Annual Report

March 31, 2023

CornerCap Small-Cap Value Fund

Table of Contents

| Manager’s Report to Shareholders (Unaudited) | 1 |

| Fund Expenses (Unaudited) | 6 |

| Schedule of Investments | 7 |

| Statement of Assets and Liabilities | 18 |

| Statement of Operations | 19 |

| Statements of Changes in Net Assets | 20 |

| Financial Highlights | 21 |

| Notes to Financial Statements | 23 |

| Report of Independent Registered Public Accounting Firm | 31 |

| Additional Information (Unaudited) | 32 |

Manager’s Report to Shareholders (Unaudited)

March 31, 2023

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

Over the past 12 months, the Federal Reserve launched an aggressive effort to fight inflation, and investors witnessed one of the fastest increases in interest rates in modern history. The policy to raise rates meaningfully throughout the year brought high volatility to equity markets and generally upended many of the popular high-flyers that dominated the pandemic of 2020 and 2021.

Despite the challenging period, we are pleased that the Fundametrics Small Cap Value Strategy performed well and largely as expected. For the year, the strategy beat its benchmark, the Russell 2000 Value, by an impressive 550 basis points and did not experience the major weakness of growth indexes.

For most of the fiscal year (the first three quarters), low valuations, strong momentum in stock price, and improving earnings fundamentals, among other factors, drove the best relative performance. These are conditions that tend to favor our approach, and our Buy decisions beat our Sell decisions by a healthy spread. By comparison, rising rates created a challenge for higher growth stocks, many of which are unprofitable, discounting their future earnings at higher rates and thereby compressing P/E multiples.

Our strategy’s research incorporates diverse fundamental factors and sectors when making decisions, and this breadth of exposure also helped our relative performance. For much of this period, our stock selection was favorable across the majority of the 11 principal sectors, with relative strength particularly in health care and technology.

At the start of 2023, equity investors began taking the view that inflation and rates are peaking, even as the economy cools, creating prospects for falling rates and low economic growth. This swing in sentiment is common and to be expected in the ebb-and-flow of investing, and it was the first time in two years where our Buy-rated stocks lagged our Sells. Among small stocks, unprofitable tech companies with high growth expectations surged.

In addition, in late February, increasingly tighter lending standards, rendered more acute by the failure of a handful of isolated banks, made investors even more defensive, seeking safety in secular growth companies and larger stocks. Our valuation-sensitive strategy is less effective when this investor preference is dominating, and we barely beat our benchmark.

During the year, our research team made two important additions to our fundamental models: one by adding exposure to unprofitable biotech companies, and the other by beginning to refine our analysis of banks stocks following the rare, “outlier” events in February and March.

In biotech, we determined that the strategy needed exposure because this group had become a relatively large part of our benchmark—and yet, our methodology traditionally avoided most of the group, since they are at early stages in their cycles and unprofitable. The team developed a new peer group, with new factors largely centering on drug pipelines, and added it to the Fundametrics model in March of last year. At the time, quantifiable datapoints indicated it was a relatively attractive time to build exposure based on observable trends in R&D spending compared to stock values.

For banks, we are in process of deepening our inputs for unrealized gains and losses on the balance sheet of banks, as well as quality of deposits. These initiatives should strengthen how we value and test capital in the sector.

Given the uncertain outlook for monetary policy, interest rates, and timing of recession, we continue to expect volatility in equity markets. We believe leading indicators indicate a high probability of recession in the next twelve months. At two standard deviations below the average, our research shows that small-cap P/E multiples are already pricing in significant recession — more so than similar metrics for large stocks. This level in small stocks has occurred three times in the last twenty years: 2008, 2009 and 2020. Median one-year returns for the small cap investable universe and Russell 2000 Value Index following these events were over 50% with no negative results.

We believe this environment should continue to create opportunities for long-term, active investment managers to exploit.

Annual Report | March 31, 2023

Manager’s Report to Shareholders (Unaudited)

March 31, 2023

| CornerCap Investment Counsel | March 31, 2023 |

The views in this letter reflect the opinions of CornerCap Group of Funds as of March 31, 2023 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund’s investment methodology and do not constitute investment advice. Past performance does not guarantee future results.

Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. Investments made in small companies may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. As interest rates rise the value of bond prices will decline. If the Fund invests in ETFs (Exchange-Traded Funds), it will be subject to the same risks as the underlying securities in which the ETF invests as well as entails higher expenses than if invested into the underlying ETF directly.

The Russell 2000 Value Index is an index that measures the 2,000 smallest of the 3,000 largest U.S. Companies (based on total market capitalization) that have lower price-to-book ratios and lower forecasted growth values. It is not possible to invest directly in an index.

Manager’s Report to Shareholders (Unaudited)

March 31, 2023

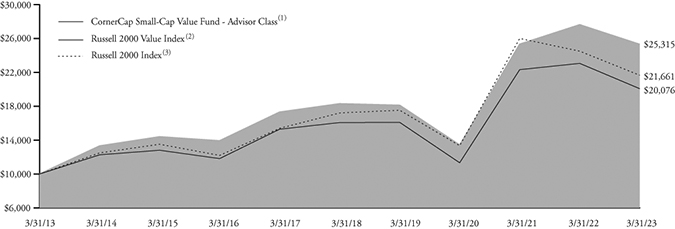

Investment Performance through March 31, 2023 (In Thousands)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 888-813-8637. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of March 31, 2023

| | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception(5) |

Advisor Class(1) | -8.38% | 23.54% | 6.70% | 9.73% | 9.32% |

Institutional Class(4) | -8.12% | 23.91% | 7.02% | 9.98% | 9.40% |

Russell 2000 Value Index(2) | -12.96% | 21.01% | 4.55% | 7.22% | 9.86% |

Russell 2000 Index(3) | -11.61% | 17.51% | 4.71% | 8.04% | 9.07% |

(1) | Performance shown for Advisor Class is that of the Predecessor Fund’s Investor Shares (See Note 12), and is calculated using the fees and expenses in effect for the Investor Shares during the periods shown, net of any applicable fee and expense limitations or waivers. |

(2) | The Russell 2000 Value Index is an index that measures the 2,000 smallest of the 3,000 largest U.S. Companies (based on total market capitalization) that have lower price-to-book ratios and lower forecasted growth values. It is not possible to invest directly in an index. |

(3) | The Russell 2000 Index is an index that measures the performance of the 2,000 smallest companies in the Russell 3000® Index. The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

(4) | Performance shown for Institutional Class is that of the Predecessor Fund’s Institutional Shares. Institutional Shares of the Predecessor Fund commenced operations on December 29, 2015. Performance for the 10 year and Since Inception periods is a blended average annual return which includes the returns of Investor Shares of the Predecessor Fund (inception date September 30, 1992) prior to the commencement of operations of Institutional Shares of the Predecessor Fund, and is calculated using the fees and expenses in effect for the Investor Shares during the periods shown, net of any applicable fee and expense limitations or waivers. If Institutional Shares had been available during periods prior to December 29, 2015, the performance shown may have been different. The performance shown for the periods following the Predecessor Fund’s commencement of Institutional Shares reflects the fees and expenses of Institutional Shares, net of any applicable fee and expense limitations or waivers. |

(5) | Inception date of the Advisor Class was September 30, 1992 and the Institutional Class was December 29, 2015. |

Annual Report | March 31, 2023

Manager’s Report to Shareholders (Unaudited)

March 31, 2023

The following is expense information for the CornerCap Small-Cap Value Fund as disclosed in the Fund’s most recent prospectus dated November 18, 2022:

| Advisor Class Gross Expense Ratio: 1.36% | Net Expense Ratio: 1.25% |

| Institutional Class Gross Expense Ratio: 1.06% | Net Expense Ratio: 0.95% |

CornerCap Investment Counsel, Inc. (the “Adviser”) has contractually agreed to waive a portion or all of its management fees and pay Fund expenses (excluding Rule 12b-1 fees, Shareholder Servicing Plan fees, leverage/borrowing interest, interest expense, dividends paid on short sales, brokerage and other transactional expenses, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, or extraordinary expenses) in order to limit the total annual fund operating expenses to 0.95% of average daily net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the day on which such fee waiver and/or expense payment was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and/or expense payment occurred and the expense limit in place at the time of recoupment. The Operating Expenses Limitation Agreement cannot be terminated through at least November 18, 2025. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser, with the consent of the Board.

The actual net expense ratio applicable to investors, as disclosed in the Financial Highlights for the year ended March 31, 2023, was 1.25% and 0.98% for the Advisor Class and Institutional Class, respectively.

Manager’s Report to Shareholders (Unaudited)

March 31, 2023

Allocation of Portfolio Net Assets(1)(2) at March 31, 2023 (% of Net Assets)

Top Ten Equity Holdings(1) at March 31, 2023 (% of Net Assets)

| iRadimed Corp. | 0.6% |

| Primoris Services Corp. | 0.5% |

| NMI Holdings, Inc. – Class A | 0.5% |

| BGC Partners, Inc. – Class A | 0.5% |

| Chord Energy Corp. | 0.5% |

| Brady Corp. – Class A | 0.5% |

| Eagle Materials, Inc. | 0.5% |

| Avanos Medical, Inc. | 0.5% |

| Blackbaud, Inc. | 0.5% |

| EMCOR Group, Inc. | 0.5% |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

(2) | Excludes securities lending collateral. |

Annual Report | March 31, 2023

Fund Expenses (Unaudited)

March 31, 2023

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, which may include but are not limited to, sales charges (loads) on purchases; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder servicing fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 18, 2022 – March 31, 2023).

Actual Expenses – For each class, the first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs may have been higher.

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | (11/18/2022) | (3/31/2023) | (11/18/2022 – 3/31/2023) |

| Advisor Class | | | |

Actual(2) | $1,000.00 | $1,096.60 | $4.77 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,013.66 | $4.59 |

| | | | |

| Institutional Class | | | |

Actual(2) | $1,000.00 | $1,098.30 | $3.63 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.76 | $3.49 |

(1) | Expenses are equal to the Fund’s annualized expense ratio for the period since the Fund’s reorganization on November 18, 2022 of 1.25% for the Advisor Class, multiplied by the average account value over the period, multiplied by 133/365 to reflect the period since the Fund’s reorganization . Expenses are equal to the Fund’s annualized expense ratio for the period since the Fund’s reorganization on November 18, 2022 of 0.95% for the Institutional Class, multiplied by the average account value over the period, multiplied by 133/365 to reflect the period since the Fund’s reorganization (See Note 1 in Notes to Financial Statements). |

(2) | Based on the actual returns for the six-month period ended March 31, 2023, of 9.66% and 9.83% for the Advisor Class and Institutional Class, respectively. |

Schedule of Investments

March 31, 2023

| | | Shares | | | Fair Value | |

| COMMON STOCK (98.7%) | | | | | | |

| | | | | | | |

| Advertising (0.2%) | | | | | | |

| Stagwell, Inc. * | | | 32,167 | | | $ | 238,679 | |

| | | | | | | | | |

| Agriculture (1.3%) | | | | | | | | |

| Fresh Del Monte Produce, Inc. | | | 18,930 | | | | 569,982 | |

| The Andersons Inc. | | | 5,862 | | | | 242,218 | |

| Turning Point Brands, Inc. | | | 8,798 | | | | 184,758 | |

| Vector Group Ltd. | | | 50,071 | | | | 601,353 | |

| | | | | | | | 1,598,311 | |

| Airlines (0.4%) | | | | | | | | |

| Alaska Air Group, Inc. * | | | 12,216 | | | | 512,583 | |

| | | | | | | | | |

| Auto Manufacturers (0.2%) | | | | | | | | |

Wabash National Corp. (a) | | | 10,104 | | | | 248,457 | |

| | | | | | | | | |

| Auto Parts & Equipment (1.0%) | | | | | | | | |

| Allison Transmission Holdings, Inc. | | | 11,060 | | | | 500,354 | |

| Douglas Dynamics, Inc. | | | 14,577 | | | | 464,861 | |

| Gentex Corp. | | | 9,724 | | | | 272,564 | |

| | | | | | | | 1,237,779 | |

| Banks (14.5%) | | | | | | | | |

| Associated Banc-Corp | | | 23,319 | | | | 419,276 | |

Bank OZK (a) | | | 12,324 | | | | 421,481 | |

| Banner Corp. | | | 4,143 | | | | 225,255 | |

| BayCom Corp. | | | 12,230 | | | | 208,888 | |

| BCB Bancorp, Inc. | | | 16,644 | | | | 218,536 | |

| Bridgewater Bancshares, Inc. * | | | 20,766 | | | | 225,103 | |

| Business First Bancshares, Inc. | | | 12,759 | | | | 218,562 | |

| Byline Bancorp, Inc. | | | 21,379 | | | | 462,214 | |

| Capital City Bank Group, Inc. | | | 4,107 | | | | 120,376 | |

| Carter Bankshares, Inc. * | | | 17,125 | | | | 239,750 | |

| Cathay General Bancorp | | | 12,634 | | | | 436,126 | |

| Coastal Financial Corp./WA * | | | 5,833 | | | | 210,046 | |

| Columbia Banking System, Inc. | | | 22,434 | | | | 480,536 | |

| ConnectOne Bancorp, Inc. | | | 23,363 | | | | 413,058 | |

| CrossFirst Bankshares, Inc. * | | | 19,812 | | | | 207,630 | |

| Customers Bancorp, Inc. * | | | 24,434 | | | | 452,518 | |

| Dime Community Bancshares, Inc. | | | 15,821 | | | | 359,453 | |

| Enterprise Financial Services Corp. | | | 11,079 | | | | 494,013 | |

First Bank/Hamilton NJ (a) | | | 18,323 | | | | 185,062 | |

| First Busey Corp. | | | 20,333 | | | | 413,573 | |

| First Commonwealth Financial Corp. | | | 37,767 | | | | 469,444 | |

First Financial Bancorp (a) | | | 21,875 | | | | 476,219 | |

| First Foundation, Inc. | | | 57,638 | | | | 429,403 | |

| First Internet Bancorp | | | 11,369 | | | | 189,294 | |

| First Merchants Corp. | | | 13,050 | | | | 429,997 | |

| FNB Corp./PA | | | 41,268 | | | | 478,709 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Annual Report | March 31, 2023

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Banks (14.5%) (continued) | | | | | | |

| Great Southern Bancorp, Inc. | | | 4,380 | | | $ | 221,978 | |

| Hancock Whitney Corp. | | | 9,769 | | | | 355,592 | |

| HBT Financial, Inc. | | | 13,031 | | | | 256,971 | |

| Heartland Financial USA, Inc. | | | 5,450 | | | | 209,062 | |

| Independent Bank Group, Inc. | | | 10,354 | | | | 479,908 | |

| Lakeland Bancorp, Inc. | | | 29,154 | | | | 455,969 | |

| Mercantile Bank Corp. | | | 14,206 | | | | 434,419 | |

| Merchants Bancorp/IN | | | 18,932 | | | | 492,989 | |

| Metropolitan Bank Holding Corp. * | | | 3,257 | | | | 110,380 | |

Mid Penn Bancorp, Inc. (a) | | | 7,700 | | | | 197,197 | |

| Northeast Bank | | | 6,015 | | | | 202,465 | |

| Northrim BanCorp, Inc. | | | 4,382 | | | | 206,743 | |

| Old Second Bancorp, Inc. | | | 15,946 | | | | 224,201 | |

| Peapack-Gladstone Financial Corp. | | | 8,008 | | | | 237,197 | |

| Pinnacle Financial Partners, Inc. | | | 8,585 | | | | 473,549 | |

| Preferred Bank/Los Angeles CA | | | 8,294 | | | | 454,594 | |

| Premier Financial Corp. | | | 10,725 | | | | 222,329 | |

| QCR Holdings, Inc. | | | 9,483 | | | | 416,399 | |

| RBB Bancorp | | | 27,123 | | | | 420,406 | |

| Republic Bancorp Inc. – Class A | | | 12,223 | | | | 518,622 | |

| Synovus Financial Corp. | | | 6,761 | | | | 208,442 | |

| The First Bancshares Inc. | | | 8,739 | | | | 225,728 | |

| UMB Financial Corp. | | | 3,841 | | | | 221,702 | |

| Univest Financial Corp. | | | 10,252 | | | | 243,382 | |

| Valley National Bancorp | | | 48,792 | | | | 450,838 | |

| Veritex Holdings, Inc. | | | 24,221 | | | | 442,275 | |

| Webster Financial Corp. | | | 12,018 | | | | 473,750 | |

| Wintrust Financial Corp. | | | 6,291 | | | | 458,928 | |

| | | | | | | | 18,200,537 | |

| Beverages (0.9%) | | | | | | | | |

| Coca-Cola Consolidated, Inc. | | | 1,125 | | | | 601,965 | |

| The Boston Beer Co. Inc. * | | | 1,592 | | | | 523,290 | |

| | | | | | | | 1,125,255 | |

| Biotechnology (4.2%) | | | | | | | | |

| Allovir, Inc. * | | | 22,843 | | | | 90,001 | |

| ANI Pharmaceuticals, Inc. * | | | 5,680 | | | | 225,610 | |

| Annexon, Inc. * | | | 22,256 | | | | 85,686 | |

| Arcus Biosciences, Inc. * | | | 6,192 | | | | 112,942 | |

| Athira Pharma, Inc. * | | | 37,648 | | | | 94,120 | |

| BioAtla, Inc. * | | | 29,805 | | | | 79,877 | |

| C4 Therapeutics, Inc. * | | | 23,160 | | | | 72,722 | |

| Caribou Biosciences, Inc. * | | | 18,665 | | | | 99,111 | |

| Century Therapeutics, Inc. * | | | 25,978 | | | | 90,144 | |

| Cullinan Oncology, Inc. * | | | 8,053 | | | | 82,382 | |

| CytomX Therapeutics, Inc. * | | | 41,458 | | | | 62,602 | |

| Denali Therapeutics, Inc. * | | | 3,241 | | | | 74,673 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Biotechnology (4.2%) (continued) | | | | | | |

| Edgewise Therapeutics, Inc. * | | | 15,147 | | | $ | 101,030 | |

| Editas Medicine, Inc. * | | | 5,658 | | | | 41,021 | |

| EQRx, Inc. * | | | 50,138 | | | | 97,268 | |

| Erasca, Inc. * | | | 27,198 | | | | 81,866 | |

| Fate Therapeutics, Inc. * | | | 20,683 | | | | 117,893 | |

| Generation Bio Co. * | | | 15,099 | | | | 64,926 | |

| Graphite Bio, Inc. * | | | 35,187 | | | | 86,208 | |

| Halozyme Therapeutics, Inc. * | | | 5,603 | | | | 213,979 | |

| Homology Medicines, Inc. * | | | 39,929 | | | | 41,127 | |

| Ikena Oncology, Inc. * | | | 14,078 | | | | 48,569 | |

| ImmunoGen, Inc. * | | | 25,306 | | | | 97,175 | |

| Intellia Therapeutics, Inc. * | | | 3,072 | | | | 114,493 | |

| Ionis Pharmaceuticals, Inc. * | | | 2,806 | | | | 100,286 | |

| Iovance Biotherapeutics, Inc. * | | | 18,507 | | | | 113,078 | |

| iTeos Therapeutics, Inc. * | | | 6,219 | | | | 84,641 | |

| Kronos Bio, Inc. * | | | 14,607 | | | | 21,326 | |

| LianBio – ADR * | | | 84,288 | | | | 164,362 | |

| MacroGenics, Inc. * | | | 27,977 | | | | 200,595 | |

| MeiraGTx Holdings Plc * | | | 13,290 | | | | 68,709 | |

| Mersana Therapeutics, Inc. * | | | 23,652 | | | | 97,210 | |

| Monte Rosa Therapeutics, Inc. * | | | 13,615 | | | | 106,061 | |

| Nektar Therapeutics * | | | 32,720 | | | | 22,999 | |

| NGM Biopharmaceuticals, Inc. * | | | 22,437 | | | | 91,543 | |

| Nkarta, Inc. * | | | 19,358 | | | | 68,721 | |

| Nurix Therapeutics, Inc. * | | | 9,383 | | | | 83,321 | |

| Nuvation Bio, Inc. * | | | 64,161 | | | | 106,507 | |

| Olema Pharmaceuticals, Inc. * | | | 27,664 | | | | 95,994 | |

Omeros Corp. *(a) | | | 27,686 | | | | 128,740 | |

| Poseida Therapeutics, Inc. * | | | 16,677 | | | | 51,365 | |

| Praxis Precision Medicines, Inc. * | | | 37,838 | | | | 30,611 | |

| Precision BioSciences, Inc. * | | | 69,694 | | | | 52,521 | |

| Puma Biotechnology, Inc. * | | | 62,472 | | | | 193,038 | |

| Sage Therapeutics, Inc. * | | | 2,919 | | | | 122,481 | |

| Sangamo Therapeutics, Inc. * | | | 33,434 | | | | 58,844 | |

| Selecta Biosciences, Inc. * | | | 51,193 | | | | 71,158 | |

| Shattuck Labs, Inc. * | | | 26,530 | | | | 77,998 | |

| Surface Oncology, Inc. * | | | 55,378 | | | | 38,698 | |

| Sutro Biopharma, Inc. * | | | 18,563 | | | | 85,761 | |

| Taysha Gene Therapies, Inc. * | | | 26,474 | | | | 21,116 | |

| TCR2 Therapeutics, Inc. * | | | 34,649 | | | | 51,974 | |

| United Therapeutics Corp. * | | | 2,027 | | | | 453,967 | |

| Vir Biotechnology, Inc. * | | | 5,227 | | | | 121,632 | |

| | | | | | | | 5,260,682 | |

| Building Materials (2.7%) | | | | | | | | |

| American Woodmark Corp. * | | | 9,452 | | | | 492,166 | |

| Apogee Enterprises, Inc. | | | 11,221 | | | | 485,308 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Annual Report | March 31, 2023

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Building Materials (2.7%) (continued) | | | | | | |

| Armstrong World Industries, Inc. | | | 3,437 | | | $ | 244,852 | |

| Eagle Materials, Inc. | | | 4,325 | | | | 634,694 | |

| Gibraltar Industries, Inc. * | | | 10,248 | | | | 497,028 | |

| Masonite International Corp. * | | | 5,615 | | | | 509,674 | |

| PGT Innovations, Inc. * | | | 19,595 | | | | 492,030 | |

| | | | | | | | 3,355,752 | |

| Chemicals (0.6%) | | | | | | | | |

| AZZ, Inc. | | | 6,745 | | | | 278,164 | |

| Ecovyst, Inc. * | | | 29,577 | | | | 326,826 | |

| Valhi, Inc. | | | 11,542 | | | | 200,946 | |

| | | | | | | | 805,936 | |

| Coal (0.2%) | | | | | | | | |

| Hallador Energy Co. * | | | 33,889 | | | | 311,440 | |

| | | | | | | | | |

| Commercial Services (7.0%) | | | | | | | | |

| Adtalem Global Education, Inc. * | | | 13,436 | | | | 518,898 | |

| Alarm.com Holdings, Inc. * | | | 10,983 | | | | 552,225 | |

| API Group Corp. * | | | 12,600 | | | | 283,248 | |

| ASGN, Inc. * | | | 2,967 | | | | 245,282 | |

| BrightView Holdings, Inc. * | | | 51,183 | | | | 287,649 | |

| Ennis, Inc. | | | 23,343 | | | | 492,304 | |

| Euronet Worldwide, Inc. * | | | 4,929 | | | | 551,555 | |

| Forrester Research, Inc. * | | | 15,601 | | | | 504,692 | |

| Graham Holdings Co. – Class B | | | 838 | | | | 499,314 | |

| Heidrick & Struggles International, Inc. | | | 15,982 | | | | 485,214 | |

| Huron Consulting Group, Inc. * | | | 3,860 | | | | 310,228 | |

Laureate Education, Inc. *(a) | | | 20,064 | | | | 235,953 | |

| LiveRamp Holdings, Inc. * | | | 27,037 | | | | 592,921 | |

| ManpowerGroup, Inc. * | | | 5,721 | | | | 472,154 | |

| Medifast, Inc. | | | 1,414 | | | | 146,589 | |

| Perdoceo Education Corp. * | | | 38,523 | | | | 517,364 | |

| Repay Holdings Corp. * | | | 77,238 | | | | 507,454 | |

| SP Plus Corp. * | | | 7,725 | | | | 264,890 | |

| Sterling Check Corp. * | | | 21,926 | | | | 244,475 | |

| The Aaron’s Co. Inc. | | | 50,874 | | | | 491,443 | |

| WEX, Inc. * | | | 3,343 | | | | 614,744 | |

| | | | | | | | 8,818,596 | |

| Computers (1.3%) | | | | | | | | |

| Integral Ad Science Holding Corp. * | | | 16,988 | | | | 242,419 | |

| NetScout Systems, Inc. * | | | 16,251 | | | | 465,591 | |

| Qualys, Inc. * | | | 3,475 | | | | 451,819 | |

| Varonis Systems, Inc. * | | | 18,361 | | | | 477,570 | |

| | | | | | | | 1,637,399 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Distribution/Wholesale (1.0%) | | | | | | |

| MRC Global, Inc. * | | | 42,976 | | | $ | 417,727 | |

| Resideo Technologies, Inc. * | | | 16,523 | | | | 302,040 | |

| ScanSource, Inc. * | | | 17,238 | | | | 524,725 | |

| | | | | | | | 1,244,492 | |

| Diversified Financial Services (2.2%) | | | | | | | | |

Affiliated Managers Group, Inc. (a) | | | 3,229 | | | | 459,874 | |

Amerant Bancorp, Inc. (a) | | | 19,535 | | | | 425,082 | |

| BGC Partners, Inc. – Class A | | | 122,392 | | | | 640,110 | |

| Blue Owl Capital, Inc. | | | 22,832 | | | | 252,978 | |

| PJT Partners, Inc. | | | 3,157 | | | | 227,904 | |

| StoneX Group, Inc. * | | | 5,130 | | | | 531,109 | |

| Victory Capital Holdings, Inc. | | | 8,519 | | | | 249,351 | |

| | | | | | | | 2,786,408 | |

| Electric (1.8%) | | | | | | | | |

| ALLETE, Inc. | | | 7,294 | | | | 469,515 | |

| Black Hills Corp. | | | 8,279 | | | | 522,405 | |

| NorthWestern Corp. | | | 8,876 | | | | 513,565 | |

| Portland General Electric Co. | | | 4,839 | | | | 236,579 | |

| Unitil Corp. | | | 8,274 | | | | 471,949 | |

| | | | | | | | 2,214,013 | |

| Electrical Components & Equipment (0.2%) | | | | | | | | |

| Acuity Brands, Inc. | | | 1,375 | | | | 251,254 | |

| | | | | | | | | |

| Electronics (2.9%) | | | | | | | | |

| Brady Corp. – Class A | | | 11,882 | | | | 638,420 | |

| Jabil, Inc. | | | 5,377 | | | | 474,036 | |

| OSI Systems, Inc. * | | | 4,789 | | | | 490,202 | |

Sanmina Corp. *(a) | | | 8,560 | | | | 522,074 | |

| Sensata Technologies Holding Plc | | | 10,285 | | | | 514,456 | |

| TTM Technologies, Inc. * | | | 34,833 | | | | 469,897 | |

| Vishay Intertechnology, Inc. | | | 21,069 | | | | 476,581 | |

| | | | | | | | 3,585,666 | |

| Engineering & Construction (1.4%) | | | | | | | | |

| EMCOR Group, Inc. | | | 3,816 | | | | 620,444 | |

| Primoris Services Corp. | | | 26,591 | | | | 655,734 | |

| Sterling Infrastructure, Inc. * | | | 12,173 | | | | 461,113 | |

| | | | | | | | 1,737,291 | |

| Entertainment (0.8%) | | | | | | | | |

| Accel Entertainment, Inc. * | | | 61,345 | | | | 558,853 | |

| Marriott Vacations Worldwide Corp. | | | 3,205 | | | | 432,226 | |

| | | | | | | | 991,079 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Annual Report | March 31, 2023

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Environmental Control (0.5%) | | | | | | |

| Centrus Energy Corp. * | | | 13,920 | | | $ | 448,224 | |

Stericycle, Inc. *(a) | | | 5,381 | | | | 234,665 | |

| | | | | | | | 682,889 | |

| Food (1.0%) | | | | | | | | |

| Calavo Growers, Inc. | | | 15,972 | | | | 459,515 | |

| Mission Produce, Inc. * | | | 21,875 | | | | 243,031 | |

| United Natural Foods, Inc. * | | | 19,448 | | | | 512,455 | |

| | | | | | | | 1,215,001 | |

| Food Service (0.5%) | | | | | | | | |

| Sovos Brands, Inc. * | | | 34,902 | | | | 582,165 | |

| | | | | | | | | |

| Gas (2.1%) | | | | | | | | |

| Chesapeake Utilities Corp. | | | 4,106 | | | | 525,527 | |

| National Fuel Gas Co. | | | 8,888 | | | | 513,193 | |

| Northwest Natural Holding Co. | | | 10,932 | | | | 519,926 | |

| Spire, Inc. | | | 7,434 | | | | 521,421 | |

UGI Corp. (a) | | | 14,876 | | | | 517,090 | |

| | | | | | | | 2,597,157 | |

| Hand/Machine Tools (0.2%) | | | | | | | | |

| Cadre Holdings, Inc. | | | 12,185 | | | | 262,465 | |

| | | | | | | | | |

| Healthcare-Products (3.6%) | | | | | | | | |

| Avanos Medical, Inc. * | | | 21,051 | | | | 626,057 | |

| Haemonetics Corp. * | | | 6,930 | | | | 573,457 | |

| Integer Holdings Corp. * | | | 3,526 | | | | 273,265 | |

Integra LifeSciences Holdings Corp. *(a) | | | 8,908 | | | | 511,408 | |

| iRadimed Corp. | | | 19,238 | | | | 757,015 | |

| Merit Medical Systems, Inc. * | | | 6,527 | | | | 482,672 | |

| NuVasive, Inc. * | | | 11,136 | | | | 460,028 | |

| Patterson Cos., Inc. | | | 18,054 | | | | 483,306 | |

| Semler Scientific, Inc. * | | | 11,681 | | | | 313,051 | |

| | | | | | | | 4,480,259 | |

| Healthcare-Services (1.0%) | | | | | | | | |

| Addus HomeCare Corp. * | | | 4,748 | | | | 506,897 | |

| Encompass Health Corp. | | | 9,398 | | | | 508,432 | |

| The Pennant Group Inc. * | | | 15,801 | | | | 225,638 | |

| | | | | | | | 1,240,967 | |

| Home Builders (0.9%) | | | | | | | | |

| Beazer Homes USA, Inc. * | | | 36,481 | | | | 579,318 | |

| M/I Homes, Inc. * | | | 8,886 | | | | 560,618 | |

| | | | | | | | 1,139,936 | |

| Household Products/Wares (0.6%) | | | | | | | | |

| ACCO Brands Corp. | | | 42,401 | | | | 225,573 | |

Quanex Building Products Corp. (a) | | | 23,304 | | | | 501,735 | |

| | | | | | | | 727,308 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Insurance (3.3%) | | | | | | |

| Axis Capital Holdings Ltd. | | | 8,593 | | | $ | 468,490 | |

| CNO Financial Group, Inc. | | | 21,922 | | | | 486,449 | |

| Essent Group Ltd. | | | 13,108 | | | | 524,975 | |

Jackson Financial, Inc. – Class A (a) | | | 14,211 | | | | 531,634 | |

| James River Group Holdings Ltd. | | | 22,813 | | | | 471,088 | |

| MGIC Investment Corp. | | | 37,862 | | | | 508,108 | |

| NMI Holdings, Inc. – Class A * | | | 29,133 | | | | 650,540 | |

| Palomar Holdings, Inc. * | | | 8,898 | | | | 491,170 | |

| | | | | | | | 4,132,454 | |

| Internet (2.1%) | | | | | | | | |

| HealthStream, Inc. * | | | 10,110 | | | | 273,981 | |

| Q2 Holdings, Inc. * | | | 9,690 | | | | 238,568 | |

| Squarespace, Inc. * | | | 18,630 | | | | 591,875 | |

| TechTarget, Inc. * | | | 13,518 | | | | 488,270 | |

TripAdvisor, Inc. *(a) | | | 24,165 | | | | 479,917 | |

| Yelp, Inc. * | | | 17,482 | | | | 536,697 | |

| | | | | | | | 2,609,308 | |

| Iron/Steel (0.8%) | | | | | | | | |

| Carpenter Technology Corp. | | | 13,118 | | | | 587,162 | |

| Haynes International, Inc. | | | 9,659 | | | | 483,819 | |

| | | | | | | | 1,070,981 | |

| Leisure Time (1.4%) | | | | | | | | |

| Brunswick Corp./DE | | | 6,352 | | | | 520,864 | |

Harley-Davidson, Inc. (a) | | | 11,436 | | | | 434,225 | |

| Malibu Boats, Inc. – Class A * | | | 9,248 | | | | 522,050 | |

| MasterCraft Boat Holdings, Inc. * | | | 7,979 | | | | 242,801 | |

| | | | | | | | 1,719,940 | |

| Lodging (1.5%) | | | | | | | | |

| Boyd Gaming Corp. | | | 9,126 | | | | 585,159 | |

| Hilton Grand Vacations, Inc. * | | | 5,934 | | | | 263,648 | |

| Playa Hotels & Resorts NV * | | | 55,126 | | | | 529,210 | |

| Travel + Leisure Co. | | | 12,443 | | | | 487,765 | |

| | | | | | | | 1,865,782 | |

| Machinery – Construction & Mining (0.6%) | | | | | | | | |

| Oshkosh Corp. | | | 5,882 | | | | 489,265 | |

| Terex Corp. | | | 4,861 | | | | 235,175 | |

| | | | | | | | 724,440 | |

| Machinery-Diversified (1.0%) | | | | | | | | |

| Cactus, Inc. – Class A | | | 5,503 | | | | 226,889 | |

| Gates Industrial Corp Plc * | | | 37,037 | | | | 514,444 | |

| Thermon Group Holdings, Inc. * | | | 19,606 | | | | 488,581 | |

| | | | | | | | 1,229,914 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Annual Report | March 31, 2023

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Media (1.9%) | | | | | | |

| AMC Networks, Inc. – Class A * | | | 9,749 | | | $ | 171,388 | |

Cable One, Inc. (a) | | | 802 | | | | 563,004 | |

| Gray Television, Inc. | | | 53,835 | | | | 469,441 | |

Sinclair Broadcast Group, Inc. – Class A (a) | | | 29,244 | | | | 501,827 | |

| TEGNA, Inc. | | | 14,009 | | | | 236,892 | |

| The EW Scripps Co. – Class A * | | | 44,778 | | | | 421,361 | |

| | | | | | | | 2,363,913 | |

| Metal Fabricate/Hardware (0.6%) | | | | | | | | |

| Northwest Pipe Co. * | | | 7,476 | | | | 233,476 | |

| Standex International Corp. | | | 4,775 | | | | 584,651 | |

| | | | | | | | 818,127 | |

| Miscellaneous Manufacturing (0.4%) | | | | | | | | |

| ESCO Technologies, Inc. | | | 5,544 | | | | 529,175 | |

| | | | | | | | | |

| Office Furnishings (0.5%) | | | | | | | | |

| Steelcase, Inc. – Class A * | | | 69,886 | | | | 588,440 | |

| | | | | | | | | |

| Office/Business Equipment (0.2%) | | | | | | | | |

| Xerox Holdings Corp. | | | 15,841 | | | | 243,951 | |

| | | | | | | | | |

| Oil & Gas (3.4%) | | | | | | | | |

| APA Corp. | | | 12,591 | | | | 454,031 | |

| Berry Corp. | | | 65,567 | | | | 514,701 | |

| Chord Energy Corp. | | | 4,745 | | | | 638,677 | |

| CVR Energy, Inc. | | | 15,261 | | | | 500,256 | |

Helmerich & Payne, Inc. (a) | | | 11,702 | | | | 418,346 | |

Magnolia Oil & Gas Corp. (a) | | | 22,763 | | | | 498,054 | |

| Murphy Oil Corp. | | | 10,766 | | | | 398,127 | |

| Ovintiv, Inc. | | | 9,601 | | | | 346,404 | |

| PDC Energy, Inc. | | | 7,275 | | | | 466,910 | |

| | | | | | | | 4,235,506 | |

| Oil & Gas Services (1.1%) | | | | | | | | |

| DMC Global, Inc. * | | | 11,275 | | | | 247,712 | |

| Liberty Energy, Inc. | | | 35,226 | | | | 451,245 | |

| ProPetro Holding Corp. * | | | 64,000 | | | | 460,160 | |

| RPC, Inc. | | | 30,342 | | | | 233,330 | |

| | | | | | | | 1,392,447 | |

| Packaging & Containers (0.3%) | | | | | | | | |

| Clearwater Paper Corp. * | | | 12,342 | | | | 412,470 | |

| | | | | | | | | |

| Pharmaceuticals (3.2%) | | | | | | | | |

| Alector, Inc. * | | | 11,767 | | | | 72,838 | |

| Amneal Pharmaceuticals, Inc. * | | | 85,996 | | | | 119,534 | |

| Amphastar Pharmaceuticals, Inc. * | | | 12,678 | | | | 475,425 | |

| Arvinas, Inc. * | | | 2,644 | | | | 72,234 | |

Assertio Holdings, Inc. *(a) | | | 57,735 | | | | 367,772 | |

| Catalyst Pharmaceuticals, Inc. * | | | 22,901 | | | | 379,699 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Pharmaceuticals (3.2%) (continued) | | | | | | |

| Enanta Pharmaceuticals, Inc. * | | | 2,784 | | | $ | 112,585 | |

| Foghorn Therapeutics, Inc. * | | | 13,147 | | | | 81,511 | |

| Fulcrum Therapeutics, Inc. * | | | 21,643 | | | | 61,683 | |

| Gritstone bio, Inc. * | | | 40,619 | | | | 112,921 | |

Herbalife Nutrition Ltd. *(a) | | | 10,784 | | | | 173,622 | |

| Jounce Therapeutics, Inc. * | | | 48,257 | | | | 89,276 | |

| Lyell Immunopharma, Inc. * | | | 44,651 | | | | 105,376 | |

| Option Care Health, Inc. * | | | 15,835 | | | | 503,078 | |

| Passage Bio, Inc. * | | | 51,410 | | | | 49,235 | |

| Premier, Inc. – Class A | | | 16,286 | | | | 527,178 | |

| Prestige Consumer Healthcare, Inc. * | | | 9,080 | | | | 568,680 | |

| Y-mAbs Therapeutics, Inc. * | | | 24,560 | | | | 123,046 | |

| | | | | | | | 3,995,693 | |

| Pipelines (0.6%) | | | | | | | | |

| EnLink Midstream LLC | | | 52,486 | | | | 568,948 | |

| Excelerate Energy, Inc. – Class A * | | | 11,508 | | | | 254,787 | |

| | | | | | | | 823,735 | |

| Real Estate Investment Trusts (REITs) (8.1%) | | | | | | | | |

| Alexander & Baldwin, Inc. | | | 22,946 | | | | 433,909 | |

| American Assets Trust, Inc. | | | 21,225 | | | | 394,573 | |

| Apple Hospitality REIT, Inc. | | | 33,392 | | | | 518,244 | |

Brixmor Property Group, Inc. (a) | | | 20,455 | | | | 440,192 | |

| CareTrust REIT, Inc. | | | 21,110 | | | | 413,334 | |

| Chatham Lodging Trust | | | 38,119 | | | | 399,868 | |

| DiamondRock Hospitality Co. | | | 54,633 | | | | 444,166 | |

Douglas Emmett, Inc. (a) | | | 14,668 | | | | 180,856 | |

EastGroup Properties, Inc. (a) | | | 2,203 | | | | 364,200 | |

| EPR Properties | | | 11,602 | | | | 442,036 | |

| Equity Commonwealth | | | 17,340 | | | | 359,111 | |

| Highwoods Properties, Inc. | | | 6,243 | | | | 144,775 | |

| Indus Realty Trust, Inc. | | | 8,557 | | | | 567,244 | |

Independence Realty Trust, Inc. (a) | | | 35,976 | | | | 576,695 | |

Innovative Industrial Properties, Inc. (a) | | | 3,585 | | | | 272,424 | |

Kilroy Realty Corp. (a) | | | 6,573 | | | | 212,965 | |

National Storage Affiliates Trust (a) | | | 12,068 | | | | 504,201 | |

| One Liberty Properties, Inc. | | | 8,416 | | | | 192,979 | |

| Outfront Media, Inc. | | | 25,663 | | | | 416,511 | |

Park Hotels & Resorts, Inc. (a) | | | 35,218 | | | | 435,294 | |

| Phillips Edison & Co, Inc. | | | 12,017 | | | | 391,995 | |

| Retail Opportunity Investments Corp. | | | 32,639 | | | | 455,640 | |

RLJ Lodging Trust (a) | | | 37,575 | | | | 398,295 | |

| The Howard Hughes Corp. * | | | 3,311 | | | | 264,880 | |

| The Necessity Retail REIT Inc. – Class A | | | 30,064 | | | | 188,802 | |

Uniti Group, Inc. (a) | | | 73,508 | | | | 260,953 | |

| Whitestone REIT | | | 51,193 | | | | 470,976 | |

| | | | | | | | 10,145,118 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Annual Report | March 31, 2023

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Retail (1.5%) | | | | | | |

| American Eagle Outfitters, Inc. * | | | 17,798 | | | $ | 239,205 | |

| FirstCash Holdings, Inc. | | | 2,917 | | | | 278,194 | |

| La-Z-Boy, Inc. | | | 15,189 | | | | 441,696 | |

| TravelCenters of America, Inc. * | | | 4,829 | | | | 417,709 | |

| World Fuel Services Corp. | | | 19,172 | | | | 489,845 | |

| | | | | | | | 1,866,649 | |

| Savings & Loans (2.7%) | | | | | | | | |

Axos Financial, Inc. *(a) | | | 11,085 | | | | 409,258 | |

| Brookline Bancorp, Inc. | | | 43,600 | | | | 457,800 | |

| Flushing Financial Corp. | | | 15,966 | | | | 237,734 | |

| FS Bancorp, Inc. | | | 9,148 | | | | 274,531 | |

| Home Bancorp, Inc. | | | 6,032 | | | | 199,237 | |

| HomeTrust Bancshares, Inc. | | | 11,645 | | | | 286,351 | |

| OceanFirst Financial Corp. | | | 29,666 | | | | 548,228 | |

| Southern Missouri Bancorp, Inc. | | | 5,714 | | | | 213,761 | |

Washington Federal, Inc. (a) | | | 17,666 | | | | 532,100 | |

| WSFS Financial Corp. | | | 6,125 | | | | 230,361 | |

| | | | | | | | 3,389,361 | |

| Semiconductors (1.1%) | | | | | | | | |

| Amkor Technology, Inc. | | | 12,239 | | | | 318,459 | |

Cohu, Inc. *(a) | | | 15,267 | | | | 586,100 | |

| MaxLinear, Inc. * | | | 14,132 | | | | 497,588 | |

| | | | | | | | 1,402,147 | |

| Software (5.1%) | | | | | | | | |

| Bandwidth, Inc. * | | | 32,863 | | | | 499,518 | |

| Blackbaud, Inc. * | | | 9,025 | | | | 625,432 | |

| Box, Inc. – Class A * | | | 15,212 | | | | 407,529 | |

| CommVault Systems, Inc. * | | | 8,062 | | | | 457,438 | |

| Concentrix Corp. | | | 1,936 | | | | 235,321 | |

| Everbridge, Inc. * | | | 8,309 | | | | 288,073 | |

| HireRight Holdings Corp. * | | | 21,848 | | | | 231,807 | |

| Immersion Corp. | | | 31,751 | | | | 283,854 | |

| JFrog Ltd. * | | | 22,850 | | | | 450,145 | |

| New Relic, Inc. * | | | 7,030 | | | | 529,289 | |

| Pegasystems, Inc. | | | 9,961 | | | | 482,909 | |

| Progress Software Corp. | | | 9,593 | | | | 551,118 | |

| RingCentral, Inc. * | | | 7,480 | | | | 229,412 | |

| Sapiens International Corp. NV * | | | 25,741 | | | | 559,095 | |

| SolarWinds Corp. * | | | 31,292 | | | | 269,111 | |

SPS Commerce, Inc. *(a) | | | 1,947 | | | | 296,528 | |

| | | | | | | | 6,396,579 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Schedule of Investments (continued)

March 31, 2023

| | | Shares | | | Fair Value | |

| Telecommunications (1.2%) | | | | | | |

| A10 Networks, Inc. | | | 35,013 | | | $ | 542,351 | |

| Cambium Networks Corp. * | | | 13,088 | | | | 231,919 | |

| CommScope Holding Co, Inc. * | | | 30,102 | | | | 191,750 | |

| Viavi Solutions, Inc. * | | | 48,759 | | | | 528,060 | |

| | | | | | | | 1,494,080 | |

| Transportation (0.9%) | | | | | | | | |

| Daseke, Inc. * | | | 36,576 | | | | 282,732 | |

| Teekay Tankers Ltd. – Class A * | | | 12,114 | | | | 520,054 | |

XPO Logistics, Inc. *(a) | | | 9,335 | | | | 297,787 | |

| | | | | | | | 1,100,573 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (COST $128,186,248) | | | | | | | 123,640,539 | |

| | | | | | | | | |

| CONTINGENT VALUE RIGHTS (0.0%) | | | | | | | | |

Ligand Pharmaceuticals, Inc. Earn-Out Shares 1 *(b) | | | 491 | | | | — | |

Ligand Pharmaceuticals, Inc. Earn-Out Shares 2 *(b) | | | 491 | | | | — | |

| TOTAL CONTINGENT VALUE RIGHTS | | | | | | | | |

| (COST $—) | | | | | | | — | |

| | | | | | | | | |

| Money Market Fund (0.9%) | | | | | | | | |

| First American Government Obligations Fund – Class X, 4.640%) ^ | | | | | | | | |

| (COST $1,129,600) | | | 1,129,600 | | | | 1,129,600 | |

| | | | | | | | | |

| Investments Purchased with Proceeds from Securities Lending (10.7%) | | | | | | | | |

| Mount Vernon Liquid Assets Portfolio LLC, 4.930%) ^ | | | | | | | | |

| (COST $13,331,257) | | | 13,331,257 | | | | 13,331,257 | |

| | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | |

| (COST $142,647,105) | | | 110.3 | % | | | 138,101,396 | |

| OTHER ASSETS AND LIABILITIES, NET | | | (10.3 | )% | | | (12,880,893 | ) |

| TOTAL NET ASSETS | | | 100.0 | % | | $ | 125,220,503 | |

| * | Non-income producing security. |

| (a) | This security or a portion of this security was out on loan at March 31, 2023. Total loaned securities had a fair value of $13,312,901 at March 31, 2023. |

| (b) | Security is categorized in Level 3 of the fair value hierarchy. These Level 3 securities have a total fair value of $0, which represents 0.0% of total net assets. See Note 3 In the Notes to the Financial Statements. |

| ADR – | American Depositary Receipt |

| REIT – | Real Estate Investment Trust |

| ^ | The rate shown is the annualized seven-day effective yield as of March 31, 2023. |

The accompanying notes to financial statements are an integral part of these financial statements.

Annual Report | March 31, 2023

Statement of Assets and Liabilities

March 31, 2023

| ASSETS: | | | |

| Investment securities: | | | |

| At cost | | $ | 142,647,105 | |

At value(1) | | $ | 138,101,396 | |

| Receivable for investment securities sold | | | 2,678,993 | |

| Dividends & interest receivable | | | 148,473 | |

| Receivable for capital shares sold | | | 7,839 | |

| Income receivable from securities lending | | | 2,402 | |

| Prepaid expenses | | | 58,799 | |

| Total Assets | | | 140,997,902 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable upon return of securities loaned (See Note 9) | | | 13,331,257 | |

| Payable for investment securities purchased | | | 2,085,254 | |

| Payable for capital shares redeemed | | | 184,240 | |

| Payable to investment adviser | | | 63,225 | |

| Payable for fund administration & accounting fees | | | 41,515 | |

| Payable for compliance fees | | | 5,461 | |

| Payable for transfer agent fees & expenses | | | 16,897 | |

| Payable for custody fees | | | 3,898 | |

| Payable for audit and tax fees | | | 21,251 | |

| Payable for trustee fees | | | 2,986 | |

| Accrued other fees | | | 21,408 | |

| Accrued distribution & shareholder service fees | | | 7 | |

| Total Liabilities | | | 15,777,399 | |

| NET ASSETS | | $ | 125,220,503 | |

| | | | | |

| COMPOSITION OF NET ASSETS | | | | |

| Paid-in capital | | $ | 129,598,764 | |

| Total accumulated losses | | | (4,378,261 | ) |

| Total net assets | | $ | 125,220,503 | |

(1) | Includes loaned securities of: | | $ | 13,312,901 | |

| Advisor Class Shares: | | | |

| Net Assets | | $ | 9,372 | |

Shares issued and outstanding(2) | | | 756 | |

| Net asset value, offering price, and redemption price per share | | $ | 12.40 | |

| Institutional Class Shares: | | | | |

| Net Assets | | $ | 125,211,131 | |

Shares issued and outstanding(2) | | | 10,042,438 | |

| Net asset value, offering price, and redemption price per share | | $ | 12.47 | |

(2) | Unlimited shares authorized without par value. |

The accompanying notes to financial statements are an integral part of these financial statements.

Statement of Operations

For the Year Ended March 31, 2023

| INVESTMENT INCOME: | | | |

| Interest income | | $ | 25,442 | |

| Dividend income | | | 2,600,373 | |

| Less: Foreign taxes withheld | | | (3,899 | ) |

| Securities lending income | | | 6,963 | |

| Total investment income | | | 2,628,879 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (See Note 4) | | | 1,210,522 | |

| Operating service fees – Investor Class (See Note 4) | | | 188,998 | |

| Operating service fees – Institutional Class (See Note 4) | | | 40,330 | |

| Fund administration & accounting fees (See Note 4) | | | 41,515 | |

| Audit & tax fees | | | 21,251 | |

| Transfer agent fees & expenses (See Note 4) | | | 16,897 | |

| Federal & state registration fees | | | 15,649 | |

| Trustee fees | | | 8,823 | |

| Compliance fees (See Note 4) | | | 5,461 | |

| Legal fees | | | 3,996 | |

| Custody fees (See Note 4) | | | 3,898 | |

| Other fees | | | 3,688 | |

| Postage & printing fees | | | 2,997 | |

| Insurance fees | | | 234 | |

| Distribution & shareholder service fees – Advisor Class (See Note 5) | | | 7 | |

| Total expenses before waiver | | | 1,564,266 | |

| Less: Fee waiver from investment adviser (See Note 4) | | | (90,816 | ) |

| Total net expenses | | | 1,473,450 | |

| NET INVESTMENT INCOME | | | 1,155,429 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

| Net realized gain on investments | | | 969,514 | |

| Net change in unrealized appreciation/depreciation of investments | | | (14,275,630 | ) |

| Net realized and unrealized loss on investments | | | (13,306,116 | ) |

| NET DECREASE IN NET ASSETS FROM OPERATIONS | | $ | (12,150,687 | ) |

The accompanying notes to financial statements are an integral part of these financial statements.

Annual Report | March 31, 2023

Statements of Changes in Net Assets

| | | CornerCap Small-Cap Value Fund | |

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | March 31, 2023 | | | March 31, 2022 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 1,155,429 | | | $ | 1,291,473 | |

| Net realized gain on investments | | | 969,514 | | | | 39,386,985 | |

| Net change in unrealized appreciation/depreciation of investments | | | (14,275,630 | ) | | | (25,635,543 | ) |

| Net increase (decrease) resulting from operations | | | (12,150,687 | ) | | | 15,042,915 | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Advisor Class: | | | | | | | | |

| Proceeds from shares sold | | | 10,000 | | | | — | |

| Proceeds from reinvestment of distributions | | | 449 | | | | — | |

| Payments for shares redeemed | | | — | | | | — | |

| Increase in net assets from Advisor Class transactions | | | 10,449 | | | | — | |

| Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 12,036,118 | | | | 18,312,919 | |

| Proceeds from reinvestment of distributions | | | 12,342,886 | | | | 17,787,764 | |

| Payments for shares redeemed | | | (21,082,709 | ) | | | (18,063,249 | ) |

| Redemption Fees | | | 7 | | | | 997 | |

| Proceeds from conversion of Investor Class (See Note 12) | | | 73,231,101 | | | | — | |

| Increase in net assets from Institutional Class transactions | | | 76,527,403 | | | | 18,037,434 | |

| Investor Class: | | | | | | | | |

| Proceeds from shares sold | | | 3,604,989 | | | | 6,898,459 | |

| Proceeds from reinvestment of distributions | | | — | | | | 23,162,296 | |

| Payments for shares redeemed | | | (8,517,907 | ) | | | (40,361,324 | ) |

| Redemption fees | | | 4 | | | | — | |

| Payments from conversion into Institutional Class | | | (73,231,101 | ) | | | — | |

| Decrease in net assets from Investor Class transactions | | | (78,144,015 | ) | | | (10,300,569 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | (1,606,163 | ) | | | 7,737,862 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Net Distributions to Shareholders – Advisor Class | | | (449 | ) | | | — | |

| Net Distributions to Shareholders – Institutional Class | | | (12,343,162 | ) | | | (41,479,890 | ) |

| Total distributions to shareholders | | | (12,343,611 | ) | | | (41,479,890 | ) |

| Total decrease in net assets | | | (26,100,461 | ) | | | (18,699,113 | ) |

| NET ASSETS: | | | | | | | | |

| Beginning of Year | | | 151,320,964 | | | | 170,020,077 | |

| End of Year | | $ | 125,220,503 | | | $ | 151,320,964 | |

The accompanying notes to financial statements are an integral part of these financial statements.

Financial Highlights

CornerCap Small-Cap Value Fund – Advisor Class

| | | Period Since | |

| | | Commencement | |

| | | of Operations(1) | |

| | | through | |

| For a Fund share outstanding throughout the period. | | March 31, 2023 | |

| PER COMMON SHARE DATA | | | |

| Net asset value, beginning of period | | $ | 14.21 | |

| INVESTMENT OPERATIONS: | | | | |

| Net investment income | | | 0.05 | (2) |

| Net realized and unrealized loss on investments | | | (0.60 | ) |

| Total from investment operations | | | (0.55 | ) |

| | | | | |

| LESS DISTRIBUTIONS FROM: | | | | |

| Net investment income | | | (0.07 | ) |

| Net realized gains | | | (1.19 | ) |

| Total distributions | | | (1.26 | ) |

| Net asset value, end of period | | $ | 12.40 | |

Total return(3) | | | -4.00 | % |

| | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | |

| Net assets, at end of period (000’s) | | $ | 9 | |

| | | | | |

RATIO OF EXPENSES TO AVERAGE NET ASSETS(4): | | | | |

| Before expense waiver | | | 1.45 | % |

| After expense waiver | | | 1.25 | % |

| | | | | |

RATIO OF NET INVESTMENT INCOME TO AVERAGE NET ASSETS(4): | | | | |

| After expense waiver | | | 1.15 | % |

| Portfolio Turnover Rate | | | 131 | % |

________________________

(1) | Commencement of operations of the Advisor Class was November 18, 2022. |

(2) | Per share amounts calculated using the average shares method. |

(3) | Not annualized. |

(4) | Annualized. |

The accompanying notes to financial statements are an integral part of these financial statements.

Annual Report | March 31, 2023

Financial Highlights

CornerCap Small-Cap Value Fund – Institutional Class

| | | Year Ended March 31, | |

| For a Fund share outstanding throughout each year. | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| PER COMMON SHARE DATA | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 14.93 | | | $ | 18.16 | | | $ | 9.69 | | | $ | 13.15 | | | $ | 15.30 | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.12 | | | | 0.17 | | | | 0.18 | | | | 0.14 | | | | 0.13 | |

| Net realized and unrealized gain (loss) on investments | | | (1.31 | ) | | | 1.63 | | | | 8.43 | | | | (3.48 | ) | | | (0.39 | ) |

| Total from investment operations | | | (1.19 | ) | | | 1.80 | | | | 8.61 | | | | (3.34 | ) | | | (0.26 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.08 | ) | | | (0.17 | ) | | | (0.14 | ) | | | (0.12 | ) | | | (0.08 | ) |

| Net realized gains | | | (1.19 | ) | | | (4.86 | ) | | | — | | | | — | | | | (1.81 | ) |

| Total distributions | | | (1.27 | ) | | | (5.03 | ) | | | (0.14 | ) | | | (0.12 | ) | | | (1.89 | ) |

Paid-in Capital from Redemption Fees(1) | | | — | (2) | | | — | (2) | | | — | (2) | | | — | (2) | | | — | (2) |

| Net asset value, end of year | | $ | 12.47 | | | $ | 14.93 | | | $ | 18.16 | | | $ | 9.69 | | | $ | 13.15 | |

| Total return | | | -8.12 | % | | | 9.45 | % | | | 89.19 | % | | | -25.72 | % | | | -0.68 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, at end of year (000’s) | | $ | 125,211 | | | $ | 69,206 | | | $ | 63,407 | | | $ | 27,890 | | | $ | 34,161 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.08 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| After expense waiver | | | 0.98 | %(3) | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF NET INVESTMENT INCOME | | | | | | | | | | | | | | | | | | | | |

| TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| After expense waiver | | | 0.96 | % | | | 0.96 | % | | | 1.31 | % | | | 1.05 | % | | | 0.84 | % |

| Portfolio Turnover Rate | | | 131 | % | | | 116 | % | | | 121 | % | | | 127 | % | | | 147 | % |

________________________

(1) | Per share amounts calculated using the average shares method. |

(2) | Less than $0.005 per share. |

(3) | Effective November 18, 2022, the Adviser entered into an Operating Expenses Limitation Agreement to ensure that total annual operating expenses do not exceed 0.95% of the average daily net assets of the Fund (See Note 4 in Notes to Financial Statements). |

The accompanying notes to financial statements are an integral part of these financial statements.

Notes to Financial Statements

March 31, 2023

1. ORGANIZATION

Managed Portfolio Series (the “Trust”) was organized as a Delaware statutory trust on January 27, 2011. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The CornerCap Small-Cap Value Fund (the “Fund”) is a diversified series with its own investment objectives and policies within the Trust. The investment objective of the Fund is long-term capital appreciation with a secondary objective of generating income from dividends or interest on securities. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946 Financial Services – Investment Companies. The Fund commenced operations on September 30, 1992. On November 18, 2022, the CornerCap Small-Cap Value Fund, a series of The CornerCap Group of Funds (the “Acquired Fund”), reorganized into the Fund, a series of the Trust. The Fund currently offers two classes, the Advisor Class and the Institutional Class. The Adviser Class commenced operations on November 18, 2022. Advisor Class shares are subject to a 0.25% of average daily net assets distribution and servicing fee and a shareholder servicing fee of up to 0.05% of average daily net assets. Each class of shares has identical rights and privileges with respect to voting on matters affecting a single share class. The Fund may issue an unlimited number of shares of beneficial interest, with no par value.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Security Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3.

Federal Income Taxes – The Fund complies with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as a regulated investment company and distributes substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income or excise tax provision is required. As of and during the year ended March 31, 2023, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. During the year ended March 31, 2023, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. taxing authorities for the tax years ended March 31, 2020 through 2023.

Security Transactions, Income and Distributions – The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities using the constant yield method of calculation.

The Fund will make distributions, if any, of net investment income annually. The Fund will also distribute net realized capital gains, if any, annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. For the year ended March 31, 2023, there were no reclassifications.

Annual Report | March 31, 2023

Notes to Financial Statements

March 31, 2023

Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. 12b-1 fees are expensed at 0.25% of average daily net assets of Advisor Class shares. Shareholder service fees are expensed at up to 0.05% of average daily net assets Advisor Class shares. Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly between the funds of the Trust, or by other equitable means.

Illiquid Securities – A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the price at which the security is valued by the Funds. Illiquid securities may be valued under methods approved by the Board as reflecting fair value. The Fund will not hold more than 15% of the value of its net assets in illiquid securities. At March 31, 2023, the Fund had investments in illiquid securities with a total value of $0 or 0.0% of total assets.

| Security | Shares | Date Acquired | Cost Basis |

| Ligand Pharmaceuticals, Inc. Earn-Out Shares 1 | 491 | 11/2022 | $0 |

| Ligand Pharmaceuticals, Inc. Earn-Out Shares 2 | 491 | 11/2022 | $0 |

Security Loans – When the Fund loans securities held in its portfolio, the Fund receives compensation in the form of fees, or retains a portion of the interest on the investment of any cash received as collateral. The Fund also continues to receive dividends on the securities loaned. The loans are secured by collateral at least equal to 105% of the value of the loaned securities that are foreign securities or 102% of the value of any other loaned securities marked-to market daily. Loans shall be marked to market daily and the margin restored in the event collateralization is below 100% of the value of securities loaned. Gain or loss in the value of securities loaned that may occur during the term of the loan will be for the account of the Fund. The Fund has the right under the lending agreement to recover the securities from the borrower on demand. See Note 9.

3. SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value.

Notes to Financial Statements

March 31, 2023

Equity Securities – Securities that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices. Securities traded primarily in the Nasdaq Global Market System for which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

Short-Term Investments – Investments in other mutual funds, including money market funds are valued at their net asset value per share and are categorized in Level 1 of the fair value hierarchy. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy.

The Board of Trustees (the “Board”) has adopted a pricing and valuation policy for use by the Funds and their Valuation Designee (as defined below) in calculating the Funds’ NAV. Pursuant to Rule 2a-5 under the 1940 Act, the Funds have designated CornerCap Investment Counsel, Inc. (the “Adviser”) as its “Valuation Designee” to perform all of the fair value determinations as well as to perform all of the responsibilities that may be performed by the Valuation Designee in accordance with Rule 2a-5. The Valuation Designee is authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are unreliable.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s securities as of March 31, 2023:

| Small-Cap Value Fund | | Uncategorized | | | Level 1 | | | Level 2 | | | Level 3** | | | Total | |

| Common Stocks | | $ | — | | | $ | 123,640,539 | | | $ | — | | | $ | — | | | $ | 123,640,539 | |

| Investment Purchased with | | | | | | | | | | | | | | | | | | | | |

| Proceeds from Securities Lending* | | | 13,331,257 | | | | — | | | | — | | | | — | | | | 13,331,257 | |

| Contingent Value Rights | | | — | | | | — | | | | — | | | | — | | | | — | |

| Money Market Fund | | | — | | | | 1,129,600 | | | | — | | | | — | | | | 1,129,600 | |

| Total Investments | | $ | 13,331,257 | | | $ | 124,770,139 | | | $ | — | | | $ | — | | | $ | 138,101,396 | |

| * | Certain investments that are measured at fair value using the NAV per share (or its equivalent) as a practical expedient have not been characterized in the fair value hierarchy. The fair value amounts presented in the table are intended to permit reconciliation of the fair value hierarchy to the amount presented in the Statements of Assets and Liabilities. See Note 9 for additional information regarding securities lending activity. |

| ** | Additional Level 3 disclosures deemed immaterial to the financial statements. |

Refer to the Schedule of Investments for further information on the classification of investments.

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | | Investments | |

| | | in Securities | |

| Balance as of 3/31/2022 | | $ | — | |

| Accrued discounts/ premiums | | | — | |

| Realized gain (loss) | | | — | |

| Change in net unrealized appreciation (depreciation) | | | — | |

| Net purchases (sales) | | | — | |

| Transfers in and/or out of Level 3 | | | — | |

| Balance as of 3/31/2023 | | $ | — | |

| Net change in unrealized appreciation/depreciation of Level 3 assets as of March 31, 2023 | | $ | — | |

Annual Report | March 31, 2023

Notes to Financial Statements

March 31, 2023

4. INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Trust has an agreement with the Adviser to furnish investment advisory services to the Fund. Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser is entitled to receive, on a monthly basis, an annual advisory fee equal to 0.88% of the Fund’s average daily net assets. Prior to November 18, 2022, the Acquired Fund had an Investment Advisory Agreement with the Adviser, pursuant to which the Adviser received, on a monthly basis, an annual advisory fee equal to 0.90% of the Acquired Fund’s average daily net assets. In addition, prior to November 18, 2022, the Acquired Fund and the Adviser entered into an Operating Services Agreement whereby the Adviser received an Operating Services Fee, computed daily and payable monthly, at an annual rate of 0.40% and 0.10% of the average daily net assets of the Acquired Fund’s Investor Class and Institutional Class, respectively. For the period April 1, 2022 to November 18, 2022, the Acquired Fund paid the Predecessor Adviser $229,328 in Operating Service Fees. The Adviser paid all operating expenses of the Acquired Fund.

Effective November 18, 2022, the Fund’s Adviser has contractually agreed to waive a portion or all of its management fees and reimburse the Fund for its expenses to ensure that total annual operating expenses (excluding Rule 12b-1 fees, Shareholder Servicing Plan fees, leverage/borrowing interest, interest expense, dividend paid on short sales, brokerage and other transactional expenses, acquired fund fees and expenses, expenses incurred in connection with any merger or reorganization, or extraordinary expenses) for the Fund do not exceed 0.95% of average daily net assets of the Fund. Prior to November 18, 2022, the contractual expense limitation in place for the Fund was 1.30% (excluding interest, taxes, brokerage fees and commissions, acquired fund fees and expenses and extraordinary expenses) of average daily net assets of the Fund’s Investor Class. Fees waived and expenses reimbursed by the Adviser may be recouped by the Adviser for a period of thirty-six months following the month during which such waiver or reimbursement was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the waiver and reimbursement occurred. The Operating Expenses Limitation Agreement cannot be terminated through at least November 18, 2025. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board of Trustees (the “Board”) or the Adviser, with the consent of the Board. For the year ended March 31, 2023, the Adviser did not recoup any previously waived expenses. Waived fees and reimbursed expenses subject to potential recovery by year of expiration are as follows:

| Expiration | Amount | |

| November 2025 – March 2026 | $90,816 | |

For the period from April 1, 2022 to November 18, 2022, the fees waived by the Adviser for the Fund was $0. Additionally, there are no previously waived fees subject to recoupment prior to November 18, 2022.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, (“Fund Services” or the “Administrator”), acts as the Fund’s Administrator, Transfer Agent, and Fund Accountant. U.S. Bank N.A. (the “Custodian”) serves as the custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. The officers of the Trust, including the Chief Compliance Officer are employees of the Administrator. As compensation for its services, the Administrator is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees paid by the Fund for administration and accounting, transfer agency, custody and compliance services for the period from November 13, 2022, through March 31, 2023, are disclosed in the Statement of Operations. Prior to November 18, 2022, the Fund engaged Atlantic Fund Administration, doing business as Apex Fund Services (“Apex”) to provide fund accounting, fund administration, and transfer agency services to the Fund. Apex was paid by the Adviser for its service from the Operating Services Fee it received.

Notes to Financial Statements

March 31, 2023

5. DISTRIBUTION & SHAREHOLDER SERVICING FEES

The Fund has adopted a Distribution Plan pursuant to Rule 12b-1 (the “Plan”) in the Advisor Class only. The Plan permits the Fund to pay for distribution and related expenses at an annual rate of 0.25% of the Advisor Class average daily net assets. The expenses covered by the Plan may include the cost of preparing and distributing prospectuses and other sales material, advertising and public relations expenses, payments to financial intermediaries and compensation of personnel involved in selling shares of the Fund. Payments made pursuant to the Plan will represent compensation for distribution and service activities, not reimbursements for specific expenses incurred. For the period ended March 31, 2023, the Advisor Class incurred expenses of $6 pursuant to the Plan.