Pursuant to Item 601(b)(10) of Regulation S-K, certain confidential portions of this exhibit have been omitted and replaced by [***], as the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

| | |

|

EXHIBIT 10.37

SALE AND PURCHASE AGREEMENT |

| 12 JANUARY 2025 |

LIFE MEDICAL GROUP LIMITED

AND

LIFE HEALTHCARE GROUP HOLDINGS LIMITED

AND

LANTHEUS RADIOPHARMACEUTICALS UK LIMITED AND

LANTHEUS MEDICAL IMAGING, INC.

|

| | | | | | | | |

Allen Overy Shearman Sterling LLP

|

|

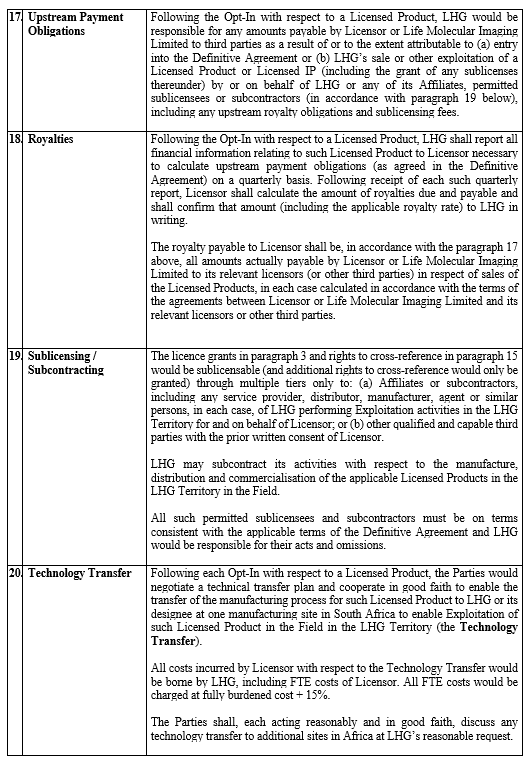

|

|

Pursuant to Item 601(b)(10) of Regulation S-K, certain confidential portions of this exhibit have been omitted and replaced by [***], as the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

CONTENTS

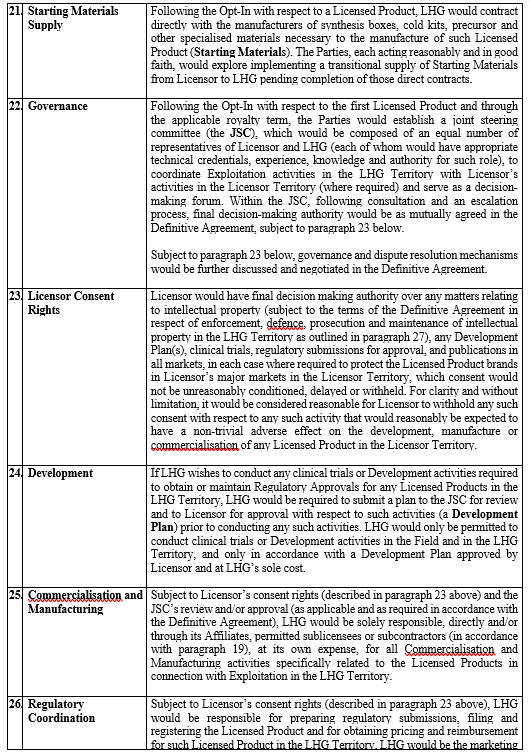

Clause Page

1. Interpretation 1

2. Sale and purchase of the Sale Shares 28 3. Initial Consideration 29 4. Additional Consideration 30

5. Conditions precedent 36 8. Completion 50

9. Post-Completion covenants 51

10. Insurance 54

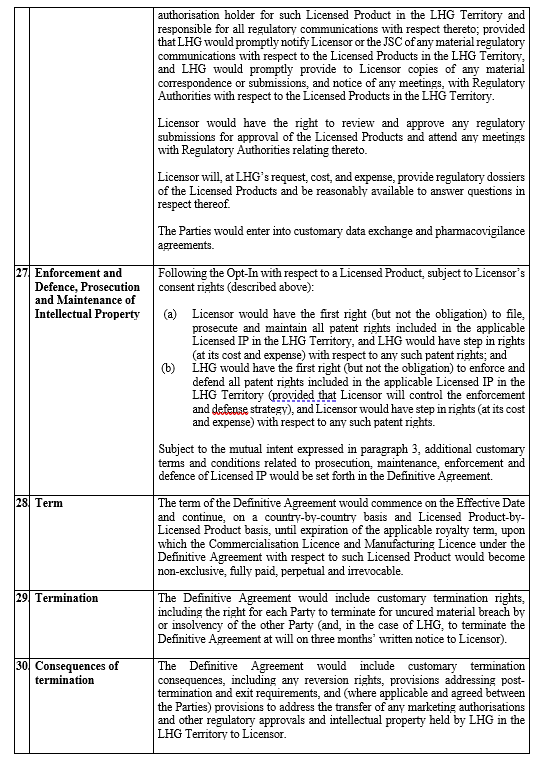

11. Non-competition and non-solicitation 56 12. Intra-group loans and guarantees 58 13. Seller’s Warranties 61 15. Purchaser’s warranties and undertakings 62 17. Specific indemnities 64 18. Conduct of Specific Tax Assessment and information sharing 66 19. Incentives 70

20. Announcements and confidentiality 74

21. Notices 76

22. Further assurances 77 25. Purchaser’s guarantee 80

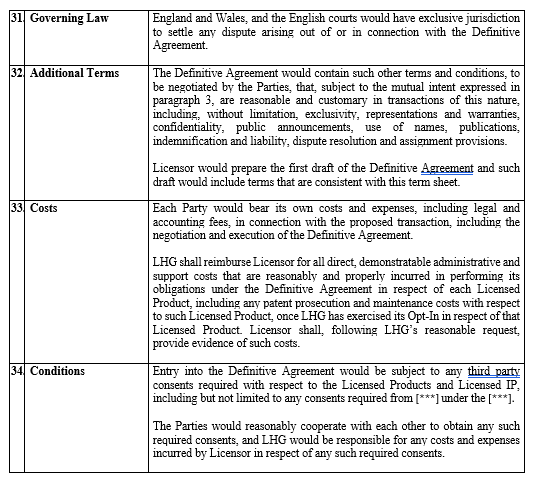

26. Purchaser’s Guarantor warranties 81

27. Seller’s guarantee 83

Pursuant to Item 601(b)(10) of Regulation S-K, certain confidential portions of this exhibit have been omitted and replaced by [***], as the identified confidential portions (i) are not material and (ii) would be competitively harmful if publicly disclosed.

Schedule Page

1.The Company and its Subsidiaries 89

Part 1The Company 89

Part 2Subsidiaries 90

2. Accounts and Applicable Accounting Standards 91

3. Properties 92

4. Seller’s Warranties 93

Part 1Seller’s Fundamental Warranties 93

Part 2Business Warranties 96

5. Claims 120

6. Tax Covenant 125

7. Completion obligations 131

Part 1Seller’s obligations 131

Part 2Purchaser’s obligations 132

8. Completion Balance Sheet and Completion Statement 133

Part 1Preparation of the Completion Balance Sheet and the Completion Statement 133

Part 2Reference balance sheet 135

Part 3Form of Draft Completion Statement and Completion Statement 137

Part 4Specific policies for preparation of the Draft Completion Balance Sheet and the Draft Completion Statement 141

9. Independent Accountants 144

10. [***] SPA 146

11. RM2 License 151

Appendix

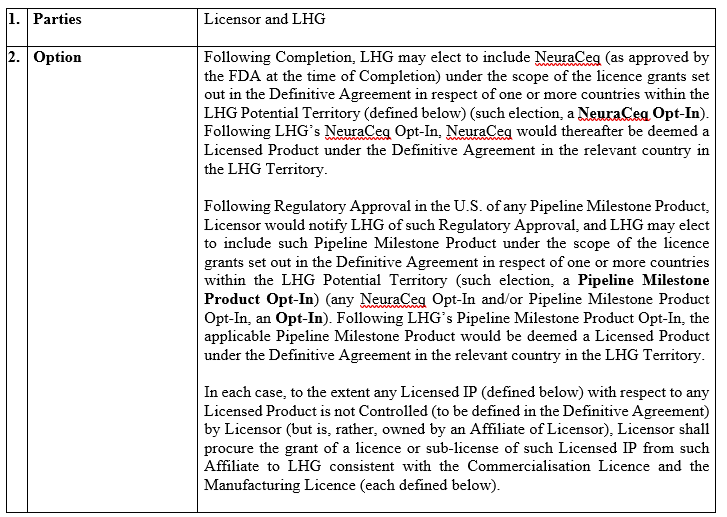

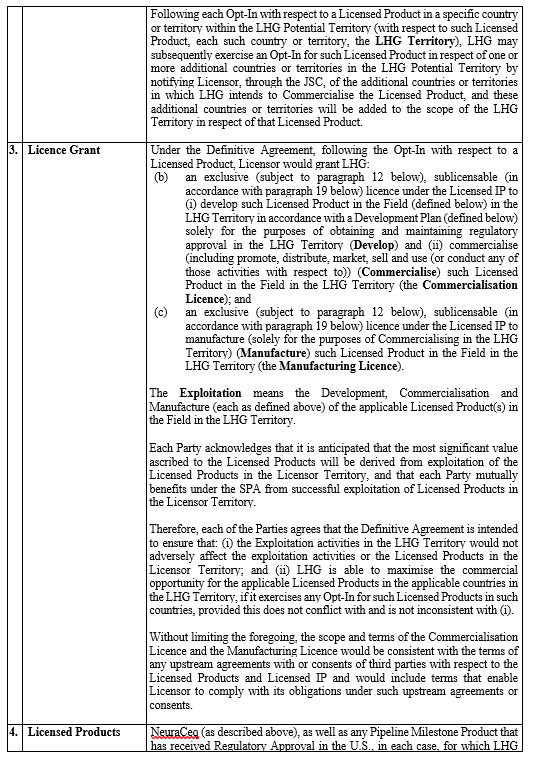

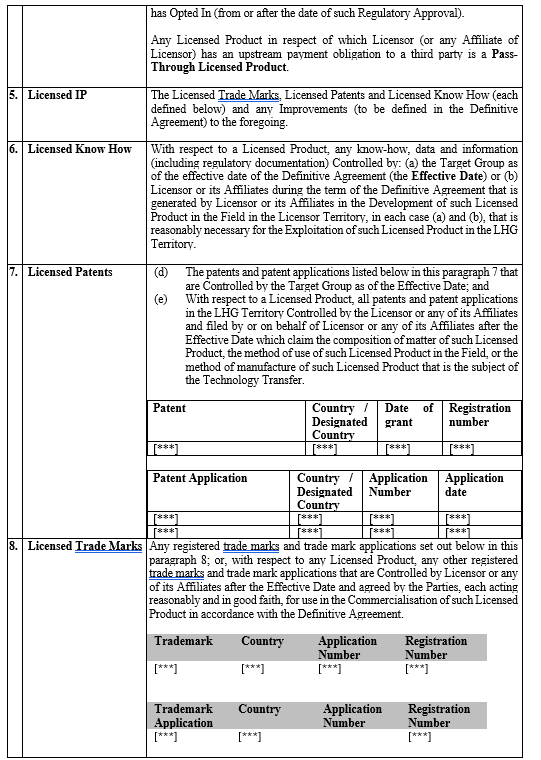

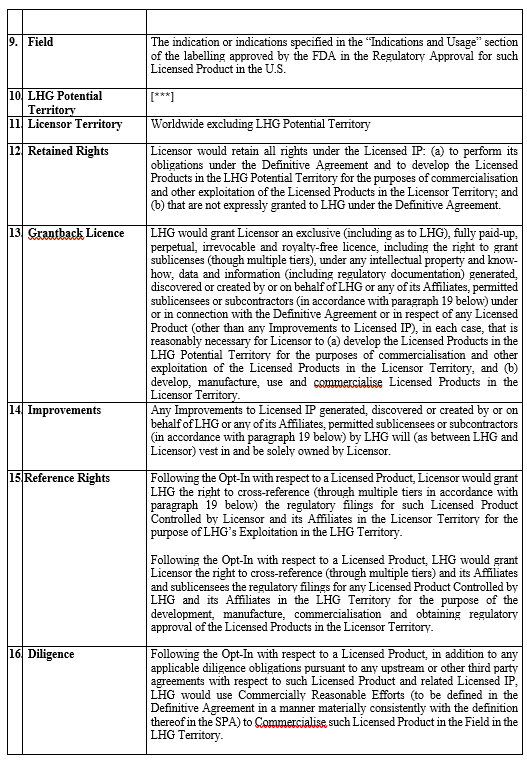

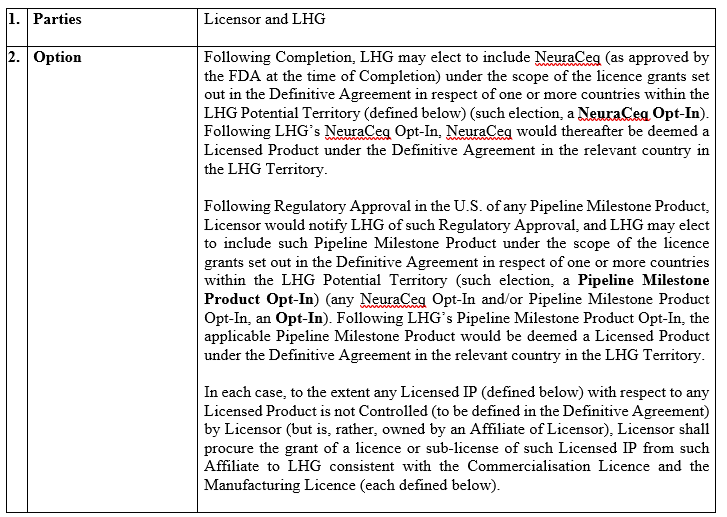

1.Licence and Commercial Agreement(s) for opted-in Licensed Products - Term Sheet 154

2.Completion Certificate Of Life Medical Group Limited 162

THIS AGREEMENT is made on 12 January 2025

BETWEEN:

(1)LIFE MEDICAL GROUP LIMITED, a private limited liability company incorporated under the laws of England with registered number 08601376 and whose registered office is at 25 Barnes Wallis Road, Fareham, Hampshire, United Kingdom, PO15 5TT (the Seller);

(2)LIFE HEALTHCARE GROUP HOLDINGS LIMITED, a public limited liability company incorporated under the laws of South Africa with registration number 2003/002733/06 and whose registered office is at Building 2, Oxford Parks, 203 Oxford Road, Dunkeld 2196, South Africa (Life Healthcare Group Holdings or the Seller’s Guarantor);

(3)LANTHEUS RADIOPHARMACEUTICALS UK LIMITED, a private limited liability company incorporated under the laws of England with registered number 16107946 and whose registered office is at Ashcombe Court, Woolsack Way, Godalming, Surrey, United Kingdom, GU7 1LQ (the Purchaser); and

(4)LANTHEUS MEDICAL IMAGING, INC., a Delaware corporation (the Purchaser’s Guarantor).

BACKGROUND:

(A)The Seller is the sole legal and beneficial owner of all the issued share capital of Life Molecular Imaging Limited (the Company, further details of which are set out in Schedule 1).

(B)The Seller wishes to sell and the Purchaser wishes to purchase all the Sale Shares (the Transaction) on the terms and subject to the Conditions set out in this agreement.

(C)The Purchaser’s Guarantor is the US operating company in the Purchaser’s Group and has agreed to guarantee the obligations of the Purchaser under this agreement.

(D)The Seller’s Guarantor is the ultimate holding company in the Seller’s Group and has agreed to guarantee certain of the obligations of the Seller under this agreement.

(E)On and subject to the terms of this agreement, the Purchaser has agreed to assume in part the Seller’s obligation to pay certain amounts to [***] in connection with the Seller’s Group’s acquisition of the Target Group, up to an aggregate amount (when combined with certain payments falling due to the LMI EBITDA Participants after Completion) of USD30,000,000.

(F)The Consideration has been agreed on the basis that the net economic benefit of the RM2 License entered into between the Company and certain members of the Purchaser’s Group will be delivered to the Seller’s Group at or immediately prior to Completion, mutatis mutandis as if the Transaction had not taken place. As further described in Schedule 11, the parties will use their respective reasonable endeavours and negotiate in good faith after the date of this agreement to deliver the net economic benefit of the RM2 License to the Seller’s Group.

IT IS AGREED as follows:

1.INTERPRETATION

1.1In this agreement:

Accounting Firm means any of PricewaterhouseCoopers LLP, Ernst & Young Global Limited or KPMG LLP, or any other U.S. nationally recognized independent certified accounting firm as may be mutually agreed in writing between the Seller and the Purchaser from time to time;

Accounts means:

(a)in respect of a Target Group Company as set out in the table in Schedule 2 which is stated as “audited” in column (3) of the table set out in Schedule 2, the audited balance sheet as at the end of, and the audited profit and loss account for, the financial year ended on the Accounts Date that is set opposite that Target Group Company’s name in column (2) of the table set out in Schedule 2; and

(b)in respect of a Target Group Company as set out in the table in Schedule 2 which is stated as “unaudited” in column (3) of the table set out in Schedule 2, the unaudited balance sheet as at the end of, and the unaudited profit and loss account for, the financial year ended on the Accounts Date that is set opposite that Target Group Company’s name in column (2) of the table set out in Schedule 2,

a copy of each of which has been provided in the Data Room;

Accounts Date means, in respect of a Target Group Company included in the table in Schedule 2, the date that is set opposite that Target Group Company’s name in column (2) of the table in Schedule 2;

Accounts Relief has the meaning given in paragraph 6.1 of Schedule 6;

Acquisition Proposal means any indication of interest, offer or proposal (other than an indication of interest, offer or proposal made or submitted by the Purchaser or one or more of its Affiliates) from any person or group contemplating or otherwise relating to:

(c)any merger, consolidation, amalgamation, share exchange, business combination, asset purchase, issuance of securities, acquisition of securities, recapitalization, tender offer, exchange offer or other similar transaction involving the Company and, directly or indirectly:

(i)15% or more of any class of voting equity securities of the Company; or

(ii)businesses or assets (including capital stock of the Subsidiaries) that constitute 15% or more of the consolidated revenues, net income or assets of the Company and its subsidiaries, taken as a whole; or

(a)any sale or license of, or joint venture or partnership with respect to, NeuraCeq or the Pipeline Products,

but, for clarity shall not include any Excluded Proposal;

Action means any judicial, arbitral or administrative claim, complaint, action, cause of action, demand, charge, suit, arbitration, investigation, litigation or other proceeding, in each case, from, by or before any Governmental Entity;

Active Component has the meaning given to it in the definition of Combination Product;

Actual Net Debt means the actual amount of Net Debt at Completion, as calculated and agreed and/or determined (as applicable) after Completion in accordance with Schedule 8;

Actual Tax Liability means a liability to make a payment of Tax;

Actual Working Capital means the actual amount of Working Capital at Completion, as calculated and agreed and/or determined (as applicable) after Completion in accordance with Schedule 8;

Adjustment Amount has the meaning given in clause 3.6;

Adverse Recommendation Change has the meaning given in clause 5.6;

Adverse Event means, in respect of any Product:

(a)any untoward medical occurrence in a patient who has administered themselves with, or has been administered, a Product, where the untoward medical occurrence is temporally associated with the use of the Product (whether or not considered related to the Product); or

(b)any unfavourable and unintended sign, symptom or disease temporally associated with the use of a Product (whether or not considered related to the Product); or

(c)failure of that Product to produce expected benefits, including a lack of efficacy; or

(d)adverse events associated with:

(i)the persistent or sporadic intentional excessive use of the Product by a patient accompanied by harmful physical and/or psychological effects; or

(ii)use of the Product in a way that is not in accordance with its Marketing Authorisation accompanied by harmful physical and/or psychological effects;

Affiliate means, in relation to a specified person:

(a)any group undertaking of such person;

(b)any general partner, trustee, manager, adviser or nominee of such person or of a group undertaking of such person, or a group undertaking of any such general partner, trustee, manager, adviser or nominee;

(c)any fund or other entity which is advised by, or the assets of which are managed from time to time by, any person referred to in (a) or (b) above, and any subsidiary undertaking of such fund or other entity; and

(d)any fund or other entity of which that person, or any person referred to in (a) or (b) above, is a general partner, trustee or nominee, and any subsidiary undertaking of such fund or other entity;

Agreed Form means, in relation to any document, the form of that document which has been initialled for the purpose of identification by the Purchaser’s Lawyers and the Seller’s Lawyers, or otherwise identified as being in the Agreed Form via an email attachment by the Purchaser’s Lawyers and the Seller’s Lawyers, or by or on behalf of the Seller and the Purchaser (respectively), with such alterations as may be agreed in writing by the aforementioned;

Alternative Acquisition Agreement has the meaning given in clause 5.6;

Anti-Bribery Laws means:

(a)the U.S. Foreign Corrupt Practices Act of 1977, as amended;

(b)the UK Bribery Act 2010; and

(c)any other applicable anti-bribery or anti-corruption law or regulation enacted in any jurisdiction;

Anti-Money Laundering Laws means all applicable anti-money laundering laws, anti-fraud, or counter-terrorism financing-related laws or regulations enacted in any jurisdiction;

Antitrust Expenses means any third-party costs, fees and expenses (including by external antitrust advisors, economists, and ediscovery document vendors) with respect to or incurred in connection with obtaining the Regulatory Clearances, to the extent reasonably incurred and documented;

Applicable Accounting Standards means, in respect of a Target Group Company included in the table in Schedule 2 and its Accounts, the accounting principles set opposite that Target Group Company’s name in column (4) of the table in Schedule 2;

Applicable Law means applicable laws, rules, regulations or similar statutes, enactments, codes, orders, judgments, injunctions, notices, decrees, ordinances, treaties, directives and administrative interpretations, in each case as may be in force from time to time;

Approved LHG Shareholder Circular means the LHG Shareholder Circular approved by the JSE;

Authority Regulatory Communication has the meaning given in subclause 6.11(f);

Avid means Avid Radiopharmaceuticals, Inc.;

Base Consideration Amount means USD350,000,000;

[***] APA means the asset purchase agreement entered into between [***] (as amended and/or novated or otherwise varied from time to time), including all Ancillary Agreements (as defined therein) entered into pursuant thereto;

[***] Guarantee means the guarantee originally given by [***] of the prompt performance by [***] of all its obligations under the [***] APA pursuant to section 12.7 of the [***] APA;

Board Recommendation Notice has the meaning given in clause 5.7;

Budget means the budget of the Target Group Companies for the period commencing 1 October 2024 and ending on 30 September 2025 and which has been provided in the Data Room at Eagle_Mainroom\08_Financials\MI Pack LMI November 2025.xlsx;

Business means the business of the Target Group which includes the Commercialisation, manufacturing and other exploitation of NeuraCeq and any Development activities in respect of the Products (including NeuraCeq), in each case, conducted by or on behalf of the Target Group as at the date of this agreement (or, where expressly provided in this agreement, as of Completion);

Business Day means any day that is not a Saturday, Sunday or public holiday in England or South Africa, or Massachusetts, USA (save that for the purposes of clause 5.2, “Business Day” shall mean any day that is not a Saturday, Sunday or public holiday in South Africa only);

Calculation Date means the final Business Day of the calendar month immediately preceding the calendar month in which the Unconditional Date occurs;

Calendar Quarter means the periods of three consecutive calendar months ending on March 31, June 30, September 30 and December 31 (or any of them);

Cash means, without double counting, the aggregate amount of:

(a)all cash in hand or credited to any account with a financial institution;

(b)all cash and cash equivalents, in each case maturing less than 60 days after the Completion Date;

(c)all short term investments that are readily convertible to known amounts of cash which are subject to an insignificant risk of changes in value;

(d)the line items mapped to “Cash” in the Draft Completion Balance Sheet (in the case of Estimated Net Debt) and in the Completion Balance Sheet (in the case of Actual Net Debt); and

(e)any Intra-Group Receivables,

in each case held by the Target Group Companies at the Effective Time or, in the case of Cash for the purposes of Estimated Net Debt, at the Calculation Date (provided that Cash shall not include cash or cash equivalents held by third parties related to any security or similar deposits, cash in escrow accounts, cash supporting obligations under letters of credit, and cash otherwise subject to any legal or contractual restriction on the ability to freely transfer or use such case for any lawful purpose), calculated and including (or excluding as the case may be) those items required to be included in (or excluded from, as the case may be) Cash in accordance with the requirements of Schedule 8, expressed as a positive number and, where applicable, converted into Dollars at the Exchange Rate;

Cash Award means any subsisting cash-based incentive granted before Completion to any current or former Employee, director, officer or consultant of any Target Group Company under the Cash Plans;

Cash Plans means the LMI EBITDA Scheme and the VCP;

CIP means the Life Healthcare Group Holdings Limited Co-Investment Policy, the terms of which have been provided in the Data Room in folder “Eagle_Cleanroom/05_Personnel_and_Benefits/Compensation & Benefits/Benefit & Bonus Mgmt/CIP”;

CIP Accrued Dividend Amount means an amount representing the accrued dividends payable by the Target Group to the CIP participant in respect of shares awarded to that participant under the CIP, as notified in accordance with 19.4;

CIP EBT means the employee benefit trust known as the Life Healthcare Share Matching and Performance Trust established pursuant to the trust deed between: (i) Life Healthcare Group (Proprietary) Limited; and (ii) Asanda Myataza, Chris Johannes Gouws, Tanya Clucas and Thaven Raja as trustees of the trust, as amended and restated on 23 February 2023 and from time to time;

Claim means a Warranty Claim or a Tax Covenant Claim or a Specific Indemnity Claim or any other claim against the Seller (or any other member of the Seller’s Group) for any breach or alleged breach of this agreement (including pursuant to any indemnity or covenant to pay but excluding in relation to any breach or alleged breach of Schedule 10);

Clause 17.1(a) Assessment means a Specific Tax Assessment that relates to a matter falling within subclause 17.1(a);

Clause 17.1(a) Assessment Amount means the amount for which the Seller is liable in respect of a Clause 17.1(a) Assessment or, where such Clause 17.1(a) Assessment has not yet been settled or otherwise finally determined, the amount for which it would be liable under subclause 17.1(a) if the Clause 17.1(a) Assessment were settled at the amount claimed by the relevant Tax Authority (before the use of available Reliefs);

Clause 17.1(b) Assessment means a Specific Tax Assessment that relates to a matter falling within subclause 17.1(b);

Clinical Trial Authorisation means, with respect to a particular Product and jurisdiction, any and all applications, approvals, licences, notifications, registrations or authorisations of any Governmental Entity necessary to conduct a clinical trial of such Product in such jurisdiction, including an Investigational New Drug Application submitted to FDA in accordance with the U.S. Code of Federal Regulations Title 21 part 312, including all amendments, modifications and supplements thereto;

CMA means the UK Competition and Markets Authority;

CMA Briefing Paper means the briefing paper in relation to the transactions contemplated by this agreement to be submitted to the CMA, in a form agreed between the parties in writing;

Code means the U.S. Internal Revenue Code of 1986, as amended;

Combination Product means:

(a)any single product containing as ingredients both:

(i)Florbetaben (18F) or a Pipeline Milestone Asset; and

(ii)one or more active pharmaceutical ingredients or components, diagnostic ingredients or components or biological ingredients or components (each, an Active Component) that are not Florbetaben (18F) or Pipeline Milestone Assets, as applicable whether co-formulated or co-packaged (i.e. within a single box or sales unit); or

(b)any product containing Florbetaben (18F) or a Pipeline Milestone Asset sold in combination with one or more products (such as drug products, devices or diagnostics) that do not contain Florbetaben (18F) or Pipeline Milestone Assets (as applicable) for a single invoice price; or

(c)any product containing Florbetaben (18F) or a Pipeline Milestone Asset sold where the sale of the product containing Florbetaben (18F) or the Pipeline Milestone Asset (as applicable) is only available from the seller with the purchase or other products that do not contain Florbetaben (18F) or a Pipeline Milestone Asset (as applicable), (such other Active Components or biological ingredients, or other such products, services or diagnostics referred to in (a) to (c) above being Other Components);

Commercialisation means the performance of any and all activities directed to promoting, marketing, pricing, importing, exporting, distributing, selling or offering to sell the relevant Product following receipt of Regulatory Approval (but excluding Development). When used as a verb, Commercialise or Commercialising means to engage in Commercialisation;

Commercially Reasonable Efforts means, with respect to the Development or Commercialisation of the Milestone Products in or for a particular country in the CRE Territories, the expenditure of efforts and resources in good faith and consistent with the usual practice of the Purchaser’s Group in pursuing, in a reasonably timely manner, the development, approval and Commercialisation of radiopharmaceutical products (other than the Milestone Products) at a similar stage of development or product life that are of similar market potential and strategic value to the Purchaser’s Group, and taking into account, without limitation: issues of safety and efficacy; product profile; proprietary position (including patent and license coverage and regulatory exclusivity); the then-current competitive market environment in the relevant CRE Territory; likely timing of the pharmaceutical product’s entry into the market in the relevant CRE Territory; the then current market penetration in the relevant CRE Territory; market potential (including market size, patient population, pricing and reimbursement);

potential profitability (including Third Party costs and expenses) of such radiopharmaceutical product in the relevant CRE Territory; regulatory environment; and other relevant legal, regulatory, scientific, technical and commercial factors; in each case, measured by the facts and circumstances at the time such efforts are due;

Company has the meaning given in recital (A);

Company Intellectual Property means the Owned Company Intellectual Property and the Non-Owned Company Intellectual Property;

Completion means completion of the sale and purchase of the Sale Shares in accordance with this agreement;

Completion Balance Sheet means the Draft Completion Balance Sheet as agreed and/or determined (as applicable) to be final and binding in accordance with paragraphs 2 and 3 of Part 1 of Schedule 8;

Completion Date means the date on which Completion takes place, being five Business Days following the Unconditional Date, provided that, where Completion would occur less than five Business Days prior to the end of any Calendar Quarter, Completion shall be on the first Business Day of the following Calendar Quarter;

Completion Disclosure Letter means the letter of the same date as Completion, written and delivered by or on behalf of the Seller to the Purchaser at Completion disclosing information constituting exceptions to the Seller’s Warranties (other than the Seller’s Fundamental Warranties) relating to facts. matters or circumstances that have arisen during the period between the date of this agreement and Completion;

Completion Statement means the Draft Completion Statement as agreed and/or determined (as applicable) to be final and binding in accordance with paragraphs 2 and 3 of Part 1 of Schedule 8;

Conditions has the meaning given in clause 5.1;

Confidentiality Agreement means the confidentiality undertaking between Lantheus Medical Imaging, Inc. and Life Healthcare Group Proprietary Limited dated 2 November 2024;

Connected Person means, in respect of a person, such person’s directors and officers;

Consideration means the aggregate of the Initial Consideration and any NeuraCeq Earn-Out Payment(s) and/or Sales Revenue Milestone Payment(s) payable in accordance with clause 4 of this agreement;

Copyright means any copyrights and copyrightable works, including all works for hire, all rights of authorship, use, publication, reproduction, distribution, performance, transformation, moral rights and rights of ownership of copyrightable works, all registrations, applications for registration and renewals of any of the foregoing anywhere in the world, and all rights to register and obtain renewals and extensions of registrations, together with all other interests accruing by reason of copyright law anywhere in the world;

Cost Coverage Amount has the meaning given in clause 6.1;

CRE Territory means any of:

(a)[***]; and

(b)[***]

(provided that, with respect to any Pipeline Milestone Asset, the countries in paragraph (b) will only be deemed a CRE Territory in respect of such Pipeline Milestone Asset after Regulatory Approval for such Pipeline Milestone Asset is granted in [***]);

Dangerous Substance means any natural or artificial substance or thing (whether in a solid, liquid, gas, vapour or other form) that is likely to cause significant damage to the Environment;

Data Room means the information and the documents in the virtual data room as of one Business Day immediately prior to the signing of this agreement in the folders named “Eagle_Mainroom” and “Eagle_Cleanroom” shared in the virtual data room hosted by Citrix ShareFile, each of which is encrypted on a USB stick and the index of which is in the Agreed Form;

Debt means, without double counting, all loans (whether or not they bear interest), financing liabilities or obligations or other indebtedness, including:

(a)any overdrafts and other liabilities in the nature of borrowed money (whether secured or unsecured);

(b)any reimbursement and payment obligations with respect to letters of credit, bills, bonds, notes, debentures or loan stock and other similar instruments;

(c)any obligations in respect of interest rate swaps or other financial derivatives stated at their fair value;

(d)any obligations and liabilities under finance or capital leases, hire purchase agreements and sale and lease-back transactions;

(e)any Transaction Costs;

(f)the line items mapped to “Debt” in the Draft Completion Balance Sheet (in the case of Estimated Net Debt) and in the Completion Balance Sheet (in the case of Actual Net Debt); and

(g)any Intra-Group Payables,

together with all interest accrued on those amounts and any break, prepayment, early payment charges payable in respect of such amounts but excluding, to the extent included in Working Capital, trading debt or liabilities arising in the ordinary and usual course of business, of the Target Group Companies as at the Effective Time or, in the case of Debt for the purposes of Estimated Net Debt, at the Calculation Date, calculated in accordance with and including (or excluding as the case may be) those items required to be included in (or excluded from, as the case may be) Debt in accordance with the requirements of Schedule 8, expressed as a positive number and, where applicable, converted into USD at the Exchange Rate;

Delayed Information has the meaning given in clause 4.9;

Development means the performance of any and all activities relating to preparation of a product or service for Regulatory Approval, including pre-clinical studies, pharmacokinetic studies, toxicology studies, formulation, test method development, assay development and stability testing, manufacturing process development, chemistry, manufacturing and control (CMC) management, manufacturing technical support, biomarker development, validation and scale-up (including bulk compound production), manufacturing of clinical supplies and activities relating to developing the ability to manufacture and to continue to manufacture, quality assurance and quality control for formulations, design and conduct of clinical trials or studies (including all post-marketing commitments), report

writing, statistical analysis and regulatory affairs including regulatory legal services (but excluding Commercialisation). When used as a verb, Develop means to engage in Development;

Disclosed means fairly disclosed with sufficient detail to enable the Purchaser to assess the nature and scope of the matter disclosed;

Disclosed Information has the meaning given in paragraph 1.1 of Schedule 5;

Dispute Notice has the meaning given in subparagraph 2.1 of Part 1 of Schedule 8;

Disputed Items has the meaning given in subparagraph 2.1 of Part 1 of Schedule 8;

Divest means to sell, assign, transfer or otherwise dispose of by any means whether directly or indirectly (including by way of share sale, merger, consolidation, asset sale, license, sublicense, assignment or other similar disposition), but shall not include to the extent relating solely to the development, manufacturing and commercialisation of any product, sublicenses, or licenses to distributors, co-promotion agreements, logistics arrangements or any arrangement conferring rights upon a Third Party to obtain, hold or maintain any Regulatory Approval or Marketing Authorisation (or equivalent) including if necessary to comply with Applicable Law, and Divestiture shall be construed accordingly;

Draft Completion Balance Sheet has the meaning given in subparagraph 1.1 of Part 1 of Schedule 8;

Draft Completion Statement has the meaning given in subparagraph 1.1 of Part 1 of Schedule 8;

Effective Time means immediately before Completion;

Employee means any person employed by a Target Group Company;

Employment Tax Liabilities has the meaning given in clause 20.7;

Encumbrance means any claim, equitable right, power of sale, retention of title, right of pre-emption, right of first refusal, option, right to acquire, mortgage, charge, pledge, lien (including mortgages, charges, pledges or liens with respect to any kind of tangible or intangible property, including any kind of intellectual property) or other third party right, form of security or encumbrance of any kind or any agreement, arrangement or obligation to create any of the foregoing;

Environment means air (including air within any building or other natural or man-made structure and whether above or below ground), water (including surface waters, underground waters, groundwater, coastal water, the seas and oceans, and inland waters and any water within any natural or man-made structure), soil and land (including land under water, surface land and sub-surface land) and any living organism or systems supported by those media;

Environmental Law means any applicable laws, statutes, regulations, common law, final and binding court and other tribunal decisions concerning the protection of the Environment and/or the release, emission, leakage, spillage, management or handling of any Dangerous Substance or to regulate the use, treatment, storage, burial, disposal or transportation of any Dangerous Substance, in all cases, capable of enforcement by legal process in the jurisdiction(s) of operation of any applicable Target Group Company as at the date of this agreement;

Environmental Licence means any permit, licence, authorisation, consent or other approval which is issued, granted or required under or in relation to any applicable Environmental Laws;

ERISA means the U.S. Employee Retirement Income Security Act of 1974, as amended;

ERISA Affiliate means any person that is (or at any relevant time was or will be) a member of a “controlled group of corporations” with, under “common control” with, or a member of an “affiliated service group” with any Target Group Company as such terms are defined in Sections 414(b), (c), (m) or (o) of the Code;

Estimated Consideration means an amount equal to the Base Consideration Amount:

(a)less the Estimated Net Debt; and

(b)either:

(i)if the Estimated Working Capital is greater than the Target Working Capital, plus an amount equal to the difference; or

(ii)if the Estimated Working Capital is less than the Target Working Capital, less an amount equal to the difference;

Estimated Intra-Group Payables means the projected amount of the Intra-Group Payables at the Calculation Date, as estimated by the Seller in accordance with clause 3.2;

Estimated Intra-Group Receivables means the projected amount of the Intra-Group Receivables at the Calculation Date, as estimated by the Seller in accordance with clause 3.2;

Estimated Net Debt means the projected amount of the Net Debt at the Calculation Date, as estimated by the Seller in accordance with clause 3.2;

Estimated Working Capital means the projected amount of the Working Capital at the Calculation Date, as estimated by the Seller in accordance with clause 3.2;

Exchange Rate means the spot closing mid-rate of exchange between the two currencies in question published in the London edition of The Financial Times on the Business Day immediately preceding the Applicable Date or, where no such rate of exchange is published, the rate quoted on the preceding date on which such rates are quoted. For the purposes of this definition, Applicable Date shall mean, save as otherwise provided in this agreement, the date on which a payment or an assessment is to be made, save that, for the following purposes, it shall mean: (a) for the purposes of clauses 3.9, 12.1 and 12.2, the date of the Seller’s notification of the Pre-Completion Estimate pursuant to clause 3.2; (b) for the purposes of clause 3.2, the Calculation Date; (c) for the purposes of clauses 3.3 to 3.7, the Completion Date; and (c) for the purposes of clause 13 and Schedule 4, the date on which the Purchaser is paid for the Loss resulting from the relevant Seller’s Warranty being not true or not accurate (whether judicially determined or by agreement between the Purchaser and the relevant payor);

Excluded Proposal means any indication of interest, offer or proposal from any person or group contemplating or otherwise relating to any transaction resulting in the acquisition by such person or group of the majority of the issued and to be issued share capital of Life Healthcare Group Holdings;

FDA means the United States Food and Drug Administration and any successor agency or authority having substantially the same function;

Finally Determined in respect of a Claim means where the parties to such Claim have so determined by mutual written agreement or, if disputed, when a matter has been resolved by a final and non-appealable judgment, decision (or equivalent) of a court of competent jurisdiction;

Foreign Investment Laws means any Applicable Law that provides for the review, clearance or notification of transactions on grounds of national security or other national or public interest, including any state, national or multi-jurisdictional Applicable Law that is designed or intended to

prohibit, restrict or regulate actions by foreigners to acquire interests in or control over domestic equities, securities, entities, assets, land or interests;

FRC means the Financial Reporting Council;

FRS102 (UK GAAP) means generally accepted accounting practice in the UK, including Financial Reporting Standards (specifically Financial Reporting Standard 102) and Statements of Standard Accounting Practice, each as issued or adopted by the FRC, abstracts issued by the FRC (and pronouncements previously issued by the Urgent Issues Task Force of the Accounting Standards Board) and pronouncements by the Conduct Committee of the FRC (or its predecessor, the Financial Reporting Review Panel) in force as at the relevant Accounts Date as set out in the table in Schedule 2;

From Authority Regulatory Communication has the meaning given in subclause 5.11(e);

Fundamental Warranty Claim means a claim by the Purchaser the basis of which is that one or more of the Seller’s Fundamental Warranties is, or is alleged to be, untrue or inaccurate;

Good Clinical Practices means all requirements and standards for designing, conducting, recording, and reporting clinical trials for pharmaceutical products, including (i) U.S. Code of Federal Regulations Title 21 parts 50, 54, 56, and 312, (ii) the applicable revision of ICH Guideline for good clinical practice E6 (ICH GCP), and (iii) Regulation (EU) No 536/2014, which are applicable, and as may be amended from, time to time;

Good Laboratory Practices means all requirements and standards for the conduct of non-clinical studies of pharmaceutical products, including (i) U.S. Code of Federal Regulations Title 21 part 58, (ii) Directive 2004/10/EC, and (iii) the OECD Principles on Good Laboratory Practice, which are applicable, and as may be amended from, time to time;

Good Manufacturing Practices means all requirements and standards for the manufacture of pharmaceutical products and their components, including (i) U.S. Code of Federal Regulations Title 21 parts 210-211, (ii) the EU Guidelines to Good Manufacturing Practice Medicinal Products for Human and Veterinary Use, as set out in Volume 4 of the European Commission’s Rules governing Medicinal Products in the European Union, and (iii) and any related guidance promulgated thereunder, which are applicable, and as may be amended from, time to time;

Governmental Entity means any supra-national, national, federal, state, municipal, provincial, regulatory, administrative or other governmental or quasi-governmental authority, agency or commission, any court, tribunal, arbitral body, administrative body, local authority entity or private body exercising any regulatory function with competent jurisdiction, or any national securities exchange or automated quotation service;

HGB (GER GAAP) means generally accepted accounting practice in Germany in force as at the relevant Accounts Date as set out in the table in Schedule 2;

HSR Act means the premerger notification and waiting period requirements of the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations promulgated thereunder;

IFRS means the body of pronouncements issued by the International Accounting Standards Board, including International Financial Reporting Standards and interpretations approved by the International Accounting Standards Board, International Accounting Standards and Standing Interpretations Committee interpretations approved by the predecessor International Accounting Standards Committee;

Incentive Award means any Share Award or Cash Award;

Independent Accountants means such firm of chartered accountants as may be appointed under Schedule 9;

Initial Consideration means an amount equal to the Base Consideration Amount:

(a)less the Actual Net Debt; and

(b)either:

(i)if the Actual Working Capital is greater than the Target Working Capital, plus an amount equal to the difference; or

(ii)if the Actual Working Capital is less than the Target Working Capital, less an amount equal to the difference;

Intangibles means certain assets held by Swiss entity Life Molecular Imaging SA until 30 April 2021;

Intangibles Acquisition means the acquisition by the Company of the Intangibles from Life Molecular Imaging SA effective on 1 May 2021;

Intangibles Dispute means the enquiry opened by HMRC in respect of the Intangibles Acquisition as evidenced (wholly or in part) by the Notice of Enquiry issued by HMRC on 20 March 2024;

Intellectual Property Rights means any and all intellectual property and similar proprietary rights of any kind or nature, whether registered or unregistered and whether protected, created or arising under any law in any jurisdiction throughout the world and all rights associated therewith, including the following: (a) Patents and other indicia of ownership of an invention recognized or issued by or filed with any Governmental Entity; (b) trade secrets, inventions, discoveries and other Know-How, including articles of manufacture, business methods, compositions of matter machines, methods, and processes and new uses for any of the preceding items; (c) Trademarks; (d) internet domain names and social media handles; (e) published and unpublished works of authorship, including audiovisual works and collective works, and Copyrights; (f) rights in designs, databases, data, collections of data and compilations of data; (g) improvements, derivatives, modifications, enhancements, revisions and releases relating to any of the foregoing; (h) instantiations of any of the foregoing in any form and embodied in any media; (i) software (including source code, executable code, systems, network tools, data, databases, applications, firmware and all related documentation); (j) rights to sue (and to secure or recover damages, royalties and other proceeds or remedies) for past, present and future infringements, misappropriations or other violations of any of the foregoing; and (k) applications for registration, and the right to apply for registration, for any of these rights; and

Intercompany Loan means the receivable with an amount (principal and interest accrued thereon) as at 30 September 2024 of [***] owed to the Seller by the Company together with any further interest accrued thereon;

Intercompany Receivable means the receivable with an amount (principal and interest accrued thereon) as at 30 September 2024 of [***] owed to the Seller by Life Molecular Imaging GmbH together with any further interest accrued thereon;

Intra-Group Payables means the aggregate amount of outstanding loans, financing liabilities or other indebtedness (other than Trade Debts) owing by the Target Group Companies to the Seller or any other member of the Seller’s Group at Completion or, in the case of Estimated Intra-Group Payables, at the Calculation Date, calculated in accordance with the requirements of paragraph 1 of Part 1 of Schedule 8 and by reference to the line items set out in Part 2 of Schedule 8, expressed as a positive number;

Intra-Group Receivables means the aggregate amount of outstanding loans, financing liabilities or other indebtedness (other than Trade Debts) owing by the Seller or any other member of the Seller’s Group to the Target Group Companies at Completion or, in the case of Estimated Intra-Group Receivables, at the Calculation Date, calculated in accordance with the requirements of paragraph 1 of Part 1 of Schedule 8 and by reference to the line items set out in Part 2 of Schedule 8, expressed as a positive number;

Irrecoverable VAT means any amount paid in respect of VAT or any amount of VAT accounted for under the reverse charge procedure by the person in question, in each case, which is not recoverable as input tax by it or the representative member of any VAT group of which it forms part (subject to that person or representative member using reasonable endeavours to recover such amount of VAT), provided that, where the amount in respect of VAT or amount of VAT is paid by a Target Group Company prior to Completion that is a member of a VAT group, the representative member of the VAT group is also a Target Group Company or accounts to a Target Group Company for the amount recoverable;

JSE means the exchange operated by JSE Limited, a company incorporated under the laws of South Africa with registration number 2005/022939/06, licensed as an exchange under the South African Financial Markets Act, No. 19 of 2012;

JSE Listings Requirements means the listings requirements of the JSE, as amended from time to time;

Know-How means all confidential and proprietary commercial, technical, scientific and other data, results, know-how and information, trade secrets, inventions, technology, methods, processes, practices, formulae, instructions, skills, techniques, procedures, knowledge, experiences, ideas, technical assistance, designs, drawings, assembly procedures, computer programs, and specifications (including biological, chemical, structural, pharmacological, toxicological, clinical, safety, assay, method of screening, study designs and protocol and related know-how and trade secrets, and manufacturing data, non-clinical information, pre-clinical and clinical data, specifications of ingredients, manufacturing processes, formulation, specifications, sourcing information, quality control and testing procedures and related know-how and trade secrets), in all cases, whether or not patented or patentable, in written, electronic or any other form now known or hereafter developed;

LHG General Meeting has the meaning given in subclause 5.1(a);

LHG Resolutions has the meaning given in subclause 5.1(a);

LHG Shareholder Approval Condition has the meaning given in subclause 5.1(a);

LHG Shareholder Circular means the shareholder circular, including notice of meeting, to be issued to the LHG Shareholders convening the LHG General Meeting and which contains the LHG Resolutions and related information;

LHG Shareholders means holders of LHG Shares;

LHG Shares means ordinary shares in the issued share capital of Life Healthcare Group Holdings, excluding shares held by any subsidiary of Life Healthcare Group Holdings;

Licence and Commercial Agreement(s) means the agreement(s) to be entered into between a Target Group Company and a member of the Seller’s Group on or before Completion, reflecting the Licence and Commercial Agreement(s) – Term Sheet;

Licence and Commercial Agreement(s) – Term Sheet means the principle terms which will form the basis of the Licence and Commercial Agreement(s), set out in Appendix 1 to this agreement;

Licensee means, with respect to any Milestone Product, any (sub)licensees of the Purchaser, any Target Group Company or any of their respective Affiliates (in multiple tiers): (a) under any Patents or any other Intellectual Property Rights, in each case, that are owned by or licensed to any Target Group Company as of Completion: (i) covering or claiming such Milestone Product or (ii) used in the Development or Commercialisation of such Milestone Product; and (b) who have the right to Develop, seek Marketing Authorisation and/or Commercialise such Milestone Product (as applicable). Notwithstanding anything to the contrary in the foregoing; (A) contract research organizations, contract manufacturers and other Third Party service providers who Develop or Commercialize the applicable Milestone Product on behalf of the Purchaser, any of its Affiliates, Licensees or Transferees, and any distributors of the Purchaser or any of its Affiliates or a Licensee or Transferee, in each case, shall not be deemed a “Licensee”; and (B) “Licensee” shall exclude any member of the Seller’s Group following Completion and any other (sub)licensees of any member of the Seller’s Group under the Licence and Commercial Agreement(s);

LMI EBITDA Participants means all individuals employed or engaged by a member of the Target Group who participate in the LMI EBITDA Scheme as at the date of this agreement;

LMI EBITDA Scheme means the Life Molecular Imaging Management EBITDA Generation Incentive Scheme as adopted by the Remuneration Committee of Life Healthcare Group Holdings on 25 February 2019;

LMI EBITDA Scheme Completion Amount means the total amount required to be paid by the Target Group to the LMI EBITDA Participants in connection with Completion, as notified in accordance with clause 19.4 and as calculated in accordance with the LMI EBITDA Scheme;

Long Stop Date means: (a) 31 December 2025; or (b) such other date as agreed between the parties in writing;

Losses means, in respect of any matter, event or circumstance, liabilities, damages, losses, charges, fees, Taxes (including Irrecoverable VAT), costs, expenses and/or penalties (including any final judgement or approved settlement payments, monetary penalties, administrative fines and reasonable legal advisor costs);

LTIP means the Life Healthcare 2015 Long-Term Incentive Plan;

Management Accounts means the monthly consolidated profit and loss account of the Company for the 12-month period ending on the Management Accounts Date and the consolidated balance sheet of the Company (internally named MI-Pack) in each case prepared in accordance with IFRS, copies of which have been provided in the Data Room at “Eagle_Mainroom\08_Financials\MI Pack LMI November 2025.xlsx;

Management Accounts Date means 30 November 2024;

Marketing Authorisations means, to the extent exclusively relating to a Product, those marketing authorisations, licences and approvals of any Governmental Entity in force at the date of this agreement which are necessary for the Commercialisation and, where relevant, manufacture of such Product;

Material Contract has the meaning given in paragraph 12.1 of Part 2 of Schedule 4;

Material IT Agreement means any material IT agreement of the Target Group as set out in folder “Eagle_Mainroom/10_IT/Material contracts” of the Data Room;

Milestone Assets means NeuraCeq and/or any of the Pipeline Milestone Assets, and Milestone Asset means any one of the foregoing;

Milestone Products means NeuraCeq and/or any of the Pipeline Milestone Products, including any Combination Product, and Milestone Product means any one of those products;

Net Debt means the aggregate of Debt less Cash at the Effective Time or, in the case of Estimated Net Debt, at the Calculation Date;

Net Debt Adjustment has the meaning given in clause 3.4;

Net Sales means the gross amounts invoiced by or behalf of the Purchaser or its Affiliates or Transferees or Licensees, as applicable, for sales of the applicable Milestone Product(s) to a Third Party (other than a Transferee or Licensee) in the Purchaser Territory, in each case less the sum of the following:

(a)trade discounts allowed or given (including cash discounts and quantity discounts), cash and noncash coupons, retroactive price reductions, charge back payments, fees and rebates paid, granted or accrued to: managed care organizations; federal, state and local governments or their agencies; purchasers, group purchasing organizations or integrated delivery networks; payors or reimbursers; or customers or patients, including co-pay assistance;

(b)credits or allowances paid, granted or accrued upon claims, damaged goods, rejections or returns of such Milestone Product(s), including Milestone Product(s) returned in connection with recalls or withdrawals;

(c)taxes or duties levied on, absorbed or otherwise imposed on sale of the Milestone Product(s), including value added taxes, healthcare taxes, withholding taxes, pharmaceutical excise taxes (such as those imposed by the United States Patient Protection and Affordable Care Act of 2010 and other comparable laws) or other governmental charges otherwise imposed upon the billed amount, as adjusted for rebates and refunds;

(d)charges and expenses for freight, customs and insurance related to the distribution of the Milestone Product(s), and wholesaler and distributor administration fees; and

(e)other future similar deductions, taken in the ordinary course of business in accordance with the recording of Net Sales under the Purchaser’s, any of its Affiliates’ or Transferees’ (as applicable and evidenced as such) applicable accounting standards consistent with past practice,

Net Sales will be determined in accordance with the Purchaser’s, any of its applicable Affiliates’ or Transferees’ or Licensees’ applicable accounting standards consistent with past practice of, as applicable, the Purchaser (and its Affiliates) (being US GAAP), Transferee (and its Affiliates) or Licensee (and its Affiliates). If any amounts included in Net Sales are expressed in a currency other than USD, then these amounts will be converted to USD at the applicable exchange rate used by the Purchaser from time to time in its audited accounts to convert Net Sales expressed in currencies other than USD. Net Sales with respect to any sale of a Milestone Product(s) shall be recognised and reported in the same financial period as the relevant delivery of such Milestone Product(s).

Notwithstanding anything to the contrary, Milestone Products transferred to Third Parties as part of an expanded access program, compassionate sales or use program, an indigent program, as samples or evaluation product, as donations, for the performance of clinical trials or other studies in each case for which no consideration is received, or for similar business purposes, shall not constitute “Net Sales” under this agreement.

The sale or transfer of Milestone Product(s) between or among the Purchaser and its Affiliates or sale or transfer of Milestone Product(s) to Transferees or Licensees shall not result in any Net Sales, with Net Sales to be based only on any subsequent sales or dispositions to a Third Party that is not a Transferee or Licensee.

To the extent that the Purchaser, any of its Affiliates or Transferees or Licensees receives consideration other than or in addition to cash upon and for the sale or disposition of a Milestone Product(s) to a Third Party, Net Sales shall be calculated based on the average cash based sales price for such Milestone Product(s) in the applicable country in the Purchaser Territory, as applicable, during the preceding calendar year, or in the absence of such sales, based on the fair market value of the Milestone Product(s) in the applicable country in the Purchaser Territory, as determined by the Purchaser in good faith.

(f)Notwithstanding anything to the contrary in any of the foregoing:

(i)Net Sales shall not include amounts or other consideration that constitutes bona fide reimbursement of the Purchaser’s or any of its Affiliate’s fully burdened full time equivalent (FTE) costs or out-of-pocket costs in connection with Development, Manufacture or Commercialisation of the applicable Milestone Product(s), in each case, provided that such consideration is not in lieu of all or a portion of the transfer price of the Milestone Product;

(ii)sales to a distributor, wholesaler, group purchasing organization, pharmacy benefit manager, or retail chain customer shall be considered sales to a Third Party, and

(iii)Net Sales to a Third Party consignee are not recognized as Net Sales by such Affiliate until the Third Party consignee sells the applicable Milestone Product(s).

In the case of any Combination Product sold in a given country in the Territory, Net Sales for such Combination Product in such country shall be calculated by multiplying actual Net Sales of such Combination Product by the fraction A/(A+B), where A is the invoice price of the product containing the relevant Pipeline Milestone Asset if sold separately in the same indication in such country, and B is the total invoice price of the Other Components in the Combination Product, if sold separately in the same indication in such country. If, on a country-by-country basis, the Other Components in the Combination Product are not sold separately in the same indication in such country, Net Sales for the purpose of determining the applicable amount of Net Sales in respect of the Combination Product for such country shall be calculated by multiplying actual Net Sales of the Combination Product by the fraction C/D, where C is the invoice price of the product containing the relevant Pipeline Milestone Asset if sold separately in the same indication in such country, and D is the invoice price of the Combination Product in such country. If neither the product containing the relevant Pipeline Milestone Asset nor the Other Components are sold separately in the same indication in a given country, then Net Sales shall be calculated consensually by the parties based on the Purchaser’s good faith estimate of the fair market value of the product containing the relevant Pipeline Milestone Asset and each of the Other Components included in such Combination Product.

Net Sales Report Contents means, with respect to a calendar year:

(a)the aggregate annual amount of all Net Sales of NeuraCeq for that calendar year, together with a breakdown on a market-by-market basis;

(b)the aggregate annual amount of all Net Sales of the Pipeline Milestone Assets for that calendar year (with breakdown by Pipeline Milestone Asset), together with a breakdown on a market-by-market basis;

(c)a statement of whether any Sales Revenue Milestone was first achieved for that calendar year;

(d)if such calendar year is an Earn-Out Payment Year, the aggregate annual amount of all Net Sales of NeuraCeq in the USA for that Earn-Out Payment Year and, if such Net Sales exceeded [***], a calculation of the applicable NeuraCeq Earn-Out Payment in accordance with clause 4.1; and

(e)the currency conversions rates used (if applicable);

NeuraCeq means any pharmaceutical product containing as an Active Component the compound Florbetaben (18F) and, for the avoidance of doubt, “NeuraCeq” shall be construed to include any other brand name under which that product is marketed or utilised in any Territory;

Non-Owned Company Intellectual Property means all Intellectual Property Rights used by a member of the Target Group that are material to the Business and that are not Owned Company Intellectual Property;

Order means, with respect to any Person, any judgment, decision, writ, decree, award, consent decree, injunction, ruling, stipulation or order rendered by, entered into with, or of any federal, state, local or other domestic or non-U.S. court or other Governmental Entity or arbitrator (in each case, whether temporary, preliminary or permanent) that, in each case, is binding on such Person or its property under Applicable Laws;

Other Claim means a Claim which is not a Warranty Claim or a Tax Covenant Claim;

Other Components has the meaning given to it in the definition of Combination Product;

Outgoing Director means each of Petrus Phillippus Van Der Westhuizen and Peter Gerard Wharton-Hood;

Outstanding Disputed Items has the meaning given in subparagraph 3.1(b) of Part 1 of Schedule 8;

Owned Company Intellectual Property means all Intellectual Property Rights owned (whether solely or jointly with others) by any member of the Target Group;

Pass-Back Amount means an amount payable pursuant to clauses 10.4 and 10.5;

Patents means (a) all patents and patent applications (provisional and non-provisional) anywhere in the world, including PCT applications, (b) all divisionals, continuations, continuations in-part thereof, or any other patent application claiming priority, or entitled to claim priority, directly or indirectly to (i) any such patents or patent applications or (ii) any patent or patent application from which such patents or patent applications claim, or are entitled to claim, direct or indirect priority, and (c) all patents issuing on any of the foregoing anywhere in the world (including from PCT applications), together with all registrations, reissues, re-examinations, patents of addition, utility models or designs, renewals, substitutions, revisions, provisionals, supplemental protection certificates, inventors’ certificates and all disclosures, or extensions (including patent term extensions) of any of the foregoing and counterparts thereof anywhere in the world;

Person means any individual, a limited liability company, a joint venture, a corporation, a company, a partnership, an association, a business trust, a trust, a Governmental Entity or any other entity or organization;

Phase 1 Investigation means an investigation by the CMA to enable it to determine whether to make a reference under Section 33 of the Enterprise Act 2002;

Pipeline Milestone Assets means each of the compounds known as: (i) [***]; (ii) [***] and (iii) [***] and Pipeline Milestone Asset means any of those;

Pipeline Milestone Product means any product containing as an Active Component a Pipeline Milestone Asset;

Pipeline Products means the products and product candidates being or to be Commercialised and researched and developed by the Target Group Companies other than NeuraCeq, including the Pipeline Milestone Assets and any Pipeline Milestone Product, and Pipeline Product means any one of those;

[***];

[***] SPA means the share purchase agreement relating to the sale and purchase of the entire issued share capital of [***], dated [***] and originally entered into between [***], as amended, restated, supplemented or novated from time to time;

[***];

Pre-Completion Estimate has the meaning given in clause 3.2;

Products means NeuraCeq and the Pipeline Products, and Product means any of those;

Properties means the properties set out in Schedule 3, and Property means any of them;

Purchaser Default has the meaning given in clause 8.4;

Purchaser Tax Assessment means:

(f)a Clause 17.1(a) Assessment; or

(g)a Clause 17.1(b) Assessment where the amount initially assessed by the Tax Authority is (i) not specified or (ii) is specified in an amount (when aggregated with any Clause 17.1(a) Assessment Amount, and together with any incurred costs and expenses for which the Seller is liable under subclause 17.1(c)) that exceeds USD 10,000,000, provided that if at any time the amount claimed by the Tax Authority is specified in an amount which, when aggregated with any Clause 17.1(a) Assessment Amount is equal to or less than USD 10,000,000 (together with any incurred costs and expenses for which the Seller is liable under subclause 17.1(c)), the Clause 17.1(b) Assessment shall cease to be a Purchaser Tax Assessment;

Purchaser Territory means worldwide excluding [***];

Purchaser’s Group means the Purchaser and all its subsidiaries, all companies of which the Purchaser is a subsidiary and all subsidiaries of such companies from time to time, including (after Completion) each Target Group Company, and member of the Purchaser’s Group shall be construed accordingly;

Purchaser’s Lawyers means Covington & Burling LLP of 22 Bishopsgate, London, EC2N 4BQ;

Purchaser’s Relief means:

(a)a Relief arising to any member of the Purchaser’s Group at any time (excluding any Target Group Company); and/or

(b)a Relief arising to a Target Group Company in respect of a period falling on or after Completion (other than a Relief arising as a result of an Event or Events which took place wholly before Completion);

Registered Company Intellectual Property means all Company Intellectual Property that is the subject of an application, certificate, filing, registration, or other document issued by, filed with, or

recorded by, any Governmental Entity in any jurisdiction, and all internet domain name registrations, websites and social media handles;

Regulatory Approval means, with respect to a Product in a country, any and all approvals (including Marketing Authorisations), licences, registrations, authorisations, or exemptions from any such approvals, licences, registrations, or authorisations, of any Governmental Entity necessary to Commercialise, distribute or market such Product in such country;

Regulatory Clearances has the meaning given in subclause 5.1(a);

Regulatory Condition has the meaning given in subclause 5.1(a);

Related Party Arrangements means any agreement between a Target Group Company and any member of the Seller’s Group, and Related Party Arrangement shall mean any one of them;

Relevant Date means the date which is 24 months prior to the date of this agreement;

Relevant Regulatory Matter has the meaning given in subclause 5.11(e);

Relevant Share Plans means the CIP, the LTIP and the SIP;

Relief means any loss, allowance, credit, relief, deduction or set-off in respect of, or taken into account, or capable of being taken into account, in the calculation of a liability to, Tax or any right to a repayment of Tax;

(c)Reporting Dates means, in respect of any written report to be delivered pursuant to subclause 4.12(a) in a calendar:

(a)in respect of the first report in such calendar year, within 30 Business Days of 31 March; and

(b)in respect of the second report in such calendar year, within 30 Business Days of 30 September;

Representatives has the meaning given in clause 5.4;

Required Regulatory Authorities means:

(a)Antitrust Division of the U.S. Department of Justice and U.S. Federal Trade Commission; and

(b)Germany’s Federal Ministry of Economic Affairs and Climate Action (BMWK); and

(c)United Kingdom’s Competition and Markets Authority;

Restricted Information has the meaning given in clause 5.11;

Restricted Person means a person or entity that is:

(a)listed or referred to on, or owned or controlled by a person or entity listed or referred to on, or acting on behalf of a person or entity listed or referred to on, any Sanctions List (as the terms “owned”, “controlled” and “acting on behalf or at the direction of” are defined in the relevant Sanctions and/or any associated guidance on the same produced by any relevant Sanctions Authority from time to time);

(b)resident in, ordinarily located in, incorporated under the laws of, or acting on behalf of a person or entity located in or organised under the laws of any Sanctioned Country; or

(c)otherwise an expressly designated target of Sanctions;

Retirement Benefit means any benefit payable under a pension scheme or arrangement by reference to reaching, or expecting to reach, retirement or a particular age or payable by reason of incapacity or death;

RM2 License means the sublicense, development and collaboration agreement with effective date 20 June 2024 entered into between Lantheus One, LLC, Lantheus Holdings, Inc. (each of which are members of the Purchaser’s Group) and the Company;

Sale Shares means the entire issued share capital of the Company on Completion;

Sales Revenue Milestone Payment has the meaning given in clause 4.4;

Sanctioned Country means any country or territory that is the target of any comprehensive country- or territory-wide Sanctions (being, as at the date of this agreement, the territories of Crimea, Donetsk and Luhansk, and the countries of Cuba, Iran, North Korea and Syria);

Sanctions means the economic, financial and trade embargoes, sanctions laws, regulations, rules and/or restrictive measures, and export controls, administered, enacted or enforced by a Sanctions Authority from time to time;

Sanctions Authority means:

(a)the United Nations Security Council;

(b)any United Nations Security Council Sanctions Committee;

(c)the U.S. Department of the Treasury (including its Office of Foreign Assets Control);

(d)the U.S. Department of State;

(e)any other U.S. Government Entity;

(f)the European Union;

(g)any Member State of the European Union;

(h)the United Kingdom; and/or

(i)any other government, public or regulatory authority or body of the aforementioned (including HM Treasury);

Sanctions List means the “Specially Designated Nationals and Blocked Persons” list maintained by the Office of Foreign Assets Control of the U.S. Department of the Treasury, the Consolidated List of Persons, Groups and Entities subject to EU Financial Sanctions maintained by the European Commission, the United Kingdom Consolidated List of Financial Sanctions Targets, or any other list maintained by, or public announcement of Sanctions designation made by, any Sanctions Authority;

Schemes means the Retirement Benefit arrangements provided in folder “Eagle_Cleanroom\05_Personnel_and_Benefits\Compensation & Benefits\” of the Data Room;

Seller Default has the meaning given in clause 8.4;

Seller Share Award means any securities-based incentive granted before Completion to any current or former Employee, director, officer or consultant of any Target Group Company under the Share Plans;

Seller Tax Assessment means a Clause 17.1(b) Assessment other than a Purchaser Tax Assessment.

Seller’s Fundamental Warranties means the statements set out in Part 1 of Schedule 4;

Seller’s Group means the Seller, all companies of which the Seller is a subsidiary and all subsidiaries of such companies from time to time, save that the Seller’s Group shall: (a) other than for the purposes of clause 11.4, exclude each Target Group Company (both before and after Completion); and (b) for the purposes of clause 11.4 include each Target Group Company before (but not after) Completion, and member of the Seller’s Group shall be construed accordingly;

Seller’s Group Trade Marks means the names “Life Healthcare” and “Life Molecular Imaging”, together with: (a) all trade marks comprising such names; and (b) all logos relating to those names and/or trade marks, in each case, whether registered or unregistered;

Seller’s Insurance Policies has the meaning given in clause 10.6;

Seller’s Lawyers means Allen Overy Shearman Sterling LLP of One Bishops Square, London E1 6AD;

Seller’s Warranties means the statements set out in Schedule 4;

Senior Employee means an employee of a Target Group Company who is an international executive, regional managing director or regional finance lead or who otherwise has an annual base salary of USD150,000 per year (or its equivalent in any other currency) or more;

Share Award means any subsisting securities-based incentive (including any award of a SIP Deferred Payment Amount) and any subsisting SIP Cash Payment Amount, in each case, granted before Completion to any current or former Employee, director, officer or consultant of any Target Group Company under the Relevant Share Plans;

Share Plans means the Relevant Share Plans, and any other securities-based incentive plan operated by the Seller (or, to the extent operated prior to Completion, any Target Group Company) in which any current or former or prospective Employee, director, officer or consultant of any Target Group Company participates or has any entitlement to and any share option plans, restricted share plans, deferred bonus plans, savings or investment plans, phantom plans and any ad hoc or individual arrangements, including in each case any such plan or arrangement which is proposed to be introduced;

Signing Disclosure Letter means the letter of the same date as this agreement, written and delivered by or on behalf of the Seller to the Purchaser immediately before the signing of this agreement disclosing information constituting exceptions to the Seller’s Warranties (other than the Seller’s Fundamental Warranties);

SIP means the Life Healthcare 2023 Single Incentive Plan;

SIP Cash Payment Amount has the meaning given to the term “Cash Payment Amount” under the SIP Rules;

SIP Deferred Payment Amount has the meaning given to the term “Deferred Payment Amount” under the SIP Rules;

SIP Rules means the plan rules applicable to the SIP as set out in folder “Eagle_Cleanroom/05_Personnel_and_Benefits/Compensation & Benefits/Benefit & Bonus Mgmt/SIP” of the Data Room;

Specific Indemnity Claim means a claim under clause 17 of this agreement;

Specific Tax Assessment means any assessment, notice, demand, letter or other document issued by or action taken by or on behalf of any Tax Authority, or any self-assessment, that in each case relates to a matter falling within subclause 17.1(a) or (b) and including the Intangibles Dispute;

State Pension Scheme means all state pension, health and other social security arrangements to which any Target Group Company is required to contribute;

Subsidiaries means the Company’s subsidiaries listed in Part 2 of Schedule 1;

Superior Proposal means a bona fide unsolicited written Acquisition Proposal, made after the date of this agreement that:

(j)if consummated, would result in any person or group (other than the Purchaser or its Affiliates) becoming the beneficial owner, directly or indirectly, of more than 50% of the consolidated assets of the Target Group or more than 50% of the total voting power of the equity securities of the Company; and

(k)the directors of Life Healthcare Group Holdings determine in good faith, after consultation with its independent financial advisor and outside legal counsel:

(i)if consummated, would result in a transaction more favorable from a financial point of view (after taking into account all relevant factors that the directors of Life Healthcare Group Holdings consider to be appropriate, including any break-up fees, expense reimbursement provisions, conditions to consummation and the time likely to be required to consummate such Acquisition Proposal) to Life Healthcare Group Holdings and/or its shareholders than the transactions contemplated by this agreement (including any revisions to the terms of this agreement proposed by the Purchaser pursuant to clause 5.9); and

(ii)is reasonably capable of being consummated on the terms proposed taking into account all relevant factors that the directors of Life Healthcare Group Holdings consider to be appropriate including any legal, financial, regulatory and shareholder approval requirements, the sources, availability and terms and conditionality of any financing, the timing to completion and the identity of the person or persons making the Acquisition Proposal;

Surviving Clauses means subclause 5.15(c), and clauses 1, 5.24, 5.25, 6, 11.4, 11.6 to 11.9 and 20 to 33, and Surviving Clause means any one of them;

Systems means all the software, hardware, network and telecommunications equipment, internet-related information technology and related services that are material to the Target Group in connection with the operation of its business, as conducted on the date of this agreement;

Target Group means the Target Group Companies taken as a whole;

Target Group Companies means the Company and its subsidiaries (including the entities set out in Part 2 of Schedule 1), and Target Group Company means any of them;

Target Group Insurance Policies has the meaning given in clause 10.6;

Target Working Capital means [***];

Tax, Taxes or Taxation means:

(a)any tax or duty, or any levy, impost, charge or withholding of any country or jurisdiction having the character of taxation, wherever chargeable, imposed for support of national, state, federal, cantonal, municipal or local government or any other governmental or regulatory authority, body or instrumentality, including tax on gross or net income, profits or gains, taxes on receipts, sales, use, occupation, franchise, transfer, value added and personal property and social security taxes; and

(b)any penalty, fine, surcharge, interest, charges or additions to taxation payable in relation to any taxation within paragraph (a) above;

Tax Authority means any taxing or other authority competent to impose, administer or collect any Taxation, acting in its capacity as such;

Tax Covenant means the tax covenant set out in paragraph 1 of Schedule 6;

Tax Covenant Claim means any claim under the Tax Covenant or any other claim made under Schedule 6;

Tax Warranties means the Seller’s Warranties contained in paragraphs 23 to 27 of Part 2 of Schedule 4 (so far as the same relate to Tax);

Territory or Territories means all countries worldwide;

Third Party means any person other than the Seller, the Purchaser and their respective Affiliates and permitted successors and assigns;

Trade Debts means amounts owing in the ordinary course of trading as a result of goods or services supplied by a Target Group Company to a member of the Seller’s Group or vice versa;

Trademarks means trademarks, service marks, trade dress, trade names, logos, slogans, words, names, symbols, designs, corporate names, doing business designations, and all other indicia of origin, quality or source, and all registrations, applications for registration and renewals of the foregoing anywhere in the world, and all goodwill associated with the foregoing;

Transaction has the meaning given in recital (B);

Transaction Costs means any professional fees, costs or expenses relating to or arising from the Transaction which are to be paid or have been agreed to be paid or incurred (and for clarity which in any such case have not been paid) or which are owing by a Target Group Company (including any amount in respect of Irrecoverable VAT payable on such Transaction Costs) at the Effective Time;

Transaction Documents means this agreement, the Signing Disclosure Letter, the Completion Disclosure Letter, the Confidentiality Agreement, each of the documents in the Agreed Form and any other document entered into or to be entered into pursuant to this agreement (including for the avoidance of doubt any Licence and Commercial Agreement(s), TSA(s) or agreement(s) entered into pursuant to Schedule 11 to deliver the net economic benefit of the RM2 License to the Seller’s Group, if and when executed by the parties thereto);

Transferee means with respect to any Milestone Product, any of the Purchaser’s, any Target Group Company’s or any of their respective Affiliates’ (direct or indirect) transferees or assignees, or any other Third Party (direct or indirect) recipient: (a) of rights in or to any Intellectual Property Rights

(including, for the avoidance of doubt, any such transferee or assignee who acquired rights in any such Intellectual Property Rights by way of (direct or indirect) acquisition of the share capital of any of the Target Group Companies or transfer by any other means including by way of a merger, consolidation or asset sale), in each case, that are owned by or licensed to any Target Group Company as of Completion covering or claiming such Milestone Product or used in the Development or Commercialisation of such Milestone Product; and (b) who have the right to Develop, seek Marketing Authorisation and/or Commercialise NeuraCeq or such Pipeline Milestone Product (as applicable), excluding any Licensee. Notwithstanding anything to the contrary in the foregoing: (1) contract research organizations, contract manufacturers and other Third Party service providers who Develop or Commercialize the applicable Milestone Product on behalf of the Purchaser, any of its Affiliates, Licensees or Transferees, and any distributors of the Purchaser or any of its Affiliates or a Licensee or Transferee, in each case, shall not be deemed a “Transferee” and (2) “Transferee” shall exclude any member of the Seller’s Group following Completion and any other (sub)licensees of any member of the Seller’s Group under the Licence and Commercial Agreement(s);

TSA has the meaning given in clause 7.7;

Unconditional Date means the date on which written notice is given pursuant to clause 4 that the final remaining Condition has been satisfied (in accordance with clauses 5.19 or 5.20) or has otherwise been waived in accordance with the terms of this agreement;