| SECOND QUARTER REPORT | JUNE 30, 2013 |

Dear Unitholders:

Net income for the three months ended June 30, 2013 was $35.2 million ($0.38 per unit), compared to $134.4 million ($1.44 per unit) during the same period in 2012. Included in net income was a fair value gain of $0.3 million, compared to $100.3 million during the same period in 2012. Equity per unit increased to $32.87 per unit from $32.57 per unit at the end of 2012.

Funds from operations was $35.4 million ($0.38 per unit) for the three months ended June 30, 2013, compared to $34.1 million ($0.37 per unit) during the same period in 2012. Adjusted funds from operations was $27.7 million ($0.30 per unit) for the three months ended June 30, 2013, compared to $26.3 million ($0.28 per unit) during the same period in 2012.

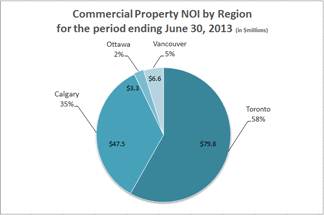

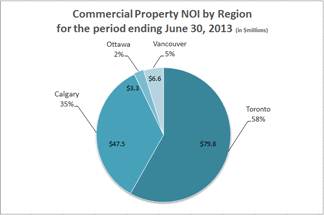

Net operating income from commercial properties increased by $1.6 million to $68.4 million for the three months ended June 30, 2013, compared to $66.8 million during the same period in 2012. Same-property net operating income increased to $68.4 million, $2.2 million over the same period in 2012.

HIGHLIGHTS FOR THE SECOND QUARTER

Brookfield Canada Office Properties (the “Trust” or “BOX”) continued its pro-active leasing strategy in the second quarter of 2013, capitalizing on new and early renewal leasing opportunities throughout the portfolio. During the quarter, the Trust leased 168,000 square feet of space, at an average net rent of $35 per square foot compared to an average expiring net rent of $32 per square foot. The Trust’s occupancy rate finished the quarter at 96.9%, up 30 basis points from the prior quarter. This compares favourably with the Canadian national average of 92.5%.

Leasing highlights from the second quarter include:

| · | 130,000 square feet in Toronto |

| - | A 10-year, 36,000-square-foot renewal with the Toronto Board of Trade at First Canadian Place |

| - | An average three-year, 32,000-square-foot renewal and expansion with Vision Critical Communications at Hudson’s Bay Centre |

| - | An eight-year, 15,000-square-foot new lease with Catlin Canada Inc. at First Canadian Place |

| - | A 10-year, 11,000-square-foot new lease with Enwave Energy Corporation at Bay Adelaide West |

| · | 30,000 square feet in Calgary |

| - | A five-year, 11,000-square-foot renewal with Cushman & Wakefield LePage at Suncor Energy Centre |

Purchased the Bay Adelaide East development from parent company Brookfield Office Properties Inc. (TSX, NYSE: BPO) for an aggregate total investment of $602 million, subsequent to quarter-end. The Trust purchased the building on an “as-if-completed-and-stabilized basis,” and will earn $32 million of net operating income upon substantial completion of the project, which is currently 60% pre-leased.

Extended the $103 million debt at Hudson’s Bay Centre, Toronto, for an additional two-year period extending the maturity to May 2015 with a fixed interest rate of 2.999% per annum.

DISTRIBUTION DECLARATION

The Board of Trustees of Brookfield Canada Office Properties announced a distribution of $0.0975 per Trust unit payable on September 13, 2013 to holders of Trust Units of record at the close of business on August 30, 2013.

OUTLOOK

“The recent acquisition of Bay Adelaide East affirms BOX’s growth strategy as we were able to deploy available capital to purchase the newest best-in-class office tower in Toronto’s financial core,” said Jan Sucharda, president and chief executive officer.

Jan Sucharda

President and Chief Executive Officer

July 22, 2013

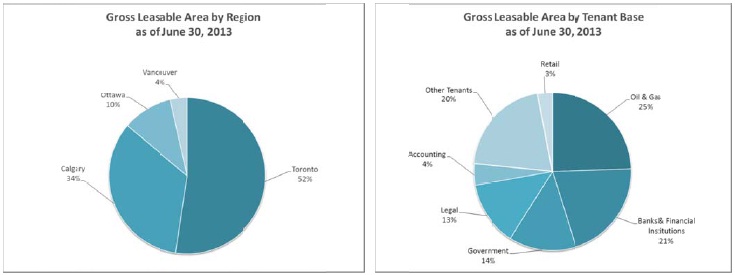

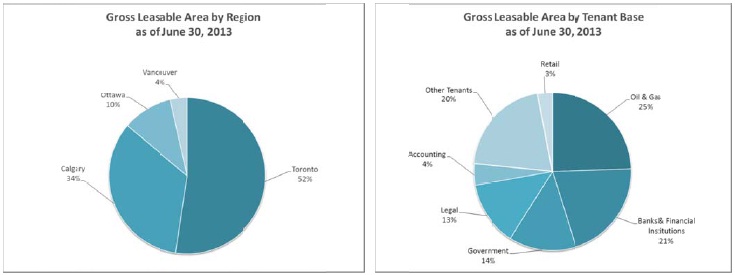

Portfolio by City

Brookfield Canada Office Properties’ portfolio is composed of interests in 28 premier office properties totaling 20.8 million square feet, including 4.1 million square feet of parking and other. Landmark properties include Brookfield Place and First Canadian Place in Toronto and Bankers Hall in Calgary.

| (Square feet in 000’s) | | Number of

Properties | | | Leased

% | | | Office | | | Retail | | | Leasable

Area | | | Parking and Other | | | Total | | | Ownership

Interest % | | | Owned

Interest | |

| TORONTO | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brookfield Place | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bay Wellington Tower | | | 1 | | | | 99.2 | % | | | 1,297 | | | | 44 | | | | 1,341 | | | | 68 | | | | 1,409 | | | | 100 | % | | | 1,409 | |

| Retail & Parking(1) | | | 1 | | | | 96.4 | % | | | — | | | | 52 | | | | 52 | | | | 503 | | | | 555 | | | | 56 | % | | | 308 | |

| First Canadian Place | | | 1 | | | | 90.6 | % | | | 2,380 | | | | 241 | | | | 2,621 | | | | 215 | | | | 2,836 | | | | 25 | % | | | 709 | |

| Bay Adelaide West | | | 1 | | | | 96.8 | % | | | 1,156 | | | | 35 | | | | 1,191 | | | | 408 | | | | 1,599 | | | | 100 | % | | | 1,599 | |

| Exchange Tower | | | 1 | | | | 91.1 | % | | | 962 | | | | 68 | | | | 1,030 | | | | 203 | | | | 1,233 | | | | 50 | % | | | 617 | |

| Hudson's Bay Centre | | | 1 | | | | 99.5 | % | | | 533 | | | | 212 | | | | 745 | | | | 175 | | | | 920 | | | | 100 | % | | | 920 | |

| 2 Queen St. East | | | 1 | | | | 100.0 | % | | | 448 | | | | 16 | | | | 464 | | | | 71 | | | | 535 | | | | 25 | % | | | 134 | |

| Queen’s Quay Terminal | | | 1 | | | | 98.2 | % | | | 429 | | | | 55 | | | | 484 | | | | 27 | | | | 511 | | | | 100 | % | | | 511 | |

| 151 Yonge St. | | | 1 | | | | 82.1 | % | | | 289 | | | | 11 | | | | 300 | | | | 113 | | | | 413 | | | | 25 | % | | | 103 | |

| 105 Adelaide St. West | | | 1 | | | | 88.7 | % | | | 177 | | | | 7 | | | | 184 | | | | 32 | | | | 216 | | | | 100 | % | | | 216 | |

| HSBC Building | | | 1 | | | | 100.0 | % | | | 194 | | | | — | | | | 194 | | | | 34 | | | | 228 | | | | 100 | % | | | 228 | |

| 22 Front St. West | | | 1 | | | | 100.0 | % | | | 137 | | | | 7 | | | | 144 | | | | 2 | | | | 146 | | | | 100 | % | | | 146 | |

| | | | 12 | | | | 94.6 | % | | | 8,002 | | | | 748 | | | | 8,750 | | | | 1,851 | | | | 10,601 | | | | | | | | 6,900 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| OTTAWA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Place de Ville I | | | 2 | | | | 99.9 | % | | | 571 | | | | 11 | | | | 582 | | | | 365 | | | | 947 | | | | 25 | % | | | 237 | |

| Place de Ville II | | | 2 | | | | 99.2 | % | | | 598 | | | | 12 | | | | 610 | | | | 329 | | | | 939 | | | | 25 | % | | | 235 | |

| Jean Edmonds Towers | | | 2 | | | | 100.0 | % | | | 542 | | | | 10 | | | | 552 | | | | 110 | | | | 662 | | | | 25 | % | | | 166 | |

| | | | 6 | | | | 99.7 | % | | | 1,711 | | | | 33 | | | | 1,744 | | | | 804 | | | | 2,548 | | | | | | | | 638 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CALGARY | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bankers Hall | | | 3 | | | | 99.7 | % | | | 1,939 | | | | 223 | | | | 2,162 | | | | 482 | | | | 2,644 | | | | 50 | % | | | 1,322 | |

| Bankers Court | | | 1 | | | | 100.0 | % | | | 257 | | | | 7 | | | | 264 | | | | 70 | | | | 334 | | | | 50 | % | | | 167 | |

| Suncor Energy Centre | | | 2 | | | | 99.7 | % | | | 1,706 | | | | 26 | | | | 1,732 | | | | 348 | | | | 2,080 | | | | 50 | % | | | 1,040 | |

| Fifth Avenue Place | | | 2 | | | | 99.8 | % | | | 1,428 | | | | 49 | | | | 1,477 | | | | 294 | | | | 1,771 | | | | 50 | % | | | 886 | |

| | | | 8 | | | | 99.7 | % | | | 5,330 | | | | 305 | | | | 5,635 | | | | 1,194 | | | | 6,829 | | | | | | | | 3,415 | |

| VANCOUVER | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Royal Centre | | | 1 | | | | 97.2 | % | | | 488 | | | | 94 | | | | 582 | | | | 258 | | | | 840 | | | | 100 | % | | | 840 | |

| OTHER | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Merivale Place, Nepean | | | 1 | | | | 100.0 | % | | | — | | | | 3 | | | | 3 | | | | — | | | | 3 | | | | 100 | % | | | 3 | |

| TOTAL PORTFOLIO | | | 28 | | | | 96.9 | % | | | 15,531 | | | | 1,183 | | | | 16,714 | | | | 4,107 | | | | 20,821 | | | | | | | | 11,796 | |

(1) Brookfield Canada Office Properties owns a 50% interest in the retail operations and is entitled to a 56% interest in the parking operations.

Contents

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL RESULTS | | | | |

| | | | | |

| PART I – OBJECTIVES AND FINANCIAL HIGHLIGHTS | | | 6 | |

| | | | | |

| PART II – FINANCIAL STATEMENT ANALYSIS | | | 11 | |

| | | | | |

| PART III – RISKS AND UNCERTAINTIES | | | 25 | |

| | | | | |

| PART IV – CRITICAL ACCOUNTING POLICIES AND ESTIMATES | | | 28 | |

| | | | | |

| CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS | | | 31 | |

| | | | | |

| NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS | | | 35 | |

| | | | | |

| UNITHOLDER INFORMATION | | | 42 | |

FORWARD-LOOKING STATEMENTS

This interim report to unitholders contains “forward-looking information” within the meaning of Canadian provincial securities laws and applicable regulations and “forward-looking statements” within the meaning of “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, include statements regarding the Trust’s operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies and outlook, as well as the outlook for the Canadian economy for the current fiscal year and subsequent periods, and include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “seeks”, “intends”, “targets”, “projects”, “forecasts”, “likely”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”.

Although the Trust believes that the anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information because they involve known and unknown risks, uncertainties and other factors, many of which are beyond the control of the Trust, which may cause the actual results, performance or achievements of the Trust to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.

Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to: risks incidental to the ownership and operation of real estate properties including local real estate conditions; the impact or unanticipated impact of general economic, political and market factors in Canada; the ability to enter into new leases or renew leases on favourable terms; business competition; dependence on tenants’ financial condition; the use of debt to finance the Trust’s business; the behavior of financial markets, including fluctuations in interest rates; equity and capital markets and the availability of equity and debt financing and refinancing within these markets; risks relating to the Trust’s insurance coverage; the possible impact of international conflicts and other developments including terrorist acts; potential environmental liabilities; changes in tax laws and other tax related risks; dependence on management personnel; illiquidity of investments; the ability to complete and effectively integrate acquisitions into existing operations and the ability to attain expected benefits therefrom; operational and reputational risks; catastrophic events, such as earthquakes and hurricanes; and other risks and factors detailed from time to time in the Trust’s documents filed with the securities regulators in Canada and the United States.

Caution should be taken that the foregoing list of important factors that may affect future results is not exhaustive. When relying on the Trust’s forward-looking statements or information, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Except as required by law, the Trust undertakes no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

Management’s Discussion and Analysis of Financial Results

July 22, 2013

PART I – OBJECTIVES AND FINANCIAL HIGHLIGHTS

BASIS OF PRESENTATION

Financial data included in this Management’s Discussion and Analysis (“MD&A”) for the three months ended June 30, 2013, includes material information up to July 22, 2013. Financial data provided has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). All dollar references, unless otherwise stated, are in millions of Canadian dollars except per unit amounts. Amounts in U.S. dollars are identified as “US$.”

Brookfield Canada Office Properties (“BOX,” the “Trust,” “we”, “our” or “us” ) was formed in connection with the reorganization of BPO Properties Ltd. (“BPP”), a wholly-owned subsidiary of Brookfield Office Properties Inc. (“BPO” or “Brookfield Office Properties”), on May 1, 2010, in which BPP’s directly owned office assets were transferred to the Trust. In connection with the reorganization, the Trust also acquired BPO’s interest in Brookfield Place, which includes Bay Wellington Tower and partial interests in the retail concourse and parking operations.

On December 1, 2011, we acquired from BPO, a 25% interest in nine office assets from its Canadian Office Fund portfolio totaling 6.5 million square feet in Toronto and Ottawa.

The following discussion and analysis is intended to provide readers with an assessment of the performance of BOX over the past three months as well as our financial position and future prospects. It should be read in conjunction with the condensed consolidated interim financial statements and appended notes, which begin on page 31 of this report. In Part II – Financial Statement Analysis, we review our operating performance and financial position as presented in our financial statements prepared in accordance with IFRS.

We included our discussion of operating performance on an IFRS basis beginning on page 19 of the MD&A followed by a discussion of non-IFRS measures. Included in non-IFRS measures are commercial property net operating income, funds from operations, and adjusted funds from operations on a total and per-unit basis. Commercial property net operating income, funds from operations and adjusted funds from operations do not have any standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other companies. We define commercial property net operating income as income from commercial property operations after direct property operating expenses, including property administration costs that have been deducted but prior to deducting interest expense, general and administrative expenses, and fair value gains (losses). We define funds from operations as net income prior to transaction costs, fair value gains (losses), and certain other non-cash items. Adjusted funds from operations is defined by us as funds from operations net of normalized second-generation leasing commissions and tenant improvements, normalized sustaining capital expenditures, and straight-line rental income.

Commercial property net operating income is an important measure that we use to assess operating performance of our commercial properties, and funds from operations is a widely used measure in analyzing the performance of real estate. Adjusted funds from operations is a measure used to assess an entity’s ability to pay distributions. We provide the components of commercial property net operating income on page 22, a reconciliation of net income to funds from operations and adjusted funds from operations beginning on page 22, and a reconciliation of cash generated from operating activities to adjusted funds from operations on page 23.

Additional information, including our Annual Information Form, is available on our Web site atwww.brookfieldcanadareit.com or at www.sedar.com or www.sec.gov.

OVERVIEW OF THE BUSINESS

BOX is a publicly traded, real estate investment trust listed on the Toronto and New York stock exchanges under the symbol BOX.UN and BOXC, respectively.

The Trust invests and operates commercial office properties in Toronto, Ottawa, Calgary, and Vancouver.

At June 30, 2013, the carrying value of BOX’s total assets was $5,343.3 million. During the three months ended June 30, 2013, we generated $35.2 million of net income ($0.38 per unit), $35.4 million of funds from operations ($0.38 per unit), and $27.7 million of adjusted funds from operations ($0.30 per unit).

FINANCIAL HIGHLIGHTS

BOX’s financial results are as follows:

| | | Three months ended Jun. 30 | | | Six months ended Jun. 30 | |

| (Millions, except per-unit amounts) | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| Results of operations | | | | | | | | | | | | |

| Commercial property revenue | | $ | 130.9 | | | $ | 124.0 | | | $ | 259.2 | | | $ | 249.2 | |

| Net income | | | 35.2 | | | | 134.4 | | | | 81.7 | | | | 286.8 | |

| Funds from operations(1) | | | 35.4 | | | | 34.1 | | | | 73.6 | | | | 67.6 | |

| Adjusted funds from operations(1) | | | 27.7 | | | | 26.3 | | | | 58.0 | | | | 52.0 | |

| Distributions | | | 27.2 | | | | 25.2 | | | | 54.5 | | | | 50.3 | |

| Per unit amounts – attributable to unitholders | | | | | | | | | | | | | | | | |

| Net income | | | 0.38 | | | | 1.44 | | | | 0.88 | | | | 3.08 | |

| Funds from operations(1) | | | 0.38 | | | | 0.37 | | | | 0.79 | | | | 0.73 | |

| Adjusted funds from operations(1) | | | 0.30 | | | | 0.28 | | | | 0.62 | | | | 0.56 | |

| Distributions | | | 0.29 | | | | 0.27 | | | | 0.58 | | | | 0.54 | |

| (Millions, except per-unit amounts) | | Jun. 30, 2013 | | | Dec. 31, 2012 | |

| Balance sheet data | | | | | | | | |

| Total assets | | $ | 5,343.3 | | | $ | 5,163.6 | |

| Investment properties | | | 5,112.0 | | | | 5,090.2 | |

| Commercial property and corporate debt | | | 2,159.3 | | | | 2,013.0 | |

| Total equity | | | 3,063.3 | | | | 3,035.6 | |

| Total equity per unit | | | 32.87 | | | | 32.57 | |

(1) Non-IFRS measure. Refer to page 9 for description of non-IFRS measures and reference to reconciliation to comparable IFRS measures.

COMMERCIAL-PROPERTY OPERATIONS

Our strategy to own premier properties in high-growth, and in many instances supply-constrained markets with high barriers to entry, has created one of Canada’s most distinguished portfolios of office properties. Our commercial-property portfolio consists of interests in 28 properties totaling 20.8 million square feet, including 4.1 million square feet of parking and other. Our markets are the financial, government and energy sectors in the cities of Toronto, Ottawa, Calgary, and Vancouver. Our strategy is concentrating operations within a select number of Canadian gateway cities with attractive tenant bases in order to maintain a meaningful presence and build on the strength of our tenant relationships within these markets.

We remain focused on the following strategic priorities:

| · | Realizing value from our investment properties through proactive leasing initiatives; |

| · | Prudent capital management, including the refinancing of mature investment properties; and |

| · | Acquiring high-quality investment properties in our primary markets for value when opportunities arise. |

The following table summarizes our investment property portfolio by region at June 30, 2013:

| Region | | Number of Properties | | | Total Area

(000’s Sq. Ft.) | | | BOX’s

Owned Interest

(000’s Sq. Ft.) | | | Fair Value

(Millions) | | | Fair Value

Per Sq. Ft. | | | Debt

(Millions) | | | Net Book Equity(1)

(Millions) | |

| Eastern region | | | 19 | | | | 13,152 | | | | 7,541 | | | $ | 3,209.5 | | | $ | 426 | | | $ | 1,442.7 | | | $ | 1,766.8 | |

| Western region | | | 9 | | | | 7,669 | | | | 4,255 | | | | 1,902.5 | | | | 447 | | | | 716.6 | | | | 1,185.9 | |

| Total | | | 28 | | | | 20,821 | | | | 11,796 | | | $ | 5,112.0 | | | $ | 433 | | | $ | 2,159.3 | | | $ | 2,952.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1)Represents fair value less debt and excludes working capital.

An important characteristic of our portfolio is the strong credit quality of our tenants. We direct special attention to credit quality, particularly in the current economic environment, in order to ensure the long-term sustainability of rental revenues through economic cycles. Major tenants with over 500,000 square feet of space in the portfolio include government and related agencies, Suncor Energy Inc., Bank of Montreal, Imperial Oil and Royal Bank. A detailed list of major tenants is included in Part III (“Risks and Uncertainties”) of this MD&A, beginning on page 25.

Our strategy is to sign long-term leases in order to mitigate risk and reduce our overall re-tenanting costs. We typically commence discussions with tenants regarding their space requirements well in advance of the contractual expiration, and although each market is different, the majority of our leases, when signed, extend between five and 10-year terms. As a result of this strategy, approximately 7.1% of our leases, on average, mature annually up to 2017.

Our average lease term is eight years. The following is a breakdown of lease maturities by region with associated in-place rental rates:

| Total Portfolio | Toronto, Ontario | Ottawa, Ontario |

| | | | Net Rent | | | Net Rent | | | Net Rent |

| | 000's | | | per | 000's | | | per | 000's | | | Per |

| Year of Expiry | Sq. Ft. | % | Sq. Ft.(1) | Sq. Ft. | % | Sq. Ft.(1) | Sq. Ft. | % | Sq. Ft.(1) |

| Currently available | 512 | 3.1 | | | 475 | 5.4 | | | 5 | 0.3 | | |

| 2013 | 1,374 | 8.2 | $ | 21 | 119 | 1.4 | $ | 30 | 1,148 | 65.8 | $ | 20 |

| 2014 | 340 | 2.0 | | 32 | 278 | 3.2 | | 32 | 10 | 0.6 | | 27 |

| 2015 | 1,302 | 7.8 | | 24 | 506 | 5.8 | | 32 | 546 | 31.3 | | 15 |

| 2016 | 1,678 | 10.0 | | 26 | 836 | 9.6 | | 29 | 9 | 0.5 | | 23 |

| 2017 | 632 | 3.8 | | 30 | 539 | 6.2 | | 30 | 8 | 0.5 | | 18 |

| 2018 | 737 | 4.4 | | 32 | 486 | 5.5 | | 30 | ¾ | ¾ | | ¾ |

| 2019 | 767 | 4.6 | | 30 | 631 | 7.2 | | 28 | ¾ | ¾ | | ¾ |

| 2020 & beyond | 9,372 | 56.1 | | 31 | 4,880 | 55.7 | | 29 | 18 | 1.0 | | 25 |

| Parking and other | 4,107 | ¾ | | ¾ | 1,851 | ¾ | | ¾ | 804 | ¾ | | ¾ |

| Total | 20,821 | 100.0 | | | 10,601 | 100.0 | | | 2,548 | 100.0 | | |

| Average market net rent(2) (3) | $ | 33 | | | $ | 33 | | | $ | 21 |

| | | | | | | | | | | | | | | | |

| Calgary, Alberta | Vancouver, B.C. | Other |

| | | | Net Rent | | | Net Rent | | | Net Rent |

| | 000's | | | per | 000’s | | | per | 000’s | | | Per |

| Year of Expiry | Sq. Ft. | % | | Sq. Ft.(1) | Sq. Ft. | % | Sq. Ft.(1) | Sq. Ft. | % | Sq. Ft.(1) |

| Currently available | 16 | 0.3 | | | 16 | 2.8 | | | ¾ | ¾ | | |

| 2013 | 23 | 0.4 | $ | 32 | 83 | 14.3 | $ | 13 | 1 | 33.3 | $ | 32 |

| 2014 | 42 | 0.7 | | 39 | 10 | 1.7 | | 27 | ¾ | ¾ | | ¾ |

| 2015 | 215 | 3.8 | | 30 | 35 | 6.0 | | 27 | ¾ | ¾ | | ¾ |

| 2016 | 756 | 13.4 | | 22 | 77 | 13.2 | | 26 | ¾ | ¾ | | ¾ |

| 2017 | 65 | 1.2 | | 28 | 20 | 3.4 | | 28 | ¾ | ¾ | | ¾ |

| 2018 | 225 | 4.0 | | 37 | 26 | 4.5 | | 38 | ¾ | ¾ | | ¾ |

| 2019 | 99 | 1.8 | | 43 | 35 | 6.0 | | 26 | 2 | 66.7 | | 28 |

| 2020 & beyond | 4,194 | 74.4 | | 35 | 280 | 48.1 | | 22 | ¾ | ¾ | | ¾ |

| Parking and other | 1,194 | ¾ | | ¾ | 258 | ¾ | | ¾ | ¾ | ¾ | | ¾ |

| Total | 6,829 | 100.0 | | | 840 | 100.0 | | | 3 | 100.0 | | |

| Average market net rent(2) | $ | 36 | | | $ | 33 | | | $ | ¾ |

| | | | | | | | | | | | | | | | |

| (1) | Net rent at expiration of lease. |

| (2) | Average market net rent represents management’s estimate of average rent per square foot for buildings of similar quality to our portfolio. However, it may not necessarily be representative of the specific space that is rolling in any specific year. Included on page 21 is the average leasing net rent achieved on our year-to-date leasing as compared to the average expiring net rent. |

| (3) | Average market net rent for Toronto reflects higher market rents for Brookfield Place and Bay Adelaide West, which comprise 30% of BOX’s exposure in Toronto. |

PERFORMANCE MEASUREMENT

The key indicators by which we measure our performance are:

| · | Commercial property net operating income; |

| · | Funds from operations per unit; |

| · | Adjusted funds from operations per unit; |

| · | Overall indebtedness level; |

| · | Weighted-average cost of debt; and |

Although we monitor and analyze our financial performance using a number of indicators, our primary business objective of generating reliable and growing cash flow is monitored and analyzed using net income, commercial property net operating income, funds from operations, and adjusted funds from operations. Although net income is calculated in accordance with IFRS, commercial property net operating income, funds from operations, and adjusted funds from operations do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other entities. We provide the components of commercial property net operating income and a full reconciliation of net income to funds from operations and adjusted funds from operations beginning on page 22 of this MD&A.

Net Income

Net income is calculated in accordance with IFRS. Net income is used as a key indicator in assessing the profitability of the Trust.

Commercial property net operating income

Commercial property net operating income is defined by us as income from commercial property operations after direct property operating expenses, including property administration costs have been deducted but prior to deducting interest expense, general and administrative expenses, and fair value gains (losses). Commercial property net operating income is used as a key indicator of performance, as it represents a measure over which management of our commercial property operations has control.

Funds from Operations

Our definition of funds from operations or “FFO” includes all of the adjustments that are outlined in the National Association of Real Estate Investment Trusts (“NAREIT”) definition of FFO including the exclusion of gains (or losses) from the sale of real estate property and the add back of any depreciation and amortization related to real estate assets. In addition to the adjustments prescribed by NAREIT, we also make adjustments to exclude any unrealized fair value gains (or losses) that arise as a result of reporting under IFRS. These additional adjustments result in an FFO measure that would be similar to that which would result if the Trust determined net income in accordance with U.S. GAAP and is also consistent with the Real Property Association of Canada (“REALPAC”) white paper on funds from operations for IFRS issued November 2012. Our FFO measure will differ from other organizations applying the NAREIT definition to the extent of certain differences between the IFRS and U.S. GAAP reporting frameworks, principally related to the recognition of lease termination income and fair value gains (or losses), which does not have a significant impact on the FFO measure reported. We provide a reconciliation of net income to funds from operations on page 22.

Adjusted Funds from Operations

Adjusted funds from operations is defined by us as funds from operations net of normalized second-generation leasing commissions and tenant improvements, normalized sustaining capital expenditures, and straight-line rental income. Adjusted funds from operations is a widely used measure used to assess an entity’s ability to pay distributions. We provide a reconciliation of funds from operations to adjusted funds from operations on page 23. We also provide a reconciliation of cash generated from operating activities to adjusted funds from operations on page 23.

Total equity per unit

Total equity per unit represents the book value of our total equity divided by total units outstanding. We believe that total equity per unit is the best indicator of our current financial position because it reflects our total equity adjusted for all inflows and outflows, including funds from operations and changes in the value of our investment properties.

Although we believe funds from operations is a widely used measure to analyze real estate, we believe that funds from operations, adjusted funds from operations, commercial property net operating income, total equity per unit and net income are all relevant measures.

KEY PERFORMANCE DRIVERS

In addition to monitoring and analyzing performance in terms of net income, commercial property net operating income, funds from operations, and adjusted funds from operations, we consider the following items to be important drivers of our current and anticipated financial performance:

| · | Increases in occupancies by leasing vacant space; |

| · | Increases in rental rates as market conditions permit; and |

| · | Reduction in operating costs through achieving economies of scale and diligently managing contracts. |

We also believe that the key external performance drivers include the availability of:

| · | Debt capital at a cost and on terms conducive to our goals; |

| · | Equity capital at a reasonable cost; |

| · | New property acquisitions that fit into our strategic plan; and |

| · | Investors for dispositions of peak value on non-core assets. |

PART II – FINANCIAL STATEMENT ANALYSIS

ASSET PROFILE

Our total asset carrying value was $5,343.3 million at June 30, 2013 (compared to $5,163.6 million at December 31, 2012). The following is a summary of our assets:

| (Millions) | | Jun. 30, 2013 | | | Dec. 31, 2012 | |

| Non-current assets | | | | | | |

| Investment properties | | $ | 5,112.0 | | | $ | 5,090.2 | |

| | | | | | | | | |

| Current assets | | | | | | | | |

| Tenant and other receivables | | | 13.7 | | | | 25.4 | |

| Other assets | | | 6.7 | | | | 7.0 | |

| Cash and cash equivalents | | | 210.9 | | | | 41.0 | |

| | | | 231.3 | | | | 73.4 | |

| Total | | $ | 5,343.3 | | | $ | 5,163.6 | |

INVESTMENT PROPERTIES

Investment properties comprise of our direct interests in wholly owned commercial properties and our proportionate share in jointly controlled commercial properties.

The fair value of our investment properties was $5,112.0 million as at June 30, 2013 (compared to $5,090.2 million at December 31, 2012). The increase in value of investment properties is attributable to capital expenditures, leasing costs and the recognition of fair value gains as a result of improvements to tenant profiles.

A breakdown of our investment properties is as follows:

| | | | | | | | | BOX’s | | | Fair Value | | | Fair Value | |

| | | Number of | | | Total Area | | | Owned Interest | | | Jun. 30, 2013 | | | Dec. 31, 2012 | |

| | | Properties | | | (000's Sq. Ft.) | | | (000's Sq. Ft.) | | | (Millions) | | | (Millions) | |

| Eastern region | | | 19 | | | | 13,152 | | | | 7,541 | | | $ | 3,209.5 | | | $ | 3,208.5 | |

| Western region | | | 9 | | | | 7,669 | | | | 4,255 | | | | 1,902.5 | | | | 1,881.7 | |

| Total investment properties | | | 28 | | | | 20,821 | | | | 11,796 | | | $ | 5,112.0 | | | $ | 5,090.2 | |

| Fair value per Sq. ft. | | | | | | | | | | | | | | $ | 433 | | | $ | 432 | |

The key valuation metrics for our investment properties are as follows:

| | | June 30, 2013 | | | December 31, 2012 | |

| | | Maximum | | | Minimum | | | Weighted Average | | | Maximum | | | Minimum | | | Weighted Average | |

| Eastern region | | | | | | | | | | | | | | | | | | | | | | | | |

| Discount rate | | | 7.75 | % | | | 6.00 | % | | | 6.45 | % | | | 7.75 | % | | | 6.00 | % | | | 6.45 | % |

| Terminal cap rate | | | 7.00 | % | | | 5.25 | % | | | 5.63 | % | | | 7.00 | % | | | 5.25 | % | | | 5.63 | % |

| Hold period (yrs) | | | 13 | | | | 10 | | | | 11 | | | | 14 | | | | 10 | | | | 11 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Western region | | | | | | | | | | | | | | | | | | | | | | | | |

| Discount rate | | | 7.25 | % | | | 6.00 | % | | | 6.43 | % | | | 7.25 | % | | | 6.00 | % | | | 6.43 | % |

| Terminal cap rate | | | 6.00 | % | | | 5.50 | % | | | 5.65 | % | | | 6.00 | % | | | 5.50 | % | | | 5.65 | % |

| Hold period (yrs) | | | 11 | | | | 10 | | | | 10 | | | | 11 | | | | 10 | | | | 10 | |

A 25 basis-point decrease in the discount and terminal capitalization rates will impact the fair value of investment properties by $88.4 million and $123.9 million or 1.7% and 2.4%, respectively at June 30, 2013.

Upon the signing of the majority of our leases, we provide a capital allowance for tenant improvements or tenant inducements for leased space in order to accommodate the specific space requirements of the tenant. In addition to these allowances, leasing commissions are paid to third-party brokers and Brookfield Properties Management Corporation. For the three and six months ended June 30, 2013, such expenditures totaled $4.0 million and $6.3 million, respectively (compared to $5.7 million and $14.1 million during the same periods in 2012). The decrease is primarily related to higher tenant installation costs incurred on the lease-up of space at Suncor Energy Centre, Bay Adelaide West and Brookfield Place in 2012.

We also invest in ongoing maintenance and capital improvement projects to sustain the high quality of the infrastructure and tenant service amenities in our properties. Capital expenditures for the three and six months ended June 30, 2013 totaled $1.3 million and $4.6 million, respectively (compared to $6.0 million and $12.2 million during the same periods in 2012). These expenditures exclude repairs and maintenance costs. Fluctuations in our capital expenditures vary period over period based on required and planned expenditures on our investment properties.

Capital expenditures include sustaining expenditures, which are those required in order to maintain the properties in their current operating state. Capital expenditures also include projects which represent improvements to an asset or reconfiguration of space that adds productive capacity in order to increase rentable area or increase current rental rates. For the three and six months ended June 30, 2013, sustaining capital expenditures totaled $1.3 million and $1.7 million, respectively (compared with $0.5 million and $0.7 million during the same periods in 2012), while the remainder of $nil million and $2.9 million, respectively (compared with $5.5 million and $11.5 million during the same periods in 2012) primarily consist of the floor conversion project at First Canadian Place and washroom upgrades at Brookfield Place, Fifth Avenue Place and First Canadian Place. Capital expenditures are recoverable in some cases through contractual tenant cost-recovery payments. During the three and six months ended June 30, 2013, $2.3 million and $4.4 million respectively, of our total capital expenditures were recoverable, compared with $2.2 million and $3.8 million during the same periods in the prior year.

The following table summarizes the second-generation leasing commissions and tenant improvements, and sustaining capital expenditures recorded on our investment properties during the three and six months ended June 30, 2013, as well as the normalized level of activities. The normalized activities are used in calculating adjusted funds from operations and they are estimated based on historical spend levels as well as anticipated spend levels over the next few years. “Second-generation” leasing commissions and tenant improvements includes both new and renewal tenants for all of our properties with the exception of Bay Adelaide West that is considered “first-generation” since it was a new development completed in 2009 and associated leasing costs may not be representative of our normal spend. Second-generation leasing commissions and tenant improvements vary with the timing of renewals, vacancies, and tenant mix. These costs historically have been lower for renewals of existing tenants compared to new tenants. Refer to the reconciliation of funds from operations to adjusted funds from operations on page 23.

For the three and six months ended June 30, 2013, second-generation leasing commissions and tenant improvements consisted primarily of leasing commissions incurred at First Canadian Place, Bankers Hall and Hudson’s Bay Centre, and tenant improvements at Hudson’s Bay Centre, First Canadian Place and HSBC Building related to tenant build-outs.

| | Three months ended Jun. 30 | Six months ended Jun. 30 | Normalized quarterly activities(1) |

| (Millions) | | 2013 | | 2012 | | 2013 | | 2012 | | 2013 |

| Second-generation leasing commissions and tenant improvements | $ | 3.7 | $ | 4.3 | $ | 5.8 | $ | 9.9 | $ | 5.1 |

| Sustaining capital expenditures | | 1.3 | | 0.5 | | 1.7 | | 0.7 | | 1.3 |

| Total | $ | 5.0 | $ | 4.8 | $ | 7.5 | $ | 10.6 | $ | 6.4 |

(1)A normalized level of activity is estimated based on historical spend levels as well as anticipated spend levels over the next few years.

The following table summarizes the changes in value of our investment properties during the six months ended June 30, 2013:

| (Millions) | | | | Jun. 30, 2013 |

| Beginning of period | | | | $ | 5,090.2 |

| Additions: | | | | | |

| Capital expenditures and tenant improvements | | | | | 8.4 |

| Leasing commissions | | | | | 2.2 |

| Tenant inducements | | | | | 0.3 |

| Fair value gains | | | | | 9.3 |

| Other changes | | | | | 1.6 |

| End of period | | | | $ | 5,112.0 |

TENANT AND OTHER RECEIVABLES

Tenant and other receivables decreased to $13.7 million at June 30, 2013, from $25.4 million at December 31, 2012.

OTHER ASSETS

The components of other assets are as follows:

| (Millions) | Jun. 30, 2013 | Dec. 31, 2012 |

| Prepaid expenses and other assets | $ | 6.7 | $ | 6.2 |

| Restricted cash | | ¾ | | 0.8 |

| Total | $ | 6.7 | $ | 7.0 |

CASH AND CASH EQUIVALENTS

We endeavor to maintain high levels of liquidity to ensure that we can meet distribution requirements and react quickly to potential investment opportunities. At June 30, 2013, cash balances were $210.9 million, compared to $41.0 million at December 31, 2012.

Subsequent to quarter-end, we utilized $170.0 million towards the acquisition of the Bay Adelaide East development from our parent company, BPO.

LIABILITIES AND EQUITY

Our asset base of $5,343.3 million is financed with a combination of debt and equity. The components of our liabilities and equity are as follows:

| (Millions) | Jun. 30, 2013 | Dec. 31, 2012 |

| Liabilities | | | | |

| Non-current liabilities | | | | |

| Commercial property and corporate debt | $ | 1,764.0 | | $ 1,396.6 |

| | | | | |

| Current liabilities | | | | |

| Commercial property and corporate debt | | 395.3 | | 616.4 |

| Accounts payable and other liabilities | | 120.7 | | 115.0 |

| | | 2,280.0 | | 2,128.0 |

| | | | | |

| Equity | | | | |

| Unitholders’ equity | | 846.2 | | 838.1 |

| Non-controlling interest | | 2,217.1 | | 2,197.5 |

| | | 3,063.3 | | 3,035.6 |

| Total liabilities and equity | $ | 5,343.3 | | $ 5,163.6 |

| | | | | | |

COMMERCIAL PROPERTY AND CORPORATE DEBT

Commercial property and corporate debt (current and non-current) totaled $2,159.3 million at June 30, 2013 (compared to $2,013.0 million at December 31, 2012). The increase is primarily attributable to refinancing related to Brookfield Place and 105 Adelaide in Toronto, offset by a repayment of our revolving corporate credit facility, and principal amortization payments. Commercial property and corporate debt at June 30, 2013 had a weighted-average interest rate of 4.49%. Debt on our investment properties are mainly non-recourse, thereby reducing overall financial risk to the Trust.

We attempt to match the maturity of our commercial property debt portfolio with the average lease term of our properties. As a result of our refinancings, at June 30, 2013, the average term to maturity of our commercial property debt increased to six years, compared to our average lease term of eight years.

The details of the financing transactions completed during the six months ended June 30, 2013, are as follows:

| (Millions) | | | New Proceeds(1) | Net Proceeds Generated (1) | Interest Rate (%) | Mortgage Detail | Maturity |

| Brookfield Place | Q1 | Refinancing | $ | 525.0 | $ | 213.0 | 3.244% | Non-recourse | January 2020 |

| 105 Adelaide St. West | Q2 | Refinancing | | 37.5 | | 16.8 | 3.870% | Non-recourse | May 2023 |

| Hudson’s Bay Centre | Q2 | Extension | | ¾ | | ¾ | 2.999% | Limited recourse | May 2015 |

(1)Excludes financing costs.

During the first quarter of 2013, we repaid the amount drawn on our revolving corporate credit facility of $68.0 million.

The details of commercial property and corporate debt at June 30, 2013, are as follows:

| | | Interest | Maturity | BOX’s Share | |

| | Location | Rate % | Date | | (Millions) | Mortgage Details |

| Commercial property | | | | | | |

| Bankers Hall | Calgary | 6.69 | November 2013 | $ | 9.6 | Non-recourse - fixed rate |

| Bankers Hall | Calgary | 7.20 | November 2013 | | 145.6 | Non-recourse - fixed rate |

| Jean Edmonds Towers | Ottawa | 5.55 | January 2014 | | 0.2 | Non-recourse - fixed rate |

| Suncor Energy Centre(1) | Calgary | 6.38 | June 2014 | | 203.5 | Non-recourse - fixed rate |

| 151 Yonge St. | Toronto | 2.92 | July 2014 | | 9.5 | Non-recourse - floating rate |

| First Canadian Place | Toronto | 5.37 | December 2014 | | 72.1 | Non-recourse - fixed rate |

| Hudson's Bay Centre(2) | Toronto | 2.99 | May 2015 | | 102.8 | Limited recourse - fixed rate |

| Royal Centre | Vancouver | 3.33 | June 2015 | | 146.0 | Non-recourse - fixed rate |

| 2 Queen St. East | Toronto | 5.64 | December 2017 | | 28.6 | Non-recourse - fixed rate |

| Brookfield Place | Toronto | 3.24 | January 2020 | | 525.0 | Non-recourse - fixed rate |

| 22 Front St. West | Toronto | 6.24 | October 2020 | | 18.1 | Non-recourse - fixed rate |

| Bankers Court | Calgary | 4.96 | November 2020 | | 45.3 | Non-recourse - fixed rate |

| Queen's Quay Terminal | Toronto | 5.40 | April 2021 | | 86.1 | Non-recourse - fixed rate |

| Fifth Avenue Place | Calgary | 4.71 | August 2021 | | 169.3 | Non-recourse - fixed rate |

| Bay Adelaide West | Toronto | 4.43 | December 2021 | | 394.9 | Non-recourse - fixed rate |

| Exchange Tower | Toronto | 4.03 | April 2022 | | 116.7 | Non-recourse - fixed rate |

| HSBC Building | Toronto | 4.06 | January 2023 | | 44.0 | Non-recourse - fixed rate |

| 105 Adelaide St. West | Toronto | 3.87 | May 2023 | | 37.4 | Non-recourse - fixed rate |

| Jean Edmonds Towers | Ottawa | 6.79 | January 2024 | | 15.6 | Non-recourse - fixed rate |

| | | | | | | |

| Corporate | | | | | | |

| $200M Corporate Revolver(3) | ¾ | ¾ | June 2014 | | ¾ | Recourse - floating rate |

| | | 4.49 | | | 2,170.3 | |

| Premium on assumed mortgages | | | | | 1.2 | |

| Deferred financing costs | | | | | (12.2) | |

| Total | | 4.49 | | $ | 2,159.3 | |

| | | | | | | | |

(1)This loan includes a $32.3 million unsecured loan payable to the property’s joint venture partner.

(2)This loan has limited recourse to the Trust’s parent, BPO, for up to $15.0 million.

(3)A one-year extension option that extends the maturity to June 2015 is available to the Trust provided that no material defaults have occurred.

Commercial property and corporate debt maturities for the next five years and thereafter are as follows:

| | | | | | Weighted-Average |

| | | Scheduled | | | Interest Rate (%) at |

| | (Millions, except interest data) | Amortization | Maturities | Total | Jun. 30, 2013 |

| Remainder of 2013 | $ | 22.3 | $ | 153.4 | $ | 175.7 | 7.17% |

| 2014 | | 40.0 | | 277.5 | | 317.5 | 6.01% |

| 2015 | | 34.2 | | 235.1 | | 269.3 | 3.20% |

| 2016 | | 32.3 | | ¾ | | 32.3 | ¾% |

| 2017 | | 33.7 | | 28.6 | | 62.3 | 5.64% |

| 2018 and thereafter | | 124.8 | | 1,177.4 | | 1,302.2 | 4.10% |

| Total | $ | 287.3 | $ | 1,872.0 | $ | 2,159.3 | 4.49% |

| | | | | | | | | | | |

CONTRACTUAL OBLIGATIONS

The following table presents our contractual obligations over the next five years and beyond:

| | | | Payments Due By Period |

| (Millions) | | Total | 1 year | 2 – 3 years | 4 – 5 Years | After 5 Years |

| Commercial property and corporate debt(1) | | $ | 2,159.3 | $ | 395.3 | $ | 383.1 | $ | 96.0 | $ | 1,284.9 |

| Interest expense – commercial property and corporate debt(2) | 480.5 | | 89.4 | | 126.2 | | 110.6 | | 154.3 |

| Minimum rental payments - ground leases(3) | | | 493.4 | | 7.0 | | 13.8 | | 13.8 | | 458.8 |

| | | $ | 3,133.2 | $ | 491.7 | $ | 523.1 | $ | 220.4 | $ | 1,898.0 |

| | | | | | | | | | | | | | | | |

(1) Net of transaction costs.

(2)Represents aggregate interest expense expected to be paid over the term of the debt, on an undiscounted basis, based at current interest rates.

(3) Represents minimum rental payments, on an undiscounted basis, on land leases or other agreements.

CORPORATE GUARANTEES AND CONTINGENT OBLIGATIONS

We and our operating subsidiaries may be contingently liable with respect to litigation and claims that arise from time to time in the normal course of business or otherwise. A specific litigation, with a judgment amount of $60.6 million ($63.0 million Australian dollars), is being pursued against one of our subsidiaries related to security on a defaulted loan. As of June 30, 2013, the final determinable cash outflow related to the litigation being pursued against us is uncertain but could be up to the judgment amount plus interest in the event we are completely unsuccessful in defending the claims. During the first quarter, a leave to appeal $45.2 million ($47.0 million Australian dollars) of the judgment amount was granted, on the question of the propriety of the principal and interest calculations determined by the Court of Appeal.

In addition, we may execute agreements that provide for indemnifications and guarantees to third parties. Disclosure of commitments, guarantees, and contingencies can be found in Note 14 of the condensed consolidated interim financial statements.

INCOME TAXES

The Trust is a “mutual fund trust” pursuant to theIncome Tax Act (Canada). The Trust distributes or designates all taxable earnings to unitholders, and as such, under current legislation, the obligation to pay tax rests with each unitholder. No current and deferred tax provisions are required on the Trust’s income.

ACCOUNTS PAYABLE AND OTHER LIABILITIES

Accounts payable and other liabilities totaled $120.7 million at June 30, 2013 (compared to $115.0 million at December 31, 2012). The increase is primarily related to timing of accrued liabilities.

A summary of the components of accounts payable and other liabilities is as follows:

| (Millions) | Jun. 30, 2013 | Dec. 31, 2012 |

| Accounts payable and accrued liabilities | $ | 104.6 | $ | 102.3 |

| Accrued interest | | 16.1 | | 12.7 |

| Total | $ | 120.7 | $ | 115.0 |

EQUITY

The components of equity are as follows:

| (Millions) | Jun. 30, 2013 | Dec. 31, 2012 |

| Trust Units | $ | 551.6 | $ | 551.1 |

| Contributed surplus | | 3.1 | | 3.1 |

| Retained earnings | | 291.5 | | 283.9 |

| Unitholders’ equity | | 846.2 | | 838.1 |

| Non-controlling interest | | 2,217.1 | | 2,197.5 |

| Total | $ | 3,063.3 | $ | 3,035.6 |

The following tables summarize the changes in the units outstanding during the three and six months ended June 30, 2013 and June 30, 2012:

| | Three months ended Jun. 30, 2013 | Six months ended Jun. 30, 2013 |

| | Trust Units | Class B LP Units | Trust Units | Class B LP Units |

| Units issued and outstanding at beginning of period | 26,141,916 | 67,088,022 | 26,132,882 | 67,088,022 |

| Units issued pursuant to Distribution Reinvestment Plan | 8,469 | ¾ | 17,503 | ¾ |

| Total units outstanding at June 30, 2013 | 26,150,385 | 67,088,022 | 26,150,385 | 67,088,022 |

| | Three months ended Jun. 30, 2012 | Six months ended Jun. 30, 2012 |

| | | | Trust Units | Class B LP Units |

| Units issued and outstanding at beginning of period | 26,116,224 | 67,088,022 | 26,110,560 | 67,088,022 |

| Units issued pursuant to Distribution Reinvestment Plan | 5,809 | ¾ | 11,473 | ¾ |

| Total units outstanding at June 30, 2012 | 26,122,033 | 67,088,022 | 26,122,033 | 67,088,022 |

At June 30, 2013, the weighted average number of Trust Units outstanding was 26,142,226 (compared to 26,121,860 at December 31, 2012).

Trust Units

Each Trust Unit is transferable and represents an equal, undivided, beneficial interest in BOX and any distributions, whether of net income, net realized capital gains, or other amounts, and in the event of the termination or winding-up of the Trust, in the Trust’s net assets remaining after satisfaction of all liabilities. All Trust Units rank among themselves equally and ratably without discrimination, preference, or priority. Each Trust Unit entitles the holder thereof to one vote at all meetings of unitholders or with respect to any written resolution of unitholders. The Trust Units have no conversion, retraction, or redemption rights.

Special Voting Units

Special Voting Units are only issued in tandem with Class B limited partnership units (“Class B LP Units”) of Brookfield Office Properties Canada LP (“BOPC LP”) and are not transferable separately from the Class B LP Units to which they relate and upon any transfer of Class B LP Units, such Special Voting Units will automatically be transferred to the transferee of the Class B LP Units. As Class B LP Units are exchanged for Trust Units or purchased for cancellation, the corresponding Special Voting Units will be cancelled for no consideration.

Each Special Voting Unit entitles the holder thereof to one vote at all meetings of unitholders or with respect to any resolution in writing of unitholders. Except for the right to attend and vote at meetings of the unitholders or with respect to written resolutions of the unitholders, Special Voting Units do not confer upon the holders thereof any other rights. A Special Voting Unit does not entitle its holder to any economic interest in BOX, or to any interest or share in BOX, or to any interest in any distributions (whether of net income, net realized capital gains, or other amounts), or to any interest in any net assets in the event of termination or winding-up.

Non-Controlling interest

We classify the outstanding Class B LP Units as non-controlling interest for financial statement purposes in accordance with IFRS. The Class B LP Units are exchangeable on a one-for-one basis (subject to customary anti-dilution provisions) for Trust Units at the option of the holder. Each Class B LP Unit is accompanied by a Special Voting Unit that entitles the holder thereof to receive notice of, to attend, and to vote at all meetings of unitholders of BOX. The holders of Class B LP Units are entitled to receive distributions when declared by BOPC LP equal to the per-unit amount of distributions payable to each holder of Trust Units. However, the Class B LP Units have limited voting rights over BOPC LP.

The following tables present distributions declared to Trust unitholders and non-controlling interest for the three and six months ended June 30, 2013 and June 30, 2012.

| | Three months ended Jun. 30, 2013 | Six months ended Jun. 30, 2013 |

| (Millions, except per unit amounts) | | Trust Units | Class B LP Units | Trust Units | Class B LP Units |

| Paid in cash or DRIP | $ | 5.1 | $ | 13.0 | $ | 12.7 | $ 32.7 |

| Payable as of June 30, 2013 | | 2.6 | | 6.5 | | 2.6 | 6.5 |

| Total | | 7.7 | | 19.5 | | 15.3 | 39.2 |

| Per unit | $ | 0.29 | $ | 0.29 | $ | 0.58 | $ 0.58 |

| | Three months ended Jun. 30, 2012 | Six months ended Jun. 30, 2012 |

| (Millions, except per unit amounts) | | Trust Units | Class B LP Units | Trust Units | Class B LP

Units |

| Paid in cash or DRIP | $ | 4.7 | $ | 12.1 | $ | 11.7 | $ 30.2 |

| Payable as of June 30, 2012 | | 2.4 | | 6.0 | | 2.4 | 6.0 |

| Total | | 7.1 | | 18.1 | | 14.1 | 36.2 |

| Per unit | $ | 0.27 | $ | 0.27 | $ | 0.54 | $ 0.54 |

We determine annual distributions to unitholders by looking at forward-looking cash flow information, including forecasts and budgets and the future business prospects of the Trust. We do not consider periodic cash flow fluctuations resulting from items such as the timing of property operating costs, property tax installments, or semi-annual debenture and mortgage payable interest payments in determining the level of distributions to unitholders. To determine the level of cash distributions made to unitholders, we consider the impact of, among other items, the future growth in the income-producing portfolio, future acquisitions, and leasing related to the income-producing portfolio. Annual distributions to unitholders are expected to continue to be funded by cash flows generated from our portfolio.

CAPITAL RESOURCES AND LIQUIDITY

We employ a broad range of financing strategies to facilitate growth and manage financial risk, with particular emphasis on the overall reduction of the weighted-average cost of capital, in order to enhance returns for unitholders. Our principal liquidity needs for the next twelve months are to:

| • | fund recurring expenses; |

| • | meet debt service requirements; |

| • | fund those capital expenditures deemed mandatory, including tenant improvements; and |

| • | fund investing activities, which could include: |

| § | discretionary capital expenditures; |

| § | property acquisitions; and |

| § | repurchase of our units. |

We believe that our liquidity needs will be satisfied using cash on hand and cash flows generated from operating and financing activities. Rental revenue, recoveries from tenants, interest and other income, available cash balances, draws on our credit facilities and refinancings (including upward refinancings) of maturing indebtedness are our principal sources of capital used to pay operating expenses, distributions, debt service, capital expenditures, and leasing costs in our commercial-property portfolio. We seek to increase income from our existing properties by controlling operating expenses and by maintaining quality standards for our properties that promote high occupancy rates and support increases in rental rates while reducing tenant turnover. We believe our revenue, along with proceeds from financing activities, will continue to provide the necessary funds for our short-term liquidity needs and to fund anticipated ongoing distributions. However, material changes in these factors may adversely affect our net cash flows.

Our principal liquidity needs for periods beyond the next year are for scheduled debt maturities, unit distributions, and capital expenditures. We plan to meet these needs with one or more of the following:

| • | cash flow from operating activities; and |

| • | credit facilities and refinancing opportunities. |

Our commercial property and corporate debt is primarily fixed-rate and non-recourse to the Trust. These investment-grade financings are typically structured on a loan-to-appraised-value basis of between 50% and 65% as market conditions permit. In addition, in certain circumstances where a building is leased almost exclusively to a high-credit-quality tenant, a higher loan-to-value financing, based on the tenant’s credit quality, is put in place at rates commensurate with the cost of funds for the tenant. This reduces our equity requirements to finance commercial property and enhances equity returns.

Most of our borrowings are in the form of long-term property-specific financings with recourse only to the specific assets. Limiting recourse to specific assets ensures that poor performance within one area does not compromise our ability to finance the balance of our operations. Our maturity schedule is fairly diversified so that financing requirements in any given year are manageable.

Our focus on structuring financings with investment-grade characteristics ensures that debt levels on any particular asset can typically be maintained throughout a business cycle. This enables us to limit covenants and other performance requirements, thereby reducing the risk of early payment requirements or restrictions on the distribution of cash from the assets being financed.

To help ensure we are able to react to investment opportunities quickly and on a value basis, we attempt to maintain a high level of liquidity. Our primary sources of liquidity consists of cash and undrawn committed credit facilities. In addition, we structure our affairs to facilitate monetization of longer-duration assets through financings, co-investor participations, or refinancings.

At June 30, 2013, our available liquidity consists of $210.9 million of cash on hand, and $166.3 million of undrawn capacity on our credit facility.

Cost of Capital

We continually strive to reduce our weighted-average cost of capital and improve unitholders’ equity returns through value-enhancement initiatives and the consistent monitoring of the balance between debt and equity financing.

As of June 30, 2013, our weighted-average cost of capital, assuming a long-term 9.0% return on equity, was 6.9%. Our cost of capital is lower than many of our peers because of the greater amount of investment-grade financing that can be placed on our assets, which is a function of the high-quality nature of both the assets and the tenant base that composes our portfolio. In determining the long-term 9.0% return on equity, management considers various factors including a review of various financial models such as dividend growth model and capital asset pricing model, as well as examination of market returns. Based on the calculations of the financial models, market returns and historic returns achieved by the Trust, management believes that the long-term 9.0% return is an appropriate benchmark.

The following schedule details the capitalization of the Trust and the related costs thereof:

| | Cost of Capital(1) | Underlying Value(2) |

| (Millions, except cost of capital data) | Jun. 30, 2013 | Dec. 31, 2012 | Jun. 30, 2013 | Dec. 31, 2012 |

| Liabilities | | | | | | |

| Commercial property and corporate debt | 4.5% | 5.2% | $ | 2,159.3 | $ | 2,013.0 |

| Unitholders’ equity | | | | | | |

| Trust Units(3) | 9.0% | 9.0% | | 683.6 | | 764.0 |

| Other equity | | | | | | |

| Non-controlling interest(3) | 9.0% | 9.0% | | 1,750.6 | | 1,964.0 |

| Total | 6.9% | 7.4% | $ | 4,593.5 | $ | 4,741.0 |

| | | | | | | | |

| (1) | Total weighted-average cost of capital is calculated on the weighted average of underlying value. |

| (2) | Underlying value of liabilities presents the cost to retire debt on maturity. Underlying value of unitholders’ equity and other equity is based on the closing unit price of BOX on the TSX. |

| (3) | Assumes a long-term 9.0% return on equity for June 30, 2013 and December 31, 2012. |

OPERATING RESULTS

Included on the following pages is a discussion of the various components of our income statement results followed by a reconciliation of funds from operations and adjusted funds from operations to comparable IFRS measures.

| | | Three months ended Jun. 30 | Six months ended Jun. 30 |

| (Millions, except per unit amounts) | | | | 2013 | | 2012 | | 2013 | | 2012 |

| Commercial property revenue | | | | | $ | 130.9 | $ | 124.0 | $ | 259.2 | $ | 249.2 |

| Direct commercial property expense | | | | | | 62.5 | | 57.2 | | 122.0 | | 116.4 |

| | | | | | | 68.4 | | 66.8 | | 137.2 | | 132.8 |

| Investment and other income | | | | | | 0.4 | | ¾ | | 0.6 | | ¾ |

| Interest expense | | | | | | 25.5 | | 27.5 | | 51.4 | | 55.0 |

| General and administrative expense | | | | | | 8.4 | | 5.2 | | 14.0 | | 10.2 |

| Income beforefair value gains | | | | | | 34.9 | | 34.1 | | 72.4 | | 67.6 |

| Fair value gains | | | | | | 0.3 | | 100.3 | | 9.3 | | 219.2 |

| Net income and comprehensive income | | | | | $ | 35.2 | $ | 134.4 | $ | 81.7 | $ | 286.8 |

| Net income and comprehensive income attributable to: | | | | | | | | | |

| Unitholders | | | | | $ | 9.9 | $ | 37.6 | $ | 22.9 | $ | 80.3 |

| Non-controlling interest | | | | | | 25.3 | | 96.8 | | 58.8 | | 206.5 |

| | | | | | $ | 35.2 | $ | 134.4 | $ | 81.7 | $ | 286.8 |

| Net income per Trust unit | | | | | $ | 0.38 | $ | 1.44 | $ | 0.88 | $ | 3.08 |

COMMERCIAL PROPERTY REVENUE

Revenue from commercial properties includes rental revenues earned from tenant leases, straight-line rent, percentage rent, and additional rent from the recovery of operating costs and property taxes. Revenue from investment properties totaled $130.9 million and $259.2 million for the three and six months ended June 30, 2013, respectively (compared to $124.0 million and $249.2 million during the same periods in 2012). The increase is primarily due to the increase in occupancy at Bay Adelaide West and the continued growth in same property revenues.

The components of revenue are as follows:

| Three months ended Jun. 30 | Six months ended Jun. 30 |

| (Millions) | 2013 | 2012 | | 2013 | | 2012 |

| Rental revenue | $ | 130.1 | $ | 121.5 | $ | 256.9 | $ | 244.7 |

| Non-cash rental revenue | | 0.8 | | 1.9 | | 1.6 | | 3.8 |

| Lease termination and other income | | ¾ | | 0.6 | | 0.7 | | 0.7 |

| Commercial property revenue | $ | 130.9 | $ | 124.0 | $ | 259.2 | $ | 249.2 |

Our strategy of owning premier properties in high-growth, and in many instances supply-constrained markets with high barriers to entry, along with our focus on executing long-term leases with strong credit-rated tenants, has created one of Canada’s most distinguished portfolios of office properties. In the past, this strategy has reduced our exposure to the cyclical nature of the real estate business. In the second quarter of 2013, we continued to reduce our lease expiry profile.We feel confident with our current rollover exposure, which is the percentage of our total managed space currently scheduled to expire, and are focused on working toward renewals on expiries in the upcoming months, as well as continuing to manage our rollover exposure in the future years.

Our leases generally have clauses that provide for the collection of rental revenues in amounts that increase every few years, with these increases negotiated at the signing of the lease. During the six months ended June 30, 2013, approximately 57% of our leases completed have rent escalation clauses that will increase rent by an average of $0.29 per square foot on an annual basis over the term of the lease. The large number of high-credit-quality tenants in our portfolio lowers the risk of not realizing these increases. IFRS requires that these increases be recorded on a straight-line basis over the life of the lease. For the three and six months ended June 30, 2013, we recognized $0.8 million and $1.6 million, respectively, of non-cash rental revenue (compared to $1.9 million and $3.8 million during the same periods in 2012). The decrease over the prior year is primarily due to the expiry of free rent periods at Brookfield Place and Bay Adelaide West in Toronto.

Direct commercial property expenses, which include real estate taxes, utilities, insurance, repairs and maintenance, cleaning, and other property-related expenses, were $62.5 million and $122.0 million for the three and six months ended June 30, 2013, respectively (compared to $57.2 million and $116.4 million during the same periods in 2012).

Substantially all of our leases are net leases, in which the lessee is required to pay its proportionate share of the property’s operating expenses such as utilities, repairs, insurance, and taxes. Consequently, leasing activity is the principal contributor to the change in same-property net operating income. Our total portfolio occupancy rate ended the quarter at 96.9%. At June 30, 2013, average in-place net rent throughout the portfolio was $27 per square foot, compared with an average market net rent of $33 per square foot. The Trust’s average in-place net rent is lower than the market net rent which is reflective of the fact that a portion of our leases were executed at a point in time wherein market rents were lower. In a market of increasing rents, this below-market gap provides a growth opportunity for the Trust as we replace lower in-place net rents with higher market rents. Accordingly, we anticipate steady growth in our net operating income as the two rates converge over time.

The following table shows the average lease term, in-place rents, and estimated current market rents for similar space in each of our markets as of June 30, 2013:

| | | Avg. | Avg. In-Place(1) | Avg. Market(2) |

| | Leasable Area | Lease Term | Net Rent | Net Rent |

| Region | (000's Sq. Ft.) | (Years) | ($ per Sq. Ft.) | ($ per Sq. Ft.) |

| Toronto, Ontario | 8,750 | 7.5 | 28 | 33 |

| Ottawa, Ontario | 1,744 | 0.9 | 18 | 21 |

| Calgary, Alberta | 5,635 | 11.2 | 28 | 36 |

| Vancouver, B.C. | 582 | 8.0 | 22 | 33 |

| Other | 3 | ¾ | ¾ | ¾ |

| Total | 16,714 | 8.1 | 27 | 33 |

| (1) | Average in-place net rent represents the annualized cash amount on a per square foot basis collected from tenants plus tenant expense reimbursements less the operating expenses being incurred for that space, excluding the impact of straight-lining rent escalations or amortizing free rent periods provided on in-place leases. |

| (2) | Average market net rent represents management’s estimate of average rent per square foot for buildings of similar quality to our portfolio. However, it may not necessarily be representative of the specific space that is rolling in any specific year. |

A summary of current and historical occupancy levels at June 30 for the past two years is as follows:

| | | Jun. 30, 2013 | | Jun. 30, 2012 |

| | Leasable | % | Leasable | % |

| (000’s Sq. Ft., except % leased data) | Area | Leased | Area | Leased |

| Toronto, Ontario | 8,750 | 94.6 | 8,759 | 94.7 |

| Ottawa, Ontario | 1,744 | 99.7 | 1,745 | 99.7 |

| Calgary, Alberta | 5,635 | 99.7 | 5,639 | 99.6 |

| Vancouver, B.C. | 582 | 97.2 | 589 | 97.7 |

| Other | 3 | 100.0 | 3 | 100.0 |

| Total | 16,714 | 96.9 | 16,735 | 97.0 |

During the six months ended June 30, 2013, we leased 699,000 square feet of space, which included 469,000 square feet of new leasing and 230,000 square feet of renewals, compared to expiries of 504,000 square feet and accelerated expiries of 180,000 square feet. The average leasing net rent was $34 per square foot, which is an increase of 21.4% over the average expiring net rent of $28 per square foot. At June 30, 2013, the average leasing net rent related to new and renewed leases was $32 per square foot and $40 per square foot, respectively.

Leasing highlights from the second quarter include:

| · | 130,000 square feet in Toronto |

| - | A 10-year, 36,000-square-foot renewal with the Toronto Board of Trade at First Canadian Place |

| - | An average three-year, 32,000-square-foot renewal and expansion with Vision Critical Communications at Hudson’s Bay Centre |

| - | An eight-year, 15,000-square-foot new lease with Catlin Canada Inc. at First Canadian Place |

| - | A 10-year, 11,000-square-foot new lease with Enwave Energy Corporation at Bay Adelaide West |

| · | 30,000 square feet in Calgary |

| - | A five-year, 11,000-square-foot renewal with Cushman & Wakefield LePage at Suncor Energy Centre |

The details of our leasing activity for the six months ended June 30, 2013, are as follows:

| | Dec. 31, 2012 | Activities during the six months ended Jun. 30, 2013 | Jun. 30, 2013 |

| | Total | | | | Average(1) | | | Year One(2) | Average(3) | | Total | |

| | Leasable | | | | Expiring | Leasing | Leasing | Leasing | | Leasable | |

| (000's Sq. Ft.) | Area | Leased | | Expiries | Net Rent | New | Renewal | Net Rent | Net Rent | | Area | Leased |

| Toronto, Ontario | 8,750 | 8,262 | | (362) | $ 27 | 262 | 113 | $ 34 | $ 35 | | 8,750 | 8,275 |

| Ottawa, Ontario | 1,744 | 1,739 | | (5) | 27 | 1 | 4 | 29 | 29 | | 1,744 | 1,739 |

| Calgary, Alberta | 5,635 | 5,609 | | (302) | 30 | 201 | 111 | 31 | 33 | | 5,635 | 5,619 |

| Vancouver, B.C. | 582 | 574 | | (15) | 28 | 5 | 2 | 34 | 36 | | 582 | 566 |

| Other | 3 | 3 | | ¾ | ¾ | ¾ | ¾ | ¾ | ¾ | | 3 | 3 |

| Total Leasing | 16,714 | 16,187 | | (684) | $ 28 | 469 | 230 | $ 33 | $ 34 | | 16,714 | 16,202 |

| (1) | Represents net rent in the final year. |

| (2) | Year one leasing net rent is the rent at the commencement of the lease term on a per square foot basis including tenant expense reimbursements, less operating expenses being incurred for that space, but excluding the impact of straight-lining rent escalations or amortization of free rent periods. |

| (3) | Average leasing net rent is the average rent over the lease term on a per square foot basis including tenant expense reimbursements, less operating expenses being incurred for that space, but including the impact of straight-ling rent escalations or amortization of free rent periods. |

Additionally, during the six months ended June 30, 2013, tenant improvements and leasing costs related to leasing activity that occurred averaged $18.17 per square foot, of which $24.75 per square foot and $4.79 per square foot related to new and renewed leases, respectively, compared to $10.16 per square foot during the same period in 2012.

INVESTMENT AND OTHER INCOME

Investment and other income totaled $0.4 million and $0.6 million during the three and six months ended June 30, 2013 (compared to $nil during the same periods in 2012). The amounts primarily include interest earned on cash balances and other income.

INTEREST EXPENSE

Interest expense totaled $25.5 million and $51.4 million during the three and six months ended June 30, 2013, respectively (compared to $27.5 million and $55.0 million during the same periods in 2012). The decrease is due to the lower average costs of borrowing of 4.5%, compared to 5.3% during the same period in 2012, primarily related to the refinancing at Exchange Tower, Brookfield Place and 105 Adelaide St. West, at lower interest rates, which occurred during the second quarter of 2012, first quarter of 2013, and second quarter of 2013, respectively, coupled with lower interest incurred as a result of the repayment of the outstanding balance on the revolving corporate credit facility and exercising the option to extend the existing debt at Hudson’s Bay Centre, at a lower interest rate, which occurred during the first and second quarter of 2013, respectively.

GENERAL AND ADMINISTRATIVE EXPENSES

General and administrative expenses were $8.4 million and $14.0 million during the three and six months ended June 30, 2013, respectively (compared to $5.2 million and $10.2 million during the same periods in 2012). The increase is primarily due to a non-recurring legal charge and an increase in asset management fees during the year.

INCOME TAX EXPENSE

The Trust is a “mutual fund trust” pursuant to theIncome Tax Act (Canada). The Trust distributes or designates all taxable earnings to unitholders, and as such, under current legislation, the obligation to pay tax rests with each unitholder. No current and deferred tax provisions are required on the Trust’s income.

FAIR VALUE GAINS

During the three and six months ended June 30, 2013, the Trust recognized fair value gains of $0.3 million and $9.3 million, respectively (compared to $100.3 million and $219.2 million during the same periods in 2012). Fair value adjustments are determined based on the movement of various parameters on a quarterly basis, including changes in projected cash flows as a result of leasing and timing, discount rates, and terminal capitalization rates. Our investment property valuations have remained relatively unchanged from December 31, 2012 supported by stable market conditions and minimal investment activities.

COMMERCIAL PROPERTY NET OPERATING INCOME

Commercial property net operating income includes commercial property revenue less direct commercial property expense and is a key indicator of performance as it represents a measure over which management of the commercial property operations has control. One of the ways in which we evaluate performance is by comparing the performance of the commercial property portfolio on a same property basis. Same property commercial property net operating income is defined as properties included in our consolidated results that we own and operate throughout both the current and prior period. Accordingly, same property results would exclude properties acquired or sold during each period, as well as significant lease termination and other income amounts that are non-recurring.

Our commercial property net operating income for the three and six months ended June 30, 2013, was $68.4 million and $137.2 million, respectively (compared to $66.8 million and $132.8 million during the same periods in 2012). The increase is primarily due to increases in occupancy at Brookfield Place, Bay Adelaide West and Hudson’s Bay Centre in Toronto, Suncor Energy Centre, Bankers Hall and Fifth Avenue Place in Calgary and continued growth in same property revenues offset by expiries at First Canadian Place and Exchange Tower.

The components of commercial property net operating income are as follows:

| | Three months ended Jun. 30 | Six months ended Jun. 30 |

| (Millions) | | 2013 | | 2012 | | 2013 | | 2012 |

| Commercial property revenue | $ | 130.9 | $ | 124.0 | $ | 259.2 | $ | 249.2 |

| Direct commercial property expense | | 62.5 | | 57.2 | | 122.0 | | 116.4 |

| Total | $ | 68.4 | $ | 66.8 | $ | 137.2 | $ | 132.8 |

| Three months ended Jun. 30 | Six months ended Jun. 30 |

| | (Millions) | 2013 | 2012 | | 2013 | | 2012 |

| | Commercial property net operating income – same property | $ | 68.4 | $ | 66.2 | $ | 136.5 | $ | 132.1 |

| | Lease termination and other income | | ¾ | | 0.6 | | 0.7 | | 0.7 |

| | Total | $ | 68.4 | $ | 66.8 | $ | 137.2 | $ | 132.8 |

| | | | | | | | | | |

| Jun. 30, 2013 | Jun. 30, 2012 |

| | Same property average in-place net rent | | | $ | 27 | | | $ | 26 |

| | Same property occupancy | | | | 96.9% | | | | 97.0% |

| | | | | | | | | | |

RECONCILIATION OF NET INCOME TO FUNDS FROM OPERATIONS

Funds from operations was $0.38 per unit and $0.79 per unit during the three and six months ended June 30, 2013, respectively (compared to $0.37 per unit and $0.73 per unit during the same periods in 2012).

| | Three months ended Jun. 30 | Six months ended Jun. 30 | |

| (Millions, except per unit amounts) | | 2013 | | 2012 | | 2013 | | 2012 | |

| Net income | $ | 35.2 | $ | 134.4 | $ | 81.7 | $ | 286.8 | |

| Add (deduct): | | | | | | | | | |

| Fair value gains | | (0.3) | | (100.3) | | (9.3) | | (219.2) | |

| Amortization of lease incentives | | 0.5 | | ¾ | | 1.2 | | ¾ | |

| Funds from operations | $ | 35.4 | $ | 34.1 | $ | 73.6 | $ | 67.6 | |

| Funds from operations attributable to unitholders | | 9.9 | | 9.6 | | 20.6 | | 19.0 | |

| Funds from operations attributable to non-controlling interest | | 25.5 | | 24.5 | | 53.0 | | 48.6 | |

| | $ | 35.4 | $ | 34.1 | $ | 73.6 | $ | 67.6 | |

| Weighted average Trust Units outstanding | | 26.1 | | 26.1 | | 26.1 | | 26.1 | |

| Funds from operations per Trust unit | $ | 0.38 | $ | 0.37 | $ | 0.79 | $ | 0.73 | |

RECONCILIATION OF FUNDS FROM OPERATIONS TO ADJUSTED FUNDS FROM OPERATIONS

Adjusted funds from operations totaled $0.30 per unit and $0.62 per unit during the three and six months ended June 30, 2013, respectively (compared to $0.28 per unit and $0.56 per unit during the same period in 2012).

| | | | | | | | | | | | |

| | | Three months ended Jun. 30 | Six months ended Jun. 30 |

| | (Millions, except per unit amounts) | | 2013 | | 2012 | | 2013 | | 2012 |

| | Funds from operations Deduct: | $ | 35.4 | $ | 34.1 | $ | 73.6 | $ | 67.6 |

| | Straight-line rental income | | (1.3) | | (1.9) | | (2.8) | | (3.8) |

| | Normalized second-generation leasing commissions and tenant improvements(1) | | (5.1) | | (4.5) | | (10.2) | | (9.0) |

| | Normalized sustaining capital expenditures(1) | | (1.3) | | (1.4) | | (2.6) | | (2.8) |

| | Adjusted funds from operations | $ | 27.7 | $ | 26.3 | $ | 58.0 | $ | 52.0 |

| | Adjusted funds from operations attributable to unitholders | | 7.7 | | 7.4 | | 16.2 | | 14.6 |

| | Adjusted funds from operations attributable to non-controlling interest | | 20.0 | | 18.9 | | 41.8 | | 37.4 |