Exhibit 99.1

Premium Master - Crafted Spirits Since 200

OTCQB:ESDI Important Cautionary Items Regarding Forward Looking Statements Except for historical information contained herein, this presentation contains forward - looking statements, which reflect the exp ectations of management of Eastside Distilling, Inc. ("Eastside") with respect to potential future events. Forward - looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such forward - looking stateme nts include, but are not limited to comments regarding; ( i ) Eastside’s plans to become a national spirits company; (ii) proposed changes in Eastside’s distilling, location and new fac ili ty, and the impact that such changes will have on Eastside’s market position, business operations and ultimate success; (iii) Eastside’s pla n to establish a relationship with a leading distributor, partner, and/or agent which will enhance scalability, and sales and marketing efforts; (iv) Eastside’s p rod uct expansion, if any; (v) Eastside’s strategic growth plan for coming years, including accelerating the growth of spirits sold on a national level; (vi) Eastside’ s p redictions of its national growth potential of the sales of its products; (vii) Eastside’s marketing initiatives, including a national campaign featuring print , b illboards, radio, television, and social media to build brand awareness and drive sales. These forward - looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements. Actual results and the timing of eve nts could differ materially from those anticipated in the forward - looking statements as a result of such risks and uncertainties, which include, without limitati on; general economic conditions and economic uncertainty in the global markets; current and continuing trends in the spirits industry; continued demand for and s ucc ess of Eastside’s products and reputation; unexpected increases in the price of raw materials or their reduced availability; Eastside’s ability to sustain i ts past growth or manage its future growth; Eastside’s ability to retain its key management personnel; continued protection of Eastside’s intellectual property; leg al, regulatory, political and economic risks; the highly competitive market for spirits and other products proposed to be developed and launched by Eastside; Eastsi de’ s inability to deliver its products to the market and to meet customer expectations due to problems with its distribution system or other unanticipated problems; Ea sts ide’s failure to obtain any future financing it requires to fund and grow its business; Eastside’s inability to expand its sales or product lines; Eastsi de’ s inability to generate growth of the sales of its current and future products; Eastside’s inability to penetrate and generate successful operations on a national level; an d other risk factors. You are urged to consider these factors carefully in evaluating the forward - looking statements contained herein and are cautioned not to place un due reliance on such forward looking statements, which are qualified in their entirety by these cautionary statements. In addition, the use of comparables in this presentation are in no way indicative of Eastside’s future financial or operating results or potential. Readers are cautioned that the foregoing factors ar e not exhaustive. Forward - looking statements in this presentation are made as of the date hereof and Eastside disclaims any intent or obligation to update publ icl y such forward - looking statements. PRESENTATION DISCLAIMER This presentation is not an offer to sell or a solicitation of an offer to purchase securities by Eastside Distilling (“Eastside”) . A ny such offer or solicitation, if any, will only be made by means of offering documents (e.g., prospectus, offering memorandum, subscription agreement and or similar doc ume nts) and only in jurisdictions where permitted by law. Certain information contained herein has been provided by or obtained from third - party sou rces and has not been independently audited or verified by Eastside. While Eastside has taken the appropriate steps to verify the accuracy of the i nfo rmation contained, the company makes no representation or warranty, express or implied as to the accuracy or completeness of such information contained in t his document, and nothing contained in this document is, or shall be relied upon as, a promise or representation by Eastside. © 2015 Eastside Distilling, Inc. All Rights Reserved 2

OTCQB:ESDI Eastside Today 3 Eastside’s portfolio of whiskeys, rums, vodka and liqueurs have received numerous industry awards & accolades Founded in 2008, Eastside Distilling is a producer of award - winning, Master Crafted Spirits Continuous innovation has created a full range of uniquely - flavored spirits Flagship distillery & tasting room on Portland’s historic Distillery Row, with local retail outlets that include Oregon’s first & only mall - based spirits tasting room Increasing demand has led to construction of new 41,000 sq. foot distillery & tasting room, designed to increase annual production capacity from 6,400 up to 1 million cases Larger distillery supports rollout of retail store tasting room concept and nationwide marketing campaign to bring our regional success to the national stage

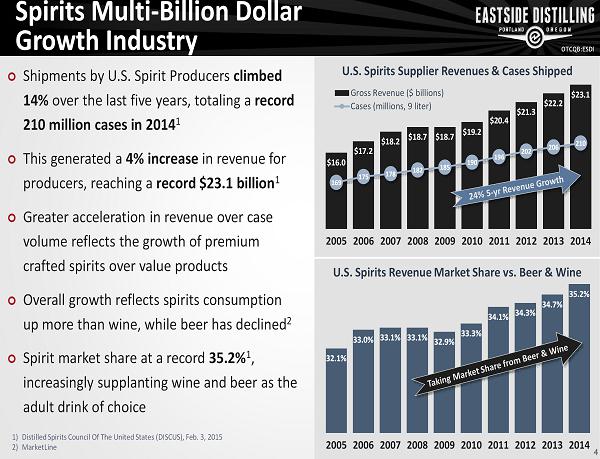

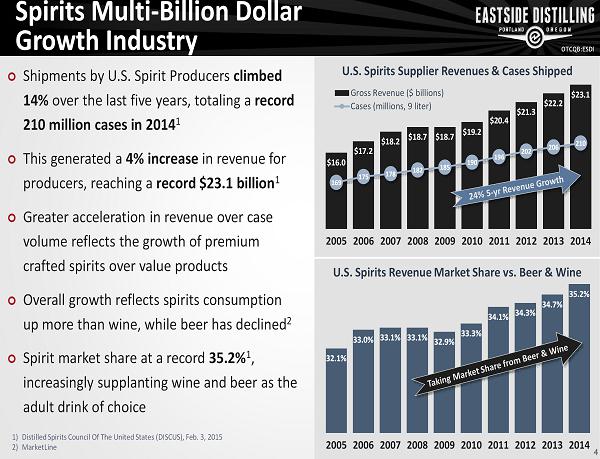

OTCQB:ESDI U.S. Spirits Supplier Revenues & Cases Shipped U.S. Spirits Revenue Market Share vs. Beer & Wine Spirits Multi - Billion Dollar Growth Industry 4 Shipments by U.S. Spirit Producers climbed 14% over the last five years, totaling a record 210 million cases in 2014 1 This generated a 4 % increase in revenue for producers, reaching a record $23.1 billion 1 Greater acceleration in revenue over case volume reflects the growth of premium crafted spirits over value products Overall growth reflects spirits consumption up more than wine, while beer has declined 2 Spirit market share at a record 35.2% 1 , increasingly supplanting wine and beer as the adult drink of choice 1) Distilled Spirits Council Of The United States ( DISCUS), Feb. 3, 2015 2) MarketLine $16.0 $17.2 $18.2 $18.7 $18.7 $19.2 $20.4 $21.3 $22.2 $23.1 169 175 178 182 185 190 196 202 206 210 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Gross Revenue ($ billions) Cases (millions, 9 liter) 32.1% 33.0% 33.1% 33.1% 32.9% 33.3% 34.1% 34.3% 34.7% 35.2% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

OTCQB:ESDI Key Industry Drivers of Growth & Market Share Expansion 5 Product innovation, especially flavored whiskeys Better access to consumers due to changing state regulations Premium products gaining favor Exports at record levels, particularly Bourbon & Whiskey Rise of the Millennials, who exhibit willingness to seek out new taste experiences and have increasing disposable income Spirits i ncreasingly preferred by women over wine, particularly flavored spirits, like cherry - flavored whiskeys W omen now account for more than 37% of whiskey drinkers in the U.S. 1) Market estimates by TTB, Park Street, US Census Bureau,

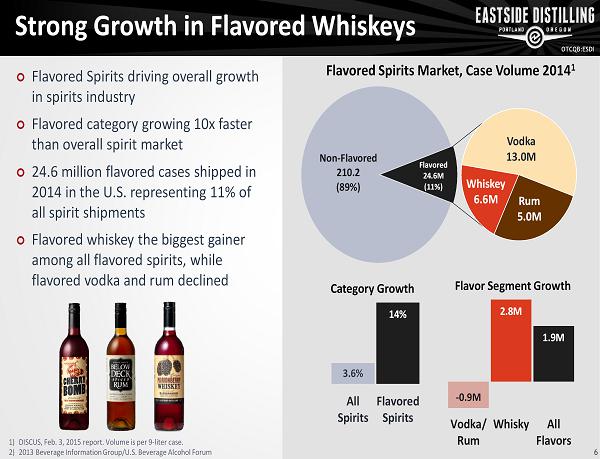

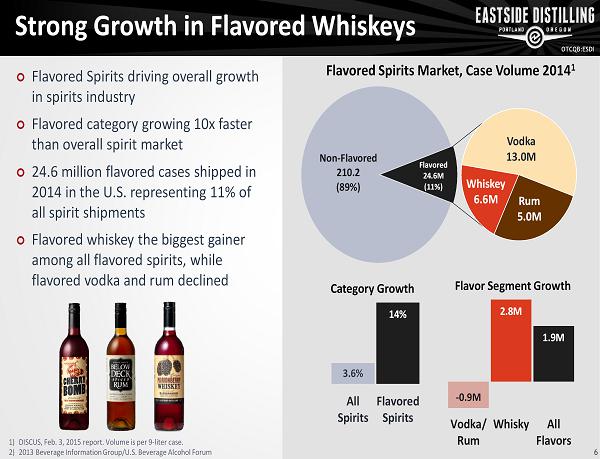

OTCQB:ESDI Strong Growth in Flavored Whiskeys 6 Flavored Spirits driving overall growth in spirits industry Flavored category growing 10x faster than overall spirit market 24.6 million flavored cases shipped in 2014 in the U.S. representing 11% of all spirit shipments Flavored whiskey the biggest gainer among all flavored spirits, while flavored vodka and rum declined Non - Flavored 210.2 ( 89% ) Whiskey 6.6M Rum 5.0M Vodka 13.0M Flavored 24.6 M ( 11% ) Flavored Spirits Market, Case Volume 2014 1 - 0.9M 2.8M 1.9M Vodka/ Rum Whisky All Flavors Flavor Segment Growth 3.6 % 14 % All Spirits Flavored Spirits Category Growth 1) DISCUS, Feb. 3, 2015 report. Volume is per 9 - liter case . 2) 2013 Beverage Information Group/U.S. Beverage Alcohol Forum

OTCQB:ESDI Fifth Straight Year of Record Spirit Exports Despite Stronger Dollar 1 Country 2004 Value (millions) 2014 Value (millions) % Growth Canada $100.6 $212.6 +111% UK $120.7 $177.6 +47% Germany $81.7 $136.7 +67% Australia $77.7 $131.2 +69% France $27.6 $111.6 +304% Japan $59 $99 +68% Spain $34.5 $82.3 +139% Netherlands $24.5 $61.2 +162% Mexico $16.8 $45.4 +170% Singapore $4.9 $31.6 +545% Growing International Opportunity 7 2014 represented five straight years of record exports by U.S. Spirit Producers, reaching $1.5 billion 1 Up 3.7% in 2014, despite stronger dollar Bourbon/Tennessee Whiskey represented ~70% of exports at $1.02 billion 1 Canada was the top importer of U.S. Spirits in 2014, taking in more than $212 million 1 1) Distilled Spirits Council Of The United States ( DISCUS), Feb. 2015 Report $1.56B 2006 2007 2008 2009 2010 2011 2012 2013 2014

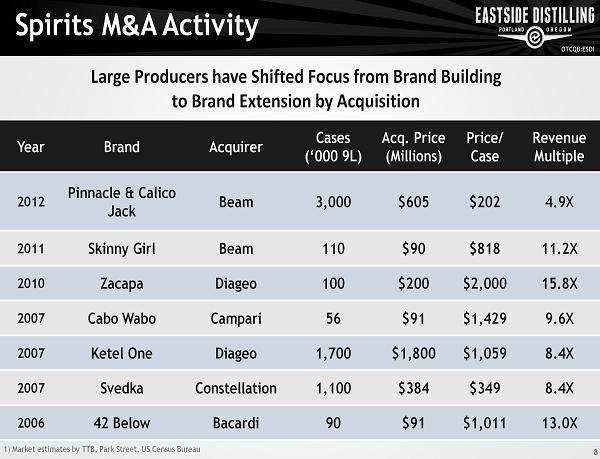

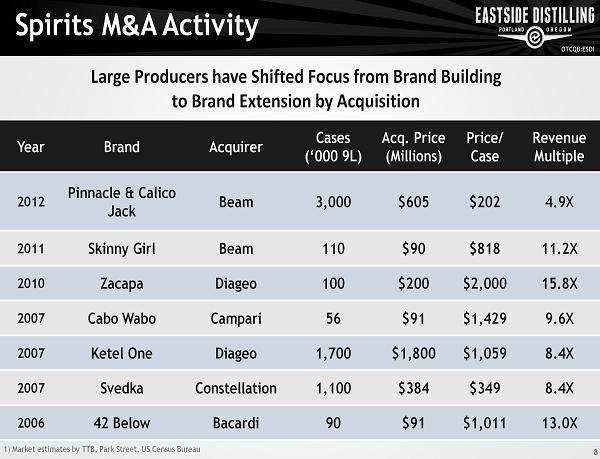

OTCQB:ESDI Year Brand Acquirer Cases (‘000 9L) Acq. Price (Millions) Price/ Case Revenue Multiple 2012 Pinnacle & Calico Jack Beam 3,000 $605 $202 4.9X 2011 Skinny Girl Beam 110 $90 $818 11.2X 2010 Zacapa Diageo 100 $200 $2,000 15.8X 2007 Cabo Wabo Campari 56 $91 $1,429 9.6X 2007 Ketel One Diageo 1,700 $1,800 $1,059 8.4X 2007 Svedka Constellation 1,100 $384 $349 8.4X 2006 42 Below Bacardi 90 $91 $1,011 13.0X Spirits M & A Activity 1) Market estimates by TTB, Park Street, US Census Bureau Large Producers have Shifted Focus from Brand Building to Brand Extension by Acquisition 8

OTCQB:ESDI Small Craft Distiller Landscape 9 Number of small U.S. distillers have grown from 92 in 2010 to 700+ in 2014 Growing consumer interest in spirits continues to create opportunities for small distillers Small distillers represent 1.7% of total spirits market by volume 2 Products tend to be at higher price points, so market share by revenue is higher 2 than market share by volume Majority of craft distillers are small producers 2014 Key stats: 2 712 distillers, each produced <50k cases annually Only 17 distillers produced 50k - 100k cases annually Total volume: ~3.5 million cases (up from 700k in 2010) producing revenues of $400 - $450 million 1) American Craft Spirits Association 2) Distilled Spirits Council Of The United States (DISCUS), Feb. 3, 2015

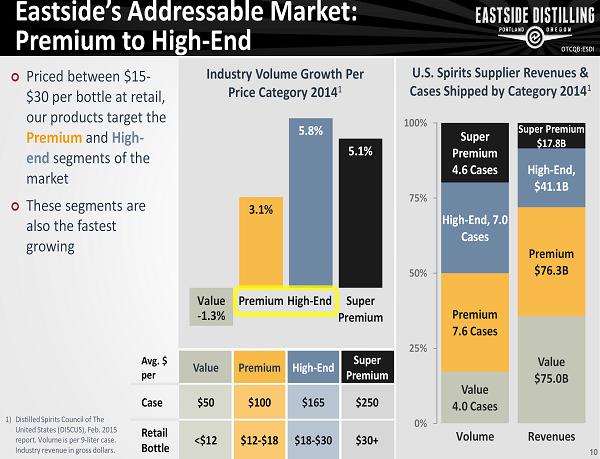

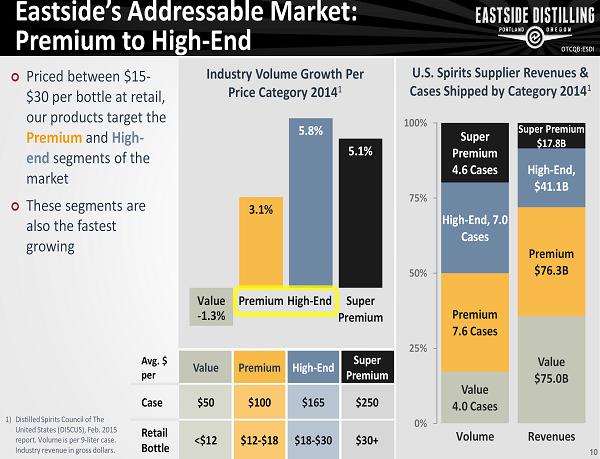

OTCQB:ESDI Eastside’s Addressable Market: Premium to High - End 10 Priced between $15 - $30 per bottle at retail, our products target the Premium and High - end segments of the market These segments are also the fastest growing Value 4.0 Cases Value $75.0B Premium 7.6 Cases Premium $76.3B High - End , 7.0 Cases High - End , $41.1B Super Premium 4.6 Cases Super Premium $17.8B 0% 25% 50% 75% 100% Volume Revenues - 1.3% 3.1% 5.8% 5.1% Value Premium High-End Super Premium 1) Distilled Spirits Council of The United States ( DISCUS), Feb. 2015 report. Volume is per 9 - liter case. Industry revenue in gross dollars. Avg. $ per Value Premium High - End Super Premium Case $50 $100 $165 $250 Retail Bottle <$12 $12 - $18 $18 - $30 $30+ Industry Volume Growth Per Price Category 2014 1 U.S. Spirits Supplier Revenues & Cases Shipped by Category 2014 1

OTCQB:ESDI Addressing this Market Opportunity with a Full Line of Award - Winning Master - Crafted Spirits 11 Burnside Bourbon A bold and spicy bourbon , with solid cinnamon and oak flavors, and at 96 proof, it’s stronger than many other bourbons on the market. Winner of two Gold Medals. Burnside Oregon Oaked Bourbon We take our award - winning Burnside Bourbon and finish the aging process in Oregon Oak barrels, adding subtle flavors to an already great - tasting Bourbon. Cherry Bomb Whiskey Cherry Bomb is a blast of real Oregon cherries and aged whiskey. The rich flavor and deep red color comes from the real fruit, nothing else. Received a prestigious gold medal from the American Wine Society , and a Micro Liquor Spirit Awards gold medal for taste and silver medal for package design. Portland Potato Vodka A premium vodka with the clean, crisp taste that mixes especially well or drinks great straight - up. Tastes so smooth the American Wine Society awarded it a silver medal and the prestigious Beverage Tasting Institute awarded it a gold medal and gave it the Institute’s coveted Best Buy rating. Below Deck Coffee Rum Our new Coffee Rum gets its deep smooth richness from full - bodied, Portland - roasted Arabica beans. Awarded the Silver Medal at the World Spirits Competition. Below Deck Ginger Rum Naturally flavored, our Ginger Flavored Rum adds a bold, spicy essence to the cocktail hour. Below Deck Silver Rum Fine, smooth and light at 60 proof, and double - distilled like all of our rums NEW Below Deck Spiced Rum A naturally flavored spiced rum with aromatic notes of clove, cinnamon, vanilla and mace . NEW Oregon Marionberry Whiskey Made with local Oregon Marionberries and aged whiskey, all of the rich flavor and deep red color comes from real fruit – no artificial coloring or flavor extracts. This unique spirit was awarded two silver medals in the 2014 Micro Liquor Spirit Awards, one for taste and another for package design. Holiday Spiced Liqueur (Seasonal) We infuse a special secret blend of seasonal spices, (cinnamon , cardamom, clove, allspice) in our Silver Rum, and added a little Hawaiian Turbinado sugar to round it out. The result is a very lovely, spicy liqueur Holiday Peppermint Bark Liqueur (Seasonal) Holiday Peppermint Bark Liqueur combines the finest French extra brute dark cocoa chocolate with real peppermint oil, and infused with our Silver Rum. Holiday Egg Nog “Advocaat” Liqueur (Seasonal) You know what Egg Nog tastes like — now imagine it infused with our 60 proof Silver Rum for out - of - the - bottle Christmas cheer like no other. Inspired by traditional Dutch and Belgian Advocaat liqueurs. Others in final development and soon to be announced… Awards Tally Gold: 5 Silver: 6 Best Buy: 1

OTCQB:ESDI Our Approach to the Craft 12 Talent & Experience: For Eastside, the Master Craft method of distilling spirits means that every bottle that leaves its premises reflects the creative ingenuity, special skill and unique talents of its master distiller, an artisan fully dedicated to the craft Authentic & Scalable: Master Crafted spirits are all about originality, authenticity, personal attention, along with the ability to scale production while preserving the original flavor profile Commitment to High Quality: Eastside spirits are created with passion. We continuously seek new ways to create and deliver high quality, innovative products Broad Portfolio: Eastside is on e of only a few craft distillers with a multi - brand product portfolio — many have only 1 - 3 products. Eastside’s robust product portfolio is especially attractive to distributors, as it “de - risks” their exposure to any one product Generate Customer Loyalty: All of these factors support Eastside in attracting loyal & enthusiastic customers, along with major distributors, like Blackheath Beverage Group and Young’s Market Company Eastside’s Chief Master Distiller, Melissa Heim, is the first female master distiller west of the Mississippi

OTCQB:ESDI Continuous Innovation – New Products 13 Eastside Distilling produces a family of branded spirits designed to suit most every taste In addition to its award - winning core brands, we will continue to create a number of strategic seasonal and limited - edition products in 2015 Small batch gin is targeted to be added to our product portfolio While all Eastside spirits are unique, each is carefully branded to make it identifiable to a growing base of customers Eastside is able to test out potential new product offerings in its tasting room, gaining real - time customer feedback on flavor preferences

OTCQB:ESDI Tasting Room Strategy The Eastside in house distillery Tasting Room is a key element of our growth strategy Eastside’s tasting room offers customers: A cool cocktail lounge where friends meet Private parties, distiller tours, concerts and special events In - store bottle and merchandise sales VIP membership special privileges, pricing, previews Benefits to Eastside: A place to connect with customers face - to - face , get important feedback to create better products, particularly new flavors Additional revenue stream : Eastside has generated as much as $95,000 in a single month from the tasting room at its current distillery. Its much larger distillery and tasting room has even greater revenue potential. 14

OTCQB:ESDI Innovative New Retail Concept Opened in Dec. 2014, Eastside’s new Clackamas Town Center store is the Oregon’s first retail tasting room for spirits in a mall location The new concept store builds upon the success of the company’s flagship distillery, where customers can browse, sample and purchase spirits directly High level of interaction of the retail tasting room helps establish the company’s brand identity in its primary market place Potential exists to launch innovative new retail concept in additional states Sampling often leads to a customer purchase, creating an additional source of revenue for Eastside Steven Earles CEO of Eastside Distilling with OLCC Commissioner Marvin Révoal at the Grand Opening of Eastside’s Clackamas Town Center Mall Retail Store, Dec. 17, 2014 “When we think about innovation, this is what it’s all about. I applaud East Side Distilling for creating new ways to improve the buying experience.” - Commissioner Marvin Révoal Oregon Liquor Control Commission, January 13, 2015 15

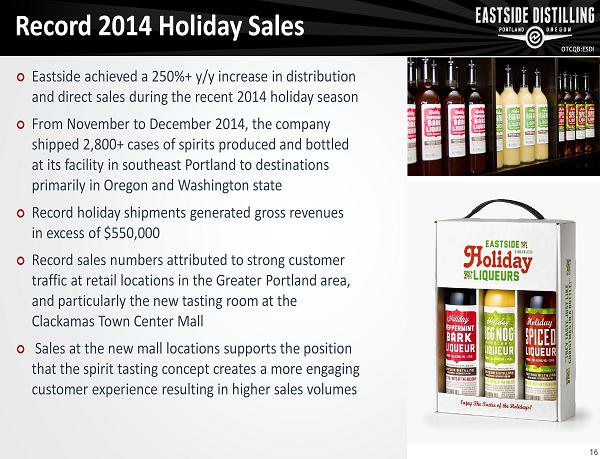

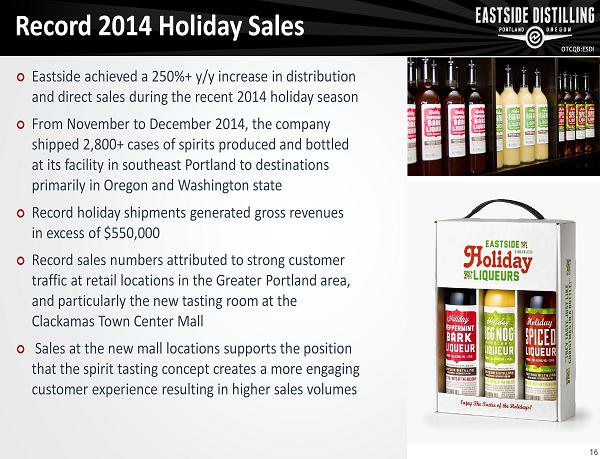

OTCQB:ESDI Record 2014 Holiday Sales 16 Eastside achieved a 250%+ y/y increase in distribution and direct sales during the recent 2014 holiday season From November to December 2014, the company shipped 2,800+ cases of spirits produced and bottled at its facility in southeast Portland to destinations primarily in Oregon and Washington state Record holiday shipments generated gross revenues in excess of $ 550,000 Record sales numbers attributed to strong customer traffic at retail locations in the Greater Portland area, and particularly the new tasting room at the Clackamas Town Center Mall Sales at the new mall locations supports the position that the spirit tasting concept creates a more engaging customer experience resulting in higher sales volumes

OTCQB:ESDI New Distillery & Tasting Room to Meet Growing Demand 17 Eastside’s current 2,500 sq. ft. distillery can produce up to 6,400 cases per year — currently operating at full capacity January 2014 the company began the build - out of a new 41,000 sq. ft. facility on Portland’s Distillery Row — the largest production facility for craft spirits in the Pacific Northwest New state - of - the art, bottling and packaging systems are being designed to accommodate annual production capacity of up to 1 million cases Facility to feature a tasting room and VIP members - only area , with special access to parties , special events, in - house concerts, and exclusive tastings of upcoming products Scheduled to become operational in Q2 2015

OTCQB:ESDI " Eastside is led by phenomenal craftsmen, innovators, and marketers, as evidenced by numerous industry awards and growing sales. The evolving flavor preferences of millennials will be a key element to any new campaign, and the unique flavor characteristics found across Eastside's product portfolio address these trends perfectly." — Jay Harkins, Co - founder & CEO, BBG New National Roll - Out Campaign 18 Eastside has begun a national rollout led by Blackheath Beverage Group (BBG) BBG has a strong track record of helping independent brands like Eastside establish a nationwide presence BBG will help develop and implement all phases of product and brand development, leading into a fully integrated marketing campaign with national sales and distribution BBG’s experience in the spirits industry will help the company navigate the government - regulated sales and distribution systems that operate in each state Eastside expect this to facilitate a fast time - to - market, along with cost - effective product marketing, sales and distribution

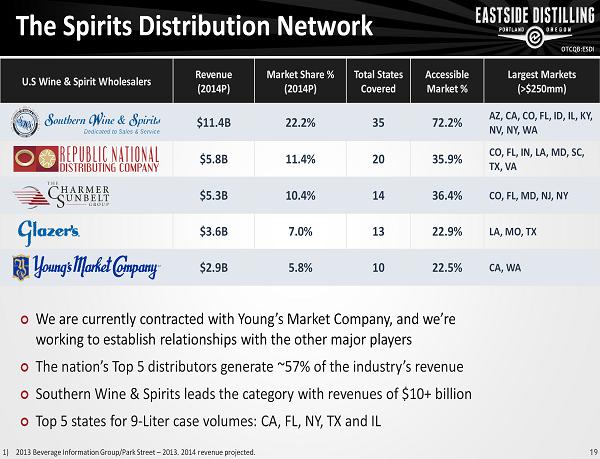

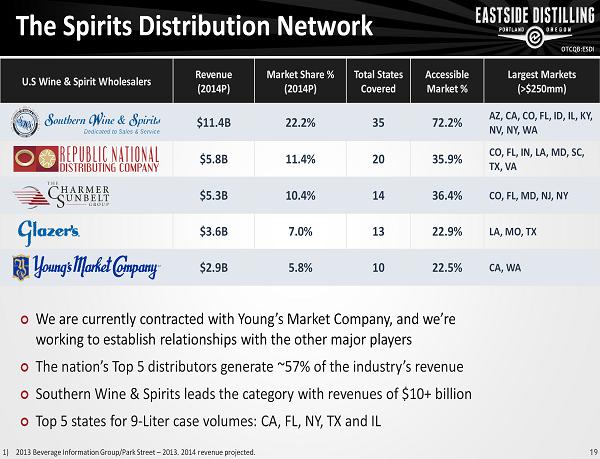

OTCQB:ESDI U.S Wine & Spirit Wholesalers Revenue (2014P) Market Share % (2014P) Total States Covered Accessible Market % Largest Markets (>$250mm) $11.4B 22.2% 35 72.2% AZ, CA, CO, FL, ID, IL, KY, NV, NY, WA Republic National $5.8B 11.4% 20 35.9% CO, FL, IN, LA, MD, SC, TX, VA $5.3B 10.4% 14 36.4% CO, FL, MD, NJ, NY $3.6B 7.0% 13 22.9% LA, MO, TX $2.9B 5.8% 10 22.5% CA, WA The Spirits Distribution Network 19 We are currently contracted with Young’s Market Company, and we’re working to establish relationships with the other major players The nation’s Top 5 distributors generate ~57% of the industry’s revenue Southern Wine & Spirits leads the category with revenues of $10+ billion Top 5 states for 9 - Liter case volumes: CA, FL, NY, TX and IL 1) 2013 Beverage Information Group/Park Street – 2013. 2014 revenue projected.

OTCQB:ESDI Multifaceted Growth Strategy 20 Build Upon Strong Base: Eastside has established a strong operational foundation with growing customer demand Stay Committed to Quality & Innovation: We have the proven ability to consistently produce and deliver quality across a family of brands Expand Capacity: New 41,000 sf distillery is designed to provide increased capacity as well as deliver better economies of scale Rollout National Marketing campaign: Aligned with industry - leading experts, Eastside is rolling out a multi - faceted sales and marketing campaign to build brand awareness and drive sales at both the state and national level Leverage public company advantage: financial markets can provide attractive access to capital and support long - term growth initiatives, including strategic acquisitions

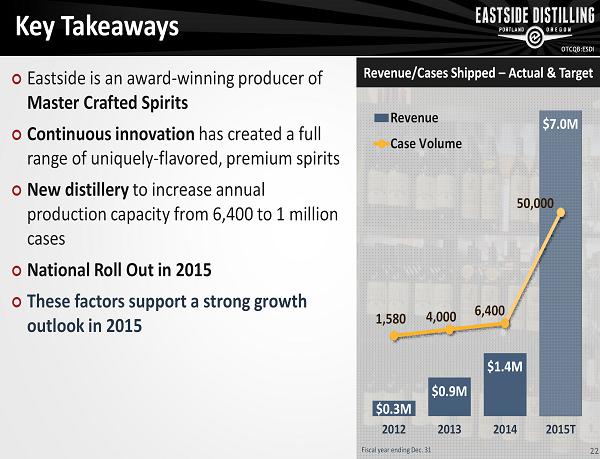

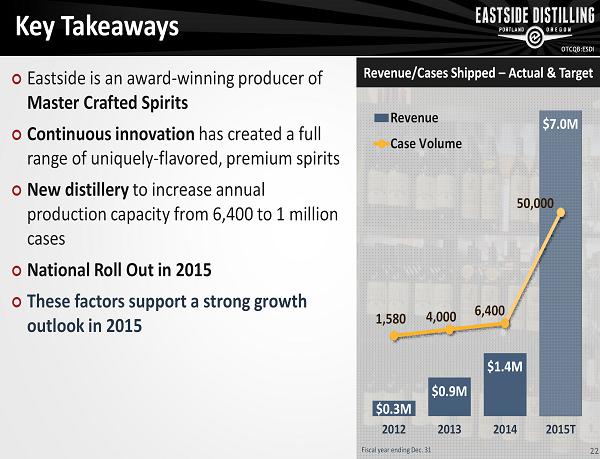

OTCQB:ESDI We have established three main revenue sources: Wholesale Distribution Distillery Tasting Room Corporate Retail Stores In 2014, revenues increased 55% to a record $1.4 million, with ~6,400 cases shipped In 2015, we’re targeting $7.0 million in revenues and 50,000+ cases shipped Strong outlook supported by the combination of these factors: 1 million case capacity distillery coming online Strength of our products and product pipeline Expected continued success with retail tasting room concept Rollout of new national marketing campaign and distribution network Revenue & Goals Revenue & Cases Shipped – Actual & Target $0.3M $0.9M $1.4M $7.0M 1,580 4,000 6,400 50,000 2012 2013 2014 2015T Revenue Case Volume Fiscal year ending Dec. 31 21

OTCQB:ESDI Key Takeaways Eastside is an award - winning producer of Master Crafted Spirits Continuous innovation has created a full range of uniquely - flavored, premium spirits New distillery to increase annual production capacity from 6,400 to 1 million cases N ational Roll Out in 2015 These factors support a strong growth outlook in 2015 Revenue/Cases Shipped – Actual & Target $0.3M $0.9M $1.4M $7.0M 1,580 4,000 6,400 50,000 2012 2013 2014 2015T Revenue Case Volume Fiscal year ending Dec. 31 22

OTCQB:ESDI 23 Contact Us Company Contacts Steven Earles, CEO Julie Bohn, Executive Assistant to the CEO Eastside Distilling, Inc. 1805 SE Martin Luther King Jr. Boulevard Portland, Oregon 97214 Tel 971 - 888 - 4264 www.eastsidedistilling.com inquiries@eastsidedistilling.com Investor Relations Chris Tyson Managing Director Liolios Group, Inc. 949 - 574 - 3860 EDSI@liolios.com 23

Appendix 24

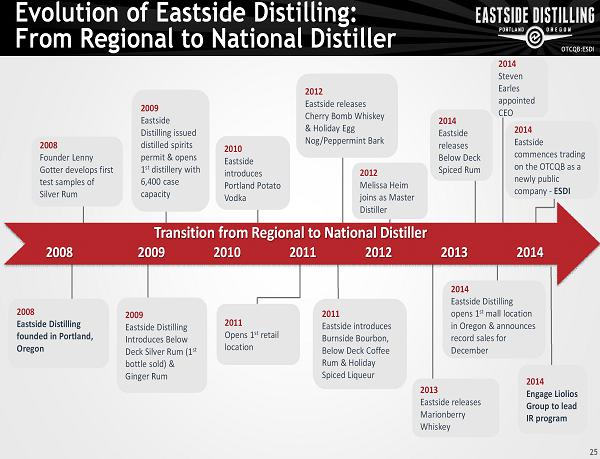

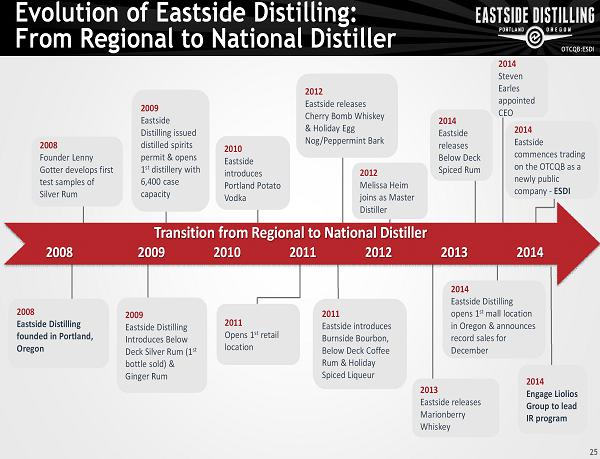

OTCQB:ESDI Evolution of Eastside Distilling: From Regional to National Distiller 25 2013 Eastside releases Marionberry Whiskey 2008 Eastside Distilling founded in Portland, Oregon 2012 Melissa Heim joins as Master Distiller 2008 Founder Lenny Gotter develops first test samples of Silver Rum 2014 Eastside commences trading on the OTCQB as a newly public company - ESDI 2009 Eastside Distilling issued distilled spirits permit & opens 1 st distillery with 6,400 case capacity 2011 Opens 1 st retail location 2011 Eastside introduces Burnside Bourbon, Below Deck Coffee Rum & Holiday Spiced Liqueur 2009 Eastside Distilling Introduces Below Deck Silver Rum (1 st bottle sold) & Ginger Rum 2014 Eastside releases Below Deck Spiced Rum 2014 Engage Liolios Group to lead IR program 2014 2012 2008 2009 2010 2011 2013 2010 Eastside introduces Portland Potato Vodka 2014 Eastside Distilling opens 1 st mall location in Oregon & announces record sales for December Transition from Regional to National Distiller 2012 Eastside releases Cherry Bomb Whiskey & Holiday Egg Nog/Peppermint Bark 2014 Steven Earles appointed CEO

OTCQB:ESDI STEVEN EARLES CEO, CFO & Director • Joined Eastside Distilling in 2009 as CEO • Responsible for Eastside’s day - to - day operations, the company’s brand development and financial strategy • Two+ decades of executive experience developing and building one of the largest land development company’s in southern California, overseeing 400+ employees • Has played a key role in numerous successful start - up companies LENNY GOTTER Founder, Director • Founded Eastside Distilling in 2008 with a passion for great spirits and recognized the potential growth of his brand in the burgeoning craft spirits movement • 20+ years' experience with emerging growth companies in the manufacturing and tech sectors in Metro Portland, Oregon • Over the last five years, Lenny’s spirit products won numerous taste and design awards • BS in Economics, University of Wisconsin Madison MELISSA HEIM Master Distiller • 15+ years of craft distilling experience, including apprenticeship as Head Distiller at Rogue Distillery and Public House in Portland’s Pearl District • First female master distiller west of the Mississippi • A Portland native, joined Eastside Distilling in 2012 as one of the few female distillers in the American craft distilling movement • BA in English, University of Oregon Leadership Team 26 MARTIN KUNKEL CMO & Director • 20+ years of executive experience with luxury brand marketing to the gaming and hospitality industry, including extensive customer relations experience • Prior to joining Eastside Distilling in 2014 as chief marketing officer, Greg served as the vice president of P layer Development/Casino Marketing at the Hard Rock Hotel & Casino in Las Vegas • 2011 - 2014 , served as an executive casino host at the Cosmopolitan of Las Vegas GREGORY NORDSTROM National Sales Manager • 20+ years of executive sales experience • Prior to joining Eastside Distilling in 2013, Greg served as the founder and managing partner of Nordstrom Management Group, a business consulting and advisory group for the auto industry • Gregory’s tactical approach to sale is derived from to his many years of experience in team building, brokering relationships, creating partnerships and meeting or exceeding sales targets CARRIE EARLES Chief Branding Officer • 10+ years of branding and sales experience with a national retail organization • Carrie brings to the position of Eastside’s chief branding officer a strong ability to strategically conceptualize and bring merchandise exposure to multiple demographics • Carrie collaborates with all company departments to develop and deliver Eastside’s brand value to the marketplace • She is the wife of company’s CEO, Steven Earles

OTCQB:ESDI Corporate Information 27 PUBLIC COMPANY INFORMATION Stock Symbol: ESDI Exchange: OTC:QB Cusip: 277802104 Shares Outstanding : 45,512,500 LEGAL Indeglia & Carney LLP 11900 Olympic Boulevard, Suite 770 Los Angeles, California 90064 Phone 310.982.2720 | Fax 310.982.2719 www.indegliacarney.com AUDITOR BMP – Burr Pilger Mayer 600 California Street, Suite 600 San Francisco, California 94108 Phone 415.421.5757 | Fax 415.288.6288 www.bpmcpa.com CORPORATE ADDRESS 1805 SE Martin Luther King Jr. Boulevard Portland, Oregon 97214 INVESTOR RELATIONS Liolios Group 20371 Irvine Avenue, Suite A - 100 Newport Beach, California 92660 Phone 949.574.3860 | Fax 949.574.3870 www.liolios.com TRANSFER AGENT Pacific Stock Transfer 4045 South Spencer Street, Suite 403 Las Vegas, Nevada 89119 Phone 702.361.3033 | (800) 785.PSTC | Fax 702.433.1979 www.pacificstocktransfer.com

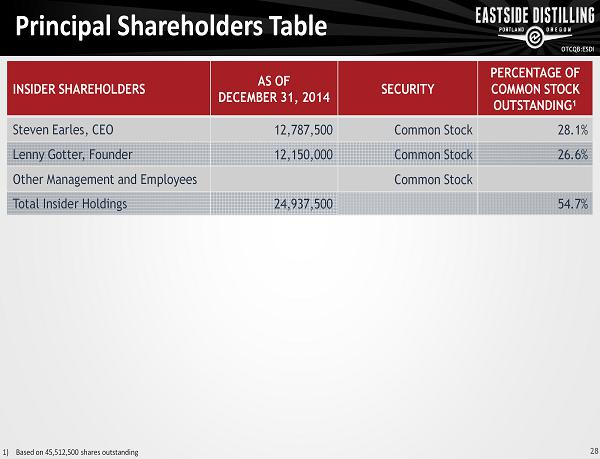

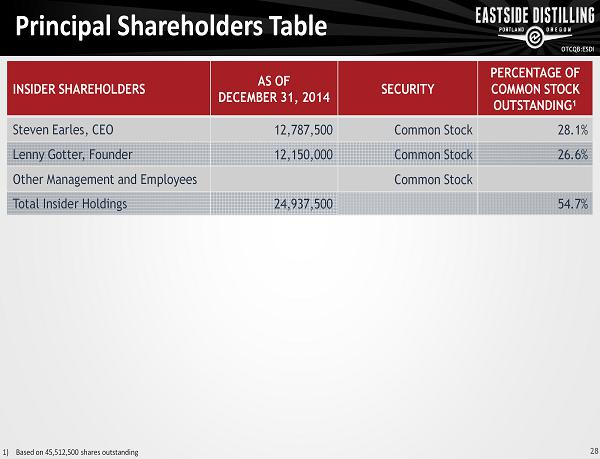

OTCQB:ESDI Principal Shareholders Table INSIDER SHAREHOLDERS AS OF DECEMBER 31, 2014 SECURITY PERCENTAGE OF COMMON STOCK OUTSTANDING¹ Steven Earles, CEO 12,787,500 Common Stock 28.1% Lenny Gotter, Founder 12,150,000 Common Stock 26.6% Other Management and Employees Common Stock Total Insider Holdings 24,937,500 54.7% 28 1) Based on 45,512,500 shares outstanding

OTCQB:ESDI Distilled Spirits Industry Primer 29 Distilled Spirits Distilled spirits, also referred to as "liquor," are beverage alcohol products which are first fermented and then distilled. Beer and wine are not included in this definition. Accurate terms to refer to all three drinks are "beverage alcohol" or "alcohol beverages ." The term "hard liquor" is generally objectionable because it reinforces the dangerous misperception that one form of alcohol is somehow "softer" than another. Beverage Alcohol Equivalence "Alcohol is alcohol." A standard drink of regular beer (12 ounces), distilled spirits (1.5 ounces of 80 - proof spirits) and wine (five ounces) each contains the same amount of alcohol . This scientific fact, known as "alcohol equivalence," is a critical aspect of responsible drinking recognized by the leading federal departments on alcohol and health matters, state driver’s manuals, and groups such as Mothers Against Drunk Driving. Alcohol & Health Approximately 110 million American adults drink responsibly. For these adults, alcohol can be part of a normal, healthy adult lifestyle . While there is a common misperception that wine is the only form of beverage alcohol associated with a reduced risk of cardiovascular disease, according to the scientific evidence, the potential benefits and risks apply equally to distilled spirits, wine and beer . Distillers do not recommend that people drink alcohol for health reasons and have always encouraged those who choose to drink, to do so responsibly. Alcohol abuse can cause serious health and other problems. Even moderate consumption can cause problems for some individuals and some people should not drink at all. If you have questions regarding alcohol, talk to your health professional. Taxes Distilled spirits are one of the most heavily taxed consumer products in the United States. More than half of the price that consumers spend on a typical bottle of distilled spirits goes towards a tax of some kind . A tax on alcohol is a tax on the hospitality industry. Beverage alcohol is the major profit component of the hospitality industry including bars, restaurants, liquor stores, hotels, convention and tourism. When beverage alcohol taxes are increased, it creates a devastating ripple effect on jobs throughout the entire hospitality industry. Market Access Beer, wine and spirits producers all share the same adult consumers. Those consumers who choose to drink should have convenient, responsible and equal access to their favorite beverage alcohol products . Sunday liquor sales and tastings laws are two important state market access initiatives for the industry. As of 2012, Sunday sales of spirits are permitted in 38 states and spirits tastings (in some form) are permitted in 44 states and the District of Columbia. Economic Contribution The distilled spirits industry is a major contributor to the nation’s economy generating over $110 billion in U.S. economic activity annually. Over 1.2 million people are employed in the United States in the production, distribution and sale of distilled spirits.

OTCQB:ESDI Advantages of Liquor Control States 30 While Eastside plans to distribute its innovative premium spirits throughout the country, it will be paying particular attention to the 18 so - called “

liquor control states” In these 18 states, distilled spirits are sold through state - owned and operated stores, often referred to as ABC (Alcohol Beverage Control) stores Doing business directly with these states not only simplifies the sales process, it increases likelihood of timely payment as the company sells to the control states on a net - 30 basis