UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2014

Commission File Number: 001-34476

BANCO SANTANDER (BRASIL) S.A.

(Exact name of registrant as specified in its charter)

Avenida Presidente Juscelino Kubitschek, 2041 and 2235

Bloco A – Vila Olimpia

São Paulo, SP 04543-011

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:Form 20-F ___X___ Form 40-F _______ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

BANCO SANTANDER (BRASIL) S.A.

Publicly-held Company with Authorized Capital

Corporate Taxpayer ID (“CNPJ/MF”) 90.400.888/0001-42

Company Registry (“NIRE”) 35.300.332.067

MINUTES OF THE BOARD OF DIRECTORS,

HELD ON OCTOBER 2, 2014

DATE, TIME, AND PLACE:

October 2, 2014, at 11:00 a.m., at the headquarters of Banco Santander (Brasil) S.A. (“Santander Brasil” or the “Company”), located in the City of São Paulo, State of São Paulo, at Avenida Presidente Juscelino Kubitschek, nº 2.235, Vila Olímpia.

ATTENDANCE:

All members of the board of directors attended the meeting, namely: Messrs. Celso Clemente Giacometti - chairman of the board of directors (independent director); Jesús María Zabalza Lotina – vice chairman of the board of directors; José de Paiva Ferreira; Viviane Senna Lalli (independent director); Marília Artimonte Rocca (independent director); Álvaro Antônio Cardoso de Souza (independent director); Conrado Engel; José Antonio Alvarez Alvarez and José Manuel Tejon Borrajo. The last two persons mentioned attended through videoconference.

CALL NOTICE:

The call notice requirement was waived as all members of the board of directors were present at the meeting.

TABLE:

The chairman of the board of directors, Mr. Celso Clemente Giacometti, presided the meeting according to Article 18, I of the Company’s by-laws, and he invited me, Mara Regina Lima Alves Garcia, director of the Company, to act as secretary of the meeting.

AGENDA:

Pursuant to the provisions set forth in item 5.8 of the Level 2 Listing Regulation of Corporate Governance ofBM&FBOVESPA S.A. - Bolsa de Valores, Mercadorias e Futuros("BM&FBOVESPA" and "Level 2 Listing Regulation"), to deliberate with respect to the issuance of an opinion concerning the exchange offers by Banco Santander, S.A. (“Santander Spain”) to acquire all of the issued and outstanding securities of Santander Brasil, including common and preferred shares issued by the Company through Brazilian Depositary Receipts (“BDRs”), Santander Brasil units (“Units”), each representing one preferred share and one common share and Santander Brasil American Depositary Shares (“ADSs”), each representing one Unit (“Exchange Offer”) and the consequent exit of the Company from the special listing segment of securities trading onthe BM&FBOVESPA, known as Corporate Governance Level 2 Segment (the “Level 2 Segment”), as approved by the shareholders of the Company in the shareholders’ meeting held on June 9, 2014.

1

DECISIONS:

At the commencement of the meeting, all board members approved the transcription of these minutes in summarized form, as well as its publication, which omits the signatures of all board members.

Subsequently, after discussing the item on the Agenda, and in accordance with the statement of the Special Independent Committee created by the board of directors on April 30, 2014, as stated in the minutes of the Special Independent Committee’s Meeting, dated October 2, 2014 (Schedule I), the members of the board of directors, unanimously and without any restrictions, with members José Antonio Alvarez and José Manuel Tejon Borrajo abstaining, decided to issue an opinion in favor of the acceptance of the Exchange Offer, pursuant to the terms of the opinion attached asSchedule II hereto, which is part of this document for all legal purposes.

CLOSING:

As there were no other items to be discussed, theses minutes were transcribed, read, approved and executed by the board members in attendance, namely, Celso Clemente Giacometti - chairman of the board of directors (independent director); Jesús María Zabalza Lotina – vice chairman of the board of directors; Conrado Engel; José de Paiva Ferreira; José Antonio Alvarez; José Manuel Tejon Borrajo; Viviane Senna Lalli (independent director); Marília Artimonte Rocca (independent director); and Álvaro Antônio Cardoso de Souza (independent director).

Theses minutes are a true copy of the original in the book of minutes of the board of directors’ meetings from Banco Santander (Brasil) S.A.

São Paulo, October 2, 2014.

Mara Regina Lima Alves Garcia

Secretary

2

SCHEDULE I

TO THE MINUTES OF THE BOARD OF DIRECTORS OF

BANCO SANTANDER (BRASIL) S.A.,

HELD ON OCTOBER 2, 2014

MINUTES OF THE SPECIAL INDEPENDENT COMMITTEE

HELD ON OCTOBER 2, 2014

BANCO SANTANDER (BRASIL) S.A.

Publicly-held Company with Authorized Capital

Corporate Taxpayer ID (“CNPJ/MF”) 90.400.888/0001-42

Company Registry (“NIRE”) 35.300.332.067

MINUTES OF THE SPECIAL INDEPENDENT COMMITTEE

HELD ON OCTOBER 2, 2014

DATE, TIME, AND PLACE:

October 2, 2014, at 9:00 a.m., at the headquarters of Banco Santander (Brasil) S.A. (“Santander Brasil” or the “Company”), located in the City of São Paulo, State of São Paulo, at Avenida Presidente Juscelino Kubitschek, nº 2.235, Vila Olímpia.

ATTENDANCE:

All members of the Special Independent Committee attended the meeting, namely: Messrs. Celso Clemente Giacometti; Jesús María Zabalza Lotina; Viviane Senna Lalli; Marília Artimonte Rocca and Álvaro Antônio Cardoso de Souza.

TABLE:

Mr. Celso Clemente Giacometti presided the meeting and he invited me, Mara Regina Lima Alves Garcia, director of the Company, to act as secretary of the meeting.

AGENDA:

Submit to the board of directors draft of the opinion concerning the exchange offers by Banco Santander, S.A. (“Santander Spain”) to acquire all of the issued and outstanding securities of Santander Brasil, including common and preferred shares issued by the Company through Brazilian Depositary Receipts (“BDRs”), Santander Brasil units (“Units”), each representing one preferred share and one common share and Santander Brasil American Depositary Shares (“ADSs”), each representing one Unit (“Exchange Offer”) and the consequent exit of the Company from the special listing segment of securities trading on theBM&FBOVESPA S.A. - Bolsa de Valores, Mercadorias e Futuros("BM&FBOVESPA"), known as Corporate Governance Level 2 Segment (the “Level 2 Segment”), as approved by the shareholders of the Company in the shareholders’ meeting held on June 9, 2014, pursuant to the provisions set forth in item 5.8 of the Level 2 Segment Listing Regulation of Corporate Governance of BM&FBOVESPA ("Level 2 Segment Listing Regulation").

3

DECISIONS:

To comply with the responsibilities charged to the Special Independent Committee by the board of directors, which created the Special Independent Committee on April 30, 2014, the members of the Special Independent Committee met on various occasions, interacted with the financial advisors, the valuation report provider and the legal advisors regarding all aspects of the Exchange Offer, and analyzed all documents related to the Exchange Offer, including: (i) the Public Notice of the Exchange Offer (Edital); (ii) the offer to exchange/prospectus; (iii) the valuation report prepared by N M Rothschild & Sons (Brasil) Ltda.; (iv) the fairness opinion and liquidity analysis prepared by Banco BTG Pactual S.A.; and (v) the publicly available information provided by Santander Spain with respect to Santander Brasil for the last 24 months, as per a letter dated as of June 25, 2014. After conducting the analysis, the members of the Special Independent Committee decided to submit to the board of directors the draft of the opinion, which is in favor of the acceptance of the Exchange Offer, as per the terms of the draft included in Schedule I, attached hereto, which is part of this document for legal purposes.

CLOSING:

As there were no other items to be discussed, the meeting was adjourned and these minutes were transcribed, read, approved, and executed by the members of the Special Independent Committee.

São Paulo, October 2, 2014

_______________________________

Celso Clemente Giacometti

_______________________________

Jesús Maria Zabalza Lotina

_______________________________

Marília Artimonte Rocca

4

_______________________________

Viviane Senna Lalli

_______________________________

Álvaro de Souza

_______________________________

Mara Garcia

Secretary

5

SCHEDULE II

TO THE MINUTES OF THE BOARD OF DIRECTORS OF

BANCO SANTANDER (BRASIL) S.A.,

HELD ON OCTOBER 2, 2014

OPINION FROM THE BOARD OF DIRECTORS OF BANCO SANTANDER (BRASIL) S.A. CONCERNING THE EXCHANGE OFFER BY BANCO SANTANDER, S.A. AND THE CONSEQUENT EXIT OF THE COMPANY FROM THE SPECIAL LISTING OF BM&FBOVESPA, KNOWN AS THE CORPORATE GOVERNANCE LEVEL 2 SEGMENT.

Pursuant to the provisions set forth in item 5.8 of the Level 2 Listing Regulation of Corporate Governance ofBM&FBOVESPA S.A. - Bolsa de Valores, Mercadorias e Futuros("BM&FBOVESPA" and "Level 2 Listing Regulation"), the board of directors of Banco Santander (Brasil) S.A. ("Santander Brasil" or the "Company") hereby presents its opinion regarding the exchange offers by Banco Santander, S.A. (“Santander Spain”) to acquire all of the issued and outstanding securities of Santander Brasil including common and preferred shares issued by the Company through Brazilian Depositary Receipts (“BDRs”), Santander Brasil units (“Units”), each representing one preferred share and one common share and Santander Brasil American Depositary Shares (“ADSs”), each representing one Unit (“Exchange Offer”) and the consequent exit of the Company from the special listing segment of securities trading on the BM&FBOVESPA, known as Corporate Governance Level 2 Segment (the “Level 2 Segment”), as approved by the shareholders of the Company in the shareholders’ meeting held on June 9, 2014 and in accordance with the notices to the market dated April 29, 2014, June 9, 2014, June 13, 2014, June 31, 2014, September 9, 2014 and September 18, 2014. The notices to the market are available on the websites of Santander Brasil(www.ri.santander.com.br), theComissão de Valores Mobiliários ("CVM")(www.cvm.gov.br) and the BMF&BOVESPA(www.bmfbovespa.com.br).

1. THE EXCHANGE OFFER AND THE BACKGROUND OF THE ISSUANCE OF THIS OPINION.

1.1 On April 29, 2014, Santander Brasil was informed by Santander Spain, its indirect controlling shareholder, that it intended to launch exchange offers in Brazil and in the United States, for the acquisition of up to the totality of the shares of Santander Brasil not held, directly or indirectly, by Santander Spain, which represents around twenty-five percent (25%) of the Company’s capital stock, with the consequent exit of Santander Brasil from the Level 2 Segment.

1.2 On the same day, April 29, 2014, Santander Brasil published a notice to the market informing its shareholders and the market of the preliminary terms and conditions of theExchange Offer and made available to the market the notice published by Santander Spain regarding the transaction.

6

1.3 On April 30, 2014, a meeting of the board of directors was held where it approved, by unanimity of votes, the creation of the Special Independent Committee, pursuant to the terms of article 14, paragraph 6th, and article 17, items XXIX of the Company’s by-laws. The Special Independent Committee was charged by the board of directors of Santander Brasil with (i) advising the board of directors of Santander Brasil on the evaluation of the Exchange Offer as required by the Level 2 Segment Listing Regulation and by Schedule 14D-9 of the Securities Exchange Act of 1934 of the United States, specifically (a) the convenience and opportunity of the exchange offers in light of the interests of the holders of Santander Brasil securities and the effect on the liquidity of Santander Brasil securities, (b) the impact of the exchange offers on the interests of Santander Brasil as a company, (c) the announced strategic plans of Santander Spain for Santander Brasil after the completion of the Exchange Offer, and (d) any other matters deemed relevant by the Committee; and (ii) advising the board of directors of Santander Brasil regarding three specialized third-party firms for the preparation of a valuation report required by Brazilian law based on the economic value of Santander Brasil and Santander Spain, contemplated by the Level 2 Listing Regulation, for presentation to the shareholders’ meeting of the Company.

1.4 It was also decided in the aforementioned meeting, held on April 30, 2014, that (a) the Special Independent Committee would be comprised of the following members of the board of directors of Santander Brasil: Celso Clemente Giacometti, the chairman of the board of directors and an independent member; Jesús María Zabalza Lotina, vice-chairman of the board of directors; Viviane Senna Lalli and Marília Artimonte Rocca, both independent directors; and (b) that the Special Independent Committee could recommend to the board of directors of Santander Brasil financial advisors to render fairness opinions and to retain legal advisors and any other advisors it deemed appropriate to carry out its responsibilities. As per the board of directors meeting held on June 30, 2014, the independent director Álvaro Antônio Cardoso de Souza joined the Special Independent Committee.

1.5 In the board of directors meeting held on May 7, 2014, the board of directors decided the matters below, by unanimity of votes, without any restrictions and in accordance with the statement of the Special Independent Committee according to the minutes of the meeting of such Committee held on May 5, 2014:

(i) that the presentation of three specialized third-party firms should be submitted for the approval of the shareholders at an extraordinary shareholders meeting, for the purpose of the preparation of a valuation report of the economic value of the Company, as required by item 10.1.1 of the Level 2 Listing Regulation (“Valuation Report”); and which shall comply with the terms of CVM Instruction No. 361/02. The list of the three specialized third-party firms included: (a)Bank of America Merrill Lynch Banco Múltiplo S.A; (b)N M Rothschild & Sons (Brasil) Ltda.; and (c)KPMG Corporate Finance Ltda.;

7

(ii) that for the benefit of accelerating the Exchange Offer's registration process, the valuation report of Santander Brasil and Santander Spain, previously prepared byGoldman Sachs do Brasil Banco Múltiplo S.A. ("Goldman Sachs") upon the offeror’s request, should be submitted to the Company’s shareholders, so that the shareholders at the shareholders’ meeting could select (a) one of the three specialized third-party firms abovementioned for the preparation of the valuation report; or (b) Goldman Sachs, in which case the valuation report already prepared by Goldman Sachs would be used for the purposes of the Exchange Offer;

(iii) that a shareholders’ meeting of the Company should be summoned to determine the Company’s exit from the Level 2 Segment, according to Section XI of the Level 2 Listing Regulation and Title X of the Company’s by-laws, as a consequence of the Exchange Offer; and

(iv) finally, the board of directors approved the Special Independent Committee’s recommendation that the Audit Committee monitor the activities related to the Exchange Offer and that it be allowed to recommend actions to be taken by the board of directors, if applicable.

1.6 On June 9, 2014, a shareholders’ meeting of Santander Brasil occurred, in which it was decided:

(i) that the Company would exit from the Level 2 Segment, subject to the effective implementation of the Exchange Offer; and

(ii) that the shareholders representing 69.11% of the outstanding shares (as defined in the Level 2 Listing Regulation) attending the shareholder’s meeting selectedN M Rothschild & Sons (Brasil) Ltda. ("Rothschild") to prepare the valuation report to be used in connection with the Exchange Offer.

1.7 The decisions taken in the shareholder’s meeting were disclosed to the market by means of a notice to the market dated June 9, 2014.

1.8 The Valuation Report of Santander Brasil and Santander Spain prepared by Rothschild, dated June 10, 2014, was delivered to Santander Brasil on June 13, 2014 and on the same day made available to the market by means of the notice to the market. Attending the request of CVM and BMF&BOVESPA, Rothschild made some adjustments to specific items of the Valuation Report, andresubmitted the Valuation Report to CVM andBMF&BOVESPA.

8

1.9 Schedule 1.9 hereto contains anexecutive summary of the Valuation Report, which summarizes its relevant aspects. The complete Valuation Report is available on the websites of the Company, the CVM and theBMF&BOVESPA.

1.10 On July 31, 2014, Santander Brasil published a notice to the market informing the market that it had received a letter from Santander Spain regarding the Exchange Offer. In summary, the letter clarifies that the exchange ratio previously disclosed in the notice to the market dated April 29, 2014 (exchanging 0.35 of a Santander Spain ordinary share for each common or preferred share of Santander Brasil and 0.70 of a Santander Spain ordinary share for each Unit), would be adjusted to reflect any dividend distribution or any other form of remuneration to the shareholders of both Santander Spain and Santander Brasil, in the event of delay in the current timeline of the Exchange Offer. The record date is established between October 10, 2014 (inclusive) and the date on which the first capital increase by Santander Spain occurs, by means of which it shall issue the shares to be delivered, in the form of BDRs to the shareholders of Santander Brasil who accept the Exchange Offer (exclusively). In the same notice to the market, the Company informs that such amendment has the purpose, independently of the date of the settlement of the Exchange Offer, of allowing the shareholders who accept the Exchange Offer to (i) benefit from the dividends that Santander Brasil usually declares in the month of September of each year, without any adjustments to the exchange ratio; and (ii) benefit from the distribution to be granted to the shareholders of Santander Spain in thePrograma Santander Dividendo Elección,scheduled to occur in the month of October, 2014, which record date should occur after October 10, 2014. The letter also stated that the additional terms of the Exchange Offer would remain unchanged and, as of that date, the registry of the Exchange Offer was still under CVM’s revision.

1.11 On September 8, 2014, the CVM granted the registration of the Exchange Offer (CVM/SRE/OPA/VOL/2014/0001), as disclosed in a notice to the market dated September 9, 2014. On September 18, 2014, the Public Notice of the Exchange Offer (“Edital”) was disclosed on the websites of Santander Brasil, CVM, and BMF&BOVESPA, and published in the newspaperValor Econômico.

2. PURPOSE OF THIS OPINION.

2.1 This opinion has the purpose of complying with item 5.8 of the Level 2 Listing Regulation and theOfício Circular 020/2013-DP of BMF&BOVESPA. In this regard, item 5.8 of the Level 2 Listing Regulation provides the following:

"5.8 Opinion of the board of directors.The board of directors of the company shall prepare and disclose a reasoned opinion with respect to any type of tender offer targeting the company’s shares, on (i) the convenience and opportunity of thetender offer in light of the interests of the shareholders and the effect on the liquidity of the securities; (ii) the impact of the offer on the interests of the company; (iii) the announced strategic plans of the offeror for the company; and (iv) any other matters deemed relevant by the board of directors. The board of directors shall express its reasoned opinion in favor or against the acceptance of the tender offer, advising the shareholders that the decision on whether to tender or not their securities is ultimately a decision to be taken in their discretion."

9

2.2 Moreover according to the Level 2 Listing Regulation, the opinion shall be “presented within fifteen (15) days of the publication of the tender offer notice” which, as specified above, was published on September 18, 2014.

2.3 Therefore, this opinion is timely presented, pursuant to the period set forth in the Level 2 Listing Regulation and in accordance with the Special Independent Committee’s opinion dated October 2, 2014.

3. CONVENIENCE AND OPPORTUNITY OF THE EXCHANGE OFFER

3.1 Convenience and opportunity of the Exchange Offer in light of the interests of the Company’s shareholders.

3.1.1 Considering the aspects of the Exchange Offer, the board of directors has the understanding that the issuance of an opinion concerning the convenience and opportunity for the acceptance of the Exchange Offer was dependent on the obtainment of an independent opinion from an expert, who would evaluate the adequacy and fairness of Santander Spain’s proposal.

3.1.2 To support this opinion, the board of directors, by means of the Special Independent Committee, requested that the Company’s management select an independent financial advisor that could issue a fairness opinion regarding the Exchange Offer.

3.1.3 Therefore, Santander Brasil hiredBanco BTG Pactual S.A., a publicly-held financial institution, headquartered in the city of Rio de Janeiro, state of Rio de Janeiro, at Praia do Botafogo, 501, 6th floor, with the CNPJ/MF No. 30.306.294/0001-45 (“Financial Advisor”), who was responsible for the preparation and issuance of the abovementioned fairness opinion regarding the terms and conditions of the Exchange Offer. The scope of their work consisted, in summary, of the preparation of an economic and financial evaluation of the Company and of Santander Spain, with the intention of supporting the economic and financial aspects of this opinion. The board of directors selected the Financial Advisor based on its qualifications, experience, reputation and knowledge of Santander Brasil’s businesses, as well as due to its experience in Latin America and especially in Brazil, as part of its business as an investment bank and its constantinvolvement in the evaluation of business and assets related to mergers and acquisition, underwriting, securities offerings and private placements.

10

3.1.4 The members of the Special Independent Committee held meetings with the representatives of the Financial Advisor before the commencement of the work by the Financial Advisor and after its completion, in order to discuss the premises and the analysis of the presented conclusions.

3.1.5 The conclusions of the Financial Advisor (“Financial Advisor’s Report”) were presented to the Special Independent Committee and the fairness opinion, attached hereto asSchedule 3.1.5 and concludes, in summary, that:

“Based on the foregoing, is BTG Pactual’s opinion, as an investment bank, that, on the date hereof, the Exchange Ratio is fair, from a financial standpoint, to the shareholders of Santander Brasil.”

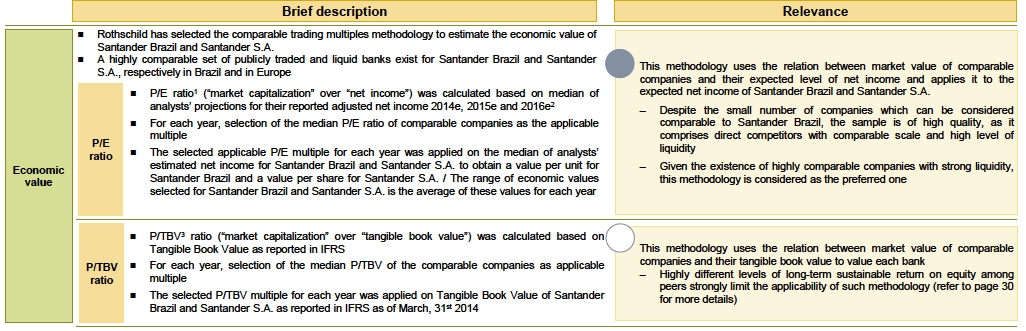

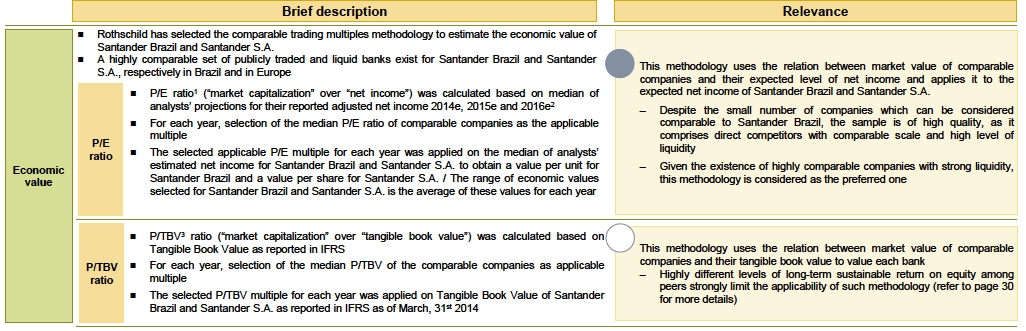

3.1.6 In addition to the analysis reflected in the fairness opinion issued by the Financial Advisor, the members of the board of directors have considered, in the formation of the opinion concerning the Exchange Offer that: (i) the Valuation Report prepared by Rothschild concluded that the exchange ratios offered by Santander Spain are more favorable than (a) the exchange ratios verified from the weighted average trading price of the Units and the Santander Brasil shares (considering the two periods of time adopted in the Report) and (b) the exchange ratios calculated based on economic value, based on the valuation methodology by multiples of comparable market players (such criteria are more relevant than the net worth, of which the result from the comparison made in the report is different); and (ii) the exchange ratios offered by Santander Spain contain a premium in relation to the Units and the Santander Brasil shares quoted on Bovespa the trading day before the announcement of the Offer.

3.1.7 Therefore, considering the conclusion contained in the fairness opinion, the board of directors reached the opinion that the exchange ratios offered by Santander Spain are in line with the interests of the Company's shareholders in the Exchange Offer.

3.1.8. The Company’s board of directors emphasizes that the individual circumstances of each shareholder should be taken into consideration, including tax aspects, expenses to be incurred and their investment strategy, taking into account, with respect to this latter point, that the acceptance of the Exchange Offer will imply the receipt of BDRs representing the outstanding shares of Santander Spain.

3.1.9. The Company’s board of directors is not aware of any relevant modifications to the financial situation of the Company that could modify its perception of the offered exchange ratios.

11

3.2 Convenience and opportunity of the Exchange Offer concerning the liquidity of the securities.

3.2.1 To assist the board of directors in the preparation of this opinion, especially with respect to this item 3.2, the board of directors also considered necessary to obtain the opinion of an independent financial institution and for such reason requested a report from the Financial Advisor about the convenience and opportunity of the Exchange Offer concerning the liquidity of the target securities.

3.2.3 The Financial Advisor examined the matter and, according to a letter dated September 24, 2014 (Schedule 3.2.3), concluded the following:

“The analysis of the potential impact on the Liquidity of the units of Santander Brasil as a result of the Transaction was based on the observation of the results in previous transactions of public tender offerings that occurred in Brasil. The sample analyzed by BTG Pactual in similar transactions indicated that the average daily trading volume of its respective shares reduced significantly after the closing of the tender offerings. Based on the analysis of such precedents, it can be stated that there is a high positive correlation among the level of adherence of the tender offer (reducing the free float) and the reduction of the daily trading volume of the shares that were subject to such tender offers (reduced daily liquidity of the shares subject to the tender offer).

Based on the foregoing, is BTG Pactual’s opinion, as an investment bank, that, considering different scenarios of adherence of shareholders of Santander Brasil to the Transaction, the resulting Liquidity of the units of Santander Brasil may be reduced with a similar correlation to the analyzed historical precedents.”

3.2.4 Considering the abovementioned opinion, as well as the other information provided in the Financial Advisor’s report on this subject, the board of directors has the opinion that the liquidity of the Units issued by Santander Brasil could suffer reduction not only as a result of the percentage of the securities tendered in the Exchange Offer but also due to the exit of Santander Brasil from the Level 2 Segment.

4. IMPACT OF THE EXCHANGE OFFER ON THE COMPANY’S INTERESTS.

4.1 The announcement of the Exchange Offer may have caused impacts, although difficult to measure, on the trading of the Units issued by Santander Brasil, whose volumes and prices may have been influenced by the evaluation of market participants with respect to the expected participation of holders of Santander Brasil securities in the Exchange Offer and also, to certain extent, by the interest of the market participants in trading onSantander Brasil securities according to their interest in the Exchange Offer.

12

4.2 Notwithstanding the impacts referred to in the previous item, the board of directors understands that regardless of the results of the Exchange Offer, Santander Brasil will continue to be able toachieve its long term strategic objectives.

5. STRATEGIC PLANS DISCLOSED BY THE OFFEROR REGARDING THE COMPANY.

5.1 With respect to this specific item, the members of the board of directors requested and received from the board of executive officers of Santander Spain the publicly available information provided by Santander Spain with respect to Santander Brasil for the last 24 months.

5.2 The information was analyzed by the board of directors who concluded that Santander Spain has not publicly disclosed any specific strategic plans related to Santander Brasil.

5.3. Notwithstanding, it is possible to verify by the information received, including those provided in the minutes of the shareholder’s meeting from Santander Spain, held on September 15, 2014, that Brazil is highlighted among the markets in which the Santander Group has operations, emphasizing that Santander Spain has confidence in the prospects of Brazil and Santander Brasil, especially with respect to the expectations and growth opportunity of the Brazilian market and, as consequence, of the stability of Santander Brasil’s current position, as well as the financial results presented by the Company, which places the Company’s operations among the most relevant operations of the group.

6. ADDITIONAL MATTERS CONSIDERED PERTINENT.

6.1 As previously mentioned, the issuance of this opinion was preceded by the elaboration of an opinion by the Special Independent Committee created by the board of directors, specifically for the purpose of issuing an opinion with respect to the Exchange Offer. The Special Independent Committee’s opinion was submitted to the board of directors on October 2, 2014.

6.2 In addition, upon request from the board of directors and the Special Independent Committee, respectively, the Company selected as legal advisors the law firms (i) Tozzini Freire Advogados and Milbank, Tweed, Hadley & McCloy LLP; and (ii) Barbosa, Müssnich e Aragão Advogados and Clifford Chance LLP, who, with respect to their respective jurisdictions, have manifested their opinion with respect to the observance by the Company’s management of the legal and regulatory aspects of the Exchange Offer,concluding, in summary, that the Exchange Offer was structured in accordance with applicable legal and regulatory provisions and that the management of the Company has adopted the mechanisms recommended in compliance with its fiduciary duties.

13

6.3 Regarding the tax impacts related to the Exchange Offer, the members of the board of directors recommend that the shareholders of Santander Brasil that intend to accept the Exchange Offer carefully read the provisions contained in item 6.8 of theEditaland, importantly, consult with their tax advisors for an effective understanding of the matter.

7. CONCLUSION.

7.1 In light of the considerations and conclusions described in the above items, and in compliance with item 5.8 of the Level 2 Listing Regulation, the Company’s board of directors, with members José Antonio Alvarez and José Manuel Tejon Borrajo abstaining, is in favor of the acceptance of the Exchange Offer, but cautions that it is the responsibility of each shareholder to make the final decision of whether to accept the Exchange Offer based on the individual circumstances of that shareholder, including tax aspects, expenses to be incurred and investment strategy.

São Paulo (SP), October 1, 2014.

Celso Clemente Giacometti

Chairman

(Independent Director)

Jesús María Zabalza Lotina

Vice-Chairman

Conrado Engel

José de Paiva Ferreira

Viviane Senna Lalli

(Independent Director)

14

(Independent Director)

Álvaro Antônio Cardoso de Souza

(Independent Director)

15

SCHEDULE 1.9

EXECUTIVE SUMMARY OF THE VALUATION REPORT

Valuation Report of Santander Brazil and Santander S.A.

June 10, 2014

1. Executive summary

1.1 Introduction

In the context of the Material Fact released on April 29th, 2014(“Material Fact”),Banco Santander (Brasil) S.A. ("Santander Brazil" or "Company") informed the Market, and thus Rothschild, that BancoSantander S.A. (“BancoSantander” or “Santander S.A.”, and together with Santander Brazil, “Companies”) intends to launch a voluntary offer inBrazil and in theUnited States of America (“USA”)to acquire up to the totality of the shares of Santander Brazil which are not held by Santander S.A. with the objective to take the company out of BM&FBOVESPA S.A.–Bolsa de Valores, Mercadorias e Futuros’ ("BM&FBOVESPA“)Nível 2 corporate governance listing segment, in exchange for shares of Santander S.A. pursuant to paragraph 4th, Article 157 of Law nº 6.404/76, CVM Instruction nº 358/02 and nº 361, Title Xof the By-Laws of Santander Brazil and Sections X and XI of Nível 2 Listing Rules (the“Voluntary Exchange TenderOffer” or “OPA”).

According to the Material Fact, the offer is voluntary and minority holders of Santander Brazil may choose whether or not to participate in the transaction, which is not subject to a minimum acceptance level. Santander S.A. shares would be traded on the São Paulo stock exchange through Brazilian Depositary Receipts (BDRs). Shareholders who accept the offer would receive, through BDRs or through American Depositary Receipts (ADRs), 0.70 newly-issued shares of Santander S.A. for every unit or ADR of Santander Brazil. Afterthe OPA, the intention of Santander S.A.’s is to keep theshares of Santander Brazil listed on BM&FBOVESPA. However, they would migrate from the Nível 2 corporategovernance listing segment to the traditional segment of BM&FBovespa.

In this context, N M Rothschild & Sons (Brasil) Ltda. (“Rothschild”) was hired by Santander Brazil to prepare the Valuation Report for purposes of the OPA, as per the Material Fact.

In this Valuation Report, Santander Brazil’s and Santander S.A.’s share price were both assessed according to the same criteria, as follows:n

nVolume weighted average trading price –In the 12-month period immediately before the date of the Material Fact, and

–Between the date of the Material Fact and June 10th, 2014

nShareholders’equity book value per share as of March 31st, 2014 (adjusted for intangible items)

nEconomic value based on the comparable trading multiples valuation methodology

Except as otherwise stated, all financial information used was prepared according to International Financial ReportingStandards (“IFRS”).

| 3 |  |

| 1. Executive summary |

| 1.2 Valuation methodology |

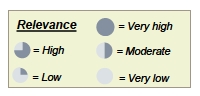

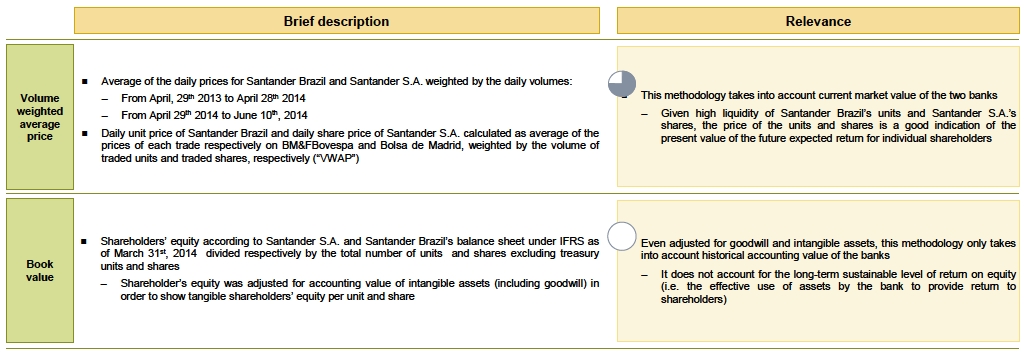

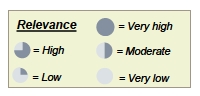

In accordance with CVM Instruction nº361, Rothschild has performed a multi-approach valuation of SantanderBrazil’sunits and of Santander S.A.’sshares based on the three required criteria: volume weighted average price, book value and economic value

| 4 |  |

| 1. Executive summary |

| 1.3 Valuation methodology (continuation) |

|

| Considerations on the applicability of the discounted cash flow methodology (DCF) in this specific case |

|

nThe valuation approach based on DCF or on dividend discount methodologies takes into consideration thecompanies’operational and financial characteristics and its growth perspectives, but may be subject to significant uncertainties and inaccuracies due to the number of variables involved and the difficulty to predict them with an acceptable level of precision. nThis methodology relies on a large number of operational and macroeconomic assumptions, especially considering that this valuation involves a multinational financial group with a large number of activities in various segments and in multiple countries which are difficult to predict over the long-term. nBecause the valuation involves, in this particular case, a multinational financial institution, this approach would entail such a level of complexity that it could actually result in a higher inaccuracy, given thevolatility of assumptions such as interest rates, spreads, default rates, among others, in multiple countries. In addition, the approach would require forecasts related to regulatory items in multiple jurisdictions,such as the regulation on minimum level of capital, which would increase the inaccuracy of the analysis. nDealing with such complexity and inherent imprecision was considered unnecessary and not recommended in this situation, especially given the existence of highly comparable companies with strong level of liquidity, as explained on pages 5, 27 and 41 of this Report nFor these reasons, we did not perform a valuation based on DCF nor on dividend discount methodologies |

|

|

|

|

|

|

|

|

|

|

|

Notes

1 Market capitalization was calculated based on 30-days volume-weighted unit price (for Santander Brazil) and share price (for Santander S.A.) as of the day of publication of the Material Fact

2 Sample of analysts’ projections include all projections of the Reuters brokers’ consensus for adjusted net income, provided by Thomson for Brazilian companies and by Factset for European companies

3 Tangible book corresponds to “Shareholders’ equity”-“Intangible assets” for Santander Brazil as per 2014 January –March Financial Report in IFRS and to Shareholders’ equity” + “Equity adjustments by valuation” – “Goodwill” as perSantander S.A. 2014 January–March Financial Report– “Other intangible assets” as per Santander S.A 2013 Auditor’s Report andAnnual Consolidated accounts

| 5 |  |

1. Executive summary

1.4 Valuation summary for Santander Brazil

| Economic value of Santander Brazil’s unit betweenR$10.63 and R$11.69 |

| Summary valuation of Santander Brazil´s unit (R$ per unit1) | | Valuation approach |

| | The valuation of Santander Brazil´s units is based on the following methodologies: nVolume weighted average price per unit –VWAP 12M before the Material Fact disclosed by Santander S.A. on April, 29th2014 –VWAP from the Material Fact date to June 10th, 2014 nBook value: –Tangible book value2(“TBV) perunit nEconomic value based on comparable trading multiples: –Valuation based on trading multiples ofselected Brazilian banks with a retail focus,namely: Itaú, Bradesco and Banco do Brasil –Source: Reuters consensus net income estimates published by Thomson as of June 10th, 2014 The methodology adopted to the definition of Santander Brazil´s units economic value was the economic based on comparable trading7.5multiples |

Source:Thomson, Reuters,Bloomberg and Santander Brazil filings and comparable companies’ filings.Notes:1) total number of units outstanding equivalent to 3,827m net of 25m treasury units. 2) Tangible book defined as“Shareholders’ equity” – “Intangible assets” (as per Santander Brazil 2014 January –March Financial Report in IFRS). 3) P/E 14E, 15E, and 16E based on consensus net income estimates published by Thomson based on Reuters consensus as of June 10th, 2014 and unit price based on Bloomberg, calculated as the weighted average unit price on the 30 days prior to the announcement date

| 6 |  |

1. Executive summary

1.5 Valuation summary for Santander S.A.

| Economic value of Santander S.A.’s share between €6.07 and€6.67 |

| Summary valuation of Santander S.A.’s share (€per share¹) | | Valuation approach |

| | The valuation of Santander S.A. shares is basedon the following methodologies:

nVolume weighted average share price:

–VWAP 12M before the Material Factdisclosed by Santander S.A. on April, 29th2014

–VWAP from the Material Fact date to June,10th2014

nBook value:

–Tangible book value2(“TBV”) per share

nEconomic value based on comparable tradingmultiples :

–Valuation based on trading multiples ofselected European banks with a retail focus,

namely: HSBC, Lloyds Banking Group, BNPParibas, BBVA, Nordea, Intesa San Paolo,Unicredit, Société Générale and CréditAgricole –Source: Reuters consensus net incomeestimates published by Factset as of June,10th2014

methodology adopted to determineSantander S.A. shares economic value was theeconomicovalue based on comparable tradingmultiples The methodology adopted to determine Santander S.A. shares economic value was the economic value based on comparable trading multiples |

Source:Factest as of June, 10th2014 and Santander S.A.filings and comparable companies’ filings.Notes:1) Total outstanding shares of 11,561m (as per Santander S.A. 2014 January–March Financial Report) net of 39m treasury shares (as per Comisión Nacional del Mercado de Valores as of June,10th 2014). 2) Tangible book defined as “Shareholders’ equity” + “Equity adjustments by valuation” – “Goodwill” (as per Santander 2014 January–March Financial Report)– “Other intangible assets” (as per Santander 2013 Auditor’s Report and Annual Consolidated accounts).3) P/E 14E, 15E and 16E based on consensus net income estimates published by Facset based on Reuters consensus as of June 10th, 2014 and share price based also on Facset, calculated as the weighted average share price on the 30 days prior to the announcement date

| 7 |  |

1. Executive summary

1.6 Exchange ratio between the Companies

| Summary of exchange ratio (Santander Brazil unit / Santander S.A. share) | | Valuation approach |

| | The values presented hereby for the exchangeratio are based on the following assumptions:

nEUR/BRL exchange rate as of June 10th, 2014: 3.02

nFor comparable trading multiples valuation ranges: – Minimum of the range correspond to the exchange ratio between the maximum value of the range for Santander S.A. share and the minimum of the range for Santander Brazil’s unit – Maximum of the range correspond to the exchange ratio between the minimum value of the range for Santander S.A. share and the maximum of the range for Santander Brazil’s unit The methodology adopted to determine the exchange ratio was the economic value based on comparable trading multiples |

| 8 |  |

SCHEDULE 3.1.5

FAIRNESS OPINION

STRICTLY CONFIDENTIAL

September 24th, 2014

To the Board of Directors of Banco Santander (Brasil) S.A.

English version is a free translation. Questions arising from the text below must be elucidated by consulting the Portuguese version, which shall always prevail.

The members of the board of directors of Banco Santander (Brasil) S.A. (“Santander Brasil”) requested Banco BTG Pactual S.A.’s (“BTG Pactual”) opinion as an investment bank about the fairness, to the shareholders of Santander Brasil from a financial standpoint, of the exchange ratio proposed by Banco Santander S.A. ("Santander") ("Exchange Ratio") in the context of the voluntary exchange tender offer for common shares, preferred shares, and units of Santander Brasil that are not owned by Santander, which represents approximately a 25% interest in Santander Basil, through either American Depositary Shares or Brazilian Depositary Receipts issued by Santander Brasil, according to the Material Fact released by Santander Brasil on April 29th, 2014 (“Transaction”).

BTG Pactual does not take any responsibility for carrying out independent verifications and did not independently verify any information that have been obtained from public sources or provided to BTG Pactual by Santander Brasil or by third parties, regarding Santander Brasil itself and Santander, including, but not limited to Santander and Santander Brasil financial information and estimates from market analysts used for the purposes of the work described herein. In addition, BTG Pactual led discussions with the Board of Directors of Santander Brasil, about the characteristics of the Transaction. BTG Pactual considered other factors and information, and other analyses judged appropriated to issue this opinion, and compared the performance of Santander and Santander Brasil with the performance of other comparable financial institutions, by analyzing publicly available information. Therefore, for the purposes of this opinion, BTG Pactual, with Santander Brasil’s permission, assumed and trusted the accuracy of the information provided, as well as in the veracity, exactness, sufficiency and integrity of all its content. In this sense, we relied ourselves in such information, including all the publicly available information or that was provided by Santander Brasil, considering such information true. We assume, as directed by Santander Brasil, that has not occurred any material change relating to the assets, financial position, results of operations, business or prospects of Santander and Santander Brasil since the dates on which the most recent financial statements or other financial or commercial information regarding Santander and Santander Brasil were available. Thus, we will not take by this opinion any responsibility for independent verification of information or for undertaking an independent verification or appraisal of any assets or liabilities (contingencies or otherwise) of Santander Brasil or Santander. Accordingly, we do not take any responsibility for the exactness, veracity, integrity, consistency, or sufficiency of such information. BTG Pactual does not express opinion about the information trustworthiness, nor about any mistake, change or modification of such information, which, if existed, could affect BTG Pactual’s opinion.

In preparing our opinion, we assume the macroeconomic environment as stable, based on market, economic and monetary conditions and other conditions existing at the time of the announcement of the Transaction. Our opinion also considered information provided to us until the present date, and our opinion is only valid on the date hereof, since future events and other developments may affect it. Accordingly, although facts and subsequent events to the date of this lettermay affect this opinion, we assume no obligation to update, revise or revoke the same as a result of any subsequent development, or for any other reason.

In the previous 12 (twelve) months, BTG Pactual maintained business relations with Santander Brasil, but did not maintain business relations with Santander. BTG Pactual’s investment banking departmentis not interested, directly or indirectly, in Santander Brasil or in the Transaction, as well as there is no other relevant circumstance that can be considered conflict of interest or that diminishes the necessary independence to the performance of its functions to the issuance of this opinion. Notwithstanding such information, BTG Pactual and/or companies of its economic conglomerate can, in the future, provide other financial services to Santander Brasil and/or Santander. For due purposes, we declare not being an accounting or auditing firm and therefore do not provide accounting or auditing services in respect to the Transaction. In preparing our opinion, we do not take into account: (i) tax effects arising from the Transaction to shareholders of Santander Brasil and Santander; (ii) the impact of any expenses that may be incurred as a result of the closing of the Transaction; (iii) any goodwill generated as a result of the Transaction.

Our opinion is limited solely to the fairness of the Exchange Ratio, and no legal, accounting, tax, or under any other point of view analysis was made. Therefore, we have no liability for such analyses.

This letter is issued with the sole purpose of being used by Santander Brasil’s board of directors to the assessment of the Transaction, as outlined above, and should not be used for any other purpose. This document is not and should not be used as a recommendation or opinion to Santander Brasil’ shareholders. BTG Pactual is not suited by this opinion to the purposes of advising Santander Brasil’ shareholders regarding the Exchange Rate, and Santander Brasil shareholders should rely on their own financial, tax and legal advisors for the purposes of assessment of the Transaction.

Based on the foregoing, is BTG Pactual’s opinion, as an investment bank, that, on the date hereof, the Exchange Ratio is fair, from a financial standpoint, to the shareholders of Santander Brasil.

BANCO BTG PACTUAL S.A.

SCHEDULE 3.2.3

LIQUIDITY ANALYSIS

STRICTLY CONFIDENTIAL

September 24th, 2014

To the Board of Directors of Banco Santander (Brasil) S.A.

English version is a free translation. Questions arising from the text below must be elucidated by consulting the Portuguese version, which shall always prevail.

The members of the board of directors of Banco Santander (Brasil) S.A. (“Santander Brasil”) requested Banco BTG Pactual S.A.’s (“BTG Pactual”) opinion as an investment bank about the potential impacts on liquidity (determined by the daily trading volume) of the units issued by Santander Brasil ("Liquidity") in the context of the voluntary exchange tender offer for common shares, preferred shares, and units of Santander Brasil that are not owned by Banco Santander S.A. (“Santander”), which represents approximately a 25% interest in Santander Basil, through either American Depositary Shares or Brazilian Depositary Receipts issued by Santander Brasil, according to the relevant fact released by Santander Brasil on April 29th, 2014 (“Transaction”).

BTG Pactual does not take any responsibility for carrying out independent verifications and did not independently verify any information that have been obtained from public sources or provided to BTG Pactual by Santander Brasil or by third parties, regarding Santander Brasil itself and Santander, including, but not limited to information about Santander and Santander Brasil. BTG Pactual considered other factors and information, and other analyzes that judged appropriate to the issuance of this opinion, as to (i) presence in indexes disclosed by BM&FBOVESPA S.A. - Bolsa de Valores, Mercadorias e Futuros ("BM&FBovespa"), and the fact that the Transaction will result in the output of Santander Brasil Level 2 of Corporate Governance of BM&FBovespa (ii) marketability of the units issued by Santander Brasil, considering different scenarios of adherence of shareholders of Santander Brasil to the Transaction and (iii) liquidity resulting from certain roles after transactions of purchase and sale of similar companies in Brasil and abroad. Therefore, for the purposes of this opinion, BTG Pactual, with Santander Brasil’s permission, assumed and trusted the accuracy of the information provided, as well as in the veracity, exactness, sufficiency, and integrity of all its content. In this sense, we relied ourselves in such information, including all the publicly available information or that was provided by Santander Brasil, considering such information true. Regarding information, assumptions and operating data relating to the Transaction provided to us or discussed with us that were discussed by the Directors and officers of Santander Brasil, we assume that such information was prepared in good faith, in an exact manner, to reflect the best estimates or assessments of the Directors and officers of Santander Brasil. We will not take by this opinion any responsibility for independent verification of information or for undertaking an independent verification of Santander Brasil or Santander. Thus, we do not any take responsibility for the exactness, veracity, integrity, consistency, or sufficiency of such information. BTG Pactual does not express opinion about the information trustworthiness, nor about any mistake, change, or modification of such information, which, if existed, could affect BTG Pactual’s opinion.

Although facts and events subsequent to the date hereof may affect this opinion, we assume no obligation to update, revise or revoke the same as a result of any subsequent development, or for any other reason.

In the previous 12 (twelve) months, BTG Pactual maintained business relations with Santander Brasil but did not maintain business relations with Santander. BTG Pactual’s investment banking departmentis not interested, directly or indirectly, in Santander or in the Transaction, as well as there is no other relevant circumstance that can be considered conflict of interest or that diminishes the necessary independence to the performance of its functions to the issuance of this opinion. Notwithstanding such information, BTG Pactual and/or companies of its economic conglomerate can, in the future, provide other financial services to Santander Brasil and/or Santander. For due purposes, we declare not being an accounting or auditing firm and therefore do not provide accounting or auditing services in respect to the Transaction.

This letter is issued with the sole purpose of being used by Santander Brasil’s Board of Directors to the assessment of the potential impact on the liquidity of the units of Santander Brasil as a result of the Transaction, as outlined above, should not be used for any other purpose. This document is not and should not be used as a recommendation or opinion to Santander Brasil shareholders.

BTG Pactual is not suited by this opinion to the purposes of advising Santander Brasil shareholders regarding the Liquidity, and Santander Brasil shareholders should rely on their own financial, fiscal, and legal advisors to the purposes of assessment of the Transaction and the resulting liquidity of it.

The analysis of the potential impact on the Liquidity of the units of Santander Brasil as a result of the Transaction was based on the observation of the results in previous transactions of public tender offerings that occurred in Brasil. The sample analyzed by BTG Pactual in similar transactions indicated that the average daily trading volume of its respective shares reduced significantly after the closing of the tender offerings. Based on the analysis of such precedents, it can be stated that there is a high positive correlation among the level of adherence of the tender offer (reducing the free float) and the reduction of the daily trading volume of the shares that were subject to such tender offers (reduced daily liquidity of the shares subject to the tender offer).

Based on the foregoing, is BTG Pactual’s opinion, as an investment bank, that, considering different scenarios of adherence of shareholders of Santander Brasil to the Transaction, the resulting Liquidity of the units of Santander Brasil may be reduced with a similar correlation to the analyzed historical precedents.

BANCO BTG PACTUAL S.A.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: October 2, 2014

Banco Santander (Brasil) S.A. |

| | |

| By: | /S/ Amancio Acurcio Gouveia

| |

| | Amancio Acurcio Gouveia

Officer Without Specific Designation

| |

| | |

|

| | |

| By: | /S/ Angel Santodomingo Martell

| |

| | Angel Santodomingo Martell

Vice - President Executive Officer

| |