- GPRK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

6-K Filing

GeoPark Limited (GPRK) 6-KCurrent report (foreign)

Filed: 12 Aug 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2016

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its charter)

Nuestra Señora de los Ángeles 179

Las Condes, Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X | Form 40-F | |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | | No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | | No | X |

GEOPARK LIMITED

TABLE OF CONTENTS

| ITEM | |

| 1. | GeoPark Limited Interim Condensed Consolidated Financial Statements for the six-months period ended 30 June 2015 and 2016 |

Item 1

GEOPARK LIMITED

Interim condensed consolidated

financial statements

AND explanatory notes

For the six-months period ended 30 June 2015 and 2016

GEOPARK LIMITED

30 JUNE 2016

CONTENTS

| Page | |

| 3 | Consolidated Statement of Income and Consolidated Statement of Comprehensive Income |

| 4 | Consolidated Statement of Financial Position |

| 5 | Consolidated Statement of Changes in Equity |

| 6 | Consolidated Statement of Cash Flow |

| 7 | Selected explanatory notes |

GEOPARK LIMITED

30 JUNE 2016

CONSOLIDATED STATEMENT OF INCOME

| Amounts in US$ ´000 | Note | Three-months period ended 30 June 2016 (Unaudited) | Three-months period ended 30 June 2015 (Unaudited) | Six-months period ended 30 June 2016 (Unaudited) | Six-months period ended 30 June 2015 (Unaudited) | |||||||||||||

| NET REVENUE | 2 | 45,924 | 62,039 | 82,487 | 116,470 | |||||||||||||

| Production and operating costs | 4 | (13,787 | ) | (22,472 | ) | (26,802 | ) | (46,367 | ) | |||||||||

| Geological and geophysical expenses | 5 | (2,931 | ) | (3,631 | ) | (5,285 | ) | (6,292 | ) | |||||||||

| Administrative expenses | 6 | (8,237 | ) | (8,377 | ) | (15,722 | ) | (18,218 | ) | |||||||||

| Selling expenses | 7 | (494 | ) | (1,113 | ) | (3,164 | ) | (3,420 | ) | |||||||||

| Depreciation | (16,614 | ) | (24,380 | ) | (38,136 | ) | (49,851 | ) | ||||||||||

| Write-off of unsuccessful efforts | 9 | (447 | ) | - | (447 | ) | - | |||||||||||

| Other expenses | (638 | ) | (1,604 | ) | (1,377 | ) | (8,763 | ) | ||||||||||

| OPERATING PROFIT (LOSS) | 2,776 | 462 | (8,446 | ) | (16,441 | ) | ||||||||||||

| Financial costs | 8 | (7,637 | ) | (8,095 | ) | (16,601 | ) | (17,125 | ) | |||||||||

| Foreign exchange income (loss) | 9,558 | 3,728 | 17,015 | (16,018 | ) | |||||||||||||

| PROFIT (LOSS) BEFORE TAX | 4,697 | (3,905 | ) | (8,032 | ) | (49,584 | ) | |||||||||||

| Income tax (expense) benefit | (6,322 | ) | (5,525 | ) | (5,637 | ) | 4,137 | |||||||||||

| LOSS FOR THE PERIOD | (1,625 | ) | (9,430 | ) | (13,669 | ) | (45,447 | ) | ||||||||||

| Attributable to: | ||||||||||||||||||

| Owners of the Company | (1,333 | ) | (7,568 | ) | (10,589 | ) | (40,224 | ) | ||||||||||

| Non-controlling interest | (292 | ) | (1,862 | ) | (3,080 | ) | (5,223 | ) | ||||||||||

Losses per share (in US$) for loss attributable to owners of the Company. Basic | (0.02 | ) | (0.13 | ) | (0.18 | ) | (0.70 | ) | ||||||||||

Losses per share (in US$) for loss attributable to owners of the Company. Diluted | (0.02 | ) | (0.13 | ) | (0.18 | ) | (0.70 | ) | ||||||||||

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

| Amounts in US$ ´000 | Three-months period ended 30 June 2016 (Unaudited) | Three-months period ended 30 June 2015 (Unaudited) | Six-months period ended 30 June 2016 (Unaudited) | Six-months period ended 30 June 2015(Unaudited) | ||||||||||||

| Loss for the period | (1,625 | ) | (9,430 | ) | (13,669 | ) | (45,447 | ) | ||||||||

| Other comprehensive income | ||||||||||||||||

| Currency translation differences | 3,205 | 489 | 5,620 | (3,886 | ) | |||||||||||

| Total comprehensive income (loss) for the period | 1,580 | (8,941 | ) | (8,049 | ) | (49,333 | ) | |||||||||

| Attributable to: | ||||||||||||||||

| Owners of the Company | 1,872 | (7,079 | ) | (4,969 | ) | (44,110 | ) | |||||||||

| Non-controlling interest | (292 | ) | (1,862 | ) | (3,080 | ) | (5,223 | ) | ||||||||

GEOPARK LIMITED

30 JUNE 2016

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| Amounts in US$ ´000 | Note | At 30 June 2016 (Unaudited) | Year ended 31 December 2015 | |||||||

| ASSETS | ||||||||||

| NON CURRENT ASSETS | ||||||||||

| Property, plant and equipment | 9 | 510,900 | 522,611 | |||||||

| Prepaid taxes | 1,136 | 1,172 | ||||||||

| Other financial assets | 18,531 | 13,306 | ||||||||

| Deferred income tax | 23,184 | 34,646 | ||||||||

| Prepayments and other receivables | 247 | 220 | ||||||||

| TOTAL NON CURRENT ASSETS | 553,998 | 571,955 | ||||||||

| CURRENT ASSETS | ||||||||||

| Inventories | 3,427 | 4,264 | ||||||||

| Trade receivables | 11,441 | 13,480 | ||||||||

| Prepayments and other receivables | 8,895 | 11,057 | ||||||||

| Prepaid taxes | 19,119 | 19,195 | ||||||||

| Other financial assets | 1,756 | 1,118 | ||||||||

| Cash at bank and in hand | 79,247 | 82,730 | ||||||||

| TOTAL CURRENT ASSETS | 123,885 | 131,844 | ||||||||

| TOTAL ASSETS | 677,883 | 703,799 | ||||||||

| EQUITY | ||||||||||

| Equity attributable to owners of the Company | ||||||||||

| Share capital | 10 | 60 | 59 | |||||||

| Share premium | 233,025 | 232,005 | ||||||||

| Reserves | 128,636 | 123,016 | ||||||||

| Accumulated losses | (220,125 | ) | (208,428 | ) | ||||||

| Attributable to owners of the Company | 141,596 | 146,652 | ||||||||

| Non-controlling interest | 50,518 | 53,515 | ||||||||

| TOTAL EQUITY | 192,114 | 200,167 | ||||||||

| LIABILITIES | ||||||||||

| NON CURRENT LIABILITIES | ||||||||||

| Borrowings | 11 | 331,395 | 343,248 | |||||||

| Provisions for other long-term liabilities | 12 | 41,004 | 42,450 | |||||||

| Deferred income tax | 4,764 | 16,955 | ||||||||

| Trade and other payables | 13 | 29,960 | 19,556 | |||||||

| TOTAL NON CURRENT LIABILITIES | 407,123 | 422,209 | ||||||||

| CURRENT LIABILITIES | ||||||||||

| Borrowings | 11 | 38,536 | 35,425 | |||||||

| Current income tax | 2,433 | 208 | ||||||||

| Trade and other payables | 13 | 37,677 | 45,790 | |||||||

| TOTAL CURRENT LIABILITIES | 78,646 | 81,423 | ||||||||

| TOTAL LIABILITIES | 485,769 | 503,632 | ||||||||

| TOTAL EQUITY AND LIABILITIES | 677,883 | 703,799 | ||||||||

GEOPARK LIMITED

30 JUNE 2016

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| Attributable to owners of the Company | ||||||||||||||||||||||||||||

| Amount in US$ '000 | Share Capital | Share Premium | Other Reserve | Translation Reserve | Accumulated losses | Non - controlling Interest | Total | |||||||||||||||||||||

| Equity at 1 January 2015 | 58 | 210,886 | 127,527 | (3,510 | ) | 40,596 | 103,569 | 479,126 | ||||||||||||||||||||

| Loss for the six-months period | - | - | - | - | (40,224 | ) | (5,223 | ) | (45,447 | ) | ||||||||||||||||||

| Currency translation differences | - | - | - | (3,886 | ) | - | - | (3,886 | ) | |||||||||||||||||||

| Total comprehensive loss for the period ended 30 June 2015 | - | - | - | (3,886 | ) | (40,224 | ) | (5,223 | ) | (49,333 | ) | |||||||||||||||||

| Repurchase of shares | - | (1,327 | ) | - | - | - | - | (1,327 | ) | |||||||||||||||||||

| Share-based payment | - | 310 | - | - | 2,805 | - | 3,115 | |||||||||||||||||||||

| - | (1,017 | ) | - | - | 2,805 | - | 1,788 | |||||||||||||||||||||

| Balance at 30 June 2015(Unaudited) | 58 | 209,869 | 127,527 | (7,396 | ) | 3,177 | 98,346 | 431,581 | ||||||||||||||||||||

| Balance at 31 December 2015 | 59 | 232,005 | 127,527 | (4,511 | ) | (208,428 | ) | 53,515 | 200,167 | |||||||||||||||||||

| Loss for the six-months period | - | - | - | - | (10,589 | ) | (3,080 | ) | (13,669 | ) | ||||||||||||||||||

| Currency translation differences | - | - | - | 5,620 | - | - | 5,620 | |||||||||||||||||||||

| Total comprehensive loss for the period ended 30 June 2016 | - | - | - | 5,620 | (10,589 | ) | (3,080 | ) | (8,049 | ) | ||||||||||||||||||

| Repurchase of shares | - | (727 | ) | - | - | - | - | (727 | ) | |||||||||||||||||||

| Share-based payment | 1 | 1,747 | - | - | (1,108 | ) | 83 | 723 | ||||||||||||||||||||

| 1 | 1,020 | - | - | (1,108 | ) | 83 | (4 | ) | ||||||||||||||||||||

| Balance at 30 June 2016 (Unaudited) | 60 | 233,025 | 127,527 | 1,109 | (220,125 | ) | 50,518 | 192,114 | ||||||||||||||||||||

GEOPARK LIMITED

30 JUNE 2016

CONSOLIDATED STATEMENT OF CASH FLOW

| Amounts in US$ ’000 | Six-months period ended 30 June 2016 (Unaudited) | Six-months period ended 30 June 2015 (Unaudited) | ||||||

| Cash flows from operating activities | ||||||||

| Loss for the period | (13,669 | ) | (45,447 | ) | ||||

| Adjustments for: | ||||||||

| Income tax expense (benefit) | 5,637 | (4,137 | ) | |||||

| Depreciation | 38,136 | 49,851 | ||||||

| Write-off of unsuccessful efforts | 447 | - | ||||||

| Amortisation of other long-term liabilities | (869 | ) | (228 | ) | ||||

| Accrual of borrowing’s interests | 13,948 | 13,037 | ||||||

| Unwinding of long-term liabilities | 1,242 | 1,447 | ||||||

| Accrual of share-based payment | 723 | 3,115 | ||||||

| Foreign exchange (income) loss | (17,015 | ) | 16,018 | |||||

| Customer advance payments | 10,000 | - | ||||||

| Income tax paid | - | (7,625 | ) | |||||

| Change in working capital | (10,150 | ) | (17,359 | ) | ||||

| Cash flows from operating activities – net | 28,430 | 8,672 | ||||||

| Cash flows from investing activities | ||||||||

| Purchase of property, plant and equipment | (14,134 | ) | (15,974 | ) | ||||

| Cash flows used in investing activities – net | (14,134 | ) | (15,974 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from borrowings | 186 | - | ||||||

| Proceeds from loans received from related parties | 5,210 | 2,400 | ||||||

| Principal paid | (10,087 | ) | (51 | ) | ||||

| Repurchase of shares | (727 | ) | (1,327 | ) | ||||

| Interest paid | (12,757 | ) | (12,987 | ) | ||||

| Cash flows used in financing activities - net | (18,175 | ) | (11,965 | ) | ||||

| Net decrease in cash and cash equivalents | (3,879 | ) | (19,267 | ) | ||||

| Cash and cash equivalents at 1 January | 82,730 | 127,672 | ||||||

| Currency translation differences | 396 | (3,106 | ) | |||||

| Cash and cash equivalents at the end of the period | 79,247 | 105,299 | ||||||

| Ending Cash and cash equivalents are specified as follows: | ||||||||

| Cash in banks | 79,236 | 105,285 | ||||||

| Cash in hand | 11 | 14 | ||||||

| Cash and cash equivalents | 79,247 | 105,299 | ||||||

GEOPARK LIMITED

30 JUNE 2016

SELECTED EXPLANATORY NOTES

Note 1

General information

GeoPark Limited (the Company) is a company incorporated under the law of Bermuda. The Registered Office address is Cumberland House, 9th Floor, 1 Victoria Street, Hamilton HM11, Bermuda.

The principal activity of the Company and its subsidiaries (“the Group”) is the exploration, development and production for oil and gas reserves in Chile, Colombia, Brazil, Peru and Argentina.

This consolidated interim financial report was authorised for issue by the Board of Directors on

10 August 2016.

Basis of Preparation

The consolidated interim financial report of GeoPark Limited is presented in accordance with IAS 34 “Interim Financial Reporting”. It does not include all of the information required for full annual financial statements, and should be read in conjunction with the annual financial statements as at and for the years ended 31 December 2014 and 2015, which have been prepared in accordance with IFRS.

The consolidated interim financial report has been prepared in accordance with the accounting policies applied in the most recent annual financial statements. For further information please refer to GeoPark Limited's consolidated financial statements for the year ended 31 December 2015.

Taxes on income in the interim periods are accrued using the tax rate that would be applicable to expected total annual profit or loss.

The activities of the Company are not subject to significant seasonal changes.

Estimates

The preparation of interim financial information requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Group’s accounting policies. Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial statements, the significant judgements made by management in applying the group’s accounting policies and the key sources of estimation uncertainty were the same as those that applied to the consolidated financial statements for the year ended 31 December 2015.

GEOPARK LIMITED

30 JUNE 2016

Note 1 (Continued)

Financial risk management

The Company’s activities expose it to a variety of financial risks: currency risk, price risk, credit risk- concentration, funding and liquidity risk, interest risk and capital risk. The interim condensed consolidated financial statements do not include all financial risk management information and disclosures required in the annual financial statements, and should be read in conjunction with the Company’s annual financial statements as at 31 December 2015.

There have been no changes in the risk management since year end or in any risk management policies.

Subsidiary undertakings

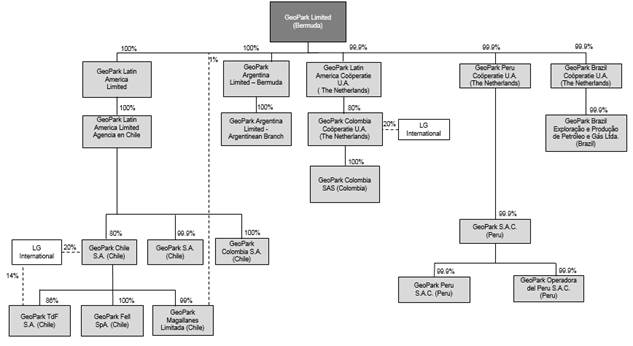

The following chart illustrates the Group structure as of 30 June 2016 (a):

(a) LG International is not a subsidiary, it is Non-controlling interest.

There have been no changes in the Group structure since December 2015.

GEOPARK LIMITED

30 JUNE 2016

Note 1 (Continued)

Subsidiary undertakings (Continued)

Details of the subsidiaries and joint operations of the Company are set out below:

| Name and registered office | Ownership interest | |||

| Subsidiaries | GeoPark Argentina Limited – Bermuda | 100% | ||

| GeoPark Argentina Limited – Argentinean Branch | 100% (a) | |||

| GeoPark Latin America Limited | 100% | |||

| GeoPark Latin America Limited – Agencia en Chile | 100% (a) | |||

| GeoPark S.A. (Chile) | 100% (a) (b) | |||

| GeoPark Brazil Exploração y Produção de Petróleo e Gás Ltda. (Brazil) | 100% (a) | |||

| GeoPark Chile S.A. (Chile) | 80% (a) (c) | |||

| GeoPark Fell S.p.A. (Chile) | 80% (a) (c) | |||

| GeoPark Magallanes Limitada (Chile) | 80% (a) (c) | |||

| GeoPark TdF S.A. (Chile) | 68.8% (a) (d) | |||

| GeoPark Colombia S.A. (Chile) | 100% (a) | |||

| GeoPark Colombia SAS (Colombia) | 80% (a) | |||

| GeoPark Latin America Coöperatie U.A. (The Netherlands) | 100% | |||

| GeoPark Colombia Coöperatie U.A. (The Netherlands) | 80% (a) (c) | |||

| GeoPark S.A.C. (Peru) | 100% (a) | |||

| GeoPark Perú S.A.C. (Peru) | 100% (a) | |||

| GeoPark Operadora del Perú S.A.C. (Peru) | 100% (a) | |||

| GeoPark Peru Coöperatie U.A. (The Netherlands) | 100% | |||

| GeoPark Brazil Coöperatie U.A. (The Netherlands) | 100% | |||

| GeoPark Colombia E&P S.A.(Panama) | 100% (b) | |||

| Joint operations | Tranquilo Block (Chile) | 50% (e) | ||

| Flamenco Block (Chile) | 50% (e) | |||

| Campanario Block (Chile) | 50% (e) | |||

| Isla Norte Block (Chile) | 60% (e) | |||

| Llanos 17 Block (Colombia) | 36.84% | |||

| Yamu/Carupana Block (Colombia) | 89.5%/100% (e) | |||

| Llanos 34 Block (Colombia) | 45% (e) | |||

| Llanos 32 Block (Colombia) | 10% | |||

| CPO-4 Block (Colombia) | 50% (e) | |||

| Puelen Block (Argentina) | 18% | |||

| Sierra del Nevado Block (Argentina) | 18% | |||

| CN-V Block (Argentina) | 50% (e) | |||

| Manati Field (Brazil) | 10% |

| (a) | Indirectly owned. |

| (b) | Dormant companies. |

| (c) | LG International has 20% interest. |

| (d) | LG International has 20% interest through GeoPark Chile S.A. and a 14% direct interest, totaling 31.2%. |

| (e) | GeoPark is the operator in all blocks. |

GEOPARK LIMITED

30 JUNE 2016

Note 2

Net Revenue

| Amounts in US$ '000 | Three-months period ended 30 June 2016 | Three-months period ended 30 June 2015 | Six-months period ended 30 June 2016 | Six-months period ended 30 June 2015 | ||||||||||||

| Sale of crude oil | 34,303 | 50,207 | 57,472 | 91,000 | ||||||||||||

| Sale of gas | 11,621 | 11,832 | 25,015 | 25,470 | ||||||||||||

| 45,924 | 62,039 | 82,487 | 116,470 | |||||||||||||

Note 3

Segment Information

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision-maker. The chief operating decision-maker, who is responsible for allocating resources and assessing performance of the operating segments, has been identified as the Executive Committee. This committee is integrated by the CEO, COO, CFO and managers in charge of the Geoscience, Operations, Corporate Governance, Finance and People departments. This committee reviews the Group’s internal reporting in order to assess performance and allocate resources. Management has determined the operating segments based on these reports.

The committee considers the business from a geographic perspective. Since 1 January 2015, the committee has changed the disclosure of certain elements of performance to be more comparable with other companies in the market and also to better follow up the performance of the business. This change impacts the segment information because gross profit or loss is no longer shown but no impact is generated in the measure of segment profit and loss.

The Executive Committee assesses the performance of the operating segments based on a measure of Adjusted EBITDA. Adjusted EBITDA is defined as profit for the period before net finance cost, income tax, depreciation, amortization, certain non-cash items such as impairments and write-offs of unsuccessful efforts, accrual of share-based payment and other non recurring events. Operating Netback is equivalent to Adjusted EBITDA before cash expenses included in Administrative, Geological and Geophysical and Other operating expenses. Other information provided to the Executive Committee is measured in a manner consistent with that in the financial statements, except as noted below.

GEOPARK LIMITED

30 JUNE 2016

Note 3 (Continued)

Segment Information (Continued)

Six-months period ended 30 June 2016

| Amounts in US$ '000 | Total | Colombia | Chile | Brazil | Argentina | Peru | Corporate | |||||||||||||||||||||

| Net Revenue | 82,487 | 47,664 | 19,006 | 15,817 | - | - | - | |||||||||||||||||||||

| Sale of crude oil | 57,472 | 47,664 | 9,445 | 363 | - | - | - | |||||||||||||||||||||

| Sale of gas | 25,015 | - | 9,561 | 15,454 | - | - | - | |||||||||||||||||||||

| Production and operating costs | (26,802 | ) | (12,135 | ) | (10,708 | ) | (3,959 | ) | - | - | - | |||||||||||||||||

| Royalties | (4,327 | ) | (2,074 | ) | (768 | ) | (1,485 | ) | - | - | - | |||||||||||||||||

| Transportation costs | (1,262 | ) | (604 | ) | (658 | ) | - | - | - | - | ||||||||||||||||||

| Share-based payment | (150 | ) | (117 | ) | (33 | ) | - | - | - | - | ||||||||||||||||||

| Other costs | (21,063 | ) | (9,340 | ) | (9,249 | ) | (2,474 | ) | - | - | - | |||||||||||||||||

| Depreciation | (38,136 | ) | (14,296 | ) | (16,529 | ) | (7,155 | ) | (91 | ) | (65 | ) | - | |||||||||||||||

| Operating (Loss) / Profit | (8,446 | ) | 8,220 | (13,177 | ) | 2,432 | 607 | (1,647 | ) | (4,881 | ) | |||||||||||||||||

| Adjusted EBITDA | 32,017 | 23,065 | 3,524 | 9,782 | 1,793 | (1,552 | ) | (4,595 | ) | |||||||||||||||||||

Six-months period ended 30 June 2015

| Amounts in US$ '000 | Total | Colombia | Chile | Brazil | Argentina | Peru | Corporate | |||||||||||||||||||||

| Net Revenue | 116,470 | 71,902 | 25,670 | 18,301 | 597 | - | - | |||||||||||||||||||||

| Sale of crude oil | 91,000 | 71,902 | 17,967 | 534 | 597 | - | - | |||||||||||||||||||||

| Sale of gas | 25,470 | - | 7,703 | 17,767 | - | - | - | |||||||||||||||||||||

| Production and operating costs | (46,367 | ) | (24,147 | ) | (17,095 | ) | (3,554 | ) | (1,571 | ) | - | - | ||||||||||||||||

| Royalties | (6,104 | ) | (3,259 | ) | (1,157 | ) | (1,654 | ) | (34 | ) | - | - | ||||||||||||||||

| Transportation costs | (2,626 | ) | (1,233 | ) | (1,393 | ) | - | - | - | - | ||||||||||||||||||

| Share-based payment | (152 | ) | (58 | ) | - | - | (94 | ) | - | - | ||||||||||||||||||

| Other costs | (37,485 | ) | (19,597 | ) | (14,545 | ) | (1,900 | ) | (1,443 | ) | - | - | ||||||||||||||||

| Depreciation | (49,851 | ) | (22,886 | ) | (19,845 | ) | (6,955 | ) | (100 | ) | (65 | ) | - | |||||||||||||||

| Operating (Loss) / Profit | (16,441 | ) | 15,121 | (26,972 | ) | 5,746 | (3,232 | ) | (2,256 | ) | (4,848 | ) | ||||||||||||||||

| Adjusted EBITDA | 44,959 | 39,942 | (1,069 | ) | 12,808 | (2,044 | ) | (2,219 | ) | (2,459 | ) | |||||||||||||||||

| Total Assets | Total | Colombia | Chile | Brazil | Argentina | Peru | Corporate | |||||||||||||||||||||

| 30 June 2016 | 677,883 | 158,087 | 358,216 | 105,278 | 3,142 | 4,927 | 48,233 | |||||||||||||||||||||

| 31 December 2015 | 703,799 | 153,071 | 381,143 | 114,974 | 3,181 | 4,287 | 47,143 | |||||||||||||||||||||

GEOPARK LIMITED

30 JUNE 2016

Note 3 (Continued)

Segment Information (Continued)

A reconciliation of total Operating netback to total profit (loss) before income tax is provided as follows:

| Three-months period ended 30 June 2016 | Three-months period ended 30 June 2015 | Six-months period ended 30 June 2016 | Six-months period ended 30 June 2015 | |||||||||||||

| Operating netback | 31,732 | 38,519 | 52,713 | 66,662 | ||||||||||||

| Geological and geophysical expenses | (3,135 | ) | (3,560 | ) | (5,438 | ) | (6,089 | ) | ||||||||

| Administrative expenses | (8,133 | ) | (6,841 | ) | (15,258 | ) | (15,614 | ) | ||||||||

| Adjusted EBITDA for reportable segments | 20,464 | 28,118 | 32,017 | 44,959 | ||||||||||||

| Depreciation(a) | (16,614 | ) | (24,380 | ) | (38,136 | ) | (49,851 | ) | ||||||||

| Write-off of unsuccessful efforts | (447 | ) | - | (447 | ) | - | ||||||||||

| Share-based payment | (233 | ) | (1,915 | ) | (723 | ) | (3,115 | ) | ||||||||

| Others(b) | (394 | ) | (1,361 | ) | (1,157 | ) | (8,434 | ) | ||||||||

| Operating Profit / (Loss) | 2,776 | 462 | (8,446 | ) | (16,441 | ) | ||||||||||

| Financial costs | (7,637 | ) | (8,095 | ) | (16,601 | ) | (17,125 | ) | ||||||||

| Foreign exchange income (loss) | 9,558 | 3,728 | 17,015 | (16,018 | ) | |||||||||||

| Profit / (Loss) before tax | 4,697 | (3,905 | ) | (8,032 | ) | (49,584 | ) | |||||||||

| (a) | Net of capitalised costs for oil stock included in Inventories. Depreciation includes US$ 1,861,000 (US$ 1,849,000 in 2015) generated by assets not related to production activities. For the three months period ended 30 June 2016 the amount included in depreciation is US$ 906,000 (US$ 933,000 in 2015). |

| (b) | Mainly includes termination costs (see Note 14 to the audited Consolidated Financial Statements as of 31 December 2015). |

The following table presents a reconciliation of Adjusted EBITDA to operating profit for the six-month periods ended 30 June 2016 and 2015:

| Six-months period ended 30 June 2016 | ||||||||||||||||||||

| Colombia | Chile | Brazil | Other(d) | Total | ||||||||||||||||

| Adjusted EBITDA for reportable segments | 23,065 | 3,524 | 9,782 | (4,354 | ) | 32,017 | ||||||||||||||

| Depreciation | (14,296 | ) | (16,529 | ) | (7,155 | ) | (156 | ) | (38,136 | ) | ||||||||||

| Write-off of unsuccessful efforts | - | (447 | ) | - | - | (447 | ) | |||||||||||||

| Share-based payment | (263 | ) | (153 | ) | (20 | ) | (287 | ) | (723 | ) | ||||||||||

| Others(c) | (286 | ) | 428 | (175 | ) | (1,124 | ) | (1,157 | ) | |||||||||||

| Operating Profit / (Loss) | 8,220 | (13,177 | ) | 2,432 | (5,921 | ) | (8,446 | ) | ||||||||||||

GEOPARK LIMITED

30 JUNE 2016

Note 3 (Continued)

Segment Information (Continued)

| Six-months period ended 30 June 2015 | ||||||||||||||||||||

| Colombia | Chile | Brazil | Other(d) | Total | ||||||||||||||||

| Adjusted EBITDA for reportable segments | 39,942 | (1,069 | ) | 12,808 | (6,722 | ) | 44,959 | |||||||||||||

| Depreciation | (22,886 | ) | (19,845 | ) | (6,955 | ) | (165 | ) | (49,851 | ) | ||||||||||

| Share-based payment | (263 | ) | (110 | ) | (44 | ) | (2,698 | ) | (3,115 | ) | ||||||||||

| Others(c) | (1,672 | ) | (5,948 | ) | (63 | ) | (751 | ) | (8,434 | ) | ||||||||||

| Operating Profit / (Loss) | 15,121 | (26,972 | ) | 5,746 | (10,336 | ) | (16,441 | ) | ||||||||||||

(c)Includes Argentina, Peru and Corporate.

(d)Includes termination costs.

Note 4

Production and operating costs

| Amounts in US$ '000 | Three-months period ended 30 June 2016 | Three-months period ended 30 June 2015 |

30 June 2016 | Six-months period ended 30 June 2015 | ||||||||||||

| Staff costs | 2,383 | 4,705 | 5,424 | 10,310 | ||||||||||||

| Well and facilities maintenance | 2,512 | 6,184 | 4,425 | 11,142 | ||||||||||||

| Royalties | 2,571 | 3,866 | 4,327 | 6,104 | ||||||||||||

| Gas plant costs | 1,602 | 381 | 3,249 | 885 | ||||||||||||

| Consumables | 1,506 | 1,810 | 3,193 | 4,301 | ||||||||||||

| Equipment rental | 813 | 677 | 1,729 | 1,717 | ||||||||||||

| Transportation costs | 506 | 1,144 | 1,262 | 2,626 | ||||||||||||

| Field camp | 183 | 565 | 675 | 1,535 | ||||||||||||

| Non operated blocks costs | 221 | 99 | 513 | 969 | ||||||||||||

| Crude oil stock variation | 47 | 873 | 308 | 2,416 | ||||||||||||

| Share-based payment | 70 | 151 | 150 | 152 | ||||||||||||

| Other costs | 1,373 | 2,017 | 1,547 | 4,210 | ||||||||||||

| 13,787 | 22,472 | 26,802 | 46,367 | |||||||||||||

GEOPARK LIMITED

30 JUNE 2016

Note 5

Geological and geophysical expenses

| Amounts in US$ '000 | Three-months period ended 30 June 2016 | Three-months period ended 30 June 2015 | Six-months period ended 30 June 2016 | Six-months period ended 30 June 2015 | ||||||||||||

| Staff costs | 2,625 | 2,715 | 4,334 | 4,734 | ||||||||||||

| Share-based payment | 57 | 228 | 109 | 359 | ||||||||||||

| Other services | 511 | 738 | 1,104 | 1,355 | ||||||||||||

| Allocation to capitalised project | (262 | ) | (50 | ) | (262 | ) | (156 | ) | ||||||||

| 2,931 | 3,631 | 5,285 | 6,292 | |||||||||||||

Note 6

Administrative expenses

| Amounts in US$ '000 | Three-months period ended 30 June 2016 | Three-months period ended 30 June 2015 | Six-months period ended 30 June 2016 | Six-months period ended 30 June 2015 | ||||||||||||

| Staff costs | 5,018 | 4,623 | 9,490 | 9,982 | ||||||||||||

| Consultant fees | 896 | 829 | 1,635 | 1,742 | ||||||||||||

| Office expenses | 595 | 538 | 1,105 | 1,439 | ||||||||||||

| Director fees and allowance | 384 | 260 | 758 | 533 | ||||||||||||

| Travel expenses | 435 | 367 | 632 | 529 | ||||||||||||

| Share-based payment | 105 | 1,536 | 464 | 2,604 | ||||||||||||

| New projects | 157 | 59 | 261 | 206 | ||||||||||||

| Other administrative expenses | 647 | 165 | 1,377 | 1,183 | ||||||||||||

| 8,237 | 8,377 | 15,722 | 18,218 | |||||||||||||

GEOPARK LIMITED

30 JUNE 2016

Note 7

Selling expenses

| Amounts in US$ '000 | Three-months period ended 30 June 2016 | Three-months period ended 30 June 2015 |

period ended 30 June 2016 |

period ended 30 June 2015 | ||||||||||||

| Transportation | 283 | 898 | 2,875 | 3,109 | ||||||||||||

| Selling taxes and other | 211 | 215 | 289 | 311 | ||||||||||||

| 494 | 1,113 | 3,164 | 3,420 | |||||||||||||

Note 8

Financial costs

| Amounts in US$ '000 | Three-months period ended 30 June 2016 | Three-months period ended 30 June 2015 | Six-months period ended 30 June 2016 | Six-months period ended 30 June 2015 | ||||||||||||

| Financial expenses | ||||||||||||||||

| Bank charges and other financial costs | 467 | 656 | 1,377 | 1,663 | ||||||||||||

| Unwinding of long-term liabilities | 397 | 733 | 1,242 | 1,447 | ||||||||||||

| Interest and amortisation of debt issue costs | 7,292 | 7,370 | 15,199 | 15,119 | ||||||||||||

| Less: amounts capitalised on qualifying assets | (28 | ) | (56 | ) | (155 | ) | (159 | ) | ||||||||

| Financial income | ||||||||||||||||

| Interest received | (491 | ) | (608 | ) | (1,062 | ) | (945 | ) | ||||||||

| 7,637 | 8,095 | 16,601 | 17,125 | |||||||||||||

GEOPARK LIMITED

30 JUNE 2016

Note 9

Property, plant and equipment

| Amounts in US$'000 | Oil & gas properties | Furniture, equipment and vehicles | Production facilities and machinery | Buildings and improvements | Construction in progress | Exploration and evaluation assets | TOTAL | |||||||||||||||||||||

| Cost at 1 January 2015 | 749,947 | 12,057 | 111,646 | 9,527 | 59,425 | 140,444 | 1,083,046 | |||||||||||||||||||||

| Additions | (709 | )(a) | 476 | - | 28 | 15,376 | 5,632 | 20,803 | ||||||||||||||||||||

| Currency translation differences | (12,580 | ) | (29 | ) | - | 198 | (1,170 | ) | (484 | ) | (14,065 | ) | ||||||||||||||||

| Transfers | 17,701 | 374 | 7,320 | 571 | (20,358 | ) | (5,608 | ) | - | |||||||||||||||||||

| Cost at 30 June 2015 | 754,359 | 12,878 | 118,966 | 10,324 | 53,273 | 139,984 | 1,089,784 | |||||||||||||||||||||

| Cost at 1 January 2016 | 648,992 | 13,745 | 124,832 | 10,518 | 29,823 | 87,000 | 914,910 | |||||||||||||||||||||

| Additions | (2,906 | ) | 270 | - | - | 8,153 | 6,058 | 11,575 | ||||||||||||||||||||

| Disposals | - | - | - | - | (300 | ) | (35 | ) | (335 | ) | ||||||||||||||||||

| Write-off of unsuccessful efforts | - | - | - | - | - | (447 | )(b) | (447 | ) | |||||||||||||||||||

| Transfers | 14,796 | 33 | 1,951 | - | (9,403 | ) | (7,377 | ) | - | |||||||||||||||||||

| Currency translation differences | 15,130 | 136 | 1,795 | 38 | 85 | 898 | 18,082 | |||||||||||||||||||||

| Cost at 30 June 2016 | 676,012 | 14,184 | 128,578 | 10,556 | 28,358 | 86,097 | 943,785 | |||||||||||||||||||||

| Depreciation and write-down at 1 January 2015 | (240,439 | ) | (4,449 | ) | (45,147 | ) | (2,244 | ) | - | - | (292,279 | ) | ||||||||||||||||

| Depreciation | (40,115 | ) | (1,398 | ) | (6,606 | ) | (451 | ) | - | - | (48,570 | ) | ||||||||||||||||

| Currency translation differences | 1,805 | (111 | ) | - | (124 | ) | - | - | 1,570 | |||||||||||||||||||

| Depreciation and write-down At 30 June 2015 | (278,749 | ) | (5,958 | ) | (51,753 | ) | (2,819 | ) | - | - | (339,279 | ) | ||||||||||||||||

| Depreciation and write-down at 1 January 2016 | (321,173 | ) | (7,317 | ) | (60,614 | ) | (3,195 | ) | - | - | (392,299 | ) | ||||||||||||||||

| Depreciation | (30,216 | ) | (1,416 | ) | (5,637 | ) | (445 | ) | - | - | (37,714 | ) | ||||||||||||||||

| Currency translation differences | (2,818 | ) | (55 | ) | 23 | (22 | ) | - | - | (2,872 | ) | |||||||||||||||||

| Depreciation and write-down at 30 June 2016 | (354,207 | ) | (8,788 | ) | (66,228 | ) | (3,662 | ) | - | - | (432,885 | ) | ||||||||||||||||

| Carrying amount at 30 June 2015 | 475,610 | 6,920 | 67,213 | 7,505 | 53,273 | 139,984 | 750,505 | |||||||||||||||||||||

| Carrying amount at 30 June 2016 | 321,805 | 5,396 | 62,350 | 6,894 | 28,358 | 86,097 | 510,900 | |||||||||||||||||||||

(a) Corresponds to the effect of change in estimate of assets retirement obligations in Colombia.

(b) Corresponds to unsuccessful exploratory activities performed in 2013 in Chile (Flamenco Block).

GEOPARK LIMITED

30 JUNE 2016

Note 10

Share capital

| Issued share capital | Six-months period ended 30 June 2016 | Year ended 31 December 2015 | ||||||

| Common stock (US$ ´000) | 60 | 59 | ||||||

| The share capital is distributed as follows: | ||||||||

| Common shares, of nominal US$ 0.001 | 59,827,059 | 59,535,614 | ||||||

| Total common shares in issue | 59,827,059 | 59,535,614 | ||||||

| Authorised share capital | ||||||||

| US$ per share | 0.001 | 0.001 | ||||||

| Number of common shares (US$ 0.001 each) | 5,171,949,000 | 5,171,949,000 | ||||||

| Amount in US$ | 5,171,949 | 5,171,949 | ||||||

GeoPark’s share capital only consists of common shares. The authorized share capital consists of 5,171,949,000 common shares of par value US$ 0.001 per share. All of the Company issued and outstanding common shares are fully paid and nonassessable. The Company also has an employee incentive program, pursuant to which it has granted share awards to its senior management and certain key employees (see Notes 25 and 29 to the audited Consolidated Financial Statements as of 31 December 2015).

Note 11

Borrowings

The outstanding amounts are as follows:

| Amounts in US$ '000 | At 30 June 2016 | Year ended 31 December | ||||||

| Notes GeoPark Latin America Agencia en Chile (a) | 303,211 | 302,495 | ||||||

| Banco Itaú (b) | 59,430 | 69,142 | ||||||

| Banco de Chile (c) | 7,119 | 7,036 | ||||||

| Banco de Crédito e Inversiones (d) | 171 | - | ||||||

| 369,931 | 378,673 | |||||||

Classified as follows:

| Current | 38,536 | 35,425 | ||||||||

| Non-Current | 331,395 | 343,248 |

GEOPARK LIMITED

30 JUNE 2016

Note 11 (Continued)

Borrowings (Continued)

(a) During February 2013, the Company successfully placed US$ 300 million notes which were offered under Rule 144A and Regulation S exemptions of the United States Securities laws.

The Notes, issued by the Company's wholly-owned subsidiary GeoPark Latin America Limited Agencia en Chile ("the Issuer"), were priced at 99.332% and carry a coupon of 7.50% per annum (yield 7.625% per annum). Final maturity of the notes will be 11 February 2020. The Notes are guaranteed by GeoPark Limited and GeoPark Latin America Cooperatie U.A. and are secured with a pledge of all of the equity interests of the Issuer in GeoPark Chile S.A., GeoPark Colombia Cooperatie U.A. and GeoPark Colombia S.A. and a pledge of certain intercompany loans. The debt issuance cost for this transaction amounted to US$ 7,637,000. The indenture governing our Notes due 2020 includes incurrence test covenants that provides among other things, that, the Debt to EBITDA ratio should not exceed 2.5 times and the EBITDA to Interest ratio should exceed 3.5 times. As of the date of these interim condensed consolidated financial statements, the Company’s Debt to EBITDA ratio was 6.1 times and the EBITDA to Interest ratio was 2.0 times, primarily due to the lower oil prices that impacted the Company’s EBITDA generation. Failure to comply with the incurrence test covenants does not trigger an event of default. However, this situation may limit the Company’s capacity to incur additional indebtedness, as specified in the indenture governing the Notes. Incurrence covenants as opposed to maintenance covenants must be tested by the Company before incurring additional debt or performing certain corporate actions including but not limited to dividend payments, restricted payments and others, (other than in each case, certain specific exceptions). As of the date of these interim condensed consolidated financial statements, the Company is in compliance of all the indenture’s provisions.

(b) During March 2014, GeoPark executed a loan agreement with Itaú BBA International for US$ 70,450,000 to finance the acquisition of a 10% working interest in the Manatí field in Brazil. The interest rate applicable to this loan is LIBOR plus 3.9% per annum. The interest will be paid semi-annually; principal will be cancelled semi-annually with a year grace period. The debt issuance cost for this transaction amounted to US$ 3,295,000. In March 2015, the Company reached an agreement to: (i) extend the principal payments that were due in 2015 (amounting to approximately US$ 15,000,000), which will be divided pro-rata during the remaining principal installments, starting in March 2016 and (ii) to increase the variable interest rate to six-month LIBOR + 4.0%. As a result of the above, in March 2016 the Company paid US$ 10,000,000 corresponding to principal payments under the current principal amortization schedule.

The facility agreement includes customary events of default, and requires the Brazilian subsidiary to comply with customary covenants, including the maintenance of a ratio of net debt to EBITDA of up to 3.5x for the first two years and up to 3.0x thereafter. The credit facility also limits the borrower’s ability to pay dividends if the ratio of net debt to EBITDA is greater than 2.5x. As of the date of these interim condensed consolidated financial statements, the Company has complied with these covenants.

GEOPARK LIMITED

30 JUNE 2016

Note 11 (Continued)

Borrowings (Continued)

(c) During December 2015, GeoPark executed a loan agreement with Banco de Chile for US$ 7,028,000 to finance the start-up of new Ache gas field in GeoPark-operated Fell Block. The interest rate applicable to this loan is LIBOR plus 2.35% per annum. The interest and the principal will be paid on monthly basis; with a six months grace period, with final maturity on December 2017.

(d) During February 2016, GeoPark executed a loan agreement with Banco de Crédito e Inversiones for US$ 186,000 to finance the acquisition of vehicles for the Chilean operation. The interest rate applicable to this loan is 4.14% per annum. The interest and the principal will be paid on monthly basis, with final maturity on February 2019.

As of the date of this interim condensed consolidated report, the Group has available credit lines for approximately US$ 45,000,000.

Note 12

Provision for other long-term liabilities

The outstanding amounts are as follows:

| Amounts in US$ '000 | At 30 June 2016 | Year ended | ||||||

| Assets retirement obligation and other environmental liabilities | 30,305 | 31,617 | ||||||

| Deferred income | 4,164 | 5,033 | ||||||

| Other | 6,535 | 5,800 | ||||||

| 41,004 | 42,450 | |||||||

GEOPARK LIMITED

30 JUNE 2016

Note 13

Trade and other payables

The outstanding amounts are as follows:

| Amounts in US$ '000 | At 30 June 2016 | Year ended | ||||||

| Trade payables | 19,283 | 25,906 | ||||||

| Payables to related parties(a) | 27,045 | 21,045 | ||||||

| Customer advance payments(b) | 10,000 | 5,266 | ||||||

| Taxes and other debts to be paid | 2,437 | 2,931 | ||||||

| Staff costs to be paid | 5,277 | 6,702 | ||||||

| V.A.T. | 463 | 908 | ||||||

| To be paid to co-venturers | 2,284 | 113 | ||||||

| Royalties to be paid | 848 | 2,475 | ||||||

| 67,637 | 65,346 | |||||||

Classified as follows:

| Current | 37,677 | 45,790 | ||||||||

| Non-Current | 29,960 | 19,556 |

| (a) | Corresponds to related parties loans granted by LGI. The maturity of these loans is July 2020 and the applicable interest rate is 8% per annum. |

| (b) | In December 2015, the Company entered into a prepayment agreement with Trafigura under which the Company sells and deliver a portion of its Colombian crude oil production at spot prices. The agreement also provides GeoPark with prepayment of up to US$ 100,000,000 from Trafigura. Funds committed are available upon request and will be repaid by the Company on a monthly basis through future oil deliveries over the period of the contract, which is 2.5 years, including a 6-month grace period. As of the date of these Financial Statements, outstanding balances related to the prepayment agreement amount to US$ 10,000,000. |

GEOPARK LIMITED

30 JUNE 2016

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GeoPark Limited | |||||

| By: | /s/ Andrés Ocampo | ||||

| Name: | Andrés Ocampo | ||||

| Title: | Chief Financial Officer | ||||

Date: August 11, 2016