Filed Pursuant to Rule 424(b)(3)

Registration No. 333-180356

RREEF PROPERTY TRUST, INC.

SUPPLEMENT NO. 8 DATED AUGUST 16, 2013

TO THE PROSPECTUS DATED APRIL 12, 2013

This document supplements, and should be read in conjunction with, our prospectus dated April 12, 2013, Supplement No. 1 dated May 6, 2013, Supplement No. 2 dated May 10, 2013, Supplement No. 3 dated May 31, 2013, Supplement No. 4 dated June 3, 2013, Supplement No. 5 dated July 1, 2013, Supplement No. 6 dated July 30, 2013, and Supplement No. 7 dated August 2, 2013 relating to our offering of up to $2,500,000,000 in shares of our common stock. Terms used in this Supplement No. 8 and not otherwise defined herein have the same meanings as set forth in our prospectus. The purpose of this Supplement No. 8 is to disclose:

| |

| • | the status of our public offering; |

| |

| • | updates to the “Plan of Operation” section of our prospectus, which is recaptioned "Management's Discussion and Analysis of Financial Condition and Results of Operations," in conformance with our disclosures in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2013, which was filed with the SEC on August 14, 2013; |

| |

| • | an update to the “Experts” section of our prospectus; and |

| |

| • | our consolidated unaudited financial statements as of and for the quarter ended June 30, 2013. |

Status of Our Public Offering

On January 3, 2013, we commenced our initial public offering of up to $2,500,000,000 in shares of any combination of our Class A and Class B common stock, consisting of up to $2,250,000,000 in shares in our primary offering and up to $250,000,000 in shares pursuant to our distribution reinvestment plan.

As of August 15, 2013, we have received aggregate gross proceeds of approximately $11,185,000, including $100,000 from the sale of 7,961 Class A shares and $11,085,000 from the sale of 922,537 Class B shares pursuant to our primary offering. As of August 15, 2013, there were approximately $2,238,815,000 in shares of our common stock in our primary offering available for sale. As of August 15, 2013, we have received approximately $85,500 pursuant to our distribution reinvestment plan, all from the sale of 7,038 Class B shares. As of August 15, 2013, there were approximately $249,914,500 in shares of our common stock available for sale pursuant to our distribution reinvestment plan.

We are structured as a perpetual-life, non-listed REIT, which means that subject to regulatory approval of our filing for additional offerings and qualification as a REIT for U.S. federal income tax purposes, we intend to effectively conduct a continuous offering of an unlimited number of shares of our common stock over an unlimited time period by filing a new registration statement prior to the end of the three-year period described in Rule 415 of the Securities Act.

Management's Discussion and Analysis of

Financial Condition and Results of Operations

The “Plan of Operation” section of our prospectus is deleted in its entirety and replaced by the following disclosure, captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations," which is consistent with disclosures included in our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2013.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated unaudited financial statements, the notes thereto and the other unaudited financial data included in this Supplement. The following discussion should also be read in conjunction with our audited consolidated financial statements and the notes thereto, included in our prospectus. The terms “we,” “us,” “our” and the “Company” refer to RREEF Property Trust, Inc. and its subsidiaries.

Overview

We are a Maryland corporation formed on February 7, 2012, our inception date, to invest in a diversified portfolio of high quality, income-producing commercial real estate properties and other real estate-related assets. We are an externally advised, perpetual-life corporation that intends to qualify as a REIT for federal income tax purposes. We intend to hold our properties, real estate-related assets and other investments through RREEF Property Operating Partnership, LP, or our operating partnership, of which we are the sole general partner.

We intend to invest primarily in the office, industrial, retail and multifamily sectors of the commercial real estate industry. Real estate-related assets include common and preferred stock of publicly traded REITs and other real estate companies, which we refer to as “real estate equity securities,” and debt investments backed by real estate, which we refer to as “real estate loans.”

Our board of directors will at all times have ultimate oversight and policy-making authority over us, including responsibility for governance, financial controls, compliance and disclosure. Pursuant to our advisory agreement, however, our board has delegated to our advisor authority to manage our day-to-day business, in accordance with our investment objectives, strategy, guidelines, policies and limitations.

On May 30, 2013, upon receipt of purchase orders from our sponsor for $10,000,000 of Class B shares and the release to us of funds in the escrow account, we commenced operations. Prior to May 30, 2013, we had neither engaged in any operations nor generated any revenues. Our entire activity from our inception date through May 30, 2013 was to prepare for and implement our public offering of our common stock.

Portfolio Information

On May 31, 2013, we acquired our first real estate investment at 9022 Heritage Parkway, a 94,233 square foot low-rise office building located in Woodridge, Illinois, approximately 25 miles west of downtown Chicago. The purchase price was $13,300,000, excluding closing costs, and was funded with $6,600,000 of proceeds from the sale of our common stock and $6,700,000 of borrowings under our line of credit with Regions Bank. The borrowing carried an initial interest rate of 2.40%.

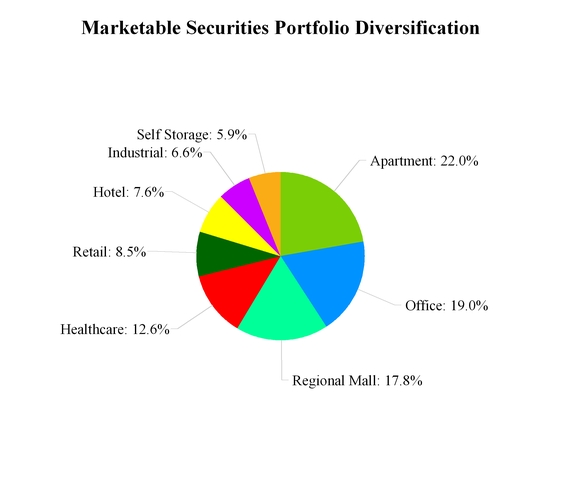

Also on May 31, 2013, we invested approximately $3,066,000 in a portfolio of publicly traded common stock of 31 REITs. We believe that investing a portion of our proceeds from our offering into a diversified portfolio of common and preferred shares of REITs and other real estate operating companies will provide the overall portfolio some flexibility with near-term liquidity as well as potentially enhance our net asset value over a longer period. The portfolio is regularly reviewed and evaluated to determine whether the marketable securities held at any time continue to serve their original intention. We will likely have a limited amount of sales and reinvestments in any given period due to repositioning of the portfolio.

The following chart summarizes our marketable securities by property type as of June 30, 2013:

Results of Operations

We commenced operations on May 30, 2013 upon receipt of $10,000,000 in proceeds from our offering. On May 31, 2013, we acquired our first property and made our initial investments in marketable securities. As a result, our operating results described below reflect only one month of investment activity and are not indicative of future periods. In addition, we have not invested all of the proceeds from our offering that we have received to date, and we expect to continue to raise additional capital, increase our borrowings and make future acquisitions, which would have a significant impact on our future results of operations.

Revenues

Our total revenue for the six months ended June 30, 2013, all of which was earned in June 2013, was $127,484, comprised of $107,494 of rental income and $19,990 of investment income. All of our rental income, which is inclusive of $10,697 of straight-line rental revenue, was derived from our first property, 9022 Heritage Parkway.

On May 31, 2013, $3,066,298 was invested in a diversified portfolio of publicly traded common stock of 31 REITs. During June, some of these securities were sold and the proceeds were reinvested in the common stock of other publicly traded REITs. All of our $19,990 of investment income was comprised of dividend income from these investments.

Operating Expenses

Our total operating expenses during the six months ended June 30, 2013, all of which were recognized during the month of June, were $704,342. The most significant component of our operating expenses, general and administrative expenses of $545,876, included a variety of corporate expenses, the largest of which were directors and officers insurance, legal fees and independent director fees. These expenses were disproportionately large, relative to other corporate expenses, because they accumulated during the period commencing in January 2013, but were not recognized as expenses until we commenced operations in May 2013. Our operating expenses also included $58,486 of acquisition-related expenses, which we incurred in connection with our acquisition of 9022 Heritage Parkway. The property is 100% leased pursuant to a net lease, whereby most the property's direct operating expenses are paid by the tenant. As a result, the property operating expenses for the month of June 2013 were $4,213. We expect our acquisition-related expenses, depreciation, amortization and property operating expenses to increase in future periods because (1) the amounts of these expenses reported during the six months ended June 30, 2013 reflect only one month of activity and (2) we anticipate acquiring additional properties in the future.

Interest Expense

On May 1, 2013, we entered into a revolving credit facility, and on May 31, 2013, we borrowed $6,700,000 under the credit facility to fund our first property acquisition. Since we entered into the credit facility, we incurred $13,847 of interest expense, $23,630 of unused line of credit fees and $35,621 of amortization of deferred financing costs. We expect our interest expense to increase in future periods because (1) the interest expense reported during the six months ended June 30, 2013 reflects only one month of interest and (2) we anticipate acquiring additional properties in the future. However, as we acquire additional properties and finance a portion of those properties with borrowings under our line of credit, we expect our unused line of credit fees to decrease.

Realized and Unrealized Losses from Marketable Securities

During June 2013, we sold a portion of our marketable securities and reinvested the proceeds in other marketable securities, resulting in a realized loss of $29,753. In addition, as of June 30, 2013, we owned a portfolio of publicly traded common stock of 35 REITs with a cost basis of $3,039,710 and a fair value of $2,980,890, resulting in an unrealized loss of $58,820.

Net Asset Value (NAV) per Share

We commenced calculating our NAV per share for each class of shares on May 30, 2013, the day we commenced operations. We calculate NAV per share in accordance with the valuation guidelines approved by our board of directors for the purposes of establishing a price for shares sold in our public offering as well as establishing a redemption price.

The following table provides a breakdown of the major components of our NAV per share as of June 30, 2013:

|

| | | | |

| Component of NAV | | Per Class B Share |

| Investments in real estate (1) | | $ | 15.79 |

|

| Investments in real estate equity securities (2) | | 3.49 |

|

| Other assets, net | | 1.29 |

|

| Line of credit | | (7.83 | ) |

| Other liabilities, net | | (0.65 | ) |

| NAV per share | | $ | 12.09 |

|

| |

| (1) | The value of our investment in real estate was approximately 1.5% more than its historical cost. |

(2) The value of our investments in real estate securities was approximately 1.9% less than their historical cost.

In the future, once we own more than one property of the same property type, we will disclose the key assumptions used by our independent valuation expert in appraising the properties in that property type and the range or weighted average for each key assumption used. We will also disclose a quantitative illustration of the sensitivity of the NAV to a change in the most significant assumption and whether any key assumptions are based on information provided by RREEF America.

Limitations and Risks

As with any valuation methodology, our methodology is based upon a number of estimates and assumptions that may not be accurate or complete. Different parties with different assumptions and estimates could derive a different NAV per share. Accordingly, with respect to our NAV per share, we can provide no assurance that:

| |

| • | a stockholder would be able to realize this NAV per share upon attempting to resell his or her shares; |

| |

| • | we would be able to achieve, for our stockholders, the NAV per share, upon a listing of our shares of common stock on a national securities exchange, selling our real estate portfolio, or merging with another company; or |

| |

| • | the NAV per share, or the methodologies relied upon to estimate the NAV per share, will be found by any regulatory authority to comply with any regulatory requirements. |

Furthermore, the NAV per share was calculated as of a particular point in time. The NAV per share will fluctuate over time in response to, among other things, changes in real estate market fundamentals, capital markets activities, and attributes specific to the properties and leases within our portfolio.

Liquidity and Capital Resources

Our primary needs for liquidity and capital resources are to fund our investments in accordance with our investment strategy and policies, make distributions to our stockholders, redeem shares of our common stock pursuant to our redemption plan, pay our offering and operating fees and expenses and pay interest on any outstanding indebtedness.

Over time, we generally intend to fund our cash needs for items, other than asset acquisitions, from operations. Our cash needs for acquisitions will be funded primarily from the sale of shares of our common stock in our offering, and the amount we may raise in our offering is uncertain. We commenced our offering on January 3, 2013. We intend to contribute any additional net proceeds from our offering which are not used or retained to pay the fees and expenses attributable to our operations to our operating partnership. Since the commencement of our offering through June 30, 2013, we raised approximately $10,020,000 from the sale of Class B shares, of which $10,000,000 was purchased by RREEF America.

We may also satisfy our cash needs for acquisitions through the assumption or incurrence of debt. On May 1, 2013, we, as guarantor, and our operating partnership, as borrower, entered into a secured revolving credit facility, or the line of credit, with Regions Bank and its affiliates, as administrative agent, sole lead arranger and sole book runner, and other lending institutions that may become parties to the credit agreement. The line of credit has an initial capacity of $50 million and is expandable up to a maximum capacity of $150 million within 12 months upon satisfaction of certain conditions. Borrowings under the line of credit carry a specified interest rate which, at our option, may be comprised of (1) a base rate, currently equal to the prime rate, or (2) a rate based on the London Interbank Offered Rate, or LIBOR, plus a spread ranging from 220 to 250 basis points, depending on our consolidated debt-to-value ratio. The applicable spread in place as of June 30, 2013 was 220 basis points, which was contractually set at the closing of the line of credit since we did not yet have any assets. The spread is adjusted once per quarter upon submission of our covenant calculations, which are due 60 days after quarter end. We believe we were in compliance with all covenants as of June 30, 2013.

The line of credit may be used to fund acquisitions, redeem shares pursuant to our redemption plan and for any other corporate purpose. The line of credit contains provisions that define the borrowing capacity, or the borrowing base, at any time as the sum of (1) the lesser of (a) 60% of the value of our real estate investments which are encumbered by the line of credit (such value as determined by the administrative agent on an annual basis), and (b) the amount determined by reference to a specified debt service coverage calculation, and (2) 50% of the value of our investments in eligible marketable securities. As of June 30, 2013, we had $6,700,000 outstanding under the line of credit, and our borrowing base was approximately $9,315,000, comprised of $7,980,000 from our real estate and $1,335,000 from our marketable securities. We do not intend to borrow from the line of credit to purchase marketable securities, but the additional borrowing base supported by the marketable securities provides us flexibility in having funds available for acquisitions, redemptions and other corporate purposes. In the future, however, as our assets increase, it may not be commercially feasible or we may not be able to secure an adequate line of credit to fund acquisitions, redemptions or other needs. Moreover, actual availability may be reduced at any given time if the values of our real estate or our marketable securities portfolio decline.

On May 29, 2013, we entered into an expense support agreement with our advisor. Pursuant to the terms of the expense support agreement, our advisor has incurred, and may continue to incur, expenses related to our operations that are not required to be reimbursed over the 60-month period following January 3, 2014 in accordance with our advisory agreement, which we refer to as "expense payments."

These expense payments may include, without limitation, expenses that are organizational and offering expenses and operating expenses under the advisory agreement. Our advisor may incur these expenses until the earlier of (i) the date we have surpassed $200,000,000 in aggregate gross proceeds from our offering or (ii) January 1, 2014.

Pursuant to the expense support agreement, commencing with the earlier of (i) the quarter beginning on January 1, 2015 or (ii) the quarter immediately following the quarter in which we surpass $200,000,000 in aggregate gross proceeds from the offering, within five business days of the beginning of such quarter and each calendar quarter thereafter, we will reimburse our advisor in an amount equal to the lesser of (i) $250,000 and (ii) the aggregate amount of all expense payments made by our advisor prior to the last day of the previous calendar quarter that have not been previously reimbursed by us to our advisor, until the aggregate of all expense payments have been reimbursed by us.

We anticipate our offering and operating fees and expenses will include, among other things, the advisory fee that we pay to our advisor, the selling commissions, dealer manager and distribution fees we pay to SC Distributors, LLC (our dealer manager), legal and audit expenses, federal and state filing fees, printing expenses, transfer agent fees, marketing and distribution expenses and fees related to appraising and managing our properties. We will not have any office or personnel expenses as we do not have any employees. Our advisor will incur certain of these expenses and fees, for which we will reimburse our advisor, subject to certain limitations. Additionally, our advisor will allocate to us out-of-pocket expenses in connection with providing services to us, including our allocable share of our advisor’s overhead, such as rent, utilities and personnel costs for personnel who are directly involved in the performance of services to us and are not our executive officers. Ultimately, total organization and offering costs incurred will not exceed 15% of the gross proceeds from the primary offering. Through June 30, 2013, our advisor has paid on our behalf or reimbursed us for $4,469,713 in offering and organizational costs and $1,063,536 in operating expenses.

Other potential future sources of capital include secured or unsecured financings from banks or other lenders and proceeds from the sale of assets. If necessary, we may use financings or other sources of capital in the event of unforeseen significant capital expenditures. We have not yet identified any sources for these types of financings.

Cash Flow Analysis

Cash flow provided by operating activities during the six months ended June 30, 2013 was $47,114. This was primarily a result of the expense support payments from our advisor that effectively reimbursed us for all of our general and administrative expenses and prepaid expenses and most of our deferred financing costs.

Cash flow used in investing activities during the six months ended June 30, 2013 was $16,380,795. During this period, we used $13,300,000 to acquire 9022 Heritage Parkway and approximately $3,100,000 (net of proceeds from sales of investments) to purchase investments in common stock of publicly traded REITs.

Cash flow provided by financing activities was $16,706,029. We raised $10,020,002 in our offering during the six months ended June 30, 2013. Of this amount, $10,000,000 was from our sponsor. Additionally, we borrowed $6,700,000 under our line of credit to acquire 9022 Heritage Parkway. Deferred financing costs paid by us in connection with obtaining our line of credit and not reimbursed by our sponsor amounted to $13,973.

Prior to our commencement of operations, we were in our organizational period and had no operations. For the period February 7, 2012, our inception date, through June 30, 2012, our cash flows consisted solely of the receipt of a $200,000 initial investment from RREEF America.

Distributions

Our board of directors authorized and declared daily cash distributions of $0.00164384 per share per day, which are payable monthly for the period commencing on June 1, 2013 and ending on September 30, 2013 for each share of Class A and Class B common stock outstanding (as adjusted to reflect applicable class-specific expenses). The amount of dividends for the month of June 2013 was $41,946. Our cash flow from operations exceeded the distributions declared for such period, although no cash was used to satisfy the dividend obligation because all distributions for the month of June 2013 were reinvested in additional shares of Class B common stock pursuant to our distribution reinvestment plan.

We expect that we will continue to pay distributions monthly in arrears. Any dividends not reinvested will be payable in cash, and there can be no assurances regarding the portion of the dividends that will be reinvested. We intend to fund distributions from cash generated by operations. However, the expense support agreement with our sponsor is scheduled to terminate in January 2014. If, by then, we are unable to acquire real estate and real estate related assets sufficient to generate enough operating cash flow to fund distributions, we may fund distributions from borrowings under our line of credit or from the proceeds of our offering.

Redemptions

Our redemption plan commenced on July 1, 2013. To date, no redemption requests have been received.

Market Outlook

The U.S. economy appears to be in a period of sustained, if still modest, growth. Consumer spending, which has firmed during the past few quarters, will likely drive growth going forward, while business investment will continue to support the economy as well. Consumer confidence continues to strengthen due to the improving job outlook, rising home and stock prices and increased credit availability. At the same time, budget sequestration by the federal government is dampening the pace of economic growth and continues to be a risk. While the effects on the U.S. economy from the downturn in Europe and slowdown in Asia Pacific have so far been muted, further retraction in these regions could adversely affect domestic economic growth.

Interest rates increased last quarter, and there is uncertainty about future movements as the Federal Reserve (“Fed”) is expected to taper its quantitative easing program; however, the Fed is expected to do so only as the economy improves. While further increases to interest rates are a risk to commercial real estate, mortgage rates remain low relative to their long-term historical averages and capitalization rates are at historically wide spreads to treasury rates. We expect that an increase in inflation rates would add further pressure to interest rates; however, real estate has historically performed well relative to other asset classes during periods of elevated inflation.

Expansions in the job base, retail spending, household growth, income levels and economic output are supporting positive absorption in the apartment, industrial, office and retail property sectors. The

development pipeline is increasing, but remains below historical average levels. The combination of increasing demand and limited supply has pushed vacancy rates downward, leading to increases in market rents, although rent gains have not yet spread to all product types and markets. If the economy does not recover as anticipated or supply exceeds expectations, the performance of the real estate sector could be negatively impacted.

Critical Accounting Policies

Our accounting policies have been established to conform with GAAP. The preparation of financial statements in conformity with GAAP requires management to use judgment in the application of accounting policies, including making estimates and assumptions. These judgments affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. If management’s judgment or interpretation of the facts and circumstances relating to various transactions had been different, it is possible that different accounting policies would have been applied, thus resulting in a different presentation of the financial statements. Additionally, other companies may utilize different estimates that may impact the comparability of our results of operations to those of companies in similar businesses. We consider our critical accounting policies to be the policies that relate to the following:

| |

| • | Investment property and lease intangibles; |

| |

| • | Value of our real estate portfolio; |

| |

| • | Investments in marketable securities; and |

A complete description of such policies and our considerations is contained in Note 2 to our financial statements included in Item 1 of this Quarterly Report.

REIT Compliance and Income Taxes

We intend to elect to be taxed as a REIT under Sections 856 through 860 of the Code, beginning with our taxable year ending December 31, 2013. In order to maintain our qualification as a REIT, we are required to, among other things, distribute as dividends at least 90% of our REIT taxable income, determined without regard to the dividends-paid deduction and excluding net capital gains, to our stockholders and meet certain tests regarding the nature of our income and assets. If we qualify for taxation as a REIT, we generally will not be subject to federal income tax to the extent our income meets certain criteria and we distribute our REIT taxable income to our stockholders. Even if we qualify for taxation as a REIT, we may be subject to (1) certain state and local taxes on our income, property or net worth, and (2) federal income and excise taxes on undistributed income, if any income remains undistributed. Many of these requirements are highly technical and complex. We will monitor the business and transactions that may potentially impact our REIT status. If we were to fail to meet these requirements, we could be subject to federal income tax on our taxable income at regular corporate rates. We would not be able to deduct distributions paid to stockholders in any year in which we fail to qualify as a REIT. We will also be disqualified for the four taxable years following the year during which qualification was lost unless we are entitled to relief under specific statutory provisions.

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for future tax consequences attributable to (1) differences between the financial statement carrying amounts and their respective tax bases, and (2) net operating losses. A valuation allowance is established for uncertainties relating to realization of deferred tax assets. As of June 30, 2013, the Company had a deferred tax asset of approximately $272,000 sourced from the net operating losses realized by the Company, for which a valuation allowance was recorded in the same amount due to the uncertainty of realization.

Inflation

The real estate property sector has not been affected significantly by inflation in the past several years due to the relatively low inflation rate. With the exception of leases with tenants in multifamily properties, we will seek to include provisions in our tenant leases designed to protect us from the impact of inflation. These provisions will include reimbursement billings for operating expense pass-through charges, real estate tax and insurance reimbursements, or in some cases, annual reimbursement of operating expenses above a certain allowance. Due to the generally long-term nature of these leases, annual rent increases may not be sufficient to cover inflation and rent may be below market. Leases in multifamily properties generally turn over on an annual basis and do not typically present the same concerns regarding inflation protection due to their short-term nature.

Off Balance Sheet Arrangements

As of June 30, 2013, we had no material off-balance sheet arrangements that had or are reasonably likely to have a current or future effect on our financial condition, results of operations, liquidity or capital resources.

Quantitative and Qualitative Disclosures About Market Risk

In connection with our line of credit, which has a variable interest rate, we are subject to market risk associated with changes in LIBOR. As of June 30, 2013, we had $6,700,000 of variable-rate debt outstanding on the line of credit at 2.40%, and a change in the interest rate of 50 basis points would result in a change in our interest expense of $33,500 per annum. In the future, we may be exposed to additional market risk associated with interest rate changes as a result of additional short-term debt, such as additional borrowings under our line of credit, and long-term debt, which, in either case, may be used to maintain liquidity, fund capital expenditures and expand our investment portfolio. Market fluctuations in real estate financing may affect the availability and cost of funds needed to expand our investment portfolio. In addition, restrictions upon the availability of real estate financing or high interest rates for real estate loans could adversely affect our ability to dispose of real estate in the future. We will seek to limit the impact of interest rate changes on earnings and cash flows and to lower our overall borrowing costs. We intend to manage market risk associated with our variable-rate financing by assessing our interest rate cash flow risk, through continually identifying and monitoring changes in interest rate exposures that may adversely impact expected future cash flows, and by evaluating hedging opportunities. We may use derivative financial instruments to hedge exposures to changes in interest rates on loans secured by our assets.

We will be exposed to credit risk, which is the risk that the counterparty will fail to perform under the terms of the derivative contract. If the fair value of a derivative contract is positive, the counterparty will owe us, which creates credit risk for us. If the fair value of a derivative contract is negative, we will owe the counterparty and, therefore, do not have credit risk. We will seek to minimize the credit risk in derivative instruments by entering into transactions with high-quality counterparties.

We will be exposed to financial market risk with respect to our marketable securities portfolio. Financial market risk is the risk that we will incur economic losses due to adverse changes in equity security prices. Our exposure to changes in equity security prices is a result of our investment in these types of securities. Market prices are subject to fluctuation and, therefore, the amount realized in the subsequent sale of an investment may significantly differ from the reported market value. Fluctuation in the market prices of a security may result from any number of factors, including perceived changes in the underlying fundamental characteristics of the issuer, the relative price of alternative investments, interest rates, default rates and general market conditions. In addition, amounts realized in the sale of a particular security may be affected by the relative quantity of the security being sold. We do not currently engage in derivative or other hedging transactions to manage our security price risk.

As of June 30, 2013, we owned $2,980,890 of marketable securities. While it is difficult to project what factors may affect the prices of equity securities and how much the effect might be, a 10% change in the value of the marketable securities we owned as of June 30, 2013 would result in a change of $298,089 to the unrealized loss on marketable securities.

Experts

The following disclosure is added to the "Experts" section of our prospectus.

The amount presented on page 5 of this Supplement in the line item “Investments in Real Estate” has been reviewed by Altus Group U.S. Inc., an independent valuation firm, and is included in this Supplement given the authority of such firm as experts in property valuations and appraisals. Altus Group U.S. Inc. will not calculate or be responsible for our daily NAV per share for either class of shares.

The prospectus is hereby supplemented with the following consolidated unaudited financial statements.

|

| |

| INDEX TO FINANCIAL STATEMENTS | |

| | |

| |

| |

| |

| |

| |

| |

RREEF PROPERTY TRUST, INC.

CONSOLIDATED BALANCE SHEETS

|

| | | | | | | |

| | June 30, 2013 (unaudited) | | December 31, 2012 |

| ASSETS | |

| |

| Investment in real estate assets: | |

| |

| Land | $ | 2,310,684 |

|

| $ | — |

|

| Buildings and improvements, less accumulated depreciation of $36,788 and $0, respectively | 7,169,702 |

|

| — |

|

| Acquired intangible lease assets, less accumulated amortization of $59,129 and $0, respectively | 3,723,697 |

|

| — |

|

| Total investment in real estate assets, net | 13,204,083 |

|

| — |

|

| Investment in marketable securities | 2,980,890 |

|

| — |

|

| Total investment in real estate assets and marketable securities, net | 16,184,973 |

|

| — |

|

| Cash and cash equivalents | 572,348 |

|

| 200,000 |

|

| Receivables | 565,610 |

|

| — |

|

| Prepaid expenses | 106,491 |

|

| — |

|

| Deferred financing costs, less accumulated amortization of $35,621 and $0, respectively | 410,135 |

|

| — |

|

| Total assets | $ | 17,839,557 |

|

| $ | 200,000 |

|

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| |

| Line of credit | $ | 6,700,000 |

|

| $ | — |

|

| Accounts payable and accrued expenses | 35,698 |

|

| — |

|

| Due to affiliates | 5,533,249 |

|

| — |

|

| Other liabilities | 532,276 |

|

| — |

|

| Total liabilities | 12,801,223 |

|

| — |

|

| Stockholders' Equity: | |

| |

| Preferred stock, $0.01 par value; 50,000,000 shares authorized, none issued | — |

|

| — |

|

| Common stock, $0.01 par value; 500,000,000 Class A shares authorized, none issued | — |

|

| — |

|

| Common stock, $0.01 par value; 500,000,000 Class B shares authorized, 855,163 and 16,667 shares issued and outstanding , respectively | 8,552 |

|

| 167 |

|

| Additional paid-in capital | 5,810,257 |

|

| 199,833 |

|

| Accumulated deficit | (721,655 | ) |

| — |

|

| Accumulated other comprehensive loss | (58,820 | ) |

| — |

|

| Total stockholders' equity | 5,038,334 |

|

| 200,000 |

|

| Total liabilities and stockholders' equity | $ | 17,839,557 |

|

| $ | 200,000 |

|

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED UNAUDITED STATEMENTS OF OPERATIONS

|

| | | | | | | |

| Three Months Ended June 30, 2013 |

| Six Months Ended June 30, 2013 |

| Revenues: |

|

| |

| Rental and other property income | $ | 107,494 |

|

| $ | 107,494 |

|

| Investment income on marketable securities | 19,990 |

|

| 19,990 |

|

| Total revenues | 127,484 |

|

| 127,484 |

|

| Expenses: |

|

| |

| General and administrative expenses | 545,876 |

|

| 545,876 |

|

| Property operating expenses | 4,213 |

|

| 4,213 |

|

| Acquisition related expenses | 58,486 |

|

| 58,486 |

|

| Depreciation | 36,788 |

|

| 36,788 |

|

| Amortization | 58,979 |

|

| 58,979 |

|

| Total operating expenses | 704,342 |

|

| 704,342 |

|

| Operating loss | (576,858 | ) |

| (576,858 | ) |

| Interest expense | (73,098 | ) |

| (73,098 | ) |

| Realized loss upon sale of marketable securities | (29,753 | ) |

| (29,753 | ) |

| Net loss | $ | (679,709 | ) |

| $ | (679,709 | ) |

| Weighted average number of common shares outstanding: | |

| |

| Basic and diluted | 310,026 |

|

| 164,157 |

|

| Net loss per common share: | |

| |

| Basic and diluted | $ | (2.19 | ) |

| $ | (4.14 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED UNAUDITED STATEMENTS OF COMPREHENSIVE INCOME

|

| | | | | | | |

| Three Months Ended June 30, 2013 |

| Six Months Ended June 30, 2013 |

| Net loss | $ | (679,709 | ) |

| $ | (679,709 | ) |

| Other comprehensive loss: | |

| |

| Reclassification of previously unrealized loss on marketable securities into net loss | 29,753 |

|

| 29,753 |

|

| Unrealized loss on marketable securities | (88,573 | ) |

| (88,573 | ) |

| Total other comprehensive loss | (58,820 | ) |

| (58,820 | ) |

| Comprehensive loss | $ | (738,529 | ) |

| $ | (738,529 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED UNAUDITED STATEMENT OF STOCKHOLDERS' EQUITY

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock |

| Class A Common Stock |

| Class B Common Stock |

| Additional Paid in Capital |

| Accumulated Deficit |

| Accumulated other comprehensive loss |

| Total

Stockholders'

Equity |

| Number of

Shares |

| Par

Value |

| Number of

Shares |

| Par

Value |

| Number of

Shares |

| Par

Value |

|

| Balance, December 31, 2012 | — |

|

| $ | — |

|

| — |

|

| $ | — |

|

| 16,667 |

|

| $ | 167 |

|

| $ | 199,833 |

|

| $ | — |

|

| $ | — |

|

| $ | 200,000 |

|

| Issuance of common stock | — |

|

| — |

|

| — |

|

| — |

|

| 835,027 |

|

| 8,350 |

|

| 10,011,652 |

|

| — |

|

| — |

|

| 10,020,002 |

|

| Issuance of common stock through the distribution reinvestment plan | — |

|

| — |

|

| — |

|

| — |

|

| 3,469 |

|

| 35 |

|

| 41,911 |

|

| — |

|

| — |

|

| 41,946 |

|

| Distributions to stockholders | — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| (41,946 | ) |

| — |

|

| (41,946 | ) |

| Other offering costs | — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| (4,443,139 | ) |

| — |

|

| — |

|

| (4,443,139 | ) |

| Comprehensive loss | — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| — |

|

| (679,709 | ) |

| (58,820 | ) |

| (738,529 | ) |

| Balance, June 30, 2013 | — |

|

| $ | — |

|

| — |

|

| $ | — |

|

| 855,163 |

|

| $ | 8,552 |

|

| $ | 5,810,257 |

|

| $ | (721,655 | ) |

| $ | (58,820 | ) |

| $ | 5,038,334 |

|

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED UNAUDITED STATEMENTS OF CASH FLOWS |

| | | | | | | |

| | Six Months Ended June 30, 2013 |

| For the Period February 7, 2012 (inception) through June 30, 2012 |

| Cash flows from operating activities: |

|

|

|

| Net loss | $ | (679,709 | ) |

| $ | — |

|

| Adjustments to reconcile net loss to net cash provided by operating activities: | |

| |

| Depreciation | 36,788 |

|

| — |

|

| Realized loss upon sale of marketable securities | 29,753 |

|

| — |

|

| Amortization of intangible lease assets | 59,129 |

|

| — |

|

| Amortization of deferred financing costs | 35,621 |

|

| — |

|

| Changes in assets and liabilities: |

|

| |

| Receivables | (22,398 | ) |

| — |

|

| Prepaid expenses | (106,491 | ) |

| — |

|

| Accounts payable and accrued expenses | 26,940 |

|

| — |

|

| Other liabilities | 396 |

|

| — |

|

| Due to affiliates | 667,085 |

|

| — |

|

| Net cash provided by operating activities | 47,114 |

|

| — |

|

| Cash flows from investing activities: | |

| |

| Investment in real estate | (13,300,000 | ) |

| — |

|

| Investment in marketable securities | (3,303,557 | ) |

| — |

|

| Proceeds from sale of marketable securities | 222,762 |

|

|

|

| Net cash used in investing activities | (16,380,795 | ) |

| — |

|

| Cash flows from financing activities: | |

| |

| Proceeds from line of credit | 6,700,000 |

|

| — |

|

| Proceeds from issuance of common stock | 10,020,002 |

|

| 200,000 |

|

| Distributions to investors | (41,946 | ) | | — |

|

| Common stock issued through the distribution reinvestment plan | 41,946 |

| | — |

|

| Deferred financing costs paid | (13,973 | ) |

| — |

|

| Net cash provided by financing activities | 16,706,029 |

|

| 200,000 |

|

| Net increase in cash and cash equivalents | 372,348 |

|

| 200,000 |

|

| Cash and cash equivalents, beginning of period | 200,000 |

|

| — |

|

| Cash and cash equivalents, end of period | $ | 572,348 |

|

| $ | 200,000 |

|

| |

|

|

|

| Supplemental disclosures of non-cash investing and financing activities: | |

|

|

| Accrued offering costs due to affiliate | $ | 4,443,139 |

|

| $ | — |

|

| Accrued deferred financing costs due to affiliate | $ | 423,025 |

|

| $ | — |

|

| Unrealized loss on marketable securities | $ | (58,820 | ) |

| $ | — |

|

| Purchases of marketable securities not yet paid | $ | 531,880 |

|

| $ | — |

|

| Proceeds from sale of marketable securities not yet received | $ | (543,212 | ) |

| $ | — |

|

| Supplemental cash flow disclosures: | |

|

|

| Interest paid | $ | — |

|

| $ | — |

|

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS

June 30, 2013

NOTE 1 — ORGANIZATION

RREEF Property Trust, Inc. (the “Company”) was formed on February 7, 2012 as a Maryland corporation and intends to qualify as a real estate investment trust (“REIT”) for federal income tax purposes. On February 14, 2012, RREEF America L.L.C., a Delaware limited liability company ("RREEF America"), the Company's sponsor and advisor, purchased 16,667 shares of the Company's Class B common stock for a total cash consideration of $200,000 to provide the Company's initial capitalization. Substantially all of the Company's business will be conducted through RREEF Property Operating Partnership, LP, the Company's operating partnership (the “Operating Partnership”). The Company is the sole general partner of the Operating Partnership and has contributed $199,000 to the Operating Partnership in exchange for its general partner interest. RREEF Property OP Holder, LLC (the “OP Holder”), a wholly-owned subsidiary of the Company and the initial limited partner of the Operating Partnership, has contributed $1,000 to the Operating Partnership. As the Company completes the settlement for purchase orders for shares of its common stock in its continuous public offering, it will transfer substantially all of the net proceeds of the offering to the Operating Partnership.

The Company was organized to invest primarily in a diversified portfolio consisting primarily of high quality, income-producing commercial real estate located primarily in the United States, including, without limitation, office, industrial, retail and multifamily properties (“Real Estate Properties”). Although the Company intends to invest primarily in Real Estate Properties, it also intends to acquire common and preferred stock of REITs and other real estate companies (“Real Estate Equity Securities”) and debt investments backed principally by real estate (“Real Estate Loans” and, together with Real Estate Equity Securities, “Real Estate-Related Assets”).

The Company is offering to the public, pursuant to a registration statement, $2,250,000,000 of shares of its common stock in its primary offering and $250,000,000 of shares of its common stock pursuant to its distribution reinvestment plan (the “Offering”). The Company is offering to the public two classes of shares of its common stock, Class A shares and Class B shares. The Company is offering to sell any combination of Class A and Class B shares with a dollar value up to the maximum offering amount. The Company may reallocate the shares offered between the primary offering and the distribution reinvestment plan. On January 3, 2013, the Offering was initially declared effective by the Securities and Exchange Commission. On May 30, 2013, RREEF America purchased $10,000,000 of the Company's Class B shares in the Offering, and the Company's board of directors authorized the release of the escrowed funds to the Company, thereby allowing the Company to commence operations.

Shares of the Company's common stock are being sold at the Company's net asset value (“NAV”) per share, plus, for Class A shares only, applicable selling commissions. Each class of shares may have a different NAV per share because of certain class specific fees and expenses, such as the distribution fee. NAV per share is calculated by dividing the NAV at the end of each business day for each class by the number of shares outstanding for that class on such day. The Company will not sell any shares to Pennsylvania investors unless, by January 3, 2014, it has received purchase orders for at least $75,000,000 (including purchase orders received from residents of other jurisdictions) in any combination of Class A shares and Class B shares from persons not affiliated with the Company or RREEF America.

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Principles of Consolidation

The accompanying consolidated financial statements have been prepared in accordance with the Financial Accounting Standards Board ("FASB") Accounting Standards Codification (“ASC”), the authoritative reference for U.S. generally accepted accounting principles (“GAAP”). The consolidated financial statements include the accounts of the Company and its subsidiaries. All significant intercompany balances and transactions are eliminated in consolidation. The financial statements of the Company's subsidiaries are prepared using accounting policies consistent with those of the Company. In the opinion of management, the unaudited interim financial statements reflect all adjustments, which are of a normal and recurring nature, necessary to a fair statement of the results for the

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

June 30, 2013

interim periods presented. In addition, the Company evaluates relationships with other entities to identify whether there are variable interest entities as required by FASB ASC 810, Consolidations, and to assess whether it is the primary beneficiary of such entities. If the determination is made that the Company is the primary beneficiary, then that entity is included in the consolidated financial statements in accordance with FASB ASC 810.

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. Cash equivalents may include cash and short-term investments. Short-term investments are stated at cost, which approximates fair value and may consist of investments in money market accounts. There are no restrictions on the use of the Company's cash balance.

Real Estate Investments and Lease Intangibles

Real estate investments are stated at cost less accumulated depreciation and amortization. Buildings and improvements are depreciated utilizing the straight-line method over an estimated useful life of 20 to 40 years for industrial, retail and office properties, and 27.5 years for residential. Tenant improvements and lease commissions are amortized over the terms of the respective tenant leases. Furniture and equipment is depreciated over an estimated useful life ranging from five to seven years.

In accordance with FASB ASC 805, Business Combinations, and FASB ASC 350, Intangibles - Goodwill and Other, acquisitions of properties are accounted for utilizing the acquisition method and, accordingly, the results of operations of acquired properties will be included in the Company's results of operations from their respective dates of acquisition. Estimates of future cash flows and other valuation techniques believed to be similar to those used by independent appraisers are used to allocate the purchase price of identifiable assets acquired and liabilities assumed such as land, buildings and improvements, equipment and identifiable intangible assets and liabilities such as amounts related to in-place leases, acquired above- and below-market leases, tenant relationships, asset retirement obligations and mortgage notes payable. Values of buildings and improvements are determined on an as-if-vacant basis. Initial allocations are subject to change until such information is finalized, which may be no later than 12 months from the acquisition date.

The estimated fair value of acquired in-place leases are the costs the Company would have incurred to lease the properties to the occupancy level of the properties at the date of acquisition. Such estimates include the fair value of leasing commissions, legal costs and other direct costs that would be incurred to lease the properties to such occupancy levels. Additionally, the Company evaluates the time period over which such occupancy levels would be achieved. Such evaluation will include an estimate of the net market-based rental revenues and net operating costs (primarily consisting of forgone rents, real estate taxes, recoverable charges and insurance) that would be incurred during the lease-up period, which generally ranges up to one year. Acquired in-place leases as of the date of acquisition are amortized over the remaining lease terms.

Acquired favorable and unfavorable lease values are estimated based on the present value (using an interest rate that reflects the risks associated with the lease acquired) of the difference between the contractual amounts to be paid pursuant to the in-place leases and the Company's estimate of fair market value lease rates for the corresponding in-place leases. The capitalized favorable and unfavorable lease values are amortized to rental revenue over the remaining terms of the respective leases, which include, for unfavorable leases, periods covered by bargain renewal options. If a lease is terminated prior to its scheduled expiration, the unamortized portion of the in-place lease is charged to amortization expense and the unamortized portion of favorable and unfavorable lease is charged to rental revenue.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

June 30, 2013

The carrying value of the real estate investments are reviewed to ascertain if there are any indicators of impairment. Factors considered include the type of asset, the economic situation in the area in which the asset is located, the economic situation in the industry in which the tenant is involved and the timeliness of the payments made by the tenant under its lease, as well as any current correspondence that may have been had with the tenant, including property inspection reports. A real estate investment is impaired if the undiscounted cash flows over the expected hold period are less than the real estate investment's carrying amount. In this case, an impairment loss will be recorded to the extent that the estimated fair value is lower than the real estate investment's carrying amount. The estimated fair value is determined primarily using information contained within independent appraisals obtained quarterly by the Company from its independent valuation agent. Real estate investments that are expected to be disposed of are valued at the lower of carrying amount or estimated fair value less costs to sell.

Investments in Marketable Securities

In accordance with the Company's investment guidelines as approved by the Company's board of directors, investments in marketable securities may consist of common and preferred stock of publicly-traded REITs and other real estate operating companies. The Company determines the appropriate classification for these securities at the time of purchase and reevaluates such designation as of each balance sheet date. As of June 30, 2013, the Company classified its investments in marketable securities as available-for-sale as the Company intends to hold the securities for the purpose of collecting dividend income and for longer term price appreciation. These investments are carried at their estimated fair value based on published prices for each security. Unrealized gains and losses are reported in accumulated other comprehensive income.

Any non-temporary decline in the market value of an available-for-sale security below cost results in a reduction in the carrying amount to fair value. The impairment is charged to earnings and a new cost basis for the security is established. When a security is impaired, the Company considers whether it has the ability and intent to hold the investment for a time sufficient to allow for any anticipated recovery in market value and considers whether evidence indicating the cost of the investment being recoverable outweighs evidence to the contrary. Evidence considered in this assessment includes the reasons for the impairment, the severity and duration of the impairment, changes in value subsequent to period end and forecasted performance of the investee.

Securities may be sold if the Company believes a security has attained its target maximum value or if other conditions exist whereby the Company believes that the value of its investment in a particular security has a larger than desired risk of declining. The Company considers many factors in determining whether to hold or sell a security, including, but not limited to, recent events specific to the issuer or industry, external credit ratings and recent changes in such ratings. Upon the sale of a particular security, the realized net gain or loss is computed assuming the shares with the highest cost are sold first.

Deferred Financing Costs

Deferred financing costs are the direct costs associated with obtaining financing. Such costs include commitment fees, legal fees and other third-party costs associated with obtaining commitments for financing that result in a closing of such financing. The Company capitalizes these costs and amortizes them on a straight-line basis, which approximates the effective interest method, over the terms of the obligations, once the loan process is completed. Amortization of deferred financing costs is included in interest expense in the consolidated statements of operations.

Borrowings

The Company may obtain various forms of borrowings from market participants. Generally, borrowings originated by the Company will be recorded at amortized cost. The Company may also assume borrowings in connection with acquisitions. The Company will estimate the fair value of assumed borrowings based upon indications of then-current market pricing for similar types of debt with similar maturities. The assumed borrowings will initially be recorded at their estimated fair value as of the assumption date, and the difference between such estimated fair value and the borrowings’ outstanding principal balance will be amortized over the remaining life of the borrowing.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

June 30, 2013

Revenue Recognition

Rental revenue from real estate investments is recognized on a straight-line basis over the terms of the related leases. The differences between rental revenue earned from real estate investments and amounts due under the respective lease agreements are amortized or accreted, as applicable, to deferred rent receivable. Rental revenue will also include amortization of above- and below-market leases. Revenues relating to lease termination fees will be recognized at the time that a tenant’s right to occupy the leased space is terminated and collectability is reasonably assured. Also included in rental revenue are tenant reimbursements of certain operating expenses and percentage rents determined in accordance with the terms of the lease agreements.

Organization and Offering Expenses

RREEF America agreed to pay all of the Company's organization and offering expenses through January 3, 2013 (the "Initial O&O"). This included costs and expenses incurred by the Company in connection with the Company's formation, preparing for the Offering, the qualification and registration of the Offering, and the marketing and distribution of the Company's shares. The offering expenses portion of the Initial O&O includes, but is not limited to, accounting and legal fees, including the legal fees of SC Distributors, LLC, the Company's dealer manager (the “Dealer Manager”), costs to amend the registration statement and the prospectus supplements, printing, mailing and distribution costs, filing fees, amounts to reimburse RREEF America, as the Company's advisor, or its affiliates for the salaries of employees and other costs in connection with preparing supplemental sales literature, amounts to reimburse the Dealer Manager for amounts that it may pay to reimburse the bona fide due diligence expenses of any participating broker-dealers supported by detailed and itemized invoices, telecommunication costs, fees of the transfer agent, registrars, trustees, depositories and experts, the cost of educational conferences held by the Company (including the travel, meal and lodging costs of registered representatives of any participating broker-dealers), and attendance fees and cost reimbursement for employees of affiliates to attend retail seminars conducted by broker-dealers. In addition to the Initial O&O, RREEF America has agreed to pay the portion of the Company's organization and offering expenses from January 3, 2013 through January 3, 2014 that are incurred in connection with sponsoring and attending industry conferences, preparing filings with the Securities and Exchange Commission under the Securities Act of 1933, as amended, membership dues for industry trade associations, broker-dealer due diligence and obtaining a private letter ruling from the Internal Revenue Service (the “Additional O&O” and, together with the Initial O&O, the "Deferred O&O"). RREEF America had incurred $4,361,565 in Deferred O&O on behalf of the Company from the Company's inception through June 30, 2013, of which $288,000 and $1,051,000 was incurred during the three and six months ended June 30, 2013, respectively. Additionally, as a result of the expense support agreement executed in May 2013, $90,000 of offering expenses were reclassified out of Deferred O&O, and instead will be covered under the expense support agreement. See Note 7. The Company will reimburse RREEF America for the Deferred O&O monthly on a straight-line basis over 60 months beginning January 3, 2014.

Prior to the Company's commencement of operations, RREEF America also agreed to pay all of the Company's expenses which are not included in the Deferred O&O (the "Other Expenses"), amounting to $940,000 from the Company's inception through May 30, 2013, of which $454,000 was incurred subsequent to March 31, 2013. The Other Expenses will be covered under the expense support agreement discussed in Note 7, and thus will be subject to the repayment provisions of that agreement.

Prior to the commencement of operations, the Company was not obligated to reimburse RREEF America for the Deferred O&O or the Other Expenses. Accordingly, prior to the commencement of operations, neither the Deferred O&O nor the Other Expenses were accrued on the Company's consolidated balance sheet.

Organizational expenses and Other Expenses which do not qualify as offering costs are expensed as incurred from and after the commencement of operations. Offering costs incurred by the Company, RREEF America and its affiliates on behalf of the Company will be deferred and will be paid from the proceeds of the Offering. These costs will be treated as a reduction of the total proceeds. Total organization and offering costs incurred by the Company will not exceed 15% of the gross proceeds from the primary offering.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

June 30, 2013

Income Taxes

The Company intends to elect to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), beginning with the year ending December 31, 2013. In order to maintain the Company's qualification as a REIT, the Company is required to, among other things, distribute as dividends at least 90% of the Company's REIT taxable income, determined without regard to the dividends-paid deduction and excluding net capital gains, to the Company's stockholders, and meet certain tests regarding the nature of the Company's income and assets. If the Company qualifies for taxation as a REIT, the Company generally will not be subject to federal income tax to the extent it meets certain criteria and distributes its REIT taxable income to its stockholders. Even if the Company qualifies for taxation as a REIT, the Company may be subject to (1) certain state and local taxes on its income, property or net worth, and (2) federal income and excise taxes on its undistributed income, if any income remains undistributed. The Company intends to operate in a manner that allows the Company to meet the requirements for taxation as a REIT, including creating taxable REIT subsidiaries to hold assets that generate income that would not be consistent with the rules applicable to qualification as a REIT if held directly by the REIT. If the Company were to fail to meet these requirements, it could be subject to federal income tax on the Company's taxable income at regular corporate rates. The Company would not be able to deduct distributions paid to stockholders in any year in which it fails to qualify as a REIT. The Company will also be disqualified for the four taxable years following the year during which qualification was lost unless the Company is entitled to relief under specific statutory provisions.

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for future tax consequences attributable to (1) differences between the financial statement carrying amounts and their respective tax bases, and (2) net operating losses. A valuation allowance is established for uncertainties relating to realization of deferred tax assets. As of June 30, 2013, the Company had a deferred tax asset of approximately $272,000 sourced from the net operating losses realized by the Company, for which a valuation allowance was recorded in the same amount due to the uncertainty of realization.

Reportable Segments

The Company intends to operate in three primary segments: (1) Real Estate Properties, (2) Real Estate Equity Securities, and (3) Real Estate Loans.

Concentration of Credit Risk

As of June 30, 2013, the Company had cash on deposit at two financial institutions, one of which had deposits in excess of federally insured levels. The Company limits significant cash holdings to accounts held by financial institutions with a high credit standing. Therefore, the Company believes it is not exposed to any significant credit risk on its cash deposits.

As of June 30, 2013, 100% of the Company’s gross rental revenues were from an office building located outside Chicago, Illinois. The property is 100% leased to Allstate Insurance Company, a wholly-owned subsidiary of The Allstate Corporation. The Allstate Corporation trades on the New York Stock Exchange under the ticker symbol "ALL."

NOTE 3 — FAIR VALUE MEASUREMENTS

Fair value measurements are determined based on the assumptions that market participants would use in pricing an asset or liability. As a basis for considering market participant assumptions in fair value measurements, FASB ASC 820, Fair Value Measurement and Disclosures, establishes a fair value hierarchy that distinguishes between market participant assumptions based on market data obtained from sources independent of the reporting entity (observable inputs that are classified within Levels 1 and 2 of the hierarchy) and the reporting entity's own assumptions about market participant assumptions (unobservable inputs classified within Level 3 of the hierarchy).

Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs may include quoted prices for similar

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

June 30, 2013

assets and liabilities in active markets, as well as inputs that are observable for the asset or liability (other than quoted prices), such as interest rates and yield curves that are observable at commonly quoted intervals. Level 3 inputs are the unobservable inputs for the asset or liability, which is typically based on an entity's own assumption, as there is little, if any, related market activity. In instances where the determination of the fair value measurement is based on input from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the entire fair value measurement falls is based on the lowest level input that is significant to the fair value measurement in its entirety. The Company's assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability.

The Company's investments in marketable securities are valued using Level 1 inputs as the securities are publicly traded on major stock exchanges.

FASB ASC 825-10-65-1 requires the Company to disclose fair value information for all financial instruments for which it is practicable to estimate fair value, whether or not recognized in the consolidated balance sheets. Fair value of lines of credit and loans payable is determined using Level 2 inputs and a discounted cash flow approach with an interest rate and other assumptions that approximate current market conditions. The carrying amount of the Company's line of credit at June 30, 2013 approximates its fair value.

The Company's financial instruments, other than the line of credit, are generally short-term in nature and contain minimal credit risk. These instruments consist of cash and cash equivalents, accounts and other receivables and accounts payable. The carrying amounts of these assets and liabilities in the consolidated balance sheets approximate their fair value.

NOTE 4 — REAL ESTATE INVESTMENTS

On May 31, 2013, the Company acquired 9022 Heritage Parkway, a low-rise office building located outside of Chicago, Illinois. The property was acquired for $13,300,000 (excluding acquisition costs) which was funded with approximately $6,600,000 of proceeds from the Offering, and $6,700,000 from the Company's line of credit. This property is 100% leased to Allstate Insurance Company through November 30, 2018. The Company allocated the purchase price of this property to the fair value of the assets acquired and liabilities assumed, as follows:

|

| | | |

| Land | $ | 2,310,684 |

|

| Building and improvements | 7,206,490 |

|

| Acquired in-place leases | 3,773,246 |

|

| Acquired favorable leases | 9,580 |

|

| Total real estate at cost | $ | 13,300,000 |

|

The Company recorded rental revenues and net loss of $107,494 and $50,972, respectively, related to this property for the three and six months ended June 30, 2013.

The following information summarizes selected financial information of the Company, as if the acquisition of 9022 Heritage Parkway were completed on January 1, 2013, for each period presented below. The table below presents the Company’s estimated rental and other property income and net loss, on a pro forma basis, for the three and six months ended June 30, 2013.

|

| | | | | | | |

| | Three Months Ended June 30, 2013 | | Six Months Ended June 30, 2013 |

| Rental and other property income | $ | 278,365 |

| | $ | 556,731 |

|

| Net loss | $ | (343,954 | ) | | $ | (742,924 | ) |

The pro forma information for the three months ended June 30, 2013 was adjusted to exclude acquisition costs related to the property and organization costs expensed upon the commencement of operations. Both of these costs

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

June 30, 2013

are included in the pro forma basis net loss for the six months ended June 30, 2013. The pro forma information is presented for informational purposes only and may not be indicative of what actual results of operations would have been had the transactions occurred at the beginning of period presented, nor does it purport to represent the results of future operations.

NOTE 5 — MARKETABLE SECURITIES

The following is a summary of the Company's marketable securities held as of June 30, 2013, fully consisting of publicly traded shares of common stock in REITs. All marketable securities held at June 30, 2013 are available-for-sale securities and none are considered impaired on an other-than-temporary basis.

|

| | | | |

| Marketable securities - cost |

| $ | 3,039,710 |

|

| Unrealized gains | | 19,996 |

|

| Unrealized losses | | (78,816 | ) |

| Net unrealized loss |

| (58,820 | ) |

| Marketable securities - fair value |

| $ | 2,980,890 |

|

Upon the sale of a particular security, the realized net gain or loss is computed assuming the shares with the highest cost are sold first. During the period ended June 30, 2013, marketable securities sold generated proceeds of $765,974 resulting in gross realized gains of $1,537 and gross realized losses of $31,290.

NOTE 6 — LINE OF CREDIT

On May 1, 2013, the Operating Partnership, as borrower, and the Company, as guarantor, entered into a secured revolving line of credit arrangement (the "Line of Credit") pursuant to a credit agreement with Regions Bank and its affiliates, as administrative agent, sole lead arranger and sole book runner, and other lending institutions that may become parties to the credit agreement. The Line of Credit has an initial capacity of $50 million and is expandable up to a maximum capacity of $150 million within 12 months upon satisfaction of certain conditions and payment of certain fees. The Line of Credit may be used to fund acquisitions, redeem shares pursuant to the Company's redemption plan and for any other corporate purpose. The initial term expires on May 1, 2015, subject to a single one-year extension option. Borrowings under the Line of Credit carry a specified interest rate which, at the option of the Company, may be comprised of (1) a base rate, currently equal to the prime rate, or (2) a rate based on the one-, two- or three-month London Interbank Offered Rate ("LIBOR") plus a spread ranging from 220 to 250 basis points, depending on the Company's consolidated debt-to-value ratio. As of June 30, 2013, the outstanding balance and interest rate were $6,700,000 and 2.40%, respectively.

If the Company does not have at least $50 million of tangible net worth (as defined in the Line of Credit agreement) by May 1, 2014, the available, undrawn commitments under the Line of Credit will be canceled, and the Company will have no ability to borrow additional amounts, or re-borrow amounts subsequently repaid, under the Line of Credit. Otherwise, the Line of Credit agreement contains customary representations, warranties, borrowing conditions and affirmative, negative and financial covenants, including minimum net worth, debt service coverage requirements, leverage ratio requirements and dividend payout and REIT status requirements. The Company believes it was in compliance with all such covenants as of June 30, 2013.

The borrowing capacity under the Line of Credit (the "Borrowing Base") at any time is equal to the sum of (1) the lesser of (a) 60% of the value of the Company's real estate investments which are encumbered by the Line of Credit (such value as determined by the administrative agent on an annual basis), and (b) the amount determined by reference to a specified debt service coverage calculation, and (2) 50% of the value of the Company's investments in eligible marketable securities. The portion of the Borrowing Base attributable to marketable securities cannot exceed 20% of the total Borrowing Base. Additionally, up to 15% of the amount of the Borrowing Base attributable to real estate investments can be utilized for ground leased properties. As of June 30, 2013, the Company's Borrowing Base was $9,315,105.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED UNAUDITED FINANCIAL STATEMENTS - continued

June 30, 2013

NOTE 7 — RELATED PARTY ARRANGEMENTS