UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

SEMIANNUAL REPORT PURSUANT TO

REGULATION A OF THE SECURITIES ACT OF 1933

For the annual period ended December 31, 2021

COLABS INT’L, CORP.

(Exact name of issuer as specified in its charter)

| Nevada | | 26-3233192 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

| | | |

| 18593 Main St, Huntington Beach, CA | | 92648 |

| (Address of principal executive offices) | | (ZIP Code) |

(888) 878-5536

(Issuer’s telephone number, including area code)

Common Stock

(Title of each class of securities issued pursuant to Regulation A)

TABLE OF CONTENTS

ITEM 1. BUSINESS

Corporate Structure

CoLabs Int’l, Corp. (the “Company,” “CoLabs,” “we,” “our,” and “us”) was incorporated on August 5, 2008 under the laws of the State of Nevada as an OTC pharmaceutical company with multi-market applications for our revolutionary targeted epidermal-drug delivery system which is identified as: QuantaSphere® Technology (QS®).

We currently hold 28 issued patents and have an additional 16 patent applications pending.

Overview

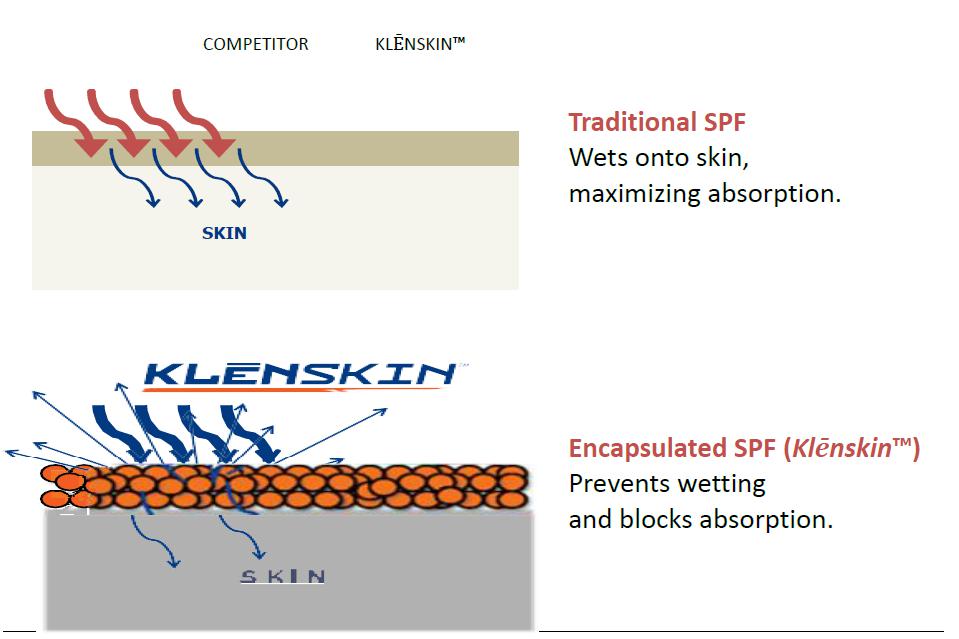

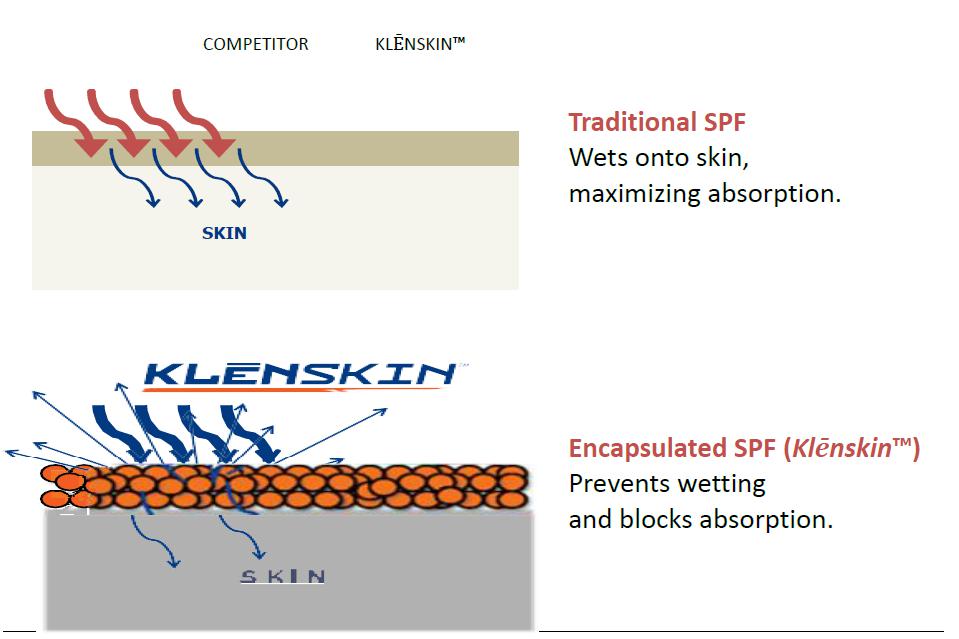

Our technology places OTC drugs, pharmaceuticals, chemicals, and agrochemicals into micro-sized, electrostatically charged encapsulates as well as into other types of micro-encapsulates. These encapsulates are then suspended in uniquely designed formulations. This formulation of a highly advanced micro-technology can: target the delivery of topically applied drugs; limit unwanted absorption of chemicals, drugs, and cosmetics through the skin; and provide a designed release of active ingredients with a prescribed depth of skin penetration.

We have already developed commercially unique and innovative targeted skin delivery systems for topical pharmacology. Our technology limits unwanted side effects that can occur as a result of absorption through the skin. The penetration of chemicals through the skin can have serious impact on the body’s organs and systems. Our current applications include anti-bacterial/viral sanitizers/soaps, sunscreens, pest-repellents, and healing cosmetic lotions. For consumers, we provide elegant skin delivery of topically applied drugs and cosmetics. This combined end purpose is the unique foundation of our technology.

The Issue—Risk of Toxic Absorption of Drugs and Chemicals when Placed on Skin:

We believe that major issues exist for the direct topical application for pharmaceutical ingredients. When drugs are applied to our largest organ, the skin, toxicity from absorption may occur. The FDA recently released an alarming, highly publicized study that revealed that topically applied sunscreens were detected in blood after several reapplications (Journal of the American Medical Association, May 6, 2019).

The Toxic Substances Control Act defines a “toxic effect” as an adverse change in the structure or function of the test subject produced as a result of exposure to a chemical substance. This adverse change can be acute, subchronic, or from chronic exposure. Acute toxicity tests demonstrate the immediate effects of exposure which occur usually within eight hours of exposure. Subchronic toxicity results show toxicity effects that occur over a period of weeks. Longer term chronic effects tests measure long-term exposure effects which are revealed in months or even years. The skin is one route of exposure. This transdermal route, sometimes shown in combination with other routes, can produce toxic effects and is a frequently tested route. The testing of product ingredients from natural or manufactured substances is used to determine the safety of cosmetics, pharmaceuticals, food additives, pesticides, chemicals, additives, and consumer products. Toxic effects, when discovered, can result and produce a variety of symptoms that can be manifested acutely or in the long term and these testing requirements are designed to avoid potential toxicity exposure.

A scientific article published in the May 6, 2019, Journal of the American Medical Association, describes the results of an exploratory maximal usage trial (MUsT) evaluating the systemic absorption (through the skin and into the body) of sunscreen active ingredients using four commercially available sunscreen products applied under maximal use conditions. A MUsT study evaluates the systemic absorption of a topical drug (i.e., one applied to the skin) when used according to the maximum limits of the product’s directions for use. Because sunscreens are formulated to work on the surface of the skin, many assumed that sunscreens would not be absorbed in appreciable quantities and therefore that MUsT studies would be unnecessary. However, in this pilot study, all four active ingredients tested were absorbed from each formulation tested, showing that absorption of sunscreens is not just a theoretical concern.

While the fact that an ingredient is absorbed through the skin and into the body does not mean the ingredient is per se unsafe, the FDA expressed concern that further testing to determine the safety of that ingredient for repeated use is necessary. Such testing is part of the standard pre-market safety evaluation of most chronically administered drugs with appreciable systemic absorption. The FDA proposed updating the regulatory requirements for most sunscreen products in the United States, where sunscreens are regulated as drugs. Initial FDA studies (as described in the May 6, 2019 Journal of the American Medical Association article), which followed FDA application protocols, showed sunscreen active ingredients were absorbed into the bloodstream at a level of 0.5 ng/mL (nanograms per milliliter) or higher. Further testing is required to determine the risk for cancer, birth defects, or other adverse effects. Currently, as there are no toxicity studies on sunscreen absorption, the FDA does not know what levels of absorption can be considered safe.

The potential threat to users of topical skin medications provides the key significance for our unique science for medicine and vast consumer products. Notably, the FDA is in the process of developing new testing protocols (MUsT) for topical OTC drugs to evaluate their effects on the body when absorbed. This major issue is the target of our QS® Technology. (See “Description of Business” – “FDA: Maximum Usage Trials (MUsT) for Topical Active Ingredients.”)

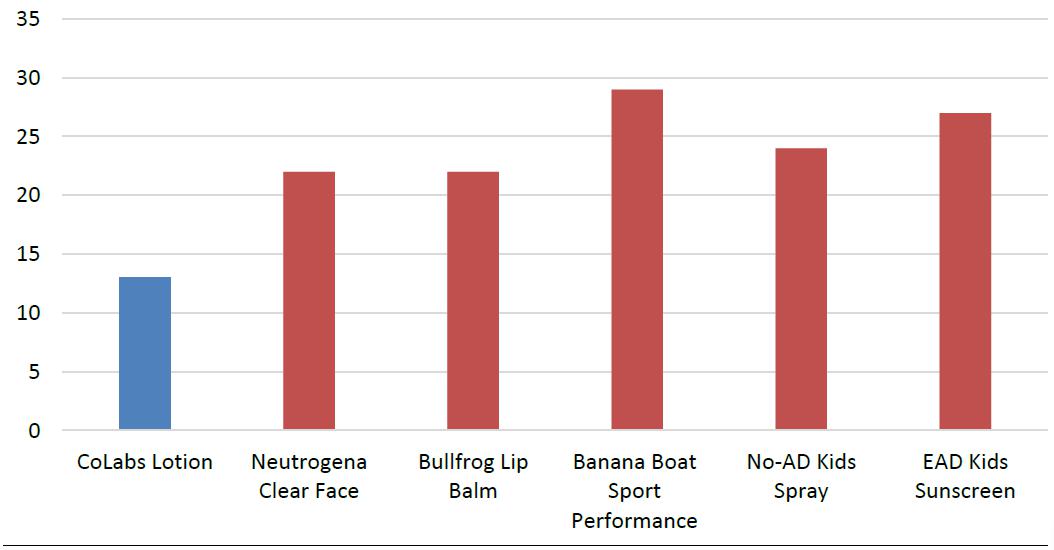

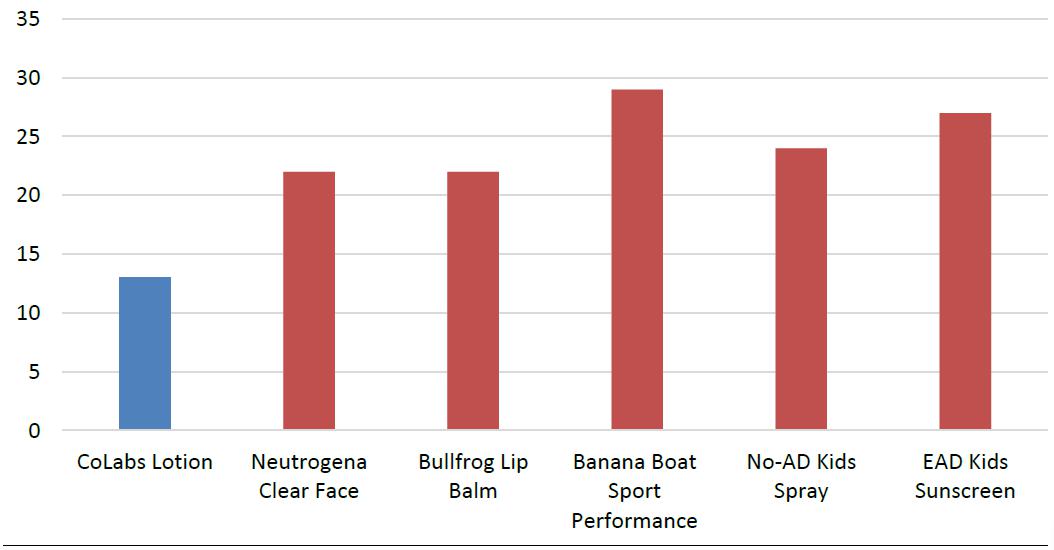

QS® Technology is designed to improve effectiveness, durability, and tenaciousness as compared to other current competing application systems. Based on our own independent testing, we found that several of our current competitors’ skin medications offered uncontrolled release and systemic absorption, as compared to our products. We believe that these issues may be unacceptable to a growing number of knowledgeable consumers.

Our Innovative Solution:

We can introduce selected cosmetic drugs as well as FDA and EPA approved pharmaceutical and chemical active ingredients into proprietary Quantasphere® formulations. When these chemical active ingredients are adapted in our new delivery system, they are enhanced in terms of the targeted delivery of the active drug agent.

We believe that our delivery system is a market disruptive, generational step to improve topical drug delivery. We believe that our QS® formulations can reduce absorption of ingredients while still being effective. New formulations include slow or time-release systems for new pharmacology actives.

It is important to note that we are providing topical delivery for existing drug active ingredients. We are not currently developing and introducing new drugs for which a New Drug Application (“NDA”) is required. Thus, as new product formulations are developed, we may be able to avoid the long and costly FDA NDA process. We have also engaged a highly regarded FDA law firm to provide necessary FDA legal guidance and support for our products.

Regulatory Landscape

The regulatory landscape affecting our products is primarily controlled by the FDA, the EPA, and state regulatory agencies. Cosmetics, unless proven to be injurious, are not regulated by the FDA. Sunscreens are subject to guidelines outlined under 21 CFR 352 - Sunscreen Products for Over-the-Counter Human Use. We believe that our currently offered sunscreen products comply with the FDA Final Rule for sunscreen products under 21 CFR 352 Sunscreen products for Over-the-Counter Human Use. The FDA requires specific testing to ensure that all OTC products meet certain criteria. These tests have specific guidelines and protocols in order to determine the efficacy and safety of the products when used by consumers, all of which are delineated in the monograph. In addition, there are specific tests associated with OTC products and non-OTC products (i.e., cosmetics). The testing required for cosmetics is in place to ensure that the product is safe from microbes and pathogens through a stability criteria. Other tests may also be performed in order to meet any specific claims made for each product (e.g., comedogenicity testing in order to prove that the product is non-comedogenic).

Pest repellents are subject to EPA and state regulations. All ingredients in our pest repellent formulations comply with the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) Minimum Risk Exemption regulations in 40 CFR 152.25(f) and our pest repellent products are thereby exempt from EPA registration. We only sell our products in states where our pest repellents are fully compliant with state law. Currently, our pest repellents are not compliant for sale only in the state of Indiana.

We have independent testing conducted for all of our products with regard to the regulatory testing protocols. We work with five different testing facilities that each perform different tests on our products. All of the testing facilities are GMP certified.

Intellectual Property

The current patent portfolio covering our QS® Technology and the products we currently commercialize are entirely owned by us. We were granted utility patents in France, Germany, Mexico, Japan, United Kingdom, and the United States, and have pending patent applications in Australia, Europe, and the United States. The series of products marketed under Klēnskin SPF 30 WashOn Sunscreens have patent protection in all of the aforementioned countries until November 6, 2033, except for Mexico, which expires on January 31, 2026. Klēnskin SPF 50 lotion and SPF 30 stick products have patent protection in France, Germany, Japan, United Kingdom, and the United States until November 6, 2033 and pending applications in Europe and the United States. Klēnskin SPF 20 SunBar products have patent protection in Japan and the United States until November 6, 2033. Klēnskin SPF 50 lip balm products have patent protection in Japan until November 6, 2033 and applications pending in Europe and the United States. Klēnskin insect repellent stick products have patent protection in the United States until November 6, 2033.

The current trademark portfolio is also entirely owned by us. KLĒNSKIN is registered in Canada, China, Europe, Japan, Singapore, and the United States in international class (IC) 003 for non-medicated skincare preparations and sunscreen preparations and 005 for medicated sunscreen preparations and insect repellents (China, Singapore, and United States only). A Malaysian trademark application for KLĒNSKIN is currently pending. The QS® logo is registered in Europe, Japan, and the United States in IC 001 for cellulose in capsule form and QUANTASPHERE® is registered in the United States in IC 001 for cellulose in capsule form. WASH ON is registered in Japan and the United States in IC 003 for sunscreen preparations and SHOWER ON is registered in the United States in IC 003 for sunscreen preparations.

Business Structure and Operations

We are a mid-stage biotech company, having developed patented, tested formulations, and commercialized products since 2008. We have four full time employees and seven independent contractors. We also have contracted laboratories for development and testing, specialized attorneys, and manufacturing facilities to support our operations.

We believe our unique and scientifically advanced technology will make us a global leader in targeted epidermal delivery systems for cosmeceuticals, fragrance delivery, antibacterial/anti-viral sanitizers/cleaners, and most importantly, topical pharmacology.

We directly market select products through the internet and in dermatologists’ offices. Additionally, we develop marketing relationships whereby we supply formulatory guidance and base formulations directly to our partners for distribution. As a supplier, we sell ingredients and/or finished products into this expanding distribution channel. We have also expanded sunscreen and sanitizers/soap distribution for our Klēnskin™ products internationally.

Our QuantaSphere® (QS®) Technology formulations provide advanced proprietary, epidermal therapeutic effects that are unique and market disruptive. As such, our products are consumer friendly. QS® Technology blends consumer needs for a healthy lifestyle with our targeted, eco-friendly, multi-tasking product. Our innovative QS® Technology reduces the penetration of active ingredients into the skin and can be applied in a variety of applications.

We have shown, in our tested and commercialized sun protection factor (“SPF”) and moisturizing formulations, that they provide anti-aging and cosmetically elegant protection. Importantly, this is being validated under the most gruelling sun-sport applications. Our Klēnskin™ SPF sunscreen, has been the official sunscreen of both the AVP Beach Volleyball Series and the International FIVB - World Series of Beach Volleyball, Auto Club Speedway, and Talladega Superspeedway.

Distribution

We have been focused on our Intellectual Property (“IP”) research and development and have not had a major shift of our attention to the marketing of our products, which is the focus of our use of proceeds of this Offering. (See “Use of Proceeds – Marketing.”)

Historically, a significant portion of our sales have come from two customers. However, during the year ended December 31, 2021 and 2020, a majority of sales were to Advanced Dermatology Care Center, a dermatology practice owned by Dr. Laura Cohen, our Chief Executive Officer, and which were $19,000 and $21,000, respectively, accounting for 24% and 20% of our revenue, respectively.

Domestically, we have participated in sports marketing and marketing to physicians to gain insight into the consumer acceptance of our products. As a result of these efforts, both distributors and retailers who have been exposed to our products have sought to engage in the sales of our products. Internationally, we have an agreement with Spero from which all of our international sales have been derived to date. With this Offering and deploying our marketing plan (see “Description of Business —Marketing Direction”), we plan to reduce our reliance on our current major customers/distributors.

We have a Distribution Agreement with Spero for the distribution of our Klēnskin™ products in the territory of Singapore, Malaysia, Vietnam, and Sri Lanka (as used in this paragraph, the “territory”). The Distribution Agreement provides Spero with a limited-exclusive right to market, sell, and distribute to retail distributors in the territory and the right to appoint any sub-distributors, retailers, or dealers for the Klēnskin™ products in the territory. The Distribution Agreement requires that Spero purchase minimum quantities of the Klēnskin™ products every year, 50% of the payment due at the time of order and the final payment due upon notification that the order is available for shipment to Spero. However, due to COVID-19 pandemic restrictions, we did not ship any products internationally during the year ended December 31, 2020. However, we resumed our international shipping to Spero in the latter half of 2021 and are continuing such shipments currently.

Our Facilities and Manufacturing

We are a Nevada corporation, with our administrative offices located in Huntington Beach, California. Our CEO, President, and CFO operate from Huntington Beach, and with its inventory space, we are able to fulfill our current product orders.

We operate a product development facility in Sarasota, Florida for our development, product design, and formulation. Daniel Traynor, our Vice-President of Product Development works in this Sarasota laboratory facility.

We also utilize certain manufacturing facilities that are compliant with FDA manufacturing guidelines that receive the specified raw materials for the manufacturing process of our commercialized products. Certain lotions and Wash-On™ products are manufactured in Florida. Our new solid SPF 30 Sticks and flavorful SPF 50 lip balms were introduced into the market in mid-2019. These are produced with a third-party manufacturer.

We also have partnerships in Asia which are expanding in several countries with a focus on the distribution of our Wash-On™ sunscreens and insect repellent products including pipeline soaps, with both natural and chemical repellents. A new ingredient-based bar-soap is in development and formulated for manufacture in the U.S. and our Aquea Wash On™ is bottled and packaged in Singapore.

Manufacturing Process

Our product development research starts in our facility in Sarasota, Florida. Testing and production design including labels and packaging is then completed. Once this process has been finalized, we then schedule production. We work with approximately 15 suppliers from which we order our ingredients. All of the ingredients come with a Certificate of Analysis and a Safety Data Sheet. All of the manufacturers that we work with are manufacturing facilities that are compliant with FDA guidelines which are GMP compliant.

Our Klenskin products go through several steps in the manufacturing process. First, since these products require an encapsulation, this step is conducted separately from the rest of the manufacturing process at another GMP certified facility. Once the actives are encapsulated, they are then sent to another manufacturing facility, along with the other ingredients, for production. Once produced, the bulk formulation is then bottled, labelled, and packaged. Throughout this process, we conduct testing to ensure specification standards are met and, if an OTC, we test for microbes and actives.

The entire manufacturing process can range from one to three months depending on the product, availability of the raw materials, packaging, and the schedule of the manufacturer.

CoLabs Int’l, Corp.— Scientific Revolution for Better Global Health and a Cleaner and Safer Environment.

Our Place in Biotechnology

Like other biotech companies, we exist because large pharmaceutical companies are not as focused, responsive, and creatively productive as the smaller, more innovative, and defined biotech companies. Our innovations have developed advanced encapsulate technology and our ownership of intellectual property provides a novel enhanced delivery system for the skin. QS® Technology is applicable for FDA approved, advanced pharmaceutical drugs and use with EPA pest repellents, pesticides, and herbicides. We designed QS® Technology, to potentially reduce potential toxic side-effects from unwanted drug absorption. Thus, we fit into the modern concept of biotech companies producing benefits that accrue to the benefit of consumers’ health and lifestyle and environmental sustainability.

Our Founder

Laura Cohen, MD, is a Board-Certified Dermatologist, Dermatologic Surgeon, and Academic Medical Clinician, in practice in Southern California. Dr. Cohen has been in private practice for over 30 years. She was previously part of the medical school clinical faculty at the University of South Florida; the Clinical Faculty at the University of California Irvine; and was the medical staff at the Veterans Hospitals in Tampa, Florida; Las Vegas, Nevada; and Long Beach, California. She has served on the Keck (USC) – Hoag Hospital Melanoma Advisory Board, St. Joseph Dermatology Specialty Advisory Group, and was a founding physician at Moffett Cancer Center in Tampa, Florida. Dr. Cohen is also a Fellow with the American Academy of Dermatology. (See “Directors, Executive Officers, And Significant Employees.”)

Dr. Cohen realized the need for precision targeting of a drug and/or its delivery system during her years of professionally treating patients with various stages and types of skin cancer. When queried to see if they used preventive sunscreen protection, the answers varied from usually, occasionally, and seldom or never. Her follow up question was, “Do you bathe?” which always resulted in an affirmative answer. Reasons for not wearing sunscreen are well documented in various marketing/research studies. Sunscreens are most typically perceived by consumers as sticky or tacky, inconvenient to use in their daily routine, irritating to the eyes, creating allergic reactions, collecting dust on the skin, and simply viewed as not needed, detrimental, or toxic. Dr. Cohen recognized the failure in the delivery system of sunscreens and sought to address this serious issue as well as the unintended drifting of topically applied chemicals and pharmaceuticals.

Unique Features of Klēnskin™ Sunscreen

Most consumers are unaware that the World Health Organization (WHO) places the sun’s UV radiation in the same category as smoking and plutonium in terms of dangerous cancer-causing sources. Sadly, most patients with skin cancers and severe skin aging, did not realize that regular use of sunscreen could have prevented or reduced the damage. Further, over 80% of sun damage is caused by daily incidental sun exposure. It was clear to Dr. Cohen and Lisa LeBlanc that a novel, new type of delivery system was needed. They concluded that a wet skin application sunscreen could become a major tool in preventing skin cancer caused by UV radiation exposure.

In 2008, Dr. Cohen and Ms. LeBlanc formed our company with a clear direction and scientific focus to develop a precise, user friendly, topical delivery system. Combining Dr. Cohen’s knowledge of skin pharmaceuticals and cosmetic chemistry with Ms. LeBlanc’s profound commitment to improved global health led to exhaustive research into polymer-based formulations that could be utilized for dermatologic applications. Together, they developed a Wash-On® SPF test of concept product which could be applied in a shower or used at the sink to provide sunscreen skin protection while performing routine daily hygiene as a wet skin application. The initial products were the Klēnskin™ Wash On® SPF 15 sunscreens, which were tested, commercialized, and dispensed through dermatologists’ offices.

The scientific significance of our advanced formulations is that the active ingredients are functionally designed to remain at the treatment site with only limited drifting and absorption. Importantly, this innovation reduces absorption systemically of drugs. In the case of sunscreens, this means that photoreaction takes place on the surface of the skin rather than in the deeper living layer of epidermis. CoLabs’ Klenskin formulations also have the active ingredients supplemented by antioxidants, which quench free radicals produced by the reaction of the chemical sunscreens and UV radiation, and also moisturizing agents, which further enhance the health of the skin.

We intend to capture a strong position in the biotechnology sector with the ongoing development of our innovative formulations and potentially with licensing our technology to major pharmaceutical companies. QS® Technology is directly applicable to the commercialization for many approved products for skin cancer prevention and treatments, pest repellents, fragrances, sanitizing products, sun protection, and topical dermatologic treatments. By introducing these agents into our scientifically unique application and delivery system, we believe these products will become more efficacious and cosmetically elegant for consumers. (See “Description of Business – Targeted Biotech Industry Sectors.”)

Strategic Direction

Our innovative QS® Technology provides non-transdermal delivery and is technologically adaptive. We are taking advantage of our presence in this unique space, utilizing our existing reputation, existing IP, and design capacity in order to formulate specific versions of our QuantaSphere® Technology for use in major health and beauty market sectors. We are currently expanding our research to include the adaptation of our QS® to agrochemicals.

We have provided major pharmaceutical companies with sample formulations for testing and evaluation with the purpose of inclusion of our technology into their next generation of products. We believe that in the long-term, this strategy will produce marketing relationships with strong operating cash flows and expanding market share across multiple market sectors. We are also focused on applying our rapidly evolving biotech delivery technology to key global market sectors both directly and with marketing partners. Our marketing strategy seeks to use regionally defined marketing alliances thereby increasing the potential sales for each targeted market sector. As a result of these efforts, we are currently negotiating a licensing agreement with a pharmaceutical company to manufacture their formulations with our adapted QS® technology; provided however that there can be no assurance that we will ultimately enter into that agreement.

We are exploring new IP relating to the adaptation of encapsulates into a cross-linked mesh formation. Additional research is being conducted to develop new encapsulates that are application specific. We believe that our encapsulates can offer a better regulated and safer delivery system for both OTC and pharmaceutical drugs.

Our pest repellent and herbicide encapsulates are in the formulation and testing phase and based on the success of the tests, will be moved into a registration phase or be reformulated to improve performance. Initial test results have been encouraging for these natural, environmentally sustainable agricultural products.

Critical Success Factors

To understand what it will take to make us successful and accelerate us to a world-class leadership position in the biotechnology and pharmacology industrial sectors, we have examined our proposal from three perspectives:

| | 1. | Determine if our science and consumer acceptance intersect to the extent that growing demand will provide strong dynamics to fuel rapid sales and product expansion. |

| | 2. | Determine where in the product life cycle our products and technology reside vis-à-vis current and future competition. |

| | 3. | Determine whether funding will provide management the necessary components to propel our success in the global market. |

Our success is dictated by the benefits provided to the consumer in the form of advanced and properly targeted formulation designs and the sale and profitability accrued to those in our distribution chain.

Critical Success Factors: Creating Demand

There are important factors that dictate and drive the demand for our products and technologies. These factors, which are vital to our business plan, can be summarized as follows:

| | ● | growth of global consumer demand for competitively priced goods; |

| | ● | developing economies’ needs for scientifically advanced products; |

| | ● | growing economic strength throughout the global marketplace; |

| | ● | growth of regional trade agreements; |

| | ● | worldwide healthcare threats and concerns; |

| | ● | global need for enhancements to preventive healthcare products; |

| | ● | consumer focus on personal care and youthful appearance; |

| | ● | increased consumer awareness of advanced and innovative technologies; and |

| | ● | regulatory compliance. |

Critical Success Factors: Product Life Cycle

The product life cycle is divided into four segments: introduction, growth, maturity, and decline.

| | 1. | Introduction: Relatively slow growth and limited profits. |

| | 2. | Growth: Rapid expansion of sales and consumer acceptance with resulting high profitability. |

| | 3. | Maturity: No major sales growth with high profits but slowing profits. |

| | 4. | Decline: Eroding markets and declining sales volume with loss of profit margins. |

We believe that the ongoing expansion of our targeted market sectors are being fueled by worldwide economic growth, consumer demands, and complex health threats. As economies and healthful practices expand, we believe that consumers will focus on products that address the various risks to their own personal and family care needs and health. Pricing, distribution, and technology are driving the healthcare market expansion. Knowledge of advanced, powerful new technologies by both distributors and consumers provides the fuel for new product sales thereby replacing older products based on outdated technology.

As such, we consider our products to have biotechnology that is in the very early stages of the product growth cycle. We hope to achieve prominence in markets needing enhancements to products that our IP brings by introducing a new generation of products of Quantasphere Technology™ based derivative products. (See “Description of Business -- Product Pipeline.”)

Critical Success Factors: Components to Success

If we achieve high levels of satisfaction from our consumers and distributors with our formulations and products, we believe it will create an influx of new customers. This customer base, in turn, will fuel the expansion of distribution channels. We believe that the repeat consumer purchase cycle in combination with cost efficient distribution alliances are capable of creating overall profits combined with the valuable intrinsic satisfaction of the consumer base.

The following major factors will determine whether we will be successful:

| | ● | ability to develop effective distribution partnerships to present and market products to consumers in vast regional markets; |

| | ● | having the ability to continually satisfy and perpetuate a loyal consumer base; |

| | ● | continued growth of product sales to global markets and the expansion of the new product pipeline for new market sectors; |

| | ● | preemptive entry of advanced product technologies into the marketplace before competitors are able to scientifically compete; |

| | ● | having a focused and defined marketing plan, specifically designed for each targeted market, and having a capable marketing staff that is knowledgeable and capable to execute the plans; |

| | ● | concentrating and developing our expertise while keeping our team directed and focused; |

| | ● | rapidly developing new technologies and formulations with the related intellectual property, through efficiencies achieved by a focused staff and limited regulatory delays; and |

| | ● | adaptive use of new marketing technologies and mediums. |

Growth Strategy

Our growth strategy is to increase revenue and net income by expanding the worldwide demand for our products, formulations, and technology. The avenues to achieve success rest on the fundamentals of our patents and wide applications of our intellectual property. Further, as described in “Strategies for Advancing Market Penetration,” developing these various sales and funding channels are key to establishing a market presence with corresponding revenue growth.

Enhancement of Product Performance

We are positioned in several key large and expanding market sectors. For example, as reported in Zippia in December 19, 2021, the cosmetic market in 2021 was forecasted to have global value of $380 billion. This is our largest targeted sector for licensing agreements. Cosmetic products (skin care) inherently have numerous applications for our QS® formulations. Anti-aging and moisturization in combination with cosmetic elegance are key basic characteristics found in most cosmetic products. The actual active ingredients for these products do vary greatly. However, skin or revitalizing serums perform best when retained on the surface of the skin or time-released into the epidermis. We believe our formulations achieve these goals to the greatest extent available in today’s market. For example, after testing by a major cosmetics partner, our moisturizing formulation provided a high level of skin moisturization and the skin felt to the touch more moisturized when we compared it to competitive products. This result was because of the partial retention of the actives on the surface of the skin due to our formulation.

Leverage the Technology to Provide Value-Added Ingredient Base

We believe that current cosmetics, pest repellents, fragrances, sun care, and soap products ingredients move a generational level higher in performance when the QS® delivery system is employed. This is our competitive strength, which we believe is well suited for licensing agreement. We believe that our goal of enhancing value will be realized by using a combination of joint ventures, and licensing and distribution agreements.

Advanced Product Design

Our formulations and QS® provide innovative, targeted delivery for FDA designated over-the-counter (“OTC”) drugs and other highly effective skin products. Many medications exist that treat and/or ameliorate health symptoms.

Our QuantaSphere® delivery system for medications can be formulated to have characteristics to increase duration, have the benefits of fewer active ingredients, have less toxic risk from medications, and greater cosmetic elegance. We are looking to advance our pipeline with the appropriate related testing protocols, and the targeted outcome of producing finished commercializing and distributing products into appropriate markets. (See “Description of Business – Targeted Biotech Industry Sectors.”)

Current Products

Our current product portfolio is as follows:

| | ● | SPF 50 Lotion – Water Resistant to 80 Minutes |

| | ● | SPF 30 Wash On™ - Wet Skin Application (Three Variations) |

| | ● | SPF 50 Lip Balm - Reef Safe (Four Flavors) |

| | ● | SPF 30 Stick - Reef Safe |

| | ● | SPF 30 Aquea Wash On™ (International) |

| | ● | SPF 30 Gel Water Resistant 80 Minutes (Reef Safe) |

| | ● | Spray Hand Sanitizer |

| | ● | Gel Pump Sanitizer |

| | ● | Bug Stick Repellent |

Product Pipeline

We have an extensive pipeline of new products that are being developed for the Klēnskin™ brand of sunscreens and bug repellents as well as for private branding.

New Products in 2022 and 2023:

Naturally Absorbent Encapsulate (application for use to wick moisture from the skin):

| | ● | We have applied for a patent for a new technology for the safe absorption (wicking) of moisture from the skin. We plan to design the formulation and continue the testing process on this technology. |

| | ● | Successful commercialization of this “wicking” technology at this early stage of this development is undeterminable. |

Medical Encapsulated Cross-Linked Mesh

| | ● | In Development- Advanced encapsulation of drugs incorporating cross-linked mesh, potentially providing a safer and more regulated release of drugs for transdermal delivery applications. |

Agricultural and Veterinary Technology

Initial agrochemicals and formulations for veterinary use which include natural herbicides, pest repellents, and fertilizer prototypes, are expected in 2022 for testing with anticipated product launch in 2023.

Bug Repellents:

| | ● | Bug Repellent Roll-On and Spray Application (Ready for Production) Mosquito and Tick |

| | ● | Bed Bug Powder (In Testing) (Household) |

| | ● | Equine Fly Spray (In Testing) |

| | ● | Porch and Turf Cleaner and Fly Repellent (Testing) |

| | ● | Pet Products – Flea and Tick Line (In Development) |

Sunscreens:

| | ● | Reef Safe SPF 30 Gel |

| | ● | Reef Safe Whipped Zinc Face Cream SPF 35 (Finalizing Production Samples) |

| | ● | Reef Safe SPF 40 Body Oil |

Cosmetics:

| | ● | Phospholipid Complex Rejuvenating Cream (Ready for Production with Pending Licensing Agreement) |

Product Development

We currently meet our R&D needs internally with our existing staff combined with contracted laboratories to assist with additional testing and development. All critical scientific and product development, formulations, and design specifications are done internally and with our contracted labs for advanced development. Product development that provides needed and market accepted formulations is fundamental and inexplicably linked to positive consumer acceptance, brand recognition, and sales growth. We believe we are developing products that meet those criteria.

Unlike many other biotech companies, the time it takes for us to develop, formulate, test, and commercialize a product, is completed in a comparatively short span of time at a substantially lower cost. We have avoided debt and dilution by concentrating our focus on already approved OTC products, which have large markets, and require few regulatory filings.

Raw material components and advanced ingredients, regulatory advice, intellectual property registration, and legal support are obtained from outside sources.

Our management is engaged in all functions critical to our operations. We believe that our skilled management team provides a focused, high quality product, with cost controls, improved manufacturing capacity utilization, defined operational control, and tight product ingredient specifications which are confirmed by outside testing. This testing is done by independent FDA and EPA testing laboratories which follow approved guidelines for each targeted test.

Our internal R&D and Product Development groups and external partners are experienced and highly respected in the industry. Further, their unique focused knowledge in our realm of technology is a significant asset and a competitive advantage for us.

We have developed IP protected biotechnology designed for multiple new applications. This IP is technology driven, tested, proven, formidable, and commercialized. We currently hold 28 issued patents and have an additional 16 patents pending.

Our internal management and scientific team is augmented by partnerships which externally provide both material and development support. We are able to directly advance our research and manufacturing skills, which are then augmented by our partners’ scientific and production teams.

New formulations are repeatedly tested by independent labs that are compliant with FDA guidelines. Testing is done during the development, pre-production, and manufacturing stages. By maximizing our leverage with suppliers and manufacturing partnerships, we have held personnel costs to an efficient level while rapidly advancing our technological growth.

Our topical delivery system, IP, and internal efficiencies allow our focus to remain directed at the development of formulations for vast commercial applications.

FDA: Maximum Usage Trials (MUsT) for Topical Active Ingredients

Issue Background and a CoLabs Proposed Testing Protocol Standard for the FDA

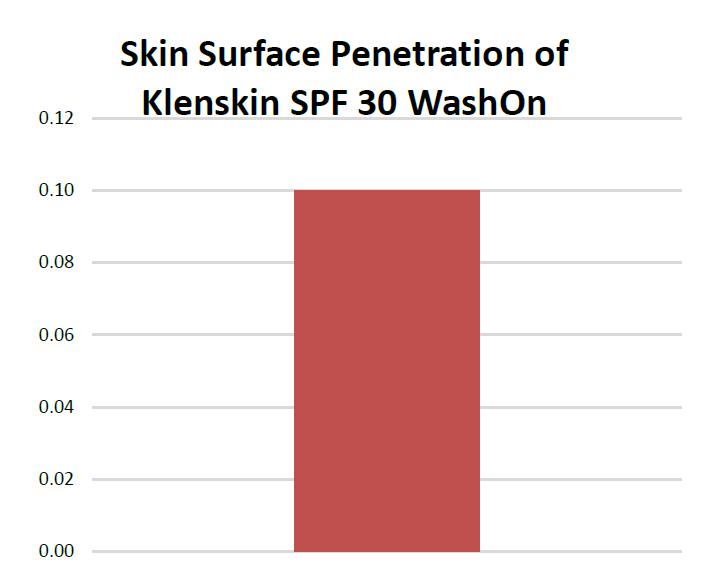

We believe that the absorption and systemic effects of active ingredients for many topically applied OTC products is a major focus of concern. Currently, topically applied active ingredients can be absorbed readily into the body. QS® Technology formulations can be designed to be minimally absorbed over-time or have virtually no absorption through the stratum corneum. It is important to first identify the degree of surface absorption by focusing on the absorption characteristics of a particular active and/or its excipients within its delivery system. As with any test, a time stamped testing protocol must be followed to determine the rate at which the product enters the skin and what depth of penetration occurs.

We have sought to create the most user-friendly sunscreen possible by encapsulating the active ingredients and placing an electrostatic charge on the surface of the encapsulate. The cationic electrostatic charge creates an attraction to the anionic stratum corneum. This charged micro-encapsulated formulation is designed to create an attraction to the surface of the skin and inhibit absorption.

With this in mind, non-absorption was one of our key concerns for three main reasons:

| | 1. | Systemic absorption and accumulation of sunscreen chemicals in the body may have unwanted effects; |

| | 2. | Scientific concerns that absorbed chemical sunscreens produce a photoreaction within the skin which releases free radicals and could be damaging to living (DNA containing) epidermal cells; and |

| | 3. | Absorption of sunscreen chemicals is potentially systemically toxic. |

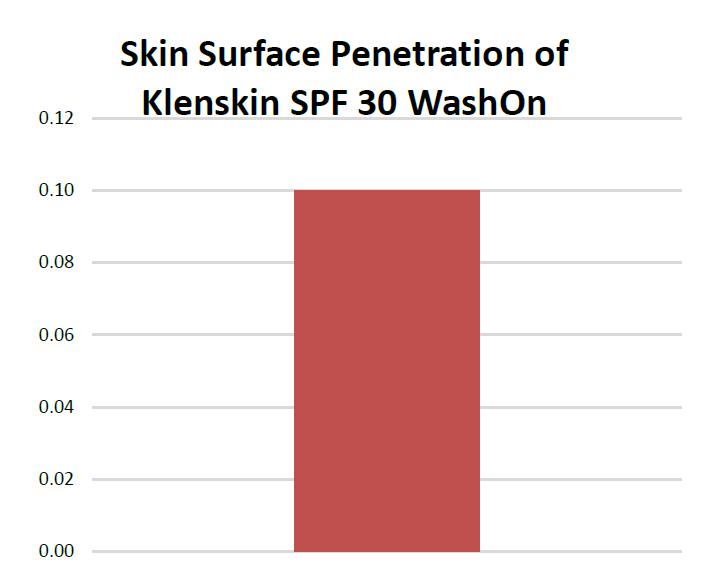

Our encapsulates are specifically manufactured to be approximately the size of a skin cell. We were confident that absorption through the epidermis is greatly inhibited by this specification. Additionally, we place an electrostatic charge on the surface of the encaps which causes the sunscreen encapsulate to attach to the stratum corneum. This unique design combination limits infiltration into the skin and possible systemic absorption. We sought to prove our scientific premise using the Confocal Stain Test (“CST”).

We proposed to the FDA that the CST be used as a methodology for a MUsT protocol for the following reasons:

| | ● | If a product is intended to stay on the surface of the skin, it is an easy testing protocol that could eliminate the need for blood or urine tests to detect unwanted chemicals introduced to the body via topical application; and |

| | ● | There are concerns regarding the accuracy of blood or urine tests because of the possibility that unwanted chemicals may be stored in the body, such as in adipose tissue or the liver. |

We have not received a direct response from the FDA. However, the FDA has conducted tests based upon the comments we previously supplied to them. We look forward to the opportunity to working with the FDA in the future to better control potential issues created by the absorption of topically applied drugs and chemicals.

Marketing Direction

We have developed a systematic long-term strategy to expand our technology, target product markets, and broaden our in-house capabilities.

We believe that we, in combination with our marketing partners, have the opportunity to become a significant force extending into a worldwide market that exceeds $380 billion as reported in Zippia (December 19, 2021). These expanding group of partnerships include pharmacy purchasing groups, retail stores, outdoor sports stores, medical practice marketers, and national and international sports organizations. We anticipate that these key market sectors, which includes the cosmetics, pest repellents, fragrances, sunscreens, and topical pharmacology markets to grow significantly over the coming years. More specifically, we have substantial scientific knowledge, expertise, and years of experience in these markets and applications.

We currently own issued and filed intellectual property addressing the next generation of product innovations that are directed at both consumers and the major industry suppliers for these global market sectors. We believe that the technology we have developed is both novel and scientifically advanced. Once adapted into products, our formulations arguably set an improved standard.

Strategies for Advancing Market Penetration

Direct Retail Distribution – We plan to expand our direct retail wholesale personnel in order to target distributers and retailers with our product lines. By servicing B2B accounts with internal and detail personnel, we can expand relationships and provide better hands-on support to retail outlets thereby encouraging their retail sales.

Distribution Partnerships – We will provide either Klēnskin™ branded products, base formulations, exclusive product formulations, or private label existing formulations to partners in order for them to market to their existing clientele.

Direct Consumer Marketing – We have been approached and have had discussions with television direct marketing groups. These discussions involved both informative commercials as well as shopping channel marketing. Typically, a celebrity or professional spokesperson is chosen to represent a company and its product lines. The cost of production, inventory, and the talent purchase are considerations weighed against the potential large volume of sales and rapid branding that occurs. We are currently considering expanding into this marketing channel.

Government Sales – Klēnskin™ products offer a generational advance in sanitizers, sunscreens, and bug repellents. These products have great potential to protect those government employees whose jobs require them performing their duties in contaminated environments and outdoors with exposure to the sun’s radiation. We intend for these products to be initially directed to military services and related job areas where these products may excel. We are in discussions with a proven government supplier who is assisting us in meeting the requirements to provide our products to agencies requesting bids for products whose specifications match Klēnskin™ products.

Global Sales – We have greatly expanded our presence in the Asian markets. We believe that targeting products designed for the tastes in this region will propel current relationships and can expand into other distribution companies. Increased marketing presence with experienced personnel, advertising, and new region-specific product offerings are key drivers to sales. We believe that the initial international market acceptance of our products has been exceptional. This is a targeted marketing area that is slated for expansion.

Internet Sales – One of our main goals is to expand sales to targeted consumers and affiliations with key online marketing sites. The priority of our internet sales and marketing staff will be to seek greater social media exposure linked to the activation of target marketing campaigns. The full engagement of social media marketing component can directly drive sales for company ecommerce, bloggers, social media exposure, lead generation, targeted promotions, and select marketing sites like Amazon. We expect this will be an important key element for new product launches.

Event Participation – As previously noted, our products are designed for active lifestyles. Branding thus far has associated Klēnskin™ with AVP Professional Beach Volleyball and NASCAR as well as prominent cancer fighting organizations and youth and college sports groups. These brands and their events and causes will be linked by our public relations firm, Brand Knew, to campaigns to develop name recognition for both Klenskin and CoLabs. One of our management principles is to support and be a part of the community to improve our health, environment, and quality of life. Our products are designed with safety as well as these societal benefits inherent in all of our formulations. We have successfully offset some of the marketing costs with sales at the event site. We have found that these fan sales are important since these purchasers have become repeat buyers. In sharing their satisfaction with our products, they become Klēnskin™ sales ambassadors to their social network.

SPIR/STTP Grants and SBA Programs – We anticipate submitting grant applications to various U.S. government agencies. These funding opportunities are designed for small businesses to provide assistance with needed product development and research prior to the products commercialization stage. SPIR/STTP Grants are not repayable and are offered in two phases. Phase 1 offers up to $225,000 in grants. Approximately 30 to 40% of applicants receive funding. Phase 2 provides up to an additional $1.5 million for product development. The SBIR/STTR programs are administered by the Small Business Administration (SBA) and processes through various government agencies. Additional SBA loan programs are being implemented to provide assistance during times of economic stress. We are hopeful that successful loan and grant applications for available SBA programs will assist with the development of several advanced products in the pipeline and provide funding for corporate operations and payroll, thereby helping assure our ongoing viability, however there can be no assurance that we will receive any funding through these programs.

Sales and Marketing Staff – We believe that it essential for our success to retain a qualified marketing team to advance sales. The development of partnerships, the expansion of internet presence, and the development of new domestic and global distribution channels, along with sufficient financial resources, are necessary for an effective campaign. Brand Ambassadors, supporting television and radio advertising linked to event sponsorship will be strategically activated to promote our participation and branding. We recognize that a well engaged and effective staff is vital because of their commitment to garnering sales and their experience to promote their existing relations for the benefit of our product lines. To that extent, we have retained retail sales brokers and consultants to assist with marketing development with retail chains, online stores, and other internet marketing sites.

Property

We currently do not own any real property. We lease office space and warehouse and product development spaces at:

18593 Main St.

Huntington Beach, CA 92648

7222 South Tamiami Trail

Sarasota, FL 34231

7251 W. Lake Mead Blvd., Ste 300

Las Vegas, NV 89128

On June 16, 2017, we entered into a First Amendment to Lease Agreement with Sarm Five Points Plaza, LLC for our Huntington Beach office for a term of five years beginning on November 1, 2016 and expiring on October 31, 2021, and we are currently on a month to month lease. Our current monthly rent is $2,956.73.

On December 1, 2017, we entered into a Commercial Lease with Branson Corp. for our Florida office for a one year term beginning on December 1, 2017, with an option to extend for subsequent one year periods. Our current monthly rent is $820.20.

We lease, on a month-to-month basis, a virtual office in Nevada in compliance with being incorporated in Nevada. The monthly rent amount is nominal.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read together with our financial statements and related notes appearing at the end of this Semiannual Report. This discussion and analysis contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed in the section entitled “Risk Factors” as disclosed in our Offering Circular, as amended or supplemented from time to time, and as may be updated from time to time by our future filings under Regulation A. The accompanying balance sheets and the related statements of operations, shareholders’ equity and cash flows as of December 31, 2021 and for the year ended December 31, 2021 and December 31, 2020 are audited.

Overview

CoLabs Int’l, Corp. (“we,” “us,” and “our”) was incorporated in Nevada in 2008 and is a closely held, majority woman-owned biotechnology company. Our corporate administrative office and warehouse facility are located in Huntington Beach, California.

We were founded upon our acquired and internally developed intellectual property on our belief that our intellectual property provides a commercial advantage in the global marketplace. We rely on patent, trade secret, copyright, and trademark law, as well as the contractual terms with our customers, to define, maintain, and enforce our intellectual property rights, technologies, and relationships.

We currently have 28 issued patents and 16 filed pending patents covering our technology. In addition, a significant amount of our intellectual property takes the form of trade secrets and copyrighted works of authorship. We currently have a portfolio of registered and pending trademarks in the United States and foreign jurisdictions, including registrations for the marks “Quantasphere®,” “QS®,” “KLĒNSKIN®,” “WASH ON®,” “KLĒN®,” AQUEA®, and “SHOWER ON®.”

Our patented Quantasphere® technology is a globally unique, widely adaptable delivery system providing improved effectiveness and consumer acceptance for a multitude of drugs, cosmetics, and chemical applications. Our technology places drugs into micro-sized encapsulates that have an electrostatic charge and then suspends these into unique formulations, limiting the unwanted absorption, or having a timed release. This one-of-a-kind unique delivery system significantly decreases the absorption of potentially dangerous chemicals into the body and organ systems, thereby avoiding potential toxic side-effects. This technology is also able to target the depth of penetration and the degree of dispersion or timed release of the active ingredients into the skin or onto the surface of the skin.

We are presently selling sunscreens, SPF lip balms, and bug repellent products, utilizing our patented Quantasphere® technology, to the consumer market under the KLĒNSKIN® brand name, with plans to expand our product lines to multiple additional markets, including dermatology, cosmetics, fragrances, and other therapeutic applications.

We amended our Articles of Incorporation on December 1, 2021, to conduct a forward stock split of 2:1 of our common stock (the “Forward Split).

Operating Results

Results of Operations for the Year Ended December 31, 2021 Compared to the Year Ended December 31, 2020

Refer to our Statements of Operations in our financial statements.

Revenue

Revenue decreased 24% to $80,000 during the year ended December 31, 2021, compared to $105,000 during the year ended December 31, 2020. The decrease in net sales of $25,000 was primarily due to the timing of orders from our international distributor.

Cost of Revenue

Cost of revenue primarily represents our material cost for manufacturing our products sold and changes in inventory reserves for slow-moving or potentially obsolete products. Our cost of revenue increased by $82,000 to $143,000 for the year ended December 31, 2021, compared to $61,000 for the year ended December 31, 2020. Our gross margin was a negative 79% for the year ended December 31, 2021, and 42% for the year ended December 31, 2020. The decrease in gross margin primarily due to inventory write downs, changes in inventory reserves, and change in product mix sold during the year ended December 31, 2021, compared to the year ended December 31, 2020.

Operating Expenses

Operating expenses include selling, general and administrative expenses, and research and development costs.

Our selling, general and administrative expenses increased approximately $284,000 to $1,022,000 during the year ended December 31, 2021, compared to $738,000 during the year ended December 31, 2020. The increase in selling, general and administrative expenses was from increased marketing related expenses of $146,000 and increased professional fees of $74,000. The remaining increase of $64,000 was from an increase in payroll related costs and routine changes in our selling, general and administrative expenses accounts to support our operations.

Research and development costs include employee, rent, advisors, consultants, product design, and development activity. Research and development expenses increased $54,000 to $181,000 during the year ended December 31, 2021 compared to $127,000 during the year ended December 31, 2020. The increase was primarily from increased payroll related costs.

Loss from Operations

Loss from operations increased $445,000 to $1,266,000 for the year ended December 31, 2022, compared to $821,000 for the year ended December 31, 2021. The increase in operating loss was due to our decreased gross profit and increased operating costs, as discussed above.

Gain on Forgiveness of Paycheck Protection Program Loans

During the year ended December 31, 2021, we received formal notice that our notes payable were forgiven. As a result, the gain from the forgiveness of the government assistance notes payable aggregating $110,000 was recognized in the statement of operations during the year ended December 31, 2021.

Interest Expense

Interest expense decreased to $1,000 for the year ended December 31, 2021 compared to $5,000 for the year ended December 31, 2020. The decrease in interest expense was due to the changes in our debt levels.

Net Loss

Net loss increased by $331,000 to $1,157,000 for the year ended December 31, 2021 compared to $826,000 for the year ended December 31, 2020. The increase in net loss was due to our decreased gross profit and increased operating costs, offset by a gain on forgiveness of Paycheck Protection Program loans, and decreased interest expense, as discussed above.

Liquidity and Capital Resources

Our financial statements have been prepared assuming that we will continue as a going concern, which contemplates continuity of operations, generation of sales revenue, realization of assets, and liquidation of liabilities in the normal course of business. As reflected in the financial statements, during the year ended December 31, 2021, we incurred a net loss of $1,157,000; used cash in operations of $1,198,000; and had a stockholders’ deficit of $12,000 as of December 31, 2021. These factors raise substantial doubt about our ability to continue as a going concern as a biotechnology company within one year after the date that the financial statements are issued without a further influx of equity capital, growth of sales, issuance of debt, or a combination of these capital inflows. The financial statements do not include any adjustments related to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might be necessary should we be unable to continue as a going concern.

In addition, our independent registered public accounting firm, in its report on our December 31, 2021 financial statements, has raised substantial doubt about our ability to continue as a going concern.

At December 31, 2021, we had cash on hand of $68,000. During the year ended December 31, 2021, we received $882,000 through the sales of our common stock, $105,000 in proceeds through the exercise of stock options, and proceeds of $49,000 from a loan. Our ability to continue as a going concern is and has been dependent on our ability to execute our strategy, raise additional funds, and expand revenue from sales. Management is currently seeking additional operating funds, primarily through the issuance of equity securities to expand marketing and overall business development. No assurance can be given that any future financing will be successful or the funding will be adequate to achieve our goals. Even if we can obtain additional financing, it may place restrictions on management. Substantial dilution for stockholders may occur from the structuring of either equity or debt financing.

Sources of Operating Revenues and Cash Flows

Refer to our Statements of Cash Flows in our financial statements and Note 2, Summary of Significant Accounting Policies, in our financial statements for further detail.

Cash Flows from Operating Assets

Net cash used in operating activities for the year ended December 31, 2021 totalled $1,198,000, compared to net cash used in operating activities for the year ended December 31, 2020 of $909,000. The increase in net cash used in operations for the year ended December 31, 2021 was primarily to fund our net loss, offset by $110,000 gain on forgiveness of Paycheck Protection Program loans.

Cash Flows from Financing Activities

Net cash provided by financing activities for the year ended December 31, 2021 was $1,036,000, which included proceeds of $105,000 from the exercise of stock options, proceeds of $882,000 received from a private placement offering of common stock, and proceeds of $49,000 received from a note payable. Net cash provided by financing activities for the year ended December 31, 2020 was $792,000, which included proceeds of $3,000 from the exercise of stock options, proceeds of $728,000 received from a private placement offering of common stock, and proceeds of $103,000 received from loans payable, offset by a $42,000 repayment of notes payable.

Outlook and Recent Trends

There are a number of trends potentially affecting our business. Both the macroeconomic and microeconomic outlook are being considered by our management team. These seemingly are impacted by public policy and the private sector response to economic packages. The COVID-19 impact of our domestic and global economies is still being addressed differently by various regulatory agencies and governments as well as the private sector.

Focusing on the U.S. economy, in the near-term, programs which will assist the country in building its infrastructure are expected to be introduced as well as further stimulus packages. The national debt has increased and may continue to increase, perhaps a catalyst for some inflation. Correspondingly, taxes are expected to increase to try to offset this deficit spending. Without an improved economy, credit risk and low credit demand will restrict expansion. Adding to this headwind is a likely decline in GDP growth. Offsetting this Keynesian solution is the pandemic and its related costs and undefinable course.

We are in the pharmaceutical/healthcare sector which due to the pandemic and the aging of baby boomers may continue to trend as a key growth area. We are focused on the delivery of drugs in multiple key sectors, including vector borne diseases, disinfectants, sun protections, anti-aging, pest repellents and anti-scabetic and anti-pediculosis drugs. We believe that our sanguine position addresses these massive focal point health issues. It is incumbent on our management to be proactive, intuitive, and farsighted to adjust to the quickly shifting sands that these uncertain economic events are presenting.

Critical Accounting Policies

See Note 2, Summary of Significant Accounting Policies, in our financial statements for further detail.

Off-Balance Sheet Arrangements

As of December 31, 2021 and December 31, 2020, we had no off-balance sheet arrangements.

Related Party Arrangements

For further information regarding Related Party Arrangements, please see Note 7 in the accompanying financial statements.

Recent Developments

In August 2021, we received notice from our SBA lender that our PPP loans in the aggregate amount of $110,000 were forgiven and no amounts were owed under the agreements (see Note 4 in our financial statements).

In August 2021, we began an offering under Rule 506(c) of Regulation D for the sale of our common stock at a price of $5.50 per share for a maximum offering of 3,000,000 shares for $16,500,000. After the Forward Split, the price per share of that offering decreased to $2.75. As of the date of this report, we have sold approximately 389,000 shares for $1,072,750.

On April 30, 2021, we began an offering pursuant to Regulation A of Section 3(6) of the Securities Act of 1933 for Tier 2 offerings, pursuant to which we began offering up to 3,000,000 shares of Common Stock at an offering price of $6.50 per share for gross proceeds of up to $19,500,000. After the Forward Split, the price per share of that offering decreased to $3.25. As of the date of this report, the Reg A+ offering was terminated. While marketing the Reg A+ we sold 5,500 shares for $18,875.

ITEM 3. DIRECTORS AND OFFICERS

| Name | | Position | | Age | | | Term of Office | |

| Executive Officers and Significant Employees: | | | | | | |

| Laura Cohen | | Chief Executive Officer | | 71 | | | 2008 - Present | |

| Lisa LeBlanc | | President | | 39 | | | 2008 - Present | |

| Daniel Traynor | | Vice President of Product Development | | 52 | | | 2017 - Present | |

| William Cohen | | Chief Financial Officer | | 76 | | | 2022- Present | |

| | | | | | | | | |

| Directors: | | | | | | | | |

| Laura Cohen, MD | | Chairman of the Board | | 71 | | | 2008 - Present | |

| Lisa LeBlanc | | Director | | 39 | | | 2008 - Present | |

| Charles Fritts, Esq. | | Independent Director | | 69 | | | 2017 - Present | |

| Dean Stathakis, Esq. | | Independent Director | | 59 | | | 2017 - Present | |

| Peter Barton Hutt, Esq. | | Independent Director | | 87 | | | 2017 - Present | |

There is no arrangement or understanding between the persons described above and any other person pursuant to which the person was selected to his or her office or position.

Family Relationships

Laura Cohen, our CEO, is the mother of Lisa LeBlanc, our President. Laura Cohen is married to William Cohen, our CFO. Aside from the aforementioned, there are no other family relationships between any other director, executive officer, person nominated or chosen by us to become a director or executive officer, or any other significant employee.

Certain Relationships

Except as set forth above and in our discussion below in “Interest of Management and Others in Certain Transactions,” none of our directors or executive officers have been involved in any transactions with us or any of our directors, executive officers, affiliates, or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Business Experience:

Laura Cohen, MD, is a Board-Certified Dermatologist, Dermatologic Surgeon and Academic Medical Clinician, in practice in Southern California. Dr. Cohen is skilled, experienced, and knowledgeable concerning dermatological conditions, prevention, and formulation of treatment and prevention products. She received her medical degree from George Washington University School of Medicine and completed her residency in Dermatology at Indiana University School of Medicine. Dr. Cohen is a Fellow in the American Academy of Dermatology and was a Clinical Professor of Medicine at the University of California School of Medicine Irvine, Department of Dermatology from October 2004 to May 2020, and is on the Hoag-USC Melanoma Advisory Board. Dr. Cohen was the Director of the Nevada VA Hospital Department of Dermatology and was a Staff Physician at the Long Beach Veterans Administration Hospital from October 2004 to October 2017. Dr. Cohen is the owner of Advanced Dermatology Care Center, Inc. a Dermatology Practice in Newport Beach and Huntington Beach, California since April 2005 to the present. Previously, Dr. Cohen founded and sold her dermatology practice in Tampa, Florida. Dr. Cohen has authored and published a number of articles relating to skin disease. Dr. Cohen has been our founder and CEO from August 2008 to the present.

Lisa LeBlanc is a graduate of Arizona State University. She has been instrumental in the development of the formulation and marketing of the KlenSkin product and has been working with us since our founding in August 2008. Ms. LeBlanc has been a Manager of Advanced Dermatology Care Center, Inc. located in Southern California, a dermatology practice and skin care facility. Ms. LeBlanc has approximately 15 years of experience managing all aspects of a medical practice and spa.

Daniel Traynor is the Vice-President of Product Development. Mr. Traynor works from our product development facility in Sarasota, Florida. Mr. Traynor started working for us as an independent contractor in August 2010 and became an employee on August 2017. Mr. Traynor is a highly trained, skilled, and accomplished chemist, widely known and respected in the realm of cosmetic chemistry. He is responsible for the product development and formulation bases for use by us and our partners. Mr. Traynor works with corporate partners, who provide formulation and raw material support. He is also assisted by a part-time chemist, who shares the facilities in Sarasota with Mr. Traynor. He also supervises the ongoing independent testing of products both in early development and through the final manufacturing stages. He also conducts quality assurance audits at manufacturing sites.

William Cohen, M.B.A., J.D., is our Chief Financial Officer. Mr. Cohen graduated with a J.D. from the Antonin Scalia Law School at George Mason University, and received his M.B.A., majoring in International Business at George Washington University School of Business Administration,. Mr. Cohen completed his BS in Business at Indiana University in Gary, IN. Mr. Cohen has been in the securities industry since 1979 and was the President/CEO of Integrated Trading and Investments, Inc., a broker dealer, from 1999 through 2018. Mr. Cohen has assisted the founders and consulted with us since 2008.

Charles Fritts, Esq. Mr. Fritts is a member of our Board of Directors and is the Chairman of our Audit Committee. He graduated from the Antonin Scalia Law School at George Mason University. He is a retired senior director of Federal Government Relations for the Biotechnology Industry Organization in Washington D.C. where he worked from 2011 to 2020. Since 2020, Mr. Fritts acts as a Legal Consultant for this organization.

Dean Stathakis, Esq., Ph.D. is a member of our Board of Directors. He attended Whittier Law School and has a Doctorate Degree in Molecular Biology from the University of Virginia. He is experienced in health care, life sciences & biotechnology, intellectual property, and patent applications. Since 2017, Mr. Stathakis has been the President of UltimateEdge Law Group LLC in Irvine, California. Prior to that, from 2013 to 2017, he was the President and Chief Operations Officer at One3 IP Management, Irvine, California. Mr. Stathakis is known for patent work on Botox while previously employed at Allergan.

Peter Barton-Hutt, Esq. is a member of our Board of Directors. He received his LL.B. from Harvard Law and his LL.M from New York University Law School. He is currently Senior Counsel in the Washington, D.C. law firm of Covington & Burling LLP, where his has worked since 1960, specializing in Food and Drug Law. Mr. Barton-Hutt was formerly General Counsel at the FDA.

Involvement in Certain Legal Proceedings

To our knowledge, none of our current directors or executive officers has, during the past ten years:

| | ● | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| | ● | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation, or business association of which he or she was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| | ● | been subject to any order, judgment, or decree, not subsequently reversed, suspended, or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| | ● | been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| | ● | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| | ● | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended, or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act, any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Except as disclosed above under “Involvement in Certain Legal Proceedings” in the “Description of Business” section, we are not currently a party to any legal proceedings, the adverse outcome of which, individually or in the aggregate, we believe will have a material adverse effect on our business, financial condition, or operating results.

Board Leadership Structure and Risk Oversight

Dr. Cohen is our Chief Executive Officer and Chairman of the Board. Our Board believes that it is in the best interest and the best interest of our stockholders for Dr. Cohen to serve in both roles at this time given her knowledge of our business the industry. We believe our board structure will provide appropriate leadership and oversight of our business and facilitates effective functioning of our management and our Board.

One of the key functions of our Board is informed oversight of our risk management process. We have formed supporting committees, including an Audit Committee and a Compensation Committee, each of which supports the Board by addressing risks specific to its respective areas of oversight.

Audit Committee

Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management takes to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Currently, we have three members on our Audit Committee, one of whom is an independent director, as follows:

| | 1. | Charles Fritts - Chair (independent) |

| | 2. | Lisa LeBlanc |

| | 3. | William Cohen |

Compensation Committee

Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Currently, we have three members on our Compensation Committee, all of whom are independent directors, as follows:

| | 1. | Peter Barton-Hutt – Chair (independent) |

| | 2. | Dean Stathakis (independent) |

| | 3. | Charles Fritts (independent) |

Term of Office

Each of our officers holds office until his or her successor is elected and qualified. Directors are appointed to serve for one year until the meeting of the Board following the annual meeting of shareholders and until their successors have been elected and qualified.

Director Independence

We use the definition of “independence” of The NASDAQ Stock Market to make this determination. NASDAQ Listing Rule 5605(a)(2) provides that an “independent director” is a person other than an officer or employee of the company or any other individual having a relationship which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The NASDAQ listing rules provide that a director cannot be considered independent if:

| | ● | the director is, or at any time during the past three years was, an employee of the company; |

| | ● | the director or a family member of the director accepted any compensation from the company in excess of $120,000 during any period of twelve consecutive months within the three years preceding the independence determination (subject to certain exemptions, including, among other things, compensation for board or board committee service); |

| | ● | the director or a family member of the director is a partner in, controlling shareholder of, or an executive officer of an entity to which the company made, or from which the company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year or $200,000, whichever is greater (subject to certain exemptions); |

| | ● | the director or a family member of the director is employed as an executive officer of an entity where, at any time during the past three years, any of the executive officers of the company served on the compensation committee of such other entity; or |

| | ● | the director or a family member of the director is a current partner of the company’s outside auditor, or at any time during the past three years was a partner or employee of the company’s outside auditor, and who worked on the company’s audit. |

Under such definitions, Charles Fritts, Esq., Peter Barton-Hutt, Esq, and Dean Stathakis, Esq. are independent directors. However, our Shares are not currently quoted or listed on any national exchange or interdealer quotation system with a requirement that a majority of our Board be independent and, therefore, we are not subject to any director independence requirements.

Executive and Director Compensation

The following table represents information regarding the total compensation of our executive officers and directors during the fiscal year ended December 31, 2021:

Name and Capacity in which Compensation was Received | | Cash Compensation ($) | | | Other Compensation ($) | | | Total Compensation ($) | |

Laura Cohen, CEO and Director(1) | | $ | 21,000 | | | $ | 0 | | | $ | 21,000 | |

| Lisa LeBlanc, President, COO, and Director(1) | | $ | 188,250 | | | $ | 0 | | | $ | 188,250 | |