EXHIBIT 3.17

COMDATA NETWORK, INC.

ARTICLES OF INCORPORATION

That we, the subscribers, Dorothy S. Weintraub, whose Post Office Address is 912 Fidelity Building, Baltimore, Maryland, 21201; Eileen F. Crum, whose Post Office Address is 912 Fidelity Building Baltimore, Maryland, 21201 and Patricia Schech, whose Post Office Address is 912 Fidelity Building, Baltimore, Maryland, 21201, each being of full legal age and each being a citizen of the State of Maryland and of the United States, do under and by virtue of the General Laws of the State of Maryland authorizing the formation of corporations, associate ourselves with the intention of forming a corporation.

1. The name of the corporation (which is hereinafter called the Corporation) is Comdata Network, Inc.

2. The object and purpose for which, and for any of which this Corporation is formed, and the business to be carried on or promoted by it are to do any or all of the following things:-

A. To establish and maintain a centralized computer network and to take all actions necessary or desirable to carry on the business thereof.

B. To borrow money and to pledge as collateral any or all of the assets of the Corporation.

1

C. To maintain margin accounts and to make short sales of all kinds.

D. To engage in any other business of whatsoever kind or description within the State of Maryland or elsewhere that may be directly or indirectly calculated to effectuate the objects and purposes of this Corporation or any of them.

E. To acquire the good will, trade name, rights and property and to undertake the whole or any part of the assets and liabilities of any person, firm, association or corporation engaged in a similar business, and to pay for the same in cash or stock of this Corporation or otherwise.

F. To buy and sell fee simple property, leasehold property, ground rents, and personal property; to acquire by subscription, purchase, exchange or otherwise, and to hold for investment or otherwise to use, sell, dispose of, pledge, mortgage, or hypothecate any bonds, stocks or other obligations of any corporation, and while the owner thereof, to exercise all of the rights, powers and privileges and ownership thereof; to borrow money and issue notes and bonds as authorized by the Laws of this State and to execute mortgages, deeds of trust or other forms of contracts as security for the same and guaranteeing the payment thereof.

G. To consolidate or merge with any other corporation.

H. In general, to carry on any lawful business and to have and to exercise all powers conferred by the general laws of the State of Maryland upon corporations formed there under and to exercise and enjoy all powers, rights and privileges granted to or conferred upon corporations of

2

this character by said general laws now or hereinafter in force the enumeration of certain powers as herein specified not being intended to exclude any such other powers, rights, and privileges granted to or conferred upon corporations of this character by said general laws now or hereafter in force; and that said Corporation is[ILLEGIBLE] visions herein expressed and subject in all particulars to the limitations pertaining to corporations which are contained in the General Laws of this State.

3. The business and operations of said Corporation are to be carried on in the State of Maryland and elsewhere in the United States and in such other localities as the Board of Directors may deem advisable.

4. The Post Office Address of the place at which the principal office of the Corporation in the State of Maryland will be located is 912 Fidelity Building, Baltimore, Maryland, 21201. The resident agent of the Corporation is Eugene H. Schreiber, whose Post Office Address is 912 Fidelity Building, Baltimore, Maryland, 21201. Said resident agent is a citizen of the State of Maryland and actually resides therein.

5. The total amount of the authorized Capital Stock of the Corporation is One Million (1,000,000) shares of $.001 par value per share or an aggregate par value of One Thousand Dollars ($1,000.00).

6. The Board of Directors may authorize the issuance from time to time of shares of its stock with or without par value of any class and securities convertible into shares of its stock with or without par value of any class and securities convertible into shares of its stock with or without par value of any class for such consideration as said Board of Directors may deem advisable. The Board of directors shall, by resolution, state

3

its opinion of the actual value of any consideration other than money for which it authorizes shares of stock without par value or securities con- [ILLEGIBLE]

7. No contract or other transaction between this Corporation and any other corporation and no act of this Corporation shall in any way be affected or invalidated by the fact that any of the directors of this Corporation are pecuniarily or otherwise interested in or are directors or officers of, such other corporation; any directors individually, or any firm of which any director may be a member, may be a party to, or may be pecuniarily or otherwise interested in, any contract or transaction of this Corporation, provided that the fact that he or such firm is so interested shall be disclosed or shall have been known to the Board of Directors or a majority thereof and any director of this Corporation who is also a director or officer of such other corporation or who is so interested may be counted in determining the existence of a quorum at any meeting of the Board of Directors of this Corporation which shall authorize any such contract or transaction, with like force and effect as if he were not such director or officer of such other corporation or not so interested.

8. The Corporation shall have three directors and the following named persons shall act as such until the first annual meeting or until their successors are duly chosen and have qualified:-

| | |

Dorothy s. Weintraub | | 912 Fidelity Building |

| | Baltimore, Maryland 21201 |

| |

Eileen F. Crum | | 912 Fidelity Building |

| | Baltimore, Maryland 21201 |

| |

Patricia Schech | | 912 Fidelity Building |

| | Baltimore, Maryland 21201 |

4

The Corporation may determine by its By-Laws the classification and number of its directors, which may from time to time be fixed at a number greater than that named in this Charter, but shall never be less than three.

IN WITNESS WHEREOF, we have hereunto set our hands and affixed our seals this 16th day of July, 1969.

Test:

| | |

| | [GRAPHIC APPEARS HERE] (SEAL) |

| | Dorothy S Weintraub |

| | |

| | [GRAPHIC APPEARS HERE] (SEAL) |

| | Eileen F. Crum |

| | |

[GRAPHIC APPEARS HERE] | | [GRAPHIC APPEARS HERE] (SEAL) |

| | Patricia Schech |

STATE OF MARYLAND, BALTIMORE COUNTY, TO WIT:

On this the 16th day of July, 1969 before me, a Notary Public, the undersigned officer, personally appeared DOROTHY S. WEINTRAUB, EILEEN F. CRUM and PATRICIA SCHECH, known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

IN WITNESS WHEREOF I hereunto set my hand and official seal.

|

[GRAPHIC APPEARS HERE] |

Notary Public |

My Commission Expires July 1st 1970

[GRAPHIC APPEARS HERE]

5

6

7

8

COMDATA NETWORK, INC.

ARTICLES OF AMENDMENT

COMDATA NETWORK, INC. , a Maryland corporation, having its principal office in Baltimore City, Maryland, (hereinafter called “Corporation”) hereby certifies to the State Department of Assessments and Taxation of Maryland, that:

FIRST: The charter of the Corporation is hereby amended as follows:

a) By striking out Articles 5. of the Articles of Incorporation and inserting in lieu thereof the following :

“5. The total amount of the authorized Capital Stock of the Corporation is One Million (1,000,000) shares of S-02 par value per share or an aggregate par value of Twenty Thousand Dollars ($20,000.00).”

b) By adding a new Article to the Articles of Incorporation to be known as Article 9. thereof and to read as follows:

“9: No holders of stock of the Corporation, of whatever class, shall have any preemptive right of subscription to any shares of any class or to any securities convertible into shares of stock of the Corporation, nor any right of subscription to any thereof other than such, if any, as the Board of Directors in its discretion may determine and at such price as the Board of Directors in its discretion

9

may fix; and any shares or convertible securities which the Board of Directors may determine to offer for subscription to holders of stock may, as said Board of Directors shall determine be offered to holders of any class or classes of stock at the time existing to the exclusion of holders of any or all other classes at the time existing.”

SECOND: The Board of Directors of the Corporation at meetings duly convened and held on July 24, 1970 and July 30, 1970 adopted resolutions in which were set forth the a foregoing amendments to the charter, declaring that said amendments to the charter were advisable and directing that they be submitted for action thereon at the Annual Meeting of the Stockholders of the Corporation to be held on July 30, 1970.

THIRD: Notice setting forth a summary of the changes to be effected by said amendments of the charter and stating that the purpose of the meeting of the stockholders would be to take action thereon was given as required by law to all stockholders entitled to vote thereon.

FOURTH: The amendments of the charter of the Corporation as hereinabove set forth were approved by the stockholders of the Corporation at said meeting by the affirmative vote of more than two-thirds of all of the votes entitled to be cast thereon.

10

FIFTH: The amendments of the charter of the Corporation as hereinabove set forth have been duly advised by the Board of Directors and approved by the stockholders of the Corporation.

IN WITNESS WHEREOF, Comdata Network, Inc. has caused these presents to be signed in its name and on its behalf by its President or one of its Vice Presidents and its corporate seal to be hereunto affixed and attested by its Secretary on August 8, 1970.

| | |

ATTEST | | COMDATA NETWORK, INC. |

[GRAPHIC APPEARS HERE] | | [GRAPHIC APPEARS HERE] |

[ILLEGIBLE] Secretary | | Vice President |

The undersigned Vice President of Comdata Network, Inc. who executed on behalf of said Corporation the aforegoing Articles of Amendment, of which this certificate is made a part, hereby acknowledges in the name and on behalf of said Corporation the foregoing Articles of Amendment to be the corporate act of said Corporation and further certifies that he is Vice President of said Corporation and that to the best of his knowledge, information and belief, the matters and facts set forth in said Articles of Amendment with respect to approval thereof are true in all material respects, under the penalties of perjury.

|

[GRAPHIC APPEARS HERE] |

Vice President |

11

I. Marilyn vance do hereby certify [ILLEGIBLE] of COMDATA NETWORK, INC., a Maryland corporation and that at a meeting of the Board of Directors of said corporation held on the 24th day of July, 1970, the following resolutions were adopted which said resolutions remain in full force and effect:

RESOLVED that The Corporation Trust Incorporated whose post office address is First National Bank Building, Baltimore, Maryland 21202 be and it hereby is designated as resident agent for the Corporation in the State of Maryland.

RESOLVED that the principal office of the Corporation in Maryland shall be located at First National Bank Building, Baltimore, Maryland 21202

| | |

[GRAPHIC APPEARS HERE] | | [GRAPHIC APPEARS HERE] |

| | |

12

DOMESTIC CORPORATIONS

STATEMENT OF CHANGE OF THE POST OFFICE ADDRESS OF

[ILLEGIBLE]

State Department of Assessments and Taxation

301 West Preston Street

Baltimore, Maryland 21201

Pursuant to the provisions of the Code of Maryland, Article 23, Section 8, THE CORPORATION TRUST INCORPORATED hereby gives notice to the State Department of Assessments and Taxation:

That the address of THE CORPORATION TRUST INCORPORATED, the resident agent for each of the domestic corporations named in the list attached hereto and made a part hereof, has been changed.

| | |

| FROM: | | First National Bank Building, Light and Redwood Streets, |

| | Baltimore, Maryland 21202 |

| | |

| TO: | | First Maryland Building, 25 South Charles Street, |

| | Baltimore, Maryland 21201 |

That the principal office of each of such corporations has been changed

| | |

| FROM: | | c/o THE CORPORATION TRUST INCORPORATED |

| | First National Bank Building, |

| | Light and Redwood Streets, Baltimore, Maryland 21202 |

| | |

| TO: | | c/o THE CORPORATION TRUST INCORPORATED |

| | First Maryland Building, 25 South Charles Street, |

| | Baltimore, Maryland 21201 |

That the post office address of the principal office of each of said corporations is the same as the post office address of the resident agent.

Written notice of the above change in principal office has been sent to each of the named corporations by THE CORPORATION TRUST INCORPORATED, as resident agent of each of the said corporations.

The change of the post office address of the resident agent and of the principal office of each of the corporations named shall become effective upon the date of filing of this certificate in the Office of the State Department of Assessments and Taxation.

| | | | | | |

| Dated: June 14, 1972. | | | | THE CORPORATION TRUST INCORPORATED |

| | | | (Resident Agent) |

| | | |

| | | | By: | |  |

| | | | | | CLINT G. DEDERICK |

| | | | | | Vice President |

(DOMESTIC)

CLEO SECURITY SERVICES INC

COL ARTS ASSOCIATES INC

COLE-CHILDRESS CORPORATION

COLITE INDUSTRIES OF MARYLAND INC

COLONIAL CARPETS INC

COLONIAL METALS INC

COLUMBIA BOILER COMPANY INC

COLUMBIA CATERING CORPORATION

COLUMBIA COMUS INC

COLUMBIA-MARYLAND RICHMAN BROTHERS INC

COLUMBIA PRECISION CORPORATION

COLUMBIA TWIN CORP

THE COLUMBINE FUND INC

COMBINED SECURITIES FUND INC

COMDATA NETWORK INC

COMFORT SPRING CORPORATION

COMMERCIAL PROPERTIES COMPANY INC

COMMERCIAL SOLVENTS CORPORATION

COMMON INVESTING FUND OF THE LUTHERAN CHURCH IN AMER INC

COMMON STOCK FUND OF STATE BOND AND MORTGAGE COMPANY

COMP-UTILITIES OF MARYLAND INC

COMPUSTREND FUND INC

COMPUTER NETWORK CORPORATION

COMPUTER TIME-SHARING INSTITUTE INC

[ILLEGIBLE] & [ILLEGIBLE] INCORPORATED MARYLAND

COMDATA NETWORK, INC.

ARTICLES OF REVIVAL

THIS IS TO CERTIFY THAT:

FIRST: The name of the Corporation at the time of the forfeiture of its charter was COMDATA NETWORK, INC.

SECOND: The name by which the Corporation will hereafter by known is COMDATA NETWORK, INC.

THIRD: (a) The post office address of the principal office of the Corporation in the State of Maryland is Corporation Trust, Incorporated, First Maryland Building, 25 S. Charles Street, Baltimore City, Maryland 21201; said principal office is located in the same city in which the principal office of the Corporation was located at the time of the forfeiture of its charter.

(b) The name and post office address of the resident agent of the Corporation in the State of Maryland are Corporation Trust, Incorporated, First Maryland Building, 25 S. Charles Street, Baltimore City, Maryland 21201.

FOURTH: The Articles of Revival are for the purpose of reinstating the Charter of the Corporation.

FIFTH: At or prior to the filing of these Articles of Revival, the Corporation has:

(a) Paid all fees required by law;

(b) Filed all annual reports which should have been filed by the Corporation if its charter had not been forfeited;

(c) Paid all State and local taxes (other than taxes on real estate) and all interest and penalties due by the Corporation, irrespective of any period of limitation otherwise prescribed by law affecting the collection of any part of such taxes; and

(d) Paid an amount equal to all State and local taxes (other than taxes on real estate) and all interest and penalties which, irrespective of any period of limitation otherwise prescribed by law affecting the collection of any part of such taxes, would have been payable by the Corporation if its charter had not been forfeited.

IN WITNESS WHEREOF, the undersigned, who were respectively the last acting Vice-President and Treasurer of the Corporation, have signed these Articles of Revival on May 27, 1975.

|

| Last Acting Vice-President |

|

|

| Robert W. Whitney |

|

| Last Acting Treasurer |

|

|

| Curtiss W. Harter, Jr. |

STATE OF MARYLAND ,

CITY of BALTIMORE , ss:

I HEREBY CERTIFY that on May 27, 1975, before me, the subscriber, a notary public of the State of Maryland in and for the City of Baltimore, personally appeared Robert W. Whitney, the last acting Vice-President and Curtiss W. Harter, Jr., the last acting Treasurer of COMDATA NETWORK, INC., a Maryland corporation, and severally acknowledged the foregoing Articles of Revival to be their act.

WITNESS my hand and notarial seal, the day and year last above written.

|

|

|

| Notary Public |

My Commission expires: 7/1/78

COMDATA NETWORK, INC.

ARTICLES OF AMENDMENT

COMDATA NETWORK, INC. (hereinafter referred to as the “Corporation”), a Maryland Corporation having its principal office in Nashville, Tennessee, hereby certifies to the State Department of Assessments and Taxation of Maryland that:

FIRST: The Articles of Incorporation of the Corporation are hereby amended by striking out Article 5 and inserting in lieu thereof the following:

| | |

“5. The total amount of the authorized Capital Stock of the Corporation is Five Million (5,000,000) shares of $.02 par value per share, or an aggregate par value of One Hundred Thousand Dollars ($100,000.00).” |

SECOND: The Board of Directors of the Corporation, at a meeting duly called, at which a quorum was present, held March 30, 1977 adopted resolutions declaring that amendment of Article 5 of the Articles of Incorporation of the Corporation is advisable and directing that it be submitted for action thereon by the stockholders of the Corporation.

THIRD: The stockholders of the Corporation, at a special meeting held on May 2, 1977, adopted resolutions approving the foregoing amendment to the Articles of Incorporation of the Corporation by the affirmative vote of not less than two-thirds of the votes entitled to be cast on the matter.

FOURTH: Before the amendment, the Corporation had authority to issue 1,000,000 shares of Capital Stock, par value $.02 per share, or an aggregate par value of $20,000.00. After

the amendment the Corporation has authority to issue 5,000,000 shares of Capital Stock, par value $.02 per share, or an aggregate par value of $100,000.00.

IN WITNESS WHEREOF, COMDATA NETWORK, INC. has caused these Articles of Amendment to be signed in its name, and on its behalf, by its President, and its corporate seal to be hereunto affixed and attested by its Secretary on this [ILLEGIBLE] day of July, 1977.

| | | | |

| ATTEST: | | COMDATA NETWORK, INC. |

| | |

| | By | |  |

| Secretary | | | | President |

THE UNDERSIGNED, President of COMDATA NETWORK, INC., who executed on behalf of said Corporation the foregoing Articles of Amendment, of which this certificate is made a part, hereby acknowledges the foregoing Articles of Amendment to be the corporate act of said Corporation and further certifies that he is the President of said Corporation and that, to the best of his knowledge, information and belief, the matters and facts set forth in said Articles of Amendment with respect to authorization and approval thereof are true in all material respects, under the penalties of perjury.

|

|

|

| President |

- 2 -

COMDATA NETWORK, INC.

ARTICLES OF AMENDMENT

COMDATA NETWORK, INC. (hereinafter referred to as the “Corporation”), a Maryland corporation having its principal office in Nashville, Tennessee, hereby certifies to the State Department of Assessments and Taxation of Maryland that:

FIRST: The Articles of Incorporation of the Corporation are hereby amended by striking out Article 5 and inserting in lieu thereof the following:

|

“5. The total amount of the authorized Capital Stock of the Corporation is Ten Million (10,000,000) shares of $.02 par value per share, or an aggregate par value of Two Hundred Thousand Dollars ($200,000.00).” |

SECOND: The Board of Directors of the Corporation, at a meeting duly called, at which a quorum was present, held April 13, 1981 adopted a resolution declaring that the foregoing amendment of Article 5 of the Articles of Incorporation of the Corporation is advisable and directing that it be submitted for action thereon by the stockholders of the Corporation.

THIRD: The stockholders of the Corporation, at the annual meeting of stockholders held on May 26, 1981 approved the foregoing amendment to the Articles of Incorporation of the Corporation by the affirmative vote of greater than two-thirds of the votes entitled to be cast on the matter.

FOURTH: Before effectiveness of the amendment, the Corporation had authority to issue 5,000,000 shares of Capital Stock, par value $.02 per share, or an aggregate par value of $100,000.00. After effectiveness of the amendment, the Corporation will have authority to issue 10,000,000 shares of Capital Stock, par value $.02 per share, or an aggregate par value of $200,000.00. The Common Stock of the Corporation constitutes the only class of its Capital Stock.

IN WITNESS WHEREOF, COMDATA NETWORK, INC. has caused these Articles of Amendment to be signed in its name, and on its behalf, by its President, and attested by its Secretary on this 29th day of June, 1981.

| | | | |

| ATTEST: | | COMDATA NETWORK, INC. |

| | |

| | By | |  |

| Secretary | | | | President |

| | (SEAL) |

THE UNDERSIGNED, President of COMDATA NETWORK, INC., who executed on behalf of said Corporation the foregoing Articles of Amendment, of which this certificate is made a part, hereby acknowledges the foregoing Articles of Amendment to be the corporate act of said Corporation and further certifies that he is the President of said Corporation and that, to the best of his knowledge, information and belief, the matters and facts set forth in said Articles of Amendment with respect to authorization and approval thereof are true in all material respects, under the penalties of perjury.

|

|

|

| President |

DOMESTIC CORPORATIONS

STATEMENT OF CHANGE OF THE POST OFFICE ADDRESS OF

THE RESIDENT AGENT AND OF PRINCIPAL OFFICE

State Department of Assessments and Taxation

301 West Preston Street

Baltimore, Maryland 21201

Pursuant to the provisions of the Annotated Code of Maryland, Section 2-108(c), Corporations and Associations Article, THE CORPORATION TRUST INCORPORATED hereby gives notice to the State Department of Assessments and Taxation:

That the address of THE CORPORATION TRUST INCORPORATED, the resident agent for each of the domestic corporations named in the list attached hereto and made a part hereof, has been changed

| | |

| FROM: | | First Maryland Building, 25 South Charles Street, |

| | Baltimore, Maryland 21201 |

| | |

| TO: | | 32 South Street, |

| | Baltimore, Maryland 21202 |

For those domestic corporations on the attached list having an asterisk following their name, THE CORPORATION TRUST INCORPORATED is furnishing only the resident agent, and not the principal office. Therefore, for such corporations, this document is changing only the post office address of the resident agent.

That the principal office of each of such corporations not having their name followed by an asterisk has been changed

| | |

| FROM: | | c/o THE CORPORATION TRUST INCORPORATED |

| | First Maryland Building |

| | 25 South Charles Street |

| | Baltimore, Maryland 21201 |

| | |

| TO: | | c/o THE CORPORATION TRUST INCORPORATED |

| | 32 South Street, |

| | Baltimore, Maryland 21202 |

That the post office address of the principal office of each of said corporations not having their name followed by an asterisk is the same as the post office address of the resident agent.

Written notice of the above change in principal office and /or address of resident agent has been sent to each of the named corporations by THE CORPORATION TRUST INCORPORATED, as resident agent of each of the said corporations.

The change of the post office address of the resident agent and/or of the principal office of each of the corporations named shall become effective upon the date of filing of this certificate in the office of the State Department of Assessments and Taxation.

| | | | | | |

| Dated: August 1[ILLEGIBLE], 1982 | | | | THE CORPORATION TRUST INCORPORATED |

| | | | (Resident Agent) |

| | | |

| | | | By: | |  |

| | | | | | JAMES D. GRIGSBY |

| | | | | | Vice President |

CHARLES GARAGE OF SALISBURY INC.

CHEMETALS CORPORATION

CHEMICAL FUND INC.

CHESAPEAKE ANTENNA TELEVISION INC.

CHESAPEAKE BAY PIZZA HUT INC.

CHESAPEAKE BEVERAGE CORPORATION

CHESAPEAKE MANOR INC.

THE CHESAPEAKE OPERATING COMPANY

CHESAPEAKE & POTOMAC AIR CONDITIONING CO

CHESAPEAKE SHELIFISH CO INC.

CHESTERTOWN CABLE TELEVISION INC.

CHESTNUT STREET CASH FUND INC.

CHRIST CHURCH HARBOR APARTMENTS

CINEMA RACES INC.

CITADEL CEMENT CORPORATION

CITY MOTOR PARTS & MACHINE INC.

CLARK ENTERPRISES INC.

CLOPAY CORPORATION

CLUB NAUTILUS OF WHITE FLINT INC.

CLUBHOUSE INC.

COAL ENERGY CONCEPTS INC.

COL ARTS ASSOCIATES INC.

COLCO INC.

COLLEGE PRO PAINTERS -U S- LTD.

COLONIAL PARKING INC.

COLUMBIA COMUS INC.

COMDATA NETWORK INC.

COMET OFFICE EQUIPMENT CENTER OF WASHINGTON INC.

COMDATA NETWORK, INC.

ARTICLES OF AMENDMENT

COMDATA NETWORK, INC., hereinafter referred to as the “Corporation”, & Maryland corporation having its principal office in Nashville, Tennessee, hereby certifies to the State Department of Assessments and Taxation of Maryland that:

FIRST: The Articles of Incorporation of the Corporation are hereby amended by striking out Article 5 and inserting in lieu thereof the following:

“5. The total amount of the authorized Capital Stock of the Corporation is Thirty Million (30,000,000) shares of $.02 par value per share, or an aggregate par value of Six Hundred Thousand Dollars ($600,000.00).”

SECOND: The Board of Directors of the Corporation, at a meeting duly called, at which a quorum was present, held January 19, 1983 adopted a resolution declaring that the foregoing amendment of Article 5 of the Articles of Incorporation of the Corporation is advisable and directing that it be submitted for action thereon by the stockholders of the Corporation.

THIRD: The stockholders of the Corporation, at the annual meeting of stockholders held on May 31, 1983 approved the foregoing amendment to the Articles of Incorporation of the Corporation by the affirmative vote of greater than two-thirds of the votes entitled to be cost on the matter.

FOURTH: Before effectiveness of the amendment, the Corporation had authority to issue 10,000,000 shares of Capital Stock, par value $.02 per share, or an aggregate par value of $200,000.00. After effectiveness of the amendment, the Corporation will have authority to issue 30,000,000 shares of Capital Stock, par value $.02 per share, or an aggregate par value of $600,000.00. The Common Stock of the Corporation constitutes the only class of its Capital Stock.

IN WITNESS WHEREOF, COMDATA NETWORK, INC. has caused these Articles of Amendment to be signed in its name, and on its behalf, by its President, and attested by its Secretary on this 31st day of May, 1983.

| | | | | | | | |

| ATTEST: | | | | COMDATA NETWORK, INC. |

| | | | |

| | /s/ James Gregoric | | | | By | | /s/ C. W. Harter |

| | Secretary James Gregoric | | | | | | President C. W. Harter, Jr. |

| | | | | | (SEAL) |

THE UNDERSIGNED, President of COMDATA NETWORK, INC., who executed on behalf of said Corporation the foregoing Articles of Amendment, of which this certificate is made a part, hereby acknowledges the foregoing Articles of

Amendment to be the corporate act of said Corporation and further certifies that he is the President of said Corporation and that, to the best of his knowledge, information and belief, the matters and facts set forth in said Articles of Amendment with respect to authorization and approval thereof are true in all material respects, under the penalties of perjury.

|

|

/s/ C. W. Harter |

President C. W. Harter, Jr. |

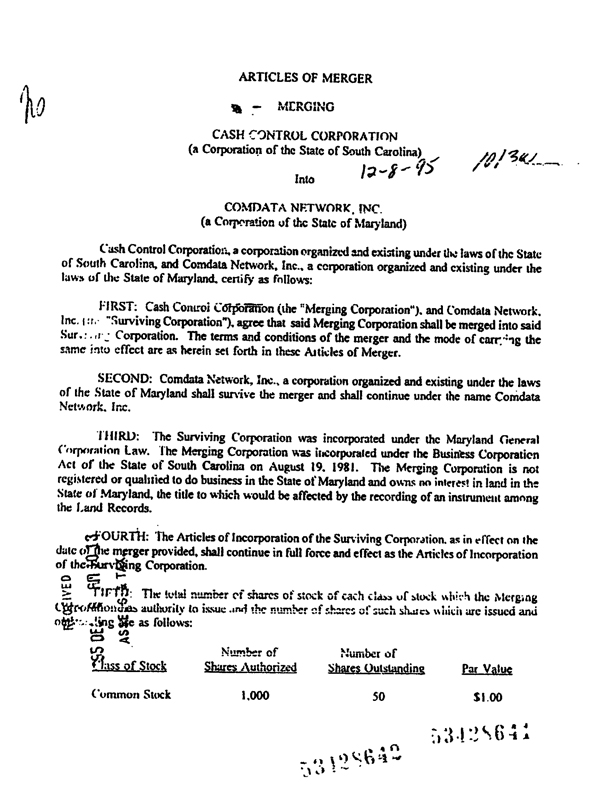

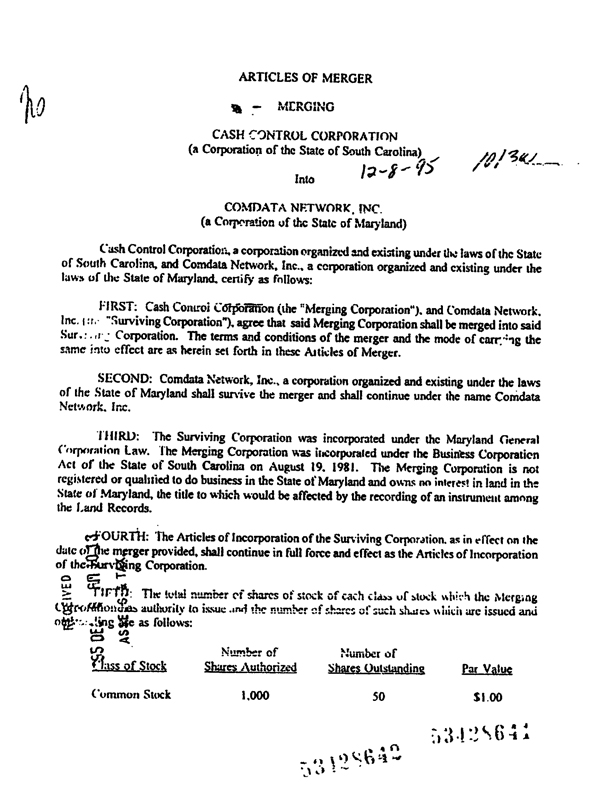

ARTICLES OF MERGER

COMDATA FINANCIAL SERVICES, INC.

INTO

| | | | |

| | COMDATA NETWORK, INC. | | 1-8-87 [ILLEGIBLE] |

The undersigned, the President and the Secretary of Comdata Network, Inc., a corporation (“Network”) and Comdata Financial Services, Inc., a North Carolina corporation (“Services”) in accordance with the Maryland Business Corporation Act and the North Carolina Business Corporation Act do hereby jointly certify that the following Plan of Merger was approved by the Board of Directors of Network on December 31, 1986, and by the Board of Directors of Services on December 31, 1986, and acknowledge that these Articles of Merger are filed with respect to the following Plan of Merger:

COMDATA NETWORK, INC.

PLAN OF MERGER

This Plan of Merger (the “Plan”) by and among Comdata Financial Services, a North Carolina corporation and Comdata Network, Inc., a Maryland corporation.

W I T N E S S E T H:

WHEREAS, Network is the record or equitable holder of all of the outstanding shares of the capital stock of Services; and

WHEREAS, the Directors of Network and Services believe that it will be in the best interest of each corporation for Services to be merged into Network.

NOW, THEREFORE, in consideration of the mutual undertakings hereinafter set forth, Network and the Services agree as follows:

1.Merger. At the effective date of the Merger (as defined in Paragraph 11 hereof), Services shall be merged with and into Network, the separate existence of Services shall cease and Network shall continue in existence as the surviving corporation and, without any further act or other transfer, shall succeed to and possess all of the properties, assets, rights, privileges, powers, franchises and immunities, whether of a public or a private nature, and shall be subject to all the

debts, liabilities, obligations, restrictions, disabilities and duties of Services, all without further act or deed, as provided under the Maryland Business Corporation Act and the North Carolina Business Corporation Act.

2.Surviving Corporation. Network shall be the surviving corporation. The name of the surviving corporation shall continue to be Comdata Network, Inc.

3.Subsidiary Corporation. Services is the wholly subsidiary of Network and was incorporated as a North Carolina corporation on September 22, 1977. Services was incorporated under the general law of the State of North Carolina in effect on the date of its incorporation. Services has not conducted business in the state of Maryland and has therefore not qualified or registered in Maryland.

4.Governing Law. The laws which are to govern the surviving corporation are the laws of the State of Maryland.

5.Registered Agent and Office. The registered agent and principal office for Network in the State of Maryland upon completion of the Merger shall be:

C T Corporation

32 South Street

Baltimore, Maryland 21202

6.Authorization of Merger. The Maryland Business Corporation Act Section 3-117 and the North Carolina Business Corporation Act Section 55-111 permit the merger of domestic and foreign corporations.

7.Articles of Incorporation. The Articles of Incorporation of Network as of the effective date of the Merger, shall remain unchanged by the Merger.

8.Bylaws. The Bylaws of Network as of the effective date of the Merger, shall remain unchanged by the Merger.

9.Directors and Officers. The Directors and Officers of Network as of the effective date of the Merger, shall continue as the Directors and Officers of Network until their respective successors are duly elected and qualified.

10.Stock Conversion. Upon consummation of the Merger all shares of stock of Services shall be cancelled. Services is the wholly-owned subsidiary of Network and no cash or shares or other securities or obligations will be distributed, or issued upon cancellation of the shares of Services.

11.Effective Date of Merger. As of the effective date of the Merger, the separate existence of Services shall cease and Services shall be merged into Network. The Merger shall be

effective pursuant to the laws of the State of Maryland and the State of North Carolina upon the later of the filing of these Articles of Merger with the Secretary of State for the State of Maryland and the Secretary of State for the State of North Carolina or to the extent that a particular state allows a corporation to specify an effective date for a merger different that the filing date, the Merger shall be deemed to be effective on December 31, 1986.

12.Shareholder Approval. Services is a wholly owned subsidiary of Network and as provided by the respective laws and bylaws governing each of the corporations this Plan of Merger does not require shareholder approval and has been duly authorized and adopted by the Board of Directors of each respective corporation.

13.Abandonment. This Plan may be abandoned or terminated, in whole or in part, at any time before or after approval or adoption thereof by the Board of Directors of Network and the Board of Directors of Services, but no later than the effective date of the Merger, by mutual consent of the Presidents of Network and Services.

14.Consent to Service of Process. Network, the surviving corporation, hereby: (a) agrees that it may be served with process in the State of North Carolina in any proceeding for the enforcement of any obligation of the undersigned domestic corporation and in any proceeding for the enforcement of the rights of a dissenting shareholder of such domestic corporation against Network; (b) irrevocably appoints the Secretary of State of North Carolina as its agent to accept service of process in any such proceeding; and (c) agrees that it will promptly pay to the dissenting shareholder of such domestic corporation the amount if any, to which they shall be entitled under the provisions of the North Carolina Business Corporation Act with respect to the rights of dissenting shareholders.

The number of shares outstanding are as follows:

| | |

Corporation | | No. of Shares Outstanding |

Comdata Network, Inc. | | 19,010,000 |

Comdata Financial Services, Inc. | | 100 |

Pursuant to the Maryland Business Corporation Act, Section 3-107 and the North Carolina Business Corporation Act, Section 55-108.1 shareholder approval is not required since Services is a wholly owned subsidiary of Network and no minority shareholders exist.

These Articles of Merger shall, to the extent a state permits an effective date different from the date of filing, shall be effective December 31, 1986. In all other instances, these Articles shall be effective when filed.

CERTIFICATE

We hereby certify that the foregoing Articles of Merger contains a true and correct copy of the Plan of Merger duly passed by the Board of Directors of each respective corporation the respective state laws, corporate charters and bylaws on the date set forth opposite our respective signatures. These Articles of Merger are being filed with the Secretary of State of the State of Maryland and the Secretary of State of the State of North Carolina to evidence the merger of our respective corporations.

| | | | |

| RESOLUTION DATE | | Comdata Network, Inc. |

| | |

| Dec. 31, 1986 | | By: | |

|

| | | | Its President |

| | |

| | By: | |

|

| | | | Its Secretary |

| | | | |

| | Comdata Financial Services, Inc. |

| | |

| Dec. 31, 1986 | | By: | |

|

| | | | Its President |

| | |

| | By: | |

|

| | | | Its Secretary |

STATE OF TENNESSEE )

) SS.

COUNTY OF DAVIDSON )

This is to certify that on the 7th day of January, 1987, R. Levis Jones, the President of Comdata Network, Inc., a Maryland corporation being duly sworn stated that he signed the foregoing instrument, that he is the president of Comdata Network, Inc., that he was authorized to sign the foregoing instrument and that the statements contained therein are true.

|

|

|

Notary Public My Commission Expires March 11, 1990 |

STATE OF TENNESSEE )

) SS.

COUNTY OF DAVIDSON )

This is to certify that on the 7th day of January, 1987, James Gregoric, the Secretary of Comdata Network, Inc., a Maryland corporation being duly sworn stated that he signed the foregoing instrument, that he is the secretary of Comdata Network, Inc., that he was authorized to sign the foregoing instrument and that the statements contained therein are true.

|

|

|

Notary Public My Commission Expires March 11, 1990 |

STATE OF TENNESSEE )

) SS.

COUNTY OF DAVIDSON )

This is to certify that on the 7th day of January, 1987, R. Levis Jones, the President of Comdata Financial Services, Inc., a North Carolina corporation being duly sworn stated that he signed the foregoing instrument, that he is the President of Comdata Financial Services, Inc., that he was authorized to sign the foregoing instrument and that the statements contained therein are true.

|

|

|

Notary Public My Commission Expires March 11, 1990 |

STATE OF TENNESSEE )

) SS.

COUNTY OF DAVIDSON )

This is to certify that on the 7th day of January, 1987, James Gregoric, the Secretary of Comdata Financial Services, Inc., a North Carolina corporation being duly sworn stated that he signed the foregoing instrument, that he is the secretary of Comdata Financial Services, Inc., that he was authorized to sign the foregoing instrument and that the statements contained therein are true.

|

|

|

Notary Public My Commission Expires March 11, 1990 |

ARTICLES OF MERGER

of

CMD SUBSIDIARY CORP.

(a Maryland corporation)

with and into

COMDATA NETWORK, INC.

(a Maryland corporation)

The undersigned parties to these Articles of Merger hereby certify to the State Department of Assessments and Taxation of Maryland that:

ARTICLE ONE

The parties to these Articles of Merger and to the Merger (the “Constituent Corporations”) are as follows: CMD Subsidiary Corp., a corporation organized and existing under the general laws of the State of Maryland (“CMD”), and Comdata Network, Inc., a corporation organized and existing under the general laws of the State of Maryland (“Comdata”). The successor corporation in the Merger (the “Successor Corporation”) shall be and shall continue under the name, Comdata Network, Inc. Each Constituent Corporation agrees to so merge.

ARTICLE TWO

The manner and basis of converting or exchanging the issued stock of the[ILLEGIBLE] Corporations in the Merger is

stated in the Agreement and Plan of Merger dated as of March 23, 1987, as amended, among Comdata, Comdata Holdings Corporation, a Delaware corporation, and CMD (the “Agreement and Plan of Merger”), relevant portions of which are attached hereto as Exhibit A and incorporated herein by reference.

ARTICLE THREE

The Board of Directors of CMD, by unanimous written consent dated March 23, 1987, May 4, 1987 and at a meeting on July 29, 1987, adopted resolutions declaring that the Merger was advisable and directing that the Agreement and Plan of Merger be submitted for action thereon to the sole stockholder of CMD. The Agreement and Plan of Merger was approved by the sole stockholder of CMD pursuant to a unanimous written consent dated as of March 23, 1987. By such actions, the Merger was duly advised by the Board of Directors and approved by the sole stockholder of CMD in the manner and by the vote required by the laws of Maryland and by the Charter of CMD.

The Board of Directors of Comdata, at meetings duly held on March 23, 1987, May 4, 1987 and July 20, 1987, adopted resolutions declaring that the Merger was advisable and directing that the Agreement and Plan of Merger be submitted for action thereon at a meeting of the stockholders of Comdata. The Agreement and Plan of Merger was approved by the stockholders of

32

Comdata by the affirmative vote of the holders of at least two thirds of the shares of its Common Stock outstanding and entitled to vote at a meeting duly held on August 25, 1987. By such actions the Merger was duly advised by the Board of Directors and approved by the stockholders of Comdata in the manner and by the vote required by the laws of Maryland and by the Charter of Comdata.

ARTICLE FOUR

The Total number of shares of stock which CMD has authority to issue is one thousand (1000) shares of common stock, $.01 par value per share, having an aggregate par value of $10.00. The total number of shares of stock which Comdata has authority to issue is thirty million (30,000,000) shares of common stock, $.02 par value per share, having an aggregate par value of $600,000.

ARTICLE FIVE

CMD has its principal office in Baltimore City, State of Maryland. Comdata has its principal office in the City of Baltimore, State of Maryland. Neither CMD nor Comdata owns any interest in land in the State of Maryland.

33

ARTICLE SIX

The Successor Corporation shall have the purposes and powers of each Constituent Corporation; the assets of each Constituent Corporation, including any legacies which it would have been capable of taking, shall transfer to, vest in, and devolve on the Successor Corporation without further act or deed; confirmatory deeds, assignments, or similar instruments to evidence the transfer may be executed and delivered at any time in the name of CMD: (i) by its last acting officers; or (ii) by the appropriate officers of the Successor Corporation; the Successor Corporation shall be liable for all the debts and obligations of CMD; an existing claim, action, or proceeding pending by or against CMD may be prosecuted to judgment as if the Merger had not taken place, or, on motion of the successor of any party, the Successor Corporation may be substituted as a party, and the judgment against the Successor Corporation will constitute a lien on the property of the Successor Corporation; and the Merger shall not impair the rights of creditors or any liens on the property of any corporation party to these Articles of Merger.

ARTICLE SEVEN

The Articles of Incorporation and By-laws of Comdata, in effect on the effective date of the Merger shall be the Articles of Incorporation and By-laws of the Successor Corporation

34

and shall remain unchanged as a result of the Merger, until otherwise amended or changed as provided therein or as provided by law.

ARTICLE EIGHT

The Merger shall become effective upon the acceptance for filing of these Articles of Merger by the State Department of Assessment and Taxation of the State of Maryland.

35

IN WITNESS WHEREOF, the corporations party to these Articles of Merger have caused these presents to be signed in their respective corporate names and on their behalfs by their respective Presidents or Vice Presidents and their corporate seals to be hereunto affixed and attested by their respective Secretaries or Assistant Secretaries, and each officer signing this document acknowledges it to be the corporate act of his respective corporation and that, to the best of his knowledge, information and belief, all matters and facts set forth herein with respect to the authorization and approval of the foregoing Articles are true in all material respects and that this verification is made under the penalties of perjury.

| | | | |

| | | | CMD Subsidiary Corp. |

| | |

| ATTEST: | | | | |

| | |

/s/ William J.[ILLEGIBLE] | | By | | /s/ Patrick J. Weleh |

| Secretary | | | | President |

| William J.[ILLEGIBLE] | | | | Patrick J. Weleh |

| | |

| | | | Comdatn Network, Inc. |

| | |

/s/ James G.[ILLEGIBLE] | | By | | /s/ R. Lewis Jones |

| Secretary | | | | President |

| James G.[ILLEGIBLE] | | | | R. Lewis Jones |

| | | | |

| | | | |

GA828618AH

36

APPENDIX A

CONFORMED COPY

AGREEMENT AND PLAN OF MERGER

Among

COMDATA NETWORK, INC.,

COMDATA HOLDINGS CORPORATION

and

CMD SUBSIDIARY CORP.

Dated as of March 23, 1987

A-1

TABLE OF CONTENTS

| | | | |

| | | | | Page |

ARTICLE I. | | MERGER | | |

SECTION | | 1.01 The Merger | | A-5 |

SECTION | | 1.02 Filing | | A-5 |

SECTION | | 1.03 Effective Date of the Merger | | A-5 |

ARTICLE II. | | BOARD OF DIRECTORS AND OFFICERS | | |

SECTION | | 2.01 Directors | | A-5 |

SECTION | | 2.02 Officers | | A-6 |

ARTICLE III. | | CONVERSION OF SHARES | | |

SECTION | | 3.01 Conversion | | A-6 |

ARTICLE IV. | | CERTAIN EFFECTS OF MERGER | | |

SECTION | | 4.01 Effect of Merger | | A-9 |

SECTION | | 4.02 Further Assurances | | A-9 |

ARTICLE V. | | COMDATA STOCK PLANS | | |

SECTION | | 5.01 Outstanding Stock Options | | A-9 |

SECTION | | 5.02 Employee Stock Purchase Plan | | A-9 |

ARTICLE VI. | | REPRESENTATIONS AND WARRANTIES | | |

SECTION | | 6.01 Representations and Warranties by Comdata | | A-10 |

(a) | | Organization and Qualification, etc. | | A-10 |

(b) | | Capital Stock | | A-10 |

(c) | | Authority Relative to Agreement | | A-10 |

(d) | | Non-Contravention | | A-10 |

(e) | | Consents, etc. | | A-11 |

(f) | | Periodic Reports | | A-11 |

(g) | | Subsidiaries | | A-11 |

(h) | | Financial Statements | | A-12 |

(i) | | Absence of Certain Changes or Events | | A-12 |

(j) | | Governmental Authorization and Compliance with Laws | | A-12 |

(k) | | Absence of Undisclosed Liabilities and Agreements | | A-12 |

(l) | | Tax Matters | | A-13 |

(m) | | Title to Properties: Absence of Liens and Encumbrances, etc. | | A-13 |

(n) | | Material Contracts | | A-13 |

(o) | | Litigation | | A-14 |

(p) | | Labor Controversies | | A-14 |

(q) | | Insider Interests | | A-14 |

(r) | | Trade Names, Trademarks, etc. | | A-14 |

(s) | | Insurance | | A-14 |

(t) | | Proxy Statement-Prospectus | | A-14 |

SECTION | | 6.02 Representations and Warranties by Holdings | | A-15 |

(a) | | Organization and Qualification, etc. | | A-15 |

(b) | | Capital Stock | | A-15 |

(c) | | Authority Relative to Agreement and Financing Arrangements | | A-15 |

(d) | | Non-Contravention | | A-15 |

(e) | | Consents, etc. | | A-16 |

A-2

| | | | |

| | | | | Page |

(f) | | Proxy Statement-Registration Statement | | A-16 |

(g) | | Other Matters | | A-16 |

SECTION | | 6.03 Representations and Warranties by CMD | | A-16 |

(a) | | Organization and Qualification, etc. | | A-16 |

(b) | | Capital Stock | | A-16 |

(c) | | Authority Relative to Agreement | | A-17 |

(d) | | Non-Contravention | | A-17 |

(e) | | Consents, etc. | | A-17 |

(f) | | Other Matters | | A-17 |

ARTICLE VII. | | ADDITIONAL COVENANTS AND AGREEMENTS | | |

SECTION | | 7.01 Conduct of Business | | A-17 |

(a) | | Operations in the Ordinary Course of Business | | A-17 |

(b) | | Forbearances | | A-17 |

SECTION | | 7.02 Stockholders’ Meeting | | A-18 |

SECTION | | 7.03 Regulatory Consents, Authorizations, etc. | | A-18 |

SECTION | | 7.04 Investigation | | A-19 |

SECTION | | 7.05 Expenses: Certain Payments | | A-19 |

SECTION | | 7.06 No Solicitation of Transactions | | A-19 |

SECTION | | 7.07 Additional Agreements | | A-20 |

SECTION | | 7.08 Listing of Holdings Common Stock | | A-20 |

SECTION | | 7.09 Commission Filings | | A-20 |

SECTION | | 7.10 Officers’ and Directors’ Indemnification: Insurance | | A-20 |

SECTION | | 7.11 Financing | | A-21 |

ARTICLE VIII. | | CONDITIONS TO THE MERGER | | |

SECTION | | 8.01 Conditions to Merger Relating to Holdings and CMD | | A-21 |

(a) | | Stockholder Approval | | A-21 |

(b) | | Regulatory Consents, Authorizations, etc. | | A-21 |

(c) | | Injunction, etc. | | A-21 |

(d) | | Representations and Warranties | | A-21 |

(e) | | Certificate | | A-22 |

(f) | | Opinion of Comdata’s Counsel | | A-22 |

(g) | | Letters from Accountants | | A-23 |

(h) | | Additional Certificates, etc. | | A-24 |

(i) | | Antitrust Improvements Act | | A-24 |

(j) | | Consummation of Transactions Contemplated by the Financing Arrangements | | A-24 |

SECTION | | 8.02 Conditions to the Merger Relating to Comdata | | A-24 |

(a) | | Stockholder Approval | | A-24 |

(b) | | Regulatory Consents, Authorizations, etc. | | A-24 |

(c) | | Injunction, etc. | | A-24 |

(d) | | Representations and Warranties | | A-25 |

(e) | | Certificate | | A-25 |

(f) | | Opinion of Holdings’ and CMD’s Counsel | | A-25 |

(g) | | Additional Certificates, etc. | | A-28 |

(h) | | Antitrust Improvements Act | | A-28 |

(i) | | Deposit Agreement | | A-28 |

A-3

| | | | |

| | | | | Page |

(j) | | Registration Statement: Indenture | | A-28 |

(k) | | Subscription Agreement | | A-28 |

(l) | | Investment Bankers’ Opinion | | A-28 |

ARTICLE IX. | | TERMINATION AND ABANDONMENT | | |

SECTION | | 9.01 Termination and Abandonment | | A-28 |

SECTION | | 9.02 Termination | | A-29 |

SECTION | | 9.03 Effect of Termination | | A-29 |

ARTICLE X. | | MISCELLANEOUS | | |

SECTION | | 10.01 Waiver of Conditions | | A-29 |

SECTION | | 10.02 Closing | | A-29 |

SECTION | | 10.03 Notices | | A-29 |

SECTION | | 10.04 Brokers | | A-29 |

SECTION | | 10.05 Counterparts | | A-30 |

SECTION | | 10.06 Headings | | A-30 |

SECTION | | 10.07 Variation and Amendment | | A-30 |

SECTION | | 10.08 No Survival of Representations or Warranties | | A-30 |

SECTION | | 10.09 Schedules | | A-30 |

SECTION | | 10.10 Miscellaneous | | A-30 |

TESTIMONIUM | | A-31 |

INDEX TO SCHEDULES (Not included in this Proxy Statement — Prospectus)

INDEX TO EXHIBITS (Not included in this Proxy Statement — Prospectus)

A-4

AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER, dated as of March 23, 1987, among COMDATA NETWORK, INC., a Maryland corporation (“Comdata”), COMDATA HOLDINGS CORPORATION, a Delaware corporation (“Holdings”), and CMD SUBSIDIARY CORP., a Maryland corporation (“CMD”).

W I T N E S S E T H :

WHEREAS, Holdings and CMD desire that CMD merge with and into Comdata, and Comdata also desires that CMD merge with and into Comdata, upon the terms and conditions set forth herein and in accordance with the General Corporation Law of the State of Maryland, and that the outstanding shares of Common Stock, $.02 par value (“Comdata Common Stock”), of Comdata, excluding any such shares held in the treasury of Comdata, be converted upon such merger (the “Merger”) into the right to elect to receive either (a) $16.50 in cash, without interest, or (b)(i) $10.00 in cash, without interest, and (ii) a unit (a “Unit”) consisting of (A) one (1) share of Common Stock, $.01 par value, of Holdings (“Holdings Common Stock”) and (B) a subunit (a “Subunit”) consisting of (1) $3.00 in principal amount of 11% Subordinated Notes due 1997 (the “Notes”) of Holdings and (2) one quarter (1/4) of a share of Holdings Common Stock, but subject to the limitations set forth herein (Comdata and CMD being hereinafter sometimes referred to as the “Constituent Corporations” and Comdata as the “Surviving Corporation”);

NOW, THEREFORE, in consideration “the mutual representations, warranties, covenants, agreements and conditions contained herein, and in order to set forth the terms and conditions of the Merger and the mode of carrying the same into effect, the parties hereto hereby agree as follows:

ARTICLE I

MERGER

SECTION 1.01The Merger.At the Effective Date (as hereinafter defined), CMD shall be merged with and into Comdata on the terms and conditions hereinafter set forth as permitted by and in accordance with the General Corporation Law of the State of Maryland. Thereupon the separate existence of CMD shall cease, and Comdata, as the Surviving Corporation, shall continue to exist under and be governed by the General Corporation Law of the State of Maryland, with its Articles of Incorporation and its By-laws as in effect at the Effective Date to remain unchanged until further amended in accordance with the provisions thereof and applicable law.

SECTION 1.02Filing.As soon as practicable following fulfillment of the conditions specified in Sections 8.01(a), (b) and (i) and 8.02(a), (b) and (h), and upon fulfillment or waiver of the remaining conditions specified in Article VIII, and provided that this Agreement has not been terminated and abandoned pursuant to Article–IX. Holdings and Comdata will cause Articles of Merger[ILLEGIBLE] prepared in accordance with Section 3-109 of the General Corporation Law of the State of Maryland (the “Articles of Merger”) to be executed and filed for record with the State Department of Assessments and Taxation of the State of Maryland (the “Department”).

SECTION 1.03Effective Date of the Merger.The Merger shall become effective at the time that[ILLEGIBLE] Articles of Merger have been accepted for record by the Department as referred to in Section 1.02. The date and time of such filing is herein sometimes referred to as the “Effective Date”.

ARTICLE II

BOARDOF DIRECTORSAND OFFICERS

SECTION 2.01Directors.From and after the Effective Date, the members of the Board of Directors of the Surviving Corporation shall consist of the members of the Board of Directors of CMD as constituted immediately prior to the Effective Date, each of the members of such Board of Directors of the Surviving Corporation to serve until his successor is elected and is qualified or until his earlier death, resignation or removal.

A-5

SECTION 2.02Officers. From and after the Effective Date, each officer of Comdata immediately prior to the Effective Date shall be an officer of the Surviving Corporation in the same capacity or capacities, until his successor is elected and qualified or until his earlier death, resignation or removal.

ARTICLE III

CONVERSIONOF SHARES

SECTION 3.01Conversion.

(a) Subject to the other subsections of this Section 3.01 and pursuant to the elections provided for herein, on the Effective Date each share of Comdata Common Stock issued and outstanding immediately prior to the Effective Date shall, by virtue of the Merger, automatically and without any action on the part on the holder thereof, become and be converted into (i) the right to receive $16.50 in cash, without interest, or (ii) the right to receive (A) $10.00 in cash, without interest, and (B) a Unit consisting of (1) one (1) share of Holdings Common Stock and (2) a Subunit consisting of (1) $3.00 in principal amount of Notes and (II) one quarter (1/4) of a share of Holdings Common Stock, such Subunit to trade only as a Subunit for up to two years after the Effective Date in accordance with the terms of a Deposit Agreement substantially in the form of Exhibit 3.01(a) hereto referred to in Section 8.02(i).

(b) Each record holder of shares of Comdata Common Stock will be entitled (i) to elect to receive $16.50 in cash for all of such shares (a “Cash Election”), (ii) to elect to receive $10.00 in cash and a Unit for all of such shares (a “Unit Election”) or (iii) to elect to receive $16.50 in cash for some of such shares and $10.00 in cash and a Unit for the remainder of such shares (in which case said record holder shall be deemed to have made separate Cash and Unit Elections with respect to the respective shares). All such elections shall be made on a form designed for that purpose (a “Form of Election”). In the event that a record owner fails for any reason to make such an election or any such election is revoked or is determined not to be effective, in each case in accordance with the provisions hereof (a “Non-Election”), such record owner shall be deemed to have made a Cash Election.

(c) Subject to Section 5.01, the maximum number of shares of Comdata Common Stock that may be converted into the right to receive cash and a Unit in the Merger shall be 7,845,232 shares (the “Unit Election Number”), it being intended that the Unit Election Number shall be equal to that number of shares which upon conversion into Units would represent 10% of the total number of shares of Holdings Common Stock that shall be outstanding immediately after the issuance of such shares, taking into account the shares to be acquired pursuant to the subscription agreement referred to in Section 6.02(b). All other shares of Comdata Common Stock shall be converted into cash.

(d) All shares of Comdata Common Stock covered by Unit Elections (“Unit Election Shares”) shall be exchanged for $10.00 in cash and a Unit in accordance with clause (a) (ii) of this Section 3.01 and all other shares of Comdata Common Stock shall be converted into the right to receive cash in the Merger in accordance with clause (a)(i) of this Section 3.01:provided, however, that, if the aggregate number of Unit Election Shares exceeds the Unit Election Number, all Unit Election Shares, if any, held by CMD, Holdings or Welsh, Carson, Anderson & Stowe IV (“WCAS IV”) shall be converted into the right to receive cash in the Merger in accordance with clause (a)(i) of this Section 3.01 and the remaining Unit Election Shares shall be converted into the right to receive cash and a Unit in the following manner:

(i) A Unit proration factor (the “Unit Proration Factor”) shall be determined by dividing (A) the Unit Election Number by (B) the total number of Unit Election Shares held by stockholders other than CMD, Holdings or WCAS IV.

(ii) The number of Unit Election Shares and fractions thereof covered by each Unit Election which are to be converted into the right to receive cash and a Unit shall be determined by multiplying the Unit Proration Factor by the total number of Unit Election Shares covered by such Unit Election.

(iii) All Unit Election Shares and fractions thereof other than those Unit Election Shares and fractions thereof converted into the right to receive cash and a Unit in accordance with the foregoing Provisions of clause (d)(ii) shall be converted into the right to receive cash in the Merger in accordance with clause (a)(i) of this Section 3.01.

A-6

(e) For the purposes hereof, a person who shall be shown as the record holder of any shares of Comdate Common Stock on Comdata’s stock transfer records immediately prior to the Effective Date and who does not submit a Form of Election which is received by the Exchange Agent (as hereinafter defined) shall be deemed to have made a Non-Election. If Holdings or the Exchange Agent shall determine that any Unit Election was not properly made with respect to shares of Comdata Common Stock, such Unit Election shall be deemed to be of no force and effect and the stockholder making such Unit Election shall, for purposes hereof, be deemed to have made a Non-Election with respect to such shares.

(f) The Form of Election shall be determined by mutual agreement between Holdings and Comdata and shall be mailed to holders of record of Comdata Common Stock simultaneously with the Proxy Statement referred to in Section 6.01(t). To be effective, the Form of Election must be properly completed, signed and submitted and accompanied by the certificates representing the shares of Comdata Common Stock as to which the election is being made (or by an appropriate guarantee of delivery by a commercial bank or trust company in the United States or a member of a registered national securities exchange or the National Association of Securities Dealers, Inc.). Holdings will have the discretion, which it may delegate in whole or in part to the exchange agent named in the Form of Election (the “Exchange Agent”), to determine whether Forms of Election have been properly completed, signed and submitted or revoked and to disregard immaterial defects in Forms of Election. The decisions of Holdings (or the Exchange Agent) in such matters shall be made in good faith and shall be conclusive and binding. Neither Holdings nor the Exchange Agent will be under any obligation to notify any person of any defect in a Form of Election submitted to the Exchange Agent. The Exchange Agent shall also make all computations contemplated by this Section 3.01 and all such computations shall be made in good faith and shall be conclusive and binding on the holders of Comdata Common Stock. Holdings shall irrevocably instruct the Exchange Agent to transmit the cash, and the certificates and other instruments representing the Holdings Common Stock and the Subunits, to the former Comdata stockholders entitled thereto in accordance with the provisions of this Agreement as promptly as practicable after the Effective Date.

(g) Holdings and Comdata shall each use its best efforts to mail the Form of Election to all persons who become holders of Comdata Common Stock during the period between the date referred to in the first sentence of clause (f) of this Section 3.01 and 10:00 a.m., New York time, on the day seven calendar days prior to the Effective Date and to make the Form of Election available to all persons who become holders of Comdata Common Stock subsequent to such day and prior to the Effective Date.

(h) A Form of Election must be received by the Exchange Agent by the close of business on the last business day prior in the Effective Date (the “Election Deadline”) in order to be effective. Any election may be revoked but only by written notice received by the Exchange Agent prior to the Election Deadline. Any certificates representing shares of Comdata Common Stock which were submitted in connection with an election shall be returned to the holder thereof in the event such election is revoked as aforesaid and such holder requests in writing the return of such certificates.

(i) On the Effective Date, holders of certificates which represent shares of Comdata Common Stock outstanding immediately prior to the Effective Date (“Old Certificates”) shall cease to be, and shall have no rights as, stockholders of Comdata.

(j) On the Effective Date, each share of Comdata Common Stock [ILLEGIBLE] if any, held in the treasury of Comdata shall be cancelled.

(k) On the Effective Date, each issued and outstanding share of Common Stock, $.01 par value, of CMD shall be converted into one share of Common Stock of the Surviving Corporation.

(l) Old Certificates shall be exchangeable by the holders thereof in the manner provided in the transmittal materials described below, to the extent such certificates have not already been submitted to the Exchange Agent with a Form of Election, for (i) the cash to which such holders shall be entitled pursuant to this Section 3.01 and/or (ii) new certificates for the number of full shares of Holdings Common Stock and the aggregate principal amount of Notes to which such holders shall be entitled pursuant to this

A-7

Section 3.01. as the case may be;provided, however, that, notwithstanding any other provisions of this Agreement, (A) each holder of Old Certificates who would otherwise have been entitled to receive fractions of a share of Holdings Common Stock (after taking into account all shares of g Common Stock converted by such holder into Holdings Common Stock) shall receive, in lieu thereof, cash in an amount equal to such fractional part of a share multiplied by $2.00, without interest, and (B) each holder of Old Certificates who would otherwise have been entitled to receive less that[ILLEGIBLE] $100 in principal amount of Notes (after taking into account all shares of Comdata Common Stock converted by such holder into Notes) shall receive, in lieu thereof, cash in an amount equal to such principal amount of Notes, without interest.

On the Effective Date, Holdings shall deposit or cause to be deposited in trust with the Exchange Agent cash in an aggregate amount equal to the estimated amount of cash to be paid to Comdata stockholders pursuant to Article III hereof (such amount being hereinafter referred to as the “Payment Fund”). In the event that such amount of cash so deposited is insufficient to pay Comdata stockholders in full, no later than three business days after the Effective Date Holdings shall deposit the shortfall with the Exchange Agent. The Payment Fund shall be invested by the Exchange Agent, as directed by Holdings (so long as such directions do not impair the rights of holders of Comdata Common Stock), in direct obligations of the United States of America, obligations for which the full faith and credit of the United States of America is pledged to provide for the payment of principal and interest, commercial paper rated of the highest quality by Moody’s Investors Service, Inc. or Standard & Poor’s Corporation or certificates of deposit issued by, or other deposit accounts of, a commercial bank having at least $1,000,000,000 in capital and surplus. Any net earnings with respect thereto shall be paid to Holdings as and when requested by Holdings. The Exchange Agent shall, pursuant to irrevocable instructions, make the payments referred to in this Article III out of the Payment Fund. The Payment Fund shall not be used for any other purpose;provided, however, that, if any amounts shall remain unclaimed in the Payment Fund one year after the Effective Date, such amounts shall be paid to Holdings and any former Comdata stockholder entitled thereto shall thereafter look only to Holdings for payment thereof.

As promptly as practicable, but in no event later than three business days after the Effective Date. Holdings shall send or cause to be sent to each former stockholder of record of Comdata immediately prior to the Election Deadline who has not previously submitted his shares of Comdata Common stock transmittal materials for use in exchanging his Old Certificates. The letter of transmittal will contain Instructions with respect to the surrender of Old Certificates.

Whenever a dividend is declared by Holdings on Holdings Common Stock after the Effective Date, the declaration shall include dividends on all shares issuable hereunder, but no stockholder will be entitled to receive his distribution of such dividends until physical exchange of his Old Certificates shall have been effected. Whenever interest is payable by Holdings on the Notes after the Effective Date, no Noteholder will be entitled to receive his interest payment until physical exchange of his Old Certificates shall have been effected. Upon physical exchange of his Old Certificates, any such person shall be entitled to receive from Holdings an amount equal to all dividends declared or interest accrued and payable, as the case may be (in either case, without interest thereon and less the amount of taxes, if any, which may have been imposed or[ILLEGIBLE] thereon), and for which the payment date has occurred, on the shares of Holdings Common Stock and Notes issued in exchange therefor. [Except as provided in the two immediately preceding sentences with respect to dividends and interest, until surrendered each Old Certificate shall be deemed for all purposes to evidence the right to receive cash and, if applicable ownership of the number of shares of Holdings Common Stock and Notes, If any, into which the shares represented by the Old Certificates have been converted as aforesaid.]

On and after the Effective Date there shall be no transfers on the stock transfer books of Comdata or Holdings of shares of Comdata Common Stock which were issued and outstanding immediately prior to the Effective Date. If, after the Effective Date, Old Certificates are properly presented to Holdings, they shall be cancelled and exchanged for cash or cash and certificates representing shares of Holdings Common Stock and Notes, as the case may be, as herein provided.

A-8

ARTICLE IV

CERTAIN EFFECTSOF MERGER

SECTION 4.01Effect of Merger. Upon and after the Effective Date, the separate existence of each Constituent Corporation party to the Articles of Merger, except the Surviving Corporation, ceases; in addition to any other purposes and powers set forth in the Articles of Merger, the Articles of Merger shall provide that the Surviving Corporation has the purposes and powers of each Constituent Corporation party to the Articles of Merger; the assets of each Constituent Corporation party to the Articles of Merger including any legacies which it would have been capable of taxing, transfer to, vest in, and devolve on the successor without further act or deed; confirmatory deeds, assignments, or similar instruments to evidence the transfer may be executed and delivered at any time in the name of the transferring corporation: (i) by its last acting officers; or (ii) by the appropriate officers of the Surviving Corporation; the Surviving Corporation is liable for all the debts and obligations of the nonsurviving corporation; an existing claim, action, or proceeding pending by or against any nonsurviving corporation may be prosecuted to judgment as if the Merger had not taken place, or, on motion of the successor or any party, the Surviving Corporation may be substituted as a party, and the judgment against the Surviving Corporation constitutes a lien on the property of the Surviving Corporation; and the Merger shall not impair the rights of creditors or any liens on the property of any corporation party to the Articles of Merger.

SECTION 4.02Further Assurances. If at any time after the Effective Date the Surviving Corporation shall consider or be advised that any further deeds assignments or assurances in law or any other acts are necessary, desirable or proper (a) to vest, perfect or confirm, of record or otherwise, in the Surviving Corporation, the title to any property or right of the Constituent Corporations acquired or to be acquired by reason of, or as a result of, the Merger, or (b) otherwise to carry out the purposes of this Agreement, the Constituent Corporations agree that the Surviving Corporation and its proper officers and directors shall and will execute and deliver all such further deeds, assignments and assurances in law and do all acts necessary, desirable or proper to vest, perfect or confirm title to such property or rights in the Surviving Corporation and otherwise to carry out the purposes of this Agreement, and that the proper officers and directors of the Constituent Corporations and the proper officers and directors of the Surviving Corporation are fully authorized in the name of the Constituent Corporations or otherwise to take any and all such actions.

ARTICLE V

COMDATA STOCK PLANS

SECTION 5.01.Outstanding Stock Options. On the date on which the stockholders of Comdata shall approve the adoption of this Agreement, all employee stock options then outstanding under Comdata’s 1983 Amended Stock Option Plan (the “Stock Option Plan”), to the extent not otherwise exercisable by their terms, shall become immediately exercisable at the exercise price set forth in such options and for a period of time terminating 30 days after the date of such stockholder approval. Each holder of an employee stock option who elects to exercise such option prior to the end of such 30-day period shall receive a Form of Election and shall have the right to elect to receive cash and/or cash and Units in accordance with Section 3.01 hereof for each share of Comdata Common Stock that the option holder would otherwise be entitled to receive. In the event the Effective Date shall occur prior to the end of such 30-day period, options outstanding on the Effective Date shall be deemed, for the purpose of Section 3.01(c), to be converted into the right to receive cash and Units. Options that shall not have been exercised prior to the end of such 30-day period shall thereupon terminate and each such option holder shall be entitled to receive $16.50 in cash, less the exercise price, for each share of Comdata Common Stock that the holder would have been entitled to receive upon exercise of his option if the Merger had not been consummated.

SECTION 5.02.Employee Stock Purchase Plan. On the date hereof, Comdata’s 1982 Employee Stock Purchase Plan (the “Stock Purchase Plan”) shall terminate and no further contributions by employees shall be permitted thereunder. As promptly as practicable after the date hereof, all contributions held for the benefit of employees under the Stock Purchase Plan shall be applied to the purchase of shares of Comdata Common Stock in accordance with the terms of the Stock Purchase Plan. To the extent any amounts shall not be so applied on the Effective Date, such amounts shall be paid by Comdata to the employees entitled thereto.

A-9

ARTICLE VI

REPRESENTATIONSAND WARRANTIES

SECTION 6.01Representations and Warranties by Comdat.Comdata represents and warrants to, and agrees with, Holdings and CMD as follows:

(a)Organization and Qualification, etc.Comdata is a corporation duly organized, validly existing and in good standing under the laws of the State of Maryland, has corporate power and authority to own all of its properties and assets and to carry on its business as it is now being conducted, and is duly qualified to do business and is in good standing in each jurisdiction where such qualification is required and where the failure to so qualify would, when taken together with all other such failures, affect materially and adversely the financial condition of Comdata and its Subsidiaries (as hereinafter defined) considered as a whole. The copies of Comdata’s Articles of Incorporation and By-Laws, as amended to date, which have been delivered to Holdings, are complete and correct, and such instruments, as so amended, are in full force and effect at the date hereof.

(b)Capital Stock. The authorized capital stock of Comdata consists of 30,000,000 shares of Comdata Common Stock of which as of December 31,[ILLEGIBLE] shares of Comdata Common Stock were validly issued and outstanding, fully paid and nonassessable, and no shares of Comdata Common Stock were held in the treasury of Comdata. As of December 31, 1986, Comdata had 838,460 authorized but unissued shares of Comdata Common Stock reserved for issuance pursuant to options granted or to be granted under the Stock Option Plan and 254,765 authorized but unissued shares of Comdata Common Stock reserved for issuance pursuant to the Stock Purchase Plan. Since December 31, 1986, no shares of Comdata Common Stock have been issued except pursuant to options granted prior to that date under the Stock Option Plan. As of the date hereof, except for outstanding options under its Stock Option Plan to purchase 560,895 shares and rights outstanding under its Stock Purchase Plan to purchase 11,783 shares. Comdata has no commitments to issue or sell any shares of its capital stock or say securities or obligations convertible into or exchangeable for, or giving any person any right to subscribe for or acquire from Comdata, any shares of its capital stock and no securities or obligations evidencing any such rights are outstanding.

(c)Authority Relative to Agreement. Comdata has the corporate power and authority to execute and deliver this Agreement and, subject to the receipt of the approval of the adoption of this Agreement by the affirmative vote of the holders of two thirds of the outstanding shares of Comdata Common Stock, to consummate the transactions contemplated on the part of Comdata hereby. The execution and delivery by Comdata of this Agreement and the consummation by Comdata of the transactions contemplated on its part hereby have been duly authorized by its Board of Directors. Except for the approval of the adoption of this Agreement by the stockholders of Comdata, no other corporate action on the part of Comdata is necessary to authorize the execution and delivery of this Agreement by Comdata or the consummation by Comdata of the transactions contemplated hereby. This Agreement has been duly executed and delivered by Comdata and is a valid and binding agreement of Comdata.

(d)Non-Contravention. Except as set forth in Schedule 6.01(d), the execution and delivery of this Agreement by Comdata do not and, subject to the approval of the adoption of this Agreement by the stockholders of Comdata, the consummation by Comdata of the transactions contemplated hereby will not violate any provision of the Articles of Incorporation or By-Laws of Comdata, or violate, or result with the giving of notice or the lapse of time or both in a violation of, any provision of, or result in the acceleration of or entitle any party to accelerate (whether after the giving of notice or lapse of time or both) any obligation under, or result in the creation or imposition of any lien, charge, pledge, security interest or other encumbrance upon any of the property of Comdata or any of its Subsidiaries pursuant to any provision of, any mortgage, lien, lease, agreement, license, instrument, law, ordinance, regulation, order, arbitration award, judgment or decree to which Comdata or any of its

A-10