UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22338

Legg Mason Global Asset Management Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: September 30

Date of reporting period: September 30, 2017

| ITEM 1. | REPORT TO STOCKHOLDERS |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | September 30, 2017 |

QS

GLOBAL MARKET

NEUTRAL FUND

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund seeks long-term capital appreciation.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of QS Global Market Neutral Fund for the twelve-month reporting period ended September 30, 2017. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

October 31, 2017

| | |

| II | | QS Global Market Neutral Fund |

Investment commentary

Economic review

The pace of U.S. economic activity fluctuated during the twelve months ended September 30, 2017 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that third quarter 2016 U.S. gross domestic product (“GDP”)i growth was revised to 2.8%. GDP growth then decelerated to 1.8% and 1.2%, as revised, for the fourth quarter of 2016 and the first quarter of 2017, respectively. Second quarter 2017 GDP growth then accelerated to 3.1%, the strongest reading in two years. Finally, the U.S. Department of Commerce’s initial estimate for third quarter 2017 GDP growth — released after the reporting period ended — was 3.0%. Slightly slower growth was attributed to a number of factors, including decelerations in personal consumption expenditures, in nonresidential fixed investment and in exports that were partly offset by an acceleration in private inventory investment and a downturn in imports.

Job growth in the U.S. was solid overall and a tailwind for the economy during the reporting period. When the reporting period ended on September 30, 2017, the unemployment rate was 4.2%, as reported by the U.S. Department of Labor. This represented the lowest unemployment rate since February 2001. However, the percentage of longer-term unemployed ticked up over the reporting period. In September 2017, 25.5% of Americans looking for a job had been out of work for more than six months, versus 25.2% when the period began.

Turning to the global economy, in its October 2017 World Economic Outlook Update — released after the reporting period ended — the International Monetary Fund (“IMF”)ii said, “The pickup in growth projected in the April 2017 World Economic Outlook is strengthening. The global growth forecast for 2017 and 2018 — 3.6 percent and 3.7 percent, respectively — is 0.1 percentage point higher in both years than in the April [2017] and July [2017] forecasts. Notable pickups in investment, trade, and industrial production, coupled with strengthening business and consumer confidence, are supporting the recovery.” From a regional perspective, the IMF estimates 2017 growth in the Eurozone will be 2.1%, versus 1.8% in 2016. Japan’s economy is expected to expand 1.5% in 2017, compared to 1.0% in 2016. Elsewhere, the IMF projects that overall growth in emerging market countries will accelerate to 4.6% in 2017, versus 4.3% in 2016.

Looking back, after an extended period of maintaining the federal funds rateiii at a historically low range between zero and 0.25%, the Federal Reserve Board (the “Fed”)iv increased the rate at its meeting on December 16, 2015. In particular, the U.S. central bank raised the federal funds rate to a range between 0.25% and 0.50%. The Fed then kept rates on hold at each meeting prior to its meeting on December 14, 2016, at which time, the Fed raised rates to a range between 0.50% and 0.75%.

After holding rates steady at its meeting that concluded on February 1, 2017, the Fed raised rates to a range between 0.75% and 1.00% at its meeting that ended on March 15, 2017. At its meeting that concluded on June 14, 2017, the Fed raised rates to a range between 1.00% and 1.25%. At its meeting that concluded on July 26, 2017, the Fed kept rates on hold, as expected. Finally, at its meeting that concluded on September 20, 2017, the Fed again kept rates on hold, but reiterated its

| | |

| QS Global Market Neutral Fund | | III |

Investment commentary (cont’d)

intention to begin reducing its balance sheet, saying, “In October, the Committee will initiate the balance sheet normalization program….”

Central banks outside the U.S. largely maintained their accommodative monetary policy stances during the reporting period. In March 2016, the European Central Bank (“ECB”)v announced that it would increase its bond purchasing program to €80 billion-per-month. It also lowered its deposit rate to -0.4% and its main interest rate to 0%. In December 2016, the ECB again extended its bond buying program until December 2017. From April 2017 through December 2017, the ECB will purchase €60 billion-per-month of bonds. Finally, in October 2017, after the reporting period ended, the ECB announced that it would continue to buy bonds through September 2018, but after December 2017 it would pare their purchases to €30 billion-per-month. However, the ECB did not change its key interest rates. In other developed countries, in August 2016, the Bank of Englandvi lowered interest rates from 0.50% to 0.25%, a new record low, and rates remained constant during the reporting period. After holding rates steady at 0.10% for more than five years, in January 2016, the Bank of Japanvii announced that it cut the rate on current accounts that commercial banks hold with it to -0.10% and kept rates on hold during the reporting period. Elsewhere, the People’s Bank of Chinaviii kept rates steady at 4.35% during the reporting period.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

October 31, 2017

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. Forecasts and predictions are inherently limited and should not be relied upon as an indication of actual or future performance.

| | |

| IV | | QS Global Market Neutral Fund |

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The International Monetary Fund (“IMF”) is an organization of 189 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iv | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| v | The European Central Bank (“ECB”) is responsible for the monetary system of European Union and the euro currency. |

| vi | The Bank of England (“BoE”), formally the Governor and Company of the BoE, is the central bank of the United Kingdom. The BoE’s purpose is to maintain monetary and financial stability. |

| vii | The Bank of Japan is the central bank of Japan. The bank is responsible for issuing and handling currency and treasury securities, implementing monetary policy, maintaining the stability of the Japanese financial system and the yen currency. |

| viii | The People’s Bank of China is the central bank of the People’s Republic of China with the power to carry out monetary policy and regulate financial institutions in mainland China. |

| | |

| QS Global Market Neutral Fund | | V |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund seeks to provide long-term capital appreciation. The Fund seeks positive returns unrelated to the broad global market by selecting both long and short positions in equity securities from anywhere in the world while applying measures that attempt to control for risk. We at QS Investors, LLC, the Fund’s subadviser, buy equity securities that we consider to be undervalued (“long positions”) and sell short equity securities that we consider to be overvalued (“short positions”). We use quantitative models to select long and short position sizes that we believe will achieve overall market neutrality, thereby attempting to limit the effects of global stock market movements on overall Fund performance. We view market neutrality to mean that the exposure of the long and short positions should offset one another producing a net equity exposure that is approximately +/- 1% under normal market conditions. Because of the Fund’s market neutral strategy, the Fund is intended to have returns that are generally independent of the returns and direction of the global stock market, although there can be no assurance that it will achieve that result.

Under normal market conditions, the Fund will invest primarily in common stocks, preferred stocks, convertible securities, American depositary receipts, global depository receipts, master limited partnerships (MLPs), real estate investment trusts (REITs)i, and securities of other investment companies including exchange-traded funds (ETFs). As a global fund, the Fund can seek investment opportunities anywhere in the world, and under normal market conditions, the Fund will invest in or have exposure to at least three countries, which may include the United States. The Fund may invest without limit in securities in any country, including countries with developed or emerging markets. The Fund may invest in issuers of any market capitalization.

When we deem it to be appropriate, the Fund may enter into various derivative transactions as a principal investment using total return swaps, equity futures, options, warrants, and other similar investments. Derivatives may be used by the Fund as a hedging technique in an attempt to manage risk; as a substitute for buying or selling securities; to provide additional exposure to investment types or market factors; to change the characteristics of the Fund’s portfolio; in an attempt to enhance returns; and to manage cash.

Q. What were the overall market conditions during the Fund’s reporting period?

A. Global equities rose modestly in the fourth quarter of 2016, in part due to the run-up in the U.S. after the U.S. presidential election of Donald Trump in November 2016. Major equity markets ended 2016 with solid economic prospects, and central banks remained generally accommodative. Globally, names in the Financials and Energy sectors outperformed, the former rising on the expectation of easing regulations, and the latter on the Organization of Petroleum Exporting Countries (“OPEC”) finally achieving a consensus on caps on oil production.

The first quarter of 2017 largely extended the so called “Trump rally”, with steady equity gains tapering off after mid-March 2017. Most major economies, including the Eurozone and the U.S., saw solid growth throughout the twelve-month reporting

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 1 |

Fund overview (cont’d)

period ended September 30, 2017. The positive trends prompted the Federal Reserve Board (the “Fed”)ii to continue to modestly raise rates, and set expectations for more hikes to follow. Globally, the Energy sector was the only decliner; oil prices declined during the first quarter of 2017 amid reports of large U.S. reserves and suspected cheating on OPEC’s recently-placed quotas.

Global equities finished the second quarter of 2017 with gains across most markets, in a low-volatility environment. Continued solid corporate earnings and growing economies outweighed news events that included cyber ransomware and other terror attacks, and a deteriorating outlook for trading relationships among some nations. Earnings revisions weakened at the end of the second quarter of 2017 after months of positive trends. Major economies, notably the Eurozone, saw largely encouraging economic trends, but the U.S. experienced some weakening in growth metrics despite robust employment gains. Numerous markets had double-digit returns for the reporting period, and globally, Energy was the lone sector to decline; amid higher-than-expected reserves, OPEC indicated that it would try to keep production low through early 2018.

These generally very strong economic statistics persisted globally through the end of the reporting period. In this environment, central banks, including those in the U.S., U.K. and the European Union, have announced modest tightening measures. The banks industry and Information Technology sector were the strongest performers for the reporting period, and the Consumer Staples and Energy sectors were the weakest.

Continental Europe was the best performing major region globally for the twelve-month reporting period. Economic gains included improving growth in both manufacturing and non-manufacturing sectors. Most European markets outperformed the MSCI World Indexiii overall, and all sectors were solidly in positive territory.

The U.S. performed in line with developed markets overall for the reporting period. The big winner was the Financials sector, as the positive economic outlook led to the expectation of continued interest rate increases. Consumer confidence continued to rise, and investors were optimistic about the possibility of deregulation and tax reform. The Fed appears optimistic and may start to pare back its balance sheet against a backdrop of strong employment and low inflation. In this environment Energy was the lagging sector, and the only one in negative territory.

The U.K. and Japan both had double digit returns for the period but underperformed other major developed markets. In the U.K., the currency declined in the last quarter of 2016 following the Brexit vote (the June 2016 U.K. referendum to leave the European Union). While the economy appeared on solid ground, businesses relying on imported goods suffered on currency weakness against both the euro and the U.S. dollar. The market turned negative across most sectors in June 2017 after the “snap” election in the U.K. did not produce a majority for the Conservative party, giving Prime Minister Theresa May a weaker hand in the Brexit negotiations. Inflation appears to be picking up as well; the Bank of England’siv head said tightening may be needed in the next few months due to inflationary pressures that may build up around Brexit.

The Bank of Japan (“BoJ”)v ended 2016 with a moderately positive outlook on improved

| | |

| 2 | | QS Global Market Neutral Fund 2017 Annual Report |

business sentiment and consumer expenditure, making no policy changes after an active year of policymaking. Japan’s gross domestic product (“GDP”)vi growth grew at a slower pace than expected at the start of 2017, although numerous indicators were positive, including the largest trade surplus in seven years. While the government maintained its stimulus program perceiving the economy as still relatively weak, consumer confidence improved in the second quarter of 2017 amid stronger GDP growth, and the BoJ’s Tankan survey at the end of the reporting period indicated that business confidence among Japan’s largest manufacturers is higher than it has been in a decade.

Q. How did we respond to these changing market conditions?

A. Given that our process is designed to limit the effects of global stock market movements on overall Fund performance, changing market conditions did not necessitate a change in our process.

Performance review

For the twelve months ended September 30, 2017, Class A shares of QS Global Market Neutral Fund, excluding sales charges, returned 8.52%. The Fund’s unmanaged benchmark, the Citigroup 3-Month U.S. Treasury Bill Indexvii, returned 0.64% for the same period. The Lipper Alternative Market Neutral Funds Category Average1 returned 1.48% over the same time frame.

| | | | | | | | |

Performance Snapshot as of September 30, 2017

(unaudited) | |

| (excluding sales charges) | | 6 months | | | 12 months | |

| QS Global Market Neutral Fund: | | | | | | | | |

Class A | | | 3.67 | % | | | 8.52 | % |

Class I | | | 3.86 | % | | | 8.81 | % |

Class IS | | | 3.85 | % | | | 8.91 | % |

| Citigroup 3-Month U.S. Treasury Bill Index | | | 0.44 | % | | | 0.64 | % |

| Lipper Alternative Equity Market Neutral Funds Category Average1 | | | -0.37 | % | | | 1.48 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/mutualfunds.

All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

| 1 | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended September 30, 2017, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 97 funds for the six-month period and among the 94 funds for the twelve-month period in the Fund’s Lipper category, and excluding sales charges, if any. |

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 3 |

Fund overview (cont’d)

|

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated February 1, 2017, the gross total annual fund operating expense ratios for Class A, Class I and Class IS shares were 6.67%, 6.43% and 6.38%, respectively.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

As a result of expense limitation arrangements, the ratio of total annual fund operating expenses, other than interest, brokerage commissions and expenses, fees, costs and expenses associated with any prime brokerage arrangement (including the costs of any securities borrowing arrangement); dividend and interest expenses on securities sold short, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets will not exceed 1.55% for Class A shares, 1.20% for Class I shares and 1.10% for Class IS shares. In addition, the ratio of total annual fund operating expenses for Class IS shares will not exceed the ratio of total annual fund operating expenses for Class I shares. Total annual fund operating expenses after waiving fees and/or reimbursing expenses exceed the expense cap for each class as a result of acquired fund fees and expenses and dividend and interest expenses on securities sold short. These expense limitation arrangements cannot be terminated prior to December 31, 2018 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts waived and/or reimbursed to a class within three years after the fiscal year in which the manager earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

Q. What were the leading contributors to performance?

A. The stock selection model we employ incorporates measures of valuation, consisting of ratios of price-to-earningsviii or sales to price, for example, and sentiment, consisting of measures such as earnings growth, earnings estimates and price momentum. For the reporting period, the stock selection results were strong across regions, with both valuation and sentiment themes driving performance. Selection in the Materials and Energy sectors in the U.S., Consumer Staples and Consumer Discretionary names in Europe and Telecommunication Services, Utilities and REITs in Japan were notable contributors.

Q. What were the leading detractors from performance?

A. Stock selection in Australia, New Zealand and Canada was the leading detractor from performance for the reporting period overall, as a result of weak sentiment indicators in that region. While more than offset by strong results in the other quarters, our stock selection model struggled during the second quarter of 2017. In this quarter, our valuation measures were negative across many regions. Sentiment measures were mostly positive, except in Japan, but were not sufficient to overcome the negative valuation measures. Performance in

| | |

| 4 | | QS Global Market Neutral Fund 2017 Annual Report |

the U.S., Japan and the U.K. was also negative in the second quarter of 2017, with Materials and Consumer Discretionary stocks the main detractors.

Thank you for your investment in QS Global Market Neutral Fund. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

QS Investors, LLC

October 20, 2017

RISKS: Equity securities are subject to market and price fluctuations. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks. Foreign investments are subject to special risks including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. The Fund uses short positions in combination with long positions in a market neutral strategy to try to neutralize exposure to the global stock market and capture a positive return, regardless of the direction of the market. The Fund’s market neutral strategy may result in greater losses or lower positive returns than if the Fund held only long positions. Although the subadviser’s models were created to improve performance and to reduce overall portfolio risk, there is no guarantee that these models and the Fund’s market neutral strategy will be successful. The overall performance of the Fund depends on the net performance of its long and short positions, and it is possible for the Fund to experience a net loss across all positions.

The Fund may employ leverage, which increases the volatility of investment returns and subjects the Fund to magnified losses if the Fund’s investments decline in value. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. The Fund may employ short selling, a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. There is no assurance strategies used by the Fund will be successful. Active and frequent trading may increase a shareholder’s tax liability and transaction costs, which could detract from Fund performance. Some assets held by the Fund may be impossible or difficult to sell, particularly during times of market turmoil. These illiquid assets may also be difficult to value. If the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss. There can be no assurance that the Fund will engage in hedging transactions at any given time, even under volatile market conditions, or that any hedging transactions the Fund engages in will be successful. Hedging transactions involve costs and may reduce gains or result in losses. Additional risks may include those risks associated with REITs, MLPs and investing in securities issued by other investment companies, including ETFs. Please see the Fund’s prospectus for a more complete discussion of these and other risks and the Fund’s investment strategies.

Portfolio holdings and breakdowns are as of September 30, 2017 and are subject to change and may not be representative of the portfolio managers’ current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of September 30, 2017 were: Entegris Inc. (0.7%), Deutsche Lufthansa AG, Registered Shares (0.7%), Qantas Airways Ltd. (0.6%), KBC Group NV (0.6%), OMV AG (0.6%), Children’s Place Inc. (0.6%), WellCare Health Plans Inc. (0.6%), HP Inc. (0.6%), Aristocrat Leisure Ltd.

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 5 |

Fund overview (cont’d)

(0.6%) and CIMIC Group Ltd. (0.6%). Please refer to pages 13 through 35 for a list and percentage breakdown of the Fund’s holdings.

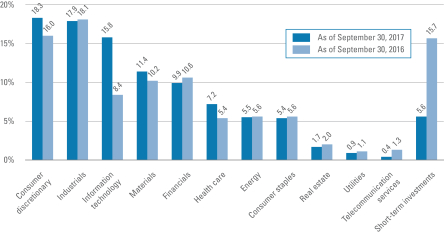

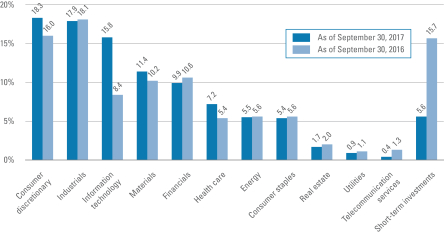

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of September 30, 2017 were: Consumer Discretionary (18.2%), Industrials (17.8%), Information Technology (15.7%), Materials (11.4%) and Financials (9.8%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | Real estate investment trusts (“REITs”) invest in real estate or loans secured by real estate and issue shares in such investments, which can be illiquid. |

| ii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iii | The MSCI World Index is an unmanaged index considered representative of growth stocks of developed countries. Index performance is calculated with net dividends. |

| iv | The Bank of England (“BoE”), formally the Governor and Company of the BoE, is the central bank of the United Kingdom. The BoE’s purpose is to maintain monetary and financial stability. |

| v | The Bank of Japan (“BoJ”) is the central bank of Japan. The bank is responsible for issuing and handling currency and treasury securities, implementing monetary policy, maintaining the stability of the Japanese financial system and the yen currency. |

| vi | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| vii | The Citigroup 3-Month U.S. Treasury Bill Index is an unmanaged index generally representative of the average yield of 3-month U.S. Treasury bills. |

| viii | The price-to-earnings (“P/E”) ratio is a stock’s price divided by its earnings per share. |

| | |

| 6 | | QS Global Market Neutral Fund 2017 Annual Report |

Fund at a glance (unaudited)

Investment breakdown† (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of September 30, 2017 and September 30, 2016 and does not include derivatives, such as forward foreign currency contracts. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

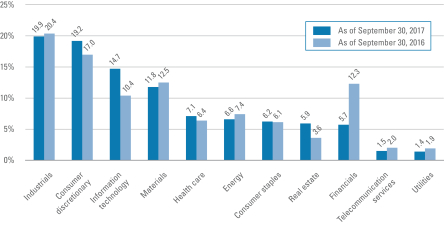

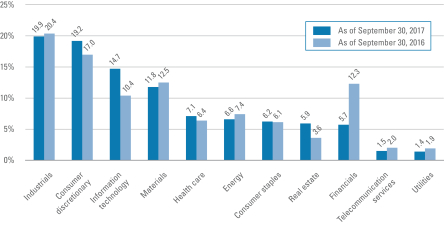

Securities sold short breakdown* (%) as a percent of total securities sold short

| * | The bar graph above represents the composition of the Fund’s securities sold short as of September 30, 2017 and September 30, 2016 and does not include derivatives. The Fund is actively managed. As a result, the composition of the Fund’s securities sold short is subject to change at any time. |

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 7 |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; service and/or distribution (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on April 1, 2017 and held for the six months ended September 30, 2017.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on actual total return1 | | | | | | Based on hypothetical total return1 | |

| | | Actual

Total Return

Without

Sales

Charge2 | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | | | | | | | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | | Ending

Account

Value | | | Annualized

Expense

Ratio | | | Expenses

Paid

During

the

Period3 | |

| Class A | | | 3.67 | % | | $ | 1,000.00 | | | $ | 1,036.70 | | | | 3.29 | % | | $ | 16.80 | | | | | | | Class A | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,008.57 | | | | 3.29 | % | | $ | 16.57 | |

| Class I | | | 3.86 | | | | 1,000.00 | | | | 1,038.60 | | | | 3.27 | | | | 16.71 | | | | | | | Class I | | | 5.00 | | | | 1,000.00 | | | | 1,008.67 | | | | 3.27 | | | | 16.47 | |

| Class IS | | | 3.85 | | | | 1,000.00 | | | | 1,038.50 | | | | 2.60 | | | | 13.29 | | | | | | | Class IS | | | 5.00 | | | | 1,000.00 | | | | 1,012.03 | | | | 2.60 | | | | 13.11 | |

| | |

| 8 | | QS Global Market Neutral Fund 2017 Annual Report |

| 1 | For the six months ended September 30, 2017. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Expenses (net of compensating balance arrangements, fee waivers and/or expense reimbursements) are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (183), then divided by 365. |

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 9 |

Fund performance (unaudited)

| | | | | | | | | | | | |

| Average annual total returns | |

| Without sales charges1 | | Class A | | | Class I | | | Class IS | |

| Twelve Months Ended 9/30/17 | | | 8.52 | % | | | 8.81 | % | | | 8.91 | % |

| Inception* through 9/30/17 | | | 2.38 | | | | 2.70 | | | | 2.75 | |

| | | |

| With sales charges2 | | Class A | | | Class I | | | Class IS | |

| Twelve Months Ended 9/30/17 | | | 2.25 | % | | | 8.81 | % | | | 8.91 | % |

| Inception* through 9/30/17 | | | -0.88 | | | | 2.70 | | | | 2.75 | |

| | | | |

| Cumulative total returns | |

| Without sales charges1 | | | |

| Class A (Inception date of 11/30/15 through 9/30/17) | | | 4.40 | % |

| Class I (Inception date of 11/30/15 through 9/30/17) | | | 5.00 | |

| Class IS (Inception date of 11/30/15 through 9/30/17) | | | 5.10 | |

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| 1 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum initial sales charge of 5.75%. |

| * | Inception date for Class A, I and IS shares is November 30, 2015. |

| | |

| 10 | | QS Global Market Neutral Fund 2017 Annual Report |

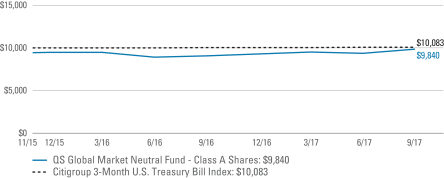

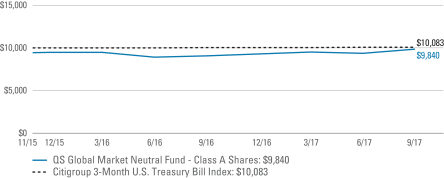

Historical performance

Value of $10,000 invested in

Class A Shares of QS Global Market Neutral Fund vs. Citigroup 3-Month U.S. Treasury Bill Index† — November 30, 2015 - September 2017

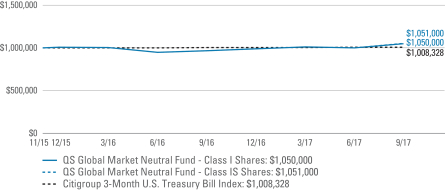

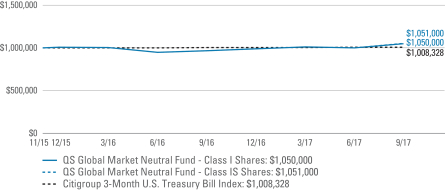

Value of $1,000,000 invested in

Class I and IS Shares of QS Global Market Neutral Fund vs. Citigroup 3-Month U.S. Treasury Bill Index† — November 30, 2015 - September 2017

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 11 |

Fund performance (unaudited) (cont’d)

All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower.

| † | Hypothetical illustration of $10,000 invested in Class A shares and $1,000,000 invested in Class I and IS shares of QS Global Market Neutral Fund on November 30, 2015 (inception date), assuming the deduction of the maximum initial sales charge of 5.75% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through September 30, 2017. The hypothetical illustration also assumes a $10,000 or $1,000,000 investment, as applicable, in the Citigroup 3-Month U.S. Treasury Bill Index. The Citigroup 3-Month U.S. Treasury Bill Index is an unmanaged market index generally representative of the average yield of 3-month U.S. Treasury bills. The Index is unmanaged and not subject to the same management and trading expenses as a mutual fund. Please note that an investor cannot invest directly in an index. |

| | |

| 12 | | QS Global Market Neutral Fund 2017 Annual Report |

Schedule of investments

September 30, 2017

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Common Stocks — 93.9% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 18.2% | | | | | | | | | | | | | | | | |

Auto Components — 3.0% | | | | | | | | | | | | | | | | |

Keihin Corp. | | | | | | | | | | | 8,800 | | | $ | 150,809 | (a) |

Lear Corp. | | | | | | | | | | | 1,056 | | | | 182,772 | (b) |

Magna International Inc. | | | | | | | | | | | 3,700 | | | | 197,462 | |

Toyo Tire & Rubber Co., Ltd. | | | | | | | | | | | 9,400 | | | | 211,569 | (a) |

Toyota Boshoku Corp. | | | | | | | | | | | 10,500 | | | | 222,624 | (a) |

Unipres Corp. | | | | | | | | | | | 8,800 | | | | 245,070 | (a) |

Total Auto Components | | | | | | | | | | | | | | | 1,210,306 | |

Automobiles — 0.5% | | | | | | | | | | | | | | | | |

Honda Motor Co., Ltd. | | | | | | | | | | | 6,900 | | | | 204,551 | (a) |

Distributors — 0.6% | | | | | | | | | | | | | | | | |

Inchcape PLC | | | | | | | | | | | 20,837 | | | | 240,990 | (a) |

Diversified Consumer Services — 0.2% | | | | | | | | | | | | | | | | |

Service Corporation International | | | | | | | | | | | 2,949 | | | | 101,740 | (b) |

Hotels, Restaurants & Leisure — 2.0% | | | | | | | | | | | | | | | | |

Aristocrat Leisure Ltd. | | | | | | | | | | | 15,498 | | | | 256,342 | (a) |

Great Canadian Gaming Corp. | | | | | | | | | | | 8,400 | | | | 216,101 | * |

Royal Caribbean Cruises Ltd. | | | | | | | | | | | 2,075 | | | | 245,971 | (b) |

Saizeriya Co., Ltd. | | | | | | | | | | | 3,200 | | | | 88,054 | (a) |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 806,468 | |

Household Durables — 4.0% | | | | | | | | | | | | | | | | |

Barratt Developments PLC | | | | | | | | | | | 23,395 | | | | 192,659 | (a) |

Berkeley Group Holdings PLC | | | | | | | | | | | 4,324 | | | | 215,381 | (a) |

Electrolux AB, Class B Shares | | | | | | | | | | | 3,843 | | | | 130,675 | (a) |

JM AB | | | | | | | | | | | 6,625 | | | | 208,146 | (a) |

Persimmon PLC | | | | | | | | | | | 7,314 | | | | 253,067 | (a) |

Redrow PLC | | | | | | | | | | | 28,417 | | | | 225,630 | (a) |

SodaStream International Ltd. | | | | | | | | | | | 3,186 | | | | 211,710 | *(b) |

Taylor Wimpey PLC | | | | | | | | | | | 80,000 | | | | 209,583 | (a) |

Total Household Durables | | | | | | | | | | | | | | | 1,646,851 | |

Internet & Direct Marketing Retail — 0.4% | | | | | | | | | | | | | | | | |

Start Today Co., Ltd. | | | | | | | | | | | 4,700 | | | | 149,110 | (a) |

Leisure Products — 1.1% | | | | | | | | | | | | | | | | |

BRP Inc. | | | | | | | | | | | 7,400 | | | | 239,362 | |

Sega Sammy Holdings Inc. | | | | | | | | | | | 16,300 | | | | 227,804 | (a) |

Total Leisure Products | | | | | | | | | | | | | | | 467,166 | |

See Notes to Financial Statements.

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 13 |

Schedule of investments (cont’d)

September 30, 2017

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Media — 0.5% | | | | | | | | | | | | | | | | |

Cogeco Communications Inc. | | | | | | | | | | | 2,500 | | | $ | 184,372 | |

Multiline Retail — 0.6% | | | | | | | | | | | | | | | | |

Big Lots Inc. | | | | | | | | | | | 2,896 | | | | 155,139 | (b) |

Target Corp. | | | | | | | | | | | 1,693 | | | | 99,904 | (b) |

Total Multiline Retail | | | | | | | | | | | | | | | 255,043 | |

Specialty Retail — 4.1% | | | | | | | | | | | | | | | | |

Aaron’s Inc. | | | | | | | | | | | 4,023 | | | | 175,523 | (b) |

Best Buy Co. Inc. | | | | | | | | | | | 2,602 | | | | 148,210 | (b) |

Big 5 Sporting Goods Corp. | | | | | | | | | | | 18,098 | | | | 138,450 | (b) |

Children’s Place Inc. | | | | | | | | | | | 2,207 | | | | 260,757 | (b) |

Francesca’s Holdings Corp. | | | | | | | | | | | 21,863 | | | | 160,912 | *(b) |

Gap Inc. | | | | | | | | | | | 6,008 | | | | 177,416 | (b) |

Home Depot Inc. | | | | | | | | | | | 1,341 | | | | 219,334 | (b) |

Pier 1 Imports Inc. | | | | | | | | | | | 25,817 | | | | 108,173 | (b) |

Ross Stores Inc. | | | | | | | | | | | 2,689 | | | | 173,629 | (b) |

Zumiez, Inc. | | | | | | | | | | | 7,542 | | | | 136,510 | *(b) |

Total Specialty Retail | | | | | | | | | | | | | | | 1,698,914 | |

Textiles, Apparel & Luxury Goods — 1.2% | | | | | | | | | | | | | | | | |

Burberry Group PLC | | | | | | | | | | | 10,231 | | | | 241,683 | (a) |

Hugo Boss AG | | | | | | | | | | | 2,781 | | | | 245,123 | (a) |

Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | | | | | 486,806 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 7,452,317 | |

| Consumer Staples — 5.4% | | | | | | | | | | | | | | | | |

Beverages — 0.6% | | | | | | | | | | | | | | | | |

Fevertree Drinks PLC | | | | | | | | | | | 7,602 | | | | 222,821 | (a) |

Food & Staples Retailing — 2.0% | | | | | | | | | | | | | | | | |

Booker Group PLC | | | | | | | | | | | 67,789 | | | | 186,287 | (a) |

Kobe Bussan Co., Ltd. | | | | | | | | | | | 4,900 | | | | 220,099 | (a) |

Wal-Mart Stores Inc. | | | | | | | | | | | 2,623 | | | | 204,961 | (b) |

William Morrison Supermarkets PLC | | | | | | | | | | | 71,509 | | | | 224,349 | (a) |

Total Food & Staples Retailing | | | | | | | | | | | | | | | 835,696 | |

Food Products — 2.1% | | | | | | | | | | | | | | | | |

GrainCorp Ltd., Class A Shares | | | | | | | | | | | 17,600 | | | | 113,061 | (a) |

Grieg Seafood ASA | | | | | | | | | | | 16,031 | | | | 158,043 | (a) |

Maple Leaf Foods Inc. | | | | | | | | | | | 9,200 | | | | 250,765 | |

Megmilk Snow Brand Co., Ltd. | | | | | | | | | | | 4,100 | | | | 111,429 | (a) |

Nichirei Corp. | | | | | | | | | | | 8,500 | | | | 213,479 | (a) |

Total Food Products | | | | | | | | | | | | | | | 846,777 | |

See Notes to Financial Statements.

| | |

| 14 | | QS Global Market Neutral Fund 2017 Annual Report |

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Personal Products — 0.5% | | | | | | | | | | | | | | | | |

YA-MAN Ltd. | | | | | | | | | | | 1,800 | | | $ | 192,763 | (a) |

Tobacco — 0.2% | | | | | | | | | | | | | | | | |

Imperial Brands PLC | | | | | | | | | | | 2,276 | | | | 97,122 | (a) |

Total Consumer Staples | | | | | | | | | | | | | | | 2,195,179 | |

| Energy — 5.4% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — 1.6% | | | | | | | | | | | | | | | | |

Enerflex Ltd. | | | | | | | | | | | 13,200 | | | | 194,655 | |

SBM Offshore NV | | | | | | | | | | | 12,404 | | | | 225,096 | (a) |

Subsea 7 SA | | | | | | | | | | | 15,500 | | | | 254,814 | (a) |

Total Energy Equipment & Services | | | | | | | | | | | | | | | 674,565 | |

Oil, Gas & Consumable Fuels — 3.8% | | | | | | | | | | | | | | | | |

Alliance Resource Partners LP | | | | | | | | | | | 9,409 | | | | 182,064 | (b) |

HollyFrontier Corp. | | | | | | | | | | | 5,073 | | | | 182,476 | (b) |

OMV AG | | | | | | | | | | | 4,496 | | | | 262,019 | (a) |

Renewable Energy Group Inc. | | | | | | | | | | | 13,546 | | | | 164,584 | *(b) |

Repsol SA | | | | | | | | | | | 13,542 | | | | 249,836 | (a) |

Saras SpA | | | | | | | | | | | 38,916 | | | | 104,450 | (a) |

Showa Shell Sekiyu KK | | | | | | | | | | | 17,900 | | | | 206,447 | (a) |

Valero Energy Corp. | | | | | | | | | | | 2,623 | | | | 201,787 | (b) |

Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 1,553,663 | |

Total Energy | | | | | | | | | | | | | | | 2,228,228 | |

| Financials — 9.8% | | | | | | | | | | | | | | | | |

Banks — 2.3% | | | | | | | | | | | | | | | | |

BNP Paribas SA | | | | | | | | | | | 2,738 | | | | 220,938 | (a) |

Danske Bank A/S | | | | | | | | | | | 5,474 | | | | 218,919 | (a) |

KBC Group NV | | | | | | | | | | | 3,096 | | | | 262,421 | (a) |

Skandinaviska Enskilda Banken AB, Class A Shares | | | | | | | | | | | 8,084 | | | | 106,706 | (a) |

Synovus Financial Corp. | | | | | | | | | | | 3,268 | | | | 150,524 | (b) |

Total Banks | | | | | | | | | | | | | | | 959,508 | |

Capital Markets — 1.2% | | | | | | | | | | | | | | | | |

Daiwa Securities Group Inc. | | | | | | | | | | | 25,000 | | | | 141,752 | (a) |

Julius Baer Group Ltd. | | | | | | | | | | | 1,745 | | | | 103,429 | *(a) |

Natixis SA | | | | | | | | | | | 31,891 | | | | 255,243 | (a) |

Total Capital Markets | | | | | | | | | | | | | | | 500,424 | |

Diversified Financial Services — 1.0% | | | | | | | | | | | | | | | | |

Euronext NV | | | | | | | | | | | 2,644 | | | | 160,923 | (a) |

ORIX Corp. | | | | | | | | | | | 8,200 | | | | 132,371 | (a) |

Wendel SA | | | | | | | | | | | 781 | | | | 126,580 | (a) |

Total Diversified Financial Services | | | | | | | | | | | | | | | 419,874 | |

See Notes to Financial Statements.

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 15 |

Schedule of investments (cont’d)

September 30, 2017

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Insurance — 4.9% | | | | | | | | | | | | | | | | |

AEGON NV | | | | | | | | | | | 39,632 | | | $ | 230,897 | (a) |

Allianz SE, Registered Shares | | | | | | | | | | | 1,082 | | | | 242,926 | (a) |

ASR Nederland NV | | | | | | | | | | | 4,240 | | | | 169,640 | (a) |

Assured Guaranty Ltd. | | | | | | | | | | | 5,513 | | | | 208,116 | (b) |

CNO Financial Group Inc. | | | | | | | | | | | 6,807 | | | | 158,875 | (b) |

Direct Line Insurance Group PLC | | | | | | | | | | | 20,854 | | | | 101,622 | (a) |

Everest Re Group Ltd. | | | | | | | | | | | 490 | | | | 111,911 | (b) |

Legal & General Group PLC | | | | | | | | | | | 64,278 | | | | 223,881 | (a) |

MS&AD Insurance Group Holdings Inc. | | | | | | | | | | | 7,500 | | | | 242,058 | (a) |

Reinsurance Group of America Inc. | | | | | | | | | | | 673 | | | | 93,904 | (b) |

SCOR SE | | | | | | | | | | | 2,528 | | | | 106,019 | (a) |

Sompo Holdings Inc. | | | | | | | | | | | 2,800 | | | | 109,184 | (a) |

Total Insurance | | | | | | | | | | | | | | | 1,999,033 | |

Thrifts & Mortgage Finance — 0.4% | | | | | | | | | | | | | | | | |

Essent Group Ltd. | | | | | | | | | | | 3,827 | | | | 154,994 | *(b) |

Total Financials | | | | | | | | | | | | | | | 4,033,833 | |

| Health Care — 7.1% | | | | | | | | | | | | | | | | |

Health Care Equipment & Supplies — 1.6% | | | | | | | | | | | | | | | | |

Baxter International Inc. | | | | | | | | | | | 3,544 | | | | 222,386 | (b) |

IDEXX Laboratories Inc. | | | | | | | | | | | 1,232 | | | | 191,564 | *(b) |

Masimo Corp. | | | | | | | | | | | 2,945 | | | | 254,919 | *(b) |

Total Health Care Equipment & Supplies | | | | | | | | | | | | | | | 668,869 | |

Health Care Providers & Services — 3.0% | | | | | | | | | | | | | | | | |

Anthem Inc. | | | | | | | | | | | 932 | | | | 176,968 | (b) |

CIGNA Corp. | | | | | | | | | | | 1,219 | | | | 227,880 | (b) |

Express Scripts Holding Co. | | | | | | | | | | | 1,936 | | | | 122,588 | *(b) |

Humana Inc. | | | | | | | | | | | 1,025 | | | | 249,721 | (b) |

Miraca Holdings Inc. | | | | | | | | | | | 4,100 | | | | 190,751 | (a) |

WellCare Health Plans Inc. | | | | | | | | | | | 1,513 | | | | 259,843 | *(b) |

Total Health Care Providers & Services | | | | | | | | | | | | | | | 1,227,751 | |

Health Care Technology — 0.2% | | | | | | | | | | | | | | | | |

Veeva Systems Inc., Class A Shares | | | | | | | | | | | 1,573 | | | | 88,733 | *(b) |

Life Sciences Tools & Services — 0.5% | | | | | | | | | | | | | | | | |

ICON PLC | | | | | | | | | | | 1,955 | | | | 222,635 | *(b) |

Pharmaceuticals — 1.8% | | | | | | | | | | | | | | | | |

Bayer AG, Registered Shares | | | | | | | | | | | 1,060 | | | | 144,450 | (a) |

H. Lundbeck A/S | | | | | | | | | | | 4,066 | | | | 234,650 | (a) |

Indivior PLC | | | | | | | | | | | 51,540 | | | | 235,219 | *(a) |

See Notes to Financial Statements.

| | |

| 16 | | QS Global Market Neutral Fund 2017 Annual Report |

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Pharmaceuticals — continued | | | | | | | | | | | | | | | | |

Tsumura & Co. | | | | | | | | | | | 2,800 | | | $ | 101,103 | (a) |

Total Pharmaceuticals | | | | | | | | | | | | | | | 715,422 | |

Total Health Care | | | | | | | | | | | | | | | 2,923,410 | |

| Industrials — 17.8% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 0.8% | | | | | | | | | | | | | | | | |

Dassault Aviation SA | | | | | | | | | | | 123 | | | | 198,832 | (a) |

Moog Inc., Class A Shares | | | | | | | | | | | 1,573 | | | | 131,235 | *(b) |

Total Aerospace & Defense | | | | | | | | | | | | | | | 330,067 | |

Airlines — 2.2% | | | | | | | | | | | | | | | | |

Air Canada | | | | | | | | | | | 8,500 | | | | 178,754 | * |

Deutsche Lufthansa AG, Registered Shares | | | | | | | | | | | 9,657 | | | | 268,334 | (a) |

International Consolidated Airlines Group SA | | | | | | | | | | | 24,075 | | | | 191,498 | (a) |

Qantas Airways Ltd. | | | | | | | | | | | 57,511 | | | | 263,859 | (a) |

Total Airlines | | | | | | | | | | | | | | | 902,445 | |

Building Products — 0.6% | | | | | | | | | | | | | | | | |

Owens Corning | | | | | | | | | | | 3,287 | | | | 254,249 | (b) |

Commercial Services & Supplies — 1.4% | | | | | | | | | | | | | | | | |

G4S PLC | | | | | | | | | | | 33,094 | | | | 123,434 | (a) |

Mitie Group PLC | | | | | | | | | | | 70,425 | | | | 241,481 | (a) |

Quad Graphics Inc. | | | | | | | | | | | 8,289 | | | | 187,415 | (b) |

Total Commercial Services & Supplies | | | | | | | | | | | | | | | 552,330 | |

Construction & Engineering — 3.9% | | | | | | | | | | | | | | | | |

ACS Actividades de Construccion y Servicios SA | | | | | | | | | | | 5,729 | | | | 212,315 | (a) |

CIMIC Group Ltd. | | | | | | | | | | | 7,364 | | | | 256,233 | (a) |

FLSmidth & Co. A/S | | | | | | | | | | | 3,562 | | | | 235,784 | (a) |

Galliford Try PLC | | | | | | | | | | | 6,630 | | | | 120,207 | (a) |

Hochtief AG | | | | | | | | | | | 1,402 | | | | 236,540 | (a) |

NCC AB, Class B Shares | | | | | | | | | | | 6,204 | | | | 147,222 | (a) |

Nishimatsu Construction Co., Ltd. | | | | | | | | | | | 7,400 | | | | 213,809 | (a) |

Okumura Corp. | | | | | | | | | | | 2,200 | | | | 84,134 | (a) |

Taisei Corp. | | | | | | | | | | | 2,000 | | | | 104,944 | (a) |

Total Construction & Engineering | | | | | | | | | | | | | | | 1,611,188 | |

Electrical Equipment — 0.6% | | | | | | | | | | | | | | | | |

Vestas Wind Systems A/S | | | | | | | | | | | 2,730 | | | | 244,999 | (a) |

Industrial Conglomerates — 0.5% | | | | | | | | | | | | | | | | |

Smiths Group PLC | | | | | | | | | | | 8,368 | | | | 177,055 | (a) |

Machinery — 2.7% | | | | | | | | | | | | | | | | |

Allison Transmission Holdings Inc. | | | | | | | | | | | 2,403 | | | | 90,185 | (b) |

Meidensha Corp. | | | | | | | | | | | 45,000 | | | | 172,029 | (a) |

See Notes to Financial Statements.

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 17 |

Schedule of investments (cont’d)

September 30, 2017

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Machinery — continued | | | | | | | | | | | | | | | | |

New Flyer Industries Inc. | | | | | | | | | | | 3,100 | | | $ | 127,975 | |

Ryobi Ltd. | | | | | | | | | | | 4,400 | | | | 118,631 | (a) |

ShinMaywa Industries Ltd. | | | | | | | | | | | 17,900 | | | | 162,582 | (a) |

Tsugami Corp. | | | | | | | | | | | 10,000 | | | | 84,385 | (a) |

VAT Group AG | | | | | | | | | | | 1,193 | | | | 165,118 | *(a) |

Wabash National Corp. | | | | | | | | | | | 8,583 | | | | 195,864 | (b) |

Total Machinery | | | | | | | | | | | | | | | 1,116,769 | |

Professional Services — 1.2% | | | | | | | | | | | | | | | | |

Adecco Group AG, Registered Shares | | | | | | | | | | | 1,232 | | | | 95,948 | (a) |

Manpowergroup Inc. | | | | | | | | | | | 2,028 | | | | 238,939 | (b) |

Meitec Corp. | | | | | | | | | | | 3,100 | | | | 155,465 | (a) |

Total Professional Services | | | | | | | | | | | | | | | 490,352 | |

Trading Companies & Distributors — 3.3% | | | | | | | | | | | | | | | | |

Ashtead Group PLC | | | | | | | | | | | 7,591 | | | | 183,232 | (a) |

Ferguson PLC | | | | | | | | | | | 3,396 | | | | 222,834 | (a) |

Kanamoto Co., Ltd. | | | | | | | | | | | 4,600 | | | | 145,169 | (a) |

Marubeni Corp. | | | | | | | | | | | 33,600 | | | | 229,649 | (a) |

Mitsubishi Corp. | | | | | | | | | | | 10,000 | | | | 232,577 | (a) |

Mitsui & Co., Ltd. | | | | | | | | | | | 10,000 | | | | 147,914 | (a) |

Sumitomo Corp. | | | | | | | | | | | 14,100 | | | | 202,989 | (a) |

Total Trading Companies & Distributors | | | | | | | | | | | | | | | 1,364,364 | |

Transportation Infrastructure — 0.6% | | | | | | | | | | | | | | | | |

Aena SME SA | | | | | | | | | | | 1,375 | | | | 248,553 | (a) |

Total Industrials | | | | | | | | | | | | | | | 7,292,371 | |

| Information Technology — 15.7% | | | | | | | | | | | | | | | | |

Communications Equipment — 1.0% | | | | | | | | | | | | | | | | |

F5 Networks Inc. | | | | | | | | | | | 776 | | | | 93,555 | *(b) |

Juniper Networks Inc. | | | | | | | | | | | 5,911 | | | | 164,503 | (b) |

Motorola Solutions Inc. | | | | | | | | | | | 1,992 | | | | 169,061 | (b) |

Total Communications Equipment | | | | | | | | | | | | | | | 427,119 | |

Electronic Equipment, Instruments & Components — 2.7% | | | | | | | | | | | | | | | | |

CDW Corp. | | | | | | | | | | | 2,742 | | | | 180,972 | (b) |

Celestica Inc. | | | | | | | | | | | 8,700 | | | | 107,656 | * |

Electrocomponents PLC | | | | | | | | | | | 28,245 | | | | 235,082 | (a) |

Hitachi Ltd. | | | | | | | | | | | 34,000 | | | | 239,834 | (a) |

KEMET Corp. | | | | | | | | | | | 7,858 | | | | 166,040 | *(b) |

Oki Electric Industry Co., Ltd. | | | | | | | | | | | 12,100 | | | | 161,259 | (a) |

Total Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | | 1,090,843 | |

See Notes to Financial Statements.

| | |

| 18 | | QS Global Market Neutral Fund 2017 Annual Report |

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

IT Services — 1.4% | | | | | | | | | | | | | | | | |

Capgemini SE | | | | | | | | | | | 824 | | | $ | 96,511 | (a) |

Computershare Ltd. | | | | | | | | | | | 13,507 | | | | 153,903 | (a) |

EVERTEC Inc. | | | | | | | | | | | 7,188 | | | | 113,930 | (b) |

Nihon Unisys Ltd. | | | | | | | | | | | 11,600 | | | | 186,072 | (a) |

Total IT Services | | | | | | | | | | | | | | | 550,416 | |

Semiconductors & Semiconductor Equipment — 6.1% | | | | | | | | | | | | | | | | |

Advanced Energy Industries Inc. | | | | | | | | | | | 2,333 | | | | 188,413 | *(b) |

Applied Materials Inc. | | | | | | | | | | | 2,617 | | | | 136,319 | (b) |

BE Semiconductor Industries NV | | | | | | | | | | | 2,521 | | | | 175,594 | (a) |

Brooks Automation Inc. | | | | | | | | | | | 3,694 | | | | 112,150 | (b) |

Entegris Inc. | | | | | | | | | | | 9,901 | | | | 285,644 | *(b) |

KLA-Tencor Corp. | | | | | | | | | | | 2,190 | | | | 232,140 | (b) |

Kulicke & Soffa Industries Inc. | | | | | | | | | | | 6,471 | | | | 139,579 | *(b) |

Marvell Technology Group Ltd. | | | | | | | | | | | 5,728 | | | | 102,531 | (b) |

Sanken Electric Co., Ltd. | | | | | | | | | | | 43,000 | | | | 236,562 | (a) |

Teradyne Inc. | | | | | | | | | | | 5,523 | | | | 205,953 | (b) |

Texas Instruments Inc. | | | | | | | | | | | 2,437 | | | | 218,453 | (b) |

Tokyo Electron Ltd. | | | | | | | | | | | 1,600 | | | | 246,655 | (a) |

Ulvac Inc. | | | | | | | | | | | 3,700 | | | | 232,917 | (a) |

Total Semiconductors & Semiconductor Equipment | | | | | | | | | | | | | | | 2,512,910 | |

Software — 2.2% | | | | | | | | | | | | | | | | |

Capcom Co., Ltd. | | | | | | | | | | | 4,200 | | | | 103,764 | (a) |

CDK Global Inc. | | | | | | | | | | | 1,408 | | | | 88,831 | (b) |

Check Point Software Technologies Ltd. | | | | | | | | | | | 1,129 | | | | 128,728 | *(b) |

Citrix Systems Inc. | | | | | | | | | | | 1,143 | | | | 87,805 | *(b) |

Electronic Arts Inc. | | | | | | | | | | | 1,577 | | | | 186,181 | *(b) |

Intuit Inc. | | | | | | | | | | | 1,153 | | | | 163,887 | (b) |

Progress Software Corp. | | | | | | | | | | | 3,447 | | | | 131,572 | (b) |

Total Software | | | | | | | | | | | | | | | 890,768 | |

Technology Hardware, Storage & Peripherals — 2.3% | | | | | | | | | | | | | | | | |

Brother Industries Ltd. | | | | | | | | | | | 3,700 | | | | 86,549 | (a) |

HP Inc. | | | | | | | | | | | 12,910 | | | | 257,684 | (b) |

Logitech International SA, Registered Shares | | | | | | | | | | | 2,980 | | | | 108,663 | |

NetApp Inc. | | | | | | | | | | | 4,280 | | | | 187,293 | (b) |

Western Digital Corp. | | | | | | | | | | | 1,865 | | | | 161,136 | (b) |

Xerox Corp. | | | | | | | | | | | 4,502 | | | | 149,871 | (b) |

Total Technology Hardware, Storage & Peripherals | | | | | | | | | | | | | | | 951,196 | |

Total Information Technology | | | | | | | | | | | | | | | 6,423,252 | |

See Notes to Financial Statements.

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 19 |

Schedule of investments (cont’d)

September 30, 2017

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Materials — 11.4% | | | | | | | | | | | | | | | | |

Chemicals — 2.5% | | | | | | | | | | | | | | | | |

Covestro AG | | | | | | | | | | | 2,755 | | | $ | 236,884 | (a) |

Dainippon Ink and Chemicals Inc. | | | | | | | | | | | 4,100 | | | | 148,635 | (a) |

Lenzing AG | | | | | | | | | | | 1,318 | | | | 191,329 | (a) |

Methanex Corp. | | | | | | | | | | | 3,100 | | | | 155,776 | |

Sika AG | | | | | | | | | | | 11 | | | | 81,846 | (a) |

Sumitomo Bakelite Co., Ltd. | | | | | | | | | | | 31,000 | | | | 228,522 | (a) |

Total Chemicals | | | | | | | | | | | | | | | 1,042,992 | |

Containers & Packaging — 0.3% | | | | | | | | | | | | | | | | |

Cascades Inc. | | | | | | | | | | | 9,400 | | | | 112,702 | |

Metals & Mining — 6.6% | | | | | | | | | | | | | | | | |

Anglo American PLC | | | | | | | | | | | 13,351 | | | | 239,688 | (a) |

BlueScope Steel Ltd. | | | | | | | | | | | 23,145 | | | | 199,378 | (a) |

Detour Gold Corp. | | | | | | | | | | | 12,800 | | | | 141,156 | * |

Eramet | | | | | | | | | | | 2,119 | | | | 143,998 | *(a) |

Evraz PLC | | | | | | | | | | | 44,341 | | | | 186,275 | *(a) |

Ferrexpo PLC | | | | | | | | | | | 59,407 | | | | 232,691 | (a) |

Fortescue Metals Group Ltd. | | | | | | | | | | | 50,296 | | | | 203,642 | (a) |

HudBay Minerals Inc. | | | | | | | | | | | 18,900 | | | | 140,112 | |

IAMGOLD Corp. | | | | | | | | | | | 38,700 | | | | 236,651 | * |

Kinross Gold Corp. | | | | | | | | | | | 21,600 | | | | 91,576 | * |

Rio Tinto PLC | | | | | | | | | | | 5,006 | | | | 233,026 | (a) |

Sandfire Resources NL | | | | | | | | | | | 53,749 | | | | 243,144 | (a) |

SSAB AB, Class A Shares | | | | | | | | | | | 51,366 | | | | 247,341 | *(a) |

Vedanta Resources PLC | | | | | | | | | | | 13,479 | | | | 157,543 | (a) |

Total Metals & Mining | | | | | | | | | | | | | | | 2,696,221 | |

Paper & Forest Products — 2.0% | | | | | | | | | | | | | | | | |

Canfor Corp. | | | | | | | | | | | 7,900 | | | | 148,408 | * |

Interfor Corp. | | | | | | | | | | | 10,000 | | | | 158,526 | * |

Nippon Paper Industries Co., Ltd. | | | | | | | | | | | 8,900 | | | | 165,740 | (a) |

Oji Holdings Corp. | | | | | | | | | | | 37,000 | | | | 199,780 | (a) |

West Fraser Timber Co., Ltd. | | | | | | | | | | | 2,500 | | | | 144,260 | |

Total Paper & Forest Products | | | | | | | | | | | | | | | 816,714 | |

Total Materials | | | | | | | | | | | | | | | 4,668,629 | |

| Real Estate — 1.7% | | | | | | | | | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 0.6% | | | | | | | | | | | | | | | | |

Stockland | | | | | | | | | | | 38,473 | | | | 130,169 | (a) |

Xenia Hotels & Resorts Inc. | | | | | | | | | | | 5,648 | | | | 118,890 | (b) |

Total Equity Real Estate Investment Trusts (REITs) | | | | | | | | | | | | | | | 249,059 | |

See Notes to Financial Statements.

| | |

| 20 | | QS Global Market Neutral Fund 2017 Annual Report |

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Real Estate Management & Development — 1.1% | | | | | | | | | | | | | | | | |

LEG Immobilien AG | | | | | | | | | | | 966 | | | $ | 97,719 | (a) |

Open House Co., Ltd. | | | | | | | | | | | 3,800 | | | | 132,774 | (a) |

Vonovia SE | | | | | | | | | | | 5,179 | | | | 220,387 | (a) |

Total Real Estate Management & Development | | | | | | | | | | | | | | | 450,880 | |

Total Real Estate | | | | | | | | | | | | | | | 699,939 | |

| Telecommunication Services — 0.5% | | | | | | | | | | | | | | | | |

Wireless Telecommunication Services — 0.5% | | | | | | | | | | | | | | | | |

KDDI Corp. | | | | | | | | | | | 6,900 | | | | 182,037 | (a) |

| Utilities — 0.9% | | | | | | | | | | | | | | | | |

Electric Utilities — 0.5% | | | | | | | | | | | | | | | | |

Shikoku Electric Power Co. Inc. | | | | | | | | | | | 16,100 | | | | 189,423 | (a) |

Multi-Utilities — 0.4% | | | | | | | | | | | | | | | | |

AGL Energy Ltd. | | | | | | | | | | | 9,721 | | | | 178,737 | (a) |

Total Utilities | | | | | | | | | | | | | | | 368,160 | |

Total Investments before Short-Term Investments (Cost — $37,003,725) | | | | | | | | 38,467,355 | |

| | | | |

| | | | | | Rate | | | | | | | |

| Short-Term Investments — 5.5% | | | | | | | | | | | | | | | | |

State Street Institutional U.S. Government Money Market Fund, Premier Class (Cost — $2,265,811) | | | | | | | 0.907 | % | | | 2,265,811 | | | | 2,265,811 | |

Total Investments — 99.4% (Cost — $39,269,536) | | | | | | | | | | | | | | | 40,733,166 | |

Other Assets in Excess of Liabilities — 0.6% | | | | | | | | | | | | | | | 253,276 | |

Total Net Assets — 100.0% | | | | | | | | | | | | | | $ | 40,986,442 | |

| * | Non-income producing security. |

| (a) | Security is valued in good faith in accordance with procedures approved by the Board of Trustees (See Note 1). |

| (b) | All or a portion of this security is held at the broker as collateral for open securities sold short. |

See Notes to Financial Statements.

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 21 |

Schedule of investments (cont’d)

September 30, 2017

QS Global Market Neutral Fund

| | | | |

| Summary of Investments by Country** (unaudited) | | | |

| United States | | | 27.2 | % |

| Japan | | | 20.0 | |

| United Kingdom | | | 12.0 | |

| Canada | | | 7.4 | |

| Australia | | | 4.9 | |

| Germany | | | 4.2 | |

| France | | | 2.8 | |

| Switzerland | | | 2.5 | |

| Netherlands | | | 2.4 | |

| Denmark | | | 2.3 | |

| Sweden | | | 2.1 | |

| Spain | | | 1.7 | |

| Austria | | | 1.1 | |

| Israel | | | 0.8 | |

| Belgium | | | 0.6 | |

| Russia | | | 0.5 | |

| Norway | | | 0.4 | |

| India | | | 0.4 | |

| Singapore | | | 0.3 | |

| Puerto Rico | | | 0.3 | |

| Italy | | | 0.3 | |

| Bermuda | | | 0.2 | |

| Short-Term Investments | | | 5.6 | |

| | | | 100.0 | % |

| ** | As a percentage of total investments. Please note that the Fund holdings are as of September 30, 2017 and are subject to change. |

See Notes to Financial Statements.

| | |

| 22 | | QS Global Market Neutral Fund 2017 Annual Report |

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

| Securities Sold Short‡ — (93.9)% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — (18.0)% | | | | | | | | | | | | | | | | |

Auto Components — (1.4)% | | | | | | | | | | | | | | | | |

Autoneum Holding AG | | | | | | | | | | | (643 | ) | | $ | (179,801 | ) (a) |

Gentherm Inc. | | | | | | | | | | | (5,508 | ) | | | (204,622 | ) * |

Toyota Industries Corp. | | | | | | | | | | | (3,500 | ) | | | (201,378 | ) (a) |

Total Auto Components | | | | | | | | | | | | | | | (585,801 | ) |

Automobiles — (0.7)% | | | | | | | | | | | | | | | | |

Daimler AG, Registered Shares | | | | | | | | | | | (1,644 | ) | | | (131,097 | ) (a) |

Tesla Inc. | | | | | | | | | | | (497 | ) | | | (169,527 | ) * |

Total Automobiles | | | | | | | | | | | | | | | (300,624 | ) |

Distributors — (0.4)% | | | | | | | | | | | | | | | | |

Core-Mark Holding Co. Inc. | | | | | | | | | | | (4,440 | ) | | | (142,702 | ) |

Hotels, Restaurants & Leisure — (6.0)% | | | | | | | | | | | | | | | | |

Accor SA | | | | | | | | | | | (4,292 | ) | | | (213,102 | ) (a) |

Domino’s Pizza Enterprises Ltd. | | | | | | | | | | | (4,279 | ) | | | (154,256 | ) (a) |

Domino’s Pizza Group PLC | | | | | | | | | | | (50,524 | ) | | | (210,043 | ) (a) |

Elior Group | | | | | | | | | | | (4,678 | ) | | | (123,793 | ) (a) |

Fiesta Restaurant Group Inc. | | | | | | | | | | | (5,522 | ) | | | (104,918 | ) * |

Greene King PLC | | | | | | | | | | | (20,012 | ) | | | (146,570 | ) (a) |

InterContinental Hotels Group PLC | | | | | | | | | | | (4,095 | ) | | | (216,096 | ) (a) |

Kyoritsu Maintenance Co., Ltd. | | | | | | | | | | | (4,200 | ) | | | (125,490 | ) (a) |

Merlin Entertainments PLC | | | | | | | | | | | (34,219 | ) | | | (204,404 | ) (a) |

MGM Resorts International | | | | | | | | | | | (3,969 | ) | | | (129,350 | ) |

Oriental Land Co., Ltd. | | | | | | | | | | | (2,600 | ) | | | (198,164 | ) (a) |

Red Rock Resorts Inc., Class A Shares | | | | | | | | | | | (8,828 | ) | | | (204,457 | ) |

Shake Shack Inc., Class A Shares | | | | | | | | | | | (2,833 | ) | | | (94,141 | ) * |

TABCORP Holdings Ltd. | | | | | | | | | | | (41,964 | ) | | | (140,907 | ) (a) |

Whitbread PLC | | | | | | | | | | | (2,424 | ) | | | (122,341 | ) (a) |

Zoe’s Kitchen Inc. | | | | | | | | | | | (7,064 | ) | | | (89,218 | ) * |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | (2,477,250 | ) |

Household Durables — (1.5)% | | | | | | | | | | | | | | | | |

Foster Electric Co., Ltd. | | | | | | | | | | | (9,400 | ) | | | (189,890 | ) (a) |

TomTom NV | | | | | | | | | | | (19,405 | ) | | | (210,671 | ) *(a) |

TRI Pointe Group Inc. | | | | | | | | | | | (14,065 | ) | | | (194,238 | ) * |

Total Household Durables | | | | | | | | | | | | | | | (594,799 | ) |

Internet & Direct Marketing Retail — (0.9)% | | | | | | | | | | | | | | | | |

Yoox Net-A-Porter Group SpA | | | | | | | | | | | (5,182 | ) | | | (203,378 | ) *(a) |

See Notes to Financial Statements.

| | |

| QS Global Market Neutral Fund 2017 Annual Report | | 23 |

Schedule of investments (cont’d)

September 30, 2017

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Internet & Direct Marketing Retail — continued | | | | | | | | | | | | | | | | |

Zalando SE | | | | | | | | | | | (3,410 | ) | | $ | (170,884 | ) *(a) |

Total Internet & Direct Marketing Retail | | | | | | | | | | | | | | | (374,262 | ) |

Leisure Products — (1.0)% | | | | | | | | | | | | | | | | |

Amer Sports OYJ | | | | | | | | | | | (5,260 | ) | | | (139,658 | ) (a) |

Mattel Inc. | | | | | | | | | | | (6,799 | ) | | | (105,248 | ) |

Shimano Inc. | | | | | | | | | | | (1,200 | ) | | | (160,073 | ) (a) |

Universal Entertainment Corp. | | | | | | | | | | | (500 | ) | | | (14,711 | ) (a) |

Total Leisure Products | | | | | | | | | | | | | | | (419,690 | ) |

Media — (3.6)% | | | | | | | | | | | | | | | | |

AMC Entertainment Holdings Inc., Class A Shares | | | | | | | | | | | (2,300 | ) | | | (33,810 | ) |

Axel Springer SE | | | | | | | | | | | (3,599 | ) | | | (231,412 | ) (a) |

Cineplex Inc. | | | | | | | | | | | (3,800 | ) | | | (118,896 | ) |

Dentsu Inc. | | | | | | | | | | | (2,800 | ) | | | (122,924 | ) |

Informa PLC | | | | | | | | | | | (18 | ) | | | (162 | ) (a) |

JCDecaux SA | | | | | | | | | | | (2,081 | ) | | | (77,881 | ) (a) |

Liberty Media Corp.-Liberty Formula One, Class A Shares | | | | | | | | | | | (3,595 | ) | | | (131,181 | ) * |

LIFULL Co., Ltd. | | | | | | | | | | | (24,200 | ) | | | (210,453 | ) (a) |

Nexstar Media Group Inc., Class A Shares | | | | | | | | | | | (2,937 | ) | | | (182,975 | ) |

Pearson PLC | | | | | | | | | | | (20,926 | ) | | | (171,619 | ) (a) |

ProSiebenSat.1 Media SE | | | | | | | | | | | (6,018 | ) | | | (205,086 | ) (a) |

Total Media | | | | | | | | | | | | | | | (1,486,399 | ) |

Multiline Retail — (0.7)% | | | | | | | | | | | | | | | | |

J. Front Retailing Co., Ltd. | | | | | | | | | | | (9,100 | ) | | | (125,947 | ) (a) |

Marui Group Co., Ltd. | | | | | | | | | | | (11,000 | ) | | | (157,656 | ) (a) |

Total Multiline Retail | | | | | | | | | | | | | | | (283,603 | ) |

Specialty Retail — (0.6)% | | | | | | | | | | | | | | | | |

Bic Camera Inc. | | | | | | | | | | | (11,000 | ) | | | (122,394 | ) (a) |

Pets at Home Group PLC | | | | | | | | | | | (38,612 | ) | | | (110,579 | ) (a) |

Total Specialty Retail | | | | | | | | | | | | | | | (232,973 | ) |

Textiles, Apparel & Luxury Goods — (1.2)% | | | | | | | | | | | | | | | | |

G-III Apparel Group Ltd. | | | | | | | | | | | (7,032 | ) | | | (204,069 | ) * |

Luxottica Group SpA | | | | | | | | | | | (3,627 | ) | | | (202,988 | ) (a) |

Under Armour Inc., Class C Shares | | | | | | | | | | | (5,461 | ) | | | (82,024 | ) * |

Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | | | | | (489,081 | ) |

Total Consumer Discretionary | | | | | | | | | | | | | | | (7,387,184 | ) |

| Consumer Staples — (5.8)% | | | | | | | | | | | | | | | | |

Beverages — (1.3)% | | | | | | | | | | | | | | | | |

Anheuser-Busch InBev SA | | | | | | | | | | | (1,345 | ) | | | (160,763 | ) (a) |

Britvic PLC | | | | | | | | | | | (19,763 | ) | | | (200,093 | ) (a) |

See Notes to Financial Statements.

| | |

| 24 | | QS Global Market Neutral Fund 2017 Annual Report |

QS Global Market Neutral Fund

| | | | | | | | | | | | | | | | |

| Security | | | | | | | | Shares | | | Value | |

Beverages — continued | | | | | | | | | | | | | | | | |

Cott Corp. | | | | | | | | | | | (12,000 | ) | | $ | (179,940 | ) |

Total Beverages | | | | | | | | | | | | | | | (540,796 | ) |

Food & Staples Retailing — (2.0)% | | | | | | | | | | | | | | | | |

Carrefour SA | | | | | | | | | | | (9,557 | ) | | | (193,070 | ) (a) |

FamilyMart UNY Holdings Co., Ltd. | | | | | | | | | | | (1,600 | ) | | | (84,388 | ) (a) |

ICA Gruppen AB | | | | | | | | | | | (2,106 | ) | | | (79,171 | ) (a) |

Koninklijke Ahold Delhaize NV | | | | | | | | | | | (5,004 | ) | | | (93,608 | ) (a) |

Lawson Inc. | | | | | | | | | | | (2,600 | ) | | | (172,199 | ) (a) |

Tsuruha Holdings Inc. | | | | | | | | | | | (1,600 | ) | | | (191,294 | ) (a) |

Total Food & Staples Retailing | | | | | | | | | | | | | | | (813,730 | ) |

Food Products — (1.6)% | | | | | | | | | | | | | | | | |

B&G Foods Inc. | | | | | | | | | | | (3,718 | ) | | | (118,418 | ) |

Bakkafrost P/F | | | | | | | | | | | (2,730 | ) | | | (125,421 | ) (a) |

Blue Buffalo Pet Products Inc. | | | | | | | | | | | (4,629 | ) | | | (131,232 | ) * |

CALBEE Inc. | | | | | | | | | | | (2,300 | ) | | | (81,080 | ) (a) |

Greencore Group PLC | | | | | | | | | | | (80,633 | ) | | | (212,188 | ) (a) |

Total Food Products | | | | | | | | | | | | | | | (668,339 | ) |

Personal Products — (0.9)% | | | | | | | | | | | | | | | | |

Coty Inc., Class A Shares | | | | | | | | | | | (8,612 | ) | | | (142,357 | ) |

Shiseido Co., Ltd. | | | | | | | | | | | (5,400 | ) | | | (216,789 | ) (a) |

Total Personal Products | | | | | | | | | | | | | | | (359,146 | ) |

Total Consumer Staples | | | | | | | | | | | | | | | (2,382,011 | ) |

| Energy — (6.2)% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — (0.5)% | | | | | | | | | | | | | | | | |

Hi-Crush Partners LP | | | | | | | | | | | (12,622 | ) | | | (119,909 | ) * |

Weatherford International PLC | | | | | | | | | | | (19,664 | ) | | | (90,061 | ) * |

Total Energy Equipment & Services | | | | | | | | | | | | | | | (209,970 | ) |

Oil, Gas & Consumable Fuels — (5.7)% | | | | | | | | | | | | | | | | |

Birchcliff Energy Ltd. | | | | | | | | | | | (31,100 | ) | | | (150,796 | ) |

Callon Petroleum Co. | | | | | | | | | | | (7,126 | ) | | | (80,096 | ) * |

Enbridge Inc. | | | | | | | | | | | (2,600 | ) | | | (108,605 | ) |

Euronav NV | | | | | | | | | | | (12,222 | ) | | | (100,561 | ) (a) |

Keyera Corp. | | | | | | | | | | | (4,100 | ) | | | (125,325 | ) |

Matador Resources Co. | | | | | | | | | | | (6,675 | ) | | | (181,226 | ) * |

MPLX LP | | | | | | | | | | | (4,787 | ) | | | (167,593 | ) |