QuickLinks -- Click here to rapidly navigate through this document

Exhibit 4.1

SQI DIAGNOSTICS INC.

ANNUAL INFORMATION FORM

June 15, 2011

TABLE OF CONTENTS

| | |

| | Page |

|---|

FORWARD-LOOKING STATEMENTS | | 3 |

CORPORATE STRUCTURE | | 5 |

GENERAL DEVELOPMENT OF THE BUSINESS | | 5 |

DESCRIPTION OF THE BUSINESS | | 7 |

RISK FACTORS | | 23 |

DIVIDENDS AND DISTRIBUTIONS | | 36 |

DESCRIPTION OF CAPITAL STRUCTURE | | 36 |

MARKET FOR SECURITIES | | 37 |

DIRECTORS AND OFFICERS | | 39 |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | | 43 |

TRANSFER AGENTS AND REGISTRARS | | 43 |

EXPERTS | | 43 |

ADDITIONAL INFORMATION | | 43 |

2

SQI DIAGNOSTICS INC.

ANNUAL INFORMATION FORM

In this annual information form ("Annual Information Form"), unless otherwise indicated, all dollar amounts are expressed in Canadian dollars and the statistical and financial data are presented as of June 15, 2011.

FORWARD-LOOKING STATEMENTS

This Annual Information Form, including the documents incorporated by reference into this Annual Information Form, contains forward-looking statements. These statements relate to future events or future performance and reflect our expectations and assumptions regarding our growth, results of operations, performance and business prospects and opportunities. Such forward-looking statements reflect our current beliefs and are based on information currently available to us. In some cases, forward-looking statements can be identified by terminology such as "our goal", "may", "would", "could", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential", "continue" or the negative of these terms or other similar expressions concerning matters that are not historical facts. The forward-looking statements in this Annual Information Form, including any documents incorporated by reference into this Annual Information Form, include, among others, statements regarding our future operating results, economic performance and product development efforts, and statements in respect of:

- •

- our expected future losses and accumulated deficit levels;

- •

- our requirement for, and our ability to obtain, future funding on favourable terms or at all;

- •

- market competition and technological advances of competitive products;

- •

- our expectations regarding the acceptance of our products by the market;

- •

- our expectations regarding the progress and the successful and timely completion of the various stages of the regulatory clearance process;

- •

- our strategy to develop new products and to enhance the capabilities of existing products;

- •

- our strategy with respect to research and development;

- •

- our dependence on expanding our customer base;

- •

- our plans to market, sell and distribute our products;

- •

- our plans in respect of strategic partnerships for research and development;

- •

- our ability to obtain a sufficient supply of the components needed for our systems;

- •

- our plans to retain and recruit personnel;

- •

- our ability to satisfy customer demand for our systems;

- •

- our plans to correct defects or errors in our systems;

- •

- the effect of litigation on our business;

- •

- our strategy with respect to the protection of our intellectual property; and

- •

- our expectations with respect to existing and future corporate alliances and licensing transactions with third parties, and the receipt and timing of any payments to be made by us or to us in respect of such arrangements.

A number of factors could cause actual events, performance or results, including those in respect of the foregoing items, to differ materially from the events, performance and results discussed in the forward-looking

3

statements. Factors that could cause actual events, performance or results to differ materially from those set forth in the forward-looking statements include, but are not limited to:

- •

- the extent of our future losses;

- •

- our ability to obtain the capital required to fund development and operations;

- •

- development or commercialization of similar products by our competitors;

- •

- our ability to develop and market our products;

- •

- our ability to comply with applicable governmental and securities regulations and standards;

- •

- our ability to develop and commercialize our technologies;

- •

- delays or failures in our ability to develop and implement new diagnostic products;

- •

- our reliance on a few key and significant customers;

- •

- the impact of changes in the business strategies and development priorities of our strategic partners;

- •

- loss of suppliers or increases to the cost of the components of our systems;

- •

- the impact of legislative changes to the healthcare system and regulatory process;

- •

- our ability to attract and retain skilled and experienced personnel;

- •

- damage to our manufacturing facility or its failure to accommodate future sales growth;

- •

- the impact of unknown defects or errors and product liability claims;

- •

- the impact of liability from the use of hazardous and biological materials and other claims;

- •

- our ability to successfully manage fluctuations in revenue;

- •

- foreign currency fluctuations;

- •

- our ability to obtain patent protection and protect our intellectual property rights and not infringe on the intellectual property rights of others;

- •

- the expense and potential harm to our business of intellectual property litigation;

- •

- stock market volatility;

- •

- changing market conditions;

- •

- the fact that further equity financing may substantially dilute the interests of our shareholders; and

- •

- other risks detailed from time-to-time in our ongoing quarterly filings, annual information forms, annual reports and annual filings with applicable securities regulators, and those which are discussed under the heading "Risk Factors".

Although the forward-looking statements contained in this Annual Information Form and in the documents incorporated by reference are based on what we consider to be reasonable assumptions based on information currently available to us, there can be no assurance that actual events, performance or results will be consistent with these forward-looking statements, and our assumptions may prove to be incorrect. These forward-looking statements are made as of the date of this Annual Information Form.

Forward-looking statements made in a document incorporated by reference into this Annual Information Form are made as of the date of the original document and have not been updated by us except as expressly provided for in this Annual Information Form. Except as required under applicable securities legislation, we undertake no obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise.

4

CORPORATE STRUCTURE

The principal and registered office of SQI Diagnostics Inc. ("SQI" or the "Company" and, in this Annual Information Form, "we", "us" and "our" refer to the Company unless the context otherwise requires) is located at 36 Meteor Drive, Toronto, ON M9W 1A4. SQI has a single subsidiary, SQI Diagnostics Systems Inc. ("SQIDS"), which is wholly-owned.

Emblem Capital Inc., the predecessor to SQI, was incorporated on September 11, 2003 pursuant to theCanada Business Corporation Act (the "CBCA") and filed articles of amendment to change its name to "SQI Diagnostics Inc."

On April 20, 2007, an amalgamation between Umedik Inc. and 670194 Canada Inc., a wholly-owned subsidiary of Emblem Capital Inc., was completed and the amalgamated company changed its name to "SQI Diagnostics Systems Inc." on September 7, 2007.

The predecessor to Umedik Inc. was formed on April 19, 1999 pursuant to theBusiness Corporations Act (Ontario) under the corporate name of Pockit Corporation. Pockit Corporation filed articles of amendment on June 9, 1999 to change its name to Poc • Kit Corporation. Poc • Kit Corporation was continued under the CBCA on December 1, 1999 under the name of e-umedik Inc. and e-umedik Inc. filed articles of amendment on October 20, 2000 to change its name to Umedik Inc. 6701914 Canada Inc. was incorporated on January 12, 2007 pursuant to the CBCA.

GENERAL DEVELOPMENT OF THE BUSINESS

Our business was founded in 1999 on the concept that more sensitive, timely and less costly disease diagnostics based on antigen, protein and antibody detection would benefit healthcare providers. We believed that diagnostic testing based on enzyme-linked immunosorbent assay ("ELISA") technology, a test involving an enzyme and an antibody, the diagnostic technology used at the time, had not changed significantly since its development in the 1950s and lacked accuracy and sensitivity, while the testing procedures were lengthy, difficult to execute and labour intensive. We also believed that DNA microarray technology, which was instrumental throughout the 1990s in mapping the human genome, could provide the basis for new antigen, protein and antibody detection technology that could advance beyond the limitations imposed by ELISA technology. However, antigen, protein and antibody microarrays present a very different set of challenges from the DNA microarrays used for the human genome project.

Until 1999, there was little published research on the use of microarrays for antigen, protein and antibody detection for humanin-vitro diagnostics ("IVD") applications. Our founders believed the problem stemmed from the following scientific problems:

- •

- Microarray surface coatings and printing technology were not sufficiently advanced to enable antigen, protein and antibody microarrays to be reliably printed with diagnostic grade signal;

- •

- Users could not reliably or consistently measure multiple biomarkers (specifically, antigens, proteins and antibodies) in the same test because these biomarkers have very different surface charge and binding characteristics; and

- •

- High levels of variability were likely related to the lack of standardization and control of titer plate-based ELISA tests leading to inaccurate or less predictable outcomes.

We believe that we have addressed these problems with our platform that allows us to detect and measure multiple antibodies and their different sub-types in the same two-dimensional planar microarray. Our use of specialty surface treatments and surface-coating processes allows us to create microarrays with consistent spot characteristics and limited background noise (in other words, with high signal to noise ratios). Our two dimensional planar array design securely fixes all reagents used in an assay to the glass surface independently of one another, which eliminates unwanted biochemical interactions. Our IgXPLEX technology can detect different antibody isotypes (IgA, IgG, IgM) simultaneously from a single microarray spot using multiple detection wavelengths of light. Our calibration technology adjusts each microarray for every test, which reduces the variability that may result from environmental factors or from the use of external calibrators. We have enhanced the precision of our microarrays through the use of our system, which uses a statistically valid number of

5

replicate spots for each biomarker being tested in combination with complex software algorithms. We believe that our technology delivers consistent, repeatable, precise test results and can measure the concentration of multiple biomarkers in a single test. Our automated technology can analyze multiple patient samples simultaneously using less time, effort, and consumables than existing titer plate technology.

Three Year History

The list below describes the development of the Company's business over the last three completed financial years.

| | |

The Company completed a private placement of 2,439,500 shares at a price of $1.50 per share for cash proceeds of $3,349,700 and also issued broker warrants for 194,200 common shares. | | June 2008 |

The Company received its license from Health Canada for the SQiDworks Diagnostics Platform. See "— Government Regulation". | |

November 2008 |

The Company received its license from Health Canada for the QuantiSpot Rheumatoid Arthritis Assay. See "— Government Regulation". | |

November 2008 |

The Company completed the first tranche of a non-brokered private placement of 2,400,000 common shares at a price of $1.25 per share for gross proceeds of $3,000,000. | |

December 2008 |

The Company completed the second tranche of a non-brokered private placement of 1,331,500 common shares at a price of $1.25 per share for gross proceeds of $1,664,375 and also issued 106,520 warrants. | |

January 2009 |

The Company's IgX PLEX Quantitative Assay and SQiDworks Diagnostics Platform were European Conformity ("CE") marked and registered. See "— Government Regulation". | |

February 2009 |

The Company's 510(k) submission for IgX PLEX Rheumatoid Arthritis Qualitative Assay and SQiDworks Diagnostics Platform was cleared by the U.S. Food and Drug Administration ("FDA"). See "— Government Regulation". | |

October 2009 |

The Company completed a private placement of 2,398,104 units at a price of $2.75 per unit for gross proceeds of $6,594,786. Each unit was comprised of one common share and one half common share purchase warrant. See "Market for Securities". | |

December 2009 |

The Company completed a private placement of 2,280,000 units at a price of $2.50 per unit for gross proceeds of $5,700,000. Each unit was comprised of one common share and one half common share purchase warrant. See "Market for Securities". | |

August 2010 |

The Company received its license from Health Canada for the IgX PLEX Celiac Qualitative Assay. See "— Government Regulation". | |

September 2010 |

The Company received its license from Health Canada for the IgX PLEX Celiac Panel. See "— Government Regulation". | |

April 2011 |

The Company received confirmation that its IgX PLEX Celiac quantitative assay had been CE marked and registered. See "— Government Regulation". | |

June 2011 |

The Company's 510(k) submission for IgX PLEX Celiac Qualitative Assay and SQiDworks Diagnostics Platform was cleared by the FDA. See "— Government Regulation". | |

June 2011 |

6

DESCRIPTION OF THE BUSINESS

General

We are a life sciences company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. Our goal is to become a leader in the development and commercialization of microarray and multiplexed diagnostics by offering our customers a comprehensive "turnkey" solution that increases the efficiency and ease of diagnostic testing and test development.

Our target customers — clinical, academic and diagnostic development laboratories — require diagnostic processing equipment and consumable tests ("systems") that are capable of processing large numbers of patient samples at low cost and with minimal labour requirements ("high-throughput systems"). High-throughput systems have not been widely employed in autoimmune disease, allergen or companion diagnostics testing and only limited use of high-throughput systems exists in infectious disease testing. To our knowledge, no fully-automated high-throughput systems exist that are capable of addressing the combined multiplex testing needs of these markets. A fully-automated system capable of providing multiple biomarker measurements in a single test array has the potential to increase a laboratory's throughput with significantly less labour, consumables and other costs.

Our proprietary microarray tests and fully-automated instruments are designed to simplify antigen, protein and antibody testing workflow, increase throughput and reduce costs, all while providing excellent data quality. In many instances, our technology enables analysis that was traditionally unavailable.

Our principal lines of business include:

- •

- the development, manufacturing, and marketing of fully-automated diagnostic instruments (our "platform");

- •

- the development and marketing of tests for the autoimmune, allergen, infectious disease and companion diagnostics testing markets (our "assays"); and

- •

- the commercialization of microarray printing technology (our "printing solutions").

Our Platform

Our FDA-cleared SQiDworks platform is comprised of three key elements: a proprietary one-time-use consumable microarray device, a validated and integrated instrument system that fully-automates the processing of patient samples in the microarray device, and a proprietary software processing system that processes and analyses the array and reports the presence or absence of a biomarker ("qualitative testing") and/or the amount of biomarker present ("quantitative testing"). Our SQiDworks platform can perform qualitative or quantitative testing for multiple biomarkers simultaneously. Our SQiDworks platform is currently the only FDA-cleared, fully-automated, microarray system and multiplexing solution in our target markets and we believe there are significant barriers to entry in these markets. We believe that our SQiDworks platform addresses many of the key challenges faced by our customers today by delivering accurate patient results in less time and with significantly reduced labour, consumables and other costs.

We are developing SQiDlite, our fully-automated, bench-top diagnostic platform for both IVD and research use only ("RUO") applications. We are also currently commercializing SQiDman, our small semi-automated platform for processing microarrays, to be used by research customers or development partners for RUO applications in the microarray development process.

Our Assays and the Development of Our Test Menu

We have received regulatory clearance to market our qualitative rheumatoid arthritis and celiac assays in the United States, our qualitative and quantitative rheumatoid arthritis and celiac assays in Canada, and our quantitative rheumatoid arthritis and celiac assays in the European Union for use on our SQiDworks platform. We have a robust pipeline of autoimmune tests and one companion diagnostic test in development, and plan to develop a broad test menu for autoimmune disease, companion diagnostics, infectious disease and allergen testing markets in the future. Our current in-development tests include multiplexed panels to aid in the diagnosis

7

of vasculitis, lupus, Crohn's disease and inflammatory bowel disease ("IBD") and in the management of treatment of autoimmune affected patients with a class of drugs referred to as "anti-TNF drugs" such as Remicade®, Enbrel® and Humira®. We are currently developing more sensitive rheumatoid arthritis and celiac assays that measure additional biomarkers.

We have targeted these testing markets because we believe:

- •

- healthcare providers require the measurement of multiple biomarkers to aid in the diagnosis and therapeutic monitoring of these diseases;

- •

- these testing markets are underserved by fully-automated, high-throughput, multiplexed systems;

- •

- tests in these markets are generally run at sufficiently high volumes in larger test facilities that would benefit from both multiplexing and automation; and

- •

- these tests typically qualify for private and public reimbursement in Canada, the United States, and the European Union.

One of our key operational goals is to continue to develop and seek regulatory approval for additional tests, as we believe that expanding our "test menu" will drive adoption of our platform and products by customers.

The development of our test menu is augmented by our partnerships with leading research institutions, including Beth Israel Deaconess Medical Center, the Cleveland Clinic, and the University of North Carolina. Our partnerships provide us with many advantages, including the rights to approximately 10,800 patient samples, which aid us in the development and validation of our assays.

We also offer development services and manufacturing of diagnostic kits and microarrays to our customers. We will convert content of laboratories and third parties into microarray products, manufacture microarray test kits for sale to these customers and, in the case of third parties, enable them to re-sell our high throughput systems on which these proprietary assays can be run. Our laboratory customers may use these custom microarray components to perform diagnostic test services using our platforms and may subsequently sell the results to their customers.

The Market for Our Products

The diagnostic products and services market is increasing in importance, complexity, breadth and size. Diagnostics are critical to high-quality healthcare and guide a majority of clinical decisions.

Over the last forty years, the number of biomarkers that can be measured by commercial laboratories has grown dramatically, with less than 4,000 different types of biomarker measured in the 1970s, more than doubling to approximately 10,000 with automation in the 1980s, and increasing to approximately 25,000 in the early 2000s.

Since 1976, the number of biomarkers measured by assays cleared through the FDA's 510(K) process to aid in the diagnosis of the six autoimmune diseases that comprise our target market has increased from four to 48. This represents an increase in the average number of biomarkers per disease state in our autoimmune disease target market from 0.7 to 8. We believe that this increase in biomarkers is indicative of a healthcare trend whereby healthcare providers are seeking to run diagnostic tests for increasing numbers of biomarkers to assist in the diagnosis of disease.

Researchers and laboratories are accelerating the rate at which new biomarkers are being commercialized for the known set of diseases being diagnosed today. It is estimated that an additional 30,000 biomarkers (molecular and protein) in various stages of development have been identified and not yet commercialized. We believe that the increased use of existing assays and the introduction of new assays will drive growth of the diagnostics testing market, a market that is estimated to have a growth rate of approximately five to nine percent annually from 2009 to 2014.

Our strategy is to focus initially on the immunoassay segment of the diagnostic test market since there are no multiplexed, microarray, IVD solutions in the immunoassay space. The 2012 global immunoassay diagnostic test market is estimated to be US$10.3 billion, of which approximately US$4.5 billion is within our strategic

8

market focus, which includes tests for autoimmune disease, infectious disease, and allergen tests. These three markets are estimated to be US$1.5 billion, US$2.4 billion and US$0.6 billion, respectively.

Autoimmune Disease Tests

Our primary testing market in the immunoassay segment is for products that aid in the diagnosis of autoimmune disease, which is estimated to be approximately US$1.5 billion per year. We have targeted the autoimmune testing segment for the following reasons:

- •

- there are ten autoimmune disease states, which include the autoimmune diseases in our target market, that command most of the blood testing revenues for the entire autoimmune testing segment;

- •

- the most common tests for autoimmune diseases currently evaluate approximately 70 biomarkers, representing an average of approximately seven biomarkers per disease;

- •

- these tests are generally run at high volumes at larger test facilities and in batches and are not typically run on a "one off" basis;

- •

- generally, autoimmune disease tests have an established reimbursement model from private and public healthcare payers;

- •

- each of the autoimmune diagnostic tests we are developing has "predicate" technologies with FDA clearance on older, single biomarker, manual titer plate technology that we intend to replace;

- •

- regulatory clearance for the majority of autoimmune assays is through the FDA 510(k) process, which is well established; and

- •

- autoimmune disease tests are regulated as Class II devices by the FDA. Class II diagnostic clearance is generally obtained following a shorter review period than for a Class III device. See "— Government Regulation".

Infectious Disease and Allergen Tests

We also plan to enter the immunoassay segment of the infectious disease diagnostics market, which is estimated to be approximately US$2.4 billion for 2012, followed by the immunoassay segment of the allergen diagnostics market, which is approximately US$0.6 billion for 2012.

Print Services

According to a press release issued by F. Hoffmann-La Roche Ltd., in 2007 the estimated market for protein and molecular microarray print equipment and services was approximately US$600 million per year.

RUO and Lab -Developed Tests

Approximately 34% of the US$3.7 billion U.S. annual market for RUO and lab-developed tests is directly addressable by our proprietary technologies. Additionally, we believe that the US$2.2 billion European market for RUO and lab-developed tests has approximately the same segmentation as the U.S. market. As such, we anticipate that the combined U.S. and European markets for RUO and lab-developed tests that are directly addressable by our proprietary technologies to be approximately US$2 billion.

Companion Diagnostics

We believe that the commercialization of "companion diagnostics" tests is a meaningful market opportunity for us. Autoimmune diseases are increasingly being treated with antibody-based or other biologic drugs. Often, there are different variants of the antibody or biologic drugs. For example, anti-TNF-based drugs are used to treat rheumatoid arthritis, Crohn's disease and IBD. The market for anti-TNF drugs was estimated to be approximately US$16 billion per year in 2008. Anti-TNF drugs are currently marketed under brand names such as Remicade®, Enbrel® and Humira®, which represented more than 99% of the anti-TNF drug market in 2008. The effectiveness of the treatment of autoimmune patients with these drugs may be enhanced by the monitoring of the concentration of these drugs in a patient's blood by a "companion diagnostic" test. Our multiplexing

9

technology allows us to combine the tests for both the diagnosis and therapeutic monitoring of a patient's disease. We expect this test combination to result in significantly less labour, consumables and other costs and provide us with a large market opportunity.

Diagnostics

Assays are used world-wide to assist healthcare providers in preventing, diagnosing and treating diseases. In order to be able to determine whether someone has a particular disease, a typical assay will test for "biomarkers", a term used to refer to a specific antigen, protein or antibody. The amount or "concentration" of the biomarker in a person's blood usually indicates one or more of the following: the predisposition or risk of getting the disease; presence or absence of the disease; and severity of the disease. For example, assays have been used for more than 50 years to detect the presence of rheumatoid factors, which are diagnostic markers for rheumatoid arthritis. The use of assays to detect rheumatoid factors first received 510(k) clearance by the FDA approximately 35 years ago. Rheumatoid factors can be detected in the blood of a patient before the first symptoms appear, can indicate the progression of the disease, and provide information that may guide a healthcare provider's determination of a patient's treatment plan.

Diagnostics "platforms" refer to the specific technology or instrument system on which a consumable device is "run" to generate test results. There are a number of different platforms on which assays can be run. For example, ELISA plates and readers, ELISA bead technology and polymerase chain reaction are all platforms for running assays.

A microarray is a device that is used to perform multiple tests simultaneously. A microarray is comprised of two principal elements.

- •

- A surface upon which capture molecules are printed in the form of spots. The surface is typically glass or plastic and is chemically coated to more easily "accept" and bind the molecules being printed without damaging the molecules.

- •

- A physical superstructure to separate individual wells. Each well contains numerous spots. Each of the spots within an individual well is analogous to a traditional microtiter plate test well.

The biological and chemical reactions that occur in each test well generate multiple test results. Each of these test results is a billable event for our customers.

Limitations of Current Technologies

Clinical, academic, and diagnostic development laboratories are faced with increasing numbers of tests or experiments required to support a diagnostic conclusion or development decision. In the diagnostic setting, there are a growing number of biomarkers that are used for each patient to aid in the diagnosis and monitoring of many diseases. This has led to a growing workload of increasingly complex and costly diagnostic tests for laboratories. Additionally, laboratories face pressure to reduce overall healthcare system costs.

Our target customers — clinical, academic and diagnostic development laboratories — require diagnostic processing equipment and consumable tests that are capable of processing large numbers of patient samples at low cost and with minimal labour requirements. High-throughput systems have not been widely employed in autoimmune disease or allergen testing and limited use of high-throughput systems exists in infectious disease testing. To our knowledge, no high-throughput systems exist that are capable of addressing the combined multiplex testing needs of these markets. A fully-automated system capable of providing multiple biomarker measurements in a single test array has the potential to increase a laboratory's throughput with significantly less labour, consumables, and other costs. We believe these cost savings would be realized because, among other things:

- •

- a fully-automated system reduces "hands-on" technician time;

- •

- the volume of liquid reagent is less and the number of other consumables, such as pipette tips, required to process one microarray is fewer when compared to traditional methods of running multiple tests in multiple titer plates;

10

- •

- the amount of serum required per patient to produce results on a 12 biomarker test is approximately 240 times greater using titer plates than using microarray plates;

- •

- a laboratory does not incur the expense of sending some tests of a larger multiplex panel to other labs;

- •

- the cost of management of multiple samples being tested by multiple technicians and combining the results to a single report would be largely eliminated by multiplexing capability; and

- •

- reducing the number of hands-on steps through automation would potentially reduce error rates.

Microtiter Plates

Laboratories almost exclusively use microtiter plates to perform immunoassay tests. The use of microtiter plates restricts an immunoassay test to the analysis of a single biomarker. Microtiter plates are predominantly processed with a high contribution of direct labour. This increases the time to produce a test result and the potential for error. Since equipment available to reduce labour is limited, the use of microtiter plates restricts the throughput of a laboratory. We estimate that 60% of our target customers' costs to produce a diagnostic result are due to direct labour.

Skilled laboratory labour capable of performing diagnostic testing in our target markets is limited and is expected to contribute to laboratories' growing cost structure at an increasing rate. The United States Department of Health and Human Services reported in 2009 that by 2012, 138,000 lab professionals, including medical technicians and laboratory assistants, will be needed, but fewer than 50,000 will be trained.

Multiplex Diagnostic Tests

A solution to the cost and labour constraints of immunoassay testing for single biomarkers is to perform diagnostic tests for multiple biomarkers simultaneously in a single assay (a "multiplex diagnostic test"). The processes used to complete a single test within a diagnostic panel of several biomarkers are complex and technically difficult. Such complexity has limited the throughput and efficiency of multiplex diagnostic testing, and technical challenges have restricted the widespread adoption of automated systems. Most laboratories do not use automated processing equipment to augment their workforce in our key target markets where the measurement of multiple antigens, proteins or antibodies is required.

Bead-Based Array Systems

Bead-based array systems were initially developed for DNA-based testing and were subsequently adapted for protein-based and antibody-based testing. Bead-based methods, however, have faced limitations that reduce their utility, particularly for multiplex diagnostics and experimentation. In particular, the workflow for bead arrays is complex, time consuming and costly. For example, standard protocols for a nine-biomarker bead array require multiple complex operations including approximately 190 steps and approximately five hours of "hands-on" time to complete.

Automated Systems

While laboratories use automated systems for many types of blood tests, to our knowledge, there are no fully-automated high-throughput microarray systems. A number of diagnostics companies have developed automated single-plex fully-automated, bench-top systems for autoimmune testing and we are only aware of one bead-based automated multiplex system.

11

Antigen, Protein and Antibody Microarrays and Their Technical Challenges

An alternate to bead-based array systems is a microarray printed on a two dimensional substrate. These antigen, protein and antibody microarrays solve several limitations of bead-based systems such as interactions between beads, but are challenging to develop as we believe there are several technological obstacles, including:

- •

- precision and accuracy of printing;

- •

- cross interference of similar molecules in the system;

- •

- calibration and standardization of multiple separate molecular signals in a single microarray well; and

- •

- complex software systems required to measure and analyze the multiple signals measured within the microarray.

Precision and Accuracy of Printing

Microarray printing has been traditionally done with contact printers that, like a quill pen, physically "spot" the biomarker capture molecules onto the microarray surface. These contact methods of printing are imprecise and lead to microarrays with high degrees of variability and significant background noise. This reduces the commercial applications of contact spotted microarrays. Contact spotting does not typically lead to IVD capable microarrays in antigen, protein and antibody applications. Some earlier versions of non-contact printers are also used today, but these technologies have similar drawbacks to contact spot printers.

Cross Interference

The ability to discriminate among different "isotypes" (types) of individual target antibodies and different antigens and proteins is important to the measurement of biomarkers and it has proven challenging to develop multiplex tests that discriminate between these different entities in a single microarray.

Calibration and Standardization

The processing of multiplex arrays is complex and is prone to high degrees of variation between test arrays. This error potentially leads to reduced test performance and has restricted the use of multiplex arrays almost exclusively to the research market where there is a tolerance for less accurate measurements.

Diagnostic approaches for measuring multiple antigen, protein or antibody biomarkers for large numbers of patients are generally unavailable or are not cleared or approved as IVD tests. Multiplexing, as it is available today, does not adequately address antigen, protein and antibody focused measurement. Most multiplexing technologies have been developed and commercialized for the processing of high-density genetic or molecular arrays. These technologies generally work from a different set of technological principles than those needed to measure multiple antigens, proteins or antibodies. Further, these technologies are used in a research setting and are generally inadequate for use in commercial diagnostic testing.

Software Systems

The sophistication of the automated systems and processing software required to analyze microarrays has restricted the commercial viability of microarrays in diagnostic laboratories.

Our Solution

Our proprietary microarray tests and automated instruments are designed to simplify antigen, protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. In many instances, our technology enables analysis that was traditionally unavailable.

Traditional biomarker testing methods using microtiter plates require approximately four minutes on average of technician "hands-on" time per biomarker per patient ("test effort"). For example, a four biomarker test for celiac on samples from 74 patients would, on average, require eight microtiter plates, assuming each patient's blood sample is tested in duplicate using standard good laboratory practices. This would have traditionally required approximately 20 hours of direct "hands-on" labour using predicate technology.

12

Our Fully-Automated SQiDworks Diagnostic Platform

Our high-throughput SQiDworks diagnostic platform is a fully-automated microarray processing and analytical system capable of 888 results per hour. By way of example, for a celiac assay that measures four biomarkers, our SQiDworks platform requires approximately 30 seconds of technician "hands-on" time per patient per panel compared to approximately 16 minutes of technician "hands-on" time using microtiter plate technology, and uses one microarray kit instead of 8 single biomarker microtiter kits to generate diagnostic results for the four biomarkers. The difference between the approximately 20 hours of direct hands-on labour using microtiter plate technology and the approximately 30 minutes of direct hands-on labour using our system results in significant cost savings, as does using one microarray kit rather than eight microtiter kits.

Additionally, the cost savings demonstrated above increase as the number of biomarkers per diagnostic test increase. For example, for a lupus test that measures twelve biomarkers, our SQiDworks platform requires the same amount of technician "hands-on" time as the celiac assay, and also requires only one microarray kit. However, microtiter plate technology would require approximately 48 minutes of technician "hands-on" time per patient per panel and the use of 24 single biomarker microtiter kits. This equates to a reduction of approximately 59 hours of direct hands-on labour using our system as well as greater savings with respect to consumables.

Our IgXPLEXMicroarrays

Our IgXPLEX microarrays have the ability to discriminate between individual isotypes of antibodies and antigens and proteins within a single well of a microarray, resulting in the measurement of multiple biomarkers in a single test.

Our microarray technology requires the use of significantly less patient blood than traditional methods. Our system requires a ten microliter drop of blood to be processed from a single sample tube, compared to the multiple milliliters of blood used by traditional methods. Our system dispenses the single drop of blood once per patient in a microarray well. Traditional methods require multiple blood samples to be manipulated into multiple test vessels over many steps. The reduction in processing steps and the ability to generate simultaneous multiplexed measurements from a single drop of blood increase the predictive value of the test. The increased predictive value of the test would allow the healthcare provider to choose a treatment plan earlier in the course of the disease.

Our IgXPLEXCHEX Technology

Our IgXPLEXCHEX technology provides multiple in-microarray checks to ensure that the test has been completed without system, control, calibration or microarray-related errors. These tests reduce errors that are common to microtiter and microarray tests.

Our proprietary multiplex assay development processes and microarray manufacturing capabilities, combined with our automated instruments, are designed to significantly reduce the complexity and cost to our customers to commercialize microarray tests using their own biomarkers. Customers with a need to perform large numbers of experiments may benefit from the use of our microarrays in their screening and development programs when traditional methods may be too onerous due to the large number of single tests that would be required.

Our Key Competitive Strengths

We believe that our key competitive strengths include the following:

- •

- Only FDA Cleared, Fully-Automated Microarray Processing System. We have received marketing clearance from the FDA, a Canadian regulatory medical device licence, and have CE marked our SQiDworks instrument system. SQiDworks is the only system for automatically processing, analyzing and providing test results in protein-based and antibody-based microarrays to achieve these regulatory clearances.

- •

- Fully-Integrated, High-Throughput Solution Dramatically Reduces Workflow and Cost. Our proprietary microarray tests and fully-automated instruments are designed to significantly simplify antigen, protein

13

and antibody workflow, increase throughput and reduce costs, all while providing excellent data quality. For example, competing systems require hundreds of steps to produce the same number of test results as can be produced by our SQiDworks fully-integrated diagnostics system in five steps.

- •

- Expertise in Microarray Assay Development. We have clinically validated development experience and have created processes, systems and development algorithms to simplify the commercialization of our products. We believe our expertise will reduce the time required to complete the commercial development of our pipeline products. We also believe that our experience can be applied to RUO products to allow us to commercialize our own and other's content in significantly less time than our competition.

- •

- Focus on Penetrating Existing Markets that Are Technically Challenging and Have Established Reimbursement. We focus on disease testing markets that have existing reimbursement and payment programs in place, which allows us to quickly bring our products into established markets. Additionally, antigen, protein and antibody multiplex tests are more technically challenging to develop, which may restrict others from easily entering these markets.

- •

- Partnerships with Leading Institutions. We have entered into agreements with leading institutions and healthcare providers to collaborate with us in developing and validating our assays including providing us with access to approximately 10,800 clinically validated patient blood samples.

- •

- Significant Intellectual Property Portfolio. Our intellectual property covers key areas of our commercial business as well as our pipeline, including microarray surfaces, multiplexing, microarray analytics, and microarray processing. We have issued patents and pending patent applications that cover aspects of our microarray technology for analyzing, identifying and quantifying analytes. We are actively seeking protection for our methods of achieving high-throughput quantitative analysis for our proprietary methods for making microarray substrates and for the systems that carry out these methods for manufacturing microarray substrates. In the course of improving our products, from time to time we develop processes and systems that provide us with a competitive advantage and the Company will keep such developments confidential.

Products

SQI Platforms

| | | | | | | | |

| |

| | Regulatory Status |

|---|

| | Development

Status |

|---|

Product | | Canada | | United States | | Europe |

|---|

SQiDworks | | Complete | | Licensed | | Cleared as a system with IgXPLEXRA | | CE Marked |

SQiDman | | Development RUO | | Not Required — RUO | | Not Required — RUO | | Not Required — RUO |

SQiDlite RUO | | In development | | Not Required — RUO | | Not Required — RUO | | Not Required — RUO |

SQiDlite IVD | | In development | | To be filed | | To be filed | | To be filed |

SQiDworks

We have developed our fully-automated SQiDworks platform to enable laboratory customers to generate multiple patient test results with less than one unit of traditional "test effort". "Test effort" refers to the number of steps required to perform a test using microtiter plate technology.

We have received marketing clearance from the FDA, a medical device license from Health Canada, and have CE marked our SQiDworks instrument system. SQiDworks is the only fully-automated microarray processing system to achieve these regulatory clearances.

Our SQiDworks platform integrates a microfluidics station, an automated microarray scanner, our drying device and our proprietary processing and analytic software.

The microfluidics station automatically performs sample handling and processing of the patient serum sample and prepares our IgXPLEXmicroarray for scanning and analysis.

14

Our dryer technology dries the microarray surface, which uniformly enhances the signal to noise ratios of our microarrays. The microarray scanner reads the various IgXPLEXmicroarray devices.

Our proprietary software uses complex algorithms to locate the array of spots containing reagents and to process the spots to measure each of the biomarkers of interest. This measurement can be either qualitative or quantitative.

SQI Assays

Our four "cleared" or "approved" assays, two for rheumatoid arthritis and two for celiac, test for two of the more common autoimmune diseases. Rheumatoid arthritis is a chronic inflammatory disease, the cause of which is unknown. The incidence of rheumatoid arthritis in North America is 1.4 cases per 100,000 in men and 3.6 cases per 100,000 in women. The prevalence of rheumatoid arthritis is approximately 2% world wide. It is estimated that total size of the patient market in the United States for rheumatoid arthritis diagnostic testing for 2010 was approximately six million patients. Celiac is an inherited autoimmune disorder that affects the digestive process of the small intestine. It is estimated that the total size of the patient market in the United States for celiac diagnostic testing for 2010 was approximately 3.5 million patients.

Our currently cleared or approved assays are as follows:

| | | | | | | | |

| |

| | Clearance/Approval Status |

|---|

| | Development

Status |

|---|

Product | | Canada | | United States | | Europe |

|---|

IgXPLEXRA

(Qualitative) | | Complete | | Licensed | | Cleared | | N/A |

IgXPLEXRA*

(Quantitative) | | Complete | | Licensed | | To be filed | | CE Marked |

IgXPLEXCeliac

(Qualitative) | | Complete | | Licensed | | Cleared | | N/A |

IgXPLEXCeliac

(Quantitative) | | Complete | | Licensed | | To be filed | | CE Marked |

- *

- Marketed in Canada under the name "QuantiSpot Rheumatoid Arthritis"

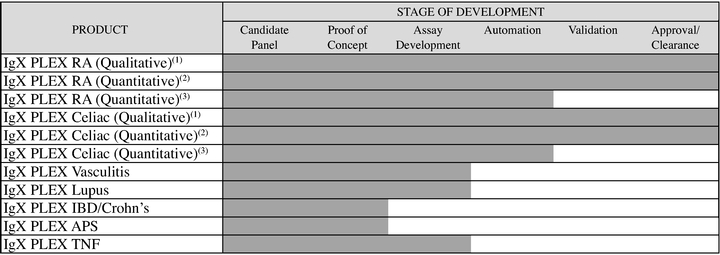

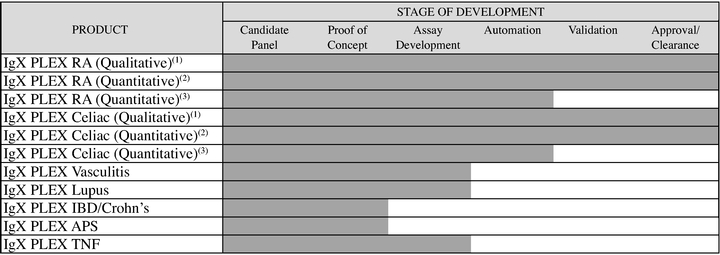

We also have IgXPLEXLupus, IgXPLEXVasculitis and IgXPLEXTNF products in the development stage and IgXPLEXIBD/Crohn's and IgXPLEXAntiphospholipid Syndrome ("APS") products at the proof of concept stage. We also have rheumatoid arthritis and celiac assays with greater sensitivity that measure additional biomarkers in development.

The table below sets out estimates by Frost and Sullivan of the total number of patients in the United States who required diagnostic testing for diseases for which we are developing diagnostic tests.

| | | | | | | | | | | | | |

Autoimmune Segment | | Lupus | | Vasculitis | | Anti-TNF | | IBD/Crohn's | |

|---|

Estimated Total Patient Market 2010 (US) | | | 5,000,000 | | | 400,000 | | | 3,100,000 | | | 550,000 | |

Research and Development

We have assembled an experienced research and development team at our Toronto facility with the scientific, microarray printing, immunoassay, engineering, software, and process development expertise that we believe is necessary to grow our business.

Platform Development

SQiDman is our small semi-automated platform that we are commercialising for RUO purposes, and SQiDlite is our fully-automated, bench-top diagnostic platform.

SQiDlite. Our engineering development team is currently focused on the near term delivery of SQiDlite, our fully-automated, bench-top diagnostic platform. This platform will be a fully-automated microarray

15

processing and analytic platform. We expect that SQiDlite will be able to process multiple sizes of microarray devices from single eight-well strips up to a single 96-well microarray plate.

SQiDlite is designed to serve the following markets:

- •

- IVD Customers who wish to run IgXPLEX assays in flexible batch sizes up to and including 96 patients per test kit. We believe that many hospitals and other laboratories would benefit from SQiDlite's more flexible batch size capability. SQiDlite is designed to run tests in volumes per run of eight to 96 patients in multiples of eight. We believe that a platform that allows for scalable testing volumes for our assays would increase the number of our potential hospital customers in North America from the largest 1,000 to the largest 5,000 by diagnostic testing volume.

- •

- Customers who seek a customizable automated microarray analyzer for RUO purposes. We believe that many RUO customers would benefit from an automated microarray analyzer that can be used in a configurable manner to optimize the development of assays. However, once assays are developed, many RUO customers seek to "lock" the settings to prevent modifications by the platform's operator. Our SQiDlite platform has been designed to accommodate these RUO customers and provide this functionality.

SQiDman. We are currently commercializing SQiDman on a pilot basis. SQiDman, our small semi-automated platform for processing microarrays, is intended to be used by research customers or development partners for RUO purposes in the microarray development process. We currently use SQiDman systems for in-house development and quality control processes. We expect the full commercial launch of SQiDman for RUO purposes in late 2011, following the enhancement of its user interface software.

Microarray Assay Development

The largest component of our current research and development efforts is microarray development. We plan to continue to focus on the commercialization of microarray content that can be run by our customers on our diagnostic platforms. Our research and development efforts are focused on the following areas:

Autoimmune Disease. We have a broad menu of autoimmune disease tests in our microarray development pipeline to augment our current product offerings. For example, in addition to our products for which we have marketing clearance or approval, we have IgXPLEX Vasculitis, IgXPLEX Lupus, and IgXPLEX TNF products in the development stage and IgXPLEX IBD/Crohn's and IgXPLEX APS at the proof of concept stage. Additionally, we have rheumatoid arthritis and celiac assays with greater sensitivity that measure additional biomarkers in development. See "— SQI Assays" for a description of the markets for the autoimmune disease tests in our microarray development pipeline.

Infectious Disease. We plan to develop tests in the area of infectious disease. Infectious disease panels leverage our strengths in multiplexing, antibodies and high-throughput diagnostic systems. We have scientists and assay development specialists with experience in infectious disease assay development.

Allergen Testing. Allergen tests are very similar to, and depend upon many of the same technological advances as, autoimmune disease tests. Because allergen panels have large numbers of biomarkers, we believe this is an excellent area of opportunity to apply our multiplexing and microarray technology.

Custom Assay Development and Print Services. We plan to add assay design and print services to our product offerings. This expansion is intended to enable our laboratory and diagnostic customers to expand their use of our platforms by converting their content to microarrays. We believe that applying our in-house processes and systems to develop microarray formatted tests incorporating customers' content will allow them to reduce their assay costs with less development risk and effort by purchasing their microarrays and development services directly from us. For example, our customers will be able to add requested target biomarkers to an existing panel of biomarkers or they may request an entire panel of protein-based or antibody-based biomarkers to be developed into a RUO microarray that they may use as a lab-developed test.

16

- (1)

- Approved or cleared in the U.S. and Canada.

- (2)

- Approved or cleared in Canada and Europe.

- (3)

- Development status for clearance in the U.S.

Our Strategy

Our goal is to become an industry leader in the development and commercialization of microarray and multiplexing IVD medical systems. We intend to accomplish this goal through:

- •

- Product development efforts. We intend to continue to focus our research and development on high-volume, high-margin, multiplexed tests for diseases for which there are existing tests that have reimbursement programs in place.

- •

- Strategic market penetration. We have identified and are marketing our turnkey SQiDworks platform and approved assays to a specific group of laboratories that process high volumes of tests and typically adopt new technologies to gain market share. Please see "— Sales and Marketing" for a description of our target laboratories.

- •

- Leveraging our core technology and expertise to access new markets and new customers. Our technology and microarray development processes enable us to provide customized third party microarray formatted test development and manufacturing services.

- •

- Seeking partnerships and strategic acquisitions. We intend to continue to seek partnerships that will enable us to expand into new markets, broaden and deepen our lines of business and develop and strengthen our relationships with our customers.

- •

- Leading through innovation. We intend to continue our research and development in each of our lines of business in order to become the industry leader in multiplexing microarrays.

Strategic Alliances

We have a number of collaboration agreements with leading global research and treatment institutes. These collaborations improve our ability to develop products by providing us with access to patient serum required for assay development, verification of products in development and final product clinical validation.

17

The following table provides an overview of our partnering collaborations and the relevant pipeline product as at June 15, 2011:

| | | | |

Partner Institute | | Pipeline Product | | Purpose |

|---|

Cleveland Clinic | | Rheumatoid arthritis, IBD | | Serum Samples

Clinical Validation

Collaboration |

Beth Israel Deaconess Medical Center | | Celiac, anti-TNF | | Serum Samples

Collaboration / Publication |

Hospital Clinic De Barcelona, Spain | | Vasculitis | | Serum Samples

Collaboration / Publication |

University Hospital Maastricht, The Netherlands | | Vasculitis | | Serum Samples

Collaboration |

The University of North Carolina at Chapel Hill | | Vasculitis | | Collaboration

Serum Samples

Clinical Validation |

We collaborate with these partners to assist our development of new candidate biomarkers for future tests and intend to continue to seek additional alliances and partnerships. We have been active in strategically publishing our progress and successes both alone and in collaboration with certain of our partners.

Sales and Marketing

We currently have a three-person marketing team. Our marketing efforts are focused on generating sales of our currently cleared or approved system, which includes SQiDworks, IgXPLEX RA and IgXPLEX Celiac, to targeted, high-volume laboratories in North America and Europe.

We have identified the 400 largest laboratories, by testing volume, of the approximately 14,000 laboratories that provide blood testing services in North America and a select group of approximately 30 European laboratories. We believe this group contains laboratories that would readily adopt new technologies, look to obtain an economic advantage over their competitors, and attempt to increase their market share of diagnostic testing services. We believe that this initial target group has sufficient testing volume to support the use of SQiDworks, our currently cleared or approved tests, and the tests that we anticipated to be cleared or approved by the end of 2011. We use various marketing strategies to provide incentives to the laboratories in our initial target group that are among the first to adopt our technology. As we expand our test menu, we intend to broaden our target market and reduce the incentives provided to the early adopters of our products.

Customers

We focus on two customer markets:

- •

- Diagnostic Markets — this market consists of reference and other diagnostic laboratories that provide for-profit diagnostic blood tests.

Customers in this market seek to purchase a full diagnostics solution, including automated platforms and IVD assays. These customers sell the results produced by running our IVD assays on our automated platforms. In addition, customers in this market seek to purchase automated platforms and RUO assays that they intend to convert into lab-developed tests that incorporate their biomarkers. These customers would run these lab-developed tests on our automated platforms and sell the results to their customers.

- •

- Life Sciences Markets — this market consists of customers seeking to commercialize their biomarkers as turnkey multiplexed products delivered by our contract development and manufacturing services. The customers in this market are expected to buy our automated platform and consumable microarray test kits, and to pay a royalty to us on their sales.

18

There are two types of customers in the life sciences markets:

- •

- Contract Manufacturing and Development Customers — these customers seek expertise for pilot and scale up microarray printing, and have needs in the molecular or protein/antibody areas; and

- •

- OEM customers — these customers seek full contract development and manufacturing services to commercialize biomarkers owned by them and seek high-throughput automated microarray analyzers to sell through their channels.

Manufacturing

Our manufacturing facility is located in Toronto, Canada. We manufacture all of our microarray kits for commercial sale and internal research and development in our facility.

We operate a "current good manufacturing practices", or "cGMP", facility that has been certified ISO 13485:2003 compliant, which enables us to meet both regulatory requirements and customer expectations. This is an international standard developed by the International Organization for Standardization that specifies the requirements for a quality management system for organizations providing medical devices and related services. Our microarray production facility is operated to ISO Class 7 clean room specifications, commonly referred to as a Class 10,000 operating level, which defines the maximum level of particles permitted per square meter.

Based on our microarray manufacturing forecasts, we expect that there is adequate space in the current location to expand our manufacturing capacity to meet our expected needs until the end of 2012. Until a facility upgrade is completed, we intend to undertake equipment upgrades to ensure sufficient manufacturing capacity to meet our expected requirements for commercial sales and our internal validation studies until the end of 2012.

To manufacture consumable tests, we acquire raw materials and custom molecules for our assays from well-established vendors who are either ISO certified or who have an established quality system. Each incoming reagent ingredient undergoes quality testing as required and scrutiny before being released to the manufacturing unit, and the reagent ingredients are then incorporated into finished goods as an IgXPLEX kit. Each kit contains the printed diagnostic array and several self-contained wet reagents that are loaded into the SQiDworks platform prior to use by the customer. We have been producing products suitable for validation studies since the beginning of 2007.

Certain key components of our SQiDworks platform are manufactured by third parties in FDA or ISO certified facilities and we manufacture one component. We assemble the components and deliver them to our customers, where they undergo a series of quality acceptance tests.

Competition

We compete with both established and development-stage life sciences companies that design, manufacture and market basic ELISA technology, lab automation products or multiplexing technologies. For example, companies such as INOVA Diagnostics, Inc., Phadia AB, Axis-Shield plc and Hycor Biomedical, Inc. have immunoassay products based on basic ELISA technology. Companies such as Roche Diagnostics Corporation, bioMérieux SA, Siemens AG and Abbott Laboratories Inc. provide laboratory automation technology. Companies such as Luminex Corporation and Bio-Rad Laboratories Inc. also provide bead-based multiplexing technology. These companies provide products that compete in certain segments in which we sell our products. In addition, a number of other companies and academic groups are in the process of developing novel technologies for life science markets.

Intellectual Property Strategy and Position

Our core intellectual property consists of patents that cover the following:

- •

- multiplexed qualification of antigens and antibodies;

- •

- internal (in-array) calibration; and

- •

- methods to create diagnostic level spot morphology.

19

We originated our core technology. Our patent strategy is to seek broad patent protection on new developments in microarray technology, tests and systems and then later file patent applications covering new implementations of the technology and new microarray platforms utilizing the technology. As these technologies are implemented and tested, we file new patent applications covering scientific methodologies enabled by our technology.

We have developed our own portfolio of issued patents, patent applications and design patents directed to our methodologies, commercial products and technologies in development. For our core technology relating to multiplexed qualification of antigens and antibodies and internal (in-array) calibration, we have obtained issued patents and approvals in certain jurisdictions from the patent family having the title "Method to Measure Dynamic Internal Calibration True Dose Response Curves". This patent family is directed to our calibration technology that adjusts each microarray for every test, which reduces the variability that may result from environmental factors or from the use of external calibrators. Other patent applications are currently pending. Patents issuing from this patent family will be in force until July 20, 2025, provided that all maintenance fees are paid.

We have also obtained either an issued patent or an allowance in some jurisdictions directed to our core technology relating to methods to create diagnostic level spot morphology. The patent family for this core technology has the title "Method and Device to Optimize Analyte and Antibody Substrate Binding by Least Energy Adsorption". The patent family is directed to the use of specialty surface treatments and surface coating process means that can create microarrays with consistent spot characteristics and limited background noise (in other words, with high signal to noise ratios). Other patent applications are currently pending. Patents issuing from this patent family will be in force until July 20, 2025, provided that all maintenance fees are paid.

We have filed patent applications that are currently pending in several jurisdictions directed to our qualitative and quantitative rheumatoid arthritis assays. In addition, patent applications are pending in several jurisdictions directed to our products and methodologies including patent families entitled "Method for Double-Dip Substrate Spin Optimization of Coated Micro-Array Supports", "Method and Device to Remove Fluid and Vapor", "Array Fluorescence Equalization Method", "Methods for Multiplex Analyte Detection and Quantification" and "Multiplex Microarrays and Methods for Quantification of Analytes".

Government Regulation

We believe that our major markets are the United States, Canada and the European Union. The following describes the regulatory clearance or approval process for diagnostic systems in each of those jurisdictions.

United States

Research Use Only

"Research use only" components are those components in the laboratory research phase of development that are not represented as effective IVD products. These components must be labelled "For Research Use Only. Not for use in diagnostic procedures." These components are exempt from regulatory oversight in the United States. Manufacturers frequently sell these components to laboratories certified under the Clinical Laboratory Improvement Amendments, or "CLIA", which are the United States federal regulatory standards that apply to clinical laboratory testing performed on human specimens in the United States with certain exceptions, including clinical trials and basic research.

Lab-Developed Tests

CLIA-compliant labs frequently develop and validate an assay from RUO components, sold to them by manufacturers, but the lab must validate these tests and assume all liability for use on patient samples. These tests are regulated as lab-developed tests.

Diagnostic Tests

Diagnostic tests or assays, known as "in vitro diagnostic", or "IVD", products by the FDA, are those reagents, instruments and systems intended for use in the diagnosis of disease or other conditions, including a

20

determination of a person's state of health, in order to cure, mitigate, treat or prevent disease or its sequelae. These tests are intended for use in the collection, preparation and examination of specimens taken from the human body.

Diagnostic tests are classified into one of three categories for FDA clearance or market approval. These categories are based on the degree of risk they pose to humans and their importance in preventing impairment in human health.

All IVD tests are subject to the following "general" requirements or controls, as well as, in the case of Class II and Class III diagnostic tests, additional requirements (except where a particular device is expressly exempt from one or more of such requirements). General controls include:

- •

- Registering the manufacturer with the FDA;

- •

- Listing the product to be marketed with the FDA;

- •

- Manufacturing the products in accordance with quality systems regulation (also known as current good manufacturing practices);

- •

- Labelling the test in accordance with labelling regulations;

- •

- Submitting a pre-market notification (also known as a "510(k)") before marketing a test; and

- •

- Reporting of adverse events and product recalls (corrections and removal).

Class I

Class I tests are subject to the least regulatory control as they present minimal potential for harm to the user. Most Class I devices and IVD products are exempt from the pre-market notification and/or good manufacturing practices regulation. Examples of Class I IVD products include pregnancy or cholesterol tests.

Class II

The FDA defines Class II test as those for which "general controls" alone are insufficient to assure safety and effectiveness, and existing methods are available to provide such assurances. In addition to complying with general controls, Class II devices are also subject to special controls.

Class II tests often require pre-market notification under the FDA's 501(k) process, in connection with which the manufacturer submits data to the FDA to demonstrate that its test is substantially equivalent to a legally marketed test (known as a "predicate" test).

Special controls may include special labelling requirements, mandatory performance standards and post-market monitoring. Examples of Class II tests include most blood tests, such as blood tests for rheumatoid arthritis, vasculitis, lupus and other immunological tests.

Class III

Class III is the most stringent regulatory category for tests. Class III tests are those for which the FDA believes insufficient information exists to assure safety and effectiveness solely through general or special controls.

Class III devices are usually those that support or sustain human life, are of substantial importance in preventing impairment of human health, or which present a potential, unreasonable risk of illness or injury.

The FDA typically requires "pre-market approval" for these tests to ensure the safety and effectiveness of Class III tests. This type of approval would require the submission and FDA review of clinical data to assess the safety and effectiveness of the test.

Examples of Class III tests include tests for the diagnosis of many infectious diseases and cancer.

21

European Economic Area

The European Economic Area, which consists of the 27 member states of the European Union and the European Free Trade Association countries of Iceland, Norway, Switzerland and Liechtenstein, requires what is called "CE" approval (the letters "CE" stand for "conformité Européenne" ("European Conformity") for, among other things, IVD tests). Under the CE regulations, a manufacturer does a preliminary self-assessment to determine whether the products comply with all relevant legislative requirements. At its most basic, the manufacturer must do a conformity assessment, set up a technical file and sign an EC declaration of conformity. This documentation must be made available to authorities upon request. The relevant European Union directive may also require that the product be examined by a conformity assessment body.

We have completed CE marking for our IgXPLEX RA quantitative assay, IgX PLEX Celiac quantitative assay, and the SQiDworks platform, which allows us to market these assays and SQiDworks platform in the European Union. We must also implement and maintain an ISO quality management system. We received our initial ISO 13485 certification in June 2008 and have maintained this certification to date.

As in the United States, components sold without any representation of performance claims may be labelled for "research use only," and are exempt from regulatory oversight in the European Union.

Canada

The Canadian Health Protection Branch regulatory regime requires approvals and submissions similar in timing and scope to European Union CE approvals. TheMedical Devices Regulations (the Regulations), promulgated under theFood and Drugs Act (Canada), set out, among other things, the requirements for the licensing of an "in vitro diagnostic device" or "IVDD".In vitro diagnostic devices include reagents, assays and equipment used for examining specimens taken from the body. IVDDs are designated as Class I, II, III and IV, based on the degree of risk associated with their use. For example, a blood test that detects bacterial meningitis is categorized as a Class III IVDD because of the risk that a false-negative test result may cause death or long-term disability due to delayed diagnosis. Class IV IVDDs include donor screening tests for transmissible viruses such as HIV and hepatitis, which present a high public health risk.

For Class I IVDDs, all that is required is an establishment licence to manufacture the IVDD. For Class II, III and IV IVDDs, the Medical Devices Regulations require the IVDDs to meet ISO standard 13485:2003, which provides both design and manufacturing standards.

An application for a Class II medical device includes, in addition to information regarding the manufacturer and specific document, the following:

- •

- a description of the medical conditions, purposes and uses for which the device is manufactured, sold or represented;

- •

- a list of the standards complied with in the manufacture of the device to satisfy the safety and effectiveness requirements;

- •

- an attestation by a senior official of the manufacturer that the manufacturer has objective evidence to establish that the device meets the safety and effectiveness requirements;

- •

- an attestation by a senior official of the manufacturer that the device label meets the applicable labelling requirements of the Regulations;

- •

- in the case of a near patientin vitro diagnostic device, an attestation by a senior official of the manufacturer that investigational testing has been conducted on the device using human subjects representative of the intended users and under conditions similar to the conditions of use; and

- •

- a copy of the quality management system certificate certifying that the quality management system under which the device is manufactured satisfies National Standard of Canada CAN/CSA-ISO 13485:03, Medical devices — Quality management systems — Requirements for regulatory purposes.

As in the United States and Europe, components sold without any representation of performance claims may be labelled for "research use only," and are exempt from regulatory oversight in Canada.

22

Approvals/Clearances

Health Canada

We have received licenses for all applications which have been made to Health Canada to date as listed in the following table.

| | | | | | | | |

| Catalog Number | | Product | | Medical Device License | | Date of Issuance |

|---|

| | 10005 | | QuantiSpot Rheumatoid Arthritis Assay* | | | 78512 | | November 2008 |

| | 10105 | | IgX PLEX Rheumatoid Arthritis Qualitative Assay | | | 81016 | | October 2009 |

| | 10505 | | IgX PLEX Celiac Qualitative Assay | | | 83945 | | September 2010 |

| | 10515 | | IgX PLEX Celiac Panel* | | | 85930 | | April 2011 |

| | 01003 | | SQiDworks Diagnostics Platform | | | 78513 | | November 2008 |

United States

Our 510(k) submission for IgX PLEX Rheumatoid Arthritis Qualitative Assay and SQiDworks Diagnostics Platform was cleared by the FDA in October 2009 and our 510(k) submission for IgX PLEX Celiac Qualitative Assay and SQiDworks Diagnostics Platform was cleared by the FDA in June 2011.

European Union

Our IgX PLEX Celiac quantitative assay (Catalog #10515), IgX PLEX RA quantitative assay (Catalog #10005) and SQiDworks Diagnostics Platform (Catalog #01004) have been CE marked and registered with the competent authority for our authorized representative.

Specific registrations for each product will be made with the notified body of each country in which commercialization is anticipated once applicable label translations have been completed.

Employees

As of May 31, 2011, we had 54 employees, of which three were in sales and marketing, 31 were in research and development, 14 were in manufacturing and operations and six were in administration. Our employees have specialized knowledge in areas such as multiplexing, immunology, microarray design and manufacture, assay development, systems engineering and medical-systems sales and servicing.

We have never experienced a work stoppage or other labour disturbance. To our knowledge, none of our employees belongs to, or is represented by, a labour union.

RISK FACTORS

An investment in our common shares involves a number of risks. In addition to the other information contained in this Annual Information Form and in the documents incorporated by reference into this Annual Information Form, including our consolidated financial statements and related notes, you should give careful consideration to the following risk factors. Any of the matters highlighted in these risk factors could have a material adverse effect on our business, results of operations and financial condition, causing an investor to lose all, or part of, its, his or her investment.

The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are not aware of or focused upon, or that we currently deem to be immaterial, may also impair our business operations and cause the trading price of our common shares to decline.

23

Risks Related to Our Business and Strategy

We have incurred losses since inception, and we expect to continue to incur losses for the foreseeable future.