| | | Ticker Symbols | |

| | Investor Class | Institutional Class | IS Class |

| Jackson Square | | | |

| Large-Cap Growth Fund | JSPJX | JSPIX | DPLGX |

| | | | |

| Jackson Square | | | |

| SMID-Cap Growth Fund | JSMVX | JSMTX | DCGTX |

Annual Report

| www.jspartners.com/funds/ | October 31, 2022 |

(This Page Intentionally Left Blank.)

Jackson Square Funds

October 31, 2022

Dear Shareholders:

Jackson Square Partners, LLC (“Jackson Square”), a U.S. registered investment adviser, is the adviser to the Jackson Square Large-Cap Growth Fund and Jackson Square SMID-Cap Growth Fund.

A broad swath of publicly-traded asset classes struggled during the fiscal period, which saw relentless volatility amid Russia’s invasion of Ukraine, persistent inflation, hawkish Fed policies, a surging U.S. dollar, continued fall-out from COVID, and increasing fears of recession. Time horizons compressed substantially and markets moved in a correlated fashion in response to headlines and shorter-term trends. Growth equities, particularly at the lower end of the cap spectrum, were especially challenged, often without much regard for underlying company fundamentals. Correlations spiked alongside volatility, with higher duration growth stocks moving largely in lockstep down in price, and equity valuations fell sharply, reaching 2016 levels for forward earnings and revenue multiples by the end of the period.

We believe the deviation between stock performance and company fundamentals is not sustainable over the long-term, making it more important than ever to retain a long-term outlook. In our view, the broader de-rating, particularly of higher duration growth stocks, has removed much of the valuation risk from the market. While bear market sell-offs are not cause for celebration, we believe it is important to take advantage of opportunistic entry points for attractive companies with strong potential for long-term growth of intrinsic value. In a meaningful shift from the capital markets’ posture over the past several years, we believe the best-positioned companies are now clearly communicating a path to profitability, taking sensible cost-cutting measures while continuing to invest in growth.

We expect inflation and rates to continue to drive market volatility. Top of mind are: (1) compressing consumer spending, particularly on the lower end of the income spectrum, with a continuation of the trend of shifting from goods to services, (2) slowing business investment, and (3) softening labor markets. We believe company fundamentals, quality, and resiliency will be increasingly important as those companies which can successfully navigate the obstacle course of macro headwinds should stand out. As we look five-to-then years ahead and compare our assessment of intrinsic value vs. recent stock movements, it is clear to us that very little of the price action in 2022 has been driven by changes in fundamental outlook. History tells us these moments (while quite humbling) tend to be transitory and it is our core, bottom-up stock theses that will drive returns through market cycles.

Regardless of policy outcomes and oscillating investor sentiment, we remain consistent in our investment philosophy: we want to own what we view as strong secular-growth companies, with solid business models and competitive positions that we believe can grow market share and have the potential to deliver shareholder value in a variety of market environments.

Jackson Square Large-Cap Growth Fund

Within the Fund

For the fiscal year ended October 31, 2022, Jackson Square Large-Cap Growth Fund IS, Institutional and Investor Classes shares returned -41.26%, -41.27%, and -41.38%, respectively. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 1000® Growth Index, returned -24.60%. For complete, annualized performance of Large-Cap Growth Fund, please see the table on page 9.

Underperformance was driven by the fund’s Information Technology and Health Care allocations. In the Information Technology sector, Disruptors (young challengers reinvesting today to drive scale, attacking large addressable markets with top-tier underlying unit economics) were a source of underperformance during the period. These names faced macro headwinds from rising rates along with a growth rotation that saw the entire subset trade in a highly correlated fashion, regardless of underlying fundamentals and despite these stocks having completely different business models, different end markets, and unique growth drivers. We believe the market has broadly penalized these assets while the Fed continues hiking at an unprecedented pace (two and likely three consecutive 75 basis point rate increases). Our view is that pace will unquestionably slow, and as it does, buyers will return to these names with a more discerning eye for business quality and cash flow growth potential – all of which should benefit our portfolio disproportionately. We believe our holdings have over-corrected to the point where the market is discounting a long-term rate of inflation that is highly improbable. We therefore maintain an appropriately sized exposure to the category at less than 20% of the portfolio.

Healthcare has also been a headwind this year, though our weight is in highly profitable, high return on invested capital growth businesses within protected industry structures. Unfortunately, despite already-reasonable valuations (which are now even cheaper), correlations spilled over into this category to an extent that surprised us. Additionally, there has been no lack of challenges from other macro headwinds – including COVID, supply chains, labor shortages, and USD strength – but all of which are transitory. After a disappointing 2022, we expect valuation support to provide a floor, and for this sector to generate significant positive attribution over the next one-to-three years as the market returns to the fundamentals.

More defensive holdings benefited from the market rotation during the period and contributed to performance.

In terms of our portfolio actions during the period – we have resisted adding broad exposure to fallen angels during this paradigm change for names lacking near-term cash flow support. Instead, we have made selective, high-impact changes grounded in visibility and medium-term risk/reward asymmetry. We have consolidated weight into those businesses where (1) our thesis conviction is strongest, (2) management understands how to set appropriate expectations for delivering both growth and incremental margin, and (3) capital allocation remains sensible. Names we hold, and new ideas initiated, remain on track along these fundamental lines.

On a stock-specific level, the following were the most significant contributors and detractors during the period.

Mastercard and Visa, two of the world’s leading digital payments companies, were contributors to performance. Both companies benefited from the continued rebound in cross-border travel as countries continued to relax international travel constraints. We believe the companies should continue to benefit from the structural growth of consumers switching from paying with cash to paying with Visa and Mastercard branded cards. In addition, both companies have a long tail of opportunities to capture new payment flows in areas such as peer-to-peer, business-to-consumer, business-to-business, and government-to-consumer. We remain bullish on both stocks given their competitive position, growth opportunities, and valuation.

Canadian Pacific Railway Limited (CP), a North American railroad, contributed to performance during the period. CP benefited from a market rotation that favored defensive names as well as commodity tailwinds. CP

Jackson Square Large-Cap Growth Fund

operates in an oligopolistic industry structure, and after the company’s acquisition of Kansas City Southern, CP is the only Class 1 rail spanning from Canada to Mexico, allowing for continuous service while circumventing many of the most congested areas in the U.S. freight system. In essence, a longer “line” means fewer touches and substantial cost saving opportunities are created by choosing CP over alternatives. We also believe CP’s CEO and management team is the most effective leadership group in the industry, having driven CP’s standalone return on invested capital (ROIC) from single-digits to high-teens over the last decade. The rail industry is now substantially finished with PSR efforts (“precision scheduled railroading”), which we believe is key to the railroads’ ability to provide the service and reliability necessary to earn greater share of freight vs. trucking, which still dominates the freight landscape despite higher costs and emissions.

Twilio, Inc. Class A, a cloud communications platform, was a detractor from performance during the period. The company is a leading communications-as-a-service platform with market share that is a multiple of its next largest competitor. It has been a driving force to digitize and simplify communications across mediums and geographies with user-friendly tools for software developers. The stock sold off with other longer duration technology names, and, in our view, failed to act with urgency to address the current market environment, which we believe called for a pivot towards profitability. Investors grew impatient as management guided toward profitability in 2023 but failed to provide specific targets. We exited the position after the close of the period as we lost faith in the management team.

Match Group, Inc., a provider of dating products worldwide, was a detractor from performance during the period. The company underperformed on challenging comps. There were both execution and macro-driven issues, including COVID as well as significant FX headwinds. Feature development was a problem for both new user acquisition and monetization. The firm took personnel action and reset guidance, as they sought to simultaneously jumpstart innovation to sustain growth while focusing on cost controls to keep margins flat. We believe the company should benefit from continued international expansion and reopening. Further, if investors can get confidence that Tinder will in fact re-accelerate and Hinge continues to operate in the top 3 of dating apps globally, the stock should generate attractive returns.

Coupa Software, Inc., a cloud-based Software as a Service (“SaaS”) platform for business spend management, was a detractor from performance. Buy-side sentiment for the stock remained negative throughout the period; however the company’s fundamentals remained solid despite continued macro headwinds which lengthened sales cycles and a strong U.S. dollar which cut into margins. The company’s new CFO seems to be earning back credibility with investors, and we believe the company can outperform as it laps compares complicated by the sizable Llamasoft acquisition and is able to showcase strong organic growth.

Jackson Square SMID-Cap Growth Fund

Within the Fund

For the fiscal year ended October 31, 2022, SMID-Cap Growth Fund IS, Institutional and Investor Class shares returned -49.75%, -49.84% and -49.97%, respectively. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 2500® Growth Index, returned -29.39%. For complete, annualized performance of Jackson Square SMID-Cap Growth Fund, please see the table on page 12.

Underperformance was driven by the fund’s Health Care allocation as well as Disruptor exposure (young challengers reinvesting today to drive scale, attacking large addressable markets with top-tier underlying unit economics) across Consumer Discretionary, Communication Services, Information Technology and Industrials.

As a result of heightened macro concerns, we feel that Style and Factor continue to have a more significant impact on portfolio performance than at any other time in our 15+ year history of managing the strategy. Covid introduced elevated Style risk in 2020-2022 and we have done a poor job navigating this risk after the 2020 uplift. We are committed to returning the portfolio to a more neutral Style footprint over time and to that end are actively incorporating more robust risk and factor dashboards, seeking more muted Style and Factor exposure.

We felt a noticeable drag from Health Care holdings during the period. This drag stands in sharp contrast to the strong secular growth we see ahead for the sector. We are disappointed by the recent weakness, which we believe has been driven by a variety of factors, including Covid-induced business slowdowns, supply chain disruptions, capital markets uncertainty around Biotech, China weakness and FX issues, etc. Few if any of these concerns impact long-term fundamentals – we view them as temporary speedbumps. Our time-tested emphasis on long investment horizons and concentration has at times required tolerating interim volatility. In the current – ongoing – instance, we are willing to accept this often painful volatility due to our conviction in the life and world-changing potential in these companies, and the strong financial returns that we believe will follow.

Though Disruptors have been a significant source of detraction over the period, it is important to note that they have been the portfolio’s single largest source of alpha over the course of the product’s history, even incorporating recent underperformance, over a range of market and interest rate environments. We continue to believe in the asymmetrical return potential of our Disruptors and note some positive signs in the 3rd quarter markets, where Disruptors performed in line with the index and correlations began to ease in September. We continue to be highly engaged with portfolio holdings in key areas that we believe can drive alpha near term. In particular, we have been engaging with company management teams on changes they can make in order to pivot towards incremental profitability. The “new” environment is rewarding slower, more sustainable growth rates at higher marginal levels of profitability.

On a stock-specific level, the following were the most significant contributors and detractors during the period.

Grocery Outlet Holding Corp. (GO), an operator of discount grocery stores in the United States, was a contributor to performance. GO came more into favor with investors seeking companies able to weather or even benefit from an economic downturn and inflationary environment. The company guided to an improvement in business trends and executed a sizable share repurchase program. As noted in last year’s annual report, we believed the shares last fall had fully discounted a long-term bear scenario, and had added to the position on that view. We continue to like Grocery Outlet given not only the tremendous unit growth opportunity we believe is ahead but also its solid economic model.

SailPoint Technologies Holding (SAIL), a software company focusing on identity governance, was a contributor to performance. SAIL was acquired at a premium by the private equity shop Thoma Bravo. As tech and high duration growth sold off, the company’s nearly flawless execution and consistent, positive earnings results limited

Jackson Square SMID-Cap Growth Fund

both its price decline and multiple compression. In our view, SAIL established a commanding lead in the critical and under-appreciated niche of cybersecurity, which likely represents the most durable bucket of IT spend over the next decade, as no company wants to be the next NYT headline.

Wyndham Hotels & Resorts, Inc. (WH), a hotel chain, was a contributor to performance. As an asset-lite hotel franchisor, with ~85% of its EBITDA generated in the U.S., the company’s earnings were hard-hit by COVID-19. We saw a severely dislocated stock, a resilient balance sheet, and a midscale / economy “drive-to-rural” footprint that would hold up better than luxury hotel peers. This played out as WH’s revenue per available room (RevPar) troughed at a fraction of the decline of its hotel peers and has since made a steady recovery. This gained further momentum during the period as earnings results came in well ahead of consensus and the company revised their rooms outlook upward. The company has also now entirely shed the remainder of its non-core, non-franchise assets, including unprofitable management contracts and owned hotels in Orlando and Puerto Rico that were clouding the narrative and impairing the cost of capital. We are encouraged that continued acceleration in rooms growth can close its valuation gap vs. peers. Additionally, WH exhibits ballast-like, uncorrelated performance during periods of volatility. We believe the company is poised for an acceleration in free cash flow (FCF) growth and capital return from here, and we that the market is re-warming to this equity after getting de-railed by COVID.

LendingClub Corp, a company that provides financial services through an internet-based platform, was a detractor from performance during the period as markets became concerned with consumer credit as a category. The market continues to digest the large step-function improvement in operating results announced since the acquisition of Radius Bank, which we believe were beyond even the most optimistic investor assumptions and highlight the strength of LendingClub’s hybrid strategy (the combination of a neo-bank and a marketplace offering). However, LC remains an underfollowed equity and as such is experiencing a pull-back on sentiment. The market is just now showing early signs of interest in what we believe is a highly compelling three-to-five year investment opportunity.

Pacific Biosciences of California, Inc. (PACB), a provider of long-read genomic sequencing systems and consumables, was a detractor to performance during the period. The stock came under pressure given the broader sell-off in growth companies. This sell-off was particularly acute in the genomics sector given exposure to several macro risks, including (1) COVID-related lockdowns in China, (2) increasing supply chain concerns, (3) greater inflationary pressures, and (4) weakening public and venture capital funding for biotech companies. The stock outperformed significantly at the end of the period as it announced new long read and short read sequencers in October, earlier than forecast and with better-than-expected instrument performance and delivery timelines. We remain constructive on PacBio’s long-term risk/reward profile given the significant under-penetration of genomic sequencing, the differentiated nature of long-read sequencing and therefore the company’s competitive position, and the attractive long-term margin profile of their business.

Vimeo, Inc. (VMEO), a subscription-driven video management platform, and a tail position in the portfolio, was a detractor from performance during the period. The company spun out of IAC in May 2021, and had a volatile start as it embarked upon a transformative business model pivot towards enterprise (away from individual self-serve). Vimeo struggled with macro headwinds, and was negatively surprised by lower-than-expected ARPU (amount of revenue per user) in its self-serve business as travel / outdoor activity picked up. Though the company brought in a new CFO – a change we had pushed for with the board of directors – Vimeo has not effectively managed investor expectations in an unforgiving market environment. We believe the company has the most complete and strongest-performing video management platform, a nascent category poised to become increasingly critical to employee and customer communication over time, especially in a permanent hybrid environment. We invested based on a thesis that it can transition its business model towards enterprise-grade customers, where interest and intent to upgrade are high. With consistent execution, this can drive stronger growth, lower churn, greater upsell opportunity, a higher-quality customer mix, and re-rating potential beyond what the market appreciates.

Jackson Square Funds

The materials provided herein are for general information purposes only and may not be copied or redistributed without Jackson Square’s prior consent. The views expressed represent Jackson Square’s assessment of the strategy and market environment as of the date identified herein and should not be considered a recommendation to buy, hold, or sell any security, and should not be relied on as research or investment advice. The information in this presentation, including statements concerning financial markets is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.

Opinions expressed are those of Jackson Square Partners, LLC and are subject to change, are not guaranteed and should not be considered investment advice.

Holdings are as of the date provided and subject to change. Please see the Schedule of Investments in this report for a complete list of fund holdings.

Mutual fund investing involves risk. Principal loss is possible. The Funds are non-diversified meaning they may concentrate their assets in fewer individual holdings than a diversified fund. Therefore these Funds are more exposed to individual stock volatility than a diversified fund. Small- and Mid-capitalization companies tend to have limited liquidity and greater price volatility than large capitalization companies. Investments in foreign securities involve greater volatility and political economic and currency risks and differences in accounting methods. These risks are greater in emerging and frontier markets. Frontier market countries generally have smaller economies and even less developed capital markets than traditional emerging markets, and, as a result, the risks of investing in emerging market countries are magnified in frontier market countries. Investments in Real Estate Investment Trusts (REITs) involve additional risks such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. When the Funds buy or sell securities on a foreign stock exchange, the transaction is undertaken in the local currency rather than in U.S. dollars. The value of the foreign currency may increase or decrease against the value of the U.S. dollar, which may impact the value of the Funds’ portfolio holdings and your investment. Other countries may adopt economic policies and/or currency exchange controls that affect their currency valuations in a manner that is disadvantageous to U.S. investors and companies. From time to time, the trading market for a particular security or type of security in which the Funds invest may become less liquid or even illiquid.

Past performance is no guarantee of future results.

Diversification does not assure a profit, nor does it protect against a loss in a declining market.

For comparison purposes, the indices are fully invested and include the reinvestment of income. Index returns do not reflect management fees, transaction costs, or expenses. The indices are unmanaged, and one cannot invest directly in an index. Benchmark information contained herein has been obtained from third party sources believed to be reliable, but we cannot guarantee its accuracy or completeness. All third-party marks are the property of their respective owners. All performance data regarding the indices are historical and are not indicative of future results, and there can be no assurance that these or comparable results will actually be achieved by the strategies or that the strategies’ investment objectives will be achieved.

Free Cash Flow – The amount of cash generated each year that is free and clear of all internal or external obligations.

Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The index is unmanned and an investment cannot be made into the index.

Russell 2500® Growth Index. The Russell 2500® Growth Index measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500® companies with higher price-to-book ratios and higher forecasted growth values. The index is unmanned and an investment cannot be made into the index.

The report must be preceded or accompanied by a prospectus.

Jackson Square Partners, LLC is the adviser to the Jackson Square Funds, which are distributed by Quasar Distributors, LLC.

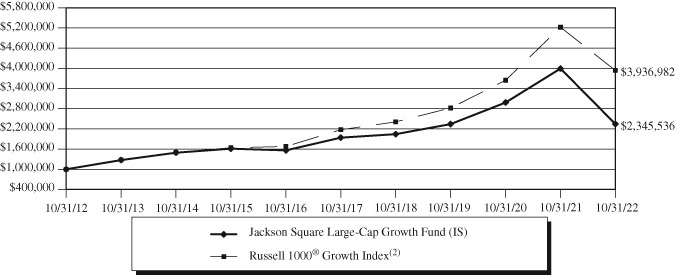

Jackson Square Large-Cap Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-577-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2022

| | 1 year | 5 years | 10 years | Since Inception(1) |

| IS Class | -41.26% | 3.87% | 8.90% | 7.48% |

| Institutional Class | -41.27% | 3.69% | 8.74% | 7.37% |

| Investor Class | -41.38% | 3.45% | 8.48% | 7.09% |

Russell 1000® Growth Index(2) | -24.60% | 12.59% | 14.69% | 9.81% |

| (1) | The Jackson Square Large-Cap Growth Fund (the “Fund”) acquired the assets and assumed the liabilities of the Delaware U.S. Growth Fund, a series of Delaware Group Adviser Funds (the “Predecessor Fund”), effective at the close of business on April 16, 2021 (the “Reorganization”), and the Predecessor Fund is the accounting and performance history survivor of the Reorganization. The performance information shown for the Fund’s Investor Class Shares represents the performance of the Predecessor Fund’s Class A shares, performance for the Fund’s Institutional Class Shares represents the performance of the Predecessor Fund’s Institutional Class shares, and performance for the Fund’s IS Class Shares represents the performance of the Predecessor Fund’s Class R6 shares. Prior to April 16, 2021, the Adviser served as sub-adviser to the Predecessor Fund. The IS Class performance has not been restated to reflect any differences in expenses paid by the Predecessor Fund and those paid by the Fund. The performance shown for the Investor Class Shares has been adjusted so that it does not reflect the Predecessor Fund’s 5.75% sales charge for its Class A shares, which does not apply to Investor Class shares. Performance shown for the periods prior to the inception of the Institutional Class and IS Class is based on the performance of the Investor Class shares, adjusted for the lower expenses applicable to the Institutional and IS classes. The Investor Class commenced operations on December 3, 1993, the Institutional Class commenced operations on February 3, 1994 and the IS Class commenced operations on May 2, 2016. |

| (2) | The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

Jackson Square Large-Cap Growth Fund

The following is expense information for the Large-Cap Growth Fund (the “Fund”) as disclosed in the most recent prospectus dated March 1, 2022: IS Class – Gross Expenses: 0.64%; Institutional Class – Gross Expenses: 0.74%; Investor Class – Gross Expenses: 0.99%. Jackson Square Partners, LLC (the “Adviser”) has contractually agreed to waive its management fees and pay Fund expenses in order to ensure the Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, shareholder servicing fees, acquired fund fees and expenses, brokerage commissions, leverage, interest, taxes, and extraordinary expenses) do not exceed 0.64% of the average daily net assets of the Fund. Prior to April 16, 2021, the Fund’s expenses were capped at 0.62% of the Fund’s average daily net assets for IS Class shares (formerly, Class R6), and 0.84% of the Fund’s average daily net assets for all other share classes. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of thirty-six months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. Expenses paid prior to April 16, 2021, may not be recouped. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least April 30, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Board of Trustees (the “Board”) or the Adviser.

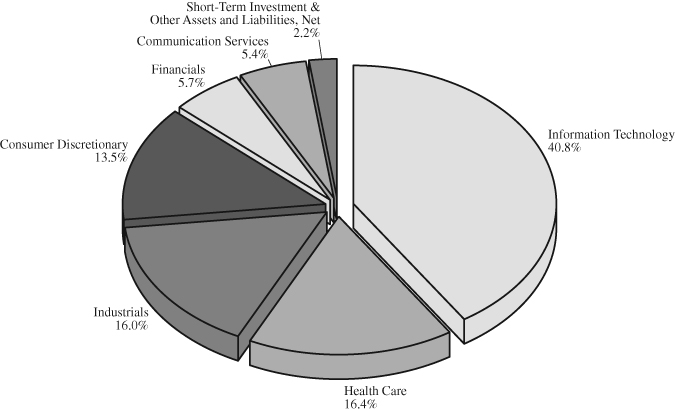

Jackson Square Large-Cap Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2022

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2022

(% of Net Assets)

| | Microsoft | | | 11.4 | % |

| | Amazon.com | | | 8.5 | % |

| | Mastercard – Class A | | | 7.7 | % |

| | Visa – Class A | | | 7.4 | % |

| | Canadian Pacific Railway | | | 4.7 | % |

| | Edwards Lifesciences | | | 4.1 | % |

| | ServiceNow | | | 4.0 | % |

| | Uber Technologies | | | 3.8 | % |

| | Waste Management | | | 3.8 | % |

| | Boeing | | | 3.7 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

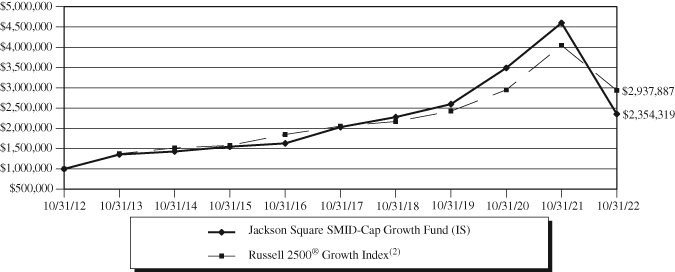

Jackson Square SMID-Cap Growth Fund

Value of $1,000,000 Investment (Unaudited)

The chart assumes an initial investment of $1,000,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 1-844-577-3863. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of October 31, 2022

| | 1 year | 5 years | 10 years | Since Inception(1) |

| IS Class | -48.81% | 2.99% | 8.94% | 8.82% |

| Institutional Class | -48.89% | 2.92% | 8.86% | 8.73% |

| Investor Class | -49.01% | 2.64% | 8.57% | 8.45% |

Russell 2500® Growth Index(2) | -27.38% | 7.41% | 11.38% | 9.11% |

| (1) | The IS Class commenced operations on December 1, 2003, the Institutional Class commenced operations on September 16, 2016 and the Investor Class commenced operations on September 19, 2016. Performance of the Institutional Class and Investor Class prior to inception of each class is based on the performance of the IS Class, adjusted for the higher expenses applicable to each class’s shares. |

| (2) | The Russell 2500® Growth Index measures the performance of the small to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500® companies with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an Index. |

The following is expense information for the SMID-Cap Growth Fund (the “Fund”) as disclosed in the most recent prospectus dated March 1, 2022: IS Class – Gross Expenses: 0.82%; Institutional Class – Gross Expenses: 0.92%; Investor Class – Gross Expenses: 1.17%. Jackson Square Partners, LLC (the “Adviser”) has contractually agreed to waive its management fees and pay Fund expenses in order to ensure the Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, shareholder servicing fees, acquired fund fees and expenses, brokerage commissions, leverage, interest, taxes, and extraordinary expenses) do not exceed 0.87% of the average daily net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of thirty-six months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement is indefinite, but cannot be terminated through at least February 28, 2023. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Board of Trustees (the “Board”) or the Adviser.

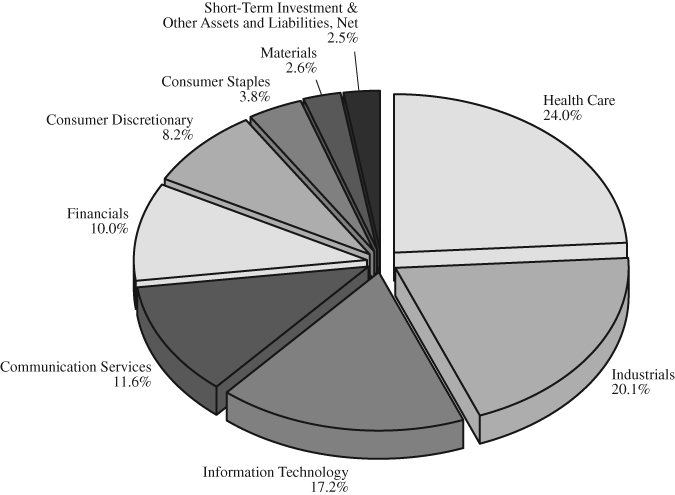

Jackson Square SMID-Cap Growth Fund

Sector Allocation(1) (Unaudited)

As of October 31, 2022

(% of Net Assets)

Top Ten Equity Holdings(1) (Unaudited)

As of October 31, 2022

(% of Net Assets)

| | New York Times – Class A | | | 7.3 | % |

| | Westinghouse Air Brake Technologies | | | 6.2 | % |

| | Charles River Laboratories International | | | 5.5 | % |

| | Graco | | | 5.1 | % |

| | Wix.com | | | 5.1 | % |

| | Pacific Biosciences of California | | | 4.6 | % |

| | Bio-Techne | | | 4.6 | % |

| | LPL Financial Holdings | | | 4.4 | % |

| | Aspen Technology | | | 3.9 | % |

| | Grocery Outlet Holding | | | 3.8 | % |

| (1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Jackson Square Funds

Expense Examples (Unaudited)

October 31, 2022

As a shareholder of a Fund, you incur two types of costs: (1) transactions costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees, shareholder servicing fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2022 – October 31, 2022).

ACTUAL EXPENSES

For each class, the first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only. Therefore, the second line of the tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds, In addition, if transactional costs were included, your costs may have been higher.

Large-Cap Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (5/1/2022) | (10/31/2022) | (5/1/2022 to 10/31/2022) |

IS Class Actual(2) | $1,000.00 | $ 842.60 | $2.97 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,021.98 | $3.26 |

| | | | |

Institutional Class Actual(2) | $1,000.00 | $ 842.50 | $3.07 |

| Institutional Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,021.88 | $3.36 |

| | | | |

Investor Class Actual(2) | $1,000.00 | $ 841.80 | $4.18 |

| Investor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.67 | $4.58 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.64%, 0.66% and 0.90% for the IS Class, Institutional Class and Investor Class, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended October 31, 2022 of -15.74%, -15.75% and -15.82% for the IS Class, Institutional Class and Investor Class, respectively. |

Jackson Square Funds

Expense Examples (Unaudited) – Continued

October 31, 2022

SMID-Cap Growth Fund

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (5/1/2022) | (10/31/2022) | (5/1/2022 to 10/31/2022) |

IS Class Actual(2) | $1,000.00 | $ 856.80 | $3.88 |

| IS Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,021.02 | $4.23 |

| | | | |

Institutional Class Actual(2) | $1,000.00 | $ 856.40 | $4.30 |

| Institutional Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,020.57 | $4.69 |

| | | | |

Investor Class Actual(2) | $1,000.00 | $ 855.30 | $5.52 |

| Investor Class Hypothetical | | | |

| (5% return before expenses) | $1,000.00 | $1,019.26 | $6.01 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.83%, 0.92% and 1.18% for the IS Class, Institutional Class and Investor Class, respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended October 31, 2022 of -14.32%, -14.36% and -14.47% for the IS Class, Institutional Class and Investor Class, respectively. |

Jackson Square Large-Cap Growth Fund

Schedule of Investments

October 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 97.8% | | | | | | |

| | | | | | | |

| Communication Services – 5.4% | | | | | | |

Charter Communications – Class A* | | | 21,584 | | | $ | 7,934,710 | |

Match Group* | | | 86,787 | | | | 3,749,198 | |

| | | | | | | | 11,683,908 | |

| | | | | | | | | |

| Consumer Discretionary – 13.5% | | | | | | | | |

Airbnb – Class A* | | | 35,878 | | | | 3,835,717 | |

Amazon.com* | | | 179,212 | | | | 18,358,478 | |

NIKE – Class B | | | 78,121 | | | | 7,240,254 | |

| | | | | | | | 29,434,449 | |

| | | | | | | | | |

| Financials – 5.7% | | | | | | | | |

KKR & Co. – Class A | | | 119,514 | | | | 5,811,966 | |

S&P Global | | | 20,272 | | | | 6,512,380 | |

| | | |

| | | | 12,324,346 | |

| | | | | | | | | |

| Health Care – 16.4% | | | | | | | | |

Align Technology* | | | 18,158 | | | | 3,528,099 | |

Catalent* | | | 106,192 | | | | 6,980,000 | |

Edwards Lifesciences* | | | 123,071 | | | | 8,914,033 | |

Intuitive Surgical* | | | 32,368 | | | | 7,977,741 | |

Veeva Systems – Class A* | | | 48,336 | | | | 8,117,548 | |

| | | | | | | | 35,517,421 | |

| | | | | | | | | |

| Industrials – 16.0% | | | | | | | | |

Boeing* | | | 56,993 | | | | 8,122,072 | |

Canadian Pacific Railway | | | 135,629 | | | | 10,103,004 | |

Uber Technologies* | | | 314,365 | | | | 8,352,678 | |

Waste Management | | | 51,815 | | | | 8,205,942 | |

| | | | | | | | 34,783,696 | |

| | | | | | | | | |

Information Technology – 40.8%# | | | | | | | | |

Coupa Software* | | | 57,312 | | | | 3,050,718 | |

Datadog – Class A* | | | 44,545 | | | | 3,586,318 | |

Gitlab* | | | 80,442 | | | | 3,898,219 | |

Mastercard – Class A | | | 50,858 | | | | 16,690,578 | |

Microsoft | | | 106,551 | | | | 24,733,684 | |

NVIDIA | | | 34,471 | | | | 4,652,551 | |

ServiceNow* | | | 20,798 | | | | 8,750,550 | |

Snowflake – Class A* | | | 23,062 | | | | 3,696,839 | |

Twilio – Class A* | | | 46,238 | | | | 3,438,720 | |

Visa – Class A | | | 77,443 | | | | 16,043,092 | |

| | | | | | | | 88,541,269 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $249,338,227) | | | | | | | 212,285,089 | |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| SHORT-TERM INVESTMENT – 2.0% | | | | | | |

| | | | | | | |

| Money Market Deposit Account – 2.0% | | | | | | |

U.S. Bank N.A., 1.50% (a) | | | | | | |

Total Money Market Deposit Account | | | 4,365,700 | | | $ | 4,365,700 | |

| TOTAL SHORT-TERM INVESTMENT | | | | | | | | |

| (Cost $4,365,700) | | | | | | | 4,365,700 | |

| Total Investments – 99.8% | | | | | | | | |

| (Cost $253,703,927) | | | | | | | 216,650,789 | |

| Other Assets and Liabilities, Net – 0.2% | | | | | | | 397,216 | |

| Total Net Assets – 100.0% | | | | | | $ | 217,048,005 | |

| * | | Non-income producing security. |

| # | | As of October 31, 2022, the Fund had a significant portion of its assets invested in this sector and therefore is subject to additional risks. See Note 10 in Notes to the Financial Statements. |

| (a) | | The Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2022. |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square SMID-Cap Growth Fund

Schedule of Investments

October 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 97.5% | | | | | | |

| | | | | | | |

| Communication Services – 11.6% | | | | | | |

New York Times – Class A | | | 2,292,375 | | | $ | 66,387,180 | |

Vimeo* | | | 2,824,130 | | | | 10,731,694 | |

Warner Music Group | | | 1,108,127 | | | | 28,833,464 | |

| | | | | | | | 105,952,338 | |

| | | | | | | | | |

| Consumer Discretionary – 8.2% | | | | | | | | |

Allbirds* | | | 846,136 | | | | 2,910,708 | |

Papa John’s International | | | 414,596 | | | | 30,112,108 | |

Peloton Interactive* | | | 1,428,396 | | | | 11,998,526 | |

Wyndham Hotels & Resorts | | | 391,972 | | | | 29,762,434 | |

| | | | | | | | 74,783,776 | |

| | | | | | | | | |

| Consumer Staples – 3.8% | | | | | | | | |

Grocery Outlet Holding* | | | 1,000,234 | | | | 34,578,089 | |

| | | | | | | | | |

| Financials – 10.0% | | | | | | | | |

LendingClub* | | | 2,159,661 | | | | 22,978,793 | |

LPL Financial Holdings | | | 157,698 | | | | 40,315,494 | |

MarketAxess Holdings | | | 114,497 | | | | 27,941,848 | |

| | | | | | | | 91,236,135 | |

| | | | | | | | | |

| Health Care – 24.0% | | | | | | | | |

ABIOMED* | | | 94,875 | | | | 23,916,090 | |

Azenta | | | 616,136 | | | | 27,356,438 | |

Bio-Techne | | | 140,110 | | | | 41,508,989 | |

Catalent* | | | 325,362 | | | | 21,386,044 | |

Charles River Laboratories International* | | | 234,976 | | | | 49,873,656 | |

Pacific Biosciences of California* | | | 5,019,530 | | | | 42,364,833 | |

Twist Bioscience* | | | 387,088 | | | | 12,708,099 | |

| | | | | | | | 219,114,149 | |

| | | | | | | | | |

| Industrials – 20.1% | | | | | | | | |

Graco | | | 673,000 | | | | 46,827,340 | |

Howmet Aerospace | | | 752,860 | | | | 26,764,173 | |

Lyft – Class A* | | | 1,100,894 | | | | 16,117,088 | |

SiteOne Landscape Supply* | | | 195,007 | | | | 22,595,461 | |

Upwork* | | | 1,062,623 | | | | 14,292,280 | |

Westinghouse Air Brake Technologies | | | 606,836 | | | | 56,605,662 | |

| | | | | | | | 183,202,004 | |

See Notes to the Financial Statements

Jackson Square SMID-Cap Growth Fund

Schedule of Investments – Continued

October 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 97.5% (Continued) | | | | | | |

| | | | | | | |

| Information Technology – 17.2% | | | | | | |

Aspen Technology* | | | 148,524 | | | $ | 35,861,120 | |

Coupa Software* | | | 377,341 | | | | 20,085,861 | |

Dolby Laboratories – Class A | | | 332,948 | | | | 22,254,244 | |

Elastic* | | | 500,485 | | | | 32,006,016 | |

Wix.com* | | | 548,256 | | | | 46,108,330 | |

| | | | | | | | 156,315,571 | |

| | | | | | | | | |

| Materials – 2.6% | | | | | | | | |

FMC Corp. | | | 200,491 | | | | 23,838,380 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $1,206,837,569) | | | | | | | 889,020,442 | |

| | | | | | | | | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT – 2.5% | | | | | | | | |

| | | | | | | | | |

| Money Market Deposit Account – 2.5% | | | | | | | | |

U.S. Bank N.A., 1.50% (a) | | | | | | | | |

Total Money Market Deposit Account | | | 23,232,750 | | | | 23,232,750 | |

| TOTAL SHORT-TERM INVESTMENT | | | | | | | | |

| (Cost $23,232,750) | | | | | | | 23,232,750 | |

| Total Investments – 100.0% | | | | | | | | |

| (Cost $1,230,070,319) | | | | | | | 912,253,192 | |

| Other Assets and Liabilities, Net – 0.0% | | | | | | | 30,439 | |

| Total Net Assets – 100.0% | | | | | | $ | 912,283,631 | |

| * | | Non-income producing security. |

| (a) | | The Money Market Deposit Account (the “MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of October 31, 2022. |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Jackson Square Funds

Statements of Assets and Liabilities

October 31, 2022

| | | Large-Cap | | | SMID-Cap | |

| | | Growth Fund | | | Growth Fund | |

| ASSETS: | | | | | | |

| Investment securities: | | | | | | |

| At cost | | $ | 253,703,927 | | | $ | 1,230,070,319 | |

| At value | | $ | 216,650,789 | | | $ | 912,253,192 | |

| Dividends & interest receivable | | | 29,639 | | | | 153,975 | |

| Dividend tax reclaim receivable | | | 327,100 | | | | 245,246 | |

| Receivable for investment securities sold | | | 1,018,567 | | | | 731,359 | |

| Receivable for capital shares sold | | | 321,313 | | | | 1,429,411 | |

| Prepaid expenses | | | 33,858 | | | | 23,444 | |

| Total Assets | | | 218,381,266 | | | | 914,836,627 | |

| LIABILITIES: | | | | | | | | |

| Payable for investment securities purchased | | | — | | | | 1,047,938 | |

| Payable for capital shares redeemed | | | 716,293 | | | | 441,884 | |

| Payable to investment adviser | | | 282,021 | | | | 548,465 | |

| Payable for fund administration & accounting fees | | | 71,725 | | | | 230,028 | |

| Payable for compliance fees | | | 4,665 | | | | 17,474 | |

| Payable for transfer agent fees & expenses | | | 91,818 | | | | 104,056 | |

| Payable for custody fees | | | 4,028 | | | | 15,083 | |

| Accrued distribution and/or shareholder service fees | | | 122,851 | | | | 116,552 | |

| Payable for audit fees | | | 18,468 | | | | 18,524 | |

| Accrued expenses | | | 21,392 | | | | 12,992 | |

| Total Liabilities | | | 1,333,261 | | | | 2,552,996 | |

| NET ASSETS | | $ | 217,048,005 | | | $ | 912,283,631 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| Paid-in capital | | | 256,793,944 | | | | 1,459,025,156 | |

| Total accumulated losses | | | (39,745,939 | ) | | | (546,741,525 | ) |

| Total net assets | | $ | 217,048,005 | | | $ | 912,283,631 | |

IS Class Shares: | | | | | | | | |

| Net Assets | | $ | 40,436,080 | | | $ | 552,793,979 | |

Shares issued and outstanding(1) | | | 2,950,580 | | | | 34,736,625 | |

| Net asset value, offering price, and redemption price per share | | $ | 13.70 | | | $ | 15.91 | |

Institutional Class Shares: | | | | | | | | |

| Net Assets | | $ | 105,097,395 | | | $ | 320,391,662 | |

Shares issued and outstanding(1) | | | 7,794,584 | | | | 20,197,531 | |

| Net asset value, offering price, and redemption price per share | | $ | 13.48 | | | $ | 15.86 | |

Investor Class Shares: | | | | | | | | |

| Net Assets | | $ | 71,514,530 | | | $ | 39,097,990 | |

Shares issued and outstanding(1) | | | 6,652,908 | | | | 2,515,454 | |

| Net asset value, offering price, and redemption price per share | | $ | 10.75 | | | $ | 15.54 | |

| (1) | Unlimited shares authorized without par value. |

See Notes to the Financial Statements

Jackson Square Funds

Statements of Operations

For the Year Ended October 31, 2022

| | | Large-Cap | | | SMID-Cap | |

| | | Growth Fund | | | Growth Fund | |

| INVESTMENT INCOME: | | | | | | |

| Dividend income | | $ | 2,655,622 | | | $ | 4,680,061 | |

| Less: Foreign taxes withheld | | | (37,198 | ) | | | (60,722 | ) |

| Interest income | | | 15,475 | | | | 77,723 | |

| Total investment income | | | 2,633,899 | | | | 4,697,062 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees (See Note 4) | | | 4,655,084 | | | | 9,613,941 | |

| Fund administration & accounting fees (See Note 4) | | | 247,695 | | | | 489,367 | |

| Transfer agent fees & expenses (See Note 4) | | | 210,221 | | | | 205,983 | |

| Federal & state registration fees | | | 102,041 | | | | 41,871 | |

| Custody fees (See Note 4) | | | 40,564 | | | | 71,176 | |

| Audit fees | | | 24,466 | | | | 18,523 | |

| Trustee fees | | | 18,072 | | | | 17,894 | |

| Compliance fees (See Note 4) | | | 15,840 | | | | 28,341 | |

| Legal fees | | | 6,045 | | | | 7,680 | |

| Insurance fees | | | 5,553 | | | | 9,956 | |

| Other expenses | | | — | | | | 19,519 | |

| Postage & printing fees | | | — | | | | 28,596 | |

| Distribution and/or shareholder service fees (See Note 5) | | | | | | | | |

| Institutional Class | | | 223,052 | | | | 520,916 | |

| Investor Class | | | 290,227 | | | | 199,529 | |

| Total expenses before reimbursement/waiver/recoupment | | | 5,838,860 | | | | 11,273,292 | |

| Plus: Adviser recoupment (See Note 4) | | | 180,716 | | | | — | |

| Less: reimbursement/waiver from adviser (See Note 4) | | | (208,134 | ) | | | (22,916 | ) |

| Total net expenses | | | 5,811,442 | | | | 11,250,376 | |

| NET INVESTMENT LOSS | | | (3,177,543 | ) | | | (6,553,314 | ) |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | |

| AND TRANSLATIONS OF FOREIGN CURRENCY | | | | | | | | |

| Net realized gain (loss) on investments, including foreign currency gain (loss) | | | 448,891,006 | (1) | | | (220,803,949 | ) |

| Net change in unrealized appreciation/depreciation of investments | | | | | | | | |

| and translations of foreign currency | | | (931,234,611 | ) | | | (765,969,373 | ) |

Net realized and unrealized loss on investments | | | (482,343,605 | ) | | | (986,773,322 | ) |

| | | | | | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (485,521,148 | ) | | $ | (993,326,636 | ) |

| (1) | Includes $107,978,005 net realized gain from an in-kind transaction. In-kind realized gains generally do not need to be distributed as capital gain distributions. |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | October 31, 2022 | | | October 31, 2021 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (3,177,543 | ) | | $ | (13,306,041 | ) |

| Net realized gain on investments, including foreign currency gain (loss) | | | 448,891,006 | | | | 734,556,392 | |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| on investments and translations of foreign currency | | | (931,234,611 | ) | | | 78,212,691 | |

Net increase (decrease) in net assets resulting from operations | | | (485,521,148 | ) | | | 799,463,042 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

IS Class(1): | | | | | | | | |

| Proceeds from shares sold | | | 96,337,923 | | | | 1,402,857,692 | |

| Proceeds from acquisition (See Note 1) | | | — | | | | 79,071,717 | |

| Proceeds from reinvestment of distributions | | | 226,234,969 | | | | 1,028,826 | |

| Payments for shares redeemed | | | (80,198,416 | ) | | | (680,330,396 | ) |

| Payment for redemption in-kind(5) | | | (650,546,364 | ) | | | — | |

| Increase (Decrease) in net assets resulting from IS Class transactions | | | (408,171,888 | ) | | | 802,627,839 | |

| Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 35,836,230 | | | | 408,684,263 | |

| Proceeds from acquisition (See Note 1) | | | — | | | | 1,272,275 | |

| Proceeds from reinvestment of distributions | | | 121,353,186 | | | | 488,179,321 | |

| Payments for shares redeemed | | | (1,066,863,744 | ) | | | (1,992,166,054 | ) |

| Decrease in net assets resulting from Institutional Class transactions | | | (909,674,328 | ) | | | (1,094,030,195 | ) |

Investor Class(2): | | | | | | | | |

| Proceeds from shares sold | | | 2,160,777 | | | | 21,085,616 | |

| Proceeds from acquisition (See Note 1) | | | — | | | | 70,894 | |

| Proceeds from reinvestment of distributions | | | 43,714,844 | | | | 34,187,695 | |

| Proceeds from exchange of Class C Shares | | | — | | | | 26,301,193 | |

| Proceeds from exchange of Class R Shares | | | — | | | | 5,427,349 | |

| Payments for shares redeemed | | | (36,354,620 | ) | | | (64,491,702 | ) |

| Increase in net assets resulting from Investor Class transactions | | | 9,521,001 | | | | 22,581,045 | |

Class C(3): | | | | | | | | |

| Proceeds from shares sold | | | — | | | | 806,788 | |

| Proceeds from reinvestment of distributions | | | — | | | | 8,161,979 | |

| Payment for shares issued in exchange for Investor Shares | | | — | | | | (26,301,193 | ) |

| Payments for shares redeemed | | | — | | | | (9,190,637 | ) |

| Decrease in net assets resulting from Class C transactions | | | — | | | | (26,523,063 | ) |

Class R(4): | | | | | | | | |

| Proceeds from shares sold | | | — | | | | 213,698 | |

| Proceeds from reinvestment of distributions | | | — | | | | 1,331,846 | |

| Payment for shares issued in exchange for Investor Shares | | | — | | | | (5,427,349 | ) |

| Payments for shares redeemed | | | — | | | | (1,666,003 | ) |

| Decrease in net assets resulting from Class C transactions | | | — | | | | (5,547,808 | ) |

Net decrease in net assets resulting from capital share transactions | | | (1,308,325,215 | ) | | | (300,892,182 | ) |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Statements of Changes in Net Assets – Continued

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | October 31, 2022 | | | October 31, 2021 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | |

IS Class(1) | | $ | (226,388,707 | ) | | $ | (1,054,886 | ) |

| Institutional Class | | | (122,858,298 | ) | | | (489,231,243 | ) |

Investor Class(2) | | | (47,708,539 | ) | | | (34,713,436 | ) |

Class C(3) | | | — | | | | (8,184,157 | ) |

Class R(4) | | | — | | | | (1,331,852 | ) |

Total distributions to shareholders | | | (396,955,544 | ) | | | (534,515,574 | ) |

| TOTAL DECREASE IN NET ASSETS | | | (2,190,801,907 | ) | | | (35,944,714 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 2,407,849,912 | | | | 2,443,794,626 | |

| End of year | | $ | 217,048,005 | | | $ | 2,407,849,912 | |

| (1) | The IS Class was previously known as Class R6 prior to April 16, 2021. See Note 1 in Notes to Financial Statements. |

| (2) | The Investor Class was previously known as Class A prior to April 16, 2021. See Note 1 in Notes to Financial Statements. |

| (3) | Class C shares converted to Investor Class shares on April 16, 2021. See Note 1 in Notes to Financial Statements. |

| (4) | Class R shares converted to Investor Class shares on April 16, 2021. See Note 1 in Notes to Financial Statements. |

| (5) | A redemption in-kind occurred on April 25, 2022 for the IS Class, which consisted of $631,793,017 in securities and $18,753,347 in cash. |

See Notes to the Financial Statements

Jackson Square SMID-Cap Growth Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | October 31, 2022 | | | October 31, 2021 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (6,553,314 | ) | | $ | (14,939,615 | ) |

| Net realized gain (loss) on investments, including foreign currency gain (loss) | | | (220,803,949 | ) | | | 363,025,635 | |

| Net change in unrealized appreciation/depreciation | | | | | | | | |

| on investments and translations of foreign currency | | | (765,969,373 | ) | | | 120,093,193 | |

Net increase (decrease) in net assets resulting from operations | | | (993,326,636 | ) | | | 468,179,213 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| IS Class: | | | | | | | | |

| Proceeds from shares sold | | | 186,086,454 | | | | 300,146,563 | |

| Proceeds from reinvestment of distributions | | | 147,698,829 | | | | 39,392,094 | |

| Payments for shares redeemed | | | (144,072,426 | ) | | | (145,332,569 | ) |

| Increase in net assets resulting from IS Class transactions | | | 189,712,857 | | | | 194,206,088 | |

| Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 253,353,654 | | | | 304,524,541 | |

| Proceeds from reinvestment of distributions | | | 139,315,673 | | | | 45,355,964 | |

| Payments for shares redeemed | | | (517,174,844 | ) | | | (220,162,155 | ) |

| Increase (Decrease) in net assets resulting from Institutional Class transactions | | | (124,505,517 | ) | | | 129,718,350 | |

| Investor Class: | | | | | | | | |

| Proceeds from shares sold | | | 8,480,345 | | | | 43,689,033 | |

| Proceeds from reinvestment of distributions | | | 16,161,227 | | | | 5,187,925 | |

| Payments for shares redeemed | | | (31,219,296 | ) | | | (38,430,286 | ) |

| Increase (Decrease) in net assets resulting from Investor Class transactions | | | (6,577,724 | ) | | | 10,446,672 | |

Net increase in net assets resulting from capital share transactions | | | 58,629,616 | | | | 334,371,110 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| IS Class | | | (154,578,237 | ) | | | (41,465,958 | ) |

| Institutional Class | | | (145,233,908 | ) | | | (47,286,027 | ) |

| Investor Class | | | (16,179,692 | ) | | | (5,199,692 | ) |

Total distributions to shareholders | | �� | (315,991,837 | ) | | | (93,951,677 | ) |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (1,250,688,857 | ) | | | 708,598,646 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 2,162,972,488 | | | | 1,454,373,842 | |

| End of year | | $ | 912,283,631 | | | $ | 2,162,972,488 | |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Financial Highlights

For a Fund share outstanding throughout the years.

IS Class(1)

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | October 31, | | | October 31, | | | October 31, | | | October 31, | | | October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 31.69 | | | $ | 28.72 | | | $ | 24.91 | | | $ | 26.72 | | | $ | 28.50 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(2) | | | (0.07 | ) | | | (0.10 | ) | | | 0.01 | | | | 0.05 | | | | 0.05 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (10.23 | ) | | | 9.16 | | | | 6.25 | | | | 2.59 | | | | 1.38 | |

| Total from investment operations | | | (10.30 | ) | | | 9.06 | | | | 6.26 | | | | 2.64 | | | | 1.43 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.04 | ) |

| Net realized gains | | | (7.69 | ) | | | (6.09 | ) | | | (2.45 | ) | | | (4.45 | ) | | | (3.17 | ) |

| Total distributions | | | (7.69 | ) | | | (6.09 | ) | | | (2.45 | ) | | | (4.45 | ) | | | (3.21 | ) |

Net asset value, end of year | | $ | 13.70 | | | $ | 31.69 | | | $ | 28.72 | | | $ | 24.91 | | | $ | 26.72 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | -41.26 | % | | | 33.81 | %(3) | | | 27.39 | %(3) | | | 14.60 | %(3) | | | 5.36 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 40,436 | | | $ | 945,973 | | | $ | 4,539 | | | $ | 3,408 | | | $ | 2,376 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement/waiver/recoupment | | | 0.63 | % | | | 0.61 | % | | | 0.65 | % | | | 0.67 | % | | | 0.65 | % |

| After expense reimbursement/waiver/recoupment | | | 0.63 | % | | | 0.61 | %(4) | | | 0.62 | % | | | 0.63 | % | | | 0.65 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense reimbursement/waiver/recoupment | | | (0.31 | )% | | | (0.17 | )% | | | 0.02 | % | | | 0.16 | % | | | 0.16 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio Turnover(5) | | | 35 | %(6) | | | 28 | % | | | 54 | % | | | 35 | % | | | 39 | % |

| (1) | Prior to April 16, 2021, the IS Class was known as Class R6. See Note 1 in Notes to Financial Statements. |

| (2) | Per share amounts calculated using the average shares method. |

| (3) | Total return during the period reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

| (4) | Prior to April 16, 2021, the annual expense limitation was 0.62% of the average daily net assets of the Fund. Thereafter, it was 0.64%. |

| (5) | Portfolio turnover disclosed is for the Fund as a whole. |

| (6) | Excludes the value of securities delivered as a result of an in-kind redemption of the Fund’s capital shares on April 25,2022. |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Financial Highlights

For a Fund share outstanding throughout the years.

Institutional Class

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | October 31, | | | October 31, | | | October 31, | | | October 31, | | | October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 31.32 | | | $ | 28.49 | | | $ | 24.78 | | | $ | 26.66 | | | $ | 28.46 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.08 | ) | | | (0.16 | ) | | | (0.04 | ) | | | (0.01 | ) | | | (0.01 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (10.07 | ) | | | 9.08 | | | | 6.20 | | | | 2.58 | | | | 1.39 | |

| Total from investment operations | | | (10.15 | ) | | | 8.92 | | | | 6.16 | | | | 2.57 | | | | 1.38 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.01 | ) |

| Net realized gains | | | (7.69 | ) | | | (6.09 | ) | | | (2.45 | ) | | | (4.45 | ) | | | (3.17 | ) |

| Total distributions | | | (7.69 | ) | | | (6.09 | ) | | | (2.45 | ) | | | (4.45 | ) | | | (3.18 | ) |

Net asset value, end of year | | $ | 13.48 | | | $ | 31.32 | | | $ | 28.49 | | | $ | 24.78 | | | $ | 26.66 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | -41.27 | % | | | 33.56 | %(2) | | | 27.10 | %(2) | | | 14.33 | %(2) | | | 5.15 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 105,097 | | | $ | 1,292,470 | | | $ | 2,268,085 | | | $ | 2,231,134 | | | $ | 2,502,062 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement/waiver/recoupment | | | 0.70 | % | | | 0.81 | % | | | 0.89 | % | | | 0.90 | % | | | 0.87 | % |

| After expense reimbursement/waiver/recoupment | | | 0.70 | % | | | 0.79 | %(3) | | | 0.84 | % | | | 0.86 | % | | | 0.87 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense reimbursement/waiver/recoupment | | | (0.39 | )% | | | (0.52 | )% | | | (0.17 | )% | | | (0.07 | )% | | | (0.06 | )% |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio Turnover(4) | | | 35 | %(5) | | | 28 | % | | | 54 | % | | | 35 | % | | | 39 | % |

| (1) | Per share amounts calculated using the average shares method. |

| (2) | Total return during the period reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

| (3) | Prior to April 16, 2021, the annual expense limitation was 0.84% of the average daily net assets of the Fund. Thereafter, it was 0.64%, excluding Shareholder Servicing Plan fees. See Note 1 in Notes to the Financial Statements. |

| (4) | Portfolio turnover disclosed is for the Fund as a whole. |

| (5) | Excludes the value of securities delivered as a result of an in-kind redemption of the funds capital shares on April 25, 2022. |

See Notes to the Financial Statements

Jackson Square Large-Cap Growth Fund

Financial Highlights

For a Fund share outstanding throughout the years.

Investor Class(1)

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | October 31, | | | October 31, | | | October 31, | | | October 31, | | | October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 26.71 | | | $ | 25.09 | | | $ | 22.15 | | | $ | 24.41 | | | $ | 26.37 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(2) | | | (0.09 | ) | | | (0.19 | ) | | | (0.10 | ) | | | (0.06 | ) | | | (0.08 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (8.18 | ) | | | 7.90 | | | | 5.49 | | | | 2.25 | | | | 1.29 | |

| Total from investment operations | | | (8.27 | ) | | | 7.71 | | | | 5.39 | | | | 2.19 | | | | 1.21 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

| Net realized gains | | | (7.69 | ) | | | (6.09 | ) | | | (2.45 | ) | | | (4.45 | ) | | | (3.17 | ) |

| Total distributions | | | (7.69 | ) | | | (6.09 | ) | | | (2.45 | ) | | | (4.45 | ) | | | (3.17 | ) |

Net asset value, end of year | | $ | 10.75 | | | $ | 26.71 | | | $ | 25.09 | | | $ | 22.15 | | | $ | 24.41 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | -41.38 | % | | | 33.25 | %(3) | | | 26.82 | %(3) | | | 14.04 | %(3) | | | 4.89 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 71,515 | | | $ | 169,407 | | | $ | 137,135 | | | $ | 116,986 | | | $ | 122,621 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement/waiver/recoupment | | | 0.91 | % | | | 1.04 | % | | | 1.14 | % | | | 1.15 | % | | | 1.12 | % |

| After expense reimbursement/waiver/recoupment | | | 0.90 | % | | | 1.03 | %(4) | | | 1.09 | % | | | 1.11 | % | | | 1.12 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment loss to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense reimbursement/waiver/recoupment | | | (0.59 | )% | | | (0.75 | )% | | | (0.42 | )% | | | (0.32 | )% | | | (0.31 | )% |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio Turnover(5) | | | 35 | %(6) | | | 28 | % | | | 54 | % | | | 35 | % | | | 39 | % |

| (1) | Prior to April 16, 2021, the Investor Class was known as Class A. |

| (2) | Per share amounts calculated using the average shares method. |

| (3) | Total return during the period reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

| (4) | Prior to April 16, 2021, the annual expense limitation was 0.84% of the average daily net assets of the Fund. Thereafter, it was 0.64%, excluding 12b-1 fees and shareholder servicing fees. |

| (5) | Portfolio turnover disclosed is for the Fund as a whole. |

| (6) | Excludes the value of securities delivered as a result of an in-kind redemption of the Fund’s capital shares on April 25, 2022. |

See Notes to the Financial Statements

Jackson Square SMID-Cap Growth Fund

Financial Highlights

For a Fund share outstanding throughout the years.

IS Class

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | October 31, | | | October 31, | | | October 31, | | | October 31, | | | October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 38.53 | | | $ | 30.75 | | | $ | 23.88 | | | $ | 23.83 | | | $ | 21.37 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.09 | ) | | | (0.26 | ) | | | (0.08 | ) | | | 0.01 | (2) | | | 0.08 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (16.44 | ) | | | 9.98 | | | | 7.99 | | | | 2.70 | | | | 2.50 | |

| Total from investment operations | | | (16.53 | ) | | | 9.72 | | | | 7.91 | | | | 2.71 | | | | 2.58 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | (0.02 | ) | | | (0.06 | ) | | | — | |

| Net realized gains | | | (6.09 | ) | | | (1.94 | ) | | �� | (1.02 | ) | | | (2.60 | ) | | | (0.12 | ) |

| Total distributions | | | (6.09 | ) | | | (1.94 | ) | | | (1.04 | ) | | | (2.66 | ) | | | (0.12 | ) |

Net asset value, end of year | | $ | 15.91 | | | $ | 38.53 | | | $ | 30.75 | | | $ | 23.88 | | | $ | 23.83 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | -48.81 | % | | | 31.80 | % | | | 34.36 | % | | | 14.02 | % | | | 12.13 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 552,794 | | | $ | 1,016,051 | | | $ | 650,845 | | | $ | 452,234 | | | $ | 197,538 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver/recoupment | | | 0.83 | % | | | 0.82 | % | | | 0.85 | % | | | 0.87 | % | | | 0.89 | % |

| After expense waiver/recoupment | | | 0.82 | % | | | 0.82 | % | | | 0.87 | % | | | 0.87 | % | | | 0.87 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | |

to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense waiver/recoupment | | | (0.46 | )% | | | (0.84 | )% | | | (0.30 | )% | | | 0.04 | % | | | 0.33 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio Turnover(3) | | | 78 | % | | | 56 | % | | | 49 | % | | | 35 | % | | | 47 | % |

| (1) | Per share amounts calculated using the average shares method. |

| (2) | Net realized and unrealized loss per share in this caption is a balancing amount necessary to reconcile the change in net asset value per share for the year and may not reconcile with the aggregate gain on the Statement of Operations due to share transactions for the year. |

| (3) | Portfolio turnover disclosed is for the Fund as a whole. |

See Notes to the Financial Statements

Jackson Square SMID-Cap Growth Fund

Financial Highlights

For a Fund share outstanding throughout the years.

Institutional Class

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | October 31, | | | October 31, | | | October 31, | | | October 31, | | | October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Per Share Data | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 38.48 | | | $ | 30.73 | | | $ | 23.89 | | | $ | 23.81 | | | $ | 21.37 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.12 | ) | | | (0.29 | ) | | | (0.10 | ) | | | (0.01 | ) | | | 0.06 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (16.41 | ) | | | 9.98 | | | | 7.98 | | | | 2.74 | | | | 2.50 | |

| Total from investment operations | | | (16.53 | ) | | | 9.69 | | | | 7.88 | | | | 2.73 | | | | 2.56 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | | | | (0.02 | ) | | | (0.05 | ) | | | — | |

| Net realized gains | | | (6.09 | ) | | | (1.94 | ) | | | (1.02 | ) | | | (2.60 | ) | | | (0.12 | ) |

| Total distributions | | | (6.09 | ) | | | (1.94 | ) | | | (1.04 | ) | | | (2.65 | ) | | | (0.12 | ) |

Net asset value, end of year | | $ | 15.86 | | | $ | 38.48 | | | $ | 30.73 | | | $ | 23.89 | | | $ | 23.81 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return | | | -48.89 | % | | | 31.71 | % | | | 34.20 | % | | | 14.08 | % | | | 12.04 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 320,392 | | | $ | 1,039,786 | | | $ | 725,204 | | | $ | 499,461 | | | $ | 297,023 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver/recoupment | | | 0.92 | % | | | 0.91 | % | | | 0.93 | % | | | 0.95 | % | | | 0.97 | % |

| After expense waiver/recoupment | | | 0.91 | % | | | 0.91 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % |

| | | | | | | | | | | | | | | | | | | | | |