GreenPower Motor Company Inc.

Annual Information Form

For the Period Ended March 31, 2020

Dated February 22, 2021

TABLE OF CONTENTS

ANNUAL INFORMATION FORM

In this Annual Information Form (this "AIF"), unless otherwise noted or the context indicates otherwise, references to the "Company", "we", "us", "our" and "GreenPower" refer to GreenPower Motor Company Inc.

All financial information in this AIF is prepared in Canadian dollars, unless otherwise indicated. The information contained herein is dated as of February 19, 2021 unless otherwise stated.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This AIF contains certain information that may constitute forward‐looking information and forward‐looking statements as such terms are defined under applicable Canadian securities laws (collectively, the "Forward‐Looking Statements") which are based on management's current internal expectations, estimates, projections, assumptions and beliefs. Forward-Looking Statements can be identified by the use of forward‐looking terminology such as "expect", "likely", "may", "will", "should", "intend", "anticipate", "potential", "proposed", "estimate", and other similar words, including negative and grammatical variations thereof. The Forward-Looking Statements may include estimates, plans, expectations, opinions, forecasts, projections, targets, guidance and other statements that are not statements of fact. The Forward‐Looking Statements are made only as of the date of this AIF. The Forward‐Looking Statements include, but are not limited to, statements with respect to:

- the intentions, plans and future actions of the Company;

- statements relating to the business and future activities of the Company;

- anticipated developments in operations of the Company;

- market position, ability to compete and future financial or operating performance of the Company;

- the timing and amount of funding required to execute the Company's business plans;

- capital expenditures;

- the effect on the Company of any changes to existing or new legislation or policy or government regulation;

- the availability of labour;

- requirements for additional capital;

- goals, strategies and future growth;

- the adequacy of financial resources;

- expectations regarding revenues, expenses and anticipated cash needs; and

- the impact of the COVID-19 pandemic on the business and operations of the Company.

The actual results, performance or achievements of the Company could differ materially from those anticipated in the Forward-Looking Statements as a result of the risk factors set forth below and under the heading "Risk Factors", including, but not limited to, risks related to: (i) the Company's ability to generate sufficient cash flow from operations and obtain financing, if needed, on acceptable terms or at all; (ii) general economic, financial market and regulatory conditions in which the Company operates; (iii) the yield from the Company's operations; (iv) consumer interest in the Company's products; (v) competition; (vi) anticipated and unanticipated costs; (vii) government regulation of the Company's products and operations; (viii) the timely receipt of any required regulatory approvals; (ix) the Company's ability to obtain qualified staff, equipment and services in a timely and cost efficient manner; (x) the Company's ability to conduct operations in a safe, efficient and effective manner; and (xi) the Company's plans and timeframe for completion of such plans.

Readers are cautioned that these factors are difficult to predict and that the assumptions used in developing the Forward-Looking Statements may prove to be incorrect. Readers are also cautioned that the list of risk factors contained in this AIF is not exhaustive. Accordingly, readers are cautioned that the Company's actual results may vary from the Forward-Looking Statements, and the variations may be material.

Although the Company believes that the expectations reflected in the Forward‐Looking Statements are reasonable, it can give no assurance that such expectations will prove to be correct, and the Forward‐Looking Statements are expressly qualified in their entirety by this cautionary statement. The purpose of the Forward‐Looking Statements is to provide the reader with a description of management's expectations, and the Forward‐Looking Statements may not be appropriate for any other purpose. The reader should not place undue reliance on the Forward‐Looking Statements. The Forward-Looking Statements are made as at the date hereof and the Company undertakes no obligation to update or revise any of the Forward‐Looking Statements, whether as a result of new information, future events or otherwise, except as required by applicable Canadian securities laws.

Additional information on these and other factors is available in the reports filed by the Company with Canadian securities regulators and available on SEDAR (as defined herein). The forward-looking statements and information contained in this AIF are made as of the date hereof.

GLOSSARY OF TERMS

In addition to terms defined elsewhere in this AIF, the following terms, when used in this AIF, will have the following meanings (unless otherwise indicated):

"AIF" means the Annual Information Form;

"Audit Committee" means the Audit Committee of the Board;

"BCBCA" means the Business Corporations Act (British Columbia);

"Board" means the board of directors of the Company;

"CARB" means California Air Resources Board;

"Creative Bus Sales" means Creative Bus Sales, Inc., the Company's main sales agent;

"Effective Date" means the date the date of this AIF;

"EV" means electric vehicle;

"FTA" means Federal Transit Administration;

"Green Commuter" means Green Commuter, Inc.;

"HVIP" means the California Hybrid and Zero-Emission Truck and Bus Voucher Incentive Program;

"Momentum" means Momentum Dynamics Corp.;

"Nasdaq" means the Nasdaq Capital Market;

"NYSERDA" means the New York State Energy Research and Development Authority;

"OEM" means an original equipment manufacturer, being a company that makes a part or subsystem that is used in another company's end product;

"OTCQB" means the OTCQB Venture Exchange;

"Perrone" means Perrone Robotics, Inc.;

"TSXV" means the TSX Venture Exchange;

"Qualifying Transaction" has the meaning given to it in the TSXV policy 2.4 - Capital Pool Companies.

CORPORATE STRUCTURE

Name, Address and Incorporation

We are a corporation incorporated under the BCBCA in British Columbia, Canada under the name "GreenPower Motor Company Inc." with an authorized share structure of an unlimited number of common shares and preferred shares without par value. Our principal place of business is located at Suite 209 - 240 Carrall Street, Vancouver, British Columbia V6J 2B2, Canada and our telephone number is (604) 563-4144.

Our registered records office is located at Suite 900 - 885 West Georgia Street, Vancouver, BC V6C 3H1, Canada and its telephone number is (604) 687-5700.

Our registered agent in the United States is GKL Corporate/Search, Inc., located at One Capitol Mall, Suite 660, Sacramento, California 95814 and its telephone number is (800) 446-5455.

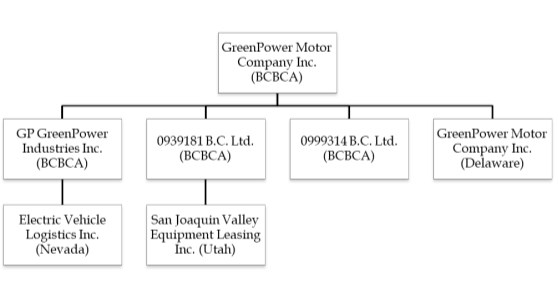

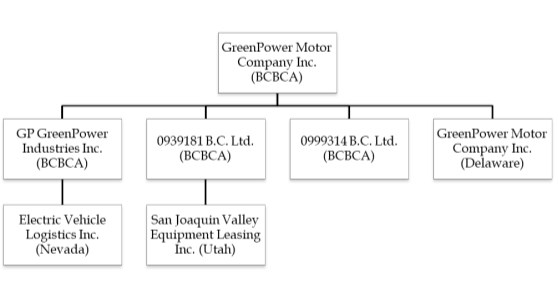

Intercorporate Relationships

GreenPower has the following wholly-owned subsidiaries:

1. GP GreenPower Industries Inc. (incorporated in the Province of British Columbia, Canada);

2. GreenPower Motor Company, Inc. (incorporated in the State of Delaware);

3. 0939181 B.C. Ltd. (incorporated in the Province of British Columbia, Canada);

4. San Joaquin Valley Equipment Leasing Inc. (formerly, Utah Manganese, Inc.) (incorporated in the State of Utah), a wholly owned subsidiary of 0939181 B.C. Ltd.;

5. 0999314 B.C. Ltd. (incorporated in the Province of British Columbia, Canada); and

6. Electric Vehicle Logistics Inc. (incorporated in the State of Nevada), a wholly owned subsidiary of GP GreenPower Industries Inc.

THREE YEAR HISTORY OF THE BUSINESS

In June 2018, our company appointed Creative Bus Sales as our exclusive sales agent. Creative Bus Sales is the largest bus dealer in the United States, with 18 physical locations, a 75-person sales team and more than 200 service and support staff.

During the year ended March 31, 2019, we delivered 14 buses to customers, pursuant to vehicle leases and vehicle sales. The customers were all located in the state of California, and include Sacramento Regional Transit, the University of California San Francisco, the Port of Oakland, Airline Coach Services and the City of Porterville. The Company provides lease financing to certain customers through its wholly owned subsidiaries, San Joaquin Valley Equipment Leasing Inc., and 00099314 B.C. Ltd.

The principal capital expenditures of our company have been investments in a 9.3 acre parcel of land in the City of Porterville and for the production of electric buses and EV equipment. To date, our principal capital expenditures have been funded with capital which has been sourced from our company's sale of convertible debentures, warrants and common shares, proceeds from the exercise of warrants and options, loans from related parties, and from our company's USD$8 million operating credit line with the Bank of Montreal.

During the three months ended March 31, 2020, GreenPower entered into agreements with Momentum to integrate wireless charging into the EV Star and with Perrone to build a fully autonomous EV Star for the transit market. GreenPower has agreed to collaborate with Momentum and separately with Perrone to integrate their components, software and technology on an EV Star, and to work with these companies on sales of EV Stars that have integrated their respective technologies. Both parties have agreed to provide technical support and training in order to integrate the technology and provide after sales support to potential customers.

Beginning in March 2020, GreenPower's business and operations began to adapt to changes brought about by the COVID-19 global pandemic. As an essential business manufacturing on behalf of the transit industry, we were able to maintain production, although levels were at times reduced compared to prior to the pandemic. Some of our suppliers and contract manufacturers have temporarily suspended or reduced their production levels, and our internal staffing levels in production were temporarily reduced in order to comply with government regulations and maintain physical distancing in order to protect the health of our staff, customers and other stakeholders. While we have maintained sales and production during this period, we have done so at a reduced rate in order to comply with physical distancing requirements and government health regulations. We were able to secure government business grants and loans in both Canada and the US to support our business through this period, including financing of USD$361,900 under the U.S. Small Business Administration's Paycheck Protection Program, and have entered into a two-year promissory note with East West Bank for this financing. Management continues to monitor and adapt to the current economic realities that have resulted from the COVID-19 pandemic, however the ultimate impacts and duration of current conditions remain uncertain.

During April 2020, GreenPower received the final report for the EV Star's Federal Transit Bus Test performed for the Federal Transit Administration at the Altoona Bus Testing site at Penn State University. This tests the maintainability, reliability, safety and performance of transit vehicles, and is required by the FTA for transit properties looking to purchase vehicles with federal funds. The EV Star passed the Altoona Test with an overall score of 92.2 which, as of the date of the test, makes the EV Star the highest scoring medium or heavy-duty vehicle that has completed the Altoona test, and the only all-electric Class 4 vehicle to have passed the Altoona test.

During the nine months ended December 31, 2020, GreenPower delivered a total of 56 vehicles, including vehicle sales of one all-electric school bus, one EV Star Cargo Plus, one EV Star Plus, and one EV Star, and 52 EV Stars for which Greenpower provided 3-year lease financing and which were accounted for as finance leases. Greenpower also delivered the first fully autonomous AV Star, developed with its partner Perrone Robotics, to the JTA.

In July, Green Commuter placed an additional 100 EV Star order with GreenPower, significantly increasing GreenPower's pipeline. During June 2020, GreenPower announced that Creative Bus Sales received an order for two EV Stars from UCLA, and in July 2020, GreenPower announced that it had received an order for 10 electric school buses from Creative Bus Sales which are being funded by Air Quality Management Districts with funding from Volkswagen settlement funds. In early August 2020, Priyankar Balekai joined GreenPower on a consultancy contract to lead the cargo, logistics and truck division of GreenPower. Mr. Balekai has over 23 years of experience in the trucking sector, including senior roles at Thor Trucks, BYD Motors, and Navistar.

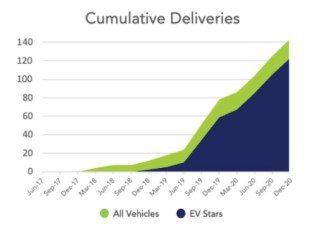

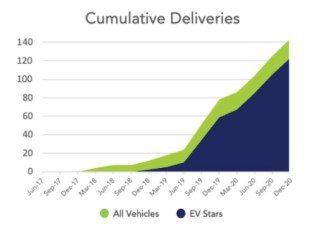

The following chart illustrates GreenPower's cumulative vehicle deliveries to the end of December 2020:

During the quarter ended September 30, 2020, GreenPower finalized a three-year dealership agreement with ABC Bus, Inc. covering the state of New York. The agreement provides for 100 vehicles to be purchased by ABC over the next 36 months. With this dealership agreement, GreenPower and ABC Bus Inc. can sell GreenPower's vehicles in the state of New York, which are eligible for several funding programs in the state including the NYSERDA program and the New York Voucher Incentive Program that provides incentives of up to USD$100,000 for the purchase of Class 4 electric trucks and transit buses and up to USD$90,000 for the purchase of Class 4 battery electric school buses and shuttle buses in the state.

On August 28, 2020, we completed a consolidation of our common shares on the basis of seven pre-consolidation shares for one post-consolidation common share. On the same date, our post-consolidation common shares began trading on Nasdaq and ceased trading on the OTCQB in the US, and the post-consolidation shares continued trading on the TSXV in Canada. A total of three fractional shares were cancelled as a result of the share consolidation. All references to share and per share amounts in this AIF have been retroactively restated to give effect to this share consolidation.

Also on August 28, 2020, we announced the pricing of our U.S. initial public offering of 1,860,000 common shares and concurrent private placement of 25,000 common shares, which closed on September 1, 2020. Both the initial public offering and the concurrent private placement priced at USD$20.00 per share for gross proceeds of USD$37.7 million before underwriting discounts and other costs.

DESCRIPTION OF THE BUSINESS

Summary

We design, build and distribute a full suite of high-floor and low-floor vehicles, including transit buses, school buses, shuttle buses, a double decker bus and cargo van. We employ a clean-sheet design to manufacture all-electric buses that are purpose built to be battery powered with zero emissions. We integrate global suppliers for key components, such as Siemens or TM4 for the drive motors, Knorr for the brakes, ZF for the axles and Parker or I/O Controls for the dash and control systems. This OEM platform allows us to meet the specifications of various operators while providing standard parts for ease of maintenance and accessibility for warranty requirements.

We are an OEM of Class 4-8 commercial, heavy-duty bus chassis for products ranging from a 25-foot Min-eBus to a 45-foot double decker bus. We utilize various contract manufacturers in Malaysia, Taiwan, Hong Kong and China for all of the major components with final assembly in Porterville, California.

We believe our battery-electric commercial vehicles offer fleet operators significant benefits, which include:

- low total cost-of-ownership vs. conventional gas or diesel-powered vehicles;

- lower maintenance costs;

- reduced fuel expenses;

- satisfaction of government mandates to move to zero-emission vehicles;

- decreased vehicle emissions and reduction in carbon footprint.

We currently sell and lease our vehicles to customers directly and through our primary distributor Creative Bus Sales. Creative Bus Sales is considered to be the largest bus dealer in the United States for sales, parts and service. With 18 physical locations, a 75-person sales team, and 200-plus service and support staff, Creative Bus Sales sold thousands of buses in the U.S. last year and represents over 20 of the top bus manufacturers. GreenPower's all-electric zero-emission vehicles are eligible for various funding programs, vouchers and incentives, including:

- the California HVIP program;

- the British Columbia Specialty Use Vehicle Program;

- the New York State voucher program;

- the VW Mitigation Trust Fund;

- CARES ACT federal funding; and

- California Air Quality Management District funding.

Products

EV Star

Greenpower's EV Star platform has six distinct models. The GreenPower EV Star minibus is a purpose built, zero-emission, multi-utility vehicle capable of a range of up to 150 miles. The 25-ft EV Star is designed from the ground up to be battery electric and is offered in 4 configurations. This includes the base model which seats up to 19 passengers and the EV Star Plus, which features a wider body and seats up to 24. Both models can be used for paratransit, employee shuttles, micro transit, and vanpool services. The EV Star is the only class 4 electric vehicle that can be built to meet Buy America Compliance and is Altoona Tested. The seating layout is customizable to an operator's needs with multiple configurations and multiple ADA positions. Additionally, the EV Star CarGo and the EV Star CarGo Plus are both commercially available, zero-emissions delivery solutions. The EV Star CarGo is a van with a capacity of 570 cubic feet and a payload of up to 6,000 pounds. The CarGo plus has a payload of up to 5,000 pounds and 833 cubic feet of storage with an optional lift gate. Finally, for OEMS who wish to use their own body, the EV Star cab and chassis is a purpose-built all electric platform that can be configured with a range of options to serve markets, such as last mile delivery, refuse trucks, and many more. All EV Star platforms are equipped with both J1772-2 and CCS DC Fast charging. They can fully charge in as little as 2 hours or overnight. The EV Star platform can also be configured with an autonomous option and wireless charging.

EV Transit Bus Line

Launched in 2014, our EV battery-electric transit bus line features multiple models that include the 30-ft EV250, the 40-ft EV350, and the double decker EV550. Our electric buses do not have heavy battery storage or battery charging systems on the roof of the bus which enhances the user experience due to the bus's low center of gravity for steering and maneuvering around corners. This design also offers ease-of-access for maintenance due to the low positioned stainless-steel battery trays that can be accessed without removing panels or the use of elaborate hoist systems to maintain the battery boxes.

EV250

The EV250 is our battery-electric 30-ft low floor transit bus with a passenger capacity of 28 seats plus standees. It features a monocoque body with a stainless-steel chassis, a GreenPower battery management system, and component integration with quality global suppliers. The EV250 features a Siemens ELFA traction motor, a 240-kWh battery capacity, and a range of up to 160 miles on a single charge. It is designed to charge using SAE standard chargers that are readily available on the open market and capable of CCS ultra-fast charging.

EV350

The EV350 is our battery-electric 40-ft low floor transit bus with a passenger capacity of 40 seats plus standees. It features a monocoque body with a stainless-steel chassis, a GreenPower battery management system, and component integration with quality global suppliers. The EV350 features a Siemens ELFA traction motor, a 430-kWh battery capacity, and a range of up to 220 miles on a single charge. It is designed to charge using SAE standard chargers that are readily available on the open market and capable of CCS ultra-fast charging.

EV550

The EV550 is our battery-electric 45-ft double-decker bus with a passenger capacity of 100 seats plus standees. It features a monocoque body with a stainless-steel chassis, a GreenPower battery management system, and component integration with quality global suppliers. The EV550 features a Siemens ELFA traction motor, a 500-kWh battery capacity, and a range of up to 300 miles on a single charge. It is designed to charge using SAE standard chargers that are readily available on the open market and capable of CCS ultra-fast charging.

BEAST Type-D School Bus

GreenPower's Type-D School Bus is marketed under the trade name Battery Electric Automotive School Transportation, or the BEAST, features a clean sheet build that was designed from the ground-up around its electric drive and battery systems. The body and chassis are integrated together to form the composite monocoque structure which provides the benefits of increased strength and a significant weight advantage in comparison to other school buses. Additionally, the design is not limited to the inner frame rails like conventional "body on chassis" school buses which allows for the maximization of interior space.

The GreenPower BEAST is offered in a 40-ft 90 passenger design that features a flat tracked floor that gives the end-user complete seating customization that can be modified with ease. The tracked flooring also allows the end-user to customize how many wheelchair positions are located on the bus and their location. Standard features include vehicle control stability, air ride suspension, and ABS brakes. With the 193.5-kWh advanced battery system, the BEAST has a reliable range of up to 150 miles on a single charge. This is paired with a state of the art TM4 electric drivetrain that is rated maintenance free for one million kilometers. The standard J1772 Level 2 charging of the B.E.A.S.T. will fully charge the electric school bus in under 7 hours.

Marketing

Our sales team is focused on the goal of securing purchase orders from commercial transportation companies, transit operators, government agencies and school districts.

Our priority is to generate customers across all of the sectors we are targeting including transit, shuttle, schools, government and commercial. As we can produce the EV Star in the shortest time compared to any of our other products and given the ease with which we can deploy an EV Star we are focused on growing this business in the short term. Many of the customers that we have deployed or are targeting with the EV Star also have other buses in their fleet that we can replace with our all-electric buses such as with our low floor transit products or our Synapse Shuttle. Ultimately, we intend to be the best choice for a vehicle in this segment regardless of the fuel type that the customer chooses. Our sales plan is to meet with the top potential customers and obtain purchase orders for new electric vehicles for their production vehicle requirements. Finally, since our competitive advantage in the marketplace is our ability to provide purpose-built solutions to customers that have unique requirements at relatively low-volume, we are also submitting proposals to companies for purpose-built vehicle applications.

Strategic Relationships

On May 25, 2018, we entered into an agreement with Creative Bus Sales to serve as the primary distributor, except with respect to certain exclusive accounts, in certain states in the United States. Creative Bus Sales will also serve as the sole and exclusive provider of certain repair services and the sole and exclusive distributor of certain vehicle parts in the United States.

We have agreed to work with Momentum to integrate wireless charging into the EV Star. Any sales of EV Stars that incorporate Momentum's wireless technology will be done collaboratively with GreenPower and Momentum. We are also working with Perrone to build a fully autonomous EV Star for the transit market. Any sales of EV Stars that incorporate Perrone's wireless technology will be done collaboratively with GreenPower and Perrone. In December of 2020, we announced that an autonomous EV Star developed with Perrone was delivered to the Jacksonville Transit Authority to undergo testing for transit applications.

During the quarter ended September 30, 2020, GreenPower finalized a three-year dealership agreement with ABC Bus, Inc. covering the state of New York. The agreement provides for 100 vehicles to be purchased by ABC over the next 36 months. With this dealership agreement, GreenPower and ABC Bus Inc. can sell GreenPower's vehicles in the state of New York, which are eligible for several funding programs in the state including the NYSERDA program and the New York Voucher Incentive Program that provides incentives of up to USD$100,000 for the purchase of Class 4 electric trucks and transit buses and up to USD$90,000 for the purchase of Class 4 battery electric school buses and shuttle buses in the state.

Competitive Conditions

Competition varies by sector with EV manufacturers that solely offer all-electric buses (such as BYD, Proterra or Lion) or traditional manufacturers of heavy-duty buses who are entering the market with all-electric buses (such as New Flyer or Blue Bird). In addition, companies such as Workhorse (Nasdaq: WKHS), Chanje, Lightning and XOS are competing with GreenPower in the commercial cargo and delivery van market. We compete with Motiv in the OEM electric cab and chassis market, and GreenPower is the only company that offers a purpose built electric cab and chassis as opposed to a gasoline or diesel cab and chassis that has been converted to an electric cab and chassis.

Some of the key differences between our company and many of our competitors in the heavy-duty bus market is that we use a clean sheet design to offer customers purpose-built solutions. Many of our competitors use an existing layout and then determine where to place the batteries or the drive motor or in some cases retrofit an existing design and build. Several of GreenPower's competitors have raised significantly more capital than GreenPower and have access to capital well in excess of the current financial resources of GreenPower.

We believe that the primary competitive factors within the medium and heavy-duty commercial vehicle market are:

• the difference in the initial purchase prices of electric vehicles and comparable vehicles powered by internal combustion engines, both including and excluding the impact of government and other subsidies and incentives designed to promote the purchase of electric vehicles;

• the total cost of vehicle ownership over the vehicle's expected life, which includes the initial purchase price and ongoing fuel, operational and maintenance costs;

• vehicle quality, performance and safety;

• access to capital in order to fund the ongoing working capital requirements and growth of the business;

• government regulations and economic incentives promoting fuel efficiency and alternate forms of energy; and

• the quality and availability of service and parts for the vehicle.

Components

Batteries

The battery pack is a key component with the design, development, and manufacture of advanced electric-vehicle powertrains. Where some other EV manufacturers build their own battery packs we purchase the batteries in a plug-and-play pack for our designs. This provides us with the flexibility to use different cell manufacturers with different battery chemistries. We believe that the underlying battery cells are a commodity and consequently have designed our products to take full advantage of the best batteries that are available at the time we manufacture our products. The performance of EV battery technology has improved over the past ten years while at the same time the cost of this key component has declined. We anticipate that due to technological advancements and economies of scale, the cost of EV batteries will continue to decline over the next several years.

Powertrains

Our powertrains encompass the complete motor assemblies, computers, and software required for vehicle electrification. We use off-the-shelf proven components such as Siemens for the drive motors for our low floor transit buses and TM4 for our EV Stars or B.E.A.S.T. school buses.

Telematics

The telematics system and associated hardware installed in almost all of our vehicles is designed to monitor the controller area network traffic for specific signals. These signals are uploaded along with GPS data to a server facility. The real-time data is stored in a database as it arrives and delivers updates to clients connected through the web interface. The information transmitted to the cloud and stored onboard the vehicle include: vehicle location, vehicle speed, vehicle energy usage, the amount of charge remaining in the battery, vehicle range, general status of the health of vehicle systems, using onboard diagnostics and driver habits monitoring.

Intangible Properties

We have invested significant resources in developing our suite of all-electric buses. Our buses were developed using a clean-sheet proprietary design and use key components from established third-party suppliers. We do not currently have patents, and licenses, but may choose to obtain patents and licenses on our designs, processes or inventions in the future.

In addition, we do not currently have any registered trademarks, but may choose to register trademarks for our brand and products in the future.

Cycles

The Company does not expect the market for EVs to experience cyclical or seasonal changes.

Economic Dependence

The Company's operations depend on its ability to purchase parts that are source globally from many different suppliers. Most of these suppliers are single-source suppliers even though we attempt to qualify and obtain components from multiple sources whenever feasible. As a result of the COVID-19 global pandemic, many of our suppliers have suspended or scaled back their operations. See "General Description of the Business - Summary" for a list of the suppliers of our main components. The loss of any of these listed suppliers would have a materially adverse impact on the Company's operations. Other parts and materials are expected to be more easily sourced, in the event of disruption in the Company's current supply.

The Company is reliant on its primary distributor Creative Bus Sales. Our relationship with Creative Bus Sales is currently the main driver of our revenue. They will continue to be so as we grow operations for the near future. While the continued relationship with our distributor is currently positive, any change in this status could lead to a materially adverse impact on the Company. Ensuring that this relationship continues is an important aspect of our business operations.

In addition, there are risks associated with foreign operations, including currency risk and regulatory risk. There is a risk that suppliers or customers may copy the products of the Company for their own use. In the event there is a dispute, the Company may be unable to obtain legal remedy or legal proceedings may be prohibitively expensive.

Environmental Protection

Environmental laws and regulations may affect the operations of the Company. We are subject to numerous environmental and health and safety laws, including statutes, regulations, bylaws and other legal requirements. These laws relate to the generation, use, handling, storage, transportation and disposal of regulated substances, including hazardous substances (such as batteries), dangerous goods and waste, emissions or discharges into soil, water and air, including noise and odors (which could result in remediation obligations), and occupational health and safety matters, including indoor air quality. It is expected that the Company, or its subsidiaries, will be required to dispose of the various electronic waste. Failure to dispose of these in a manner compliant with local environmental regulation could expose the Company to penalties and clean-up costs. These legal requirements vary by location and can arise under federal, provincial, state or municipal laws. Any breach of such laws, regulations or requirements may negatively effect on our company and its operating results.

Changes to Contracts

The Company does not reasonably expect any material changes to contracts or business relationships in the current financial year.

Employees

Our workforce is based out of our corporate office in Vancouver, British Columbia, Canada, our sales office in Rancho Cucamonga, California and our manufacturing facilities based in Porterville, California, as well as regional sales managers in the US South and the Mid-West.

The breakdown of full-time employees by main category of activity and geographic location, as at February 15, 2021 is as follows:

Activity | Number of Full-Time Employees | Location |

Engineering, Production, Research & Development | 29 | Vancouver, British Columbia, Canada, Rancho Cucamonga, CA and Porterville, CA |

Sales & Marketing | 8 | Rancho Cucamonga, CA, Orlando, FL, Kansas City, MO, |

General & Administration | 12 | Vancouver, British Columbia, Canada, Porterville, CA, Sacramento, CA, and Rancho Cucamonga, CA. |

Executives | 6 | Vancouver, British Columbia, Canada, Rancho Cucamonga, CA, and Porterville, CA. |

Specialized Skill and Knowledge

There is a specialized skill required for the development, operations, maintenance, sales and marketing of the Company's technology. The Company's current staff possesses the necessary skills and knowledge required for the Company's business; however, additional employees will be added to staff as needed.

As we expand operations and continue to grow, ensuring that all of our employees possess the necessary skills, educations, and appropriate licenses as required by regulatory agencies will be important in sustaining the Company's growth.

Foreign Operations

The Company operates extensively in the state of California sells and leases their products throughout the United States. See "Three Year History of the Business" for details of our foreign operations. As we continue to grow, we expect to expand our United States operations.

Lending

The Company's operations generally do not include any lending operations. Invoices paid by customers must be paid in a reasonable time period.

RISK FACTORS

There are various risk factors that could cause the Company's future results to differ materially from those described in this AIF. The risks and uncertainties described below are those we currently believe to be material, but they are not the only ones we face. If any of the following risks, or any other risks and uncertainties that we have not yet identified or that we currently consider not to be material, actually occur or become material risks, our business, financial condition, results of operations and cash flows, and consequently the price of the common shares, could be materially and adversely affected. The risks discussed below also include Forward-Looking Statements and our actual results may differ substantially from those discussed in the Forward-Looking Statements. See "Note Regarding Forward-Looking Statements" in this AIF.

Risks Related to our Business and Industry

The COVID-19 global pandemic has had and is expected to continue to have a negative impact on our financial results, operations, outlook, goals, growth prospects, cash flows, liquidity and share price, and the potential timing and ultimate duration of these negative impacts is uncertain.

The COVID-19 global pandemic has had, and is expected to continue to have, a material adverse impact on our business and financial condition and may negatively impact our ability to obtain financing on acceptable terms, if at all, to fund shortfalls in our cash flow from operations. The future impact of the COVID-19 global pandemic is inherently uncertain, and is expected to negatively impact the financial ability of our customers to purchase vehicles from us, of our suppliers ability to deliver products used in the manufacture of our all-electric vehicles in a timely manner, if at all, in our employees' ability to manufacture our vehicles and to carry out their other duties in order to sustain our business, and in our ability to collect certain receivables owing to us, among other factors. While we have taken steps to modify our business and staffing levels in order to manage impacts caused by the COVID-19 global pandemic and resulting government and regulatory health orders, these factors are expected to continue to have a negative impact on our financial results, operations, outlook, goals, growth prospects, cash flows, liquidity and share price, and the potential timing and ultimate duration of these negative impacts is uncertain.

Government disaster relief assistance offered in response to COVID-19 could impose limitations on our corporate activities and may not be on terms favorable to us.

Government disaster relief assistance may impose certain requirements and restrictions on our corporate activities, including restrictions on executive officer compensation, share buybacks, dividends, prepayment of debt and other similar restrictions until the aid is repaid or redeemed in full. We cannot provide assurance that any such government disaster relief assistance will not significantly limit our corporate activities or be on terms that are favorable to us. Such restrictions and terms could adversely impact our business and operations.

We have not reached profitability and currently have negative operating cash flows

For the fiscal year ended March 31, 2020, we generated a loss of USD$(5,145,966), bringing our accumulated deficit to USD$(23,852,634).

We have minimal revenues and expect significant increases in costs and expenses as we invest in expanding our production and operations. Even if we are successful in increasing revenues from sales of our products, we may be unable to achieve positive cash flow or profitability for a number of reasons, including but not limited to, an inability to control production costs, increases in our selling general and administrative expenses, and a reduction in our product sales price due to competitive or other factors. An inability to generate positive cash flow and profitability until we reach a sufficient level of sales with positive gross margins that cover operating expenses, or an inability to raise additional capital on reasonable terms, will adversely affect our viability as an operating business.

We operate in a capital-intensive industry and will require a significant amount of capital to continue operations

If the revenue from the sale of our electric buses, if any, is not sufficient to cover our cash requirements, we will need to raise additional funds through the sale of equity or other securities, or the issuance of additional debt. Financing may not be available at terms that are acceptable to us, if at all. The disruption to our business caused by the COVID-19 global pandemic may make it difficult to raise financing on terms acceptable to our company, if at all.

Our ability to obtain the necessary financing for our business is subject to a number of factors, including general market conditions and investor acceptance of our business plan. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise sufficient funds, we will have to significantly reduce our spending, delay or cancel our planned activities, or substantially change our current operations and plans in order to reduce our cost structure. Our competitors, many of which have raised or who have access to significant capital, may be able to compete more effectively in our markets given their access to capital, if our access to capital does not improve or is further limited. We might not be able to obtain any funding, and we might not have sufficient resources to conduct our business as projected, both of which could mean that we would be forced to curtail or discontinue our operations.

Developments in alternative technologies or improvements in the internal combustion engine may materially adversely affect the demand for our electric vehicles

Significant developments in alternative technologies, such as advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements in the fuel economy of the internal combustion engine, may materially and adversely affect our business and prospects in ways we do not currently anticipate. For example, fuel which is abundant and relatively inexpensive in North America, such as compressed natural gas, may emerge as consumers' preferred alternative to petroleum-based propulsion. Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of new and enhanced electric vehicles, which could result in the loss of competitiveness of our vehicles, decreased revenue and a loss of market share to competitors.

If we are unable to keep up with advances in electric vehicle technology, we may suffer a decline in our competitive position

We may be unable to keep up with changes in electric vehicle technology and, as a result, may suffer a decline in our competitive position. Any failure to keep up with advances in electric vehicle technology would result in a decline in our competitive position which would materially and adversely affect our business, prospects, operating results and financial condition. Our research and development efforts may not be sufficient to adapt to changes in electric vehicle technology. As technologies change, we plan to upgrade or adapt our vehicles and introduce new models to continue to provide vehicles with the latest technology. However, our vehicles may not compete effectively with alternative vehicles if we are not able to source and integrate the latest technology into our vehicles at a competitive price. For example, we do not manufacture battery cells or drive motors which makes us dependent upon suppliers of these products for our vehicles.

The majority of our manufacturing is currently contracted out to third party manufacturers and we are dependent on these manufacturers to operate competitively

We currently contract out the majority of the manufacturing of our vehicles to third party manufacturers in Asia, with final assembly performed by our employees in North America. As a result, we are dependent on third party manufacturers to manufacture our vehicles according to our specifications and quality, at a competitive cost and within agreed upon timeframes. If our chosen manufacturing vendors are unable or unwilling to perform these functions, then our financial results and reputation may suffer, which may prevent us from being able to continue as a going concern. In addition, we are subject to inherent risks involved in shipping our vehicles from these primary manufacturers to our facilities in North America. During the shipping process our vehicles are subject to theft, loss or damage due to a number of factors, some of which we may be unable to insure cost-effectively, if at all.

We may need to defend ourselves against intellectual property infringement claims, which may be time-consuming and could cause us to incur substantial costs.

Others, including our competitors, may hold or obtain patents, copyrights, trademarks or other proprietary rights that could prevent, limit or interfere with our ability to make, use, develop, sell or market our products and services, which could make it more difficult for us to operate our business. From time to time, the holders of such intellectual property rights may assert their rights and urge us to take licenses, and/or may bring suits alleging infringement or misappropriation of such rights. We may consider the entering into licensing agreements with respect to such rights, although no assurance can be given that such licenses can be obtained on acceptable terms or that litigation will not occur, and such licenses could significantly increase our operating expenses. In addition, if we are determined to have infringed upon a third party's intellectual property rights, we may be required to cease making, selling or incorporating certain components or intellectual property into the goods and services we offer, to pay substantial damages and/or license royalties, to redesign our products and services, and/or to establish and maintain alternative branding for our products and services. In the event that we were required to take one or more such actions, our business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs, negative publicity and diversion of resources and management attention.

We depend on certain key personnel, and our success will depend on our continued ability to retain and attract such qualified personnel

Our success depends on the efforts, abilities and continued service of our executive officers and management. A number of these key employees have significant experience in the electric vehicle industry, and valuable relationships with our suppliers, customers, and other industry participants. A loss of service from any one of these individuals may adversely affect our operations, and we may have difficulty or may be unable to locate and hire a suitable replacement. We have not obtained any "key person" insurance on any of our executives or managers.

We may be involved in litigation or legal proceedings that are deemed to be material and may require recognition as a provision or a contingent liability on our financial statements.

We may in the future be involved in litigation or legal proceedings that are material and may require recognition as a provision or contingent liability on our financial statements. We have filed a civil claim against the former CEO and a director of our company in the Province of British Columbia, and he has filed a response with a counterclaim for wrongful dismissal in the Province of British Columbia.. In addition, a company that was previously owned by the brother of the former CEO and director of our company, and that was dissolved by the B.C. Corporate Registry on November 6, 2015 and only reinstated on June 29, 2020, has filed vague claims that we have misused certain unspecified designs that purportedly belong to this company. We do not expect the outcome of either our claim, or the claims filed against us, to be material, and as of the date of this AIF the resolution of these claims, including the potential timing or financial impact of these claims is inherently uncertain. However, we may in the future determine that this claim becomes material or we may be subject to other claims that alone or in addition to other claims are considered to be material, and require recognition as a provision or contingent liability on our financial statements.

We are subject to numerous environmental and health and safety laws and any breach of such laws may have a material adverse effect on our business and operating results

We are subject to numerous environmental and health and safety laws, including statutes, regulations, bylaws and other legal requirements. These laws relate to the generation, use, handling, storage, transportation and disposal of regulated substances, including hazardous substances (such as batteries), dangerous goods and waste, emissions or discharges into soil, water and air, including noise and odors (which could result in remediation obligations), and occupational health and safety matters, including indoor air quality. These legal requirements vary by location and can arise under federal, provincial, state or municipal laws. Any breach of such laws, regulations or requirements could have a material adverse effect on our company and its operating results.

Our vehicles are subject to motor vehicle standards and the failure to satisfy such mandated safety standards would have a material adverse effect on our business and operating results.

All vehicles sold must comply with federal, state and provincial motor vehicle safety standards. In both Canada and the United States, vehicles that meet or exceed all federally mandated safety standards are certified under the federal regulations. In this regard, Canadian and U.S. motor vehicle safety standards are substantially the same. Rigorous testing and the use of approved materials and equipment are among the requirements for achieving federal certification. Failure by us to have our current or future electric vehicles satisfy motor vehicle standards would have a material adverse effect on our business and operating results.

If our vehicles fail to perform as expected, our ability to continue to develop, market and sell our electric vehicles could be harmed

Our vehicles may contain defects in design and manufacture that may cause them not to perform as expected or that may require repair. For example, our vehicles use technologically complex battery management software to operate. Given the inherent complexity of this software, it may contain defects and errors which would adversely impact the operation of our vehicles. While we have performed extensive testing of our vehicles, we currently have a limited frame of reference to evaluate the performance of our vehicles in the hands of our customers under a range of operating conditions.

We may not succeed in establishing, maintaining and strengthening the GreenPower brand, which would materially and adversely affect customer acceptance of our vehicles and components and our business, revenues and prospects.

Our business and prospects heavily depend on our ability to develop, maintain and strengthen the GreenPower brand. Any failure to develop, maintain and strengthen our brand may materially and adversely affect our ability to sell our planned electric vehicles. If we are not able to establish, maintain and strengthen our brand, we may lose the opportunity to expand our customer base. Promoting and positioning our brand will depend significantly on our ability to provide high quality electric vehicles and maintenance and repair services, and we have limited experience in these areas. In addition, we expect that our ability to develop, maintain and strengthen the GreenPower brand will also depend heavily on the success of our marketing efforts. To date, we have limited experience with marketing activities as we have relied primarily on the internet, word of mouth and attendance at industry trade shows to promote our brand. To further promote our brand, we may be required to change our marketing practices, which could result in substantially increased advertising expenses. We operate in a competitive industry, and we may not be successful in building, maintaining and strengthening our brand. Many of our current and potential competitors, particularly automobile manufacturers headquartered in the United States, Japan and the European Union have greater name recognition, broader customer relationships and substantially greater marketing resources than we do. If we do not develop and maintain a strong brand, our business, prospects, financial condition and operating results will be materially and adversely impacted.

We are dependent on our suppliers, many of which are single-source suppliers, and the inability of these suppliers to deliver necessary components of our products according to our schedule and at prices, quality levels and volumes acceptable to us, or our inability to efficiently manage these components, could have a material adverse effect on our financial condition and operating results.

Our products contain numerous purchased parts which we source globally directly from suppliers, many of which are single-source suppliers, although we attempt to qualify and obtain components from multiple sources whenever feasible. Any significant increases in our production may require us to procure additional components in a short amount of time, and in the past we have also replaced certain suppliers because of their failure to provide components that met our quality control standards or our timing requirements. Many of our suppliers have either temporarily suspended their operations or scaled back their operations in order to comply with government and regulatory orders and to protect the health of their employees due to the COVID-19 global pandemic. At this point the ultimate timing, and whether our supplier's business and output will return to normal levels is unknown and uncertain. There is no assurance that we will be able to secure additional or alternate sources of supply for our components or develop our own replacements in a timely manner, if at all. If we encounter unexpected difficulties with key suppliers, and if we are unable to fill these needs from other suppliers, we could experience production delays and potential loss of access to important technology and parts for producing, servicing and supporting our products.

This limited, and in many cases single source, supply chain exposes us to multiple potential sources of delivery failure or component shortages for production of our products. Furthermore, unexpected changes in business conditions, materials pricing, labor issues, wars, governmental changes, and natural disasters could also affect our suppliers' ability to deliver components to us on a timely basis. The loss of any single or limited source supplier or the disruption in the supply of components from these suppliers could lead to product design changes and delays in product deliveries to our customers, which could hurt our relationships with our customers and result in negative publicity, damage to our brand and a material and adverse effect on our business, prospects, financial condition and operating results.

Changes in our supply chain may lead to an increased cost for our products. We have also experienced cost increases from certain of our suppliers in order to meet our quality targets and timelines as well as due to our design changes, and we may experience similar cost increases in the future. Certain suppliers have sought to renegotiate the terms of supply arrangements. Additionally, we are negotiating with existing suppliers for cost reductions and are seeking new and less expensive suppliers for certain parts. If we are unsuccessful in our efforts to control and reduce supplier costs, our operating results will suffer.

There is no assurance that our suppliers will be able to sustainably and timely meet our cost, quality and volume needs. Furthermore, if the scale of our vehicle production increases, we will need to accurately forecast, purchase, warehouse and transport to our manufacturing facilities components at much higher volumes. If we are unable to accurately match the timing and quantities of component purchases to our actual needs, or successfully manage our inventory to accommodate the increased complexity in our supply chain, we may incur unexpected production disruption, storage, transportation and write-off costs, which could have a material adverse effect on our financial condition and operating results.

The reduction or elimination of government and economic incentives, funding approval or the delay in the timing of advancing funding that has been approved, in particular in the state of California, could have a material adverse effect on our business, financial condition, operating results and prospects.

Any reduction, elimination or discriminatory application of government subsidies and economic incentives because of policy changes, the reduced need for such subsidies and incentives for electric vehicles may result in the diminished competitiveness of the alternative fuel vehicle industry generally or our electric vehicles in particular. This could materially and adversely affect the growth of the alternative fuel automobile markets and our business, prospects, financial condition and operating results.

Our vehicles are eligible for vouchers from specific government programs, including the HVIP from the CARB in partnership with Calstart, the clean trucks NYSERDA program and the New York Voucher Incentive Program, and the Specialty-Use Vehicle Incentive Program funded by the Province of British Columbia, Canada. The ability for potential purchasers to receive funding from these programs is subject to the risk of the programs being funded by governments, and the risk of the delay in the timing of advancing funds to the specific programs. To the extent that program funding is not approved, or if the funding is approved but timing of advancing of funds is delayed, subject to cancellation, or otherwise uncertain, this could have a material adverse effect on our business, financial condition, operating results and prospects. On November 1, 2019, CARB announced that it had received voucher requests for the entire USD$142 million budget allocated to the HVIP program for the current fiscal year and does not anticipate it will accept new voucher requests until late 2020 when fiscal 2020-21 funding becomes available. This announcement has negatively impacted new sales prospects for GreenPower buses in the state of California.

To date the vast majority of our electric vehicle sales have been in the state of California, in part due to subsidies and grants for electric vehicles and electric charging infrastructure available from the California state government. In some cases these grants or subsidies have covered the entire vehicle cost, and in many cases the grants or subsidies have reduced the net cost to our customers to a point that the vehicle is less expensive than purchasing a comparable diesel powered vehicle. The recent announcement from CARB that it is no longer accepting new applications to the HVIP program until new funding for the program is identified has negatively impacted new sales prospects for GreenPower buses in the state of California and any further reduction or elimination of the grants or incentives in the state of California would have a material negative impact on our business, financial condition, operating results and prospects.

If we fail to manage future growth effectively, we may not be able to market and sell our vehicles successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and financial condition. We are expecting significant growth in sales, and are currently expanding our employees, facilities and infrastructure in order to accommodate this growth. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. Risks that we face in undertaking this expansion include:

• training new personnel;

• forecasting production and revenue;

• controlling expenses and investments in anticipation of expanded operations;

• establishing or expanding manufacturing, sales and service facilities;

• implementing and enhancing administrative infrastructure, systems and processes;

• addressing new markets; and

• establishing international operations.

We intend to continue to hire a number of additional personnel, including manufacturing personnel and service technicians for our electric vehicles. There is significant competition for individuals with experience manufacturing and servicing electric vehicles, and we may not be able to attract, assimilate, train or retain additional highly qualified personnel in the future. The failure to attract, integrate, train, motivate and retain these additional employees could harm our business and prospects.

Our business may be adversely affected by labor and union activities.

Although none of our employees are currently represented by a labor union, it is common throughout the automobile industry for employees to belong to a union. Having a unionized workforce may result in higher employee costs and increased risk of work stoppages. Additionally, we are in the process of expanding our in-house manufacturing capabilities and increasing the number of employees in this area. If our employees engaged in manufacturing were to unionize, this may increase our future production costs and negatively impact our gross margins and financial results.

We also directly and indirectly depend upon other companies with unionized work forces, such as parts suppliers and trucking and freight companies, and work stoppages or strikes organized by such unions could have a material adverse impact on our business, financial condition or operating results. If a work stoppage occurs within our business or in one of our key suppliers, it could delay the manufacture and sale of our electric vehicles and have a material adverse effect on our business, prospects, operating results and financial condition.

We may become subject to product liability or warranty claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

We may become subject to product liability or warranty claims, which could harm our business, prospects, operating results and financial condition. The automobile industry experiences significant product liability claims and we face inherent risk of exposure to claims in the event our vehicles do not perform as expected or malfunction resulting in personal injury or death. Our risks in this area are particularly pronounced given our vehicles have only been operating for a short period of time. A successful product liability claim against us could require us to pay a substantial monetary award. Moreover, a product liability claim could generate substantial negative publicity about our vehicles and business which would have a material adverse effect on our brand, business, prospects and operating results.

Global economic conditions could materially adversely impact demand for our products and services.

Our operations and performance depend significantly on economic conditions. The COVID-19 global pandemic and resulting government health regulations have resulted in significant reductions in global economic output and have negatively impacted global economic conditions. The ultimate impact and duration of current negative global economic conditions are highly uncertain. Uncertainty about global economic conditions could result in customers postponing purchases of our products and services in response to tighter credit, unemployment, negative financial news and/or declines in income or asset values and other macroeconomic factors, which could have a material negative effect on demand for our products and services and, accordingly, on our business, results of operations or financial condition.

The trade agreement with China includes tariffs on goods imported to the U.S. from China, and these tariffs negatively impact our financial performance, financial position, and financial results.

The United States and China signed a trade agreement in January 2020 after a trade war between the two countries led to the implementation of tariffs on approximately USD$360 billion of Chinese imports to the United States. The trade agreement includes terms providing protection for intellectual property and includes a commitment from China to purchase goods and services from the United States, however the majority of the current tariffs on goods imported to the United States from China will remain in place under the trade agreement. GreenPower's buses include parts and components imported from China, and tariffs are applied to imports of these products to the United States. These tariffs have increased the cost of GreenPower's buses imported to the United States and have had and will continue to have a negative impact on our gross margins, profitability, financial performance and financial position. Any escalation of the tariffs on imported goods from China to the United States will cause further negative impacts to our gross margin, profitability, financial performance and financial position.

Our line of credit contains covenant restrictions that may limit our ability to access funds on the line of credit or engage in other commercial activities.

The terms of our line of credit contains, and future debt agreements we enter into may contain, covenant restrictions that limit our ability to incur additional debt or issue guarantees, create liens, and make certain dispositions of property or assets. As a result of these covenants, our ability to respond to changes in business and economic conditions and engage in beneficial transactions, including obtaining additional financing as needed, may be restricted. Furthermore, our failure to comply with our debt covenants could result in a default under our line of credit, which would permit the lender to demand repayment.

The demand for commercial zero-emission electric vehicles depends, in part, on the continuation of current trends resulting from historical dependence on fossil fuels. Extended periods of low diesel or other petroleum-based fuel prices could adversely affect demand for electric vehicles, which could adversely affect our business, prospects, financial condition and operating results.

We believe that much of the present and projected demand for commercial zero-emission electric vehicles results from concerns about volatility in the cost of petroleum-based fuel, the dependency of the United States on oil from unstable or hostile countries, government regulations and economic incentives promoting fuel efficiency and alternative forms of energy, as well as the belief that poor air quality and climate change results in part from the burning of fossil fuels. If the cost of petroleum-based fuel decreased significantly, or the long-term supply of oil in the United States improved, the government may eliminate or modify its regulations or economic incentives related to fuel efficiency and alternative forms of energy. If there is a change in the perception that the burning of fossil fuels does not negatively impact the environment, the demand for commercial zero-emission electric vehicles could be reduced, and our business and revenue may be harmed. Diesel and other petroleum-based fuel prices have been extremely volatile, and we believe this continuing volatility will persist. Lower diesel or other petroleum-based fuel prices over extended periods of time may lower the current perception in government and the private sector that cheaper, more readily available energy alternatives should be developed and produced. If diesel or other petroleum-based fuel prices remain at deflated levels for extended periods of time, the demand for commercial electric vehicles may decrease, which could have an adverse effect on our business, prospects, financial condition and operating results.

We may be compelled to undertake product recalls.

Any product recall in the future may result in adverse publicity, damage to our brand and may adversely affect our business, prospects, operating results and financial condition. We may at various times, voluntarily or involuntarily, initiate a recall if any of our electric vehicle components prove to be defective. Such recalls, voluntary or involuntary, involve significant expense and diversion of management attention and other resources, which would adversely affect our brand image in our target markets and could adversely affect our business, prospects, financial condition and results of operations.

Security breaches and other disruptions to our information technology networks and systems could substantially interfere with our operations and could compromise the confidentiality of our proprietary information, notwithstanding the fact that no such breaches or disruptions have materially impacted us to date.

We rely upon information technology systems and networks, some of which are managed by third-parties, to process, transmit and store electronic information, and to manage or support a variety of business processes and activities, including supply chain management, manufacturing, invoicing and collection of payments from our customers. Additionally, we collect and store sensitive data, including intellectual property, proprietary business information, the proprietary business information of our suppliers, as well as personally identifiable information of our employees, in data centers and on information technology systems. The secure operation of these information technology systems, and the processing and maintenance of this information, is critical to our business operations and strategy. Despite security measures and business continuity plans, our information technology systems and networks may be vulnerable to damage, disruptions or shutdowns due to attacks by hackers or breaches due to errors or malfeasance by employees, contractors and others who have access to our networks and systems, or other disruptions during the process of upgrading or replacing computer software or hardware, hardware failures, software errors, third-party service provider outages, power outages, computer viruses, telecommunication or utility failures or natural disasters or other catastrophic events. The occurrence of any of these events could compromise our systems and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability or regulatory penalties under laws protecting the privacy of personal information, disrupt operations and reduce the competitive advantage we hope to derive from our investment in technology. Our insurance coverage may not be available or adequate to cover all the costs related to significant security attacks or disruptions resulting from such attacks.

Our electric vehicles make use of lithium-ion battery cells, which, if not appropriately managed and controlled, have occasionally been observed to catch fire or vent smoke and flames. If such events occur in our electric vehicles, we could face liability associated with our warranty, for damage or injury, adverse publicity and a potential safety recall, any of which would adversely affect our business, prospects, financial condition and operating results.

The battery packs in our electric vehicles use lithium-ion cells, which have been used for years in laptop computers and cell phones. Highly publicized incidents of laptop computers and cell phones bursting into flames have focused consumer attention on the safety of these cells. These events also have raised questions about the suitability of these lithium-ion cells for automotive applications. There can be no assurance that a field failure of our battery packs will not occur, which would damage the vehicle or lead to personal injury or death and may subject us to lawsuits. Furthermore, there is some risk of electrocution if individuals who attempt to repair battery packs on our vehicles do not follow applicable maintenance and repair protocols. Any such damage or injury would likely lead to adverse publicity and potentially a safety recall. Any such adverse publicity could adversely affect our business, prospects, financial condition and operating results.

It may be difficult for non-Canadian investors to obtain and enforce judgments against us because of our Canadian incorporation and presence.

We are a corporation existing under the laws of British Columbia, Canada. Some of our directors and officers, and the experts named in this AIF, are residents of Canada, and all or a substantial portion of their assets, and a substantial portion of our assets, are located outside the United States. Consequently, although we have appointed an agent for service of process in the United States, it may be difficult for holders of our common shares who reside in the United States to effect service within the United States upon our directors and officers and experts who are not residents of the United States. It may also be difficult for holders of our common shares who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors, officers and experts under the United States federal securities laws. Investors should not assume that Canadian courts (i) would enforce judgments of United States courts obtained in actions against us or our directors, officers or experts predicated upon the civil liability provisions of the United States federal securities laws or the securities or "blue sky" laws of any state within the United States or (ii) would enforce, in original actions, liabilities against us or our directors, officers or experts predicated upon the United States federal securities laws or any such state securities or "blue sky" laws.

We are an "emerging growth company," and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our common shares less attractive to investors.

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012, or the "JOBS Act". For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We will cease to be an emerging growth company upon the earliest of:

- the last day of the fiscal year during which we have total annual gross revenues of USD$1,000,000,000 (as such amount is indexed for inflation every five years by the Securities and Exchange Commission or more);

- the last day of our fiscal year following the fifth anniversary of the completion of our first sale of common equity securities pursuant to an effective registration statement under the Securities Act of 1933;

- the date on which we have, during the previous three-year period, issued more than USD$1,000,000,000 in non- convertible debt; or

- the date on which we are deemed to be a "large accelerated filer", as defined in Rule 12b-2 of the Securities Exchange Act of 1934.

We cannot predict if investors will find our common shares less attractive because we may rely on these exemptions. If some investors find our common shares less attractive as a result, there may be a less active trading market for our common shares and our share price may be more volatile.

As a foreign private issuer, we are not subject to certain United States securities law disclosure requirements that apply to a domestic United States issuer, which may limit the information that would be publicly available to our shareholders.

As a foreign private issuer, we will be exempt from certain rules under the Securities Exchange Act of 1934 that impose disclosure requirements as well as procedural requirements for proxy solicitations under Section 14 of the Securities Exchange Act. In addition, our officers, directors and principal shareholders will be exempt from the reporting and "short-swing" profit recovery provisions of Section 16 of the Securities Exchange Act. Moreover, we are not required to file periodic reports and financial statements with the Securities and Exchange Commission as frequently or as promptly as a company that files as a U.S. domestic issuer whose securities are registered under the Securities Exchange Act of 1934, nor are we generally required to comply with the Securities and Exchange Commission's Regulation FD, which restricts the selective disclosure of material non-public information. For as long as we are a "foreign private issuer" we intend to file our annual financial statements on Form 20-F and furnish our quarterly updates on Form 6-K to the Securities and Exchange Commission. However, the information we file or furnish is not the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for U.S. domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a U.S. domestic issuer.

Our shareholders approved a shareholder rights plan which may be implemented by management and may impede a change in control.

Our shareholders approved a shareholder rights plan which has not been implemented by management, but which, if implemented, may impede a change in control. The shareholder rights plan provides for the issuance of one right for each common share of our company outstanding, and the rights become separable and exercisable upon the receipt of a take-over bid or similar proposal other than those meeting certain conditions or those that are exempted by the Board. The potential for the rights becoming separable and exercisable may have the effect of impeding a change of control of our company.

The report of our independent registered public accounting firm for the year ended March 31, 2020 includes a "going concern" explanatory paragraph.