Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the registrant ■

Filed by a party other than the registrant ☐

Check the appropriate box:

☐ Preliminary proxy statement

☐ Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

■ Definitive proxy statement

☐ Definitive additional materials

☐ Soliciting material under § 240.14a-12

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of filing fee (Check the appropriate box):

■ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials:

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, schedule or registration statement no.:

(3) Filing party:

(4) Date filed:

This page left intentionally blank.

| 105 W. Eighth Street, Port Angeles, Washington 98362 3

| 105 W. Eighth Street, Port Angeles, Washington 98362 3

LETTER FROM OUR PRESIDENT AND CEO

March 20, 2020

Dear Shareholder:

On behalf of the Board of Directors and management of First Northwest Bancorp, we cordially invite you to attend the 2020 annual meeting of shareholders. The meeting will be held virtually at 4:00 p.m. (Pacific Time) on Tuesday, May 5, 2020.

The matters expected to be acted upon at the meeting are described in the attached Proxy Statement. In addition, we will report on our results of operations. After the meeting, we will also address your questions and comments.

We encourage you to attend the meeting virtually. Whether or not you plan to attend, please take the time to read the Proxy Statement and vote via the Internet or telephone or by completing and mailing the proxy card or voting instruction form (if you received one) as promptly as possible. This will save us the additional expense of soliciting proxies and will ensure that your shares are represented at the annual meeting.

Your Board of Directors and management are committed to the continued success of First Northwest Bancorp and the enhancement of your investment. We appreciate your confidence and support and look forward to the meeting.

Sincerely,

MATTHEW P. DEINES

President and Chief Executive Officer

| Proxy Statement for the 2020 Annual Shareholders' Meeting 4

| Proxy Statement for the 2020 Annual Shareholders' Meeting 4

This page left intentionally blank.

| 105 W. Eighth Street, Port Angeles, Washington 98362 5

| 105 W. Eighth Street, Port Angeles, Washington 98362 5

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 5, 2020

Notice is hereby given that the 2020 annual meeting of shareholders of First Northwest Bancorp will be held virtually on Tuesday, May 5, 2020 at 4:00 p.m. (Pacific Time). At the meeting, shareholders will be asked to consider the following:

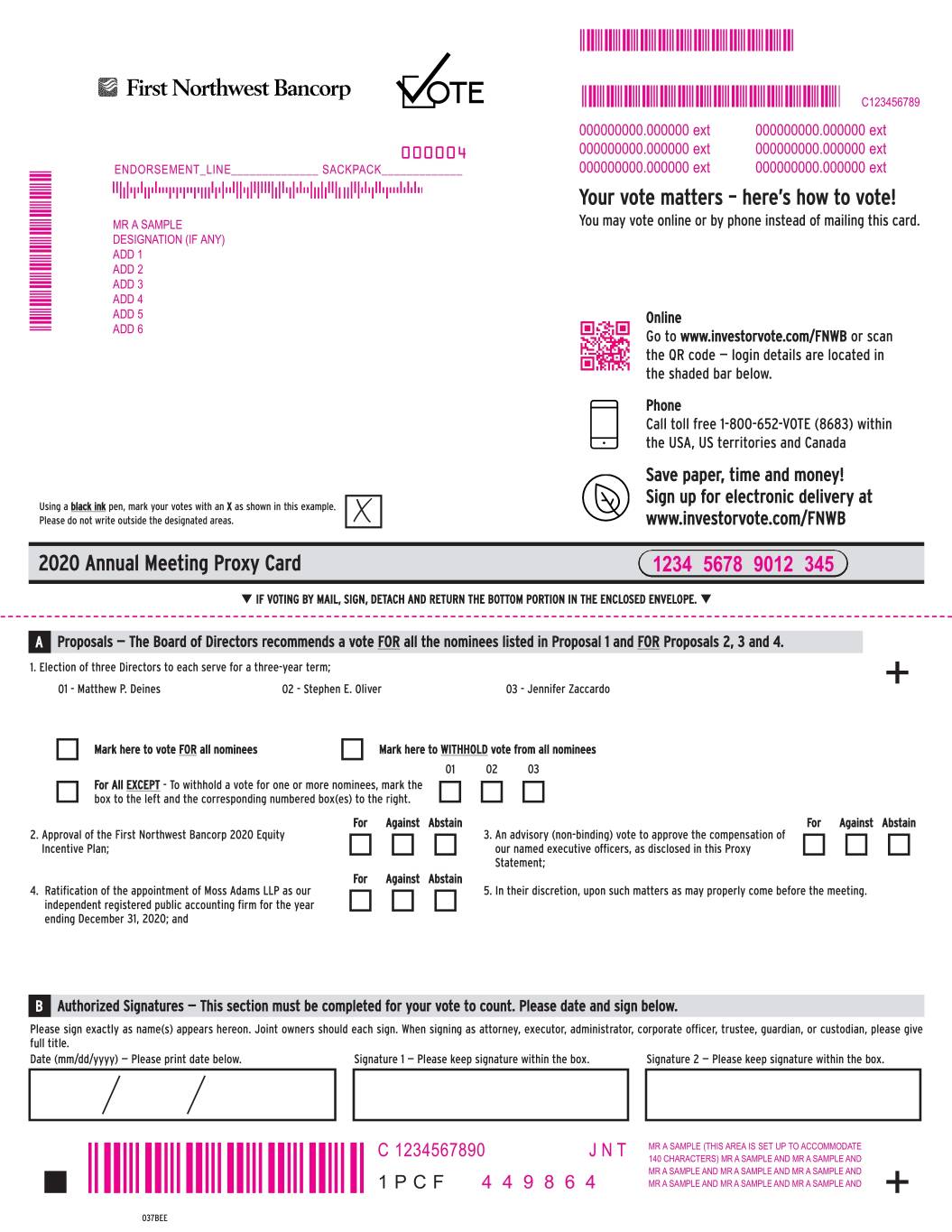

PROPOSAL 1 - Election of three directors to each serve for a three-year term;

PROPOSAL 2 - Approval of the First Northwest Bancorp 2020 Equity Incentive Plan;

PROPOSAL 3 - An advisory (non-binding) vote to approve the compensation of our named executive officers, as disclosed in this Proxy Statement; and

PROPOSAL 4 - Ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the year ending December 31, 2020.

We will also consider and act upon such other business as may properly come before the meeting, or any adjournments or postponements thereof. As of the date of this notice, we are not aware of any other business to come before the annual meeting.

The Board of Directors has fixed the close of business on February 28, 2020 as the record date for the annual meeting. This means that shareholders of record at the close of business on that date are entitled to receive notice of and to vote at the meeting and any adjournment thereof.

YOUR VOTE IS IMPORTANT. We urge you to read this Proxy Statement carefully. Whether or not you plan to attend the virtual annual meeting, we urge you to vote promptly through the Internet, by telephone or by mail. This will ensure the presence of a quorum at the meeting. For instructions on voting, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail. You can request to receive proxy materials by mail or e-mail. Promptly voting your shares via the Internet, by telephone, or by signing, dating, and returning the proxy card or voting instruction form, will save us the expense and extra work of additional solicitation. If you are a shareholder of record and vote at the annual meeting, your proxy will not be used.

BY ORDER OF THE BOARD OF DIRECTORS

CHRISTOPHER J. RIFFLE

Chief Operating Officer, General Counsel, and Corporate Secretary

Port Angeles, Washington

March 20, 2020

| Proxy Statement for the 2020 Annual Shareholders' Meeting 6

| Proxy Statement for the 2020 Annual Shareholders' Meeting 6

This page left intentionally blank.

| 105 W. Eighth Street, Port Angeles, Washington 98362 7

| 105 W. Eighth Street, Port Angeles, Washington 98362 7

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 5, 2020

The Board of Directors of First Northwest Bancorp (the "Board") is using this Proxy Statement to solicit proxies from our shareholders for use at our 2020 annual meeting of shareholders. We first provided electronic access to this Proxy Statement, a form of proxy card, and our Annual Report to our shareholders on or about March 20, 2020.

The information provided in this Proxy Statement relates to First Northwest Bancorp and its wholly owned subsidiary, First Federal Savings and Loan Association of Port Angeles. First Northwest Bancorp may also be referred to as "First Northwest" and First Federal Savings and Loan Association of Port Angeles may also be referred to as "First Federal" or the "Bank." References to "we," "us" and "our" refer to First Northwest and, as the context requires, First Federal.

INFORMATION ABOUT THE ANNUAL MEETING

Our annual meeting will be held as follows:

DATE Tuesday, May 5, 2020

TIME 4:00 p.m. (Pacific Time)

Due to concerns about containing the spread of COVID-19, this year’s Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted solely online via live webcast. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: www.meetingcenter.io/290198981 at the meeting date and time described in the accompanying proxy statement. The password for the meeting is FNWB2020. There is no physical location for the Annual Meeting.

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

At the meeting, you will be asked to consider and vote upon the following proposals:

PROPOSAL 1 - Election of three directors to each serve for a three-year term;

PROPOSAL 2 - Approval of the First Northwest Bancorp 2020 Equity Incentive Plan;

PROPOSAL 3 - Approval, on a non-binding advisory basis, of the compensation of our named executive officers, as disclosed in this Proxy Statement; and

PROPOSAL 4 - Ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the year ending December 31, 2020.

We also will transact any other business that may properly come before the annual meeting. As of the date of this Proxy Statement, we are not aware of any other business to be presented for consideration at the annual meeting other than the matters described in this Proxy Statement.

| Proxy Statement for the 2020 Annual Shareholders' Meeting 8

| Proxy Statement for the 2020 Annual Shareholders' Meeting 8

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 5, 2020

Our proxy materials are available at: https://www.snl.com/IRW/corporateprofile/4343673. The following materials are available for review:

| |

| • | Notice of Internet Availability of Proxy Materials (which includes directions on how to attend the annual meeting, where you may vote if you are a shareholder of record); |

| |

| • | Annual Report to Shareholders. |

We provided electronic access to our proxy materials beginning on or about March 20, 2020. On or about, March 25, 2020, we mailed to our shareholders the Notice of Availability of Proxy Materials, which contains instructions on how to access the Proxy Statement and our Annual Report via the Internet and how to vote online. The Securities and Exchange Commission ("SEC") allows us to deliver proxy materials to shareholders over the Internet. We believe that this offers a convenient way for shareholders to review the annual meeting materials. It also reduces printing and mailing expenses and lessens the environmental impact of paper copies.

WHO IS ENTITLED TO VOTE?

We have fixed the close of business on February 28, 2020 as the record date for shareholders entitled to receive notice of and to vote at our annual meeting. Only holders of record of First Northwest’s common stock on that date are entitled to receive notice of and to vote at the annual meeting. You are entitled to one vote for each share of First Northwest common stock you own, unless you own more than ten percent of First Northwest’s outstanding shares. On February 28, 2020, the voting record date, there were 10,628,030 shares of First Northwest common stock outstanding and entitled to vote at the annual meeting.

HOW CAN I ATTEND THE ANNUAL MEETING ?

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held.

You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.meetingcenter.io/290198981. You also will be able to vote your shares online by attending the Annual Meeting by webcast.

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. The password for the meeting is FNWB2020.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

| 105 W. Eighth Street, Port Angeles, Washington 98362 9

| 105 W. Eighth Street, Port Angeles, Washington 98362 9

The online meeting will begin promptly at 4:00 p.m. (Pacific Time). We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

HOW DO I REGISTER TO ATTEND THE ANNUAL MEETING VIRTUALLY ON THE INTERNET?

If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the notice or proxy card that you received. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the Internet.

To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your First Northwest holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 4:00 p.m. (Pacific Time) on May 5, 2020.

You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

| |

By email: | Forward the email from your broker, or send an image of your legal proxy to legalproxy@computershare.com |

By mail: Computershare

FNWB Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

WHY ARE YOU HOLDING A VIRTUAL MEETING INSTEAD OF A PHYSICAL MEETING?

The decision to hold this year’s Annual Meeting online was not made without significant consideration regarding how this meeting format will impact shareholders and their access to the information and communication from the Meeting. The decision to hold its 2020 Annual Meeting online should not be misunderstood as an indication that First Northwest intends to hold future annual meetings using an online-only format. First Northwest remains committed to using the in-person format it has traditionally used for its annual meetings, with the possibility of enhancing access to and participation in those meetings by adding an online attendance option.

HOW DO I VOTE AT THE ANNUAL MEETING?

Proxies are solicited to provide all shareholders of record as of the voting record date an opportunity to vote on matters scheduled for the annual meeting as described in these materials. You are a shareholder of record if your shares of First Northwest common stock are held in your name. If you are a beneficial owner of First Northwest common stock held by a broker, bank or other nominee (i.e., in "street name"), please see the instructions below under "What If My Shares Are Held in Street Name?"

Shares of First Northwest common stock can only be voted by the shareholder or by proxy at the annual meeting. To ensure your representation at the annual meeting, we recommend you vote by proxy even if you plan to

| Proxy Statement for the 2020 Annual Shareholders' Meeting 10

| Proxy Statement for the 2020 Annual Shareholders' Meeting 10

attend the annual meeting virtually. You can vote by telephone or the Internet by following the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail. You may also vote by signing, dating, and returning the proxy card or voting instruction form if you requested a copy of the proxy materials by mail. You can always change your vote at the virtual meeting if you are a shareholder of record.

Shares of First Northwest common stock represented by properly executed proxies will be voted by the Proxy Committee of the Board in accordance with the shareholder’s instructions. Where properly executed proxies are returned to us with no specific instruction as to how to vote at the annual meeting, the Proxy Committee will vote the shares FOR the election of each of our director nominees, FOR approval of the adoption of the First Northwest Bancorp 2020 Equity Incentive Plan, FOR advisory approval of the compensation of our named executive officers as disclosed in this Proxy Statement, and FOR the ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm (also referred to as "independent auditor") for 2020. If any other matters are properly presented at the annual meeting for action, the Proxy Committee will have the discretion to vote on these matters in accordance with its best judgment. We do not currently expect that any other matters will be properly presented for action at the annual meeting.

You may receive more than one Notice of Internet Availability of Proxy Materials depending on how your shares are held. For example, you may hold some of your shares individually, some jointly with your spouse and some in trust for your children. In this case, you will receive three separate (but similar) notices explaining how to access the proxy materials and vote.

WHAT IF MY SHARES ARE HELD IN STREET NAME?

If you are the beneficial owner of shares held in "street name" by a broker, your broker or other custodian is required to vote the shares in accordance with your instructions. If you do not give instructions to your broker, stock exchange rules permit your broker to vote the shares only with respect to discretionary items. In the case of non-discretionary items, the shares not voted will be treated as "broker non-votes." The proposal to elect directors, approval of the First Northwest Bancorp 2020 Equity Incentive Plan, and the advisory vote on executive compensation are considered non-discretionary items; therefore, you must provide instructions to your broker in order to have your shares voted on these proposals.

If your shares are held in street name, you will need proof of ownership to be admitted to the annual meeting. A legal proxy issued by your broker, a recent brokerage statement, or a letter from the record holder of your shares are examples of proof of ownership. If you want to vote your shares of common stock held in street name at the annual meeting, you will need to obtain a legal proxy in your name from the broker, bank or other nominee who holds your shares.

HOW WILL MY SHARES OF COMMON STOCK HELD IN THE EMPLOYEE STOCK OWNERSHIP PLAN BE VOTED?

We maintain the First Northwest Bancorp Employee Stock Ownership Plan ("ESOP") for the benefit of our employees. Each participant may instruct the ESOP trustees how to vote the shares of First Northwest common stock allocated to his or her account under the ESOP by completing the proxy card distributed by the administrator. If a participant properly executes the proxy card, the administrator will instruct the trustees to vote the participant’s shares in accordance with the participant’s instructions. Unallocated shares of First

| 105 W. Eighth Street, Port Angeles, Washington 98362 11

| 105 W. Eighth Street, Port Angeles, Washington 98362 11

Northwest common stock held in the ESOP and allocated shares for which proper voting instructions are not received will be voted by the trustees in the same proportion as shares for which the trustees have received voting instructions. In order to give the trustees sufficient time to vote, all vote authorization forms must be received by the transfer agent on or before April 30, 2020 at 10:00 a.m. (Pacific Time). The ESOP third party administrator is Northwest Plan Services, Inc.

HOW WILL MY SHARES OF COMMON STOCK HELD IN THE FIRST FEDERAL 401(K) PLAN BE VOTED?

We also maintain the First Federal Savings and Loan Association of Port Angeles 401(k) Plan ("401(k) Plan") for the benefit of our employees. First Northwest's common stock is an investment choice for participants in the 401(k) Plan. Each participant may instruct the trustees how to vote the shares of First Northwest common stock allocated to his or her account under the 401(k) Plan by completing the proxy card distributed by the administrator, Northwest Plan Services, Inc. If a participant properly executes the proxy card, the administrator will instruct the trustee to vote the participant’s shares in accordance with the participant’s instructions. Shares for which proper voting instructions are not received will be voted by the trustee as directed by the administrator. In order to give the trustee sufficient time to vote, all vote authorization forms must be received by the administrator on or before April 30, 2020 at 10:00 a.m. (Pacific Time).

HOW MANY SHARES MUST BE PRESENT TO HOLD THE ANNUAL MEETING?

A quorum must be present at the meeting for any business to be conducted. The presence at the meeting or by proxy of at least a majority of the shares of First Northwest common stock entitled to vote at the annual meeting as of the record date will constitute a quorum. Abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining whether a quorum exists at the annual meeting.

WHAT IF A QUORUM IS NOT PRESENT AT THE ANNUAL MEETING?

If a quorum is not present at the scheduled time of the meeting, a majority of the shareholders present or represented by proxy may adjourn the meeting until a quorum is present. The time and place of the adjourned meeting will be announced at the time the adjournment is taken, and no other notice will be given unless the adjourned meeting is set to be held 120 days or more after the original meeting. An adjournment will have no effect on the business that may be conducted at the meeting.

VOTE REQUIRED TO APPROVE PROPOSAL 1: ELECTION OF DIRECTORS

Directors are elected by a plurality of the votes cast, individually or by proxy, at the annual meeting by holders of First Northwest common stock. Accordingly, the three nominees for election as directors who receive the highest number of votes cast will be elected. Our Articles of Incorporation do not permit shareholders to cumulate their votes for the election of directors. Votes may be cast for or withheld from each nominee. Votes that are withheld and broker non-votes will have no effect on the outcome of the election because the three nominees receiving the greatest number of votes will be elected.

Our Board of Directors unanimously recommends that you vote FOR the election of each of its director nominees.

| Proxy Statement for the 2020 Annual Shareholders' Meeting 12

| Proxy Statement for the 2020 Annual Shareholders' Meeting 12

VOTE REQUIRED TO APPROVE PROPOSAL 2: APPROVAL OF FIRST NORTHWEST BANCORP 2020 EQUITY INCENTIVE PLAN

Approval of the First Northwest Bancorp 2020 Equity Incentive Plan requires the affirmative vote of a majority of the votes, individually or by proxy, cast at the annual meeting. Abstentions and broker non-votes do not constitute votes cast and therefore will have no effect on the outcome of the proposal.

Our Board of Directors unanimously recommends that you vote FOR approval of the 2020 Equity Incentive Plan.

VOTE REQUIRED TO APPROVE PROPOSAL 3: ADVISORY APPROVAL OF EXECUTIVE COMPENSATION

Approval, on a non-binding advisory basis, of the compensation of our named executive officers requires the affirmative vote of a majority of the votes cast, individually or by proxy, at the annual meeting. Abstentions and broker non-votes do not constitute votes cast and therefore will have no effect on the outcome of the proposal.

Our Board of Directors unanimously recommends that you vote FOR approval of the compensation of our named executive officers.

VOTE REQUIRED TO APPROVE PROPOSAL 4: RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT AUDITOR

The Audit Committee has appointed Moss Adams LLP as our independent auditor for the year ending December 31, 2020. Ratification of the appointment of Moss Adams LLP as our independent auditor requires the affirmative vote of a majority of the votes cast, individually or by proxy, at the annual meeting. Abstentions do not constitute votes cast and therefore will have no effect on the outcome of the proposal.

Our Board of Directors unanimously recommends that you vote FOR the ratification of the appointment of the independent auditor.

MAY I REVOKE MY PROXY?

You may revoke your proxy before it is voted by:

•submitting a new proxy with a later date;

| |

| • | notifying the Corporate Secretary of First Northwest in writing (or if you hold your shares in street name, your broker, bank or other nominee) before the annual meeting that you have revoked your proxy; or |

| |

| • | voting virtually at the annual meeting. |

If your shares are held in street name, you must obtain a validly executed legal proxy from your broker or other custodian indicating that you have the right to vote your shares.

| 105 W. Eighth Street, Port Angeles, Washington 98362 13

| 105 W. Eighth Street, Port Angeles, Washington 98362 13

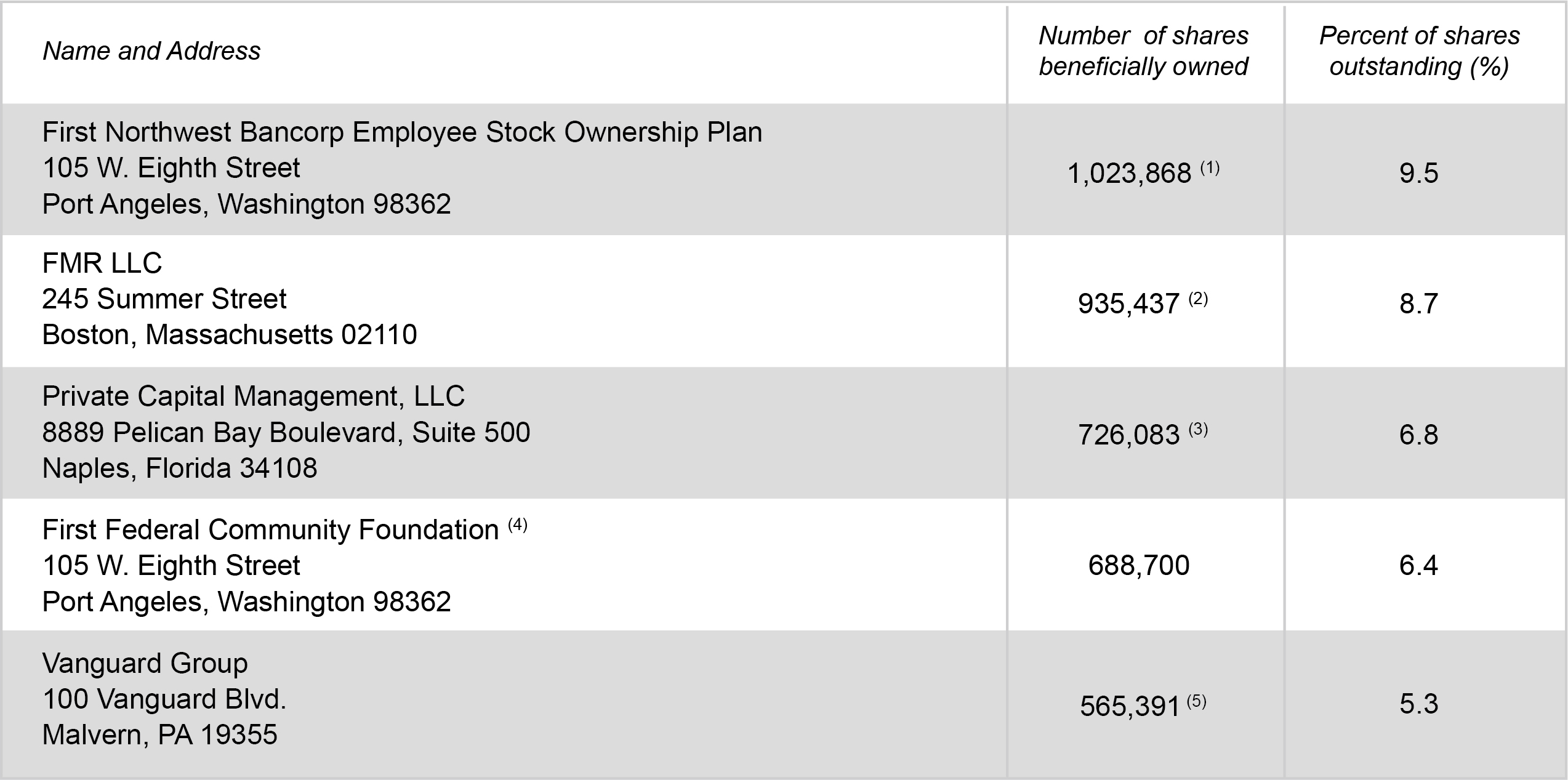

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Persons and groups who beneficially own in excess of five percent of First Northwest’s outstanding shares of common stock ("5% beneficial owners") are required to file with the SEC reports disclosing their ownership. The following table sets forth, as of December 31, 2019, information regarding the share ownership of each person or entity known by management to be a 5% beneficial owner:

1) The ESOP has sole voting power as to 820,874 shares, shared voting power with respect to 202,994 shares and sole dispositive power with respect to 1,023,868 shares.

(2) Based on information contained in the schedule 13G/A filed on February 7, 2020, reporting shared voting and dispositive power as to all shares by FMR LLC and Abigail P. Johnson, the Chairman and Chief Executive Officer of FMR LLC.

(3) Based on information contained in the schedule 13G filed on February 7, 2020, reporting sole voting and dispositive power as to 162,037 shares and shared voting and dispositive power as to 564,046 shares.

(4) We established the First Federal Community Foundation in connection with the mutual to stock conversion of First Federal in 2015 to further our commitment to the local community. Shares of common stock held by the Foundation will be voted in the same proportion as all other shares of common stock voted on all proposals by First Northwest’s shareholders.

(5) Based on information contained in the schedule 13G filed on February 11, 2020, reporting sole voting and dispositive power as to 7,416 shares and shared voting and dispositive power as to 557,975 shares.

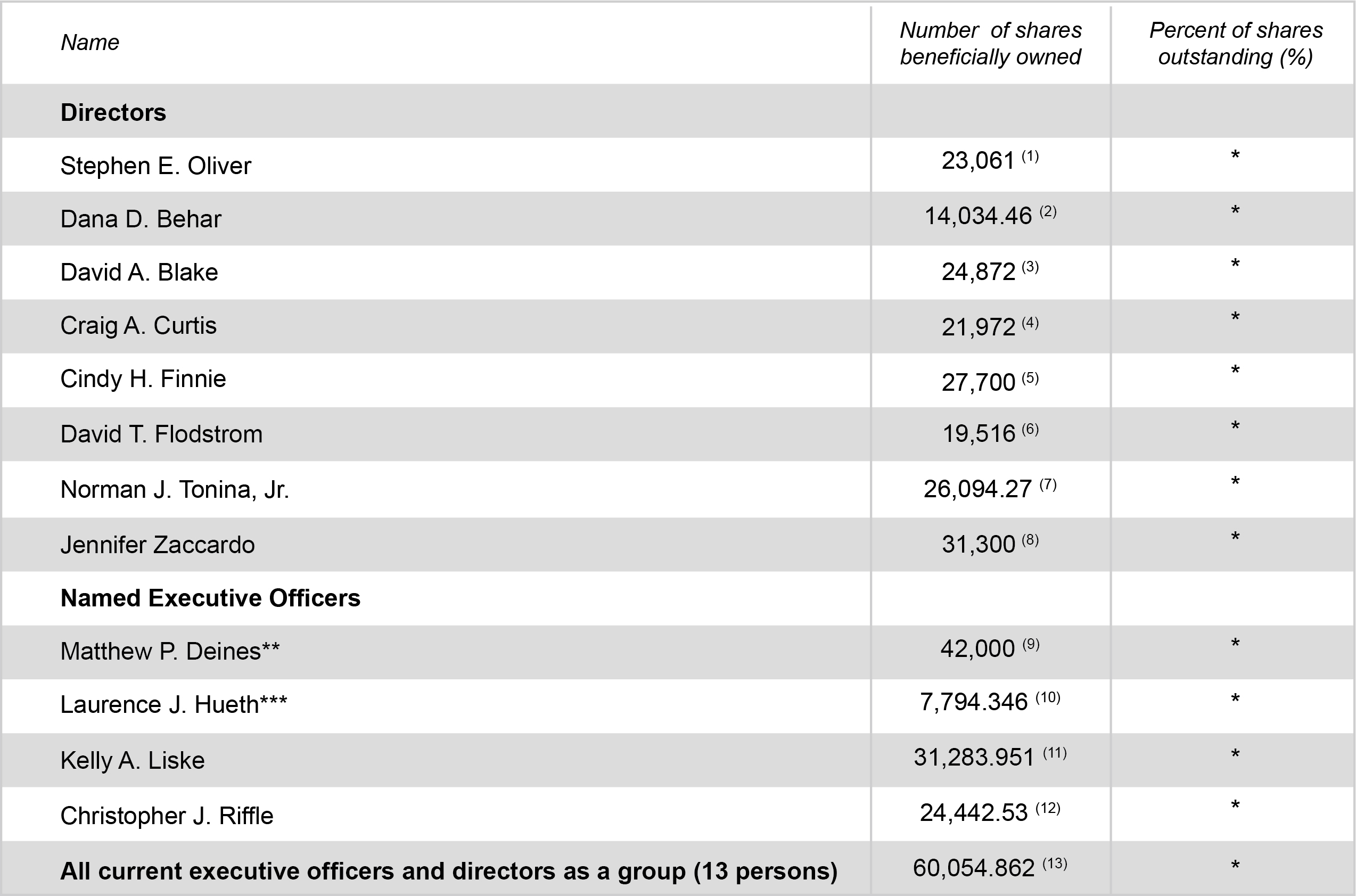

BENEFICIAL OWNERSHIP BY DIRECTORS AND NAMED EXECUTIVE OFFICERS

The following table sets forth, as of February 28, 2020, the record date for the annual meeting, information regarding share ownership of our directors and director nominees, each current or former executive officer of First Northwest or any of its subsidiaries named in the Summary Compensation Table appearing under "Executive Compensation" below (referred to as "named executive officers"), and all current directors and executive officers of First Northwest and its subsidiaries as a group.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In accordance with Rule 13d-3 of the Securities Exchange Act of 1934 (the “Exchange Act”), a person is deemed to be the beneficial owner of any shares of common stock if he or she has voting or dispositive power with respect to those shares. Therefore, the table below includes shares held by spouses, by other immediate family members

| Proxy Statement for the 2020 Annual Shareholders' Meeting 14

| Proxy Statement for the 2020 Annual Shareholders' Meeting 14

in trust, in retirement accounts or funds for the benefit of the named individuals, and in the ESOP and 401(k) Plan.

As of February 28, 2020, the record date for the annual meeting, there were 10,628,030 shares of First Northwest common stock outstanding.

* Less than one percent of shares outstanding.

** Mr. Deines is also a Board director.

*** Mr. Hueth served as our President and CEO and as a Board director until December 5, 2019.

(1) Includes 7,500 shares held jointly with spouse and 7,200 shares of restricted stock as to which Mr. Oliver has voting power.

(2) Includes 5,000 shares held jointly with spouse and 3,600 shares of restricted stock as to which Mr. Behar has voting power.

(3) Includes 7,200 shares of restricted stock as to which Mr. Blake has voting power.

(4) Includes 4,600 shares held jointly with spouse and 7,200 shares of restricted stock as to which Mr. Curtis has voting power.

(5) Includes 7,200 shares of restricted stock as to which Ms. Finnie has voting power.

(6) Includes 7,200 shares of restricted stock as to which Mr. Flodstrom has voting power.

(7) Includes 7,200 shares of restricted stock as to which Mr. Tonina has voting power.

(8) Includes 12,000 shares held jointly with spouse and 7,200 shares of restricted stock as to which Ms. Zaccardo has voting power.

(9) Includes 27,000 shares of restricted stock as to which Mr. Deines has voting power.

(10) Includes 7,794.346 shares held in the ESOP.

(11) Includes 12,500 shares of restricted stock as to which Ms. Liske has voting power, 100 shares held as custodian for minors of which Ms. Liske disclaims beneficial ownership, 3,212.204 units held in the 401(k) Plan, and 5,387.747 shares held in the ESOP. The units consist of shares of First Northwest common stock and a liquidity cash component.

(12) Includes 20,000 shares of restricted stock as to which Mr. Riffle has voting power, and 633.525 shares held in the ESOP.

(13) Includes 32,500 shares of restricted stock as to which two additional executive officers have voting power, as well as 7,622.575 units held in the 401(k) Plan, and 5,332.287 shares held in the ESOP for their account. The units consist of shares of First Northwest common stock and a liquidity cash component.

| 105 W. Eighth Street, Port Angeles, Washington 98362 15

| 105 W. Eighth Street, Port Angeles, Washington 98362 15

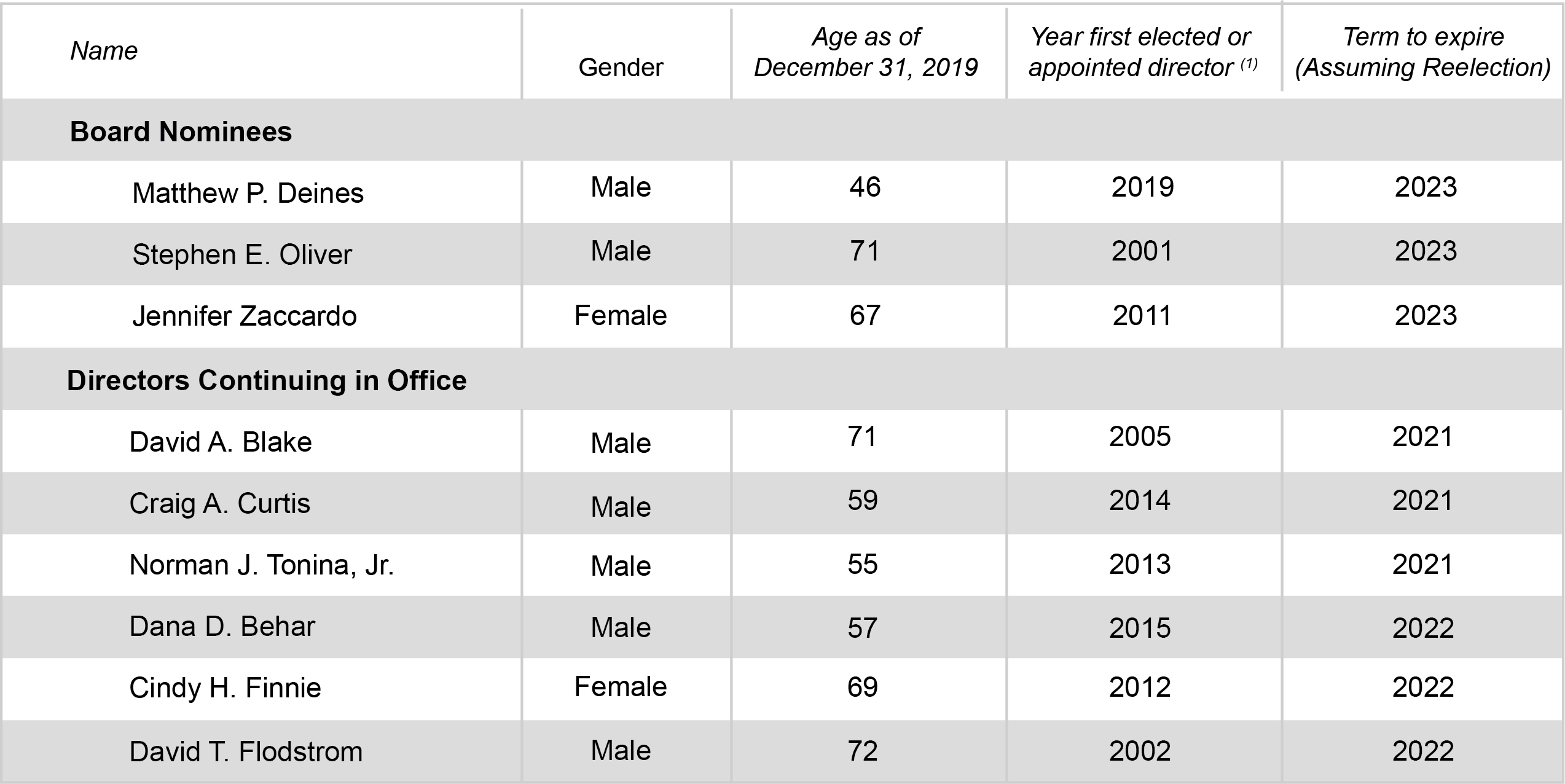

PROPOSAL 1 – ELECTION OF DIRECTORS

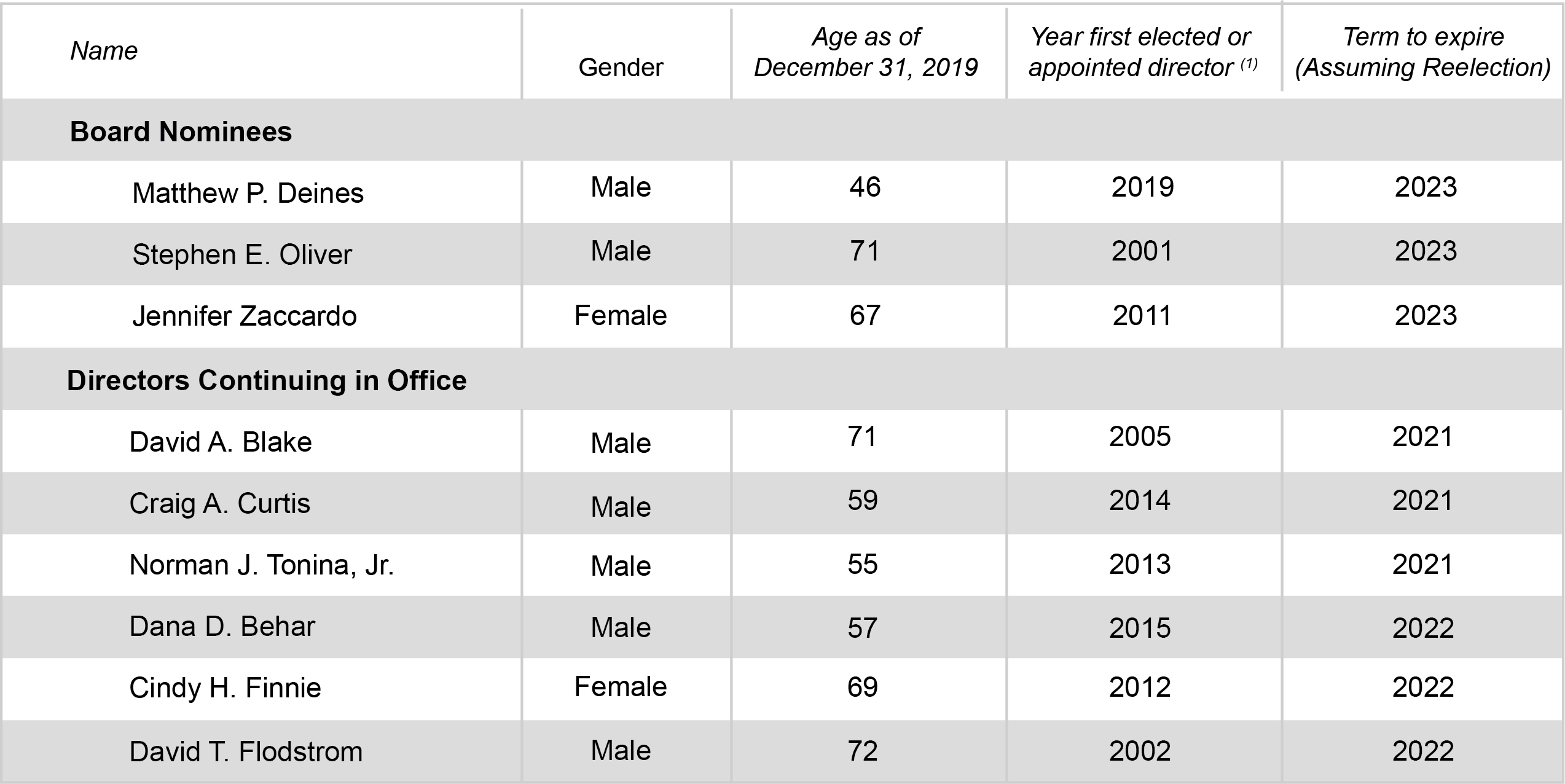

Our Board consists of nine members and, in accordance with our Articles of Incorporation, is divided into three classes. One-third of the directors are elected annually to serve for a three-year period or until their respective successors are elected and qualified. The table below sets forth information regarding each director of First Northwest and each Board nominee for director. All nominees and continuing directors are also directors of First Federal.

The Nominating and Corporate Governance Committee of the Board selects nominees for election as directors and presents its nominees to the Board for consideration. All nominees currently serve as First Northwest directors. Each nominee has consented to being named in this Proxy Statement and has agreed to serve if elected. It is intended that the proxies solicited on behalf of the Board (other than proxies in which the vote is withheld as to the nominee) will be voted at the annual meeting for the election of the nominees identified in the table below. If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have withheld authority. At this time, we are not aware of any reason why a nominee might be unable to serve if elected.

The Board of Directors unanimously recommends a vote "FOR" the election of Matthew P. Deines, Stephen E. Oliver, and Jennifer Zaccardo, each for a three-year term.

(1) For years prior to 2015, includes service on the Board of Directors of First Federal.

(1) For years prior to 2015, includes service on the Board of Directors of First Federal.

| Proxy Statement for the 2020 Annual Shareholders' Meeting 16

| Proxy Statement for the 2020 Annual Shareholders' Meeting 16

Information Regarding Nominees for Election and Continuing Directors. Set forth below is the principal occupation and other business experience, during at least the last five years, of each nominee for director and each continuing director.

Dana D. Behar has been the owner of Discovery Bay Investments, LLC, a private equity investment firm based in Seattle, Washington, and focused on agricultural land and real estate, since September 2015. Prior to that, Mr. Behar worked at HAL Real Estate Investments Inc., a private equity real estate investment entity based in Seattle, Washington, for 23 years. Mr. Behar served as President and Chief Executive Officer of HAL Real Estate Investments Inc. from 2005 until September 2015 and Director from 2005 to 2016. Mr. Behar previously worked in brand management at Proctor & Gamble, served as Director of Marketing for the retail chain Egghead Software, and was a management consultant with the Wharton Small Business Development Center. He is active in his community, serving as a board member of Capitol Hill Housing and the Forterra Strong Communities Fund, and as a trustee of the Samis Foundation. Mr. Behar has a Bachelor of Arts degree in business with a concentration in finance from the University of Washington and a Master of Business Administration degree with a concentration in finance from the Wharton School of the University of Pennsylvania.

Cindy H. Finnie retired in 2011 from Allstate Insurance Company after 38 years of leadership experience. Her range of responsibilities included property and casualty underwriting, sales management, business development, agency management, financial management and developing insurance agencies. Ms. Finnie was also responsible for introducing and developing the financial services market in her area. Ms. Finnie is the co-owner and President of Rainshadow Properties, Inc., a boutique hotel and property management company that she co-founded in 1995. She is also a former member of the Centrum Foundation, past chair of the Washington State Arts Commission, past chair of the Fort Worden Public Development Authority, a former director of the Jefferson County Community Foundation, a member of the City of Port Townsend Lodging Tax Advisory Committee, director of the Fort Worden Foundation, and board member of the First Federal Community Foundation. Ms. Finnie has a Bachelor of Arts degree from the University of Colorado.

David T. Flodstrom, P.E. retired in 2005 after a 36-year career in municipal management and industrial relations. During his career, Mr. Flodstrom served as the City Engineer for Port Angeles for 5 years, the Port Angeles City Manager for 10 years, and worked in industrial relations and human resources for private industries for 15 years. Mr. Flodstrom’s career has provided him with expertise in management, human resources and governance. Mr. Flodstrom is a board member of the First Federal Community Foundation, past commissioner of the Peninsula Housing Authority, past president of Nor’ Western Rotary Club and former board member of the Olympic Medical Foundation and the Washington Business Association. He has also spent over 30 years as a coach and umpire for youth baseball clubs. Mr. Flodstrom has a Bachelor of Science degree in civil engineering and maintains a professional engineering.

Matthew P. Deines became President and Chief Executive Officer (“CEO”) of First Federal in August 2019, and was elected President, CEO, and director of First Northwest on December 5, 2019. In over 18 years of banking he has experience in a variety of areas, including strategic planning and acquisitions, investor relations, financial reporting, and digital banking, as well as operations, payments, internal controls and board governance. Mr. Deines served as Executive Vice President and Chief Financial Officer (“CFO”) of Liberty Bay Bank from

| 105 W. Eighth Street, Port Angeles, Washington 98362 17

| 105 W. Eighth Street, Port Angeles, Washington 98362 17

November 2018 until May 2019. Prior to that, he began work at Sound Community Bank as its CFO in February 2002 and was promoted to Executive Vice President in January 2005. In 2008, Mr. Deines also became Executive Vice President, CFO, and Corporate Secretary of the newly incorporated Sound Financial, Inc., the predecessor to Sound Financial Bancorp, Inc. ("SFBC"). He held these roles at Sound and SFBC until March 2018. In 2000, he received his Washington Certified Public Accountant certificate, currently inactive, while working for O’Rourke, Sacher & Moulton, LLP. Mr. Deines has been a conference speaker and instructor for the Washington Bankers Association and is actively involved with several non-profit organizations.

Stephen E. Oliver has served as Chairman of the Board since January 2015. Mr. Oliver is a retired attorney with over 35 years of experience in the areas of banking, real estate development, environmental and municipal law. From 2010 until his retirement in December 2014, he owned the legal consulting firm, S.E. Oliver, Inc. Prior to starting his consulting firm, Mr. Oliver was a stockholder in the Platt Irwin Law Firm (which served as general counsel to First Federal through 2017), beginning his affiliation in 1978 and serving as President from 1991 through 2009. Mr. Oliver serves as President of the Board of Directors of the Northwest Maritime Center located in Port Townsend, Washington, and previously served as president of the Board of Directors of the Olympic Medical Center Foundation located in Port Angeles, Washington. Much of Mr. Oliver’s professional activity was devoted to assessing risk in banking and real estate development transactions, as well as general litigation risk. He has served on bank boards continuously since 2001 and, in that capacity, has chaired both audit and loan committees for extended periods. Mr. Oliver earned a Bachelor of Arts, cum laude, with distinction in Economics from the University of Washington. He also earned a Juris Doctorate, Order of the Coif, from the University of Washington and served as a Law Clerk to Washington State Supreme Court Justice Robert Utter.

Jennifer Zaccardo is President and Tax Partner of Baker, Overby & Moore Inc., P.S., a public accounting firm with which she has been affiliated since 1983. She is a Certified Public Accountant with particular expertise in the timber industry and small business financial reporting and taxation. Ms. Zaccardo is a member of the Washington Society of Certified Public Accountants and the American Institute of Certified Public Accountants. She is a past president and treasurer of the Peninsula College Foundation Board of Governors and served on the Quillayute Valley School Board of Directors for 10 years. Ms. Zaccardo earned a Bachelor of Science degree in Forest Resources from the University of Washington, Bachelor of Arts degree in Business Administration from the University of Washington and is a Certified Public Accountant.

David A. Blake is the Chief Operations Officer of Blake Sand and Gravel, a producer of washed sand and aggregate and crushed rock, and Secretary/Treasurer of Blake Tile & Stone, a landscaping and tile supplier. He joined the family business in 1969 and served as President and Chief Executive Officer from 1980 until 2010. Mr. Blake continues to serve on the Board of Directors of both companies. He is a board member of the Albert Haller Foundation and the Olympic Medical Foundation and served on the Sequim School Board of Directors for 31 years. Mr. Blake earned an Associate of Arts degree from Peninsula College.

Craig A. Curtis is Chief Architect with Katerra, Inc., a vertically integrated company founded by Silicon Valley entrepreneurs to reinvent the way buildings are delivered, through leveraging technology, supply chain and off-site factory prefabrication. Katerra began in 2015 and Mr. Curtis joined in January 2016 to open a North American Design Division for the company. At that time there were approximately 40 people in the

| Proxy Statement for the 2020 Annual Shareholders' Meeting 18

| Proxy Statement for the 2020 Annual Shareholders' Meeting 18

company, worldwide. By the end of 2019, Katerra had grown to over 8,000 employees, with approximately half of those in North America. Mr. Curtis oversees building design for all North American Katerra Building Platforms, leads business development for emerging markets, and has led the launch of Katerra’s mass timber design division, including North America’s largest cross laminated timber (CLT) factory, located in Spokane, Washington. Prior to joining Katerra, Mr. Curtis was employed by The Miller Hull Partnership since 1987 and served as a partner from 1994 until 2016. In 2004, Miller Hull was awarded the American Institute of Architects (AIA) National Firm Award, and in 2008, Mr. Curtis was elected to the AIA College of Fellows, a distinction awarded to approximately 3% of its members. Mr. Curtis has degrees in Architecture and Construction Management from Washington State University. A resident of Kitsap County since 1991, Mr. Curtis has served on committees for the North Kitsap School District and Suquamish Community Advisory Council.

Norman J. Tonina, Jr. has served as the Chairman of the Fort Worden Public Development Authority in Port Townsend, Washington since 2015. He is also an adjunct faculty member in Seattle Pacific University’s graduate program in Industrial and Organizational Psychology. Mr. Tonina most recently worked at Grameen Foundation, a non-governmental organization focused on enabling the poor to create a world without poverty, where he served as an advisor to the Chief Executive Officer and Board of Directors (2012-2016) and as its Chief Human Resources Officer (2010-2012), focused on driving strategic alignment, organizational effectiveness, and human resource re-engineering initiatives. He began his career at Digital Equipment Corporation in 1987 and joined Microsoft in 1993 as a Finance Manager for its Systems products, rising to become Senior Director of Finance for Microsoft’s Platforms and Applications business. In 1999, Mr. Tonina transitioned to Human Resources, where he directed major strategic global human resources initiatives, spending the majority of his time focused on culture, leadership, and talent strategies. He continues to be actively involved in community organizations in both Seattle and Port Townsend, Washington, and is the Chairman of the First Federal Community Foundation. Mr. Tonina earned his Bachelor of Arts degree in Business Administration from Northeastern University, a certificate in human resources from the University of Michigan, and a Masters in Organizational Psychology degree from Antioch University.

Director Qualifications and Experience. The following table identifies the experience, qualifications, attributes and skills the Nominating and Corporate Governance Committee considered in making its decision to nominate directors to our Board. The fact that a particular attribute was not considered does not mean that the director lacks such an attribute.

| 105 W. Eighth Street, Port Angeles, Washington 98362 19

| 105 W. Eighth Street, Port Angeles, Washington 98362 19

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

AND CORPORATE GOVERNANCE MATTERS

Board of Directors. The Boards of Directors of First Northwest and First Federal conduct their business through board and committee meetings. During 2019, the Board held nine meetings and the Board of Directors of the Bank held ten meetings. No director of First Northwest or the Bank attended fewer than 75 percent of the total meetings of the boards and committees on which that person served during 2019.

Committees and Committee Charters. The Board has standing Audit, Compensation, Nominating and Corporate Governance, and Executive Committees. The Board has adopted written charters for the Audit, Compensation, and Nominating and Corporate Governance Committees, copies of which are available under the "Investor Relations" tab on our website at www.ourfirstfed.com. All members of the Audit, Compensation, and Nominating and Corporate Governance Committees are independent, in accordance with the requirements for companies listed on NASDAQ.

The Audit Committee consists of Directors Zaccardo (Chair), Behar, Blake, Finnie and Oliver. This committee’s primary responsibilities are to: oversee the integrity of First Northwest’s financial reporting processes, financial statement audits and systems of internal controls regarding finance, accounting and legal compliance; oversee the independence and performance of First Northwest’s independent auditors and internal audit function; and provide an avenue of communication among the independent auditor, management and the Board of Directors. In addition, the Board of Directors has determined that Ms. Zaccardo meets the definition of "audit committee

| Proxy Statement for the 2020 Annual Shareholders' Meeting 20

| Proxy Statement for the 2020 Annual Shareholders' Meeting 20

financial expert," as defined by the SEC. The Audit Committee meets quarterly and on an as needed basis. The Audit Committee met eight times during 2019.

The Compensation Committee consists of Directors Finnie (Chair), Flodstrom, Oliver and Tonina. This committee meets semiannually and on an as needed basis, and provides general oversight regarding the personnel, compensation and benefits matters of First Northwest. In furtherance of this purpose, the committee is responsible for setting the compensation of our Chief Executive Officer and reviewing his performance, approving the compensation arrangements and performance goals for other senior executives, and recommending board member compensation. The Compensation Committee met three times during 2019.

The Nominating and Corporate Governance Committee consists of Directors Blake (Chair), Curtis, Finnie, Oliver, Tonina and Zaccardo. This committee is responsible for assessing board and committee membership composition, succession planning, and implementing policies and processes regarding corporate governance matters. The committee also ensures that the requisite expertise, diversity and independence of the Board are considered in evaluating board composition and director nominations. The Nominating and Corporate Governance Committee meets semiannually, and on an as needed basis, and met three times during 2019.

The Executive Committee consists of Directors Oliver, Finnie, and Zaccardo. This committee acts for the Board of Directors when formal board action is required between regular meetings. The Executive Committee did not meet during 2019.

Leadership Structure. First Northwest has separated the positions of Chairman and Chief Executive Officer. The Chairman, who is an independent director, leads the Board and presides at all board meetings, while the President and Chief Executive Officer runs the day-to-day business of First Northwest. The Board supports having an independent director in a board leadership position. Having an independent chairman enables non-management directors to raise issues and concerns for board consideration without immediately involving management. The Chairman also serves as a liaison between the Board and senior management.

Classified Board Structure. Under its classified board structure, one-third of the directors are elected each year to serve three-year terms. Through its Nominating and Corporate Governance Committee and Board meetings, the Board routinely considers the merits of its classified board structure. The Board continues to believe that the classified board structure is in the best interests of First Northwest. The Board believes that the longer time required to elect a majority of a classified board will help assure continuity and stability of corporate policies since a majority of the directors will always have prior experience. The banking industry is becoming increasingly complex, and effective bank holding company directors must be knowledgeable of the market and regulatory forces that shape and redefine the banking industry.

Board Involvement in Risk Management Process. As part of its overall responsibility to oversee the management, business and strategy of our company, one of the primary responsibilities of our Board is to oversee the amount and types of risk taken by management in executing our corporate strategy, and to monitor our risk experience against the policies and procedures set to control those risks. The Board’s risk oversight function is carried out through its approval of various policies and procedures, such as our lending and investment policies, and regular monitoring of risk such as interest rate risk exposure, liquidity, cyber-security, and problem assets. Some oversight functions are delegated to committees of the Board, with such committees

| 105 W. Eighth Street, Port Angeles, Washington 98362 21

| 105 W. Eighth Street, Port Angeles, Washington 98362 21

regularly reporting to the full Board the results of their oversight activities. For example, the Audit Committee is responsible for oversight of the independent auditor and meets directly with the auditors at various times during the course of the year. The Audit Committee also receives quarterly reports on technology and information security, including cybersecurity.

Corporate Governance Policy. The Board has adopted a corporate governance policy. The policy covers the following matters:

| |

| • | the composition, size, and tenure of the Board in order to ensure the requisite experience, diversity, and independence; |

| |

| • | responsibilities and operation of the Board; |

| |

| • | the establishment and operation of board committees, including audit, nominating and corporate governance, and compensation committees; |

| |

| • | succession planning for the Board and Chief Executive Officer; |

| |

| • | executive sessions of independent directors; |

| |

| • | the Board’s interaction with management and third parties; |

| |

| • | evaluation of the performance of the Board and the Chief Executive Officer; |

| |

| • | communications with shareholders and annual meeting attendance; and |

| |

| • | director orientation and continuing education. |

Director Independence. Our common stock is listed on the NASDAQ Global Market. In accordance with NASDAQ requirements, at least a majority of our directors must be independent directors. The Board has determined that eight of our nine directors are independent, as defined by NASDAQ. Directors Behar, Blake, Curtis, Finnie, Flodstrom, Oliver, Tonina, and Zaccardo are all independent. Only Matthew Deines, who is our President and Chief Executive Officer, is not independent.

Code of Ethics. The Code of Ethics is applicable to each of our directors, officers and employees, and requires individuals to maintain the highest standards of professional conduct. The Code is reviewed and updated from time to time. The Board approved updates to the Code in December 2019. A copy of the Code of Ethics is available under the "Investor Relations" tab on our website at www.ourfirstfed.com.

Director Continuing Education. Continuing education programs assist directors in maintaining skills and knowledge necessary or appropriate for the performance of their responsibilities. These programs may include internally developed materials and presentations, programs presented by third parties, and financial and administrative support to attend qualifying academic or other independent programs. Our Board maintains a strong commitment to continuing education activities each year.

Board Evaluation. The Nominating and Corporate Governance Committee conducts an annual evaluation of the performance of the Board, the Board Chairman, and each of its members, including director self-assessment, and one-on-one meetings between each director and the Board chairman. The results are reported to the Board. The report includes an assessment of the Board’s compliance with the principles of corporate governance, including its Corporate Governance Policy, and identification of areas in which the Board could improve its performance.

| Proxy Statement for the 2020 Annual Shareholders' Meeting 22

| Proxy Statement for the 2020 Annual Shareholders' Meeting 22

Shareholder Communication with the Board of Directors. The Board welcomes communication from shareholders. Shareholders may send communications to the Board of Directors, First Northwest Bancorp, 105 W. Eighth Street, Port Angeles, Washington 98362. Shareholders should indicate clearly the director or directors to whom the communication is being sent so that each communication may be forwarded appropriately.

Annual Meeting Attendance by Directors. We encourage, but do not require, our directors to attend the annual meeting of shareholders. All directors, except Director Curtis, attended the annual meeting of shareholders held on May 7, 2019.

Transactions with Related Persons. First Federal has followed a policy of granting loans to executive officers and directors which fully complies with all applicable federal regulations. Loans to directors and executive officers are made in the ordinary course of business and on the same terms and conditions, including interest rates and collateral, as those of comparable transactions with persons not related to First Federal prevailing at the time (unless made pursuant to the employee loan program described below), in accordance with our underwriting guidelines, and do not involve more than the normal risk of collectability or present other unfavorable features. All loans to directors and executive officers and their related persons at December 31, 2019 were performing in accordance with their terms.

Stock Ownership Guidelines. In May 2017, the Board adopted a stock ownership policy because it believes that it is in our best interest to align the financial interests of our non-employee directors and Chief Executive Officer with those of our shareholders. The policy requires non-employee directors to own shares of First Northwest’s common stock equal in value to three times the respective director’s annual cash retainer. Directors must meet these ownership guidelines by May 2020 or within three years of joining the Board, whichever is later. All of our eight non-employee directors have been compliant with this policy requirement throughout 2019. In addition, our stock ownership guidelines require our Chief Executive Officer to hold First Northwest shares valued at three times his annual base salary within three years of his date of hire. Since being appointed as Chief Executive Officer of First Federal in August 2019 and First Northwest in December 2019, Mr. Deines has shown strong commitment to meeting this stock ownership requirement with 42,000 shares held, consisting of 15,000 shares held by direct ownership and 27,000 shares of restricted stock. See “Executive Compensation” below for a description of our anti-hedging policy applicable to directors, officers and employees.

Employee Loan Program. First Federal offers an employee loan program to all employees to assist employees with loans for a variety of personal, family or household credit needs, or for the purchase, construction or refinancing of a home which is the employee’s primary residence. All loans offered to employees are closed on the same terms as those available to members of the general public except, following closing, the terms of employee loans are modified to reflect a preferential interest rate. Existing loans may be modified to conform to the terms of the employee loan program. If an employee terminates employment at First Federal, the interest rate on the loan reverts to the original rate for the general public. No director or executive officer had total indebtedness that exceeded $120,000 during 2018 or 2019 to the Bank or First Northwest for personal, family or household needs.

| 105 W. Eighth Street, Port Angeles, Washington 98362 23

| 105 W. Eighth Street, Port Angeles, Washington 98362 23

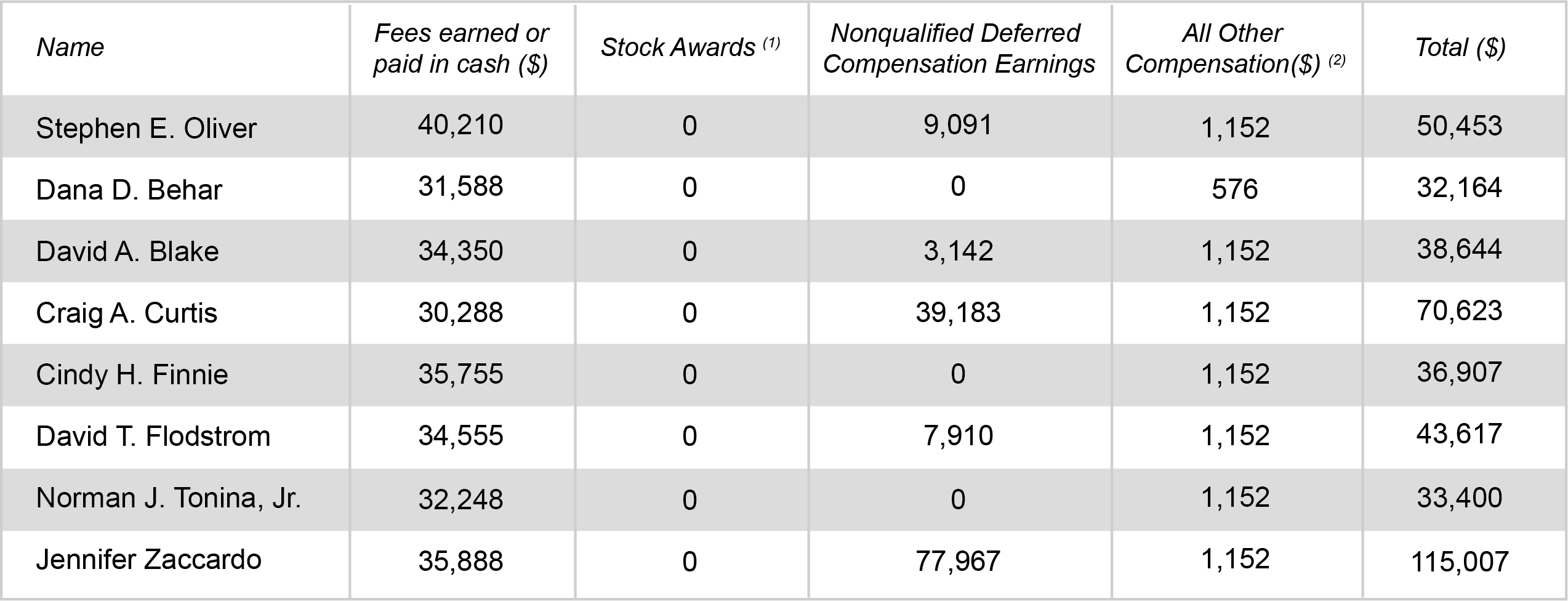

DIRECTOR COMPENSATION

The following table shows the compensation paid to our directors for the year ended December 31, 2019, except for Mr. Deines, our President and Chief Executive Officer, and Mr. Hueth, our former President and Chief Executive Officer, whose compensation is presented in the Summary Compensation Table in the section entitled "Executive Compensation" below.

(1) Shares of restricted stock granted in July 2016 and unvested as of December 31, 2019 were as follows: Director Behar, 3,600 shares; each of Directors Blake, Curtis, Finnie, Flodstrom, Oliver, Tonina, and Zaccardo, 7,200 shares.

(2) Amounts paid in cash dividends on unvested shares of restricted stock.

The non-employee (outside) directors of First Northwest receive compensation for their service on the board. In setting their compensation, the Board of Directors considers the significant amount of time and level of skill required for director service. For 2019, outside directors received an annual retainer (paid in monthly installments), as follows: Chairman, $36,300; Vice Chairman and Committee Chairs, $31,500; and all other directors, $28,500. Directors do not receive a fee for attending Board meetings. Committee members received fees for committee meeting attendance of $325 per meeting for regular members and $425 per meeting for committee chairs, with the exception of the Audit Committee Chair, who received $625 per meeting. Fees for interim committee meetings called for a particular purpose and not to discuss regular agenda items were paid at half the committee meeting fee.

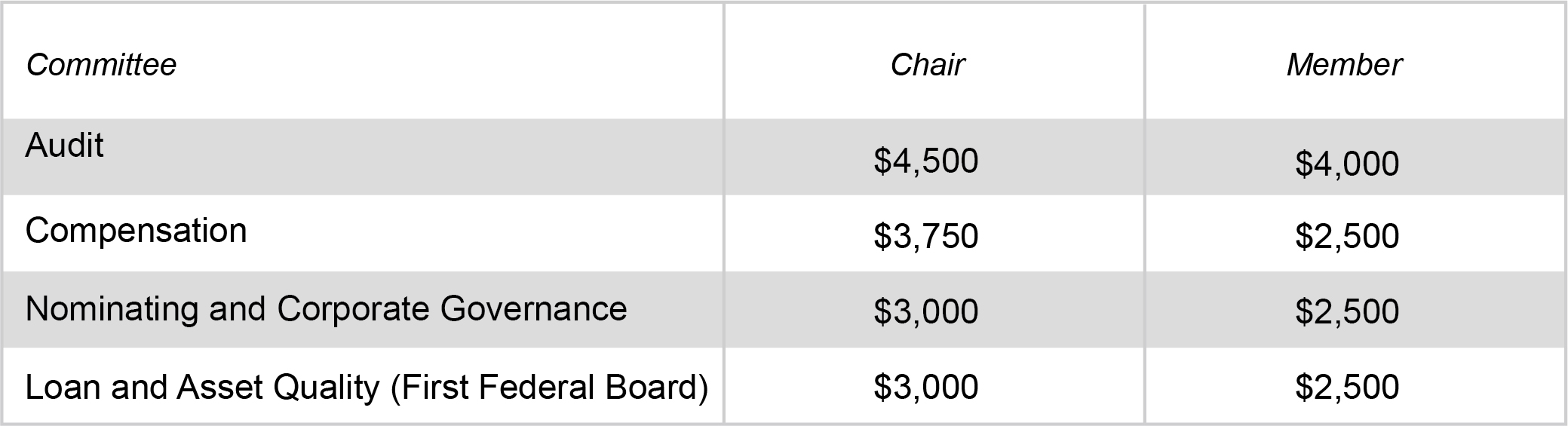

In October 2019 the Board adopted a Non-Employee Director Compensation Policy effective January 1, 2020, that sets the annual retainer for service as a non-employee director of First Northwest at $32,000. The Board Chairperson will be paid an additional annual retainer of $9,600. Under the new policy, annual retainers for committee service are as follows:

| Proxy Statement for the 2020 Annual Shareholders' Meeting 24

| Proxy Statement for the 2020 Annual Shareholders' Meeting 24

All retainers are paid in equal monthly installments. No additional compensation is paid to Board directors for services on the First Federal Board of Directors.

Deferred Compensation Plan. In order to encourage the retention of qualified directors, we offer a deferred compensation plan whereby directors may defer all or a portion of their regular fees until a permitted distribution event occurs under the plan. Each director may direct the investment of the deferred fees among investment options made available by First Federal. We have established a grantor trust to hold the plan investments. Grantor trust assets are considered part of our general assets, and the directors have the status of unsecured creditors of First Northwest with respect to the trust assets. The plan permits the payment of benefits upon a separation from service (on account of termination of service, pre-retirement death or disability), a change in control, an unforeseeable emergency or upon a date specified by the director, in an amount equal to the value of the director’s account balance (or the amount necessary to satisfy the unforeseeable emergency, in that case). A director may elect, at the time he or she makes a deferral election, to receive the deferred amount and related earnings in a lump sum or in annual installments over a period not exceeding 15 years. A director may subsequently elect to change when or how he or she receives his or her plan benefit, if certain required conditions are met. At December 31, 2019, our estimated deferred compensation liability accrual with respect to non-employee directors under the deferred compensation plan totaled approximately $641,300.

EXECUTIVE COMPENSATION

Description of Executive Compensation Program. This section provides a brief overview of our executive compensation program and the process followed by our Compensation Committee in making decisions about executive compensation. Following this discussion are various tables and additional information about the compensation paid or payable to our "named executive officers."

Compensation Philosophy and Objectives. In general, our executive compensation policies are designed to establish an appropriate relationship between executive pay and our performance. In particular, our executive compensation program is intended to:

| |

| • | attract and retain key executives who are vital to our long-term success; |

| |

| • | provide levels of compensation competitive with our peers and commensurate with our performance; |

| |

| • | compensate executives in ways that inspire and motivate them; and |

| |

| • | properly align risk-taking and compensation. |

Role of the Compensation Committee. The Compensation Committee is responsible for setting the policies and compensation levels for our directors and executive officers. The Committee is responsible for evaluating the performance of the Chief Executive Officer and setting his compensation and for reviewing the Chief Executive Officer's report regarding the performance of other senior executives. The Chief Executive Officer is not involved in decisions regarding his own compensation.

| 105 W. Eighth Street, Port Angeles, Washington 98362 25

| 105 W. Eighth Street, Port Angeles, Washington 98362 25

Role of Compensation Consultants. Our Compensation Committee has the authority to engage its own advisors to assist in carrying out its responsibilities. In 2019, the Compensation Committee engaged Aon McLagan ("McLagan"), an independent compensation consultant, to assist with its duties, including providing advice relating to our compensation peer group selection, support and specific analysis with regard to compensation data, and recommendations for executive and non-employee director compensation. McLagan reports directly to our Compensation Committee and not to management, is independent from us and has provided no other services to us other than compensation-related services. The Compensation Committee relies, in part, on the information and advice from McLagan, as well as other industry information and surveys regarding executive and non-employee director compensation, as a market comparison of compensation levels and practices and to assess the competitiveness of our executive and director compensation program. Our Compensation Committee has assessed the independence of McLagan and concluded that there are no conflicts of interest regarding the work that McLagan performs for the Committee.

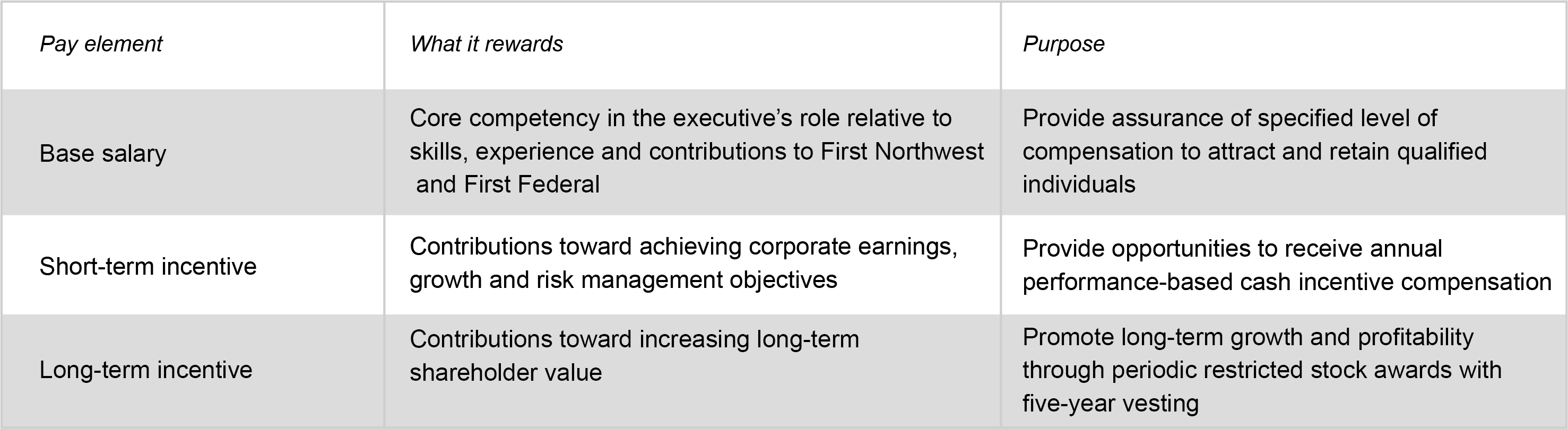

Compensation Program Elements. For several years, our executive compensation program has focused primarily on the following components:

Executive officers may also participate in a deferred compensation plan, the 401(k) plan, and the ESOP as described in more detail under "Retirement Benefits" below. We have also entered into employment agreements with Mr. Deines, Ms. Liske and Mr. Riffle that provide, among other things, for severance compensation upon involuntary termination in certain situations, as described under "Employment Agreements for Named Executive Officers" below. In addition, First Federal and First Northwest offer medical and dental insurance coverage, vision care coverage, group life insurance coverage, and long-term disability insurance coverage under welfare and benefit plans in which most employees, including executive officers, are eligible to participate.

Compensation Clawback Provision. In the event that First Northwest or First Federal is required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under securities laws, First Federal will recover incentive compensation awarded to current or former executive officers, during the preceding three years, to the extent the original awards exceed the amounts that would have been paid under the restated results, or as otherwise required by applicable laws or regulations.

| Proxy Statement for the 2020 Annual Shareholders' Meeting 26

| Proxy Statement for the 2020 Annual Shareholders' Meeting 26

Anti-Hedging and Anti-Pledging Policy. Under our Anti-Hedging and Anti-Pledging Policy, we prohibit hedging the economic risk of ownership of our common stock through short sales or the purchase or sale of options, puts, calls, straddles, equity swaps or other derivative securities that are directly linked to First Northwest stock, by our directors and officers. We also prohibit our directors and officers from holding our stock in a margin account or pledging our stock as collateral for a loan.

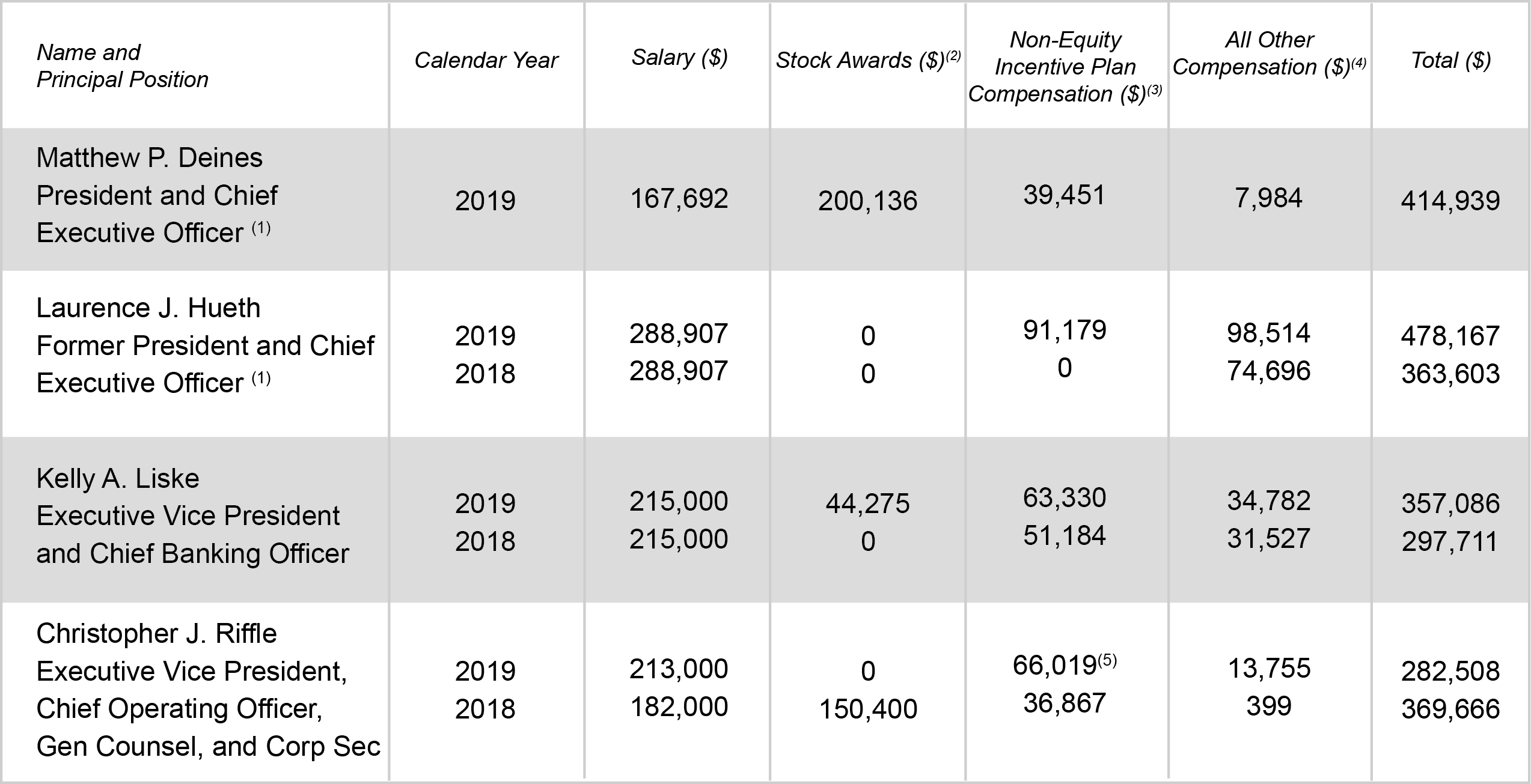

Summary Compensation Table. The following table presents information regarding the compensation of: (1) our President and Chief Executive Officer; (2) our next two most highly compensated executive officers who were serving as executive officers on December 31, 2019; and (3) an executive officer who was one of our two most highly paid executive officers for 2019 but left First Northwest prior to year-end.

(1) Mr. Deines joined First Federal effective August 1, 2019. Mr. Deines’ salary reflects salary earned in 2019. Mr. Hueth ceased to be employed by First Northwest on December 5, 2019.

(2) Represents the aggregate grant date fair value of awards, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, "Compensation – Stock Compensation" ("FASB ASC Topic 718"). For a discussion of valuation assumptions, see Note 10 of the Notes to Consolidated Financial Statements in First Northwest’s Annual Report on Form 10-K for the year ended December 31, 2019.

(3) Reflects amounts earned under the Cash Incentive Plan. The material terms of the Cash Incentive Plan for 2019 are described below under "Short-Term Incentive Compensation."

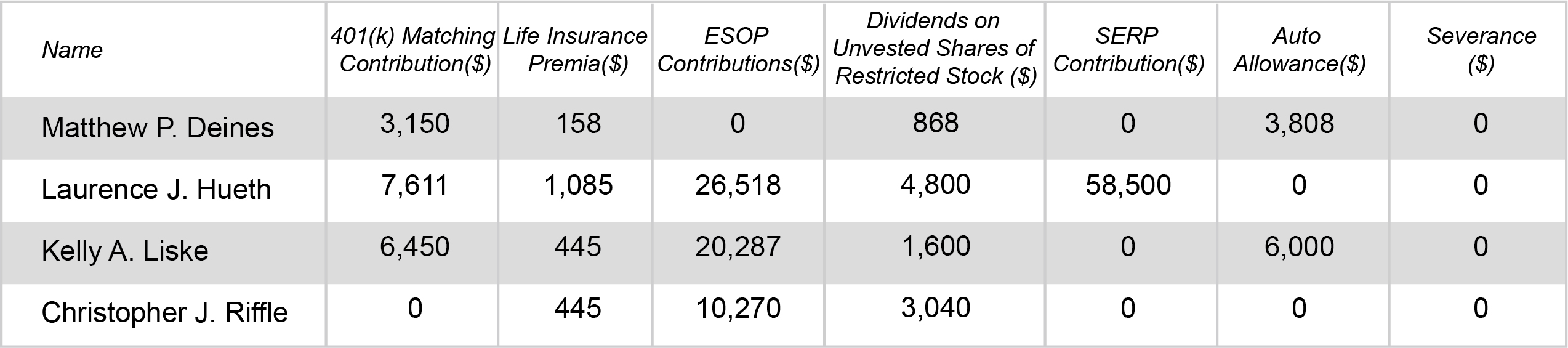

(4) Amounts reported for 2019 that represent "All Other Compensation" for each of the named executive officers are described in the table below.

(5) Reflects a one-time $10,000 discretionary award for additional responsibilities and results produced during the recent management transition period.

| 105 W. Eighth Street, Port Angeles, Washington 98362 27

| 105 W. Eighth Street, Port Angeles, Washington 98362 27

Short-Term Incentive Compensation. We believe that the opportunity for performance-based pay for officers is a significant factor in aligning the interests of the officers with those of shareholders. The Compensation Committee reviews and approves incentive compensation for the Board and Chief Executive Officer on an annual basis to ensure alignment with First Federal’s business objectives. The Chief Executive Officer is not permitted to be present during any Committee deliberations or voting with respect to his compensation. After Committee approval, incentive compensation is authorized by the Board of Directors.

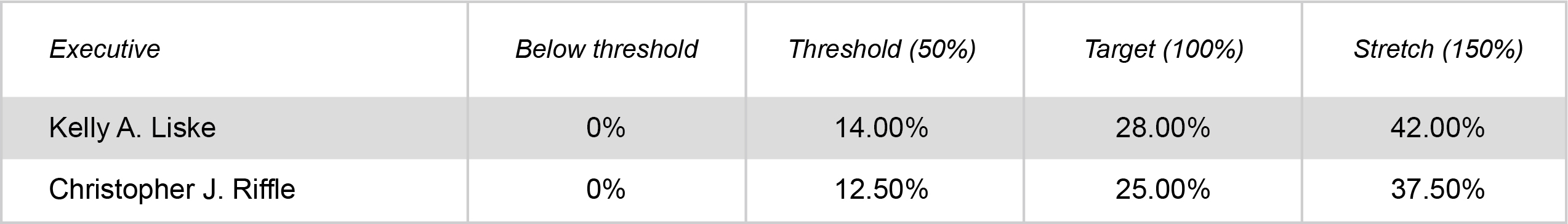

Each named executive officer has a set of predefined goals which consist of annual corporate performance goals and may also include personal goals outlined in the officer’s individual participation agreement. Each participant is assigned a target award level and range that defines their incentive opportunity. Each executive’s actual incentive compensation will be determined on whether the executive exceeds "threshold," "target" and "stretch" performance levels. Actual awards will be allocated based on specific performance goals defined for each participant and will range from 0% to 150% of their target incentive opportunity. Each participant’s payout is calculated on eligible earnings, as defined in the Cash Incentive Plan, and will be made in a cash lump sum.

On November 27, 2018, the Compensation Committee selected the participants under the Cash Incentive Plan, including all Executive and Senior Vice Presidents and selected Vice Presidents, and established performance goals for all participants. The annual incentive opportunities for the named executive officers, other than Mr. Deines, expressed as a percentage of annualized base salary at December 31, 2019, were as follows:

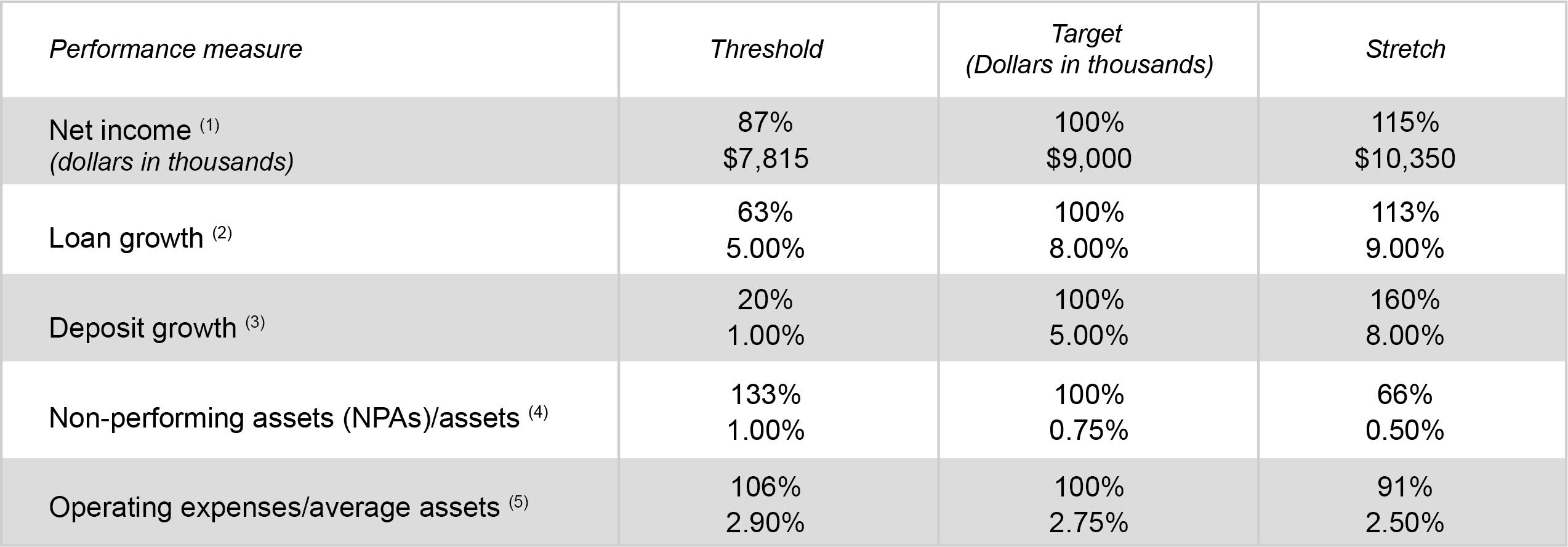

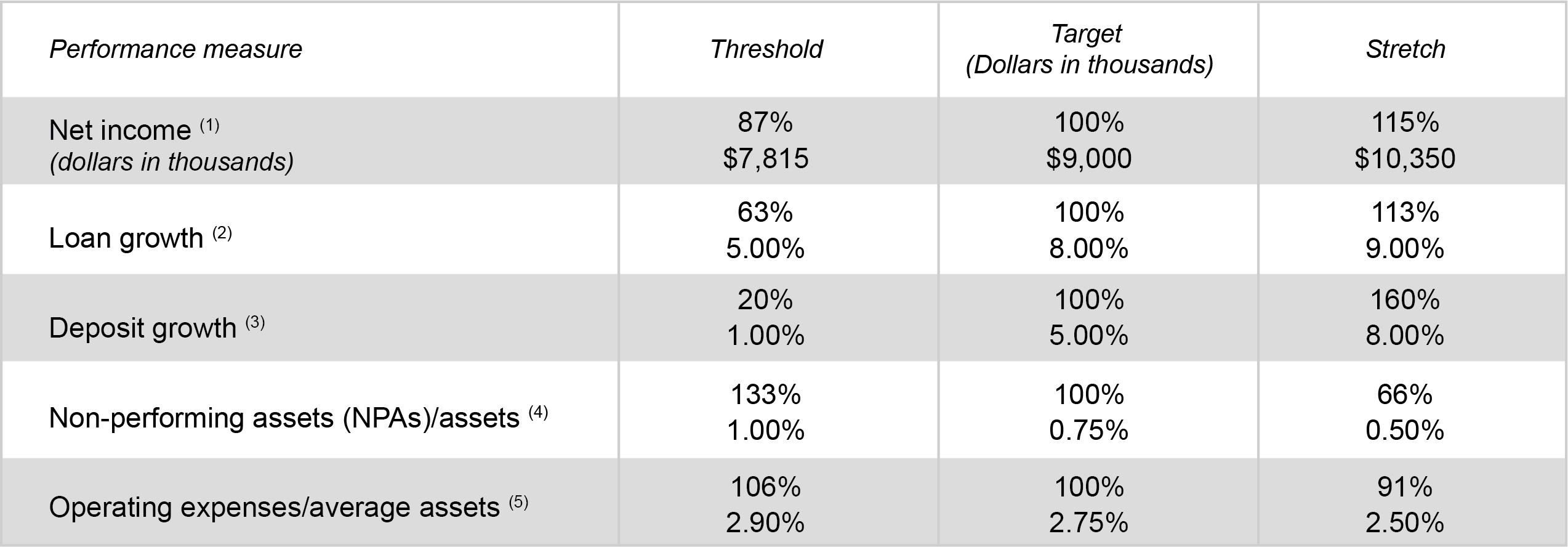

For 2019, the named executive officers’ goals consisted entirely of corporate goals. The Compensation Committee approved the following corporate performance measures for the named executive officers other than Mr. Deines:

(1) Net income for the year ended December 31, 2019.

(2) Net loans at December 31, 2019 less net loans at December 31, 2018, divided by net loans at December 31, 2018.

(3) Total deposits at December 31, 2019 less total deposits at December 31, 2018, divided by total deposits at December 31, 2019.

(4) NPAs (excluding restructured loans and impaired securities) as of December 31, 2019, divided by total assets at December 31, 2019.

(5) Total noninterest expense divided by annual average total assets.

| Proxy Statement for the 2020 Annual Shareholders' Meeting 28

| Proxy Statement for the 2020 Annual Shareholders' Meeting 28

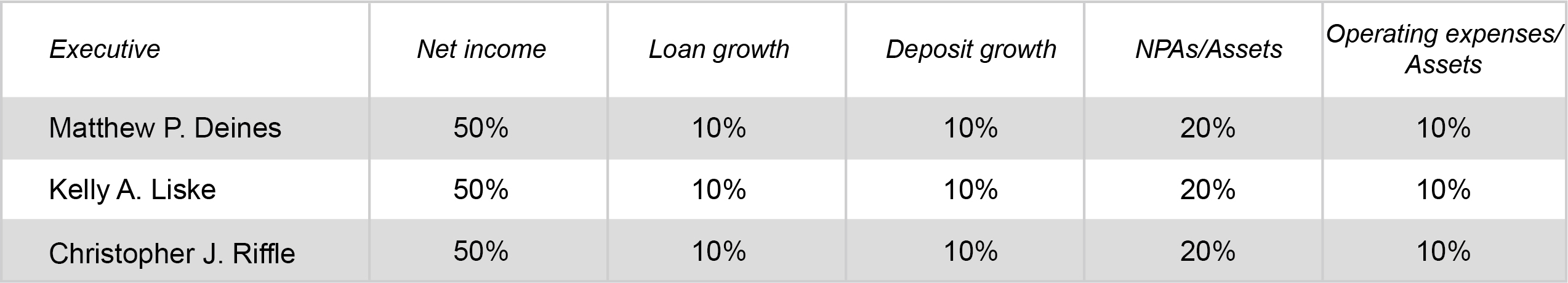

These corporate performance measures are based on the consolidated performance of First Northwest. For the year ended December 31, 2019, the corporate performance weightings applicable to the named executive officers were as follows:

The following table summarizes First Northwest’s performance and resulting payouts associated with the corporate goals for the year ended December 31, 2019:

(1) Net income for the year ended December 31, 2019.

(2) Net loans at December 31, 2019 less net loans at December 31, 2018, divided by net loans at December 31, 2018.

(3) Total deposits at December 31, 2019 less total deposits at December 31, 2018, divided by total deposits at December 31, 2019.

(4) NPAs (excluding restructured loans and impaired securities) as of December 31, 2019, divided by total assets at December 31, 2019.

(5) Total noninterest expense divided by annual average total assets.

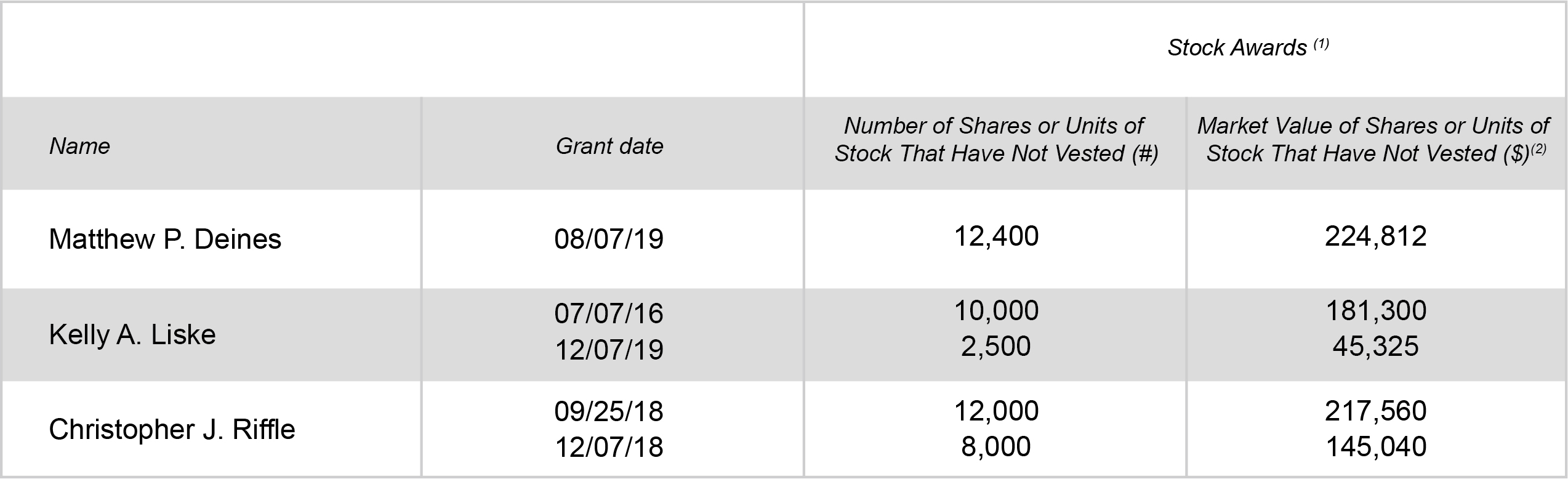

Outstanding Equity Awards. The purpose of the First Northwest Bancorp 2015 Equity Incentive Plan (the "2015 Plan") is to promote the long-term growth and profitability of First Northwest, to provide plan participants with an incentive to achieve corporate objectives, to attract and retain individuals of outstanding competence and to provide plan participants with incentives that are closely linked to the interests of all shareholders of First Northwest. The Plan was approved by shareholders in 2015 and allows for the grant of stock options and restricted stock awards to eligible participants. As described under "Proposal 2 – Approval of First Northwest Bancorp 2020 Equity Incentive Plan," the Board has adopted a new equity compensation plan subject to approval by the shareholders at the 2020 annual meeting.

In July 2016, each of our then-current named executive officers received a restricted stock award with a five-year vesting schedule, with the first 20% vesting on the one-year anniversary of the grant date and an additional 20% vesting each year thereafter. Named executive officers hired since then received a restricted stock award with the same vesting schedule, and any unvested shares held by departing named executive officers prior to the completion of the vesting schedule were returned to the 2015 Plan pool, all as provided by the 2015 Plan.

| 105 W. Eighth Street, Port Angeles, Washington 98362 29

| 105 W. Eighth Street, Port Angeles, Washington 98362 29

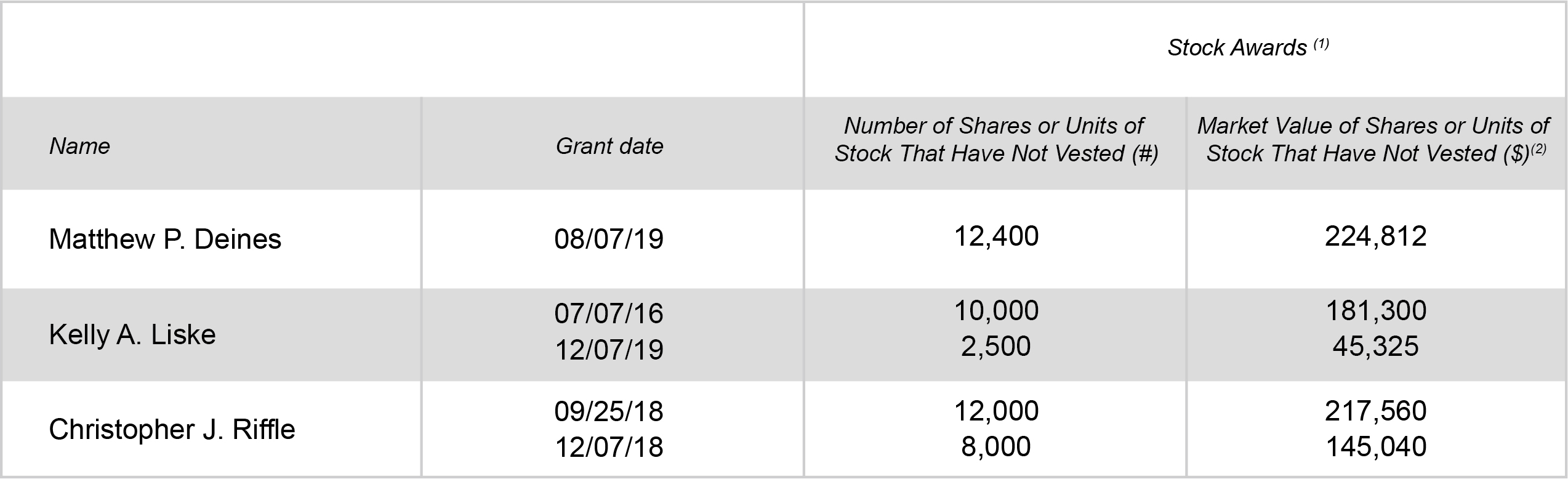

The following information with respect to outstanding stock awards as of December 31, 2019, is presented for the named executive officers.

(1) Awards vest pro rata over a five-year period from the grant date, with the first 20 percent vesting one year after the grant date. (2) Market value is based on the per-share closing price of FNWB stock on December 31, 2019 of $18.13.

The 2015 Plan provides for accelerated vesting of awards in the event of a recipient’s death or disability, or a change in control. Unvested awards will become exercisable or vest upon the date of the recipient’s death or disability. With respect to a change in control, unvested awards will become exercisable or vest only if the participant experiences an involuntary termination within 365 days following the change in control event or the acquiring company does not either assume the outstanding award or replace the outstanding award with an equivalently-valued award.

Retirement Benefits. In order to encourage the retention of qualified officers, we offer a deferred compensation plan whereby certain officers may defer all or a portion of their annual salary until a permitted distribution event occurs under the plan. Each officer may direct the investment of the deferred salary among investment options made available by First Federal. We have established a grantor trust to hold the plan investments. Grantor trust assets are considered part of our general assets, and the officers have the status of unsecured creditors of First Federal with respect to the trust assets. The plan permits the payment of benefits upon a separation from service (whether on account of termination of employment, pre-retirement death, or disability), a change in control, an unforeseeable emergency or upon a date specified by the officer, in an amount equal to the value of the officer’s account balance (or the amount necessary to satisfy the unforeseeable emergency, in that case). An officer may elect, at the time of the deferral election, to receive the deferred amount and related earnings in a lump sum or in annual installments over a period not exceeding 15 years. An officer may subsequently elect to change when or how he or she receives his or her plan benefit, if certain required conditions are met. During 2019, Mr. Hueth was the only named executive officer who participated in this plan. In 2014, the Board of Directors voted to begin making an annual contribution to Mr. Hueth’s deferred compensation plan account in an amount equal to ten percent of his base salary, referred to in the summary compensation table above as "SERP Contribution".

We currently offer a qualified, tax-exempt savings plan to eligible employees with a cash or deferred feature qualifying under Section 401(k) of the Internal Revenue Code (the "401(k) Plan"). Participants are permitted to make pre-tax contributions to the 401(k) Plan of up to a maximum of $18,500 in 2019. In addition, participants who have attained age 50 may defer an additional $6,000 annually as a 401(k) "catch-up" contribution. First Federal matches 50% of the first six percent of participants’ contributions to the 401(k) Plan, including catch-

| Proxy Statement for the 2020 Annual Shareholders' Meeting 30

| Proxy Statement for the 2020 Annual Shareholders' Meeting 30

up contributions. All participant 401(k) contributions, rollovers and earnings are fully and immediately vested. Matching contributions and related earnings vest at a rate of 25% after one year of employment, 50% after two years of employment, 75% after three years of employment, and 100% after four years of employment.

In connection with the conversion of First Federal from the mutual to the stock form of organization, we established an employee stock ownership plan. The ESOP provides eligible employees a beneficial interest in First Northwest and an additional retirement benefit in the form of First Northwest common stock. Participants will have a nonforfeitable interest in their individual account based on a vesting schedule of 25% after one year of employment, 50% after two years of employment, 75% after three years of employment, and 100% after four years of employment.

Employment Agreements for Named Executive Officers. On July 28, 2015, we entered into amended three-year employment agreements with Mr. Hueth and Ms. Liske, which were updated in 2018. Mr. Riffle entered into a three-year employment agreement in 2018, and Mr. Deines entered into a three-year employment agreement in 2019. Under the employment agreements, the base salary level for each named executive officer is specified, which amounts will be paid by First Northwest and First Federal and may be increased at the discretion of the Compensation Committee. Prior to the anniversary date of the employment agreements, unless notice is given by First Northwest or First Federal to the executive, or by the executive to First Northwest or First Federal, at least 90 days prior to the anniversary date, the term of the agreements will be extended for an additional year upon review and approval by the Board or the Compensation Committee.

The agreements provide that the executives may participate, to the same extent as executive officers of First Northwest and First Federal generally, in all plans of First Northwest and First Federal relating to pension, retirement, thrift, profit-sharing, savings, group or other life insurance, hospitalization, medical and dental coverage, travel and accident insurance, education, cash bonuses, and other retirement or employee benefits or combinations thereof. In addition, the executives are entitled to participate in any other fringe benefit plans or perquisites which are generally available to executive officers of First Northwest or First Federal, including supplemental retirement, deferred compensation programs, supplemental medical or life insurance plans, company cars, club dues, physical examinations, and financial planning and tax preparation services. The executives also will receive annual paid vacation, and voluntary leaves of absence, with or without pay, from time to time at such times and upon such conditions as the Board or the Compensation Committee may determine.

The employment agreements with each of the named executive officers provide for potential payments upon the executive’s involuntary termination in certain situations, or upon death or disability. Any such payments are conditioned on receipt of the executive's signed release of claims against First Northwest and First Federal. The agreements may be terminated by the Board at any time. If an executive’s employment is terminated other than for cause, without the executive’s consent, or by the executive for "Good Reason", then for one year after the date of termination First Northwest and First Federal would be required to pay the executive’s salary at the rate in effect immediately prior to the date of termination and the pro rata portion of any incentive award or bonus, the amount of which will be determined by the Compensation Committee in its sole discretion, and continue the executive’s and the executive’s dependents’ coverage under First Northwest’s and First Federal’s health, life and disability programs. "Good Reason" means, in the absence of the Employee's written consent,

| 105 W. Eighth Street, Port Angeles, Washington 98362 31

| 105 W. Eighth Street, Port Angeles, Washington 98362 31

any of the following: (i) a material diminution in the executive's base compensation; (ii) a material diminution in the executive's authority, duties, or responsibilities; or (iii) a material change in the geographic location at which the executive must perform services of more than 35 miles.