|

Exhibit 99.1

|

Transforming Healthcare from the Inside

J.P. Morgan Healthcare Conference

January 12, 2016

|

|

Forward-looking statements—Certain statements included in this presentation, including, but not limited to, those related to our financial and business outlook, strategy and growth drivers, member retention and renewal rates and revenue visibility, cross and upsell opportunities, leverage and financial flexibility, acquisition activities and pipeline, revenue available under contract, long-term financial goals, and 2016 financial guidance and related assumptions, are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause the actual results of Premier to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on any forward looking statements. Readers are urged to consider statements in the conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to Premier’s beliefs and expectations as to future events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside Premier’s control. More information on potential risks and other factors that could affect Premier’s financial results is included, and updated, from time to time, in Premier’s periodic and current filings with the SEC, including Premier’s most recent Form 10-K for the year ended June 30, 2015. Forward looking statements speak only as of the date they are made. Premier undertakes no obligation to publicly update or revise any forward-looking statements.

Non-GAAP financial measures—This presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 10-Q for the fiscal first quarter ended September 30, 2015, filed with the SEC, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with this presentation.

Susan Devore

President & CEO

Premier Inc.

PREMIER IS…

WHY HOW WHAT

Able and committed to Improving quality, reducing Unique depth and breadth

transform healthcare costs and paving the way of data, technology and

together with member for a population health services to provide a

systems. world. holistic and integrated set

of solutions.

GOVERNMENT

INSURERS SUPPLIERS

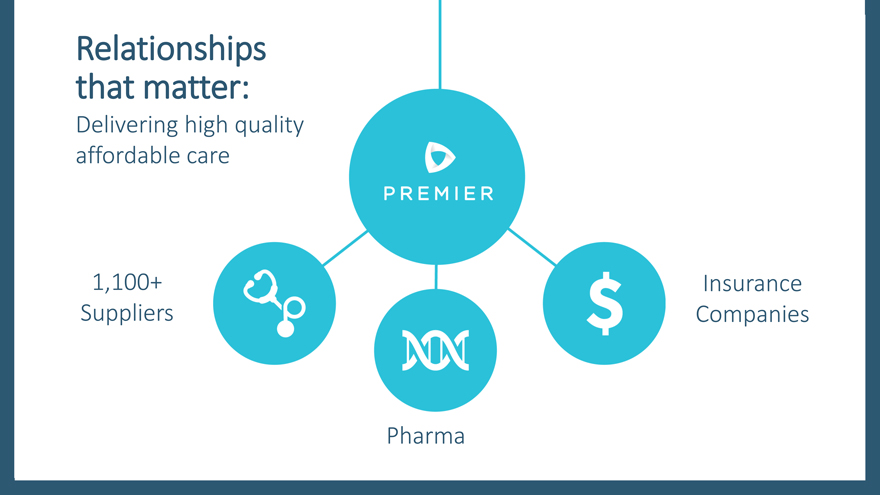

Relationships that matter:

Delivering high quality affordable care

1,100+ Suppliers

Pharma

Insurance Companies

HOW

Premier has an inside-out, outside-in approach.

Majority owned by healthcare systems

Embedded employees Test, fast-track and prove solutions together

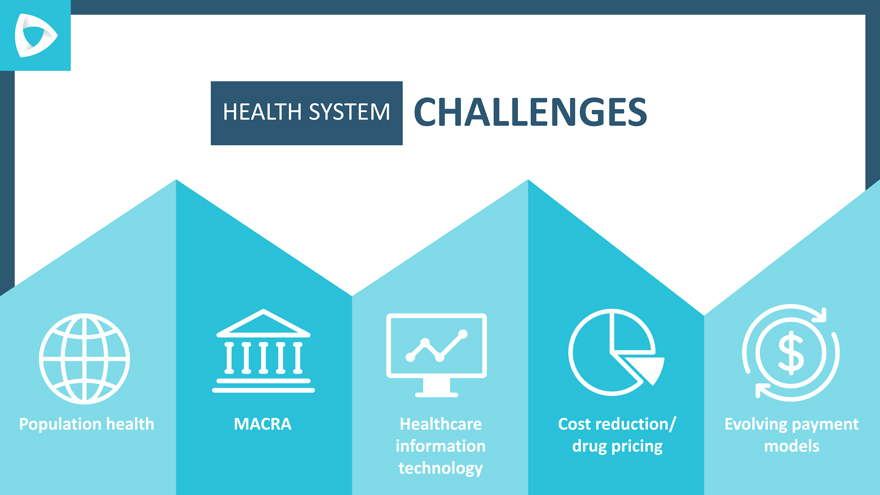

HEALTH SYSTEM CHALLENGES

Population health MACRA Healthcare Cost reduction/ Evolving payment

information drug pricing models

technology

Pull from multiple sources

Create actionable insights

Use intelligence to improve care and lower cost

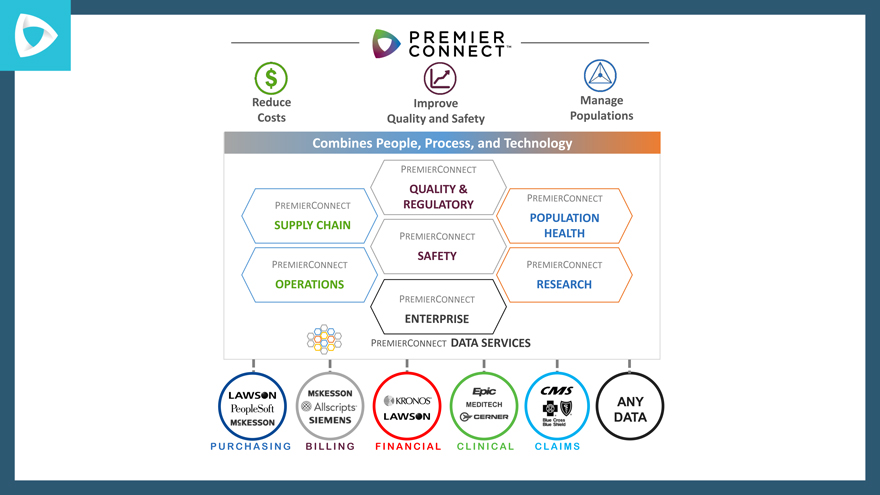

Reduce Improve Manage

Costs Quality and Safety Populations

Combines People, Process, and Technology

PREMIERCONNECT

SUPPLY CHAIN

ANY

DATA

P U R C H A S I N G B I L L I N G F I N A N C I A L C L I N I C A L C L A I M S

HEALTH SYSTEM Premier

Challenges SOLUTIONS

CHALLENGE CHALLENGE CHALLENGE CHALLENGE CHALLENGE

Population health MACRA Healthcare information Cost reduction/ Evolving payment

technology drug pricing models

SOLUTION SOLUTION SOLUTION SOLUTION SOLUTION

#1 KLAS-rated Analytics Integrated Integrated cost and Collaboratives,

population health Physician enterprise data platform pharmacy solutions technology &

D.C. presence

services optimization

Integrate solutions

Tackle challenges holistically

Attack and succeed in a reform environment

Strong performance

Minimal debt

Significant flexibility

INOVATM

First Health

OF THE CAROLINAS

PREMIER +

DRIVING

PERFORMANCE

Craig McKasson

CFO

Premier Inc.

DIVERSIFIED FINANCIAL MODEL

AND POWERFUL

Multiple growth Core “chassis” Recurring and Cross and up-sell Financial

drivers built visible revenue opportunities flexibility

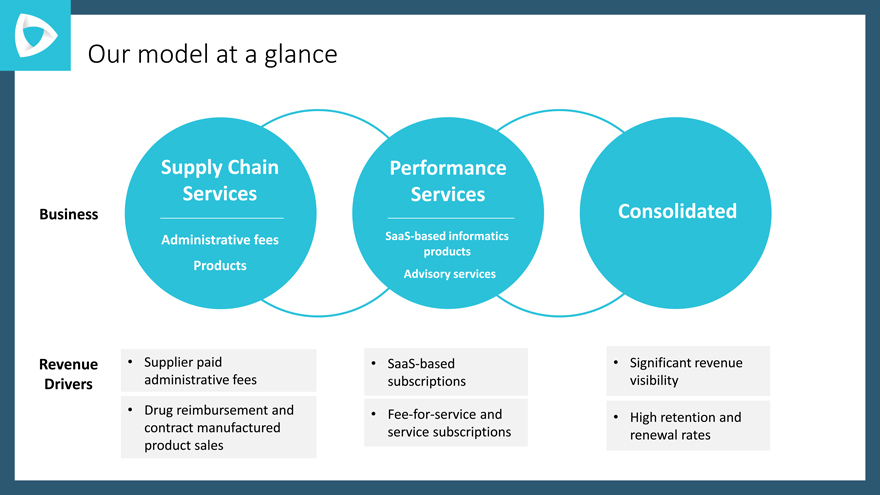

Our model at a glance

Supply Chain Performance

Services Services

Business Consolidated

Administrative fees SaaS-based informatics

products

Products

Advisory services

Revenue Supplier paid SaaS-based Significant revenue

Drivers administrative fees subscriptions visibility

Drug reimbursement and Fee-for-service and High retention and

contract manufactured service subscriptions renewal rates

product sales

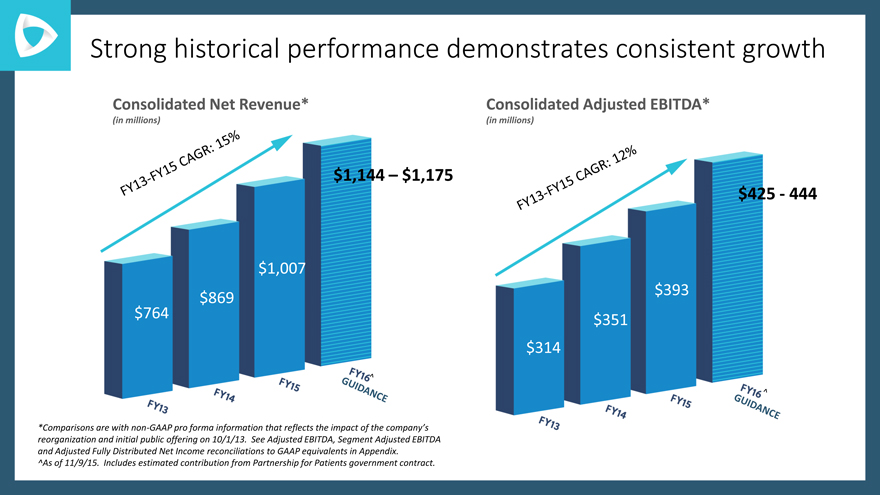

Strong historical performance demonstrates consistent growth

Consolidated Net Revenue*

(in millions)

$1,144 – $1,175

$1,007

$869

$764

Consolidated Adjusted EBITDA*

(in millions)

$425—444

$393

$351

$314

*Comparisons are with non-GAAP pro forma information that reflects the impact of the company’s reorganization and initial public offering on 10/1/13. See Adjusted EBITDA, Segment Adjusted EBITDA and Adjusted Fully Distributed Net Income reconciliations to GAAP equivalents in Appendix.

^As of 11/9/15. Includes estimated contribution from Partnership for Patients government contract.

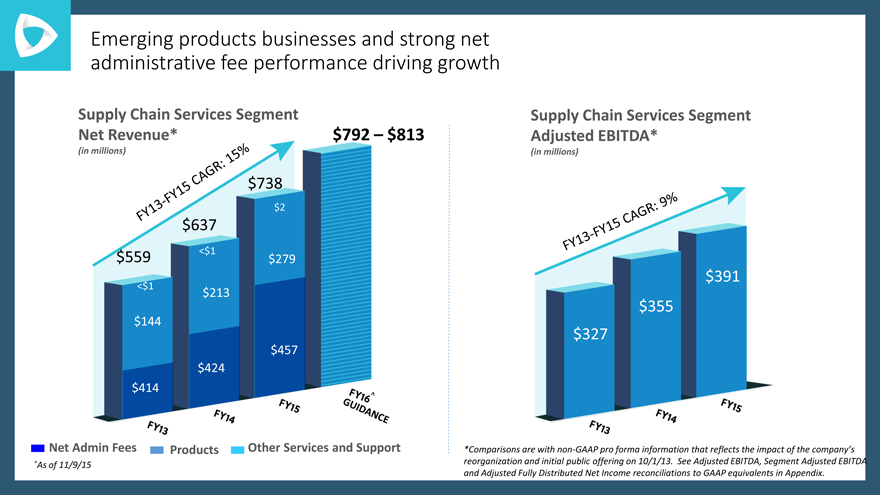

Emerging products businesses and strong net administrative fee performance driving growth

Supply Chain Services Segment

Net Revenue* $792 – $813

(in millions)

$738

$2

$637

$559 <$1 $279

<$1 $213

$144

$457

$424

$414

Net Admin Fees Products Other Services and Support

^As of 11/9/15

Supply Chain Services Segment

Adjusted EBITDA*

(in millions)

$391

$355

$327

*Comparisons are with non-GAAP pro forma information that reflects the impact of the company’s reorganization and initial public offering on 10/1/13. See Adjusted EBITDA, Segment Adjusted EBITDA and Adjusted Fully Distributed Net Income reconciliations to GAAP equivalents in Appendix.

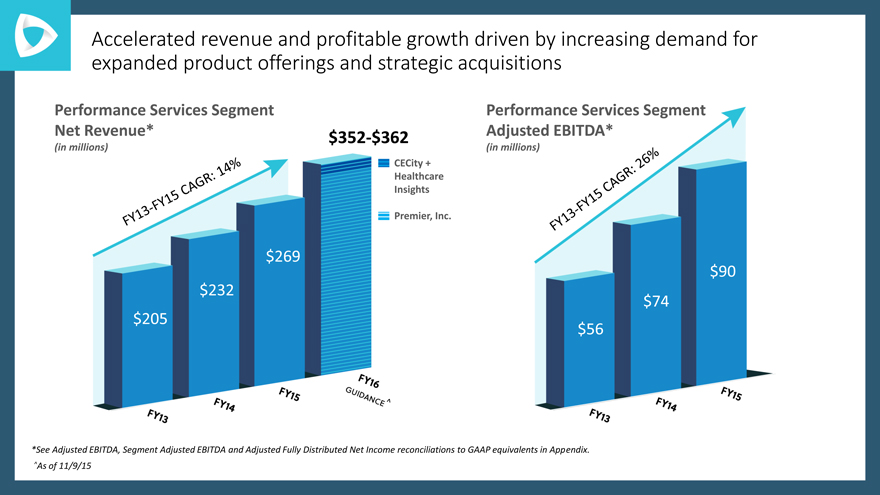

Accelerated revenue and profitable growth driven by increasing demand for expanded product offerings and strategic acquisitions

Performance Services Segment

Net Revenue* $352-$362

(in millions)

CECity +

Healthcare

Insights

Premier, Inc.

$269

$232

$205

Performance Services Segment

Adjusted EBITDA*

(in millions)

$90

$74

$56

*See Adjusted EBITDA, Segment Adjusted EBITDA and Adjusted Fully Distributed Net Income reconciliations to GAAP equivalents in Appendix. ^As of 11/9/15

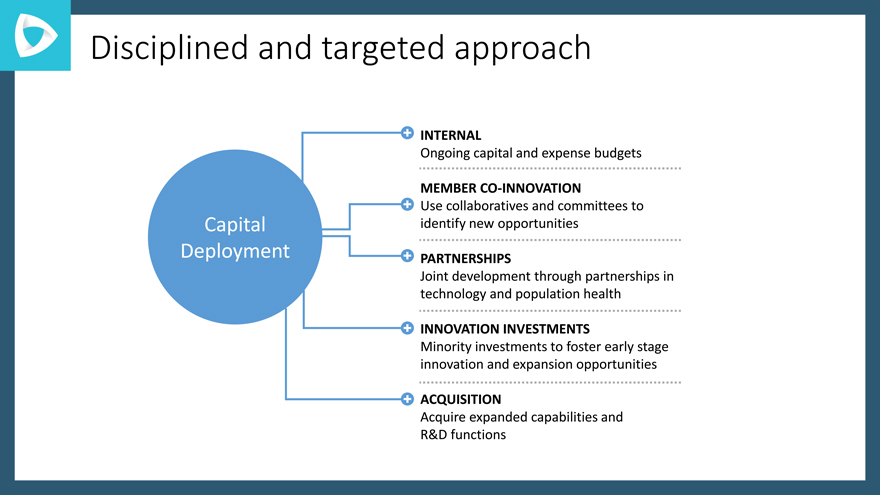

Capital Deployment Strategy

Disciplined and targeted approach

INTERNAL

Ongoing capital and expense budgets

MEMBER CO-INNOVATION

Use collaboratives and committees to

Capital identify new opportunities

Deployment PARTNERSHIPS

Joint development through partnerships in

technology and population health

INNOVATION INVESTMENTS

Minority investments to foster early stage

innovation and expansion opportunities

ACQUISITION

Acquire expanded capabilities and

R&D functions

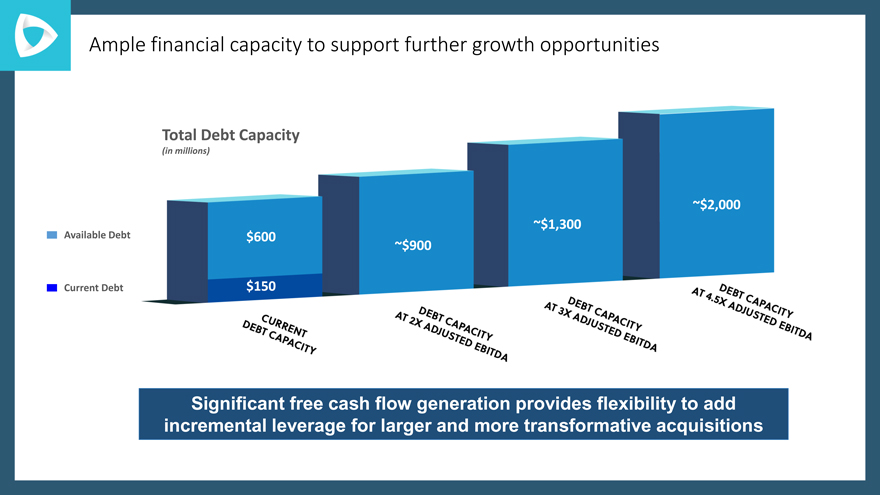

Ample financial capacity to support further growth opportunities

Total Debt Capacity

(in millions)

~$2,000

~$1,300

Available Debt $ 600

~$900

Current Debt $ 150

Significant free cash flow generation provides flexibility to add incremental leverage for larger and more transformative acquisitions

Well-positioned for

CONTINUED

LONG-TERM GROWTH

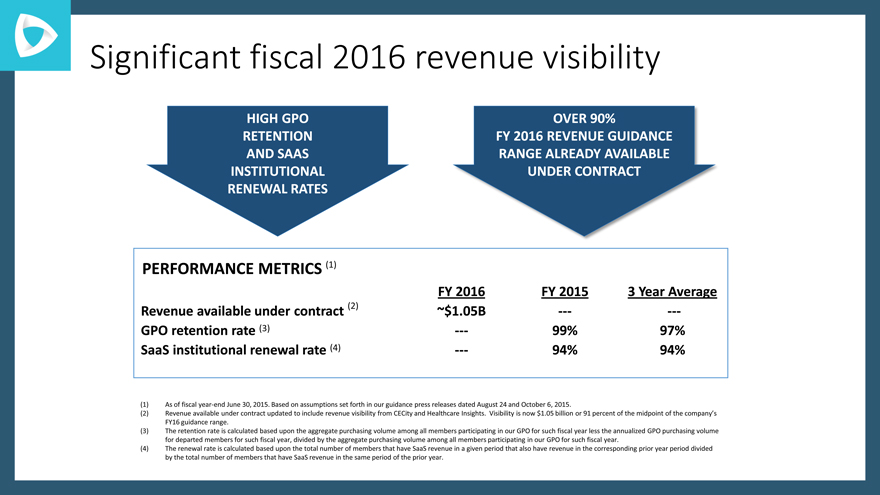

Significant fiscal 2016 revenue visibility

HIGH GPO OVER 90%

RETENTION FY 2016 REVENUE GUIDANCE

AND SAAS RANGE ALREADY AVAILABLE

INSTITUTIONAL UNDER CONTRACT

RENEWAL RATES

PERFORMANCE METRICS (1)

FY 2016 FY 2015 3 Year Average

Revenue available under contract (2) ~$1.05B —- —-

GPO retention rate (3) —- 99% 97%

SaaS institutional renewal rate (4) —- 94% 94%

As of fiscal year-end June 30, 2015. Based on assumptions set forth in our guidance press releases dated August 24 and October 6, 2015.

Revenue available under contract updated to include revenue visibility from CECity and Healthcare Insights. Visibility is now $1.05 billion or 91 percent of the midpoint of the company’s FY16 guidance range.

The retention rate is calculated based upon the aggregate purchasing volume among all members participating in our GPO for such fiscal year less the annualized GPO purchasing volume for departed members for such fiscal year, divided by the aggregate purchasing volume among all members participating in our GPO for such fiscal year.

The renewal rate is calculated based upon the total number of members that have SaaS revenue in a given period that also have revenue in the corresponding prior year period divided by the total number of members that have SaaS revenue in the same period of the prior year.

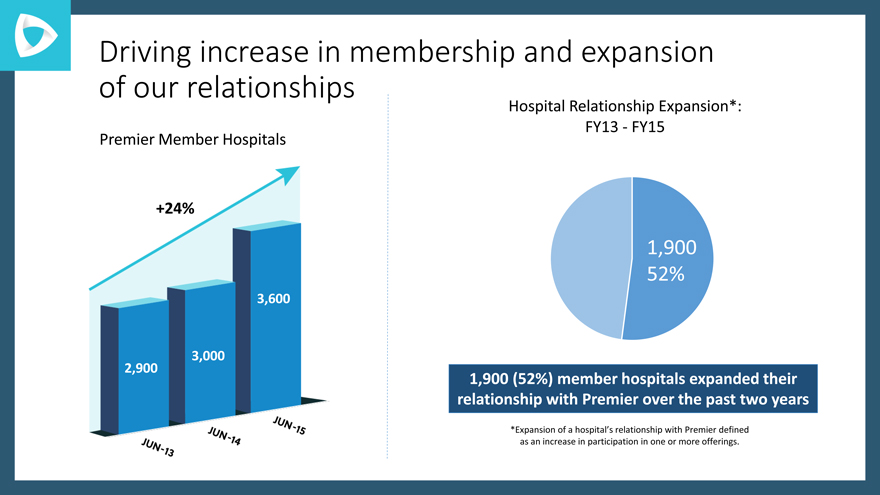

Driving increase in membership and expansion of our relationships

Premier Member Hospitals

+24%

3,600

3,000

2,900

Hospital Relationship Expansion*:

FY13—FY15

1,900

52%

1,900 (52%) member hospitals expanded their relationship with Premier over the past two years

*Expansion of a hospital’s relationship with Premier defined as an increase in participation in one or more offerings.

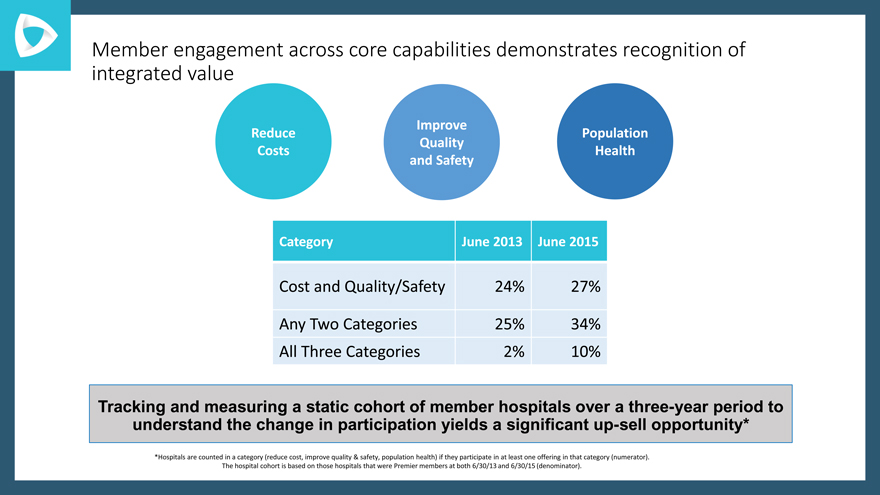

Member engagement across core capabilities demonstrates recognition of integrated value

Improve

Reduce

Population

Quality

Costs

Health

and Safety

Category June 2013 June 2015

Cost and Quality/Safety 24% 27%

Any Two Categories 25% 34%

All Three Categories 2% 10%

Tracking and measuring a static cohort of member hospitals over a three-year period to understand the change in participation yields a significant up-sell opportunity*

*Hospitals are counted in a category (reduce cost, improve quality & safety, population health) if they participate in at least one offering in that category (numerator). The hospital cohort is based on those hospitals that were Premier members at both 6/30/13 and 6/30/15 (denominator).

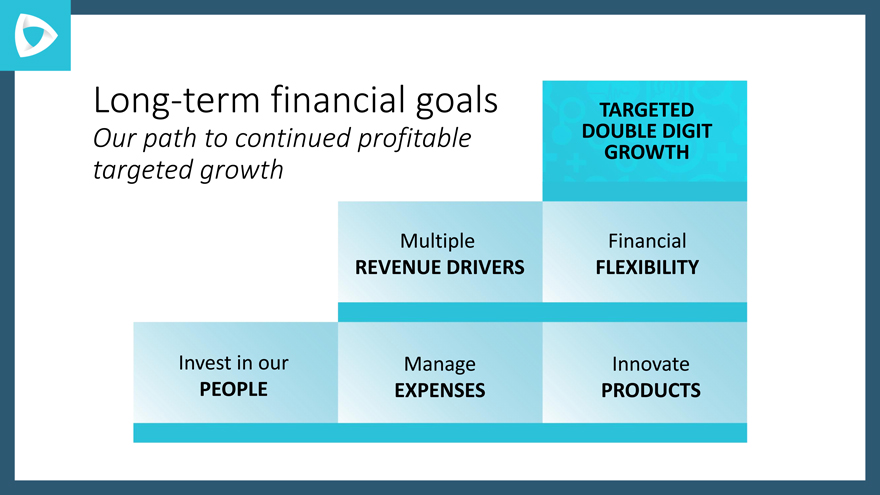

Long-term financial goals TARGETED

Our path to continued profitable DOUBLE DIGIT

GROWTH

targeted growth

Multiple Financial

REVENUE DRIVERS FLEXIBILITY

Invest in our Manage Innovate

PEOPLE EXPENSES PRODUCTS

Transforming Healthcare from the Inside

J.P. Morgan Healthcare Conference

January 12, 2016

Appendix

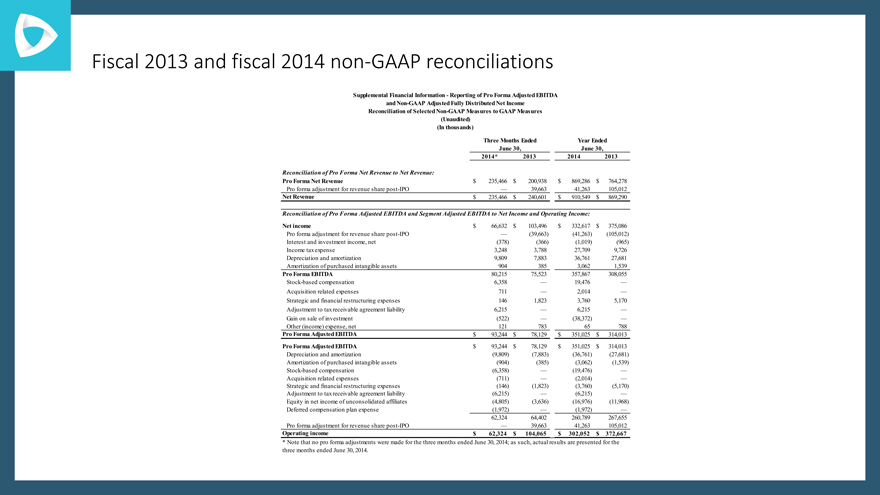

Fiscal 2013 and fiscal 2014 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Pro Forma Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands)

Three Months Ended Year Ended

June 30, June 30,

2014* 2013 2014 2013

Reconciliation of Pro Forma Net Revenue to Net Revenue:

Pro Forma Net Revenue $ 235,466 $ 200,938 $ 869,286 $ 764,278

Pro forma adjustment for revenue share post-IPO — 39,663 41,263 105,012

Net Revenue $ 235,466 $ 240,601 $ 910,549 $ 869,290

Reconciliation of Pro Forma Adjusted EBITDA and Segment Adjusted EBITDA to Net Income and Operating Income:

Net income $ 66,632 $ 103,496 $ 332,617 $ 375,086

Pro forma adjustment for revenue share post-IPO —(39,663)(41,263)(105,012)

Interest and investment income, net(378)(366)(1,019)(965)

Income tax expense 3,248 3,788 27,709 9,726

Depreciation and amortization 9,809 7,883 36,761 27,681

Amortization of purchased intangible assets 904 385 3,062 1,539

Pro Forma EBITDA 80,215 75,523 357,867 308,055

Stock-based compensation 6,358 — 19,476 —

Acquisition related expenses 711 — 2,014 —

Strategic and financial restructuring expenses 146 1,823 3,760 5,170

Adjustment to tax receivable agreement liability 6,215 — 6,215 —

Gain on sale of investment(522) —(38,372) —

Other (income) expense, net 121 783 65 788

Pro Forma Adjusted EBITDA $ 93,244 $ 78,129 $ 351,025 $ 314,013

Pro Forma Adjusted EBITDA $ 93,244 $ 78,129 $ 351,025 $ 314,013

Depreciation and amortization(9,809)(7,883)(36,761)(27,681)

Amortization of purchased intangible assets(904)(385)(3,062)(1,539)

Stock-based compensation(6,358) —(19,476) —

Acquisition related expenses(711) —(2,014) —

Strategic and financial restructuring expenses(146)(1,823)(3,760)(5,170)

Adjustment to tax receivable agreement liability(6,215) —(6,215) —

Equity in net income of unconsolidated affiliates(4,805)(3,636)(16,976)(11,968)

Deferred compensation plan expense(1,972) —(1,972) —

62,324 64,402 260,789 267,655

Pro forma adjustment for revenue share post-IPO — 39,663 41,263 105,012

Operating income $ 62,324 $ 104,065 $ 302,052 $ 372,667

* Note that no pro forma adjustments were made for the three months ended June 30, 2014; as such, actual results are presented for the three months ended June 30, 2014.

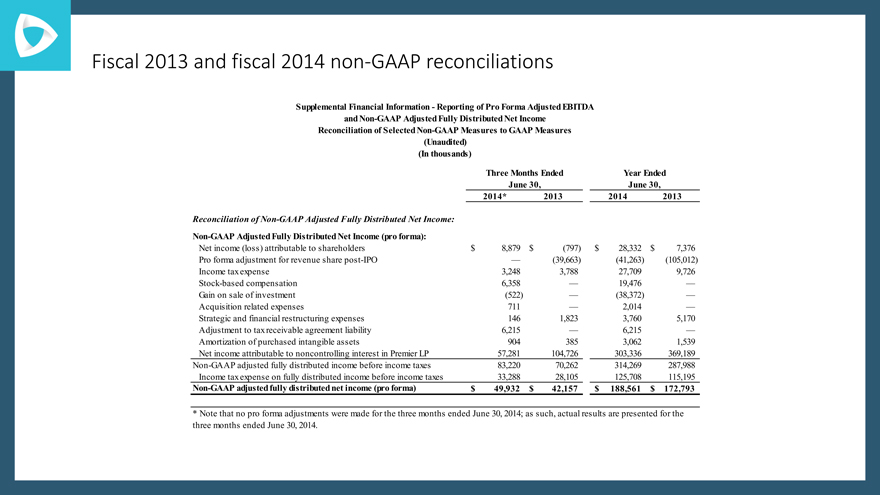

Fiscal 2013 and fiscal 2014 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Pro Forma Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands)

Three Months Ended Year Ended

June 30, June 30,

2014* 2013 2014 2013

Reconciliation of Non-GAAP Adjusted Fully Distributed Net Income:

Non-GAAP Adjusted Fully Distributed Net Income (pro forma):

Net income (loss) attributable to shareholders $ 8,879 $(797) $ 28,332 $ 7,376

Pro forma adjustment for revenue share post-IPO —(39,663)(41,263)(105,012)

Income tax expense 3,248 3,788 27,709 9,726

Stock-based compensation 6,358 — 19,476 —

Gain on sale of investment(522) —(38,372) —

Acquisition related expenses 711 — 2,014 —

Strategic and financial restructuring expenses 146 1,823 3,760 5,170

Adjustment to tax receivable agreement liability 6,215 — 6,215 —

Amortization of purchased intangible assets 904 385 3,062 1,539

Net income attributable to noncontrolling interest in Premier LP 57,281 104,726 303,336 369,189

Non-GAAP adjusted fully distributed income before income taxes 83,220 70,262 314,269 287,988

Income tax expense on fully distributed income before income taxes 33,288 28,105 125,708 115,195

Non-GAAP adjusted fully distributed net income (pro forma) $ 49,932 $ 42,157 $ 188,561 $ 172,793

* Note that no pro forma adjustments were made for the three months ended June 30, 2014; as such, actual results are presented for the three months ended June 30, 2014.

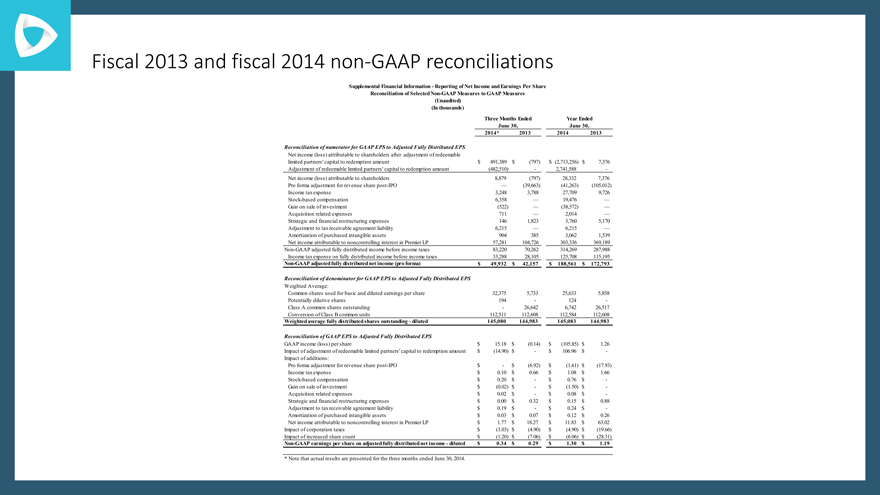

Fiscal 2013 and fiscal 2014 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Net Income and Earnings Per Share Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands)

Three Months Ended Year Ended

June 30, June 30,

2014* 2013 2014 2013

Reconciliation of numerator for GAAP EPS to Adjusted Fully Distributed EPS

Net income (loss) attributable to shareholders after adjustment of redeemable

limited partners’ capital to redemption amount $ 491,389 $(797) $ (2,713,256) $ 7,376

Adjustment of redeemable limited partners’ capital to redemption amount(482,510)—2,741,588 -

Net income (loss) attributable to shareholders 8,879(797) 28,332 7,376

Pro forma adjustment for revenue share post-IPO —(39,663)(41,263)(105,012)

Income tax expense 3,248 3,788 27,709 9,726

Stock-based compensation 6,358 — 19,476 —

Gain on sale of investment(522) —(38,372) —

Acquisition related expenses 711 — 2,014 —

Strategic and financial restructuring expenses 146 1,823 3,760 5,170

Adjustment to tax receivable agreement liability 6,215 — 6,215 —

Amortization of purchased intangible assets 904 385 3,062 1,539

Net income attributable to noncontrolling interest in Premier LP 57,281 104,726 303,336 369,189

Non-GAAP adjusted fully distributed income before income taxes 83,220 70,262 314,269 287,988

Income tax expense on fully distributed income before income taxes 33,288 28,105 125,708 115,195

Non-GAAP adjusted fully distributed net income (pro forma) $ 49,932 $ 42,157 $ 188,561 $ 172,793

Reconciliation of denominator for GAAP EPS to Adjusted Fully Distributed EPS

Weighted Average:

Common shares used for basic and diluted earnings per share 32,375 5,733 25,633 5,858

Potentially dilutive shares 194—124 -

Class A common shares outstanding—26,642 6,742 26,517

Conversion of Class B common units 112,511 112,608 112,584 112,608

Weighted average fully distributed shares outstanding—diluted 145,080 144,983 145,083 144,983

Reconciliation of GAAP EPS to Adjusted Fully Distributed EPS

GAAP income (loss) per share $ 15.18 $(0.14) $ (105.85) $ 1.26

Impact of adjustment of redeemable limited partners’ capital to redemption amount $ (14.90) $—$ 106.96 $ -

Impact of additions:

Pro forma adjustment for revenue share post-IPO $—$(6.92) $ (1.61) $(17.93)

Income tax expense $ 0.10 $ 0.66 $ 1.08 $ 1.66

Stock-based compensation $ 0.20 $—$ 0.76 $ -

Gain on sale of investment $ (0.02) $—$ (1.50) $ -

Acquisition related expenses $ 0.02 $—$ 0.08 $ -

Strategic and financial restructuring expenses $ 0.00 $ 0.32 $ 0.15 $ 0.88

Adjustment to tax receivable agreement liability $ 0.19 $—$ 0.24 $ -

Amortization of purchased intangible assets $ 0.03 $ 0.07 $ 0.12 $ 0.26

Net income attributable to noncontrolling interest in Premier LP $ 1.77 $ 18.27 $ 11.83 $ 63.02

Impact of corporation taxes $ (1.03) $(4.90) $ (4.90) $(19.66)

Impact of increased share count $ (1.20) $(7.06) $ (6.06) $(28.31)

Non-GAAP earnings per share on adjusted fully distributed net income—diluted $ 0.34 $ 0.29 $ 1.30 $ 1.19

* Note that actual results are presented for the three months ended June 30, 2014.

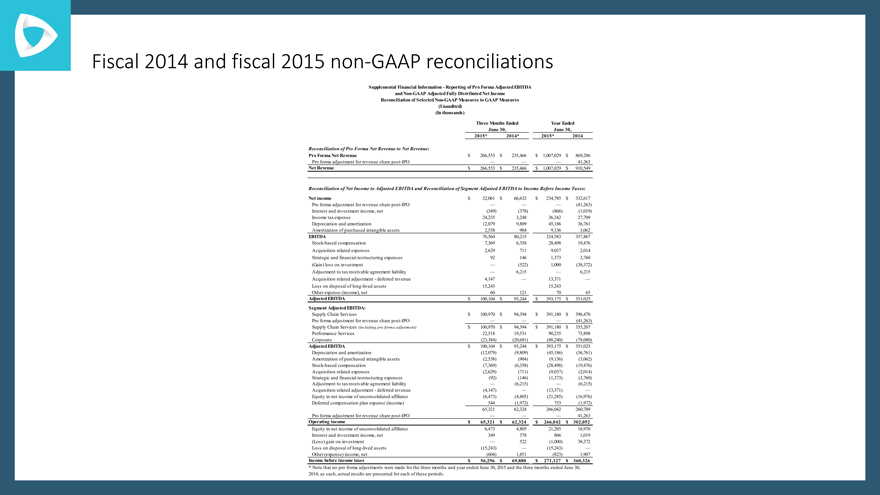

Fiscal 2014 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Pro Forma Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands)

Three Months Ended Year Ended

June 30, June 30,

2015* 2014* 2015* 2014

Reconciliation of Pro Forma Net Revenue to Net Revenue:

Pro Forma Net Revenue $ 266,553 $ 235,466 $ 1,007,029 $ 869,286

Pro forma adjustment for revenue share post-IPO — — — 41,263

Net Revenue $ 266,553 $ 235,466 $ 1,007,029 $ 910,549

Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes:

Net income $ 32,061 $ 66,632 $ 234,785 $ 332,617

Pro forma adjustment for revenue share post-IPO — — —(41,263)

Interest and investment income, net(349)(378)(866)(1,019)

Income tax expense 24,235 3,248 36,342 27,709

Depreciation and amortization 12,079 9,809 45,186 36,761

Amortization of purchased intangible assets 2,538 904 9,136 3,062

EBITDA 70,564 80,215 324,583 357,867

Stock-based compensation 7,369 6,358 28,498 19,476

Acquisition related expenses 2,629 711 9,037 2,014

Strategic and financial restructuring expenses 92 146 1,373 3,760

(Gain) loss on investment —(522) 1,000(38,372)

Adjustment to tax receivable agreement liability — 6,215 — 6,215

Acquisition related adjustment—deferred revenue 4,147 — 13,371 —

Loss on disposal of long-lived assets 15,243 15,243

Other expense (income), net 60 121 70 65

Adjusted EBITDA $ 100,104 $ 93,244 $ 393,175 $ 351,025

Segment Adjusted EBITDA:

Supply Chain Services $ 100,970 $ 94,394 $ 391,180 $ 396,470

Pro forma adjustment for revenue share post-IPO — — —(41,263)

Supply Chain Services (including pro forma adjustment) $ 100,970 $ 94,394 $ 391,180 $ 355,207

Performance Services 22,518 19,531 90,235 73,898

Corporate(23,384)(20,681)(88,240)(78,080)

Adjusted EBITDA $ 100,104 $ 93,244 $ 393,175 $ 351,025

Depreciation and amortization(12,079)(9,809)(45,186)(36,761)

Amortization of purchased intangible assets(2,538)(904)(9,136)(3,062)

Stock-based compensation(7,369)(6,358)(28,498)(19,476)

Acquisition related expenses(2,629)(711)(9,037)(2,014)

Strategic and financial restructuring expenses(92)(146)(1,373)(3,760)

Adjustment to tax receivable agreement liability —(6,215) —(6,215)

Acquisition related adjustment—deferred revenue(4,147) —(13,371) —

Equity in net income of unconsolidated affiliates(6,473)(4,805)(21,285)(16,976)

Deferred compensation plan expense (income) 544(1,972) 753(1,972)

65,321 62,324 266,042 260,789

Pro forma adjustment for revenue share post-IPO — — — 41,263

Operating income $ 65,321 $ 62,324 $ 266,042 $ 302,052

Equity in net income of unconsolidated affiliates 6,473 4,805 21,285 16,976

Interest and investment income, net 349 378 866 1,019

(Loss) gain on investment — 522(1,000) 38,372

Loss on disposal of long-lived assets(15,243) —(15,243) —

Other (expense) income, net(604) 1,851(823) 1,907

Income before income taxes $ 56,296 $ 69,880 $ 271,127 $ 360,326

* Note that no pro forma adjustments were made for the three months and year ended June 30, 2015 and the three months ended June 30,

2014; as such, actual results are presented for each of these periods.

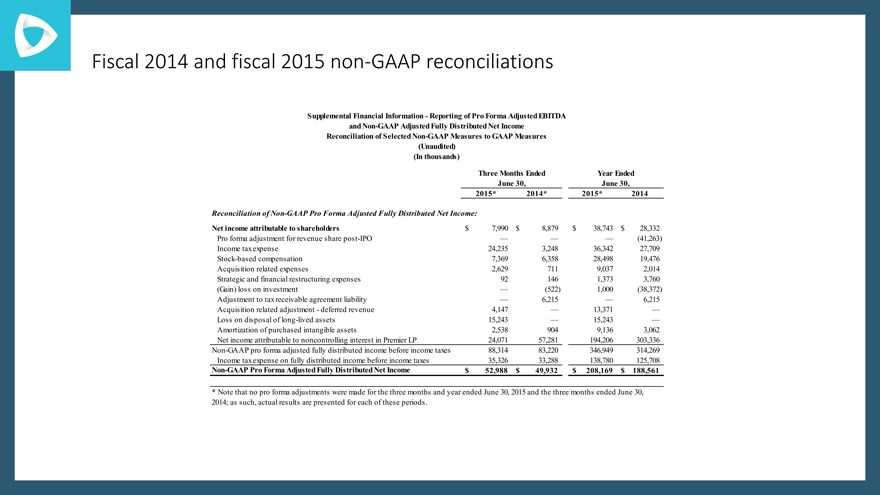

Fiscal 2014 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Pro Forma Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands)

Three Months Ended Year Ended

June 30, June 30,

2015* 2014* 2015* 2014

Reconciliation of Non-GAAP Pro Forma Adjusted Fully Distributed Net Income:

Net income attributable to shareholders $ 7,990 $ 8,879 $ 38,743 $ 28,332

Pro forma adjustment for revenue share post-IPO — — —(41,263)

Income tax expense 24,235 3,248 36,342 27,709

Stock-based compensation 7,369 6,358 28,498 19,476

Acquisition related expenses 2,629 711 9,037 2,014

Strategic and financial restructuring expenses 92 146 1,373 3,760

(Gain) loss on investment —(522) 1,000(38,372)

Adjustment to tax receivable agreement liability — 6,215 — 6,215

Acquisition related adjustment—deferred revenue 4,147 — 13,371 —

Loss on disposal of long-lived assets 15,243 — 15,243 —

Amortization of purchased intangible assets 2,538 904 9,136 3,062

Net income attributable to noncontrolling interest in Premier LP 24,071 57,281 194,206 303,336

Non-GAAP pro forma adjusted fully distributed income before income taxes 88,314 83,220 346,949 314,269

Income tax expense on fully distributed income before income taxes 35,326 33,288 138,780 125,708

Non-GAAP Pro Forma Adjusted Fully Distributed Net Income $ 52,988 $ 49,932 $ 208,169 $ 188,561

* Note that no pro forma adjustments were made for the three months and year ended June 30, 2015 and the three months ended June 30, 2014; as such, actual results are presented for each of these periods.

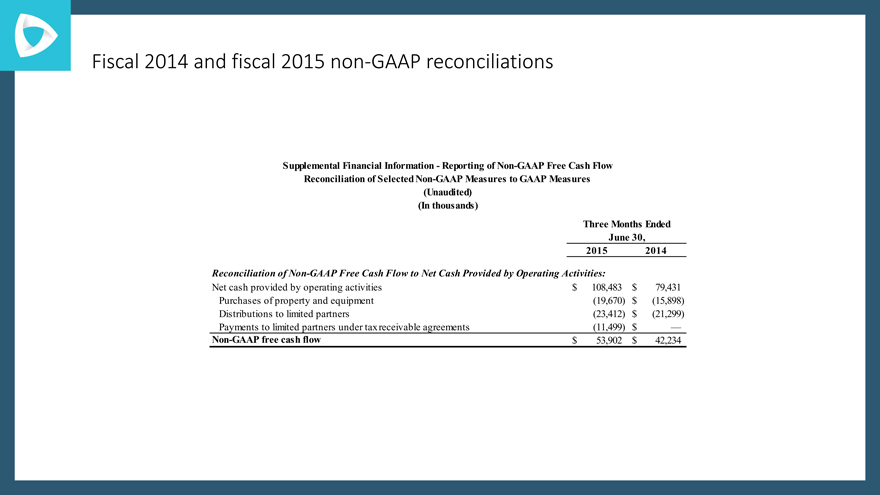

Fiscal 2014 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Non-GAAP Free Cash Flow Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands)

Three Months Ended

June 30,

2015 2014

Reconciliation of Non-GAAP Free Cash Flow to Net Cash Provided by Operating Activities:

Net cash provided by operating activities $ 108,483 $ 79,431

Purchases of property and equipment(19,670) $(15,898)

Distributions to limited partners(23,412) $(21,299)

Payments to limited partners under tax receivable agreements(11,499) $ —

Non-GAAP free cash flow $ 53,902 $ 42,234

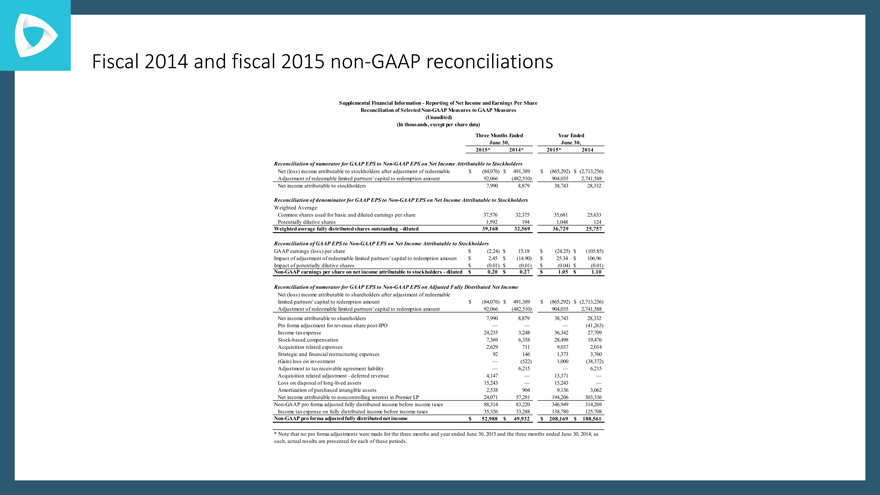

Fiscal 2014 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Net Income and Earnings Per Share Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands, except per share data)

Three Months Ended Year Ended

June 30, June 30,

2015* 2014* 2015* 2014

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Net Income Attributable to Stockholders

Net (loss) income attributable to stockholders after adjustment of redeemable $ (84,076) $ 491,389 $ (865,292) $(2,713,256)

Adjustment of redeemable limited partners’ capital to redemption amount 92,066(482,510) 904,035 2,741,588

Net income attributable to stockholders 7,990 8,879 38,743 28,332

Reconciliation of denominator for GAAP EPS to Non-GAAP EPS on Net Income Attributable to Stockholders

Weighted Average:

Common shares used for basic and diluted earnings per share 37,576 32,375 35,681 25,633

Potentially dilutive shares 1,592 194 1,048 124

Weighted average fully distributed shares outstanding—diluted 39,168 32,569 36,729 25,757

Reconciliation of GAAP EPS to Non-GAAP EPS on Net Income Attributable to Stockholders

GAAP earnings (loss) per share $(2.24) $ 15.18 $ (24.25) $(105.85)

Impact of adjustment of redeemable limited partners’ capital to redemption amount $ 2.45 $(14.90) $ 25.34 $ 106.96

Impact of potentially dilutive shares $(0.01) $(0.01) $ (0.04) $(0.01)

Non-GAAP earnings per share on net income attributable to stockholders—diluted $ 0.20 $ 0.27 $ 1.05 $ 1.10

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Adjusted Fully Distributed Net Income

Net (loss) income attributable to shareholders after adjustment of redeemable

limited partners’ capital to redemption amount $ (84,076) $ 491,389 $ (865,292) $(2,713,256)

Adjustment of redeemable limited partners’ capital to redemption amount 92,066(482,510) 904,035 2,741,588

Net income attributable to shareholders 7,990 8,879 38,743 28,332

Pro forma adjustment for revenue share post-IPO — — —(41,263)

Income tax expense 24,235 3,248 36,342 27,709

Stock-based compensation 7,369 6,358 28,498 19,476

Acquisition related expenses 2,629 711 9,037 2,014

Strategic and financial restructuring expenses 92 146 1,373 3,760

(Gain) loss on investment —(522) 1,000(38,372)

Adjustment to tax receivable agreement liability — 6,215 — 6,215

Acquisition related adjustment—deferred revenue 4,147 — 13,371 —

Loss on disposal of long-lived assets 15,243 — 15,243 —

Amortization of purchased intangible assets 2,538 904 9,136 3,062

Net income attributable to noncontrolling interest in Premier LP 24,071 57,281 194,206 303,336

Non-GAAP pro forma adjusted fully distributed income before income taxes 88,314 83,220 346,949 314,269

Income tax expense on fully distributed income before income taxes 35,326 33,288 138,780 125,708

Non-GAAP pro forma adjusted fully distributed net income $ 52,988 $ 49,932 $ 208,169 $ 188,561

* Note that no pro forma adjustments were made for the three months and year ended June 30, 2015 and the three months ended June 30, 2014; as such, actual results are presented for each of these periods.

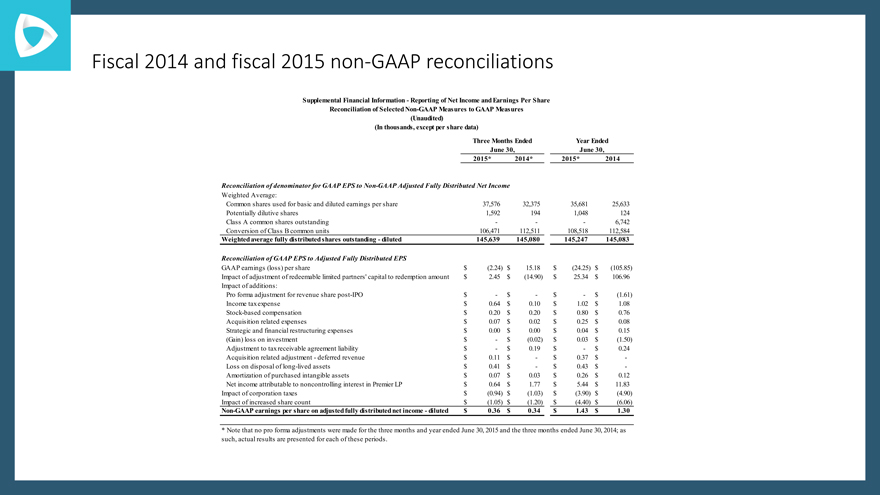

Fiscal 2014 and fiscal 2015 non-GAAP reconciliations

Supplemental Financial Information—Reporting of Net Income and Earnings Per Share Reconciliation of Selected Non-GAAP Measures to GAAP Measures (Unaudited) (In thousands, except per share data)

Three Months Ended Year Ended

June 30, June 30,

2015* 2014* 2015* 2014

Reconciliation of denominator for GAAP EPS to Non-GAAP Adjusted Fully Distributed Net Income

Weighted Average:

Common shares used for basic and diluted earnings per share 37,576 32,375 35,681 25,633

Potentially dilutive shares 1,592 194 1,048 124

Class A common shares outstanding ——6,742

Conversion of Class B common units 106,471 112,511 108,518 112,584

Weighted average fully distributed shares outstanding—diluted 145,639 145,080 145,247 145,083

Reconciliation of GAAP EPS to Adjusted Fully Distributed EPS

GAAP earnings (loss) per share $(2.24) $ 15.18 $(24.25) $(105.85)

Impact of adjustment of redeemable limited partners’ capital to redemption amount $ 2.45 $(14.90) $ 25.34 $ 106.96

Impact of additions:

Pro forma adjustment for revenue share post-IPO $—$—$—$(1.61)

Income tax expense $ 0.64 $ 0.10 $ 1.02 $ 1.08

Stock-based compensation $ 0.20 $ 0.20 $ 0.80 $ 0.76

Acquisition related expenses $ 0.07 $ 0.02 $ 0.25 $ 0.08

Strategic and financial restructuring expenses $ 0.00 $ 0.00 $ 0.04 $ 0.15

(Gain) loss on investment $—$(0.02) $ 0.03 $(1.50)

Adjustment to tax receivable agreement liability $—$ 0.19 $—$ 0.24

Acquisition related adjustment—deferred revenue $ 0.11 $—$ 0.37 $ -

Loss on disposal of long-lived assets $ 0.41 $—$ 0.43 $ -

Amortization of purchased intangible assets $ 0.07 $ 0.03 $ 0.26 $ 0.12

Net income attributable to noncontrolling interest in Premier LP $ 0.64 $ 1.77 $ 5.44 $ 11.83

Impact of corporation taxes $(0.94) $(1.03) $(3.90) $(4.90)

Impact of increased share count $(1.05) $(1.20) $(4.40) $(6.06)

Non-GAAP earnings per share on adjusted fully distributed net income—diluted $ 0.36 $ 0.34 $ 1.43 $ 1.30

* Note that no pro forma adjustments were made for the three months and year ended June 30, 2015 and the three months ended June 30, 2014; as such, actual results are presented for each of these periods.