UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended August 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 333-174780

POSTMEDIA NETWORK CANADA CORP.

(Exact names of registrants as specified in their charters)

N/A

(Translation of registrant’s name into English)

Postmedia Network Canada Corp.

Canada

(Jurisdiction of incorporation or organization)

98-0667225

(I.R.S. Employer Identification No.)

365 Bloor Street East, 12th Floor

Toronto, Ontario Canada M4W 3L4

(416) 383-2300

(Address, of each of the registrants’ principal executive offices)

Douglas Lamb, Executive Vice President and Chief Financial Officer

365 Bloor Street East, 12th Floor

Toronto, Ontario Canada M4W 3L4

Phone: (416) 383-2300 Fax: (416) 443-6046

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

1,040,153 Class C voting shares and 280,141,692 Class NC variable voting shares outstanding as of August 31, 2015

Indicate by check mark if the registration is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. x Yes ¨ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ¨ Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

¨ U.S. GAAP | | x International Financial Reporting Standards as issued by the International Accounting Standards Board | | ¨ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17. ¨ Item 18. ¨

If this is an annual report, indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

TABLE OF CONTENTS

GENERAL INFORMATION

Unless otherwise indicated, all references herein are to Canadian dollars.

Capitalized terms, except as otherwise defined herein, are defined in the section entitled“Glossary of Terms”.

Except as otherwise indicated or the context otherwise requires in this annual report, for periods prior to the Acquisition, references to the “Corporation”, the “Company”, “we”, “us” and “our” refer to Canwest LP and its consolidated subsidiaries; and for periods following the Acquisition, those terms refer to Postmedia Network Canada Corp. and, if the context requires, Postmedia Network Inc.

The Corporation was incorporated under theCanada Business Corporations Act, which is referred to as the “CBCA”. The Corporation’s principal executive offices are located at 365 Bloor Street East, 12th Floor, Toronto, Ontario, Canada, M4W 3L4 and its telephone number at that address is (416) 383-2300. The Corporation’s website is located athttp://www.postmedia.com. Information about the Corporation is included on its website. The Corporation’s website and the information contained on its website are not part of this report.

Glossary of Terms

In this annual report, the following terms will have the meanings set forth below, unless otherwise indicated. Words importing the singular include the plural and vice versa and words importing any gender include all genders.

“ABL Collateral” means the accounts receivable, cash and cash equivalents, inventory and related assets of Postmedia Network Inc. and Postmedia Network Canada Corp., which constitute collateral for the ABL Facility on a first-priority basis, for the First-Lien Notes on a second-priority basis and for the Second-Lien Notes on a third-priority basis.

“ABL Facility” has the meaning ascribed to such term in “Item 10.C Material Contracts – ABL Facility.”

“Acquisition” has the meaning ascribed to such term in “Item 4.A History and Development of the Company - Acquisition.”

“Acquisition Consideration” has the meaning ascribed to such term in “Item 4.A History and Developmentof the Company - Acquisition.”

“annual report” means this annual report on Form 20-F.

“Board” means the board of directors of Postmedia Network Canada Corp.

“Business Day” means a day on which banks are open for business in Toronto, but does not include a Saturday, Sunday or a holiday in the Province of Ontario.

“Canso” has the meaning ascribed to such term in “Item 4.A History and Development of the Company – SignificantPost-Acquisition Events.”

“CBCA” means theCanada Business Corporations Act.

“CCAA” means theCompanies’Creditors Arrangement Act (Canada).

“Canwest Global” means Canwest Global Communications Corp., a corporation incorporated under the laws of Canada and the indirect parent company of Canwest LP.

“Canwest LP” means the Canwest Limited Partnership/Canwest Societe en Commandite, a limited partnership formed under the laws of the province of Ontario whose general and limited partnership interests were owned by Canwest (Canada) Inc. and 4501071 Canada Inc., respectively, together with its subsidiaries.

“Conversion Restriction Agreement” has the meaning ascribed to such term under “Item 7. Major Shareholders and Related Party Transactions.”

“Disposed Properties” has the meaning ascribed to such term in “Item 4.A History and Development of the Company – Significant Post-Acquisition Events.”

“dollars” or “$” means Canadian dollars.

“DSU” means a right to receive, on a deferred basis, an amount of money subject to and in accordance with the terms of the DSU Plan, credited to a Member (as such term is defined in the DSU Plan) and reflected as an entry in a Member’s DSU Account (as such term is defined in the DSU Plan) in accordance with the DSU Plan.

“DSU Plan” means the deferred share unit plan of the Corporation dated as of July 13, 2010, as amended thereafter.

“EDGAR” means the Electronic Data-Gathering, Analysis and Retrieval system of the US Securities and Exchange Commission.

“Equity Subscription Receipts” has the meaning ascribed to such term in “Item 4.A History and Development of the Company – Significant Post-Acquisition Events.”

“First-Lien Notes” means the 8.25% Senior Secured Notes due 2017 issued by Postmedia Network Inc. on August 16, 2012 pursuant to the terms and conditions of the First-Lien Notes indenture.

“First-Lien Notes Collateral” means substantially all the assets of Postmedia Network Inc. and Postmedia Network Canada Corp. (other than ABL Collateral) and certain customary exclusions, which constitutes collateral for the First-Lien Notes on a first-priority basis, Second-Lien Notes on a second-priority basis and for the ABL Facility on a third-priority basis.

“Fiscal” means the twelve month period ending on August 31 of such year.

“Glacier Transaction” has the meaning ascribed to such term in “Item 4.A History and Development of the Company – Significant Post-Acquisition Events.”

“GoldenTree” means GoldenTree Asset Management LP.

“IFRS” means generally accepted accounting principles in accordance with Part I of the Handbook of the Canadian Institute of Chartered Accountants. IFRS as applied by the Corporation is in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

“LP Entities” means Canwest Publishing Inc./Publications Canwest Inc., Canwest Books Inc., Canwest (Canada) Inc. and Canwest LP.

“MD&A” means Postmedia Network Canada Corp’s management’s discussion and analysis for the years ended August 31, 2015, 2014 and 2013, attached hereto as Exhibit 15.2.

“National Post” means the daily national newspaper published by the Corporation.

“Non-Canadian” has the meaning ascribed to such term in “Item 10.B Memorandum and Articles of Association – Voting Shares.”

“Notes Subscription Receipts” has the meaning ascribed to such term in “Item 4.A History and Development of the Company – Significant Post-Acquisition Events.”

“Option” means the right to purchase Voting Shares or Variable Voting Shares, as applicable, under the Option Plan.

“Option Plan” means the stock option plan of the Corporation dated as of July 13, 2010.

“Plan” has the meaning ascribed to such term in “Item 4.A History and Development of the Company - Acquisition.”

“Postmedia” means Postmedia Network Canada Corp. and, if the context requires, its subsidiary, Postmedia Network Inc.

“Postmedia Rights Plan” means the Shareholder rights plan agreement entered into between Postmedia and Computershare Investor Services Inc., as rights agent.

“Prospectus” means the Canadian non-offering prospectus filed by Postmedia on June 7, 2011.

“Purchase Agreement” has the meaning ascribed to such term in “Item 4.A History and Development of the Company – Significant Post-Acquisition Events.”

“QMI” has the meaning ascribed to such term in “Item 4.A History and Development of the Company – Significant Post-Acquisition Events.”

“QMPI” has the meaning ascribed to such term in “Item 4.A History and Development of the Company – Significant Post-Acquisition Events.”

“Qualifying Public Corporation” has the meaning ascribed to such term in “Item 4.B Business Overview – Regulation.”

“Rights Offering” has the meaning ascribed to such term in “Item 4.A History and Development of the Company – Significant Post-Acquisition Events.”

“SEC” means the U.S. Securities and Exchange Commission.

“Sarbanes-Oxley” means the U.S.Sarbanes-Oxley Act of 2002.

“Second-Lien Notes” means the 12.50% Senior Secured Notes due 2018 issued by Postmedia Network Inc. pursuant to the terms and conditions of the Second-Lien Notes indenture.

“SEDAR” means the System for Electronic Data Analysis and Retrieval operated by the Canadian Securities Administrators.

“Shareholder” means both registered and non-registered owners of the Shares.

“Shares” means, collectively, the Voting Shares and the Variable Voting Shares.

“Standby Purchase Agreement” has the meaning ascribed to such term in “Item 7. Major Shareholders and Related Party Transactions.”

“Subscription Agreement” has the meaning ascribed to such term in “Item 4.A History and Development of the Company - Significant Post-Acquisition Events.”

“Subscription Receipt Indenture” has the meaning ascribed to such term in “Item 4.A History and Development of the Company - Significant Post-Acquisition Events.”

“Sun Acquisition” has the meaning ascribed to such term in “Item 4.A History and Development of the Company - Significant Post-Acquisition Events.”

“Tax Act” means theIncome Tax Act (Canada).

“Term Loan Facility” means the previous Senior Secured Term Loan Credit Facility of Postmedia Network Inc. entered into on July 13, 2010.

“Toronto Head Office” has the meaning ascribed to such term in “Item 4.A History and Development of the Company - Incorporation.”

“TSX” means the Toronto Stock Exchange.

“US$” and “US dollars” means United States dollars.

“Variable Voting Shares” means the Class NC variable voting shares in the capital of the Corporation which trade on the TSX under the symbol PNC.B.

“Voting Shares” means the Class C voting shares in the capital of the Corporation which trade on the TSX under the symbol PNC.A.

NOTICE REGARDING FORWARD LOOKING STATEMENTS

This annual report includes statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results, and therefore are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes”, “estimates”, “anticipates”, “expects”, “seeks”, “projects”, “intends”, “plans”, “may”, “will”, “could” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this annual report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies, expenditures, costs and the industry in which we operate. These statements reflect management’s current beliefs with respect to future events and are based on information currently available to management. Forward-looking statements involve significant known and unknown risks, uncertainties and assumptions. Many factors could cause the Corporation’s actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, without limitation, those listed in the “Risk Factors” section of the MD&A, attached hereto as Exhibit 15.2. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements could vary materially from those expressed or implied by the forward-looking statements contained in this annual report. Such risks include, but are not limited to: competition from digital and other forms of media; the Corporation’s ability to compete successfully in newspaper and online industries; the influence of prevailing economic conditions and the prospects of the Corporation’s advertising customers on advertising revenue; the failure to fulfill the Corporation’s strategy of building its digital media and online businesses; failure to maintain print and online newspaper readership and circulation levels; the negative impact of decreases in advertising revenue on results of operations; financial difficulties of certain contractors and vendors; competition with alternative emerging technologies; not being able to achieve a profitable balance between circulation levels and advertising revenues; not realizing anticipated cost savings from cost savings initiatives; seasonal variations in revenue; intellectual property rights; damage to the Corporation’s reputation; variations in the cost and availability of newsprint; disruptions in information systems and technology and other manufacturing systems; labour disruptions; equipment failure; environmental, health and safety laws and regulations; controversial editorial content; unresolved litigation matters; failure to comply with “Canadian Newspaper” status for purposes of the Tax Act; the collectability of accounts receivable; goodwill and intangible asset impairment charges; disruptions in the credit markets; changes to the availability and terms of insurance policies; under-funded registered pension plans; changes in pension fund investment performance; foreign exchange fluctuations; increases in distribution costs due to increases in fuel prices; outsourcing certain aspects of the business to third-party vendors; retaining and attracting sufficient qualified personnel; increases in sales and other taxes; the occurrence of natural orman-made disasters; failure to comply with theSarbanes-Oxley Act; failure to maintain effective internal controls; change of laws; security breaches and other disruptions could compromise information and expose the Corporation to liability; risks related to the assets acquired in the Sun Acquisition and the integration of those assets; the substantial indebtedness of the Corporation and the possibility that it may be able to incur substantially more debt which could adversely affect its financial condition; the Corporation did not refinance its ABL Facility; the terms of the indentures that govern the First-Lien Notes and Second-Lien Notes, may restrict the Corporation’s current and future operations; the possibility that the Corporation will not be able to generate sufficient cash to service all of its indebtedness; the lack of an active public market for the Shares; volatility of the market price for Shares; dual class share structure; Postmedia Network Canada Corp. having a holding company structure; risks relating to the future sales of Shares by directors and officers and risks relating to dilution. See the section entitled “Risk Factors” in the Corporation’s MD&A dated October 21, 2015, attached hereto as Exhibit 15.2 and which is available on SEDAR atwww.sedar.com and EDGAR for a complete description of risks relating to an investment in the Corporation. These risk factors are incorporated in this annual report by reference. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. These risk factors should not be construed as exhaustive and should be read with the other cautionary statements in this annual report and with the risk factors described in the MD&A.

These risk factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the Corporation bases its forward-looking statements on assumptions that it believes were reasonable when made, which assumptions include, but are not limited to, the Corporation’s future growth potential, results of operations, future prospects and opportunities, execution of the Corporation’s business strategy, a stable workforce, no material variations in the current tax and regulatory environments, future levels of indebtedness and the ability to achieve future cost savings, the Corporation cautions the reader that forward-looking statements are not guarantees of future performance and that the Corporation’s actual results of operations, financial condition and liquidity, and the development of the industry in which the Corporation operates, may differ materially from those made in or suggested by the forward-looking statements contained in this annual report. In addition, even if the Corporation’s results of operations, financial condition and liquidity, and the development of the industry in which it operates are consistent with the forward-looking statements contained in this annual report, those results or developments may not be indicative of results or developments in subsequent periods.

Any forward-looking statements which are made in this annual report speak only as of the date of such statement, and the Corporation does not undertake, and specifically declines, except as required by applicable law, any obligation to update such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. All of the forward-looking statements made in this annual report are qualified by these cautionary statements.

The Corporation owns or has rights to use the trademarks, service marks and trade names that it uses in connection with its business, such as Postmedia Network, Infomart and National Post. Each trademark, service mark and trade name of any other company appearing in this annual report is to the Corporation’s knowledge, owned by such other company. Solely for convenience, the trademarks, service marks and trade names referred to in this annual report are listed without the® and ™ symbols, but such references are not intended to indicate in any way that the Corporation will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

Industry Information

This annual report includes market share, ranking, industry data and forecasts that the Corporation obtained from industry publications, surveys, public filings, documents and internal sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. The Corporation has not independently verified any of the data from third-party sources nor has it ascertained the underlying economic assumptions relied upon therein.

Unless otherwise stated herein:

| | • | | individual newspaper circulation figures were obtained from the Alliance for Audited Media (“AAM”), the Canadian Media Circulation Audit (“CMCA”) and the Canadian Circulations Audit Board (“CCAB”), which are independent audit organizations that audit the circulation of print media entities, including newspapers; |

| | • | | information regarding industry-wide newspaper circulation revenue and circulation were obtained from Newspapers Canada, a partnership between the Canadian Newspaper Association and the Canadian Community Newspaper Association, which are not-for-profit industry associations representing publishers of Canadian daily newspapers and weekly newspapers, respectively. The Circulation Data Report, prepared by Newspapers Canada, calculates circulation levels based on data provided by AAM, CMCA and CCAB reports. No single publication schedule applies across the Canadian newspaper industry. Therefore, in the Circulation Data Report, Newspapers Canada makes further calculations based on AAM, CMCA and CCAB data to derive industry-wide figures; |

| | • | | newspaper readership information was obtained from the eMarketer Global Media Report, and Vividata (“Vividata”), the amalgamated organization of NADbank Inc. and Print Measurement Bureau (PMB), a not-for-profit research association of publishers, agencies and advertisers that provides audience measurement for magazines and newspapers to its members; and |

| | • | | digital audience measurement information was obtained from comScore Media Metrix, the audience measurement division of comScore, Inc. (“comScore”), which defines “total unique visitors,” a measure that the Corporation cites throughout this document, as “the estimated number of different individuals (in thousands) that visited any content of a website or mobile platform (smartphone/tablet), a category, a channel, or an application during the reporting period”. |

Statements as to the Corporation’s market position and ranking are based in part on market data currently available to it and management’s estimates and assumptions that have been made regarding the size of its markets within its industry. The Corporation believes data regarding the size of the markets and market share are inherently imprecise, but generally indicate size and position and market share within its markets. Although the Corporation is not aware of any misstatements regarding the industry data presented herein, the estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the section entitled “Risk Factors” in the Corporation’s MD&A dated October 21, 2015, attached hereto as Exhibit 15.2. The Corporation cannot guarantee the accuracy or completeness of such information contained in this annual report.

NOTICE REGARDING PRESENTATION OF FINANCIAL INFORMATION

The financial statements included in this annual report are presented in Canadian dollars. In this annual report, references to “$” and “dollars” are to Canadian dollars and references to “US$” and “US dollars” are to United States dollars. See “Item 3.A Selected Financial Data – Currency and Exchange Rates.”

Unless otherwise indicated, all financial statement data in this annual report in respect of periods commencing on or after September 1, 2010 has been derived from financial statements prepared in accordance with IFRS as issued by the International Accounting Standards Board. Postmedia Network Canada Corp.’s audited consolidated financial statements for the years ended August 31, 2015, 2014, and 2013 included in this annual report, attached hereto as Exhibit 15.1 are prepared in accordance with IFRS as issued by the International Accounting Standards Board.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable

ITEM 3. KEY INFORMATION

| A. | Selected Financial Data. |

Set forth below is selected financial data of the Corporation, at the dates and for the periods indicated.

The selected financial data as of and for the years ended August 31, 2015, 2014 and 2013 have been derived from Postmedia’s audited consolidated financial statements for the years ended August 31, 2015, 2014 and 2013, attached hereto as Exhibit 15.1. In addition, financial data pertaining to the years ended August 31, 2012 and 2011 are also disclosed. As a result of Postmedia’s adoption of new and amended accounting standards in accordance with their respective transition provisions effective September 1, 2013, the selected financial data as of and for the years ended August 31, 2013 and 2012 has been revised to reflect the adoption of these new and amended standards. For a summary of the impact of the new and amended standards refer to note 2 of the audited consolidated financial statements for the years ended August 31, 2014, 2013 and 2012 which can be obtained from the Postmedia Network Canada Corp.’s 20-F for the year ended August 31, 2014.

The selected financial data should be read in conjunction with, and are qualified by reference to, Items 4 and 5 of this annual report on Form 20-F. In addition, the selected financial data for periods presented prior to April 13, 2015 does not include the results of the properties acquired in the Sun Acquisition as described in “Item 4.A History and Development of the Company - Significant Post-Acquisition Events.” The results of operations for the year ended August 31, 2015 includes the results of the properties acquired in the Sun Acquisition for the period April 13, 2015 to August 31, 2015.

| | | | | | | | | | |

| | | Postmedia |

| | | Years ended August 31, |

| | | 2011(8) | | 2012(2)(8) | | 2013(2) | | 2014 | | 2015(1) |

| (in millions of Canadian dollars) | | | | | | | | | | |

| | | | | |

Revenues | | 898.9 | | 831.9 | | 751.6 | | 674.3 | | 750.3 |

Expenses | | 709.7 | | 688.0 | | 621.7 | | 564.8 | | 638.9 |

| | | | | | | | | | |

Operating income before depreciation, amortization, impairment and restructuring | | 189.2 | | 143.9 | | 129.9 | | 109.5 | | 111.4 |

Depreciation | | 27.0 | | 26.2 | | 29.9 | | 66.6 | | 32.0 |

Amortization | | 45.2 | | 43.6 | | 43.3 | | 39.1 | | 40.1 |

Impairments(3) | | — | | — | | 100.0 | | — | | 153.0 |

Restructuring and other items(4) | | 38.0 | | 35.3 | | 34.2 | | 39.3 | | 34.6 |

| | | | | | | | | | |

Operating income (loss) | | 79.0 | | 38.8 | | (77.5) | | (35.5) | | (148.3) |

Interest expense | | 72.3 | | 65.4 | | 61.9 | | 61.9 | | 69.2 |

Loss on debt repayment(5) | | 11.0 | | 9.2 | | — | | — | | — |

Net financing expense relating to employee benefit plans | | 3.0 | | 5.7 | | 7.5 | | 5.6 | | 5.6 |

(Gain) loss on derivative financial instruments | | 21.4 | | (8.6) | | 7.3 | | (1.6) | | 18.4 |

Foreign currency exchange (gains) losses | | (17.9) | | 6.4 | | 7.1 | | 6.3 | | 61.8 |

(Gain) loss on disposal of property and equipment, intangible assets and asset held-for-sale | | 0.2 | | 0.3 | | (1.0) | | (0.3) | | (1.2) |

Acquisition costs(6) | | 1.2 | | — | | — | | — | | — |

| | | | | | | | | | |

Net loss before income taxes | | (12.2) | | (39.6) | | (160.3) | | (107.4) | | (302.1) |

Recovery of income taxes(7) | | — | | — | | — | | — | | (38.7) |

| | | | | | | | | | |

Net loss from continuing operations | | (12.2) | | (39.6) | | (160.3) | | (107.4) | | (263.4) |

Net earnings from discontinued operations(8) | | 2.6 | | 13.5 | | — | | — | | — |

| | | | | | | | | | |

Net loss | | (9.6) | | (26.1) | | (160.3) | | (107.4) | | (263.4) |

| | | | | | | | | | |

| | | | | |

Net loss per share from continuing operations: | | | | | | | | | | |

Basic | | $(0.30) | | $(0.98) | | $(3.98) | | $(2.67) | | $(1.98) |

Diluted | | $(0.30) | | $(0.98) | | $(3.98) | | $(2.67) | | $(1.98) |

Net loss per share: | | | | | | | | | | |

Basic | | $(0.24) | | $(0.65) | | $(3.98) | | $(2.67) | | $(1.98) |

Diluted | | $(0.24) | | $(0.65) | | $(3.98) | | $(2.67) | | $(1.98) |

| | | | | |

Balance sheet data: | | | | | | | | | | |

Long-term debt (including current portion) | | 572.3 | | 499.9 | | 486.9 | | 486.3 | | 672.3 |

Total assets | | 1,180.2 | | 1,044.8 | | 862.8 | | 740.6 | | 874.1 |

Net assets (liabilities) | | 315.3 | | 231.8 | | 134.2 | | 10.9 | | (89.3) |

Capital stock | | 371.1 | | 371.1 | | 371.1 | | 371.1 | | 535.5 |

| | | | | |

Other: | | | | | | | | | | |

Number of shares outstanding | | 40.3 | | 40.3 | | 40.2 | | 40.2 | | 281.2 |

Dividends declared per share | | — | | — | | — | | — | | — |

Notes:

| (1) | The selected financial data for the year ended August 31, 2015 includes the results of the properties acquired in the Sun Acquisition for the period from April 13, 2015 to August 31, 2015. |

| (2) | The selected financial data of Postmedia as at and for the years ended August 31, 2013 and 2012 have been revised as a result of the adoption of new and amended accounting standards in accordance with their respective transition provisions effective September 1, 2013. For a summary of the impact of the new and amended standards refer to note 2 of the audited consolidated financial statements for the years ended August 31, 2014, 2013 and 2012 which can be obtained from the Postmedia Network Canada Corp.’s 20-F for the year ended August 31, 2014. |

| (3) | During the years ended August 31, 2015 and 2013, as a result of interim and annual impairment testing of goodwill and indefinite life intangible assets Postmedia recorded an impairment of $150.7 million and $93.9 million, respectively. During the year ended August 31, 2015 the impairment consisted of $80.0 million related to goodwill and $70.7 million related to indefinite life intangible assets (2013 - $73.9 million related to goodwill, $16.4 million related to indefinite life intangible assets and $3.6 million related to property and equipment). The impairments were as a result of lower than anticipated long-term revenue projections due to economic and structural factors including the uncertainty of the print advertising market and the rapidly evolving digital advertising market. In addition, during the year ended August 31, 2015, Postmedia recorded an impairment of $2.3 million with respect to the sale of a production facility and during the year ended August 31, 2013, Postmedia recorded an impairment of $6.1 million with respect to a production facility upon reclassification of the asset from property and equipment to asset held-for-sale. For more information refer to note 5 of the audited consolidated financial statements for the years ended August 31, 2015, 2014, and 2013 included in this annual report, attached hereto as Exhibit 15.1 |

| (4) | Restructuring and other items expense primarily reflects employee termination costs related to various initiatives undertaken by Postmedia with the objective of permanently reducing or eliminating costs. Also included in this line item for the years ended August 31, 2015 and 2014 are expenses related to the Sun Acquisition and for the year ended August 31, 2013 an expense related to changes made to an employee benefit plan as a result of an arbitrator’s ruling. In addition, also included in this line item for the years ended August 31, 2012 and 2011 are curtailment gains relating to employee benefit plans a result of the termination of employees under the restructuring initiatives. The restructuring initiatives resulted in the elimination, for a significant number of employees, of the right to earn defined benefits and as a result curtailments occurred. |

| (5) | During the years ended August 31, 2011 and 2012, Postmedia recorded a loss on debt repayment related to the first amendment of its ABL Facility and the repayment of the Term Loan Facility, respectively. |

| (6) | Acquisition costs relate to advisory, legal, valuation, and other professional fees incurred in connection with the Acquisition of Canwest LP which are non-recurring. |

| (7) | Recovery of income taxes for the year ended August 31, 2015 was as a result of the recognition of a portion of Postmedia’s historical tax loss carryforwards which offset the scheduled reversal of taxable temporary differences acquired in the Sun Acquisition. For the years ended August 31, 2014, 2013, 2012 and 2011, Postmedia has not recorded a current or deferred tax expense or recovery as any current taxes payable or recoverable result in a decrease or increase, respectively, to Postmedia’s tax loss carryforward balances. The cumulative tax loss carryforward balances have not been recognized as a net deferred tax asset on the statement of financial position. |

| (8) | On November 30, 2011, Postmedia completed the sale of the Disposed Properties. As a result of the sale, Postmedia has presented the results of the Disposed Properties as discontinued operations as at and for the period ended November 30, 2011, and as such the statement of operations for the year ended August 31, 2011 prepared in accordance with IFRS reflects this change in presentation. The statement of financial position and the statements of cash flows for the year ended August 31, 2011 have not been revised to reflect this change in presentation. Net earnings from discontinued operations for the year ended August 31, 2012 includes a gain on sale of discontinued operations of $17.1 million and additional interest expense allocated to discontinued operations of $6.4 million. |

| B. | Capitalization and indebtedness. |

Not applicable

| C. | Reason for the Offer and Use of Proceeds. |

Not applicable

The Corporation is subject to a number of risks and uncertainties which are described in detail in its MD&A, attached hereto as Exhibit 15.2, under the section entitled “Risk Factors” which section is incorporated by reference in this annual report. The risks and uncertainties described in the MD&A are those the Corporation currently believe to be material, but they are not the only ones the Corporation faces. If any of the risks, or any other risks and uncertainties that have not yet been identified or that are currently considered not to be material, actually occur or become material risks, the Corporation’s business, financial condition, results of operations and cash flows and consequently, the price of the Corporation’s securities, could be materially and adversely affected.

ITEM 4. INFORMATION ON THE COMPANY

| A. | History and Development of the Company. |

Incorporation

7535538 Canada Inc. was incorporated pursuant to the CBCA on April 26, 2010. Its name was changed to Postmedia Network Canada Corp. pursuant to Articles of Amendment filed on June 25, 2010. 7536321 Canada Inc. was incorporated pursuant to the CBCA on April 27, 2010. Its name was changed to Postmedia Network Inc. pursuant to Articles of Amendment filed on June 25, 2010 and it is a wholly-owned subsidiary of the Corporation. The Corporation’s registered office is located at 365 Bloor Street East, 12th Floor Toronto, Ontario Canada, M4W 3L4 and its telephone number at that address (416) 383-2300 (the “Toronto Head Office”).

Both Postmedia Network Canada Corp. and Postmedia Network Inc. were specifically incorporated for the sole purpose of facilitating the acquisition on July 13, 2010 of substantially all of the newspaper and related online, digital, and mobile assets of the LP Entities including the shares of National Post Inc. See “History and Development of the Corporation — Acquisition” below.

Acquisition

Canwest LP previously owned newspaper and related online, digital, and mobile assets and was wholly-owned by Canwest Global, a parent company that also wholly-owned, among other entities, CPI, CBI and CCI.

CPI, CBI, and CCI sought, and on January 8, 2010 obtained, protection under the CCAA granting protection from creditors. Although not itself an applicant, the protections provided by the CCAA were extended to Canwest LP. National Post Inc. was excluded from the CCAA protection.

Pursuant to the Asset Purchase Agreement that was entered into in connection with the implementation of the plan of arrangement and compromise under the CCAA relating to the LP Entities (the “Plan”), Postmedia Network Inc. purchased substantially all of the assets, including the shares of National Post Inc., and assumed certain liabilities of Canwest LP (the “Acquisition”) for $1.05 billion (the “Acquisition Consideration”). The Acquisition Consideration consisted of cash consideration of $927.8 million and non-cash consideration, through the issuance of equity, having a value of $120.1 million. To satisfy the cash portion of the purchase price and to fund certain transaction costs under the Asset Purchase Agreement and the Plan, Postmedia raised an aggregate of $954.4 million of financing, consisting of the Term Loan Facility, Second-Lien Notes and the issuance of equity. See “Item 10. C Material Contracts – Second-Lien Notes Indenture.”

The Acquisition closed and the Plan was implemented on July 13, 2010.

Significant Post-Acquisition Events

On January 31, 2011, National Post Inc. was dissolved and its assets and liabilities were transferred to Postmedia Network Inc.

On June 7, 2011, the Corporation filed the Prospectus in all provinces of Canada other than Quebec. On June 14, 2011, the Corporation’s Voting Shares and Variable Voting Shares were listed and began trading on the TSX under the symbols “PNC.A” and “PNC.B”, respectively.

On November 30, 2011, the Corporation sold substantially all of the assets and liabilities of the Lower Mainland Publishing Group, the Victoria Times Colonist and the Vancouver Island Newspaper Group, to Glacier Media Inc., collectively herein referred to as the “Disposed Properties” (the “Glacier Transaction”).

On August 16, 2012, the Corporation issued $250 million in aggregate principal amount of First-Lien Notes, the proceeds of which were used to repay the Term Loan Facility in its entirety. See “Item 10.C Material Contracts – First-Lien Notes Indenture.”

On October 6, 2014, the Corporation entered into a purchase agreement (the “Purchase Agreement”) with Quebecor Media Inc. (“QMI”) to purchase all of the outstanding shares of 7717415 Canada Inc. (previously known as Quebecor Media Printing Inc.) (“QMPI”). As at the acquisition date of April 13, 2015, QMPI owned Sun Media Corporation’s stable of more than 170English-language newspapers and specialty publications as well as digital properties. The purchase price consisted of cash consideration of $305.5 million, less a final closing working capital receivable of $1.2 million which was received subsequent to August 31, 2015 (the “Sun Acquisition”). Upon acquisition, QMPI and its subsidiary, 8869332 Canada Inc., amalgamated to form a new corporation which subsequently amalgamated with Postmedia Network Inc. The Corporation financed the purchase price and transaction costs associated with the Sun Acquisition through the issuance of First-Lien Notes, the issuance of Variable Voting Shares pursuant to a rights offering of subscription receipts (the “Rights Offering”), net proceeds related to the sale of the Montreal Gazette production facility and corporate cash, all as described below.

The debt financing for the Sun Acquisition was provided through the issuance of additional First-Lien Notes for proceeds of $140.0 million to an existing noteholder, Canso Investment Counsel Ltd. (“Canso”), acting on behalf of certain accounts that it manages. On October 31, 2014, pursuant to a subscription agreement with Canso (the “Subscription Agreement”), the Corporation issued subscription receipts (“Notes Subscription Receipts”) which were automatically exchanged for the additional First-Lien Notes on April 13, 2015. The Notes Subscription Receipts were governed by a subscription receipts indenture between Postmedia Network Inc. and Computershare Trust Company of Canada (the “Subscription Receipt Indenture”) and bore interest at the same rate as the First-Lien Notes with interest commencing as of November 1, 2014.

The equity financing for the Sun Acquisition was provided pursuant to the Rights Offering for proceeds of $173.5 million. Under the terms of the Rights Offering, shareholders of the Corporation as of February 17, 2015 received one right for each share held to subscribe for 5.9929 subscription receipts (“Equity Subscription Receipts”). On March 18, 2015, the Rights Offering closed, with a total of 240,972,226 Equity Subscription Receipts issued at a subscription price of $0.72, which represented a significant discount to the market price of the Variable Voting Shares at the time. On April 13, 2015, each Equity Subscription Receipt was automatically exchanged for one Variable Voting Share without additional consideration.

The remaining financing for the Sun Acquisition was provided through the net proceeds related to the sale of the Montreal Gazette production facility of $12.4 million and corporate cash.

As of August 31, 2015, the Corporation completed its three year business transformation program that was announced in July 2012 that targeted total operating cost reductions of 15% to 20%. In total, the Corporation implemented net annualized cost savings of approximately $136 million, or 20% of operating costs under the Transformation Program. The net annualized cost savings primarily relate to decreases in compensation expenses partially offset by increases in production expenses as a result of outsourced production of several newspapers including the Edmonton Journal in August 2013, the Calgary Herald in November 2013, the Montreal Gazette in August 2014 and the Vancouver newspapers (The Vancouver Sun and The Province) in February 2015. As a result of the Sun Acquisition and the continuing trends in advertising revenue, the Corporation continues to pursue additional cost reduction initiatives. In July 2015, the Corporation announced that it would undertake cost reduction initiatives targeted to deliver an estimated additional $50 million in operating costs by the end of Fiscal 2017. These additional cost reductions are expected to come from a combination of acquisition synergies and further streamlining of operations.

On October 16, 2014 the Corporation entered into a new senior secured asset-based revolving credit facility (the “ABL Facility”) for an aggregate amount of up to $20 million. The ABL Facility replaced the Corporation’s previous facility that matured on July 13, 2014. The ABL Facility was not previously used, and upon maturity on October 16, 2015, management chose not to replace it.

General

Postmedia’s business consists of news and information gathering and dissemination operations, with products offered in local, regional and major metropolitan markets in Canada through a variety of print, web, tablet and smartphone platforms. Postmedia is the largest publisher by circulation of daily newspapers in Canada, according to Newspapers Canada’s 2014 Circulation Data Report. The Corporation has the highest weekly print readership of daily newspapers in Canada, based on Vividata Fall 2015 survey data.

The combination of these distribution platforms provides audiences with a variety of media through which to access and interact with Postmedia’s content. The breadth of Postmedia’s reach and the diversity of its content enable advertisers to reach their target audiences on a local, regional or national scale through the convenience of a single provider.

Postmedia had an approximately 37% share of Canada’s total daily newspaper circulation according to Newspapers Canada’s 2014 Circulation Data Report, and weekly readership of 7.6 million Canadian adults according to the Vividata Fall 2015 survey data. The Corporation has the leading English-language daily newspaper, based on weekly print readership, in five out of the six largest advertising markets in Canada according to the Vividata Fall 2015 survey data. Its daily metropolitan newspaper brands are among the oldest in Canada with an average publication history of 108 years.

Postmedia has one operating segment, the Newsmedia segment. The Newsmedia segment publishes daily and non-daily newspapers and operates digital media and online assets including the canada.com and canoe.com websites, each newspaper’s online website, various classified advertising websites and Infomart, the Corporation’s media monitoring service.

The Corporation owns and operates the National Post, which is one of Canada’s two daily national newspapers, 15 daily metropolitan newspapers, two free daily commuter newspapers in Toronto and Vancouver, 27 daily newspapers in smaller community markets, 123 non-daily community newspapers and non-daily shopping guides, and various specialty publications and newspaper-related publications. Its operations also include Flyer Force, a distribution service for advertising flyers and circulars for third parties. The Corporation also provides sales representation services to third-party owned publications.

Postmedia also has an extensive portfolio of digital media and online assets. It owns and operates 162 destination websites that make up the Postmedia digital network, one of Canada’s leading online general news and information sources, covering its newspapers’ websites, including classified websites and other online properties. The Corporation also provides sales representation services to third-party branded sites.

The Corporation has also developed its mobile network, which includes mobile optimized websites and mobile applications across various tablet and smartphone platforms such as iOS, Android and BlackBerry. The Corporation’s mobile applications include, but are not limited to, applications relating to its newspaper operations.

Postmedia’s expertise in content production and digital product development allows for expanded service offerings to Canadian marketers and advertisers. National and local sales teams work collaboratively with clients to develop new programs on and off Postmedia’s digital network. New areas under development include digital and content marketing services.

Newsmedia Operations

The Corporation publishes 15 daily metropolitan newspapers (nine broadsheets and six tabloids) and a national newspaper. Its daily metropolitan newspapers are geographically diverse and located in major metropolitan centres across Canada, which provides the Corporation and its advertisers access to target audiences throughout Canada. Postmedia’s daily newspapers are well-established in the communities that they serve several dating back more than 100 years. Postmedia’s combination of national reach and local presence makes the Corporation’s daily newspapers attractive to both national and local advertisers. Postmedia’s newspapers have consistently been recognized for the quality of their content, having received numerous nominations and awards. Recent recognition includes: Several National Newspaper awards including journalists and teams from National Post, Ottawa Citizen, Toronto Sun, Edmonton Journal and The Vancouver Sun; Newspapers Canada Great Idea Awards for Ottawa Citizen, Calgary Herald and Montreal Gazette; National Post won 91 awards of excellence and was a finalist for World’s Best-Designed Newspaper at the Society for News Design Best of Newspaper Design; Montreal Gazette took home three Awards of Excellence and Postmedia won an Award of Excellence for our Postmedia Reimagined redesign at the Society for News Design Best of Digital Design; the International News Media Association (INMA) recognized Postmedia, with Ottawa Citizen’s “Trending Since 1845” campaign taking home the second place prize and the Montreal Gazette and Calgary Herald Reimagined launch campaigns coming in third; National Post, Edmonton Journal and Gastropost each won Canadian Online Publishing Awards; at the Jack Webster awards The Vancouver Sun won a first place award and The Province won two top prizes; and the Calgary Herald won a top prize at the Online Journalism Awards, presented by the Online News Association.

According to Newspapers Canada’s 2014 Circulation Data Report, the Corporation had an approximately 37% share of Canada’s total daily newspaper circulation. In addition, in nine out of the eleven daily metropolitan newspaper markets in which the Corporation operates, it has the highest circulation and readership among English-language newspapers based on average daily circulation and readership.

The National Post, the Corporation’s daily national newspaper, provides benefits to the Corporation’s overall operations, including the provision of a newspaper with a national audience footprint. A new daily print section, 6 to 10 pages in length, of national and international news, commentary and analysis provided by the National Post has, to date, been included in five Postmedia newspapers (Edmonton Journal, Windsor Star, Montreal Gazette, Regina Leader-Post and Saskatoon StarPhoenix). This section extends National Post’s measurable readership and provides national and local advertising opportunities.

The following table provides details about the Corporation’s metropolitan daily newspapers:

| | | | | | | | | | | | | | | | | | | | |

Publication | | Market | | Year

Established | | Market

Position(1) | | Local

Newspaper

Market Share(1) |

Daily Metropolitan Newspapers | | | | | | | | | | | |

The Province | | Vancouver | | 1884 | | 2(2) | | | | 100 | %(7) |

The Vancouver Sun | | Vancouver | | 1886 | | 1 | | | | 100 | %(7) |

Montreal Gazette | | Montreal | | 1778 | | 3(3) | | | | 100 | % |

Calgary Herald | | Calgary | | 1883 | | 1 | | | | 100 | %(7) |

Calgary Sun | | Calgary | | 1980 | | 2(4) | | | | 100 | %(7) |

Edmonton Journal | | Edmonton | | 1903 | | 1 | | | | 100 | %(7) |

Edmonton Sun | | Edmonton | | 1978 | | 2(5) | | | | 100 | %(7) |

Ottawa Citizen | | Ottawa | | 1845 | | 1 | | | | 100 | %(7) |

Ottawa Sun | | Ottawa | | 1988 | | 2(6) | | | | 100 | %(7) |

Toronto Sun | | Toronto | | 1971 | | 2 | | | | 29 | % |

Windsor Star | | Windsor | | 1918 | | 1 | | | | 100 | % |

London Free Press | | London | | 1821 | | 1 | | | | 100 | % |

Saskatoon StarPhoenix | | Saskatoon | | 1902 | | 1 | | | | 100 | % |

Regina Leader-Post | | Regina | | 1883 | | 1 | | | | 100 | % |

Winnipeg Sun | | Winnipeg | | 1980 | | 2 | | | | 33 | % |

Daily National Newspaper | | | | | | | | | | | |

National Post | | National | | 1997 | | 2 | | | | N/A | |

Notes:

| 1) | Market position and local newspaper market share for English language newspapers are determined by average paid circulation of daily newspapers. Source: Newspapers Canada – 2014 Circulation Data Report. |

| 2) | Second to The Vancouver Sun, which is also operated by the Corporation. |

| 3) | Number one English-language paid daily newspaper; number three overall among paid daily newspapers. |

| 4) | Second to the Calgary Herald, which is also operated by the Corporation. |

| 5) | Second to the Edmonton Journal, which is also operated by the Corporation. |

| 6) | Second to the Ottawa Citizen, which is also operated by the Corporation. |

| 7) | Includes all properties operated by the Corporation in this market. |

The following table provides the average paid daily circulation of the Corporation’s 27 community daily newspapers per the Newspapers Canada 2014 Circulation Data Report:

| | | | |

Newspaper | | Location | | Average Daily Paid

Circulation |

The Standard | | St. Catharines, Ontario | | 23,160 |

The Expositor | | Brantford, Ontario | | 18,113 |

The Kingston Whig-Standard . | | Kingston, Ontario | | 17,342 |

The Peterborough Examiner | | Peterborough, Ontario | | 15,384 |

The Sun Times | | Owen Sound, Ontario | | 14,076 |

The Barrie Examiner | | Barrie, Ontario | | 13,911 |

Niagara Falls Review | | Niagara Falls, Ontario | | 13,148 |

The Recorder & Times | | Brockville, Ontario | | 10,796 |

The Tribune | | Welland, Ontario | | 10,460 |

The Sault Star | | Sault Ste. Marie, Ontario | | 9,947 |

The Sudbury Star | | Sudbury, Ontario | | 9,573 |

Simcoe Reformer | | Simcoe, Ontario | | 9,468 |

The Observer | | Sarnia, Ontario | | 9,317 |

Packet & Times | | Orillia, Ontario | | 8,654 |

North Bay Nugget | | North Bay, Ontario | | 8,509 |

Cornwall Standard Freeholder | | Cornwall, Ontario | | 7,511 |

The Intelligencer | | Belleville, Ontario | | 7,233 |

The Daily Press | | Timmins, Ontario | | 7,121 |

Northumberland Today | | Cobourg, Ontario | | 6,858 |

The Beacon Herald | | Stratford, Ontario | | 6,680 |

The Chatham Daily News | | Chatham, Ontario | | 5,395 |

Daily Herald Tribune | | Grande Prairie, Alberta | | 3,728 |

Sentinel-Review | | Woodstock, Ontario | | 3,713 |

The Daily Observer | | Pembroke, Ontario | | 3,331 |

St. Thomas Times-Journal | | St. Thomas, Ontario | | 3,293 |

Fort McMurray Today | | Fort McMurray, Alberta | | 1,902 |

Kenora Daily Miner & News | | Kenora, Ontario | | 1,187 |

| | | | |

Total Average Daily Paid Circulation | | 249,810 |

| | | | |

The Corporation publishes 123 non-daily newspapers and shopping guides distributed in Ontario, Alberta, Manitoba and Saskatchewan. Postmedia’s non-daily newspapers and shopping guides are generally delivered to every household in the respective communities in which they operate, thereby providing advertisers with substantial coverage of these community markets. In addition, the Corporation publishes two free daily commuter newspapers in Toronto and Vancouver that have average daily circulation of 219,199 and 115,178, respectively, per the Newspapers Canada 2014 Circulation Data Report.

Postmedia seeks to grow its revenue by leveraging its industry leading print brands and strong customer relationships into its expanding digital media and online product offerings. The Corporation’s digital media and online operations include the Postmedia digital network, websites for the Corporation’s daily and community newspapers, online classified websites, and Infomart (a subscription-based media monitoring service). In addition, Postmedia’s digital media and online operations sell advertising on behalf of third-party websites. These agreements extend the reach of the Postmedia digital network and increase the Corporation’s advertising sales opportunities. The Corporation has also developed its mobile network, which includes mobile optimized websites and mobile applications across various tablet and smartphone platforms such as iOS, Android and BlackBerry.

The Postmedia digital network is a comprehensive 24/7 online news, entertainment and information network of content distributed through websites and mobile platforms that leverages the Corporation’s content, brands and customer relationships. The Postmedia digital network is one of Canada’s leading online general news and information sources that integrates Canadian news and specialty content. The Postmedia digital network hosts the websites and electronic editions of the Corporation’s daily and community newspapers as well as other select websites. Being hosted on the Postmedia digital network offers these websites a platform to extend their audience reach and market, as well as to build and reinforce relationships with respect to both advertisers and audiences. The Postmedia digital network has also developed its mobile products, which includes mobile optimized websites and mobile applications across various smartphone platforms such as iOS, Android and BlackBerry. The Postmedia digital network had 11.4 million average monthly unique visitors for the fourth quarter of Fiscal 2015.

Through the Corporation’s proprietary content, as well as technology partners and third-party content providers, the Postmedia digital network provides a number of personalized online tools, including internet search and other services. The Postmedia digital network currently provides up-to-date international, national and local news coverage sourced from the Corporation’s newspapers and third-party newswire services including text, photos, videos, databases and interactive applications. The licensed content covers a broad range of topics, including sports, entertainment, automotive, recreation and travel from a variety of well-known content providers.

As part of its effort to grow its digital media and online business, Postmedia’s newspapers deliver content across multiple platforms including desktop, tablet and mobile devices.

Through expertise in exporting electronic press pages intended for print editions to web-friendly formats, the daily newspapers publish page-by-page e-Papers, complete with stories, columns, photos and advertising. The e-Papers are available to print subscribers at no cost for broadsheet publications and for an additional $1.99 per month for tabloid publications. Readers of thee-Papers are able to view page layouts, photos and advertisements exactly as they appear in the print edition of the newspaper. The experience is enhanced by a variety of digital features and tools, including search, aimed to ease navigation and add value.

Postmedia’s print subscribers receive free access to their print newspaper’s website via desktop, tablet and mobile devices, each of which provides headlines, breaking news, analysis, commentary and selected stories from the daily newspaper editions. Fornon-print subscribers, Canadian users can access ten free articles and international users can access five free articles every 30 days or purchase a digital access subscription to obtain unlimited access. The Corporation’s newspapers’ websites also serve as customer relationship tools, promoting subscriptions to the print editions, allowing for the purchase or renewal of newspaper subscriptions, permitting notification of vacation stops and reactivations, and processing of billing inquiries.

Postmedia’s digital audience ranked number one for average monthly unique visitors in the newspaper category based on the year ended August 31, 2015 in Canada, according to comScore, and these sites reach 43% of all Canadians who visit newspaper websites.

Infomart is a subscription-based business-to-business service for Canadian news and business information and a one-stop resource for media monitoring, research insights, brand solutions and financial and corporate data. The service offers online media monitoring covering print, broadcast television and radio, social media, and newswires in a single integrated platform. Print sources include all of the Corporation’s publications plus other Canadian and international sources such as third-party newspapers. As of August 31, 2015, Infomart had approximately 800 subscribers.

In addition to subscriptions, Infomart also generates revenue through an electronic licensing and rights management service of the Corporation’s news content, corporate data and third-party content via domestic and international third-party channels used by businesses across North America.

The Corporation is branching into new revenue streams, including the launch of digital marketing services, which include search engine optimization, search engine marketing, website design and creation. The Corporation is also entering content marketing with the creation of its Content Works group. This group will focus on content creation, distribution and measurement for brands. Measurement will occur through the Infomart platform.

Functional Operations

Editorial

Editorial content is generated across the Corporation’s digital platforms and publications and Postmedia’s infrastructure allows for sharing of its generated content among newspapers in an efficient and cost effective manner. Generally, editorial policy is developed for each of the Corporation’s newspapers by local newsroom management. This leadership ensures that each newspaper is responsive to local issues and meets the editorial needs of its readers. The Corporation’s newspapers and digital platforms focus on readers of various ages and demographics and aim to reflect the values and interests of their respective markets. Each of the Corporation’s newspapers has its own editorial staff that is responsible for producing local editorial content of the newspaper and digital platforms supplemented by certain content which comes from Postmedia’s centralized editorial services, other wire services and freelancers.

The Corporation owns or has the rights to use the editorial content that is produced by its employees and freelancers, which allows for sharing of information and editorial content among its various publications. Further, since the Corporation’s newspapers operate across a broad geographic spectrum, reporters familiar with local issues can be assigned to cover national events in a particular region. Management believes that sharing of editorial content and expertise allows the Corporation to achieve substantial operating efficiencies compared to other publishers which own a smaller number of publications.

The Corporation also provides centralized pagination and production services to some of the Corporation’s newspapers.

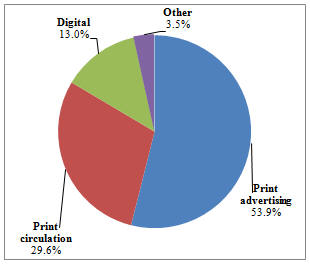

Sales and Advertising

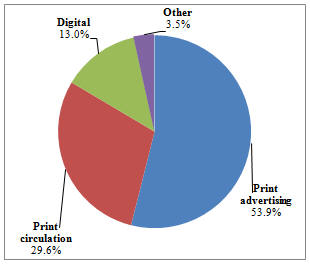

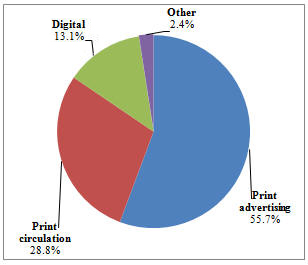

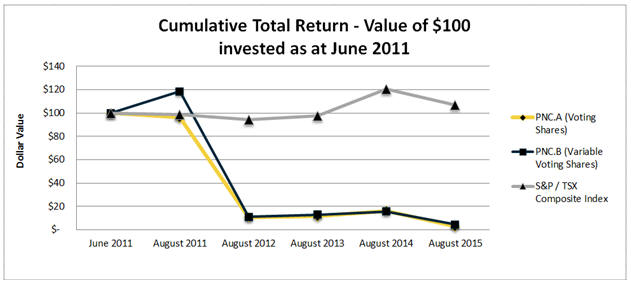

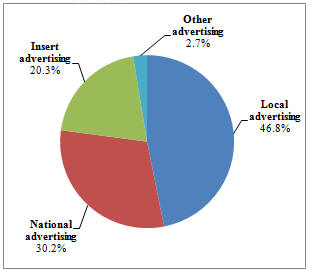

The following charts provide a breakdown of the Corporation’s revenue for Fiscal 2015 and 2014:

| | |

Fiscal 2015 | | Fiscal 2014 |

| |  |

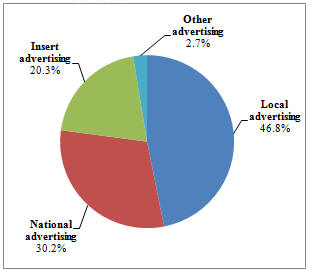

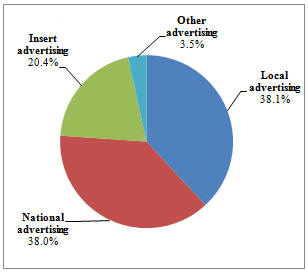

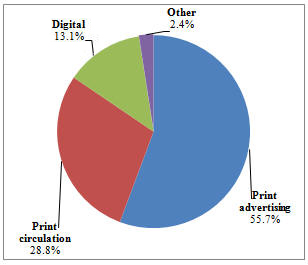

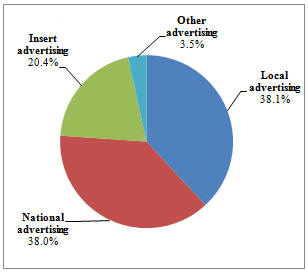

The following charts provide a breakdown of the Corporation’s total print advertising revenue for Fiscal 2015 and 2014:

| | |

Fiscal 2015 | | Fiscal 2014 |

| |  |

The Corporation offers advertisers extensive audience reach through a combination of circulation and readership of its newspapers, e-Papers, unique visitors to its websites and various mobile and tablet products.

The Corporation’s local advertising is sold on a publication-by-publication and regional basis. Each of the Corporation’s newspapers has a locally-based sales team that sells advertising for both print and digital, principally to local businesses and organizations. The majority of local advertising relates to automotive, employment and real estate advertisements. The Corporation also uses an outsourced call centre to generate classified sales.

National advertising takes the form of advertisements for both print and digital, primarily from large national companies. The major national advertising categories are automotive, food & drug, home and department stores, financial services and technology. The sale of national advertisements is handled by a national sales group (Postmedia Integrated Advertising or “PIA”), which employs a dedicated sales team that services the Corporation’s group of newspapers and digital properties and provides individual newspapers with advertising sales representation, insertion order processing and invoicing. PIA operates through offices in Toronto, Montreal and Vancouver, in addition to one contract representative in the U.S. PIA also represents several third-party publishers and publications acting as their national advertising sales agent on a commissioned basis.

Circulation and Distribution

The Corporation’s circulation revenue is generated from subscription revenue (both print and digital), single copy sales made through retailers and vending boxes, and corporate bulk sales. Newspapers are shipped from printing plants to depot drop locations or single copy retail outlets by independent trucking companies in the daily markets. Postmedia’s newspaper distribution is carried out primarily by independent distributors and carriers that deliver newspapers to subscribers. These third-party distribution networks enable the Corporation to operate via short-term contracts and reduce supplier concentration issues. Postmedia’s non-daily newspapers are generally delivered via Canada Post and independent carriers.

The Corporation benefits from agreements with distributors which provide for the delivery of newspapers from printing facilities to bulk locations, retailers, vending boxes and residential and corporate subscribers. Typically, a newspaper division is party to several distribution agreements, covering different stages of delivery and geographical areas.

In addition to distributing newspapers, Postmedia also offers three types of insert distribution services:

| | • | | Paid subscriber base—distribution to existing newspaper subscribers; |

| | • | | Extended market coverage—distribution of flyers or other materials to non-subscriber households; and |

| | • | | Total market coverage—both subscriber and non-subscriber households for full coverage to specific areas. |

These distribution options allow broader penetration of the Corporation’s markets, allowing advertisers to target specific demographic and geographic segments. Extended market coverage and/or total market coverage distribution services are offered in the Corporations 27 daily newspaper markets as well as Regina, Saskatoon, Windsor and London. In addition, Flyer Force, a distribution service for advertising flyers, distributes insert packages to non-subscribers in Calgary, Edmonton and Ottawa, providing extended market coverage for their associated Postmedia newspapers.

The Corporation offers pre-authorized monthly payment programs to its subscribers. These automatic credit card and bank debit payment programs lower the cost of collection and enhance subscriber retention.

Printing

Other than as described in “Outsourced Functions” below, the Corporation owns all of the manufacturing equipment for its newspapers and other publications, including printing presses and mailroom inserting equipment. In some markets, in order to improve the operating efficiency of its printing presses, the Corporation also uses its printing press capacity to print advertising inserts, flyers and other third-party publications.

Outsourced Functions

As part of Postmedia’s ongoing focus on cost containment, various outsourcing initiatives have been implemented. Advertising production at the majority of its newspapers have been outsourced to suppliers in the Philippines and India. Subscriber customer service call centre operations are operated by third parties in Canada and Jamaica. These subscriber services include answering and handling customer calls, customer service inquiries and complaints. Postmedia has also outsourced its centralized classified call centre operations to a third party in the United States. In addition, printing operations have been outsourced for certain of its magazines and newspapers including the Edmonton Journal, the Calgary Herald, the Montreal Gazette, The Vancouver Sun, The Province and 24 Hrs Vancouver, as well as the National Post in most regions.

Competitive Conditions

The Corporation faces competition in each of its markets as information is now widely disseminated through many media platforms on a local, national and international basis. Participants in the newsmedia industry depend primarily upon advertising sales to generate revenue, while newspaper companies also rely on paid subscriptions and single copy newspaper and digital subscription sales. Competition for advertising, subscribers, readers and distribution is intense and comes primarily from digital media, as well as television; radio; local, regional and national newspapers; magazines; free publications; direct mail; telephone directories; and other communications and advertising and subscriber-based media that operate in these markets.

In recent years there has been a growing shift in advertising dollars from newspaper advertising to other advertising platforms, particularly digital media competitors such as search engines and social media websites. To date, the newsmedia industry has made limited progress in replacing print advertising revenue with digital advertising revenue.

Advertising on digital platforms is evolving rapidly, with technology driving innovations that make digital media a very effective competitor and substitute for advertising in print newspapers. The scope and pace of technological change has entrenched the role of the largest international players – U.S.-based technology companies such as Google, Microsoft, Facebook and Yahoo! – in existing and rapidly expanding forms of digital advertising.

The Corporation’s digital competition is not limited to news sites. Digital advertising takes various forms, such as search-engine marketing, display advertising, online classified, online telephone directories, mobile advertising and video advertising.

More and more content and related advertising is being communicated over social networks operated by companies such as Facebook and Twitter. As geo-tagging becomes more sophisticated, the recent increase in advertising on mobile platforms – driven by the adoption and penetration of smartphones and tablets – allows digital advertising to be targeted more locally, making it a more effective substitute for local advertising in daily newspapers.

In addition, there is increasing consolidation in the Canadian newsmedia industry, and competitors include market participants with interests in multiple media. These competitors may be more attractive than Postmedia to certain advertisers because they may be able to bundle advertising sales across newspaper, television and digital media platforms. Some of these competitors also have access to greater financial and other resources than Postmedia does.

In 2014, the Canadian newspaper industry comprised approximately 91 paid daily English and French newspapers and 13 free dailies for a total of 104 daily newspapers. Paid daily newspapers accounted for a total of 4,043,553 copies on an average publishing day, according to Newspapers Canada 2014 Circulation Data Report.

The Canadian daily newspaper industry’s revenue was $2.4 billion in 2014, with 68% of that revenue derived from print, web and mobile advertising and the balance from circulation and other revenue, according to the Canadian Newspaper Association. Canadian newspaper publishers typically sell advertising based primarily on readership and secondarily on circulation. In contrast, U.S. newspaper publishers typically sell advertising based solely on circulation figures. Canadian newspapers have higher penetration compared to the U.S., with 65% of Canadian adults reading a daily newspaper (in print and digital) in the past three months compared to only 38% of American adults in the past six months, according to the Vividata Fall 2015 survey data and the eMarketer Global Media Report, September 2015, respectively.

Components

Newsprint is the principal raw material used in the production of Postmedia’s daily newspapers and other print publications. It is a commodity that is generally subject to price volatility. Newsprint expenses fluctuate due to both changes in volume and changes in price.

Postmedia’s cost of newsprint is influenced by its strong supplier relationships, volume purchasing power, proximity to Canadian paper mills and regional supply arrangements that reduce transportation costs. The Corporation opportunistically enters into newsprint purchase agreements with varying terms of up to six months depending on external factors such as foreign export demand, North American mill capacity, operating rates and inventory.

Intangible Properties

Postmedia uses a number of trademarks, service marks and trade names to identify its products and services. Many of these trademarks are registered by the Corporation in the appropriate jurisdictions. In addition, the Corporation has legal rights in the unregistered marks arising from their use. Postmedia has taken affirmative legal steps to protect its trademarks, and it believes its trademarks are adequately protected.

The content of Postmedia’s newspapers and digital media and online assets are protected by copyright. The Corporation owns copyrights in each of its publications as a whole and in all individual content items created by its employees in the course of their employment, subject to limited exceptions. Postmedia has entered into licensing agreements with wire services, freelancers and other content suppliers on terms that it believes are sufficient to meet the needs of its operations. Postmedia believes that it has taken appropriate and reasonable measures to secure, protect and maintain its rights or obtain agreements from licensees to secure, protect and maintain copyright protection of content produced or distributed by the Corporation.

Postmedia has registered a number of domain names, many of which constitute trademarks, service marks and trade names used in its business, under which it operates websites. As every Internet domain name is unique, its domain names cannot be registered by other entities as long as its registrations are valid.

Postmedia’s intellectual property constitutes a significant part of the value of the Corporation. The Corporation relies on the trademark, copyright, internet/domain name, trade secret and other laws of Canada and other countries, as well as nondisclosure and confidentiality agreements, to protect its intellectual property rights. However, the Corporation may be unable to prevent third-parties from using its intellectual property without its authorization, breaching any nondisclosure agreements with the Corporation, acquiring and maintaining domain names that infringe or otherwise decrease the value of its trademarks and other proprietary rights, or independently developing intellectual property that is similar to the Corporation’s, particularly in those countries that do not protect the Corporation’s proprietary rights as fully as in Canada.

Third-parties may challenge the validity or scope of Postmedia’s intellectual property rights from time to time, and such challenges could result in the limitation or loss of intellectual property rights. Irrespective of their validity, such claims may result in substantial costs and diversion of resources, which could have an adverse effect on the Corporation’s operations.

Cycles

Advertisers’ budgets tend to be cyclical, reflecting the general economic climate and consumers’ buying habits. As a result, Postmedia’s revenue has experienced, and is expected to continue to experience, seasonal variances due to advertising patterns and influences on people’s media consumption habits. Typically, the Corporation’s revenue is lowest during the fourth quarter of its fiscal year, which ends in August, and highest during the first and third quarters, which end in November and May, respectively, while expenses are relatively constant throughout the fiscal year. These seasonal variations may lead to short-term fluctuations in cash flow at certain times during the fiscal year.

Environmental Protection

Postmedia’s operations are subject to a variety of laws and regulations concerning, among other things, emissions to the air, water and land, sewer discharges, handling, storage and disposal of, or exposure to, hazardous substances and wastes, recycling, remediation of contaminated sites or otherwise relating to protection of the environment and employee health and safety. The Corporation uses and stores hazardous substances such as inks and solvents in conjunction with its operations at its printing facilities. Such hazardous substances have in the past been stored in underground storage tanks at some of the Corporation’s properties. Some of its printing and other facilities are located in areas with a history of long-term industrial use, and may be impacted by past activities onsite or by contamination emanating from nearby industrial sites. In the past, a Postmedia predecessor has had contamination resulting from leaks and spills at some of its locations. Postmedia has incurred and will continue to incur costs to comply with environmental, health and safety requirements but, to date, such costs have not been material.

Regulation

The publication of newspapers in Canada is not directly regulated by federal or provincial laws. There are, however, indirect restrictions on the foreign ownership of Canadian newspapers by virtue of certain provisions of the Tax Act. The Tax Act limits the deductibility by Canadian taxpayers of expenditures for advertisements in issues of newspapers other than, except in limited circumstances, “Canadian issues” of “Canadian newspapers”.