UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22498

New Frontiers Trust

(Exact name of registrant as specified in charter)

30195 CHAGRIN BLVD. Suite 118N

Pepper Pike, OH 44124

(Address of principal executive offices) (Zip code)

Rakesh Mehra

30195 Chagrin Blvd., Suite 118N,

Pepper Pike, OH 44124

(Name and address of agent for service)

Registrant's telephone number, including area code: (216) 831-8400

Date of fiscal year end: January 31

Date of reporting period: July 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e -1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

NEW FRONTIERS KC INDIA FUND

SEMI-ANNUAL REPORT

July 31, 2011

NEW FRONTIERS KC INDIA FUND

NEW FRONTIERS KC INDIA FUND

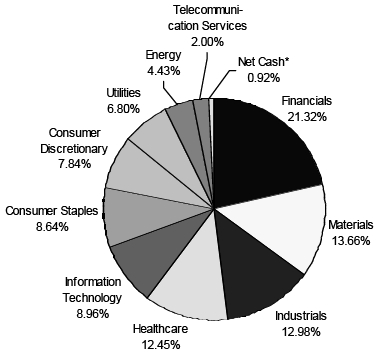

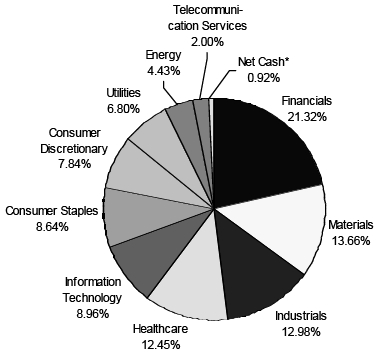

by Sectors (Unaudited)

(as a percentage of Net Assets) |

* Net Cash represents cash equivalents and other assets less liabilities.

PERFORMANCE INFORMATION (Unaudited)

7/31/11 NAV $10.06

AVERAGE ANNUAL RATE OF RETURN (%) FOR THE PERIOD ENDED JULY 31, 2011

| | |

| | Since | |

| | Inception(A) | |

| New Frontiers KC India Fund | 0.60% | |

| Bombay Stock Exchange 100 Index(B) | 0.07% | |

(A)Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the New Frontiers KC India Fund was February 24, 2011. The performance numbers represent performance beginning on the first day of security trading (May 17, 2011).

(B)The Bombay Stock Exchange 100 Index (BSE-100) is a market capitalization weighted index of the 100 stocks listed on the Bombay Stock Exchange.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH-END, PLEASE CALL 1-800-839-6587.

2011 Semi-Annual Report 1

Disclosure of Expenses (Unaudited)

Shareholders of this Fund incur ongoing costs, including investment advisor fees and other Fund expenses. The following example is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with similar costs of investing in other mutual funds. If shares are redeemed within 90 days of purchase from the Fund, the shares are subject to a 1% redemption fee. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from February 24, 2011 to July 31, 2011.

The first line of the table below provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) and then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period." The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid by a shareholder for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds' shareholder reports.

| | | | | | | |

| | | | | | | Expenses Paid | |

| | | Beginning | | Ending | | During the Period | |

| | | Account Value | | Account Value | | February 24, 2011 | |

| | | February 24, 2011 | | July 31, 2011 | | to July 31, 2011 | |

| |

| Actual | | $1,000.00 | | $1,006.00 | | $7.21* | |

| |

| Hypothetical** | | $1,000.00 | | $1,016.56 | | $8.30 | |

| (5% annual return | | | | | | | |

| before expenses) | | | | | | | |

| | * Expenses are equal to the Fund’s annualized expense ratio of 1.66%, multiplied by the average

account value over the period, multiplied by 158/365 (to reflect the partial year period).

** The hypothetical example is calculated assuming that the Fund has been in operation for the

full six-month period from February 1, 2011 to July 31, 2011. As a result, expenses shown in

this row are equal to the Fund’s annualized expense ratio of 1.66%, multiplied by the average

account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

Availability of Quarterly Schedule of Investments (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission ("SEC") for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC's Web site at http://www.sec.gov. The Fund’s Form N-Q may also be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Proxy Voting Guidelines (Unaudited)

New Frontiers Advisory Group, LLC, the Fund’s investment advisor (“Advisor”), is responsible for exercising the voting rights associated with the securities held by the Fund. A description of the policies and procedures used by the Advisor in fulfilling this responsibility is available without charge on the Fund’s website at www.newfrontiersfund.com. It is also included in the Fund’s Statement of Additional Information, which is available on the SEC’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies, Form N-PX, relating to portfolio securities during the most recent 12-month period ended June 30th, is available without charge, upon request, by calling our toll free number (1-800-839-6587). This information is also available on the SEC’s website at http://www.sec.gov.

2011 Semi-Annual Report 2

| | | | | |

| New Frontiers KC India Fund |

| | | | Schedule of Investments |

| | | | July 31, 2011 (Unaudited) |

| Shares/Principal Amount | | Fair Value | % of Net Assets |

| COMMON STOCKS (INDIA) | | | | |

| Auto Components | | | | |

| 34,900 | Exide Industries, Ltd. | | $ 122,420 | 5.26 | % |

| Automobiles | | | | | |

| 2,800 | Tata Motors, Ltd. | | 60,077 | 2.58 | % |

| Chemicals | | | | | |

| 1,700 | Asian Paints, Ltd. | | 120,571 | 5.18 | % |

| Commercial Banks | | | | |

| 20,000 | Allahabad Bank | | 91,382 | | |

| 4,200 | HDFC Bank, Ltd. | | 46,269 | | |

| 5,000 | ICICI Bank, Ltd. | | 117,311 | | |

| 4,000 | Axis Bank, Ltd. | | 121,073 | | |

| | | | 376,035 | 16.15 | % |

| Construction & Engineering | | | | |

| 2,500 | Larsen & Toubro, Ltd. | | 97,625 | 4.19 | % |

| Consumer Finance | | | | |

| 4,000 | Shriram Transport Finance Co. | | 57,984 | 2.49 | % |

| Electrical Equipment | | | | |

| 7,000 | Havells India, Ltd. | | 57,512 | | |

| 19,000 | Crompton Greaves, Ltd. | | 72,860 | | |

| | | | 130,372 | 5.60 | % |

| Electrical Utilities | | | | |

| 1,500 | Tata Power Co. | | 43,491 | 1.87 | % |

| Food | | | | | |

| 1,700 | GlaxoConsumer Healthcare, Ltd. | | 93,017 | 4.00 | % |

| Gas Utilities | | | | | |

| 11,000 | Gail India, Ltd. | | 114,784 | 4.93 | % |

| Information Technology Services | | | | |

| 4,000 | Tata Consultancy Services, Ltd. | | 102,924 | | |

| 12,000 | Wipro, Ltd. | | 105,721 | | |

| | | | 208,645 | 8.96 | % |

| Metals & Mining | | | | |

| 4,500 | Sesa Goa, Ltd. | | 28,010 | | |

| 3,500 | Tata Steel, Ltd | | 44,673 | | |

| 21,000 | Welspun Corp., Ltd. | | 70,550 | | |

| 10,000 | NMDC, Ltd. | | 54,302 | | |

| | | | 197,535 | 8.49 | % |

| Mortgage Finance | | | | |

| 4,000 | Housing Development Financial Corp. | | 62,370 | 2.68 | % |

| Oil & Gas | | | | | |

| 5,500 | Reliance Industries, Ltd. | | 103,053 | 4.43 | % |

| Personal Care | | | | | |

| 1,900 | Colgate-Palmolive India, Ltd. | | 41,962 | 1.80 | % |

| Pharmaceuticals | | | | |

| 13,500 | Aurobindo Pharma, Ltd. | | 52,166 | | |

| 4,000 | Sun Pharmaceuticals, Ltd. | | 46,909 | | |

| 7,000 | Cipla, Ltd. | | 48,570 | | |

| 19,000 | Glenmark Pharmaceuticals, Ltd. | | 142,087 | | |

| | | | 289,732 | 12.45 | % |

| Road & Rail | | | | | |

| 3,000 | Container Corp. of India, Ltd. | | 74,399 | 3.20 | % |

| Tobacco | | | | | |

| 14,000 | ITC, Ltd. | | 66,011 | 2.83 | % |

| Wireless Telecom | | | | |

| 4,700 | Bharti Airtel, Ltd. | | 46,507 | 1.99 | % |

| Total for Common Stocks (India) (Cost $2,305,291) | | $ 2,306,590 | 99.08 | % |

The accompanying notes are an integral part of these

financial statements. |

2011 Semi-Annual Report 3

| | | | | |

| New Frontiers KC India Fund |

| | | Schedule of Investments |

| | | July 31, 2011 (Unaudited) |

| Shares/Principal Amount | | Fair Value | | % of Net Assets |

| MONEY MARKET FUNDS (United States) | | | | | |

| 61,231 Highmark 100% US Treasury 0.00% * | | 61,231 | | 2.63 | % |

| (Cost $61,231) | | | | | |

| Total Investment Securities | | 2,367,821 | | 101.71 | % |

| (Cost $2,366,522) | | | | | |

| Liabilities In Excess of Other Assets | | (39,834 | ) | -1.71 | % |

| Net Assets | | $ 2,327,987 | | 100.00 | % |

* Variable rate security; the yield rate shown represents the

rate at July 31, 2011.

The accompanying notes are an integral part of these

financial statements. |

2011 Semi-Annual Report 4

| | | |

| New Frontiers KC India Fund |

| |

| Statement of Assets and Liabilities (Unaudited) | | | |

| July 31, 2011 | | | |

| |

| Assets: | | | |

| Investment Securities at Fair Value | | $ 2,367,821 | |

| (Cost $2,366,522) | | | |

| Foreign Currency at Value | | 391,737 | |

| (Cost $393,063) | | | |

| Cash | | 1,000 | |

| Dividends Receivable | | 5,604 | |

| Total Assets | | 2,766,162 | |

| Liabilities: | | | |

| Payable For Securities Purchased | | 434,054 | |

| Payable to Advisor | | 3,700 | |

| Payable to Custodian | | 421 | |

| Total Liabilities | | 438,175 | |

| Net Assets | | $ 2,327,987 | |

| |

| Net Assets Consist of: | | | |

| Capital Paid In | | $ 2,331,735 | |

| Accumulated Undistributed Net Investment Income | | 2,995 | |

| Accumulated Realized Loss on Investments and Foreign Currency | | (6,765 | ) |

| Related Transactions - Net | | | |

| Unrealized Appreciation in Value of Investments and Foreign | | | |

| Related Transactions Based on Identified Cost - Net | | 22 | |

| Net Assets, for 231,348 Shares Outstanding | | $ 2,327,987 | |

| (Without par value, unlimited shares authorized) | | | |

| Net Asset Value and Offering Price Per Share | | | |

| ($2,327,987/231,348 shares) | | $ 10.06 | |

| Minimum Redemption Price Per Share ($10.06 * 0.99) (Note 2) | | $ 9.96 | |

| |

| Statement of Operations (Unaudited) | | | |

| For the period February 24, 2011* through July 31, 2011 | | | |

| |

| Investment Income: | | | |

| Dividends | | $ 11,840 | |

| Interest | | 3 | |

| Total Investment Income | | 11,843 | |

| Expenses: | | | |

| Management Fees | | 10,531 | |

| Custody Transaction Charges | | 421 | |

| Total Expenses | | 10,952 | |

| Less: Expenses Waived | | (2,104 | ) |

| Net Expenses | | 8,848 | |

| |

| Net Investment Income | | 2,995 | |

| |

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | | | |

| Related Transactions: | | | |

| Realized Loss on Investments and Foreign Currency Related Transactions | | (6,765 | ) |

| Net Change in Unrealized Appreciation on Investments and Foreign Currency | | | |

| Related Transactions | | 22 | |

| Net Realized and Unrealized Loss on Investments | | (6,743 | ) |

| |

| Net Decrease in Net Assets from Operations | | $ (3,748 | ) |

* The Fund commenced operations on February 24, 2011 and commenced

investment operations on May 17, 2011. |

The accompanying notes are an integral part of these

financial statements. |

2011 Semi-Annual Report 5

| | | |

| New Frontiers KC India Fund |

| |

| Statement of Changes in Net Assets | | (Unaudited) | |

| | | 2/24/2011* | |

| | | to | |

| | | 7/31/2011 | |

| From Operations: | | | |

| Net Investment Income | | $ 2,995 | |

| Net Realized Loss on Investments and Foreign Currency | | (6,765 | ) |

| Related Transactions | | | |

| Change in Net Unrealized Depreciation on Investments and | | | |

| Foreign Currency Related Transactions | | 22 | |

| Decrease in Net Assets from Operations | | (3,748 | ) |

| From Distributions to Shareholders: | | | |

| Net Investment Income | | - | |

| Net Realized Gain from Security Transactions | | - | |

| Change in Net Assets from Distributions | | - | |

| From Capital Share Transactions: | | | |

| Proceeds From Sale of Shares | | 2,231,775 | |

| Proceeds From Redemption Fees (Note 2) | | - + | |

| Shares Issued on Reinvestment of Dividends | | - | |

| Cost of Shares Redeemed | | (40 | ) |

| Net Increase (Decrease) from Shareholder Activity | | 2,231,735 | |

| |

| Net Increase (Decrease) in Net Assets | | 2,227,987 | |

| |

| Net Assets at Beginning of Period | | 100,000 | |

| Net Assets at End of Period (Including Accumulated Undistributed | | | |

| Net Investment Income of $2,995) | | $ 2,327,987 | |

| |

| Share Transactions: | | | |

| Issued | | 221,352 | |

| Reinvested | | - | |

| Redeemed | | (4 | ) |

| Net Increase in Shares | | 221,348 | |

| Shares Outstanding Beginning of Period | | 10,000 | |

| Shares Outstanding End of Period | | 231,348 | |

* The Fund commenced operations on February 24, 2011 and commenced

investment operations on May 17, 2011.

+ Amount calculated is less than $0.50. |

The accompanying notes are an integral part of these

financial statements. |

2011 Semi-Annual Report 6

| | | |

| New Frontiers KC India Fund |

| |

| Financial Highlights | | | |

| Selected data for a share outstanding | | (Unaudited) | |

| throughout the period: | | 2/24/2011* | |

| | | to | |

| | | 7/31/2011 | |

| Net Asset Value - | | | |

| Beginning of Period | | $ 10.00 | |

| Net Investment Income (a) | | 0.02 | |

| Net Gain (Loss) on Investments and Foreign Currency Related | | | |

| Transactions (Realized and Unrealized) (b) | | 0.04 | |

| Total from Investment Operations | | 0.06 | |

| |

| Distributions (From Net Investment Income) | | - | |

| Distributions (From Realized Capital Gains) | | - | |

| Total Distributions | | - | |

| Proceeds from Redemption Fees (Note 2) | | - | (c) |

| |

| Net Asset Value - | | | |

| End of Period | | $ 10.06 | |

| Total Return (d) | | 0.60% | ***(e) |

| Ratios/Supplemental Data | | | |

| Net Assets - End of Period (Thousands) | | $ 2,328 | |

| |

| Before Waiver | | | |

| Ratio of Expenses to Average Net Assets | | 2.06% | ** |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | 0.17% | ** |

| After Waiver | | | |

| Ratio of Expenses to Average Net Assets | | 1.66% | ** |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | 0.56% | ** |

| Portfolio Turnover Rate | | 0.00% | *** |

+ Amount calculated is less than $0.50.

* The Fund commenced operations on February 24, 2011 and commenced investment

operations on May 17, 2011.

** Annualized.

*** Not Annualized.

(a) Per share amounts were calculated using the average shares method.

(b) Realized and unrealized gains and losses per share in this caption are balancing amounts

necessary to reconcile the change in net asset value for the period, and may not reconcile

with the aggregate gains and losses in the Statement of Operations due to share transactions

for the period.

(c) Amount calculated is less than $0.005.

(d) Total return in the above table represents the rate that the investor would have earned

or lost on an investment in the Fund assuming reinvestment of dividends and distributions.

(e) Represents performance beginning on the first day of security trading (May 17, 2011). |

The accompanying notes are an integral part of these

financial statements. |

2011 Semi-Annual Report 7

NOTES TO FINANCIAL STATEMENTS

NEW FRONTIERS KC INDIA FUND

July 31, 2011

(UNAUDITED)

1.) ORGANIZATION:

New Frontiers KC India Fund (the "Fund") is a non-diversified series of the New Frontiers Trust (the "Trust"), an open-end investment company under the Investment Company Act of 1940, as amended. The Trust was organized in Ohio as a business trust on November 18, 2010 and may offer an unlimited number of shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. At present, there is one series authorized by the Trust. The Fund commenced operations on February 24, 2011 and the Fund commenced investing in line with its objectives on May 17, 2011. The Fund's investment objective is to seek long-term capital appreciation. The investment advisor to the Fund is New Frontiers Advisory Group, LLC (the “Advisor”).

2.) SIGNIFICANT ACCOUNTING POLICIES

SECURITY VALUATION:

All investments in securities are recorded at their estimated fair value, as described in Note 3.

ORGANIZATIONAL AND OFFERING EXPENSES:

All costs incurred by the Trust in connection with the organization, offering and initial registration of the Trust, principally professional fees, were paid on behalf of the Trust by the Advisor and will not be borne by the Fund.

FEDERAL INCOME TAXES:

The Fund’s policy is to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Fund’s policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Internal Revenue Code. This Internal Revenue Code requirement may cause an excess of distributions over the book year-end accumulated income. In addition, it is the Fund’s policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

The Fund recognizes the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund’s 2011 tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal and State tax authorities; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the Fund did not incur any interest or penalties.

SHARE VALUATION:

The net asset value per share of the Fund is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding, rounded to the nearest cent. The offering and redemption price per share is equal to the net asset value per share, except that shares of the Fund are subject to a redemption fee of 1% if redeemed after holding them for 90 days or less. During the period February 24, 2011 through July 31, 2011, proceeds from redemption fees amounted to less than $0.50.

FOREIGN CURRENCY:

Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based on the exchange rate of such currencies against U.S. dollars on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts at the exchange rate in effect on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices

2011 Semi-Annual Report 8

Notes to the Financial Statements (Unaudited) - continued

of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

DISTRIBUTIONS TO SHAREHOLDERS:

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date.

The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense, or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, result of operations, or net asset value per share of the Fund.

USE OF ESTIMATES:

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

CONCENTRATION OF RISK:

The Fund will invest primarily in the securities of Indian companies, and as a result, the value of its shares will be significantly affected by political, economic, regulatory and other developments in India, as well as changes in the status of India's relation with other countries. Investments in India generally are considered to be more speculative than investments in more developed markets of the world, and therefore may be subject to a greater risk of loss.

OTHER:

The Fund records security transactions based on the trade date. Dividend income is generally recognized on the ex-dividend date. Dividend income for certain issuers headquartered in India may not be recorded until approved by the shareholders (which may occur after the ex-dividend date) if, in the judgment of management, such dividends are not reasonably determined as of the ex-dividend date. Interest income is recognized on an accrual basis. The Fund uses the specific identification method in computing gain or loss on the sale of investment securities. Discounts and premiums on securities purchased are amortized over the life of the respective securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund's understanding of the applicable country's tax rules and rates.

3.) SECURITIES VALUATIONS:

As described in Note 2, the Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

2011 Semi-Annual Report 9

Notes to the Financial Statements (Unaudited) - continued

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

FAIR VALUE MEASUREMENTS

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock). Equity securities are carried at fair value. The market quotation used for common stocks, including those listed on the NASDAQ National Market System, is the last sale price on the date on which the valuation is made or, in the absence of sales, at the closing bid price. Foreign securities are usually valued on the basis of the most recent closing price of the foreign markets on which such securities principally trade. Over-the-counter securities will be valued on the basis of the bid price at the close of each business day. Generally, if the security is traded in an active market and is valued at the last sale price, the security is categorized as a level 1 security. When the security position is not considered to be part of an active market or when the security is valued at the bid price, the position is generally categorized as level 2. When market quotations are not readily available, when the Advisor determines the last bid price does not accurately reflect the current value or when restricted securities are being valued, such securities are valued as determined in good faith by the Advisor, in conformity with guidelines adopted by and subject to review of the Board of Trustees (the “Trustees”) and are categorized in level 2 or level 3, when appropriate.

The Fund may invest in portfolio securities that are primarily listed on foreign exchanges or other markets that trade on weekends and other days when the Fund does not price its shares. As a result, the market value of these investments may change on days when the Fund does not calculate the value of such investments. In this regard, it should be noted that the National Stock Exchange of India is generally open Monday through Friday from 9:15 a.m. until 3:30 p.m., India time (10:45 p.m. until 5:00 a.m., Eastern time), except for certain holidays recognized by the exchange or the Indian government. The Fund may use pricing services to determine market value.

Money market funds. Shares of money market funds are valued at a net asset value of $1.00 and are classified in level 1 of the fair value hierarchy.

Fixed income securities. Fixed income securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. When prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Advisor, subject to review of the Trustees. Short-term investments in fixed income securities with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity, are valued by using the amortized cost method of valuation. Generally, fixed income securities are categorized as level 2.

In accordance with the Trust's good faith pricing guidelines, the Advisor is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. There is no single standard for deter-

2011 Semi-Annual Report 10

Notes to the Financial Statements (Unaudited) - continued

mining fair value, since fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Advisor would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods.

Foreign securities held by the Fund may be traded on days and at times when the NYSE is closed. Accordingly, the NAV of the Fund may be significantly affected on days when shareholders have no access to the Fund.

The following table summarizes the inputs used to value the Fund’s assets measured at fair value as of July 31, 2011:

| | | | | | | | |

| Valuation Inputs of Assets | | Level 1 | | Level 2 | | Level 3 | | Total |

| Common Stock | | $2,306,590 | | $0 | | $0 | | $2,306,590 |

| Money Market Funds | | 61,231 | | 0 | | 0 | | 61,231 |

| Total | | $2,367,821 | | $0 | | $0 | | $2,367,821 |

Refer to the Fund’s Schedule of Investments for a listing of securities by industry. The Fund did not hold any Level 3 assets during the period February 24, 2011 through July 31, 2011. There were no transfers into or out of level 1 and level 2 during the period February 24, 2011 through July 31, 2011. It is the Fund’s policy to consider transfers into or out of level 1 and level 2 as of the end of the reporting period.

4.) INVESTMENT ADVISORY AGREEMENT AND RELATED PARTY TRANSACTIONS:

The Fund has entered into an investment advisory agreement (“Management Agreement”) with the Advisor. Under the terms of the Fund's Management Agreement, the advisor manages the Fund's investments subject to approval of the Board of Trustees and pays all of the expenses of the Fund except brokerage fees and commissions, transaction charges of the Fund's custodian on Fund trades, taxes, borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short), 12b-1 fees and such extraordinary or non-recurring expenses as may arise, including litigation to which the Fund may be a party and indemnification of the Trust's Trustees and officers with respect thereto. As compensation for its management services and agreement to pay the Fund's expenses, the Fund is obligated to pay the advisor a fee (based on average daily net assets) computed and accrued daily and paid monthly at the following annual rates: 2.00% on the first $500 million in assets, 1.75% for the assets over $500 million up to $1 billion, and 1.55% for assets in excess of $1 billion.

For the period February 24, 2011 to July 31, 2011, the Advisor earned management fees totaling $10,531 before the voluntary waiver of management fees described below. The Advisor voluntarily agreed to waive its managemnet fees for the period February 24, 2011 to May 16, 2011 (prior to the commencement of investment operations), which amounted to $2,104. The Fund owed the Advisor $3,700 as of July 31, 2011 for management fees earned from May 17, 2011 through July 31, 2011.

The Fund has adopted a plan pursuant to Rule 12b-1 under the 1940 Act (the "Plan"). The Fund pays the Advisor for certain distribution and promotion expenses related to marketing shares of the Fund pursuant to the Plan. Under the terms of the Plan, the amount payable annually by the Fund would be 0.25% of its average daily net assets. At present, the Plan is not implemented, although the Board of Trustees may do so at any time upon notice to shareholders.

An officer and a shareholder of the Advisor is also an officer and a Trustee of the Trust. These individuals may receive benefits from the Advisor resulting from management and services fees paid to the Advisor by the Fund.

The Trustees who are not interested persons of the Fund were each paid Trustees’ fees of $0 plus travel and related expenses for the period February 24, 2011 through July 31, 2011. Under the Management Agreement, the Advisor pays these fees.

5.) CAPITAL SHARES:

The Trust is authorized to issue an unlimited number of shares of beneficial interest. Paid in capital at July 31, 2011 was $2,331,735 representing 231,348 shares outstanding.

2011 Semi-Annual Report 11 |

Notes to the Financial Statements (Unaudited) - continued

6.) PURCHASES AND SALES OF SECURITIES:

For the period February 24, 2011 through July 31, 2011, purchases and sales of investment securities other than U.S. Government obligations and short-term investments aggregated $2,305,591 and $0, respectively. Purchases and sales of U.S. Government obligations aggregated $0 and $0, respectively.

7.) SECURITY TRANSACTIONS:

For Federal income tax purposes, the cost of investments owned at July 31, 2011 was $2,366,522. At July 31, 2011, the composition of unrealized appreciation (the excess of value over tax cost) and depreciation (the excess of tax cost over value) on investments was as follows:

| | | | | | |

| | Appreciation | | (Depreciation) | | | Net Appreciation (Depreciation) |

| | $90,594 | | ($89,295) | | | $1,299 |

8.) CONTROL OWNERSHIP:

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of July 31, 2011, Band & Co. and National Financial Services, LLC, for the benefit of their clients, held, in aggregate 25.60% and 46.43% of the shares of the Fund, respectively, and therefore each may be deemed to control the Fund.

9.) DISTRIBUTIONS TO SHAREHOLDERS:

There were no distributions paid during the period February 24, 2011 through July 31, 2011.

2011 Semi-Annual Report 12

ADDITIONAL INFORMATION

July 31, 2011

(UNAUDITED)

APPROVAL OF MANAGEMENT AGREEMENT:

On January 20, 2011 the Board of Trustees (the “Board”) considered the approval of the Management Agreement (the "Agreement"). In approving the Agreement, the Board reviewed a memorandum from legal counsel regarding the duties of Trustees with respect to the approval of investment advisory contracts. Legal counsel explained that in fulfilling their responsibilities to the Fund and its shareholders, the Board must apply their business judgment to the question of whether the overall arrangements provided under the terms of the investment advisory contract are reasonable business arrangements for the Fund. They also discussed the specific factors the Board should consider in evaluating an investment advisory contract which include, but are not limited to, the following: the investment performance of the fund and the investment advisor; the nature, extent and quality of the services to be provided by the investment advisor to the fund; the costs of the services to be provided and the profits to be realized by the advisor and its affiliates from the relationship with the fund; the extent to which economies of scale will be realized as the fund grows; and whether the fee levels reflect these economies of scale to the benefit of shareholders.

Legal counsel discussed with the Board the fact that the 1940 Act and court decisions place the responsibility on the Board of Trustees (and especially the independent Trustees) to exercise their good faith business judgment on behalf of the Fund and its shareholders in determining whether to enter into or renew an investment advisory contract. Legal counsel also noted that the Board must make a reasonable and good faith attempt to ascertain all facts relevant to their deliberations and that their review should generally involve two fundamental areas of inquiry: the nature and quality of the services provided under the investment advisory contract and the reasonableness of the fee.

The Board reviewed the responses of the Advisor to a questionnaire provided by legal counsel, as well as the proposed Agreement between the Trust and the Advisor, copies of which had previously been supplied to the Board for their review. Legal Counsel noted that the Agreement provided that the Advisor would pay all of the operating expenses of the Fund, with limited exceptions, and that as a result, the Fund’s major expense would be the advisory fee. The Advisor discussed with the Board the expenses that would be paid by the Fund. In particular, it was suggested that transaction charges by the Fund's custodian remain as expenses of the Fund, and after further discussion, the Board agreed to modify the Agreement to indicate that such expenses would be expenses of the Fund. The Board received and considered information regarding the Advisor’s financial resources, and it was the consensus of the Board that the Advisor had the wherewithal to pay the operating expenses of the Fund as required by the Agreement.

As to the Advisor’s business and the qualifications of its personnel, the Board examined a copy of the Advisor’s registration statement on Form ADV and discussed the experience of the Advisor. The Board noted that the Advisor is not affiliated with the transfer agent or custodian, and therefore does not derive any benefits from the relationships these parties have with the Trust. The Advisor informed the Board that it does not have an affiliated broker-dealer through which Fund transactions could be executed. The Board noted that the Advisor would be compensated under the proposed Rule 12b-1 Plan, if implemented.

The Board also discussed with the Advisor its experience as an investment advisor and familiarity with Indian securities, as well as the proposed strategy for the Fund. The Advisor explained that its investment style could be described as growth at a reasonable price (or “GARP”), and that the Fund’s investments would not be limited by the capitalization of a company, but would generally be skewed toward large-cap stocks.

As to the nature, extent and quality of the services to be provided by the Advisor to the Fund, the Board considered that, under the terms of the Agreement, the Advisor would, subject to the supervision of the Board of Trustees of the Trust, provide or arrange to be provided to the Fund such investment advice as the Advisor in its discretion deems advisable and will furnish or arrange to be furnished a continuous investment program for the Fund consistent with the Fund’s investment objective and policies. The Board also considered that the Advisor would determine or arrange for others to determine the securities to be purchased for the Fund, the portfolio securities to be held or sold by the Fund and the portion of the Fund’s assets to be held uninvested, subject always to the Fund’s investment objective, policies, and restrictions, and subject further to such policies and instructions as the Board of Trustees may from time to time establish. The Board noted the Advisor would furnish any reports, evaluations, information, or analysis to the Trust as the Board of Trustees may request from time to time or as the Advisor deems to be desirable. The Board also noted that the Advisor would pay all advertising, promotion, and other distribution expenses incurred in connection with the Fund’s shares to the extent such expenses

2011 Semi-Annual Report 13

Additional Information (Unaudited) - continued

are not permitted to be paid by the Fund under any distribution expense plan or any other permissible arrangement that may be adopted in the future. The Board noted that the Advisor had adopted a compliance program to monitor and review investment decisions and to prevent and detect violations of the Fund’s investment policies and limitations, as well as the federal securities laws.

The Board next considered the scope of the services to be provided by the Advisor, and noted that the Advisor is responsible for maintaining and monitoring the compliance programs for the Fund. The Board considered the investment experience of the Advisor, as well as its familiarity with the Indian securities markets. The Advisor indicated that it would consider hiring additional personnel as the Fund grows, but indicated that it believed that the services as proposed were currently adequate given the anticipated level of assets at the Fund’s inception. The Board discussed with the Advisor the impact on the Fund, if any, if the Advisor were unavailable to manage the Fund. The Advisor stated that a member of the Advisor was familiar with the Advisor's strategy and would be capable of serving as portfolio manager if the Advisor was unavailable to manage the Fund. The Board also discussed other options for the Fund in the event the Advisor was unavailable, including closing the Fund. The Board concluded that the nature, extent, and quality of the services to be provided to the Fund under the Agreement were consistent with the Board’s expectations.

Because the Fund had not yet commenced operations and the Advisor was newly formed, the Board could not consider the investment performance of the Fund or the Advisor. However, the Board reviewed a “Retirement Composite Equity Performance of Portfolios Under Direct Management” report that had been prepared by the Advisor with respect to accounts managed by an affiliate of the Advisor, which is also controlled and managed by the Advisor. The report included approximately 20 years of performance figures for the composite portfolio that had been managed by the Advisor using a strategy similar to that proposed for the Fund (except that the composite did not have a strategy to invest primarily in Indian securities). The Board considered the report informative and noted that the composite returns had outperformed the S&P 500 over the period since inception of the composite accounts. The Board concluded that the performance was very good.

As to the costs of the services to be provided and the profits to be realized by the Advisor, the Board reviewed information regarding the Advisor’s financial condition and its anticipated profitability from managing the Fund assuming different levels of assets under management, and discussed the same with the Advisor. Based on their review, the Board concluded that they were satisfied that the Advisor’s expected level of profitability from its relationship with the Fund was not excessive.

As to comparative fees and expenses, the Board considered the management fee to be paid to the Advisor and compared those fees to the fees and expense ratios of funds in a peer group of Pacific/Asia ex-Japan equity funds with assets between $1 million and $10 million. The Advisor noted that the proposed management fee for the Fund is 2.00%, indicating that in exchange the Advisor will provide investment advisory services and also pay all of the Fund’s operating expenses, subject to certain limited exceptions, which he reviewed with the Board. The Board then reviewed in detail the expense comparisons provided. The Board noted that it was more appropriate to look at the total expense ratio of the funds in the peer groups because of the fact that the Fund had a universal fee. The Board further noted that Fund’s total expense ratio was slightly lower than the peer group mean expense ratio. The Board also reviewed information indicating that the Fund’s total expense ratio was higher than the management fee charged by RM Investment Management, Inc., an affiliate of the Advisor, which was generally 1.00% . The Advisor explained that for those separately managed accounts, its affiliate is not required to pay many of the “other” expenses that will be paid on behalf of the Fund, which is why the fee charged to the Fund is higher. The Board also discussed the Fund’s possible investment in ETFs and similar products and concluded that the fees to be paid to the Advisor are based on services provided that are different from and not duplicative of the services provided under the advisory agreement of the ETFs and similar products. The Board concluded that the Fund’s proposed management fee was very reasonable in light of the quality of services the Fund expected to receive from the Advisor and the level of fees paid by funds in the peer groups.

As to economies of scale, the Board noted that the Agreement contains breakpoints that reduce the fee rate on assets above specified levels. The Board concluded that breakpoints are an appropriate way for the Advisor to share its economies of scale with a Fund and its shareholders if the Fund experiences a substantial growth in assets.

The Board then temporarily adjourned and the Independent Trustees met in executive session with legal counsel to the Fund and the Independent Trustees. Upon reconvening, it was the consensus of the Board, including the disinterested Trustees, that the approval of the Management Agreement would be in the best interests of the Fund and the shareholders.

2011 Semi-Annual Report 14

Board of Trustees

Gerald A. Fallon

Rakesh Mehra

Richard C. Ruhland

Robert Warren, Jr.

Investment Advisor

New Frontiers Advisory Group, LLC

Legal Counsel

Thompson Hine LLP

Custodian

Union Bank, N.A.

Dividend Paying Agent,

Shareholders' Servicing Agent,

Transfer Agent

Mutual Shareholder Services, LLC

Administrator

Premier Fund Solutions, Inc.

Independent Registered Public Accounting Firm

Cohen Fund Audit Services, Ltd.

Distributor

Rafferty Capital Markets, LLC

|

This report is provided for the general information of the shareholders of the New

Frontiers KC India Fund. This report is not intended for distribution to prospective

investors in the Fund, unless preceded or accompanied by an effective prospectus. |

NEW FRONTIERS KC INDIA FUND

30195 Chagrin Blvd., Suite 118N

Pepper Pike, OH 44124

Item 2. Code of Ethics. Not applicable.

Item 3. Audit Committee Financial Expert. Not applicable.

Item 4. Principal Accountant Fees and Services. Not applicable.

Item 5. Audit Committee of Listed Companies. Not applicable.

Item 6. Schedule of Investments. Not applicable. Schedule filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds. Not applicable.

Item 8. Portfolio Managers of Closed End Funds. Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers. Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) The Registrant’s president and chief financial officer concluded that the disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) were effective as of a date within 90 days of the filing date of this report, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the registrant’s second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Code of Ethics. Not applicable.

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(b) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Filed herewith.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

By: /s/ Rakesh Mehra

Rakesh Mehra

President

Date: 9/30/11

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ Rakesh Mehra

Rakesh Mehra

President

Date: 9/30/11

By: /s/ Rakesh Mehra

Rakesh Mehra

Chief Financial Officer

Date: 9/30/11