conditions of the DIP facility; (ii) to improve profitability; (iii) to generate sufficient cash flow from operations to satisfy liabilities as they come due; and (iv) to obtain additional financing to meet the Company’s future obligations

As further described in Note 6, the Company has long-term obligations. These obligations have been classified as a current liability as a result of the filing for Chapter 11 bankruptcy protection under the United States Bankruptcy Code.

The preparation of the consolidated financial statements in accordance with U.S. Generally Accepted Accounting Principles requires management of the Company to make estimates and assumptions relating to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the period.

Significant items subject to such estimates and assumptions include the carrying amount of property, building, and equipment, valuation allowances for receivables, tax obligations and certain other accrued liabilities. Actual results could differ from those estimates.

Greektown Holdings recognizes as Casino revenues the net win from gaming activities, which is the difference between gaming wins and losses. Revenues from food and beverage and hotel operations are recognized at the time of sale or upon the provision of service.

The retail value of food, beverage, and other complimentary items furnished to customers without charge is included in revenues and then deducted as promotional allowances. The costs of providing such promotional allowances for the years ended December 31, 2009, 2008, and 2007, were as follows (in thousands):

The Company considers all highly liquid debt instruments with original maturities of three months or less to be cash equivalents. Certificates of deposit represent cash deposits with maturities in excess of three months.

Accounts receivable—gaming consists primarily of gaming markers issued to casino patrons on the gaming floor. A marker is a voucher for a specified amount of dollars negotiable solely within Greektown Casino. Markers are recorded at issued value and do not bear interest. The allowance for doubtful accounts is Greektown Casino’s best estimate of the amount of probable credit losses in Greektown Casino’s existing accounts receivable.

Notes receivable represents a balance owed from a patron, which is evidenced by an unsecured promissory note with a principal balance of $2,000,000. The note matured on March 31, 2009 and

GREEKTOWN HOLDINGS, L.L.C.

(Debtor-In-Possession)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

bears interest at a rate of 6% per annum, of which $460,000, $370,000, and $250,000 was earned through December 31, 2009, 2008, and 2007, respectively. The Company served a collection notice related to this note and expects full payment of the principal amount.

Greektown Casino determines the allowance based on historical write-off experience and review of returned gaming markers, past-due balances, and individual collection analysis. Account balances are charged off against the allowance after all reasonable means of collection have been exhausted and the potential for recovery is considered remote.

Concentrations of Credit Risk

Financial instruments that potentially subject us to significant concentration of credit risk consist primarily of cash and equivalents, certificates of deposit and accounts receivable. We control our exposure to credit risk associated with these instruments by (i) maintaining strict controls and security procedures to safeguard cash balances on our gaming floors and in controlled areas in our facility; and (ii) maintaining strict policies over credit extension that include credit evaluations, credit limits and monitoring procedures.

Advertising Expense

The Company expenses costs associated with advertising and promotion as incurred. Advertising and promotion expense was approximately $8,310,000, $4,620,000, and $5,541,000 for the years ended December 31, 2009, 2008, and 2007, respectively.

Prepaid Expenses

Prepaid expenses consist of payments made for items to be expensed over future periods. At December 31, 2009 and 2008, prepaid expenses included approximately $12,211,000 and $12,333,000, respectively, related to the annual gaming license and municipal service fees that will be expensed in subsequent periods.

Inventories

Inventories, consisting of food, beverage, and gift shop items, are stated at the lower of cost or market. Cost is determined by the first-in, first-out method.

Property, Building, and Equipment

Property, building, and equipment are stated at cost and are depreciated using the straight-line method over the estimated useful lives of the assets.

Expenditures for repairs and maintenance are charged to expense as incurred and approximated $725,000, $584,000, and $888,000 for the years ended December 31, 2009, 2008, and 2007, respectively. Depreciation and amortization expense includes amortization of assets recorded under capital leases.

Reserve for Club Greektown

Greektown Casino sponsors a players club (“Club Greektown”) for its repeat customers. Members of the club earn points for playing Greektown Casino’s electronic video and table games. Club Greektown members may redeem points for cash. Club Greektown members may also earn special coupons or awards as determined by Greektown Casino.

Greektown Casino expenses the cash value of points earned by club members and recognizes a related liability for any unredeemed points. Greektown Casino has adopted the provisions of the

F-10

GREEKTOWN HOLDINGS, L.L.C.

(Debtor-In-Possession)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Revenue Recognition topic of the ASC applicable to instances where consideration is given by a vendor to a customer. Accordingly, Greektown Casino has recognized the cash value of points earned as a direct reduction in casino revenue. For the years ended December 31, 2009, 2008, and 2007, this reduction totaled $6,727,000, $6,459,000, and $7,151,000, respectively, and is deducted from casino revenue in the accompanying consolidated statement of operations.

Concentrations of Risk

As of December 31, 2009, approximately 1,700 of the Company’s employees were covered by collective bargaining agreements, including a majority of the Company’s hourly staff.

Fair Value of Financial Instruments

The carrying amount of cash and cash equivalents, certificates of deposit, accounts receivable, and accounts payable approximates fair value because of the short-term maturity of these instruments. The fair value of long-term debt, lawsuit settlement obligation, and long-term payables approximates their carrying value, as determined by the Company, using available market information.

Financing Fees

The Company has incurred certain financing costs in order to secure financing for its Casino and the Expanded Complex. These costs were capitalized and are being amortized over the term of the respective financing agreements.

Capitalized financing fees, net of amortization, totaled $9,712,000 and $14,105,000 at December 31, 2009 and 2008, respectively. The amortization of these fees was $12,923,000, $8,464,000, and $3,378,000 for the years ended December 31, 2009, 2008, and 2007, respectively.

Income and Other Taxes

A provision for federal income taxes is not recorded because, as a limited liability company, taxable income or loss is allocated to the members based on their respective ownership percentages in accordance with the Member Agreement (as defined elsewhere herein). On July 12, 2007, the Michigan legislature enacted the Michigan Business Tax (MBT) which is considered an income tax under the provisions of the Income Taxes topic of the ASC. The MBT has a gross receipts tax and an income tax component. Due to these changes, the enactment has resulted in the recording of both a deferred tax asset and a deferred tax liability related to the gross receipts component. The deferred tax asset was approximately $1.2 million and $1.2 million at December 31, 2009 and 2008, respectively, and the deferred tax liability was $3.6 million and $3.9 million, respectively. These amounts are presented net as a long term deferred tax liability of approximately $2.4 million and $2.7 million at December 31, 2009 and 2008, respectively. The deferred tax asset is the result of future deductions allowed under the enactment provisions of the new law for the 2015 to 2029 tax years, whereas the deferred tax liability is the result of the enactment of the law and the liability resulting from the temporary differences related to capital acquisitions reversing in future periods related to the gross receipts calculation. In addition, the Company has a deferred tax asset of approximately $8 million and approximately $8.2 million at December 31, 2009 and 2008, respectively, related to the tax effect of timing differences between book and tax expense related to the income tax component. Based on historical losses in Michigan and the uncertainty of the Company’s ability to utilize them, a full valuation allowance has been provided against these deferred tax assets at December 31, 2009 and 2008. During the years ended December 31, 2009 and 2008, the Company recorded a current provision for MBT of $1,117,000 and $1,553,000, respectively, and a deferred benefit of $305,000 and a deferred provision of $2,675,000, respectively.

F-11

GREEKTOWN HOLDINGS, L.L.C.

(Debtor-In-Possession)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Impairment or Disposal of Long-lived Assets

The Company accounts for long-lived assets in accordance with the Property, Plant and Equipment topic of the ASC, which requires that long-lived assets be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to future net cash flows expected to be generated by the asset.

If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized in the amount by which the carrying amount of the asset exceeds the fair value of the asset. Assets to be disposed of are reported at the lower of the carrying amount or fair value, less costs to sell.

Intangible Assets

The Revised Development Agreement gives rise to an identifiable intangible asset that has been determined to have an indefinite life.

The Company complies with the provisions of the Intangible Assets-Goodwill and Other topic of the ASC, which provides guidance on how identifiable intangible assets should be accounted for upon acquisition and subsequent to their initial financial statement recognition. This topic requires that identifiable intangible assets with indefinite lives be capitalized and tested for impairment at least annually by comparing the fair values of those assets with their recorded amounts.

Accordingly, the Company performs its impairment test as of October 1 of each year by comparing their estimated fair value to the related carrying value as of that date.

Interest Costs

The interest costs associated with debt incurred in connection with the construction of long-lived assets are capitalized until the project is complete, at which time the interest is amortized over the life of the related capitalized assets. The Company uses either the interest rate on the borrowing specific to the capital expenditure or a weighted-average interest rate on outstanding indebtedness. Interest costs capitalized were $2,086,000, $6,987,000, and $7,199,000 for the years ended December 31, 2009, 2008, and 2007, respectively, in connection with the Expanded Complex.

Reclassification

Certain amounts related to the consulting company success fees have been reclassified as “operating expenses” (previously classified as “other expense”) in the consolidated statement of operations for the year ended December 31, 2009.

Recently Issued Accounting Pronouncements

Effective July 1, 2009, the Financial Accounting Standards Board (the “FASB”) issued the FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles (the “ASC”), and the ASC became the single official source of authoritative, nongovernmental GAAP. The historical GAAP hierarchy was eliminated and the ASC became the only level of authoritative GAAP, other than guidance issued by the SEC. All other literature became non-authoritative. The ASC is effective for financial statements issued for interim and annual periods ending after September 15, 2009. As the ASC was not intended to change or alter existing GAAP, it will not have any impact on the Company’s consolidated financial position, results of operations and cash flows.

In September 2006, the FASB issued a new standard which defines fair value, establishes a framework for measuring fair value in U.S. GAAP, and expands the disclosure requirements regarding fair value measurements. The standard does not introduce new requirements mandating the use of fair value.

The new standard defines fair value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement

F-12

GREEKTOWN HOLDINGS, L.L.C.

(Debtor-In-Possession)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

date.” The definition is based on an exit price rather than an entry price, regardless of whether the entity plans to hold or sell the asset.

The topic also establishes presentation and disclosure requirements in order to facilitate comparisons between entities choosing different measurement attributes for similar types of assets and liabilities. This standard does not affect existing accounting requirements for certain assets and liabilities to be carried at fair value.

The Company adopted this standard as it relates to financial assets and liabilities on January 1, 2008, and as it relates to non-financial assets and liabilities on January 1, 2009. The adoption of this standard did not have a material impact on the Company’s consolidated financial statements.

In March 2008, the FASB issued a new pronouncement which seeks to enhance disclosure about how and why a company uses derivative and hedging activities, how derivative instruments and related hedged items are accounted for (and the interpretations of that topic) and how derivatives and hedging activities affect a company’s financial position, financial performance and cash flows. This standard is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. The adoption of this standard did not have a material impact on the Company’s consolidated financial statements.

In May 2009, the FASB issued a new standard regarding subsequent events which introduces the concept of financial statements being available to be issued. This standard is effective for fiscal years and interim periods beginning after June 15, 2009. During the second quarter of 2009, the Company adopted the provisions of the Subsequent Events topic of the ASC, which establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued. The adoption of the topic did not have a material impact on the Company’s consolidated financial position, results of operations or cash flows.

3. Petition for Relief Under Chapter 11

On May 29, 2008 (the “Petition Date”), the Company filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court, Eastern District of Michigan (the “Bankruptcy Court”). The Company sought protection under Chapter 11 of the United States Bankruptcy Code to allow the Company time to secure adequate funding to complete the Expanded Complex and to protect itself from a forced sale of Greektown Casino by the Michigan Gaming Control Board as provided in the Revised Development Agreement. The Restructuring Proceedings were initiated in response to the Company not meeting the loan covenants put in place by both the lenders and the Michigan Gaming Control Board. Curing these covenants would have required the equity owners of the Company to contribute capital far in excess of their financial strength. As a result, the Company sought protection under Chapter 11 to stay the potential forced sale, and allow it to obtain the financing required to preserve its going concern value for the benefit of all parties involved.

On June 9, 2008, Holdings and the Company entered into a $150 million DIP financing facility in order to finance the remainder of the Expanded Complex and provide funding for working capital and reorganization expenses. The DIP financing facility was amended and restated on February 20, 2009 to provide up to an additional $46 million in two delayed draw term loans and effectuate certain other modifications (see Note 6).

On August 26, 2009, the Debtors, together with their existing pre and post-petition lenders (the Debtor Plan Proponents), filed the Second Amended Joint Plans of Reorganization Pursuant to Chapter 11 of the United States Bankruptcy Code (the “Debtor Plan”) and the Second Amended Disclosure Statement for Joint Plans of Reorganization Pursuant to Chapter 11 of the United States Bankruptcy Code (the “Disclosure Statement”). On September 3, 2009, the Bankruptcy Court approved the Disclosure Statement. On November 2, 2009, certain of the holders of the Senior

F-13

|

GREEKTOWN HOLDINGS, L.L.C. |

(Debtor-In-Possession) |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) |

Notes due 2013 issued by Holdings and Holdings II, together with certain of the pre-petition secured lenders (the “Noteholder Plan Proponents”) filed a alternative plan of reorganization with the Bankruptcy Court (the “Noteholder Plan”). The Noteholder Plan was confirmed by the Bankruptcy Court on January 22, 2010, and, pursuant to the terms of the Noteholder Plan, must become effective, upon the occurrence of the conditions precedent to such effectiveness, on or before June 30, 2010. Conditions precedent to the occurrence of the effective date of the Noteholder Plan include receipt from the MGCB and the City of Detroit of all required regulatory approvals and consents. Upon the effective date of the Noteholder Plan, among other things, the DIP Lenders and the Pre-Petition Secured Lenders shall be paid, and certain of the Noteholder Plan Proponents shall own the equity of the Reorganized Greektown. Pursuant to a stipulation entered into among the Noteholder Plan Proponents and the Debtor Plan Proponents, the Debtor Plan is currently being held in abeyance pending the occurrence of the effective date of the Noteholder Plan.

On December 29, 2009, the Company entered into a new $210 million DIP facility, which refinanced the amended and restated DIP facility dated February 20, 2009 and provided funding for working capital and the costs associated with the Company’s reorganization (see Note 6).

Under Chapter 11, certain claims against the Company in existence prior to the filing of the petitions for relief under the federal bankruptcy laws are stayed while the Company continues business operations as DIP. These claims are reflected in the consolidated balance sheet as “pre-petition payables” and “pre-petition amounts due to related parties.” These amounts represent the Company’s estimate of known or potential prepetition claims and related post-petition interest to be resolved in connection with the Restructuring Proceedings. Such claims remain subject to future adjustments. Future adjustments may result from (i) negotiations; (ii) actions of the Bankruptcy Court, or the actions of the Debtors or Reorganized Debtors pursuant to the Noteholder Plan, assuming the Noteholder Plan becomes effective; (iii) further developments with respect to disputed claims; (iv) rejection of executory contracts; (v) the determination as to the value of any collateral securing claims; (vi) proofs of claim; or (vii) other events. Payment terms for these claims will be established in connection with the Restructuring Proceedings, including in connection with the Noteholder Plan, if it becomes effective.

Chapter 11 related reorganization expenses in the consolidated statement of operations consist of legal and financial advisory fees resulting from or related to the bankruptcy proceedings.

4. Property, Building, and Equipment

Property, building, and equipment and related depreciable lives as of December 31, 2009 and 2008, were as follows (in thousands):

| | | | | | | | | | |

| | December 31 | | | | |

| |

| | Depreciable

Lives | |

| | 2009 | | 2008 | | |

| |

| |

| |

| |

Land | | $ | 104,391 | | $ | 104,391 | | | — | |

Gaming building and improvements | | | 151,506 | | | 136,865 | | | 3–35 years | |

Gaming equipment and furnishings | | | 62,983 | | | 59,772 | | | 3–5 years | |

Nongaming buildings and improvements | | | 253,913 | | | 70,968 | | | 39 years | |

Nongaming office furniture and equipment | | | 43,914 | | | 28,208 | | | 5–7 years | |

Construction in progress | | | 8,560 | | | 183,910 | | | — | |

| |

|

| |

|

| | | | |

| | | 625,267 | | | 584,114 | | | | |

Less accumulated depreciation and amortization | | | 152,996 | | | 135,529 | | | | |

| |

|

| |

|

| | | | |

Property, building, and equipment, net | | $ | 472,271 | | $ | 448,585 | | | | |

| |

|

| |

|

| | | | |

F-14

|

GREEKTOWN HOLDINGS, L.L.C. |

(Debtor-In-Possession) |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) |

Certain costs incurred relate to the development and construction of the Expanded Complex, in accordance with the terms of the Revised Development Agreement. These costs are capitalized, and depreciation commenced in February 2009, when the Expanded Complex opened.

5. Casino Development Rights and Impairment

In accordance with the Revised Development Agreement, Greektown Casino is authorized to own and operate on a permanent basis, within certain boundaries in the City, a casino complex containing specified amenities. Under the terms of the Revised Development Agreement:

| | |

| (a) | Greektown Casino agreed to pay the City $44 million in installment payments (the “Installment Payments”), and contributed certain investment assets. |

| | |

| (b) | Greektown Casino was required to maintain standby letters of credit, totaling $49,360,000, to secure principal and interest payments on certain bonds issued by the Economic Development Corporation of the City (the “EDC”); however, these letters of credit were called by the EDC in June 2008 as a result of the Chapter 11 Bankruptcy filing (see Note 13). |

| | |

| (c) | Greektown Casino signed an indemnity agreement with the City and the EDC with respect to certain matters. Payments made under this indemnity agreement plus liabilities accrued, resulted in capitalizing costs of $32,047,000 at December 31, 2009 and 2008, respectively. |

| | |

| This amount includes the costs to settle a lawsuit as more fully described in Note 13. |

| | |

| (d) | Greektown Casino contributed to the City its one-third interest, with a cost basis of $2,833,000, in Jefferson Casino, LLC. |

The Installment Payments, EDC payments, payments under the indemnity agreement and lawsuit settlement, and the contribution of the ownership interest in Jefferson Holdings, LLC gave rise to an identifiable intangible asset, Casino Development Rights, in the amount of $128,240,000, which under the terms of the Development Agreement, have an indefinite life.

The Company’s last license was renewed on December 14, 2007 and the annual renewal period expired on December 14, 2008 and its renewal is currently held in abeyance by the Michigan Gaming Control Board pending the Company’s bankruptcy reorganization.

Goodwill and indefinite-lived intangible assets must be reviewed for impairment at least annually or more frequently if impairment indicators are present. The Company performs its annual impairment test for Casino Development Rights as of October 1 of each fiscal year. In the fourth quarter of 2008, in connection with the preparation of the Company’s financial statements, management determined it was necessary to revise its assumptions and perform an interim impairment test of the Casino Development Rights intangible asset at December 31, 2008 due to several factors, which included (i) the uncertainty in the gaming market, (ii) continued uncertainty around the Company’s bankruptcy filing, and (iii) the recent and ongoing deterioration in the local and national economies.

Given the uncertainties in the gaming markets, coupled with the Company’s bankruptcy filing, management determined that the Casino Development Rights of the Company were fully impaired. Accordingly, during the fourth quarter of 2008, the Company impaired this asset in its entirety based on a discounted cash flow analysis. As a result, the Company recorded an impairment charge of $128,240,000 in the statement of operations for the year ended December 31, 2008.

6. Long-Term Debt, Notes Payable, and Debtor in Possession Financing

The Company entered into a financing agreement on December 2, 2005 that provided for a $190 million term loan and a $100 million revolving credit facility, to finance the payment for Greektown Casino’s existing credit facilities that were expiring. Effective April 2007, the Company’s

F-15

|

GREEKTOWN HOLDINGS, L.L.C. |

(Debtor-In-Possession) |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) |

existing five-year revolving credit facilities (including letter-of-credit facilities) were increased to $125,000,000, expiring December 2010. The funds received by the Company under these credit facilities were advanced to Greektown Casino under the following terms:

| | |

| • | Seven-year maturity for the original long-term indebtedness and five-year maturity for revolving credit facility. |

| | |

| • | Quarterly amortization of $475,000, beginning on December 31, 2006 through December 31, 2011; thereafter, quarterly amortization payments of one-fourth the remaining outstanding amount for each of the four quarters beginning on March 31, 2012. As a result of the bankruptcy filing, these amortization payments have been stayed. |

| | |

| • | Interest payments are payable monthly or quarterly, at a rate equal to, at the Company’s option: (i) for a base rate loan, (a) the greater of (I) the rate of interest then most recently established by the administrative agent (Merrill Lynch Capital Corporation) in New York, New York, as its base rate for U.S. dollars loaned in the United States, and (II) the federal funds rate plus 0.50%, plus (b) a margin based on the ratio of total net senior debt to Earnings Before Interest Taxes Depreciation and Amortization (“EBITDA”) (1.50% or 1.75%) or (ii) for a LIBOR loan, LIBOR plus a margin based on the ratio of total net senior debt to EBITDA (2.50% or 2.75%). The margins mentioned above have been increased by 2% as a result of the bankruptcy filing. |

| | |

| • | Interest rate swap agreement with notional amount of $70 million, as more fully described below. |

The funds received and outstanding from the financing agreement are considered secured debt in default. As of December 31, 2009 and 2008, outstanding secured debt in default, along with the interest rates associated with such funds, consists of the following:

| | | | | | | | | | | | |

Amount of Obligation | | | Interest Rate Structure | | | Rate of

Interest | |

| | |

| | |

| |

December 31 | | | | | |

| | | | | |

2009 | | 2008 | | | | | |

| |

| | | | | |

(In Thousands) | | | | | |

$ | 172,157 | | $ | 160,561 | | BASE RATE + 3.250% | | | 7.00 | % |

| 34,370 | | | 32,054 | | BASE RATE + 3.250% | | | 7.00 | % |

| 135,527 | | | 126,717 | | BASE RATE + 3.000% | | | 6.75 | % |

|

| |

|

| | | | | | |

$ | 342,054 | | $ | 319,332 | | | | | | |

|

| |

|

| | | | | | |

On June 9, 2008, Holdings and the Company entered into a $150 million debtor-in-possession financing facility (the “DIP Financing”) in order to finance the remainder of the Expanded Complex and provide funding for working capital and reorganization expenses. The DIP Financing included a delayed draw term loan agreement for $135 million and a revolving credit facility for $15 million. There were strict guidelines as to how these funds would be used and were required to be approved and monitored by the U.S. Trustee as well as the MGCB.

The funds from the delayed draw term loan facility were only for construction related expenditures, while the funds from the revolving credit facility could be used to pay operational and construction related expenses.

F-16

|

GREEKTOWN HOLDINGS, L.L.C. |

(Debtor-In-Possession) |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) |

As of December 31, 2008, the Company’s obligations, as they related to the DIP Financing, and the interest rates on these obligations are set forth below:

| | | | | | | | | |

Amount of Obligation | | | Interest Rate Structure | | | Rate of

Interest | |

| | |

| | |

| |

(In Thousands) | | | | | | | |

$ | 115,134 | | BASE + 5.25% payable monthly | | | 8.50 | % |

| 15,000 | | BASE + 5.25% payable monthly | | | 8.50 | % |

|

| | | | | | |

$ | 130,134 | | | | | | |

|

| | | | | | |

The DIP Financing was amended and restated on February 20, 2009 (the “Amended DIP Financing”) to provide up to an additional $46 million in two delayed draw term loans. There were strict guidelines as to how these additional funds could be used and had to be approved and monitored by the U.S. Trustee as well as the MGCB. Of the funds received from the two delayed draw term loans, $26 million could only be used for construction related expenses, while up to $20 million of the remaining commitment could be used to pay operational and construction related expenses and was available to the Company in increments upon achieving certain milestones as set forth in the agreement.

In addition to providing additional borrowings, the Amended DIP Financing adjusted the rate of interest on the delayed draw term loan and revolving credit facility as provided by the original DIP Financing from the base rate plus 5.25% per annum to the base rate plus 7.25% per annum. The interest rate applicable to the additional delayed draw term loans was the base rate plus 5.25%. The Amended DIP Financing restated the covenant requirements which the Company must comply with under the terms of the agreement.

The Amended DIP Financing also set forth an additional Paid-in-Kind interest (“PIK”) amount that was accrued and added to the then outstanding DIP Financing. The PIK was 5% of the outstanding amount of the original DIP Financing and had the same maturity date as the DIP Financing.

On December 29, 2009 the Company executed the Senior Secured Superpriority Debtor-in-Possession credit agreement (the “New DIP Credit Facility”), which provides maximum aggregate principal of $210 million. The New DIP Credit Facility consists of a $190 million Term A loan and a $20 million delayed draw term loan; the interest rate associated with these borrowings is 14.50% of which 11% is cash interest and 3.50% is PIK. Under the terms of the New DIP Credit Facility, the Term A Loan was utilized to fund the repayment in full of the DIP Credit Facility and the Amended DIP Credit Facility, while the delayed draw term loan may be used for operational needs. As of December 31, 2009 the Company was fully extended on the Term A Loan and had $20 million available to it under the delayed draw term loan. The PIK interest accrued at December 31, 2009 totaled $37,000.

The New DIP Credit Facility contains covenants including limitations on additional indebtedness, capital expenditures, mergers or acquisitions, dispositions of assets, loans and advances, and transactions with affiliates. Further, the Agreement requires the Company to maintain specific financial ratios including monthly minimum earnings before interest, taxes, depreciation, amortization, and restructuring costs (EBITDAR), as defined in the New DIP Credit Facility. At December 31, 2009, the Company was in compliance with the various covenants of the New DIP Credit Facility.

F-17

|

GREEKTOWN HOLDINGS, L.L.C. |

(Debtor-In-Possession) |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) |

As of December 31, 2009, the Company’s obligations, as they relate to the New DIP Credit Facility and the interest rates on these obligations are set forth below:

| | | | | | |

Amount of Obligation | | | Rate of Interest | | |

| | |

| | |

(In Thousands) | | | | | |

$ | 190,037 | | 11.00% fixed rate payable quarterly; 3.50% PIK | |

|

| | | |

$ | 190,037 | | | |

|

| | | |

As security for the term loan and any amounts owing under the revolving credit facility, the Company has pledged its 100% equity interest in Greektown Casino.

Further, Greektown Casino also assigned a security interest in all of its assets as collateral for the above agreements, and has guaranteed repayment of these borrowings.

Except as permitted under the terms of the New DIP Credit Facility and other existing credit facilities, the Company will not be permitted to incur any other indebtedness.

Unsecured Notes

The Company also issued $185,000,000 in unsecured notes in December 2005 to finance its operations and meet its liability and equity commitments. The maturity date of the notes is December 1, 2013. As a result of the Chapter 11 filing the notes became unsecured pre-petition liabilities subject to compromise. Upon effectiveness of the Noteholder Plan, it is anticipated that the notes will be cancelled (See Note 3).

Effective January 19, 2006 and September 28, 2007, Holdings entered into interest rate swap agreements with notional amounts of $195 million and $70 million, respectively. The purpose of these interest rate swaps was to manage the cash flows related to well-defined interest rate costs and the risk associated with variable rate debt. These financial instruments were terminated as a result of the Chapter 11 filing. On the date of termination, the liabilities under the swap agreements became fixed at $9,270,000 related to the $195 million interest rate swap agreement and $2,750,000 related to the $70 million interest rate swap agreement and were included in liabilities not subject to compromise. Interest on these obligations is recorded in accrued expenses and other liabilities and monthly interest is accrued at an 8.5% interest rate.

7. Leases

Greektown Casino entered into a non-cancelable operating lease for warehouse space; however, this agreement expired during May 2009, and the new agreement includes a thirty (30) day cancellation clause. Rental expense under these agreements for the years ended December 31, 2009, 2008, and 2007, was $80,000, $423,000, and $2,662,000, respectively. Greektown Casino also subleases certain portions of its owned or leased facilities under noncancelable operating leases. Rental income under these leases for the years ended December 31, 2009, 2008, and 2007 was $506,000, $660,000, and $778,000, respectively.

In addition, during 2007 Greektown Casino entered into a settlement agreement with the lessor of a parking garage whereby Greektown Casino agreed to pay $2.25 million related to lease restoration costs; this amount was recorded as an expense during 2007, and the related liability is recorded in pre-petition payables subject to compromise at December 31, 2009 and 2008.

F-18

|

GREEKTOWN HOLDINGS, L.L.C. |

(Debtor-In-Possession) |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) |

At December 31, 2009, future minimum rental payments required under noncancelable operating leases, with initial or remaining lease terms in excess of one year and lease and sublease income were as follows:

| | | | | | | |

| | Capital

Lease

Payments | | Lease and

Sublease

Income | |

| |

|

| |

|

| |

Periods ending December 31: | | | | | | | |

2010 | | $ | 336 | | $ | 446 | |

2011 | | | 336 | | | 428 | |

2012 | | | 336 | | | 319 | |

2013 | | | 336 | | | 319 | |

2014 | | | 336 | | | 265 | |

Thereafter | | | 7,364 | | | 1,993 | |

| |

|

| |

|

| |

| | | 9,044 | | $ | 3,770 | |

| | | | |

|

| |

| | | | | | | |

Less amount representing interest | | | 8,258 | | | | |

| |

|

| | | | |

Present value of net minimum capital lease payments | | | 786 | | | | |

Less current installments of obligation under a capital lease | | | — | | | | |

| |

|

| | | | |

| | $ | 786 | | | | |

| |

|

| | | | |

Certain of the leases include escalation clauses relating to the consumer price index, utilities, taxes, and other operating expenses. Greektown Casino will receive additional rental income in future years based on those factors that cannot be estimated currently.

8. Related-Party Transactions

The Company and Greektown Casino have entered into certain business transactions with individuals or entities related to the ownership of direct or indirect member interests. Under the provisions of their internal control system, expenditures to any one related party in excess of $50,000 annually must be approved by the Company’s management board.

For the years ended December 31, 2009, 2008, and 2007 payments to related parties, other than financing-related activities and member distributions, totaled approximately $8,926,000, $2,136,000, and $784,000, respectively.

Greektown Casino entered into a management services agreement with the Sault Ste. Marie Tribe of Chippewa Indians (the “Tribe”), a related entity to Kewadin, Monroe, and the Company, which required the Greektown Casino to pay a base management fee of $110,000 per month, as well as the reimbursement of travel, lodging, and out-of-pocket expenses incurred and all reasonable salary costs and fringe benefit expenses of key personnel who are providing such contracted services. This agreement was rejected by the Debtors in the restructuring proceedings. As such, these payments were discontinued, however, the pre-petition amount owed to the Tribe as of December 31, 2009 and 2008 is $550,000, which is classified as liabilities subject to compromise.

In November 2007, Kewadin made a $35 million equity contribution to the Company to cure non-compliance with certain financial covenants under the Company’s pre-petition credit facility. Additionally, Kewadin made equity contributions of approximately $600,000, $10 million and $1.5 million to Greektown Holdings for construction fees related to the construction of the Expanded Complex in January 2008, March 2008, and May 2008, respectively.

Greektown Casino periodically enters into certain business transactions with persons related to the direct or indirect ownership of their member interests. Since 2007, Greektown Casino has entered into the following related person transactions:

F-19

|

GREEKTOWN HOLDINGS, L.L.C. |

(Debtor-In-Possession) |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) |

| | |

| • | Greektown Casino has entered into various transactions with New Millennium Advisors, LLC to purchase uniforms used in the operation of Greektown Casino (e.g., uniforms for dealers, kitchen staff, security, etc.) which totaled approximately $1,000, $83,000 and $129,000 for the years ended December 31, 2009, 2008, and 2007, respectively. New Millennium Advisors, LLC is owned, in whole or in part, by Marvin Beatty, a former director of Holdings and Greektown Casino and current member of Monroe. |

| | |

| • | Customers of Greektown Casino have the ability to earn food complimentaries (comps) for use at Fishbones, an upscale seafood restaurant located near Greektown Casino. Greektown reimburses Fishbones at a discounted rate for the costs to Fishbones for providing food to customers redeeming the comps. Greektown LLC expenses with respect to the Fishbones comps totaled approximately $672,000, $1 million, and $0 for the years ended December 31, 2009, 2008, and 2007, respectively. Fishbones is owned in part by Ted Gatzaros, a former director of Greektown LLC and current member of Monroe. |

| | |

| • | Customers of Greektown have the ability to earn hotel comps for use at the Atheneum Suite Hotel at a discounted rate for the costs to the hotel for providing lodging to customers redeeming the comps. Greektown LLC expenses with respect to the Atheneum Suite Hotel complimentaries totaled approximately $169,000, $306,000, and $0 for the years ended December 31, 2009, 2008, and 2007, respectively. The Atheneum Suite Hotel is owned in part by Ted Gatzaros, a former director of Greektown Casino and current member of Monroe. |

Randall A. Fine, who was the Chief Executive Officer until December 31, 2009, is the Managing Director of the Fine Point Group. Greektown Casino and the Fine Point Group entered into the Consulting Agreement (as subsequently defined) as of December 31, 2008 (See Note 11).

Accounts receivable—other includes $298,000 as of December 31, 2009 and 2008, for the amounts due from Monroe, a member of the Company.

9. Members’ Deficit

When it was formed in September 2005, Holdings’ interest in Greektown Casino was transferred to Holdings by the two owners. Consistent with their former ownership interests in Greektown Casino, Kewadin and Monroe each own a 50% interest in Holdings. The transactions involving a substitution of Holdings for the members’ interests in Greektown Casino have been considered as transactions between common control entities, and therefore have been accounted for at carrying value.

As part of this ownership transaction, the member agreement among Kewadin, Monroe, and Greektown Holdings became the member agreement among Kewadin, Monroe, and the Company.

During the years ended December 31, 2009, 2008, and 2007, a member of the Company made equity contributions totaling $0, $12,100,000, and $35,000,000, respectively, to the Company. The 2008 contributions were made in the first and second quarter, and all contributions were made before the Chapter 11 filing.

10. Gaming Taxes and Fees

Under the provisions of the Michigan Gaming Control and Revenue Act (the “Act”), casino licensees are subject to the following gaming taxes and fees on an ongoing basis:

| | |

| • | An annual licensing fee; |

| | |

| • | An annual payment, together with the other two casino licensees, of all MGCB regulatory and enforcement costs. Greektown Casino was assessed $10,233,000, $10,003,000, and $9,826,000, for its portion of the annual payment for the years ended December 31, 2009, 2008, and 2007, respectively; |

F-20

|

GREEKTOWN HOLDINGS, L.L.C. |

(Debtor-In-Possession) |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) |

| | |

| • | A wagering tax, calculated based on adjusted gross gaming receipts, payable daily, of 24% (the Act also provides for certain increases in the wagering tax if Greektown Casino’s Expanded Complex facilities are not operational from and after July 1, 2009, and a reduction in that tax once they are operational); and, |

| | |

| • | A municipal services fee in an amount equal to the greater of 1.25% of adjusted gross gaming receipts or $4 million annually. |

These gaming taxes and fees are in addition to the taxes, fees, and assessments customarily paid by business entities conducting business in the State of Michigan and the City and amounted to $75,635,000, $83,116,000, and $89,596,000, for the years ended December 31, 2009, 2008, and 2007, respectively.

Effective January 1, 2006, the Company has also been required to pay a daily fee to the City of 1% of adjusted gross receipts, increasing to 2% of adjusted gross receipts if adjusted gross receipts exceed $400 million in any one calendar year. Additionally, if and when adjusted gross receipts exceed $400 million, the Company will be required to pay $4 million to the City. The Company’s adjusted gross receipts did not exceed $400 million during the calendar years 2009, 2008, or 2007.

The Act, was amended in 2004 to increase the wagering tax rate for the three Detroit casinos from 18% of adjusted gross receipts to 24% of adjusted gross receipts. If the MGCB determines that (1) the licensee has been “fully operational” for 30 consecutive days and (2) the licensee has been in compliance with its Revised Development Agreement for at least 30 consecutive days, then the MGCB is required to certify the licensee and the tax rate will revert to a 1% increase only, resulting in a tax rate for Greektown of 19% of adjusted gross receipts (the “Tax Rollback”).

Greektown was “fully operational” and had complied with the first requirement (fully operational for 30 consecutive days) on March 17, 2009. “Fully operational” is defined in the Gaming Act as follows: “a certificate of occupancy has been issued to the casino licensee for the operation of a hotel with not fewer than 400 guest rooms and, after issuance of the certificate of occupancy, the casino licensee’s casino, casino enterprise and 400-guest room hotel have been opened and made available for public use at their permanent location and maintained in that status.” MCL 432.212(15)(a). Greektown received a temporary certificate of occupancy on the 400 guest room hotel on February 6, 2009, and opened all of the 400 guest rooms to the public on February 15, 2009.

The Company also has met the second requirement, that it had been in compliance with the Development Agreement for 30 consecutive days, however, the City had asserted that it did not believe Greektown was in compliance with the Development Agreement.

On October 9, 2009, the Debtors filed a motion with the Bankruptcy Court to approve a settlement agreement (the “Settlement Agreement”) with the City, which resolved all disputes with the City. The Bankruptcy Court approved the Settlement Agreement on February 22, 2010, which reached a resolution of all disputes with the City. The Settlement Agreement provides, among other things:

| | |

| • | The City should use its best efforts to support the Debtors efforts in obtaining the Tax Rollback effective as of February 15, 2009 before the MGCB (which was subsequently obtained on March 9, 2010); |

| | |

| • | The Debtors should pay the City a settlement amount in the aggregate of $16,629,000 (the “Settlement Payment”), less certain credits described below, subject to the following provisions: (i) the Debtor should pay initial cash payment of $3.5 million (the “Initial Cash Payment”) within two business days after entry of an order by the Bankruptcy court approving the Settlement Agreement; (ii) a credit should be applied to reduce the Settlement Payment in an amount equal to the difference between (a) the amount of gaming taxes actually paid to the City between February 15, 2009 and February 15, 2010 and (b) the |

F-21

|

GREEKTOWN HOLDINGS, L.L.C. |

(Debtor-In-Possession) |

|

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) |

| | |

| | amount of gaming taxes that would have been paid through the date of the settlement to the City had the Tax Rollback been effective as of February 15, 2009); and (iii) the Debtors should pay a final cash amount of $9,600,000 (“Final Cash Payment”), which is the remaining amount of Settlement Payment after the Initial Cash Payment and the application of the credit described above. |

| | |

| • | Upon the receipt of the Final Cash Payment, the City should be deemed to have dismissed and waived any and all claims of default under the Development Agreement; |

| | |

| • | The City should cease its demand for a 1% tax increase due to the delayed completion of the Expanded Complex; |

| | |

| • | The City should consent to the transfer of the ownership of the Greektown Casino and the Development Agreement to the reorganized Debtors in accordance with the Plan; and |

| | |

| • | The City should take actions to dismiss all related litigation. |

The Settlement Agreement was conditioned upon (i) approval of the Settlement Agreement by the Bankruptcy Court, which was obtained on February 22, 2010; and (ii) final approvals of the Settlement Agreement from various offices of the City, which was obtained on February 24, 2010.

On March 9, 2010, the Michigan Gaming Control Board certified that the casino was in compliance with the development agreement as of February 15, 2009 and as such was entitled to a tax adjustment retroactive to February 15, 2009. As a result of the retroactive adjustment, the Company recorded a receivable from the State of Michigan for approximately $12.3 million at December 31, 2009.

On December 11, 2007, the Company entered into an Acknowledgement of Violation (“AOV”) with the Michigan Gaming Control Board. The AOV included four complaints addressing procurement, kiosks, electronic gaming device meters, and signage. Under the terms of the AOV, a total fine of $750,000 was assessed, of which $300,000 was immediately payable and $450,000 would not be an obligation unless the Company commits further violation for three years. The Company recorded the $300,000 as expense during 2007. The remaining amount has not been recorded as no further violations occurred during the years ended December 31, 2009 and 2008.

11. Commitments and Contingencies

Millennium Management Group LLC (“Millennium”) was previously retained to provide the Company with certain consulting services related to the operation of the casino for a period through November 30, 2010, $1 million was paid for the year ended December 31, 2007 under the terms of this agreement. During 2008, a motion was filed with the U.S. Bankruptcy Court to reject the contract and the motion was granted by the bankruptcy judge.

In 2009, the Company entered into a consulting agreement with the Fine Point Group (the “Consultants”) as required by the bankruptcy court. The Consultants received a fixed fee of $150,000 per month plus expenses.

The Consultants also received a success fee, which was calculated on a quarterly basis, based on preset EBITDAR numbers.

F-22

GREEKTOWN HOLDINGS, L.L.C.

(Debtor-In-Possession)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The table below shows the budgeted EBITDAR numbers that were required to be attained in order to receive the success fee:

| | | | | | | |

| | A | | B | |

| |

| |

| |

Quarter ended: | | | | | | | |

03/31/09 | | $ | 9,436,000 | | $ | 11,534,000 | |

06/30/09 | | | 11,058,000 | | | 13,515,000 | |

09/30/09 | | | 10,688,000 | | | 13,063,000 | |

12/31/09 | | | 13,818,000 | | | 16,888,000 | |

| |

|

| |

|

| |

| | $ | 45,000,000 | | $ | 55,000,000 | |

| |

|

| |

|

| |

For any calendar quarter during 2009, the success fee was equal to: (i) 10% of the amount by which actual quarterly EBITDAR exceeds the amount referenced in column A for the corresponding quarter, up to the amount referenced in column B; plus (ii) 30% of the amount by which actual quarterly EBITDAR exceeds the amount referenced in column B for the corresponding quarter. For purposes of calculating EBITDAR, the fees earned by and owing to the consultants, including all out of pocket expenses reimbursed to the Consultants, shall be included as expenses. For the year ended December 31, 2009, expenses related to the consulting agreement with the Fine Point Group consisted of the following: success fees of $6,240,000, fixed fees of $1,725,000 and expenses of $434,000. The Consultants’ agreement expired as of December 31, 2009 and was not renewed.

During the construction period, the Company entered into several agreements with various vendors providing goods and services related to the development of the Expanded Complex. As of December 31, 2009, there were no material commitments related to construction of the Expanded Complex.

The Company is a defendant in various pending litigation. In management’s opinion, the ultimate outcome of such litigation will not have a material adverse effect on the results of operations or the financial position of the Company.

The Revised Development Agreement also provides that should a triggering event as defined, occur, the Company must sell its assets, business, and operations as a going concern at their fair market value to a developer named by the City.

12. Selected Quarterly Financial Data (unaudited)

The following tables present selected quarterly financial information for the years ended December 31, 2009 and 2008.

| | | | | | | | | | | | | |

| | 2009 Quarter Ended | |

| |

| |

| | March 31 | | June 30 | | September 30 | | December 31 | |

| |

| |

| |

| |

| |

| | (In Thousands) | |

Net revenues | | $ | 78,568 | | $ | 85,500 | | $ | 86,272 | | $ | 81,265 | |

Operating expenses | | | 66,180 | | | 69,445 | | | 72,981 | | | 76,833 | |

Income from operations | | | 12,388 | | | 16,055 | | | 13,291 | | | 4,432 | |

Net loss | | | (10,208 | ) | | (10,902 | ) | | (15,997 | ) | | (28,837 | ) |

| | | | | | | | | | | | | |

| | 2008 Quarter Ended | |

| |

| |

| | March 31 | | June 30 | | September 30 | | December 31 | |

| |

| |

| |

| |

| |

| | (In Thousands) | |

Net revenues | | $ | 80,538 | | $ | 72,887 | | $ | 69,100 | | $ | 64,203 | |

Operating expenses | | | 65,590 | | | 60,474 | | | 58,250 | | | 188,135 | |

Income (loss) from operations | | | 14,948 | | | 12,413 | | | 10,850 | | | (123,932 | ) |

Net (loss) income | | | (3,626 | ) | | 929 | | | (9,643 | ) | | (140,568 | ) |

F-23

GREEKTOWN HOLDINGS, L.L.C.

(Debtor-In-Possession)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

13. Long-Term Payables to the City

Under the original Development Agreement among the Company, the City, and the EDC, the Company was required to provide letters of credit (“LOCs”) to support certain bonds issued by the EDC in connection with the acquisition and development of a proposed permanent casino site. Under the Revised Development Agreement, the Company was required to maintain its standby LOCs, totaling $49,928,000, recorded as a long-term payable for the year ended December 31, 2007, to secure principal and interest payments on certain bonds issued by the EDC; however, the LOCs were redeemed as a result of the Chapter 11 Bankruptcy filing. On June 12, 2008, the EDC redeemed the LOCs for a total amount of $49,393,000 of which $49,360,000 was the payment of the principal amount and the $33,000 was accrued interest through eleven (11) days of June, which resulted in the retirement of the long-term payable to the City and effectively converted the balance to secured debt in default. The proceeds of the bonds were used to acquire land along the Detroit River, where the permanent casino facilities were initially proposed to be located. Under the Revised Development Agreement, the Company and the other Detroit casino developers will forgo their right to receive any of the land.

14. 401(k) Plan

Employees of the Company can participate in a 401(k) Plan (the “Plan”). For union employees, Greektown Casino shall make contributions to the Plan based on years of service. The total payments made and expense recognized under the Plan by the Company for the years ended December 31, 2009, 2008, and 2007 amounted to $1,606,000, $1,969,000, and $2,178,000, respectively. In December 2008, the Company terminated the matching contribution as it relates to salaried employees.

15. Lawsuit Settlement Obligation

A settlement agreement was reached in various lawsuits that were filed challenging the constitutionality of the Casino Development Competitive Selection Process Ordinance. As of December 31, 2009, payments totaling $17 million have been made against this settlement obligation. Additional payments required under the agreement include $1 million (inclusive of interest) annually for the next 24 years through 2031. As a result of the Chapter 11 filing the estimated settlement of $12,303,000 as of December 31, 2009 and 2008, is classified as “Liabilities Subject to Compromise” and no payments have been made in 2009.

F-24

Greektown Holdings, L.L.C.

(Debtor-In-Possession)

Condensed Consolidated Balance Sheets

(In Thousands)

| | | | | | | |

| | March 31,

2010 | | December 31,

2009 | |

| |

| |

| |

| | | (Unaudited) | | | | |

Assets | | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | | $ | 20,063 | | $ | 25,692 | |

Certificate of deposit | | | 531 | | | 530 | |

Accounts receivable – gaming, less allowance for doubtful accounts of $247 and $236 at March 31, 2010 and December 31, 2009, respectively | | | 3,270 | | | 3,603 | |

Accounts receivable – other, less allowance for doubtful accounts of $40 at March 31, 2010 and December 31, 2009 | | | 598 | | | 1,069 | |

Notes receivable | | | 2,000 | | | 2,460 | |

Inventories | | | 378 | | | 433 | |

State of Michigan gaming tax refundable | | | 13,068 | | | 12,328 | |

Prepaid expenses and other current assets | | | 20,096 | | | 19,498 | |

Current portion of financing fees | | | 5,002 | | | — | |

| |

|

| |

|

| |

Total current assets | | | 65,006 | | | 65,613 | |

| | | | | | | |

Property, building, and equipment, net | | | 470,024 | | | 472,271 | |

| | | | | | | |

Other assets: | | | | | | | |

Financing fees, net | | | 13,199 | | | 9,712 | |

Deposits and other assets | | | 30 | | | 30 | |

| | | | | | | |

| |

|

| |

|

| |

Total assets | | $ | 548,259 | | $ | 547,626 | |

| |

|

| |

|

| |

FQ-1

| | | | | | | |

| | March 31,

2010 | | December 31,

2009 | |

| |

| |

| |

| | (Unaudited) | | | |

Liabilities and members’ deficit | | | | | | | |

Current liabilities: | | | | | | | |

Debtor-in-possession financing | | $ | 191,723 | | $ | 190,037 | |

Secured debt in default | | | 348,974 | | | 342,054 | |

Accounts payable | | | 13,668 | | | 12,846 | |

Accrued City of Detroit settlement | | | 9,600 | | | 13,547 | |

Notes payable | | | 1,439 | | | 1,890 | |

Accrued expenses and other liabilities | | | 24,185 | | | 22,597 | |

| |

|

| |

|

| |

Total current liabilities not subject to compromise | | | 589,589 | | | 582,971 | |

| | | | | | | |

Long-term liabilities: | | | | | | | |

Obligation under capital lease | | | 786 | | | 786 | |

Deferred Michigan business tax, net | | | 2,333 | | | 2,370 | |

| |

|

| |

|

| |

Total long-term liabilities not subject to compromise | | | 3,119 | | | 3,156 | |

| | | | | | | |

Liabilities subject to compromise: | | | | | | | |

Long-term debt and notes payable | | | 185,000 | | | 185,000 | |

Pre-petition payables | | | 12,334 | | | 12,334 | |

Pre-petition accrued interest | | | 9,944 | | | 9,944 | |

Accrued interest subject to compromise | | | 36,460 | | | 31,489 | |

Pre-petition amounts due to parent | | | 1,350 | | | 1,350 | |

Lawsuit settlement obligation | | | 12,303 | | | 12,303 | |

| |

|

| |

|

| |

Total liabilities subject to compromise | | | 257,391 | | | 252,420 | |

| |

|

| |

|

| |

| | | | | | | |

Total liabilities | | | 850,099 | | | 838,547 | |

Contributed capital | | | 47,588 | | | 47,588 | |

Accumulated deficit | | | (349,428 | ) | | (338,509 | ) |

Total members’ deficit | | | (301,840 | ) | | (290,921 | ) |

| |

|

| |

|

| |

Total liabilities and members’ deficit | | $ | 548,259 | | $ | 547,626 | |

| |

|

| |

|

| |

The accompanying notes are an integral part of these condensed consolidated financial statements.

FQ-2

Greektown Holdings, L.L.C.

(Debtor-In-Possession)

Condensed Consolidated Statements of Operations

(In Thousands)

| | | | | | | |

| | Three-Month Period Ended

March 31, | |

| | 2010 | | 2009 | |

| |

|

|

| |

| | (Unaudited) | |

Revenues | | | |

Casino | | $ | 88,168 | | $ | 78,572 | |

Food and beverage | | | 6,229 | | | 4,919 | |

Hotel | | | 2,192 | | | 751 | |

Other | | | 1,233 | | | 1,152 | |

| |

|

| |

|

| |

Total revenues | | | 97,822 | | | 85,394 | |

Less promotional allowances | | | 11,742 | | | 6,826 | |

| |

|

| |

|

| |

Net revenues | | | 86,080 | | | 78,568 | |

| | | | | | | |

Operating expenses | | | | | | | |

Casino | | | 19,373 | | | 18,389 | |

Gaming taxes | | | 19,618 | | | 21,500 | |

Food and beverage | | | 3,914 | | | 3,988 | |

Hotel | | | 2,087 | | | 819 | |

Marketing, advertising and entertainment | | | 2,075 | | | 1,038 | |

Facilities | | | 4,786 | | | 4,862 | |

Depreciation and amortization | | | 5,217 | | | 2,579 | |

General and administrative expenses | | | 10,896 | | | 10,238 | |

Other | | | 52 | | | 151 | |

Pre-opening expenses | | | — | | | 1,043 | |

Consulting company success fee | | | — | | | 1,572 | |

| |

|

| |

|

| |

Operating expenses | | | 68,018 | | | 66,179 | |

| |

|

| |

|

| |

Earnings before reorganization items | | | 18,062 | | | 12,389 | |

| | | | | | | |

Chapter 11 related reorganization items | | | (8,106 | ) | | (5,764 | ) |

| | | | | | | |

Other income (expense) | | | | | | | |

Interest expense | | | (18,815 | ) | | (13,382 | ) |

Amortization of finance fees and accretion of discount on senior notes | | | (1,039 | ) | | (3,805 | ) |

Miscellaneous income (expense) | | | (298 | ) | | 154 | |

| |

|

| |

|

| |

Total other expenses | | | (20,152 | ) | | (17,033 | ) |

| |

|

| |

|

| |

Loss before provisions for state income taxes | | | (10,196 | ) | | (10,408 | ) |

| | | | | | | |

Michigan business tax (expense)/benefit | | | (723 | ) | | 201 | |

| |

|

| |

|

| |

Net loss | | $ | (10,919 | ) | $ | (10,207 | ) |

| |

|

| |

|

| |

I. The accompanying notes are an integral part of these condensed consolidated financial statements.

FQ-3

Greektown Holdings, L.L.C.

(Debtor-In-Possession)

Condensed Consolidated Statements of Cash Flows

(In Thousands)

| | | | | | | |

| | Three-Month Period Ended

March 31, | |

| | 2010 | | 2009 | |

| |

|

|

| |

| | (Unaudited) | |

Operating activities | | | | | | | |

Net loss | | $ | (10,919 | ) | $ | (10,207 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | |

Depreciation and amortization | | | 5,217 | | | 2,579 | |

Amortization of financing fees and accretion of discount on senior notes | | | 1,039 | | | 3,805 | |

Accrued PIK interest | | | 8,606 | | | 781 | |

Deferred Michigan business tax | | | (37 | ) | | (401 | ) |

Changes in current assets and liabilities: | | | | | | | |

Accounts receivable – gaming | | | 333 | | | (136 | ) |

Accounts receivable – other | | | 471 | | | (393 | ) |

State of Michigan gaming tax refundable | | | (740 | ) | | — | |

Inventories | | | 55 | | | 79 | |

Prepaid expenses and other current assets | | | (931 | ) | | 440 | |

Notes receivables | | | 460 | | | (30 | ) |

Accounts payable | | | 10,099 | | | 6,906 | |

City of Detroit settlement | | | (3,947 | ) | | — | |

Accrued expenses, interest, and other liabilities | | | 6,559 | | | 12,844 | |

| |

|

| |

|

| |

Net cash provided by operating activities before reorganization items | | | 16,265 | | | 16,267 | |

Operating cash flows for reorganization items | | | (9,276 | ) | | (4,878 | ) |

| |

|

| |

|

| |

Net cash provided by operating activities | | | 6,989 | | | 11,389 | |

| | | | | | | |

Investing activities | | | | | | | |

Capital expenditures | | | (2,970 | ) | | (21,945 | ) |

Investment in certificate of deposit | | | (1 | ) | | (3 | ) |

| |

|

| |

|

| |

Net cash used in investing activities | | | (2,971 | ) | | (21,948 | ) |

| | | | | | | |

Financing activities | | | | | | | |

Proceeds from borrowings under DIP Financing and Amended DIP Financing | | | — | | | 21,904 | |

Payments on notes payable | | | (452 | ) | | (2,498 | ) |

Financing fees paid | | | (9,195 | ) | | (7,435 | ) |

| |

|

| |

|

| |

Net cash provided by (used in) financing activities | | | (9,647 | ) | | 11,971 | |

| |

|

| |

|

| |

| | | | | | | |

Net increase (decrease) in cash and cash equivalents | | | (5,629 | ) | | 1,412 | |

Cash and cash equivalents at beginning of year | | | 25,692 | | | 24,032 | |

| |

|

| |

|

| |

Cash and cash equivalents at end of year | | $ | 20,063 | | $ | 25,444 | |

| |

|

| |

|

| |

| | | | | | | |

Supplemental disclosure of cash flow information | | | | | | | |

Cash paid during the period for interest | | $ | 5,410 | | $ | 4,008 | |

| |

|

| |

|

| |

Cash paid during the period for income taxes | | $ | 600 | | $ | — | |

| |

|

| |

|

| |

II. The accompanying notes are an integral part of these condensed consolidated financial statements.

FQ-4

Greektown Holdings, L.L.C.

(Debtor-In-Possession)

Condensed Consolidated Statements of Members’ Deficit

(In Thousands)

| | | | | | | | | | |

| | Contributed

Capital | | Accumulated

Deficit | | Total

Members’ Deficit | |

| |

|

|

|

|

|

|

| | (Unaudited) | |

|

Balance at December 31, 2009 | | $ | 47,588 | | $ | (338,509 | ) | $ | (290,921 | ) |

Net loss | | | — | | | (10,919 | ) | | (10,919 | ) |

| |

|

|

|

|

|

|

Balance at March 31, 2010 | | $ | 47,588 | | $ | (349,428 | ) | $ | (301,840 | ) |

| |

|

|

|

|

|

|

|

|

|

FQ-5

Greektown Holdings, L.L.C.

(Debtor-In-Possession)

Notes to Condensed Consolidated Financial Statements (Unaudited)

1. Description of Business

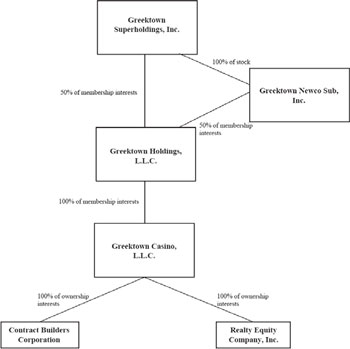

Greektown Holdings, L.L.C. (the “Company”) was formed in September 2005 as a limited liability company owned by Kewadin Greektown Casino, L.L.C. (“Kewadin”) and Monroe Partners, L.L.C. (“Monroe”). The Company owns Greektown Casino, L.L.C. (“Greektown Casino”), which is engaged in the operation of a casino gaming facility in the City of Detroit (the “City”), which opened November 10, 2000 under a license granted by the Michigan Gaming Control Board (“MGCB”), and the development of an expanded hotel/casino complex (the “Expanded Complex”) under the terms of a development agreement between Greektown Casino and the City (the “Development Agreement”).

2. Summary of Significant Accounting Policies

Presentation and Basis of Accounting

The accompanying condensed consolidated financial statements present the financial position, results of operations and cash flows of Greektown Holdings, L.L.C. and its wholly owned subsidiaries – Greektown Holdings II, Inc., and Greektown Casino, L.L.C. and its wholly owned subsidiary, Trappers GC Partner, LLC and two nonoperating real estate subsidiaries.

On May 29, 2008 (the “Petition Date”), the Company filed a voluntary petition for reorganization (the “Restructuring Proceedings”) under Chapter 11 of the United States Bankruptcy Code (see Note 3). The accompanying condensed consolidated financial statements have been prepared in accordance with the Reorganizations topic of the FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles (the “ASC”) (as subsequently defined) and on a going-concern basis, which contemplates continuity of operations and realization of assets and liquidation of liabilities in the ordinary course of business. However, as a result of the Restructuring Proceedings, such realization of assets and liquidation of liabilities is uncertain. While operating as debtors-in-possession (“DIP”) under the protection of Chapter 11 of the Bankruptcy Code, and subject to approval of the Bankruptcy Court, the Company may sell or otherwise dispose of assets and liquidate or settle liabilities for amounts other than those reflected in the consolidated financial statements.

The Reorganizations topic of the ASC generally does not change the manner in which financial statements are prepared. However, it does require that the financial statements for periods subsequent to the filing of the Chapter 11 petition distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business. Revenues, expenses, realized gains and losses, and provisions for losses that can be directly associated with the reorganization and restructuring of the business must be reported separately as reorganization items in the statement of operations. The balance sheet must distinguish pre-petition liabilities subject to compromise from both those pre-petition liabilities that are not subject to compromise and from post-petition liabilities. Liabilities that may be affected by a plan of reorganization must be reported at the amounts expected to be allowed, even if they may be settled for lesser amounts. In addition, reorganization items must be disclosed separately in the statement of cash flows.

The appropriateness of using the going-concern basis for the Company’s financial statements is dependent upon, among other things: (i) the Company’s ability to comply with the terms of the DIP financing agreement; (ii) the ability of the Company to maintain adequate cash on hand; (iii) the ability of the Company to generate sufficient cash flow from operations to satisfy liabilities as they come due; (iv) the Company’s ability to improve profitability; and (v) the Company’s ability to obtain additional financing to meet future obligations.

As further described in Note 6, the Company has long-term obligations. Certain of these obligations have been classified as a current liability as a result of the filing for Chapter 11 bankruptcy protection under the United States Bankruptcy Code.

The accompanying condensed consolidated financial statements have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures herein are adequate to make the information presented not misleading. In the opinion of management, all adjustments (which include only normal recurring adjustments) necessary for a fair presentation of the results for the interim periods have been made. The results for the three months ended March 31, 2010 are not necessarily indicative of results to be expected for the full fiscal year. These condensed

FQ-6

consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto in the Company’s consolidated financial statements for the year ended December 31, 2009.

Revenues

Greektown Holdings recognizes as Casino revenues the net win from gaming activities, which is the difference between gaming wins and losses. Revenues from food and beverage and hotel operations are recognized at the time of sale or upon the provision of service.

Promotional Allowances

The retail value of food, beverage, and other complimentary items furnished to customers without charge is included in revenues and then deducted as promotional allowances. The costs of providing such promotional allowances are as follows:

| | | | | | | |

| | Three Months Ended March 31, | |

| | 2010 | | 2009 | |

| |

|

|

|

|

| | (In Thousands) | |

| | | | | | | |

Food and beverage | | $ | 3,019 | | $ | 1,961 | |

Hotel | | | 744 | | | 157 | |

| |

|

|

|

|

|

|

| | $ | 3,763 | | $ | 2,118 | |

| |

|

|

|

|

|

|

Prepaid Expenses

Prepaid expenses consist of payments made for items to be expensed over future periods. At March 31, 2010 and December 31, 2009, prepaid expenses included approximately $8,511,000 and $12,211,000, respectively, related to the annual gaming license and municipal service fees that will be expensed in subsequent periods.

Inventories

Inventories, which consists of food and beverage, are stated at the lower of cost or market. Cost is determined by the first-in, first-out method.

Income and Other Taxes

A provision for federal income taxes is not recorded because, as a limited liability company, taxable income or loss is allocated to the members based on their respective ownership percentages in accordance with the Member Agreement (as defined elsewhere herein). On July 12, 2007, the Michigan legislature enacted the Michigan Business Tax (“MBT”) which is considered an income tax under the provisions of the Income Taxes topic of the ASC. The MBT has a gross receipts tax and an income tax component. During the three months ended March 31, 2010 and 2009, the Company recorded a provision for MBT of $723,000 and a benefit of $201,000, respectively. The Company received a credit related to capital additions during 2009 in connection with the construction of the expanded gaming complex. As the construction of the expanded complex was completed in 2009 the capital addition credit under the MBT for 2010 will be reduced.

Subsequent Events

The Company has evaluated events through May 24, 2010 in connection with the preparation of the interim condensed consolidated financial statements.

3. Petition for Relief Under Chapter 11

On the Petition Date the Company filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court, Eastern District of Michigan (the “Bankruptcy Court”). The Company sought protection under Chapter 11 of the United States Bankruptcy Code to allow the Company time to secure adequate funding to complete the Expanded Complex and to protect itself from a forced sale of Greektown Casino by the Michigan Gaming Control Board as provided in the Revised Development Agreement. The Restructuring Proceedings were initiated in response to the Company not meeting the loan covenants put in place by both the lenders and the Michigan Gaming Control Board. Curing these covenants would have required the equity owners of the Company to contribute capital far in excess of their financial strength. As a result, the

FQ-7

Company sought protection under Chapter 11 to stay the potential forced sale, and allow it to obtain the financing required to preserve its going concern value for the benefit of all parties involved.

On June 9, 2008, the Company entered into a $150 million DIP financing facility in order to finance the remainder of the Expanded Complex and provide funding for working capital and reorganization expenses. The DIP financing facility was amended and restated on February 20, 2009 to provide up to an additional $46 million in two delayed draw term loans and effectuate certain other modifications (see Note 6).