QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on September 8, 2011

Registration No. 333-175382

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

To

Form F-10

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

SQI DIAGNOSTICS INC.

(Exact name of Registrant as specified in its charter)

| | | | |

| Canada | | 2835 | | N/A |

(Province or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification

Number, if any) |

36 Meteor Drive

Toronto, Ontario

Canada M9W 1A4

(416) 674-9500

(Address and telephone number of Registrant's principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Neward, DE 19711

(302) 738-6680

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Copies to:

| | | | | | | | | | | | |

Daniel M. Miller

Dorsey & Whitney LLP

Suite 1605, 777 Dunsmuir Street

P.O. Box 10444, Pacific Centre

Vancouver, B.C.

Canada V7Y 1K4

(604) 630-5199 | | Andrew Morris

Chief Financial Officer

SQI Diagnostics Inc.

36 Meteor Drive

Toronto, Ontario

Canada M9W 1A4

(416) 674-9500 | | Vanessa Grant

McCarthy Tetrault LLP

Box 48, Suite 5300

Toronto Dominion Bank Tower

Toronto, Ontario

Canada M5K 1E6

(416) 601-7525 |

Patrick O'Brien

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199-3600

(617) 951-7000 |

|

|

|

Gordon Raman

Borden Ladner Gervais LLP

Scotia Plaza

40 King Street West, 44th Floor

Toronto, Ontario

Canada M5H 3Y4

(416) 367-6000

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

Province of Ontario, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

| | | | | | |

| A. | | o | | upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). |

| B. | | ý | | at some future date (check appropriate box below) |

| | | 1. | | o | | pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than seven calendar days after filing). |

| | | 2. | | o | | pursuant to Rule 467(b) on ( ) at ( ) (designate a time seven calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). |

| | | 3. | | o | | pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. |

| | | 4. | | ý | | after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. o

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective as provided in Rule 467 under the Securities Act of 1933 or on such date as the Commission, acting pursuant to Section 8(a) of the Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated September 7, 2011

Preliminary Prospectus

US$30,000,000

• common shares

SQI DIAGNOSTICS INC.

Common Shares

We are offering • of our common shares. This is the initial public offering of our common shares in the United States and includes a new issue of our common shares in Canada.

Our common shares are listed and posted for trading on the TSX Venture Exchange under the symbol "SQD-V". Our common shares have been approved for listing on the NYSE Amex LLC under the symbol "SQD". On September 6, 2011, the closing sale price of our common shares on the TSXV was C$2.71, or US$2.73 based on the U.S.-Canadian dollar noon exchange rate on September 6, 2011, as quoted by the Bank of Canada.

Investing in our common shares involves risks. See "Risk Factors" beginning on page • of this prospectus and see the risk factors incorporated by reference into this prospectus.

We are permitted, under a multi-jurisdictional disclosure system adopted by the United States, to prepare this prospectus in accordance with Canadian disclosure requirements, which are different from those of the United States. We prepare our financial statements, which are included in, and incorporated by reference into, this prospectus, in accordance with Canadian generally accepted accounting principles, and they are subject to Canadian auditing and auditor independence standards. Our financial statements may not be comparable to the financial statements of United States companies.

Acquiring, holding and disposing of our common shares may subject you to tax consequences both in the United States and Canada. This prospectus may not describe these tax consequences fully. You should read the tax discussion in this prospectus.

Your ability to enforce civil liabilities under United States federal securities laws may be adversely affected because we are organized under the laws of Canada, the majority of our officers and directors and the experts named in this prospectus are residents of Canada, and all or a substantial portion of our assets and the assets of those officers, directors and experts are located outside of the United States.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | |

| | | | | | |

| |

| | Price to Public

| | Underwriters' Fees

| | Net Proceeds to SQI, before expenses

|

|---|

| |

Per common share | | US$ | | US$ | | US$ |

| |

Total | | US$ | | US$ | | US$ |

|

The purchase price for investors in Canada will be payable in Canadian dollars and the purchase price for investors in the United States will be payable in U.S. dollars unless the underwriters otherwise agree. All of the proceeds of the offering will be paid by the underwriters in U.S. dollars based on the U.S. dollar offering price. The Canadian dollar offering price is the equivalent of the U.S. dollar offering price, based upon the U.S.-Canadian dollar noon exchange rate on , 2011, as quoted by the Bank of Canada.

We will pay all expenses of the offering.

The underwriters may also purchase up to an additional • common shares from us at the public offering price, less the underwriters' commission, within 30 days after the closing of this offering to cover over-allotments, if any, and for market stabilization purposes. If the underwriters exercise the option in full, the total underwriters' commission paid by us will be US$ • and the net proceeds to us, before expenses, will be US$ • .

The common shares will be ready for delivery in New York, New York on or about , 2011.

| | |

| Leerink Swann | | Rodman & Renshaw, LLC |

Kingsdale Capital Markets Inc. |

The date of this prospectus is , 2011

TABLE OF CONTENTS

| | | |

| | Page |

|---|

GENERAL MATTERS | | 1 |

FORWARD-LOOKING STATEMENTS | | 2 |

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION | | 3 |

PROSPECTUS SUMMARY | | 5 |

| | Corporate Information | | 11 |

| | Details of the Offering | | 12 |

| | Selected Financial Information | | 13 |

RISK FACTORS | | 15 |

CAPITALIZATION | | 30 |

USE OF PROCEEDS | | 30 |

BUSINESS OF THE COMPANY | | 31 |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | | 53 |

ACQUISITION OF SCIENION AG | | 53 |

SELECTED CONSOLIDATED FINANCIAL INFORMATION | | 54 |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 55 |

DIRECTORS AND OFFICERS | | 85 |

DESCRIPTION OF CAPITAL STRUCTURE | | 90 |

DIVIDEND POLICY | | 90 |

MARKET FOR SECURITIES | | 91 |

| | Prior Sales | | 91 |

PRINCIPAL SHAREHOLDERS | | 93 |

PLAN OF DISTRIBUTION | | 94 |

DOCUMENTS INCORPORATED BY REFERENCE | | 98 |

WHERE YOU CAN FIND MORE INFORMATION | | 99 |

AUDITORS, TRANSFER AGENTS AND REGISTRARS | | 99 |

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | | 99 |

CERTAIN MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | | 102 |

DOCUMENTS FILED AS PART OF THE U.S. REGISTRATION STATEMENT | | 107 |

ENFORCEABILITY OF CIVIL LIABILITIES | | 107 |

EXPERTS | | 108 |

LEGAL MATTERS | | 108 |

MATERIAL CONTRACTS | | 108 |

EXEMPTIONS FROM THE INSTRUMENT | | 108 |

INTEREST OF EXPERTS | | 109 |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS OF SQI DIAGNOSTICS INC. | | SQI-F-1 |

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS OF SCIENION AG | | SC-F-1 |

INDEX TO PRO FORMA FINANCIAL STATEMENTS | | PF-1 |

GENERAL MATTERS

Unless otherwise noted or the context otherwise indicates, in this preliminary and amended and restated short form base PREP prospectus (the "prospectus"), the terms "SQI", "we", "us", "our" or "the Company" refer to SQI Diagnostics Inc. and our wholly-owned subsidiary, SQI Diagnostics Systems Inc., through which we conduct our business. Our trademarks include "SQI Diagnostics™", "SQiDWorks™", "IgXPLEX™", "QuantiSpot™" and others. Our assays for rheumatoid arthritis are referred to in this prospectus as "IgXPLEX RA". Our IgXPLEX RA quantitative assay is marketed in Canada under the name QuantiSpot Rheumatoid Arthritis. This prospectus contains company names, product names, trade names, trademarks and service marks of other organizations, all of which are the property of their respective owners.

Documents incorporated by reference into this prospectus may include market share information and industry data and forecasts obtained from independent industry publications and surveys. References in such documents to research reports, surveys or articles should not be construed as depicting the complete findings of the entire referenced report, survey or article. The information in any such report, survey or article is not incorporated by reference into this prospectus. Although we believe these sources are reliable, we have not independently verified any of the data nor ascertained the underlying economic assumptions relied upon in such reports, surveys or articles. Some data is also based on our estimates, which are derived from our review of our internal surveys, as well as independent sources. We cannot and do not provide you with any assurance as to the accuracy or completeness of such information. Market forecasts, in particular, are likely to be inaccurate, especially in respect of emerging markets, such as those for our products, or over long periods of time.

The information in this prospectus regarding the financial statements and business of Scienion AG has been furnished by Scienion.

You should rely only on the information contained in or incorporated by reference into this prospectus. Neither we nor the underwriters, have authorized any other person to provide you with different information.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus, unless otherwise noted in this prospectus or as required by law. It should be assumed that the information appearing in this prospectus and the documents incorporated by reference into this prospectus are accurate only as of their respective dates. Our business, financial condition, results of operations or prospects may have changed since those dates.

Information contained on our website, www.sqidiagnostics.com, is not part of this prospectus and is not incorporated by reference into this prospectus and may not be relied upon by prospective purchasers for the purpose of determining whether to invest in the common shares.

1

FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated by reference into this prospectus, contains forward-looking statements. These statements relate to future events or future performance and reflect our expectations and assumptions regarding our growth, results of operations, performance and business prospects and opportunities. Such forward-looking statements reflect our current beliefs and are based on information currently available to us. In some cases, forward-looking statements can be identified by terminology such as "our goal", "may", "would", "could", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential", "continue" or the negative of these terms or other similar expressions concerning matters that are not historical facts. The forward-looking statements in this prospectus, including any documents incorporated by reference into this prospectus, include, among others, statements regarding our future operating results, economic performance and product development efforts, and statements in respect of:

- •

- our expected future losses and accumulated deficit levels;

- •

- our requirement for, and our ability to obtain, future funding on favourable terms or at all;

- •

- market competition and technological advances of competitive products;

- •

- our expectations regarding the acceptance of our products by the market;

- •

- our expectations regarding the progress and the successful and timely completion of the various stages of the regulatory clearance process;

- •

- our strategy to develop new products and to enhance the capabilities of existing products;

- •

- our strategy with respect to research and development;

- •

- our dependence on expanding our customer base;

- •

- our plans to market, sell and distribute our products;

- •

- our plans in respect of strategic partnerships for research and development;

- •

- our ability to obtain a sufficient supply of the components needed for our systems;

- •

- the effect of operating as a public company in the United States and our plans for compliance;

- •

- our plans to acquire Scienion;

- •

- our plans to retain and recruit personnel;

- •

- our ability to satisfy customer demand for our systems;

- •

- our plans to correct defects or errors in our systems;

- •

- the effect of litigation on our business;

- •

- our strategy with respect to the protection of our intellectual property; and

- •

- our expectations with respect to existing and future corporate alliances and licensing transactions with third parties, and the receipt and timing of any payments to be made by us or to us in respect of such arrangements.

A number of factors could cause actual events, performance or results, including those in respect of the foregoing items, to differ materially from the events, performance and results discussed in the forward- looking statements. Factors that could cause actual events, performance or results to differ materially from those set forth in the forward-looking statements include, but are not limited to:

- •

- the extent of our future losses;

- •

- our ability to obtain the capital required to fund development and operations;

- •

- development or commercialization of similar products by our competitors;

- •

- our ability to develop and market our products;

- •

- our ability to comply with applicable governmental and securities regulations and standards;

2

- •

- our ability to develop and commercialize our technologies;

- •

- delays or failures in our ability to develop and implement new diagnostic products;

- •

- our reliance on a few key and significant customers;

- •

- our ability to attract and retain skilled and experienced personnel;

- •

- the impact of changes in the business strategies and development priorities of our strategic partners;

- •

- loss of suppliers or increases to the cost of the components of our systems;

- •

- the impact of legislative changes to the healthcare system and regulatory process;

- •

- the expense of compliance initiatives as a result of operating as a public company in the United States;

- •

- our ability to maintain effective internal control over financial reporting;

- •

- our ability to complete the proposed acquisition of Scienion and successfully integrate its business;

- •

- damage to our manufacturing facility or its failure to accommodate future sales growth;

- •

- the impact of unknown defects or errors and product liability claims;

- •

- the impact of liability from the use of hazardous and biological materials and other claims;

- •

- our ability to successfully manage fluctuations in revenue;

- •

- foreign currency fluctuations;

- •

- our ability to obtain patent protection and protect our intellectual property rights and not infringe on the intellectual property rights of others;

- •

- the expense and potential harm to our business of intellectual property litigation;

- •

- stock market volatility;

- •

- changing market conditions;

- •

- the fact that further equity financing may substantially dilute the interests of our shareholders; and

- •

- other risks detailed from time-to-time in our ongoing quarterly filings, annual information forms, annual reports and annual filings with applicable securities regulators, and those which are discussed under the heading "Risk Factors".

Although the forward-looking statements contained in this prospectus and in the documents incorporated by reference are based on what we consider to be reasonable assumptions based on information currently available to us, there can be no assurance that actual events, performance or results will be consistent with these forward-looking statements, and our assumptions may prove to be incorrect. These forward-looking statements are made as of the date of this prospectus.

Forward-looking statements made in a document incorporated by reference into this prospectus are made as of the date of the original document and have not been updated by us except as expressly provided for in this prospectus. Except as required under applicable securities legislation, we undertake no obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

In this prospectus, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in Canadian dollars. All references to "dollars", "C$" or "$" are to Canadian dollars and all references to "US$" are to United States dollars. For the amounts referenced under "Use of Proceeds" and "Plan of Distribution", the rate of exchange was US$1.00 = C$0.9910 or C$1.00 = US$1.0091, each based on the Bank of Canada's noon exchange rate on September 6, 2011.

The following table sets out (1) the high and low rate of exchange for one Canadian dollar in U.S. dollars during the indicated periods, (2) the average of the rate of exchange during those periods, and (3) the exchange

3

rate in effect as at the end of each of those periods, each based on the noon exchange rate published by the Bank of Canada. On September 6, 2011, the Bank of Canada's noon exchange rate was US$1.00 = C$1.0091 or C$1.00 = US$0.9910.

| | | | | | | | | | | | | | |

| | High | | Low | | Average | | End of

Period | |

|---|

Nine Month Periods ended June 30, | | | | | | | | | | | | | |

| | 2011 | | | 1.0542 | | | 0.9690 | | | 1.0115 | | | 1.0370 | |

| | 2010 | | | 1.0039 | | | 0.9221 | | | 1.0412 | | | 1.0606 | |

Fiscal Years Ended | | | | | | | | | | | | | |

| | September 30, 2010 | | | 1.0039 | | | 0.9221 | | | 0.9604 | | | 0.9429 | |

| | September 30, 2009 | | | 0.9426 | | | 0.7692 | | | 0.8472 | | | 0.9327 | |

4

PROSPECTUS SUMMARY

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary may not contain all the information that you should consider before investing in our common shares. You should read the entire prospectus carefully, including "Risk Factors" starting on page 15 and our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. Unless otherwise indicated, the terms "SQI", "we", "us", "our" and "the Company" refer to SQI Diagnostics Inc. and our wholly-owned subsidiary, SQI Diagnostics Systems Inc., through which we conduct our business.

SQI Diagnostics Inc.

Overview

We are a life sciences company that develops and commercializes proprietary technologies and products for advanced microarray diagnostics. Our goal is to become a leader in the development and commercialization of microarray and multiplexed diagnostics by offering our customers a comprehensive "turnkey" solution that increases the efficiency and ease of diagnostic testing and test development.

Our target customers — clinical, academic and diagnostic development laboratories — require diagnostic processing equipment and consumable tests ("systems") that are capable of processing large numbers of patient samples at low cost and with minimal labor requirements ("high-throughput systems"). High-throughput systems have not been widely employed in autoimmune disease, allergen or companion diagnostics testing and only limited use of high-throughput systems exists in infectious disease testing. To our knowledge, no fully-automated high-throughput systems exist that are capable of addressing the combined multiplex testing needs of these markets. A fully-automated system capable of providing multiple biomarker measurements in a single test array has the potential to increase a laboratory's throughput with significantly less labor, consumables and other costs.

Our proprietary microarray tests and fully-automated instruments are designed to simplify diagnostic testing workflow, increase throughput and reduce costs, all while providing excellent data quality. In many instances, our technology enables analysis that was traditionally unavailable.

Our Principal Business Lines

- •

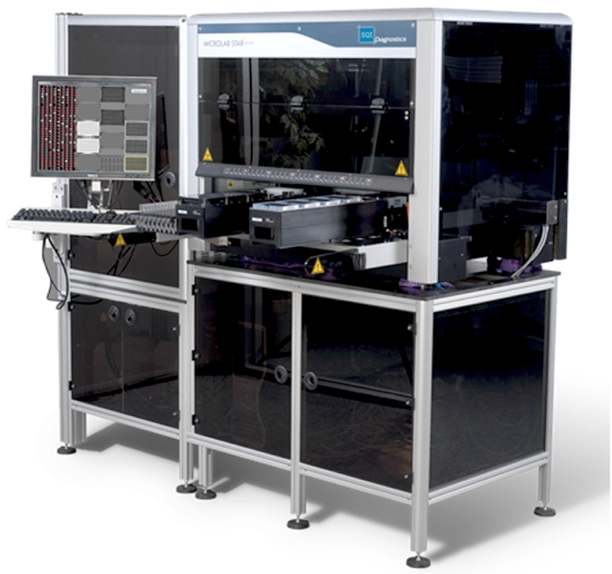

- The development, manufacturing and marketing of fully-automated diagnostics instruments

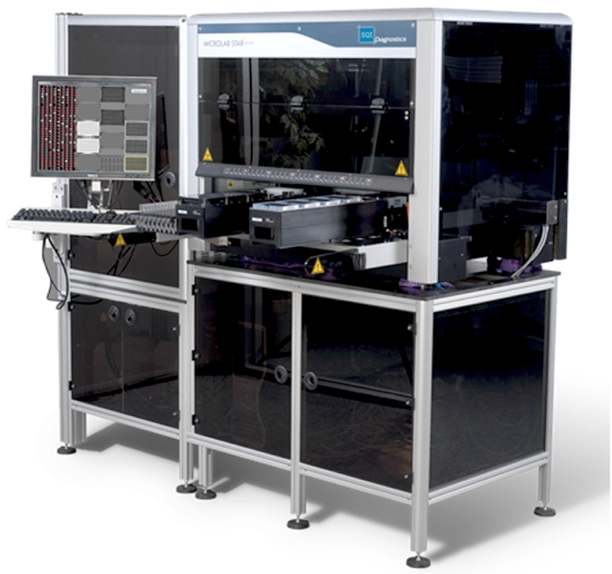

SQiDworks is the only FDA-cleared, fully-automated, microarray system and multiplexing solution in our target markets, which can perform qualitative or quantitative testing for multiple biomarkers simultaneously. We also have a prototype of a fully-automated, bench-top diagnostic platform as well as a small, semi-automated system.

- •

- The development and marketing of tests for the autoimmune, allergen, infectious disease and companion diagnostics testing markets

We have received regulatory clearance to market our qualitative rheumatoid arthritis and celiac assays in the United States, our qualitative and quantitative rheumatoid arthritis and celiac assays in Canada, and our quantitative rheumatoid arthritis and celiac assays in the European Union. One of our key operational goals is to continue to develop and seek regulatory approval for additional tests, as we believe that expanding our "test menu" will drive adoption of our platform and products by customers. We also offer development services and manufacturing of diagnostic kits to our customers.

- •

- Our Printing Solutions

5

Acquisition of Scienion AG

On July 4, 2011, we announced the proposed acquisition of all of the issued and outstanding shares of Scienion, a German company that we believe is a market leader for microarray development, production arrayer printing systems and contract print and development services for the life sciences industry.

Scienion develops and markets a range of commercial microarray printing equipment and provides custom print and commercial print services.

We believe that the combination of our platform, our assays and the development of our test menu and, if the acquisition is completed, Scienion's industry leading print technologies, will enable the combined company to become a leader in sales of end-to-end microarray-based diagnostic systems, microarray printing and assay development services.

Our Target Markets

Diagnostics are critical to high-quality healthcare and guide a majority of clinical decisions. Over the last forty years, the number of biomarkers measured by laboratories has increased dramatically, and we believe there is a trend whereby healthcare providers are seeking to run diagnostic tests for an increasing number of biomarkers to aid in the diagnosis of disease. These tests are becoming increasingly complex and costly.

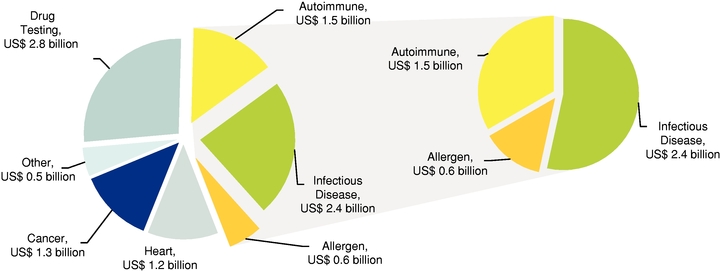

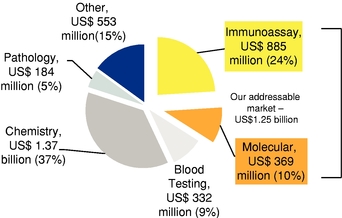

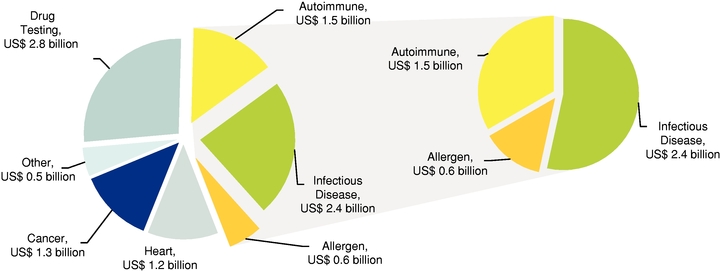

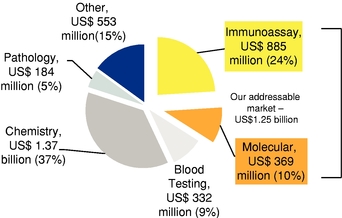

The 2012 global immunoassay diagnostic test market is estimated to be US$10.3 billion, of which we are strategically focusing on a directly addressable market of approximately US$4.5 billion, which includes immunological tests for autoimmune disease, infectious disease, and allergenecity. These three markets are estimated to be US$1.5 billion, US$2.4 billion and US$0.6 billion, respectively.

We have targeted these testing markets because we believe:

- •

- healthcare providers require the measurement of multiple biomarkers to aid in the diagnosis and therapeutic monitoring of these diseases;

- •

- these testing markets are typically underserved by fully-automated, high-throughput, multiplexed systems;

- •

- tests in these markets are generally run at sufficiently high volumes in larger test facilities which would benefit from both multiplexing and automation; and

- •

- these tests typically qualify for private and public reimbursement in Canada, the United States and the European Union.

We will also address selected areas of the companion diagnostics market, the "research use only" or "RUO" and lab-developed test markets and the market for microarray print and assay development tools.

Autoimmune Disease Tests

We have initially targeted the autoimmune testing segment for several reasons, which include:

- •

- there are ten autoimmune disease states that command most of the blood testing revenues for the entire autoimmune testing segment;

- •

- the most common tests for autoimmune diseases currently evaluate approximately 70 biomarkers, representing an average of approximately seven biomarkers per disease;

- •

- these tests are generally run at high volumes at larger test facilities and in batches and are not typically run on a "one off" basis;

- •

- each of the autoimmune diagnostic tests we are developing has predicate technologies with FDA clearance on older, single biomarker, manual titer plate technology that we intend to replace; and

- •

- regulatory clearance for the majority of autoimmune assays is through the FDA 510(k) process, which is well established.

6

Infectious Disease and Allergen Tests

We also plan to enter the immunoassay segment of the infectious disease diagnostics market, which is estimated to be approximately US$2.4 billion for 2012, followed by the immunoassay segment of the allergen diagnostics market, which is approximately US$0.6 billion for 2012.

Companion Diagnostics

Autoimmune diseases, such as rheumatoid arthritis, Crohn's disease and inflammatory bowel disease ("IBD"), are increasingly being treated with antibody-based or other biologic drugs. We believe that the effectiveness of the treatment of autoimmune patients with these drugs may be enhanced by the monitoring of the concentration of these drugs in a patient's blood by a "companion diagnostic" test. Our multiplexing technology allows us to combine the tests for both the diagnosis and therapeutic monitoring of a patient's disease.

RUO and Lab-Developed Tests

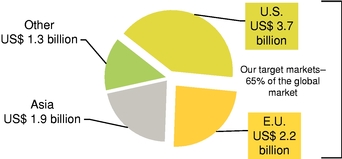

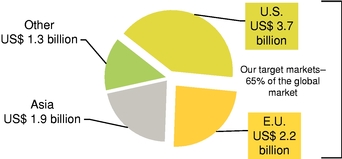

In addition to thein-vitro diagnostics ("IVD") market, we are targeting the market for RUO products and custom microarrays for lab-developed tests. Approximately one-third of the US$3.7 billion U.S. market for RUO and lab-developed tests is directly addressable by our proprietary technologies. We believe the combined U.S. and European markets for RUO and lab-developed tests that are directly addressable by our proprietary technologies to be approximately US$2 billion per year.

Microarray Print and Assay Development Tools

The market for protein and molecular microarray print equipment and services has been estimated to be approximately US$600 million per year.

Limitations of Current Technology

There are an increasing number of complex and costly diagnostic tests used to aid in the diagnosis and monitoring of many diseases. Our target customers — clinical, academic and diagnostic development laboratories — require diagnostic processing equipment and consumable tests that are capable of processing large numbers of patient samples at low cost and with minimal labor requirements. To our knowledge, no high-throughput systems exist that are capable of addressing the combined multiplex testing needs of these markets. A fully-automated system capable of providing multiple biomarker measurements in a single test array has the potential to increase a laboratory's throughput with significantly less labor, consumables, and other costs. We believe these cost savings would be realized because, among other things:

- •

- a fully-automated system reduces "hands-on" technician time;

- •

- the volume of liquid reagent is less and the number of other consumables, such as pipette tips, required to process one microarray is fewer when compared to traditional methods of running multiple tests in multiple titer plates;

- •

- a laboratory does not incur the expense of sending some tests (e.g. a large multiplex panel) to other labs;

- •

- the cost of managing multiple samples being tested by multiple technicians and combining the results to a single report would be largely eliminated by multiplexing capability; and

- •

- multiplexing and reducing the number of hands-on steps through automation would potentially reduce error rates.

Microtiter Plates

Laboratories almost exclusively use microtiter plates to perform immunoassay tests. The use of microtiter plates restricts an immunoassay test to the analysis of a single biomarker. Microtiter plates are predominantly

7

processed with a high contribution of direct labor. This increases the time to produce a test result and the potential for error and restricts the throughput of a laboratory.

Multiplex Diagnostic Tests

The processes used to complete a single test within a diagnostic panel of several biomarkers are complex and technically difficult. Such complexity has limited the throughput and efficiency of multiplex diagnostic testing, and technical challenges have restricted the widespread adoption of automated systems.

Bead-Based Array Systems

Bead-based array systems were initially developed for DNA-based testing and were subsequently adapted for protein-based and antibody-based testing. Bead-based methods, however, have faced limitations that reduce their utility, particularly for multiplex diagnostics and experimentation. In particular, the workflow for bead arrays is complex, time consuming and costly.

Automated Systems

While laboratories use automated systems for many types of blood tests, to our knowledge, there are no fully-automated high-throughput microarray systems for our target markets.

Antigen, Protein and Antibody Microarrays and Their Technical Challenges

Antigen, protein and antibody microarrays printed on a two-dimensional substrate solve several limitations of bead-based systems such as interactions between beads, but are challenging to develop as we believe there are several technological obstacles, including:

- •

- precision and accuracy of printing;

- •

- cross interference of similar molecules in the system;

- •

- calibration and standardization of multiple separate molecular signals; and

- •

- complex software systems required to analyze and measure the multiple signals.

Our Solution

Our proprietary microarray tests and automated systems are designed to simplify antigen, protein and antibody testing workflow, increase throughput, reduce costs and provide excellent data quality. In many instances, our technology enables analysis that was traditionally unavailable.

Our high-throughput SQiDworks diagnostic platform is a fully-automated microarray processing and analytical instrument, which provides significant cost savings and other benefits over existing technologies. Additionally, the incremental cost savings of tests run on our fully-automated platform versus existing technologies increase as the complexity of the test increases.

Our IgXPLEX microarrays have the ability to accurately measure multiple biomarkers in a single test. Additionally, our microarray technology uses less patient blood and has fewer steps than traditional methods, which increases the predictive value of the test. The increased predictive value of the test may allow the healthcare provider to choose a treatment plan earlier in the course of the disease.

Our IgXPLEX CHEX technology provides multiple in-microarray checks to ensure that the test has been completed without system, control, calibration or microarray-related errors. These tests reduce undetected errors that are common to microtiter and microarray tests.

Our proprietary multiplex assay development processes and microarray manufacturing capabilities, combined with our automated systems, are designed to significantly reduce the complexity and cost to our customers to commercialize microarray tests using their own biomarkers.

8

Products

SQI Platforms

| | | | | | | | |

| |

| | Clearance/Approval Status |

|---|

| | Development

Status |

|---|

Product | | Canada | | United States | | Europe |

|---|

SQiDworks | | Complete | | Licensed | | Cleared as a system with

IgXPLEX RA | | CE Marked |

SQiDman | | Development RUO | | Not Required — RUO | | Not Required — RUO | | Not Required — RUO |

SQiDlite RUO | | Prototype | | Not Required — RUO | | Not Required — RUO | | Not Required — RUO |

SQiDlite IVD | | Prototype | | To be filed | | To be filed | | To be filed |

We have developed our fully-automated SQiDworks platform to enable our customers to generate numerous patient test results with significantly less labor, consumables and other costs, while maintaining excellent data quality. We have received marketing clearance from the FDA and Canadian regulatory approval for, and have CE marked, our SQiDworks instrument system. SQiDworks is the only fully-automated microarray processing system to achieve these regulatory clearances.

SQiDman is our small semi-automated platform that we are commercialising for RUO purposes, and SQiDlite is our fully-automated, bench-top diagnostic platform.

SQI Assays

Our currently cleared or approved assays are as follows:

| | | | | | | | |

| |

| | Clearance/Approval Status |

|---|

| | Development

Status |

|---|

Product | | Canada | | United States | | Europe |

|---|

IgXPLEX RA (Qualitative) | | Complete | | Licensed | | Cleared | | N/A |

IgXPLEX RA* (Quantitative) | | Complete | | Licensed | | To be filed | | CE Marked |

IgXPLEX Celiac (Qualitative) | | Complete | | Licensed | | Cleared | | N/A |

IgXPLEX Celiac (Quantitative) | | Complete | | Licensed | | To be filed | | CE Marked |

- *

- Marketed in Canada under the name QuantiSpot Rheumatoid Arthritis.

Our four cleared or approved assays test for two of the more common autoimmune diseases. Rheumatoid arthritis is a chronic inflammatory disease. The prevalence of rheumatoid arthritis is approximately 2% world wide. It is estimated that total size of the patient market in the United States for rheumatoid arthritis diagnostic testing for 2010 was approximately six million patients. Celiac is an inherited autoimmune disorder that affects the digestive process of the small intestine. It is estimated that the total size of the patient market in the United States for celiac diagnostic testing for 2010 was approximately 3.5 million patients.

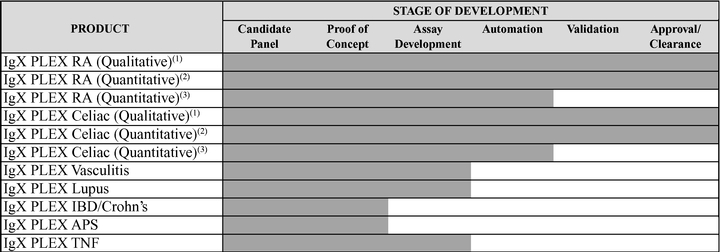

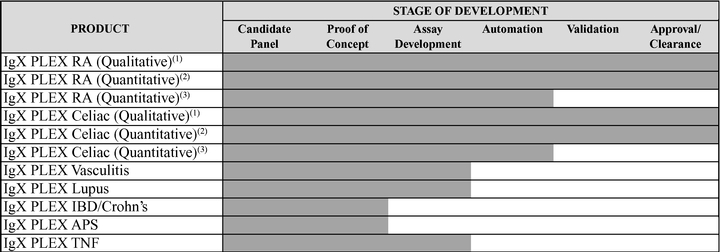

We also have IgXPLEX Lupus, IgXPLEX Vasculitis and IgXPLEX TNF products in the development stage and IgXPLEX IBD/Crohn's and IgXPLEX Antiphospholipid Syndrome products at the proof of concept stage. In addition, we are developing rheumatoid arthritis and celiac assays with greater sensitivity that measure additional biomarkers.

Scienion Products

Scienion offers a range of microarray printing equipment and associated services. Scienion's sciFLEXARRAYER range of microarray printing equipment is targeted to address research customers seeking bench-top equipment up to large customers seeking commercial-scale automated microarray printing equipment

9

as described in the table below. Scienion also markets contract microarray manufacturing and microarray development services.

| | | | |

Application | | Product | | Description |

|---|

Printing | | sciFLEXARRAYER S1 / DW | | Entry-level model of Scienion's sciFLEXARRAYER product line |

| | sciFLEXARRAYER S3 | | Automated non-contact dispensing system of ultra-low volumes designed for academic and research and development labs |

| | sciFLEXARRAYER S5 and S11 | | Automated non-contact dispensing systems of ultra-low volumes designed to manufacture high quality arrays |

| | sciFLEXARRAYER Sx | | Scalable robotic dispensing platforms that enable users to choose size of working area |

| | sciFLEXARRAYER S100 | | High-throughput array and biosensor production instrument |

Microarray Platform | | sciPLEXPLATE | | A specifically developed plate to array RNA, DNA, proteins, antigens and antibodies |

Liquid Handling | | sciSWIFT | | Storable and disposable liquid dispensing pens |

Key Competitive Strengths

We believe that our key competitive strengths include the following:

- •

- Only FDA Cleared, Fully-Automated Microarray Processing System. We have received marketing clearance from the FDA, Canadian regulatory approval for, and have CE marked, our SQiDworks instrument system as well as diagnostic tests for rheumatoid arthritis and celiac. SQiDworks is the only system for automatically processing, analyzing and providing test results in protein-based and antibody-based microarrays to achieve these regulatory clearances.

- •

- Fully-Integrated, High-Throughput Solution Dramatically Reduces Workflow and Cost. Our proprietary microarray tests and fully-automated systems are designed to significantly simplify antigen, protein and antibody workflow, increase throughput and reduce costs, all while providing excellent data quality. For example, competing systems require hundreds of steps to produce the same number of test results as can be produced by our SQiDworks fully-integrated diagnostics system in five steps.

- •

- Expertise in Microarray Assay Development. We have clinically validated development experience and have created processes, systems and development algorithms to simplify the commercialization of our products. We believe our expertise will reduce the time required to complete the commercial development of our pipeline products.

- •

- Focus on Penetrating Existing Markets that Are Technically Challenging and Have Established Reimbursement. We focus on disease testing markets that have existing reimbursement and payment programs in place, which allows us to quickly bring our products into established markets. Additionally, antigen, protein and antibody multiplex tests are more technically challenging to develop, which may restrict others from easily entering these markets.

10

- •

- Partnerships with Leading Institutions. We have entered into agreements with leading institutions and healthcare providers to collaborate with us in developing and validating our assays including providing us with access to approximately 10,800 clinically validated patient blood samples.

- •

- Significant Intellectual Property Portfolio. Our intellectual property covers key areas of our commercial business as well as our pipeline, including microarray surfaces, multiplexing, microarray analytics, and microarray processing.

Strategy

Our goal is to become an industry leader in the development and commercialization of microarray and multiplexing diagnostic systems. We intend to accomplish this goal through:

- •

- Product development efforts. We are continuing to focus our research and development on high-volume, high-margin, multiplexed tests for diseases for which there are existing tests that have reimbursement programs in place and predicate technologies that have received FDA clearance.

- •

- Strategic market penetration. We have identified and are marketing our turnkey SQiDworks platform and approved assays to a specific group of laboratories which process high volumes of tests and typically adopt new technologies to gain market share. Please see "— Sales and Marketing" for a description of our target laboratories.

- •

- Leveraging our core technology and expertise to access new markets and new customers. Our technology and microarray development processes enable us to provide customized third party microarray formatted test development and manufacturing services.

- •

- Seeking partnerships and strategic acquisitions. With our proposed acquisition of Scienion, we intend to become the industry leader in printing solutions, which will enable us to quickly expand our third party development and microarray manufacturing services. We intend to continue to seek partnerships that will enable us to expand into new markets, broaden and deepen our lines of business and develop and strengthen our relationships with our customers.

- •

- Leading through innovation. We intend to continue our research and development in each of our lines of business in order to become the industry leader in multiplexing microarrays.

Corporate Information

Our principal and registered office is located at 36 Meteor Drive, Toronto, ON M9W 1A4, and our telephone number is (416) 674-9500. We have a single subsidiary, SQI Diagnostics Systems Inc., which is wholly-owned.

Emblem Capital Inc., the predecessor to SQI Diagnostics Inc. was incorporated on September 11, 2003 pursuant to theCanada Business Corporation Act (the "CBCA") and filed articles of amendment to change its name to "SQI Diagnostics Inc."

On April 20, 2007, an amalgamation between Umedik Inc. and 670194 Canada Inc., a wholly-owned subsidiary of Emblem Capital Inc., was completed and the amalgamated company changed its name to "SQI Diagnostics Systems Inc." on September 7, 2007.

The predecessor to Umedik Inc. was formed on April 19, 1999 pursuant to theBusiness Corporations Act (Ontario) under the corporate name of Pockit Corporation. Pockit Corporation filed articles of amendment on June 9, 1999 to change its name to Poc•Kit Corporation. Poc•Kit Corporation was continued under the CBCA on December 1, 1999 under the name of e-umedik Inc. and e-umedik Inc. filed articles of amendment on October 20, 2000 to change its name to Umedik Inc. 6701914 Canada Inc. was incorporated on January 12, 2007 pursuant to the CBCA.

11

Details of the Offering

| | |

| Common Shares Offered: | | • common shares. |

Offering Price: |

|

US$ • (C$ • ) per common share. |

Size of Offering: |

|

US$ • (C$ • ) |

Common Shares Outstanding Assuming Completion of the Offering: |

|

As of September 6, 2011, we had 33,946,258 common shares outstanding (38,437,444 on a fully diluted basis). There will be • common shares outstanding immediately following the closing of the offering ( • on a fully diluted basis, including the shares issuable in connection with our proposed acquisition of Scienion). These calculations assume no exercise of the over-allotment option. See "Capitalization". |

Offering Type: |

|

Offering in the U.S. under the multi-jurisdictional disclosure system and in each of the Provinces of Ontario and British Columbia. |

Use of Proceeds: |

|

The estimated net proceeds of the offering of common shares to us, assuming no exercise of the over-allotment option, after deducting the underwriters' commission and our estimated expenses will be $ • . We intend to use approximately $15 million of the net proceeds in satisfaction of the cash portion of the purchase price payable for the Scienion acquisition, a portion for sales and marketing initiatives, a portion for research and development activities, a portion for the expansion of our manufacturing operations and the balance for working capital and other general corporate purposes. See "Use of Proceeds". |

Over-Allotment Option: |

|

We have granted the underwriters the over-allotment option exercisable for a period of 30 days from the closing of the offering to purchase up to an additional • common shares equal to 15% of the offered shares at the offering price to cover over-allotments, if any, and for market stabilization purposes. See "Underwriting". |

Dividend Policy: |

|

To date, we have not paid any dividends and do not expect to do so in the foreseeable future. We currently intend to retain all future earnings for the operation and expansion of our business. See "Dividend Policy". |

Listing: |

|

Our outstanding common shares are listed and posted for trading on the TSXV under the symbol "SQD". Our common shares have been approved for listing on NYSE Amex under the trading symbol "SQD". |

Risk Factors: |

|

There are certain risk factors inherent in an investment in our common shares and in our activities. You should carefully review the information set out under "Risk Factors" and all other information in and incorporated by reference into this prospectus before making an investment in our common shares. |

Lock-up Agreements: |

|

Our directors and officers have agreed to enter into lock-up agreements with the underwriters. These lock-up agreements restrict the ability of our directors and these officers to sell or transfer their common shares for a period of 90 days after the date of the final prospectus. |

12

Selected Financial Information

The following table sets forth selected financial information for the dates and periods indicated. Our selected financial information as of September 30, 2010 and 2009 has been derived from our audited consolidated financial statements for those annual periods, which are included elsewhere in this prospectus and incorporated by reference into this prospectus, and our selected financial information as of June 30, 2011 and 2010 has been derived from our unaudited interim consolidated financial statements for the nine month periods ended June 30, 2011 and 2010, which are included elsewhere in this prospectus and incorporated by reference into this prospectus. Our consolidated financial statements have been prepared in Canadian dollars and in accordance with Canadian generally accepted accounting principles. For a reconciliation of the significant differences in our consolidated annual financial statements between Canadian GAAP and U.S. GAAP, see "Supplemental Note Regarding the Reconciliation of the Consolidated Financial Statements for the Years Ended September 30, 2010 and 2009 with U.S. GAAP", which is included elsewhere in this prospectus and incorporated by reference into this prospectus. For a reconciliation of the significant differences in our interim consolidated financial statements between Canadian GAAP and U.S. GAAP, see the "Supplemental Note Regarding the Reconciliation of the Interim Consolidated Financial Statements for the Three and Nine Month Periods Ended June 30, 2011 and 2010 with U.S. GAAP", which is included elsewhere in this prospectus and incorporated by reference into this prospectus. Operating results for the nine month period ended June 30, 2011 are not necessarily indicative of the results that may be expected for the fiscal year ended September 30, 2011 or any other future period. The summary financial information below should be read in conjunction with our financial statements and the notes thereto and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus and incorporated by reference into this prospectus.

| | | | | | | | | | | | | | |

| | Year Ended

September 30, | | 9 Months Ended

June 30, | |

|---|

Consolidated Statement of Operations Data

C$ in 000's except per share data | | 2009 | | 2010 | | 2010 | | 2011 | |

|---|

Revenue: | | | | | | | | | | | | | |

| | Product sales | | $ | 5 | | $ | 5 | | $ | — | | $ | 22 | |

| | Consulting fees | | | 27 | | | 30 | | | 21 | | | 9 | |

| | | | | | | | | | |

Total Revenue | | | 32 | | | 35 | | | 21 | | | 31 | |

| | | | | | | | | | |

Expenses | | | | | | | | | | | | | |

| | Salaries and wages | | | 469 | | | 556 | | | 404 | | | 607 | |

| | General and administrative | | | 447 | | | 471 | | | 324 | | | 449 | |

| | Professional and consulting | | | 436 | | | 659 | | | 437 | | | 669 | |

| | Sales and marketing | | | 409 | | | 474 | | | 309 | | | 329 | |

| | Stock based compensation | | | 380 | | | 402 | | | 184 | | | 372 | |

| | Research and Development | | | 3,362 | | | 5,059 | | | 3,438 | | | 4,056 | |

| | Amortization — property and equipment | | | 417 | | | 415 | | | 310 | | | 337 | |

Amortization — patent and trademark | | | 98 | | | 100 | | | 85 | | | 88 | |

| | | | | | | | | | |

Total expenses | | | 6,018 | | | 8,136 | | | 5,491 | | | 6,907 | |

| | | | | | | | | | |

Operating loss before interest | | | (5,986 | ) | | (8,101 | ) | | (5,470 | ) | | (6,876 | ) |

Interest Income | | | 121 | | | 32 | | | 20 | | | 56 | |

Interest Expense | | | (45 | ) | | (4 | ) | | (2 | ) | | — | |

| | | | | | | | | | |

Net loss | | $ | (5,910 | ) | $ | (8,073 | ) | $ | (5,452 | ) | $ | (6,820 | ) |

| | | | | | | | | | |

Basic and diluted loss per share | | $ | (0.23 | ) | $ | (0.27 | ) | $ | (0.18 | ) | $ | (0.20 | ) |

Weighted average number of shares | | | 25,158 | | | 30,349 | | | 29,553 | | | 33,849 | |

13

| | | | | | | | | | |

Consolidated Balance Sheet Data | | September 30,

2009 | | September 30,

2010 | | June 30,

2011 | |

|---|

Cash and cash equivalents | | $ | 3,180 | | $ | 9,408 | | $ | 2,817 | |

Working capital | | | 3,280 | | | 8,930 | | | 2,238 | |

Total assets | | | 6,205 | | | 13,134 | | | 7,488 | |

Total shareholders' equity | | | 5,836 | | | 12,162 | | | 5,960 | |

14

RISK FACTORS

An investment in our common shares involves a number of risks. In addition to the other information contained in this prospectus and in the documents incorporated by reference into this prospectus, including our consolidated financial statements and related notes, you should give careful consideration to the following risk factors. Any of the matters highlighted in these risk factors could have a material adverse effect on our business, results of operations and financial condition, causing an investor to lose all, or part of, its, his or her investment.

The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are not aware of or focused upon, or that we currently deem to be immaterial, may also impair our business operations and cause the trading price of our common shares to decline.

If our proposed acquisition of Scienion is completed, our combined businesses will face similar risks to those described below.

Risks Related to Our Business and Strategy

We have incurred losses since inception, and we expect to continue to incur losses for the foreseeable future.

We have a limited operating history and have incurred significant losses in each fiscal year since our inception, including net losses of $3.8 million, $5.9 million, $8.1 million and $6.8 million during fiscal 2008, 2009, 2010 and the nine months ended June 30, 2011, respectively. As of June 30, 2011, we had an accumulated deficit of $40.3 million. These losses have resulted principally from costs incurred in our research and development programs and from our selling, general and administrative expenses. We expect to continue to incur operating and net losses and negative cash flow from operations, which may increase, for the foreseeable future due in part to anticipated increases in expenses for research and product development and expansion of our sales and marketing capabilities. Additionally, following this offering, we expect that our selling, general and administrative expenses will increase due to the additional operational and reporting costs associated with being a SEC reporting company. We anticipate that our business will generate operating losses until we successfully implement our commercial development strategy and generate significant additional revenues to support our level of operating expenses. Because of the numerous risks and uncertainties associated with our commercialization efforts and future product development, we are unable to predict when we will become profitable, and we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase our profitability.

Our future capital needs are uncertain and we may need to raise additional funds in the future, which may not be available on a timely basis or on commercially reasonably terms.

We believe that the net proceeds from this offering remaining after the completion of our proposed acquisition of Scienion described in this prospectus, together with our existing cash and cash equivalents, will be sufficient to meet our anticipated cash requirements for at least the next 18 months. However, we may need to raise substantial additional capital to:

- •

- expand the commercialization of our products;

- •

- manufacture our platforms in advance of placing them with our customers;

- •

- fund our operations; and

- •

- further our research and development.

Our future funding requirements will depend upon many factors, including:

- •

- development of new and existing products;

- •

- market acceptance of our products;

- •

- the cost of our research and development activities;

- •

- the cost of potential licensing of technologies patented by others;

- •

- the cost of filing and prosecuting patent applications;

15

- •

- the cost of defending, in litigation or otherwise, any claims that we infringe third party patents or violate other intellectual property rights;

- •

- the cost and timing of regulatory clearances or approvals;

- •

- the cost and timing of establishing additional sales, marketing and distribution capabilities;

- •

- the cost and timing of establishing additional technical support capabilities;

- •

- the effect of competing technological and market developments; and

- •

- the extent to which we acquire or invest in businesses, products and technologies, although we currently have no commitments or agreements relating to any of these types of transactions, other than our proposed acquisition of Scienion.

If we raise additional funds by issuing equity securities, our shareholders may experience dilution. Debt financing, if available, may involve covenants restricting our operations or our ability to incur additional debt. Any debt or additional equity financing may contain terms that are not favorable to us or our shareholders. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish some rights to our technologies or our products, or grant licenses on terms that are not favorable to us.

If we do not have, or if we are unable to timely obtain additional funds on acceptable terms, or at all, we may have to delay development or commercialization of our products or license to third parties the rights to commercialize products or technologies that we would otherwise seek to commercialize. We also may have to liquidate some or all of our assets, reduce the scope of or eliminate some or all of our development programs, reduce marketing, customer support or other resources devoted to our products, or cease operations. Any of these factors could harm our business, financial condition and results of operations.

Market competition and technological advances of similar diagnostics products could reduce the attractiveness of our products or render them obsolete.

The markets for our products are characterized by rapidly changing technology, evolving industry standards, changes in customer needs, emerging competition, new product introductions and strong price competition. We compete with both established and development stage companies, universities, research institutions, governmental agencies and healthcare providers that design, manufacture and market similar diagnostic products. Many of our current competitors have significantly greater name recognition, greater financial and human resources, broader product lines and product packages, larger sales forces, larger existing installed bases, larger intellectual property portfolios and greater experience and capabilities in researching, developing and testing products, in obtaining FDA and other regulatory approvals or clearances, and in manufacturing, marketing and distribution, than we have. For example, companies such as Bio-Rad Laboratories Inc., Phadia AB, Axis-Shield plc, and INOVA Diagnostics, Inc. have products that compete in certain segments of the market in which we sell our products, including immunoassays. In addition, a number of other companies and academic groups are in the process of developing novel products and technologies for diagnostics markets.

With respect to our proposed acquisition of Scienion, the largest array print manufacturers that are also offering custom array services and whom we believe represent Scienion's most significant competitors include, in the United States, Arrayit Corporation, Bio-Synthesis Inc., Full Moon Biosystems, Inc., Microarrays Inc., Aushon BioSystems, Inc., and Applied Microarrays, Inc. and, in Europe, GeSiM mbH, and Arrayjet Limited.

Our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. In light of these advantages, even if our technology is more effective than the product or service offerings of our competitors, current or potential customers might accept competitive products and services in lieu of purchasing our technology. We anticipate that we will face increased competition in the future as existing companies and competitors develop new or improved products and as new companies enter the market with new technologies. We may not be able to compete effectively against these organizations. Increased competition is likely to result in pricing pressures, which could harm our sales, profitability or market share. Our failure to compete effectively could materially and adversely affect our business, financial condition and results of operations.

16

If our products fail to achieve and sustain sufficient market acceptance, our revenue will be adversely affected.

We currently have one customer and our success depends, in part, upon our ability to develop and market products that are recognized and accepted as reliable, accurate, timely and cost effective by physicians, lab technicians and administrators. Most of our potential customers already use expensive diagnostic products and systems in their laboratories and may be reluctant to replace those systems. Market acceptance of our products and technologies will depend upon many factors, including our ability to provide a broad test menu of assays to potential customers, and our ability to convince potential customers that our systems are an attractive cost- and time-saving alternative to existing technologies. Compared to most competing technologies, our microarray assay technology is relatively new, and most potential customers have limited knowledge of, or experience with, our products. Prior to adopting our microarray assay technology, some potential customers may need to devote time and effort to testing and validating our systems. Any failure of our systems to meet these customer benchmarks could result in customers choosing to retain their existing systems or to purchase systems other than ours.

We are subject to complex regulatory compliance requirements and the failure to obtain, or the withdrawal of, regulatory clearance or approval for our products could adversely affect our ability to market our products and/or require us to incur significant costs to comply with such requirements.

We operate in a highly regulated industry and we are subject to the authority of certain regulatory agencies, including Health Canada, the FDA, European Conformity (CE) and applicable health authorities in other countries, with regard to the development, testing, manufacturing, marketing and sale of our diagnostic products. The process of obtaining such clearances or approvals can be costly and time-consuming, and if we are unable to timely obtain or maintain regulatory clearances or approvals, it would have a material adverse effect on our business. Clearance by regulatory authorities can be suspended or revoked, or we could be fined, based on a failure to continue to comply with applicable standards. Any failure to obtain (or significant delay in obtaining) or maintain applicable regulatory clearances or approvals (or, to a lesser extent, approval of applicable health authorities in other countries) for our new or existing products could materially affect our ability to market its products successfully and could therefore have a material adverse effect on our business. Additionally, the authority of the regulatory agencies or the application of certain regulations may be expanded or otherwise changed in such a manner that would place additional regulatory burdens on us or our customers. Such a change in our industry could have a material adverse effect on our business.

We must manufacture products in compliance with regulatory requirements, in sufficient quantities and on a timely basis, while maintaining product quality and acceptable manufacturing costs. If we or our suppliers are unable to manufacture or contract for such capabilities on acceptable terms, our plans for commercialization could be materially adversely affected.

Our manufacturing facilities are subject to periodic regulatory inspections by the regulatory agencies and these facilities are subject to quality standards requirements of the applicable regulatory authorities. We, or our contractors, may not satisfy such regulatory or standards requirements, and any failure to do so may have a material adverse effect on our business, financial condition and results of operations.

We may not be able to develop new products or enhance the capabilities of our existing diagnostics products to keep pace with rapidly changing technology and customer requirements.

The field of diagnostics is characterized by rapidly changing and developing technologies that include new products that could render our diagnostic processing equipment and consumable tests obsolete at any time and thereby adversely affect our financial condition and future prospects. Our success depends upon our ability to develop new products with improved performance and cost effectiveness in existing and new markets. New technologies, techniques or products could emerge that might offer better combinations of price and performance than our current or future product lines. It is critical to our success for us to anticipate changes in technology and customer requirements and to successfully introduce new, enhanced and competitive technology to meet our prospective customers' needs on a timely basis.

Developing and marketing new products and services will require us to incur substantial development costs and we may not have adequate resources available to be able to successfully introduce new versions of, or

17

enhancements to, our products. We cannot guarantee that we will be able to maintain technological advantages over emerging technologies in the future. While we plan to continue to make improvements to our current and future cleared or approved and marketed diagnostic processing equipment and consumable tests, we may not be able to successfully implement these improvements. If we fail to keep pace with emerging technologies, demand for our products will not grow, and our business, revenue, financial condition and operating results could suffer materially. Even if we successfully implement some or all of these planned improvements, we cannot guarantee that potential customers will find our enhanced products to be an attractive alternative to existing technologies, including our current products.

Research and development of diagnostic products requires significant testing and investment and may not result in commercially viable products within the timeline anticipated, if at all.

New diagnostic products, and improvements to existing diagnostic products, require significant research, development, testing and investment prior to any final commercialization. Our business depends upon the continued development and improvement of our existing products, our development of new products to serve existing markets and our development of new products to create new markets and applications that were previously not practical with existing systems. We believe that the adoption of our platform by potential customers depends, in part, upon our ability to provide a test menu of assays to potential customers. To date, we have obtained regulatory approval for only a few diagnostic assays.

We intend to devote significant personnel and financial resources to research and development activities designed to advance the capabilities of our diagnostic technology and, in the case of ourin vitro diagnostics business, to obtain regulatory approval of additional assays. In the past, our product development projects have been delayed. We may have similar delays in the future, and we may not obtain any benefits from our research and development activities. Any delay or failure by us to develop new products or enhance existing products would have a material adverse effect on our business and results of operations. If we are unable to successfully develop these products, accomplish such improvements, receive applicable regulatory clearances or approvals, produce the products in commercial quantities at reasonable costs, or successfully market the products, it would have a material adverse effect on our business and results of operations. Our long-term success must be considered in light of the expenses, difficulties and delays frequently encountered in connection with the development of new technology and the competitive and highly regulated environment in which we operate.

We may need additional capacity to meet our manufacturing needs at the end of 2012.

Based on our microarray manufacturing forecasts, we expect that there is adequate capacity in our current location to expand our manufacturing capacity to meet our expected needs until the end of 2012. Until a facility upgrade is completed, we intend to undertake equipment upgrades to ensure sufficient manufacturing capacity to meet our expected requirements for commercial sales and our internal validation studies until the end of 2012.

Our inability to obtain our required manufacturing space in a timely manner and on terms acceptable to us will result in delays which could have a material adverse effect on our financial condition and results of operations.

If it becomes necessary to relocate our operations even if we are able to enter into a lease for a new facility, we must implement and maintain an international standard "ISO" quality management system for such new facility. Any delay in implementing an ISO quality management system will have a material adverse effect on our financial condition and results of operations.

Our future success depends upon our ability to expand our customer base and introduce new products and services.

Our success will depend upon our ability to gain acceptance, and then increase our market share, among our customers, attract additional customers outside of our initial target markets, and bring to market new products and services. Attracting new customers and introducing new products and services requires substantial time and expense. For example, it may be difficult to identify, engage and market to customers who are unfamiliar with the benefits of our products and services. Any failure to establish and expand our existing customer base or launch new products or services would adversely affect our ability to increase our revenues.

18

We have limited experience in marketing, selling and distributing our products, and we need to expand our internal and external sales and marketing force and distribution capabilities to successfully commercialize and sell our products.

As we are in the early stages of commercializing and marketing our products, we have limited experience in marketing, selling and distributing our products. We may not be able to market, sell and distribute our products effectively enough to support our planned growth. We intend to market, sell and distribute our products directly through our own sales force in North America, Europe and elsewhere. Our future sales will depend in large part upon our ability to develop and substantially expand our direct sales force and to increase the scope of our marketing efforts.

Our products are technically complex and used for specialized applications. Our ability to market our products effectively will depend, in part, upon our ability to convince laboratories that our products will deliver accurate patient results in less time and with significantly reduced labor, consumables and other costs. As a result, we believe it is necessary to develop a direct sales force that includes people with specific scientific backgrounds and expertise and a marketing group with technical sophistication. Competition for such employees is intense. We may not be able to attract and retain personnel, or be able to build an efficient and effective sales and marketing force, which could negatively impact sales of our products, and reduce any future revenues and profitability.

If our sales, marketing and distribution efforts are not successful, our technologies and products may not gain market acceptance, which would materially impact our business operations.

We rely on strategic partnerships for research and development and commercialization of our products.

We have entered into and may continue to enter into strategic partnerships with a number of medical institutions. For example, we have entered into strategic agreements with the Cleveland Clinic, Beth Israel Deaconess Medical Center, Hospital Clinic De Barcelona, University Hospital Maastricht, and The University of North Carolina at Chapel Hill. If any of our strategic partners were to change their business strategies or development priorities, they may no longer be willing or able to participate in such strategic partnerships which could have a material adverse effect on the timing of our future development efforts. In addition, we may not control the strategic partnerships in which we participate. We may also have certain obligations with regard to our strategic partnerships, in addition to the obligation to pay money, such as an obligation to publish the results of research.

If any of our strategic partners terminate their relationship with us or fail to perform their obligations in a timely manner, or if we fail to perform our obligations in a timely manner, the development or commercialization of our technology in potential products may be affected, delayed or terminated.

We depend upon key suppliers for some of the components and materials used in our platform technologies and our microarrays, and the loss of any of these suppliers could harm our business.

We rely on key suppliers for certain components and materials used in our platform technologies, including our SQiDworks diagnostic platform and our microarrays. We do not have agreements with these key suppliers to supply us with components in the future. The loss of any of these key suppliers would require significant time and effort to locate and qualify an alternative source of supply. There are a limited number of suppliers who can manufacture the highly specialized equipment that forms a part of our SQiDworks system.

Our first set of assays being commercialized requires a highly specific mono-layer coating on the glass surface which is used to bond each of the microarray "spots". We have worked closely with these manufacturers to extend the capabilities of their standard products to support the unique needs of our platform technologies and microarray devices. Any change in any component that forms a part of our SQiDworks system will require additional testing to ensure that it performs in a substantially similar manner to the existing component.

Our reliance on these suppliers also subjects us to other risks that could harm our business, including the following:

- •

- we may be subject to increased component costs;

19

- •

- we may not be able to ensure that any component that we change performs in a substantially similar manner to the existing component;

- •

- we may not be able to obtain adequate supply in a timely manner or on commercially reasonable terms;

- •

- our suppliers may make errors in manufacturing components that could negatively affect the efficacy of our systems or cause delays in shipment of our systems; and

- •

- our suppliers may encounter financial hardships unrelated to our demand for components, which could inhibit their ability to fulfill our orders and meet our requirements.

We may not be able to quickly establish additional or replacement suppliers, particularly for our single source components. Any interruption or delay in the supply of components or materials, or our inability to obtain components or materials from alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our strategic partners and future customers.

Future legislative or regulatory changes to the healthcare system, including reimbursement, may adversely affect our business.

The healthcare regulatory environments in the jurisdictions in which we operate and plan to operate may change in a way that restricts our ability to market our diagnostic testing products due to medical coverage or reimbursement limits. Sales of our diagnostic systems will depend, in part, upon the extent to which the costs to patients of such tests are paid by health maintenance, managed care, and similar healthcare management organizations, or reimbursed by government health payor administration authorities, private health coverage insurers and other third party payors. These healthcare management organizations and third party payors are increasingly challenging the prices charged for medical products and services. The containment of healthcare costs has become a priority of governments. Accordingly, our potential products may not be considered cost effective, and reimbursement to the ultimate patient may not be available or sufficient to allow us to sell our products on a competitive basis. Legislation and regulations affecting reimbursement for our products may change at any time and in ways that are difficult to predict and these changes may be adverse to us. For example, a reduction in U.S. Medicare, Medicaid or other third party payor reimbursements for diagnostic services could have a negative effect on our operating results. In June 2011, the FDA issued draft guidance that sets forth the FDA's proposed interpretation of laws regarding the marketing of IVD products labelled as RUO products that could be used forin vitro diagnostic purposes. Among other things, the draft guidance suggests that it is generally inappropriate for a manufacturer to sell RUO products to clinical laboratories that the manufacturer knows, or has reason to know, use the products for clinical diagnostic uses. Given that the guidance is in draft form and has only recently been issued by the FDA, it is not clear how the FDA will interpret this guidance. As a result, we cannot be certain what impact, if any, this guidance will have on our business.