UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22525

Managed Portfolio Series

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Brian R. Wiedmeyer, President

Managed Portfolio Series

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Ave, 5th Fl

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 765-6844

Registrant's telephone number, including area code

Date of fiscal year end: November 30, 2021

Date of reporting period: November 30, 2021

Item 1. Reports to Stockholders.

2021 Annual Report

November 30, 2021

| |

| |

| |

| |

| TortoiseEcofin |

| 2021 Annual Report |

| |

This combined financial report provides you with a comprehensive review of our funds that span the entire energy value chain.

| | | |

| Table of Contents | | |

| | | |

| Letter to Shareholders | | 2 |

| Tortoise MLP & Pipeline Fund | | 5 |

| Tortoise MLP & Energy Income Fund | | 8 |

| Ecofin Global Energy Transition Fund | | 11 |

| Ecofin Global Renewables Infrastructure Fund | | 14 |

| Expense Examples | | 18 |

| Financial Statements | | 21 |

| Notes to Financial Statements | | 46 |

| Report of Independent Registered Public Accounting Firm | | 56 |

| Investment Advisory Agreement | | 57 |

| Trustees & Officers | | 59 |

| Additional Information | | 61 |

TortoiseEcofin

| |

| |

| 2021 Annual Report | November 30, 2021 |

| |

| |

| |

| |

Open-end fund comparison

| | | | | Total assets | | | | |

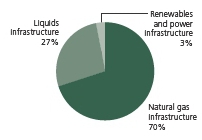

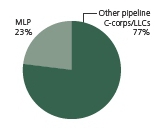

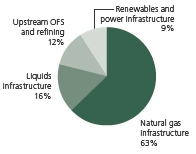

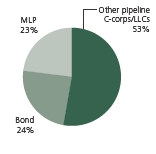

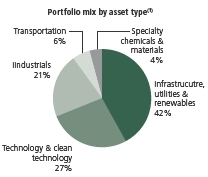

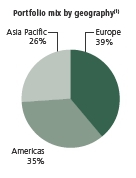

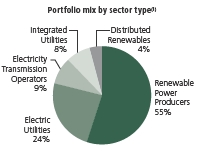

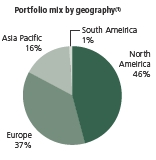

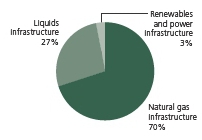

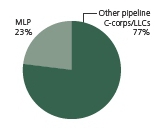

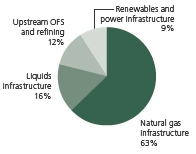

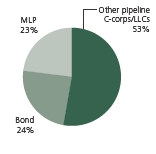

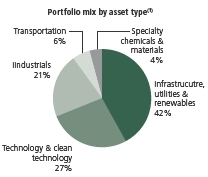

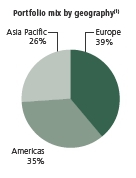

| Name/Ticker | | Primary focus | | ($ Millions)(1) | | Portfolio mix by asset type(1) | | Portfolio mix by ownership(1) |

| Tortoise MLP & Pipeline

Fund Institutional Class (TORIX)

A Class (TORTX)

Inception: 5/2011

C Class (TORCX)

Inception: 9/2012 | | North American pipeline companies | | $1,932.1 | |  | |  |

Tortoise MLP & Energy

Income Fund Institutional Class (INFIX)

A Class (INFRX)

Inception: 5/2011

C Class (INFFX)

Inception: 4/2012 | | Energy infrastructure equity and debt | | $415.8 | |  | |  |

| Ecofin Global Energy

Transition Fund Institutional Class (EETIX)

A Class (EETAX)

Inception: 10/2021 | | Global Securities benefiting from long-term growth associated with energy transition | | $51.0 | |  | |  |

Ecofin Global Renewables

Infrastructure Fund

Institutional Class (ECOIX)

A Class (ECOAX)

Inception: 8/2020 | | Global Securities benefiting from long-term growth associated with energy transition | | $382.4 | |  | |  |

| (unaudited) | |

| | |

| TortoiseEcofin | 1 |

| |

| |

| |

| |

| Tortoise |

| 2021 Annual Report |

Dear shareholder

After years of suboptimal returns, energy was the top performing sector in 2021. The broad energy sector performance surged in spite of investor concerns about the COVID-19 Omicron variant’s impact on global energy demand. The global economic recovery is expected to continue into 2022, driving further demand for essential assets.

Energy and power infrastructure

The broader energy sector, as represented by the S&P Energy Select Sector® Index, finished the fiscal year ending November 30, 2021, returning 47.1%. Global underinvestment resulting from environmental, social and governance (ESG) commitments and energy transition is likely to keep global inventories balances for all energy commodities tight for the foreseeable future, a dynamic that presents higher but perhaps more volatile prices.

Throughout 2021, OPEC+ producers closely managed the crude oil market resulting in a drawdown in inventories. A tighter market led to rising commodity prices even with bouts of the Delta and Omicron COVID variants during the second half of 2021. Despite uncertainty, OPEC+ maintained plans to increase production by 400,000 barrels per month. Various OPEC+ countries face obstacles to raising production, complicating assessments of the actual amount of supply that will be added over the next year. Finally, in 2022 the OPEC+ group’s spare capacity is in focus. If spare capacity is lower than market participants assume, prices could be biased towards further upside.

In North America, higher prices spurred a revival of shale drilling. The Permian, America’s biggest oil field, was the primary driver of production growth. In fact, during the fourth quarter, production within the basin reached an all-time high of almost 5.0 million barrels per day.1 The surge is driven by private operators, rather than the publicly traded companies that fueled the previous booms. For 2022, the Energy Information Agency (EIA) forecasts U.S. production will increase from 11.8 million barrels per day (b/d), up from 11.2 million b/d at the end of 2021.

In the second half of 2021, stress on global power markets pulled on all available natural gas supplies, pushing prices to the highest levels in over a decade. This led to switching to coal and even fuel oil for power generation. Due to its low emission intensity relative to other dispatchable fuels, natural gas is being called on to fill power generation gaps created by intermittent renewable sources. Demand for U.S. liquefied natural gas (LNG) was on full display in the fourth quarter. Exports of U.S. feedgas hit an incredible 13 billion cubic feet per day (bcf/d) during the quarter, or 14% of U.S. production.2 From zero a few years ago, the U.S. is now the world’s largest LNG exporter.

Midstream energy, represented by the Tortoise North American Pipeline IndexSM, returned 31.1% during the fiscal year. This performance resulted in outperformance versus the S&P 500® Index in calendar year 2021 for the first time since 2016. 2021 was a story of consistency for energy infrastructure fundamentals. A pandemic recovery coupled with growing free cash flow and the return of capital to shareholders were the main drivers of returns. 2021 EBITDA expectations were consistently revised higher based on increasing pipeline volumes as the economy reopened. Companies stayed disciplined on capital expenditures and used excess cash flow to reduce debt with stock buybacks as a secondary and growing consideration. At year-end, seventeen midstream companies maintained active equity buyback programs totaling more than $2 billion in buybacks through the third quarter of 2021. In 2022, we expect return of capital to continue with capital expenditures declining and free cash flow returned to investors via buybacks and higher distributions. Finally, with balance sheets strengthened, the industry could see additional mergers and acquisitions (M&A) as we saw in 2021 with exploration and production companies (E&Ps).

On the legislative front, the Congressional infrastructure bill was passed in November. Hydrogen received significant funding with targeted development of regional hubs presenting growth opportunities for energy infrastructure companies. Of more significance is the outcome of climate change legislation. If a bill is passed in 2022, it will likely focus more on tax credits rather than more restrictive, comprehensive climate policies. We believe the bill will also include regulatory support for existing infrastructure. For example, the expansion of Section 45Q tax credit would incentivize more widespread carbon capture adoption for harder to abate sectors such as steel, cement, and chemicals.

On the regulatory front, demand for low-cost U.S. natural gas created a need for additional natural gas pipelines and LNG export terminals. In the northeast Marcellus Basin, pipeline infrastructure is constrained. Despite this need, the regulatory environment remains incredibly challenging as evidenced by the recent cancellations of the Atlantic Coast Pipeline and the Constitution Pipeline. The one major pipeline under construction is the Mountain Valley Pipeline. The long-haul natural gas pipeline received key water permits during the fourth quarter with a couple hurdles to overcome before becoming operational. While LNG export facilities take time to construct, with the largest outstanding LNG opportunity, Cheniere Energy expects to advance their Corpus Christi stage 3 in 2022, once remaining investment and commercial parameters are met. Finally, Enbridge received final regulatory approval on its Line 3 crude oil pipeline project and started moving volumes during the fourth quarter, making it the largest crude oil project to come online in 2021.

| (unaudited) | |

| | |

| 2 | TortoiseEcofin |

| |

| |

| 2021 Annual Report | November 30, 2021 |

| |

| |

| |

| |

Several events in 2021 reminded investors how critical energy infrastructure is to daily life. Notable events like Winter Storm Uri in Texas, the cyber-attack of the Colonial Pipeline, Hurricane Ida in the Gulf Coast, or U.S. LNG cargoes rapidly replenishing Europe’s low gas storage levels via LNG tankers all argue towards a holistic view towards energy transition. With the understanding that fossil fuels will remain critical to the economy for decades, we believe focusing on decarbonizing existing infrastructure is the best approach to reducing emissions.

Midstream companies concentrated on decarbonization throughout 2021. Sustainability reports included more granular detail than previous annual reports, net-zero emission targets were established, pledges were made to reduce methane intensity, and companies engaged with projects and growth opportunities around energy transition. Energy transition projects support the longevity of existing assets and cash flow growth. Fuels including carbon (through carbon capture and sequestration), hydrogen, renewable diesel, and renewable natural gas all create a pathway to a lower carbon future. Repurposing existing pipelines significantly reduces the capital expenditures versus building a new pipeline as we expect energy infrastructure companies to take advantage of the existing infrastructure already in the ground.

With inflation increasing throughout the year, many investors began to recognize midstream as an asset class with inflation protection. Pipelines typically have long-term contracts with inflation protection from regulated tariff escalators. Additionally, tariffs on regulated liquid pipelines typically include an inflation escalator. This allows increases aligned with the Producer Price Index (PPI) offering some protection from inflation. Through November 2021, the PPI increased by 9.0% from the prior year which could be a material driver of cash flows in 2022.

As the world economy continues to reopen, the energy sector is positioned for a reflation around increased energy demand. The focus continues to be on companies with strong balance sheets and exposure to the most competitive basins for hydrocarbon production, including the Permian and Marcellus basins. The fund also continues to emphasize export infrastructure, both LNG and liquefied petroleum gas (LPG).

The downstream portion of the energy value chain continues its recovery from the COVID-19 pandemic. The EIA sees refined product demand increasing 3% year over year driven largely by increases in jet fuel. U.S. demand for gasoline and distillate normalized in 2021 relative to 2019 levels while jet fuel demand is still down from pre-COVID levels. The natural gas liquids backdrop is strong entering 2022. NGL prices have been elevated on favorable fundamentals including constrained supply and low stockpiles. There has been particular strength in LPGs (liquid petroleum gases) where demand is driven by global population growth and improvements in living standards in Asia, notably in China and India.

Sustainable infrastructure

The renewables sector had a difficult year in terms of share price performance— in part due to the starting point left by large gains from 2020. After being recognized in 2020 as a larger secular growth sector than previously realised, some near-term challenges to fundamental momentum emerged. A combination of fears around equipment cost inflation and its impact on development project returns, rising interest rates and their impact on discounted cash flows, and COVID-related development and construction delays and their impact on the pace of growth all conspired to question the robustness of the growth story. Consequently, concerns about near-term earnings growth prospects emerged for some companies, leading to negative near-term revisions, with attendant share price weakness, especially for smaller companies and unregulated companies who have less offsetting predictable businesses that provide greater visibility into their growth prospects.

At the same time, the sector saw improved policy frameworks in some emerging markets (particularly in China) but lost some momentum on the policy front in certain developed markets, which also had an adverse impact on the sector and the strategy. The following developments from late in the fourth quarter are worth highlighting:

California Net Energy Metering 3.0 (NEM 3.0): NEM allows customers who generate their own energy to receive a financial credit on their electric bills for any surplus energy sent to the grid. The Californian Public Utility Commission (CPUC) reviewed the financial benefit received in particular by rooftop solar customers and its proposed decision (NEM 3.0) was worse than expected, with lower prices for excess power and particularly with regard to a “connection fee”, which would introduce a new monthly fixed cost for future rooftop solar owners to remain connected to the grid. The reaction of the stocks exposed to rooftop solar reflected that worse-than-expected proposed decision. The final decision on NEM 3.0 is due at the end of January at the earliest. It is unlikely that the final decision will be even more onerous on the rooftop solar industry, and there is a chance that after the consultation period the outcome could be either neutral or improved relative to the proposal.

Build Back Better (BBB): The proposed US BBB bill seems to be highly uncertain at this stage, due to objections from a single Senator, whose vote is needed for passage. This development late in December was negative for investor sentiment across much

| (unaudited) | |

| | |

| TortoiseEcofin | 3 |

of the energy transition space as the bill was not only a targeted form of financial support for renewables, storage, green hydrogen and electric vehicles, but importantly also signalled a somewhat unprecedented U.S. intent to accelerate decarbonization. We believe that current incentive policies such as the solar ITC (Investment Tax Credit) and wind PTC (Production Tax Credit) have a higher probability to be extended through a tax extenders package should BBB fail to be enacted in any form. However, policies that require new legislation – such as green hydrogen subsidization, Carbon Capture & Storage (CCS) incentives, standalone storage ITCs, domestic manufacturing credits – have a lower probability of making it into subsequent legislation, thereby removing the odds of an important positive catalyst. As with all political negotiations, these situations are fluid and could break in either direction.

Concluding thoughts

We are extremely optimistic about our essential asset investments for 2022 and well into the future. It appears that the end may be in sight on the global pandemic, which will support increased pent-up demand for the assets in which the funds invest. There are indications of global acceptance that natural gas should be included as a sustainable energy source along with renewables and an investment option as energy transitions. We believe that all of these catalysts will lead to strong returns. We are positioning the funds to take advantage of this momentum and have a positive outlook for 2022 and beyond.

The S&P 500® Index is an unmanaged market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. The S&P Energy Select Sector® Index is a capitalization-weighted index of S&P 500® Index companies in the energy sector involved in the development or production of energy products. The Tortoise North American Pipeline IndexSM is a float adjusted, capitalization-weighted index of energy pipeline companies domiciled in the United States and Canada. The Tortoise MLP Index® is a float-adjusted, capitalization-weighted index of energy master limited partnerships.

The Tortoise indices are the exclusive property of TIS Advisors which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Tortoise MLP Index® and Tortoise North American Pipeline IndexSM (the “Indices”). The Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, “S&P Dow Jones Indices LLC”). S&P Dow Jones Indices will not be liable for any errors or omission in calculating the Indices. “Calculated by S&P Dow Jones Indices” and its related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by TIS Advisors and its affiliates. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”), and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).

Free cash flow is the cash a company produces through its operations, less the cost of total capital expenditures (growth and maintenance).

It is not possible to invest directly in an index.

Performance data quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment, when sold, may be worth more or less than its original cost.

1 | EIA Drilling Productivity Report |

2 | S&P Global Market Intelligence |

| (unaudited) | | |

| | | |

| 4 | | TortoiseEcofin |

| |

| |

| 2021 Annual Report | November 30, 2021 |

| |

| Tortoise |

| MLP & Pipeline Fund |

| |

Basic fund facts

Investment objective: Total return

Structure: Regulated investment company

| | Institutional | | A Class | | C Class |

| Ticker | | | TORIX | | | | TORTX | | | TORCX | |

| Gross expense ratio | | | 0.94% | | | | 1.19% | | | 1.94% | |

| Redemption fee | | | None | | | | None | | | None | |

| Maximum front-end | | | None | (1) | | | 5.50% | (2) | | None | (1) |

| sales load | | | | | | | | | | | |

| Maximum deferred | | | None | | | | None | (3) | | 1.00% | (4) |

| sales load | | | | | | | | | | | |

| (1) | While the Institutional and C Classes have no front-end load, advisory and other expenses still apply. |

| (2) | You may qualify for sales charge discounts if you invest at least $50,000. |

| (3) | No front-end sales charge is payable on A Class investments of $1 million or more, although the fund may impose a Contingent Deferred Sales Charge (“CDSC”) of 1% on certain redemptions made within 12 months of purchase. |

| (4) | The C Class CDSC applies to redemptions made within 12 months of purchase. |

Targeted investment characteristics

The fund’s targeted investments generally will have the following characteristics:

| ● | Strategic assets that fuel the economy |

| | |

| ● | Diversified asset base |

| | |

| ● | Limited direct commodity price exposure |

| | |

| ● | History of predictable, recurring cash flows |

| | |

| ● | Total-return potential through growth and current income |

| | |

| ● | Experienced management teams |

Top ten holdings (as of November 30, 2021)

| 1. | Cheniere Energy, Inc. | | 10.6% |

| 2. | Targa Resources Corp. | | 9.3% |

| 3. | ONEOK, Inc. | | 8.3% |

| 4. | Enbridge Inc. | | 7.9% |

| 5. | The Williams Companies, Inc. | | 7.7% |

| 6. | Kinder Morgan, Inc. | | 7.4% |

| 7. | Energy Transfer LP | | 5.0% |

| 8. | MPLX LP | | 5.0% |

| 9. | Plains GP Holdings, L.P | | 5.0% |

| 10. | Pembina Pipeline Corporation | | 4.9% |

Key asset performance drivers

| ● | All segments had positive performance |

| | |

| ● | The fund’s large allocation to natural gas pipeline companies added the most to performance |

| | |

| ● | The fund’s allocation to energy technology companies added the least to performance |

| Top five contributors |

| Targa Resources Corp. |

| Cheniere Energy Inc. |

| ONEOK, Inc. |

| Williams Companies, Inc. |

| MPLX LP |

| Bottom five contributors |

| NuStar Energy L.P |

| Crestwood Equity Partners LP |

| DT Midstream Inc. |

| Sempra Energy |

| Nextera Energy Inc. |

| (unaudited) | |

| | |

| TortoiseEcofin | 5 |

| |

| |

| |

| |

| Tortoise |

| MLP & Pipeline Fund (continued) |

| |

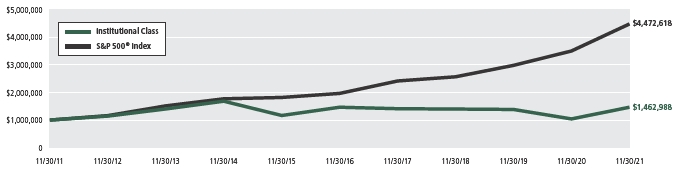

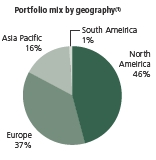

| Value of $1,000,000 vs. S&P 500® Index |

| November 30, 2011 through November 30, 2021 |

|

This chart illustrates the performance of a hypothetical $1,000,000 investment made on November 30, 2011 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for a fund and dividends for the index.

The performance data quoted above represents past performance since inception on November 30, 2011 through November 30, 2021. Past performance is no guarantee of future results. The investment return and value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be obtained through the most recent month-end by calling 855-TCA-FUND (855-822-3863). Future performance may be lower or higher than the performance stated above.

The S&P 500® Index is an unmanaged market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. Returns include reinvested dividends. You cannot invest directly in an index.

| (unaudited) | |

| | |

| 6 | TortoiseEcofin |

| |

| |

| 2021 Annual Report | November 30, 2021 |

| |

| |

| |

| |

Total returns (as of November 30, 2021)

| Ticker | | Class | | 1 year | | 3 years | | 5 years | | 10 years(1) | | Since Inception(2) | | Gross expense ratio |

| TORIX | | Institutional | | 40.51% | | 1.52% | | | -0.01% | | | | 3.88% | | | | 4.72% | | | | 0.94 | % | |

| TORTX | | A Class (excluding load)(3) | | 40.12% | | 1.23% | | | -0.31% | | | | 3.59% | | | | 4.41% | | | | 1.19 | % | |

| TORTX | | A Class (maximum load)(3) | | 32.41% | | -0.67% | | | -1.44% | | | | 3.01% | | | | 3.85% | | | | 1.19 | % | |

| TORCX | | C Class (excluding CDSC) | | 39.00% | | 0.49% | | | -1.01% | | | | 2.84% | | | | 3.66% | | | | 1.94 | % | |

| TORCX | | C Class (including CDSC) | | 38.00% | | 0.49% | | | -1.01% | | | | 2.84% | | | | 3.66% | | | | 1.94 | % | |

| S&P 500® Index(4) | | | | 27.92% | | 20.38% | | | 17.90% | | | | 16.16% | | | | 14.62% | | | | — | | |

| TNAPT(5) | | | | 31.13% | | 5.33% | | | 3.88% | | | | 6.17% | | | | 6.63% | | | | — | | |

| (1) | The C Class Shares commenced operations on September 19, 2012. Performance shown for the C Class prior to the inception of the C Class is based on the performance of the Institutional Class Shares, adjusted for the higher expenses applicable to the C Class Shares. |

| (2) | Reflects period from May 31, 2011 through November 30, 2021. The Institutional and A Class Shares commenced operations on May 31, 2011 and C Class Shares commenced operations on September 19, 2012. Performance shown for the C Class prior to inception of the C Class Shares is based on the performance of the Institutional Class Shares, adjusted for the higher expenses applicable to C Class Shares. |

| (3) | Prior to March 30, 2019, A Class Shares were known as Investor Class Shares. |

| (4) | The S&P 500® Index is an unmanaged market-value weighted index of stocks, which is widely regarded as the standard for measuring large-cap U.S. stock market performance. Returns include reinvested dividends. You cannot invest directly in an index. |

| (5) | The Tortoise North American Pipeline IndexSM is a float-adjusted, capitalization weighted index of pipeline companies headquartered in the United States and Canada. You cannot invest directly in an index. |

Note: For periods over 1 year, performance reflected is for the average annual returns. Performance data shown for the A Class (maximum load) reflects a sales charge of 5.50%. Performance data shown “excluding load” does not reflect the deduction of the maximum sales load. Performance data shown for the C Class (including CDSC) reflects a contingent deferred sales charge (“CDSC”) of 1% for the first 12 months of investment. Performance data shown “excluding CDSC” does not reflect the deduction of the CDSC. If reflected, the load and CDSC would reduce the performance quoted. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855-TCA-FUND (855-822-3863).

| (unaudited) | |

| | |

| TortoiseEcofin | 7 |

| |

| |

| |

| |

| Tortoise |

| MLP & Energy Income Fund |

| |

Basic fund facts

Investment objective: Current income and long-term capital appreciation

Structure: Regulated investment company

| | Institutional | | A Class | | C Class |

| Ticker | | | INFIX | | | | INFRX | | | INFFX | |

| Gross expense ratio(5) | | | 1.14% | | | | 1.39% | | | 2.14% | |

| Redemption fee | | | None | | | | None | | | None | |

| Maximum front-end | | | None | (1) | | | 5.50% | (2) | | None | (1) |

| sales load | | | | | | | | | | | |

| Maximum deferred | | | None | | | | None | | | 1.00% | (4) |

| sales load | | | | | | | | | | | |

| (1) | While the Institutional and C Classes have no front-end load, advisory and other expenses still apply. |

| (2) | You may qualify for sales charge discounts if you invest at least $50,000. |

| (3) | No front-end sales charge is payable on A Class investments of $1 million or more, although the fund may impose a Contingent Deferred Sales Charge (“CDSC”) of 1% on certain redemptions made within 12 months of purchase. |

| (4) | The C Class CDSC applies to redemptions made within 12 months of purchase. |

| (5) | The expense ratios reflect those in the most recent prospectus and may not agree to the financial highlights. |

Targeted investment characteristics

The fund’s targeted investments generally will have the following characteristics:

| ● | Securities from across the capital structure and energy value chain |

| | |

| ● | Strategic assets that fuel the economy |

| | |

| ● | Diversified asset base |

| | |

| ● | Limited direct commodity price exposure |

| | |

| ● | History of predictable, recurring cash flows |

| | |

| ● | Current income through distributions |

| | |

| ● | A flexible asset allocation dependent on current market opportunities |

| | |

| ● | Experienced management team |

Top ten holdings (as of November 30, 2021)

| 1. | Cheniere Energy, Inc. | | 5.8% |

| 2. | ONEOK, Inc. | | 4.8% |

| 3. | The Williams Companies, Inc. | | 4.7% |

| 4. | DCP Midstream, LP | | 4.6% |

| 5. | Energy Transfer LP | | 4.2% |

| 6. | NextEra Energy Partners LP | | 3.9% |

| 7. | MPLX LP | | 3.8% |

| 8. | Plains GP Holdings, L.P | | 3.7% |

| 9. | NGPL Pipeco LLC | | 3.1% |

| 10. | ConocoPhillips | | 3.0% |

Key asset performance drivers

| ● | All segments had positive performance |

| | |

| ● | The fund’s large allocation to natural gas pipeline companies added the most to performance |

| | |

| ● | The fund’s small allocation to local gas distribution companies added the least to performance |

| Top five contributors |

| Cheniere Energy Inc. |

| ONEOK, Inc. |

| MPLX LP |

| DCP Midstream LP |

| Energy Transfer LP |

| Bottom five contributors |

| New Fortress Energy Inc. |

| New Fortress Energy Inc., 6.750% Due 9/15/2025 |

| Ovintiv Inc. |

| Crestwood Equity Partners LP |

| New Fortress Energy Inc., 6.500% Due 9/30/2026 |

| (unaudited) | |

| | |

| 8 | TortoiseEcofin |

| |

| |

| 2021 Annual Report | November 30, 2021 |

| |

| |

| |

| |

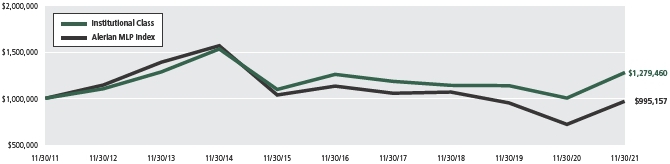

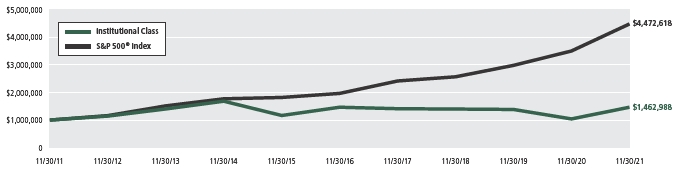

| Value of $1,000,000 vs. the Alerian MLP Index |

| November 30, 2011 through November 30, 2021 |

|

This chart illustrates the performance of a hypothetical $1,000,000 investment made on November 30, 2011 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for a fund and dividends for the index.

The performance data quoted above represents past performance from November 30, 2011 through November 30, 2021. Past performance is no guarantee of future results. The investment return and value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be obtained through the most recent month-end by calling 855-TCA-FUND (855-822-3863). Future performance may be lower or higher than the performance stated above.

The Alerian MLP Index is the leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a pricereturn basis (AMZ) and on a total-return basis (AMZX).

| (unaudited) | |

| | |

| TortoiseEcofin | 9 |

| |

| |

| |

| |

| Tortoise |

| MLP & Energy Income Fund (continued) |

| |

Total returns (as of November 30, 2021)

| Ticker | | Class | | 1 year | | 3 years | | 5 years | | 10 years(1) | | Since Inception(2) | | Gross expense ratio |

| INFIX | | Institutional | | 27.63% | | | 3.91% | | | | 0.31% | | | | 2.50% | | | | 3.36% | | | | 1.16 | % | |

| INFRX | | A Class (excluding load) | | 27.19% | | | 3.70% | | | | 0.08% | | | | 2.25% | | | | 3.12% | | | | 1.41 | % | |

| INFRX | | A Class (maximum load) | | 20.27% | | | 1.76% | | | | -1.04% | | | | 1.67% | | | | 2.59% | | | | 1.41 | % | |

| INFFX | | C Class (excluding CDSC) | | 26.35% | | | 2.87% | | | | -0.69% | | | | 1.46% | | | | 2.41% | | | | 2.16 | % | |

| INFFX | | C Class (including CDSC) | | 25.35% | | | 2.87% | | | | -0.69% | | | | 1.46% | | | | 2.41% | | | | 2.16 | % | |

| Alerian MLP Index(3) | | | | 38.75% | | | -2.31% | | | | -2.55% | | | | -0.05% | | | | 0.80% | | | | — | | |

| (1) | The C Class Shares commenced operations on April 2, 2012. Performance shown for the C Class prior to the inception of the C Class is based on the performance of the Institutional Class Shares, adjusted for the higher expenses applicable to the C Class Shares. |

| (2) | Reflects period from fund inception on December 27, 2010 through November 30, 2021. The Institutional Class commenced operations on December 27, 2010, the A Class Shares commenced operation on May 18, 2011 and the C Class Shares commenced operations on April 2, 2012. Performance shown for the A Class and C Class prior to the inception of the A Class Shares and C Class Shares is based on the performance of the Institutional Class Shares, adjusted for the higher expenses applicable to the A Class Shares and the C Class Shares, respectively. |

| (3) | The Alerian MLP Index is the leading gauge of energy infrastructure Master Limited Partnerships (MLPs). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a pricereturn basis (AMZ) and on a total-return basis (AMZX). |

Note: For periods over 1 year, performance reflected is for the average annual returns. Performance data shown for the A Class (maximum load) reflects a sales charge of 5.50%. Performance data shown “excluding load” does not reflect the deduction of the maximum sales load. Performance data shown for the C Class (including CDSC) reflects a contingent deferred sales charge (“CDSC”) of 1% for the first 18 months of investment. Performance data shown “excluding CDSC�� does not reflect the deduction of the CDSC. If reflected, the load and CDSC would reduce the performance quoted. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855-TCA-FUND (855-822-3863).

| (unaudited) | |

| | |

| 10 | TortoiseEcofin |

| |

| |

2021 Annual Report | November 30, 2021 |

| |

| Ecofin |

| Global Energy Transition Fund |

| |

Basic fund facts

Investment objective: Current income and long-term capital appreciation

Structure: Regulated investment company

| | Institutional | | A Class |

| Ticker | | | EETIX | | | | EETAX | | |

| Net expense ratio(1) | | | 0.90% | | | | 1.15% | | |

| Redemption fee | | | None | | | | None | | |

| Maximum front-end sales load | | | None | (2) | | | 5.50% | (3) | |

| Maximum deferred sales load | | | None | | | | None | (4) | |

| (1) | Tortoise has contractually agreed to limit total operating expenses (excluding acquired fund fees and expenses, brokerage commissions, leverage/borrowing interest, interest expense, taxes and extraordinary expenses) through 8/25/2022. Reimbursed expenses may be recouped for a period of thirty-six months if such recoupment can be achieved without exceeding these expense limits. |

| (2) | While the Institutional Class has no front-end load, advisory and other expenses still apply. |

| (3) | You may qualify for sales charge discounts if you invest at least $50,000. |

| (4) | No front-end sales charge is payable on A Class investments of $1 million or more, although the fund may impose a Contingent Deferred Sales Charge (“CDSC”) of 1% on certain redemptions made within 12 months of purchase. |

Targeted investment characteristics

Top ten holdings (as of November 30, 2021)

| 1. | NextEra Energy, Inc. | | 6.3% |

| 2. | TE Connectivity Ltd. | | 5.5% |

| 3. | Exelon Corporation | | 5.4% |

| 4. | EDP - Energias de Portugal, S.A. | | 5.3% |

| 5. | ROHM Co., Ltd. | | 5.2% |

| 6. | Nidec Corp. | | 4.8% |

| 7. | Prysmian SpA | | 4.4% |

| 8. | China Longyuan Power Group Corp Ltd. | | 4.3% |

| 9. | Autodesk, Inc. | | 4.2% |

| 10. | Infineon Technologies AG | | 4.0% |

Key asset performance drivers

| ● | The fund’s relatively small allocation to global wind companies contributed the most to the fund’s positive performance |

| | |

| ● | Exposure to raw materials companies in the industrials sector also added to performance |

| | |

| ● | A data center in the technology and clean technology sector was the biggest detractor from performance |

| Top five contributors |

| China Longyuan Power |

| Contemporary Amperex |

| Norsk Hydro |

| Covanta Holding Corporation |

| TE Connectivity LTD |

| Bottom five contributors |

| GDS Holdings LTD |

| Orsted A/S |

| Scatec Solar USA |

| Volkswagen AG-Pref |

| Sunrun Inc. |

| (unaudited) | |

| | |

| TortoiseEcofin | 11 |

| |

| |

|

| |

| Ecofin |

| Global Energy Transition Fund (continued) |

| |

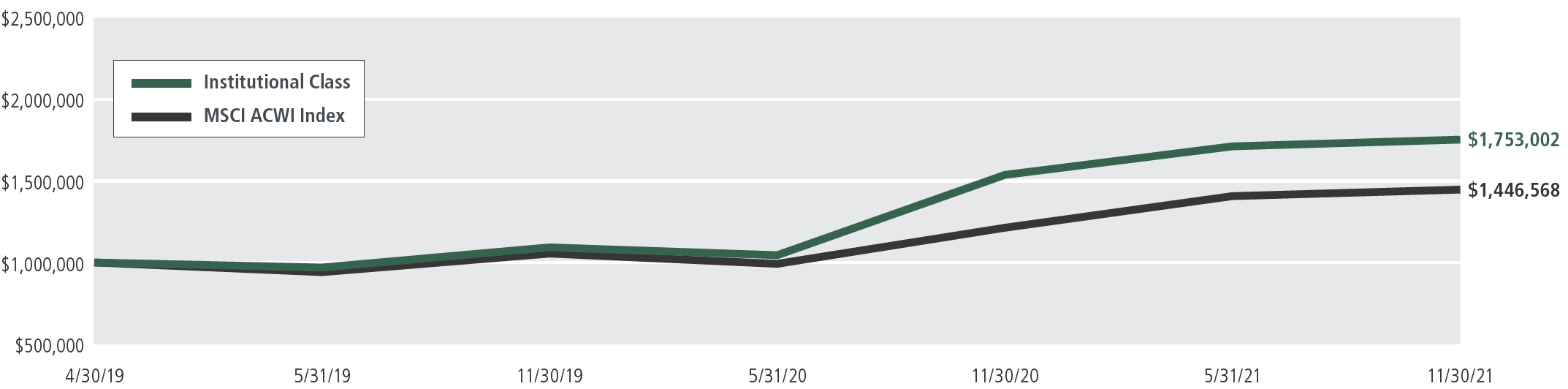

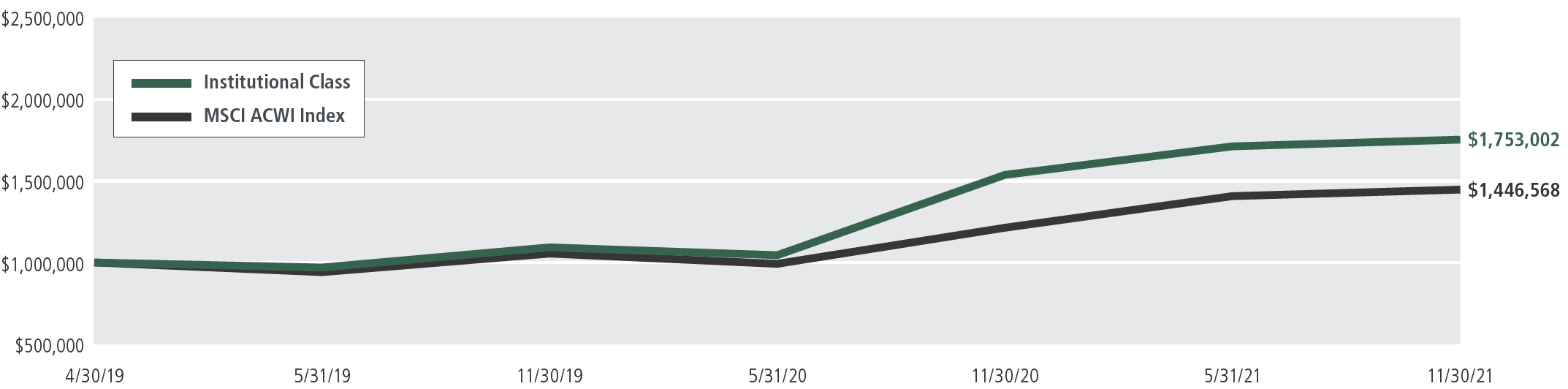

| Value of $1,000,000 vs. MSCI ACWI Index |

| April 30, 2019 through November 30, 2021 |

|

The Fund commenced operations on October 15, 2021. This chart illustrates the performance of a hypothetical $1,000,000 investment made on April 30, 2019 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for a fund and dividends for the index.

The performance data quoted above represents past performance on April 30, 2019 through November 30, 2021. Past performance is no guarantee of future results. The investment return and value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be obtained through the most recent month-end by calling 855-TCA-FUND (855-822-3863). Future performance may be lower or higher than the performance stated above.

The MSCI ACWI Index is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 25 emerging markets. You cannot invest directly in an index.

| (unaudited) | |

| | |

| 12 | TortoiseEcofin |

| |

| |

2021 Annual Report | November 30, 2021 |

| |

| |

| |

| |

Total returns (as of November 30, 2021)

| Ticker | | Class | | 1 year | | Since Inception | | Gross expense ratio(5) |

| EETIX(1)(2) | | Institutional | | | 14.06 | % | | | | 24.24 | % | | | | 1.40 | % | |

| EETAX(1)(3) | | A Class (excluding load) | | | 13.69 | % | | | | 23.89 | % | | | | 1.65 | % | |

| EETAX(1)(3) | | A Class (including load) | | | 7.46 | % | | | | 21.21 | % | | | | 1.65 | % | |

| MSCI ACWI Index (Net)(4) | | | | | 19.27 | % | | | | 15.34 | % | | | | — | | |

| (1) | Fund commenced operations on October 15, 2021. |

| (2) | The performance data quoted for the period prior to October 18, 2021 is that of the Long Only sub-fund of the Ecofin Vista Master Fund Limited (the “Predecessor Fund”) and has been adjusted to reflect the Fund’s share class’ fees and expenses. The Predecessor Fund commenced operations on April 30, 2019, and was not a registered mutual fund subject to the same investment and tax restrictions as the Fund. If it had, the Predecessor Fund’s performance might have been lower. The Predecessor Fund’s shares were exchanged for the Fund’s Institutional Class shares on October 15, 2021. |

| (3) | Performance of the A Class prior to the inception of the class is based on the performance of the Predecessor Fund, adjusted for the higher expenses applicable to the class compared to the Institutional Class. |

| (4) | The MSCI ACWI Index is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 25 emerging markets. You cannot invest directly in an index. |

| (5) | The gross expense ratio is in line with the Global Energy Transition Fund’s most recent effective prospectus and may not reflect current year activity. |

Note: For periods over 1 year, performance reflected is for the average annual returns. Performance data shown for the A Class (maximum load) reflects a sales charge of 5.50%. Performance data shown “excluding load” does not reflect the deduction of the maximum sales load.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855-TCA-FUND (855-822-3863).

| (unaudited) | |

| | |

| TortoiseEcofin | 13 |

| |

| |

|

| |

| Ecofin |

| Global Renewables Infrastructure Fund |

| |

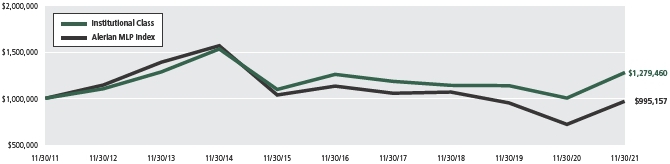

Basic fund facts

Investment objective: Total Return

Structure: Regulated Investment Company

| | Institutional | | A Class |

| Ticker | | | ECOIX | | | | | ECOAX | | |

| Net Expense Ratio(1) | | | 1.00% | | | | | 1.25% | | |

| Redemption fee | | | None | | | | | None | | |

| Maximum front-end sales load | | | None | (2) | | | | 5.50% | (3) | |

| Maximum deferred sales load | | | None | | | | | None | (4) | |

| (1) | Tortoise has contractually agreed to limit total operating expenses (excluding acquired fund fees and expenses, brokerage commissions, leverage/borrowing interest, interest expense, taxes and extraordinary expenses) through 3/31/2022. Reimbursed expenses may be recouped for a period of thirty-six months if such recoupment can be achieved without exceeding these expense limits. |

| (2) | While the Institutional Class has no front-end load, advisory and other expenses still apply. |

| (3) | You may qualify for sales charge discounts if you invest at least $50,000. |

| (4) | No front-end sales charge is payable on A Class investments of $1 million or more, although the fund may impose a Contingent Deferred Sales Charge (“CDSC”) of 1% on certain redemptions made within 12 months of purchase. |

Targeted investment characteristics

The fund’s targeted investments generally will have the following characteristics:

| ● | Securities from across the capital structure and energy value chain |

| | |

| ● | Strategic assets that fuel the economy |

| | |

| ● | Diversified asset base |

| | |

| ● | Limited direct commodity price exposure |

| | |

| ● | History of predictable, recurring cash flows |

| | |

| ● | Current income through distributions |

| | |

| ● | A flexible asset allocation dependent on current market opportunities |

| | |

| ● | Experienced management team |

Top ten holdings (as of November 30, 2021)

| 1. | NextEra Energy, Inc. | | 5.4% |

| 2. | EDP - Energias de Portugal, S.A. | | 4.5% |

| 3. | TransAlta Renewables Inc. | | 4.4% |

| 4. | Edison International | | 4.3% |

| 5. | ERG SpA | | 4.0% |

| 6. | China Longyuan Power Group Corp Ltd. | | 4.0% |

| 7. | China Suntien Green Energy Corp Ltd. | | 4.0% |

| 8. | Exelon Corporation | | 3.9% |

| 9. | Atlantica Yield plc | | 3.9% |

| 10. | Terna - Rete Elettrica Nazionale SpA | | 3.8% |

Key asset performance drivers

| ● | The fund’s large allocation to power companies focusing on renewable energy contributed the most to the fund’s positive performance |

| | |

| ● | Exposure to transportation and storage companies also added to performance |

| | |

| ● | Exposure to renewables infrastructure, including solar detracted from performance |

| Top five contributors |

| China Suntien Green Energy |

| China Longyuan Power |

| Covanta Holding Corporation |

| Renova Inc. |

| Exelon Corp. |

| Bottom five contributors |

| Scatec Solar USA |

| Enel Chile SA |

| Orsted A/S |

| Sunrun Inc. |

| Renew Energy Global PLC |

| (unaudited) | |

| | |

| 14 | TortoiseEcofin |

| |

| |

2021 Annual Report | November 30, 2021 |

| |

| |

| |

| |

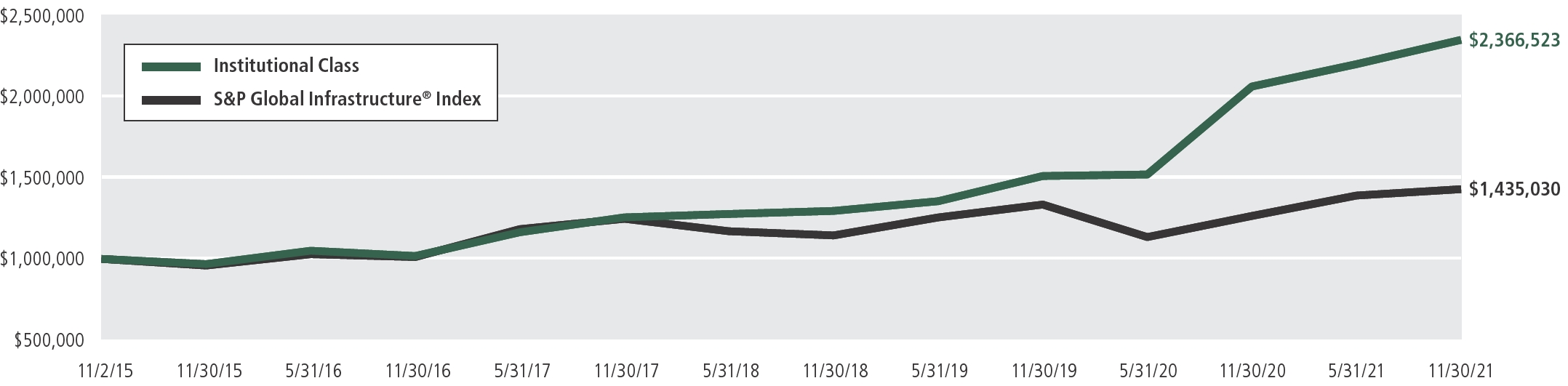

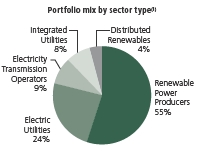

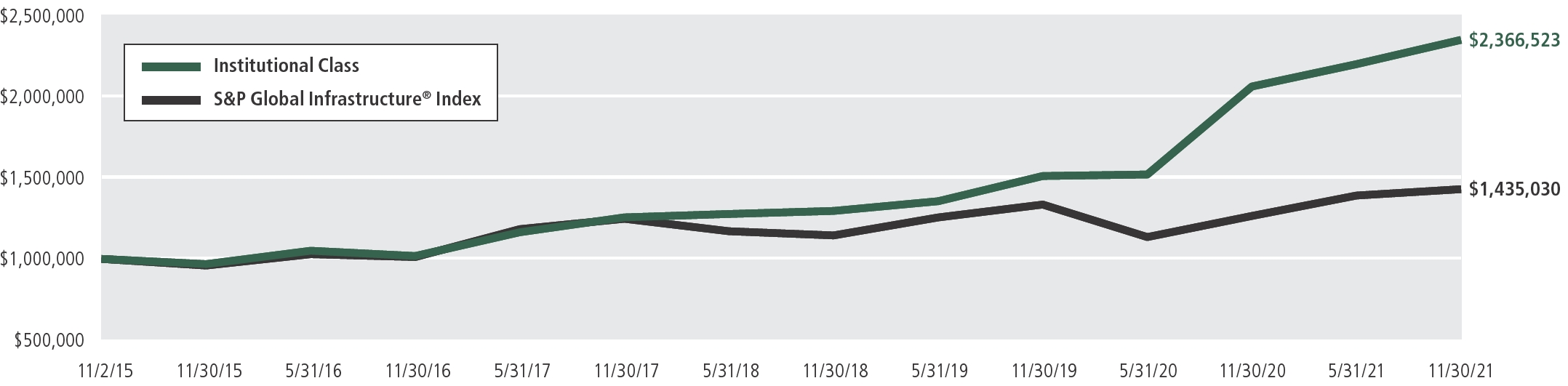

Value of $1,000,000 vs. S&P Global Infrastructure® Index |

November 2, 2015 through November 30, 2021 |

|

The Fund commenced operations on August 7, 2020. This chart illustrates the performance of a hypothetical $1,000,000 investment made on November 2, 2015 and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced. The chart assumes reinvestment of capital gains and dividends for a fund and dividends for the index.

The performance data quoted above represents past performance on November 2, 2015 through November 30, 2021. Past performance is no guarantee of future results. The investment return and value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be obtained through the most recent month-end by calling 855-TCA-FUND (855-822-3863). Future performance may be lower or higher than the performance stated above.

The S&P Global Infrastructure® Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. You cannot invest directly in an index.

| (unaudited) | |

| | |

| TortoiseEcofin | 15 |

Total returns (as of November 30, 2021)

| Ticker | | Class | | 1 Year | | 3 Years | | 5 Years | | Since inception | | Gross expense ratio(5) |

| ECOIX(1)(2) | | Institutional | | | 14.02% | | | | 21.72% | | | | 18.40% | | | | 15.24% | | | | 0.99% | |

| ECOAX(1)(3) | | A Class (excluding load) | | | 13.66% | | | | 21.44% | | | | 18.12% | | | | 14.97% | | | | 1.24% | |

| ECOAX(1)(3) | | A Class (including load) | | | 7.46% | | | | 19.18% | | | | 16.79% | | | | 13.90% | | | | 1.24% | |

| S&P Global Infrastructure Index(4) | | | | | 8.05% | | | | 6.76% | | | | 7.03% | | | | 6.12% | | | | — | |

| S&P Global Infrastructure Index (Net)(4) | | | | | 7.26% | | | | 5.86% | | | | 6.09% | | | | 5.19% | | | | — | |

| (1) | Fund commenced operations on August 7, 2020. |

| (2) | The performance data quoted for the period prior to August 7, 2020 is that of the Tortoise Global Renewables Infrastructure Fund Limited (the “Predecessor Fund”) and has been adjusted to reflect the Fund’s share class’ fees and expenses. The Predecessor Fund commenced operations on November 2, 2015, and was not a registered mutual fund subject to the same investment and tax restrictions as the Fund. If it had, the Predecessor Fund’s performance might have been lower. The Predecessor Fund’s shares were exchanged for the Fund’s Institutional Class shares on August 7, 2020. |

| (3) | Performance of the A Class prior to the inception of the class is based on the performance of the Predecessor Fund, adjusted for the higher expenses applicable to the class compared to the Institutional Class. |

| (4) | The S&P Global Infrastructure® Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. You cannot invest directly in an index. |

| (5) | The gross expense ratio is in line with the Global Renewables Infrastructure Fund’s most recent effective prospectus and may not reflect current year activity. |

Note: For periods over 1 year, performance reflected is for the average annual returns. Performance data shown for the A Class (maximum load) reflects a sales charge of 5.50%. Performance data shown “excluding load” does not reflect the deduction of the maximum sales load.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855-TCA-FUND (855-822-3863).

| (unaudited) | |

| | |

| 16 | TortoiseEcofin |

| |

| |

2021 Annual Report | November 30, 2021 |

| |

| |

| |

| |

Mutual fund investing involves risk. Principal loss is possible. The funds are non-diversified, meaning they may concentrate their assets in fewer individual holdings than a diversified fund. Therefore, the funds are more exposed to individual stock volatility than diversified funds. Investing in specific sectors such as North American energy may involve greater risk and volatility than less concentrated investments. Risks include, but are not limited to, risks associated with energy investments, including upstream energy companies, midstream companies, downstream companies, energy company beneficiaries, master limited partnerships (MLPs), MLP affiliates, commodity price volatility, supply and demand, regulatory, environmental, operating, capital markets, terrorism, natural disaster and climate change risks. The tax benefits received by an investor investing in the funds differ from that of a direct investment in an MLP by an investor. The value of the funds’ investments in an MLP will depend largely on the MLP’s treatment as a partnership for U.S. federal income tax purposes. If the MLP is deemed to be a corporation then its income would be subject to federal taxation, reducing the amount of cash available for distribution to the funds which could result in a reduction of the funds’ values. Investments in foreign companies involve risk not ordinarily associated with investments in securities and instruments of U.S. issuers, including risks related to political, social and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risk and market practices, as well as fluctuations in foreign currencies. The funds invest in large, small and mid-cap companies, which involve additional risks such as limited liquidity and greater volatility than larger companies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The funds may also write call options which may limit the funds’ abilities to profit from increases in the market value of a security, but cause it to retain the risk of loss should the price of the security decline. Some funds may invest in other derivatives including options, futures and swap agreements, which can be highly volatile, illiquid and difficult to value, and changes in the value of a derivative held by the funds may not correlate with the underlying instrument or the fund’s other investments and can include additional risks such as liquidity risk, leverage risk and counterparty risk that are possibly greater than risks associated with investing directly in the underlying investments. Some funds may engage in short sales and in doing so are subject to the risk that they may not always be able to borrow a security, or close out a short position at a particular time or at an acceptable price.

Nothing contained on this communication constitutes tax, legal, or investment advice. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation.

This report reflects our views and opinions as of the date herein, which are subject to change at any time based on market and other conditions. We disclaim any responsibility to update these views. The views should not be relied on as investment advice or an indication of trading intent on behalf of the funds.

Fund holdings and allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the fund’s Schedule of Investments in this report.

| (unaudited) | |

| | |

| TortoiseEcofin | 17 |

Expense example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (June 1, 2021 – November 30, 2021).

Actual expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Tortoise MLP & Pipeline Fund | | | | | | |

| | Beginning | | Ending | | Expenses Paid |

| | Account Value | | Account Value | | During Period(1) |

| | (06/01/2021) | | (11/30/2021) | | (06/01/2021 – 11/30/2021) |

| Institutional Class Actual(2)(3) | | $ 1,000.00 | | $ 1,037.60 | | $ 4.70 |

| Institutional Class Hypothetical (5% annual return before expenses)(4) | | $ 1,000.00 | | $ 1,020.46 | | $ 4.66 |

| A Class Actual(2)(3) | | $ 1,000.00 | | $ 1,035.20 | | $ 5.97 |

| A Class Hypothetical (5% annual return before expenses)(4) | | $ 1,000.00 | | $ 1,019.20 | | $ 5.92 |

| C Class Actual(2)(3) | | $ 1,000.00 | | $ 1,031.80 | | $ 9.78 |

| C Class Hypothetical (5% annual return before expenses)(4) | | $ 1,000.00 | | $ 1,015.44 | | $ 9.70 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.92%, 1.17%, and 1.92% for the Institutional Class, A Class and C Class, respectively, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended November 30, 2021 of 3.76%, 3.52% and 3.18% for the Institutional Class, A Class and C Class, respectively. |

| (3) | Excluding interest expense, the actual expenses would be $4.70, $5.97 and $9.78 for the Institutional Class, A Class and C Class, respectively. |

| (4) | Excluding interest expense, the hypothetical expenses would be $4.66, $5.92 and $9.70 for the Institutional Class, A Class and C Class, respectively. |

| (unaudited) | |

| | |

| 18 | TortoiseEcofin |

| |

| |

| 2021 Annual Report | November 30, 2021 |

| |

| |

| |

| |

| Tortoise MLP & Energy Income Fund | | | | | | |

| | Beginning | | Ending | | Expenses Paid |

| | Account Value | | Account Value | | During Period(1) |

| | (06/01/2021) | | (11/30/2021) | | (06/01/2021 – 11/30/2021) |

| Institutional Class Actual(2) | | | $ | 1,000.00 | | | | $ | 1,028.60 | | | | $ | 6.97 | |

| Institutional Class Hypothetical (5% annual return before expenses) | | | $ | 1,000.00 | | | | $ | 1,018.20 | | | | $ | 6.93 | |

| A Class Actual(2) | | | $ | 1,000.00 | | | | $ | 1,027.00 | | | | $ | 7.11 | |

| A Class Hypothetical (5% annual return before expenses) | | | $ | 1,000.00 | | | | $ | 1,018.05 | | | | $ | 7.08 | |

| C Class Actual(2) | | | $ | 1,000.00 | | | | $ | 1,023.30 | | | | $ | 5.07 | |

| C Class Hypothetical (5% annual return before expenses) | | | $ | 1,000.00 | | | | $ | 1,020.05 | | | | $ | 5.06 | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.15%, 1.40%, and 2.15% for the Institutional Class, A Class and C Class, respectively, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended November 30, 2021 of 2.86%, 2.70% and 2.33% for the Institutional Class, A Class and C Class, respectively. |

| Ecofin Global Energy Transition Fund | | | | | | | | | | | | | | | |

| | Beginning | | Ending | | Expenses Paid |

| | Account Value | | Account Value | | During Period(1) |

| | (06/01/2021) | | (11/30/2021) | | (06/01/2021 – 11/30/2021) |

| Institutional Class Actual(2) | | | $ | 1,000.00 | | | | $ | 1,022.00 | | | | $ | 1.10 | |

| Institutional Class Hypothetical (5% annual return before expenses) | | | $ | 1,000.00 | | | | $ | 1,004.94 | | | | $ | 1.09 | |

| A Class Actual(2) | | | $ | 1,000.00 | | | | $ | 997.00 | | | | $ | 1.38 | |

| A Class Hypothetical (5% annual return before expenses) | | | $ | 1,000.00 | | | | $ | 1,004.64 | | | | $ | 1.39 | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the period since commencement of operations of 0.90% and 1.15% for the Institutional Class and A Class, respectively, multiplied by the average account value over the period, multiplied by 44/365 to reflect the period since commencement of operations. |

| (2) | Based on the actual returns for the period October 15, 2021 (inception date) through November 30, 2021 of 2.20% for the Institutional Class and for the period October 18, 2021 (inception date) through November 30, 2021 of -0.30% for the A Class. |

| (unaudited) | |

| | |

| TortoiseEcofin | 19 |

| Ecofin Global Renewables Infrastructure Fund | | | | | | | | | | | | | | | |

| | Beginning | | Ending | | Expenses Paid |

| | Account Value | | Account Value | | During Period(1) |

| | (06/01/2021) | | (11/30/2021) | | (06/01/2021 – 11/30/2021) |

| Institutional Class Actual(2) | | | $ | 1,000.00 | | | | $ | 1,068.40 | | | | $ | 5.13 | |

| Institutional Class Hypothetical (5% annual return before expenses) | | | $ | 1,000.00 | | | | $ | 1,020.10 | | | | $ | 5.01 | |

| A Class Actual(2) | | | $ | 1,000.00 | | | | $ | 1,066.40 | | | | $ | 6.42 | |

| A Class Hypothetical (5% annual return before expenses) | | | $ | 1,000.00 | | | | $ | 1,018.85 | | | | $ | 6.28 | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.99% and 1.24% for the Institutional Class and A Class, respectively, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended November 30, 2021 of 6.84% for the Institutional Class and 6.64% for the A Class, respectively. |

| (unaudited) | |

| | |

| 20 | TortoiseEcofin |

| |

| |

| 2021 Annual Report | November 30, 2021 |

| |

| Tortoise MLP & Pipeline Fund |

| Schedule of Investments |

| November 30, 2021 |

| Shares | | Fair Value | |

| | | | | |

| Common Stock — 76.9%(1) | | | | | |

| Canadian Crude Oil Pipelines — 12.8%(1) | | | | | |

| Enbridge Inc. | 3,932,817 | | $ | 147,637,950 | |

| Pembina Pipeline Corporation | 3,081,744 | | | 91,189,419 | |

| | | | 238,827,369 | |

| | | | | |

| Canadian Natural Gas/Natural Gas Liquids Pipelines — 7.0%(1) | | | | | |

| Keyera Corp. | 2,436,175 | | | 53,512,130 | |

| TC Energy Corporation | 1,630,079 | | | 76,467,006 | |

| | | | 129,979,136 | |

| | | | | |

| United States Crude Oil Pipelines — 5.0%(1) | | | | | |

| Plains GP Holdings, L.P. | 9,372,593 | | | 93,725,930 | |

| | | | | |

| United States Energy Technology — 0.4%(1) | | | | | |

| ESS Tech Inc. | 454,808 | | | 7,254,188 | |

| | | | | |

| United States Natural Gas Gathering/Processing — 15.1%(1) | | | | | |

| Antero Midstream Corporation | 1,960,135 | | | 19,032,911 | |

| DT Midstream, Inc. | 355,906 | | | 16,325,408 | |

| EnLink Midstream, LLC | 1,437,466 | | | 9,357,903 | |

| Equitrans Midstream Corporation | 5,573,600 | | | 53,618,032 | |

| Hess Midstream LP | 441,009 | | | 10,919,383 | |

| Targa Resources Corp. | 3,354,170 | | | 173,175,797 | |

| | | | 282,429,434 | |

| | | | | |

| United States Natural Gas/Natural Gas Liquids Pipelines — 33.9%(1) | | | | | |

| Cheniere Energy, Inc. | 1,889,807 | | | 198,070,672 | |

| Kinder Morgan, Inc. | 8,893,390 | | | 137,491,809 | |

| ONEOK, Inc. | 2,588,214 | | | 154,878,726 | |

| The Williams Companies, Inc. | 5,373,886 | | | 143,966,406 | |

| | | | 634,407,613 | |

| | | | | |

| United States Renewables and Power Infrastructure — 2.7%(1) | | | | | |

| Clearway Energy, Inc. | 377,640 | | | 14,093,525 | |

| NextEra Energy Partners LP | 331,649 | | | 28,206,747 | |

| Sempra Energy | 72,564 | | | 8,698,247 | |

| | | | 50,998,519 | |

| Total Common Stock | | | | | |

| (Cost $1,049,332,113) | | | | 1,437,622,189 | |

| | | | | |

| Master Limited Partnerships — 23.0%(1) | | | | | |

| United States Crude Oil Pipelines — 1.7%(1) | | | | | |

| Genesis Energy, L.P. | 558,695 | | | 5,637,232 | |

| Nustar Energy L.P. | 1,864,436 | | | 26,102,104 | |

| | | | 31,739,336 | |

| | | | | |

| United States Natural Gas Gathering/Processing — 2.7%(1) | | | | | |

| Crestwood Equity Partners LP | 304,605 | | | 7,785,704 | |

| Western Midstream Partners, LP | 2,210,335 | | | 42,504,742 | |

| | | | 50,290,446 | |

| | | | | |

| United States Natural Gas/Natural Gas Liquids Pipelines — 10.8%(1) | | | | | |

| DCP Midstream, LP | 1,240,142 | | | 32,652,939 | |

| Energy Transfer LP | 11,164,090 | | | 94,001,638 | |

| Enterprise Products Partners L.P. | 3,470,153 | | | 74,226,572 | |

| | | | 200,881,149 | |

| | | | | |

| United States Other — 0.1%(1) | | | | | |

| Westlake Chemical Partners LP | 115,077 | | | 2,664,033 | |

| | | | | |

| United States Refined Product Pipelines — 7.7%(1) | | | | | |

| Magellan Midstream Partners, L.P. | 722,278 | | | 33,499,254 | |

| MPLX LP | 3,199,946 | | | 93,790,417 | |

| Phillips 66 Partners LP | 492,451 | | | 16,960,012 | |

| | | | 144,249,683 | |

| Total Master Limited Partnerships | | | | | |

| (Cost $382,793,949) | | | | 429,824,647 | |

| | | | | |

| Short-Term Investment — 0.6%(1) | | | | | |

| United States Investment Company — 0.6%(1) | | | | | |

| First American Government Obligations Fund, | | | | | |

| Class X, 0.03%(2) | | | | | |

| (Cost $11,152,675) | 11,152,675 | | | 11,152,675 | |

| | | | | |

| Total Investments — 100.5%(1) | | | | | |

| (Cost $1,443,278,737) | | | | 1,878,599,511 | |

| Liabilities in Excess of | | | | | |

| Other Assets, Net — (0.5%)(1) | | | | (8,881,344 | ) |

| Total Net Assets — 100.0%(1) | | | $ | 1,869,718,167 | |

| (1) | Calculated as a percentage of net assets. |

| (2) | Rate indicated is the current yield as of November 30, 2021. |

| See accompanying Notes to Financial Statements. | |

| | |

| TortoiseEcofin | 21 |

| |

| |

| |

| |

| Tortoise MLP & Energy Income Fund |

| Schedule of Investments |

| November 30, 2021 |

| Shares | | Fair Value |

| Common Stocks — 51.6%(1) | | | | | |

| Britain Renewables and Power Infrastructure — 1.7%(1) | | | | | |

| Atlantica Yield plc | | 182,140 | | $ | 6,986,890 |

| | | | | |

| Canadian Crude Oil Pipelines — 2.8%(1) | | | | | |

| Enbridge Inc. | | 304,484 | | | 11,430,329 |

| | | | | |

| Canadian Natural Gas Pipelines — 3.1%(1) | | | | | |

| Ovintiv, Inc. | | 55,000 | | | 1,911,800 |

| TC Energy Corporation | | 235,875 | | | 11,064,896 |

| | | | | 12,976,696 |

| | | | | |

| United States Crude Oil Pipelines — 3.7%(1) | | | | | |

| Plains GP Holdings, L.P. | | 1,538,108 | | | 15,381,080 |

| | | | | |

| United States Gathering and Processing — 4.0%(1) | | | | | |

| Equitrans Midstream Corporation | | 706,020 | | | 6,791,912 |

| Targa Resources Corp. | | 194,134 | | | 10,023,139 |

| | | | | 16,815,051 |

| | | | | |

| United States Local Distribution Pipelines — 1.1%(1) | | | | | |

| CenterPoint Energy, Inc. | | 169,528 | | | 4,392,472 |

| | | | | |

| United States Natural Gas/Natural Gas Liquids Pipelines — 19.7%(1) | | | | | |

| Cheniere Energy, Inc. | | 228,685 | | | 23,968,475 |

| Kinder Morgan, Inc. | | 770,377 | | | 11,910,028 |

| New Fortress Energy, Inc. | | 271,245 | | | 6,751,288 |

| ONEOK, Inc. | | 329,694 | | | 19,728,889 |

| The Williams Companies, Inc. | | 720,624 | | | 19,305,517 |

| | | | | 81,664,197 |

| | | | | |

| United States Oil & Gas Production — 9.2%(1) | | | | | |

| Cabot Oil & Gas Corporation | | 97,500 | | | 1,957,800 |

| ConocoPhillips | | 178,975 | | | 12,551,517 |

| Devon Energy Corporation | | 53,000 | | | 2,229,180 |

| EQT Corporation(2) | | 487,205 | | | 9,466,393 |

| Pioneer Natural Resources Company | | 67,190 | | | 11,981,321 |

| | | | | 38,186,211 |

| | | | | |

| United States Renewables and Power Infrastructure — 6.3%(1) | | | | | |

| Clearway Energy, Inc. | | 261,095 | | | 9,744,066 |

| NextEra Energy Partners LP | | 192,040 | | | 16,333,002 |

| | | | | 26,077,068 |

| Total Common Stocks | | | | | |

| (Cost $187,911,163) | | | | | 213,909,994 |

| | | | | | |

| | | Principal Amount | | | |

| Corporate Bonds — 23.6%(1) | | | | | |

| Canadian Natural Gas Pipelines — 1.8%(1) | | | | | |

| Rockpoint Gas Storage Canada Ltd. | | | | | |

| 7.000%, 03/31/2023(3) | | 7,600,000 | | | 7,548,966 |

| | | | | |

| Marshall Island Marine Transportation — 1.0%(1) | | | | | |

| Teekay Corporation | | | | | |

| 9.250%, 11/15/2022(3) | | 4,050,000 | | | 4,165,931 |

| | | | | |

| United States Gathering and Processing — 10.8%(1) | | | | | |

| Antero Midstream Partners LP / | | | | | |

| Antero Midstream Finance Corp. | | | | | |

| 5.750%, 03/01/2027(3) | | 6,370,000 | | | 6,419,686 |

| Blue Racer Midstream LLC / | | | | | |

| Blue Racer Finance Corp. | | | | | |

| 7.625%, 12/15/2025(3) | | 3,575,000 | | | 3,770,231 |

| 6.625%, 07/15/2026(3) | | 3,800,000 | | | 3,872,656 |

| EnLink Midstream Partners, LP | | | | | |

| 4.850%, 07/15/2026 | | 7,550,000 | | | 7,759,815 |

| EnLink Midstream, LLC | | | | | |

| 5.375%, 06/01/2029 | | 4,455,000 | | | 4,483,601 |

| Hess Midstream Operations LP | | | | | |

| 5.625%, 02/15/2026(3) | | 8,125,000 | | | 8,320,284 |

| 5.125%, 06/15/2028(3) | | 4,050,000 | | | 4,148,233 |

| Targa Resources Partners LP / Targa | | | | | |

| Resources Partners Finance Corp. | | | | | |

| 6.500%, 07/15/2027 | | 5,537,000 | | | 5,897,514 |

| | | | | 44,672,020 |

| | | | | |

| United States Natural Gas Pipelines — 5.2%(1) | | | | | |

| NGPL Pipeco LLC | | | | | |

| 7.768%, 12/15/2037(3) | | 9,125,000 | | | 13,030,230 |

| Tallgrass Energy Partners LP / | | | | | |

| Tallgrass Energy Finance Corp. | | | | | |

| 6.000%, 03/01/2027(3) | | 850,000 | | | 873,409 |

| 5.500%, 01/15/2028(3) | | 7,925,000 | | | 7,757,426 |

| | | | | 21,661,065 |

| | | | | |

| United States Oil Field Services — 1.6%(1) | | | | | |

| Archrock Partners LP / | | | | | |

| Archrock Partners Finance Corp. | | | | | |

| 6.875%, 04/01/2027(3) | | 6,575,000 | | | 6,851,512 |

| | | | | |

| United States Other — 3.2%(1) | | | | | |

| New Fortress Energy, Inc. | | | | | |

| 6.750%, 09/15/2025(3) | | 8,800,000 | | | 8,471,100 |

| 6.500%, 09/30/2026(3) | | 5,000,000 | | | 4,738,325 |

| | | | | 13,209,425 |

| Total Corporate Bonds | | | | | |

| (Cost $94,720,308) | | | | | 98,108,919 |

| See accompanying Notes to Financial Statements. | |

| | |

| 22 | TortoiseEcofin |

| |

| |

| 2021 Annual Report | November 30, 2021 |

| |

| Tortoise MLP & Energy Income Fund |

| Schedule of Investments (continued) |

| November 30, 2021 |

| Shares | | Fair Value |

| Master Limited Partnerships — 22.2%(1) | | | | |

| United States Natural Gas Gathering/Processing — 2.6%(1) | | | | |

| Crestwood Equity Partners LP | 80,135 | | $ | 2,048,250 |

| Western Midstream Partners, LP | 446,900 | | | 8,593,887 |

| | | | 10,642,137 |

| | | | |

| United States Natural Gas Pipelines — 11.5%(1) | | | | |

| DCP Midstream, LP | 725,924 | | | 19,113,579 |

| Energy Transfer LP | 2,063,943 | | | 17,378,400 |

| Enterprise Products Partners L.P. | 523,312 | | | 11,193,644 |

| | | | 47,685,623 |

| | | | |

| United States Refined Product Pipelines — 8.1%(1) | | | | |

| Magellan Midstream Partners, L.P. | 261,848 | | | 12,144,510 |

| MPLX LP | 532,817 | | | 15,616,866 |

| Phillips 66 Partners LP | 171,090 | | | 5,892,340 |

| | | | 33,653,716 |

| Total Master Limited Partnerships | | | | |

| (Cost $71,773,189) | | | | 91,981,476 |

| | | | | |

| Short-Term Investment — 2.0%(1) | | | | |

| United States Investment Company — 2.0%(1) | | | | |

| First American Government Obligations Fund, | | | | |

| Class X, 0.03%(4) | | | | |

| (Cost $8,433,696) | 8,433,696 | | | 8,433,696 |

| | | | |

| Total Investments — 99.4%(1) | | | | |

| (Cost $362,838,356) | | | | 412,434,085 |

| Other Assets in Excess of | | | | |

| Liabilities, Net — 0.6%(1) | | | | 2,609,829 |

| Total Net Assets — 100.0%(1) | | | $ | 415,043,914 |

| (1) | Calculated as a percentage of net assets. |

| (2) | Non-income producing security. |

| (3) | Security purchased within the terms of a private placement memorandum, except from registration under Rule 144A of the Securities Act 0f 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” As of November 30, 2021, the value of these investments were $79,967,989 or 19.3% of total net assets. |

| (4) | Rate indicated is the current yield as of November 30, 2021. |

| See accompanying Notes to Financial Statements. | |

| | |

| TortoiseEcofin | 23 |

| |

| |

| |

| |

Ecofin Global Energy Transition Fund

Schedule of Investments |

| November 30, 2021 |

| Shares | | Fair Value |

| Common Stock — 84.3%(1) | | | | |

| Denmark Infrastructure, Utilities and Renewables — 3.9%(1) |

| Orsted A/S | 15,365 | | $ | 1,975,603 |

| Germany Clean Technology — 4.0%(1) | | | | |

| Infineon Technologies AG | 45,255 | | | 2,046,127 |

| Hong Kong Clean Technology — 4.0%(1) | | | |

| GDS Holdings Ltd.(2) | 284,194 | | | 2,006,699 |

| Hong Kong Infrastructure, Utilities and Renewables — 4.3%(1) |

| China Longyuan Power Group Corp Ltd. | 1,064,334 | | | 2,175,570 |

| Ireland Industrials — 2.4%(1) | | | | |

| Trane Technologies Plc | 6,487 | | | 1,210,799 |

| Italy Industrials — 4.4%(1) | | | | |

| Prysmian SpA | 60,677 | | | 2,249,585 |

| Japan Industrials — 10.0%(1) | | | | |

| Nidec Corp. | 21,093 | | | 2,415,309 |

| Japan Clean Technology — 5.0%(1) | | | | |

| ROHM Co., Ltd. | 28,316 | | | 2,629,542 |

| Japan Infrastructure, Utilities and Renewables — 3.4%(1) |

| Keyence Corp. | 2,830 | | | 1,747,756 |

| Norway Infrastructure, Utilities and Renewables — 2.5%(1) |

| Scatec ASA | 72,485 | | | 1,273,995 |

| Norway Specialty Chemicals & Materials — 0.4%(1) | | | |

| Norsk Hydro ASA | 33,105 | | | 214,391 |

| Portugal Infrastructure, Utilities and Renewables — 5.3%(1) |

| EDP — Energias de Portugal, S.A. | 487,679 | | | 2,672,442 |

| Switzerland Clean Technology — 5.5%(1) | | | |

| TE Connectivity Ltd. | 18,017 | | | 2,773,357 |

| Switzerland Specialty Chemicals & Materials — 3.3%(1) | | | |

| Sika AG | 4,254 | | | 1,661,191 |

| Taiwan Clean Technology — 0.8%(1) | | | | |

| Delta Electronics, Inc. | 42,378 | | | 389,577 |

| United States Clean Technology — 4.2%(1) | | | |

| Autodesk, Inc.(2) | 8,471 | | | 2,153,244 |

| United States Infrastructure, Utilities and Renewables — 13.1%(1) |

| Exelon Corporation | 52,116 | | | 2,748,077 |

| First Solar, Inc.(2) | 13,394 | | | 1,387,618 |

| Fluence Energy, Inc.(2) | 34,570 | | | 1,095,523 |

| STEM, Inc.(2) | 66,007 | | | 1,400,669 |

| | | | | 6,631,887 |

| United States Infrastructure, Utilities and Renewables — 6.3%(1) |

| NextEra Energy, Inc. | 36,828 | | $ | 3,195,934 |

| United States Industrials — 3.7%(1) | | | | |

| Sunrun, Inc.(2) | 40,242 | | | 1,852,742 |

| United States Transportation — 2.8%(1) | | | | |

| Lyft, Inc.(2) | 34,925 | | | 1,418,304 |

| Total Common Stock | | | | |

| (Cost $37,487,665) | | | | 42,694,054 |

| |

| Preferred Stock — 2.0%(1) | | | | |

| Germany Transportation — 2.0%(1) | | | | |

| Volkswagen AG | | | | |

| (Cost $1,387,440) | 5,641 | | | 1,030,579 |

| |

| Short-Term Investment — 0.5%(1) | | | | |

| United States Investment Company — 0.5%(1) | | | |

| First American Government Obligations Fund, | | | |

| Class X, 0.03%(3) | | | | |

| (Cost $269,055) | 269,055 | | | 269,055 |

| |

| Total Investments — 86.8%(1) | | | | |

| (Cost $39,144,160) | | | | 43,993,688 |

| Other Assets in Excess of | | | | |

| Liabilities, Net — 13.2%(1) | | | | 6,675,543 |

| Total Net Assets — 100.0%(1) | | | $ | 50,669,231 |

| (1) | Calculated as a percentage of net assets. |

| (2) | Non-income producing security. |

| (3) | Rate indicated is the current yield as of November 30, 2021. |

| See accompanying Notes to Financial Statements. | |

| | |

| 24 | TortoiseEcofin |

| |

| |

| 2021 Annual Report | November 30, 2021 |

| |

Ecofin Global Energy Transition Fund

Open Swap Contracts |

| November 30, 2021 |

| | | | | | | | | | | | | | | | | | | |

| | | | | | Pay/Receive | | | | | | | | | | | | | |

| | | | | | on | | | | | | | | | | | Unrealized |

| | | | Termination | | Financing | | | | Payment | | | | Notional | | Appreciation |

| Counterparty | | Security | | Date | | Rate | | Financing Rate | | Frequency | | Shares | | Amount | | (Depreciation)* |

| Morgan Stanley | | Schneider SA | | 5/6/22 | | Pay | | 0.200% + Euro | | Monthly | | 12,043 | | $ | 2,133,639 | | $ | (50,261 | ) |

| | | | | | | | Overnight Index Average | | | | | | | | | | | |

| Morgan Stanley | | Drax Group PLC | | 8/17/22 | | Pay | | 0.200% + Federal | | Monthly | | 185,557 | | | 1,357,295 | | | (70,028 | ) |

| | | | | | | | Funds Effective Rate | | | | | | | | | | | |

| Morgan Stanley | | Amperex Tech | | 5/27/22 | | Pay | | 0.510% + Federal | | Monthly | | 12,120 | | | 1,293,581 | | | 18,181 | |

| | | | | | | | Funds Effective Rate | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | $ | (102,108 | ) |

| * | Based on the net swap value held at each counterparty. Unrealized appreciation (depreciation) is a receivable (payable). |

| See accompanying Notes to Financial Statements. | |

| | |