On October 29, 2020, we provided a loan of $467,600 to Alvir Navin, our Chief Operating Officer, to finance the exercise of certain options to purchase our Class A common stock held by Mr. Navin. The loan was repaid in full on November 8, 2021.

On October 29, 2020, we provided a loan of $83,403 to David Harrison, our former Chief Technology Officer and former member of our board of directors, to finance the exercise of certain options to purchase our Class A common stock held by Mr. Harrison.

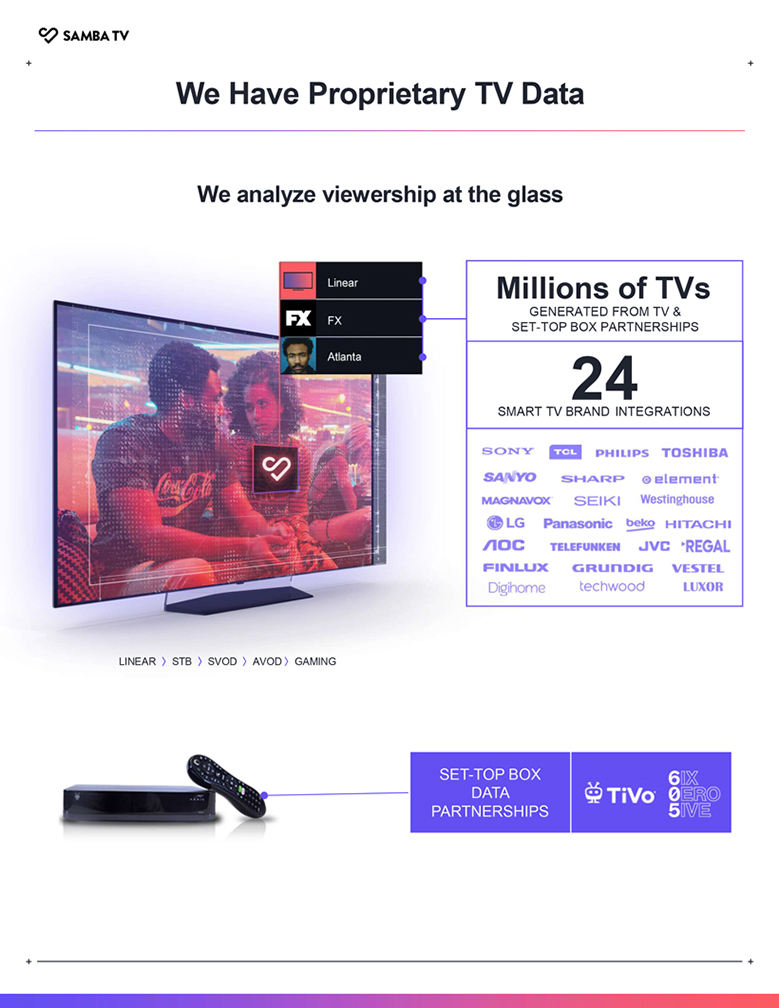

Data Provision Agreement with TiVo

In June 2020, we entered into a Data Provision Agreement (Data Provision Agreement) with TiVo Research and Analytics, Inc. (TiVo) to complement our first-party CTV data with TiVo’s set-top box data. Jon Kirchner is a member of our board of directors and the chief executive officer of Xperi Corporation, which is the parent company of TiVo. Pursuant to the Data Provision Agreement, we paid TiVo $200,000 in 2020. We have ongoing commitments under the Data Provision Agreement and expect to pay TiVo approximately $1.1 million for services performed in 2021.

2014 Warrants

In July and August 2014 and May 2015, we issued warrants to purchase shares of our Series B preferred stock with an exercise price of $0.01 per share in connection with the issuance of certain convertible notes (2014 Notes) to certain related persons, including David Harrison, a former member of our board of directors; certain of our executive officers, Ashwin Navin and Alvir Navin; and entities affiliated with August Capital, who currently holds more than 5% of our outstanding common stock and are affiliated with Howard Hartenbaum, a member of our board of directors. In July and August 2021, our board of directors and a majority in interest of the holders of the 2014 Notes approved an amendment to the 2015 Warrants to extend the expiration date through September 15, 2021. Mr. Harrison, Mr. Ashwin Navin, Mr. Alvir Navin and August Capital each exercised their 2014 Warrants for 3,319 shares, 6,637 shares, 3,319 shares and 26,554 shares of our Series B preferred stock, respectively.

Other Transactions

In August 2019, we purchased certain assets of Wove Technologies, Inc. (Wove) in exchange for 318,043 shares of our Series B preferred stock. August Capital and/or its affiliates were investors in Wove, and Howard Hartenbaum, a member of our board of directors, is affiliated with August Capital V, L.P.

We are party to that certain Amended and Restated Investors’ Rights Agreement, dated February 19, 2021, pursuant to which certain holders of our common stock, including August Capital, Ashwin Navin, and Michael Farrow, have the right to demand that we file a registration statement or request that their shares of our common stock be covered by a registration statement that we are otherwise filing. See the section titled “Description of Capital Stock—Registration Rights” for additional information. Mr. Hartenbaum, a member of our board of directors, is affiliated with August Capital, which is party to this agreement. Ashwin Navin, our Chief Executive Officer and a member of our board of directors, Michael Farrow, our Chief Financial Officer, and David Harrison, our former Chief Technology Officer and former director are also parties to this agreement.

Pursuant to our equity compensation plans and certain agreements with our stockholders, including that certain Amended and Restated First Refusal and Co-Sale Agreement, dated February 19, 2021, with certain holders of our redeemable convertible preferred stock, we or our assignees have a right to purchase shares of our capital stock which stockholders propose to sell to other parties. This right will terminate upon the completion of this offering. Mr. Hartenbaum, a member of our board of directors, is affiliated with August Capital V, L.P., which is party to this agreement. Ashwin Navin, our Chief Executive Officer and a member of our board of directors, Michael Farrow, our Chief Financial Officer, and David Harrison, our former Chief Technology Officer and former director, are also parties to this agreement.

128