As filed with the Securities and Exchange Commission on December 2, 2011

File No. 000-54532

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

BREF HR, LLC

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 27-4938906 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

Three World Financial Center 200 Vesey Street, 11th Floor New York, NY | | 10281 |

| (Address of principal executive office) | | (Zip Code) |

(212) 417-7265

(Registrant’s telephone number, including area code)

Copies of correspondence to:

Matthew D. Bloch, Esq.

Weil Gotshal & Manges LLP

767 Fifth Avenue

New York, NY 10153

SECURITIES TO BE REGISTERED PURSUANT TO SECTION 12(B) OF THE ACT:

| | |

Title of each class To be so registered | | Name of each exchange on which Each class to be registered |

| NOT APPLICABLE | | NOT APPLICABLE |

SECURITIES TO BE REGISTERED PURSUANT TO SECTION 12(G) OF THE ACT:

CLASS A UNITS

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non–accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b–2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non–accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller Reporting Company | | ¨ |

TABLE OF CONTENTS

i

EXPLANATORY NOTE

Unless otherwise specified, the terms the “Company,” “we,” “us” or “our” refer to BREF HR, LLC and its consolidated subsidiaries, or any one or more of them, as the context may require. This registration statement on Form 10 is being filed by the Company in order to register its Class A Units voluntarily pursuant to Section 12(g) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company is not required to file this registration statement pursuant to the Exchange Act.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This registration statement contains certain “forward-looking statements”, which represent our expectations or beliefs concerning future events. Statements containing expressions such as “believes,” “anticipates,” “expects” or other similar words or expressions are intended to identify forward-looking statements. We caution that these and similar statements included in this registration statement are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. Although we believe our expectations are based upon reasonable assumptions within the bounds of our knowledge of our business and operations, we cannot guarantee future results, levels of activity, performance or achievements. The factors that could cause actual results to differ materially from expected results include changes in economic, business, competitive market and regulatory conditions. Important risks and factors that could cause our actual results to differ materially from any forward-looking statements include, but are not limited to:

| | • | | the recent downturn in the U.S. economy, particularly in levels of spending in the Las Vegas hotel, resort and casino industry; |

| | • | | reliance on a single location in the Las Vegas and Southern California markets; |

| | • | | changes in the competitive environment in our industry, particularly in the Las Vegas market; |

| | • | | volatility of and access to capital markets and increases in interest rates; |

| | • | | damage to our brand through the use of the “Hard Rock” brand name by entities other than us; |

| | • | | hostilities, including future terrorist attacks, or fear of hostilities that affect travel; |

| | • | | the seasonal nature of the hotel, resort and casino industry; |

| | • | | costs associated with compliance with extensive regulatory requirements; |

| | • | | increases in uninsured and underinsured losses; |

| | • | | the impact of any material litigation; and |

| | • | | the other risks discussed in this registration statement in the section entitled “Risk Factors.” |

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date thereof. We undertake no obligation to publicly release any revisions to such forward-looking statements to reflect events or circumstances after the date hereof. We undertake no obligation, and are under no duty, to update any of the forward-looking statements to conform these statements to reflect events or circumstances after the date hereof.

1

THE COMPANY

BREF HR, LLC is a Delaware limited liability company that was formed on February 11, 2011. The affairs of the Company are governed by a Limited Liability Company Agreement dated as of March 1, 2011 (the “LLC Agreement”).

The Company was formed by certain affiliates of Brookfield Financial, LLC as to its Series B (“Brookfield Financial”) to acquire the limited liability company interests of HRHH JV Junior Mezz, LLC (“HRHH JV Junior Mezz”) and HRHH Gaming Junior Mezz, LLC (“HRHH Gaming Junior Mezz”), which indirectly own the Hard Rock Hotel & Casino Las Vegas and certain related assets. These assets were acquired pursuant to the assignment from Hard Rock Hotel Holdings, LLC (“HRH Holdings”) in connection with the default by HRH Holdings and its subsidiaries on the real estate financing facility, and the resulting settlement agreement, as described below. Brookfield Financial is managed by Brookfield Real Estate Financial Partners LLC (together with its affiliates, “Brookfield”).

Prior Acquisition of HRH Holdings by Morgans and DLJMBP and entering into the Facility

HRH Holdings was formed by DLJ Merchant Banking Partners (“DLJMBP”) and Morgans Hotel Group Co. (“Morgans” and together with an affiliated entity, the “Morgans Parties”) to acquire Hard Rock Hotel, Inc. (“HRHI”). HRHI was the subsidiary of HRH Holdings that owned the Hard Rock Hotel & Casino Las Vegas during the period from February 2, 2007 to February 28, 2011 prior to the Assignment (as defined below).

On May 11, 2006, Morgans, MHG HR Acquisition Corp., HRHI and Peter A. Morton entered into an Agreement and Plan of Merger pursuant to which Morgans would acquire the Hard Rock Hotel & Casino Las Vegas (the “Acquisition”), which acquisition closed on February 2, 2007. Additionally, Morgans Group LLC, an affiliate of Morgans, entered into purchase and sale agreements with affiliates of Mr. Morton to acquire an approximately 23–acre parcel of land adjacent to the Hard Rock Hotel & Casino Las Vegas.

In connection with the Acquisition, certain of HRH Holdings’ subsidiaries entered into a real estate financing facility (the “Facility”), which was secured by HRH Holdings’ assets. As of March 1, 2011, immediately prior to the Assignment, there was approximately $1.3 billion in outstanding debt, all of which was variable rate debt.

In January 2011, HRH Holdings received a notice of acceleration from its lenders under the Facility, and also from NRFC WA Holdings, LLC (“NRFC”), the second mezzanine lender pursuant to the First Amended and Restated Second Mezzanine Loan Agreement, dated as of December 24, 2009 (the “Second Mezzanine Loan Agreement”), and declaring all unpaid principal and accrued interest immediately due and payable. On February 1, 2011 NRFC commenced an action in the Supreme Court of New York and on February 2, 2011 Brookfield Financial and Vegas HR Private Limited (the “Mortgage Lender”) commenced an action in the Supreme Court of New York. Following filing of such actions, subsidiaries of HRH Holdings, the Mortgage Lender, Brookfield Financial, NRFC, Morgans, certain affiliates of DLJMBP, and certain other related parties entered into a Standstill and Forbearance Agreement, dated as of February 6, 2011. Pursuant to such agreement, among other things, until February 28, 2011, the Mortgage Lender, Brookfield Financial and NRFC agreed not to take any action or assert any right or remedy arising with respect to any of the applicable loan documents or the collateral pledged under such loan documents. In addition, pursuant to the Standstill and Forbearance Agreement, NRFC agreed to withdraw its foreclosure notice, and the parties agreed to jointly request a stay of all action on the pending motions that had been filed by various parties to enjoin such foreclosure proceedings.

The Assignment

On March 1, 2011, HRH Holdings, the Mortgage Lender, Brookfield Financial, NRFC, the Morgans Parties and certain affiliates of DLJMBP, as well as other interested parties entered into the Agreement to Transfer in Lieu of Foreclosure and Settlement Agreement (the “Settlement Agreement”) pursuant to which the membership

2

interests of HRHH JV Junior Mezz and HRHH Gaming Junior Mezz were transferred and assigned to the Company. The description of the Settlement Agreement set forth below discusses all of the terms of the Settlement Agreement that are material to the Company’s ongoing business and operations. The transactions contemplated by the Settlement Agreement are referred to as the “Assignment.”

The Assignment provided for, among other things:

| | • | | the transfer by HRH Holdings to an affiliate of Brookfield Financial of 100% of the indirect equity interests in the Hard Rock Hotel & Casino Las Vegas and other related assets, namely HHRH JV Junior Mezz and HRHH Gaming Junior Mezz; |

| | • | | release of the non-recourse carve-out guaranties provided by HRH Holdings with respect to the loans made by the Mortgage Lender, Brookfield Financial and NRFC to the direct and indirect owners of the Hard Rock Hotel & Casino Las Vegas; and |

| | • | | termination of the Morgans management agreement. |

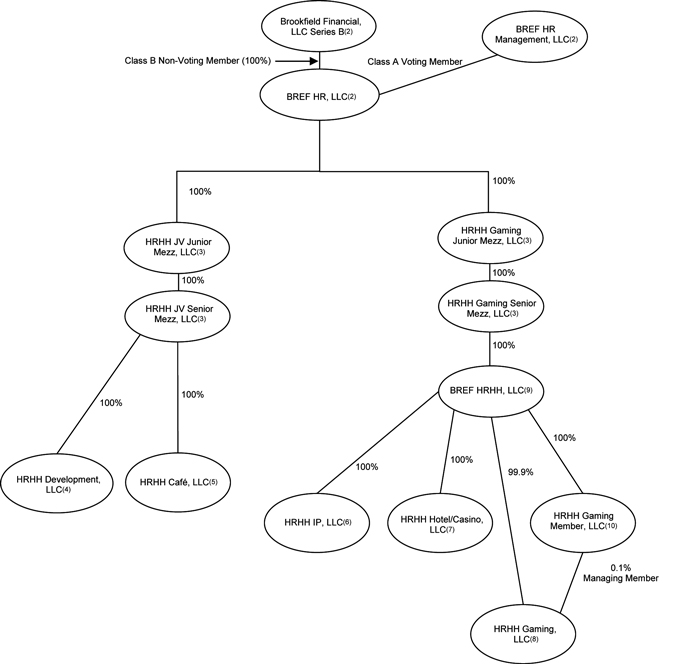

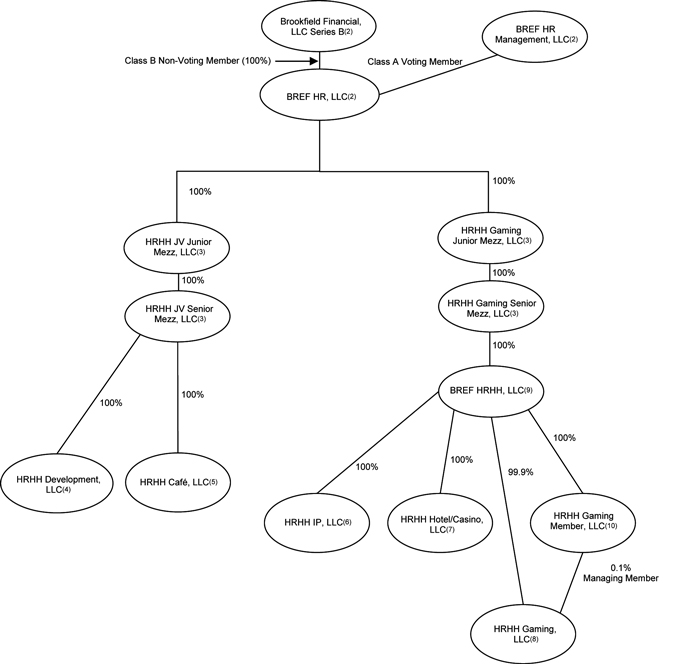

Corporate Structure

The subsidiaries that served as mortgage borrowers under the Facility were HRHH Hotel/Casino, LLC (“HRHH Hotel/Casino”) (owner of the Hard Rock Hotel & Casino Las Vegas), HRHH Development, LLC (“HRHH Development”) (prior owner of the parcel of land adjacent to the Hard Rock Hotel & Casino Las Vegas), HRHH Cafe, LLC (“HRHH Cafe”, owner of the parcel of land on which the Hard Rock Cafe is situated), HRHH IP, LLC (“HRHH IP”, owner of certain intellectual property used in connection with the Hard Rock Hotel & Casino Las Vegas, among other things) and HRHH Gaming, LLC (“HRHH Gaming”), an entity formed by HRH Holdings for the purpose of holding the gaming licenses and conducting gaming operations at the Hard Rock Hotel & Casino Las Vegas. The gaming operations at the Hard Rock Hotel & Casino Las Vegas are currently being conducted by LVHR Casino, Inc. (“LVHR”), a third party operator, until satisfaction of the conditions to our licensure under applicable gaming laws. See “—Nevada Gaming Regulation and Licensing” and “—Agreements Governing the Operation of the Hard Rock Hotel & Casino Las Vegas—Management Agreement.” Upon satisfaction of the conditions to our licensure under applicable gaming laws, the current third party operator, LVHR, will become one of our indirect subsidiaries and we will assume operation of the gaming facilities at the Hard Rock Hotel & Casino Las Vegas.

Amendment to the Facility and Entering into the Second Mortgage

As part of the Assignment, the Company assumed the obligations under the Facility and entered into an amendment thereof (as amended, the “Amended Facility”) pursuant to which the land, building and improvements, equipment, fixtures and all personal properties relating to the Hard Rock Hotel & Casino Las Vegas were pledged as security and collateral. HRHH Hotel/Casino, HRHH Development, HRHH Cafe, HRHH IP and HRHH Gaming continue to serve as mortgage borrowers under the Amended Facility. As of March 1, 2011, approximately $863.0 million of principal amount was outstanding under the Amended Facility. Also on March 1, 2011, HRHH Hotel/Casino, HRHH Development, HRHH Cafe, HRHH IP and HRHH Gaming entered into a second mortgage loan agreement with Brookfield Financial (the “Second Mortgage”) in the amount of $30.0 million pursuant to which certain land, building and improvements, equipment, fixtures and personal properties were pledged as security and collateral. The Second Mortgage is subordinate in right of payment to the Amended Facility.

Regulatory Matters Related to The Assignment

On February 24, 2011, the Nevada Gaming Commission (the “Nevada Commission”) approved the Assignment and granted the Company and certain affiliates of the Company temporary waivers of the mandatory requirements of the Nevada Gaming Control Act and its regulations for licensing, findings of suitability, or registration, attendant to a transfer of interests of the equity securities of a company registered with the Nevada Commission. The temporary waivers of the mandatory requirements of the Nevada Gaming Control Act and its regulations for licensing, findings of suitability or registration, attendant to a transfer of interest of the equity securities of a company registered with the Nevada Commission allowed the Company to consummate the Assignment without completing the normal investigatory process and background checks required for licensing, findings of suitability or registration that are attendant to a transfer of interest of the equity securities of a company registered with the Nevada Commission. The normal investigatory process and background checks associated with licensing, findings of suitability or registration that is attendant to a transfer of interest of the equity securities of a company registered with the Nevada Commission can take at least six months. The Nevada Commission approved the temporary waivers for period that expired on March 10, 2011, which allowed the Company to acquire the equity securities of HRHH Gaming Junior Mezz, LLC without having to be licensed and to enter into the Casino Lease (as defined herein) with LVHR. Had the Nevada Commission not granted the temporary waivers, the Assignment could not have been consummated in a timely manner.

On February 24, 2011, the Nevada Commission also approved the applications of LVHR for nonrestricted gaming licenses to operate the gaming operations at the Hard Rock Hotel & Casino Las Vegas. The Nevada Commission also approved the applications of WG-Harmon, LLC (“WG-Harmon”) for a gaming license as the key employee and to receive a percentage of gaming revenue from LVHR in connection with the gaming operations at the Hard Rock Hotel & Casino Las Vegas. The Nevada Commission also registered Warner Gaming, LLC (“Warner Gaming”) to own the equity securities of LVHR and WG-Harmon. On March 2, 2011, HRHH Gaming surrendered to the Nevada State Gaming Control Board (the “Nevada Board”) all of its prior gaming licenses associated with the gaming operations at the Hard Rock Hotel & Casino Las Vegas to satisfy conditions mandated by the Nevada Commission.

In April, 2011, the Company applied to the Nevada Commission, the Nevada Board and the Clark County Liquor and Gaming Licensing Board (the “Clark County Board” and, together with the Nevada Commission and the Nevada Board, collectively, the “Nevada Gaming Authorities”) for all required approvals and licenses to assume the gaming operations at the Hard Rock Hotel & Casino Las Vegas. Since the submission of applications, the Company and the required individuals have pursued such required approvals and anticipate appearances before the Nevada Gaming Authorities in December 2011. We anticipate that we will assume operation of the gaming facilities at the Hard Rock Hotel & Casino Las Vegas as soon as practicable after we receive approval from and are licensed by the Nevada Gaming Authorities. We cannot be certain that we will obtain all required approvals and licenses on a timely basis or at all. See “—Nevada Gaming Regulation and Licensing.”

3

Corporate Structure

As of June 30, 2011(1)

| (1) | LVHR is currently the third party operator of all gaming operations at the Hard Rock Hotel & Casino Las Vegas. We do not currently own any interest in LVHR or its affiliated entities, WG-Harmon and Warner Gaming. However, since we believe that we are the primary beneficiary of the gaming operations under current accounting standard ASC 810-10 because we both have the power to direct the activities of the variable interest entity that most significantly impacts the entity’s economic performance and the obligation to absorb losses or the right to receive benefits from the entity that could potentially be significant to the variable interest entity. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In April, 2011, the Company applied to the Nevada Gaming Authorities for all required approvals and licenses to assume the gaming operations at the Hard Rock Hotel & Casino Las Vegas. Since the submission of applications, the Company, its subsidiaries and the required individuals have diligently pursued such required approvals and anticipate appearances before the Nevada Gaming Authorities in December 2011. We anticipate that we will assume operation of the gaming facilities at the Hard Rock Hotel & Casino Las Vegas as soon as practicable after we receive approval from and are licensed by the Nevada Gaming Authorities. We anticipate that we will assume operation of the gaming facilities at the Hard Rock Hotel & Casino Las Vegas as soon as practicable after we receive approval from and are licensed by the Nevada Gaming Authorities. We cannot be certain that we will obtain all required |

4

| | approvals and licenses on a timely basis or at all. See “—Nevada Gaming Regulation and Licensing” and “—Agreements Governing the Operation of the Hard Rock Hotel & Casino Las Vegas—Management Agreement.” |

| (2) | The Company does not have a board of directors. The Company is managed by BREF HR Management, LLC (“BREF Management”), the sole holder of the Class A Units. Brookfield Financial, the sole holder of the Class B Units, does not participate in the management or control of the business of, and does not have any rights or powers with respect to, the Company except that BREF Management is be permitted to transfer, assign, convey or otherwise dispose of any assets of the Company only with the written consent of Brookfield Financial. In addition, Brookfield Financial may cause BREF Management to resign and forfeit its interest in the Company and admit a new Class A member (subject to the approval of the Nevada Commission). Subject to approval of the Nevada Commission, all distributions of the Company are made to Brookfield Financial. |

| (3) | Special purpose entities that previously incurred senior, junior and subordinate junior mezzanine debt under the Facility. |

| (4) | HRHH Development is a mortgage borrower under the Amended Facility, and is the prior owner of the parcel of land adjacent to the Hard Rock Hotel & Casino Las Vegas. |

| (5) | HRHH Café is a mortgage borrower under the Amended Facility, and is the owner of the parcel of land on which the Hard Rock Cafe is situated. |

| (6) | HRHH IP is a mortgage borrower under the Amended Facility, and is the owner of certain intellectual property used in connection with the Hard Rock Hotel & Casino Las Vegas, among other things. |

| (7) | HRHH Hotel/Casino is a mortgage borrower under the Amended Facility, and is the owner of the Hard Rock Hotel & Casino Las Vegas. |

| (8) | HRHH Gaming is an entity formed by HRH Holdings for the purpose of holding the gaming licenses and conducting gaming operations at the Hard Rock Hotel & Casino Las Vegas. The gaming operations at the Hard Rock Hotel & Casino Las Vegas are currently being conducted by LVHR, a third party operator, until satisfaction of the conditions to our licensure under applicable gaming laws. |

| (9) | BREF HRHH, LLC is a holding company formed by the Company in connection with the Assignment. |

| (10) | HRHH Gaming Member, LLC is a holding company that holds an interest in HRHH Gaming. |

FORM 10 REGISTRATION

The Company is not required to file this registration statement pursuant to the Exchange Act, the Securities Act of 1933, as amended (the “Securities Act”) or the rules and regulations of the Securities and Exchange Commission (the “SEC”) promulgated thereunder.

On February 24, 2011, LVHR received licenses from the Nevada Commission to serve as the operator of the gaming facilities at the Hard Rock Hotel & Casino Las Vegas. In addition, WG-Harmon received a license from the Nevada Commission as a key employee and to receive a percentage of gaming revenue from LVHR in connection with the gaming operations at the Hard Rock Hotel & Casino Las Vegas. WG-Harmon and Warner Gaming are currently affiliates of LVHR. Upon the effectiveness of this registration statement, the Company’s Class A Units will be registered under Section 12(g) of the Exchange Act. Because the Class A Units will be registered under the Exchange Act, the Company will at that time be a “publicly traded corporation” under the gaming laws of the State of Nevada. Any beneficial owner of the Company’s voting securities or other equity securities may be required to file an application, be investigated and have such holder’s suitability as a beneficial owner of the Company’s voting securities or other equity securities determined if the Nevada Commission has reason to believe that such ownership would otherwise be inconsistent with the declared policies of the State of Nevada. However, as the Company will be a “publicly traded corporation,” the Company expects that the Nevada Commission will require only that certain beneficial owners of the Class A Units be found suitable, and, since the holders of Class B Units will have no voting control, it is anticipated that the holders of Class B Units will not be subject to licensure or registration under the gaming laws of the State of Nevada. It is customary practice of Clark County to defer to Nevada Gaming Authorities with respect to the background and suitability investigation of applications of the nature filed by the Company. Holders of Class B Units will, however, remain subject to the discretionary authority of the Nevada Gaming Authorities and Clark County and may be required to file an application and have their suitability determined. Therefore, we anticipate that the Nevada Commission and Clark County will require only Andrea S. Balkan, Barry S. Blattman, Theresa A. Hoyt and William M. Powell and, the members and managers of BREF Management, to be found suitable in connection with the Assignment. See “—Nevada Gaming Regulation and Licensing.”

We are prohibited from receiving any revenues of the casino at the Hard Rock Hotel & Casino Las Vegas until we have obtained the necessary gaming approvals. As such, we have entered into a definitive lease agreement with a third party casino operator, LVHR, for all gaming and related activities at the casino. A portion of our revenues from our operations, therefore, is dependent on our ability to collect lease payments from LVHR. In April, 2011, the Company applied to the Nevada Gaming Authorities for all required approvals and licenses to assume the gaming operations at the Hard Rock Hotel & Casino Las Vegas. Since the submission of applications, the Company and the required individuals have diligently pursued such required approvals and anticipate appearances before the Nevada Gaming Authorities in December 2011. Once we have satisfied all conditions to obtain all necessary gaming approvals, including becoming a “publicly traded corporation,” we anticipate that we will assume the gaming operations at the casino. We cannot be certain we will be able to obtain the necessary licenses on a timely basis or at all.

Following effectiveness of this registration statement, the Company will be required to file annual, quarterly and current reports and other information with the SEC. You may read and copy any reports, statements or other information filed by the Company at the SEC’s public reference facilities at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. The Company’s filings are also available to the public from commercial document retrieval services and at the world wide web site maintained by the SEC at http://www.sec.gov.

5

OVERVIEW OF HARD ROCK HOTEL & CASINO LAS VEGAS

We own and operate the Hard Rock Hotel & Casino Las Vegas, which we believe is a premier destination entertainment resort with a rock music theme. Commencing operations in 1995, the Hard Rock Hotel & Casino Las Vegas is modeled after the highly successful Hard Rock Cafe restaurant chain and is decorated with an extensive collection of rare rock and roll memorabilia. The original Hard Rock Cafe was co-founded in 1971 by Peter Morton, and the “Hard Rock” name has grown to become widely recognized throughout the world. The Hard Rock Hotel & Casino Las Vegas received numerous acclamations in 2010, including being named “One of America’s Sexiest Hotels” by Trip Advisor, and The Joint (the Hard Rock Hotel & Casino Las Vegas’ live music concert hall) being named the “Best New Major Concert Venue” by Pollstar Magazine. The property continues to retain a strong following among its target customer base, now ranging generally between the ages of 25 and 54, who seek a vibrant, energetic entertainment and gaming experience with the services and amenities associated with a boutique luxury resort hotel.

In 2009, the majority of a large-scale expansion project was completed at the Hard Rock Hotel & Casino Las Vegas. The expansion included the addition of approximately 865 guest rooms and suites, approximately 490 of which are in the Paradise Tower that opened in July 2009 and the remaining approximately 375 of which are in the all-suite HRH Tower that opened in late December 2009. As part of the expansion project, in April 2009, approximately 74,000 square feet of additional meeting and convention space, several new food and beverage outlets and a new and larger live concert venue, The Joint, was opened. In December 2009, approximately 30,000 square feet of new casino space, a new spa, salon and fitness center, named Reliquary and a new nightclub, named Vanity was opened at the Hard Rock Hotel & Casino Las Vegas. The expansion project also included upgrades to existing suites, restaurants and bars, retail shops and common areas, each of which were completed in 2008. This expansion focused on retaining the heart and soul that we believe has made the Hard Rock Hotel & Casino Las Vegas the icon that it is today, and preserving an intimate and exclusive environment with unique advantages such as a world-class pool and a comfortable boutique feel. In March 2010, an expanded hotel pool, outdoor gaming and additional food and beverage outlets were opened, which completed the remaining portions of the expansion project as scheduled and within the parameters of the original budget.

The Hard Rock Hotel & Casino Las Vegas currently consists of:

| | • | | three hotel towers with approximately 1,500 stylishly furnished hotel rooms averaging approximately 500 square feet in size (including 450 suites, nine penthouses, 10 pool villas and eight multi-level spa villas); |

| | • | | an approximately 60,000 square-foot uniquely styled casino with approximately 599 slot machines, approximately 80 table games and five poker tables for Las Vegas locals, as well as tourists, where rock music is played continuously to provide the casino with an energetic and entertaining, club-like atmosphere; |

| | • | | an approximately 3,000 square-foot high-end Lounge with a connected bar; |

| | • | | an approximately 3,600 square-foot retail store, a jewelry store and a lingerie store; |

| | • | | an approximately 15,400 square-foot night club, called “Vanity,” with a capacity of 1,400 persons; |

| | • | | approximately 80,000 square feet of banquet and meeting facilities; |

| | • | | a live music concert hall, called “The Joint,” with a capacity of 4,100 persons; |

| | • | | a beach club encompassing nearly 5 acres, including “The Beach Club” and “Rehab pool”; |

| | • | | seven high quality restaurants at multiple price points (Nobu Las Vegas, LTO, 35 Steaks and Martinis, Pink Taco, Johnny Smalls, Espumoso Caffe and Mr. Lucky’s) and a Starbucks; |

6

| | • | | nine cocktail lounges, including two circular lounges, called “Luxe Bar” and “Center Bar,” that are surrounded by the gaming floor; and |

| | • | | an approximately 21,000 square-foot spa, salon and fitness center, called “Reliquary,” and an approximately 8,000 square-foot health club, called “The Rock Fitness Center.” |

BUSINESS STRATEGY

We aim to uniquely position the Hard Rock Hotel & Casino Las Vegas within the Las Vegas hotel, resort and casino industry. Our primary business and marketing strategies center on creating a vibrant and energetic entertainment and gaming environment that appeals to a customer base of youthful and “hip” individuals. We leverage certain of our strengths, including a theme consistent with the “Hard Rock” brand and our vibrant atmosphere and personalized service, to differentiate the Hard Rock Hotel & Casino Las Vegas from the substantially larger “mega resorts” approximately one mile west on the Las Vegas Strip. Key elements of our business strategy include the following.

Target Clientele

We believe that we have successfully differentiated the Hard Rock Hotel & Casino Las Vegas in the Las Vegas market by targeting a predominantly youthful and “hip” customer base that consists primarily of rock music fans and youthful individuals, as well as actors, musicians and other members of the entertainment industry. To attract this target audience, we promote the Hard Rock Hotel & Casino Las Vegas as “the place to be” in Las Vegas. The “Hard Rock Hotel” and “Hard Rock Casino” trademarks, along with an extensive network of contacts in the music and entertainment industry, have helped to attract a number of famous actors, musicians and celebrities to the Hard Rock Hotel & Casino Las Vegas. We believe this customer base is comprised of demographic groups that remain underserved by competing facilities despite recent competition from other properties in Las Vegas.

Entertainment

We believe that our live music venue The Joint’s concerts and the Hard Rock Hotel & Casino Las Vegas’ special events generate significant worldwide publicity and reinforce the Hard Rock Hotel & Casino Las Vegas’ marquee image and unique position in the Las Vegas marketplace and provide an added source of visitors for the hotel, casino, retail and food and beverage operations.

Gaming Mix Targeted To Customer Base

Our casino houses approximately 599 slot machines, 80 table games, five poker tables and up to an approximately 5,836 square-foot race and sports book. Our target gaming customer has a higher propensity to play table games and we strive to create a fun and enthusiastic gaming environment through the use of music themed gaming chips and playing surfaces and by promoting interaction between table game dealers and customers. The casino also features the latest slot machines, some of which reflect the Hard Rock Hotel & Casino Las Vegas’ rock music theme, as well as more traditional machines.

Significant Revenues From Non-Gaming Operations

We derive significant revenues from non-gaming operations. Our hotel, beach clubs, retail, food and beverage, and other operations allow us to market the Hard Rock Hotel & Casino Las Vegas as a full-service destination. Our diversified revenue base should allow us to be less dependent on the casino as a source of revenues and profits once we have assumed the operation of the gaming facility at the Hard Rock Hotel & Casino Las Vegas. We believe this diversified revenue base may result in less volatility in our earnings.

Emphasis on Customer Service

We believe that one of the cornerstones of our business strategy is providing our customers with a high level of personal service. Our employees are trained to interact with guests and continually strive to instill in our

7

employees a dedication to superior service designed to exceed guests’ expectations. We regularly gather and respond to feedback regarding customer satisfaction.

LOCATION

The Hard Rock Hotel & Casino Las Vegas occupies what we believe is one of the most highly visible and easily accessible sites in Las Vegas. The Hard Rock Hotel & Casino Las Vegas is located on approximately 30 acres of land near the intersection of Paradise Road and Harmon Avenue, approximately two miles from McCarran International Airport and approximately one mile east of the Las Vegas Strip, the main tourist area in Las Vegas. We believe the Hard Rock Hotel & Casino Las Vegas represents an attractive alternative for tourists, business travelers and locals who wish to maintain close and easy access to the Las Vegas Strip, while avoiding its crowds and congestion. We believe the Hard Rock Hotel & Casino Las Vegas’ location is particularly attractive due to its proximity to:

| | • | | a high concentration of popular Las Vegas restaurants and nightclubs; |

| | • | | the Las Vegas Convention Center; |

| | • | | the Thomas & Mack Center at the University of Nevada Las Vegas, Las Vegas’ primary sporting and special events arena; and |

| | • | | a number of non-gaming hotels, which have an aggregate of more than 1,000 guest rooms. |

THE HARD ROCK HOTEL & CASINO LAS VEGAS

The Hard Rock Hotel & Casino Las Vegas currently consists of the hotel, casino, retail stores, Vanity, banquet and meeting facilities, The Joint, The Beach Club, Rehab pool, seven restaurants, nine cocktail lounges, Reliquary Spa, The Rock Fitness Center and a Starbucks.

The Hotel

The Hard Rock Hotel & Casino Las Vegas’ three towers consist of approximately 1,500 hotel rooms, 450 or approximately 30% of which are suites, including nine penthouses, 10 pool villas and eight multi-level spa villas. The hotel rooms average approximately 500 square feet, which is larger than the average Las Vegas hotel room. Consistent with the Hard Rock Hotel & Casino Las Vegas’ distinctive decor, the hotel rooms are stylishly furnished, with oversized bathrooms, pedestal beds with leather headboards and photos of famous rock musicians. The rooms also include special amenities such as large 40-plus inch flat screen televisions with high speed internet access, stereo systems and, in certain cases, French doors that open to the outdoors and/or personal iPod compatible sound systems. A full-service concierge and 24-hour room service are available to all guests of the hotel.

The following table illustrates certain historical information relating to our hotel for the nine months ended September 30, 2011 and years ended December 31, 2010, 2009 and 2008:

| | | | | | | | | | | | | | | | |

| | | Year Ended | |

| | | Nine Months Ended

September 30, 2011 | | | December 31,

2010 | | | December 31

2009 | | | December 31,

2008 | |

Average number of hotel rooms | | | 1,505 | | | | 1,492 | | | | 742 | | | | 612 | |

Average occupancy rate (1) | | | 81.8 | % | | | 78.3 | % | | | 88.2 | % | | | 91.7 | % |

Average daily rate (1) | | $ | 135 | | | $ | 128 | | | $ | 135 | | | $ | 190 | |

Revenues per available room (2) | | $ | 112 | | | $ | 102 | | | $ | 121 | | | $ | 174 | |

| (1) | The Company calculates (a) average daily rate by dividing total daily lodging revenue by total daily rooms rented and (b) average occupancy rate by dividing total rooms occupied by total number of rooms available. The Company accounts for lodging revenue on a daily basis. As is customary for companies in the gaming industry, average occupancy rate and average daily rate include rooms provided on a |

8

| | complimentary basis. Rooms provided on a complimentary basis include rooms provided free of charge or at a discount to the rate normally charged to customers as an incentive to use the casino. Complimentary rooms reduces average daily rate for a given period to the extent the provision of such rooms reduces the amount of revenue the Company would otherwise receive. The Company does not separately account for the number of occupied rooms that are provided on a complimentary basis, and obtaining such information would require unreasonable effort and expense within the meaning of Rule 12b-21 under the Exchange Act. |

| (2) | The Company calculates revenues per available room by dividing total lodging revenue by total rooms available for rent. |

The Casino

Gaming operations at the Hard Rock Hotel & Casino Las Vegas are currently operated by LVHR pursuant to the Casino Lease dated as of March 1, 2011 between LVHR, as Tenant, and HRHH Hotel/Casino, as Landlord. Pursuant to the Management Agreement (Gaming Operations) dated as of March 1, 2011 between LVHR and WG-Harmon (the “Management Agreement”), WG-Harmon will manage the gaming operations at the Hard Rock Hotel & Casino Las Vegas for LVHR. We anticipate that we will assume gaming operations at the Hard Rock Hotel & Casino Las Vegas once we receive approval from and are licensed by the Nevada Gaming Authorities. In April, 2011, the Company applied to the Nevada Gaming Authorities for all required approvals and licenses to assume the gaming operations at the Hard Rock Hotel & Casino Las Vegas. Since the submission of applications, the Company and the required individuals have diligently pursued such required approvals and anticipate appearances before the Nevada Gaming Authorities in December 2011. We cannot be certain we will obtain all required approvals and licenses on a timely basis or at all. See “—Nevada Gaming Regulation and Licensing” and “—Agreements Governing the Operation of the Hard Rock Hotel & Casino Las Vegas—Management Agreement.”

We believe that the innovative, distinctive style of the 60,000 square-foot casino at the Hard Rock Hotel & Casino Las Vegas is a major attraction for both Las Vegas visitors and local residents. The casino is designed with an innovative layout around two lounges, Luxe Bar and Center Bar, which allows the casino’s patrons to see and be seen from nearly every area of the casino. Rock music is played continuously to provide the casino with an energetic and entertaining club-like atmosphere. In addition, the casino promotes a friendly, intimate atmosphere by encouraging its employees to smile at and interact with casino players. Dealers, for example, are encouraged to “High Five” winning players.

The casino houses approximately 80 table games including 57 Blackjack tables, seven Craps tables, six Roulette tables, two Mini-Baccarat tables, two Three Card Poker tables, one Let-it-Ride table, one Ultimate Texas Holdem table, two Switch Blackjack tables, two Pai Gow Poker tables, 599 slot machines, five poker tables, and a new, state of the art up to 5,836 square-foot race and sports book that opened February 3 of this year. The race and sports book is operated by Cantor G&W (Nevada), L.P. (“Cantor Gaming”) under a lease arrangement. Some of the casino’s gaming chips are themed to coincide with current concerts and the casino also offers patrons other attractions, such as cutting edge slot technology, proprietary slot graphics and distinctive slot signage.

Retail

The Hard Rock Hotel & Casino Las Vegas’ retail operations consist of a 3,600 square-foot retail shop. Visitors may purchase clothing and other accessories, including merchandise displaying the popular “Hard Rock Hotel” and “HRH” logos, from the retail shop and from a sundry store located in the Hard Rock Hotel & Casino Las Vegas. Our retail operations offer a convenient and inexpensive outlet to market and advertise the “Hard Rock Hotel” trademark and attract other Las Vegas visitors to the Hard Rock Hotel & Casino Las Vegas. Our in-house design team is responsible for maintaining the consistency of the Hard Rock Hotel & Casino Las Vegas’ image while creating new merchandise to expand and diversify the retail selection.

Vanity

On December 31, 2009, the Company opened a new 15,400 square-foot night club, Vanity. The venue features two marble bars, a sunken dance floor, 50 intimate VIP booths, an outdoor terrace, including five cabanas, and a women’s lounge.

9

Banquet and Meeting Facilities

Our 80,000 square-foot conference center and entertainment areas have capacity to accommodate groups of up to 3,000 persons. The banquet facility is located adjacent to The Joint and can accommodate one large event/group or has the capability of being separated into smaller convention spaces.

The Joint

The Joint is a live music venue with a capacity of 4,100 that draws audiences from Las Vegas visitors and local residents. In 2009, the original 2,000-person capacity Joint was closed and a new $60.0 million The Joint with over double the capacity was opened. In addition to increased capacity, The Joint includes enhanced production capabilities and a high-end VIP level.

Rehab Pool

The Rehab pool features a 300-foot long, sand bottomed pool with a water slide, a water fall, a running stream and underwater rock music. The Rehab pool also features beaches with white sand imported from Monterey, California, rock outcroppings and whirlpools. In addition, the Rehab pool features swim-up blackjack, a bar and grill, 42 Tahitian-style private cabanas, and a removable dance floor that extends from one of the beach areas, providing the perfect party space amid thousands of tons of imported sand. The private cabanas include water misters, a refrigerator, a safe, a television and (for an additional fee) an on-site massage service.

The Beach Club

As part of the expansion project, The Beach Club (formerly known as the “HRH Beach Club”) was opened that nearly doubles the pool vicinity to encompass five acres. The Beach Club features an expansive pool area, sandy beach, 17 daybeds and 24 luxury cabanas, a unique island pool, a Bar & Grill, eight luxurious Spa Villas, swim-up blackjack and a gaming lounge.

Food and Beverage

The Hard Rock Hotel & Casino Las Vegas offers its patrons a selection of high-quality food and beverages at multiple price points. The Hard Rock Hotel & Casino Las Vegas’ food and beverage operations include seven restaurants (LTO, 35 Steaks and Martinis, Johnny Smalls, Pink Taco, Mr. Lucky’s, Espumoso Caffe and Nobu Las Vegas), nine bars (Luxe Bar, Lobby Lounge Bar, Midway Bar, Sports Deluxe, Juice Bar, The Bar, The Lounge and Center Bar), four bars in The Joint, a bar at the Rehab pool, a bar at The Beach Club and catering service for corporate events, conventions, banquets and parties. 35 Steaks and Martinis, with seating capacity of approximately 167 persons, is a unique marriage of traditional steakhouse cuisine and libations, complemented with clean, classic yet cutting edge design. Pink Taco, with seating capacity of approximately 214 persons, is a stylish, authentic Mexican eatery with seasonal outside dining. Mr. Lucky’s, a 24-hour restaurant with seating capacity for approximately 200 persons, specializes in high-quality, moderately priced American cuisine. Nobu Las Vegas, with seating capacity of approximately 300 persons, is an upscale Japanese restaurant created by renowned chef Nobu Matsuhisa and serves traditional Japanese cuisine infused with South American and Western flavors. Nobu Las Vegas is owned and operated independently of the Hard Rock Hotel & Casino Las Vegas. LTO, with a seating capacity of approximately 120 persons, is a casual eatery that features Italian dishes, such as pizza, sandwiches and pasta. Johnny Smalls, with a seating capacity of 132, offers small plates and big fun with a menu of more than 50 shareable dishes encompassing Spanish tapas, Italian antipasti, Mediterranean mezze, Mexican antojitos, classic American starters and zesty original skewers. Espumoso Caffe, a Latin-infused coffee house, with a seating capacity of approximately 20, that offers a diverse array of organic coffees, loose leaf teas, house made panini’s, empanadas, Italian gelato, freshly-blended smoothies and European pastries.

10

Reliquary

Our new spa, salon and fitness center, which opened in late December 2009, features a 1,500 square-foot Roman bath, 21 treatment rooms, including couples facilities and hydro therapy rooms, a fitness room with CYBEX machines and a Spa Bar.

The Rock Fitness Center

Our health club facility features amenities such as treadmills, stair-masters, stationary bicycles, CYBEX machines and a variety of free weights.

Banquets and Corporate Events

The Hard Rock Hotel & Casino Las Vegas hosts a number of corporate events, conventions, banquets and private parties for up to 3,000 persons. Depending upon the size of the event, customers can choose to host their corporate functions, conventions and banquets indoors at The Joint or Ballrooms, or outdoors, around one of our four swimming pools and beach clubs.

MARKETING

Our marketing efforts are targeted at both the visitor market (tourists and business travelers) as well as local patrons. Our marketing department uses both traditional and innovative marketing strategies to promote the “Hard Rock Hotel” and “Hard Rock Casino” trademarks. We employ targeted marketing programs through the use of the proprietary database acquired in February 2007. The Hard Rock Hotel & Casino Las Vegas is aggressively marketed not only through domestic and international public relations activities, direct mail, online, print, outdoor and broadcast advertising, but also through special arrangements with various members of the entertainment industry. The Hard Rock Hotel & Casino Las Vegas hosts many well-publicized and televised events such as The Real World Las Vegas.

The casino marketing also maintains the Rockstar Player’s Club program for casino guests. The Rockstar Player’s Club loyalty program utilizes a casino player tracking card. The program, which is available to all casino visitors, tracks each patron’s gaming record, and based upon the level of gaming activity, members may become eligible for discounted or complimentary services, invitations to special events and merchandise at the Hard Rock Hotel & Casino Las Vegas.

We target local residents through direct mail advertising as well as through hosting special events and parties specifically geared to the local population. In addition, we believe the recent property developments and enhancements to the off-Las Vegas Strip location help attract local residents to the Hard Rock Hotel & Casino Las Vegas.

TRADEMARKS

“Hard Rock Hotel” and “Hard Rock Casino” are registered trademarks owned by Hard Rock Cafe International (USA), Inc. (“HRCI”), which we understand is controlled by the Seminole Tribe of Florida. We are successors in interest to a license agreement obtained from HRCI’s predecessors (the “Hard Rock License”) that, in substance, grants us the exclusive, royalty-free and perpetual right to use and exploit these trademarks in connection with hotel/casino operations or casino operations in certain geographic areas, defined in the Hard Rock License as the “Morton Territories.” The Morton Territories include the State of Illinois and all states and possessions of the United States that are located west of the Mississippi River, including the entire state of Louisiana, but excluding Texas, except for the Greater Houston Area. The Morton Territories also include the nations of Australia, Brazil, Israel and Venezuela, and the Greater Vancouver Area, British Columbia, Canada. In addition, under the Hard Rock License we have the right to sell licensed merchandise bearing the geographic location where it is sold in stores located in or contiguous to a Hard Rock Hotel/Casino or a Hard Rock Casino.

Our subsidiary HRHH IP is currently one of a number of defendants (“Defendants”) in an action commenced by HRCI on September 21, 2010 in the United States District Court for the Southern District of New York, captioned Hard Rock Café International (USA), Inc. v. Hard Rock Hotel Holdings, LLC, et al. (the “Hard Rock IP Action”). HRCI filed an amended complaint in the Hard Rock IP Action on November 23, 2010. HRCI claims that Defendants owe it damages and profits, and seeks an injunction prohibiting further use of various HRCI trademarks as well as termination of the Hard Rock License. The gravamen of the Hard Rock IP Action is that Defendants allegedly have engaged in various conduct that infringes and dilutes HRCI’s trademarks and/or violates the Hard Rock License. The amended complaint purports to state claims for breach of contract, federal trademark dilution, federal trademark infringement, unfair competition, New York trademark dilution, common law trademark infringement and common law unfair competition. See “Risk Factors—Risks Related to Our Business—Litigation relating to our use of the “Hard Rock” trademarks could have a material effect on our business and results of operations.” and “Legal Proceedings.” The Hard Rock IP Action presently is in settlement discussions and a court-supervised process of mediation. A negative outcome in the Hard Rock IP Action could have a material effect on our business and results of operations, potentially including an award of monetary damages and/or the termination of the Hard Rock License and with it our right to utilize any “Hard Rock” trademarks.

11

On November 11, 2008, HRH Holdings executed a license agreement with Cherokee Nation Enterprises, LLC (“CNE”), an entity indirectly wholly owned by the Cherokee Nation. Pursuant to the license agreement, we have agreed to sublicense certain intellectual property, including the “Hard Rock Hotel” and “Hard Rock Casino” trademarks, to CNE in connection with a hotel and a casino that CNE opened in Catoosa, Oklahoma. Under the terms of the license agreement, CNE has agreed to pay us a certain percentage of its annual gross revenues based on the performance of its Hard Rock Hotel/Casino as well as certain other license fees. On February 17, 2009, HRH Holdings received notice from the National Indian Gaming Commission (the “NIGC”) that the CNE license agreement (i) is not a management agreement requiring the NIGC Chairman’s approval under the Indian Gaming Regulatory Act, and (ii) does not provide us or any other party with an impermissible proprietary interest in Indian gaming. The CNE license agreement became effective upon receipt of this NIGC notice.

On October 13, 2009, HRH Holdings executed a license agreement with the Pueblo of Isleta (“Isleta”). Pursuant to the Isleta license agreement, the Company sublicenses certain intellectual property, including the “Hard Rock Hotel” and “Hard Rock Casino” trademarks, to Isleta in connection with a hotel and a casino that Isleta opened in Albuquerque, New Mexico. Under the terms of the Isleta license agreement, Isleta has agreed to pay us a certain percentage of its annual gross revenues based on the performance of its Hard Rock Hotel/Casino as well as certain other license fees. Similar to the CNE license agreement, the effectiveness of the Isleta license agreement was conditioned upon receipt of confirmation from the NIGC that the Isleta license agreement does not require its approval. On December 9, 2009, HRH Holdings received notice from the NIGC that the Isleta license agreement does not constitute a management contract and does not need to be approved by the NIGC Chairman. The Isleta license agreement became effective upon receipt of this NIGC notice.

The Company currently expects to enter into additional sublicenses with parties located in California and elsewhere on certain Native American owned lands, pursuant to the right provided by the Hard Rock Licenses. However, no definitive agreements have been entered into as of the date hereof.

LAS VEGAS MARKET

During 2010, according to the Las Vegas Convention and Visitors Authority (the “LVCVA”), gaming revenues in Clark County increased 0.8% to approximately $8.9 billion from $8.8 billion in 2009. In addition, according to the LVCVA:

| | • | | the number of visitors traveling to Las Vegas was approximately 37.3 million in 2010, representing a compound annual growth rate of approximately 3.2% since 1989’s 18.1 million visitors; |

| | • | | the aggregate expenditures by Las Vegas visitors was $35.2 billion in 2009 and $10.0 billion in 1988, representing a compound annual growth rate of 5.6%; and |

| | • | | the number of hotel and motel rooms in Las Vegas was 67,391 in 1989 and 148,935 in 2010, representing a compound annual growth rate of approximately 3.8%. |

The Las Vegas market has been adversely affected by weakness in the United States economy. This economic trend negatively impacted our operating results for the year ended December 31, 2010, as we experienced lower visitation at our property and strategically lowered room prices to maximize occupancy levels. We expect the trend to continue for some portion, if not all, of 2011 and that it could adversely affect our revenue in future periods.

The following table sets forth certain statistical information for the Las Vegas market for the years 2006 through 2010, as reported by the LVCVA.

12

LAS VEGAS MARKET STATISTICS

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Jan 1 to

Sept 30,

2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

Visitor Volume (in thousands) | | | 29,523 | | | | 37,335 | | | | 36,351 | | | | 37,482 | | | | 39,197 | | | | 38,915 | |

Clark County Gaming Revenues (in millions) | | $ | 6,872 | | | $ | 8,908 | | | $ | 8,838 | | | $ | 9,797 | | | $ | 10,868 | | | $ | 10,643 | |

Hotel/Motel Rooms | | | 150,425 | | | | 148,935 | | | | 148,941 | | | | 140,529 | | | | 132,947 | | | | 132,605 | |

Airport Passenger Traffic (in thousands) | | | 31,212 | | | | 39,757 | | | | 40,469 | | | | 44,075 | | | | 47,728 | | | | 46,193 | |

Convention Attendance (in thousands) | | | 3,875 | | | | 4,473 | | | | 4,492 | | | | 5,900 | | | | 6,209 | | | | 6,308 | |

COMPETITION

The hotel and casino industry in general, and the markets in which we compete in particular, are highly competitive. The Hard Rock Hotel & Casino Las Vegas, located less than one mile east of the Las Vegas Strip, competes with other high-quality Las Vegas resorts and other Las Vegas hotel casinos, including those located on the Las Vegas Strip, on the basis of overall atmosphere, range of amenities, price, location, entertainment offered, theme and size. Many of these Las Vegas resorts seek to attract customers to their properties by not only offering casino gaming, but also by providing hotel accommodations, food and beverage outlets, retail stores and other related amenities. To the extent that the Hard Rock Hotel & Casino Las Vegas seeks to enhance its revenue base by offering its own various resort amenities, it competes with the service offerings provided by these Las Vegas resorts. Some of these hotel casinos are operated by companies that have more than one operating facility and may have greater name recognition and financial and marketing resources than we do and market to the same target demographic group. There can be no assurance the Las Vegas market will show future growth or hotel casinos will continue to be popular. In the event we lose market share due to competition or there is a continued decline or sustained leveling off of the growth or popularity of gaming facilities generally, this would adversely affect our financial condition and results of operations.

We face additional competition from HRCI, which pursuant to the Hard Rock License may open competing “Hard Rock” hotels in jurisdictions other than Nevada and may open “Hard Rock” hotel/casinos in jurisdictions other than the Morton Territories. For example, HRCI uses or licenses the use of the “Hard Rock” name in connection with its Seminole Hard Rock Hotels in Hollywood and Tampa, Florida and a number of other Hard Rock Hotels or Hotel-Casinos. There can be no assurance that our business and results of operations will not be adversely affected by the management or the enforcement of the “Hard Rock” brand name by parties outside of our control.

The Hard Rock Hotel & Casino Las Vegas also competes with hotel casinos in the Mesquite, Laughlin, Reno and Lake Tahoe areas of Nevada, and in a growing number of other jurisdictions in which gaming is now permitted. The Hard Rock Hotel & Casino Las Vegas also competes with state-sponsored lotteries, on- and off-track wagering, card parlors, riverboat and Native American gaming ventures, and other forms of legalized gaming in the United States, as well as with gaming on cruise ships, Internet gaming ventures and international gaming operations. In 1998, California enacted The Tribal Government Gaming and Economic Self-Sufficiency Act (the “Tribal Act”). The Tribal Act provides a mechanism for federally recognized Native American tribes to conduct certain types of gaming on their land. The California electorate approved Proposition 1A on March 7, 2000. Proposition 1A gives all California Indian tribes the right to operate a limited number of certain kinds of gaming machines and other forms of casino wagering on California Indian reservations. In February 2008, additional propositions were approved in California permitting certain Indian tribes to increase the number of slot machines on their properties. Continued proliferation of gaming activities permitted by Proposition 1A may materially negatively affect Nevada gaming markets and our financial position and results of operations. We are currently unable, however, to assess the magnitude of the specific impact on us. See “Risk Factors—Risks Related to Our Business—We face intense local competition which could impact our operations and adversely affect our business and results of operations.”

13

EMPLOYEES

As of September 30, 2011, we had 1,419 full-time employees and 770 on-call and seasonal employees who are employed on an as-needed basis. Except as set out below, none of our employees are represented by unions. On November 6, 2009 the National Labor Relations Board conducted an election to determine whether approximately 35 valet employees wished to be represented by the Teamsters Union. Although the National Labor Relations Board initially ruled that a majority of the voters chose the union, the Company has filed a legal challenge to the conduct of the election and therefore the election result is not final. We have been approached by other unions on various occasions and cannot be certain that one or more unions will not approach our employees. We consider our relations with our employees to be good and have never experienced an organized work stoppage, strike or labor dispute.

NEVADA GAMING REGULATION AND LICENSING

Introduction

The gaming industry is highly regulated. Gaming registrations, licenses and approvals, once obtained, can be suspended or revoked for a variety of reasons. We cannot be certain that we will obtain all required, registrations, licenses and approvals on a timely basis or at all, or that, once obtained, the registrations, findings of suitability, licenses and approvals will not be suspended, conditioned, limited or revoked. The ownership and operation of casino gaming facilities in the State of Nevada are subject to the Nevada Gaming Control Act and the regulations made under such Act, as well as to various local ordinances (the “Nevada Gaming Control Act”). The Hard Rock Hotel & Casino Las Vegas is subject to the licensing and regulatory control of the Nevada Gaming Authorities.

Owner and Operator Licensing Requirements

We have applied for approval and the required licenses from the Nevada Gaming Authorities to acquire and own the equity securities of LVHR. LVHR currently holds all of the licenses necessary to operate the gaming-related activities at the Hard Rock Hotel & Casino Las Vegas as a nonrestricted licensee, which we may refer to herein as a company licensee. If we are granted the approvals and licenses necessary to acquire and own the equity securities of LVHR, it must continue to pay periodic fees and taxes. The gaming licenses are not transferable. If we are granted the approvals and licenses necessary to acquire and own the equity securities of LVHR, we will cause the merger of HRHH Gaming with and into LVHR and change the name of LVHR to HRHH Gaming. Since the submission of applications, the Company and the required individuals have diligently pursued such required approvals and anticipate appearances before the Nevada Gaming Authorities in December 2011. We anticipate that we will assume operation of the gaming facilities at the Hard Rock Hotel & Casino Las Vegas as soon as practicable after we receive approval from and are licensed by the Nevada Gaming Authorities. We cannot be certain that we will be able to obtain all approvals and licenses from the Nevada Gaming Authorities on a timely basis or at all.

Company Registration Requirements

In connection with our obtaining approvals and licenses to acquire and own the equity securities of LVHR, our Class A members are required to apply to, and be found suitable by, the Nevada Commission to own our voting securities, and we are required to be registered by the Nevada Commission as a “publicly traded corporation,” which we refer to herein as a registered company, for the purposes of the Nevada Gaming Control Act. The Company and its subsidiaries in the line of ownership of LVHR are also required to apply to, and be found suitable by the Nevada Commission to own the equity interests of their respective subsidiaries and to be registered by the Nevada Commission as intermediary companies. All of the required applications by the prospective registrants have been filed. In April, 2011, the Company applied to the Nevada Gaming Authorities for all required approvals and licenses to assume the gaming operations at the Hard Rock Hotel & Casino Las Vegas. Since the submission of applications, the Company and the required individuals have diligently pursued such required approvals and anticipate appearances before the Nevada Gaming Authorities in December 2011. We anticipate that we will assume operation of the gaming facilities at the Hard Rock Hotel & Casino Las Vegas as soon as practicable after we receive approval from and are licensed by the Nevada Gaming Authorities.

Once we have been registered by the Nevada Commission, we will be required to submit detailed financial and operating reports to the Nevada Commission and provide any other information that the Nevada Commission may require. Substantially all of our material loans, leases, sales of securities and similar financing transactions must be reported to, or approved by, the Nevada Commission.

14

Individual Licensing Requirements

No person may become a stockholder of, or receive any percentage of the profits of, a registered intermediary company or company licensee without first obtaining licenses and approvals from the Nevada Gaming Authorities. The Nevada Gaming Authorities may investigate any individual who has a material relationship to or material involvement with us to determine whether the individual is suitable or should be licensed as a business associate of a gaming licensee. The Company and the members and managers of BREF Management have filed applications with the Nevada Gaming Authorities and may be required to be licensed or found suitable by the Nevada Gaming Authorities. The Nevada Gaming Authorities may deny an application for licensing for any cause which they deem reasonable. A finding of suitability is comparable to licensing, and both require submission of detailed personal and financial information followed by a thorough investigation. An applicant for licensing or an applicant for a finding of suitability must pay or must cause to be paid all the costs of the investigation. Changes in licensed positions must be reported to the Nevada Gaming Authorities and, in addition to their authority to deny an application for a finding of suitability or licensing, the Nevada Gaming Authorities have the jurisdiction to disapprove a change in a corporate position.

If the Nevada Gaming Authorities were to find an officer or director or a member or manager of BREF Management, as applicable, or a key employee unsuitable for licensing or unsuitable to continue having a relationship with us, we would have to sever all relationships with that person. In addition, the Nevada Commission may require us to terminate the employment of any person who refuses to file appropriate applications. Determinations of suitability or questions pertaining to licensing are not subject to judicial review in Nevada.

Consequences of Violating Gaming Laws

If the Nevada Commission decides that we have violated the Nevada Gaming Control Act or any of its regulations, it could limit, condition, suspend or revoke our applications, or registrations and gaming license. In addition, we and the persons involved could be subject to substantial fines for each separate violation of the Nevada Gaming Control Act at the discretion of the Nevada Commission. Further, the Nevada Commission could appoint a supervisor to operate the gaming-related activities at the Hard Rock Hotel & Casino Las Vegas and, under specified circumstances, earnings generated during the supervisor’s appointment (except for the reasonable rental value of the premises) could be forfeited to the State of Nevada. Limitation, conditioning or suspension of any gaming licenses obtained and the appointment of a supervisor could, and revocation of any such gaming license would, have a significant negative effect on our gaming operations.

Requirements for Security Holders

Regardless of the number of shares or other interests held, any beneficial holder of the voting or non-voting securities of a registered company may be required to file an application, be investigated and have that person’s suitability as a beneficial holder of voting or non-voting securities determined if the Nevada Commission has reason to believe that the ownership would otherwise be inconsistent with the declared policies of the State of Nevada. If the beneficial holder of such securities who must be found suitable is a corporation, partnership, limited partnership, limited liability company or trust, it must submit detailed business and financial information including a list of its beneficial owners. The applicant must pay all costs of the investigation incurred by the Nevada Gaming Authorities in conducting any investigation.

The Nevada Gaming Control Act requires any person who acquires more than 5% of the voting securities of a registered company to report the acquisition to the Nevada Commission. The Nevada Gaming Control Act requires beneficial owners of more than 10% of a registered company’s voting securities to apply to the Nevada Commission for a finding of suitability within 30 days after the Chairman of the Nevada Board mails the written notice requiring such filing. However, an “institutional investor,” as defined in the Nevada Gaming Control Act, which beneficially owns more than 10% but not more than 11% of a registered company’s voting securities as a result of a stock repurchase by the registered company may not be required to file such an application. Further, an institutional investor which acquires more than 10%, but not more than 25%, of the registered company’s voting securities may apply to the Nevada Commission for a waiver of a finding of suitability if the institutional investor holds the voting securities for investment purposes only. An institutional investor that has obtained a waiver may own more than 25% but not more than 29% of the voting securities of a registered company and maintain the waiver

15

where the additional ownership results from a stock repurchase by the registered company. An institutional investor will not be deemed to hold voting securities for investment purposes unless the voting securities were acquired and are held in the ordinary course of business as an institutional investor and not for the purpose of causing, directly or indirectly, the election of a majority of the members of the board of directors of the registered company, a change in the corporate charter, bylaws, management, policies or operations of the registered company, or any of its gaming affiliates, or any other action which the Nevada Commission finds to be inconsistent with holding the registered company’s voting securities for investment purposes only. Activities which are not deemed to be inconsistent with holding voting securities for investment purposes only include:

| | • | | voting on all matters voted on by stockholders or interest holders; |

| | • | | making financial and other inquiries of management of the type normally made by securities analysts for informational purposes and not to cause a change in its management, policies or operations; and |

| | • | | other activities that the Nevada Commission may determine to be consistent with such investment intent. |

Consequences of Being Found Unsuitable

Any person who fails or refuses to apply for a finding of suitability or a license within 30 days after being ordered to do so by the Nevada Commission or by the Chairman of the Nevada Board, or who refuses or fails to pay the investigative costs incurred by the Nevada Gaming Authorities in connection with the investigation of its application, may be found unsuitable. The same restrictions apply to a record owner if the record owner, after request, fails to identify the beneficial owner. Any person found unsuitable and who holds, directly or indirectly, any beneficial ownership of any security of a registered company beyond the period of time as may be prescribed by the Nevada Commission may be guilty of a criminal offense. We will be subject to disciplinary action if, after we receive notice that a person is unsuitable to hold an equity interest or to have any other relationship with, we:

| | • | | pay that person any dividend or interest upon any voting securities; |

| | • | | allow that person to exercise, directly or indirectly, any voting right held by that person relating to the Company; |

| | • | | pay remuneration in any form to that person for services rendered or otherwise; or |

| | • | | fail to pursue all lawful efforts to require the unsuitable person to relinquish such person’s voting securities including, if necessary, the immediate purchase of the voting securities for cash at fair market value. |

Approval of Public Offerings

A registered company may not make a public offering of its securities without the prior approval of the Nevada Commission if it intends to use the proceeds from the offering to construct, acquire or finance gaming facilities in Nevada, or to retire or extend obligations incurred for those purposes or for similar transactions. Any approval that we might receive in the future relating to future offerings will not constitute a finding, recommendation or approval by any of the Nevada Board or the Nevada Commission as to the accuracy or adequacy of the offering memorandum or the investment merits of the securities. Any representation to the contrary is unlawful.

The regulations of the Nevada Commission also provide that any entity which is not an “affiliated company,” as that term is defined in the Nevada Gaming Control Act, or which is not otherwise subject to the provisions of the Nevada Gaming Control Act, such as the Company, that plans to make a public offering of securities intending to use such securities, or the proceeds from the sale thereof, for the construction or operation of gaming facilities in Nevada, or to retire or extend obligations incurred for such purposes, may apply to the Nevada Commission for prior approval of such offering. The Nevada Commission may find an applicant unsuitable based

16

solely on the fact that it did not submit such an application, unless upon a written request for a ruling, referred to as a Ruling Request, the Chairman of the Nevada Board has ruled that it is not necessary to submit an application.

Approval of Changes in Control

We must obtain prior approval of the Nevada Commission with respect to a change in control through merger, consolidation, stock or asset acquisitions, management or consulting agreements or any act or conduct by a person by which the person obtains control of us. Entities seeking to acquire control of a registered company must satisfy the Nevada Board and Nevada Commission with respect to a variety of stringent standards before assuming control of the registered company. The Nevada Commission may also require controlling stockholders, officers, directors and other persons having a material relationship or involvement with the entity proposing to acquire control to be investigated and licensed as part of the approval process relating to the transaction.

Approval of Defensive Tactics

The Nevada legislature has declared that some corporate acquisitions opposed by management, repurchases of voting securities and corporate defense tactics affecting Nevada gaming licenses or affecting registered companies that are affiliated with the operations permitted by Nevada gaming licenses may be harmful to stable and productive corporate gaming. The Nevada Commission has established a regulatory scheme to reduce the potentially adverse effects of these business practices upon Nevada’s gaming industry and to further Nevada’s policy to:

| | • | | assure the financial stability of corporate gaming operators and their affiliates; |

| | • | | preserve the beneficial aspects of conducting business in the corporate form; and |

| | • | | promote a neutral environment for the orderly governance of corporate affairs. |

Approvals may be required from the Nevada Commission before we can make exceptional repurchases of voting securities above their current market price and before a corporate acquisition opposed by management can be consummated. The Nevada Gaming Control Act also requires prior approval of a plan of recapitalization proposed by a registered company’s board of directors in response to a tender offer made directly to its stockholders for the purpose of acquiring control.

Fees and Taxes

License fees and taxes, computed in various ways depending on the type of gaming or activity involved, are payable to the State of Nevada and to the counties and cities in which the licensed subsidiaries respective operations are conducted. Depending upon the particular fee or tax involved, these fees and taxes are payable monthly, quarterly or annually and are based upon:

| | • | | a percentage of the gross revenue received; |

| | • | | the number of gaming devices operated; or |

| | • | | the number of table games operated. |

A live entertainment tax is also paid by gaming operations where entertainment is furnished in connection with admission fees, the selling or serving of food or refreshments or the selling of merchandise.

Foreign Gaming Investigations

Any person who is licensed, required to be licensed, registered, required to be registered, or is under common control with those persons (collectively, “licensees”), and who proposes to become involved in a gaming venture outside of Nevada, is required to deposit with the Nevada Board, and thereafter maintain, a revolving fund in the amount of $10,000 to pay the expenses of investigation of the Nevada Board of the licensee’s or registrant’s

17

participation in such foreign gaming. The revolving fund is subject to increase or decrease in the discretion of the Nevada Commission. Licensees and registrants are required to comply with the reporting requirements imposed by the Nevada Gaming Control Act. A licensee or registrant is also subject to disciplinary action by the Nevada Commission if it:

| | • | | knowingly violates any laws of the foreign jurisdiction pertaining to the foreign gaming operation; |

| | • | | fails to conduct the foreign gaming operation in accordance with the standards of honesty and integrity required of Nevada gaming operations; |

| | • | | engages in any activity or enters into any association that is unsuitable because it poses an unreasonable threat to the control of gaming in Nevada, reflects or tends to reflect, discredit or disrepute upon the State of Nevada or gaming in Nevada, or is contrary to the gaming policies of Nevada; |

| | • | | engages in activities or enters into associations that are harmful to the State of Nevada or its ability to collect gaming taxes and fees; or |

| | • | | employs, contracts with or associates with a person in the foreign operation who has been denied a license or finding of suitability in Nevada on the ground of unsuitability. |

License for Conduct of Gaming and Sale of Alcoholic Beverages

The conduct of gaming activities and the service and sale of alcoholic beverages at the Hard Rock Hotel & Casino Las Vegas are subject to licensing, control and regulation by the Clark County Board. In addition to approving the licensee, the Clark County Board has the authority to approve all persons owning or controlling the stock of any business entity controlling a gaming or liquor license. All licenses are revocable and are not transferable. The Clark County Board has full power to limit, condition, suspend or revoke any license. Any disciplinary action could, and revocation of a license would, have a substantial negative impact upon the operations of the Hard Rock Hotel & Casino Las Vegas.

AGREEMENTS GOVERNING THE OPERATION OF THE HARD ROCK HOTEL & CASINO LAS VEGAS