SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August, 2021

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

| |

MARKETLETTER 2Q21 |

INTRODUCTION

Rio de Janeiro, August 11, 2021

A Eletrobras (Centrais Elétricas Brasileiras S.A.)

[B3: ELET3 and ELET6 – NYSE: EBR e EBR-B – LATIBEX: XELTO and XELTB]

Eletrobras, the largest company in the electric energy sector in Latin America, active in the generation, transmission and commercialization segment, controlling 5 operating subsidiaries and a holding company – Eletropar –, a research center – Cepel, holding 50% of the share capital of Itaipu Binacional and, on June 30, 2021, with direct and indirect interest in 83 Special Purpose Entities, announces, on this date, its results for the period referring to the second quarter of 2021.

2nd QUARTER OF 2021

Eletrobras presented, in the second quarter of 2021 (2Q21), a net profit of R$ 2,530 million, higher than the profit of R$ 469 million obtained in the second quarter of 2020 (2Q20). The 2Q21 profit was positively impacted by transmission results, as a result of the Periodic Tariff Review with effect from July 2020 and by the improvement in generation results, mainly due to the increase in volume and prices practiced in bilateral agreements of ACL (free market) and higher income in the short-term market arising from the settlement at the CCEE due to the increase in the price of the PLD (+ R$517 million), and negatively impacted due to provisions for contingencies of R$ 1,099 million, especially R$ 600 million related to the compulsory loan.

Net Operating Revenue went from R$ 5,337 million in 2Q20 to R$ 7,959 million in 2Q21, a growth of 49%, influenced by the effect on transmission revenue from the tariff review, the higher revenue from settlement with the CCEE, mentioned above. Ebtida IFRS, in the amount of R$ 1,992 million in 2Q20, increased to an amount of R$ 3,222 million in 2Q21, impacted by the aforementioned effect on revenue. Recurring Net Operating Revenue grew by 49%, from R$5,326 million in 2Q20 to R$ 7,943 million in 2Q21. Recurring EBITDA increased by 116%, from R$2,219 million in 2Q20 to R$ 4,794 million in 2Q21.

With the application of Circular Letter CVM/SNC/SEP 04/2020, issued on December 1, 2020, Eletrobras made, since 4Q20, retrospective adjustments in the measurement of its: (i) transmission assets - Existing Basic Systems Network (RBSE), until then classified as financial assets, starting to treat them as contract assets under the terms of CPC 47/IFRS 15 - Revenue from Contracts with Customers; and (ii) change in the remuneration rate of its other transmission assets considering the new criteria established in the guidance issued by CVM. Retrospective adjustments (2Q20) were made to maintain the comparative basis. For more information, see Note 4.4 to the 2Q21 Financial Statements.

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 3 |

| |

MARKETLETTER 2Q21 |

OTHER 2Q21 HIGHLIGHTS

| Cash of R$20 billion, Net Debt of R$ 16.9 billion and LTM Recurring EBITDA of R$ 17.8 billion, forming a Net Debt/ LTM Recurring EBITDA indicator of 1.0x. |

| Negative impact of the net exchange variation of R$ 960 million in 2Q21. |

| Reversal PCLD (provision for doubtful accounts) Eletronorte – Roraima of R$ 513 million. |

| TABLE 01: MAIN INDICATORS (R$ MILLION) |

| 2021 | 2020 | % | 2Q21 | 2Q20 | % | |

| 96.7 | 100.2 | -3.5% | Energy Sold - Generation GWh (1) | 45.3 | 46.7 | -3.0% |

| 19,390 | 15,878 | 22% | Gross Revenue | 9,570 | 6,757 | 42% |

| 19,373 | 15,859 | 22% | Recurring Gross Revenue (2) | 9,553 | 6,747 | 42% |

| 16,168 | 12,941 | 25% | Net operating revenue | 7,959 | 5,337 | 49% |

| 16,151 | 12,921 | 25% | Recurring Net Operating Revenue (3) | 7,943 | 5,326 | 49% |

| 7,134 | 5,455 | 31% | EBITDA | 3,276 | 1,992 | 64% |

| 9,846 | 6,037 | 63% | Recurring EBITDA (4) | 4,794 | 2,219 | 116% |

| 44% | 42% | 1.97 | Ebitda Margin | 41% | 37% | 3.84 |

| 61% | 47% | 14.24 | Recurring Ebitda Margin | 60% | 42% | 18.68 |

| 46,284 | 49,481 | -6% | Gross debt without third party RGR | 46,284 | 49,481 | -6% |

| 16,928 | 21,047 | -20% | Recurring Net Debt | 16,928 | 21,047 | -20% |

| 1,0 | 1,6 | -65% | Recurring Net Debt / Recurring LTM EBITDA | 1,0 | 1,6 | -65% |

| 4,139 | 1,697 | 144% | Net Profit | 2,530 | 469 | 439% |

| 1,502 | 709 | 112% | Investments | 983 | 380 | 159% |

| 12,182 | 12,552 | -3% | Employees | 12,182 | 12,552 | -3% |

| (1) | Does not consider the energy allocated to quotas, from plants renewed by Law 12,783/2013; (2), (3) and (4) Adjustments detailed in the consolidated analysis presented below. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 4 |

| |

MARKETLETTER 2Q21 |

1 ANALYSIS OF THE

CONSOLIDATED RESULT(R$ MILLION)

| TABLE 02: CONSOLIDATED RESULTS |

| 2021 | 2020 | Financial Statements | 2Q21 | 2Q20 |

| 11,562 | 10,797 | Generation Revenue | 5,716 | 4,848 |

| 7,477 | 4,801 | Transmission Revenue | 3,675 | 1,759 |

| 352 | 280 | Others Revenue | 178 | 151 |

| 19,390 | 15,878 | Gross Revenue | 9,570 | 6,757 |

| -3,223 | -2,938 | Deductions from Revenue | -1,610 | -1,420 |

| 16,168 | 12,941 | Net Operating Revenue | 7,959 | 5,337 |

| -3,563 | -3,190 | Operational costs | -1,922 | -1,439 |

| -4,218 | -3,821 | Personnel, Material, Services and Others | -2,184 | -1,676 |

| -905 | -932 | Depreciation and amortization | -447 | -463 |

| -2,039 | -1,006 | Operating Provisions | -934 | -614 |

| 5,442 | 3,992 | 2,472 | 1,145 | |

| 787 | 506 | Shareholding | 357 | 384 |

| 0 | 25 | Others Revenues and Expenses | 0 | 0 |

| 6,229 | 4,523 | 2,829 | 1,529 | |

| -62 | -1,474 | Financial Result | 521 | -302 |

| 6,167 | 3,049 | Income before tax | 3,350 | 1,227 |

| -2,028 | -1,352 | Income tax and social contribution | -820 | -758 |

| 4,139 | 1,697 | NET INCOME FOR THE PERIOD | 2,530 | 469 |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 5 |

| |

MARKETLETTER 2Q21 |

| TABLE 03: RECURRING CONSOLIDATED RESULT |

| 2021 | 2020 | Recurring Financial Statement * | 2Q21 | 2Q20 |

| 11,537 | 10,778 | Generation Revenue Recurring | 5,700 | 4,837 |

| 7,477 | 4,801 | Transmission Revenue Recurring | 3,675 | 1,759 |

| 360 | 280 | Others Revenue Recurring | 178 | 151 |

| 19,373 | 15,859 | Gross Revenue Recurring | 9,553 | 6,747 |

| -3,223 | -2,938 | Deductions from Revenue Recurrent | -1,610 | -1,420 |

| 16,151 | 12,921 | Net Operating Revenue Recurring | 7,943 | 5,326 |

| -3,525 | -3,171 | Operational costs Recurring | -1,902 | -1,428 |

| -3,844 | -3,623 | Personnel, Material, Services and Others Recurring | -2,008 | -1,662 |

| -905 | -932 | Depreciation and amortization Recurring | -447 | -463 |

| 277 | -596 | Operating Provisions Recurring | 404 | -400 |

| 8,154 | 4,599 | 3,990 | 1,373 | |

| 787 | 506 | Shareholdings Recurring | 357 | 384 |

| 8,941 | 5,105 | 4,346 | 1,757 | |

| 292 | -1,256 | Financial Result Recurring | 739 | -356 |

| 9,233 | 3,849 | Income before tax Recurring | 5,085 | 1,401 |

| -1,786 | -1,352 | Income tax and social contribution Recurring | -578 | -758 |

| 7,448 | 2,497 | Net Income for the year Recurring | 4,507 | 643 |

* Non-recurring adjustments mentioned in the Highlights.

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 6 |

| |

MARKETLETTER 2Q21 |

1.1 MAIN VARIATIONS OF FINANCIAL STATEMENTS Highlights in the Analysis 2Q20 X 2Q21

OPERATING INCOME

| TABLE 04: GENERATION REVENUE |

| Operating Revenue - Generation | 2Q21 | 2Q20 | % | 2021 | 2020 | % |

| Generation Revenue | ||||||

| Energy supply to distribution companies | 3,195 | 3,171 | 1% | 6,817 | 7,174 | -5% |

| Supply | 809 | 659 | 23% | 1,528 | 1,332 | 15% |

| CCEE | 643 | 126 | 411% | 1,108 | 479 | 131% |

| Operation and Maintenance Revenue | 1,018 | 934 | 9% | 2,053 | 1,863 | 10% |

| Construction Revenue | 16 | 11 | 50% | 25 | 19 | 30% |

| Itaipu Transfer | 35 | -52 | -167% | 31 | -69 | -145% |

| Generation Revenue | 5,716 | 4,848 | 18% | 11,562 | 10,797 | 7% |

| Non-recurring events | ||||||

| (-) Construction Generation | -16 | -11 | 50% | -25 | -19 | 30% |

| Recurring Generation Revenue | 5,700 | 4,837 | 18% | 11,537 | 10,778 | 7% |

VARIATION ANALYSIS 2Q20X2Q21

ENERGY SUPPLY TO DISTRIBUTION COMPANIES

| • | At Eletronorte (+R$ 256 million): (i) 128% increase in revenue from sales to traders (2Q20 R$ 221 million X 2Q21 R$ 503 million), due to the 83% increase in sales price (2Q20 R$ 80.97/MWh X 2Q21 R$ 148.17/MWh) and the increase in the amount of energy sold (2Q20 1,249 MWmed X 2Q21 1,554 MWmed); (ii) in relation to the revenue foreseen in the ACR, there was a decrease of 95% (2Q20 R$ 28 million X 2Q21 R$ 1.5 million) due to the end, in Dec/20, of the products of the 18th Auction, which reduced the amount of energy sold by 95% (2Q20 73 MWmed X 2Q21 4MWmed) and the sale price by 5% (2Q20 R$ 175.00 X 2Q21 R$ 167.31). |

| • | At Amazonas GT (+R$ 124 million): (i) increase of R$71 million in revenue from PIE, due to an average increase of 15% as a result of the annual adjustment of Contract Prices linked to the IGPM of the Supply Portion of which 43 million refer to the supply portion and 28 million refer to fuel. (ii) Increase of R$ 32.5 million in revenue from own generation due to the reduction in the energy tariff of approximately 12%, based on the IPCA. (iii) an increase of R$3 million in revenue from UTE Coari, due to the 1% increase (206.5MW) in energy production, which reflected in the increase in the final cost of this operation in 2Q21; (iii) an increase of R$ 2.6 million in the UTEs in the Interior, highlighting the UTE Caapiranga and Anori whose CCVE contracts showed a greater variation than the others due to the increase in natural gas consumption caused by the expansion of generation with the installation of generator sets in these locations, in addition to the increase caused by the annual readjustment of prices through the IPCA index, which also applies to the other TPPs in the Interior; (iv) Increase of R$ 17 million referring to the registration of the 3rd installment of the CCEAR in May and the 1st and 2nd installment in June, these installments would be released in July, however due to the process of incorporation of Amazonas GT by Eletronorte they were registered in June. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 7 |

| |

MARKETLETTER 2Q21 |

| • | At CGT Eletrosul (+R$ 14 million): (i) increase of R$ 6.9 million in ACR revenue and R$ 6.4 million in ACL revenue. SPE Livramento accounted for an increase of R$0.9 million. ACR revenue increased by R$6.9 million and is due to: (i) a 4.1% price readjustment, which represented an increase of R$ 9.5 million; and, (ii) reduction in the quantity sold, from 436 MWm in 2Q20 to 432 MWm in 2Q21, reducing revenue by R$ 2.4 million. In ACL, the increase in revenue was R$6.4 million and is due to: (iii) a +12% variation in the average energy sale price, representing an increase of R$13.5 million in revenue; and, an average 17 MW reduction in energy sold, generating a decrease of R$7.1 million in revenues. |

| • | At Chesf (+R$ 7 million): (i) an increase of 19 average MW sold in 2Q21 compared to the same period of the previous year, due to: increase in the volume sold in annual contracts; the start of commercial operations at EOL Casa Nova A, resulting in an increase in revenue of approximately R$14 million; recording the revenue from the supply of the SPEs in the Pindaí Complex in the 2Q20 consolidated result in R$ 15 million. |

Partially offset by:

| • | At Eletronuclear (-R$ 318 million): (i) reduction of around R$ 75.4 million in the Fixed Revenue of the Angra 1 and 2 Plants by 8.1%, according to ANEEL Ratifying Resolution No. 2,821 of 12/15/ 2020, due to the non-performance of nuclear fuel expenses; (ii) R$31.3 million increase in reimbursement estimates for the calculation of negative energy deviation in the comparison between the quarters (R$27.5 million in 2Q20 against R$58.8 million in 2Q21); (iii) the net energy supply from the Angra 1 and 2 nuclear plants was 28.8% lower, being 3,538,527 MWh in 2Q20, compared to the net supply of 2,519,253 MWh in 2Q21, which represented a reduction of R$211.4 million due to: (a) scheduled shutdown for maintenance and exchange of nuclear fuel at the Angra 1 plant occurred between the dates of 04/17/2021 to 05/18/2021 (32 days) ; (b) scheduled shutdown for maintenance and exchange of nuclear fuel at the Angra 2 plant occurred between the dates of 06/06/2021 to 07/22/2021 (47 days), including 25 days in the reported quarter; (c) scheduled shutdown for maintenance and exchange of nuclear fuel at the Angra 2 plant between the dates of 06/22/2020 to 08/17/2020 (57 days) impacting only 9 days within the reported quarter. |

| • | In Furnas (-R$ 12 million): (i) lower amount of energy traded in the ACL (1,808 GWh in 2020 to 1,768 GWh in 2021, representing a decrease of R$ 3 million; (ii) dispatch from the Santa Cruz Plant in period carried out, as an emergency, outside the order of merit, resulting in a decrease in this item by R$ 28 million, because when dispatched outside the order of merit, part of the revenue is received by system service charges, which integrate the result of the MCP; In On the other hand, there was (iii) price adjustment of ACR contracts (3%, R$ 3 million); and (iv) a variation of R$ 16 million referring to Brasilventos' supply revenue, when comparing the two quarters, due to the The start-up of commercial operation of the generation complex occurred at the end of 2Q20, reflecting a lower amount of revenue in the period, while in 2Q21 the generation complex was fully operational. |

SUPPLY FOR END CONSUMERS

| • | At Eletronorte (+R$ 130 million): (i) Increase in Albras' sales in the amount of R$ 128 million due to the readjustment of the base price, in May/21, from R$ 134.77/MWh to R$ 177 .92/MWh. Albras' final sales price has a derivative component associated with the price of aluminum, which increased by 51% (2Q20 US$ 1,540 X 2Q21 US$ 2,333), Dollar, IGP-M, which increased by 32% (adjustment in May ), and sector charges. (ii) Additionally, there was an increase of R$ 3 million for other consumers, due to the price adjustment and seasonality of contracts. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 8 |

| |

MARKETLETTER 2Q21 |

| • | In Furnas (+R$ 13 million): The variation is mainly due to: (i) readjustment in unit prices of supply contracts, linked to UHE Itumbiara (Law 13,182) of approximately 4.5%; (ii) due to the variation in the ICMS levy (R$ 140 thousand), which is added to the accounting revenue. These variations occur according to tax actions and characteristics inherent to each customer and consumer unit. |

| • | In the subsidiary Chesf (+R$ 22 million): (i) increase of 62 average MW in the consumption of industrial customers achieved by Law 13182/2015 in 2Q21, compared to the same period of the previous year, influenced by the gradual resumption of activities in an industrial consumer in the state of Alagoas. |

CCEE

| • | At Eletronorte (+R$375 million): (i) 251% increase in the energy to be settled in the MCP (2Q20 91 MWmed X 2Q21 319 MWmed) at prices 200% higher (2Q20 R$40/MWh X 2Q21 R$120, 43/MWh), as a result of several factors, including: (i) 34% increase in the Physical Seasonal Guarantee in the period, 2,170MWmed in 2Q20 X 2,915MWmed in 2Q21; (ii) a 6% improvement in the average GSF (2Q20 1.0776 X 2Q21 1.1385). |

| • | At the holding (+R$62 million): sale in the CCEE short-term market, of energy originating from energy imports from Uruguay, on demand by the SIN. In the same period of 2020, there was no imported energy sold in the spot market by Eletrobras. |

| • | At Chesf (+R$ 43 million): The variation is mainly due to: (i) increase in the average PLD from R$ 75.47/MWh (2Q20) to R$ 229.44/MWh (2Q21) and from the GSF from 92.04% (2Q20) to 99.76% (2Q21), despite the increase in energy sold by about 82 average MW in the supply and supply accounts above, and, therefore, the lower energy surplus in relation to to the same period of 2020. |

| • | In Furnas (+R$31 million): (i) The variation is mainly due to the following reasons: (i) an increase of R$83 million arising from the booking of the Santa Cruz Plant in the MCP, which had higher generation in the period 2021, by emergency dispatch; On the other hand, (ii) despite the GSF variation showing an increase of approximately 8% (92% in 2020 and 100% in 2021), there was a greater negative exposure in the period, which together with the increase in the PLD (2020: R$ 75.47 / 2021: R$ 229.44), resulted in an impact of R$ 54 million. . |

| • | At CGT Eletrosul (+R$27 million): (i) increase of 204% in the PLD (from R$75 / MWh in 2Q20 to R$230 / MWh in 2Q21), corresponding to a positive variation of R$26 million; (iii) SPE Livramento was responsible for an increase of R$0.21 million in 2Q21; and, (iii) other variations caused by other effects of market accounting. |

Partially offset by:

| • | In the subsidiary Amazonas GT (-R$ 17 million): (i) in 2Q20, due to the greater dispatch controlled by the ONS, the UTE Mauá 03 plant had a revenue of approximately R$ 15.5 million, while in 2Q21, we had a greater exposure in the short-term market due to the unavailability of UTE Aparecida due to claims occurred in two Generating Units. |

OPERATION AND MAINTENANCE REVENUE - PLANTS RENEWED BY LAW 12.783/2013

| • | In subsidiary Chesf (+R$ 52 million): (i) annual readjustment of RAG of approximately 10%, pursuant to Ratifying Resolution 2746/2020 (cycle 2020-2021); offset by (ii) CFURH reduction (-11%) due to lower generation verified in 2Q21 compared to the same period in 2020, resulting in a revenue reduction of approximately R$ 4 million. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 9 |

| |

MARKETLETTER 2Q21 |

| • | In Furnas (+R$ 33 million): (i) annual readjustment of the RAG (approximately 11%) which reflects an increase of R$ 33 million, pursuant to Aneel Ratifying Resolution 2746/2020; (ii) entry of the Jaguari plant (Ex. CPFL) in Jan/21, temporarily operated by Furnas, representing an increase in revenue of R$ 3 million, without comparison in 2020. On the other hand, (iii) the variation in CFURH and, consequently, PIS/COFINS, in the sum of the period, account for the remainder of the difference (R$ -2 million). |

CONSTRUCTION REVENUE

| • | Higher level of investment made in 2Q21, but with no effect on results as it has an equivalent amount in construction expenses. |

Itaipu TRANSFER

| • | At the Holding (+R$ 87 million): (i) Tariff variation on which the monetary restatement is applied, calculated based on the American Commercial Price and Industrial goods price indices, levied on Itaipu's financial asset, which offset the levied exchange variation on said asset, recognized by interministerial ordinance 04/2018 of the MME and Ministry of Finance that determines the revenue of Itaipu. |

ANALYSIS OF VARIATION 2021X2020

| • | Revenue from the Power Generation segment grew by 7% in the 1st half of 2021, in line with the same period of the previous year. This growth was mainly influenced by the higher revenue at the CCEE, caused by the increase in pld and the import of energy from Uruguay by the holding, for sale, by order of the ONS, due to the low volume of reservoirs in Brazil, and by the growth in revenue of Operation and Maintenance Revenue, caused by the annual readjustment of the RAG. This revenue growth was partially offset by the reduction in supply revenue at the subsidiary Eletronuclear, especially in 2Q21, as explained above. |

| TABLE 05: TRANSMISSION REVENUE |

| Operating Transmission Revenue | 2Q21 | 2Q20 | % | 2021 | 2020 | % |

| Transmission Revenue | 3,675 | 1,759 | 109% | 7,477 | 4,801 | 56% |

| O&M Revenue - Renewed Lines | 924 | 577 | 60% | 1,962 | 1,419 | 38% |

| O&M Revenue - Regime Exploration | 413 | 257 | 61% | 717 | 504 | 42% |

| Construction Revenue | 203 | 112 | 82% | 322 | 265 | 22% |

| Contractual Revenue - Transmission | 2,136 | 813 | 163% | 4,476 | 2,614 | 71% |

| Recurring Transmission Operating Revenue | 3,675 | 1,759 | 109% | 7,477 | 4,801 | 56% |

ANALYSIS OF VARIATION 2Q20X2Q21

O&M REVENUE - RENEWED LINES LAW 12.783/13

| • | In subsidiary Chesf (+R$ 189 million): (i) effect of the tariff review of CC 061/2001, relating to the period from Jan/13 to Jan/18, with retroactive effect to 2018, considered in REH Aneel 2,725/20; (ii) annual readjustment of 1.88%; and (iii) reinforcements without previously established RAP and improvements included by Aneel for the 2020/2021 cycle totaling R$8.6 million. |

| • | In the subsidiary Furnas (+R$149 million): (i) increase due to the exchange of tariff cycles, which included the annual adjustment and also the tariff review, based on current regulations - Technical Note 119/2020-SGT/ANEEL - which details the readjustments of the RAPs of the Transmitters and the effects of the revision. The Tariff Revision represented about 18%, without considering the Adjustment Portion which for the cycle (20-21) was positive. The main variations in the effects above arise from the following monthly changes - (a) 2Q21 (Apr/21 = R$162.5 million; May/21 = R$162.9 million; Jun/21 = R$166.8 million) ; and (b) 2Q20 (Apr/20 = R$118.2 million; May/20 = R$116.4 million; Jun/20 = R$108.5 million). |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 10 |

| |

MARKETLETTER 2Q21 |

| • | In the subsidiary Eletronorte (+R$ 33 million): increase in the RAP approved for the 2020/2021 cycle (REH No. 2725/2020), which contributed to the increase in billed revenue (R$ 33.2 million), despite the increase of the Variable Portion (in R$10.4 million). |

Partially offset by:

| • | In the subsidiary CGT Eletrosul (-R$8 million: (i) reduction of approximately 53% of the O&M RAP, which will occur gradually in 1/5 per cycle, during the period 2018/19 to 2022/23, as stipulated by ANEEL, in the periodic tariff review process, highlighting the decrease in the RAP of the Basic Network of R$ 44 million in the period, partially offset by (ii) Increase in revenue of R$ 35 million resulting from various effects, with emphasis on the Apportionment of Anticipation of R$ 22 million, Calculation Adjustment Installments of R$9 million and additional new works totaling R$ 4 million. |

O&M REVENUE - EXPLORATION REGIME

| • | In the subsidiary Eletronorte (+R$ 69 million), mainly due to: (i) increase in the RAP approved for the 2020/2021 cycle (REH No. 2725/2020), which contributed to the increase in billed revenue (R$69 .3 million), even with the increase in the Variable Portion (by R$ 15 million). |

| • | In Furnas (+R$21 million): (i) increase due to the change in tariff cycles, based on current regulation - Technical Note 119/2020-SGT/ANEEL - which details the readjustments of the RAPs of the Transmitters. The main variations in the effects above arise from the following monthly changes - (a) 2Q21 (Apr/21 = R$13.5 million; May/21 = R$13.3 million; Jun/21 = R$13 million); and (b) 2Q20 (Apr/20 = R$10.4 million; May/20 = R$9.6 million; Jun/20 = R$2.6 million). |

| • | At CGT Eletrosul (+R$18 million): (i) repricing of O&M, in 2020, in the amount of R$10 million, of concession 004/2004, at the time of the periodic tariff review. (ii) R$ 6 million prepayment apportionment. |

Partially offset by:

| • | In subsidiary Chesf (-R$5 million): (i) higher prepayment apportionment, with a negative effect of R$7.5 million; (ii) smaller variable portion, with a positive effect of R$0.2 million; (iii) lower adjustment portion, with a positive effect of R$0.6 million; and (iv) tariff review of contracts: 007/2005 and 006/2009 with positive IRTs for the 2020/2021 cycle, in addition to the tariff readjustment on 07/01/20. |

CONSTRUCTION REVENUE – TRANSMISSION

| • | Variation in Revenue reflects the greater volume of transmission projects being built by the company in 2021, linked to authorizing resolutions, with emphasis on Chesf (+R$ 43 million), Eletronorte (+R$ 39 million) and Furnas (+R$ 7 million). |

CONTRACTUAL REVENUE – TRANSMISSION

| • | Furnas (+R$ 618 million), Eletronorte (+R$ 272 million), Chesf (+R$ 282 million), CGT Eletrosul (+R$166 million): (i) The variation is mainly due to the following reasons: ( i) increase in inflation rates in the period (IPCA), from -0.62% to to 2.08% a.t.; and (ii) increase in the balance of contractual assets due to adjustments arising from tariff reviews consolidated in ANEEL Resolution 2725/2020, recorded in September/2020, with emphasis on the review with increase in RBSE revenues associated with Ordinance 120/2016 of the Ministry of Mines and Energy, where the increase in the remuneration of the cost of capital on the financial component of RBSE was reconsidered. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 11 |

| |

MARKETLETTER 2Q21 |

Partially and negatively offset by:

| • | Amazonas GT (-R$ 14 million): due to the loss of the auction, in March 2021, after receiving the indemnity for the sale of Transmissão's assets, Amazonas GT ended its transmission activities. |

VARIATION ANALYSIS 2021X2020

| • | Variation in Transmission Revenue especially reflects: (i) increase in inflation rates in 2021; and (ii) increase in the balance of contractual assets due to the adjustments made, in June/2020, as a result of tariff revisions by ANEEL. The balance of contractual assets increased significantly due to the approval of the tariff review of transmission concessions extended under Law 12,783/2013, granted by Aneel in June 2020, which approved the new Permitted Annual Revenue ("RAP") of these concessions for the 2020-2021 tariff cycle, bringing the following changes to RBSE: (a) retrospective change in the wacc for the years 2018 and 2019; (b) change in the asset base incorporating write-offs in the 2013-2018 cycle and the readjustment of the new replacement value of assets associated with RBSE; (c) Incorporation of the payment of the controversial installment "Ke" that has been under court since 2017. |

| TABLE 06: OTHER OPERATING REVENUE |

| Operating Income | 2Q21 | 2Q20 | % | 2021 | 2020 | % |

| Others Revenues | 178 | 151 | 18% | 352 | 280 | 26% |

| Non-recurring events | ||||||

| Procel retroactive chargeback | 0 | 0 | 0% | 8 | 0 | 100% |

| Other recurring income | 178 | 151 | 18% | 360 | 280 | 29% |

OTHERS REVENUES

VARIATION ANALYSIS 2Q20X2Q21

| • | At Eletronorte (+R$18 million): (i) increase in the following accounts - (a) CDE: R$11.6 million; and (b) Proinfa: R$8.7 million. |

| • | In Furnas (+R$6 million): (i) increase in revenue from operating, communication and tele-assistance services provided by FURNAS in the amount of R$5.8 million: Main customers - (a) Empresa de Energia São Manoel and (b) Madeira Electric Interconnection (in May/21). |

| • | At Eletrobras Holding (+R$6 million): Increase in Procel revenue. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 12 |

| |

MARKETLETTER 2Q21 |

OPERATIONAL COSTS AND EXPENSES

| TABLE 07: OPERATIONAL COSTS AND EXPENSES |

| Operational costs | 2Q21 | 2Q20 | % | 2021 | 2020 | % |

| Energy purchased for resale | -507 | -360 | 41% | -1,006 | -1,007 | 0% |

| Charges on use of the electricity grid | -488 | -394 | 24% | -943 | -840 | 12% |

| Fuel for production electric power | -665 | -528 | 26% | -1,203 | -996 | 21% |

| Construction | -262 | -157 | 67% | -411 | -347 | 18% |

| Personnel, Material, Services and Others | -2,184 | -1,676 | 30% | -4,218 | -3,821 | 10% |

| Depreciation and amortization | -447 | -463 | -3% | -905 | -932 | -3% |

| Operating Provisions | -934 | -614 | 52% | -2,039 | -1,006 | 103% |

| Total Operating Costs and Expenses | -5,487 | -4,192 | 30,9% | -10,725 | -8,949 | 20% |

| Non-recurring events | ||||||

| (-) Non-recurring PMSO events | 176 | 14 | 1147% | 374 | 197 | 90% |

| (-) Non-recurring provisions | 1,338 | 214 | 527% | 2,316 | 410 | 465% |

| (-) Generation Construction | 16 | 11 | 50% | 25 | 19 | 30% |

| (-) Transfer of coal from the Material heading | 4 | 0 | - | 13 | 0 | - |

| Total Recurring Operating Costs and Expenses | -3,953 | -3,953 | 0% | -7,997 | -8,323 | -4% |

VARIATION ANALYSIS 2Q20X2Q21

ENERGY PURCHASED FOR RESALE

| • | In the subsidiary Furnas (+R$59 million): (i) variation of R$64 million in 'Energy Purchased for Resale', due to (a) price readjustments of the contracts in force, which together represent R$52 million in the due period, mainly, to the IGPM, which presented a significant variation in the period; (b) One-off purchases made in 2021 (contracts signed in order to reduce the negative exposure in the MCP, taking advantage of the discount existing in short-term bilateral operations, as well as the tax benefit against settlement at the CCEE) of approximately R$12 million; partially offset by (ii) a reduction of R$4.3 million related to the energy purchased by Brasilventos in 2Q20, which did not occur in 2Q21. |

| • | At the Holding (+R$54 million): mainly due to the expansion of international energy exchange by request of the National Interconnected System (SIN) in 2Q21. This situation was caused by the reduction in the volumes of the main hydrographic basins that make up the interconnected system and by the drop in prices offered by Uruguay to the SIN. There were no energy imports in the same period in 2020. |

| • | At Amazonas GT (+R$ 10 million): (i) an increase of R$ 6.3 million in the purchase of energy in the short-term market due to the greater exposure of UTE Aparecida, due to the damages occurred in two LM6000 turbines installed in the Generating Units; and (ii) an increase of R$3.6 million in 2Q21 due to the contractual adjustment based on the IGPM which, in November 2020, showed an accumulated increase of 23.14%. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 13 |

| |

MARKETLETTER 2Q21 |

| • | At CGT Eletrosul (+R$8 million): (i) 4% increase in the average acquisition price, increasing the cost by R$5.7 million; (ii) positive variation in energy purchased through the MCP, mitigated by tax and financial effects of the PIS/COFINS discount, which accounted for an increase of approximately R$1.9 million compared to 2Q20. The company has four purchase contracts, three of which are PPAs carried out with companies in which CGT Eletrosul holds or has previously held an equity interest. In the event of a deficit in any of the generating units, these contracts can supply without the need to purchase additional energy. |

Partially offset by:

| • | At Chesf (-R$16 million): (i) termination of the purchase agreement in December/2020 (reduction of 80 average MW), representing a reduction of R$26 million; (ii) change in purchasing strategy in 2Q21 (reduction of 7 average MW), with a reduction of R$0.5 million; and (iii) readjustment of existing contracts with a decrease of R$0.4 million; On the other hand, (iv) there was an accounting adjustment to readjust the records of contracts with SPEs by R$9 million. In total, there was a reduction of 87 average MW in energy purchased in 2Q21. |

CHARGES ON USE OF THE ELECTRICITY GRID

| • | In Furnas (+R$145 million): (i) updates to contractual parameters; and (ii) the fact, specifically, that the generation of the Santa Cruz Plant was higher in the second quarter (485,342 MWh in 2021 against 228,241 MWh in 2020) due to the greater order ordered by the ONS in the period in question. |

Partially offset by:

| • | At Eletronuclear (-R$44 million): (i) reduction in the consumption of fissile uranium equivalent (Kg Ueqv) by 47%, with 166.822 Kg Ueqv in 2Q21 and 315.252 Kg Ueqv in 2Q20, due to the greater number of days of stoppage in 2Q21. In 2020, the highest concentration of downtime impacted 3Q20. Plant shutdown schedule as reported in the supply counter. |

CHARGES ON USE OF THE ELECTRICITY GRID

| • | At Chesf (+R$ 30 million): (i) readjustment of approximately 14% of TUST, determined by ANEEL Ratifying Resolution No. 2,748/2020 (cycle 2020-2021); and (ii) incorporation of the Pindaí Complex as of April/2021, which caused an additional increase in TUST payable, with no basis for comparison in 2020. |

| • | In Furnas (+R$ 23 million): (i) the Tariffs for the Use of the Transmission System in effect in the second quarter of 2020 refer to ANEEL Ratifying Resolution No. 2,562 of 06/25/2019, as well as the tariffs in effect in the second quarter of 2021 refer to ANEEL Ratifying Resolution No. 2726 of 07/14/2020. |

CONSTRUCTION

| • | At Chesf (+R$72 million): (i) increase in O&M revenue influenced by the tariff review of concession contracts 061/2001, 006/2009, 007/2005, 017/2009 and 018/2009. |

| • | At Eletronorte (+R$37 million): the resumption of investments in reinforcements and improvements after the low realization during 2Q20 due to the impacts of COVID-19. |

| • | In Furnas (+R$ 12 million): (i) the amount is based on the variations occurred in the investments in the generation and transmission contracts in the period, as follows: (a) The generation construction expense in 2Q20 totaled R$ 10, 8 million and 2Q21 the amount was R$ 16.1 million, but with no effect on the result due to the equivalent amount in generation construction revenue. (b) In the transmission, the values referring to contract 062/01 in 2020 were R$31.4 million and in 2021 R$41.8 million. (c) In the other contracts, the values for 2020 and 2021 totaled R$4 million and R$343,000, respectively. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 14 |

| |

MARKETLETTER 2Q21 |

VARIATION ANALYSIS 2021X2020

| • | The sum of the costs of Energy purchased for resale, Charges on the use of the electricity network, Fuel for the production of electricity and construction, in the 1st half of 2021, increased by 11%, mainly impacted by: (i) the increase in costs with fuel, greater dispatch from the Santa Cruz plant and increased consumption at UTE Mauá 03 and a 12% increase in the price of raw material; (ii) Increase in network usage charges, mainly caused by the readjustment of about TUST and incorporation of the Pindaí Complex as of April/2021 by Chesf. |

| TABLE 08: PERSONNEL, MATERIAL, SERVICES AND OTHER |

| Personnel, Material, Services and Others | 2Q21 | 2Q20 | % | 2021 | 2020 | % |

| Personnel | -1,209 | -1,028 | 18% | -2,456 | -2,155 | 14% |

| Material | -73 | -52 | 40% | -133 | -154 | -14% |

| Services | -474 | -432 | 10% | -853 | -898 | -5% |

| Others | -427 | -165 | 160% | -776 | -614 | 26% |

| PMSO total | -2,184 | -1,676 | 30,3% | -4,218 | -3,821 | 10,4% |

| Non-Recurring Items | ||||||

| Incentive Plans (PAE, PDC) | -2 | -4 | -37% | -5 | -8 | -41% |

| Eletronorte resignation | 17 | 0 | - | 80 | 0 | - |

| Foundations contributions reversal - CVM 600 adjustment | -7 | 0 | - | -15 | 0 | - |

| Indemnities (Labor Claims) – Furnas | 29 | 24 | 19% | 47 | 33 | 42% |

| FGTS and INSS at Eletronorte - Early launch in April 2020 | 0 | -22 | -100% | 0 | 0 | - |

| Historical Hour Bank Payment 25% | 1 | 0 | - | 1 | 0 | - |

| Transfer of coal from 1Q21 to Fuel account | -4 | 0 | - | -13 | 0 | - |

| PIS/COFINS Credit Adjustments - inputs from UTE Candiota III prior periods | -4 | 0 | - | -4 | 0 | - |

| SWAP expenses for 1Q21 | -2 | 0 | - | 0 | 0 | - |

| Income tax not collected 2015 | 0 | 0 | - | 42 | 0 | - |

| IR on Debt Donation Charges - Transfer from AmGT | 40 | 0 | - | 40 | 0 | - |

| Cour costs and fees – Parent Company | 35 | 0 | - | 44 | 0 | - |

| Labor Costs | 8 | 0 | - | 13 | 0 | - |

| Indemnities - Loss and Damage | 0 | 0 | - | 38 | 0 | - |

| Debenture issue commissions in 1Q21 | 0 | 0 | - | -8 | 0 | - |

| Worthless SPE FOTE | 7 | 0 | - | 7 | 0 | - |

| Write-off of Energisa assets in 1Q21 (Assets of Distributed Distributors) | 0 | 0 | - | 29 | 0 | - |

| Generator group rental (emergency service to Amapá) | 13 | 0 | - | 41 | 0 | - |

| Sale of Transmission Assets to Energisa | 0 | 0 | - | -3 | 0 | - |

| Reimbursement of Transmission Assets to Energisa | 0 | 0 | - | 2 | 0 | - |

| Problem of accounting for previous years | 0 | 0 | - | -7 | 0 | - |

| Camargo Correa Furnas Process | 0 | 0 | - | 0 | 98 | -100% |

| Installments of the agreement between Furnas and Inepar | 0 | 16 | -100% | 0 | 29 | -100% |

| Indemnities, losses and damages - Nova Engevix, CIEN and Furnas Outsourced | 45 | 0 | - | 45 | 46 | -1% |

| PMSO Recurrent | -2,008 | -1,662 | 21% | -3,844 | -3,623 | 6% |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 15 |

| |

MARKETLETTER 2Q21 |

VARIATION ANALYSIS 2Q20X2Q21

PERSONEL

| • | Salary adjustment, from 12.01.2020, of 2.4%, as provided for in the Collective Bargaining Agreement, 1% annual and distribution of merit by only 2 companies - estimated impact on the payroll of R$ 30 millions; |

| • | In subsidiary Chesf: increase in interest cost, indexed by the IGPM, due to the restatement of the actuarial liability of the CD and BD benefit plans by R$32 million. |

| • | Higher expense with the use of the Health Plan in compared periods (+ R$ 32 million): (i) +R$ 27.1 million in co-participation in Eletronorte's Health Plan, since, 2020 was impacted by a reversal in the period. In addition, there were delays in receiving invoices from the E-Vida that impacted the monthly accounting in 2021, having been made, in April/21, an adjustment from previous months' invoices of approximately R$10 million; (ii) Electronuclear (+R$5 millions).; |

| • | Dismissals at Eletronorte: there were 44 dismissals in the 2nd quarter of 2021 at a cost of approximately R$16.6 million (non-recurring). |

| • | At Eletronuclear (+R$11 million): higher expenses with overtime and on call due to the seasonality of the shutdown periods of plants 1 and 2. In 2Q21, there was an shutdown of Angra 1 (1P16 04/17/2021 to 05/18/2021 ) and start of the shutdown of Angra 2 (2P17 06/06/2021 to 7/22/2021. In 2Q20, there was only one shutdown of the Angra 2 plant (2P16) between the dates of 06/22/2020 to 7/17 08/2020, counting only 9 days within the reported quarter |

| • | Higher spending on social security and social charges in the amount of R$36 million; |

| • | At Eletronuclear and Amazonas GT: In 2020, there was a reduction adjustment for non-recurring vacation provision expenses, reducing the cost in 2Q20, causing a variation of R$25 million in the compared periods. |

| • | Lower vacations in 2Q20 compared to 2Q21, due to the pandemic, and work in the home office, generating a variation of R$14 million due to the postponement of vacations between periods compared; |

| • | These amounts were partially offset by higher allocation of labor for investment in the amount of R$32 million. |

Material

| • | At Eletronuclear (+R$16 million): (i) near the end of 2Q20, Angra 2 was stopped (2P16 between the dates of 06/22/2020 to 08/17/2020), with its costs impacting its majority in 3Q20; (ii) in 2Q21, the shutdown of Angra 1 occurred (1P26 occurred between the dates of 04/17/2021 to 05/18/2021), and also the shutdown of Angra 2 (2P17 occurred between the dates of 06/06/ 2021 until 07/22/2021), facts that generated cost increases, specifically, in 2Q21 without counterpart in 2Q20. |

| • | At Chesf (+R$6 million): (i) R$5.3 million increase in expenses with various materials, such as compressors, pistons, curtains; and (ii) an increase in expenses with fuels/lubricants of R$0.7 million. |

| • | At Amazonas GT (+R$ 3 million): (i) an increase of R$ 2.8 million due to materials used in large-scale maintenance at the Balbina, Aparecida and Mauá 3 plants; (ii) an increase of R$575,000 related to the purchase of food for the Preservation Center (Environment - Peixe Boi); and (iii) an increase of R$196 thousand related to the acquisition of lubricants. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 16 |

| |

MARKETLETTER 2Q21 |

Partially offset by:

| • | At CGT Eletrosul (-R$4 million): (i) mistaken releases of mineral coal in 2021 in the material item whose adjustment was made in Jun/2021, retroactive to Jan/21 and, therefore, values from 1Q21 had a positive impact ( reducing expenses) in the material item by R$3.7 million in 2Q21; (ii) R$2.3 million of mineral coal mistakenly allocated to Material in 2Q20. |

ServiCES

| • | At Eletronuclear (+R$64 million): (i) near the end of 2Q20, the stoppage of Angra 2 took place (2P16 between 06/22/2020 and 08/17/2020), with its costs impacting its majority in 3Q20; (ii) in 2Q21, the stoppage of Angra 1 occurred (1P26 between the dates of 04/17/2021 to 05/18/2021), and also the stoppage of Angra 2 (2P17 between the dates of 06/06/ 2021 until 07/22/2021), facts that generated cost increases, specifically, in 2Q21 without counterpart in 2Q20. |

Partially offset by:

| • | In Furnas (-R$4 million): (i) reduction in the following items - (a) Medical, Hospital and Dental Care by R$4.7 million; (b) Hired labor in R$4.2 million; and (ii) on the other hand, there were increases in - (c) Third-party services - contractors by R$ 3.4 million; and (d) Maintenance - Operating Assets at R$1.6 million. |

OTHERS

| • | Holding (+R$90 million): (i) payment of income tax of R$40 million levied on debt charges settled by Eletrobras with Eletronorte, upon payment in kind that resulted in the transfer of control from Amazonas GT to the aforementioned controlled; (ii) court fees of R$27 million related to the payment of fees, court fees and fines related to legal proceedings, especially the compulsory loan. |

| • | In Furnas (+R$65 million): (i) increase, in 2Q21, of R$32.1 million in indemnities (non-recurring) for losses and damages to Nova Engevix related to UTE Sta's gas combined cycle refurbishment service Cruz, in the amount of R$45.1 million, which was partially offset by payments made to INEPAR in 2Q20 of R$16 million; (ii) an increase of R$29.2 million in Operating Losses, of which R$28.9 million derives from the entry in Non-operating Losses in the investee SPE Serra do Facão, due to the adjustment made by Eletrobras to adjust the accounting practice , related to the reservation made by the external auditor of said SPE. When the adjustment was made by Eletrobras in 2Q21, the SPE's equity became negative and the adjustment was accounted for as non-operating losses. for having this SPE a negative PL. In May/21, Furnas acquired a stake in SPE Serra do Facão, held by Camargo Correa; and (iii) an increase of R$3.8 million in Hydrological Risk Insurance - GSF. |

| • | At Eletronorte (+R$54 million): (i) increase in the following accounts: (a) Legal costs (except labor), of R$21.6 million, due to the reclassification of the write-off of the judicial deposit used in the payment;(b ) Rental of generator groups, of R$ 13.5 million (emergency assistance to the state of Amapá), and Eletronorte is negotiating with Aneel for full reimbursement of the expense; (c) Write-off of unrecovered ICMS taxes, of R$4.9 million; (d) Sundry expenses with Trocará/Assurini indigenous communities, of R$ 4.2 million; (e) Recovery of expense, of R$3.2 million (reduction account, in which the recovery was higher in 2020 - R$17.8 million); (f) Insurance for facilities, equipment and inventories of R$3.2 million; (g) Environmental licenses, of R$1.7 million; (h) R$1.3 million reduction in rental expenses; and (i) Real estate rental, of R$1 million. (ii) On the other hand, there was a R$1.1 million reduction in vehicle rental expenses. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 17 |

| |

MARKETLETTER 2Q21 |

VARIATION ANALYSIS 2021X2020

| • | The costs and expenses of personnel, material, services and others presented, in the 1st half of 2021, a variation of 10.4% compared to the same period of the previous year, mainly reflecting: (i) non-recurring expenses of approximately R$ 80 million due to the dismissal of 285 employees between January and March 2021. Increase of R$54 million in the Eletronuclear Personnel account, impacted by the adjustment of the vacation provision in 2020, reducing the cost and causing a variation of R$42 million in compared periods and higher expenses with social charges in the amount of R$15.5 million; Increase in Eletronuclear's Services bill of R$42 million, mainly explained by: (i) in both periods compared, there were 2 plant shutdowns, however, the scope of work for the shutdowns in 2020 was reduced due to the Covid Pandemic -19. Several activities were not performed in that year, being transferred to execution in 2021, which caused a higher expense in the compared periods. |

DEPRECIATION AND AMORTIZATION

| Depreciation and Amortization | 2Q21 | 2Q20 | % | 2021 | 2020 | % |

| Depreciation and amortization | -447 | -463 | -3% | -905 | -932 | -3% |

| TABLE 09: OPERATING PROVISIONS |

| Operating Provisions | 2Q21 | 2Q20 | % | 2021 | 2020 | % |

| Operational provisions / reversals | -934 | -614 | 52% | -2.039 | -1.006 | 103% |

| Operational provisions / reversals | ||||||

| Contingencies | -499 | 181 | -136% | -996 | 113 | -111% |

| Provisions and Reversals Compulsory Loan | -600 | -176 | -71% | -1.035 | -35 | -97% |

| Provisão/Reversão PCLD RGR de Terceiros/ Estimativa de perda de crédito prospectiva (CPC 48)/ Reversão PCLD CIEN/ RPCs Chesf | 118 | 39 | 205% | 118 | -107 | -210% |

| Onerous Contracts | -94 | -4 | 2034% | -109 | -120 | -10% |

| RAP Adjustment Portion | 0 | -224 | -100% | 0 | -224 | -100% |

| Impairment de ativos de longo prazo | 0 | 20 | -100% | 0 | 20 | -100% |

| Provision for Implantation of Shares - Compulsory Loan | -52 | 0 | - | -46 | 0 | - |

| ANEEL Provision - CCC | -209 | 16 | -1391% | -240 | 9 | -2772% |

| Usina Candiota III - Inflexibility | 0 | -65 | -100% | 0 | -65 | -100% |

| Usina Candiota III - Fuel | -1 | 0 | - | -8 | 0 | - |

| Non-recurring provisions / reversals | -1.338 | -214 | 527% | -2.316 | -410 | 465% |

| Provisões/Reversões Recorrentes | ||||||

| Guarantees | 2 | 5 | -66% | 20 | -2 | -1074% |

| PCLD (excluded PCLD Prospective credit loss estimate for privatized distributors (CPC 48)) and RPCs Chesf | 374 | -337 | -211% | 275 | -453 | -161% |

| GAG Improvement | -1 | -51 | -98% | -52 | -109 | -52% |

| Others | 29 | -17 | -275% | 34 | -32 | -205% |

| Recurring provisions / reversals | 404 | -400 | -201% | 277 | -596 | -146% |

The positive values in the table above mean provision reversal.

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 18 |

| |

MARKETLETTER 2Q21 |

ANALYSIS OF VARIATION 2Q20X2Q21

The variation is mainly explained by:

| • | Provision for Contingencies of R$1,066 million: (i) At the Holding, R$583 million of provisions for contingencies, highlighting R$600 million of provision for compulsory loan lawsuits; (ii) At the subsidiary Chesf, R$331 million in provisions for contingencies, highlighting (a) an increase due to the update of the K-Factor lawsuit, most of which by the IGPM (R$76 million); (b) increase in the provision for the process discussing the GSF (+R$ 156 million), mainly impacted by the increase in the PLD and hydrological situation between the compared periods. Chesf withdrew from this process in July 2021, therefore, after June 30, 2021 and paid the amount of R$1,420 million. In 3Q21, this process should be downloaded; (c) reduction in other civil and tax provisions (+R$14 million); (d) increase in labor provisions (R$ 8 million). |

| • | Provision ANEEL – CCC, in the amount of R$209 million, referring to the adjustment of credits assumed by the Holding of the companies Eletroacre (-R$162.5 million), Ceron (-R$44.7 million) and Boa Vista (R$2, 3 million) related to the 2nd inspection period, partially offset by the update of receivables (see table 19 of this report). |

| • | Consumer and reseller PCLD with reversal of R$513 million at Eletronorte, related to Roraima Energia, and R$ 118 million, at Chesf, due to the analysis of long-term overdue credits with clients Ligas do Brasil SA, Equatorial Alagoas and Energisa Sergipe, with counterpart of financial expense of the same amount. |

ANALYSIS OF VARIATION 2021X2020

| • | Operating provisions presented, in the 1st half of 2021, growth of 24% compared to the same period of the previous year, mainly reflecting: (i) At the Holding, R$1,034 million of provisions for contingencies, highlighting R$698 million of provision for compulsory loan lawsuits; (ii) ANEEL provision – CCC, in the amount of R$240 million, according to ANEEL technical notes 106/2021 and 101/2021 that provide for the result of the second inspection period (July 2016 to April 2017) of CCC credits assigned by the companies CERON and Boa Vista to Eletrobras, in the process of privatizing the distributors; increase in the provision for GSF lawsuit [BRL 369 million in 2021], against [BRL 73 million in 2020] mainly impacted by the increase in the PLD and hydrological situation between the compared periods, partially offset by (iii) PCLD reversal of R$513 million in Eletronorte, related to Roraima Energia. |

SHAREHOLDINGS

| TABLE 10: SHAREHOLDINGS |

| Shareholdings | 2Q21 | 2Q20 | % | 2021 | 2020 | % |

| Shareholdings | 302 | 384 | -21% | 732 | 506 | 45% |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 19 |

| |

MARKETLETTER 2Q21 |

ANALYSIS OF VARIATION 2Q20X2Q21

SHAREHOLDINGS

| • | The main highlights were: (i) negative variation in the equity in the earnings of affiliates (-R$22 million), with emphasis on CTEEP and CEEE; (ii) the worsening of the equivalence result of SPE Madeira Energia (-R$196 million), due to the increase in energy purchases from TUST, inspection fees and financial expenses; (iii) partially offset by the improvement in the result of IE Madeira (+R$153 million), due to the contractual revenue, which increased by 265%, mainly due to the effect of the application of the correction by the IPCA, which was of 2.07% in 2Q21, and -0.62% in 2Q20. |

ANALYSIS OF VARIATION 2021X2020

| • | Equity interests showed, in the 1st half of 2021, a variation of 18% in relation to the same period of the previous year, mainly reflecting: (i) positive variation in the equity accounting of the affiliates in the amount, with emphasis on the 1st quarter of 2021 of CTEEP and Lajeado; (ii) comparative improvement in the result of IE Madeira (+R$159 million), due to the increase in contractual revenue, mainly due to the effect of the application of the IPCA correction; (iii) partially offset by the worsening in the equity income of SPE Madeira Energia (-R$229 million), due to the increase in energy purchases from TUST, inspection fees and financial expenses. |

FINANCIAL RESULT

| TABLE 11: FINANCIAL INCOME AND EXPENSES |

| Financial Result | 2Q21 | 2Q20 | % | 2021 | 2020 | % |

| Financial Income | ||||||

| Interest, commission and fee income | 192 | 256 | -25% | 331 | 483 | -31% |

| Income from financial investments | 99 | 268 | -63% | 190 | 826 | -77% |

| Additional moratorium on electricity | 4 | 61 | -93% | 132 | 116 | 14% |

| Active monetary updates | -96 | 147 | -165% | 230 | 197 | 17% |

| Exchange rate variations | 960 | -197 | -586% | 360 | -799 | -145% |

| Net Derivative gains | 153 | 11 | 1278% | 437 | -107 | -507% |

| Financial expenses | ||||||

| Debt charges | -682 | -624 | 9% | -1.175 | -1.663 | -29% |

| Leasing charges | -113 | -92 | 22% | -228 | -186 | 22% |

| Charges on shareholder resources | 104 | -97 | -207% | -39 | -144 | -73% |

| Other net financial income and expenses | -101 | -34 | 195% | -301 | -196 | 54% |

| Financial Result | 521 | -302 | -273% | -62 | -1.474 | -96% |

| Non-recurring adjustments | ||||||

| (-) Revenue from loans owed by privatized distributors | -72 | -107 | -32% | -153 | -220 | -30% |

| (-) Bonus Award + FIDC Commission | 0 | 0 | - | 91 | 298 | -69% |

| (-) Eletrosul multa sobre o recolhimento do IR retido | 0 | - | 0 | - | ||

| (-) Regularization of credits related to Compulsory Judicial Deposits / Fine and Notices of Violation 1Q21 | 10 | 0 | - | 81 | 0 | - |

| (-) RPCs Chesf – Addition of late payment and monetary variation | 118 | 0 | - | 118 | 0 | - |

| (-) Monet update. company compulsory | 162 | 53 | 206% | 219 | 140 | 56% |

| Recurring Financial Result | 739 | -356 | -307% | 292 | -1.256 | -123% |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 20 |

| |

MARKETLETTER 2Q21 |

FINANCIAL RESULT

ANALYSIS OF VARIATION 2Q20X2Q21

In 2Q21, the financial result improved, with a negative result of R$302 million in 2Q20 and a positive result of R$521 million in 2Q21. The main variations were in the accounts of:

| • | The net exchange variation went from a negative variation of R$197 million in 2Q20 to a positive net variation of R$960 million in 2Q21, mainly due to the variation of the dollar in the respective periods. |

| • | Derivatives gains and losses went from a net revenue of R$11 million in 2Q20 to a net revenue of R$153 million in 2Q21, especially for the subsidiary Eletronorte, due to the pricing of assets as provided for in the energy sales agreement entered into with Albras, which is mainly linked to the LME (Aluminum) and dollar quotation; |

Partially offset by:

| • | Net monetary restatements suffered a strong reduction, from a positive variation of R$147 million in 2Q20 to a negative variation of R$96 million in 2Q21, mainly due to the variation in loan payable indexes(DIPCA and Others). |

ANALYSIS OF VARIATION 2021X2020

| • | The Financial Result presented, in the 1st half of 2021, a variation of 96% in relation to the same period of the previous year, mainly reflecting: (i) the net exchange variation (+R$1,159 million), reflecting the variation of the dollar in the respective periods and; (ii) Gains and losses with Derivatives (+R$545 million), with emphasis on the subsidiary Eletronorte, due to the pricing of assets as provided for in the energy sales agreement entered into with Albras, which is mainly linked to the LME quotation (Aluminium) and dollar; partially offset by (iii) the decrease in income from financial investments (-R$636 million) mainly due to the reduction in the rate of the indexes that remunerate the investments. |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 21 |

| |

MARKETLETTER 2Q21 |

1.2 EBITDA Consolidated

| TABLE 12: EBITDA DETAIL |

| EBITDA | 2021 | 2020 | % | 2Q21 | 2Q20 | % |

| Resulto f the period | 4,139 | 1,697 | 144% | 2,530 | 469 | 439% |

| + Income Tax and Social Contribution Provision | 2,028 | 1,352 | 50% | 820 | 758 | 8% |

| + Financial Result | 62 | 1,474 | -96% | -521 | 302 | -273% |

| + Depreciation and Amortization | 905 | 932 | -3% | 447 | 463 | -3% |

| = EBITDA | 7,134 | 5,455 | 31% | 3,276 | 1,992 | 64% |

| Non recurring adjustments | ||||||

| Other revenues and expenses | 0 | -25 | -100% | 0 | 0 | - |

| Reversal of Energy Revenue between Brazil and Uruguay | 8 | 0 | - | 0 | 0 | - |

| Transfer of coal from the Material | 13 | 0 | - | 4 | 0 | - |

| Dismissal Plans (PAE and PDC) | -5 | -8 | -41% | -2 | -4 | -37% |

| Eletronorte Dismissal | 80 | 0 | - | 17 | 0 | - |

| Reversal of contributions to foundations - CVM 600 adjustment | -15 | 0 | - | -7 | 0 | - |

| Indemnities (Labor Claims) - Furnas | 47 | 33 | 42% | 29 | 24 | 19% |

| FGTS and INSS of Eletronorte – Early release of April,2020 | 0 | 0 | - | 0 | -22 | -100% |

| Historical working-hour bank Payment 25% | 1 | 0 | - | 1 | 0 | - |

| Transfer of coal from 1Q21 to Fuel account | -13 | 0 | - | -4 | 0 | - |

| PIS/COFINS credit – prior periods of TPP Candiota III | -4 | 0 | - | -4 | 0 | - |

| SWAP expenses of 1Q21 | 0 | 0 | - | -2 | 0 | - |

| Income tax not collected from injunctuin paid in 2015 | 42 | 0 | - | 0 | 0 | - |

| IR arising from Transfer of Amz GT | 40 | 0 | - | 40 | 0 | - |

| Court costs and fess – Parent Compant | 44 | 0 | - | 35 | 0 | - |

| labor costs | 13 | 0 | - | 8 | 0 | - |

| Indemnities - Loss and Damage | 38 | 0 | - | 0 | 0 | - |

| Debenture issue commissions in 1Q21 | -8 | 0 | - | 0 | 0 | - |

| Worthless SPE FOTE | 7 | 0 | - | 7 | 0 | - |

| Write-off of Energisa assets (Assets of Distributed Distributors) | 29 | 0 | - | 0 | 0 | - |

| Generator group rental (Amapá emergency service) | 41 | 0 | - | 13 | 0 | - |

| Sale of Transmission Assets to Energisa | -3 | 0 | - | 0 | 0 | - |

| Reimbursement of Transmission Assets to Energisa | 2 | 0 | - | 0 | 0 | - |

| Accounting issues if previous years | -7 | 0 | - | 0 | 0 | - |

| Camargo Correa claim - Furnas | 0 | 98 | -100% | 0 | 0 | - |

| Installments of the agreement between Furnas and Inepar | 0 | 29 | -100% | 0 | 16 | -100% |

| Indemnities, losses and damages - Nova Engevix, CIEN and Furnas Outsourced | 45 | 46 | -1% | 45 | 0 | - |

| Contingêncies (a) | 2,031 | -78 | -2712% | 1,099 | -5 | -22245% |

| PCLD Credit Loss Estimate (CPC 48) / PCLD Reversal CIEN / RPCs Chesf | -118 | 107 | -210% | -118 | -39 | 205% |

| (Provision)/Reversal for investment losses | 109 | 120 | -10% | 94 | 4 | 2034% |

| RAP Adjustment Portion | 0 | 224 | -100% | 0 | 224 | -100% |

| Impairment of long-term assets | 0 | -20 | -100% | 0 | -20 | -100% |

| Provision for Implementation of Shares - Compulsory Loan | 46 | 0 | - | 52 | 0 | - |

| Provision ANEEL - CCC (c) | 240 | -9 | -2772% | 209 | -16 | -1391% |

| TPP Candiota III - Inflexibility | 0 | 65 | -100% | 0 | 65 | -100% |

| TPP Candiota III - Coal | 8 | 0 | - | 1 | 0 | - |

| = Recurring EBITDA | 9,846 | 6,037 | 63,1% | 4,794 | 2,219 | 116% |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 22 |

| |

MARKETLETTER 2Q21 |

Note: As of 2019, the Company started to consider, in its recurring EBITDA, the RBSE revenue from concessions extended under Law 12,783/2013, in order to maintain a protocol similar to the debenture covenants issued in 2019. , considering the privatization of the distributors was completed in April 2019, and these operations are no longer part of its core business, the company treated as non-recurring the relevant effects of financial income, expenses, PL reversals and prospective allowance for loan losses ( CPC 48) of loans contracted with them before or as a result of the privatization process, although revenues and eventual provisions arising from contracted loans may continue to affect the company's accounting result until its complete exhaustion. However, they were treated as recurring PCLDs of outstanding effective debt of distributors as well as debts related to energy supply.

| Recurring Cash Generation with Adjustment of Regulatory Transmission RAP |

| 2Q21 | 2Q20 | |

| 1. EBITDA Recurrent | 4,794 | 2,219 |

| 2. (-) Total Corporate Revenue from Transmission | 3,675 | 1,759 |

| O&M Revenue | 924 | 577 |

| Construction Revenue | 413 | 257 |

| Finance - Return on Investment - RBSE | 203 | 112 |

| Contractual Revenue Transmission | 2,136 | 813 |

| Periodic Tariff Revenue | 0 | 0 |

| 3. (+)Total Payment of Allowed Annual Revenue | 3,417 | 2,435 |

| Revenue of RAP and indemnities | 2,494 | 1,857 |

| O & M Revenue | 924 | 577 |

| 4 = 1 - 2 + 3 : Approximate Cash Generation | 4,536 | 2,896 |

1.3 Consolidated Results by Continued Operations segment:

| TABLE 14: FINANCIAL STATEMENT BY SEGMENT – R$ THOUSAND |

| 2021 | |||||

Finacial Statement by Segment | Administration | Generation | Transmission | Eliminations | Total |

| Net Operating Revenue | 123 | 9,750 | 6,763 | -469 | 16,168 |

| Operating Costs | -183 | -5,310 | -1,288 | 462 | -6,318 |

| Operating Expenses | -3,145 | -914 | -355 | 7 | -4,407 |

| Operating Income Before Financial Result | -3,205 | 3,527 | 5,121 | 0 | 5,442 |

| Financial Result | -62 | ||||

| Result of Equity Interests | 787 | ||||

| Other income and expenses | 0 | ||||

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 23 |

| |

MARKETLETTER 2Q21 |

| 2021 | |||||

| Income tax and social contribution | -2,028 | ||||

| Net income (loss) for the period | 4,139 | ||||

| 2020 | |||||

| Finacial Statement by Segment | Administration | Generation | Transmission | Eliminations | Total |

| Net Operating Revenue | 109 | 9,039 | 4,340 | -547 | 12,941 |

| Operating Costs | -31 | -4,633 | -1,893 | 545 | -6,012 |

| Operating Expenses | -1,323 | -1,082 | -415 | -117 | -2,937 |

| Operating Income Before Financial Result | -1,245 | 3,324 | 2,032 | -119 | 3,992 |

| Financial Result | -1,474 | ||||

| Result of Equity Interests | 506 | ||||

| Other income and expenses | 25 | ||||

| Income tax and social contribution | -1,352 | ||||

| Net income (loss) for the period | 1,697 | ||||

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 24 |

| |

MARKETLETTER 2Q21 |

1.3.1. INDEBTEDNESS AND RECEIVABLES

| TABLE 15: GROSS DEBT AND NET DEBT |

| 06/30/2021 | |

| Gross Debt - R$ million | 46,284 |

| (-) (Cash and cash equivalents + marketable securities) | 19,999 |

| (-) Financing Receivable | 8,373 |

| (-) Net balance of Itaipu Financial Assets1 | 984 |

| Net debt | 16,928 |

1 See Explanatory Note 15a to the Financial Statements.

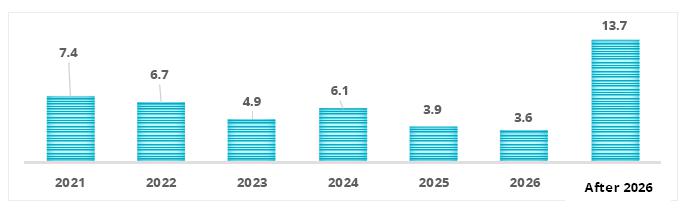

| Table 16: Debt Maturity Schedule and Debentures of the Holding and Subsidiaries included:

|

* For further information, see note 20 to ITR 2Q21.

| Gross Consolidated Debt Total – R$ billion |

| Parent Company Gross Debt – R$ billion |

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | After 2026 | Total (R$ billion) | |

| Amortization and Debentures | 5.9 | 4.1 | 2.3 | 4.2 | 2.9 | 2.5 | 6.4 | 28.4 |

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 25 |

| |

MARKETLETTER 2Q21 |

| Table 17: Foreign Exchange Exposure |

| Asset | US$ million | % |

| Itaipu Loans Receivables | 471,520 | 71% |

| Itaipu Financial Asset | 196,729 | 29% |

| TOTAL | 668,249 | 100% |

| Liabilities * | US$ million | % |

| Bônus 2021 - Eletrobras | 632.098 | 61% |

| Bônus 2025 - Eletrobras | 502.737 | 49% |

| Bônus 2030 - Eletrobras | 748.620 | 73% |

| Others | 280.615 | 27% |

| TOTAL | 1.029.235 | 100% |

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | After 2026 | TOTAL | |

| Asset (US$ million) | 393.24 | 229.63 | 43.89 | 1.49 | 0.00 | 0.00 | 0.00 | 668.25 |

| Liabilities (US$ million) | 672.50 | 45.89 | 46.36 | 19.80 | 522.54 | 19.81 | 837.17 | 2,164.07 |

| Foreign Exchange Exposure | -279.26 | 183.74 | -2.47 | -18.31 | -522.54 | -19.81 | -837.17 | -1,495.82 |

Due to the atypical scenario and potentially unpredictable characteristics, it is not possible to accurately predict the scenarios that could materialize in the coming months in the company's operations.

* In the balance of Bonuses 2030 and 2025, there is an accounting effect on the deferral of expenses with repurchase of the 2021 bonus due to the operation carried out in February.

Ratings

| Table 18: Ratings |

| Agency | National Classification / Perspective | Last Report |

| Moody’s BCA | “Ba3”: / Estable | 09/16/2020 |

| Moody’s Senior Unsecured Debt | “Ba2”: / Estable | 09/16/2020 |

| Fitch - Issuer Default Ratings (Foreign Currency) | “BB-”: / Negative | 06/02/2021 |

| Fitch - Issuer Default Ratings (Local Currency) | “BB-”: / Negative | 06/02/2021 |

| S&P LT Local Currency – Escala Nacional Brasil | brAAA/ Estable | 03/12/2021 |

| S&P Issuer Credit Rating – Escala Global | BB-/ Estable | 03/12/2021 |

*CreditWatch

Financing and loans granted (receivables)

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 26 |

| |

MARKETLETTER 2Q21 |

| Table 19: Receivables |

| Tx. Average | CONSOLIDATED | ||||||

| 06/30/2021 | 12/31/2020 | 06/30/2021 | 12/31/2020 | ||||

| Itaipu | 6.73 | 6.93 | 2,358,637 | 4,200,471 | |||

| CEAL | 2.88 | 3.45 | 1,324,866 | 1,505,962 | |||

| Eletropaulo | 2.07 | 3.75 | 663,722 | 1,008,052 | |||

| Amazonas D | 5.27 | 5.78 | 4,003,126 | 3,998,324 | |||

| CEPISA | 2.65 | 2.50 | 491,573 | 571,127 | |||

| Boa Vista | 2.03 | 2.22 | 144,103 | 147,764 | |||

| Others | - | - | 148,719 | 248,201 | |||

| (-) PECLD | - | - | (761,578) | (755,002) | |||

| Total | 8,373,168 | 10,924,899 | |||||

The graphs and table below exclude charges, allowance for loan losses and financial assets of Itaipu.

* For more information, see note 9 to ITR 2Q21.

| Total Consolidated Loans and Financing Receivables – R$ billion |

Does not include: receivable from Itaipu's financial assets of R$984 million and PCLD of R$761 million and current charges.

| Loans and financing receivable Parent company - R$ million |

| Projection Receivables | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | after 2026 | TOTAL |

| Parent Company | 2,435 | 2,870 | 2,122 | 1,466 | 1,004 | 813 | 3,860 | 14,571 |

Does not include charges and allowance for loan losses.

Table 20: CCC credits assigned by Privatized Distributors

In the process of privatizing the distributors, credits contained in the right to reimbursement account recorded in the assets of the distributors in June/17 were transferred to Eletrobras and which are still being analyzed and inspected by Aneel. These credits are activated in the Company's Financial Statements, of 06/30/2021, in two accounts, which are Right to Reimbursement and Financing receivable, according to Explanatory Notes 9 and 13 of 2Q21, and detailed below:

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 27 |

| |

MARKETLETTER 2Q21 |

REIMBURSEMENT RIGHT

| Registered Net Assets |

| R$ thousand | Amazonas | Ceron | Eletroacre | Boa Vista | Total |

| NT Aneel + Claims under analysis Aneel + "inefficiency" | 2,001,849 |

2,920,502

|

112,768

| 182,045 |

5,217,164

|

| Current Rights | 239,080 | 62,810 | 28,204 | 330,095 | |

| Total (a) | 2,001,849 | 3,159,582 | 175,578 | 210,249 | 5,547,258 |

* The balance of R$ 2,001 million from Amazonas is composed of an obligation to return to the CCC in the amount of R$ 489.7 million referring to the final result of the inspection of the first and second periods carried out by Aneel, and a credit receivable from the Treasury National economic and energy “inefficiency” of R$ 2.49 billion. The economic and energy “inefficiency” credit is being updated by Selic. The amount to be returned to the CCC must be deducted from the credit receivable from the CCC in relation to the amounts transferred from the other distributors.

| Explanatory Note 9 - Loan and Financing |

| R$ thousand | Amazonas | Ceron | Eletroacre | Boa Vista | Total |

| Conversion into Loans (b) | 442,366 | 442,366 |

Note: The R $ 442.4 million credit in the table above originates from CCC credits assigned by Amazonas to Eletrobras, however, as it is not part of the inspection period mentioned above, and because it is a current credit, it has already been paid by CCC to Amazonas Distribuidora, then it was converted into the distributor's debt with Eletrobras.

| Total Credits Granted (Note 9 + Note 13) |

| R$ thousand | Amazonas | Ceron | Eletroacre | Boa Vista | Total |

| Credit assigned Net (1) | 2,444,215

| 3,159,582

| 175,578

| 210,249

| 5,989,624

|

(1) Credits updated until 06/30/2021, by IPCA, from the credit generating event, except for the portion of economic and energy "inefficiency" (R$ 2.53 billion) granted by Amazonas Energia and Boa Vista Energia , which are updated by SELIC.

The National Electric Energy Agency - Aneel recognized, by decision of its collegiate board, on March 10, 2020, (i) the right to receive credits from the Ceron Fuel Consumption Account, in the amount of R$1,904 million (a July 2019 prices), referring to the inspection of benefits due in the period from July 30, 2009 to June 30, 2016, considered as the first period of the inspection process ("First Inspection Period"), credits assigned to Eletrobras at the time the privatization of said distributor; and (ii) the right to receive credits from the Fuel Consumption Account – CCC to the Electricity Company of Acre (“Eletroacre”), in the amount of R$ 192 million (July 2019 prices), referring to the inspection of benefits due from July 30, 2009 to June 30, 2016, credits that were also assigned to Eletrobras at the time of privatization of the aforementioned distributor.

Aneel's Board of Directors also approved, on March 10, 2020, the obligation to return R$ 2,061 million (at March 2019 prices), referring to the CCC inspection and monthly reprocessing process paid to Amazonas Distribuidora de Energia SA ( “Amazonas Energia”), in the period from July 2016 to April 2017, referring to the Second Inspection Period. With this decision, Amazonas Energia had completed its entire inspection

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 28 |

| |

MARKETLETTER 2Q21 |

process, as Aneel's Board of Directors had already deliberated, on March 19, 2019, the result of the First Inspection Period of CCC reimbursements to Amazonas Energia, with the company entitled to receive a credit in the order of R$1,592 million (at September 2018 prices), to be offset against the credits to be returned. The net balance of credits assigned by Amazonas Energia, positive in R$ 2.44 billion, refers, in addition to the contract signed with the distributor, with the payment of the amount of R$ 442 million in current credits, upon revenue of the disallowances of the CCC arising from economic and energy efficiency criteria, a right recognized by Law 13,299/2016, in the historical amount of R$ 1,358 million to be paid by the National Treasury. Eletrobras updated the value of economic and energy “inefficiency” by Selic until 06/30/2021.

On June 15, 2021, Aneel approved the result of the inspection and monthly reprocessing of the benefits reimbursed by CCC to Boa Vista Energia, setting the amount to be reimbursed by CCC to the distributor at R$ 103,883,187.32, at prices of February 2020, and establishing that the payment to Eletrobras, holder of the credits, must await the final result (1st and 2nd periods) of the inspections carried out at Amazonas Energia, Ceron, Eletroacre and Boa Vista Energia. As the result was in line with the information contained in Technical Note No. 49/2020-SFF-SFG-SRG/ANEEL, of April 6, 2020, Eletrobras did not need to make new adjustments to the credits assumed by Boa Vista.

Technical Note No. 106/2021-SFF-SFG-SRG/ANEEL, of June 14, 2021, informed the value, still preliminary, of the result of the 2nd inspection period of Ceron. In this technical note, in addition to the analysis of CCC processing and reimbursements for the 2nd inspection period, the two claims still pending analysis by Aneel were also analyzed, and which Eletrobras understood as likely to be accepted by the Agency: i) Financial costs arising from CCDs, based on two Interministerial Ordinances (652/2014 and 372/2015); and ii) Recognition of guaranteed energy and specific consumption of the Guascor and Rovema contracts, signed before Law 12,111/2009 and Aneel Normative Resolution No. 427/2011.

Aneel partially accepted both claims. Recognized the effects of Interministerial Ordinance No. 652/2014 for CCDs, correction by Selic from the taxable event and accumulated debt balance until Nov/2014, but did not recognize the effects of Interministerial Ordinance No. 372/2015, which increased the term for training of the outstanding balance until Jun/15. Regarding the energy supply contracts signed with Guascor (1998) and Rovema (2006), Aneel recognized the contractual issue on guaranteed energy, but did not accept the claim regarding the recognition of the specific consumption limit defined in the contract. Thus, the technical note contains the total amount to be received by Ceron of R$806,574,733.65, in the April/2021 position, to be reimbursed by the CCC to Eletrobras.

On June 21, 2021, Technical Note No. 111/2021-SFF-SFG-SRG/ANEEL was issued on the 2nd inspection period of Eletroacre. As previously reported, Aneel partially accepted the two claims still pending analysis: i) Financial costs arising from CCDs; and ii) Recognition of guaranteed energy and specific consumption of the contract with Guascor. The total result shown in the technical note is the return of BRL 97,529,535.30, in the position of April/2021, from Eletroacre to the CCC, that is, negative result for the 2nd pe inspection period of the distributor.

Thus, by June 30, 2021, Aneel has completed five inspection processes of the CCC, Amazonas (1st and 2nd periods), Ceron (1st period), Eletroacre (1st period), and Boa Vista (1st period), remaining finalize the inspection processes for the 2nd period of the last three mentioned distributors. The total value of these five inspections closed is R$1,937 million, position of June 2021. Additionally, Aneel released technical notes on the 2nd inspection period of Ceron and Eletroacre, and if the agency's board of directors decides to maintain the amount that contained in the technical notes, the result of the inspection will be R$ 2,656 million to be paid to Eletrobras. Only the 2nd inspection period at Boa Vista still does not have a technical note issued by Aneel with the preliminary result of the inspection.

MARKETLETTER 2Q2021 Disclaimer: This material contains calculations that may not produce an accurate sum or result due to rounding.

| 29 |

| |

MARKETLETTER 2Q21 |

It is noteworthy that Eletrobras made adjustments in this 2nd ITR in the credits assigned from the distributors and which depend on the inspection by the CCC, in line with the values contained in the technical notes issued by Aneel referring to the 2nd inspection period of Ceron and Eletroacre.