UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended August 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 333-174780

POSTMEDIA NETWORK CANADA CORP.

(Exact names of registrants as specified in their charters)

N/A

(Translation of registrant’s name into English)

Postmedia Network Canada Corp.

Canada

(Jurisdiction of incorporation or organization)

98-0667225

(I.R.S. Employer Identification No.)

1450 Don Mills Road

Toronto, Ontario Canada M3B 2X7

(416) 383-2300

(Address, of each of the registrants’ principal executive offices)

Douglas Lamb, Executive Vice President and Chief Financial Officer

1450 Don Mills Road

Toronto, Ontario Canada M3B 2X7

Phone: (416) 383-2300 Fax: 416-443-6046

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

12.50% Senior Secured Notes due 2018

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

1,091,115 Class C voting shares and 39,232,055 Class NC variable voting shares

outstanding as of August 31, 2011

Indicate by check mark if the registration is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated file ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

¨ U.S. GAAP | | ¨ International Financial Reporting Standards as issued by the International Accounting Standards Board | | x Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17.¨ Item 18. x

If this is an annual report, indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

TABLE OF CONTENTS

GENERAL INFORMATION

Unless otherwise indicated, all references herein are to Canadian dollars.

Capitalized terms, except as otherwise defined herein, are defined in the section entitled “Glossary of Terms.”

Except as otherwise indicated or the context otherwise requires in this annual report, for periods prior to the Acquisition references to “the Corporation,” “the Company,” “we,” “us” and “our” refer to Canwest LP and its consolidated subsidiaries; and for periods following the Acquisition those terms refer to Postmedia Network Canada Corp. and, if the context requires, its consolidated subsidiaries.

We are incorporated under theCanada Business Corporations Act,which we refer to as the “CBCA.” Our principal executive offices are located at 1450 Don Mills Road, Toronto, Ontario M3B 2X7 and our telephone number at that address is (416) 383-3300. Our website is located athttp://www.postmedia.com. Information about us is included on our website. Our website and the information contained on our website are not part of this report.

Glossary of Terms

In this annual report, the following terms will have the meanings set forth below, unless otherwise indicated. Words importing the singular include the plural and vice versa and words importing any gender include all genders.

“ABL Collateral” means the accounts receivable, cash and cash equivalents, inventory and related assets of Postmedia Network Inc. and the guarantors, which constitute collateral for the ABL Facility on a first-priority basis, for the Term Loan Facility on a second-priority basis and for the Notes on a third-priority basis.

“ABL Facility” has the meaning ascribed to such term in Item 10.C Material Contracts – The ABL Facility Credit Agreement.

“Acquisition” has the meaning ascribed to such term in Item 4.A History and Development of the Company.

“Acquisition Consideration” has the meaning ascribed to such term in Item 4.A History and Development of the Company.

“Acquisition Date” means July 13, 2010.

“Ad Hoc Committee” means the ad hoc committee of senior subordinated noteholders and lenders of Canwest LP.

“annual report” means this annual report.

“Asset Purchase Agreement” means an asset purchase agreement dated May 10, 2010 that was entered into in connection with the implementation of the Plan under the CCAA relating to the LP Entities, whereby Postmedia Network Inc. purchased substantially all of the assets, including the shares of National Post Inc., and assumed certain liabilities of Canwest LP for $1.047 billion.

“Assumed Typographers” has the meaning ascribed to such term in Item 8.A Consolidated Statements and Other Financial Information – Legal Proceedings.

“Board” or “Board of Directors” means the board of directors of Postmedia Network Canada Corp.

“Borrowing Base” means the excess availability that Postmedia Network Inc. is required to maintain at all times in accordance with specific reserve calculations contained in the ABL Facility.

4

“Business Day” means a day on which banks are open for business in Toronto, but does not include a Saturday, Sunday or a holiday in the Province of Ontario.

“Canadian Tranche” has the meaning ascribed to such term in Item 10.C Material Contracts – The Term Loan Facility Credit Agreement.

“Canwest Global” means Canwest Global Communications Corp., a corporation incorporated under the laws of Canada and, prior to the Acquisition, the indirect parent company of Canwest LP.

“Canwest Group” means Canwest Global and its subsidiaries, but specifically excluding the LP Entities.

“Canwest LP” means the Canwest Limited Partnership/Canwest Societe en Commandite, a limited partnership formed under the laws of the province of Ontario whose general and limited partnership interests were owned by Canwest (Canada) Inc. and 4501071 Canada Inc., respectively, together with its subsidiaries.

“CBCA” means theCanada Business Corporations Act.

“CBI” means Canwest Books Inc., a corporation incorporated under the laws of Canada and a wholly-owned subsidiary of CPI.

“CCAA” means theCompanies’ Creditors Arrangement Act (Canada).

“CCI” means Canwest (Canada) Inc., a corporation incorporated under the laws of Canada and a wholly-owned subsidiary of 4501071 Canada Inc.

“CEP” means the Communications, Energy and Paperworkers’ Union of Canada, Local 145.

“CEP Application” has the meaning ascribed to such term in Item 8.A Consolidated Statements and Other Financial Information – Legal Proceedings.

“Corporation” means Postmedia Network Canada Corp.

“Court” means the Ontario Superior Court of Justice (Commercial List).

“CPI” means Canwest Publishing Inc./Publications Canwest Inc., a corporation incorporated under the laws of Canada and a wholly-owned subsidiary of CCI.

“digital media and online” means the digital media assets and the online websites of the Corporation reported within both the Newspapers segment and the All other segment category.

“Disposed Properties” has the meaning ascribed to such term in Item 4.A History and Development of the Company.

“dollars” or “$” means Canadian dollars.

“DSU” means a right to receive, on a deferred basis, an amount of money subject to and in accordance with the terms of the DSU Plan, credited to a Member (as such term is defined in the DSU Plan) and reflected as an entry in a Member’s DSU Account (as such term is defined in the DSU Plan) in accordance with the DSU Plan.

“DSU Plan” means the deferred share unit plan of the Corporation dated as of July 13, 2010.

“EDGAR” means the Electronic Data-Gathering, Analysis and Retrieval system of the US Securities and Exchange Commission.

5

“Exchange Notes” has the meaning ascribed to such term in Item 10.C Material Contracts – The Notes Indenture and Registration Rights Agreement.

“First Amendment” has the meaning ascribed to such term in Item 10.C Material Contracts – The First Amendment to the Term Loan Facility.

“fiscal year” means the twelve month period ending on August 31 of such year.

“Funding Commitment” has the meaning ascribed to such term in Item 4.A History and Development of the Company.

“GAAP” means generally accepted accounting principles in accordance with Part V of the Handbook of the Canadian Institute of Chartered Accountants.

“IFRS” means International Financial Reporting Standards in accordance with Part 1 of the Handbook of the Canadian Institute of Chartered Accountants.

“LIBOR”means the London Interbank Offered Rate.

“LP Entities” means CPI, CBI, CCI and Canwest LP.

“MD&A” means Postmedia Network Canada Corp’s management’s discussion and analysis for the year ended August 31, 2011, attached hereto as Exhibit 15.2

“Minister of Heritage” has the meaning ascribed to such term in Item 8.A Consolidated Statements and Other Financial Information – Legal Proceedings.

“NADbank” means NADbank Inc.

“National Post” means the daily national newspaper published by the Corporation.

“Newspaper operations” means the print operations of the Corporation reported within the Newspapers segment.

“Non-Canadian” has the meaning ascribed to such term in Item 10.B Memorandum and Articles of Association – Voting Shares.

“Notes” means the 12.50% Senior Secured Notes due 2018 issued by Postmedia Network Inc.

“Option” means a right to purchase Voting Shares or Variable Voting Shares, as applicable, under the Option Plan.

“Option Plan” means the stock option plan of the Corporation dated as of July 13, 2010.

“OTRA” has the meaning ascribed to such term in Item 4.A History and Development of the Company – Intercompany Reorganizations.

“PES” means Postmedia Editorial Services.

“PIA” means Postmedia Integrated Advertising.

“Plan” has the meaning ascribed to such term in Item 4.A History and Development of the Company.

“PN” means Postmedia News.

6

“Postmedia” means Postmedia Network Canada Corp.

“Postmedia Rights Plan”means the shareholder rights plan agreement entered into between Postmedia and Computershare Investor Services Inc., as rights agent.

“Qualifying Public Corporations” has the meaning ascribed to such term in Item 4.B Business Overview – Regulation.

“Sarbanes-Oxley” means theSarbanes-Oxley Act of 2002.

“SEDAR” means the System for Electronic Data Analysis and Retrieval.

“Shares” means, collectively, the Voting Shares and the Variable Voting Shares.

“Tax Act” means theIncome Tax Act (Canada).

“Term Loan Collateral” means substantially all the assets of Postmedia Network Inc. and the guarantors (other than ABL Collateral) and certain customary exclusions, which constitutes collateral for the Term Loan Facility on a first-priority basis, for the ABL Facility on a third-priority basis and for the Notes on a second-priority basis.

“Term Loan Facility” has the meaning ascribed to such term in Item 10.C Material Contracts – The Term Loan Facility Credit Agreement.

“Transaction”has the meaning ascribed to such term in Item 4.A History and Development of the Company.

“TSX” means the Toronto Stock Exchange.

“Tranche C” has the meaning ascribed to such term in Item 10.C Material Contracts – The First Amendment to the Term Loan Facility.

“Typographers” has the meaning ascribed to such term in Item 8.A Consolidated Statements and Other Financial Information – Legal Proceedings.

“US$” and “US dollars” means United States dollars.

“US Tranche” has the meaning ascribed to such term in Item 10.C Material Contracts – The Term Loan Facility Credit Agreement.

“Variable Voting Shares” means the Class NC variable voting shares in the capital of the Corporation, which trade on the TSX under the symbol PNC.B.

“Voting Shares” means the Class C voting shares in the capital of the Corporation which trade on the TSX under the symbol PNC.A.

NOTICE REGARDING FORWARD LOOKING STATEMENTS

This annual report includes statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, and therefore are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or

7

comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this annual report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate. These statements reflect management’s current beliefs with respect to future events and are based on information currently available to management. Forward-looking statements involve significant known and unknown risks, uncertainties and assumptions. Many factors could cause the Corporation’s actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, without limitation, those listed in the “Risk Factors” section of the MD&A attached hereto as Exhibit 15.2. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements could vary materially from those expressed or implied by the forward-looking statements contained in this annual report. Such risks include, but are not limited to: competition from other newspapers and alternative forms of media; the Corporation’s ability to compete successfully in newspaper and online industries; the influence of prevailing economic conditions and the prospects of the Corporation’s advertising customers on advertising revenue; the failure to fulfill the Corporation’s strategy of building its digital media and online businesses; failure to maintain print and online newspaper readership and circulation levels; the negative impact of decreases in advertising revenue on results of operations; financial difficulties of certain contractors and vendors; competition with alternative emerging technologies; not being able to achieve a profitable balance between circulation levels and advertising revenues; not realizing anticipated cost savings from cost savings initiatives; seasonal variations; intellectual property rights; damage to the Corporation’s reputation; variations in the cost and availability of newsprint; disruptions in information systems and technology and other manufacturing systems; labour disruptions; equipment failure; environmental, health and safety laws and regulations; controversial editorial content; unresolved litigation matters; failure to comply with “Canadian Newspaper” status; the collectability of accounts receivable; goodwill and intangible asset impairment charges; disruptions in the credit markets; changes to insurance policies; under-funded registered pension plans; changes in pension fund investment performance; foreign exchange fluctuations; increases in distribution costs due to increases in fuel prices; outsourcing certain aspects of the business to third-party vendors; retaining and attracting sufficient qualified personnel; the occurrence of natural or man-made disasters; compliance withSarbanes-Oxley Act; internal controls; change of laws; the substantial indebtedness of the Corporation and the possibility that it may be able to incur substantially more debt; the terms of the ABL Facility, the Term Loan Facility and the indenture that governs the Notes, may restrict the Corporation’s operating subsidiary’s current and future operations; interest rate risks; the possibility that the Corporation’s subsidiaries will not be able to generate sufficient cash to service all of their indebtedness; the possibility that an active public market for the shares will not develop; volatility of the market price for Shares; dual class share structure; holding company structure; risks relating to the future sales of Shares by directors and officers and risks relating to dilution. See the section entitled “Risk Factors” in the MD&A dated October 27, 2011, attached hereto as Exhibit 15.2 and which is posted on SEDAR, EDGAR and the Corporation’s website at www.postmedia.com, for a complete list of risks relating to an investment in the Corporation. Said risk factors are incorporated in this annual report by reference. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. These factors should not be construed as exhaustive and should be read with the other cautionary statements in this annual report.

Any forward-looking statements which are made in this annual report speak only as of the date of such statement, and the Corporation does not undertake, and specifically decline, except as required by applicable law, any obligation to update such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. All of the forward-looking statements made in this annual report are qualified by these cautionary statements.

8

This annual report includes market share, ranking, industry data and forecasts that the Corporation obtained from industry publications, surveys, public filings, documents and internal sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. The Corporation has not independently verified any of the data from third-party sources nor has it ascertained the underlying economic assumptions relied upon therein.

NOTICE REGARDING PRESENTATION OF FINANCIAL INFORMATION

The financial statements included in this annual report are presented in Canadian dollars. In this annual report, references to “$” and “dollars” are to Canadian dollars and references to “US$” and “US dollars” are to United States dollars. See Item 3.A Selected Financial Date – Currency and Exchange Rates.

The financial statements included in this annual report have been prepared in accordance with Part V of Canadian generally accepted accounting principles, or “GAAP.”

References to fiscal years refer to years ended August 31 of the relevant year.

The Corporation is a holding company that has a 100% interest in its subsidiary Postmedia Network Inc. The Corporation was incorporated on April 26, 2010 to purchase indirectly, the assets and certain liabilities of Canwest Limited Partnership, or “Canwest LP,” on July 13, 2010, which we refer to as the “Acquisition.” Concurrent with such Acquisition, Postmedia Network Canada Corp. issued 27 million shares for gross proceeds of $250 million. Pursuant to the asset purchase agreement, which we will refer to as the “Asset Purchase Agreement,” in connection with the implementation of the Plan under theCompanies’ Creditors Arrangement Act (Canada), which we refer to as the “CCAA,” relating to the LP Entities and certain of their affiliates, Postmedia Network Inc., purchased substantially all of the assets, including all of the outstanding shares of National Post Inc., and assumed certain liabilities of Canwest LP, for $927.8 million payable in cash and the issuance of 13 million shares of the Corporation.

In accordance with the Canadian Securities Administrators requirements, the Corporation will report under GAAP, until it is required or elects to adopt International Financial Reporting Standards or “IFRS,” which takes effect for fiscal years beginning on or after January 1, 2011 with a required restatement of the comparative period. The Corporation has adopted IFRS effective September 1, 2011 and as a result our interim consolidated financial statements for the three months ending November 30, 2011 will be the first interim consolidated statements required to be prepared in accordance with IFRS. A description of the status of the Corporation’s IFRS transition is included in our MD&A, attached hereto as Exhibit 15.2. Accordingly, investors should consider this in making their investment decision.

GAAP AND NON-GAAP FINANCIAL MATTERS

Unless otherwise indicated, all financial statement data in this annual report has been prepared using GAAP. This annual report also makes reference to certain non-GAAP financial measures. Non-GAAP financial measures do not have any standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other issuers. Rather, these measures are provided as additional information to complement GAAP measures by providing a further understanding of our results of operations from management’s perspective. Accordingly, non-GAAP measures should not be considered in isolation or as a substitute for analysis of our financial information reported under GAAP. See “Differences between Canadian and US GAAP” in our MD&A, attached hereto as Exhibit 15.2.

Additionally, GAAP differs from U.S. GAAP in several respects. For a discussion of the principal differences between GAAP and U.S. GAAP, see note 20 to our audited consolidated financial statements for the year ended August 31, 2011, attached hereto as Exhibit 15.1.

9

PART 1

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

Set forth below is selected financial data of Postmedia and Canwest LP, at the dates and for the periods indicated.

The selected financial data as of and for the year ended August 31, 2011 and the period from July 13, 2010 to August 31, 2010 has been derived from Postmedia’s audited consolidated financial statements for the year ended August 31, 2011 and the period ended August 31, 2010, attached hereto as Exhibit 15.1, which have been audited by PricewaterhouseCoopers LLP, our independent auditors.

The selected financial data as of and for the years ended August 31, 2007, August 31, 2008, August 31, 2009 and for the nine months ended May 31, 2010 and the period from June 1, 2010 to July 12, 2010 has been derived from Canwest LP’s audited financial statements for the periods ended May 31, 2010 and July 12, 2010 and the years ended August 31, 2009, August 31, 2008 and August 31, 2007. Canwest LP’s audited financial statements for the periods ended May 31, 2010 and July 12, 2010 and years ended August 31, 2009 and August 31, 2008 have been audited by PricewaterhouseCoopers LLP, its independent auditors.

Canwest LP adopted the liquidation basis of accounting as of May 31, 2010 and as a result, did not present a statement of earnings or statement of cash flows subsequent to May 31, 2010 or a balance sheet as at May 31, 2010 or subsequent thereto.

The selected financial data should be read in conjunction with, and are qualified by reference to, Items 4 and 5 of this annual report on Form 20-F, the audited consolidated financial statements, attached hereto as Exhibit 15.1, and related notes of Postmedia for the year ended August 31, 2011 and the period ended August 31, 2010 and the audited financial statements and related notes of Canwest LP for the periods ended May 31, 2010 and July 12, 2010 and the years ended August 31, 2009 and August 31, 2008. In addition, the historical financial statements of Canwest LP are not comparable to the financial statements of Postmedia following the Acquisition due to the effect of the Plan (such terms as defined below in Item 4.A.) and related events as discussed in Item 4.A. History and Development of the Company.

Canwest LP’s historical financial data has been reclassified to be consistent with Postmedia’s segment presentation.

Our financial information is prepared in accordance with GAAP. GAAP differs from U.S. GAAP in several respects. For a discussion of the principal differences between GAAP and U.S. GAAP, see note 20 to our audited consolidated financial statements for the year ended August 31, 2011 and period ended August 31, 2010, attached hereto as Exhibit 15.1, and note 29 of Canwest LP’s audited financial statements for the periods ended May 31, 2010 and July 12, 2010 and years ended August 31, 2009 and August 31, 2008.

10

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Canwest LP | | | Postmedia | |

| | | Year ended August 31, | | | Nine

months

ended May

31, | | | Period from

June 1, 2010

to July 12, | | | Period from

July 13, 2010

to August 31, | | | Year ended

August 31, | |

($ in millions) | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2010 | | | 2010 | | | 2011 | |

Statement of operations data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 1,282.5 | | | $ | 1,298.1 | | | $ | 1,099.1 | | | $ | 811.2 | | | $ | 119.2 | | | $ | 122.1 | | | $ | 1,019.1 | |

Operating expenses | | | 1,013.1 | | | | 1005.0 | | | | 927.2 | | | | 650.3 | | | | 99.7 | | | | 111.4 | | | | 818.0 | |

Amortization(1) | | | 49.6 | | | | 48.8 | | | | 40.5 | | | | 30.7 | | | | 7.1 | | | | 11.1 | | | | 75.1 | |

Restructuring of operations and other items(2) | | | 6.8 | | | | 10.7 | | | | 28.8 | | | | 2.7 | | | | (0.5 | ) | | | 11.2 | | | | 42.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | | 213.0 | | | | 233.6 | | | | 102.6 | | | | 127.5 | | | | 12.9 | | | | (11.6 | ) | | | 83.2 | |

Interest expense | | | 58.8 | | | | 109.2 | | | | 98.4 | | | | 60.6 | | | | 4.5 | | | | 12.7 | | | | 80.3 | |

Loss on debt prepayment | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 11.0 | |

Other income(3) | | | (2.5 | ) | | | (2.5 | ) | | | (2.5 | ) | | | (1.5 | ) | | | (0.3 | ) | | | — | | | | — | |

Loss (gain) on disposal of property and equipment | | | (0.3 | ) | | | 0.6 | | | | (2.2 | ) | | | — | | | | — | | | | — | | | | 0.2 | |

Gain on disposal of investment(4) | | | (1.3 | ) | | | (1.2 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Loss on disposal of interest rate swap(5) | | | (22.5 | ) | | | — | | | | 180.2 | | | | — | | | | — | | | | — | | | | — | |

Ineffective portion of hedging derivative instrument(5) | | | — | | | | — | | | | 60.1 | | | | — | | | | — | | | | — | | | | — | |

Loss (gain) on derivative financial instruments(6) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (7.6 | ) | | | 21.4 | |

Impairment loss on masthead(7) | | | — | | | | — | | | | 28.3 | | | | — | | | | — | | | | — | | | | — | |

Foreign currency exchange (gains) losses(5)(8) | | | 0.1 | | | | (0.5 | ) | | | (154.5 | ) | | | (49.6 | ) | | | (4.5 | ) | | | 9.6 | | | | (18.0 | ) |

Acquisition costs(9) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 18.3 | | | | 1.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net earnings (loss) before reorganization costs and income taxes | | | 180.7 | | | | 128.0 | | | | (105.2 | ) | | | 118.0 | | | | 13.2 | | | | (44.6 | ) | | | (12.9 | ) |

Reorganization costs(10) | | | — | | | | — | | | | 25.8 | | | | 41.2 | | | | 16.5 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net earnings (loss) before income taxes | | | 180.7 | | | | 128.0 | | | | (131.0 | ) | | | 76.8 | | | | (3.3 | ) | | | (44.6 | ) | | | (12.9 | ) |

Provision for (recovery of) income taxes(11) | | | (4.5 | ) | | | (0.4 | ) | | | (8.9 | ) | | | (18.1 | ) | | | n/a | (12) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net earnings (loss) | | $ | 185.2 | | | $ | 128.4 | | | $ | (122.1 | ) | | $ | 94.9 | | | | n/a | (12) | | $ | (44.6 | ) | | $ | (12.9 | ) |

Earnings (loss) per share data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | $ | (1.11 | ) | | $ | (0.32 | ) |

Diluted | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | $ | (1.11 | ) | | $ | (0.32 | ) |

Balance sheet data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Long-term debt (including current portion)(8) | | | 1,352.8 | | | | 1,331.9 | | | | 1,380.1 | | | | n/a | (12) | | | n/a | (12) | | | 646.0 | | | | 572.3 | |

Total assets | | | 720.5 | | | | 684.3 | | | | 654.9 | | | | n/a | (12) | | | n/a | (12) | | | 1,266.2 | | | | 1,180.2 | |

Net assets (liabilities) | | | (1,024.3 | ) | | | (1,107.4 | ) | | | (1,229.0 | ) | | | n/a | (12) | | | n/a | (12) | | | 315.4 | | | | 304.3 | |

Capital stock | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | | n/a | (12)(13) | | | n/a | (12)(13) | | | 371.1 | | | | 371.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

US GAAP data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | | 213.0 | | | | 233.6 | | | | 102.6 | | | | 127.5 | | | | 12.9 | | | | (11.6 | ) | | | 85.2 | |

Net earnings (loss) | | | 162.6 | | | | 97.9 | | | | (90.9 | ) | | | 94.9 | | | | n/a | (12) | | | (44.7 | ) | | | (11.0 | ) |

Earnings (loss) per share | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | $ | (1.11 | ) | | $ | (0.27 | ) |

Diluted | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | | n/a | (13) | | $ | (1.11 | ) | | $ | (0.27 | ) |

Segment operating statistics(15): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Newspapers segment | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue | | | 1,253.3 | | | | 1,261.2 | | | | 1,058.2 | | | | 785.9 | | | | 115.9 | | | | 117.7 | | | | 984.7 | |

Operating profit | | | 305.5 | | | | 318.1 | | | | 182.3 | | | | 169.6 | | | | 22.3 | | | | 17.7 | | | | 222.8 | |

Inter-segment revenue | | | (4.6 | ) | | | (4.3 | ) | | | (4.7 | ) | | | (3.4 | ) | | | (0.5 | ) | | | (0.8 | ) | | | (4.2 | ) |

All other | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue | | | 33.8 | | | | 41.2 | | | | 45.6 | | | | 28.7 | | | | 3.8 | | | | 5.2 | | | | 38.7 | |

Operating profit (loss) | | | 0.7 | | | | 5.3 | | | | 8.0 | | | | 11.0 | | | | 0.3 | | | | (0.8 | ) | | | 13.2 | |

Corporate | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating loss | | | (36.8 | ) | | | (30.3 | ) | | | (18.4 | ) | | | (19.7 | ) | | | (3.1 | ) | | | (6.2 | ) | | | (34.8 | ) |

11

Notes:

| (1) | Amortization reflects amortization of property and equipment and definite life intangibles. The increase in amortization for the period from July 13, 2010 to August 31, 2010 and for the year ended August 31, 2011, reflects the recording of fair value increases to the carrying value of property and equipment and intangible assets as a result of the Acquisition. |

| (2) | Restructuring of operations and other items for the years ended August 31, 2008, 2009 and 2011, and for each of the periods during 2010 primarily relate to employee termination costs for various initiatives undertaken by Canwest LP and Postmedia with the objective of permanently reducing or eliminating costs. These initiatives are largely the result of standardization, centralization, outsourcing and automation of business processes. |

| (3) | Other income recognized by Canwest LP represents a charge to the Canwest group of companies under the shared services agreement for the use of equipment that was owned by Canwest LP. |

| (4) | During fiscal 2007, Canwest LP sold its investment in a joint venture and recorded a gain of $1.3 million. During fiscal 2008, Canwest LP divested an investment in Edmonton Investors Group Holdings Ltd and recorded a gain of $1.2 million. |

| (5) | During fiscal 2007, Canwest LP settled an interest rate swap agreement and recorded a gain of $22.5 million. On May 29, 2009, as a result of a payment default by Canwest LP, the hedging agreements in place were terminated resulting in the termination of hedging derivative instruments. In the year ended August 31, 2009, Canwest LP recorded an interest rate and foreign currency swap loss of $180.2 million, reclassified $60.1 million of accumulated other comprehensive losses to the income statement as a result of hedge ineffectiveness and recorded a foreign currency exchange gain on the related long-term debt of $152.1 million. |

| (6) | Loss (gain) on derivative financial instruments reflects Postmedia’s accounting treatment for a foreign currency interest rate swap that was not designated as a hedge and a variable prepayment option on Postmedia’s Senior Secured Notes that represents an embedded derivative that is accounted for separately at fair value. |

| (7) | During fiscal 2009, due to a decline in operating results, and lower expectations for advertising revenue growth, Canwest LP recorded an impairment charge on intangible assets of $28.3 million related to the masthead of the National Post. |

| (8) | Foreign currency exchange gains and losses were nominal for the years ended August 31, 2007 and 2008 due to hedging agreements that were in place by Canwest LP. For the nine months ended May 31, 2010 and the period ended July 12, 2010, Canwest LP did not enter into any derivatives to hedge foreign currency risk. Postmedia has entered into derivative financial instruments to hedge foreign currency risk on a portion of its US dollar denominated debt, however, Postmedia did not designate all of these derivative financial instruments as hedges and as a result does not use hedge accounting for financial reporting purposes on the fair value swap related to the Term Loan Credit Facility and as a result recorded a foreign currency exchange loss for the period ended August 31, 2010 and a foreign currency exchange gain for the year ended August 31, 2011. See the MD&A – Financial Instruments and Financial Instruments Risk Management, attached hereto as Exhibit 15.2. |

| (9) | Acquisition costs relate to advisory, legal, valuation and other professional fees in connection with the Acquisition of Canwest LP which are non-recurring. |

| (10) | Reorganization costs represent costs that can be directly associated with the reorganization and CCAA filing of Canwest LP. These costs consist of professional fees, advisory fees, management incentive plan and key employee retention plan costs, and foreign currency exchange losses resulting from translating monetary items that are subject to compromise at the period end compared to the translated amounts at January 8, 2010, the date of the CCAA filing, and amounts related to resolution of legal claims outstanding on the date of Canwest LP’s CCAA filing. |

| (11) | Canwest LP was not a taxable entity so the income tax recoveries for the years ended August 31, 2007, August 31, 2008 and August 31, 2009 represent income taxes recoverable of its incorporated subsidiaries. Postmedia had taxable losses for the period ended August 31, 2010 and the year ended August 31, 2011 and has recorded a valuation allowance to reduce the tax recovery to nil in these periods. |

| (12) | Canwest LP adopted the liquidation basis of accounting as of May 31, 2010 and as a result a consolidated balance sheet was not presented. As Canwest LP was under the liquidation basis of accounting for the period from June 1, 2010 to July 12, 2010, the supplementary financial information in note 5 of the annual audited financial statements of Canwest LP did not include a provision for income taxes. Additionally, under the liquidation basis of accounting a balance sheet as at July 12, 2010 and a cash flow statement for the period from June 1, 2010 to July 12, 2010 was not prepared for Canwest LP and as a result balance sheet information as at May 31, 2010 and July 12, 2010, has not been presented in the above table and cash flows from operating activities and additions to property and equipment and intangible assets for the period from June 1, 2010 to July 12, 2010 have also not been presented in the above table. |

| (13) | Canwest LP was a partnership and as a result no capital stock balance has been presented. In addition, earnings per share information has not been provided for the partnership units of Canwest LP. |

| (14) | As of September 1, 2009, Canwest LP began attributing the portion of national display advertising revenues and expenses associated with the newspaper websites to the Newspapers segment. Canwest LP has not restated the prior periods because they are not able to generate the data for earlier periods and, as a result, prior period segment information is not comparable. |

12

Currency and Exchange Rates:

The following table lists the monthly high and low exchange rates for US$1.00 to the Canadian dollar for the following periods based on the noon buying rate for US dollars published by the Bank of Canada. These rates are presented for information purposes. For information about the basis of translating US dollars into Canadian dollars in our financial statements, see note 2 to our audited consolidated financial statements attached hereto as Exhibit 15.1.

| | | | | | | | | | | | |

| Month | | Year | | | High (CAD$) (1) | | | Low (CAD$) (1) | |

August | | | 2011 | | | | 0.9910 | | | | 0.9580 | |

July | | | 2011 | | | | 0.9668 | | | | 0.9449 | |

June | | | 2011 | | | | 0.9861 | | | | 0.9643 | |

May | | | 2011 | | | | 0.9809 | | | | 0.9490 | |

April | | | 2011 | | | | 0.9691 | | | | 0.9486 | |

March | | | 2011 | | | | 0.9918 | | | | 0.9686 | |

| | (1) | noon buying rate for US dollars published by the Bank of Canada |

The following table lists, for each period presented, the high and low exchange rates, the average of the closing exchange rates, or “Closing Rates,” on the last day of each month during the period indicated and the exchange rates at the end of the applicable period for one US dollar, expressed in Canadian dollars, based on the closing rate as announced by the Bank of Canada.

| | | | | | | | | | | | | | | | |

(Canadian dollars) | | High | | | Low | | | Average | | | Period end | |

Year ended August 31, | | | | | | | | | | | | | | | | |

2007 | | $ | 1.1855 | | | $ | 1.0378 | | | $ | 1.1208 | | | $ | 1.0562 | |

2008 | | $ | 1.0693 | | | $ | 0.9215 | | | $ | 1.0067 | | | $ | 1.0620 | |

2009 | | $ | 1.2991 | | | $ | 1.0328 | | | $ | 1.1776 | | | $ | 1.0950 | |

2010 | | $ | 1.1048 | | | $ | 0.9988 | | | $ | 1.0452 | | | $ | 1.0665 | |

2011 | | $ | 1.0535 | | | $ | 0.9428 | | | $ | 0.9893 | | | $ | 0.9794 | |

| | | | | | | | | | | | | | | | |

In this annual report, the relevant period end closing rate has been used to calculate balance sheet data and the average closing rate has been used to calculate statement of operations data. We do not represent that Canadian dollar or US dollar amounts could be converted into US dollars or Canadian dollars, as the case may be, at any particular rate, the rates above, or at all. The closing rate used to record the transactions that occurred on July 13, 2010, including the Acquisition, was $1.0337, which is the closing rate announced by the Bank of Canada on July 13, 2010 to convert one US dollar to one Canadian dollar. On November 23, 2011, the corresponding closing rate was $1.0485.

B. Capitalization and Indebtedness

Not applicable.

C. Reason For the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The Corporation is subject to a number of risks and uncertainties which are described in detail in its MD&A, attached hereto as Exhibit 15.2, under the section entitled “Risk Factors” which section is incorporated by reference in this annual report. The risks and uncertainties described in the MD&A are those the Corporation currently believe to be material but they are not the only ones the Corporation faces. If any of the risks, or any other risks and uncertainties that have not yet been identified or that are currently considered not to be material, actually occur or become material risks, the Corporation’s business, financial condition, results of operations and cash flows and consequently the price of the Shares and Notes could be materially and adversely affected.

13

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

7535538 Canada Inc. was incorporated under the CBCA on April 26, 2010. Its name was changed to Postmedia Network Canada Corp. pursuant to Articles of Amendment filed on June 25, 2010. 7536321 Canada Inc. was incorporated under CBCA on April 27, 2010. Its name was changed to Postmedia Network Inc. pursuant to Articles of Amendment filed on June 25, 2010 and it is a wholly-owned subsidiary of the Corporation.

Both the Corporation and Postmedia Network Inc. were specifically incorporated for the sole purpose of facilitating the acquisition of substantially all of the newspaper and related online, digital, and mobile assets of the LP Entities and National Post Inc. All of the newspapers, online, digital and mobile assets that the Corporation now operate were previously operated by Canwest LP.

Canwest LP was formed on September 7, 2005 under the laws of the Province of Ontario to acquire the newspaper and related online, digital, and mobile assets of CanWest MediaWorks Inc. for purposes of facilitating an income fund spinoff whereby approximately 25.8% of Canwest LP’s business was offered to the public. On May 5, 2007, Canwest LP was privatized pursuant to a privatization agreement and Canwest LP’s business was once again indirectly, but wholly, owned by Canwest Global, a parent company that also wholly owned, among other entities, Canwest Publishing Inc., CBI and CCI.

CPI, CBI, and CCI sought, and on January 8, 2010 obtained, protection under the CCAA granting protection from creditors. Although not itself an applicant, the protections provided by the CCAA were extended to Canwest LP. National Post Inc. was excluded from the CCAA protection.

Pursuant to the Asset Purchase Agreement that was entered into in connection with the implementation of the plan of arrangement and compromise (the “Plan”) under the CCAA relating to the LP Entities, Postmedia Network Inc. purchased substantially all of the assets, including the shares of National Post Inc., and assumed certain liabilities of Canwest LP (the “Acquisition”) for $1.05 billion (the “Acquisition Consideration”). The Acquisition Consideration consisted of cash consideration of $927.8 million and non-cash consideration, through the issuance of equity having a value of $120.1 million. To satisfy the cash portion of the purchase price and to fund certain transaction costs under the Asset Purchase Agreement and the Plan, Postmedia raised an aggregate of $954.4 million of financing, consisting of the Term Loan Facility, the offering of Notes and the Funding Commitment (defined below).

Pursuant to an amended funding commitment letter received by the Corporation and Postmedia Network Inc. (the “Funding Commitment”) and a subscription agreement dated July 2, 2010 (the “Subscription Agreement”), on the Acquisition Date, members of the Ad Hoc Committee or their assignees purchased 27 million Shares of the Corporation for an aggregate of $250 million, which represented at such time approximately 67.5% of the Shares of the Corporation. The proceeds from the sale of the Shares to the members of the Ad Hoc Committee or their assignees pursuant to the Funding Commitment and the Subscription Agreement were contributed by the Corporation to Postmedia Network Inc. as a capital contribution and Postmedia Network Inc. used such capital contribution as part of the consideration for the Acquisition.

The Acquisition closed, and the Plan was implemented, on July 13, 2010 and, at such time, title to and in all of the assets were transferred to Postmedia Network Inc., free and clear of encumbrances (other than certain permitted encumbrances) pursuant to a vesting order of the Court issued on June 18, 2010 and an assignment and assumption agreement dated as of July 13, 2010 between certain of the LP Entities and Postmedia Network Inc.

On January 31, 2011, National Post Inc. was dissolved and its assets and liabilities were transferred to Postmedia Network Inc.

14

On June 7, 2011, the Corporation filed a Prospectus in all provinces of Canada other than Quebec. On June 14, 2011, the Corporation’s Voting Shares and Variable Voting Shares were listed and began trading on the TSX under the symbols “PNC.A” and PNC.B,” respectively.

On October 18, 2011, the Corporation entered into an asset purchase agreement with affiliates of Glacier Media Inc. (the“Transaction”) to sell substantially all of the assets and liabilities of Lower Mainland Publishing Group, Victoria Times Colonist and Vancouver Island Newspaper Group, (collectively, the“Disposed Properties”), for gross proceeds of approximately $86.5 million subject to typical closing adjustments. The gross proceeds less transaction costs (“net proceeds”) are required to be used to repay a portion of the outstanding loans under Tranche C in accordance with the terms and conditions of the Term Loan Facility. On November 21, 2011 GVIC Communications Corp. received a no-action letter from the Commissioner of Competition with respect to its proposed purchase of certain newspaper assets of the Company located on Vancouver Island and the Lower Mainland of British Columbia. The no-action letter satisfies the condition in the purchase agreement relating to the Competition Act. The Transaction is subject to customary closing conditions and other regulatory approvals and is currently expected to close on or about November 30, 2011. Simultaneous with the closing of the Transaction, the Corporation will enter into agreements with the purchaser for the provision of certain services. The information included in this annual report, including, without limitation, information relating to the Corporation’s daily and non-daily newspapers, is based on information prior to the completion of the Transaction.

Intercompany Reorganizations

In 2009, the Canwest Group and the LP Entities determined to undergo discrete and parallel restructurings to separate their businesses, with a view to enabling the Canwest Group and the LP Entities to operate independently of one another as restructured enterprises. The process of disentangling certain shared services commenced in October 2009 through an internal corporate reorganization that was agreed to by the Canwest Group and the LP Entities pursuant to the terms of a transition and reorganization agreement dated October 26, 2009 and related agreements.

In connection with entering into the Asset Purchase Agreement, the Canwest Group and the LP Entities determined that additional steps were necessary to complete the disentanglement of their respective businesses. These steps were set out in an omnibus transition and reorganization agreement (the “OTRA”), dated June 8, 2010, which was approved by the Court in connection with the Plan. Upon consummation of the Acquisition, the OTRA was assigned to Postmedia Network Inc.

B. Business Overview

General

Postmedia is the largest publisher of English-language paid daily newspapers by circulation in Canada, according to Newspapers Canada’s 2010 Circulation Data Report. The Corporation’s English-language paid-daily newspapers have, in total, the highest weekly print readership when compared to the total weekly print readership of English-language paid dailies belonging to each of the other media organizations in Canada, based on the NADbank 2010 survey data. Its business consists of news and information gathering and dissemination operations, with products offered in major Canadian markets and a number of regional and local markets in Canada through a variety of print, online, digital and mobile platforms. The combination of these distribution platforms provides readers with a variety of media through which to access and interact with its content. The breadth of Postmedia’s reach and the diversity of its content enable advertisers to reach their target audiences through the convenience of a single provider, on local, regional and national scales.

Postmedia had an approximately 31% share of Canada’s total daily newspaper paid circulation according to Newspapers Canada’s 2010 Circulation Data Report. The Corporation has the leading English-language paid daily newspapers, based on weekly print readership, in five out of the six largest advertising markets in Canada according to 2010 NADbank survey data. Its daily newspaper brands are among the oldest in Canada with an average publication history of 132 years.

15

Postmedia’s operations consist of news and information gathering and dissemination operations, with products offered in a number of markets across Canada through a variety of daily and community newspapers, online, digital and mobile platforms. The Corporation has one reportable segment, being the Newspapers segment. The Newspapers segment publishes daily and non-daily newspapers, distributes flyers and circulars and operates newspaper websites, including, but not limited to, classified advertising websites, each newspaper’s website andSwarmJam.com.

The Corporation owns and operates ten daily metropolitan newspapers, the National Post, one of Canada’s two daily national newspapers, two other daily community newspapers, and 24 non-daily community newspapers, non-daily shopping guides and newspaper-related publications. Its operations also include Postmedia News, or “PN” a news gathering and dissemination service that provides national and international news and news features to itself and to third parties, Postmedia Editorial Services, or “PES” a newspaper production service, and the Flyer Force, a distribution service for advertising flyers and circulars for third parties.

Postmedia also has an extensive portfolio of digital media and online assets. It owns and represents 58 destination websites that make up thecanada.com network, one of Canada’s leading online general news and information sources, covering its newspapers’ websites, including classified websites (such as driving.ca, working.com and househunting.ca) and other online properties such as dose.ca (an entertainment-focused website), as well as providing sales representation services to third-party branded sites. Thecanada.com network averaged 7.1 million monthly unique visitors in fiscal 2011 (as compared to an average of 6.6 million monthly unique visitors in fiscal 2010). In addition, Postmedia’s digital media and online assets includeFPinfomart.ca, a subscription-based, business-to-business online news monitoring service that provides corporate and financial data on Canadian companies.FPinfomart.ca served approximately 1,100 clients with approximately 55,000 users accessing approximately 5,660 domestic and international sources.

As illustrated in the following table, nine of the Corporation’s ten daily metropolitan newspapers are either the only English-language newspaper in their respective markets or have the leading market position among English-language newspapers in their respective markets, based on average daily paid circulation.

Daily metropolitan newspaper market statistics

| | | | | | | | |

Publication | | Market | | Market

Position(1) | | Local

Market

Share(1) | |

The Province | | Vancouver | | 2(2) | | | 100 | %(4) |

The Vancouver Sun | | Vancouver | | 1 | | | 100 | %(4) |

The Gazette | | Montreal | | 3(3) | | | 100 | % |

Ottawa Citizen | | Ottawa | | 1 | | | 77 | % |

Edmonton Journal | | Edmonton | | 1 | | | 70 | % |

Calgary Herald | | Calgary | | 1 | | | 74 | % |

The Windsor Star | | Windsor | | 1 | | | 100 | % |

Times Colonist | | Victoria | | 1 | | | 100 | % |

The StarPhoenix | | Saskatoon | | 1 | | | 100 | % |

Leader-Post | | Regina | | 1 | | | 100 | % |

Notes:

| (1) | Market positions and local market share are determined by average paid circulation of daily newspapers. Source: Newspapers Canada – 2010 Circulation Data Report. |

| (2) | Second to The Vancouver Sun, which is also operated by the Corporation. |

| (3) | Number one among English language paid daily newspapers, number three overall among paid daily newspapers. |

| (4) | Includes The Vancouver Sun and The Province. |

16

As illustrated in the table below, many of the websites that we own or operate have experienced growth in unique monthly visitors since 2007.

Digital media and online operations — unique monthly average visitor trends

| | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | Fiscal

2007 | | | Fiscal

2008 | | | Fiscal

2009 | | | Fiscal

2010 | | | Fiscal

2011 | |

Sites owned and represented by Postmedia (which comScore refers to as “Postmedia Network”) – Digital and online operations (unduplicated) | | | 4,512 | | | | 4,673 | | | | 6,410 | | | | 7,381 | | | | 7,716 | |

canada.com network(1) (unduplicated) | | | 4,319 | | | | 4,600 | | | | 5,551 | | | | 6,602 | | | | 7,077 | |

Postmedia newspapers(2) | | | 2,236 | | | | 2,320 | | | | 3,065 | | | | 4,050 | | | | 4,825 | |

canada.com television(3) | | | 703 | | | | 1,042 | | | | 1,415 | | | | 1,720 | | | | 2,049 | |

canada.com classifieds(4) | | | 1,859 | | | | 1,636 | | | | 1,339 | | | | 1,309 | | | | 1,496 | |

dose.ca network | | | N/A | | | | N/A | | | | 626 | | | | 601 | | | | 495 | |

Third-party represented sites which do not form part of thecanada.com network(5) | | | N/A | | | | N/A | | | | 1,910 | | | | 1,413 | | | | 1,031 | |

Source: comScore, Inc., Total Canada, Home & Work, All Persons 2+, Monthly Average Sept 2007 to Aug 2011.

Notes:

| (1) | Includes Postmedia newspapers, canada.com classifieds, dose.ca network and canada.com television. |

| (2) | As of April, 2011, the definition became Postmedia newspapers. Prior to this, the definition was canada.com newspapers. |

| (3) | For fiscal 2007 to fiscal 2011, canada.com television custom data was supplied by comScore Canada Inc. As of April 2011, several sites such as GLOBALTV.CA, HGTV.CA, FOODNETWORK.CA etc. (now Shaw Media) ceased to be part of canada.com television. |

| (4) | canada.com classifieds represents unduplicated audience to the Corporation’s classifieds (INGs: driving.ca sites, working.com sites, househunting.ca sites, remembering.ca, canada.com ShopLocal, Swarmjam.com and Oodle Classifieds). Custom data was supplied by comScore Canada Inc. |

| (5) | Custom data for third-party represented sites was supplied by comScore Canada Inc. |

Newspaper Operations

Daily newspapers

The Corporation publishes ten daily metropolitan newspapers (nine broadsheets and one tabloid) and two other daily newspapers (broadsheets). Its daily newspapers are geographically diverse and located in major metropolitan centers across Canada which provides the Corporation and its advertisers access to target audiences throughout Canada. The average publication history of Postmedia’s daily newspapers is 132 years. Postmedia’s daily newspapers are well-established in the communities that they serve. This combination of national reach and local presence makes the Corporation’s daily newspapers attractive to both national and local advertisers. Postmedia’s newspapers have consistently been recognized for the quality of their content, having received numerous nominations and awards. Recent recognition includes: three National Newspaper Awards; The National Post was amongst the top five newspapers in the world at the international 32nd Annual Best of Newspaper Design Creative Competition with 32 awards in total; National Post’s managing editor of design, Gayle Grin, received the Society of News Design’s highest honour, the Lifetime achievement award; five awards were received from Newspapers Canada Great Ideas Competition and four awards from the News Photographers Association of Canada. According to Newspapers Canada’s 2010 Circulation Data Report we had approximately a 31% share of Canada’s total paid daily newspaper circulation. Each of the Corporation’s daily newspapers has the highest circulation and readership among English-language newspapers in the market that it serves (except for The Vancouver Sun, which is second in its market to another one of Postmedia’s newspapers, The Province).

17

The National Post provides benefits to our overall operations, including the provision of a newspaper with a national audience footprint and editorial content infrastructure for the Toronto market.

The following table provides details about our paid daily newspapers and their respective circulation and readership statistics.

| | | | | | | | | | | | | | | | | | | | | | |

Publication | | Market | | Year

established | | | Total daily

avg. paid

circulation(1) | | | Weekly

print

readership(2) | | | Market

position(3) | | | Local

newspaper

market

share(1) | |

Daily Metropolitan Newspapers | | | | | | | | | | | | | | | | | | | | | | |

The Province | | Vancouver | | | 1884 | | | | 159,692 | | | | 883,300 | | | | 2 | (4) | | | 100 | %(6) |

The Vancouver Sun | | Vancouver | | | 1886 | | | | 178,672 | | | | 817,800 | | | | 1 | | | | 100 | %(6) |

The Gazette | | Montreal | | | 1778 | | | | 156,379 | | | | 492,600 | | | | 3 | (5) | | | 100 | % |

Calgary Herald | | Calgary | | | 1883 | | | | 130,595 | | | | 492,900 | | | | 1 | | | | 74 | % |

Edmonton Journal | | Edmonton | | | 1903 | | | | 108,021 | | | | 473,900 | | | | 1 | | | | 70 | % |

Ottawa Citizen | | Ottawa | | | 1845 | | | | 120,440 | | | | 434,500 | | | | 1 | | | | 77 | % |

Times Colonist | | Victoria | | | 1884 | | | | 62,709 | | | | 202,000 | | | | 1 | | | | 100 | % |

The Windsor Star | | Windsor | | | 1918 | | | | 59,849 | | | | 194,100 | | | | 1 | | | | 100 | % |

The StarPhoenix | | Saskatoon | | | 1902 | | | | 52,648 | | | | 135,300 | | | | 1 | | | | 100 | % |

Leader-Post | | Regina | | | 1883 | | | | 46,894 | | | | 111,100 | | | | 1 | | | | 100 | % |

Daily National Newspaper | | | | | | | | | | | | | | | | | | | | | | |

National Post | | National | | | 1997 | | | | 158,250 | | | | 1,044,700 | | | | 2 | (7) | | | N/A | |

Other Daily Newspapers | | | | | | | | | | | | | | | | | | | | | | |

Nanaimo Daily News | | Nanaimo | | | 1874 | | | | 6,209 | | | | N/A | | | | 1 | | | | 100 | % |

Alberni Valley Times | | Port Alberni | | | 1919 | | | | 4,104 | | | | 13,454 | | | | 1 | | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Total (unduplicated) | | | | | | | | | 1,244,462 | (8) | | | 4,470,454 | (8) | | | | | | | | |

Notes:

| (1) | Market positions and local market share are determined by average paid circulation of daily newspapers. Source: Newspapers Canada – 2010 Circulation Data Report, based on the ABC FAS-fax for the 6-month periods ending March 31, 2010 and September 30, 2010, subject to audit by the Audit Bureau of Circulations. |

| (2) | Source: NADbank Weekly Print Readership of daily paid circulation newspapers by Resident Market, NADbank 2010 (based upon 6/7 day cumulative average of adults ages 18 and older). Source for Port Alberni Valley Times is ComBase 2008/2009. |

| (3) | As measured by average daily paid circulation as reported in Newspapers Canada 2010 Circulation Data Report, based on the ABC FAS-fax for the 6-month periods ending March 31, 2010 and September 30, 2010, subject to audit by the Audit Bureau of Circulations. |

| (4) | Second to The Vancouver Sun, which is also operated by the Corporation. |

| (5) | Number one English-language paid daily newspaper; number three overall among paid daily newspapers. |

| (6) | Includes The Vancouver Sun and The Province. |

| (7) | Second to The Globe and Mail, the other Canadian national newspaper. |

| (8) | Combined total does not equal sum of individual papers due to duplication in the Vancouver market and duplication with the National Post in Postmedia markets. |

Non-daily newspapers

The Corporation publishes 24 non-daily free newspapers distributed in various communities – 12 covering the Lower Mainland of British Columbia, seven on Vancouver Island and five covering the Windsor-Essex community in Ontario. Postmedia’s non-daily newspapers are generally delivered to every household in the respective regions in which they operate, thereby providing advertisers with substantial coverage of these community markets.

18

Digital Media and Online Operations

Postmedia intends to grow its revenue by leveraging its industry leading print brands and strong customer relationships into its expanding digital media product offerings. The Corporation’s digital media and online operations include thecanada.com network, websites for our daily and community newspapers, online classified websites, dose.ca (an entertainment-focused website), andFPinfomart.ca (a subscription-based media monitoring service). In addition, Postmedia’s digital media and online operations sell advertising on behalf of third-party websites.

canada.com network

Thecanada.com network is a comprehensive 24/7 online news, entertainment and information network of websites which leverages our content, brands and customer relationships across the Corporation. Thecanada.com network is one of Canada’s leading online general news and information sources with a monthly average of 7.1 million unique visitors in fiscal 2011 (as compared to 6.6 million unique visitors for the same period in fiscal 2010), which integrates Canadian news and specialty content at the country’s most recognizable web address.

Thecanada.com network hosts the websites and electronic editions of the Corporation’s daily and community newspapers as well as other select newspapers and the youth-oriented entertainment website dose.ca. Being hosted on thecanada.com network offers these properties a platform to extend their audience reach, market and promote key off-line activities, and build and reinforce relationships with respect to both advertisers and audiences.

Through the Corporation’s proprietary content, as well as technology partners and content providers,canada.com provides a number of personalized online tools, including internet search, deal-of-the-day coupons and other services. Thecanada.com network currently provides up-to-date international, national and local news coverage sourced from the Corporation’s newspapers, PN and third-party newswire services.

Digital media and online operations

As part of its effort to grow its digital media and online business, Postmedia’s newspapers’ newsrooms produce “today’s news today” in multiple formats specifically tailored for the applicable platform.

Through their expertise in exporting electronic press pages intended for print editions to web-friendly formats, the daily newspapers publish page-by-page digital editions, complete with stories, columns, photos and advertising. With a single exception, digital editions are available without charge to print subscribers and as digital-only paid subscriptions. Revenue generated from digital editions was $2.1 million in fiscal 2011. Readers of the digital editions are able to view page layouts, photos and advertisements exactly as they appear in the print edition of the newspaper. The experience is enhanced by a variety of digital features and tools, including search, aimed to ease navigation and add value.

Headlines, breaking news, analysis, commentary and selected stories from the daily newspaper editions are available to the public on the newspapers’ websites and on mobile devices. The Corporation’s newspapers’ websites also serve as customer relationship tools, promoting subscriptions to the print editions, allowing for the purchase or renewal of newspaper subscriptions, permitting notification of vacation stops and reactivations, and processing of billing inquiries, all via the internet.

FPinfomart.ca

FPinfomart.ca is an electronic resource for Canadian news and business information and a one-stop resource for media monitoring, business intelligence and financial and corporate data. The service offers complete online media monitoring covering print, broadcast television and radio, social media, and newswires in a single integrated platform. Print sources include all of the Corporation’s publications plus other Canadian and international sources such as third party newspapers.

19

FPinfomart.ca is a subscription-based business-to-business service that provides a wide range of products to support cross-organizational research, media-monitoring, reputation/issue management and business intelligence. As of August 31, 2011,FPinfomart.ca had approximately 1,100 subscribers representing approximately 55,000 users.FPinfomart.ca also provides in-depth research on publicly traded and private companies, which covers approximately 5,660 domestic and international sources.

In addition to subscriptions,FPinfomart.ca also generates revenue through an electronic licensing and rights management service of the Corporation’s news content, corporate data and third-party content via domestic and international third-party channels used by businesses across North America.

SwarmJam.com

In December 2010, Postmedia launchedSwarmJam.com, a collective buying site. Offering daily deals with 50% or better savings and catering to local businesses, consumers have access to products and services that are relevant, timely and valuable. These daily deals are promoted across the Corporation’s properties in print and online. Advertising onSwarmJam.com is sold by both the Corporation’s national and local sales representatives, as well as third-party sales agents in specific markets.

Third-party and other websites

Pursuant to certain agreements, the Corporation sells online advertising and advertising production and placement services on third-party branded websites. These agreements extend the reach of thecanada.com network and increase the Corporation’s advertising sales opportunities.

Other digital media agreements

The Corporation is party to various agreements under which it receives exclusive electronic rights to the content produced by certain newspapers in exchange for a royalty fee. For example, the Corporation has exclusive rights to the content produced by two daily newspapers in Western Canada in exchange for a royalty on revenues attributable to that content.

Although much of its content is proprietary, the Corporation is also party to various agreements under which it licenses content for its websites, including text, photos, videos, databases and interactive applications. The licensed content covers a broad range of topics, including sports, entertainment, automotive, recreation and travel from a variety of well-known content providers.

Operations

Regional organization and markets

Postmedia’s operations are headquartered in Toronto, Ontario. Its head office sets business plans and operating and capital budgets and co-ordinates central purchasing and delivery of newsprint, ink and printing.

The Corporation’s daily metropolitan newspapers, the National Post and the Flyer Force, are organized into two regional groups: Western and Eastern Canada. The publications within each group often share printing and mailroom facilities, distribution services and management resources.

Editorial

Editorial content is generated across the Corporation’s websites and publications and Postmedia’s infrastructure allows for sharing of its generated content among sites in an efficient and cost effective manner. Editorial policy is developed for each of the Corporation’s newspapers by an editorial board led by the newspaper’s editor-in-chief and publisher. Each editorial group ensures that each newspaper is responsive to national and local issues and meets the editorial needs of its readers. The Corporation’s newspapers focus on readers of various ages and demographics and aim to reflect the values and interests of their respective markets.

20

Each of the Corporation’s newspapers has its own editorial staff that is responsible for producing local editorial content of the newspaper, supplemented by certain content which comes from PN, other wire services, and freelancers.

The Corporation owns or has the rights to use the editorial content that is produced by its employees and freelancers, which allows for sharing of information and editorial content among its various publications. Further, since the Corporation’s newspapers operate across a broad geographic spectrum, reporters familiar with local issues can be assigned to cover events in a particular region. Management believes that sharing of editorial content and expertise allows the Corporation to achieve substantial operating efficiencies compared to other publishers which own a smaller number of publications.

The Corporation also provides various centralized editorial services, including PN and PES, to its newspapers and third parties. PN, its news service, provides news, sports, entertainment, photography, financial and feature information and data to the Corporation’s newspapers and digital media and online properties, and a number of third-party clients in Canada and the United States. PN currently draws editorial content from its own editorial team, including a group of news, feature and specialist writers and from journalists working throughout the Corporation’s newspaper and digital media and online operations. In addition, PN coordinates Postmedia’s news gathering and editorial content sharing across its operations, thereby eliminating duplication of editorial efforts, reducing the net cost of news gathering and enabling the coverage of a greater range of stories.

PES, the Corporation’s editorial services division, provides centralized pagination services and standardized editorial content packages to all of the Corporation’s newspapers and external newspaper clients, reducing editorial content costs across Postmedia’s Newspaper operations. External clients rely on PES’ pagination products for sports and business updates, television listings, comics and puzzles, and paginated features content. PES supports the Corporation’s 11 Canadian daily newspapers and in fiscal 2011, had four external newspaper clients in Canada and between 19 and 72 external newspaper clients in the United States due to the seasonal fluctuations associated with professional sports seasons.

Sales and advertising

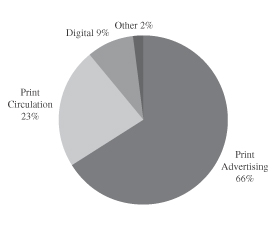

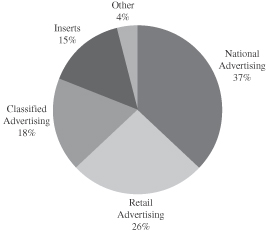

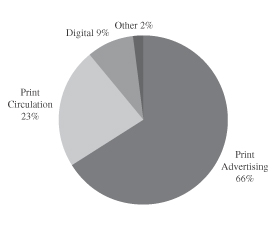

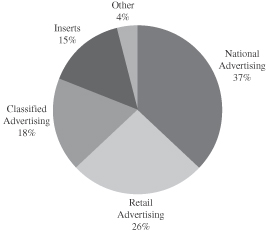

The following charts provide a breakdown of the Corporation’s fiscal 2011 total revenue and fiscal 2011 total print advertising revenue.

| | |

| Total Revenue | | Total Print Advertising Revenue |

| |  |

The Corporation offers advertisers extensive audience reach through a combination of circulation and readership of its newspapers (including online editions), unique visitors to its websites and various mobile products.

21

Each of the Corporation’s newspapers has a dedicated sales force and classified advertising call center to generate local sales. The classified call centre is consolidated in Calgary. The remainder of the Corporation’s advertising sales are generated from national and multi-market retail accounts. National and multi-market retail sales for the Corporation are sold by Postmedia Integrated Advertising, or “PIA.” PIA operates through offices in Toronto, Montreal and Vancouver in addition to two contract representatives in the U.S. In fiscal 2011, the Corporation’s ten largest advertisers represented approximately 10% of the Corporation’s total consolidated revenue (14% of fiscal 2011 consolidated print advertising revenue).

The Corporation’s local retail and classified advertising is sold on a publication-by-publication basis. Each of the Corporation’s newspapers has a locally-based sales team that sells display, commercial and third-party classified advertisement space, principally to local businesses and organizations. The majority of commercial classifieds relate to automotive, employment and real estate advertisements. In addition to commercial classified advertising, each newspaper also sells private party classifieds and online classified advertisement placement, which are primarily administered locally.

In addition, Postmedia has digital advertising sales specialists to develop digital advertising opportunities for its newspapers. Currently, a significant portion of the Corporation’s local and national sales forces sell both newspaper and digital media and online advertising.

National advertising takes the form of advertisements primarily from large national companies. The sale of national advertisements is handled by PIA, which employs a dedicated sales team that services the Corporation’s group of newspapers and digital properties and provides individual newspapers with advertising sales representation, insertion order processing and invoice remittance. The largest segment of the Corporation’s total advertising revenues is its advertising that runs in the printed newspaper, often referred to as Postmedia’s “run-of-print” advertising revenue. In fiscal 2011, national advertisements accounted for approximately 46% of total run-of-print newspaper advertising revenue. No single customer is dominant and the renewal rate for all national customers is high. PIA also represents several third-party publishers and publications acting as their national advertising sales agent on a commissioned basis. In fiscal 2011, the Corporation generated approximately $1.4 million in commission revenue from representing third-party print media organizations.

Production and Services

Circulation and distribution

The Corporation’s circulation revenue is generated from home delivery sales, single copy sales made through retailers and vending boxes, and corporate bulk sales. Newspapers are shipped from the Corporation’s printing plants to depot drop locations or single copy retail outlets by independent trucking companies in each market. Postmedia’s newspaper distribution is carried out primarily by independent distributors and carriers along with other third-party distributors that deliver newspapers to subscribers. These third-party distribution networks enable the Corporation to operate via short-term contracts and reduce supplier concentration issues. Single copies are also sold through vending boxes and retail outlets in the relevant circulation areas.

The Corporation benefits from agreements with distributors which provide for the delivery of newspapers from printing facilities to bulk locations, retailers, vending boxes and residential and corporate subscribers. Typically, a newspaper division is party to several distribution agreements, covering different stages of delivery and geographical areas.

For fiscal 2011, approximately 78% of the Corporation’s circulation revenue was derived from home delivery subscriptions, 19% from single copy sales and the remaining 3% from corporate/bulk, Newspapers in Education and electronic sales. As of August 31, 2011, the Corporation had an average of 754,601 subscribers for home delivery, as compared to an average of 807,317 subscribers for home delivery as of August 31, 2010. Aggregate average daily paid circulation for Corporation’s daily paid newspapers, print and online editions, was approximately 1.2 million copies for fiscal 2011. Total distribution costs, including cartage and carriers, for the Corporation were approximately $147 million for fiscal 2011, or 18.0% of its consolidated operating costs.

22