FDA approval is obtained.

Our Risks

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the “Risk Factors”

section immediately following this Offering Circular summary. These risks include, but are not limited to, the following:

| | · | We have incurred significant operating losses since inception and may continue to incur losses for the foreseeable future; |

| | · | We only recently received approval in Europe to commercialize our Z-Lig products, and we have no significant experience or capability to sell our products on a commercial scale; |

| | · | Our Z-Lig products may not gain market acceptance among surgeons, physicians, patients, healthcare payors and the medical community; |

| | · | We may not be able to generate long-term or additional positive clinical data to support or expand our commercialization efforts; |

| | · | We may not be able to protect our intellectual property; and |

| | · | CrossCart LLC, our controlling stockholder, controls all aspects of our business. |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| | · | only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| | · | reduced disclosure about our executive compensation arrangements; |

| | · | no non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| | · | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of this offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Commission. We may choose to take advantage of some but not all of these exemptions. We have taken advantage of reduced reporting requirements in this offering circular. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock. We have irrevocably elected to ‘‘opt out’’ of the exemption for the delayed adoption of certain accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Company and Other Information

We were initially incorporated under the laws of the State of California as CrossCart, Inc., in 1996. In June 2008, CrossCart, Inc. was reincorporated under the laws of the State of Delaware, and in May 2009, CrossCart, Inc. changed its name to “Aperion Biologics, Inc.” Our principal executive office is located at 11969 Starcrest Dr. San Antonio, TX 78247, and our telephone number is (210) 858-7070. Our website address is www.aperionbiologics.com. We do not incorporate the information on or accessible through our website into this Offering Circular, and you should not consider any information on, or that can be accessed through, our website a part of this Offering Circular.

We own various U.S. federal trademark registrations and applications, and unregistered trademarks, including the following marks referred to in this Offering Circular: “Z-Lig” and “Aperion Biologics”. All other trademarks or trade names referred to in this Offering Circular are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Offering Circular are referred to without the symbols ® and ™, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

This Offering Circular summary highlights information contained elsewhere and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire Offering Circular, including our financial statements and the related notes included elsewhere in this Offering Circular. You should also consider, among other things, the matters described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case appearing elsewhere in this Offering Circular.

The Offering

| Common stock offered by us | 2,500,000 Shares |

| | |

| |

| Common stock to be outstanding immediately after this offering | 6,465,396 Shares |

| | |

| Use of proceeds | We intend to use approximately $700,000 of net proceeds from this offering to pay certain accounts payable. We also intend to use a portion of the net proceeds to repay outstanding principal amounts and interest on certain demand notes and line of credit notes issued to CrossCart LLC in the amount of approximately $186,720, including accrued interest. We also intend to use approximately $300,000 of net proceeds to pay certain compensation owed to our employees as a result of the reduction of their salaries and fees. We intend to use the remaining net proceeds to launch our commercialization plan for Z-Lig products in Europe, South Africa and other countries that accept our approved CE Mark; fund post-market registry studies of Z-Lig; conduct pre-clinical and R&D activities for additional product candidates; and initiate clinical trials for Z-Lig products in the U.S. See “Use of Proceeds” on page 28. |

| | |

| Risk factors | You should carefully read “Risk Factors” on page 9 in this Offering Circular for a discussion of factors that you should consider before deciding to invest in our common stock. |

| | |

| Proposed NASDAQ Capital Market Symbol | “ZLIG” |

The number of shares of our common stock to be outstanding after this offering is based on 3,965,396 shares of our common stock outstanding as of June 30, 2015 and excludes:

| | · | 350,421 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2015 at a weighted average exercise price of $1.47 per share; |

| | · | 659,937 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2015 at a weighted average exercise price of $1.47 per share, which warrants prior to the completion of this offering are exercisable to purchase common stock or convertible preferred stock, assuming such warrants will not be exercised prior to the completion of this offering; |

| | · | 102,651 shares of common stock reserved for future issuance under our 2008 Stock Option/Stock Issuance Plan; |

| | | |

| | · | ______ shares of common stock reserved for future issuance under our 2015 Stock Option and Incentive Plan (the “2015 Plan”), which will become effective immediately prior to the completion of this offering. |

| · | 47,026 shares of common stock issued to our directors in October 2015 as payments to a portion of certain fees for board services which were deferred since July 2013, and 3,261 shares of common stock issued to outside contractors for services under consulting agreements. |

Unless otherwise indicated, all information in this Offering Circular reflects or assumes the following:

| | · | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, which will occur immediately prior to the completion of this offering; |

| | · | the conversion of all of our outstanding shares of convertible preferred stock into an aggregate of 2,038,314 shares of common stock upon the completion of this offering, including 448,220 shares of common stock to be issued as cumulative dividends accrued under such preferred stock; |

| | · | the issuance of 1,704,713 shares of common stock upon the conversion of approximately an aggregate of $9,838,058 in outstanding principal and accrued interest on our convertible promissory notes (which is currently convertible into shares of our preferred stock but will be amended to be convertible into shares of our common stock in connection with the offering), upon the completion of this offering, at an average conversion price of $5.70 per share, assuming that the offering is completed on June 30, 2015; |

| | · | the issuance of additional shares of common stock as a result of anti-dilution adjustments provided in our certificate of incorporation; and |

| | · | a one-for-18.4 reverse split of our common stock, which became effective on 2015. |

| · | no exercise of options after June 30, 2015. |

Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below along with all of the other information contained in this Offering Circular, including our financial statements and the related notes, before deciding whether to purchase our common stock. If any of the adverse events described in the following risk factors, as well as other factors which are beyond our control, actually occurs, our business, results of operations and financial condition may suffer significantly. As a result, the trading price of our common stock could decline, and you may lose all or part of your investment in our common stock.

Risks Related to Our Business and Finance

We have incurred significant operating losses since inception, anticipate that we will continue to incur losses for the foreseeable future and will need to raise additional capital.

We have generated operating losses since we began operations in 2008, and our net losses attributable to common stockholders for the fiscal year ended September 30, 2014 and 2013 were $3.29 million and $5.45 million respectively. We expect to continue to incur additional operating losses for the foreseeable future as we plan the commercialization of Z-Lig products and continue our clinical and pre-clinical studies. Our recurring operating losses and our need for additional sources of capital to fund our ongoing operations raise substantial doubt about our ability to continue as a going concern. As a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year ended September 30, 2014 with respect to this uncertainty. If the time required to generate material revenues and achieve profitability is longer than we currently anticipate, or if we are unable to raise new capital through equity or obtain debt financing or other sources of funding, we may be forced to curtail or suspend our operations, which would have a material adverse effect on the value of your investment.

We expect capital outlays and operating expenditures to increase over the next several years as we establish and expand our marketing infrastructure to commercialize our Z-Lig products. Following the completion of this offering, we believe our financial resources will be adequate to sustain our current operations through the end of calendar year 2017. However, we will need to raise additional capital. We cannot be certain that we will be able to obtain financing on terms acceptable to us, or at all. Our failure to obtain adequate and timely funding will materially adversely affect our business and our ability to develop our products and would have a material adverse effect on the value of your investment.

We only recently received approval in Europe to commercialize our Z-Lig products, and we have no significant experience or capability to sell our products on a commercial scale.

Our future is significantly dependent on the commercial success of our Z-Lig family of products. We have only recently received a CE Mark in April 2014 that allowed us to conduct limited sales in select European markets beginning in February 2015. As a result, we have no significant history or experience in selling Z-Lig or any other products in Europe or in any other markets, and we have limited relationships with surgeons, physicians, clinicians and hospitals that may purchase or use our products. In order for us to commercialize our products successfully, we will need to develop, or obtain through outsourcing arrangements, the capability to market and

sell our products on a commercial scale. We may not have the ability and sufficient resources to establish the infrastructure and organizations needed to execute these functions, which can be complex and costly. Our effort to commercialize Z-Lig products is also subject to a number of additional risks, which could have a material adverse effect on the value of your investment, including:

| | · | competitors’ established relationships with our potential customers; |

| | · | limitations in our ability to demonstrate the advantages of our products compared to competing products and the relative safety, efficacy and ease of use of our products; |

| | · | our inability to convince doctors and hospitals to use our products; and |

| | · | the introduction and market acceptance of competing products and technologies. |

Our Z-Lig products may not gain market acceptance among surgeons, physicians, patients, healthcare payors and the medical community.

A critical element in our commercialization strategy is to persuade and educate the medical community on the safe and effective use of our products and how Z-Lig products differentiate from the existing supplies of surgical issues. Surgeons, physicians and hospitals may not perceive the benefits of our products and may be unwilling to change from the devices they are currently using. A number of factors may limit the market acceptance of our Z-Lig products, including the following:

| | · | rate of adoption by healthcare practitioners; |

| | · | rate of a product’s acceptance by the target population; |

| | · | timing of market entry relative to competitive products; |

| | · | availability of third-party reimbursement; |

| | · | government review and approval requirements; |

| | · | extent of marketing efforts by us and third-party distributors or agents retained by us; and |

| | · | side effects or unfavorable publicity concerning our products or similar products. |

Therefore, even after we have demonstrated the effectiveness of the Z-Lig products, we may not be able to commercialize these products successfully if we cannot achieve an adequate level of market acceptance. Our inability to successfully commercialize our products will have a material adverse effect on the value of your investment.

We may experience defects and manufacturing issues in our supplies of animal issues or raw materials.

As we continue to expand our clinical development and commercialization activities, we expect to scale up the manufacturing and supplies of animal tissues that are the main component of our Z-Lig products. We may not be able to control or maintain a consistent and high quality of

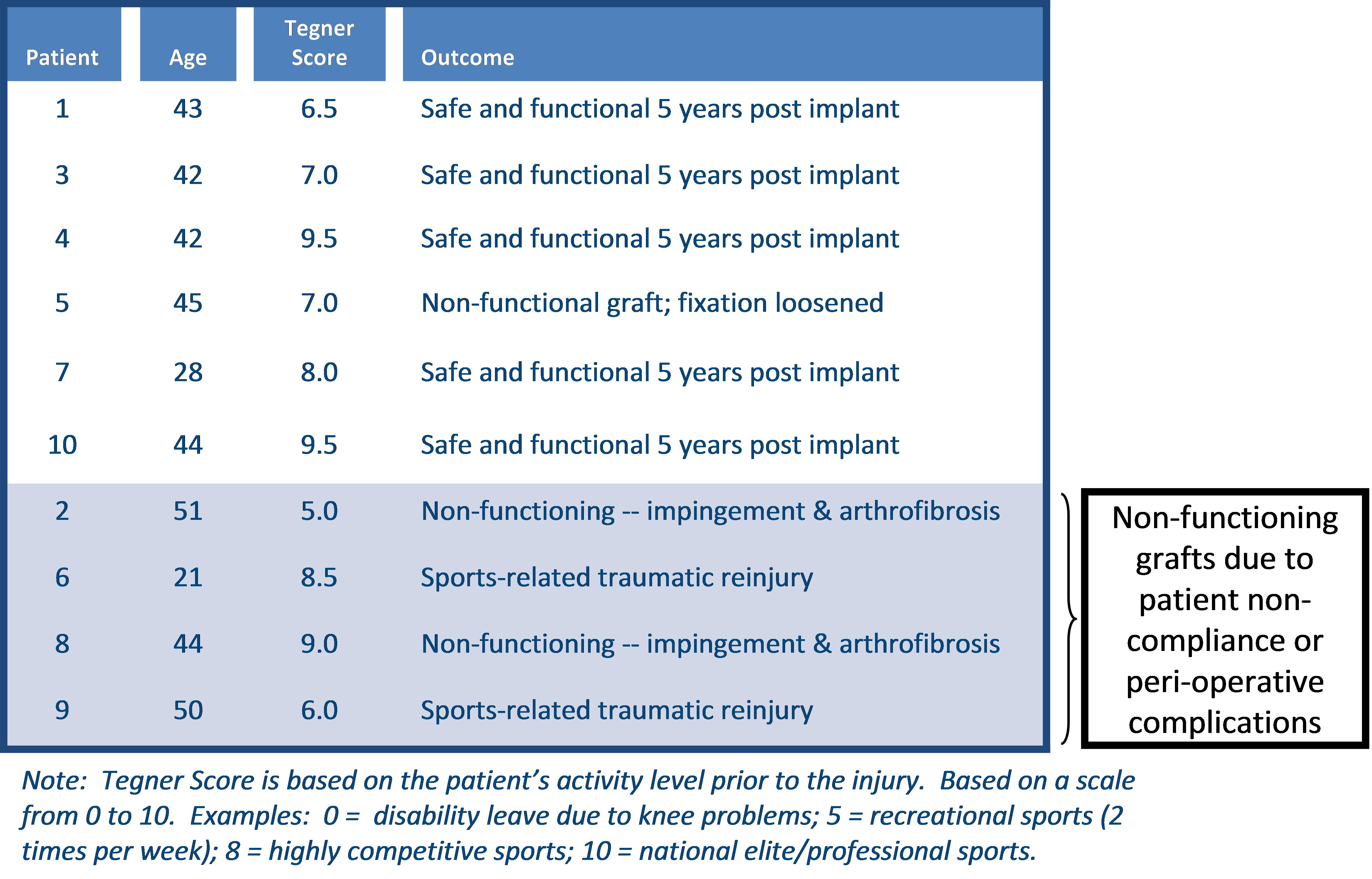

raw materials, such as porcine tissues, or uncover defects prior to implantation in humans. In the past, we observed and experienced contamination in porcine tissues resulting from the processing and handling of these materials during clinical trials, which led to bacterial infections associated with the grafts in patients implanted with Z-Lig in the trial. While we have implemented stringent validation, safety and corrective procedures and intend to conduct additional post-market studies to confirm the effectiveness of such preventive measures, there is no guarantee that we can eliminate this risk in the future. In addition, external factors outside of our control may affect the quality of our supplies of animal or porcine issues. For example, swine diseases or pandemics may severely reduce the supply of porcine tissues required to manufacture our Z-Lig products. Mishandling or lack of quality control at our third-party suppliers may also negatively impact our ability to obtain a sufficient and acceptable level of porcine tissues to meet our needs. Our failure to eliminate contamination and deficiency in the animal and porcine issues used in our products may require us to incur additional costs to implement preventive measures, or cause significant delays and disruptions in the development and commercialization of our products, which would have an adverse effect on our business operations and financial condition.

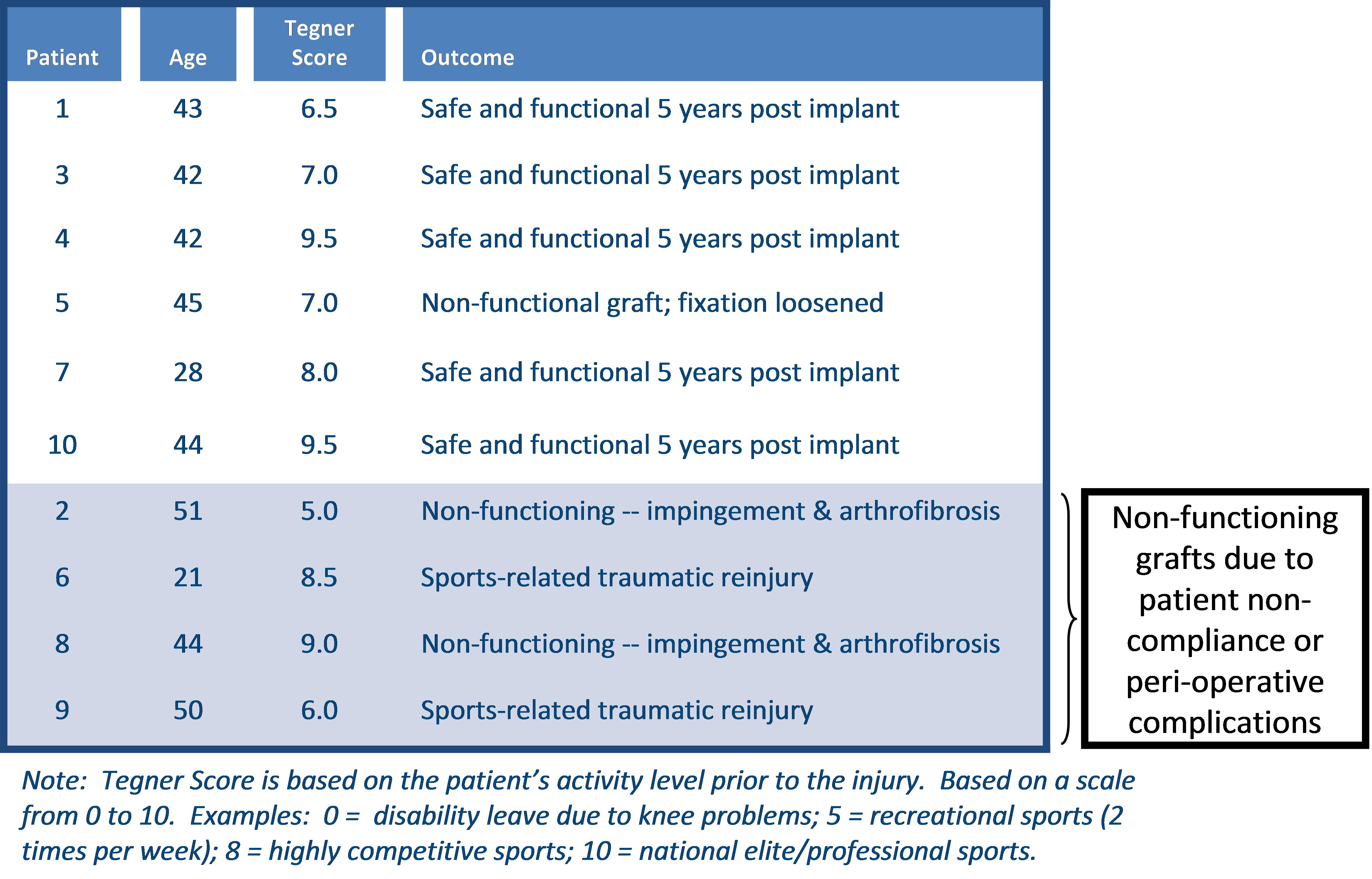

The safety and efficacy of our products is supported by limited clinical data, and we may not be able to generate long-term or additional positive clinical data to support or expand our commercialization efforts.

We have obtained a CE Mark to market and sell our Z-Lig products in Europe based on the 6- and 12-month data collected from our clinical studies in 2013 and the longer term (12 years) safety data from the U.S. pilot safety trial. We have committed to continue these clinical studies to support post-market commercial activities in Europe and to meet certain post-market approval requirements by European regulatory agencies. In addition, we intend to conduct additional clinical studies to support further commercialization efforts and expand the markets for our Z-Lig products. For example, the CE Mark we received in April 2014 is limited to revision and multiligament ACL surgeries and does not cover primary ACL surgeries. We have established post-market clinical plans to generate additional data required to expand the indication of Z-Lig products to cover primary ACL surgeries, which would allow us to reach a broader ACL reconstruction market. There is no guarantee that we can duplicate the positive results from our earlier trials for future studies or generate the required data to support the expansion of Z-Lig indication. Our failure to do so may result in the loss of CE Mark approval or other regulatory approvals, delays, failures in the adoption of our products by surgeons and physicians, damage to our reputation and legal claims against us.

In addition, any negative data from our post-market clinical studies may adversely impact our ability to conduct clinical trials and seek regulatory approval of our products from the FDA to market our products in the United States. Furthermore, we are developing several products based on our Z-process that would allow a commercialization path based on FDA’s Section 510(K) pre-market clearance procedures. This procedure is shorter and typically requires the submission of less supporting documentation than other FDA approval processes and does not require long-term clinical studies. As result, we may encounter difficulties and delays in marketing these products which otherwise may not be the case if the products have been proven safe and effective in more extensive and long-term clinical trials.

Our clinical studies of our current or future products may not produce results necessary to support regulatory clearance or approval in the United States or elsewhere.

We plan to seek FDA approval of Z-Lig by conducting pivotal clinical trials in the United States. While we have conducted a limited safety pilot study in the United States showing that Z-Lig was safe, and we have received a CE Mark based on the clinical studies in Europe and South Africa, there is no guarantee that the same results will be duplicated in a clinical trial with a larger patient population in the United States. Our inability to achieve acceptable results in future clinical studies would have a material adverse effect on our business operations and financial condition and the value of your investment.

If third-party payors fail to provide appropriate levels of reimbursement for the use of our products, our revenues could be adversely affected.

Sales of our products depend on the availability of adequate reimbursement from third-party payors. In each market in which we do business, our inability to obtain reimbursement approval or the failure of third-party payors to reimburse health care providers at a level which justifies the use of our products instead of cheaper alternatives will hurt our business.

Moreover, we are unable to predict what changes will be made to the reimbursement methodologies used by third-party payors in the future. We cannot be certain that under current and future payment systems, in which healthcare providers may be reimbursed a set amount based on the type of procedure performed, such as those utilized by Medicare and in many privately managed care systems, the cost of our products will be justified and incorporated into the overall cost of the procedure. A failure by third-party payors to provide appropriate levels of reimbursement for the use of our products will have a material adverse effect on our business operations and financial condition and the value of your investment.

As we expand into multiple international markets, we will face similar risks relating to adverse changes in coverage and reimbursement procedures and policies in those markets. Reimbursement and healthcare payment systems vary significantly among markets in different jurisdictions. Our inability to obtain international coverage and reimbursement approval, or any adverse changes in coverage and the reimbursement policies of foreign third-party payors, could negatively affect our ability to sell our products.

We rely on third party suppliers for our raw materials, including porcine tissues, and their inability to supply us with an adequate supply of materials could harm our business.

We rely on third-party suppliers to supply and manufacture the raw materials, including porcine tissues, for the development of our products. To be successful, our suppliers must be able to provide us with products and components in substantial quantities, in compliance with regulatory requirements (including ISO 22442), in accordance with agreed upon specifications, at acceptable cost and on a timely basis. Among other factors, our anticipated growth could strain the ability of suppliers to deliver an increasingly large supply of products, materials and components. If we are unable to obtain sufficient quantities of high quality components to meet customer demand on a timely basis, we could lose customers, our reputation may be harmed and our business could suffer.

In addition, we currently use one supplier for the supply of porcine tissues required to manufacture our Z-Lig products, biologics, and components. Our dependence on one supplier involves several risks, including limited control over pricing, availability, quality and delivery schedules. If any one or more of our suppliers cease to provide us with sufficient quantities of our components in a timely manner or on terms acceptable to us, we would have to seek alternative sources of supplies. We could incur significant delays while we locate and engage

alternative qualified suppliers, including delays associated with qualifying the new supplier to meet all applicable regulatory requirements in the United States, Europe and other markets in which we develop and sell our products. Even if we are able to identify an alternative supplier, we might not be able to negotiate or receive the same or more favorable terms as those provided by our existing suppliers. Any such disruption or increased expenses could harm our commercialization efforts and adversely affect our ability to generate revenue. Any inability to meet our customers’ demands for these products could lead to decreased sales and harm our reputation and result in the loss of customers, which would have a material adverse effect on our business operations and financial condition and the value of your investment.

Failure to attract, retain, and motivate skilled personnel may delay our commercialization plans and research and development efforts.

Our commercial success depends on our continued ability to attract, retain, and motivate highly qualified management and scientific personnel. Competition for skilled and qualified personnel in the medical device industry is intense. If we lose the services of personnel with the necessary skills, including the members of our senior management team, it could significantly impede our commercialization and research and development objectives. Replacing key personnel and consultants may be difficult and may take an extended period of time because of the limited number of individuals in our industry with the breadth of skills and experience required to develop, gain regulatory approval of and commercialize products successfully.

Our international operations subject us to certain risks.

We intend to market our Z-Lig products initially in select European countries and in South Africa, including Denmark, United Kingdom, Netherlands, Belgium, Spain, Italy and Poland. We also have plans to expand our commercialization activities to other non-European countries that accept the CE Mark, such as Canada, Turkey, Saudi Arabia, Australia and Korea. We will also pursue various clinical and pre-clinical activities in the United States and Europe. Our international operations will subject us to rules, regulations and customs of multiple jurisdictions, and compliance with these rules and regulations is costly and exposes us to penalties for non-compliance. Other laws and regulations that can significantly impact us include various anti-bribery laws, including the U.S. Foreign Corrupt Practices Act and anti-boycott laws, as well as export controls laws. Any failure to comply with applicable legal and regulatory obligations could impact us in a variety of ways that include, but are not limited to, significant criminal, civil and administrative penalties, denial of export privileges, seizure of shipments and restrictions on certain business activities. Also, the failure to comply with applicable legal and regulatory obligations could result in the disruption of our sales activities.

Our international operations expose us to additional risks, including:

| | · | difficulties in enforcing or defending intellectual property rights; |

| | · | pricing pressure that we may experience internationally; |

| | · | third-party reimbursement policies that may require some of the patients who receive our products to directly absorb medical costs or that may necessitate the reduction of the selling prices of our products; |

| | · | competitive disadvantage to competition with established business and customer relationships; |

| | · | the imposition of additional U.S. and foreign governmental controls or regulations; changes in duties and tariffs, license obligations and other non-tariff barriers to trade; |

| | · | foreign currency exchange rate fluctuations; |

| | · | difficulties in communicating with our employees, partners and collaborators, and maintaining consistency with our internal guidelines; |

| | · | difficulties in enforcing agreements and collecting receivables through certain foreign legal systems; and |

| | · | difficulties in establishing and maintaining an effective internal control system to ensure timely and accurate financial reporting. |

If we experience any of these risks, our sales in international countries may be harmed and our results of operations would suffer.

We may face product liability claims that could result in costly litigation and significant liabilities.

Manufacturing and marketing of our products, and clinical testing of our products under development, may expose us to product liability and other tort claims. Although we have, and intend to maintain, liability insurance, the coverage limits of our insurance policies may not be adequate and one or more successful claims brought against us may have a material adverse effect on our business and results of operations. Additionally, product liability claims could negatively affect our reputation, product sales, and our ability to obtain and maintain regulatory approval for our products.

We have identified material weaknesses in our internal control over financial reporting and may identify additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls.

Effective internal controls are necessary for us to provide reliable financial reports and prevent fraud. If we fail to maintain an effective system of internal controls, we might not be able to report our financial results accurately or prevent fraud; and in that case, our stockholders could lose confidence in our financial reporting, which would harm our business and could negatively impact the price of our stock. We have limited accounting personnel and other resources with which to address our internal controls and procedures. During the course of preparing for this offering, we determined that as of September 30, 2014 and through the date of this filing, we had a material weakness due to the lack of accounting personnel with sufficient experience with United States generally accepted accounting principles to address the accounting for complex debt and equity transactions. In addition,we have identified a material weakness due to the lack of segregation of duties in accounting personnel so that all journal entries and account reconciliations are reviewed by someone other than the preparer, heightening the risk of error or fraud.

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. We plan to remediate the material weaknesses primarily by implementing additional review procedures within the finance department and hiring additional personnel with the requisite accounting and financial reporting experience to enhance our internal computation and review processes. We cannot assure you that the measures we have taken to date, or any measures we may take in the future, will be sufficient to remediate the material weakness in our internal control over financial reporting or to avoid potential future material weaknesses. Even if we conclude that our internal control over financial reporting provides reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles, because of its inherent limitations, internal control over financial reporting may not prevent or detect fraud or misstatements. Failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our results of operations or cause us to fail to meet our future reporting obligations.

Our reporting obligations as a public company will place a significant strain on our management, operational and financial resources and systems for the foreseeable future. If we fail to timely achieve and maintain the adequacy of our internal control over financial reporting, we may not be able to produce reliable financial reports or help prevent fraud. Our failure to achieve and maintain effective internal control over financial reporting could prevent us from filing our periodic reports on a timely basis which could result in the loss of investor confidence in the reliability of our financial statements, harm our business, negatively impact the trading price of our common stock and cause our common stock to be delisted from NASDAQ.

The requirements of being a public company may strain our resources and divert management’s attention.

As a public company, we will be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act, the continued listing requirements of The NASDAQ Capital Market and other applicable securities rules and regulations. Despite recent reforms made possible by the JOBS Act, compliance with these rules and regulations will nonetheless increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company.” The Exchange Act requires, among other things, that we file annual, quarterly, and current reports with respect to our business and operating results.

As a result of disclosure of information in this Offering Circular and in filings required of a public company, our business and financial condition will become more visible, which we believe may result in threatened or actual litigation, including by competitors and other third parties. If such claims are successful, our business and operating results could be harmed, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and adversely affect our business, brand and reputation and results of operations.

We also expect that being a public company and these new rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our Board of Directors, particularly to serve on our audit committee and Compensation Committee, and qualified executive officers.

We are an “emerging growth company,” and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an emerging growth company for up to five years, although circumstances could cause us to lose that status earlier, including if the market value of our common stock held by non-affiliates exceeds $700 million as of any March 31 before that time, in which case, we would no longer be an emerging growth company as of the following September 30. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Risks Relating to Our Intellectual Property

If we are unable to protect our intellectual property, our business will be negatively affected.

The market for medical devices is subject to frequent litigation regarding patent and other intellectual property rights. It is possible that our patents or licenses may not withstand challenges made by others or protect our rights adequately.

Our success depends in large part on our ability to secure effective patent protection for our products and processes in Europe and the United States. We have filed and intend to continue to file patent applications to protect our proprietary technology. However, we face the risks that:

| | · | we may fail to secure necessary patents prior to or after obtaining regulatory clearances, thereby permitting competitors to market competing products; and |

| | · | our already-granted patents may be re-examined, invalidated or not extended. |

We also own trade secrets and confidential information that we try to protect by entering into confidentiality agreements with our employees and other parties. However, the confidentiality agreements may not be honored or, if breached, we may not have sufficient remedies to protect our confidential information. Further, our competitors may independently learn our trade secrets or develop similar or superior technologies. To the extent that our consultants, key employees

or others apply technological information to our projects that they develop independently or others develop, disputes may arise regarding the ownership of proprietary rights to such information, and such disputes may not be resolved in our favor. If we are unable to protect our intellectual property adequately, our business and commercial prospects will suffer.

Because it is difficult and costly to protect our proprietary rights, and third parties have filed patent applications that are similar to ours, we cannot ensure the proprietary protection of our technologies and products.

Our commercial success will depend in part on obtaining patent protection of our technology and successfully defending any of our patents that may be challenged. The patent positions of medical device companies can be highly uncertain and can involve complex legal and factual questions, and we cannot predict the breadth of claims allowed in patents we own or license.

We are a party to certain license agreements that give us rights under specified patents and patent applications, including a license agreement with the University of Missouri. Our current licenses, and our future licenses frequently will, contain performance obligations. If we fail to meet those obligations, the licenses could be terminated. If we are unable to continue to license these technologies on commercially reasonable terms, or at all, we may be forced to delay or terminate our product development and research activities.

We are unable to exercise the same degree of control over intellectual property that we license from third parties as we exercise over our internally developed intellectual property. We do not control the prosecution of certain of the patent applications that we license from third parties; therefore, the patent applications may not be prosecuted as we desire or in a timely manner.

The degree of future protection for our proprietary rights is uncertain, and we cannot ensure that:

| | · | we or our licensors will be the first to file patent applications for these inventions; |

| | · | the patents of others will not have an adverse effect on our ability to do business; |

| | · | others will not independently develop similar or alternative technologies or reverse engineer any of our products, processes or technologies; |

| | · | any of our pending patent applications will result in issued patents; |

| | · | any patents issued or licensed to us or our collaborators or strategic partners will provide a basis for commercially viable products or will provide us with any competitive advantages; |

| | · | any patents issued or licensed to us will not be challenged and invalidated by third parties; or |

| | · | we will develop additional products, processes or technologies that are patentable. |

Others have filed and in the future are likely to file patent applications that are similar to ours. The costs of litigating any infringement claim could be substantial. Moreover, we cannot predict whether we, our collaborators, or strategic partners would prevail in any actions. In addition, if the relevant patent claims were upheld as valid and enforceable and our products or processes

were found to infringe the patent or patents, we could be prevented from making, using, or selling the relevant product or process unless we could obtain a license. We can give no assurance that we will be able to obtain such license on commercially reasonable terms, or at all. Negotiation of licensing agreements in the biotechnology and life science industries can be intense and difficult, and we may not be able to negotiate terms with respect to royalty rates and milestone fees that are equivalent to or more favorable than what we have previously negotiated under our existing license agreements. If we cannot obtain a license agreement, we would be forced to design around the relevant patent claims, and there is no assurance that we can do so in a cost effective manner, or at all. There may be significant litigation in our industry regarding patent and other intellectual property rights, which could subject us to litigation. If we become involved in litigation, it could consume a substantial portion of our managerial and financial resources.

We rely on trade secrets to protect technology where we believe patent protection is not appropriate or obtainable. Trade secrets, however, are difficult to protect. While we require employees, and consultants to enter into confidentiality agreements, we may not be able to adequately protect our trade secrets or other proprietary information or enforce these confidentiality agreements.

We may infringe the intellectual property rights of others, which may prevent or delay our product development efforts.

Our success will depend in part on our ability to operate without infringing the proprietary rights of third parties. We cannot guarantee that our products, or manufacture or use of our product candidates, will not infringe third-party patents. Furthermore, a third party may claim that we are using inventions covered by the third party’s patent rights and may go to court to stop us from engaging in our normal operations and activities, including making or selling our product candidates. These lawsuits are costly and could affect our results of operations and divert the attention of managerial and scientific personnel. Some of these third parties may be better capitalized and have more resources than us. There is a risk that a court would decide that we are infringing the third party’s patents and would order us to stop the activities covered by the patents. In that event, we may not have a viable way around the patent and may need to halt commercialization of the relevant product candidate. In addition, there is a risk that a court will order us to pay the other party damages for having violated the other party’s patents. In addition, we may be obligated to indemnify our licensors and collaborators against certain intellectual property infringement claims brought by third parties, which could require us to expend additional resources. The pharmaceutical and biotechnology industries have produced a proliferation of patents, and it is not always clear to industry participants, including us, which patents cover various types of products or methods of use. The coverage of patents is subject to interpretation by the courts, and the interpretation is not always uniform.

Patent litigation is costly and time consuming, even in cases where the claims against us are without merit. We may not have sufficient resources to bring these actions to a successful conclusion. In addition, if we do not obtain a license, develop or obtain non-infringing technology, fail to defend an infringement action successfully or have infringed patents declared invalid, we may incur substantial monetary damages, encounter significant delays in bringing our product candidates to market and be precluded from manufacturing or selling our product candidates.

International patent protection is particularly uncertain, and if we are involved in opposition proceedings in foreign countries, we may have to expend substantial sums and management resources.

The laws of some foreign countries may not protect our intellectual property rights to the same extent as the laws of the United States. For example, certain countries do not grant patent claims that are directed to the treatment of humans. We may participate in opposition

proceedings to determine the validity of our foreign patents or our competitors’ foreign patents, which could result in substantial costs and diversion of our efforts.

The medical device industry is characterized by extensive patent litigation, and we could become subject to litigation that could be costly, result in the diversion of management’s attention, and harm our business and financial condition.

Our success depends in part on not infringing the patents or violating the other proprietary rights of others. Significant litigation regarding patent rights occurs in the medical industry, including among companies focused on regenerative medicine. It is possible that U.S. and foreign patents and pending patent applications controlled by third parties may be alleged to cover our Z-Process. Our competitors in Europe, the United States and abroad, many of which have substantially greater resources and have made substantial investments in patent portfolios and competing technologies, may have applied for or obtained or may in the future apply for and obtain, patents that will prevent, limit or otherwise interfere with our ability to make, use and sell our products. At any given time, we may be involved as either a plaintiff or a defendant in a number of patent infringement actions, the outcomes of which may not be known for prolonged periods of time.

The large number of patents, the rapid rate of new patent applications and issuances, the complexities of the technologies involved and the uncertainty of litigation significantly increase the risks related to any patent litigation. Any potential intellectual property litigation also could force us to do one or more of the following:

| | · | stop selling, making, or using products that use the disputed intellectual property; |

| | · | obtain a license from the intellectual property owner to continue selling, making, licensing, or using products, which license may require substantial royalty payments and may not be available on reasonable terms, or at all; |

| | · | incur significant legal expenses; |

| | · | pay substantial damages or royalties to the party whose intellectual property rights we may be found to be infringing; |

| | · | pay the attorney fees and costs of litigation to the party whose intellectual property rights we may be found to be infringing; or |

| | · | redesign those products that contain the allegedly infringing intellectual property, which could be costly, disruptive and/or infeasible. |

If any of the foregoing occurs, we may have to withdraw existing products from the market or may be unable to commercialize one or more of our products, all of which could have a material adverse effect on our business, results of operations and financial condition. Any litigation or claim against us, even those without merit, may cause us to incur substantial costs, and could place a significant strain on our financial resources, divert the attention of management from our core business and harm our reputation. Further, as the number of participants in the regenerative tissue industry grows, the possibility of intellectual property infringement claims against us increases.

Risks Related to Our Industry

We are in a highly competitive market segment, and if our competitors are better able to develop and market products that are safer, more effective, less costly, easier to use or otherwise superior than any products that we may develop, our business will be adversely impacted.

The medical device industry is highly competitive and subject to technological change. Our success depends, in part, upon our ability to maintain a competitive position in the development of technologies and products for use in the ACL knee reconstruction graft and other orthopaedic markets. Any product we develop that achieves regulatory clearance or approval will have to compete for market acceptance and market share. We believe that the primary competitive factors in ACL replacement graft markets are clinical effectiveness, product safety, reliability and durability, and eligible patient populations, physician experience and comfort with use of a particular device, ease of use, product support and service, sales force experience and relationships and price. We face significant competition in the United States and internationally, and we expect the intensity of competition will increase over time. We compete with companies that provide allograft and traditional xenograft solutions for orthopaedic surgical procedures. Many of the companies developing or marketing competing products enjoy several advantages to us, including:

| | · | greater financial and human resources for product development, sales and marketing; |

| | · | greater name recognition; |

| | · | long established relationships with physicians and hospitals; |

| | · | longer-term clinical trial data due to earlier regulatory approval; |

| | · | the ability to offer rebates or bundle multiple product offerings to offer greater discounts or incentives; and |

| | · | more established sales and marketing programs and distribution networks; and |

Our competitors may develop and patent processes or products competitive with us, obtain regulatory clearance or approvals for competing products more rapidly than us or develop more effective or less expensive products or technologies that render our technology or products obsolete or less competitive. We also face fierce competition in recruiting and retaining qualified sales, scientific, and management personnel, establishing clinical trial sites and enrolling patients in clinical studies. Our inability to successfully compete with existing and future market competitors will have a material adverse effect on our business operations and financial condition and the value of your investment.

Our business is subject to extensive governmental regulation that could make it more expensive and time consuming for us to introduce new or improved products.

Our products must comply with regulatory requirements imposed by various regulatory agencies. These requirements involve lengthy and detailed laboratory and clinical testing procedures, sampling activities, an extensive agency review process, and other costly and time-consuming procedures. It often takes several years to satisfy these requirements, depending on the complexity and novelty of the product. We also are subject to numerous additional licensing

and regulatory requirements relating to safe working conditions, manufacturing practices, environmental protection, fire hazard control, and disposal of hazardous or potentially hazardous substances. Some of the most important requirements we face include:

| | · | European Union CE mark requirements; |

| | · | Medical Device Quality Management System Requirements (ISO 13485:2003); and |

| | · | Occupational Safety and Health Administration requirements. |

Government regulation may impede our ability to conduct clinical studies and to manufacture our existing and future products. Government regulation also could delay our marketing of new products for a considerable period of time and impose costly procedures on our activities. The regulatory agencies may not approve any of our future products on a timely basis, if at all. Any delay in obtaining, or failure to obtain, such approvals could negatively impact our marketing of any future products and reduce our product revenues.

Our products remain subject to strict regulatory controls on manufacturing, marketing and use. We may be forced to modify or recall a product after release in response to regulatory action or unanticipated difficulties encountered in general use. Any such action could have a material effect on the reputation of our products and on our business and financial position.

Further, regulations may change, and any additional regulation could limit or restrict our ability to use any of our technologies, which could harm our business. We could also be subject to new international, federal, state or local regulations that could affect our research and development programs and harm our business in unforeseen ways. If this happens, we may have to incur significant costs to comply with such laws and regulations, which will harm our results of operations.

Risks Related to Our Common Stock and Corporate Structure

CrossCart LLC controls all aspects of our business.

CrossCart LLC (“CrossCart”) is our largest and controlling stockholder and currently beneficially owns approximately 77.7% of our outstanding shares of common stock on a fully-diluted basis assuming the conversion of all of our outstanding preferred stock and convertible notes. Following the completion of this offering, CrossCart will beneficially own approximately 48.2% of our outstanding shares of common stock. In addition, Dr. Kevin R. Stone, Chairman of our Board of Directors, is the controlling member and manager of CrossCart. In addition, CrossCart is our most significant creditor and historically we have depended on the funding of CrossCart and Dr. Stone to maintain our operations. As a result, CrossCart and Dr. Stone are and will be able to exercise significant control over our business operations and on all matters requiring stockholders’ approval, including the election of directors, approval of significant corporate transactions and the definition of rights and privileges of all securities. Due to CrossCart’s and Dr. Stone’s controlling position, we may take actions with respect to our business that may conflict with the desire of other stockholders.

An active trading market for our common stock may not develop and you may not be able to resell your shares at or above the initial offering price.

Prior to this offering, there has been no public market for shares of our common stock. In the absence of an active trading market for our common stock, investors may not be able to sell their common stock at or above the initial public offering price or at the time that they would like to sell. In addition, we intend to submit a listing application for our common stock to be listed on a national securities exchange, including the NASDAQ Capital Market (“NASDAQ”), and there is no guarantee that we can meet the listing standards or that such listing application will be accepted. Even if such application is accepted and our common stock is listed on NASDAQ or other exchanges, an active trading market for our common stock may never develop, which will adversely impact your ability to sell our shares. If shares of common stock are not listed on NASDAQ or another national securities exchange, we anticipate that our common stock will be quoted at over-the-counter, or OTC markets, following the completion of this offering. There is no assurance that an active trading market for our common stock will develop on the OTC market.

Our stock price may be influenced by public perception of alternative tissue replacement and government regulation of such technology.

External events in the field of ligament reconstruction or the use of animal-derived tissue in human transplantation may have a significant negative impact on the public perception and stock price of certain companies involved in this kind of work. Potential adverse events in this field may occur in the future that could result in increased governmental regulation of our Z-Lig device. These external events may have a negative impact on public perceptions of our business, which could cause our stock price to decline.

We do not intend to pay dividends on our common stock.

We have never paid dividends on our common stock and we currently intend to retain any future earnings and do not expect to pay any cash dividends on our common stock in the foreseeable future. The declaration and payment of all future dividends, if any, will be at the sole discretion of our Board of Directors, which retains the right to change our dividend policy at any time, and may be limited by our debt arrangements in place from time to time. Consequently, stockholders must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their investment.

New stockholders will incur substantial and immediate dilution as a result of this offering.

The initial public offering price is substantially higher than the book value per share of our outstanding common stock. As a result, investors purchasing common stock in this offering will incur substantial and immediate dilution. At the assumed initial public offering price of $8.00 per share, the midpoint of the price range set forth on the cover page of this Offering Circular, purchasers in this offering will experience immediate and substantial dilution of approximately $5.41 per share, representing the difference between our historical net tangible book value per share after giving effect to this offering and the initial public offering price. In addition, we have issued options to acquire common stock at prices significantly below the public offering price. To the extent such options are ultimately exercised, there will be further dilution to investors in this offering.

Anti-takeover provisions in our certificate of incorporation and Delaware law could make an acquisition of the Company more difficult and could prevent attempts by our stockholders to remove or replace current management.

Provisions of Delaware law and our amended and restated certificate of incorporation and amended and restated bylaws, which will be effective upon the completion of this offering, may discourage, delay or prevent a merger, acquisition or other change in control that stockholders may consider favorable, including transactions in which stockholders might otherwise receive a premium for their shares. These provisions may also prevent or delay attempts by stockholders to replace or remove our current management or members of our Board of Directors. These provisions include:

| | · | advance notice requirements for stockholder proposals and nominations; |

| | · | the inability of stockholders to act by written consent or to call special meetings; |

| | · | the ability of our Board of Directors to make, alter or repeal our amended and restated bylaws: and |

| | · | the authority of our Board of Directors to issue preferred stock with such terms as our Board of Directors may determine. |

The affirmative vote of the holders of at least 75% of our shares of capital stock entitled to vote, and not less than 75% of the outstanding shares of each class entitled to vote thereon as a class, is generally required to amend or repeal the above provisions that are contained in our amended and restated certificate of incorporation. In addition, absent approval of our Board of Directors, our amended and restated bylaws may only be amended or repealed by the affirmative vote of the holders of at least 75% of our shares of capital stock entitled to vote.

In addition, upon the completion of this offering, we will be subject to the provisions of Section 203 of the Delaware General Corporation Law, which limits business combination transactions with stockholders of 15% or more of our outstanding voting stock that our Board of Directors has not approved. These provisions and other similar provisions make it more difficult for stockholders or potential acquirers to acquire us without negotiation. These provisions may apply even if some stockholders may consider the transaction beneficial to them.

As a result, these provisions could limit the price that investors are willing to pay in the future for shares of our common stock. These provisions might also discourage a potential acquisition proposal or tender offer, even if the acquisition proposal or tender offer is at a premium over the then-current market price for our common stock.

Dilution

If you invest in our common stock in this offering, your interest will be diluted to the extent of the difference between the public offering price per share of our common stock and the pro forma as adjusted net tangible book value per share of our common stock immediately after this offering.

Our historical net tangible book value as of June 30, 2015 was ($28,398,077), or ($127.71) per share of our common stock. Historical net tangible book value per share represents our total tangible assets less total liabilities divided by the number of shares of our common stock outstanding. Our pro forma net tangible book value (deficit) as of June 30, 2015 was approximately ($1,388,463), or ($0.35) per share of common stock. Pro forma tangible book value per share represents our total tangible assets less total liabilities divided by the number of shares of common stock outstanding as of June 30, 2015 after giving effect to (i) the automatic conversion of all of the outstanding shares of our convertible preferred stock into an aggregate of 2,038,314 shares of our common stock upon the completion of this offering, including 448,220 shares of common stock to be issued as cumulative dividends accrued under such preferred stock and (ii) the conversion of approximately an aggregate of $9,838,058 in outstanding principal and accrued interest on our convertible promissory notes into shares of our common stock, upon the completion of this offering, at an average conversion price of $5.70 per share, assuming that the offering is completed on June 30, 2015. Pro forma as adjusted net tangible book value per share gives further effect to the issuance of 2,500,000 shares of our common stock at an assumed initial public offering price of $8.00 per share, the midpoint of the price range set forth on the cover page of this Offering Circular, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Our pro forma, as

adjusted net tangible book value as of June 30, 2015 would have been $16,773,537, or $2.59 per share. This represents an immediate increase in pro forma net tangible book value of $2.94 per share to existing stockholders and an immediate dilution in pro forma net tangible book value of $5.41 per share to investors purchasing common stock in this offering.

The following table illustrates this per share dilution:

| Assumed initial public offering price per share | | | | | | $ | 8.00 | |

| Historical net tangible book value per share as of June 30, 2015 | | $ | (127.71 | ) | | | | |

| Increase attributable to the conversion of outstanding convertible preferred stock and convertible promissory notes | | | 127.36 | | | | | |

| Pro forma net tangible book value per share as of June 30, 2015 | | | (0.35 | ) | | | | |

| Increase in net tangible book value per share | | | 2.94 | | | | | |

| | | | | | | | | |

| Pro forma, as adjusted net tangible book value per share after this offering | | $ | 2.59 | | | | | |

| | | | | | | | | |

| Dilution per share to investors in this offering | | | | | | $ | 5.41 | |

The following table summarizes on an as adjusted basis as of June 30, 2015, the difference between the number of shares of common stock purchased from us, the total consideration paid and the average price per share paid by existing stockholders and by new investors, assuming an initial public offering price of $8.00 per share, the midpoint of the price range set forth on the cover page of this Offering Circular, and before deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us:

| | | Shares Purchased | | | Total Consideration (1) | | | Average

Price per | |

| | | Number | | | Percent | | | Amount | | | Percent | | | Share | |

| Existing stockholders | | | 3,965,396 | | | | 70.0 | % | | $ | 41,672,495 | | | | 67.6 | % | | $ | 10.51 | |

| New investors | | | 2,500,000 | | | | 30.0 | | | | 20,000,000 | | | | 32.4 | % | | | 8.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | | 6,465,396 | | | | 100 | % | | $ | | | | | 100 | % | | $ | 9.54 | |

| (1) | A $1.00 increase (decrease) in the assumed initial public offering price of $8.00 per share, the midpoint of the price range set forth on the cover of this Offering Circular, would increase (decrease) the total consideration paid to us by new investors and total consideration paid to us by all stockholders by $2,362,500, assuming that the number of shares offered by us, as set forth on the cover page of this Offering Circular, remains the same and after deducting estimated placement agent fees and estimated offering expenses payable by us. An increase (decrease) of 1.0 million shares in the number of shares offered by us would increase (decrease) the total consideration paid |

to us by new investors and total consideration paid to us by all stockholders by $7,560,000, assuming the assumed initial public offering price of $8.00 per share remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

As of June 30, 2015, options to purchase 350,421 shares of common stock were outstanding at a weighted average exercise price of $1.47 per share and warrants to purchase 659,937 shares of common stock and preferred stock were outstanding at a weighted average exercise price of $1.47 per share. Assuming all of our outstanding options and warrants are exercised, new investors will own approximately 13.5% of our outstanding shares while contributing approximately 8.1% of the total amount paid to fund our company.

Underwriting

General

We and WR Hambrecht + Co, LLC (the underwriter) intend to enter into an underwriting agreement with respect to the shares being offered. Subject to certain conditions, the underwriter has agreed to use its best efforts to procure potential purchasers for the shares of our common stock offered hereby. This offering is being undertaken on a best efforts only basis. The underwriter is not required to take or pay for any specific number or dollar amount of our common stock.

The shares are being offered on an all or none basis. Investor funds will be deposited into an escrow account for the benefit of investors set up by American Stock Transfer and Trust Company (“AST”) at J.P. Morgan Chase Bank, N.A. The offering will not be completed unless we sell the number of shares specified on the cover page of this Offering Circular. All investor funds received prior to the closing will be deposited into the escrow account until closing. The escrow account will be opened on the date of this Offering Circular and will remain open until the closing date. All funds received into the escrow account after the pricing of the offering will be held in a non-interest bearing account in accordance with Rule 15c2-4 under the Exchange Act. The escrow account will not be opened until the date of this Offering Circular. All funds must be transmitted directly by wire to the specified bank account at J.P. Morgan Chase Bank, N.A. per the instructions disseminated at pricing by the underwriter. AST will not accept or handle any funds. On the closing date, the escrow agent will notify the underwriter whether the full amount necessary to purchase the shares to be sold in this offering has been received. If, on the closing date, investor funds are not received in respect of the full amount of shares to be sold in this offering, then all investor funds that were deposited into the escrow account will be returned promptly to investors, and the offering will terminate. The following table shows the per share and total underwriting discounts and commissions to be paid to the underwriter.

| | | Per

Share | | | Total | |