Exhibit 99.1

Technical Report on the HOMESTAKE RIDGE Project, SKEENA MINING DIVISION, NORTHWESTERN BRITISH COLUMBIA

PREPARED FOR AURYN RESOURCES Inc.

Report for NI 43-101

Qualified Persons:

David Ross, P.Geo.

Paul Chamois, P.Geo.

September 29, 2017

Report Control Form

| Document Title | | Technical Report on the Homestake Ridge Project, Skeena Mining Division, Northwestern British Columbia |

| | | |

Client Name & Address | | Auryn Resources Inc. 600 – 1199 West Hastings St. Vancouver, British Columbia V6E 3T5 |

| | | |

| Document Reference | | Project #2861 | | Status & Issue No. | | FINAL Version | |

| | | | |

| Issue Date | | September 29, 2017 | |

| | | | |

| Effective Date | | September 1, 2017 | |

| | | | |

| Lead Author | | David Ross | | (Signed) |

| | | | | |

| Peer Reviewer | | Deborah McCombe | | (Signed) |

| | | | | |

| Project Manager Approval | | David Ross | | (Signed) |

| | | | | |

| Project Director Approval | | Deborah McCombe | | (Signed) |

| | | | | |

| Report Distribution | | Name | No. of Copies |

| | | | |

| | | Client | |

| | | | |

| | | RPA Filing | 1 (project box) |

| | | | | | | | | | |

| | Roscoe Postle Associates Inc. 55 University Avenue, Suite 501 Toronto, ON M5J 2H7 Canada Tel: +1 416 947 0907 Fax: +1 416 947 0395 mining@rpacan.com |

Table Of Contents

PAGE

| 1 Summary | 1-1 |

| Executive Summary | 1-1 |

| Technical Summary | 1-6 |

| 2 Introduction | 2-1 |

| 3 Reliance on Other Experts | 3-1 |

| 4 Property Description and Location | 4-1 |

| 5 Accessibility, Climate, Local Resources, Infrastructure and Physiography | 5-1 |

| 6 History | 6-1 |

| 7 Geological Setting and Mineralization | 7-1 |

| Regional Geology | 7-1 |

| Local Geology | 7-4 |

| Property Geology | 7-6 |

| Mineralization | 7-10 |

| 8 Deposit Types | 8-1 |

| 9 Exploration | 9-1 |

| 10 Drilling | 10-1 |

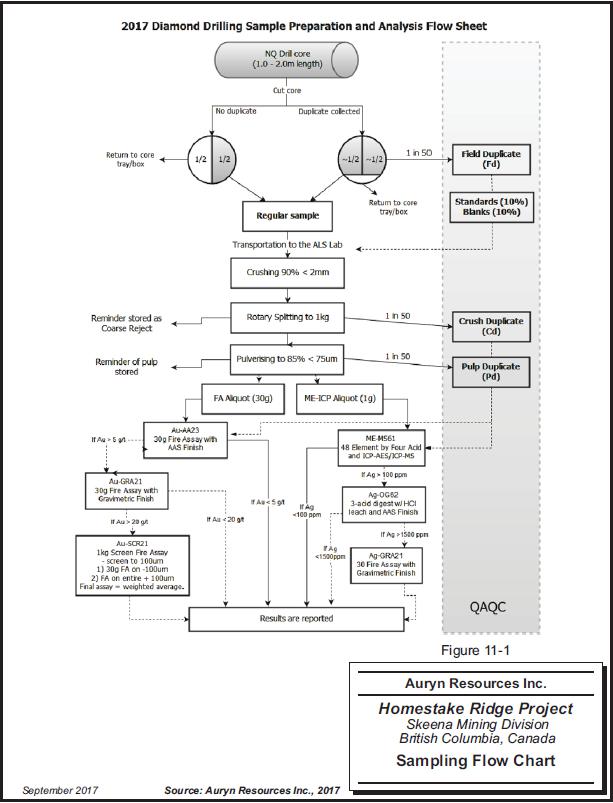

| 11 Sample Preparation, Analyses and Security | 11-1 |

| Historic Sampling | 11-1 |

| Homestake Resources Sampling | 11-1 |

| Agnico Eagle Sampling | 11-4 |

| Auryn Sampling | 11-5 |

| 12 Data Verification | 12-1 |

| Site Visit | 12-1 |

| Data Verification | 12-1 |

| 13 Mineral Processing and Metallurgical Testing | 13-1 |

| Historical Metallurgical Testing | 13-1 |

| Recent Metallurgical Testing | 13-10 |

| 14 Mineral Resource Estimate | 14-1 |

| Database | 14-4 |

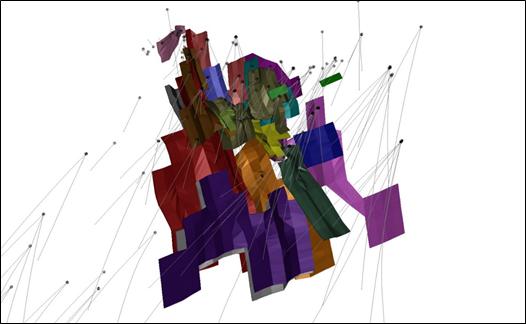

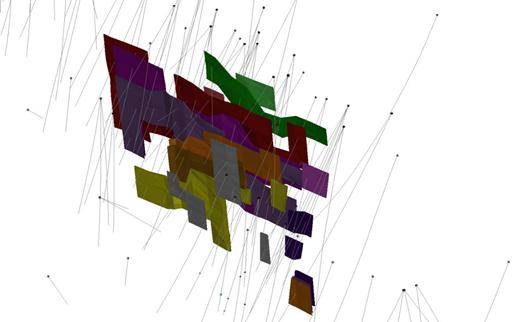

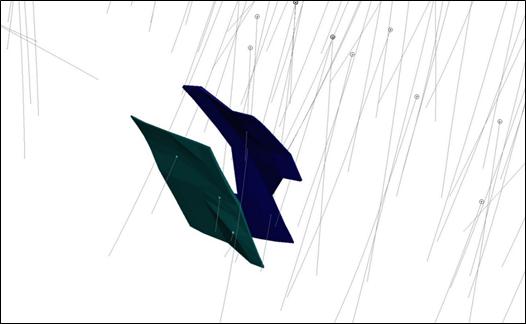

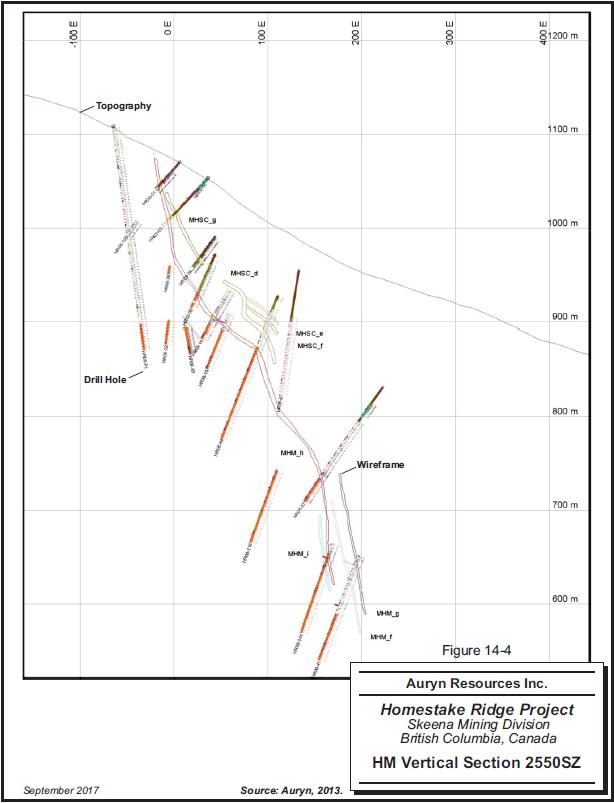

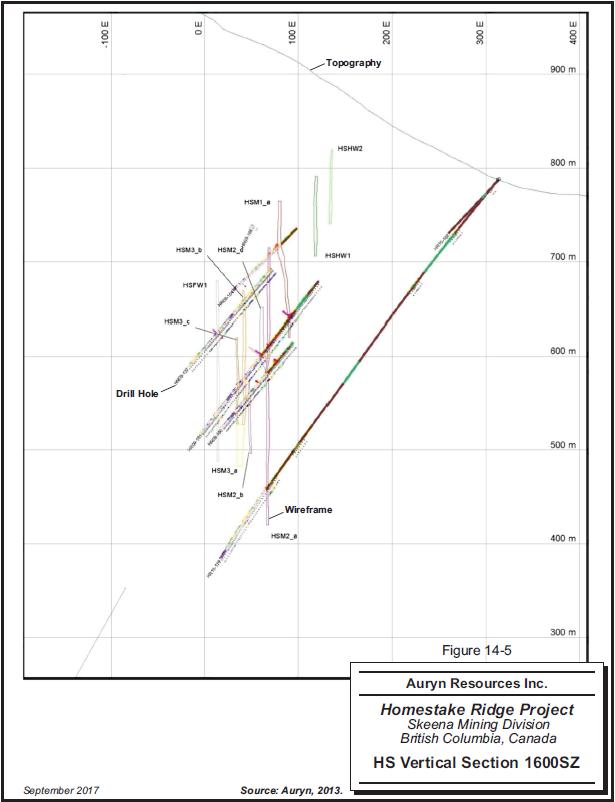

| Wireframe Models | 14-4 |

| Sample Statistics | 14-14 |

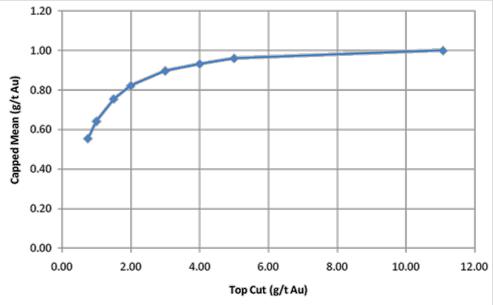

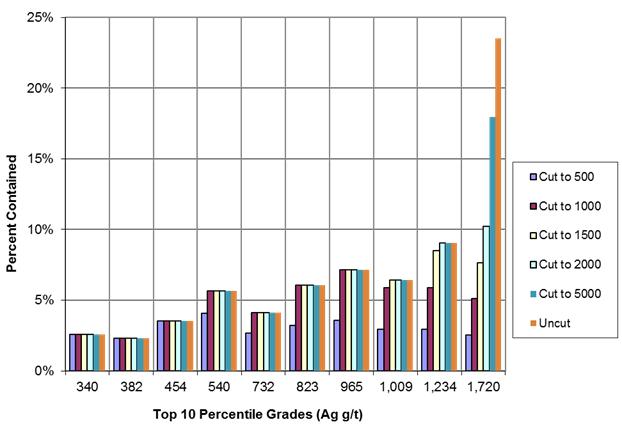

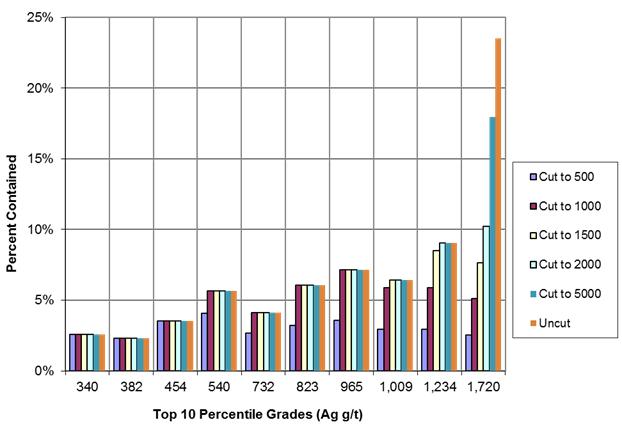

| Cutting of High Assays | 14-15 |

| Compositing | 14-19 |

| Variography | 14-20 |

| Search Parameters | 14-21 |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page i |

| | www.rpacan.com |

| Bulk Density | 14-22 |

| Block Models | 14-24 |

| Validation | 14-25 |

| Classification | 14-29 |

| Cut-off Grade | 14-30 |

| Comparison to Previous Estimates | 14-31 |

| Other Considerations | 14-32 |

| 15 Mineral Reserve Estimate | 15-1 |

| 16 Mining Methods | 16-1 |

| 17 Recovery Methods | 17-1 |

| 18 Project Infrastructure | 18-1 |

| 19 Market Studies and Contracts | 19-1 |

| 20 Environmental Studies, Permitting, and Social or Community Impact | 20-1 |

| 21 Capital and Operating Costs | 21-1 |

| 22 Economic Analysis | 22-1 |

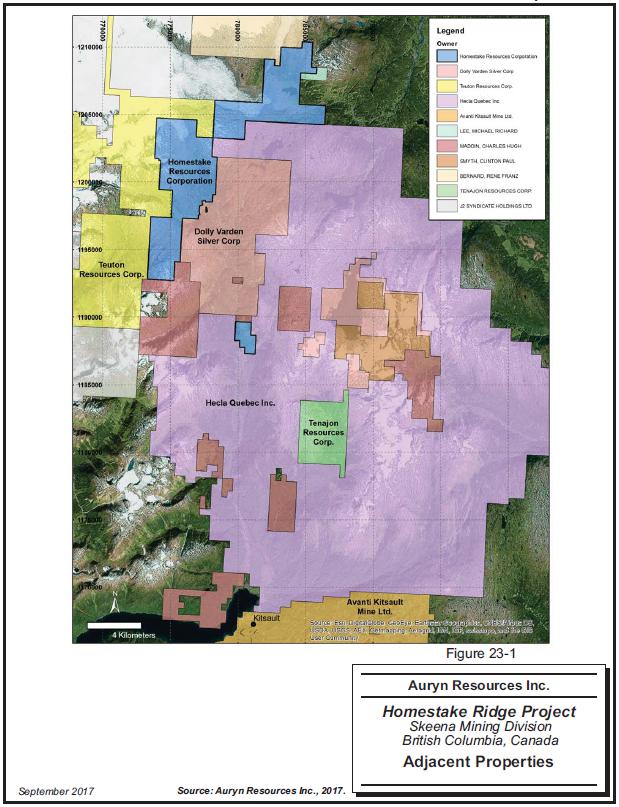

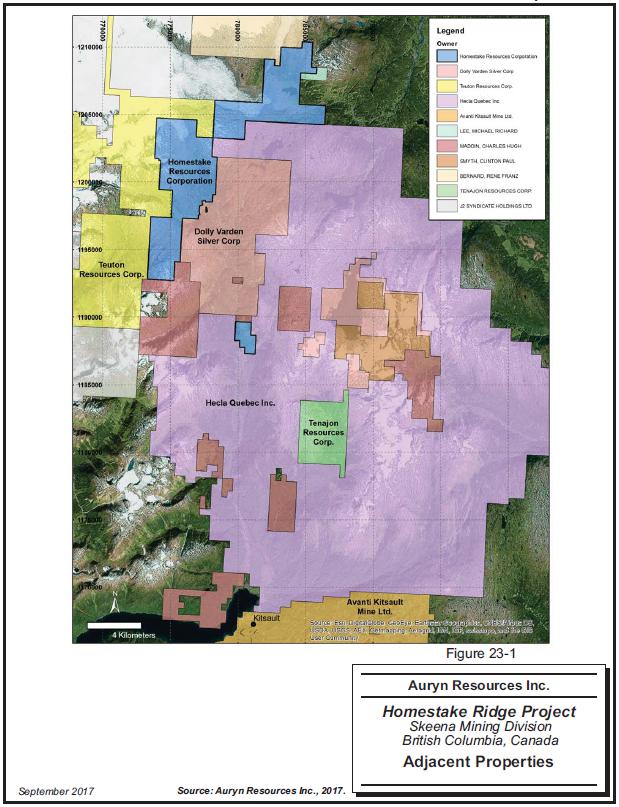

| 23 Adjacent Properties | 23-2 |

| 24 Other Relevant Data and Information | 24-1 |

| 25 Interpretation and Conclusions | 25-1 |

| 26 Recommendations | 26-1 |

| 27 References | 27-1 |

| 28 Date and Signature Page | 28-1 |

| 29 Certificate of Qualified Person | 29-1 |

List Of Tables

PAGE

| Table 1-1 Mineral Resource Statement as at September 1, 2017 | 1-2 |

| Table 1-2 Proposed Budget – Phase 1 | 1-4 |

| Table 1-3 Proposed Budget – Phase 2 | 1-5 |

| Table 4-1 Tenure Data | 4-3 |

| Table 5-1 Climatic Data | 5-2 |

| Table 6-1 Mineral Resources – March 31, 2010 | 6-4 |

| Table 6-2 Mineral Resources – December 31, 2010 | 6-5 |

| Table 6-3 Mineral Resources –June 7, 2013 | 6-5 |

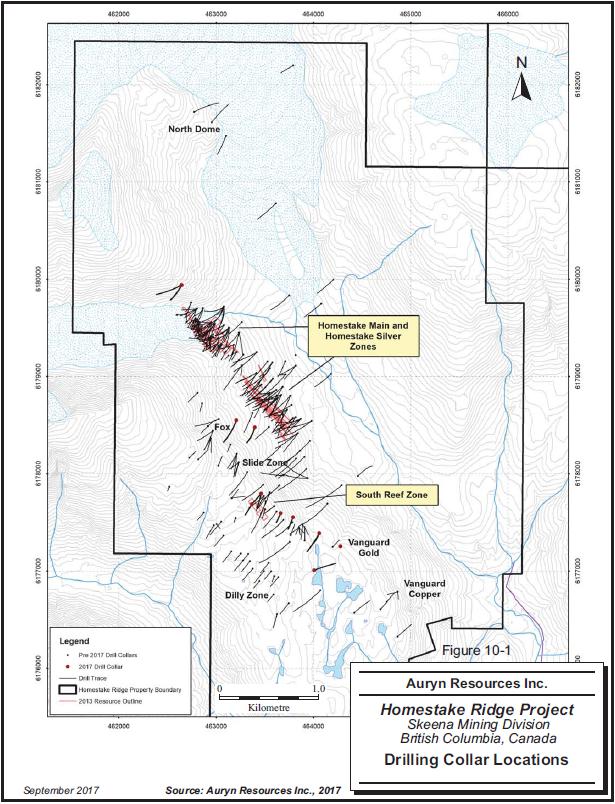

| Table 10-1 Previous Drilling | 10-1 |

| Table 10-2 Auryn 2017 Drilling | 10-3 |

| Table 10-3 Certified Reference Materials | 10-6 |

| Table 13-1 Composite Sample Analysis | 13-2 |

| Table 13-2 Composite HR Locked Cycle Test Results | 13-5 |

| Table 13-3 Composite SZ Locked Cycle Test Results | 13-6 |

| Table 13-4 Composite HS Assay Head Grade | 13-8 |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page ii |

| | www.rpacan.com |

| Table 13-5 75 µm LCT Metallurgical Projection | 13-9 |

| Table 13-6 Recovery of Gold and Silver, Gravity + Leach vs. Gravity + Flotation | 13-10 |

| Table 13-7 Summary of Test Work | 13-19 |

| Table 14-1 Mineral Resources by Area | 14-3 |

| Table 14-2 Mineral Resources by Cut-off | 14-3 |

| Table 14-3 Resource Wireframe Details | 14-7 |

| Table 14-4 Descriptive Statistics of Resource Assays | 14-14 |

| Table 14-5 Top Cuts | 14-18 |

| Table 14-6 Effect of Top Cuts | 14-18 |

| Table 14-7 Composite Statistics | 14-19 |

| Table 14-8 Variography Results | 14-20 |

| Table 14-9 Bulk Density | 14-23 |

| Table 14-10 Block Model Geometries | 14-24 |

| Table 14-11 Cross-Validation Results | 14-27 |

| Table 14-12 Comparison of Mean Composite and Block Grades | 14-28 |

| Table 14-13 Mineral Resource Statement as at December 31, 2012 | 14-31 |

| Table 26-1 Proposed Budget – Phase 1 | 26-1 |

| Table 26-2 Proposed Budget – Phase 2 | 26-2 |

List Of Figures

PAGE

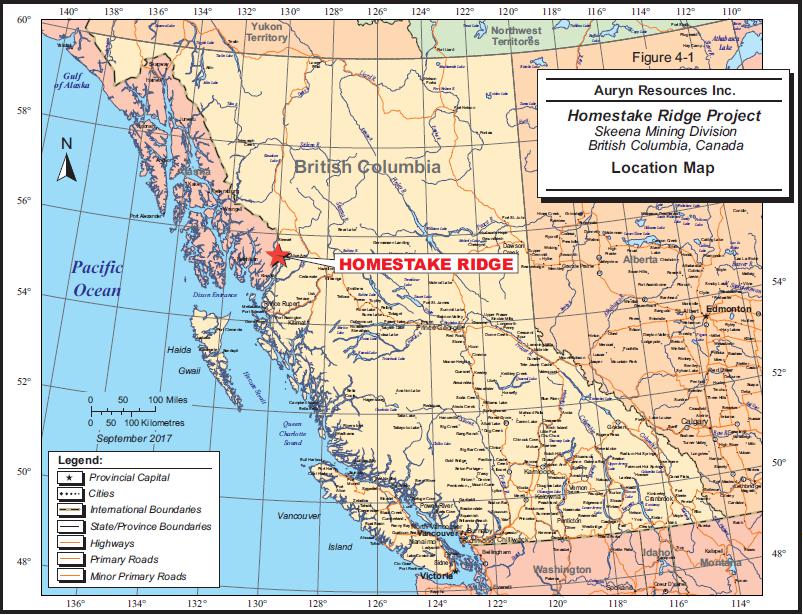

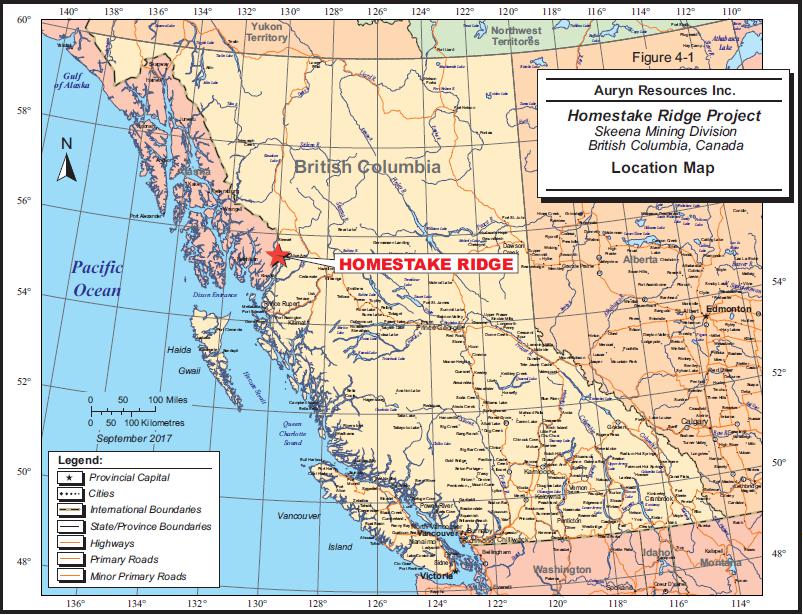

| Figure 4-1 Location Map | 4-5 |

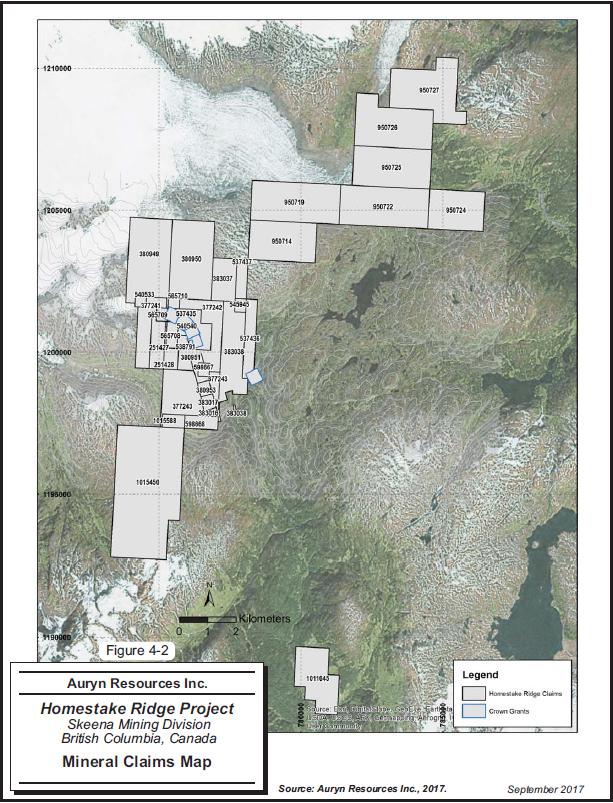

| Figure 4-2 Mineral Claims Map | 4-6 |

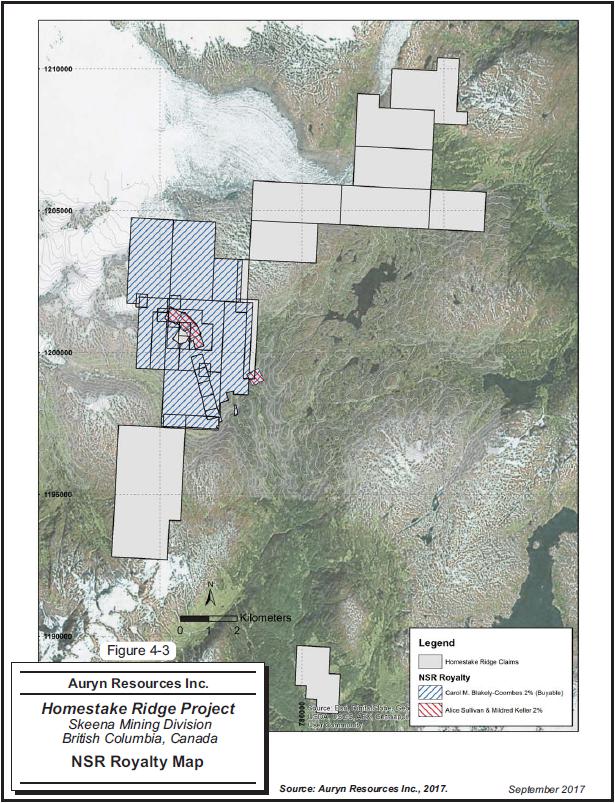

| Figure 4-3 NSR Royalty Map | 4-7 |

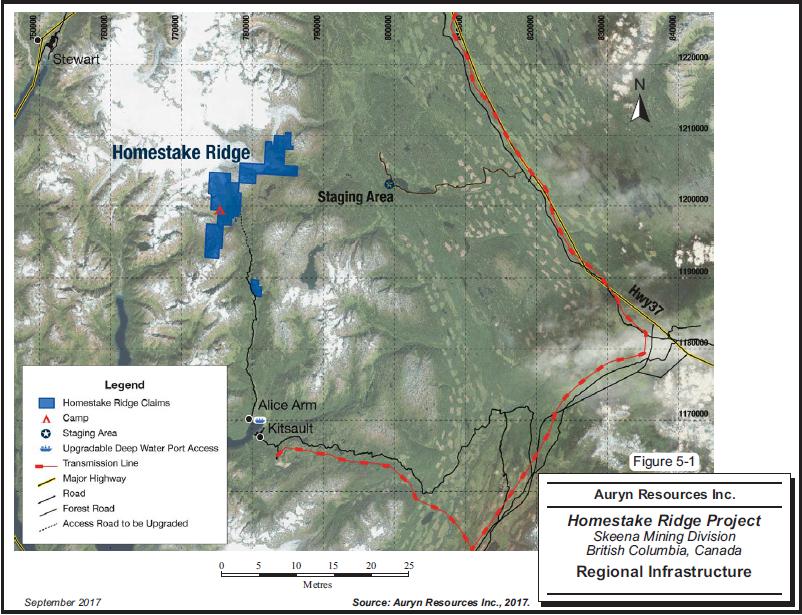

| Figure 5-1 Regional Infrastructure | 5-4 |

| Figure 7-1 Regional Geology | 7-3 |

| Figure 7-2 Local Geology | 7-5 |

| Figure 7-3 Property Geology | 7-7 |

| Figure 9-1 IP Survey | 9-3 |

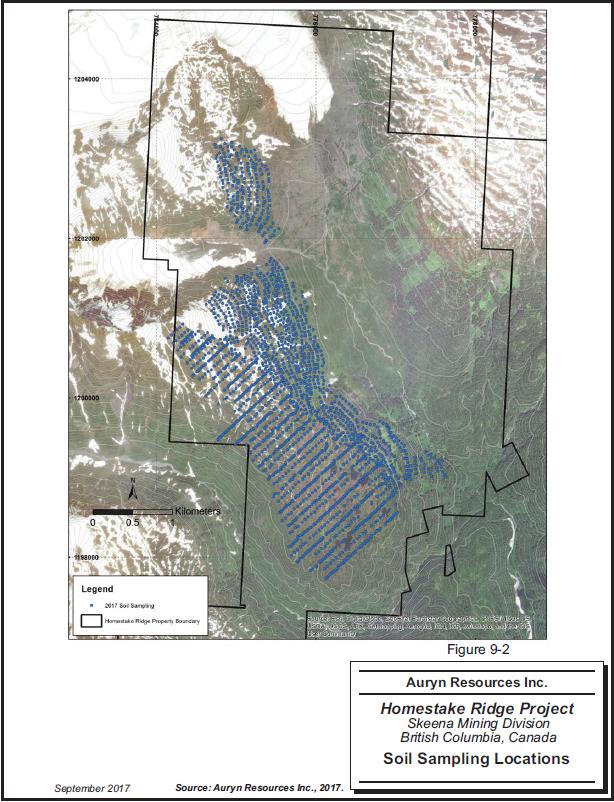

| Figure 9-2 Soil Sampling Locations | 9-4 |

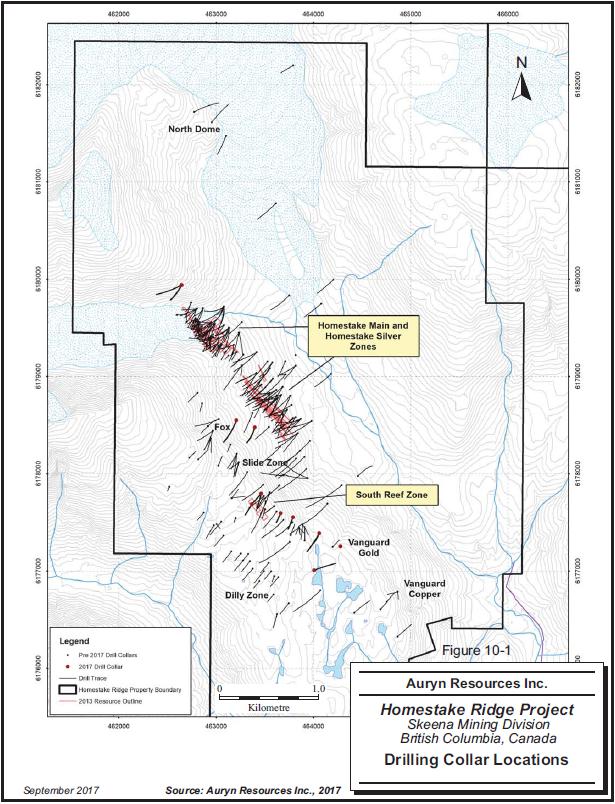

| Figure 10-1 Auryn Drilling Collar Locations | 10-4 |

| Figure 10-2 Core Shack Job Flow Chart | 10-7 |

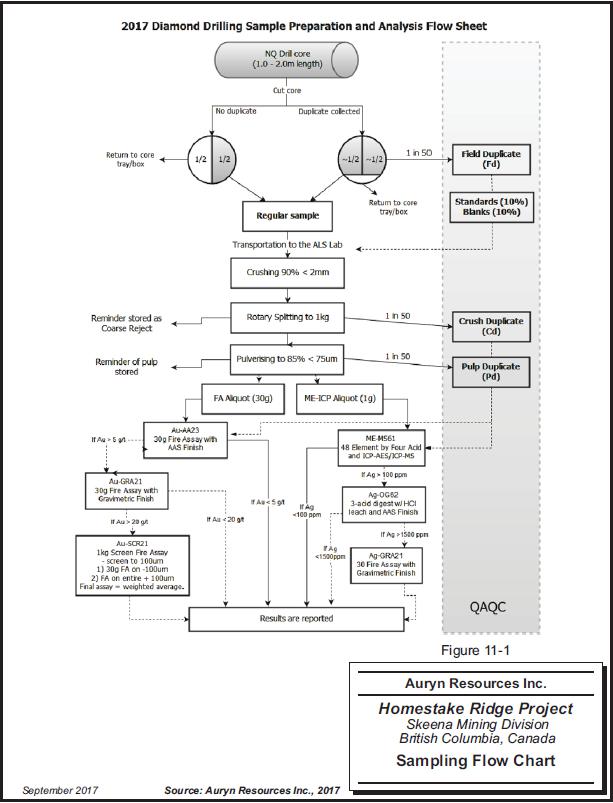

| Figure 11-1 Sampling Flow Chart | 11-7 |

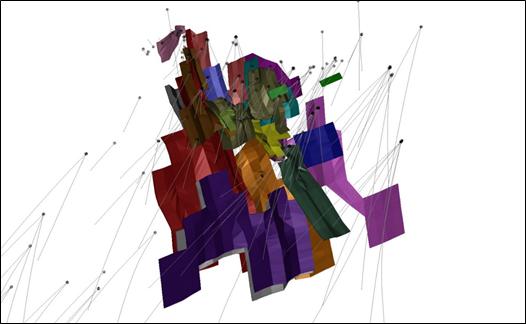

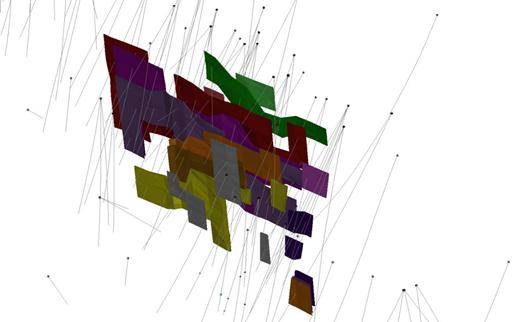

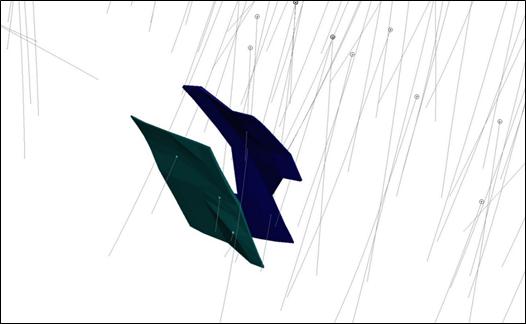

| Figure 14-1 HM Wireframes (View Looking Southwest) | 14-5 |

| Figure 14-2 HS Wireframes (View Looking North) | 14-5 |

| Figure 14-3 SR Wireframes (View Looking North) | 14-6 |

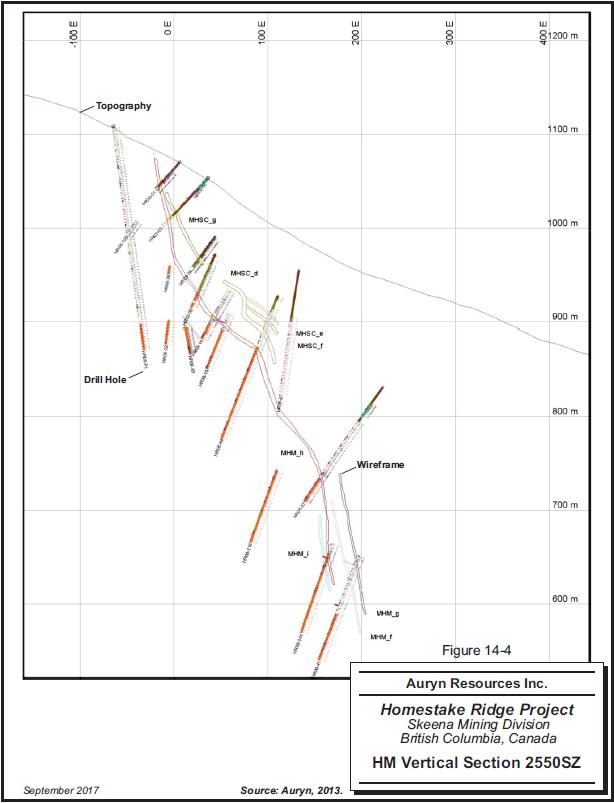

| Figure 14-4 HM Vertical Section 2550SZ | 14-8 |

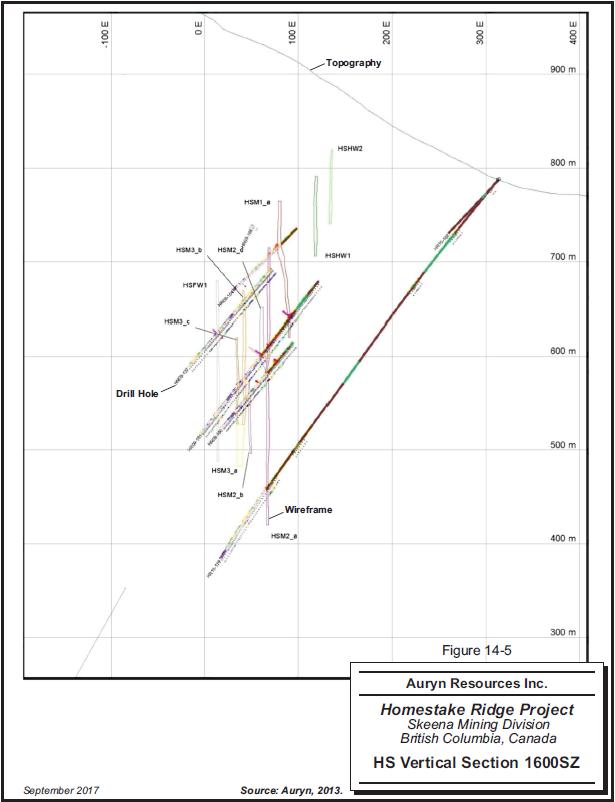

| Figure 14-5 HS Vertical Section 1600SZ | 14-9 |

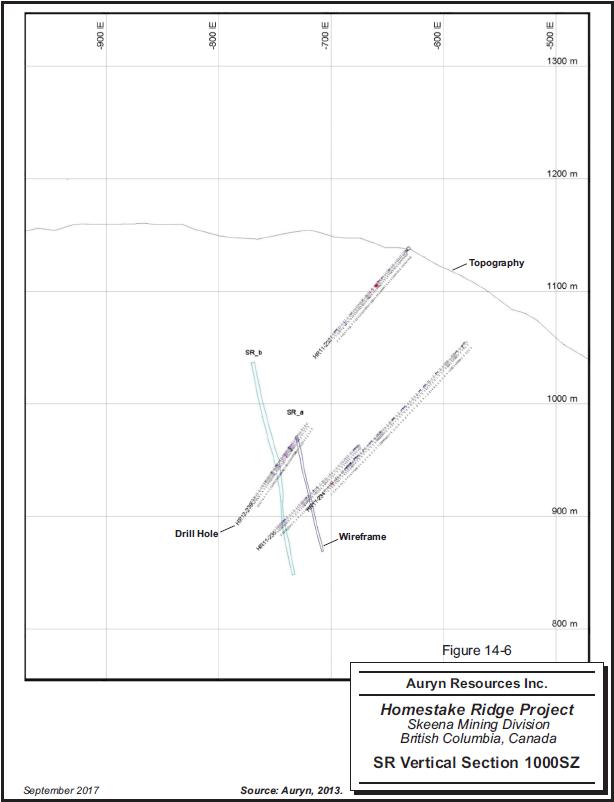

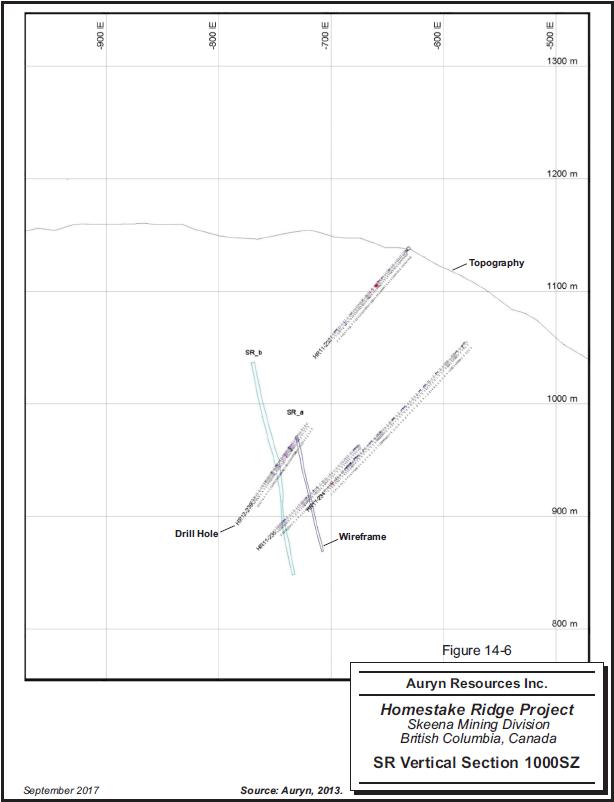

| Figure 14-6 SR Vertical Section 1000SZ | 14-10 |

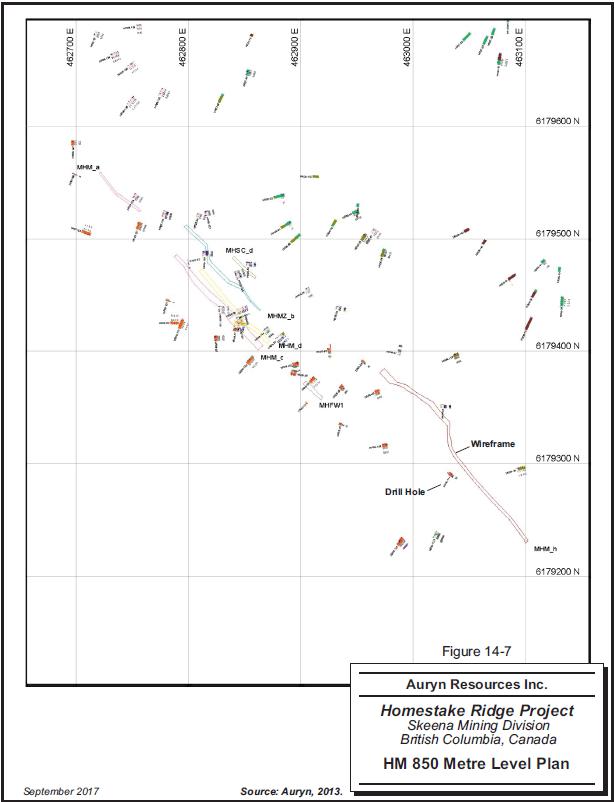

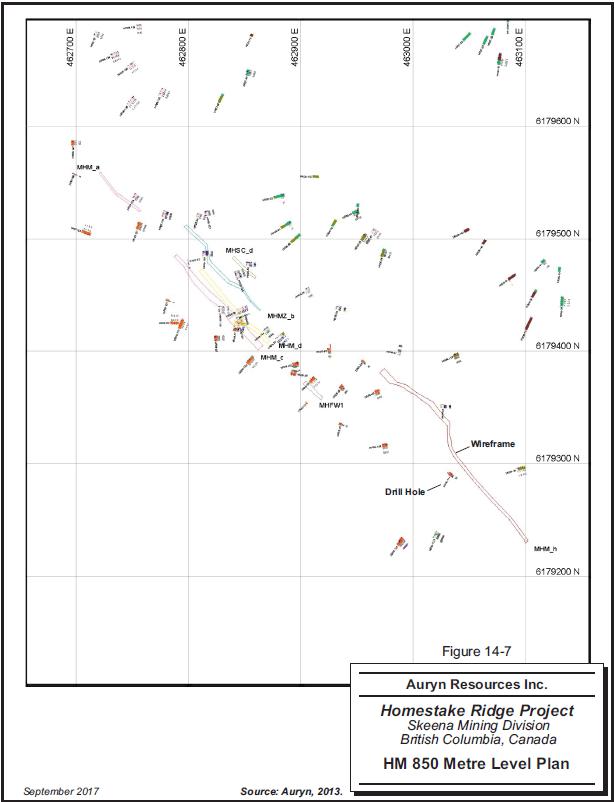

| Figure 14-7 HM 850 Metre Level Plan | 14-11 |

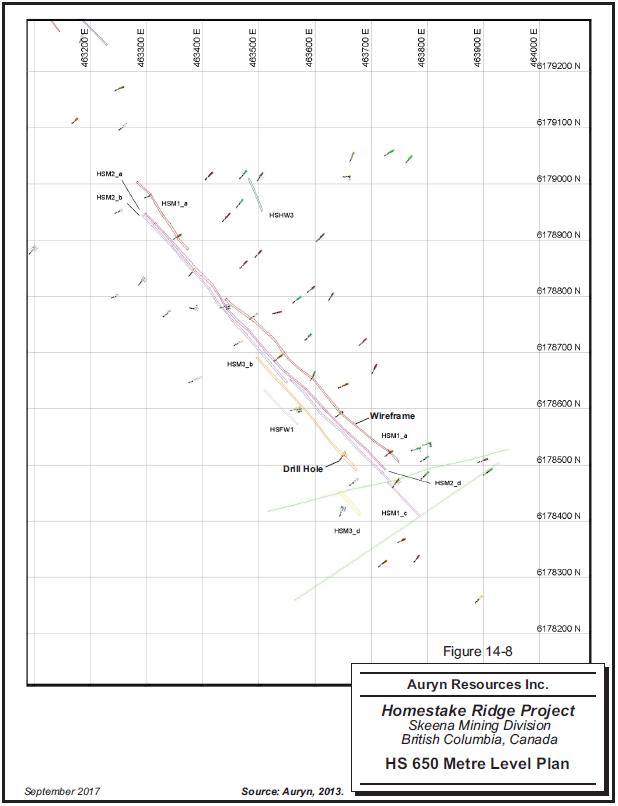

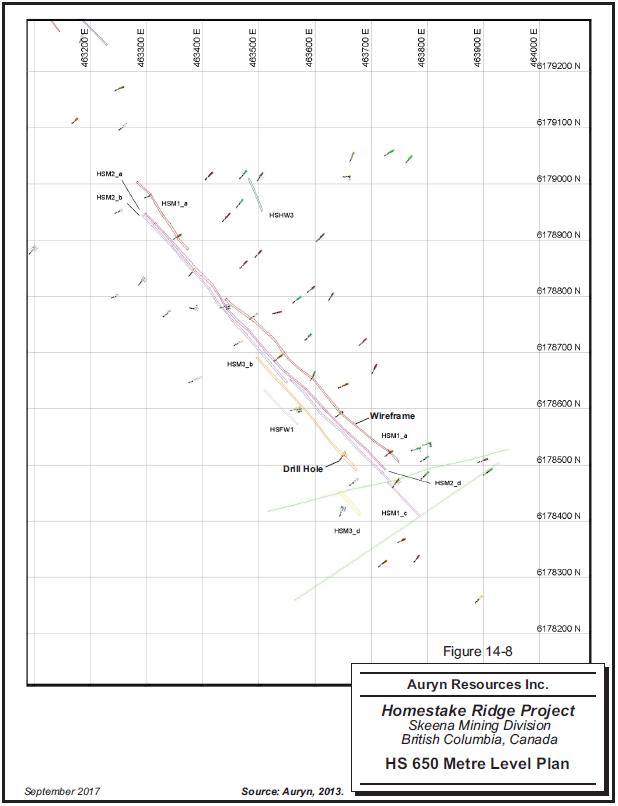

| Figure 14-8 HS 650 Metre Level Plan | 14-12 |

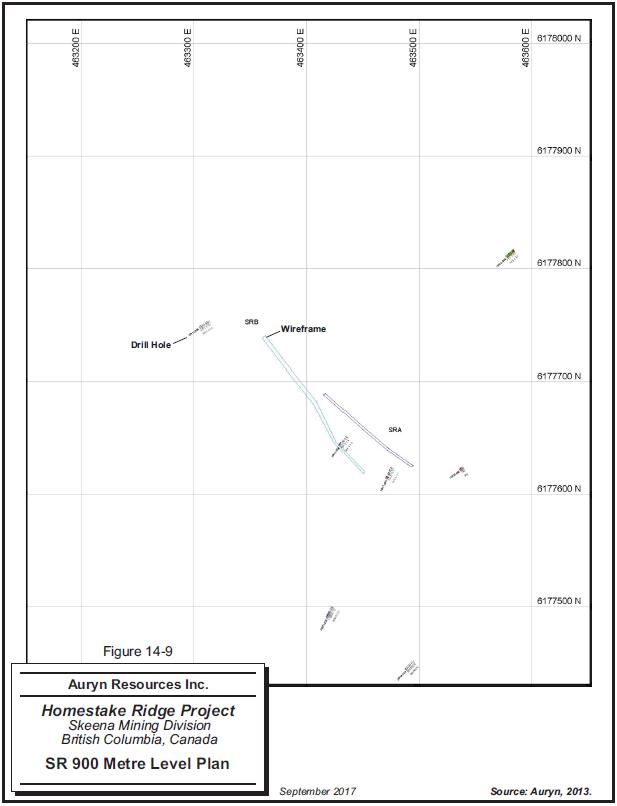

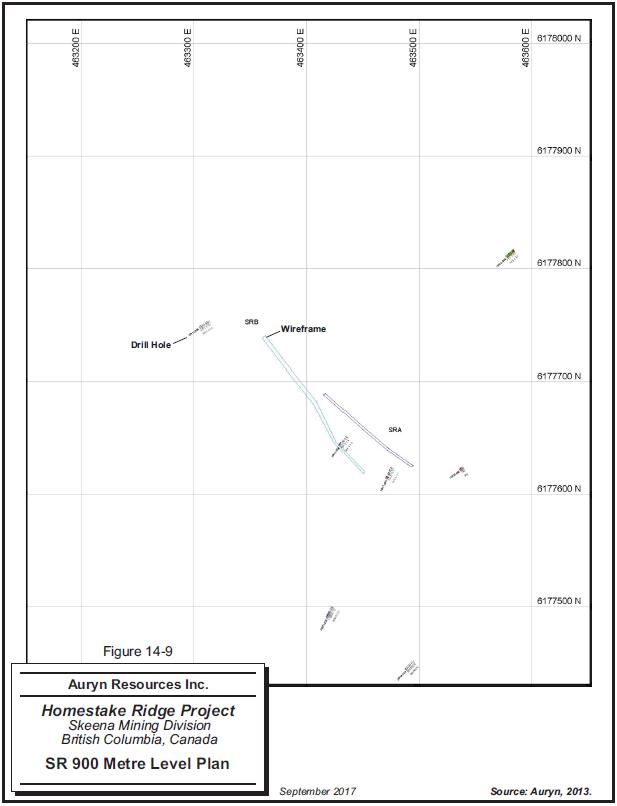

| Figure 14-9 SR 900 Metre Level Plan | 14-13 |

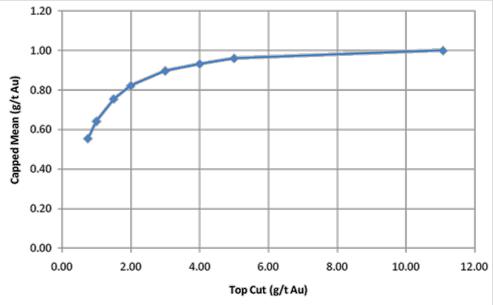

| Figure 14-10 Example Cutting Curve for Gold | 14-16 |

| Figure 14-11 Example Decile Plot Silver from HS | 14-17 |

| Figure 23-1 Adjacent Properties | 23-6 |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page iii |

| | www.rpacan.com |

1 Summary

Executive Summary

Roscoe Postle Associates Inc. (RPA) was retained by Auryn Resources Inc. (Auryn) to prepare an independent Technical Report on the Homestake Ridge Project (the Project), located in the Skeena Mining Division, northwestern British Columbia, Canada. The purpose of this report is to support the disclosure of an updated Mineral Resource estimate. This Technical Report conforms to NI 43-101 Standards of Disclosure for Mineral Projects. RPA visited the property from August 26 to 28, 2017. The effective date of the updated Mineral Resource estimate and this report is September 1, 2017.

The Project comprises four non-contiguous blocks consisting of seven crown grants and 36 mineral claims and totalling 7,547.15 ha, located in 1:50,000 scale National Topographic System (NTS) map sheet 102/P13, approximately 32 km southeast of Stewart, British Columbia. The Property is accessible only by air.

Auryn is a Vancouver-based company formed in June 2008 and is a reporting issuer in British Columbia, Alberta, and Ontario. The common shares of Auryn trade on the Toronto Stock Exchange and the NYSE American exchange. The company is under the jurisdiction of the British Columbia Securities Commission and the US Securities and Exchange Commission (SEC).

On June 14, 2016, Auryn announced that it had entered into a binding letter agreement whereby it would acquire all the issued and outstanding common shares of Homestake Resource Corporation (“Homestake”). On September 8, 2016, Auryn announced that it had completed a plan of arrangement and that Homestake had become a wholly-owned subsidiary of Auryn. Homestake holds a 100% interest in the Project, subject to various royalty interests on certain claims held by vendors.

Currently, the major asset associated with the Project is a strategic land position covering prospective lithologies and structures. The property hosts the Homestake Main, Homestake Silver and South Reef zones which are at the resource definition stage as well as a large land position which merits additional exploration. Recent work has expanded the known mineralization envelope and identified previously unknown mineralized corridors.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-1 |

| | www.rpacan.com |

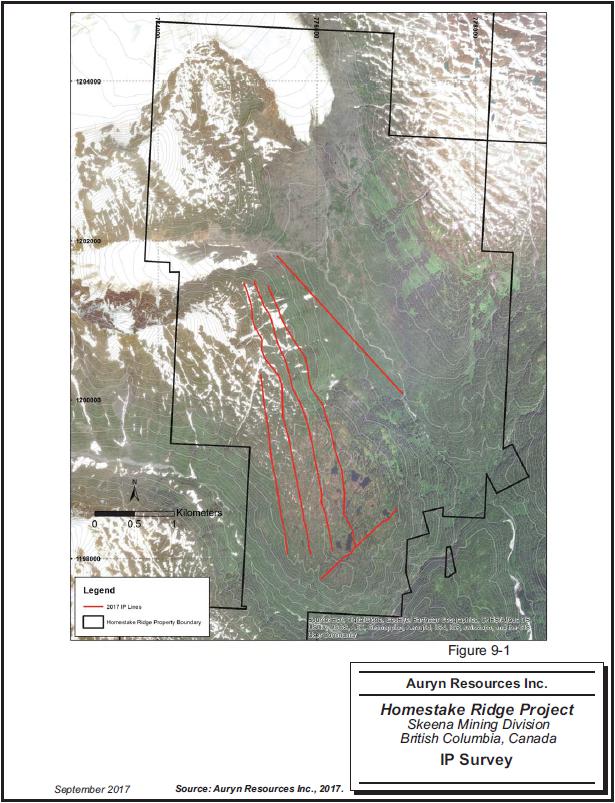

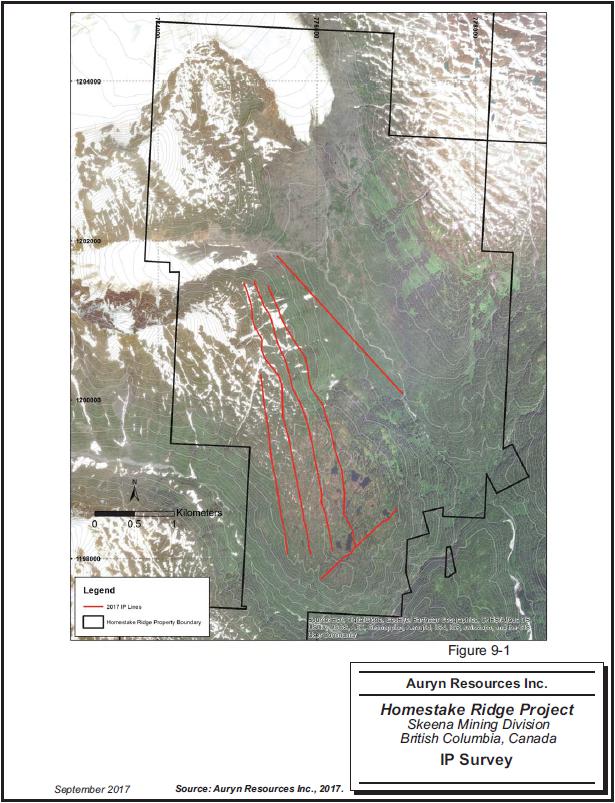

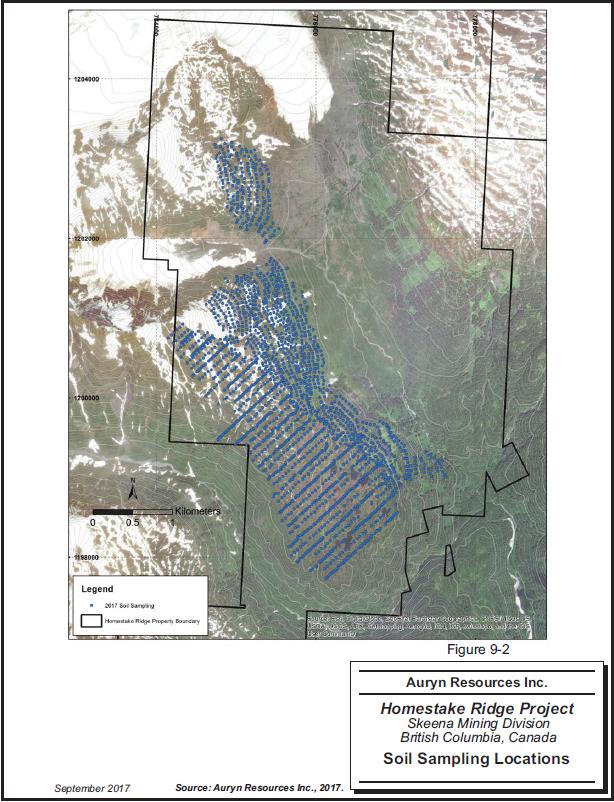

Since acquiring the Project, Auryn completed a limited amount of induced polarization (IP) surveying, a soil sampling program and a 13 hole diamond drilling program totalling 5,571.3 m as of the effective date of this report (the total program is expected to be approximately 35 holes over 12,000 m to 15,000 m).

RPA and Scott Wilson RPA Inc. (Scott Wilson RPA), a predecessor company to RPA, estimated Mineral Resources on the Project in 2010, 2011, and 2013 and disclosed the results in NI 43-101 compliant Technical Reports.

The current Mineral Resource estimate on the Project is summarized in Table 1-1.

Table 1-1 Mineral Resource Statement as at September 1, 2017

Auryn Resources Inc. – Homestake Ridge Project

| Classification | Tonnage | Gold | Gold | Silver | Silver | Copper | Copper |

| | (Mt) | (g/t) | (oz) | (g/t) | (Moz) | (%) | (Mlb) |

| Indicated | 0.624 | 6.25 | 125,000 | 47.9 | 1.0 | 0.18 | 2.4 |

| Inferred | 7.245 | 4.00 | 932,000 | 90.9 | 21.2 | 0.11 | 16.9 |

Notes:

| 1. | CIM definitions were followed for Mineral Resources. |

| 2. | Mineral Resources are estimated at a cut-off grade of 2.0 g/t AuEq. |

| 3. | Assumptions used to calculate AuEq values are described below in the text of this report. |

| 4. | Mineral Resources are estimated using a long-term gold price of US$1,300 per ounce, and a US$/C$ exchange rate of 1.2. |

| 5. | A minimum horizontal width of two metres was used. |

| 6. | Bulk density ranges from 2.66 t/m3 to 2.85 t/m3 depending on the domain. |

Conclusions

The Property is located within the prolific Iskut-Stewart-Kitsault Belt which hosts several precious and base metal mineral deposits. Diverse mineralization styles include stratabound sulphide zones, stratabound silica-rich zones, sulphide veins, and disseminated or stockwork sulphides. Mineralization is related to Early Jurassic feldspar-hornblende-phyric sub-volcanic intrusions and felsic volcanism and commonly occurs with zones of pyrite-sericite alteration. Numerous genetic models can be proposed for the area and local deposits present a broad range of characteristics.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-2 |

| | www.rpacan.com |

Drilling has outlined mineralization with three-dimensional continuity, and size and grades that can potentially be extracted economically. Project geologists have a good understanding of the regional, local, and deposit geology and controls on mineralization. The geological models are reasonable and plausible interpretations of the drill results. Exploration protocols for drilling, sampling, analysis, security, and database management meet industry standard practices. The drill hole database was verified by RPA and is suitable for Mineral Resource estimation work.

RPA updated the Mineral Resource estimate for the Homestake Ridge Project using the block model dated December 31, 2012 and a AuEq cut-off grade based on adjusted metal price, exchange rate and operating cost assumptions. No new drilling information has been received within the resource area and therefore a new effective date of September 1, 2017 was assigned to the Mineral Resource estimate. Data from the drilling being carried out in the late summer and fall of 2017 is expected to be received in October or November of 2017, and the Mineral Resource model and statement will be updated.

Mineral Resources were estimated considering a potential underground mining scenario. At a cut-off grade of 2 g/t AuEq, Indicated Mineral Resources were estimated to total 0.624 Mt at average grades of 6.25 g/t Au, 47.9 g/t Ag, and 0.18% Cu. At the same cut-off grade, Inferred Mineral Resources were estimated to total 7.245 Mt at average grades of 4.00 g/t Au, 90.9 g/t Ag, and 0.11% Cu. There are no Mineral Reserves estimated on the Property.

The wireframe models of the mineralization have done a reasonably good job of segregating the various zones (domains) within the deposit. The sample statistics show that there are still multiple populations within some of the domains. In RPA’s opinion, this may be due to higher grade zones within the relatively lower grade wireframes. Additional interpretive work may be able to segregate these higher grade domains, which would result in more robust grade interpolations.

Results from metallurgical test work suggest that the expected recoveries from a combined gravity/flotation processing plant would be: 85% to 93% for gold; 75% to 88% for silver; 85% to 90% for copper.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-3 |

| | www.rpacan.com |

Recommendations

Exploration work carried out at Homestake Ridge by previous operators and Auryn has identified significant gold, silver and base metal mineralization. Previous operators focused on stratabound mineralization models similar to that of Eskay Creek. Homestake highlighted several key structures that appear to be the main control on mineralization throughout the property. Work expanded the previously known mineralization in addition to identifying previously unknown mineralization corridors within the Project boundaries. Following up on these structures and structural corridors is highly recommended. A two phase multi-year program is recommended to complete additional exploration and resource definition drilling followed by a Preliminary Economic Assessment (PEA).

RPA has reviewed and concurs with Auryn’s proposed exploration programs and budgets. Phase 1 of the recommended work program will build on the results of the 2017 exploration program by expanding and infilling both newly discovered zones of mineralization as well as known deposits with the aim of completing an updated mineral resource estimate. To complete Phase 1, it is recommended that a 20,000 m diamond drilling program be completed. Details of the recommended Phase I program can be found in Table 1-2.

Table 1-2 Proposed Budget – Phase 1

Auryn Resources Inc. – Homestake Ridge Project

| Item | C$ |

| PHASE 1 | |

| Head Office Expenses and Property Holding Costs | 500,000 |

| Geologic and Support Staff Cost | 2,000,000 |

| Geophysical and Drone Surveys | 250,000 |

| Surface Sampling and XRF | 500,000 |

| Diamond Drilling | 7,500,000 |

| Assaying/Analyses | 1,125,000 |

| Camp Costs | 650,000 |

| Helicopter Support | 2,500,000 |

| Engineering and Baseline Studies | 500,000 |

| Subtotal | 15,525,000 |

| Contingency | 1,552,500 |

| TOTAL | 17,077,500 |

A Phase 2 exploration program, contingent on the results of Phase 1, will also be diamond drill focussed with the goal of determining the extent of mineralization around the existing deposits and increasing the confidence level in certain areas of the resource by way of additional in-fill drilling. The goal of the Phase 2 drilling would be to bring the resource to the point that it could support the preparation of a PEA in 2019. In addition to the resource targeted drilling, it is recommended that satellite mineralized zones be investigated to determine their significance as the Project advances. It is recommended that the Phase 2 program consist of 20,000 m of drilling in addition to environmental, engineering and metallurgical studies as required to support the PEA. Details of the recommended Phase 2 program can be found in Table 1-3.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-4 |

| | www.rpacan.com |

Table 1-3 Proposed Budget – Phase 2

Auryn Resources Inc. – Homestake Ridge Project

| Item | C$ |

| PHASE 2 | |

| Head Office Expenses and Property Holding Costs | 750,000 |

| Geologic Staff and Support Staff Cost | 3,000,000 |

| Geophysical and Drone Surveys | 250,000 |

| Surface Sampling and XRF | 350,000 |

| Diamond Drilling | 7,500,000 |

| Assaying/Analyses | 1,125,000 |

| Engineering and Baseline Studies | 1,500,000 |

| Helicopter Support | 2,500,000 |

| Camp Costs | 750,000 |

| Subtotal | 17,725,000 |

| Contingency | 1,772,500 |

| TOTAL | 19,497,500 |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-5 |

| | www.rpacan.com |

Technical Summary

Property Description and Location

The Homestake Ridge Project covers 7,547.15 ha and is located approximately 32 km southeast of Stewart, BC, and approximately 32 km north-northwest of the tidewater communities of Alice Arm and Kitsault, BC. The property is located within NTS 1:50,000 scale topographic map 102/P13. It is centred at approximately 55° 45' 12.6" N latitude and 129° 34' 39.8" W longitude on Terrain Resource Integrated Management (TRIM) maps 103P072 and 103P073 and lies within Zone 9 of the UTM projection using the NAD83 datum.

Land Tenure

The property comprises four non-contiguous blocks consisting of seven crown grants and 36 mineral claims covering a total area of 7,547.15 ha in the Skeena Mining Division. The crown grants include surface rights, while the mineral claims do not include surface rights.

On June 14, 2016, Auryn announced that it had entered into a binding letter agreement whereby it would acquire all the issued and outstanding common shares of Homestake. On September 8, 2016, Auryn announced that it had completed a plan of arrangement and that Homestake had become a wholly-owned subsidiary of Auryn. Homestake holds a 100% interest in the Project, subject to various royalty interests on certain claims held by vendors, with some claims requiring annual royalty payments.

Existing Infrastructure

There is no permanent infrastructure on the Project. A temporary camp capable of housing 40 people was established at 55°44.406’ N and 129°35.128’ W for the duration of the 2017 exploration program.

History

The Homestake Ridge property comprises two areas of historic exploration. The Homestake and the Vanguard groups have been tested by past explorers starting in the early 1900s after the discoveries at Anyox and in the Stewart region. Claims were first staked at the Homestake group between 1914 and 1917. In 1925, the original claims were given “Crown Grant” status.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-6 |

| | www.rpacan.com |

In 1939, the property was optioned by British Lion Mines Ltd (British Lion). British Lion conducted extensive trenching and excavated two (Smith and Myberg) adits, shipping eight tonnes of selected ore that returned 1,120 g Au, 1,617 g Ag, 63.5 kg Pb, 303 kg Zn and 599 kg Cu from the Homestake group of claims. This is the only known production from the property.

In 1947, a cross-cut adit was begun on the Nero claim (operator unknown) that formed part of the Vanguard group. Work continued until the early 1950s when the claims were abandoned.

In 1964, Dwight Collison of Alice Arm staked the area, conducted surface trenching, limited underground work, and drilled seven holes for an aggregate of 58.2 m, on the Lucky Strike and Cascade claims which make up part of the Homestake group. In 1966, Canex Aerial Exploration Ltd. undertook an exploration program and in 1967, Amax Exploration conducted and extended examination of the Vanguard group.

In 1979, Newmont Exploration of Canada Ltd. (Newmont) optioned part of the property, which excluded the original Homestake and Vanguard claims and targeted near surface massive sulphides. Newmont terminated the option in late 1980. Caulfield Resources Ltd. explored the Vanguard group in 1981, but no subsequent work was done.

Homeridge Resources Ltd. optioned the property in 1984, but no work was done. The claims were allowed to lapse in 1986, were re-staked and optioned to Cambria Resources Ltd., which completed geological mapping, lithogeochemical sampling, trenching and 4.3 line km of IP and resistivity surveys.

The ground was optioned to Noranda Exploration Company Limited (Noranda). Between 1989 and 1991, Noranda consolidated ground by optioning more area including the Cambria, Homestake, and Vanguard claims. Geological mapping and geophysical surveys were conducted and twelve diamond drill holes were cored for a total of 1,450.05 m.

Teck acquired the current Homestake Ridge property in 2000 via option agreements and staking. From 2000 to 2002, Teck conducted geochemical and geological surveys, trenching, and drilling for volcanogenic massive sulphide (VMS) deposits.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-7 |

| | www.rpacan.com |

Homestake (formally Bravo Venture Group) optioned the property from Teck in 2003. Homestake’s work, prior to 2009, consisted of the compilation of historic data, the performance of geochemical and geophysical surveys, geological mapping, and the drilling of 27,289 m in 120 NQ2 and BTW diamond drill holes. In 2007, Homestake released a NI 43-101-compliant Mineral Resource estimate at a 0.5 g/t AuEq cut-off grade which totalled 11.9 Mt in the Inferred category grading 2.36 g/t Au, 15.0 g/t Ag, and 0.11% Cu.

From 2008 to 2009, resumed diamond drilling and was successful in confirming the known mineralized zones as well as discovering the Homestake Silver Zone located approximately 700 m to the southeast of the Main Homestake deposit.

In 2010, Scott Wilson RPA prepared an updated NI 43-101 compliant Mineral Resource estimate for the project at a 3 g/t AuEq cut-off grade which totalled 888,000 t in the indicated category grading 6.69 g/t Au, 47.2 g/t Ag and 0.15% Cu and 2.34 Mt in the inferred category grading 4.62 g/t Au, 106 g/t Ag and 0.13% Cu.

From 2010 to 2012, Homestake completed additional surface exploration including further mapping, soil and rock sampling, 13.54 line km of IP surveying, and diamond drilling resulting in the identification of new exploration targets and the significant expansion of Mineral Resources estimate on the Project.

In April of 2011, Homestake announced the results of an updated Mineral Resource estimate at the Homestake Silver Zone by RPA, which resulted in a significant increase in the inferred resources of the previous estimate. The reported resource at a 3.0 g/t AuEq cut-off grade totalled 888,000 t in the indicated category grading 6.69 g/t Au, 47.2 g/t Ag and 4.1 Mt in the inferred category grading 4.62 g/t Au, 103 g/t Ag.

In 2011 a new discovery was made 800 m to the southwest of, and parallel to, the Main Homestake and Homestake Silver deposits. This area, known as the South Reef target was tested by three holes with all three intersecting +30 g/t Au mineralization.

During 2012, Homestake completed two phases of drilling focussed on the delineation and extension of the South Reef target. The second phase of drilling was funded by Agnico Eagle Mines Limited (Agnico Eagle) as part of an option agreement (see below). The 2012 drilling was successful in identifying an approximate 250 m strike by 250 m down dip before ending in, or being offset by, a major fault structure. Mineralization is open along the strike to the northwest. Other targets remain on the property.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-8 |

| | www.rpacan.com |

Agnico Eagle optioned the property from Homestake in 2012. From 2013 to 2014, Agnico Eagle completed exploration consisting of prospecting, reconnaissance geological mapping, soil sampling, a limited amount of ground geophysical (magnetics and IP) surveying and diamond drilling consisting of 16 holes totalling approximately 6,525 m. The drilling suggested that the Slide Zone is concordant with the Homestake Main and Homestake Silver zones and trends north northwesterly and dips steeply to the northeast. The option was subsequently terminated.

Geology and Mineralization

The Project is located within a lobe of Upper Triassic to Middle Jurassic strata exposed along the western edge of the Bowser Basin within the Stikinia Terrane of the Intermontane Belt. Stikinia formed in the Pacific Ocean during Carboniferous to Early Jurassic (320 Ma to 190 Ma) and collided with North America during the Middle Jurassic.

The Property occurs within the metallogenic region known as the Stewart Complex. Described as the contact of the eastern Coast Plutonic Complex with the west-central margin of the successor Bowser Basin, the Stewart Complex ranges from Middle Triassic to Quaternary in age and is comprised of sedimentary, volcanic and metamorphic rocks.

The Project covers the transition between the sedimentary and volcanic rocks of the Upper Triassic to Lower Jurassic Stuhini Group, a complex sequence of Lower to Middle Jurassic sedimentary, volcanic and intrusive rocks of the Hazelton Group and sedimentary rocks of the Upper to Middle Jurassic Bowser Lake Group.

The Lower Hazelton rocks comprise fine-grained to feldspar-hornblende phyric volcanic and volcaniclastic rocks of andesite to latite/trachyte composition and may include some phases of hypabyssal monzonite. This lower stratigraphy of the Hazelton Group extends along the length of the Homestake Ridge from the Main Homestake Zone to the Vanguard Copper showings and is the host rock and footwall sequences to the three known mineral deposits, the Main Homestake, Homestake Silver and South Reef zones as well as numerous other showings.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-9 |

| | www.rpacan.com |

The cessation of Hazelton volcanism and continued sub-basin development resulted in a rapid facies changes into calcareous sandstones, grits, and conglomerates progressing upwards to thinly laminated and alternating beds of black graphitic and pyritic mudstones and light grey siltstones or very fine-grained sandstones (possible “pyjama beds”) correlated to the Salmon River formation.

In the northern part of the property at the headwaters of Homestake Creek, rhyolitic volcanic rocks occur at the base of the Salmon River sediments.

The eastern part of the property is dominated by the Middle to Upper Jurassic Bowser Basin Group which conformably overlies the thin bedded graphitic argillites of the Salmon River formation.

Structure on the property largely reflects northeast-southwest compression that has continued from the Jurassic to present day. Recent drilling and mapping suggest that the local stratigraphy has undergone several deformation events including uplift and local extension of the Stuhini and lower Hazelton stratigraphy. Large northeast trending ankerite bearing faults have been mapped and related to Tertiary east-west extension.

Exploration Status

The Project is at the resource development stage.

Mineral Resources

RPA updated the Mineral Resource estimate for the Homestake Ridge Project at a cut-off grade of 2 g/t (AuEq). Grades for gold, silver, copper, arsenic and antimony were estimated into the blocks using ID3 weighting. Three block models, one for each of the three main deposit zones, were created in 2013 using GEMS software. Block size for all models was 5 m x 5 m x 5 m. The wireframe models were constructed in Surpac by Homestake personnel working in consultation with RPA. The assay data comprised drilling and trench sampling results from programs conducted by Homestake.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-10 |

| | www.rpacan.com |

The main areas of the deposit are the Homestake Main Zone (HM), the Homestake Silver Zone (HS), and the South Reef Zone (SR). The HM is the more copper-rich of the zones, with both gold-rich and silver-rich variants and an apparent trend of increasing copper grade with depth. The HM consists of a broad corridor of sub-parallel anastomosing zones which strike approximately 137° and dip steeply to moderately to the northeast. Most of the zones dip at 75° to 80°, flattening to 45° in the central section between elevations 750 MASL and 900 MASL. Widths range from centimetre-scale to four metres in true thickness. Locally, the zones are observed to jog abruptly in a left-lateral sense which is attributed to cross-faulting. These disruptions can be 30 m or more. The HM has been traced on surface and in drill intercepts for a strike length of 750 m, and a vertical extent of approximately 500 m.

Mineral Reserves

There are no Mineral Reserves on the Project.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 1-11 |

| | www.rpacan.com |

2 Introduction

Roscoe Postle Associates Inc. (RPA) was retained by Auryn Resources Inc. (Auryn) to prepare an independent Technical Report on the Homestake Ridge Project, located in the Skeena Mining Division, northwestern British Columbia, Canada. The purpose of this report is to support the disclosure of an updated Mineral Resource estimate. This Technical Report conforms to NI 43-101 Standards of Disclosure for Mineral Projects. The effective date of the updated Mineral Resource estimate and Technical Report is September 1, 2017.

Auryn is a Vancouver-based exploration company formed in June 2008 which is engaged in acquiring, exploring, and evaluating natural resource properties in Canada and Peru. It is a reporting issuer in British Columbia, Alberta, and Ontario whose common shares trade on the Toronto Stock Exchange (TSX:AUG) and the NYSE American Exchange (US:AUG). Auryn is under the jurisdiction of the British Columbia Securities Commission and the US Securities and Exchange Commission (SEC).

In addition to the Homestake Ridge Project, Auryn controls a large land position along the Committee Bay greenstone belt in Nunavut which includes the Three Bluffs development stage gold deposit, a large land position along the Gibsons MacQuoid greenstone belt elsewhere in Nunavut, and a portfolio of properties with the potential to host epithermal Au-Ag and porphyry Cu-Au mineralization in Peru.

On June 14, 2016, Auryn announced that it had entered into a binding letter agreement whereby it would acquire all the issued and outstanding common shares of Homestake Resource Corporation (“Homestake”). On September 8, 2016, Auryn announced that it had completed a plan of arrangement and that Homestake had become a wholly-owned subsidiary of Auryn. Homestake holds a 100% interest in the Project, subject to various royalty interests on certain claims held by vendors.

Currently, the major asset associated with the Project is a strategic land position covering prospective lithologies and structures. The Project hosts the Homestake Main, Homestake Silver and South Reef zones which are at the resource definition stage as well as a large land position which merits additional exploration. Recent work has expanded the known mineralization envelope and identified previously unknown mineralized corridors.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 2-1 |

| | www.rpacan.com |

Since acquiring the Project, Auryn has completed a program of core re-logging, a limited amount of Induced Polarization (IP) surveying, a soil sampling program and a 13 hole diamond drilling program totalling 5,571.3 m as of the effective date of this report.

RPA and Scott Wilson RPA Inc. (Scott Wilson RPA), a predecessor company to RPA, estimated Mineral Resources on the Project in 2010, 2011, and 2013 and disclosed the results in NI 43-101 compliant Technical Reports.

Sources of Information

A site visit to the Homestake Ridge Project was carried out by Paul Chamois, M.Sc.(A), P.Geo., Principal Geologist with RPA, from August 26 to 28, 2017. During the visit, Mr. Chamois examined core from the on-going drilling program, confirmed the local geological setting, reviewed the core handling and data collection methodologies, and investigated factors that might affect the Project. Discussions were held with the following personnel:

| · | Andy Orr, Senior Geologist, Auryn Resources Inc. |

| · | Nils Peterson, Senior Geologist, Auryn Resources Inc. |

| · | Ben Stanley, Geologist, Auryn Resources Inc. |

| · | Rob L’Heureux, Vice President, APEX Geoscience |

| · | Fraser Kirk, Geologist, APEX Geoscience |

| · | Ed Parker, Geologist, APEX Geoscience |

David Ross, P.Geo., RPA Principal Geologist prepared Sections 12 and 14 of the Technical Report and contributed to Sections 1, 25, and 26. Mr. Chamois prepared Sections 2 to 11, 13, 15 to 24, and 27 and contributed to Sections 1, 25, and 26.

The documentation reviewed, and other sources of information, are listed at the end of this report in Section 27 References.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 2-2 |

| | www.rpacan.com |

List of abbreviations

Units of measurement used in this report conform to the metric system. All currency in this report is Canadian dollars (C$) unless otherwise noted.

| a | annum | kWh | kilowatt-hour |

| A | ampere | L | litre |

| bbl | barrels | lb | pound |

| btu | British thermal units | L/s | litres per second |

| °C | degree Celsius | m | metre |

| C$ | Canadian dollars | M | mega (million); molar |

| cal | calorie | m2 | square metre |

| cfm | cubic feet per minute | m3 | cubic metre |

| cm | centimetre | m | micron |

| cm2 | square centimetre | MASL | metres above sea level |

| d | day | mg | microgram |

| dia | diameter | m3/h | cubic metres per hour |

| dmt | dry metric tonne | mi | mile |

| dwt | dead-weight ton | min | minute |

| °F | degree Fahrenheit | mm | micrometre |

| ft | foot | mm | millimetre |

| ft2 | square foot | mph | miles per hour |

| ft3 | cubic foot | MVA | megavolt-amperes |

| ft/s | foot per second | MW | megawatt |

| g | gram | MWh | megawatt-hour |

| G | giga (billion) | oz | Troy ounce (31.1035g) |

| Gal | Imperial gallon | oz/st, opt | ounce per short ton |

| g/L | gram per litre | ppb | part per billion |

| Gpm | Imperial gallons per minute | ppm | part per million |

| g/t | gram per tonne | psia | pound per square inch absolute |

| gr/ft3 | grain per cubic foot | psig | pound per square inch gauge |

| gr/m3 | grain per cubic metre | RL | relative elevation |

| ha | hectare | s | second |

| hp | horsepower | st | short ton |

| hr | hour | stpa | short ton per year |

| Hz | hertz | stpd | short ton per day |

| in. | inch | t | metric tonne |

| in2 | square inch | tpa | metric tonne per year |

| J | joule | tpd | metric tonne per day |

| k | kilo (thousand) | US$ | United States dollar |

| kcal | kilocalorie | USg | United States gallon |

| kg | kilogram | USgpm | US gallon per minute |

| km | kilometre | V | volt |

| km2 | square kilometre | W | watt |

| km/h | kilometre per hour | wmt | wet metric tonne |

| kPa | kilopascal | wt% | weight percent |

| kVA | kilovolt-amperes | yd3 | cubic yard |

| kW | kilowatt | yr | year |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 2-3 |

| | www.rpacan.com |

3 Reliance on Other Experts

This report has been prepared by RPA for Auryn Resources Inc. The information, conclusions, opinions, and estimates contained herein are based on:

| · | Information available to RPA at the time of preparation of this report, |

| · | Assumptions, conditions, and qualifications as set forth in this report, and |

| · | Data, reports, and other information supplied by the Client and other third-party sources. |

For the purpose of this report, RPA has relied on ownership information provided by Auryn and Broughton Law Corporation (Broughton Law), Homestake’s solicitors, regarding title to the Homestake Ridge Project. Broughton Law provided a legal review and opinion dated September 7, 2016. This information was used in Sections 1 and 4 of this report. RPA has not researched property title or mineral rights for the Homestake Ridge Project and expresses no opinion as to the ownership status of the property.

Except for the purposes legislated under provincial securities laws, any use of this report by any third party is at that party’s sole risk.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 3-1 |

| | www.rpacan.com |

4 Property Description and Location

The Homestake Ridge Project covers 7,547.15 ha and is located 32 km southeast of Stewart, BC, and approximately 32 km north-northwest of the tidewater communities of Alice Arm and Kitsault, BC (Figure 4-1). The property is located on 1:50,000 scale NTS map 102/P13. The four claim blocks comprising the Project are located within a rectangular area extending for a distance of approximately 23 km in a north-south direction and approximately 13 km in an east-west direction. The claim block hosting the known Mineral Resources is centred on approximately 55° 45' 12.6" N latitude and 129° 34' 39.8" W longitude on Terrain Resource Integrated Management (TRIM) maps 103P072 and 103P073 and lies within Zone 9 of the UTM projection using the NAD’83 datum.

Land Tenure

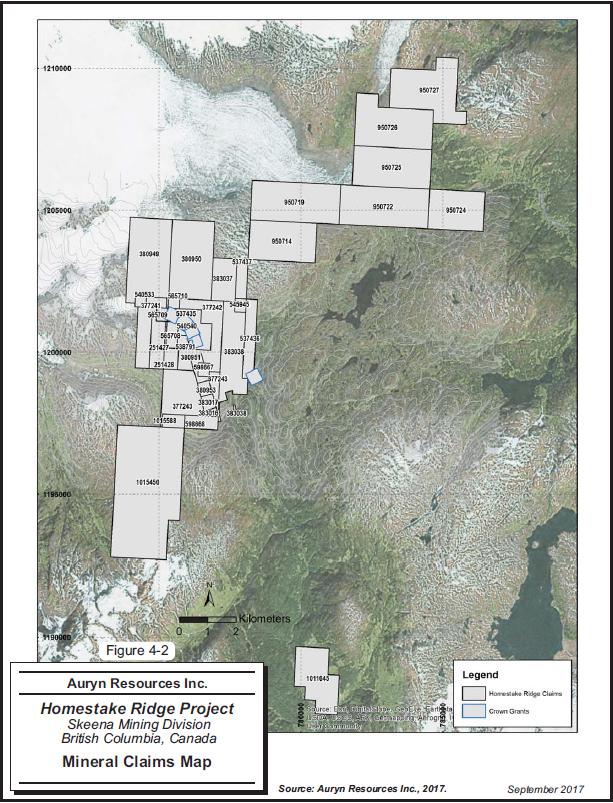

The Project comprises four non-contiguous blocks consisting of seven crown granted claims covering 96.712 ha and 36 mineral claims covering 7,547.15 ha (Figure 4-2). Table 4-1 lists the subject claims and crown grants along with the relevant individual tenure information including tenure number and name, issue and expiry dates, title type, and area.

The crown grants include surface rights, while the mineral claims do not include surface rights.

Annual holding costs including concession taxes and fees and advanced royalty payments total $109,160. Assessment work requirements for 2017 total $44,474.70.

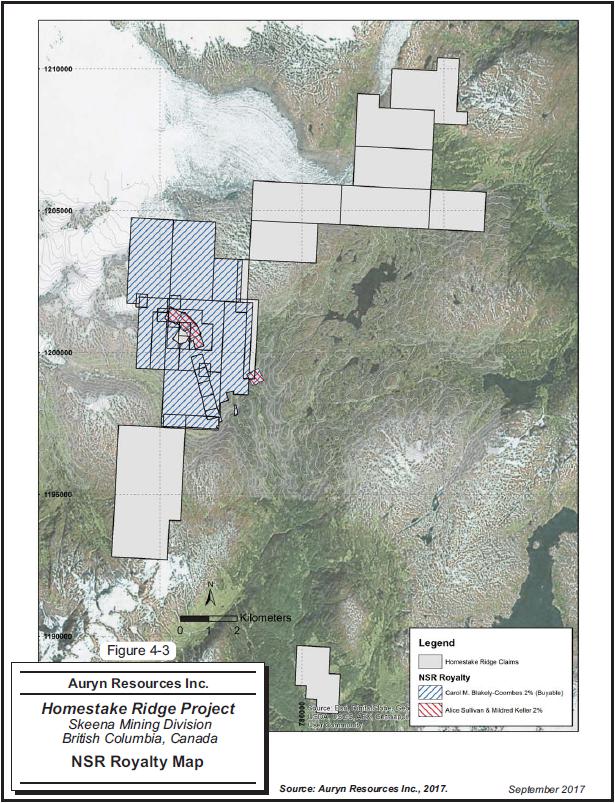

Homestake earned a 100% interest in 14 Homestake Ridge mineral claims through its option with Teck Cominco Limited, now Teck Resources (Teck). Teck failed to exercise its back-in rights in 2008 but retained a 2% net smelter return (NSR) royalty, 1% of which could be purchased at a future date for $1.0 million. On May 16, 2016 Homestake announced that it had closed an agreement with Teck to purchase the 2% royalty and ancillary rights for $100,000, effectively extinguishing this royalty.

The Coombes Claims (including Cambria 1, Cambria 2, KW1, KW2, KW3, KW4, KW5, WK1, WK3, WK4, WK6 and WK7) are subject to a 2% NSR royalty by virtue of an option agreement dated July 5, 2000. The royalty includes a purchase right in favour of Homestake for $1,000,000.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 4-1 |

| | www.rpacan.com |

The crown grants (including DL 3975, DL 3976, DL 3977, DL 3978, DL 3979, DL 3980 and DL 6322) are subject to a 2% NSR royalty which includes an annual advanced minimum royalty of $50,000 in favour of Alice Sullivan and Mildred Keller.

Figure 4-3 illustrates those mineral claims and Crown Grants that are subject to NSR royalties.

On June 14, 2016, Auryn announced that it had entered into a binding letter agreement with Homestake whereby it would acquire Homestake under a plan of arrangement (the Arrangement). In consideration of 100% of Homestake’s issued and outstanding shares, Auryn would issue approximately 3.3 million shares to Homestake shareholders. During the Arrangement process, Auryn also agreed to provide Homestake with a demand loan of up to $150,000 on an interest free, unsecured basis. On September 8, 2016, Auryn announced that it had completed the Arrangement and that Homestake had become a wholly-owned subsidiary of Auryn.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 4-2 |

| | www.rpacan.com |

Table 4-1 Tenure Data

Auryn Resources Inc. - Homestake Ridge Project

Tenure Number | Claim Name | Issue Date | Good Until | Area (ha) | Title Holder | Title Type Description | Tenure Sub-Type |

| L3975 | HOMESTAKE | N/A | N/A | 20.902 | Homestake Resource Corporation | Crown Granted | N/A |

| L3976 | HOMESTAKE No. 1 | N/A | N/A | 20.283 | Homestake Resource Corporation | Crown Granted | N/A |

| L3977 | HOMESTAKE No. 2 | N/A | N/A | 15.042 | Homestake Resource Corporation | Crown Granted | N/A |

| L3978 | HOMESTAKE No. 3 | N/A | N/A | 13.962 | Homestake Resource Corporation | Crown Granted | N/A |

| L3979 | HOMESTAKE FRACTION | N/A | N/A | 0.919 | Homestake Resource Corporation | Crown Granted | N/A |

| L3980 | HOMESTAKE No. 1 FRACTION | N/A | N/A | 4.702 | Homestake Resource Corporation | Crown Granted | N/A |

| DL6322 | MILLSITE | N/A | N/A | 20.902 | Homestake Resource Corporation | Crown Granted | N/A |

| 950714 | BRAVO N1 | 19-Feb-12 | 28-Jul-17 | 327.49 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 950719 | BRAVO N2 | 19-Feb-12 | 28-Jul-17 | 436.51 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 950722 | BRAVO N3 | 19-Feb-12 | 28-Jul-17 | 436.50 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 950724 | BRAVO N4 | 19-Feb-12 | 28-Jul-17 | 272.81 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 950725 | BRAVO N5 | 19-Feb-12 | 28-Jul-17 | 381.82 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 950726 | BRAVO N6 | 19-Feb-12 | 28-Jul-17 | 418.04 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 950727 | BRAVO N7 | 19-Feb-12 | 28-Jul-17 | 417.96 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 1011645 | KN HSR 1 | 01-Aug-12 | 28-Jul-17 | 273.86 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 251427 | CAMBRIA 1 | 06-May-12 | 17-Dec-24 | 100.00 | Homestake Resource Corporation | Four Post Claim | Claim |

| 251428 | CAMBRIA 2 | 06-May-12 | 17-Dec-24 | 75.00 | Homestake Resource Corporation | Four Post Claim | Claim |

| 377241 | WK 1 | 23-May-86 | 17-Dec-24 | 250.00 | Homestake Resource Corporation | Four Post Claim | Claim |

| 377242 | WK 2 | 23-May-86 | 17-Dec-24 | 500.00 | Homestake Resource Corporation | Four Post Claim | Claim |

| 377243 | WK 3 | 23-May-86 | 17-Dec-24 | 400.00 | Homestake Resource Corporation | Four Post Claim | Claim |

| 380949 | WK 4 | 20-Sep-00 | 17-Dec-24 | 450.00 | Homestake Resource Corporation | Four Post Claim | Claim |

| 380950 | WK 5 | 20-Sep-00 | 17-Dec-24 | 450.00 | Homestake Resource Corporation | Four Post Claim | Claim |

| 380951 | KW 1 | 20-Sep-00 | 17-Dec-24 | 25.00 | Homestake Resource Corporation | Two Post Claim | Claim |

| 380952 | KW 2 | 20-Sep-00 | 17-Dec-24 | 25.00 | Homestake Resource Corporation | Two Post Claim | Claim |

| 380953 | KW 3 | 20-Sep-00 | 17-Dec-24 | 25.00 | Homestake Resource Corporation | Two Post Claim | Claim |

| 383016 | KW 5 | 28-Nov-00 | 17-Dec-24 | 25.00 | Homestake Resource Corporation | Two Post Claim | Claim |

| 383017 | KW4 | 28-Nov-00 | 17-Dec-24 | 25.00 | Homestake Resource Corporation | Two Post Claim | Claim |

| 383037 | WK 6 | 28-Nov-00 | 17-Dec-24 | 150.00 | Homestake Resource Corporation | Four Post Claim | Claim |

| 383038 | WK 7 | 28-Nov-00 | 17-Dec-24 | 400.00 | Homestake Resource Corporation | Four Post Claim | Claim |

| 537435 | HR | 20-Jul-06 | 17-Dec-24 | 127.45 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 537436 | HRMARGIN 1 | 20-Jul-06 | 17-Dec-24 | 109.25 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 537437 | HRMARGIN2 | 20-Jul-06 | 17-Dec-24 | 54.60 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 538791 | HOMESTAKE RIDGE 1 | 05-Aug-06 | 17-Dec-24 | 18.21 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 540533 | HOMESTAKE RIDGE 2 | 06-Sep-06 | 17-Dec-24 | 18.20 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 540540 | HOMESTAKE RIDGE 3 | 06-Sep-06 | 17-Dec-24 | 18.21 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 545945 | HOMESTAKE RIDGE 4 | 27-Nov-06 | 17-Dec-24 | 18.20 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 565708 | HOMESTAKE RIDGE 5 | 07-Sep-07 | 17-Dec-24 | 36.42 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 565709 | HOMESTAKE RIDGE 6 | 07-Sep-07 | 17-Dec-24 | 18.21 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 565710 | HOME STAKE 7 | 07-Sep-07 | 17-Dec-24 | 18.20 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 598667 | VANGUARD GOLD | 03-Feb-09 | 17-Dec-24 | 18.21 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 598668 | VANGUARD EXTENSION | 03-Feb-09 | 17-Dec-24 | 54.66 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 1015450 | KINSKUCH NW2 | 22-Dec-12 | 17-Dec-24 | 1039.18 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| 1015588 | HS SOUTH 1 | 22-Dec-12 | 17-Dec-24 | 36.44 | Homestake Resource Corporation | Mineral Cell Title Submission | Claim |

| | | | Total | 7547.15 | | | |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 4-3 |

| | www.rpacan.com |

Mineral rights

In Canada, natural resources fall under provincial jurisdiction. In the Province of British Columbia, the management of mineral resources and the granting of exploration and mining rights for mineral substances and their use are regulated by the Mines Act, R.S.B.C. (1996) that is administered by the British Columbia Ministry of Energy and Mines. Mineral rights are owned by the Crown and are distinct from surface rights.

Royalties and Other Encumbrances

RPA is not aware of any other royalties, back-in rights, or other obligations related to the Arrangement or any other underlying agreements.

Permitting

RPA is not aware of any environmental liabilities associated with the Project. RPA understands that Auryn has all required permits to conduct the proposed work on the Property.

RPA is not aware of any other significant factors and risks that may affect access, title, or the

right or ability to perform work on the Project.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 4-4 |

| | www.rpacan.com |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 4-5 |

| | www.rpacan.com |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 4-6 |

| | www.rpacan.com |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 4-7 |

| | www.rpacan.com |

5 Accessibility, Climate, Local Resources, Infrastructure and Physiography

Accessibility

The Homestake Ridge Project is located 32 km southeast of Stewart, BC, at the southern extent of the Cambria ice field. Access to the Project from the town of Kitsault is by boat/barge to the community of Alice Arm. From there, an upgraded tractor trail follows an old railway bed for a distance of 32 km into the area of the past producing Dolly Varden silver mine, approximately four kilometres from the southern boundary of the Project. From there, overgrown mule trails lead to the historic workings of the Vanguard and Homestake areas of the Project. Helicopters are available for charter from either Prince Rupert, Terrace, or Stewart.

Climate

Climate in the area is classified as Oceanic or Marine West Coast and is characterized by moderately cool summers and mild winters with a narrower annual range of temperatures compared to sites of similar latitude. Climate data derived from the closest monitoring station (Nass Camp) indicates that temperatures range from an average low of -6.6°C in January to an average high of 21.6°C in July. The mean temperature for the year is 5.3°C.

The area receives 1,065 mm of precipitation each year (expressed in mm of water). Rainfall peaks in October with 165 mm. Snowfall is highest in December and January when accumulations are 92 cm and 91 cm respectively. The property is reported to be covered in snow from late September to late June (Bryson, 2007). Precipitation and heavy fog often impact on airborne access to the Project. Table 5-1 summarizes climate data in the area.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 5-1 |

| | www.rpacan.com |

Table 5-1 Climatic Data |

| Auryn Resources Inc. – Homestake Ridge Project |

| |

| Headings | Stewart (0 MASL) | Prince Rupert (0 MSAL) | Terrace (67 MASL) | Smithers (490 MASL) | Nass Camp |

| Mean January Temperature | -3.0°C | 2.4°C | -3.0°C | -7.2°C | N/A |

| Mean July Temperature | 15.1°C | 13.4°C | 16.5°C | 15.2°C | N/A |

| Extreme Maximum Temperature | 35.0°C | 32.2°C | 37.3°C | 36.0°C | 36.0°C |

| Extreme Minimum Temperature | -30.0°C | -24.4°C | -26.7°C | -43.9°C | -32.5°C |

| Average Annual Precipitation | 1,866.8 mm | 2,619.1 mm | 1,340.8 mm | 508.5 mm | 1,066.9 mm |

| Average Annual Rainfall | 1,338.9 mm | 2,530.4 mm | 1,025.3 mm | 367.2 mm | N/A |

| Average Annual Snowfall | 570.2 cm | 92.4 cm | 331.5 cm | 182.7 cm | N/A |

Harsh conditions related to high snowfall precludes exploration activities during the winter months.

Local Resources

The Project is located north of the historic mining towns of Kitsault and Alice Arm. Both towns are located at Alice Arm, a branch of the Observatory Inlet and part of the Portland inlet system which hosts Canada’s most northerly, ice-free, deep sea port at Stewart

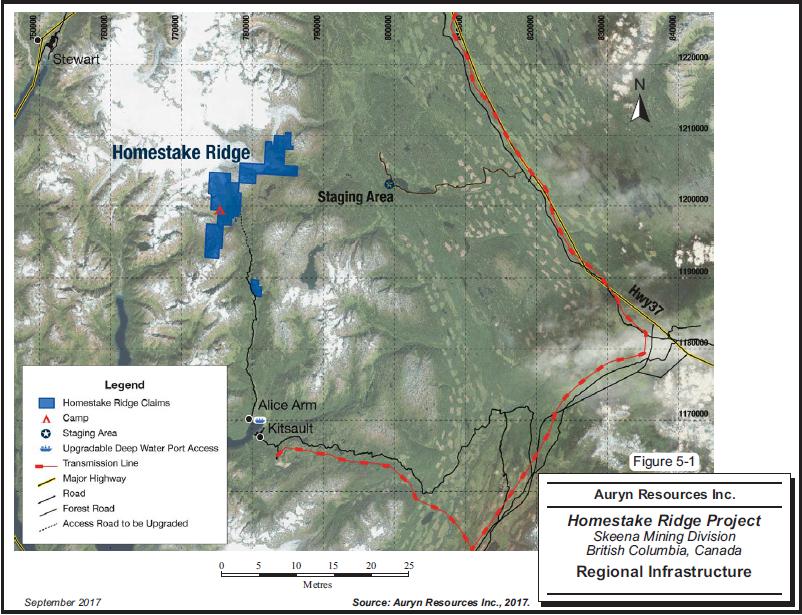

Sprott Power Corp. (Sprott Power) initiated development of six hydroelectric projects in the Upper Kitsault Valley. To facilitate the construction, roads and bridges are being upgraded in that area. Sprott Power is also redeveloping shutdown hydroelectric utilities in the area including the Kitsault dam and powerhouse. The Government of British Columbia has announced the resurfacing of 18 km of Highway 113, which will improve access to Kitsault from Terrace. Regional infrastructure is shown in Figure 5-1.

Labour and supplies for the project can be brought in from Terrace, which lies 185 km to the south, along Highway 113. Terrace has a population of 12,109 (2001 census) and hosts wide range of supplies, services, and trained labour. Terrace is serviced by three air carriers with daily scheduled flights. Stewart with 661 people (2001 census) is located 240 km, by road, from Kitsault. Stewart is well serviced, has trained labour with mining expertise, and hosts a deep-sea port that has been used for shipping ore and concentrate from other mines. Kitwanga, 180 km by road from Kitsault, lies on the Canadian National Railway mainline and Trans-Canada Highway 16. Like Stewart, Kitwanga has served as a shipping centre for mineral ores and concentrates. Mining is supported in the local communities and, historically, companies have been able to form productive joint venture partnerships with local First Nations.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 5-2 |

| | www.rpacan.com |

Infrastructure

There is no permanent infrastructure on the Project.

Physiography

With the exception of the subalpine plateau at the south end of the property, the topography is steep. In some areas, the relief is precipitous and poses a challenge for exploration work. Elevations in the area range from 430 MASL at the Kitsault River to 1,780 MASL at the ice-covered ridgeline. Property elevations vary from 860 MASL to 1300 MASL (Kasper and Metcalfe, 2004).

Subalpine forests, comprised of fir, hemlock, spruce, and cedar cover the eastern and southern portions of the property at lower elevations. The Project overlays a south-southeast trending ridge at the headwaters of the Kitsault River and the lower portions of the Kitsault and Little Kitsault Glaciers. East of this ridge, subalpine forest is broken up by a large slide area that is covered by slide alder, grass, and lichen. The upper slopes are populated by alpine grass, moss, and lichen with intermittent patches of dwarf alpine spruce (Knight and Macdonald, 2010).

RPA is of the opinion that, to the extent relevant to the mineral project, there is a sufficiency

of surface rights and water.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 5-3 |

| | www.rpacan.com |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 5-4 |

| | www.rpacan.com |

6 History

Prior Ownership

Claims were first staked at the Homestake group between 1914 and 1917 and, in 1918, the claims were bonded to the Mineral Claims Development Company (MCDC). MCDC was reorganized into the Homestake Mining and Development Company (Homestake Development) in 1921.

Exploration and Development History

The following is taken from Macdonald and Rennie (2016).

The Homestake Ridge property comprises two areas of historic exploration. The Homestake and the Vanguard groups have been tested by past explorers starting in the early 1900s after the discoveries at Anyox and in the Stewart region. Claims were first staked at the Homestake group between 1914 and 1917 and, in 1918, the claims were bonded to the MCDC. MCDC was reorganized into Homestake Development in 1921. Limited surface and underground work was done on the property. In 1925, the claims were given “Crown Grant” status. In 1926, Homestake Development and three other groups bonded to the interests of C. Spencer. The option was abandoned, with no further work being done on the property (Knight and Macdonald, 2010).

In 1939, the property was optioned by a Vancouver syndicate that became British Lion Mines Ltd. (British Lion). British Lion conducted extensive trenching and excavated two (Smith and Myberg) adits, shipping 8.0 tonnes of selected ore that returned 1,120 g Au, 1,617 g Ag, 63.5 kg Pb, 303 kg Zn, and 599 kg Cu on the Homestake group of claims (Bryson, 2007). This is the only known production from the property.

Because of the outbreak of World War II little work was done until 1947 when a cross-cut adit was begun on the Nero claim that formed part of the Vanguard group. Work continued, intermittently, on the cross-cut until the early 1950s. The claims were abandoned (Folk and Makepeace, 2007).

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 6-1 |

| | www.rpacan.com |

In 1964, Dwight Collison of Alice Arm staked the area and conducted surface trenching, limited underground work and drilled seven holes to an aggregate depth of 58.2 m, on the Lucky Strike and Cascade claims which comprise part of the Homestake group (Knight and Macdonald, 2010).

In 1966, Canex Aerial Exploration Ltd. (Canex) undertook a program of prospecting, geochemical sampling, electromagnetic (EM) surveying, and chip sampling in the Vanguard area. In 1967, Amax Exploration conducted and extended examination of the Vanguard group but did not return (Folk and Makepeace, 2007). Dwight Collison died in 1979.

In 1979, Newmont Exploration of Canada Ltd. (Newmont) optioned part the property, known as the Wilberforce group, from Collison’s widow, Ruby Collison. The Wilberforce group excluded the original Homestake and Vanguard claims. Newmont explored for near surface, massive sulphides conducting magnetometer and Max-Min geophysical surveys, geological mapping, and trenching. A total of 595 soil samples and 82 rock samples were assayed. Newmont terminated the option in late 1980 (Folk and Makepeace, 2007).

Caulfield Resources Ltd. explored over the Vanguard group in 1981 taking 102 soil samples and conducting 5.25 line km of ground magnetic surveys, but no subsequent work was done (Folk and Makepeace, 2007).

Homeridge Resources Ltd. optioned the property from Ruby Collison in 1984, but no work was done (Bryson, 2007). The claims were allowed to lapse in 1986, were re-staked and optioned to Cambria Resources Ltd. (Cambria), which completed geological mapping, lithogeochemical sampling, trenching, and 4.3 line km of IP and resistivity surveying. Weather deferred drilling for that year and the ground was eventually optioned to Noranda Exploration Company Limited (Noranda) (Folk and Makepeace, 2007).

Between 1989 and 1991, Noranda consolidated ground by optioning more area including the Cambria (formerly Collison), Homestake, and Vanguard claims. A 44.3 km grid was cut along which magnetometer and IP surveys were performed in addition to geological mapping. A total of 1,930 rock samples and 1,943 silt and soil samples were taken. Twelve diamond drill holes were cored (diameter unknown) for an aggregate depth of 1,450.05 m (Folk and Makepeace, 2007).

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 6-2 |

| | www.rpacan.com |

Teck acquired the current Homestake Ridge property in 2000 via option agreements and staking. From 2000 to 2002, Teck conducted geochemical and geological surveys, trenching, and diamond drilling, exploring for volcanogenic massive sulphide (VMS) deposits. A total of 21 NQ (47.6 mm dia.) holes were drilled to an aggregate depth of 4,374.6 m yielding 618 core samples. In addition, 778 rock samples were analyzed by Inductively Coupled Plasma (ICP) multi-element geochemistry plus Au and another 31 samples were subjected to “whole rock” X-Ray Fluorescence (XRF) analysis (Folk and Makepeace, 2007).

From 2010 to 2012, Homestake completed additional surface exploration including further mapping, soil and rock sampling and 13.54 line km of IP geophysical surveys, and diamond drilling.

In 2011 a new discovery was made 800 m to the southwest of, and parallel to, the previously discovered Main Homestake and Homestake Silver deposits. This area, known as the South Reef target was tested by three holes with all three intersecting +30 g/t gold mineralization.

During 2012, Homestake completed two phases of drilling focussed on the delineation and extension of the South Reef target. The second phase of drilling was funded by Agnico Eagle Mines Limited (Agnico Eagle) as part of an option agreement (see below). The 2012 drilling was successful in identifying an approximate 250 m strike by 250 m down dip before ending in, or being offset by, a major fault structure. Mineralization is open along strike to the northwest. Other targets on the property remain to be explored.

Agnico Eagle optioned the property from Homestake in 2012. In 2013, Agnico Eagle completed an exploration program consisting of geological mapping, soil sampling (785 samples), approximately 21 line km of ground geophysical surveying including IP/resistivity and magnetics and a 10-hole drilling program totalling 3,947.24 m. The drilling was meant to test various exploration targets outside of the Homestake Main and Homestake Silver deposits (Swanton et al., 2013). In 2014, Agnico Eagle completed a limited amount of prospecting, reconnaissance geological mapping and rock sampling (57 samples) as well as a 6-hole drilling program totalling 2,578 m designed to test the Slide Zone. The drilling suggested that the Slide Zone is concordant with the Homestake Main and Homestake Silver Zones and trends north northwesterly and dips steeply to the northeast.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 6-3 |

| | www.rpacan.com |

PREVIOUS RESOURCE ESTIMATES

The information on the historical Mineral Resource estimates is taken from Macdonald and Rennie (2016).

In 2007, Homestake (at the time Bravo Venture Group Inc.) released a Mineral Resource estimate using an Inverse Distance Cubed (ID3) search method with a maximum search radius of 100 m. The estimate totalled 11.9 Mt of Inferred Mineral Resources grading 2.34 g/t Au, 15.1 g/t Ag, and 0.15% Cu. The cut-off used was 0.5 g/t Au. RPA notes that this resource was preliminary and was estimated to identify the mineral potential of the deposit. No minimum width constraint was applied nor was the resource constrained by a pit shell.

Following diamond drill programs conducted by Homestake in 2008 and 2009, Scott Wilson RPA, updated the Mineral Resource estimate. The March 2010 estimate is summarized in Table 6-1.

Table 6-1 Mineral Resources – March 31, 2010

Auryn Resources Inc. - Homestake Ridge Project

| Zone | Class | Tonnes | Au (g/t) | Ag (g/t) | Cu (%) |

| Main | Indicated | 888,000 | 6.69 | 47.2 | 0.15 |

| | | | | | |

| Main | Inferred | 1,140,000 | 5.02 | 50.9 | 0.25 |

| HS | Inferred | 1,200,000 | 4.25 | 158 | 0.02 |

| | | | | | |

| Total | Inferred | 2,340,000 | 4.62 | 106 | 0.13 |

Notes:

| 1. | CIM definitions were followed for Mineral Resources. |

| 2. | Mineral Resources were estimated at an average cut-off grade of 3.0 g/t Au Equivalent (AuEq). Tonnage and grade at this cut-off is highlighted. |

| 3. | Mineral Resources were estimated using an average long-term gold price of US$1,050 per ounce Au, US$18.00 per ounce Ag, and US$3.25 per pound Cu, with an exchange rate of C$1.00=US$0.90. |

| 4. | Gold equivalence was calculated based on a ratio of metal prices with no provision for metallurgical recoveries. |

In April of 2011, Homestake announced an updated estimate resource for the Homestake Silver deposit completed by RPA, which resulted in a doubling of the previous estimate (Table 6-2). This significantly increased the gold and silver ounces in the combined Main Homestake and Homestake Silver deposits, which were reported as follows at a 3.0 g/t AuEq cut-off.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 6-4 |

| | www.rpacan.com |

Table 6-2 Mineral Resources – December 31, 2010

Auryn Resources Inc. - Homestake Ridge Project

| Zone | Class | Tonnes | Au (g/t) | Ag (g/t) | Cu (%) |

| Main | Indicated | 888,000 | 6.69 | 47.2 | 0.15 |

| | | | | | |

| Main | Inferred | 1,140,000 | 5.02 | 50.9 | 0.25 |

| HS | Inferred | 2,920,000 | 3.69 | 123 | n/a |

| | | | | | |

| Total | Inferred | 4,060,000 | 4.06 | 103 | n/a |

| 1. | CIM definitions were followed for Mineral Resources. |

| 2. | Mineral Resources were estimated at an average cut-off grade of 3.0 g/t Au Equivalent (AuEq). |

| 3. | Mineral Resources for Homestake Main were estimated using an average long-term gold price of US$1,050 per ounce Au, US$18.00 per ounce Ag, and US$3.25 per pound Cu, with an exchange rate of C$1.00=US$0.90. |

| 4. | Gold equivalence was calculated based on a ratio of 62:1 Ag to Au with no provision for metallurgical recovery. |

In 2013, Homestake announced an updated resource prepared by RPA using block models constrained by wireframe models. Grade for gold, silver, copper, arsenic, and antimony were estimated into the blocks using ID3 weighting. Three block models, one for each of the three main deposit zones, were created using GEMS (Gemcom) software. Block size for all models was 5 m x 5 m x 5 m. The wireframe models were constructed in Surpac by Homestake personnel, working in consultation with RPA. The assay data comprised drilling and trench sampling results from programs conducted by Homestake. The Mineral Resource estimate was reported in a NI 43-101 report prepared for Homestake as of December 31, 2012 (Macdonald and Rennie, 2013) and subsequently in a readdressed NI 43-101 report prepared for Auryn (Macdonald and Rennie, 2016). The effective date of the readdressed Mineral Resource estimate remained unchanged and the estimate is summarized in Table 6-3.

TABLE 6-3 MINERAL RESOURCES – DECEMBER 31, 2012

Auryn Resources Inc. - Homestake Ridge Project

| Zone | Class | Tonnes | Au (g/t) | Ag (g/t) | Cu (%) |

| Main | Indicated | 604,000 | 6.40 | 48.3 | 0.18 |

| | | | | | |

| Main | Inferred | 2,031,000 | 5.65 | 28.60 | 0.31 |

| HS | Inferred | 4,400,000 | 2.85 | 130.40 | 0.03 |

| SR | Inferred | 332,000 | 13.04 | 3.60 | 0.04 |

| | | | | | |

| Total | Inferred | 6,763,000 | 4.19 | 93.60 | 0.11 |

| 1. | CIM definitions were followed for Mineral Resources. |

| 2. | Mineral Resources are estimated at a Net Smelter Return (NSR) cut-off value of US$85/t. |

| 3. | Mineral Resources are estimated using an average long-term gold price of US$1,500 per ounce Au, US$27.00 per ounce Ag, and US$3.50 per pound Cu, with an exchange rate of C$1.00=US$1.00. |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 6-5 |

| | www.rpacan.com |

The December 2012 block model was reviewed with respect to new data and cost and metal price assumptions. In RPA’s opinion, that block model remains representative of the mineralization and therefore suitable to report Mineral Resources. As discussed in Section 14, Mineral Resource Estimate of this report, cut-off grades were adjusted based on updated metal price, exchange rate, and operating cost assumptions and the Mineral Resource was assigned a new effective date of September 1, 2017.

Past Production

In 1939, British Lion shipped eight tonnes of selected ore that returned 1,120 g Au, 1,617 g Ag, 63.5 kg Pb, 303 kg Zn, and 599 kg Cu from the Homestake group of claims (Bryson, 2007). This is the only known production from the Property.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 6-6 |

| | www.rpacan.com |

7 Geological Setting and Mineralization

Regional Geology

Section 7 of this report is taken from Macdonald and Rennie (2016).

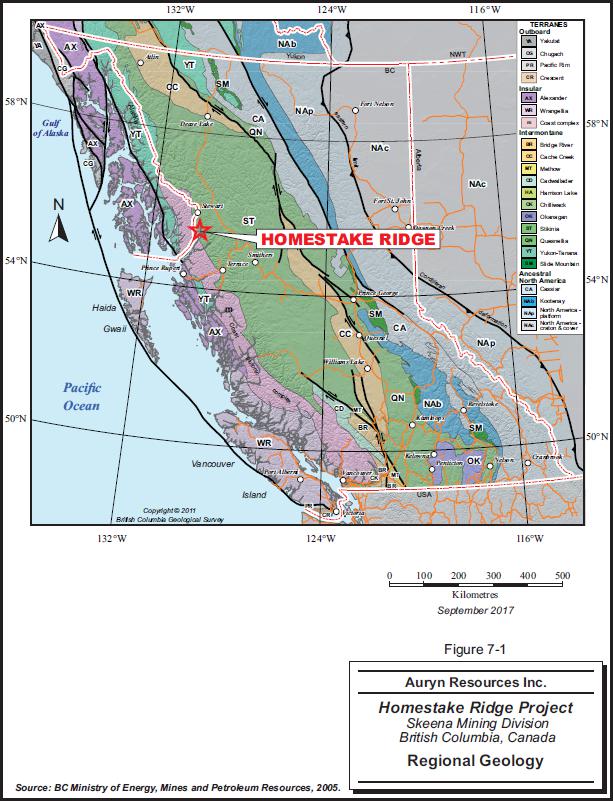

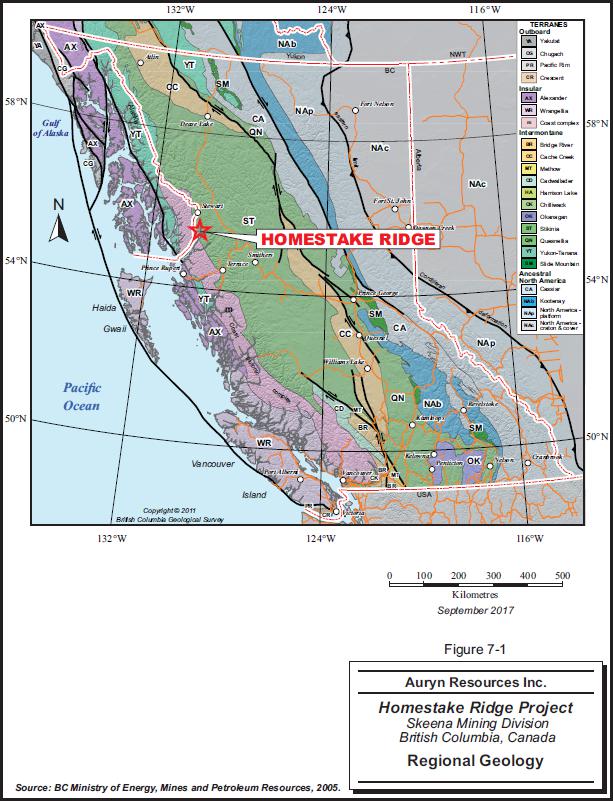

Four major building blocks constitute the terrane superstructure of northwestern British Columbia as shown on Figure 7-1 (Colpron and Nelson (2011): a western block of poly-deformed, metamorphosed Proterozoic to middle Paleozoic peri-continental rocks (Nisling Assemblage); an eastern block of exotic oceanic crustal and low-latitude marine strata (Cache Creek Terrane); central blocks including Paleozoic Stikine Assemblage and Triassic arc-volcanic and flanking sedimentary rocks of Stikine Terrane; and overlying Late Triassic to Middle Jurassic arc-derived strata of the Whitehorse Trough (including the Inklin overlap assemblage).

The following description of the Regional Geology is derived from Kasper and Metcalfe (2004), Knight and Macdonald (2010).

The Homestake Ridge property is located within a lobe of Upper Triassic to Middle Jurassic strata exposed along the western edge of the Bowser Basin within the Stikinia Terrane of the Intermontane Belt. Stikinia formed in the Pacific Ocean during Carboniferous to Early Jurassic (320 Ma to 190 Ma) and collided with North America during the Middle Jurassic (Folk and Makepeace, 2007).

The Project occurs within the metallogenic region known as the Stewart Complex (Grove 1986, Aldrick, 1993). Described as the contact of the eastern Coast Plutonic Complex with the west-central margin of the successor Bowser Basin, the Stewart Complex ranges from Middle Triassic to Quaternary in age and is comprised of sedimentary, volcanic and metamorphic rocks (Grove, 1986). The Stewart Complex is one of the largest volcanic arc terranes in the Canadian Cordilleran. It forms a northwest-trending belt extending from the Iskut River in the north and Alice Arm in the south. The Coast Plutonic Complex forms the western boundary of the prospective stratigraphy; continental derived sediments of the Bowser Lake Group form the eastern border. The Stewart Complex is host to more than 200 mineral occurrences including the historic gold mines Eskay Creek, Silbak-Premier and SNIP, as well as the Granduc, Anyox and Dolly Varden-Torbrit base-metal and silver mines. The dominant mineral occurrences are precious metal vein type, with related skarn, porphyry, and massive sulphide occurrences (Knight and Macdonald, 2010).

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 7-1 |

| | www.rpacan.com |

Stikinia, which contains both the Stewart Complex and the Homestake Ridge Property, is comprised of at least four Paleozoic to Cenozoic tectonostratigraphic packages (Kasper and Metcalfe, 2004) including: Paleozoic Stikine Assemblage consisting of quartz-rich rocks, carbonate slope deposits, and minor mafic to felsic volcanic rocks; Early Mesozoic volcanic and inter-arc and back-arc basin sedimentary rocks; Middle to Upper Jurassic Bowser Basin turbiditic sedimentary rocks; and Tertiary post-kinematic granitoid intrusions of the Coast Plutonic Complex.

Magmatic episodes of Stikinia alternated with the development of sedimentary basins. These basins formed during the Late Triassic to Early Jurassic, the Toarcian to Bajocian (183 to 168 Ma) and the Bathonian to Oxfordian (168 Ma to157 Ma) ages. The basin which formed during the Toarcian-Bajocian is of considerable importance because this west-facing, north-trending back arc basin contains the Eskay Creek “contact zone” rocks (Hazelton Group), which are overlain by Middle and Upper Jurassic marine basin sediments (Bowser Lake Group).

At least two periods of deformation occurred in the region, a contractional deformation during the post-Norian-pre-Hettangian (204 Ma to 197 Ma) and an Early Jurassic hiatus. These periods of deformation are represented by unconformities one of which also separates two metalliferous events that took place in the Early Jurassic (e.g., Silbak-Premier and SNIP) and Middle Jurassic (e.g., Eskay Creek).

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 7-2 |

| | www.rpacan.com |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 7-3 |

| | www.rpacan.com |

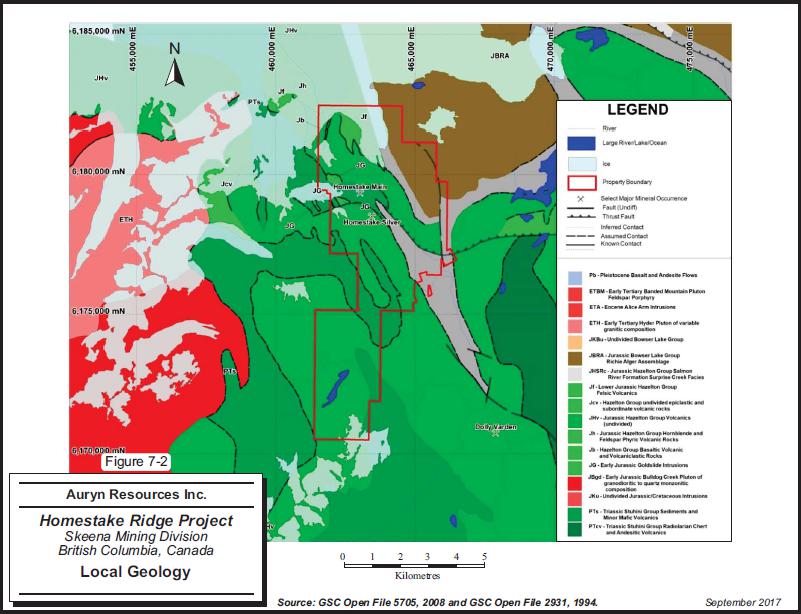

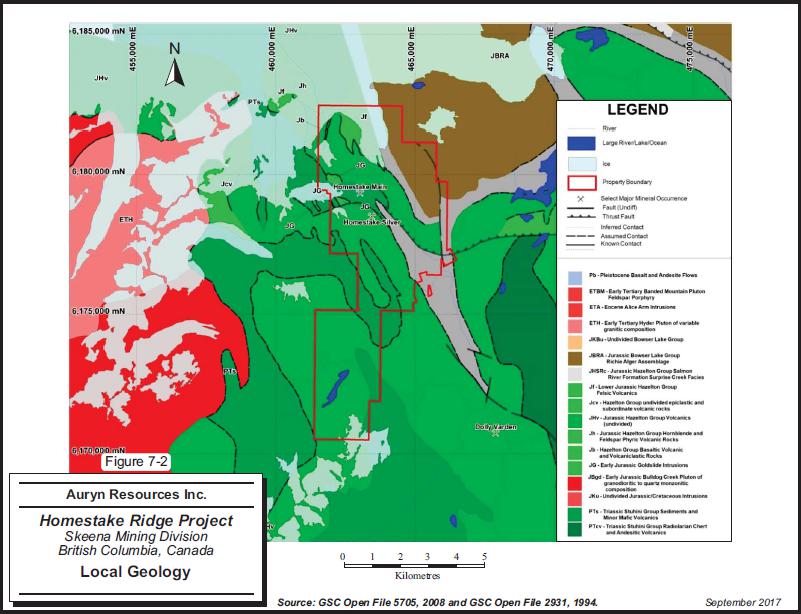

Local Geology

This section is derived from Kasper and Metcalfe (2004) and Knight and Macdonald (2010). Figure 7-2 illustrates the Local Geology.

The Stuhini Group rocks are found in the cores of anticlines and represent the oldest known rocks in the area. These rocks are composed of a thick sequence of volcanic and sedimentary rocks of Upper Triassic (Norian) age, interpreted as the products of a volcanic arc. The volcanic Stuhini Group rocks are generally pyroxene-bearing, a contrast to the well-defined early crystallized hornblende phenocrysts commonly found in the Lower Jurassic Hazelton Group volcanic rocks. Kasper and Metcalfe noted that the re-evaluation of bedrock mapping in the Homestake Ridge area in 2002 resulted in the assignation of some lithologies on the property to the Stuhini Group.

The Hazelton Group overlies the Stuhini Group. The Lower Jurassic Hazelton Group is represented by a lower unit comprising massive, hornblende+feldspar-phyric andesitic to latitic ignimbrites, flows and associated volcanic sedimentary rocks. Overlying these intermediate volcanic rocks is the Lower-Middle Jurassic Eskay Creek stratigraphy composed of marine felsic volcanic rocks and associated epiclastic sedimentary rocks and fossiliferous clastic sedimentary rocks. Kasper and Metcalfe noted that rocks of similar lithology and stratigraphic relationship have been identified in the Homestake Ridge area.

The dominant local intrusive rocks are of Cretaceous to Eocene age associated with the Coast Plutonic Complex. However, intrusive rocks identified in the Homestake Ridge area are hornblende+feldspar phyric and resemble Early Jurassic Texas Creek Suite rocks, which are related to important mineralization elsewhere in the Stewart Complex.

Important local deposits include the Dolly Varden-Torbrit Silver camp located ten kilometres south of the Homestake Ridge property, which produced 19.9 million oz Ag and 11 million lb Pb, and various properties in the Stewart area such as Red Mountain, Granduc, Silbak-Premier and Brucejack Lake. Some of the mineralization on the Homestake Ridge property is thought to be similar in age and genesis to the VMS deposit at Eskay Creek, located about 115 km to the north-northwest.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 7-4 |

| | www.rpacan.com |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 7-5 |

| | www.rpacan.com |

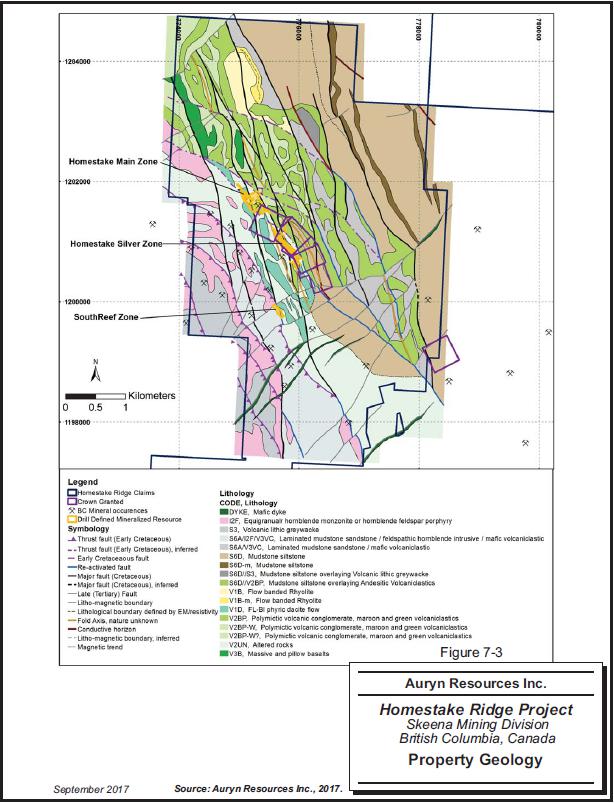

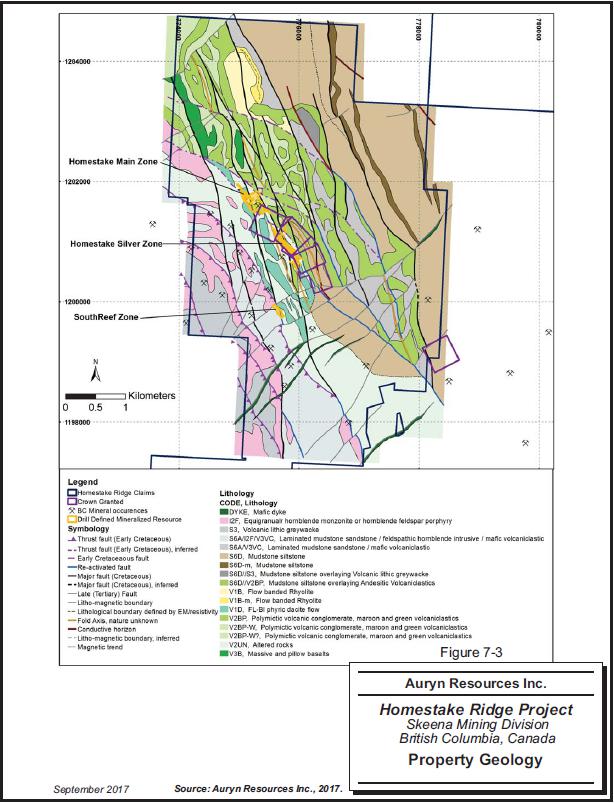

Property Geology

This section is derived from Kasper and Metcalfe (2004), Knight and Macdonald (2010), and the results for mapping on the property by Homestake over the last several years. Figure 7-3 illustrates the Property Geology. The southern part of the property has been omitted from this map because no property scale geological mapping has been conducted on these claims. These were staked in December 2012 and became part of the property.

The Homestake Project covers the transition between the sedimentary and volcanic rocks of the Upper Triassic to Lower Jurassic Stuhini Group, a complex sequence of Lower to Middle Jurassic sedimentary, volcanic and intrusive rocks of the Hazelton Group and sedimentary rocks of the Upper to Middle Jurassic Bowser Lake Group. The Hazelton Group rocks on the Homestake property mark a transition from a high-energy volcanic dominated lower stratigraphy through a hiatus and into a fining sequence of volcanic tuffs and sediments punctuated by bi-modal mafic and felsic volcanism and finally into fine clastic sedimentation of the Salmon River Formation (Upper Hazelton Stratigraphy) and the Bowser Lake Group (Evans and Lehtinen, 2001). This sequence hosts many sulphide occurrences and extensive areas of alteration on the property which are associated with the Lower to Middle Jurassic stratigraphy.

The oldest lithology on the property is marine sediments believed to be related to the Upper Triassic to Lower Jurassic Stuhini Group (unit LS). Sediments within this package vary from thinly bedded black mudstone-siltstone to grey sandstone to pebble to cobble conglomerates.

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 7-6 |

| | www.rpacan.com |

Auryn Resources Inc. – Homestake Ridge Project, Project #2861 Technical Report NI 43-101 – October 23, 2017 | Page 7-7 |

| | www.rpacan.com |

Overlying the Stuhini sediments is a complex series of volcanic, sedimentary, and intrusive rocks of the Hazelton Group. The Lower Hazelton rocks comprise fine-grained to feldspar-hornblende phyric volcanic and volcaniclastic rocks of andesite to latite/trachyte composition (unit LF), and may include some phases of hypabyssal monzonite. This lower stratigraphy of the Hazelton extends along the length of the Homestake Ridge from the Main Homestake to the Vanguard Copper showings and is the host rock and footwall sequences to the three known mineral deposits, the Main Homestake, Homestake Silver and South Reef zones as well as numerous other showings. Porphyritic monzonite dykes and hypabasal domes (unit MONZ) intrude the Stuhini sediments and are believed to be coeval with the Lower Hazelton volcanic rocks. Greig et al (1994) has related the Lower Hazelton Group feldspar-hornblende porphyry volcanic package to the Goldslide Intrusions at Red Mountain and refer to them as unit Jkg on the regional scale.