Exhibit 15.2

POSTMEDIA NETWORK CANADA CORP.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEARS ENDED AUGUST 31, 2013, 2012 and 2011

Issued: October 24, 2013

1

OCTOBER 24, 2013

MANAGEMENT’S DISCUSSION AND ANALYSIS

This management’s discussion and analysis of financial condition and results of operations of Postmedia Network Canada Corp. and its subsidiary Postmedia Network Inc. (collectively, “we”, “our”, “us”, or “Postmedia”) should be read in conjunction with the annual audited consolidated financial statements and related notes of Postmedia for the years ended August 31, 2013, 2012 and 2011. The audited consolidated financial statements of Postmedia for the years ended August 31, 2013, 2012 and 2011 are available on SEDAR atwww.sedar.com and on the EDGAR system maintained by the U.S. Securities and Exchange Commission atwww.sec.gov.

This discussion contains statements that are not historical facts and are forward-looking statements. These statements are subject to a number of risks described in the section entitled “Risk Factors”. Risks and uncertainties may cause actual results to differ materially from those contained in such forward-looking statements. Such statements reflect management’s current views and are based on certain assumptions. They are only estimates of future developments, and actual developments may differ materially from these statements due to a number of factors. Investors are cautioned not to place undue reliance on such forward-looking statements. No forward-looking statement is a guarantee of future results. We have tried, where possible, to identify such statements by using words such as “believe”, “expect”, “estimate”, “anticipate”, “will”, “could” and similar expressions in connection with any discussion of future operating or financial performance. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

All amounts are expressed in Canadian dollars unless otherwise noted. The audited consolidated financial statements of Postmedia for the years ended August 31, 2013, 2012 and 2011 have been prepared in accordance with International Financial Reporting Standards (“IFRS”).

This management’s discussion and analysis is dated October 24, 2013 and does not reflect changes or information subsequent to this date. Additional information in respect of Postmedia is available on SEDAR atwww.sedar.com and EDGAR atwww.sec.gov.

2

Additional IFRS Measures

We use operating income before depreciation, amortization, impairment and restructuring, as presented in the consolidated statements of operations for the years ended August 31, 2013, 2012 and 2011 and described in note 3 thereto, to assist in assessing our financial performance. Management and the Board of Directors of Postmedia use this measure to evaluate consolidated operating results and to assess Postmedia’s ability to incur and service debt. In addition, this measure is used to make operating decisions as it is an indicator of how much cash is being generated by Postmedia and assists in determining the need for additional cost reductions, evaluation of personnel and resource allocation decisions. Operating income before depreciation, amortization, impairment and restructuring is referred to as an additional IFRS measure and may not be comparable to similar measures presented by other companies.

Overview and Background

We are the largest publisher by circulation of paid English-language daily newspapers in Canada, according to the Newspapers Canada 2012 Circulation Data Report. Our paid English-language daily newspapers have, in total, the highest weekly print readership in Canada, based on the NADbank 2012 survey data. Our business consists of news and information gathering and dissemination operations, with products offered in major Canadian markets and a number of regional and local markets in Canada through a variety of print, web, tablet and smartphone platforms. The combination of these distribution platforms provides readers with a variety of mediums through which to access and interact with our content. The breadth of our reach and the diversity of our content enable advertisers to reach their target audiences on a local, regional or national scale through the convenience of a single provider.

During the year ended August 31, 2013, we amended our operating segments to reflect our change to a functional reporting structure which resulted in the elimination of publishers at our individual newspapers and the creation of Senior Vice President roles which will be responsible for specific functions across the entire business (the “Reorganization”). Prior to the Reorganization, we disclosed separately the results of both the Newspaper operating segment and an All other category which included other business activities and an operating segment which was not separately reportable. As a result of the changes to the reporting structure the All other category is now included in the Newspaper operating segment. Changes in reporting segments are to be applied retroactively; so because we now operate in only one operating segment there is no segment information to disclose and accordingly we have removed the discussion surrounding our segment operations from this management’s discussion and analysis. The Newspaper segment publishes daily and non-daily newspapers and operates digital media and online assets including the canada.com network, each newspaper’s online website and Infomart, our media monitoring service.

Significant developments

On April 4, 2011, we entered into an agreement with our lenders which amended certain terms of the Senior Secured Term Loan Credit Facility (“Term Loan Facility”). The amounts then outstanding under the original agreement, including a US tranche of $238.0 million (US$247.0 million) and a Canadian tranche of $107.3 million were repaid and replaced with a new US tranche. The new US tranche was issued for US$365.0 million (CDN$351.7 million), at a discount of 0.25%, for net proceeds of $350.8 million, before financing fees of $5.4 million.

On October 18, 2011, we entered into an asset purchase agreement with affiliates of Glacier Media Inc. to sell substantially all of the assets and liabilities of the Lower Mainland Publishing Group, the Victoria Times Colonist and the Vancouver Island Newspaper Group, collectively herein referred to as the Disposed Properties, for a purchase price of $86.5 million. On November 30, 2011, we completed the Transaction and recorded a gain on sale of the Disposed Properties of $17.1 million. In accordance with the terms and conditions of the Term Loan Facility, on November 30, 2011 the proceeds from the sale of the Disposed Properties were used to make a principal payment of US$84.6 million (CDN$86.5 million) on the Term Loan Facility. As a result of the Transaction we have presented the results of the Disposed Properties as discontinued operations for the years ended August 31, 2012 and 2011. Additional information on this transaction is available in note 23 of our audited consolidated financial statements for the years ended August 31, 2013, 2012 and 2011.

3

On June 26, 2012, we entered into an agreement of purchase and sale to sell the land and building located at 1450 Don Mills Road in Don Mills, Ontario for gross proceeds of $24 million. The sale closed on October 12, 2012. On November 12, 2012, the net proceeds from the sale were used for a mandatory redemption of $23.2 million aggregate principal amount of 8.25% Senior Secured Notes due 2017 (“First-Lien Notes”) at par in accordance with the terms and conditions of the First-Lien Notes indenture.

On August 16, 2012, we issued $250.0 million in aggregate principal amount of First-Lien Notes. The proceeds from the issuance were used to repay the amounts then outstanding on the Term Loan Facility of $238.3 million (US$240.0 million), accrued and unpaid interest of $3.4 million, and transaction fees of $6.6 million. The issuance of the First-Lien Notes and subsequent repayment of the then outstanding Term Loan Facility gave rise to a potential termination event under our existing foreign currency interest rate swap associated with the 12.5% Senior Secured Notes due 2017 (“Second-Lien Notes”). As a result, in September 2012, we settled a notional amount of US$97.5 million of the foreign currency interest rate swap for a cash payment of $9.6 million including accrued interest.

In August 2013, we outsourced production of the Edmonton Journal. In addition, on September 9, 2013, we announced our intention to sell two of our real estate holdings. The net proceeds from these potential sales will be used to make an offer to redeem an equal amount of our First-Lien Notes. We also entered into a print outsourcing agreement for the production of the Calgary Herald, beginning November 2013.

Selected Annual Information

| | | | | | | | | | | | |

| | | For the years ended August 31, | |

| | | 2013 | | | 2012 | | | 2011 | |

Revenue | | | 751,583 | | | | 831,877 | | | | 898,888 | |

| | | |

Net loss from continuing operations | | | (153,829 | ) | | | (37,275 | ) | | | (12,154 | ) |

Net loss per share from continuing operations | | | | | | | | | | | | |

Basic | | $ | (3.82 | ) | | $ | (0.92 | ) | | $ | (0.30 | ) |

Diluted | | $ | (3.82 | ) | | $ | (0.92 | ) | | $ | (0.30 | ) |

| | | |

Net loss attributible to equity holders of the Company | | | (153,829 | ) | | | (23,222 | ) | | | (9,589 | ) |

Net loss per share attributible to equity holders of the Company | | | | | | | | | | | | |

Basic | | $ | (3.82 | ) | | $ | (0.58 | ) | | $ | (0.24 | ) |

Diluted | | $ | (3.82 | ) | | $ | (0.58 | ) | | $ | (0.24 | ) |

| | | |

Total assets | | | 862,797 | | | | 1,044,848 | | | | 1,180,243 | |

Total long-term financial liabilities | | | 474,380 | | | | 480,118 | | | | 586,529 | |

| | | | | | | | | | | | |

Key Factors Affecting Operating Results

Revenue is earned primarily from advertising, circulation and digital sources. Print advertising revenue is a function of the volume, or linage, of advertising sold and rates charged. Print circulation revenue is derived from home-delivery subscriptions for newspapers, single copy sales at retail outlets and vending machines and is a function of the number of newspapers sold and the price per copy. Digital revenue consists of revenue from national and local display advertising on our newspaper and other websites, includingcanada.com, revenue from e-Papers and digital access subscriptions, as well as subscription revenue generated through Infomart, our media monitoring service.

As part of our fiscal 2014 planning process we updated our long-term financial forecast and as a result of lower than anticipated long-term revenue projections we recorded impairment losses during both the three months ended May 31, 2013 and August 31, 2013.

4

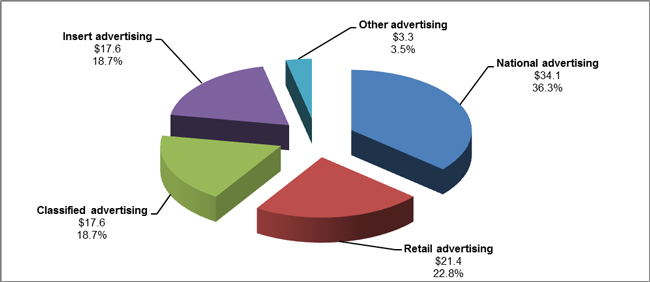

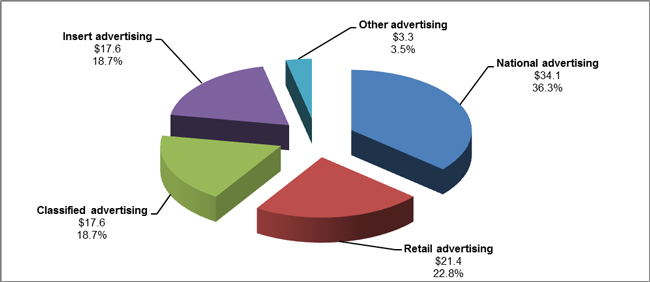

Print advertising revenue was $94.0 million for the three months ended August 31, 2013, representing 55.5% of total revenue. The following chart summarizes our print advertising revenue by category for the three months ended August 31, 2013 ($ in millions):

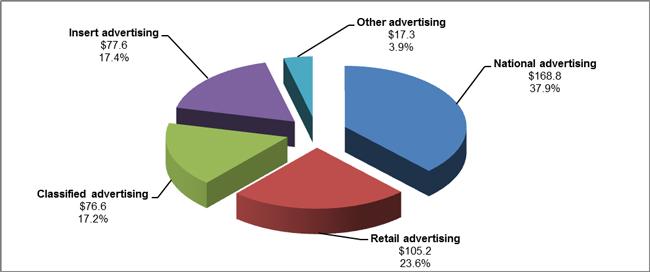

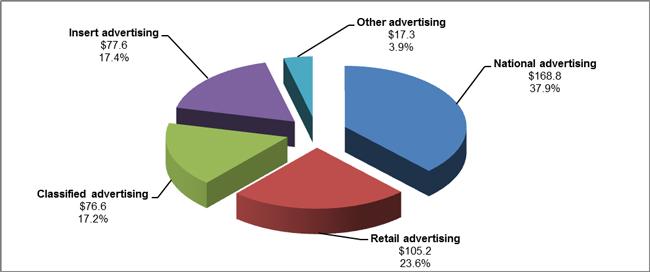

Print advertising revenue was $445.5 million for the year ended August 31, 2013, representing 59.3% of total revenue. The following chart summarizes our print advertising revenue by category for the year ended August 31, 2013 ($ in millions):

Print advertising is influenced by both the overall strength of the economy and significant structural changes in the newspaper industry and media in general. In recent years and continuing to date, economic uncertainty and structural changes in the industry have resulted in significant declines in print advertising as well as a continuing shift in advertising dollars from print advertising to advertising in other formats, particularly online and other digital platforms such as search and social media websites. This shift is expected to continue and may be permanent. We anticipate the print advertising market to remain challenging and expect current trends to continue into fiscal 2014. During the three months and year ended August 31, 2013, we experienced print advertising revenue declines of 16.2% and 13.5%, respectively, as compared to the same periods in the prior year.

5

The decline in print advertising revenue in the three months and year ended August 31, 2013 primarily relates to weakness in all major advertising categories including classified, retail and national.

Print circulation revenue was $49.4 million and $195.9 million for the three months and year ended August 31, 2013, representing 29.2% and 26.1% of total revenue for such periods, respectively. Declines in circulation volumes have been experienced over the last few years and this trend continued in the three months and year ended August 31, 2013. Circulation volume decreases have been partially offset by price increases. We expect these trends to continue into fiscal 2014. A portion of the print circulation volume decrease relates to the implementation of initiatives such as the elimination of unprofitable publishing days and circulation.

Digital revenue was $21.4 million and $91.6 million for the three months and year ended August 31, 2013, representing 12.6% and 12.2% of total revenue for such periods, respectively. Digital revenues decreased 2.4% and increased 2.8% in the three months and year ended August 31, 2013, respectively, as compared to the same periods in the prior year. Increases in digital revenue for the year ended August 31, 2013 are primarily a result of increases in local digital advertising revenue, partially offset by declines in digital classified revenue. We continue to believe digital revenue represents a future growth opportunity for Postmedia and as a result we are focused on various new products and initiatives in this area.

Our principal expenses consist of compensation, newsprint, and distribution. These composed 50.4%, 6.0% and 17.7%, respectively, of total operating expenses excluding depreciation, amortization, impairment and restructuring for the three months ended August 31, 2013 and 51.6%, 6.6% and 17.4%, respectively, of total operating expenses excluding depreciation, amortization, impairment and restructuring for the year ended August 31, 2013. We experienced declines in compensation, newsprint and distribution expenses of 9.5%, 25.0% and 11.7%, respectively, in the three months ended August 31, 2013 and declines of 7.9%, 22.3% and 12.9%, respectively, in the year ended August 31, 2013, as compared to the same periods in the prior year.

We are in the process of implementing a three year business transformation program which was announced in July 2012 (“Transformation Program”) that will focus on the development of our digital products and is expected to result in net operating cost savings of 15% to 20%. During the three months ended August 31, 2013 as part of our Transformation Program we implemented initiatives which are expected to result in an additional $20 million of net annualized cost savings, resulting in net annualized cost savings since the Transformation Program started of $82 million, or approximately a 12% decrease in net operating costs.

Our operating results are impacted by variations in the cost and availability of newsprint. Newsprint is the principal raw material used in the production of our daily newspapers and other print publications. It is a commodity that is generally subject to price volatility. We take advantage of the purchasing power that comes with the large volume of newsprint we purchase, as well as our proximity to paper mills across Canada, to minimize our total newsprint expense. Changes in newsprint prices can significantly affect our operating results. A $50 per tonne increase or decrease in the price of newsprint would be expected to affect our newsprint expense by approximately $3.3 million on an annualized basis. We don’t expect a material change in newsprint prices in fiscal 2014.

Our distribution is primarily outsourced to third party suppliers. The key drivers of our distribution expenses are fuel costs and circulation and insert volumes. Our distribution expenses have decreased during the three months and year ended August 31, 2013 as a result of Transformation Program initiatives implemented over the last year as well as decreased circulation and insert volumes. We are working to reduce distribution costs and expect to see further reductions in distribution expense in fiscal 2014.

6

Other Factors

Seasonality

Revenue has experienced, and is expected to continue to experience, significant seasonality due to seasonal advertising patterns and seasonal influences on media consumption habits. Typically, our advertising revenue is highest in the first and third fiscal quarters, while expenses are relatively constant throughout the fiscal year. These seasonal variations may lead to increased borrowing needs at certain points within the fiscal year.

Critical accounting estimates

The preparation of financial statements in accordance with IFRS requires management to make estimates, assumptions and judgements that affect the reported amounts of assets and liabilities, related amounts of revenues and expenses, and disclosure of contingent assets and liabilities. Although these estimates, assumptions and judgements are based upon management’s best knowledge of the amount, event or actions; actual results could differ from those estimates, assumptions and judgements.

We have identified the following significant areas that require management to use estimates, assumptions and judgements. These accounting estimates, assumptions and judgements are considered critical as changes in such estimates, assumptions an judgements have the potential to materially impact the consolidated financial statements. For a summary of our significant accounting policies please refer to note 2 of our audited consolidated financial statements for the years ended August 31, 2013, 2012 and 2011.

The following significant areas require management to use assumptions and to make estimates:

Impairment of goodwill and indefinite life intangible assets

We test goodwill and indefinite life intangible assets for impairment annually, or more frequently if there are indicators that an impairment may have arisen. In testing for impairment, assets, including indefinite lived intangible assets, are grouped into a cash generating unit (“CGU” or “CGUs”) which represent the lowest level for which there are separately identifiable cash inflows. For the purpose of goodwill impairment testing, goodwill is allocated to each CGU (or group of CGUs) based on the level at which management monitors goodwill, however not higher than an operating segment. Accordingly, management has allocated its goodwill to its single operating segment, the Newspaper operating segment, which is at the entity level, and the level at which goodwill is monitored, herein referred to as the Goodwill CGU. The recoverable amount of each CGU or group of CGUs is based on the higher of value in use and fair value less cost to sell calculations. We have computed the fair value less cost to sell of the Goodwill CGU and each individual CGU using a discounted cash flow model that requires market participant assumptions about future cash flows and discount rates. The future cash flows are based on management’s best estimate considering historical and expected operating plans, current strategies, economic conditions and the general outlook for the industry and markets in which we operate. The discounted cash flow calculations use cash flow projections which are based upon financial forecasts prepared by management covering a three year period. Cash flows after the three year period are extrapolated using industry growth rates.

7

Employee future benefits

The cost of defined benefit pension benefit plans, post-retirement benefit plans and other long-term employee benefit plans and the present value of the defined benefit obligation are determined using actuarial valuations. An actuarial valuation involves making various assumptions including the discount rate to measure obligations and the expected long-term rate of return on plan assets, among others. Due to the complexity of the actuarial valuations and the long-term nature of employee future benefits, the corresponding obligation is highly sensitive to changes in assumptions. A change in the discount rate used in the valuation of defined benefit obligations, affects the reported funded status of our plans as well as the net benefit cost in subsequent fiscal years. As at August 31, 2013 a 50 basis-point decrease in the discount rate would increase our defined benefit obligations by $34.0 million and a 50 basis-point increase in the discount rate would decrease our defined benefit obligations by $31.9 million. Discount rates and the expected return on plan assets compared to the actual return on plan assets are reviewed at each reporting date and corresponding adjustments are recognized in other comprehensive income and deficit.

The following area requires management to use significant judgements apart from those involving estimates:

Determination of useful lives for the depreciation and amortization of assets with finite lives

For each class of assets with finite lives, management has to determine over which period we will consume the assets future economic benefits. The determination of such periods and if necessary, the subsequent revision of such periods, involves judgement and has an impact on the depreciation and amortization recorded in the consolidated statements of operations. We take into account industry trends and industry specific factors, including changing technologies and expectations for the in-service period of assets when determining their respective useful lives.

8

Operating Results

Postmedia’s operating results for the three months ended August 31, 2013 as compared to the three months ended August 31, 2012

| | | | | | | | |

| | | 2013 | | | 2012 | |

Revenues | | | | | | | | |

Print advertising | | | 93,968 | | | | 112,157 | |

Print circulation | | | 49,359 | | | | 51,223 | |

Digital | | | 21,408 | | | | 21,937 | |

Other | | | 4,574 | | | | 4,807 | |

| | | | | | | | |

Total revenues | | | 169,309 | | | | 190,124 | |

Expenses | | | | | | | | |

Compensation | | | 73,673 | | | | 81,367 | |

Newsprint | | | 8,791 | | | | 11,717 | |

Distribution | | | 25,806 | | | | 29,218 | |

Other operating | | | 37,800 | | | | 39,649 | |

| | | | | | | | |

Operating income before depreciation, amortization, impairment and restructuring | | | 23,239 | | | | 28,173 | |

Depreciation | | | 9,613 | | | | 6,593 | |

Amortization | | | 10,646 | | | | 10,881 | |

Impairments | | | 6,100 | | | | — | |

Restructuring and other items | | | 10,746 | | | | 13,014 | |

| | | | | | | | |

Operating loss | | | (13,866 | ) | | | (2,315 | ) |

Interest expense | | | 15,133 | | | | 17,726 | |

Loss on debt repayment | | | — | | | | 9,178 | |

Net financing expense relating to employee benefit plans | | | 387 | | | | 975 | |

(Gain) loss on disposal of property and equipment and intangible assets | | | (16 | ) | | | 180 | |

Loss on derivative financial instruments | | | 4,656 | | | | 6,628 | |

Foreign currency exchange (gains) losses | | | 1,779 | | | | (8,651 | ) |

| | | | | | | | |

Loss before income taxes | | | (35,805 | ) | | | (28,351 | ) |

Provision for income taxes | | | — | | | | — | |

| | | | | | | | |

Net loss attributable to equity holders of the Company | | | (35,805 | ) | | | (28,351 | ) |

| | | | | | | | |

Revenue

Print advertising

Print advertising revenue decreased $18.2 million, or 16.2%, to $94.0 million for the three months ended August 31, 2013, as compared to the same period in the prior year. This decrease relates to most of our major categories of print advertising revenue, including decreases from national advertising of 20.3%, retail advertising of 14.0%, classified advertising of 16.7%, and insert advertising of 7.3%. The total print advertising linage and average line rate related to national, retail and classified advertising decreased 8.6% and 9.9%, respectively, during the three months ended August 31, 2013, as compared to the same period in the prior year. Insert revenue decreases are primarily related to volume decreases of 5.0% during the three months ended August 31, 2013, as compared to the same period in the prior year.

Print circulation

Print circulation revenue decreased $1.9 million, or 3.6%, to $49.4 million for the three months ended August 31, 2013, as compared to the same period in the prior year. Net paid circulation decreased 13.8% for the three months ended August 31, 2013, as compared to the same period in the prior year and was partially offset by price increases. A portion of the print circulation revenue decrease relates to the implementation of initiatives which include the elimination of unprofitable publishing days and circulation.

9

Digital

Digital revenue decreased $0.5 million, or 2.4%, to $21.4 million for the three months ended August 31, 2013, as compared to the same period in the prior year. The decline in digital revenue is primarily a result of declines of $1.1 million in digital classified revenue, partially offset by increases in local digital advertising revenue of $0.9 million.

Other

Other revenue decreased $0.2 million, or 4.8%, to $4.6 million for the three months ended August 31, 2013, as compared to the same period in the prior year.

Expenses

Compensation

Compensation expenses decreased $7.7 million, or 9.5%, to $73.7 million for the three months ended August 31, 2013, as compared to the same period in the prior year. The decrease is primarily due to lower salary costs of $10.4 million which are primarily as a result of a reduction in employees under the Transformation Program, partially offset by an increase in employee benefit plan expense of $2.1 million.

Newsprint

Newsprint expenses decreased $2.9 million, or 25.0%, to $8.8 million for the three months ended August 31, 2013, as compared to the same period in the prior year. Newsprint expense decreases are primarily a result of consumption decreases of 21.6% due to continued usage reduction efforts, reduced publishing days and lower newspaper circulation volumes, combined with a decrease in newsprint cost per tonne of 4.3%.

Distribution

Distribution expenses decreased $3.4 million, or 11.7%, to $25.8 million for the three months ended August 31, 2013, as compared to the same period in the prior year. Decreases in distribution expenses are primarily a result of a reduction in newspaper circulation volumes, the elimination of unprofitable publishing days and circulation and other cost reduction initiatives.

Other operating

Other operating expenses decreased $1.8 million, or 4.7%, to $37.8 million for the three months ended August 31, 2013, as compared to the same period in the prior year. Decreases in other operating expenses are primarily a result of ongoing cost savings initiatives.

Operating income before depreciation, amortization, impairment and restructuring

Operating income before depreciation, amortization, impairment and restructuring decreased $4.9 million, or 17.5%, to $23.2 million for the three months ended August 31, 2013, as compared to the same period in the prior year. The decrease relates primarily to decreases in revenue, partially offset by decreases in expenses as discussed above.

10

Depreciation

Depreciation increased $3.0 million to $9.6 million for the three months ended August 31, 2013, as compared to the same period in the prior year. The increase relates primarily to the change in the estimate of the useful lives of certain production assets as a result of production outsourcing agreements.

Amortization

Amortization decreased $0.2 million to $10.6 million for the three months ended August 31, 2013, as compared to the same period in the prior year.

Impairments

During the three months ended August 31, 2013, we completed our annual impairment testing of goodwill and indefinite life intangible assets. As a result of the impairment analysis we recorded an impairment loss of $6.1 million which consists of $2.5 million related to indefinite life intangible assets and $3.6 million related to property and equipment. The impairments were as a result of lower than anticipated long-term revenue projections due to economic and structural factors including the uncertainty of the print advertising market and the rapidly evolving digital advertising market. There were no such impairments in the three months ended August 31, 2012.

Restructuring and other items

Restructuring and other items expense decreased $2.3 million to $10.7 million for the three months ended August 31, 2013 as compared to the same period in the prior year. Restructuring and other items expense for the three months ended August 31, 2013 consists of severance costs, which include both involuntary terminations and voluntary buyouts. Restructuring and other items expense for the three months ended August 31, 2012 consisted of severance costs, which included both involuntary terminations and voluntary buyouts of $17.1 million and a recovery of $4.1 million which represented a curtailment gain in respect of our pension benefit plans related to such involuntary termination and voluntary buyouts.

Operating loss

Operating loss was $13.9 million for the three months ended May 31, 2013, as compared to $2.3 million for the same period in the prior year primarily as a result of increased operating loss before depreciation, amortization, impairment and restructuring, increased depreciation and the impairments recorded in the three months ended August 31, 2013 partially offset by decreased restructuring expenses, all as discussed above.

Interest expense

Interest expense decreased $2.6 million, or 14.6%, to $15.1 million for the three months ended August 31, 2013, as compared to the same period in the prior year. Interest expense primarily relates to interest on our long-term debt that is recognized using the effective interest rate method, which amortizes the initial debt issuance costs and includes both cash and non-cash interest. The decrease in interest expense for the three months ended August 31, 2013 relates to both a decrease in non-cash interest expense due to changes in amortization assumptions and cash interest as a result of lower debt levels as compared to the same period in the prior year, partially offset by an increase in the effective interest rate as a result of the refinancing on August 16, 2012. Cash interest expense decreased $0.6 million during the three months ended August 31, 2013, as compared to the same period in the prior year, due to reduced hedging on the Second-Lien Notes and lower debt levels, partially offset by an increase in the interest rate on first-lien debt as a result of the refinancing completed in August 2012.

11

Loss on debt repayment

During the three months ended August 31, 2012, we recorded a non-cash loss on debt repayment of $9.2 million representing unamortized discounts and financing fees related to the repayment of the then outstanding Term Loan Facility. There were no such losses in the three months ended August 31, 2013.

Net financing expense relating to employee benefit plans

Net financing expense relating to employee benefit plans decreased $0.6 million to $0.4 million for the three months ended August 31, 2013, as compared to the same period in the prior year. The decrease relates to both a decrease in the interest cost on plan obligations and an increase in the expected return on plan assets.

(Gain) Loss on disposal of property and equipment and intangible assets

During the three months ended August 31, 2013, we disposed of property and equipment and realized a nominal gain. During the three months ended August 31, 2012, we disposed of intangible assets and realized a loss of $0.2 million.

Loss on derivative financial instruments

Loss on derivative financial instruments for the three months ended August 31, 2013 was $4.7 million as compared to $6.6 million during the same period in the prior year. The loss for the three months ended August 31, 2013 relates to the change in fair value of our variable prepayment option embedded derivatives on the First-Lien Notes and Second-Lien Notes. The loss for the three months ended August 31, 2012 included a loss of $1.2 million related to the settlement of a cash flow swap designated as a hedge for cash consideration of $0.6 million, a realized loss of $0.8 million which represented a payment made to amend the terms of a cash flow swap designated as a hedge, a realized loss of $8.8 million related to the settlement of a fair value swap not designated as a hedge, partially offset by a gain of $2.4 million which occurred prior to the settlement of the fair value swap that was not designated as a hedge and gains of $1.9 million related to the variable prepayment option embedded derivatives on the First-Lien Notes and Second-Lien Notes.

Foreign currency exchange (gains) losses

Foreign currency exchange losses for the three months ended August 31, 2013 were $1.8 million as compared to foreign currency exchange gains of $8.7 million during the same period in the prior year. On August 16, 2012 we repaid our Term Loan Facility in its entirety, which was denominated in US dollars, and replaced it with the First-Lien Notes which are denominated in Canadian dollars, thereby permanently reducing our exposure to foreign currency fluctuations on a significant portion of our long-term debt. In September 2012, we settled a notional amount of US$97.5 million of the foreign currency interest rate swap designated as a cash flow hedge thereby increasing our exposure to foreign currency fluctuations on the non-swapped portion of the Second-Lien Notes from US$3.6 million to US$101.1 million. For the three months ended August 31, 2013 foreign currency exchange losses consist primarily of $1.6 million related to the non-swapped portion of the Second-Lien Notes. For the three months ended August 31, 2012 foreign currency exchange gains consisted primarily of realized gains of $8.4 million related to the repayment of the Term Loan Facility on August 16, 2012 and unrealized gains of $0.2 million related to the non-swapped portion of the Second-Lien Notes.

Loss before income taxes

Loss before income taxes was $35.8 million for the three months ended August 31, 2013, as compared to $28.4 million for the same period in the prior year. The increase in loss before income taxes is primarily the result of increased operating loss and foreign currency exchange losses, partially offset by decreased interest expense, decreased losses on derivative financial instruments and the loss on debt repayment in the three months ended August 31, 2012, all as discussed above.

12

Provision for income taxes

We have not recorded a current or deferred tax expense or recovery for the three months ended August 31, 2013 or 2012. Current taxes payable or recoverable result in a decrease or increase, respectively, to our tax loss carryforward balances. The cumulative tax loss carryforward balances have not been recognized as a net deferred tax asset on the statement of financial position.

Net loss attributable to equity holders of the Company

Net loss for the three months ended August 31, 2013 was $35.8 million as compared to $28.4 million for the same period in the prior year, as a result of the factors described above in loss before income taxes.

13

Postmedia’s operating results for the year ended August 31, 2013 as compared to the year ended August 31, 2012

| | | | | | | | |

| | | 2013 | | | 2012 | |

Revenues | | | | | | | | |

Print advertising | | | 445,547 | | | | 514,987 | |

Print circulation | | | 195,899 | | | | 209,177 | |

Digital | | | 91,606 | | | | 89,076 | |

Other | | | 18,531 | | | | 18,637 | |

| | | | | | | | |

Total revenues | | | 751,583 | | | | 831,877 | |

Expenses | | | | | | | | |

Compensation | | | 320,749 | | | | 348,133 | |

Newsprint | | | 40,902 | | | | 52,628 | |

Distribution | | | 107,905 | | | | 123,872 | |

Other operating | | | 151,626 | | | | 162,908 | |

| | | | | | | | |

Operating income before depreciation, amortization, impairment and restructuring | | | 130,401 | | | | 144,336 | |

Depreciation | | | 29,949 | | | | 26,157 | |

Amortization | | | 43,325 | | | | 43,566 | |

Impairments | | | 99,983 | | | | — | |

Restructuring and other items | | | 34,171 | | | | 35,355 | |

| | | | | | | | |

Operating income (loss) | | | (77,027 | ) | | | 39,258 | |

Interest expense | | | 61,900 | | | | 65,446 | |

Loss on debt repayment | | | — | | | | 9,178 | |

Net financing expense relating to employee benefit plans | | | 1,536 | | | | 3,900 | |

(Gain) loss on disposal of property and equipment and intangible assets | | | (1,005 | ) | | | 258 | |

(Gain) loss on derivative financial instruments | | | 7,306 | | | | (8,632 | ) |

Foreign currency exchange losses | | | 7,065 | | | | 6,383 | |

| | | | | | | | |

Loss before income taxes | | | (153,829 | ) | | | (37,275 | ) |

Provision for income taxes | | | — | | | | — | |

| | | | | | | | |

Net loss from continuing operations | | | (153,829 | ) | | | (37,275 | ) |

Net earnings from discontinued operations, net of tax of nil | | | — | | | | 14,053 | |

| | | | | | | | |

Net loss attributable to equity holders of the Company | | | (153,829 | ) | | | (23,222 | ) |

| | | | | | | | |

Revenue

Print advertising

Print advertising revenue decreased $69.4 million, or 13.5%, to $445.5 million for the year ended August 31, 2013, as compared to the same period in the prior year. This decrease relates to most of our major categories of print advertising revenue, including decreases from national advertising of 15.7%, retail advertising of 9.3%, classified advertising of 18.9%, and insert advertising of 7.3%. The total print advertising linage and average line rate related to national, retail and classified advertising decreased 9.3% and 5.9%, respectively, during the year ended August 31, 2013, as compared to the same period in the prior year. Insert revenue decreases are primarily related to volume decreases of 5.7% during the year ended August 31, 2013, as compared to the same period in the prior year.

14

Print circulation

Print circulation revenue decreased $13.3 million, or 6.3%, to $195.9 million for the year ended August 31, 2013, as compared to the same period in the prior year. Net paid circulation decreased 12.7% for the year ended August 31, 2013, as compared to the same period in the prior year and was partially offset by price increases. A portion of the print circulation revenue decrease relates to the implementation of initiatives which include the elimination of unprofitable publishing days and circulation.

Digital

Digital revenue increased $2.5 million, or 2.8%, to $91.6 million for the year ended August 31, 2013, as compared to the same period in the prior year. Growth in digital revenue is primarily a result of increases in local digital advertising revenue of $7.1 million partially offset by declines of $4.5 million in digital classified revenue.

Other

Other revenue decreased $0.1 million for the year ended August 31, 2013, as compared to the same period in the prior year.

Expenses

Compensation

Compensation expenses decreased $27.4 million, or 7.9%, to $320.7 million for the year ended August 31, 2013, as compared to the same period in the prior year. This decrease is primarily due to lower salary costs of $33.8 million as a result of a reduction in employees under the Transformation Program, partially offset by increased share-based and other long-term incentive plan compensation expense of $3.8 million as a result of changes in the share price of our Class C voting shares which is used to compute the fair value of our other long-term incentive plan and an increase in employee benefit plan expense of $2.3 million. Excluding non-cash share-based and other long-term incentive plan compensation expense, compensation expense decreased $31.2 million, or 8.9%.

Newsprint

Newsprint expenses decreased $11.7 million, or 22.3%, to $40.9 million for the year ended August 31, 2013, as compared to the same period in the prior year. Newsprint expense decreases are primarily a result of consumption decreases of 20.1% due to continued usage reduction efforts, reduced publishing days and lower newspaper circulation volumes, combined with a decrease in newsprint cost per tonne of 2.8%.

Distribution

Distribution expenses decreased $16.0 million, or 12.9%, to $107.9 million for the year ended August 31, 2013, as compared to the same period in the prior year. Decreases in distribution expenses are primarily a result of a reduction in newspaper circulation volumes, the elimination of unprofitable publishing days and circulation and other cost reduction initiatives.

Other operating

Other operating expenses decreased $11.3 million, or 6.9%, to $151.6 million for the year ended August 31, 2013, as compared to the same period in the prior year. Decreases in other operating expenses are primarily a result of ongoing cost savings initiatives. Partially offsetting these decreases are increased rent and occupancy costs associated with new property operating leases.

15

Operating income before depreciation, amortization, impairment and restructuring

Operating income before depreciation, amortization, impairment and restructuring decreased $13.9 million, or 9.7%, to $130.4 million for the year ended August 31, 2013, as compared to the same period in the prior year. The decrease relates primarily to decreases in revenue, partially offset by decreases in expenses as discussed above. Excluding non-cash share-based and other long-term incentive plan compensation expense, operating income before depreciation, amortization, impairment and restructuring decreased $10.2 million, or 7.2%.

Depreciation

Depreciation increased $3.8 million to $30.0 million for the year ended August 31, 2013, as compared to the same period in the prior year. The increase relates primarily to the change in the estimate of the useful lives of certain production assets as a result of production outsourcing arrangements.

Amortization

Amortization decreased $0.2 million to $43.3 million for the year ended August 31, 2013, as compared to the same period in the prior year.

Impairments

During the year ended August 31, 2013 as a result of interim and annual impairment testing of our goodwill and indefinite life intangible assets we recorded an impairment loss of $93.9 million which consists of $73.9 million related to goodwill, $16.4 million related to indefinite life intangible assets and $3.6 million related to property and equipment. The impairments were as a result of lower than anticipated long-term revenue projections due to economic and structural factors including the uncertainty of the print advertising market and the rapidly evolving digital advertising market. In addition, during the year ended August 31, 2013, we recorded an impairment loss of $6.1 million with respect to a production facility upon reclassification of the asset from property and equipment to asset held-for-sale. There were no such impairments in the year ended August 31, 2012.

Restructuring and other items

Restructuring and other items expense for the year ended August 31, 2013 decreased $1.2 million to $34.2 million as compared to the same period in the prior year. Restructuring and other items expense for the year ended August 31, 2013 includes an expense of $2.3 million related to changes made to an employee benefit plan as a result of an arbitrator’s ruling. Additionally, included in restructuring and other items is $31.9 million of severance costs, which include both involuntary terminations and voluntary buyouts. Restructuring and other items expense for the year ended August 31, 2012 consisted of $39.5 million related to severance costs, which included both involuntary terminations and voluntary buyouts and a recovery of $4.1 million which represented a curtailment gain in respect of our pension benefit plans related to such involuntary terminations and voluntary buyouts.

Operating income (loss)

Operating loss was $77.0 million for the year ended August 31, 2013, compared to operating income of $39.3 million for the same period in the prior year, primarily as a result of decreased operating income before depreciation, amortization, impairment and restructuring, increased depreciation and the impairments recorded in the year ended August 31, 2013, all as discussed above.

16

Interest expense

Interest expense decreased $3.5 million to $61.9 million for the year ended August 31, 2013, as compared to the same period in the prior year. Interest expense primarily relates to interest on our long-term debt that is recognized using the effective interest rate method which amortizes the initial debt issuance costs and includes both cash and non-cash interest. The decrease in interest expense for the year ended August 31, 2013 relates to decreases in interest expense due to lower debt levels as compared to the same period in the prior year, partially offset by an increase in the effective interest rate as a result of the refinancing on August 16, 2012. Cash interest expense decreased $1.6 million during the year ended August 31, 2013, as compared to the same period in the prior year, due to reduced hedging on the Second-Lien Notes and lower debt levels, partially offset by an increase in the interest rate on first-lien debt as a result of the refinancing completed in August 2012.

Loss on debt repayment

During the year ended August 31, 2012, we recorded a non-cash loss on debt repayment of $9.2 million representing unamortized discounts and financing fees related to the repayment of the then outstanding Term Loan Facility. There were no such losses in the year ended August 31, 2013.

Net financing expense relating to employee benefit plans

Net financing expense relating to employee benefit plans decreased $2.4 million to $1.5 million for the year ended August 31, 2013, as compared to the same period in the prior year. The decrease relates to both a decrease in the interest cost on plan obligations and an increase in the expected return on plan assets.

(Gain) loss on disposal of property and equipment and intangible assets

During the year ended August 31, 2013, we disposed of property and equipment and intangible assets and realized a net gain of $1.0 million. During the year ended August 31, 2012, we disposed of property and equipment and intangible assets and realized a loss of $0.3 million.

(Gain) loss on derivative financial instruments

Loss on derivative financial instruments for the year ended August 31, 2013 was $7.3 million as compared to a gain of $8.6 million during the same period in the prior year. The loss for the year ended August 31, 2013 relates to the change in fair value of our variable prepayment option embedded derivatives on the First-Lien Notes and Second-Lien Notes. The gain for the year ended August 31, 2012 included a gain of $13.4 million which occurred prior to the settlement of a fair value swap that was not designated as a hedge, gains of $9.6 million related to the variable prepayment option embedded derivatives on the First-Lien Notes and Second-Lien Notes, partially offset by a loss of $1.9 million related to the settlement of cash flow swaps designated as hedges for cash consideration of $1.3 million, a realized loss of $0.8 million which represents a payment made to amend the terms of cash flow swap designated as a hedge, a realized loss of $8.8 million related to the settlement of the fair value swap not designated as a hedge and net cash outflows of $2.8 million related to contractual cash interest settlements on a fair value swap not designated as a hedge.

17

Foreign currency exchange losses

Foreign currency exchange losses for the year ended August 31, 2013 were $7.1 million as compared to $6.4 million during the same period in the prior year. On August 16, 2012 we repaid our Term Loan Facility in its entirety, which was denominated in US dollars, and replaced it with the First-Lien Notes which are denominated in Canadian dollars, thereby permanently reducing our exposure to foreign currency fluctuations on a significant portion of our long-term debt. In September 2012, we settled a notional amount of US$97.5 million of the foreign currency interest rate swap designated as a cash flow hedge thereby increasing our exposure to foreign currency fluctuations on the non-swapped portion of the Second-Lien Notes from US$3.6 million to US$101.1 million. For the year ended August 31, 2013 foreign currency exchange losses consist primarily of unrealized losses of $6.8 million related to the non-swapped portion of the Second-Lien Notes. For the year ended August 31, 2012 foreign currency exchange losses consisted primarily of net realized losses of $6.3 million related to repayments of the Term Loan Facility and realized losses of $0.8 million on contractual principal settlements on the foreign currency interest rate swap not designated as a hedge, partially offset by unrealized gains of $0.5 million related to the non-swapped portion of the Second-Lien Notes.

Loss before income taxes

Loss before income taxes was $153.8 million for the year ended August 31, 2013, as compared to $37.3 million for the same period in the prior year. The increase in loss before income taxes is primarily the result of operating losses as discussed above.

Provision for income taxes

We have not recorded a current or deferred tax expense or recovery for the year ended August 31, 2013 and 2012. Current taxes payable or recoverable result in a decrease or increase, respectively, to our tax loss carryforward balances. The cumulative tax loss carryforward balances have not been recognized as a net deferred tax asset on the statement of financial position.

Net loss from continuing operations

Net loss from continuing operations was $153.8 million for the year ended August 31, 2013, as compared to $37.3 million for the same period in the prior year, as a result of the factors described above in loss before income taxes.

Net earnings from discontinued operations

We completed the sale of substantially all of the assets and liabilities of the Disposed Properties on November 30, 2011, and as a result there were no discontinued operations for the year ended August 31, 2013. Net earnings from discontinued operations for the year ended August 31, 2012 was $14.1 million and included a $17.1 million gain on sale of discontinued operations and an allocation of $6.4 million of interest expense representing an acceleration of debt issuance costs related to the debt repayment made with the net proceeds from the sale.

Net loss attributable to equity holders of the Company

Net loss for the year ended August 31, 2013 was $153.8 million as compared to $23.2 million for the same period in the prior year. The decrease is due to an increase in the net loss from continuing operations and no net earnings from discontinued operations, both as discussed above.

18

Postmedia’s operating results for the year ended August 31, 2012 as compared to the year ended August 31, 2011

| | | | | | | | |

| | | 2012 | | | 2011 | |

Revenues | | | | | | | | |

Print advertising | | | 514,987 | | | | 573,920 | |

Print circulation | | | 209,177 | | | | 219,296 | |

Digital | | | 89,076 | | | | 87,050 | |

Other | | | 18,637 | | | | 18,622 | |

| | | | | | | | |

Total revenues | | | 831,877 | | | | 898,888 | |

Expenses | | | | | | | | |

Compensation | | | 348,133 | | | | 368,516 | |

Newsprint | | | 52,628 | | | | 57,423 | |

Distribution | | | 123,872 | | | | 126,825 | |

Other operating | | | 162,908 | | | | 156,922 | |

| | | | | | | | |

Operating income before depreciation, amortization, and restructuring | | | 144,336 | | | | 189,202 | |

Depreciation | | | 26,157 | | | | 27,015 | |

Amortization | | | 43,566 | | | | 45,209 | |

Restructuring and other items | | | 35,355 | | | | 38,011 | |

| | | | | | | | |

Operating income | | | 39,258 | | | | 78,967 | |

Interest expense | | | 65,446 | | | | 72,284 | |

Loss on debt repayment | | | 9,178 | | | | 11,018 | |

Net financing expense relating to employee benefit plans | | | 3,900 | | | | 2,971 | |

Loss on disposal of property and equipment and intangible assets | | | 258 | | | | 176 | |

(Gain) loss on derivative financial instruments | | | (8,632 | ) | | | 21,414 | |

Foreign currency exchange (gains) losses | | | 6,383 | | | | (17,959 | ) |

Acquisition costs | | | — | | | | 1,217 | |

| | | | | | | | |

Loss before income taxes | | | (37,275 | ) | | | (12,154 | ) |

Provision for income taxes | | | — | | | | — | |

| | | | | | | | |

Net loss from continuing operations | | | (37,275 | ) | | | (12,154 | ) |

Net earnings from discontinued operations, net of tax of nil | | | 14,053 | | | | 2,565 | |

| | | | | | | | |

Net loss attributable to equity holders of the Company | | | (23,222 | ) | | | (9,589 | ) |

| | | | | | | | |

Revenue

Print advertising

Print advertising revenue decreased $58.9 million, or 10.3%, to $515.0 million for the year ended August 31, 2012, as compared to the same period in the prior year. This decrease relates to most of our major categories of print advertising revenue, including decreases from national advertising of 14.2%, retail advertising of 7.7%, classified advertising of 11.7%, and insert advertising of 3.6%. The total print advertising linage and average line rate related to national, retail and classified advertising decreased 8.4% and 3.8%, respectively, during the year ended August 31, 2012, as compared to the same period in the prior year. Insert revenue decreases are primarily related to volume decreases of 2.3% during the year ended August 31, 2012 as compared to the same period in the prior year.

Print circulation

Print circulation revenue decreased $10.1 million, or 4.6%, to $209.2 million for the year ended August 31, 2012, as compared to the same period in the prior year. Net paid circulation decreased 7.2% for the year ended August 31, 2012, as compared to the same period in the prior year and was partially offset by price increases.

19

Digital

Digital revenue increased $2.0 million, or 2.3%, to $89.1 million for the year ended August 31, 2012, as compared to the same period in the prior year. Growth in digital revenue is primarily a result of increases in revenue associated with Infomart of $0.5 million and increases in local digital advertising revenue of $6.5 million, partially offset by declines of $2.2 million in national digital advertising revenue and the loss of $2.8 million associated with a digital sales representation agreement that ended August 31, 2011.

Other

Other revenue was $18.6 million for the years ended August 31, 2012 and 2011.

Expenses

Compensation

Compensation expenses decreased $20.4 million, or 5.5%, to $348.1 million for the year ended August 31, 2012, as compared to the same period in the prior year. The decrease is the result of lower salary costs as a result of a reduction in employees under the Transformation Program, decreases to our short-term incentive plan awards, decreases in share-based and other long-term incentive plan compensation expense, partially offset by increases in employee benefit plan expenses. Excluding non-cash share-based and other long-term incentive plan compensation expense, compensation expense decreased $10.9 million, or 3.0%.

Newsprint

Newsprint expenses decreased $4.8 million, or 8.4%, to $52.6 million for the year ended August 31, 2012, as compared to the same period in the prior year. Newsprint expense decreases are primarily a result of consumption decreases of 7.2% due to continued usage reduction efforts and lower newspaper circulation volume, combined with a decrease in newsprint cost per tonne of 1.2%.

Distribution

Distribution expenses decreased $3.0 million, or 2.3%, to $123.9 million for the year ended August 31, 2012, as compared to the same period in the prior year. Decreases in distribution expenses are primarily a result of a reduction in newspaper circulation and insert volumes, combined with other cost reduction initiatives.

Other operating

Other operating expenses increased $6.0 million, or 3.8%, to $162.9 million for the year ended August 31, 2012, as compared to the same period in the prior year. Increases in other operating expenses are primarily related to marketing and promotion, legal and regulatory costs associated with being a public company. In addition during the year ended August 31, 2012, other operating expenses include a provision of $0.4 million for certain claims asserted against us as compared to a recovery to a previously recorded provision for certain claims asserted against us of $1.5 million in the year ended August 31, 2011.

Operating income before depreciation, amortization and restructuring

Operating income before depreciation, amortization and restructuring decreased $44.9 million, or 23.7%, to $144.3 million for the year ended August 31, 2012, as compared to the same period in the prior year. The decrease relates primarily to decreases in revenue and increases in other operating expenses, partially offset by decreases in compensation, newsprint and distribution expenses, all as discussed above. Excluding non-cash share-based and other long-term incentive plan compensation expense, operating income before depreciation, amortization, and restructuring decreased $54.4 million, or 27.7%.

20

Depreciation

Depreciation decreased $0.9 million, or 3.2%, to $26.2 million for the year ended August 31, 2012, as compared to the same period in the prior year.

Amortization

Amortization decreased $1.6 million, or 3.6%, to $43.6 million for the year ended August 31, 2012, as compared to the same period in the prior year.

Restructuring and other items

Restructuring and other items expense for the year ended August 31, 2012 decreased $2.7 million to $35.4 million as compared to the year ended August 31, 2011. Restructuring and other items expense for the year ended August 31, 2012 consisted of $39.5 million related to severance costs, which included both involuntary terminations and voluntary buyouts and a recovery of $4.1 million which represented a curtailment gain in respect of our pension benefit plans related to such involuntary terminations and voluntary buyouts. Restructuring and other items expense for the year ended August 31, 2011 included $38.5 million related to severance costs, which include both involuntary terminations and voluntary buyouts, a recovery of $3.7 million which represented curtailment gains in respect of our pension and post-retirement benefit plans related to such involuntary terminations and voluntary buyouts, and $3.2 million of expenses relating to the preparation of a non-offering prospectus and expenses incurred to comply with our contractual obligation to make an exchange offer for the Second-Lien Notes that is registered with the U.S. Securities and Exchange Commission and management oversight expenses of our various restructuring initiatives.

Operating income

Operating income was $39.3 million for the year ended August 31, 2012, as compared to $79.0 million for the same period in the prior year, as a result of the factors described above.

Interest expense

Interest expense decreased $6.8 million, or 9.5%, to $65.4 million for the year ended August 31, 2012, as compared to the same period in the prior year. The decrease relates to the lower effective interest rate in the year ended August 31, 2012 as a result of the refinancing of the Term Loan Facility on April 4, 2011 as well as the overall reduction in the Term Loan Facility due to principal repayments.

Loss on debt repayment

During the year ended August 31, 2012 we recorded a non-cash loss on debt repayment of $9.2 million representing unamortized discounts and financing fees related to the repayment of the then outstanding Term Loan Facility. During the year ended August 31, 2011 we recorded a loss on debt prepayment of $11.0 million. This included cash costs of $1.4 million incurred on the repayment of debt and a non-cash loss of $9.6 million of unamortized discounts and financing fees related to the repayment of the US and Canadian tranches of the Term Loan Facility.

Net financing expense relating to employee benefit plans

Net financing expense relating to employee benefit plans increased $0.9 million to $3.9 million for the year ended August 31, 2012, as compared to the same period in the prior year.

21

Loss on disposal of property and equipment and intangible assets

During the year ended August 31, 2012, we disposed of property and equipment and intangible assets and realized a loss of $0.3 million. During the year ended August 31, 2011, we disposed of property and equipment and realized a loss of $0.2 million.

(Gain) loss on derivative financial instruments

Gain on derivative financial instruments for the year ended August 31, 2012 was $8.6 million as compared to a loss of $21.4 million during the same period in the prior year. The gain for the year ended August 31, 2012 included a gain of $13.4 million which occurred prior to the settlement of a fair value swap that was not designated as a hedge, gains of $9.6 million related to the variable prepayment option embedded derivatives on the First-Lien Notes and Second-Lien Notes, partially offset by a loss of $1.9 million related to the settlement of cash flow swaps designated as a hedge for cash consideration of $1.3 million, a realized loss of $0.8 million which represents a payment made to amend the terms of cash flow swap designated as a hedge, a realized loss of $8.8 million related to the settlement of the fair value swap not designated as a hedge and net cash outflows of $2.8 million related to contractual cash interest settlements on a fair value swap not designated as a hedge. The loss for the year ended August 31, 2011 included a loss of $16.9 million related to a fair value swap that was not designated as a hedge, net cash outflows of $4.2 million related to contractual cash interest settlements on a fair value swap not designated as a hedge, a loss of $1.8 million which represents a payment made to amend the terms of our fair value swap that was not designated as a hedge, partially offset by a gain of $1.5 million related to a variable prepayment option embedded derivative on the Second-Lien Notes.

Foreign currency exchange (gains) losses

Foreign currency exchange losses for the year ended August 31, 2012 were $6.4 million as compared to gains of $18.0 million during the same period in the prior year. For the year ended August 31, 2012 foreign currency exchange losses consisted primarily of net realized losses of $6.3 million related to repayments of the Term Loan Facility and realized losses of $0.8 million on contractual principal settlements on the foreign currency interest rate swap not designated as a hedge, partially offset by unrealized gains of $0.5 million related to the non-swapped portion of the Second-Lien Notes. For the year ended August 31, 2011 foreign currency exchange gains consisted primarily of net realized gains of $26.9 million related to the US tranche of the Term Loan Facility that was repaid on April 4, 2011. Partially offsetting these gains were unrealized losses of $5.7 million related to the non-swapped portion of the Term Loan Facility and realized losses of $2.2 million on contractual principal settlements on the foreign currency interest rate swap not designated as a hedge.

Acquisition costs

During the year ended August 31, 2011, we incurred additional net acquisition costs of $1.2 million related to the July 13, 2010 acquisition of Canwest Limited Partnership. These costs were expensed as they were not directly related to either the issuance of debt or equity.

Loss before income taxes

Loss before income taxes was $37.3 million for the year ended August 31, 2012, as compared to $12.2 million for the same period in the prior year. The increase in loss before income taxes is primarily the result of decreased operating income, foreign currency exchange losses and decreased interest expense, partially offset by gains on derivative financial instruments, all as discussed above.

Provision for income taxes

We have not recorded a current or deferred tax expense or recovery for the year ended August 31, 2012 and 2011. Current taxes payable or recoverable result in a decrease or increase, respectively, to our tax loss carryforward balances. The cumulative tax loss carryforward balances have not been recognized as a net deferred tax asset on the statement of financial position.

22

Net loss from continuing operations

Net loss from continuing operations was $37.3 million for the year ended August 31, 2012, as compared to $12.2 million for the same period in the prior year as a result of the factors described above in loss before income taxes.

Net earnings from discontinued operations

Net earnings from discontinued operations for the year ended August 31, 2012 was $14.1 million and includes a $17.1 million gain on sale of discontinued operations and an allocation of $6.4 million of interest expense representing an accelerated amortization of debt issuance costs related to the debt repayment made with the net proceeds from the sale. The Transaction was completed on November 30, 2011, as a result there were no discontinued operations for the three months ended February 29, 2012, May 31, 2012 and August 31, 2012, as such the earnings are not comparable to the net earnings from discontinued operations of $2.6 million for the year ended August 31, 2011.

Net loss attributable to equity holders of the Company

Net loss for the year ended August 31, 2012 was $23.2 million as compared to $9.6 million for the same period in the prior year. The increase in net loss is due to the increase in net loss from continuing operations partially offset by the increase in net earnings from discontinued operations both as discussed above.

Consolidated quarterly financial information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal 2013 | | | Fiscal 2012 | |

($ in thousands of Canadian dollars,

except per share information) | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

Revenue | | | 169,309 | | | | 191,784 | | | | 178,818 | | | | 211,672 | | | | 190,124 | | | | 212,021 | | | | 198,642 | | | | 231,090 | |

| | | | | | | | |

Net earnings (loss) from continuing operations | | | (35,805 | ) | | | (112,166 | ) | | | (14,162 | ) | | | 8,304 | | | | (28,351 | ) | | | (12,137 | ) | | | (11,065 | ) | | | 14,278 | |

Net earnings (loss) per share from continuing operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (0.89 | ) | | $ | (2.79 | ) | | $ | (0.35 | ) | | $ | 0.21 | | | $ | (0.70 | ) | | $ | (0.30 | ) | | $ | (0.27 | ) | | $ | 0.35 | |

Diluted | | $ | (0.89 | ) | | $ | (2.79 | ) | | $ | (0.35 | ) | | $ | 0.20 | | | $ | (0.70 | ) | | $ | (0.30 | ) | | $ | (0.27 | ) | | $ | 0.35 | |

| | | | | | | | |

Net earnings (loss) attributible to equity holders of the Company | | | (35,805 | ) | | | (112,166 | ) | | | (14,162 | ) | | | 8,304 | | | | (28,351 | ) | | | (12,137 | ) | | | (11,065 | ) | | | 28,331 | |

Net earnings (loss) per share attributible to equity holders of the Company | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (0.89 | ) | | $ | (2.79 | ) | | $ | (0.35 | ) | | $ | 0.21 | | | $ | (0.70 | ) | | $ | (0.30 | ) | | $ | (0.27 | ) | | $ | 0.70 | |

Diluted | | $ | (0.89 | ) | | $ | (2.79 | ) | | $ | (0.35 | ) | | $ | 0.20 | | | $ | (0.70 | ) | | $ | (0.30 | ) | | $ | (0.27 | ) | | $ | 0.70 | |

| | | | | | | | |

Cash flows from operating activities | | | (11,562 | ) | | | 15,975 | | | | 20,706 | | | | 13,228 | | | | (7,472 | ) | | | 24,046 | | | | 16,045 | | | | 9,922 | |

23

Liquidity and capital resources

Our principal uses of funds are for working capital requirements, debt servicing and capital expenditures. Based on our current and anticipated level of operations, we believe that our cash on hand, cash flows from operations and available borrowings under our senior secured asset-based revolving credit facility (“ABL Facility”) will enable us to meet our working capital, capital expenditure, debt servicing and other funding requirements. However, our ability to fund our working capital needs, debt servicing and other obligations depends on our future operating performance and cash flows. There are a number of factors which may adversely affect our operating performance and our ability to meet these obligations. See “Key Factors Affecting Operating Results”. Our cash flows from operating activities may be impacted by, among other things, the overall strength of the economy, competition from other newspapers and alternative forms of media and competition from alternative emerging technologies. In addition, in recent years there has been a growing shift in advertising dollars from newspaper advertising to other advertising formats, particularly online and other digital platforms such as search and social media websites. Although we expect to fund our capital needs with our available cash, cash generated from operations and available borrowings under the ABL Facility, our indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under our debt agreements. As at August 31, 2013, no amounts were drawn under the ABL Facility. See “Risk Factor - We may not be able to refinance our ABL Facility on attractive terms, or at all”.

As part of our annual budgeting process, management projects capital expenditures for the forthcoming fiscal year. Each project is subject to a detailed review on a case by case basis prior to approval. Investment projects must achieve an acceptable return on investment and generally are expected to demonstrate a payback period of no more than three years. In certain instances where there are strategic considerations, a longer timeframe may be considered. For the year ending August 31, 2014, we expect our major non-operating cash requirements to include discretionary capital expenditures of approximately $20 to $25 million and contractual principal repayments of long-term debt to total $12.5 million, which does not include the proceeds from certain potential asset sales which will be used to make an offer to redeem an equal amount of First-Lien Notes.

Sources of Cash

Cash flows from operating activities

Our principal sources of liquidity are cash flows from operating activities. For the three months and year ended August 31, 2013, our cash flows from operating activities were outflows of $11.6 million and inflows of $38.3 million, respectively (2012 – outflows of $7.5 million and inflows of $42.5 million, respectively) (year ended August 31, 2011 – inflows of $38.6 million). Cash flows from operating activities decreased $4.1 million for the three months ended August 31, 2013, as compared to the same period in the prior year due to a decrease in cash flows as a result of declines in operating income before depreciation, amortization, impairment and restructuring. Cash flows from operating activities decreased $4.2 million for the year ended August 31, 2013, as compared to the same period in the prior year due to a decrease in cash flows as a result of declines in operating income before depreciation, amortization, impairment and restructuring and the settlement of the foreign currency interest rate swap designated as a cash flow hedge offset by lower funding obligations on our employee benefit plans. Cash flows from operating activities increased $3.9 million for the year ended August 31, 2012, as compared to the same period in the prior year due to a decrease in non-cash working capital, partially offset by decreases in operating income before depreciation, amortization and restructuring. As at August 31, 2013 we had cash of $40.8 million (August 31, 2012 - $22.2 million) and our ABL Facility was undrawn (August 31, 2012 – nil). Availability under the ABL Facility as at August 31, 2013 was $20.7 million (August 31, 2012 - $23.3 million).

24

Cash flows from investing activities

For the three months and year ended August 31, 2013, our cash flows from investing activities were outflows of $4.1 million and inflows of $12.4 million, respectively (2012 – outflows of $4.2 million and inflows of $72.4 million) (year ended August 31, 2011 – outflows of $19.2 million). The net cash outflows from investing activities during the three months ended August 31, 2013 include outflows on capital expenditures related to property and equipment of $2.1 million and intangible assets of $2.0 million. The net cash outflows from investing activities during the three months ended August 31, 2012 included the outflows on capital expenditures related to property and equipment of $2.6 million and intangible assets of $1.6 million. The net cash inflows from investing activities during the year ended August 31, 2013 include the net proceeds received on the sale of property and equipment, intangible assets and asset held-for-sale of $25.9 million, which includes the proceeds from the sale of 1450 Don Mills Road discussed previously, offset by outflows on capital expenditures related to property and equipment of $7.6 million and intangible assets of $5.9 million. The net cash inflows from investing activities during the year ended August 31, 2012 included the net proceeds from the sale of the Disposed Properties of $87.3 million as discussed previously, offset by outflows on capital expenditures related to property and equipment of $8.2 million and intangible assets of $6.7 million. The net cash outflows from investing activities during the year ended August 31, 2011 included the net proceeds from the sale of property and equipment and intangible assets of $1.2 million, offset by outflows on capital expenditures related to property and equipment of $11.7 million and intangible assets of $8.7 million.

Uses of Cash

Cash flows from financing activities

Cash outflows from financing activities for the three months and year ended August 31, 2013, were nil and $32.2 million, respectively (2012 – inflows of $5.1 million and outflows of $103.2 million, respectively) (year ended August 31, 2011 – outflows of $49.2 million), and were related to our indebtedness as discussed below.

Indebtedness

As of August 31, 2013, we have $218.0 million First-Lien Notes and US$268.6 million Second-Lien Notes outstanding (August 31, 2012 - $250.0 million and US$268.6 million, respectively). During the three months and year ended August 31, 2013, we redeemed nil and $32.0 million, respectively, aggregate principal amount of First-Lien Notes at par in accordance with the terms and conditions of the First-Lien Notes indenture. During the three months ended August 31, 2012 we issued $250.0 million in aggregate principal amount of First-Lien Notes, before financing fees of $6.6 million. The net proceeds from issuance were used to repay the amounts then outstanding on the Term Loan Facility of $238.3 million (US$240.0 million). During the year ended August 31, 2012 we made mandatory and optional principal repayments on the Term Loan Facility of $102.0 million (US$100.0 million), which included the required repayment due to the sale of discontinued operations, as discussed previously. In addition, during the year ended August 31, 2012 we repurchased and retired US$6.4 million of the Second-Lien Notes for total cash consideration of $6.3 million (US$6.2 million).

During the year ended August 31, 2011 we made mandatory and optional principal repayments on the Term Loan Facility of $47.4 million (US$45.5 million and CDN$2.8 million). On April 4, 2011, we entered into an agreement to amend certain terms of the Term Loan Facility. As a result, amounts then outstanding under the Term Loan Facility including a US tranche of $238.0 million (US$247.0 million) and a Canadian tranche of $107.3 million were repaid and replaced with a new US tranche. The new US tranche was issued for US$365.0 million (CDN$351.7 million) at a discount of 0.25% for net proceeds of $350.8 million, before financing fees of $5.4 million. In addition, during the year ended August 31, 2011 we made a payment on a finance lease of $1.8 million.

25

The following tables set out the principal and carrying amount of our long-term debt outstanding as at August 31, 2013 and 2012. The first column of the table translates, where applicable, our US dollar debt to the Canadian equivalent based on foreign exchange rates specified in our foreign currency swap agreements for swapped debt and at the closing foreign exchange rate on August 31, 2013 and 2012, respectively, for our non-swapped debt.

| | | | | | | | | | | | | | | | |

| | | August 31, 2013 | |

($ in thousands of Canadian dollars) | | Principal

Outstanding

(US$ Debt

translated at

swapped or

period end rates) | | | Principal

Outstanding

(US$ Debt

translated at

period end

exchange rates) | | | Financing

fees,

discounts

and other | | | Carrying

Value | |

First-Lien Notes (CDN$218.0M) | | | 217,960 | | | | 217,960 | | | | 5,927 | | | | 212,033 | |