| | | | | |

| ¨ | | Preliminary Proxy Statement |

| | |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ¨ | | Definitive Proxy Statement |

| | |

| ¨ | | Definitive Additional Materials |

| | |

| x | | Soliciting Material Pursuant to §240.14a-12 |

| |

| GREEKTOWN SUPERHOLDINGS, INC. |

| (Name of registrant as specified in its charter) |

| |

Brigade Leveraged Capital Structures Fund Ltd. Brigade Capital Management, LLC Donald E. Morgan, III Neal P. Goldman |

| (Name of person(s) filing proxy statement, if other than the registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| x | | No fee required. |

| | |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | (5) | | Total fee paid: |

| | | |

| | | | | |

| | | | | |

| | |

| ¨ | | Fee paid previously with preliminary materials. |

| | |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount Previously Paid: |

| | | | | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | (3) | | Filing Party: |

| | | | | |

| | | (4) | | Date Filed: |

| | | | | |

Brigade Leveraged Capital Structures Fund Ltd. (“Brigade”), together with the other participants named herein, has filed a definitive proxy statement with the Securities and Exchange Commission and accompanying WHITE proxy card to be used to solicit proxies for the election of its director nominee, Neal P. Goldman, at the 2012 annual meeting of shareholders of Greektown Superholdings, Inc. (“Greektown”), a Delaware corporation.

Today, Brigade released the following open letter to Greektown shareholders:

April 19, 2012

To Shareholders of Greektown Superholdings, Inc. (the “Company”):

Please support Brigade Capital Management’s (“Brigade”) efforts to represent the interests of the Company’s shareholders and build shareholder value.Your vote is important and Brigade urges you to sign, date and return the enclosedWHITEproxy card to vote FOR the election of Neal P. Goldman to the Company’s board.

THE ANNUAL MEETING IS ONLY DAYS AWAY

VOTE BRIGADE’S WHITE PROXY CARD TODAY

The Company’s largest shareholders have been unable to influence the affairs of the Company since emergence from bankruptcy.As a result of their status as institutional investors, none of the four leading proponents of the Company’s plan of reorganization (the “Plan Proponents”) were able to influence or affect the affairs of the Company. Brigade took the initiative to go through the required regulatory process to nominate Neal P. Goldman to the Company’s board in order to bring a shareholder perspective that will be focused on enhancing the value of the Company.

Since emergence from bankruptcy the Company has performed poorly under the oversight of some directors selected during the bankruptcy.In the twenty months since the Company emerged from bankruptcy no professional management company has been engaged to manage the Company and the interim management has produced the deteriorating financial results which have been reported in the Company’s SEC filings. The Company has underperformed its peers and destroyed significant shareholder value.

In particular:

Company performance on an earnings before income, taxes, depreciation, amortization and restructuring charges or, EBITDAR, basis has been presented by the Company in a misleading manner that is inconsistent with Wall Street research and the true economic reality.

The EBITDAR numbers that Greektown’s Chairman, George Boyer, chose to highlight in public presentations understated the Company’s EBITDAR decline as compared to independent Wall Street research. In particular, 2009 EBITDAR is 11% lower in the Company’s shareholder presentation and leaves out proper adjustments including the very material 5% tax rollback Greektown was awarded. The Company’s presentation implies a 4.5% EBITDAR decline since George Boyer commenced as Chairman when the real EBITDAR decline is a much higher 14.8%.

We are concerned by the erosion of the Company’s margins and market share.

In the midst of a recovery of the gaming industry in Detroit, the Greektown Casino has lost a cumulative 105 basis points of market share and 384 basis points of EBITDA margin in the two years since the Company emerged from bankruptcy and George Boyer started as Chairman of the Company.

We believe the current management’s leadership has led to equity value destruction.

While the vast majority of all publicly-traded middle-market gaming companies have seen equity value grow considerably since emergence from bankruptcy on June 30, 2010, Greektown has seen its equity value decline almost 30% as implied by its equity valuation.

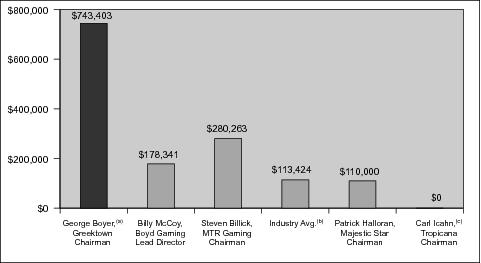

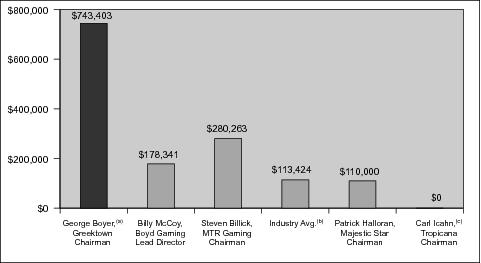

We believe that the Las Vegas based Chairman of the Greektown board has been paid unjustifiably high compensation.

We believe George Boyer’s ability to properly address the issues facing the Company is compromised by the misalignment between his compensation and the Company’s performance. Despite being the only single asset company in this comparison, the Company compensates Mr. Boyer substantially more than the Chairman or Lead Director of other regional gaming companies. Mr. Boyer’s compensation is outrageous by any standard, but particularly for a Chairman who has destroyed equity value under his tenure while residing in Las Vegas and spending limited time in Detroit.

2010 Director Total Compensation

|

(a) | | | | Includes expenses paid relating to life, accidental disbursement and disability, long term disability, medical, dental and vision insurance. |

|

(b) | | | | The 2011 BDO 600 Survey—Board of Directors Pay Study; $325 million-$650 million category. |

|

(c) | | | | Each independent director was entitled to $50,000. |

Neal P. Goldman will represent the interests of all of the Company’s shareholders on the board.Mr. Goldman has substantial board experience and has an extensive investment background including substantial turnaround management, mergers and acquisitions, capital markets and private equity experience. While on the board of NII Holdings, a Nasdaq listed company, Mr. Goldman served on the company’s nominating and compensation committees and helped create hundreds of millions of dollars in shareholder value during his tenure. Brigade believes that Mr. Goldman’s skill set is ideally suited to addressing the pressing challenges currently facing the Company and reversing the value destruction that has occurred.

Specifically Brigade believes that the board’s focus must be on:

|

• | | | | turning around the Company’s weak financial performance; |

|

• | | | | building the Company’s market share and profitability to match or surpass that of its peers; and |

|

• | | | | advancing the Company toward a successful liquidity event. |

Mr. Goldman will be certain to keep the board focused on those objectives.

John Bitove has chaired the Company’s compensation committee during the period of value destruction.Mr. Bitove does not have a material investment interest in the Company and has limited gaming experience. In addition, Mr. Bitove has chaired the board’s compensation committee which authorized the outrageous compensation to Executive Chairman George Boyer discussed above. Furthermore, while Mr. Bitove was the chairman of the Company’s compensation committee, the Company hired a new CEO, Mike Puggi, who also commutes and presumably does the work that should be done by the Executive Chairman. Mr. Puggi was paid $925,302 for 6 months of work in 2011.

Furthermore, the Company continues to employ its old President, Cliff Vallier, in a re-titled role as “General Manager”. His compensation is also costing us an additional $500,000 annually. Brigade believes that these compensation packages are inconsistent with industry standards and that the work of the compensation committee under chair John Bitove has contributed to shareholder value destruction.

THE ANNUAL MEETING IS ONLY DAYS AWAY

VOTE BRIGADE’S WHITE PROXY CARD TODAY

Brigade urges you to elect Neal P. Goldman to the Company’s board.

Neal P. Goldman, Brigade’s nominee will bring integrity, discipline, experience and accountability to the Company, for the benefit ofALLstockholders. We’ve provided you with the facts, now it is time to vote—vote Brigade’sWHITEproxy card today.

We encourage you to read our proxy statement and related materials, which are available at no cost at www.sec.gov or by contacting our proxy solicitor Georgeson, Inc. at (866) 295-3782 or brigade@georgeson.com. If you have any questions, or need assistance voting yourWHITEproxy card, please contact Georgeson.

Sincerely,

BRIGADE LEVERAGED CAPITAL

STRUCTURES FUND LTD.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

THE PARTICIPANTS STRONGLY ADVISE ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT ON SCHEDULE 14A FILED BY THEM AND OTHER RELEVANT DOCUMENTS WITH THE SEC IN CONNECTION WITH ITS SOLICITATION OF PROXIES FOR THE 2012 ANNUAL MEETING OF GREEKTOWN (THE “PROXY STATEMENT”). BRIGADE, BRIGADE CAPITAL MANAGEMENT, LLC, DONALD E. MORGAN, III AND NEAL P. GOLDMAN (COLLECTIVELY, THE “PARTICIPANTS”) HAVE MAILED THE PROXY STATEMENT AND A PROXY CARD TO EACH GREEKTOWN STOCKHOLDER ENTITLED TO VOTE AT THE 2012 ANNUAL MEETING.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT CAREFULLY AND IN ITS ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BECAUSE THEY CONTAIN IMPORTANT INFORMATION. INVESTORS AND SECURITY HOLDERS MAY OBTAIN A FREE COPY OF THESE MATERIALS AND OTHER DOCUMENTS FILED BY BRIGADE WITH THE SEC AT THE WEBSITE MAINTAINED BY THE SEC AT WWW.SEC.GOV. THE PROXY STATEMENT AND RELATED MATERIALS MAY ALSO BE OBTAINED FOR FREE BY CONTACTING THE PARTICIPANTS’ PROXY SOLICITOR, GEORGESON, INC., TOLL-FREE AT (866) 295-3782 OR VIA EMAIL AT BRIGADE@GEORGESON.COM.

IMPORTANT INFORMATION RELATING TO THE ABOVE-NAMED PARTICIPANTS IN THIS PROXY SOLICITATION, INCLUDING THEIR DIRECT OR INDIRECT INTERESTS IN THE COMPANY, BY SECURITY HOLDINGS OR OTHERWISE, IS CONTAINED IN THE DEFINITIVE PROXY STATEMENT FILED BY BRIGADE AND THE OTHER PARTICIPANTS WITH THE SEC ON APRIL 6, 2012. THE DEFINITIVE PROXY STATEMENT IS AVAILABLE TO SHAREHOLDERS OF THE COMPANY AT NO CHARGE AT THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV OR BY CONTACTING THE PARTICIPANTS’ PROXY SOLICITOR, GEORGESON, INC. AT ITS TOLL-FREE NUMBER (866) 295-3782 OR VIA EMAIL AT BRIGADE@GEORGESON.COM.