UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22298

Starboard Investment Trust

(Exact name of registrant as specified in charter)

116 South Franklin Street, Post Office Box 69, Rocky Mount, North Carolina 27802

(Address of principal executive offices) (Zip code)

Terrence O. Davis

116 South Franklin Street, Post Office Box 69, Rocky Mount, North Carolina 27802

(Name and address of agent for service)

Registrant's telephone number, including area code: 252-972-9922

Date of fiscal year end: August 31

Date of reporting period: August 31, 2013

Item 1. REPORTS TO STOCKHOLDERS.

Statements in this Annual Report that reflect projections or expectations of future financial or economic performance of the Roumell Opportunistic Value Fund (“Fund”) and of the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include, without limitation, general economic conditions such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

An investment in the Fund is subject to investment risks, including the possible loss of some or the entire principal amount invested. There can be no assurance that the Fund will be successful in meeting its investment objective. Investment in the Fund is also subject to the following risks: market risk, opportunistic investment strategy risk, sector risk, non-diversified fund risk, investment advisor risk, new fund risk, operating risk, common stocks risk, preferred stock risk, warrants risk, convertible securities risk, large-cap securities risk, small-cap and mid-cap securities risk, micro-cap securities risk, risks related to investing in other investment companies, interest rate and credit risk, maturity risk, inflation risk, investment-grade securities risk, lower-rated securities or “junk bonds” risk, risks of investing in municipal securities, risks of investing in REITs, risk of investing in corporate debt securities, government debt markets may be illiquid or disrupted, foreign securities risk, and currency risk. More information about these risks and other risks can be found in the Fund’s prospectus.

The performance information quoted in this annual report represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting ncfunds.com.

An investor should consider the investment objectives, risks, and charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. A copy of the prospectus is available at ncfunds.com or by calling Shareholder Services at 800-773-3863. The prospectus should be read carefully before investing.

This Annual Report was first distributed to shareholders on or about October 30, 2013.

For More Information on Your Roumell Opportunistic Value Fund:

See Our Web site @ ncfunds.com.

or

Call Our Shareholder Services Group at 800-773-3863.

August 31, 2013

For the year ended August 31, 2013, the return on the Institutional class shares was 20.71%. This compares to 24.38% for the Russell 2000 Value Index, 13.04% for the 60% Russell 2000 Value Index/40% Barclays Government Credit Index and 18.70% for the S&P 500 over the same period. These returns were attained with an allocation of about 26% in cash, 58% in equities, and 16% in fixed income during the fiscal year.

Please see the table below for the Fund’s historical performance information through the calendar quarter ended September 30, 2013.

Average Annual Total Returns | | | Net | Gross |

Period Ended September 30, 2013 | Past 1 Year | Since Inception* | Expense Ratio** | Expense Ratio*** |

Roumell Opportunistic Value Fund – Institutional Class Shares | 19.51% | 4.71% | 1.23% | 1.83% |

Russell 2000 Value Index | 27.04% | 12.21% | | |

60% Russell 2000 Value index, and 40% Barclays Capital U.S. Government Credit Index | 15.09% | 9.05% | | |

S&P 500 Total Return Index | 19.34% | 13.57% | | |

The quoted performance data represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain more current performance data regarding the Fund, including performance data current to the Fund’s most recent month-end, please visit ncfunds.com or call the Fund at (800)525-3863. Fee waivers and expenses reimbursements have positively impacted Fund performance.

*The Fund’s inception date is December 31, 2010.

**The Advisor has entered into an Operating Plan with the Fund’s administrator through January 1, 2015, under which it has agreed to (i) to pay the administrator a fee based on the daily average net assets of the Fund when net assets are below $77 million; (ii) if these payments are less than a designated minimum, then the Advisor pays a fee that makes up the difference; and (iii) to assume expenses of the Fund outlined in the Operating Plan that are not covered by the fee paid under Fund Accounting and Administration Agreement. These measures are intended to limit the Fund’s operating expenses to 1.23% of the average daily net assets, exclusive of brokerage fees and commissions, portfolio transaction fees, registration fees taxes, borrowing costs (such as interest or dividend expenses on securities sold short), acquired fund fees and expenses, extraordinary expenses, and distribution and/or service (12b-1) fees. The Fund’s net expense ratio will be higher than 1.23% to the extent the Fund incurs expenses excluded from this arrangement. The Operating Plan can only be terminated prior to the conclusion of the current term with the approval of the Fund’s Board of Trustees. The net expense ratio does not include acquired fund fees and expenses. More recent expense ratios are found in the Financial Highlights.

***Gross expense ratio is from the Fund’s prospectus dated July 23, 2013 and includes acquired fund fees and expenses and other expenses.

Roumell Asset Management, LLC (“RAM”) pursues long-term capital growth and income through opportunistic value investing. We seek to own a basket of deeply researched, conservatively financed securities that are out of favor, overlooked, or misunderstood by Wall Street and thus able to be bought at a significant discount to our calculation of intrinsic value. We believe this strategy maximizes the probability of above-average rates of return over time.

RAM is an opportunistic capital allocator. As such, we have the advantage of waiting for opportunities, unlike the vast majority of mutual fund managers, who must live with investment mandates to remain fully invested at all times. RAM sits patiently in cash in the absence of exceptional pricing. We are in the business of valuing companies (in terms of their earnings power and asset value), determining an appropriate discount level required to live with the risks embedded in the security, and buying when that price level is met. We ask this central question: would we take this company private in a heartbeat? One doesn’t take a company private as a result of anticipated Fed action, interest rate expectations, or attempts to handicap money flows into select asset classes. That’s market “stuff,” and it’s not what we do.

We take comfort in our portfolio of conservatively financed companies with unique assets which we own at meaningful discounts to our calculation of intrinsic value. We invest predominantly in companies with strong balance sheets, an approach that we believe dramatically reduces our risk of permanent loss of capital. The companies in which we invest possess valuable assets, tend to have substantial cash

positions, and are typically unencumbered by significant liabilities. We believe selecting specific securities at very specific prices will prove to be the most effective way to manage risk while capturing attractive rates of return over time.

Price Trumps Economic Forecasting

In July 2009, the very popular macroeconomic investment strategist Marc Faber predicted that the United States was about to enter a period of hyperinflation approaching the levels of Zimbabwe. PIMCO’s Bill Gross in May of 2009 expressed his belief in “accelerating inflation” and low market returns because of subdued growth. Inflation has been modest, at best. Nouriel Roubini, the widely regarded NYU economist who correctly predicted the housing collapse, rightly indicated in 2009 that the economic recovery would be anemic; unfortunately for those who may have taken his advice, he recommended investors keep all their assets safely in cash, thereby missing the past few years’ dramatic market rise. Columbia University Professor Edmund Phelps, winner of a Nobel Prize in economics in 2006, predicted in 2009 that it may take as long as 15 years for U.S. households to restore the wealth lost in the financial crisis. It actually took four years, having recently climbed to $70 trillion, above the 2008 peak of $67 trillion.

There’s no shortage of examples of “the dismal science’s” dismal record in predicting the economy’s future. In July 2005, the same month that home-builder stocks peaked, soon-to-be Federal Reserve chairman Ben Bernanke disputed the existence of a housing bubble. Bernanke said, “We’ve never had a decline in house prices on a nationwide basis. So what I think is more likely is that house prices will slow, maybe stabilize. … I don’t think it’s going to drive the economy too far from its full employment path, though.” A few months later, his predecessor, Alan Greenspan, said, “We’re not about to go into a situation where prices will go down. … There is no evidence home prices are going to collapse.” Moreover, macroeconomic conditions do not foretell market responses, as Roubini’s correct economic forecast, but dead wrong market prediction, well illustrates. If the best trained, most highly educated economists, possessing the best information, cannot reasonably predict the future or, more importantly, markets’ reactions, why do investors keep trying to use economics as an investment tool?

In the past, we have weighed in over the past few years with our own economic observations. Like many investors, we have wrestled with how much time we should allocate to understanding macroeconomic trends. We have noted—as points of concern—economic growth rates that seem to be perennially reset down, in both the United States and Europe, persistently high real unemployment

levels, and overleveraged consumers. Particularly in the aftermath of the financial crisis, we focused more time on these issues. However, three factors appear to undermine the utility of economic forecasting as an investment tool: the absence of price in the equation, the scarcity of original thinking, and the difficulty of predicting human behavior.

As investors, we have come to appreciate that an economic perspective is useless if not viewed in relation to security prices. And prices, in turn, must be viewed in relation to a reasonable range of earnings and/or asset values through the entirety of an economic cycle. To wit, in January of 2000, the economy was doing quite well: a budget surplus coincided with a sub-5% unemployment rate and robust GDP growth. The market fell more than 40% in the following 30 months. By March 2009, the country’s deficit climbed to $1.5 trillion, unemployment shot above 10%, and GDP was declining. The market has risen by more than 100% since that time. The most prescient variable seems to have been price. Prices in 2000 were high (while the economy was quite strong), and prices were cheap in 2009 (while the economy was abysmally weak).

What you pay (price), in relation to what you get (value), is the most important determinant of investment results over time, period. A superior price occurs when it occurs. It can happen in any market environment. Certainly, markets themselves get overvalued, in aggregate, and finding a great price is more difficult during those times, such as now, in our opinion. The simple question for us has always been: would we take this company private in a heartbeat at the price being offered? Intrinsic value is determined by a company’s cash flows and/or asset values (e.g., non-core real estate, salable divisions, intellectual property, or oil and gas reserves), regardless of how those things are measured in the stock market at an arbitrary point in time. Private market value is what steadies us, keeps us focused and reasonably sane during periods of market volatility and economic uncertainty. It will always be our North Star.

The second reason economic forecasting has limited investment appeal to us is the challenge of noting something that isn’t widely recognized and thus already incorporated in prices. We often end up hearing what John Maynard Keynes referred to as “the average opinion of the average opinion.” Following are some of the headlines in 2009, precisely when security prices were superior, that give the strong impression of an echo chamber. There is an absence of truly variant views, which is more often than not a prerequisite to making money:

· “2009 Will Be Very, Very Bleak,” Nouriel Roubini, Forbes

· “U.S. Foreclosure Filings Up 81% in 2008,” Yahoo News

· “Gloom Deepens among Executives, Economists at Davos,” Bloomberg

· “Bad News: We’re Back to 1931. Good News: It’s Not 1933 Yet,” Telegraph

· “Morgan Stanley Says S&P 500 to Drop 25%, Cuts Outlook,” Bloomberg

Morgan Stanley’s claim was made on March 13, 2009, four days after the S&P 500’s 13-year bottom. What was the utility to investors of rehashing widely known information that was likely fully incorporated into stock prices?

The last reason that makes forecasting’s investment efficacy wanting is the human actor — he or she is very difficult to predict. Yale professor Robert Shiller, a superb economist in our view, who in fact correctly predicted the housing collapse, has written extensively about why economic modeling will always remain a big challenge, ranging from estimating a housing recovery to predicting savings rates. “Animal spirits,” so important to economic growth, seem to happen when they happen and what triggers them remains a mystery, like much of human behavior. Shiller doesn’t look for economists’ batting average to rise, noting, “The rational expectations models will be tweaked to account for the current crisis. The basic curriculum will not change.”

We believe that an investor’s time is best spent deepening his or her understanding of a specific company’s dynamics, and the less followed a company is by the broader investment community the better because less information is likely to be “priced-in.” If you focus on securities with the least amount of information priced-in, detailed, exhaustive research can provide a significant investment edge, in our opinion. Time spent talking to a company’s customers is more valuable than time spent trying to gauge the direction of interest rates. Recently, in Birmingham, Alabama, we met with a significant customer of one of our holdings and learned that this client’s satisfaction and loyalty to our company were quite high, but that the client had nonetheless used new competition in the marketplace to extract much better pricing. Our investors will be far better served by that interview than had we attempted to forecast interest rates. Information pertaining to specific securities beats musing about overall economics, in our view.

Notwithstanding such observations, compiling reported economic data to form a general view on the economy is useful. We simply believe economic data must be considered in the context of price, while the usefulness of economic forecasting must be discounted. Our view is that current growth levels in the United States are insufficient to absorb population and productivity gains, and although the headline unemployment number has come down, 2.8 million of the 5.3 million employment gains since June 2009 are low-paying part-time jobs. In Europe, bank liabilities are 3x GDP, compared to 0.8x in the

United States, making credit expansion in Europe all but impossible. China’s economic growth appears to be slowing, and countries around the world seem to be ready to use their currencies to compete for market share by driving their values down and thus making their exports cheaper. The unforeseen U.S. energy boom exemplifies the diversity of this economy and is Exhibit A as to why this country should never be likened to Greece. With those general views, among others, we go about searching for value wherever we might find it. We might invest in a retailer despite consumer deleveraging, or in a company leveraged to copper despite a slowing Chinese economy, if those particular securities are adequately priced to compensate us for risk attributed to the economic headwinds.

This general discussion shouldn’t lead one to believe that dedicated bottom-up company investors, in contrast to macroeconomic ones, are in the clear. Hardly. We make mistakes selecting securities. In 2011, our individual security holdings diverged from the market as we were early on a number of investments and we experienced a period of negative returns when the overall market advanced. We put a high focus on extracting lessons from our mistakes.

Peter Lynch, the famed 1980s manager of the Fidelity Magellan Fund, once said, “If an investor spends fifteen minutes a year studying the economy, he’s wasted ten.” Essentially, the cost to relying on macroeconomic data to determine investment allocation will likely be many missed opportunities, as fear about the world supplants the facts of a well-priced particular security. Similarly, a booming economy can instill false confidence when price doesn’t warrant investment. There are a handful of successful macro-oriented investors, such as George Soros, who has been particularly adroit at trading currencies. A. Gary Shilling deserves recognition for his persistent and quite contrarian investment call in long-term treasury securities. The odds of success, however, are decidedly in favor of bottom-up investors. The lack of wealthy economists seems instructive. Since the firm’s founding 15 years ago, we have had a company-specific investment focus and will continue to do so due to our conviction that particulars are more important than generalities.

Best Regards,

Jim Roumell

Lead Portfolio Manager

Roumell Opportunistic Value Fund

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | | | | | | |

| Institutional Class Shares | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

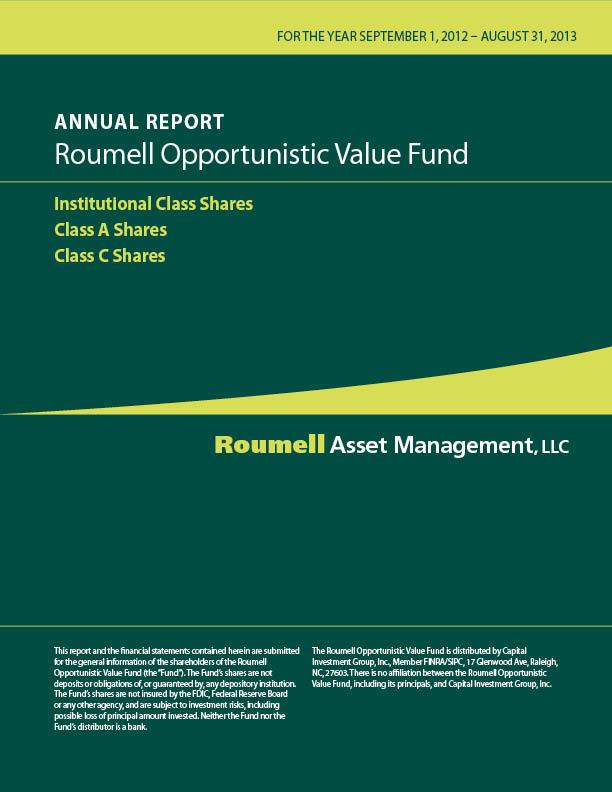

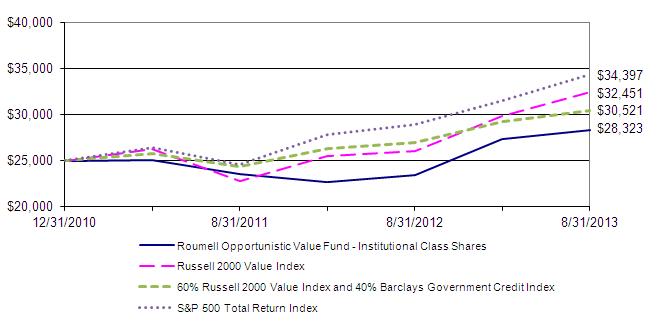

| For the period from December 31, 2010 (Date of Initial Public Investment) to August 31, 2013 | |

| | | | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $25,000 Investment | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |  | | |

| | | | | | | | | | | | | | | | | | | | |

| This graph assumes the minimum initial investment of $25,000 at December 31, 2010 (Date of Initial Public Investment). All dividends and distributions are reinvested. This graph depicts the performance of the Roumell Opportunistic Value Fund Institutional Class Shares (the “Fund”) versus the Russell 2000 Value Index, a blend of 60% of the Russell 2000 Value Index and 40% of the Barclays Government Credit Index, and the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | Gross | | |

| | | As of | | | | | | One | | Since | | Inception | Expense | |

| | | August 31, 2013 | | | | | Year | | Inception | | Date | | Ratio* | | |

| | | Institutional Class Shares | | | | | 20.71% | | 4.79% | | 12/31/10 | | 1.83% | | |

| | | Russell 2000 Value Index | | | | | 24.38% | | 10.27% | | N/A | | N/A | | |

| | | 60% Russell 2000 Value Index and | | | | | | | | | | | |

| | | | 40% Barclays Government Credit Index | | | 13.04% | | 7.76% | | N/A | | N/A | | |

| | | S&P 500 Total Return Index | | | | 18.70% | | 12.70% | | N/A | | N/A | | |

| | | | | | | | | | | | | | | | | | | | |

| * The gross expense ratio shown is from the Fund's prospectus dated July 23, 2013. | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

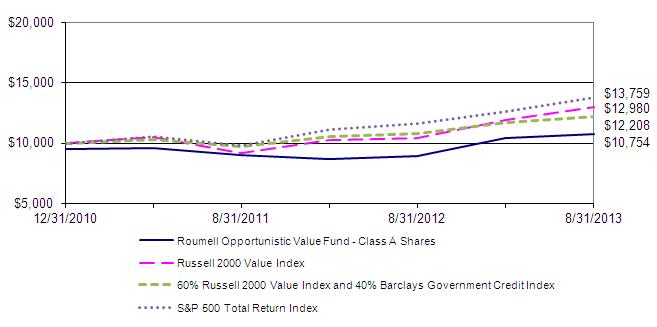

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

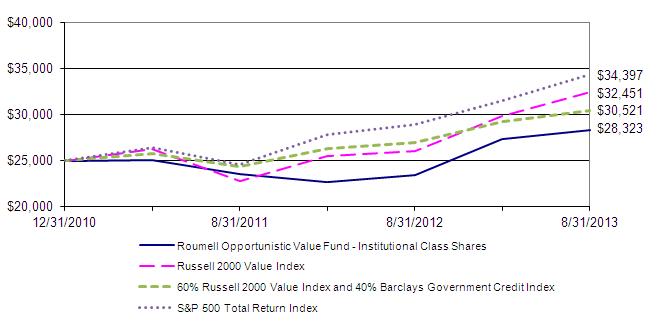

| For the period from December 31, 2010 (Date of Initial Public Investment) to August 31, 2013 | | |

| | | | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |  | |

| | | | | | | | | | | | | | | | | | | | |

| This graph assumes an initial investment of $10,000 ($9,550 after maximum sales load of 4.50%) at December 31, 2010 (Date of Initial Public Investment). All dividends and distributions are reinvested. This graph depicts the performance of the Roumell Opportunistic Value Fund Class A Shares (the “Fund”) versus the Russell 2000 Value Index, a blend of 60% of the Russell 2000 Value Index and 40% of the Barclays Government Credit Index, and the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Gross | | |

| | | As of | | | | | | One | | Since | | Inception | | Expense | |

| | | August 31, 2013 | | | | | Year | | Inception | | Date | | Ratio* | | |

| | | Class A Shares - No Sales Load | | | 20.46% | | 4.55% | | 12/31/10 | | 2.08% | | |

| | | Class A Shares - 4.50% Maximum Sales Load | | 15.01% | | 2.76% | | 12/31/10 | | 2.08% | | |

| | | Russell 2000 Value Index | | | | 24.38% | | 10.27% | | N/A | | N/A | | |

| | | 60% Russell 2000 Value Index and | | | | | | | | | | | |

| | | | 40% Barclays Government Credit Index | | 13.04% | | 7.76% | | N/A | | N/A | | |

| | | S&P 500 Total Return Index | | | | 18.70% | | 12.70% | | N/A | | N/A | | |

| * The gross expense ratio shown is from the Fund's prospectus dated July 23, 2013. | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

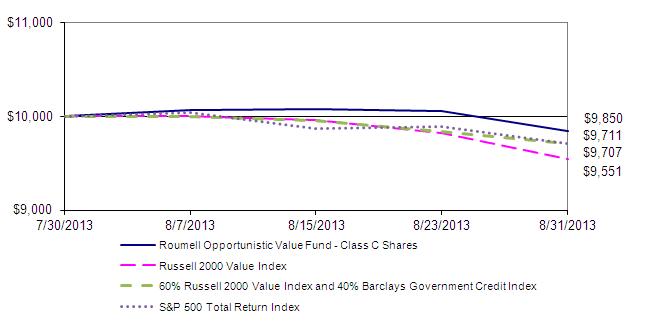

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

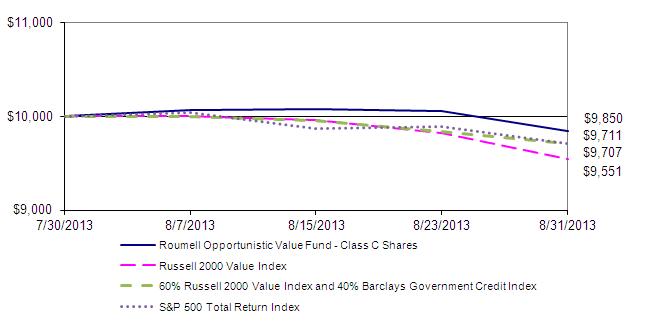

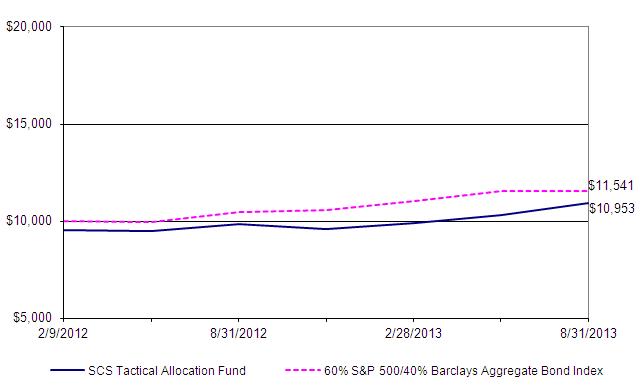

| For the period from July 30, 2013 (Date of Initial Public Investment) to August 31, 2013 | | |

| | | | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |  | | |

| | | | | | | | | | | | | | | | | | | | |

| This graph assumes an initial investment of $10,000 at July 30, 2013 (Date of Initial Public Investment) and includes the 1% maximum deferred sales charge. All dividends and distributions are reinvested. This graph depicts the performance of the Roumell Opportunistic Value Fund Class C Shares (the “Fund”) versus the Russell 2000 Value Index, a blend of 60% of the Russell 2000 Value Index and 40% of the Barclays Government Credit Index, and the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Gross | | |

| | | As of | | | | Since | | | | Inception | | | | Expense | |

| | | August 31, 2013 | | | Inception | | | | Date | | | | Ratio* | | |

| | | Class C Shares | | | -1.50% | | | | 07/30/13 | | | | 2.83% | | |

| | | Russell 2000 Value Index | | -4.49% | | | | N/A | | | | N/A | | |

| | | 60% Russell 2000 Value Index and | | | | | | | | | | | |

| | | | 40% Barclays Government Credit Index | -2.93% | | | | N/A | | | | N/A | | |

| | | S&P 500 Total Return Index | | -2.89% | | | | N/A | | | | N/A | | |

| | | | | | | | | | | | | | | | | | | | |

| * The gross expense ratio shown is from the Fund's prospectus dated July 23, 2013. | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | |

| | | | | | | | | | | |

| Schedule of Investments | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| As of August 31, 2013 | | | | | | | |

| | | | | | | Shares | | Cost | | Value (Note 1) |

| | | | | | | | | | | |

| COMMON STOCKS - 38.48% | | | | | | | |

| | | | | | | | | | | |

| | Consumer Discretionary - 4.68% | | | | | | |

| | * | Aeropostale, Inc. | | | 73,000 | $ | 967,425 | $ | 593,490 |

| | * | Digital Generation, Inc. | | | 92,000 | | 743,427 | | 1,128,840 |

| | | | | | | | | | | 1,722,330 |

| | Energy - 8.00% | | | | | | | |

| | * | TETRA Technologies, Inc. | | | 132,000 | | 894,196 | | 1,551,000 |

| | *β | Thunderbird Energy Corp. | | | 413,500 | | 52,225 | | 5,889 |

| | * | Ultra Petroleum Corp. | | | 67,000 | | 1,260,980 | | 1,386,900 |

| | | | | | | | | | | 2,943,789 |

| | Financials - 4.46% | | | | | | | |

| | * | American Safety Insurance Holdings Ltd. | | 5,000 | | 82,525 | | 150,650 |

| | * | First Acceptance Corp. | | | 345,546 | | 426,524 | | 611,616 |

| | * | Lai Sun Development Company Ltd. | | 30,500,000 | | 835,215 | | 877,115 |

| | | | | | | | | | | 1,639,381 |

| | Health Care - 2.41% | | | | | | | |

| | * | Itamar Medical Ltd. | | | 215,000 | | 92,837 | | 79,676 |

| | * | Transcept Pharmaceuticals, Inc. | | 300,000 | | 1,288,499 | | 807,000 |

| | | | | | | | | | | 886,676 |

| | Industrials - 5.18% | | | | | | | |

| | * | Tecumseh Products Co. Cl. A | | 187,000 | | 784,889 | | 1,808,290 |

| | * | Tecumseh Products Co. Cl. B | | 10,400 | | 35,464 | | 95,472 |

| | | | | | | | | | | 1,903,762 |

| | Information Technology - 11.23% | | | | | | |

| | | Apple, Inc. | | | 4,574 | | 2,139,322 | | 2,228,526 |

| | * | DSP Group, Inc. | | | 65,000 | | 349,978 | | 412,750 |

| | | QAD, Inc. Cl. A | | | 43,900 | | 458,442 | | 543,482 |

| | | QAD, Inc. Cl. B | | | 9,500 | | 99,599 | | 104,690 |

| | * | Seachange International, Inc. | | 84,070 | | 624,708 | | 840,700 |

| | | | | | | | | | | 4,130,148 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | (Continued) |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | |

| | | | | | | | | | | |

| Schedule of Investments | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| As of August 31, 2013 | | | | | | | |

| | | | | | | Shares | | Cost | | Value (Note 1) |

| | | | | | | | | | | |

| | Materials - 2.52% | | | | | | | |

| | *β | Sandstorm Metals & Energy Ltd. | | 651,000 | $ | 1,721,122 | $ | 927,174 |

| | | | | | | | | | | 927,174 |

| | | | | | | | | | | |

| | | Total Common Stocks (Cost $12,857,377) | | | | | 14,153,260 |

| | | | | | | | | | | |

| EXCHANGE TRADED PRODUCT - 0.73% | | | | | | |

| | | Market Vectors Gold Miners ETF | | 9,570 | | 455,224 | | 269,205 |

| | | | | | | | | | | |

| | | Total Exchange Traded Product (Cost $455,224) | | | | 269,205 |

| | | | | | | | | | | |

| | | | | Par | | Interest Rate | | Maturity Date | | |

| CORPORATE BONDS - 8.04% | | | | | | | |

| | | Clayton Williams Energy, Inc. | | $ | 820,000 | | 7.750% | | 4/1/2019 | | 836,400 |

| | ε | GMX Resources, Inc. | 185,000 | | 9.000% | | 3/2/2018 | | 18,500 |

| | | Goodrich Petroleum Corp. | 1,280,000 | | 8.875% | | 3/15/2019 | | 1,318,400 |

| | | Resolute Energy Corp. | 770,000 | | 8.500% | | 5/1/2020 | | 785,400 |

| | | | | | | | | | | |

| | | Total Corporate Bonds (Cost $3,083,196) | | | | | 2,958,700 |

| | | | | | | | | | | |

| | | | | Shares | | Dividend Rate | | | |

| PREFERRED STOCKS - 5.60% | | | | | | |

| | | MVC Capital, Inc. | 33,000 | | 7.250% | | | | 825,000 |

| | | Oxford Lane Capital Corp. | 16,666 | | 8.500% | | | | 433,316 |

| | | SandRidge Energy, Inc. | 8,200 | | 8.500% | | | | 803,600 |

| | | | | | | | | | | |

| | | Total Preferred Stocks (Cost $2,031,829) | | | | | 2,061,916 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | (Continued) |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | |

| | | | | | | | | | | |

| Schedule of Investments | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| As of August 31, 2013 | | | | | | | |

| | | | | | | Shares | | Cost | | Value (Note 1) |

| | | | | | | | | | | |

| SHORT-TERM INVESTMENT - 46.98% | | | | | | |

| | § | Federated Treasury Obligations Fund, 0.01% | 17,279,996 | | 17,279,996 | | 17,279,996 |

| | | | | | | | | | | |

| | | Total Short-Term Investment (Cost $17,279,996) | | | | 17,279,996 |

| | | | | | | | | | | |

| Total Value of Investments (Cost $35,707,622) - 99.83% | | | $ | 36,723,077 |

| | | | | | | | | | | |

| Other Assets Less Liabilities - 0.17% | | | | | | 61,976 |

| | | | | | | | | | | |

| | Net Assets - 100.00% | | | | | | $ | 36,785,053 |

| | | | | | | | | | | |

| * | Non-income producing investment | β | Canadian security | | |

| § | Represents 7 day effective yield | ε | Security is in default | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | Summary of Investments | | |

| | | | | | | % of Net | | | | |

| | | | | | | Assets | | Value | | |

| | | | Common Stocks | | | 38.48% | $ | 14,153,260 | | |

| | | | Exchange Traded Product | | 0.73% | | 269,205 | | |

| | | | Corporate Bonds | | | 8.04% | | 2,958,700 | | |

| | | | Preferred Stocks | | | 5.60% | | 2,061,916 | | |

| | | | Short-Term Investment | | | 46.98% | | 17,279,996 | | |

| | | | Total | | | 99.83% | $ | 36,723,077 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | |

| | | | | | | | |

| Statement of Assets and Liabilities | | |

| | | | | | | | |

| | | | | | | | |

| As of August 31, 2013 | | | |

| | | | | | | | |

| Assets: | | | | | |

| | Investments, at value (cost $35,707,622) | $ | 36,723,077 |

| | Receivables: | | | |

| | | Fund shares sold | | | 196,170 |

| | | Dividends and interest | | 100,804 |

| | Total assets | | | 37,020,051 |

| | | | | | | | |

| Liabilities: | | | | |

| | Payables: | | | | |

| | | Investments purchased | | 143,030 |

| | | Fund shares repurchased | | 53,587 |

| | Accrued expenses | | | |

| | | Advisory fees | | | 28,041 |

| | | Administration fees | | | 9,449 |

| | | Distribution and service fees | | 891 |

| | Total liabilities | | | 234,998 |

| | | | | | | | |

| Net Assets | | | $ | 36,785,053 |

| | | | | | | | |

| Net Assets Consist of: | | | |

| | Paid in Capital | | $ | 33,352,697 |

| | Undistributed net investment income | | 1,842 |

| | Undistributed net realized gain on investments | | 2,415,059 |

| | Net unrealized appreciation on investments | | 1,015,455 |

| | Total Net Assets | | $ | 36,785,053 |

| | | | | | | | |

| Institutional Class Shares of beneficial interest outstanding, no par value (a) | | 3,013,988 |

| | Net Assets | | $ | 33,616,850 |

| | Net Asset Value, Offering Price and Redemption Price Per Share (b) | $ | 11.15 |

| | | | | | | | |

| Class A Shares of beneficial interest outstanding, no par value (a) | | 230,011 |

| | Net Assets | | $ | 2,553,387 |

| | Net Asset Value and Redemption Price Per Share (b) | $ | 11.10 |

| | Offering Price Per Share ($11.10 ÷ 95.50%) | $ | 11.62 |

| | | | | | | | |

| Class C Shares of beneficial interest outstanding, no par value (a) | | 61,762 |

| | Net Assets | | $ | 614,816 |

| | Net Asset Value, Offering Price and Redemption Price Per Share (b)(c) | $ | 9.95 |

| | | | | | | | |

| (a) | Unlimited Authorized Shares | | |

| (b) | The fund charges a 1% redemption fee on redemptions made within 60 days of initial purchase. |

| (c) | Contingent deferred sales charge for Class C Shares is imposed on proceeds redeemed within |

| | one year of purchase date (note 1). | | |

| | | | | | | | |

| See Notes to Financial Statements | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | |

| | | | | | | | |

| Statement of Operations | | |

| | | | | | | | |

| | | | | | | | |

| For the Year ended August 31, 2013 | | |

| | | | | | | | |

| Investment Income: | | |

| | Interest | | | $ | 283,906 |

| | Dividends | | | 126,757 |

| | | | | | | | |

| | Total Investment Income | | 410,663 |

| | | | | | | | |

| Expenses: | | | | |

| | Advisory fees (note 2) | | 245,484 |

| | Administration fees (note 2) | | 82,717 |

| | Distribution and service fees - Class A Shares (note 3) | | 4,852 |

| | Distribution and service fees - Class C Shares (note 3) | | 289 |

| | | | | | | | |

| | Total Expenses | | 333,342 |

| | | | | | | | |

| Net Investment Income | | 77,321 |

| | | | | | | | |

| Realized and Unrealized Gain on Investments: | | |

| | | | | | | | |

| | Net realized gain from investments and foreign currency transactions | | 2,676,127 |

| | | | | | | | |

| | Net change in unrealized appreciation on investments and translation of | | |

| | | assets and liabilities in foreign currency | | 1,924,396 |

| | | | | | | | |

| Net Realized and Unrealized Gain on Investments | | 4,600,523 |

| | | | | | | | |

| Net Increase in Net Assets Resulting from Operations | $ | 4,677,844 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | |

| | | | | | | | | | | | |

| Statements of Changes in Net Assets | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| For the Year ended August 31, | | | | | 2013 | | 2012 |

| | | | | | | | | | | | |

| Operations: | | | | | | | | |

| | Net investment income | | | | $ | 77,321 | $ | 191,525 |

| | Net realized gain from investments and foreign | | | | |

| | | currency transactions | | | | | 2,676,127 | | (247,244) |

| | Net change in unrealized appreciation on investments and | | | | |

| | | translation of assets and liabilities in foreign currency | | 1,924,396 | | 152,790 |

| | | | | | | | | | | | |

| Net Increase in Net Assets Resulting from Operations | | 4,677,844 | | 97,071 |

| | | | | | | | | | | | |

Distributions to Shareholders: (note 5) | | | | | | |

| | Net investment income | | | | | | | |

| | | Institutional Class Shares | | | | | (169,985) | | (121,586) |

| | | Class A Shares | | | | | (11,086) | | (11,542) |

| | | | | | | | | | | | |

| Decrease in Net Assets Resulting from Distributions | | (181,071) | | (133,128) |

| | | | | | | | | | | | |

| Capital Share Transactions: | | | | | | | |

| | Shares sold | | | | | 17,785,572 | | 8,773,842 |

| | Redemption fees | | | | | 344 | | 220 |

| | Reinvested dividends and distributions | | | | 161,618 | | 120,749 |

| | Shares repurchased | | | | | (5,334,117) | | (3,225,860) |

| | | | | | | | | | | | |

| Increase from Capital Share Transactions | | | | 12,613,417 | | 5,668,951 |

| | | | | | | | | | | | |

| Net Increase in Net Assets | | | | | 17,110,190 | | 5,632,894 |

| | | | | | | | | | | | |

| Net Assets: | | | | | | | | |

| | Beginning of Year | | | | | 19,674,863 | | 14,041,969 |

| | End of Year | | | | $ | 36,785,053 | $ | 19,674,863 |

| | | | | | | | | | | | |

| Undistributed Net Investment Income | | | $ | 1,842 | $ | 104,617 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | (Continued) |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | |

| | | | | | | | | | | | |

| Statements of Changes in Net Assets (continued) | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| For the Year ended | August 31, 2013 | | August 31, 2012 |

| | | | | | | | | | | | |

| Share Information: | | | | | | | |

| | Institutional Class Shares | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | 1,513,598 | $ | 16,237,651 | | 936,132 | $ | 8,506,230 |

| | | Redemption fees | - | | 344 | | - | | 217 |

| | | Reinvested dividends | | | | | | | |

| | | | and distributions | 15,546 | | 150,992 | | 12,541 | | 109,860 |

| | | Shares repurchased | (476,166) | | (5,206,363) | | (300,289) | | (2,727,037) |

| | Net Increase in Capital Shares | 1,052,978 | $ | 11,182,624 | | 648,384 | $ | 5,889,270 |

| | | | | | | | | | | | |

| | Class A Shares | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | 87,457 | $ | 927,154 | | 29,318 | $ | 267,612 |

| | | Redemption fees | - | | - | | - | | 3 |

| | | Reinvested dividends | | | | | | | |

| | | | and distributions | 1,097 | | 10,626 | | 1,244 | | 10,889 |

| | | Shares repurchased | (12,217) | | (127,754) | | (54,781) | | (498,823) |

| | Net Increase (Decrease) | | | �� | | | | |

| | | in Capital Shares | 76,337 | $ | 810,026 | | (24,219) | $ | (220,319) |

| | | | | | | | | | | | |

| | Class C Shares* | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | 61,762 | $ | 620,767 | | - | $ | - |

| | | Redemption fees | - | | - | | - | | - |

| | | Reinvested dividends | | | | | | | |

| | | | and distributions | - | | - | | - | | - |

| | | Shares repurchased | - | | - | | - | | - |

| | Net Increase in Capital Shares | 61,762 | $ | 620,767 | | - | $ | - |

| | | | | | | | | | | | |

| | *For the period from July 30, 2013 (Date of Initial Public Investment) to August 31, 2013. |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | | |

| | | | | | | | | | | | |

| Financial Highlights | | | | | | | |

| | | | | | | | | | | | |

| For a share outstanding during the | | Institutional Class Shares |

| fiscal year or period ended August 31, | | 2013 | | 2012 | | 2011 (e) | |

| | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 9.31 | $ | 9.42 | $ | 10.00 | |

| | | | | | | | | | | | |

| Income (Loss) from Investment Operations | | | | | | | |

| | Net investment income | | 0.03 | | 0.09 | | 0.03 | |

| | Net realized and unrealized gain (loss) on investments | 1.89 | | (0.13) | | (0.61) | |

| Total from Investment Operations | | 1.92 | | (0.04) | | (0.58) | |

| | | | | | | | | | | | |

| Less Distributions: | | | | | | | |

| | From net investment income | | (0.08) | | (0.07) | | - | |

| Total Distributions | | �� (0.08) | | (0.07) | | - | |

| | | | | | | | | | | | |

| Paid in Capital: | | | | | | | |

| | Paid in Capital (from redemption fees) (note 1) | | 0.00 | (f) | 0.00 | (f) | - | |

| Total Paid in Capital | | 0.00 | (f) | 0.00 | (f) | - | |

| | | | | | | | | | | | |

| Net Asset Value, End of Period | $ | 11.15 | $ | 9.31 | $ | 9.42 | |

| | | | | | | | | | | | |

| Total Return (c)(d) | | 20.71% | | (0.36)% | | (5.80)% | (b) |

| | | | | | | | | | | | |

| Net Assets, End of Period (in thousands) | $ | 33,617 | $ | 18,249 | $ | 12,368 | |

| | | | | | | | | | | | |

| Ratios of: | | | | | | | | | |

| Total Expenses to Average Net Assets | | 1.23% | | 1.23% | | 1.23% | (a) |

| Net Investment Income to Average Net Assets | | 0.31% | | 1.10% | | 1.08% | (a) |

| | | | | | | | | | | | |

| Portfolio turnover rate | | 77.73% | | 49.34% | | 33.08% | (b) |

| | | | | | | | | | | | |

| (a) | Annualized. | | | | | | | |

| (b) | Not annualized. | | | | | | | |

| (c) | Total return does not reflect sales charge, if any. | | | | | | | |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United |

| | States of America and, consequently, the net asset value for financial reporting purposes and |

| | the returns based upon those net asset values may differ from the net asset values and returns |

| | for shareholder transactions. | | | | | | | |

| (e) | For a share outstanding for the initial period from December 31, 2010 (Date of Initial Public |

| | Investment) to August 31, 2011. | | | | | | | |

| (f) | Actual amount is less than $0.01 per share. | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | (Continued) |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | | |

| | | | | | | | | | | | |

| Financial Highlights | | | | | | | |

| | | | | | | | | | | | |

| For a share outstanding during the | | Class A Shares |

| fiscal year or period ended August 31, | | 2013 | | 2012 | | 2011 (e) | |

| | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 9.28 | $ | 9.41 | $ | 10.00 | |

| | | | | | | | | | | | |

| Income (Loss) from Investment Operations | | | | | | | |

| | Net investment income | | 0.01 | | 0.08 | | 0.03 | |

| | Net realized and unrealized gain (loss) on investments | 1.88 | | (0.15) | | (0.62) | |

| Total from Investment Operations | | 1.89 | | (0.07) | | (0.59) | |

| | | | | | | | | | | | |

| Less Distributions: | | | | | | | |

| | From net investment income | | (0.07) | | (0.06) | | - | |

| Total Distributions | | (0.07) | | (0.06) | | - | |

| | | | | | | | | | | | |

| Paid in Capital: | | | | | | | |

| | Paid in Capital (from redemption fees) (note 1) | | - | | 0.00 | (f) | - | |

| Total Paid in Capital | | - | | 0.00 | (f) | - | |

| | | | | | | | | | | | |

| Net Asset Value, End of Period | $ | 11.10 | $ | 9.28 | $ | 9.41 | |

| | | | | | | | | | | | |

| Total Return (c)(d) | | 20.46% | | (0.56)% | | (6.00)% | (b) |

| | | | | | | | | | | | |

| Net Assets, End of Period (in thousands) | $ | 2,553 | $ | 1,426 | $ | 1,674 | |

| | | | | | | | | | | | |

| Ratios of: | | | | | | | | | |

| Total Expenses to Average Net Assets | | 1.48% | | 1.48% | | 1.48% | (a) |

| Net Investment Income to Average Net Assets | | 0.03% | | 0.89% | | 0.73% | (a) |

| | | | | | | | | | | | |

| Portfolio turnover rate | | 77.73% | | 49.34% | | 33.08% | (b) |

| | | | | | | | | | | | |

| (a) | Annualized. | | | | | | | |

| (b) | Not annualized. | | | | | | | |

| (c) | Total return does not reflect sales charge, if any. | | | | | | | |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United |

| | States of America and, consequently, the net asset value for financial reporting purposes and | |

| | the returns based upon those net asset values may differ from the net asset values and returns | |

| | for shareholder transactions. | | | | | | | |

| (e) | For a share outstanding for the initial period from December 31, 2010 (Date of Initial Public | |

| | Investment) to August 31, 2011. | | | | | | | |

| (f) | Actual amount is less than $0.01 per share. | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | (Continued) |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | |

| | | | | | | | |

| Financial Highlights | | | |

| | | | | | | | |

| For a share outstanding during the period from | | Class C Shares |

| July 30, 2013 (Date of Initial Public Investment) to August 31, 2013 | | | |

| | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 10.00 | |

| | | | | | | | |

| Loss from Investment Operations | | | |

| | Net investment loss | | (0.01) | |

| | Net realized and unrealized loss on investments | | (0.04) | |

| Total from Investment Operations | | (0.05) | |

| | | | | | | | |

| Net Asset Value, End of Period | $ | 9.95 | |

| | | | | | | | |

| Total Return (c)(d) | | (0.50)% | (b) |

| | | | | | | | |

| Net Assets, End of Period (in thousands) | $ | 615 | |

| | | | | | | | |

| Ratios of: | | | | | |

| Total Expenses to Average Net Assets | | 2.23% | (a) |

| Net Investment Loss to Average Net Assets | | (1.20)% | (a) |

| | | | | | | | |

| Portfolio turnover rate | | 77.73% | (b) |

| | | | | | | | |

| (a) | Annualized. | | | |

| (b) | Not annualized. | | | |

| (c) | Total return does not reflect sales charge, if any. | | | |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United |

| | States of America and, consequently, the net asset value for financial reporting purposes and | |

| | the returns based upon those net asset values may differ from the net asset values and returns | |

| | for shareholder transactions. | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements | | | |

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

| 1. | Organization and Significant Accounting Policies |

The Roumell Opportunistic Value Fund (“Fund”) is a series of the Starboard Investment Trust (“Trust”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund is a separate non-diversified series of the Trust.

The Fund commenced operations on December 31, 2010. The investment objective of the Fund is to seek capital appreciation and income. Roumell Asset Management, LLC (“Roumell Asset Management” or the “Advisor”) seeks to achieve the Fund’s investment objective by using an opportunistic investment strategy. The Advisor is an opportunistic capital allocator (OCA) with a deep value bias in selecting individual securities. The Advisor will wait until an investment situation is presented where, in its opinion, the odds of success are favorable relative to the risks. In the absence of such situations, the Fund will stay liquid and on the sidelines invested in Cash and Cash Equivalents. The Advisor’s approach to opportunistic investing emphasizes purchasing securities at a meaningful, quantifiable discount to its calculation of intrinsic value taking into consideration the understandability of the business model, the safety of the capital structure, and the competency of the company’s management. Using this opportunistic strategy, however, may result in the Advisor finding many suitable investment opportunities for the Fund during certain periods, but finding very few during other periods.

The Fund currently has an unlimited number of authorized shares, which are divided into three classes - Institutional Class Shares, Class A Shares, and Class C Shares. Each class of shares has equal rights as to assets of the Fund, and the classes are identical except for differences in sales charges and ongoing distribution and service fees. Class A Shares are subject to an initial sales charge of 4.50%. Class C Shares are subject to a contingent deferred sales charge of 1% of the proceeds redeemed within one year of the purchase date. Class A Shares and Class C Shares are subject to distribution plan fees, which are further discussed in Note 3. All share classes are subject to redemption fees within 60 days of the issuance of such shares of 1.00%. Income, expenses (other than distribution and service fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based upon its relative net assets. All classes have equal voting privileges, except where otherwise required by law or when the Trustees determine that the matter to be voted on affects only the interests of the shareholders of a particular class.

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

The following accounting policies have been consistently followed by the Fund and are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Investment Valuation

The Fund’s investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the portfolio security is principally traded closes early or if trading of the particular portfolio security is halted during the day and does not resume prior to the Fund’s net asset value calculation) or which cannot be accurately valued using the Fund’s normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. A portfolio security’s “fair value” price may differ from the price next available for that portfolio security using the Fund’s normal pricing procedures. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value.

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: quoted prices in active markets for identical securities

Level 2: other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of August 31, 2013 for the Fund’s assets measured at fair value:

| Investments in Securities (a) | | Total | | Level 1 | | Level 2 | | Level 3 |

| Common Stocks* | $ | 14,153,260 | $ | 14,153,260 | $ | - | $ | - |

| Exchange Traded Product | | 269,205 | | 269,205 | | - | | - |

| Short-term Investment | | 17,279,996 | | 17,279,996 | | - | | - |

| Corporate Bonds | | 2,958,700 | | - | | 2,958,700 | | - |

| Preferred Stock | | 2,061,916 | | 2,061,916 | | - | | - |

| Total | $ | 36,723,077 | $ | 33,764,377 | $ | 2,958,700 | $ | - |

*Refer to Schedule of Investments for breakdown by Sector

(a) The Fund had no significant transfers into or out of Level 1, 2, or 3 during the year ended August 31, 2013. The Fund did not hold any Level 3 securities during the year.

Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities and income items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

the recorded amounts of dividends, interest, and foreign withholding taxes, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Interest income is recorded on the accrual basis and includes amortization of discounts and premiums. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Expenses

The Fund bears expenses incurred specifically on its behalf as well as a portion of general expenses, which are allocated according to methods reviewed annually by the Trustees.

Distributions

The Fund may declare and distribute dividends from net investment income (if any) quarterly. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are recorded on ex-date.

Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reported period. Actual results could differ from those estimates.

Fees on Redemptions

The Fund charges a redemption fee of 1.00% on redemptions of Fund shares occurring within 60 days following the issuance of such shares. The redemption fee is not a fee to finance sales or sales

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

promotion expenses, but is paid to the Fund to defray the costs of liquidating an investor and discouraging short-term trading of the Fund’s shares. No redemption fee will be imposed on the redemption of shares representing dividends or capital gains distributions, or on amounts representing capital appreciation of shares.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

| 2. | Transactions with Affiliates and Service Providers |

Advisor

As full compensation for the investment advisory services provided to the Fund, the Advisor receives a monthly fee equal to an annualized rate of 0.92% of the Fund’s average daily net assets. The fee paid to the Advisor is calculated by multiplying the average daily net assets of the Fund, computed at the end of each month and payable within five days thereafter.

Administrator

Fund Accounting and Administration Agreement: The Administrator provides the Fund with administrative, fund accounting, and compliance services. The Administrator receives compensation from the Fund at a maximum annual rate of 0.31% and is responsible for the coordination and payment of vendor services and other Fund expenses from such compensation. Pursuant to this arrangement, the Administrator pays the following expenses: (i) compensation and expenses of any employees of the Trust and of any other persons rendering any services to the Fund; (ii) clerical and shareholder service staff salaries; (iii) office space and other office expenses; (iv) fees and expenses incurred by the Fund in connection with membership in investment company organizations; (v) fees and expenses of counsel to the Trustees who are not interested persons of the Fund and Trust; (vi) fees and expenses of counsel to the Fund and Trust engaged to assist with preparation of Fund and Trust documents and filings and

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

provide other ordinary legal services; (vii) fees and expenses of independent public accountants to the Fund, including fees and expense for tax preparation; (viii) expenses of registering shares under federal and state securities laws; (ix) insurance expenses; (x) fees and expenses of the custodian, shareholder servicing, dividend disbursing and transfer agent, administrator, distributor, and accounting and pricing services agents of the Fund; (xi) compensation for a chief compliance officer for the Trust; (xii) expenses, including clerical expenses, of issue, sale, redemption, or repurchase of shares of the Fund; (xiii) the cost of preparing and distributing reports and notices to shareholders; (xiv) the cost of printing or preparing prospectuses and statements of additional information for delivery to the Fund’s current shareholders; (xv) the cost of printing or preparing documents, statements or reports to shareholders; and (xvi) other expenses not specifically assumed by the Fund or Advisor. The Administrator cannot recoup from the Fund any Fund expenses in excess of the administration fees payable under the Fund Accounting and Administration Agreement.

Operating Plan: The Advisor has entered into an Operating Plan with the Administrator under which it has agreed make the following payments to the Administrator: (i) when the Fund’s assets are below $77 million, the Advisor pays the Administrator a fee based on the daily average net assets of the Fund; and (ii) when the consolidated fee collected by the Administrator is less than a designated minimum operating cost, then the Advisor pays the Administrator a fee that makes up the difference. The Advisor is also obligated to pay the following Fund expenses under the Operating Plan: (i) marketing, distribution, and servicing expenses related to the sale or promotion of Fund shares that the Fund is not authorized to pay pursuant to the Investment Company Act; (ii) expenses incurred in connection with the organization and initial registration of shares of the Fund; (iii) expenses incurred in connection with the dissolution and liquidation of the Fund; (iv) expenses related to shareholder meetings and proxy solicitations; (v) fees and expenses related to legal, auditing, and accounting services that are outside of the scope of ordinary services; and (vi) hiring employees and retaining advisers and experts as contemplated by Rule 0-1(a)(7)(vii) of the Investment Company Act.

Compliance Services

Nottingham Compliance Services, LLC (“NCS”), a fully owned affiliate of the Administrator, provides services which assist the Trust’s Chief Compliance Officer in monitoring and testing the policies and procedures of the Trust in conjunction with requirements under Rule 38a-1 of the 1940 Act. NCS is entitled to receive compensation from the Administrator pursuant to the Administrator’s fee arrangements with the Fund.

Transfer Agent

Nottingham Shareholder Services, LLC (“Transfer Agent”) serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

compensation from the Administrator pursuant to the Administrator’s fee arrangements with the Fund.

Distributor

Capital Investment Group, Inc. (the “Distributor”) serves as the Fund’s principal underwriter and distributor. For its services, the Distributor is entitled to receive compensation from the Administrator pursuant to the Administrator’s fee arrangements with the Fund.

Certain Trustees and officers of the Trust may also be officers of the Advisor or the Administrator.

| 3. | Distribution and Service Fees |

The Board of Trustees, including a majority of the Trustees who are not “interested persons” as defined in the 1940 Act, adopted a distribution and service plan pursuant to Rule 12b-1 of the 1940 Act (the “Plan”) for the Class A Shares and Class C Shares. The 1940 Act regulates the manner in which a registered investment company may assume costs of distributing and promoting the sales of its shares and servicing of its shareholder accounts. The Plan provides that the Fund may incur certain costs, which may not exceed 0.25% per annum of the average daily net assets of the Class A Shares and 1.00% per annum of the average daily net assets of the Class C Shares for each year elapsed subsequent to adoption of the Plan, for payment to the Distributor and others for items such as advertising expenses, selling expenses, commissions, travel, or other expenses reasonably intended to result in sales of the Class A Shares and Class C Shares or servicing of Class A Shares and Class C Shares shareholder accounts.

| 4. | Purchases and Sales of Investment Securities |

For the fiscal year ended August 31, 2013, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

| Purchases of Securities | Proceeds from Sales of Securities |

| $14,960,176 | $16,136,206 |

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

There were no long-term purchases or sales of U.S. Government Obligations during the fiscal year ended August 31, 2013.

The following table shows the realized gains and losses that resulted from sales of securities during the fiscal year ended August 31, 2013:

| Description | | Cost | | Sales Proceeds | Realized Gain/(Loss) Percentage | | Realized Gain (Loss) |

| Abercrombie and Fitch Co. | | $373,203 | | 569,234 | 52.53% | $ | 196,031 |

| American Safety Insurance | | 668,665 | | 1,020,912 | 52.68% | | 352,247 |

| Checkpoint Systems, Inc. | | 839,867 | | 1,102,787 | 31.30% | | 262,920 |

| Chesapeake Energy Corp.** | | 589,354 | | 685,138 | 16.25% | | 95,784 |

| Compuware Corporation | | 632,623 | | 950,738 | 50.29% | | 318,115 |

| Comstock Resources** | | 935,314 | | 1,039,175 | 11.10% | | 103,861 |

| Dell, Inc. | | 715,578 | | 797,720 | 11.48% | | 82,142 |

| Digital Generation, Inc. | | 903,700 | | 940,410 | 4.06% | | 36,710 |

| Dover Motorsports, Inc. | | 364,074 | | 724,391 | 98.97% | | 360,317 |

| DSP Group, Inc. | | 517,880 | | 534,995 | 3.30% | | 17,115 |

| First Acceptance Corp. | | 72,993 | | 115,258 | 57.90% | | 42,265 |

| Gilat Satellite Networks Ltd. | | 526,443 | | 614,866 | 16.80% | | 88,423 |

| JC Penney Corp., Inc.** | | 1,336,689 | | 1,361,328 | 1.84% | | 24,639 |

| Saizen REIT* | | 454,845 | | 474,281 | 4.27% | | 19,437 |

| SeaChange International, Inc. | | 630,511 | | 801,370 | 27.10% | | 170,859 |

| Sierra Wireless, Inc. | | 917,146 | | 1,343,334 | 46.47% | | 426,188 |

| Stone Energy Corp.** | | 489,691 | | 490,000 | 0.06% | | 309 |

| Stonemor Operating LLC** | | 692,728 | | 676,894 | (2.29)% | | (15,834) |

| Tecumseh Products Company | | 1,062,514 | | 1,264,182 | 18.98% | | 201,668 |

| Tellabs, Inc. | | 39,485 | | 24,346 | (38.34)% | | (15,139) |

| TETRA Technologies, Inc. | | 186,487 | | 242,012 | 29.77% | | 55,525 |

| TransAct Technologies, Inc. | | 752,011 | | 604,556 | (19.61)% | | (147,455) |

| Net Realized Gain | | | | | | $ | 2,676,127 |

*Includes settlement of foreign currency sales.

**Excludes interest earned on bonds over the holding period.

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

Distributions are determined in accordance with Federal income tax regulations, which differ from generally accepted accounting principles, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The Fund has reviewed all taxable years / periods that are open for examination (i.e., not barred by the applicable statute of limitations) by taxing authorities of all major jurisdictions, including the Internal Revenue Service. As of August 31, 2013, open taxable years consisted of the taxable year / period ended August 31, 2011, August 31, 2012, and August 31, 2013. No examination of tax returns is currently in progress for the Fund.

Reclassifications relate primarily to differing book/tax treatment of foreign currency transactions. For the year ended August 31, 2013, the following reclassifications were made:

| Undistributed Net Investment Income | $ | 975 |

| Accumulated Net Realized Gain on Investments | | (975) |

Distributions during the fiscal years ended were characterized for tax purposes as follows:

| | | Distributions from |

For the Fiscal Years Ended | | Ordinary Income | | Long-Term- Capital Gains |

| 08/31/2013 | $ | 181,071 | $ | - |

| 08/31/2012 | $ | 133,128 | $ | - |

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

At August 31, 2013, the tax-basis cost of investments and components of distributable earnings were as follows:

| Cost of Investments | $ | 35,707,626 |

| | | |

| Unrealized Appreciation | $ | 3,213,638 |

| Unrealized Depreciation | | (2,198,187) |

| Net Unrealized Appreciation | | 1,015,451 |

| | | |

| Undistributed Ordinary Income | | 265,412 |

| Undistributed Long-Term Gains | | 2,151,886 |

| Late Year Losses | | (393) |

| | | |

| Distributable Earnings | $ | 3,432,356 |

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the tax deferral of losses from wash sales.

Late year losses incurred after December 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes.

| 6. | Commitments and Contingencies |

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects risk of loss to be remote.

| 7. | New Accounting Pronouncements |

In December 2011, FASB issued ASU No. 2011-11 related to disclosures about offsetting assets and liabilities. The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The ASU is effective for annual reporting periods beginning on or after

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

January 1, 2013, and interim periods within those annual periods. The guidance requires retrospective application for all comparative periods presented.

In January 2013, the FASB issued ASU No. 2013-01 “Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities.” ASU No. 2013-01 clarifies that ordinary trade receivables and payables are not included in the scope of ASU No. 2011-11. ASU No. 2011-11 applies only to derivatives, repurchase agreements and reverse repurchase agreements, and securities borrowing and lending that are offset in accordance with specific criteria contained in the FASB Accounting Standards codification.

Management is currently evaluating the impact ASU No. 2011-11 and ASU No. 2013-01 will have on the Fund’s financial statements and disclosures.

| 8. | Underlying Investments in Other Investment Companies |

The Fund currently invests a portion of its assets in the Federated Treasury Obligations Fund. The Fund may redeem its investment from the Federated Treasury Obligations Fund at any time if the Advisor determines that it is in the best interest of the Fund and its shareholders to do so.

The performance of the Fund may be directly affected by the performance of the Federated Treasury Obligations Fund. The financial statements of the Federated Treasury Obligations Fund, including the portfolio of investments, can be found at Federated’s website, federatedinvestors.com or the Securities and Exchange Commission’s website at sec.gov, and should only be read in conjunction with the Fund’s financial statements. As of August 31, 2013, the percentage of the Fund’s net assets invested in the Federated Treasury Obligations Fund was 46.98%.

| 9. | Change in Independent Registered Public Accounting Firm |

On October 25, 2012, BBD, LLP was selected as the Trust’s independent registered public accounting firm for the 2013 fiscal year. The selection of BBD, LLP was recommended by the Trust’s Audit Committee, comprised of all non-interested Trustees, and was approved by the Board of Trustees. The report of the predecessor independent registered public accounting firm, on the financial statements of

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

the Fund for the fiscal year ended August 31, 2012, did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principle. In addition, there were no disagreements between the Trust and the predecessor auditor on accounting principles, financial statement disclosures or audit scope, which, if not resolved to the satisfaction of the predecessor auditor would have caused them to make reference to the disagreement in their report on the financial statements for such period.

The Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. This evaluation did not result in any additional subsequent events that necessitated disclosures and/or adjustments.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of the Roumell Opportunistic Value Fund and

The Board of Trustees of the Starboard Investment Trust