|

Exhibit 99.3

|

First-Quarter Fiscal 2016 Financial Results and Update

November 9, 2015

Forward-looking statements and Non-GAAP financial measures

Forward-looking statements—Certain statements included in this presentation, including, but not limited to, those related to our financial and business outlook, strategy and growth drivers, member retention and renewal rates and revenue visibility, cross and upsell opportunities, acquisition activities and pipeline, revenue available under contract, and 2016 financial guidance and related assumptions, are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward looking statements. Readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside

Premier’s control. You should carefully read Premier’s current and future filings with the SEC for more information on potential risks and other factors that could affect Premier’s financial results. Forward-looking statements speak only as of the date they are made. Premier undertakes no obligation to publicly update or revise any forward-looking statements.

Non-GAAP financial measures—This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 10-Q for the fiscal first quarter ended September 30, 2015 provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with this presentation.

© 2015 PREMIER, INC.

2

Overview and Business Update

Susan DeVore, President & CEO

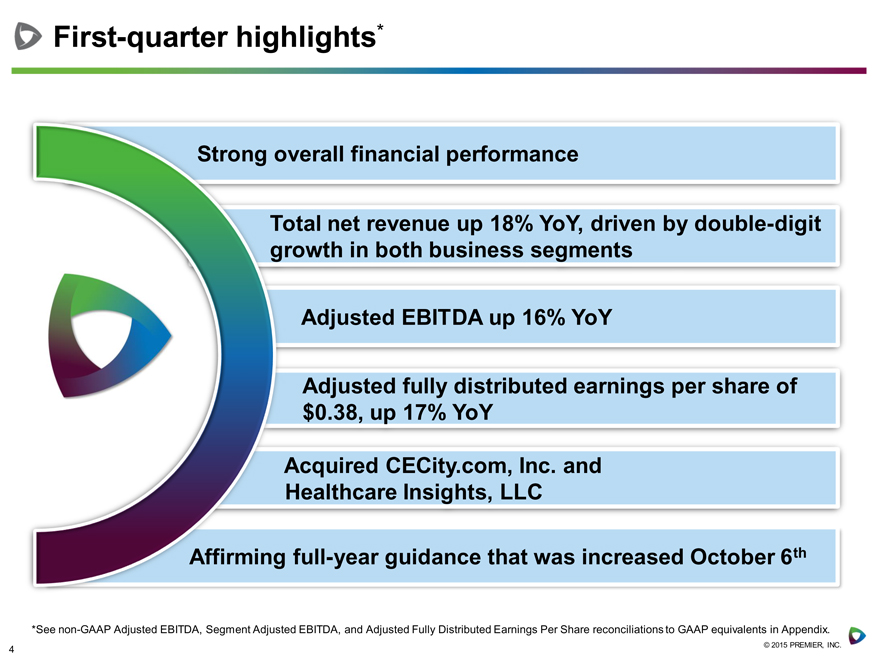

First-quarter highlights*

Strong overall financial performance

Total net revenue up 18% YoY, driven by double-digit growth in both business segments

Adjusted fully distributed earnings per share of $0.38, up 17% YoY

Adjusted EBITDA up 16% YoY

Acquired CECity.com, Inc. and

Healthcare Insights, LLC

Affirming full-year guidance that was increased October 6th

*See non-GAAP Adjusted EBITDA, Segment Adjusted EBITDA, and Adjusted Fully Distributed Earnings Per Share reconciliations to GAAP equivalents in Appendix.

© 2015 PREMIER, INC.

4

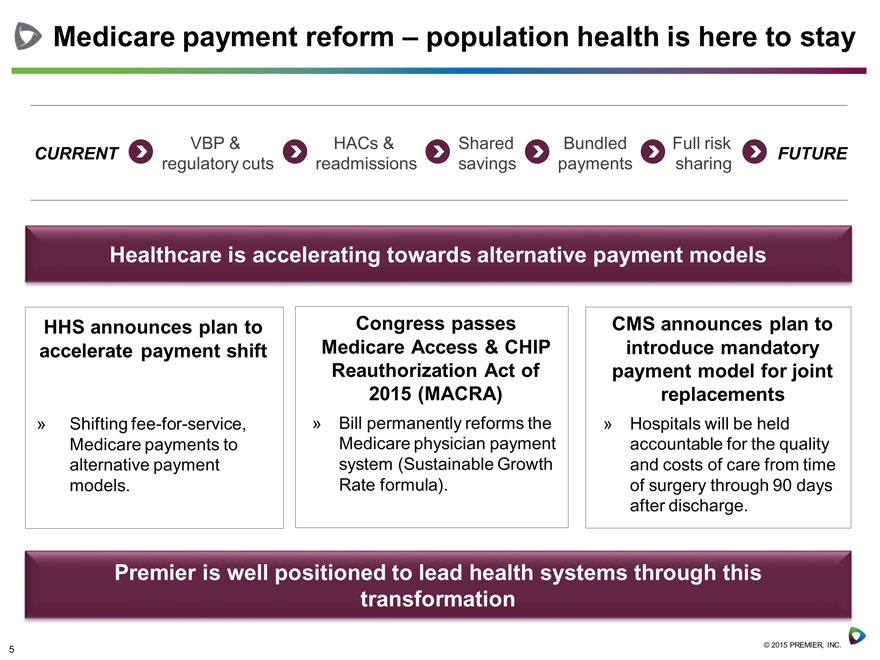

Medicare payment reform – population health is here to stay

VBP & HACs & Shared Bundled Full risk

CURRENT FUTURE regulatory cuts readmissions savings payments sharing

Healthcare is accelerating towards alternative payment models

HHS announces plan to accelerate payment shift

Shifting fee-for-service, Medicare payments to alternative payment models.

Congress passes Medicare Access & CHIP

Reauthorization Act of 2015 (MACRA)

Bill permanently reforms the Medicare physician payment system (Sustainable Growth Rate formula).

CMS announces plan to introduce mandatory payment model for joint replacements

Hospitals will be held accountable for the quality and costs of care from time of surgery through 90 days after discharge.

Premier is well positioned to lead health systems through this transformation

© 2015 PREMIER, INC.

5

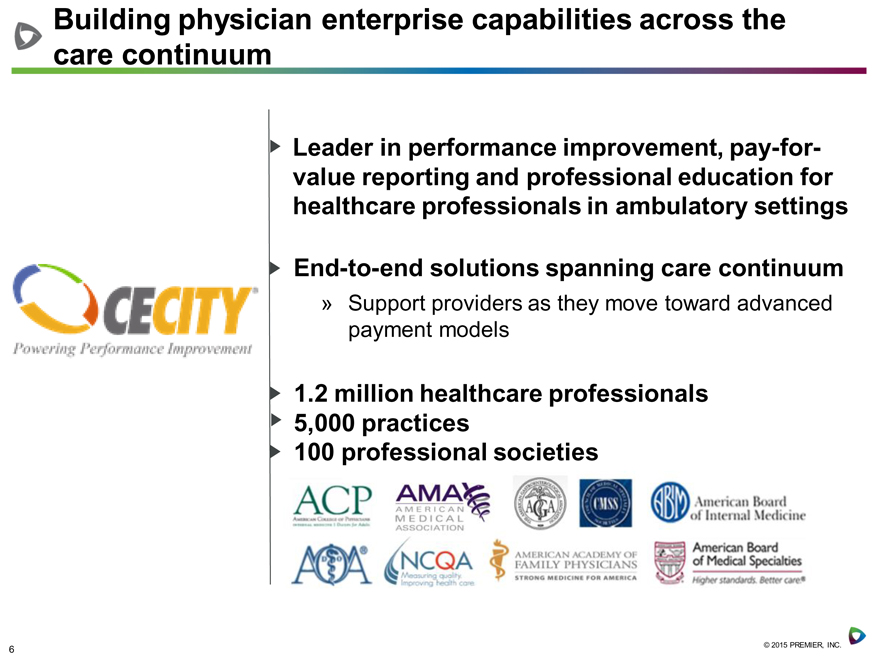

Building physician enterprise capabilities across the care continuum

Leader in performance improvement, pay-for-value reporting and professional education for healthcare professionals in ambulatory settings

End-to-end solutions spanning care continuum

Support providers as they move toward advanced payment models

1.2 million healthcare professionals 5,000 practices

100 professional societies

© 2015 PREMIER, INC.

6

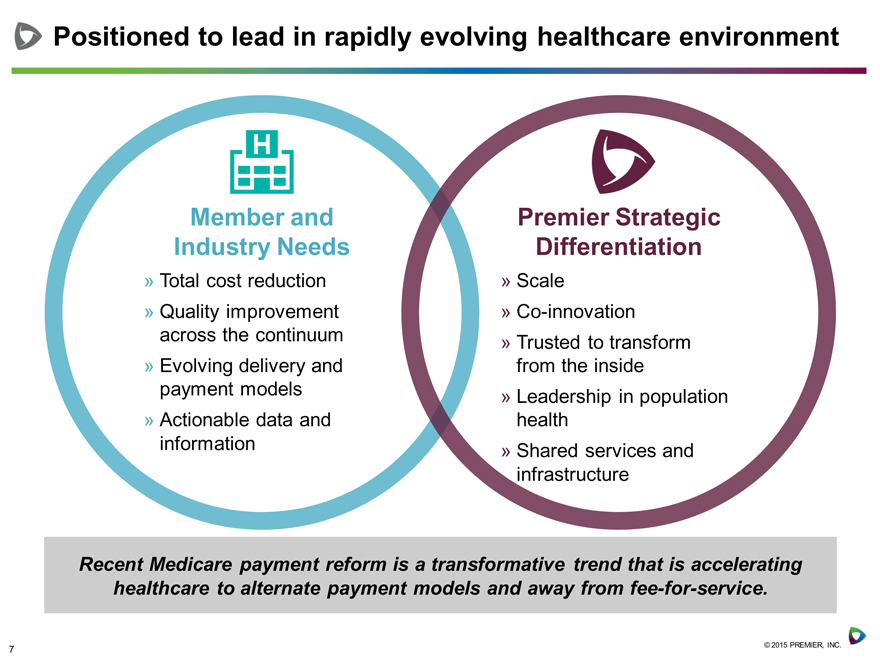

Positioned to lead in rapidly evolving healthcare environment

Member and Industry Needs

Total cost reduction

Quality improvement across the continuum

Evolving delivery and payment models

Actionable data and information

Premier Strategic Differentiation

Scale

Co-innovation

Trusted to transform from the inside

Leadership in population health

Shared services and infrastructure

Recent Medicare payment reform is a transformative trend that is accelerating healthcare to alternate payment models and away from fee-for-service.

© 2015 PREMIER, INC.

7

Operations Update

Michael Alkire, Chief Operating Officer

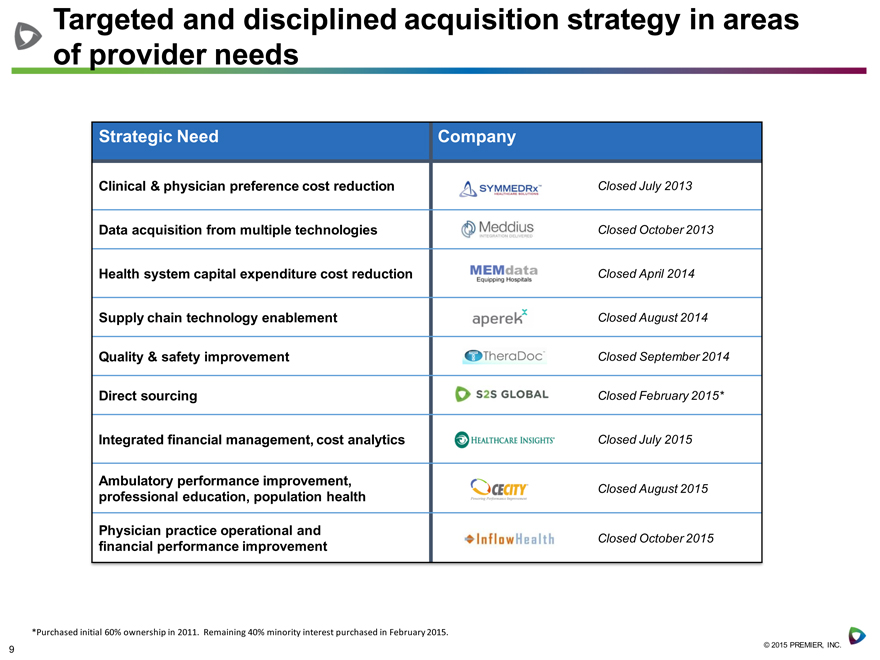

Targeted and disciplined acquisition strategy in areas of provider needs

Strategic Need Company

Clinical & physician preference cost reduction Closed July 2013

Data acquisition from multiple technologies Closed October 2013

Health system capital expenditure cost reduction Closed April 2014

Supply chain technology enablement Closed August 2014

Quality & safety improvement Closed September 2014

Direct sourcing Closed February 2015*

Integrated financial management, cost analytics Closed July 2015

Ambulatory performance improvement,

professional education, population health Closed August 2015

Physician practice operational and

financial performance improvement Closed October 2015

© 2015 PREMIER, INC.

*Purchased initial 60% ownership in 2011. Remaining 40% minority interest purchased in February 2015.

9

InflowHealth acquisition further extends Premier’s reach into the ambulatory market

SaaS-based software developer specializing in improving the operational and financial performance of physician practices

Furthers extends Premier’s reach into the ambulatory market providing physicians with new capabilities

» Unique insights into financial, operational and strategic performance, allowing physicians to identify opportunities for improvement and guide practice budgeting and strategic investments

Purchase price of $6.0 million* Closed on October 1, 2015

*The acquisition provides selling owners an earn-out opportunity of up to $26.9 million based on InflowHealth’s future qualifying annual revenues through 2019

© 2015 PREMIER, INC.

10

CECity acquisition expands performance improvement capabilities across the healthcare continuum

Leader in performance management and improvement, pay-for-value reporting and professional education for healthcare professionals in ambulatory settings

Provides the ability to deliver unique end-to-end solutions that span the continuum of care

Supporting providers as they move toward value-based payment models

Purchase price of $400 million

Closed on August 20, 2015

© 2015 PREMIER, INC.

11

Healthcare Insights acquisition enhances PremierConnect Supply Chain

Integrated financial management software developer providing budgeting, forecasting, labor productivity and cost analytics capabilities

Enabling a more comprehensive analytics solution to Premier’s existing cost and quality applications

» Preparing for the growing movement to value-based payments to include bundling, shared savings and risk-based contracting

Purchase price of $65 million

Closed on July 31, 2015

© 2015 PREMIER, INC.

12

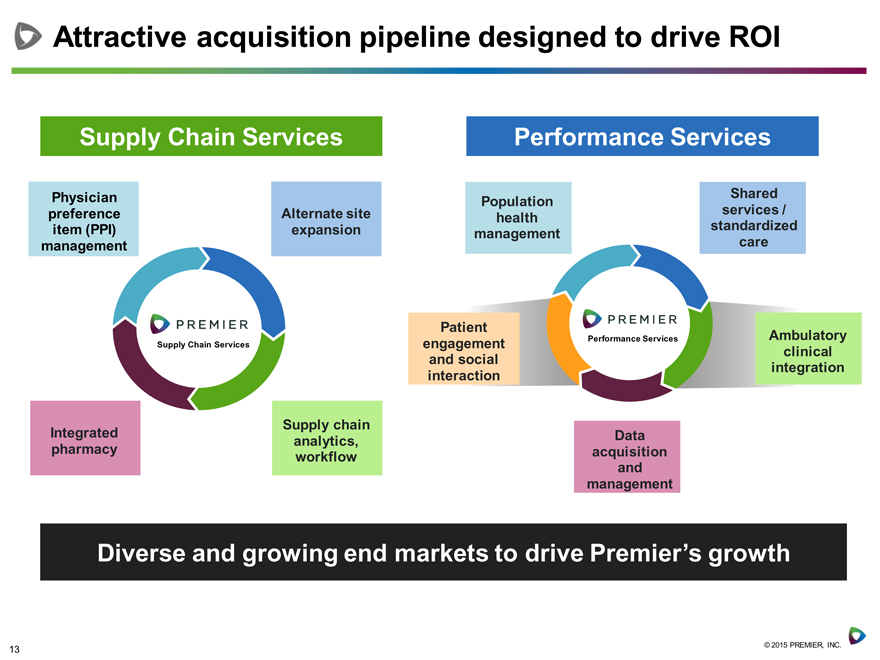

Attractive acquisition pipeline designed to drive ROI

Supply Chain Services

Physician

preference Alternate site

item (PPI) expansion

management

Supply Chain Services

Integrated Supply chain

analytics,

pharmacy workflow

Performance Services

Population Shared

services /

health standardized

management care

Patient

engagement Performance Services Ambulatory

and social clinical

interaction integration

Data

acquisition

and

management

Diverse and growing end markets to drive Premier’s growth

© 2015 PREMIER, INC.

13

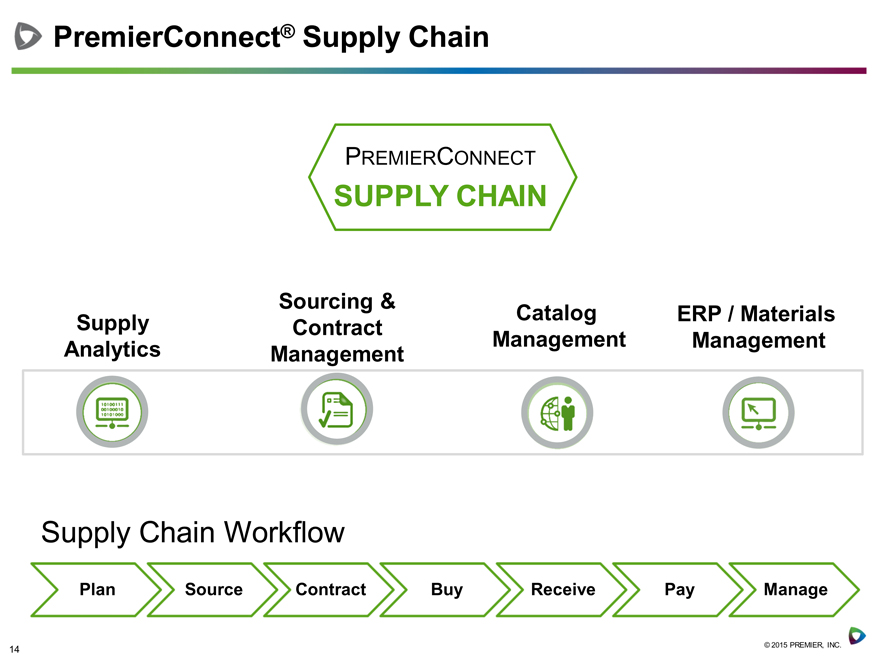

PremierConnect® Supply Chain

PREMIERCONNECT

SUPPLY CHAIN

Sourcing &

Catalog ERP / Materials

Supply Contract

Management Management Analytics Management

Supply Chain Workflow

Plan Source Contract Buy Receive Pay Manage

© 2015 PREMIER, INC.

14

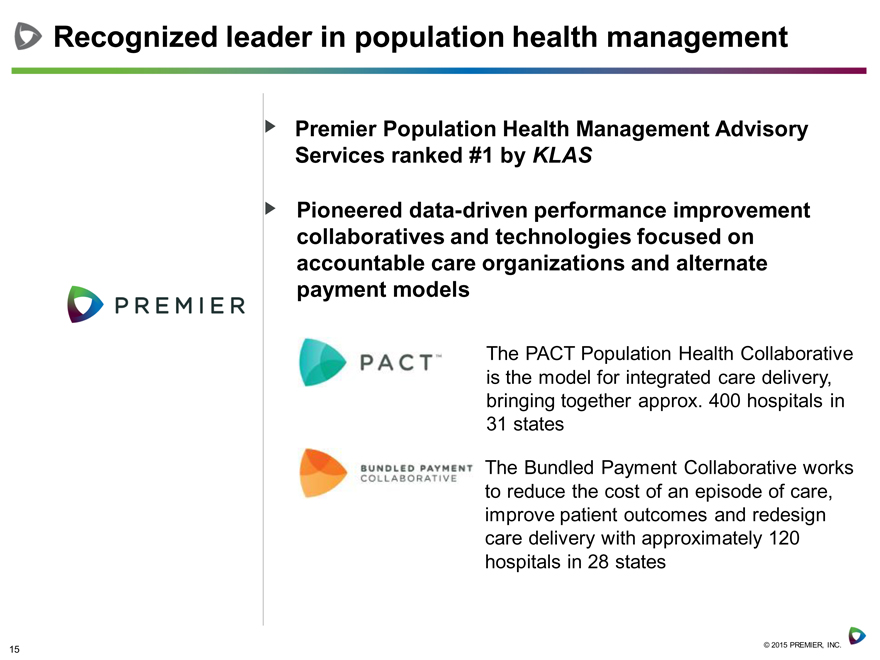

Recognized leader in population health management

Premier Population Health Management Advisory

Services ranked #1 by KLAS

Pioneered data-driven performance improvement collaboratives and technologies focused on accountable care organizations and alternate payment models

The PACT Population Health Collaborative is the model for integrated care delivery, bringing together approx. 400 hospitals in 31 states

The Bundled Payment Collaborative works to reduce the cost of an episode of care, improve patient outcomes and redesign care delivery with approximately 120 hospitals in 28 states

© 2015 PREMIER, INC.

15

Providing a solution to rising drug costs

Create healthier supply markets

Quantify the value of therapies for drug manufacturers

Integrated pharmacy strategy

© 2015 PREMIER, INC.

16

Financial Review

Craig McKasson, Chief Financial Officer

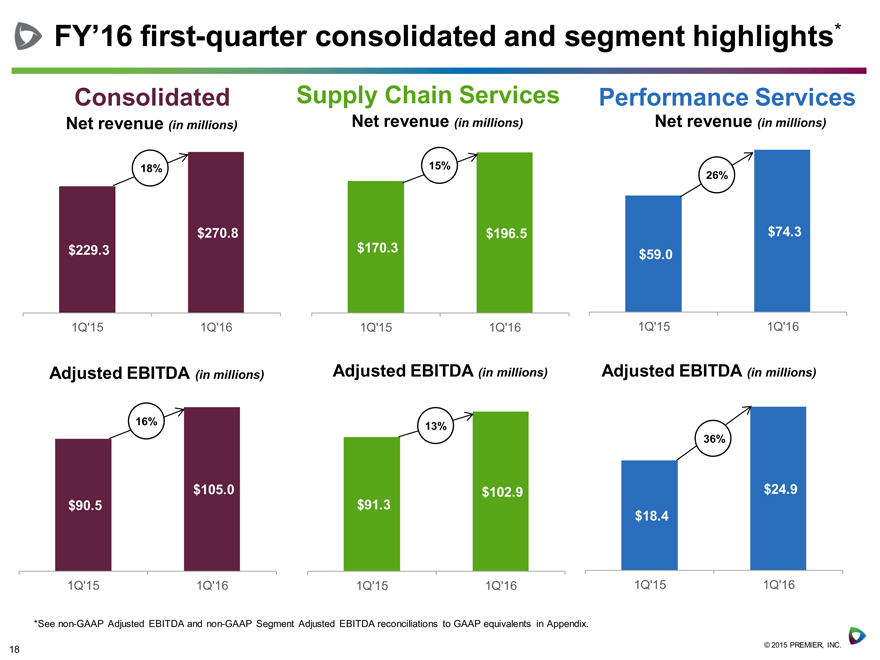

FY’16 first-quarter consolidated and segment highlights*

Consolidated

Net revenue (in millions)

18%

$270.8

$229.3

1Q’15 1Q’16

Supply Chain Services

Net revenue (in millions)

15%

$196.5

$170.3

1Q’15 1Q’16

Performance Services

Net revenue (in millions)

26%

$74.3

$59.0

1Q’15 1Q’16

Adjusted EBITDA(in millions)

16%

$105.0

$90.5

1Q’15 1Q’16

Adjusted EBITDA (in millions) Adjusted EBITDA (in millions)

13%

36%

$102.9 $24.9

$91.3

$18.4

1Q’15 1Q’16 1Q’15 1Q’16

*See non-GAAP Adjusted EBITDA and non-GAAP Segment Adjusted EBITDA reconciliations to GAAP equivalents in Appendix.

© 2015 PREMIER, INC.

18

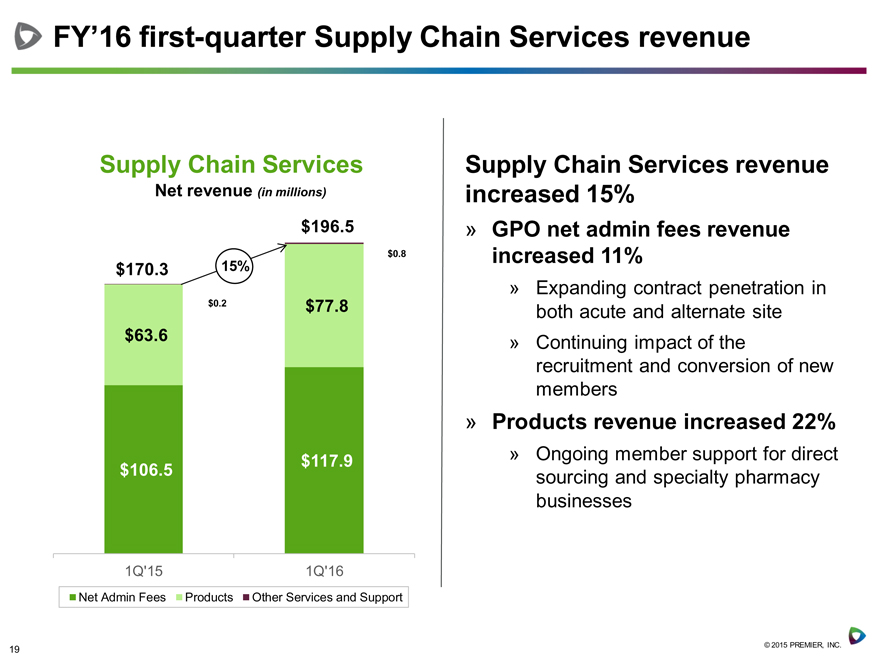

FY’16 first-quarter Supply Chain Services revenue

Supply Chain Services

Net revenue (in millions)

$196.5

$0.8

$170.3 15%

$0.2 $77.8

$63.6

$106.5 $117.9

1Q’15 1Q’16

Net Admin Fees Products Other Services and Support

Supply Chain Services revenue increased 15%

GPO net admin fees revenue increased 11%

Expanding contract penetration in both acute and alternate site

Continuing impact of the recruitment and conversion of new members

Products revenue increased 22%

Ongoing member support for direct sourcing and specialty pharmacy businesses

© 2015 PREMIER, INC.

19

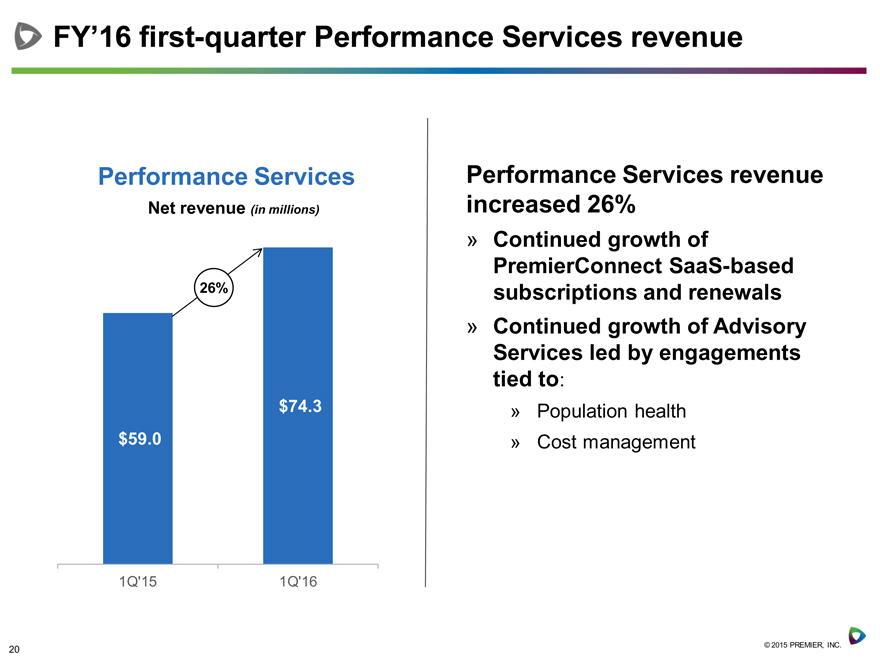

FY’16 first-quarter Performance Services revenue

Performance Services

Net revenue (in millions)

26%

$74.3

$59.0

1Q’15 1Q’16

Performance Services revenue increased 26%

Continued growth of

PremierConnect SaaS-based subscriptions and renewals

Continued growth of Advisory Services led by engagements tied to:

Population health

Cost management

© 2015 PREMIER, INC.

20

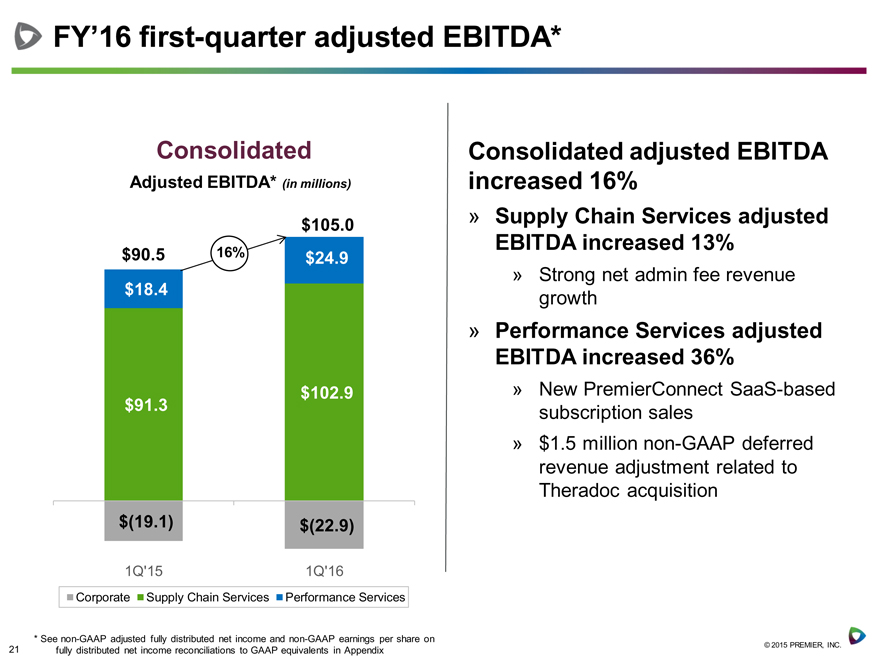

FY’16 first-quarter adjusted EBITDA*

Consolidated

Adjusted EBITDA* (in millions)

$105.0

$90.5 16% $24.9

$18.4

$102.9

$91.3

$(19.1) $(22.9)

1Q’15 1Q’16

Corporate Supply Chain Services Performance Services

Consolidated adjusted EBITDA increased 16%

Supply Chain Services adjusted

EBITDA increased 13%

Strong net admin fee revenue growth

Performance Services adjusted EBITDA increased 36%

New PremierConnect SaaS-based subscription sales

$1.5 million non-GAAP deferred revenue adjustment related to Theradoc acquisition

* See non-GAAP adjusted fully distributed net income and non-GAAP earnings per share on fully distributed net income reconciliations to GAAP equivalents in Appendix

© 2015 PREMIER, INC.

21

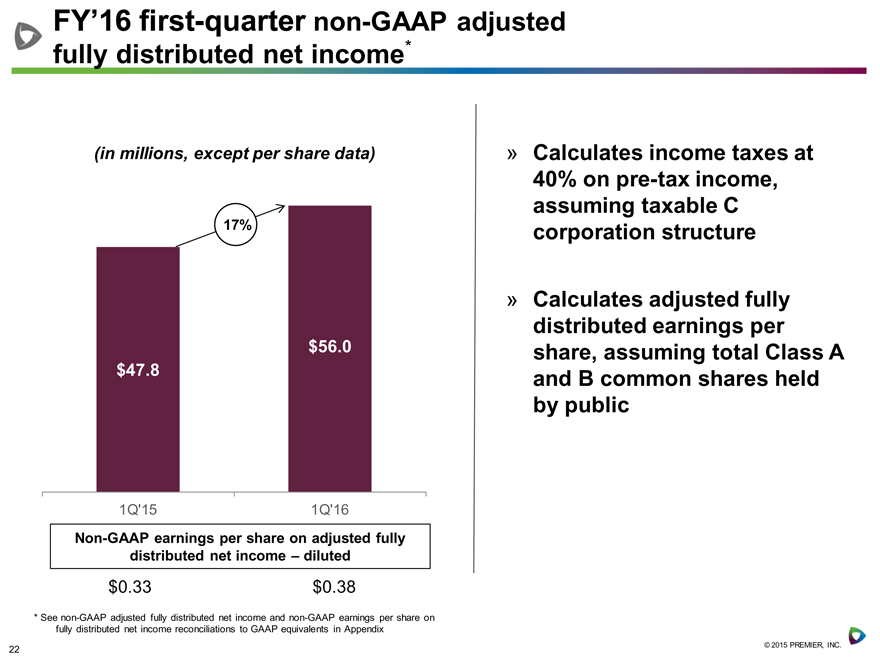

FY’16 first-quarter non-GAAP adjusted

fully distributed net income*

(in millions, except per share data)

17%

$56.0

$47.8

1Q’15 1Q’16

Non-GAAP earnings per share on adjusted fully

distributed net income – diluted

$0.33 $0.38

Calculates income taxes at 40% on pre-tax income, assuming taxable C corporation structure

Calculates adjusted fully distributed earnings per share, assuming total Class A and B common shares held by public

* See non-GAAP adjusted fully distributed net income and non-GAAP earnings per share on fully distributed net income reconciliations to GAAP equivalents in Appendix

© 2015 PREMIER, INC.

22

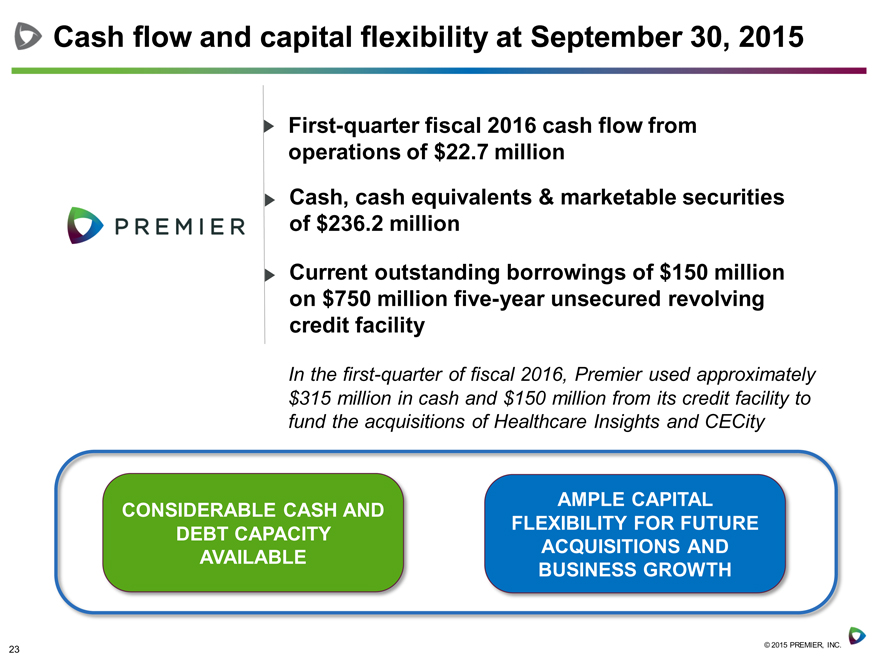

Cash flow and capital flexibility at September 30, 2015

First-quarter fiscal 2016 cash flow from operations of $22.7 million

Cash, cash equivalents & marketable securities of $236.2 million

Current outstanding borrowings of $150 million on $750 million five-year unsecured revolving credit facility

In the first-quarter of fiscal 2016, Premier used approximately $315 million in cash and $150 million from its credit facility to fund the acquisitions of Healthcare Insights and CECity

CONSIDERABLE CASH AND DEBT CAPACITY AVAILABLE

AMPLE CAPITAL FLEXIBILITY FOR FUTURE ACQUISITIONS AND BUSINESS GROWTH

© 2015 PREMIER, INC.

23

Continuing our momentum into fiscal 2016

Expect year-over-year double-digit revenue and adjusted EBITDA increases

Provider-centric model focused on serving our members

Developing solutions in close collaboration with members

Positioned to deliver consistent long-term value to stockholders

Provider-centric and co-innovative alignment drives consistent and increasing demand for our solutions

© 2015 PREMIER, INC.

24

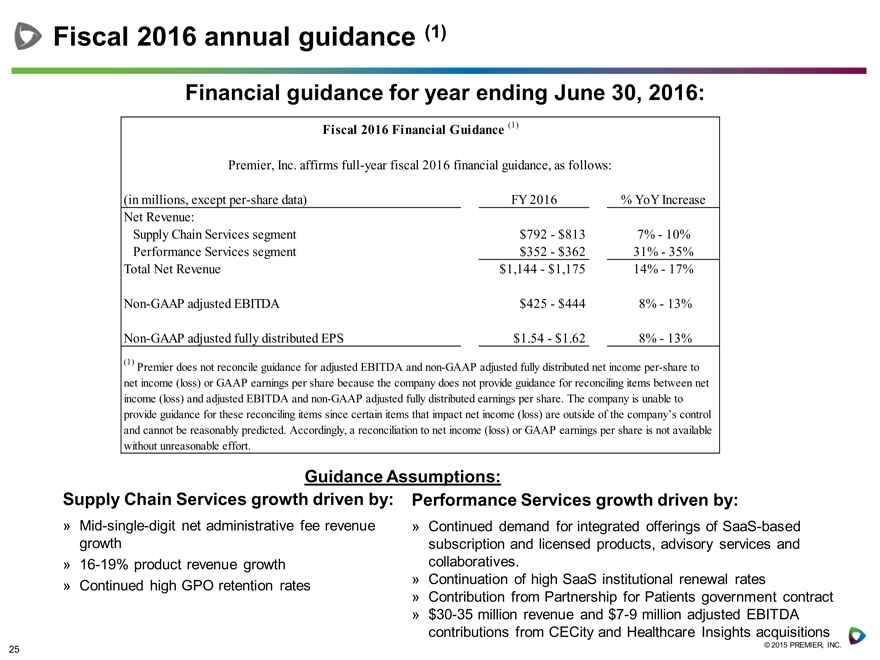

Fiscal 2016 annual guidance (1)

Financial guidance for year ending June 30, 2016:

Fiscal 2016 Financial Guidance (1)

Premier, Inc. affirms full-year fiscal 2016 financial guidance, as follows:

(in millions, except per-share data) FY 2016% YoY Increase

Net Revenue:

Supply Chain Services segment $792—$813 7%—10%

Performance Services segment $352—$362 31%—35%

Total Net Revenue $1,144—$1,175 14%—17%

Non-GAAP adjusted EBITDA $425—$444 8%—13%

Non-GAAP adjusted fully distributed EPS $1.54—$1.62 8%—13%

(1) Premier does not reconcile guidance for adjusted EBITDA and non-GAAP adjusted fully distributed net income per-share to

net income (loss) or GAAP earnings per share because the company does not provide guidance for reconciling items between net

income (loss) and adjusted EBITDA and non-GAAP adjusted fully distributed earnings per share. The company is unable to

provide guidance for these reconciling items since certain items that impact net income (loss) are outside of the company’s control

and cannot be reasonably predicted. Accordingly, a reconciliation to net income (loss) or GAAP earnings per share is not available

without unreasonable effort.

Guidance Assumptions:

Supply Chain Services growth driven by: Performance Services growth driven by:

Mid-single-digit net administrative fee revenue » Continued demand for integrated offerings of SaaS-based growth subscription and licensed products, advisory services and

16-19% product revenue growth collaboratives.

Continuation of high SaaS institutional renewal rates

Continued high GPO retention rates

Contribution from Partnership for Patients government contract

$30-35 million revenue and $7-9 million adjusted EBITDA contributions from CECity and Healthcare Insights acquisitions

© 2015 PREMIER, INC.

25

Exchange update

On November 2, 2015, approximately 5.8 million

Class B units were exchanged for Class A common shares on 1-for-1 basis; equal number of Class B common shares retired

Premier is evaluating an underwritten company directed offering for a portion of the exchanged shares

© 2015 PREMIER, INC.

26

Questions

Appendix

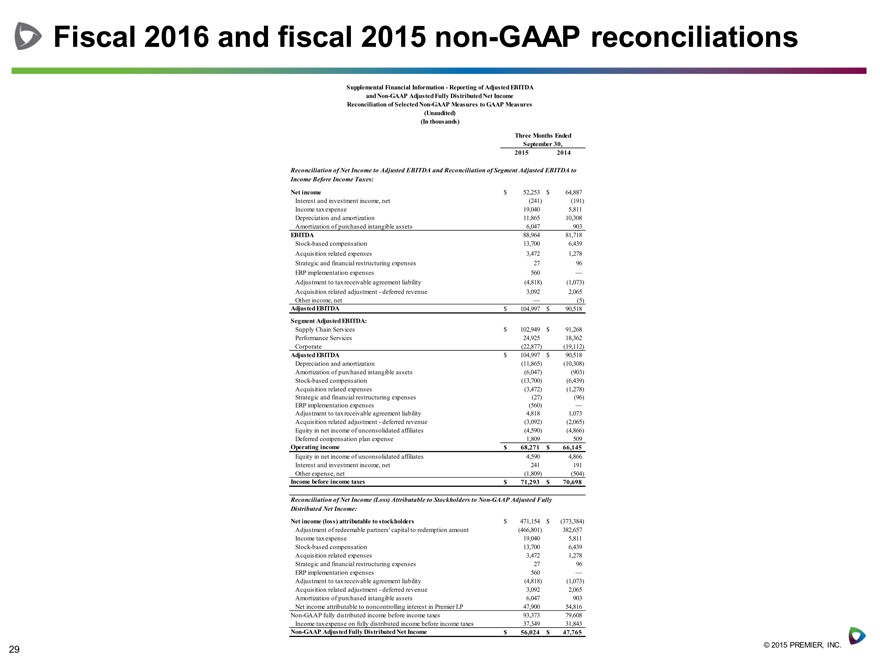

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Adjusted EBITDA

and Non-GAAP Adjusted Fully Distributed Net Income

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(In thousands)

Three Months Ended

September 30,

2015 2014

Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to

Income Before Income Taxes:

Net income $ 52,253 $ 64,887

Interest and investment income, net(241)(191)

Income tax expense 19,040 5,811

Depreciation and amortization 11,865 10,308

Amortization of purchased intangible assets 6,047 903

EBITDA 88,964 81,718

Stock-based compensation 13,700 6,439

Acquisition related expenses 3,472 1,278

Strategic and financial restructuring expenses 27 96

ERP implementation expenses 560 —

Adjustment to tax receivable agreement liability(4,818)(1,073)

Acquisition related adjustment—deferred revenue 3,092 2,065

Other income, net —(5)

Adjusted EBITDA $ 104,997 $ 90,518

Segment Adjusted EBITDA:

Supply Chain Services $ 102,949 $ 91,268

Performance Services 24,925 18,362

Corporate(22,877)(19,112)

Adjusted EBITDA $ 104,997 $ 90,518

Depreciation and amortization(11,865)(10,308)

Amortization of purchased intangible assets(6,047)(903)

Stock-based compensation(13,700)(6,439)

Acquisition related expenses(3,472)(1,278)

Strategic and financial restructuring expenses(27)(96)

ERP implementation expenses(560) —

Adjustment to tax receivable agreement liability 4,818 1,073

Acquisition related adjustment—deferred revenue(3,092)(2,065)

Equity in net income of unconsolidated affiliates(4,590)(4,866)

Deferred compensation plan expense 1,809 509

Operating income $ 68,271 $ 66,145

Equity in net income of unconsolidated affiliates 4,590 4,866

Interest and investment income, net 241 191

Other expense, net(1,809)(504)

Income before income taxes $ 71,293 $ 70,698

Reconciliation of Net Income (Loss) Attributable to Stockholders to Non-GAAP Adjusted Fully

Distributed Net Income:

Net income (loss) attributable to stockholders $ 471,154 $(373,384)

Adjustment of redeemable partners’ capital to redemption amount(466,801) 382,657

Income tax expense 19,040 5,811

Stock-based compensation 13,700 6,439

Acquisition related expenses 3,472 1,278

Strategic and financial restructuring expenses 27 96

ERP implementation expenses 560 —

Adjustment to tax receivable agreement liability(4,818)(1,073)

Acquisition related adjustment—deferred revenue 3,092 2,065

Amortization of purchased intangible assets 6,047 903

Net income attributable to noncontrolling interest in Premier LP 47,900 54,816

Non-GAAP fully distributed income before income taxes 93,373 79,608

Income tax expense on fully distributed income before income taxes 37,349 31,843

Non-GAAP Adjusted Fully Distributed Net Income $ 56,024 $ 47,765

© 2015 PREMIER, INC.

29

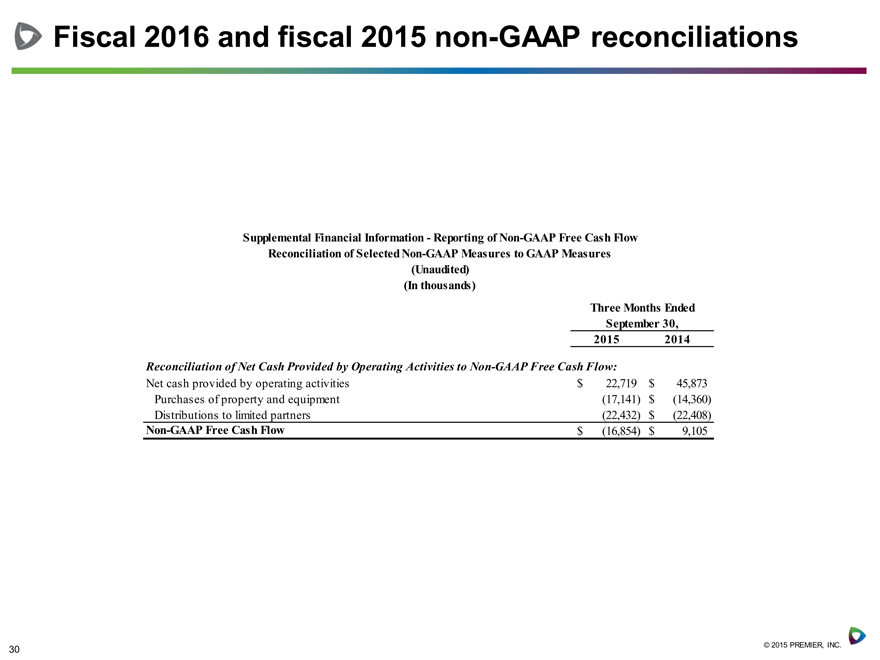

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Non-GAAP Free Cash Flow

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(In thousands)

Three Months Ended

September 30,

2015 2014

Reconciliation of Net Cash Provided by Operating Activities to Non-GAAP Free Cash Flow:

Net cash provided by operating activities $ 22,719 $ 45,873

Purchases of property and equipment(17,141) $(14,360)

Distributions to limited partners(22,432) $(22,408)

Non-GAAP Free Cash Flow $(16,854) $ 9,105

© 2015 PREMIER, INC.

30

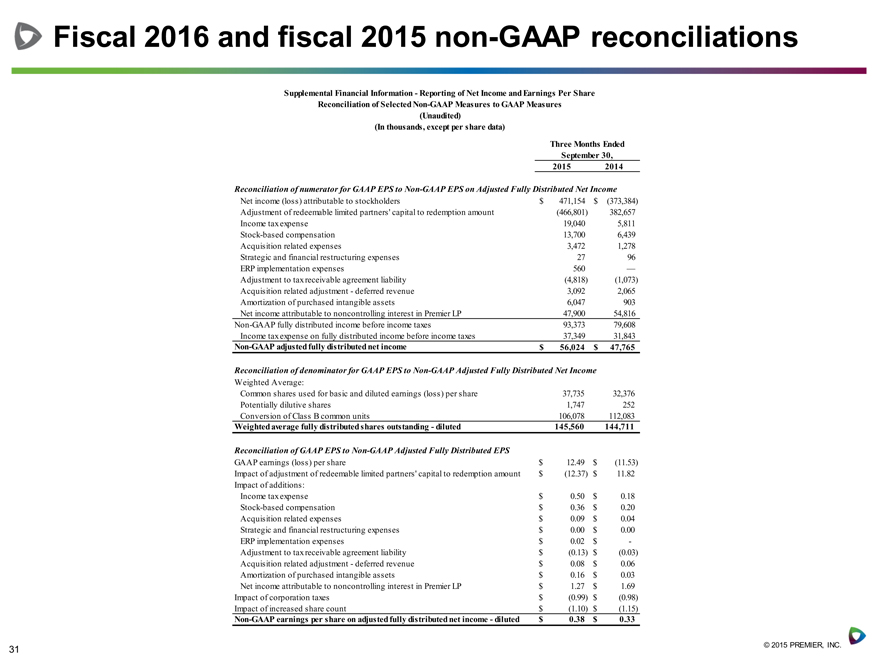

Fiscal 2016 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Net Income and Earnings Per Share

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(In thousands, except per share data)

Three Months Ended

September 30,

2015 2014

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Adjusted Fully Distributed Net Income

Net income (loss) attributable to stockholders $ 471,154 $(373,384)

Adjustment of redeemable limited partners’ capital to redemption amount(466,801) 382,657

Income tax expense 19,040 5,811

Stock-based compensation 13,700 6,439

Acquisition related expenses 3,472 1,278

Strategic and financial restructuring expenses 27 96

ERP implementation expenses 560 —

Adjustment to tax receivable agreement liability(4,818)(1,073)

Acquisition related adjustment—deferred revenue 3,092 2,065

Amortization of purchased intangible assets 6,047 903

Net income attributable to noncontrolling interest in Premier LP 47,900 54,816

Non-GAAP fully distributed income before income taxes 93,373 79,608

Income tax expense on fully distributed income before income taxes 37,349 31,843

Non-GAAP adjusted fully distributed net income $ 56,024 $ 47,765

Reconciliation of denominator for GAAP EPS to Non-GAAP Adjusted Fully Distributed Net Income

Weighted Average:

Common shares used for basic and diluted earnings (loss) per share 37,735 32,376

Potentially dilutive shares 1,747 252

Conversion of Class B common units 106,078 112,083

Weighted average fully distributed shares outstanding—diluted 145,560 144,711

Reconciliation of GAAP EPS to Non-GAAP Adjusted Fully Distributed EPS

GAAP earnings (loss) per share $ 12.49 $(11.53)

Impact of adjustment of redeemable limited partners’ capital to redemption amount $(12.37) $ 11.82

Impact of additions:

Income tax expense $ 0.50 $ 0.18

Stock-based compensation $ 0.36 $ 0.20

Acquisition related expenses $ 0.09 $ 0.04

Strategic and financial restructuring expenses $ 0.00 $ 0.00

ERP implementation expenses $ 0.02 $ -

Adjustment to tax receivable agreement liability $(0.13) $(0.03)

Acquisition related adjustment—deferred revenue $ 0.08 $ 0.06

Amortization of purchased intangible assets $ 0.16 $ 0.03

Net income attributable to noncontrolling interest in Premier LP $ 1.27 $ 1.69

Impact of corporation taxes $(0.99) $(0.98)

Impact of increased share count $(1.10) $(1.15)

Non-GAAP earnings per share on adjusted fully distributed net income—diluted $ 0.38 $ 0.33

© 2015 PREMIER, INC.

31