The power of Digital Realty Trust, Inc.’s Board of Directors to revoke Digital Realty Trust, Inc.’s REIT election without stockholder approval may cause adverse consequences to Digital Realty Trust, Inc.’s stockholders and Digital Realty Trust, L.P.’s unitholders.

Digital Realty Trust, Inc.’s charter provides that its Board of Directors may revoke or otherwise terminate its REIT election, without the approval of its stockholders, if the Board determines that it is no longer in Digital Realty Trust, Inc.’s best interests to continue to qualify as a REIT. If Digital Realty Trust, Inc. ceases to qualify as a REIT, it would become subject to U.S. federal and state corporate income taxes on its taxable income and it would no longer be required to distribute most of its taxable income to its stockholders and, accordingly, distributions Digital Realty Trust, L.P. makes to its unitholders could be similarly reduced.

If Digital Realty Trust, L.P. were to fail to qualify as a partnership for U.S. federal income tax purposes, Digital Realty Trust, Inc. would fail to qualify as a REIT and suffer other adverse consequences.

We believe that Digital Realty Trust, L.P. has been organized and operated in a manner that will allow it to be treated as a partnership, and not an association or publicly traded partnership taxable as a corporation, for U.S. federal income tax purposes. As a partnership, Digital Realty Trust, L.P. is not subject to U.S. federal income tax on its income. Instead, each of its partners, including Digital Realty Trust, Inc., is allocated, and may be required to pay tax with respect to, that partner’s share of Digital Realty Trust, L.P.’s income. No assurance can be provided, however, that the IRS will not challenge Digital Realty Trust, L.P.’s status as a partnership for U.S. federal income tax purposes or that a court would not sustain such a challenge. If the IRS were successful in treating Digital Realty Trust, L.P. as an association or publicly traded partnership taxable as a corporation for U.S. federal income tax purposes, Digital Realty Trust, Inc. would fail to meet the gross income tests and certain of the asset tests applicable to REITs and, accordingly, would cease to qualify as a REIT. Such REIT qualification failure could impair our ability to expand our business and raise capital, and would materially adversely affect the value of Digital Realty Trust, Inc.’s stock and Digital Realty Trust, L.P.’s units. Also, the failure of Digital Realty Trust, L.P. to qualify as a partnership would cause it to become subject to federal corporate income tax, which would reduce significantly the amount of its cash available for debt service and for distribution to its partners, including Digital Realty Trust, Inc.

Tax liabilities and attributes inherited in connection with acquisitions may adversely impact our business.

From time to time, we may acquire other corporations or entities and, in connection with such acquisitions, we may succeed to the historic tax attributes and liabilities of such entities. For example, if we acquire a C corporation and subsequently dispose of its assets within five years of the acquisition, we could be required to pay tax on any built-in gain attributable to such assets determined as of the date on which we acquired the assets. In addition, in order to qualify as a REIT, at the end of any taxable year, we must not have any earnings and profits accumulated in a non-REIT year. As a result, if we acquire a C corporation, we must distribute the corporation’s earnings and profits accumulated prior to the acquisition before the end of the taxable year in which we acquire the corporation. We also could be required to pay the acquired entity’s unpaid taxes even though such liabilities arose prior to the time we acquired the entity.

Changes in U.S. or foreign tax laws and regulations, including changes to tax rates, legislation and other actions may adversely affect our results of operations, our stockholders, Digital Realty Trust, L.P.’s unitholders and us.

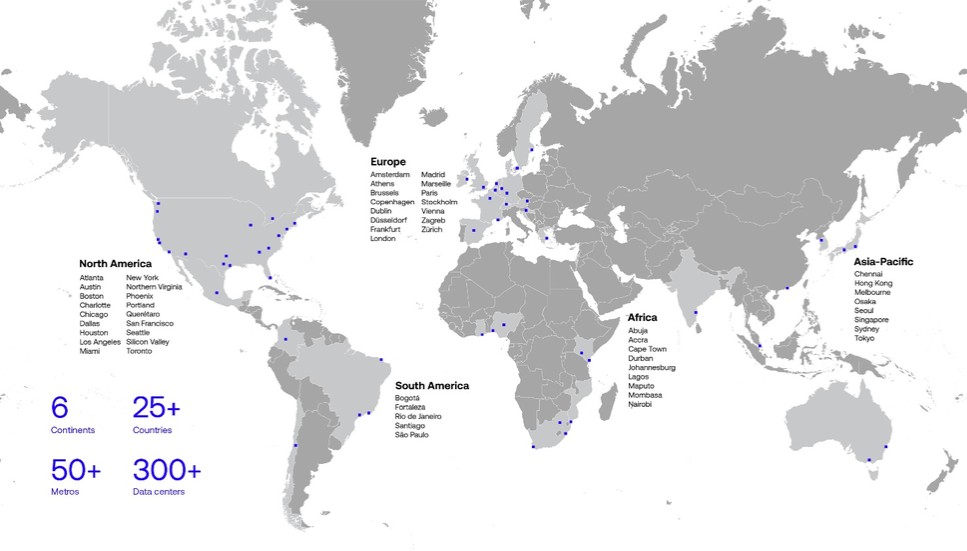

We are headquartered in the United States with subsidiaries and operations globally and are subject to income taxes in these jurisdictions. Significant judgment is required in determining our provision for income taxes. Although we believe that we have adequately assessed and accounted for our potential tax liabilities, and that our tax estimates are reasonable, there can be no assurance that additional taxes will not be due upon audit of our tax returns or as a result of changes to applicable tax laws. The governments of many of the countries in which we operate may enact changes to the tax laws of such countries, including changes to the corporate recognition and taxation of worldwide income. The nature and timing of any changes to each jurisdiction’s tax laws and the impact on our future tax liabilities cannot be predicted with any accuracy but could materially and adversely impact our results of operations and cash flows. The Organization for Economic Cooperation and Development (the “OECD”) has developed a framework to establish certain international standards for taxing the worldwide income of multinational companies, including, among other things, provisions that would ensure all companies pay a global minimum tax of 15% (the “Pillar Two rules”). While the United States has not yet adopted the Pillar Two rules, various other governments around the world have enacted or are enacting such legislation. We are continuing to evaluate the impacts of these developments in the jurisdictions in which we operate, including our qualification for certain exceptions to the application of these rules.