Filed Pursuant to Rule 424(b)(3)

Registration No. 333-251136

HINES GLOBAL INCOME TRUST, INC.

SUPPLEMENT NO. 4, DATED AUGUST 18, 2021

TO THE PROSPECTUS, DATED JUNE 2, 2021

This prospectus supplement (this “Supplement”) is part of and should be read in conjunction with the prospectus of Hines Global Income Trust, Inc., dated June 2, 2021 (the “Prospectus”), as supplemented by Supplement No. 1, dated June 16, 2021, Supplement No. 2, dated July 16, 2021 and Supplement No. 3, dated August 17, 2021. Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

The purpose of this Supplement is to include our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, as filed with the Securities and Exchange Commission on August 16, 2021. The report (without exhibits) is attached to this Supplement.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| (Mark One) | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2021

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-55599

Hines Global Income Trust, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | 80-0947092 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 2800 Post Oak Boulevard | |

| Suite 5000 | |

| Houston | Texas | 77056-6118 |

| (Address of principal executive offices) | (Zip code) |

(888) 220-6121

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act: None.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ | | Non-accelerated filer | ☒ |

| Smaller reporting company | ☐ | | | | | Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 1, 2021, approximately 25.4 million shares of the registrant’s Class AX common stock, 11.9 million shares of the registrant’s Class TX common stock, 0.1 million shares of the registrant’s Class IX common stock, 48.5 million shares of the registrant’s Class T common stock, 15.1 million shares of the registrant’s Class D common stock and 31.3 million shares of the registrant’s Class I common stock were outstanding.

TABLE OF CONTENTS

| | | | | | | | |

| PART I – FINANCIAL INFORMATION |

| Item 1. | Condensed Consolidated Financial Statements (Unaudited): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II – OTHER INFORMATION |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PART I - FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

HINES GLOBAL INCOME TRUST, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | | | |

| | June 30, 2021 | | December 31, 2020 |

| (in thousands, except per share amounts) |

| ASSETS | | | |

| Investment property, net | $ | 1,880,960 | | | $ | 1,558,060 | |

| | | |

| Investments in real estate-related securities | 65,146 | | | 51,137 | |

| Cash and cash equivalents | 65,399 | | | 55,998 | |

| Restricted cash | 15,803 | | | 21,565 | |

| Derivative instruments | 240 | | | 286 | |

| Tenant and other receivables, net | 20,625 | | | 16,644 | |

| Intangible lease assets, net | 218,367 | | | 121,830 | |

| Right-of-use asset, net | 4,284 | | | 4,367 | |

| Deferred leasing costs, net | 33,508 | | | 17,471 | |

| Deferred financing costs, net | 843 | | | 1,372 | |

| | | |

| | | |

| Other assets | 15,723 | | | 14,687 | |

| | | |

| Total assets | $ | 2,320,898 | | | $ | 1,863,417 | |

| LIABILITIES AND EQUITY | | | |

| Liabilities: | | | |

| Accounts payable and accrued expenses | $ | 51,389 | | | $ | 35,549 | |

| Due to affiliates | 40,088 | | | 39,295 | |

| Intangible lease liabilities, net | 39,428 | | | 21,393 | |

| Operating lease liability | 1,578 | | | 1,598 | |

| Other liabilities | 20,932 | | | 17,637 | |

| Derivative instruments | — | | | 22 | |

| Distributions payable | 5,971 | | | 4,909 | |

| | | |

| Notes payable, net | 1,143,947 | | | 880,796 | |

| | | |

| Total liabilities | 1,303,333 | | | 1,001,199 | |

| | | |

| Commitments and contingencies (Note 11) | — | | | — | |

| | | |

| Equity: | | | |

| Stockholders’ equity: | | | |

| Preferred shares, $0.001 par value per share; 500,000 preferred shares authorized, none issued or outstanding as of June 30, 2021 and December 31, 2020 | — | | | — | |

| Common shares, $0.001 par value per share (Note 6) | 125 | | | 104 | |

| Additional paid-in capital | 1,147,965 | | | 938,736 | |

| Accumulated distributions in excess of earnings | (149,756) | | | (99,451) | |

| | | |

| Accumulated other comprehensive income (loss) | 19,231 | | | 22,829 | |

| Total stockholders’ equity | 1,017,565 | | | 862,218 | |

| Noncontrolling interests | — | | | — | |

| Total equity | 1,017,565 | | | 862,218 | |

| Total liabilities and equity | $ | 2,320,898 | | | $ | 1,863,417 | |

See notes to the condensed consolidated financial statements.

HINES GLOBAL INCOME TRUST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| (in thousands, except per share amounts) |

| Revenues: | | | | | | | |

| Rental revenue | $ | 40,424 | | | $ | 27,001 | | | $ | 77,900 | | | $ | 60,120 | |

| Other revenue | 967 | | | 813 | | | 1,783 | | | 1,539 | |

| Total revenues | 41,391 | | | 27,814 | | | 79,683 | | | 61,659 | |

| Expenses: | | | | | | | |

| Property operating expenses | 10,239 | | | 7,139 | | | 19,613 | | | 15,213 | |

| Real property taxes | 4,777 | | | 3,489 | | | 9,180 | | | 6,971 | |

| Property management fees | 1,426 | | | 1,192 | | | 2,910 | | | 2,549 | |

| Depreciation and amortization | 24,916 | | | 14,457 | | | 44,943 | | | 30,686 | |

| Acquisition related expenses | 15 | | | 274 | | | 15 | | | 291 | |

| Asset management fees | 3,845 | | | 2,747 | | | 7,306 | | | 5,538 | |

| | | | | | | |

| Performance participation allocation | 5,249 | | | — | | | 7,483 | | | — | |

| General and administrative expenses | 1,445 | | | 1,286 | | | 2,810 | | | 2,324 | |

| Total expenses | 51,912 | | | 30,584 | | | 94,260 | | | 63,572 | |

| | | | | | | |

| Other income (expenses): | | | | | | | |

| | | | | | | |

| Gain (loss) on derivative instruments | (185) | | | 1,514 | | | (276) | | | 8,470 | |

| Gain (loss) on investments in real estate-related securities | 5,750 | | | 3,136 | | | 9,089 | | | (4,601) | |

| Gain on sale of real estate | 1,402 | | | 80,457 | | | 1,440 | | | 130,101 | |

| Foreign currency gains (losses) | 1,397 | | | 1,374 | | | 367 | | | (1,145) | |

| Interest expense | (6,370) | | | (4,463) | | | (11,748) | | | (10,395) | |

| Interest and other income | 470 | | | 159 | | | 976 | | | 710 | |

| Income (loss) before benefit (provision) for income taxes | (8,057) | | | 79,407 | | | (14,729) | | | 121,227 | |

| Benefit (provision) for income taxes | (3,637) | | | 1,906 | | | (2,683) | | | 1,838 | |

| Provision for income taxes related to sale of real estate | — | | | (7,773) | | | — | | | (7,773) | |

| Net income (loss) | (11,694) | | | 73,540 | | | (17,412) | | | 115,292 | |

| Net (income) loss attributable to noncontrolling interests | (4) | | | (4) | | | (7) | | | (7) | |

| Net income (loss) attributable to common stockholders | $ | (11,698) | | | $ | 73,536 | | | $ | (17,419) | | | $ | 115,285 | |

| Basic and diluted income (loss) per common share | $ | (0.10) | | | $ | 0.77 | | | $ | (0.15) | | | $ | 1.23 | |

| Weighted average number of common shares outstanding | 120,707 | | | 95,490 | | | 115,175 | | | 93,900 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Comprehensive income (loss): | | | | | | | |

| Net income (loss) | $ | (11,694) | | | $ | 73,540 | | | $ | (17,412) | | | $ | 115,292 | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustment | 4,080 | | | 5,483 | | | (3,598) | | | (10,130) | |

| Comprehensive income (loss) | $ | (7,614) | | | $ | 79,023 | | | $ | (21,010) | | | $ | 105,162 | |

| Comprehensive (income) loss attributable to noncontrolling interests | (4) | | | (4) | | | (7) | | | (7) | |

| Comprehensive income (loss) attributable to common stockholders | $ | (7,618) | | | $ | 79,019 | | | $ | (21,017) | | | $ | 105,155 | |

See notes to the condensed consolidated financial statements.

HINES GLOBAL INCOME TRUST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(UNAUDITED)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hines Global Income Trust, Inc. Stockholders |

| | Common Shares | | Additional Paid-in Capital | | Accumulated Distributions in Excess of Earnings | | Accumulated Other Comprehensive Income (Loss) | | Total Stockholders’ Equity | | Noncontrolling Interests |

| Shares | | Amount | | | | | |

| Balance as of January 1, 2021 | 103,781 | | | $ | 104 | | | $ | 938,736 | | | $ | (99,451) | | | $ | 22,829 | | | $ | 862,218 | | | $ | — | |

| Issuance of common shares | 10,424 | | | 10 | | | 105,427 | | | — | | | — | | | 105,437 | | | — | |

| | | | | | | | | | | | | |

| Distributions declared | — | | | — | | | — | | | (15,593) | | | — | | | (15,593) | | | (3) | |

| Redemption of common shares | (1,354) | | | (1) | | | (11,741) | | | — | | | — | | | (11,742) | | | — | |

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — | | | — | | | (2,717) | | | — | | | — | | | (2,717) | | | — | |

| Offering costs | — | | | — | | | (723) | | | — | | | — | | | (723) | | | — | |

| Net income (loss) | — | | | — | | | — | | | (5,721) | | | — | | | (5,721) | | | 3 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | (7,678) | | | (7,678) | | | — | |

| | | | | | | | | | | | | |

| Balance as of March 31, 2021 | 112,851 | | | $ | 113 | | | $ | 1,028,982 | | | $ | (120,765) | | | $ | 15,151 | | | $ | 923,481 | | | $ | — | |

| Issuance of common shares | 13,297 | | | 13 | | | 135,778 | | | — | | | — | | | 135,791 | | | — | |

| Distributions declared | — | | | — | | | — | | | (17,293) | | | — | | | (17,293) | | | (4) | |

| Redemption of common shares | (1,296) | | | (1) | | | (10,871) | | | — | | | — | | | (10,872) | | | — | |

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — | | | — | | | (5,238) | | | — | | | — | | | (5,238) | | | — | |

| Offering costs | — | | | — | | | (686) | | | — | | | — | | | (686) | | | — | |

| Net income (loss) | — | | | — | | | — | | | (11,698) | | | — | | | (11,698) | | | 4 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | 4,080 | | | 4,080 | | | — | |

| | | | | | | | | | | | | |

| Balance as of June 30, 2021 | 124,852 | | | $ | 125 | | | $ | 1,147,965 | | | $ | (149,756) | | | $ | 19,231 | | | $ | 1,017,565 | | | $ | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hines Global Income Trust, Inc. Stockholders |

| | Common Shares | Additional Paid-in Capital | | Accumulated Distributions in Excess of Earnings | | Accumulated Other Comprehensive Income (Loss) | | Total Stockholders’ Equity | | Noncontrolling Interests |

| Shares | | Amount | | | | | |

| Balance as of January 1, 2020 | 81,847 | | | $ | 83 | | | $ | 735,545 | | | $ | (146,830) | | | $ | 2,723 | | | $ | 591,521 | | | $ | — | |

| Issuance of common shares | 10,735 | | | 12 | | | 112,179 | | | — | | | — | | | 112,191 | | | — | |

| | | | | | | | | | | | | |

| Distributions declared | — | | | — | | | — | | | (12,401) | | | — | | | (12,401) | | | (3) | |

| Redemption of common shares | (464) | | | — | | | (5,395) | | | — | | | — | | | (5,395) | | | — | |

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — | | | — | | | (6,240) | | | — | | | — | | | (6,240) | | | — | |

| Offering costs | — | | | — | | | (863) | | | — | | | — | | | (863) | | | — | |

| Net income (loss) | — | | | — | | | — | | | 41,749 | | | — | | | 41,749 | | | 3 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | (15,613) | | | (15,613) | | | — | |

| Balance as of March 31, 2020 | 92,118 | | | $ | 95 | | | $ | 835,226 | | | $ | (117,482) | | | $ | (12,890) | | | $ | 704,949 | | | $ | — | |

| Issuance of common shares | 4,822 | | | 3 | | | 49,404 | | | — | | | — | | | 49,407 | | | — | |

| Distributions declared | — | | | — | | | — | | | (13,452) | | | — | | | (13,452) | | | (4) | |

| Redemption of common shares | (1,037) | | | (1) | | | (11,399) | | | — | | | — | | | (11,400) | | | — | |

| Selling commissions, dealer manager fees and distribution and stockholder servicing fees | — | | | — | | | (4,009) | | | — | | | — | | | (4,009) | | | — | |

| Offering costs | — | | | — | | | (987) | | | — | | | — | | | (987) | | | — | |

| Net income (loss) | — | | | — | | | — | | | 73,536 | | | — | | | 73,536 | | | 4 | |

| Foreign currency translation adjustment | — | | | — | | | — | | | — | | | 2,323 | | | 2,323 | | | — | |

| Foreign currency translation adjustment reclassified into earnings | | | | | — | | | — | | | 3,160 | | | 3,160 | | | — | |

| Balance as of June 30, 2020 | 95,903 | | | $ | 97 | | | $ | 868,235 | | | $ | (57,398) | | | $ | (7,407) | | | $ | 803,527 | | | $ | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

See notes to the condensed consolidated financial statements.

HINES GLOBAL INCOME TRUST, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| | 2021 | | 2020 |

| (In thousands) |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income (loss) | $ | (17,412) | | | $ | 115,292 | |

| Adjustments to reconcile net income (loss) to net cash from (used in) operating activities: | | | |

| Depreciation and amortization | 46,693 | | | 31,842 | |

| | | |

| Gain on sale of real estate | (1,440) | | | (130,101) | |

| Foreign currency (gains) losses | (367) | | | 1,145 | |

| (Gain) loss on derivative instruments | 276 | | | (8,470) | |

| (Gain) loss on investments in real estate-related securities | (9,089) | | | 4,601 | |

| Changes in assets and liabilities: | | | |

| Change in other assets | 211 | | | (4,453) | |

| Change in tenant and other receivables | (2,884) | | | (3,016) | |

| Change in deferred leasing costs | (17,918) | | | (2,691) | |

| | | |

| Change in accounts payable and accrued expenses | 10,275 | | | (569) | |

| Change in other liabilities | 1,809 | | | (6,510) | |

| Change in due to affiliates | (1,357) | | | (8,941) | |

| Net cash from (used in) operating activities | 8,797 | | | (11,871) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Investments in acquired properties and lease intangibles | (436,811) | | | (164,096) | |

| Capital expenditures at operating properties | (5,607) | | | (4,613) | |

| | | |

| Proceeds from sale of real estate | — | | | 340,532 | |

| Purchases of real estate-related securities | (32,251) | | | (24,575) | |

| Proceeds from settlement of real estate-related securities | 27,331 | | | 18,812 | |

| | | |

| | | |

| | | |

| | | |

| Net cash from (used in) investing activities | (447,338) | | | 166,060 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from issuance of common shares | 223,869 | | | 147,932 | |

| | | |

| Redemption of common shares | (26,619) | | | (14,985) | |

| Payment of offering costs | (3,129) | | | (2,850) | |

| | | |

| Payment of selling commissions, dealer manager fees and distribution and stockholder servicing fees | (4,965) | | | (5,516) | |

| Distributions paid to stockholders and noncontrolling interests | (15,517) | | | (11,575) | |

| Proceeds from notes payable | 376,549 | | | 75,970 | |

| Payments on notes payable | (107,448) | | | (248,750) | |

| | | |

| Payments on related party note payable | — | | | (75,000) | |

| Change in security deposit liability | 294 | | | 736 | |

| Deferred financing costs paid | (71) | | | (404) | |

| Payments related to interest rate contracts | (12) | | | — | |

| Net cash from (used in) financing activities | 442,951 | | | (134,442) | |

| Effect of exchange rate changes on cash, restricted cash and cash equivalents | (771) | | | 1,495 | |

| Net change in cash, restricted cash and cash equivalents | 3,639 | | | 21,242 | |

| Cash, restricted cash and cash equivalents, beginning of period | 77,563 | | | 56,438 | |

| Cash, restricted cash and cash equivalents, end of period | $ | 81,202 | | | $ | 77,680 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

See notes to the condensed consolidated financial statements.

HINES GLOBAL INCOME TRUST INC, INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

For the Three and Six Months Ended June 30, 2021 and 2020

1. ORGANIZATION

The accompanying interim unaudited condensed consolidated financial information has been prepared according to the rules and regulations of the United States Securities and Exchange Commission (“SEC”). In the opinion of management, all adjustments and eliminations, consisting only of normal recurring adjustments, necessary to present fairly and in conformity with accounting principles generally accepted in the United States of America (“GAAP”) the financial position of Hines Global Income Trust, Inc. as of June 30, 2021 and December 31, 2020, and the results of operations for the three and six months ended June 30, 2021 and 2020, the changes in stockholders’ equity for each of the quarterly periods in the six months ended June 30, 2021 and 2020, and cash flows for the six months ended June 30, 2021 and 2020 have been included. The results of operations for such interim periods are not necessarily indicative of the results for the full year. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted according to such rules and regulations. For further information, refer to the financial statements and footnotes included in Hines Global Income Trust, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2020.

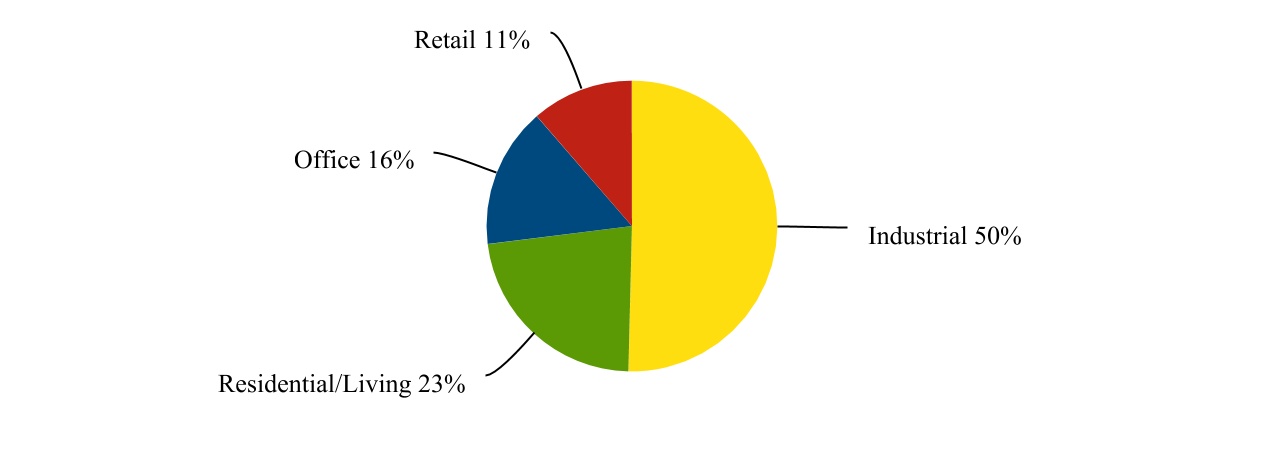

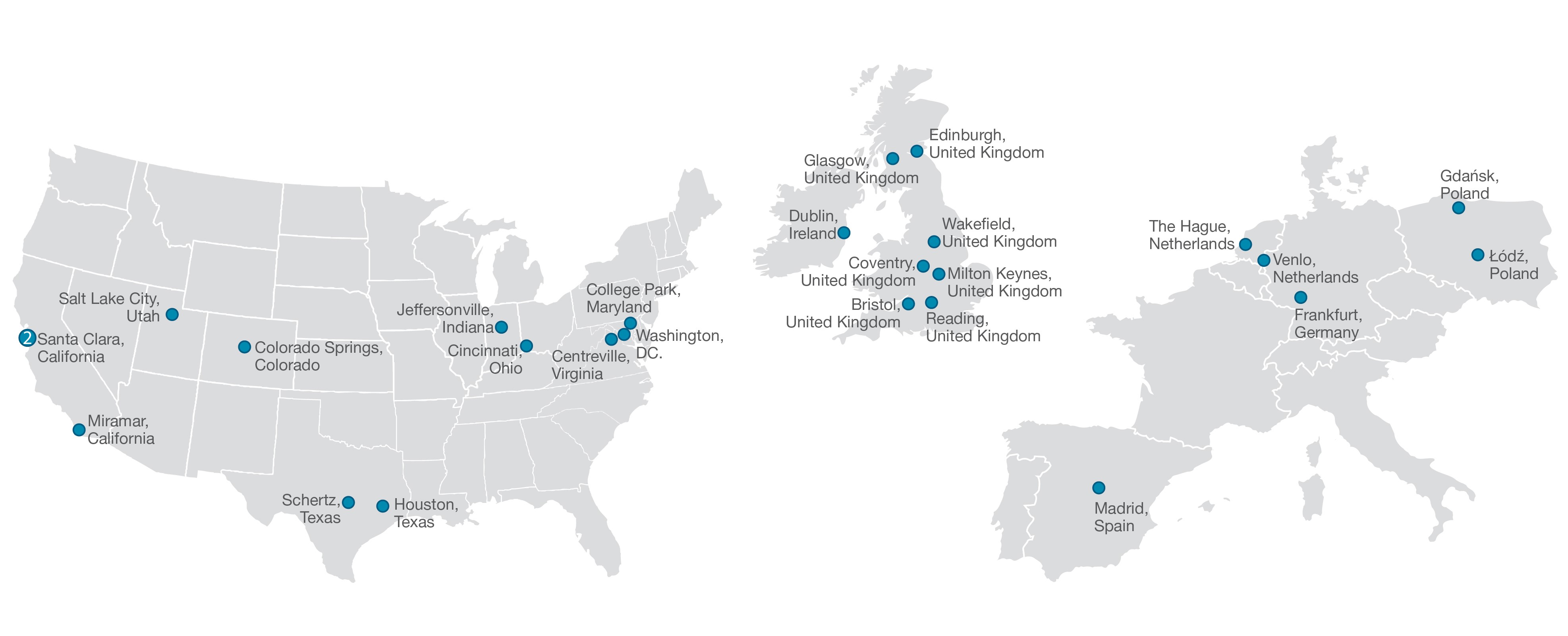

Hines Global Income Trust, Inc. (the “Company”), is a Maryland corporation formed to invest in a diversified portfolio of quality commercial real estate properties and other real estate investments throughout the United States and internationally, and to a lesser extent, invest in real-estate related securities. The Company is sponsored by Hines Interests Limited Partnership (“Hines”), a fully integrated global real estate investment and management firm that has acquired, developed, owned, operated and sold real estate for over 60 years. The Company is managed by HGIT Advisors LP (the “Advisor”), an affiliate of Hines. The Company conducts substantially all of its operations through HGIT Properties, LP (the “Operating Partnership”). An affiliate of the Advisor, Hines Global REIT II Associates LP, owns less than a 1% limited partner interest in the Operating Partnership as of June 30, 2021 and the Advisor also owns the special limited partnership interest in the Operating Partnership. The Company has elected to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes beginning with its taxable year ended December 31, 2015.

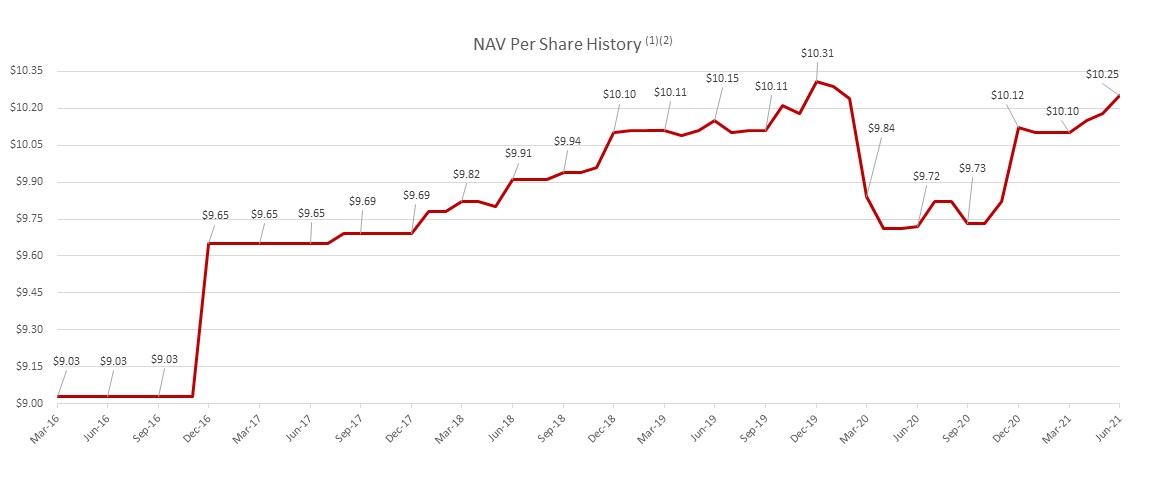

As of June 30, 2021, the Company owned direct real estate investments in 26 properties totaling 12.9 million square feet that were 95% leased. The Company raises capital for its investments through continuous public offerings of its common stock. The Company launched its third public offering of up to $2.5 billion in shares of its common stock (the “Third Offering”) on June 2, 2021 through which it is offering of up to $2.5 billion in shares of common stock including $500.0 million of shares offered under its distribution reinvestment plan. The Company terminated its second public offering immediately prior to the commencement of the Third Offering. As of August 16, 2021, the Company had received gross offering proceeds of approximately $1.5 billion from the sale of 143.5 million shares through its public offerings, including shares issued pursuant to its distribution reinvestment plan.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The condensed consolidated financial statements of the Company included in this Quarterly Report on Form 10-Q include the accounts of Hines Global Income Trust, Inc. and the Operating Partnership (over which the Company exercises financial and operating control). All intercompany balances and transactions have been eliminated in consolidation.

Coronavirus Outbreak

The preparation of financial statements in conformity with U.S GAAP requires the Company’s management to make estimates and assumptions that affect the amounts reported in the financial statements. Although these estimates are based on management’s knowledge of current events and actions it may undertake in the future, actual results may differ from these estimates. In particular, the COVID-19 pandemic (more commonly referred to as the Coronavirus pandemic), has adversely impacted and may further adversely impact the Company’s business, the businesses of the Company’s tenants and the real estate market generally. The full extent to which the pandemic will directly or indirectly impact the Company's business, results of operations and financial condition, including fair value measurements, and asset impairment charges, will depend on future developments that are highly uncertain and difficult to predict. These developments include, but are not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or address its impact, governmental actions to contain the spread of the pandemic and respond to the reduction in global economic activity, and how quickly and to what extent normal economic and operating conditions can resume.

The ongoing global outbreak of the Coronavirus pandemic continues to adversely impact global commercial activity. It has disrupted global travel and supply chains, adversely impacted global commercial activity, and its long-term economic impact remains uncertain. Although the outlook is improving in certain areas of the world, including the United States, the United Kingdom and Europe, considerable uncertainty still surrounds the Coronavirus and its potential effects on the population, as well as the effectiveness of any responses taken on a national and local level by government authorities and businesses. The travel restrictions, limits on hours of operations and/or closures of non-essential businesses and other efforts to curb the spread of the Coronavirus have significantly disrupted business activity globally, including in the markets where the Company invests, and has had an adverse impact on the performance of certain of the Company’s investments. Many of the Company’s tenants have been subject to various quarantine restrictions. These restrictions particularly adversely impacted many of the Company’s retail tenants (other than grocery tenants), as government instructions regarding social distancing, capacity limitations and mandated closures have reduced and, in some cases, eliminated customer foot traffic, causing many of the Company’s retail tenants to temporarily close their brick and mortar stores for a portion of 2020. Although businesses in most markets where the Company invests have been permitted to fully or partially re-open, certain areas have experienced a return to restrictions such as mask mandates subsequent to re-opening and no assurance can be given as to when such restrictions will be lifted or that additional closures will not occur. While vaccines have been widely administered, vaccination rates in the U.S. and markets outside the U.S. where the Company invests lag behind the levels desired by public health officials and it is unclear when businesses around the world will return to pre-pandemic activity levels. As of June 30, 2021, the Company owned two retail properties in the U.S., which comprised 16% of the Company’s total revenue for the six months ended June 30, 2021. The Company agreed to grant $3.8 million of rent relief to its retail tenants during the year ended December 31, 2020, as a result of their lost revenues resulting from the Coronavirus pandemic at these properties. Such rent relief consisted of rental payments that were forgiven or reduced due to the conversion of fixed rental payments to rental payments based on a percentage of the tenant’s revenues as well as rent payments that were deferred to future periods. We have not granted significant additional rent relief during the six months ended June 30, 2021. While rent collections were adversely affected in the early months of the pandemic, consumer traffic at these properties has recovered to near pre-pandemic levels in recent months. During the six months ended June 30, 2021, rent collections had recovered to 99% of billed rent, which includes the collection of certain 2020 rent payments that were deferred to 2021. However, if infection rates begin to materially increase and there are additional government mandated shutdowns it could reduce consumer traffic at the Company’s retail properties and negatively impact future rent collections.

Additionally, the Company refunded $2.2 million in rent to students across its international student housing portfolio during the year ended December 31, 2020 and $0.7 million for the six months ended June 30, 2021 as a result of temporary university closures. The Company expects in-campus learning to resume at the start of the 2021/2022 school year, but it is difficult to predict whether additional closures may occur. The Company’s other property types have not been materially impacted by the Coronavirus pandemic to date. The Company is unable to estimate the impact the Coronavirus pandemic will have on its results in future periods.

Correction of Immaterial Error

During the quarter ended June 30, 2021, the Company identified an immaterial error in the calculation of deferred tax assets and related valuation allowance at one of its properties. As a result of this error, “Other Assets” included in the Company’s Consolidated Balance Sheet as of December 31, 2020 was overstated by $2.9 million and the “Benefit (provision) for income taxes” and “Net Income” included in the Consolidated Statements of Operations and Comprehensive Income (Loss) was overstated by $2.9 million for the year then ended. Additionally, “Other Assets” included in the Company’s Condensed Consolidated Balance Sheet as of March 31, 2021 was overstated by $3.9 million and the “Benefit (provision) for income taxes” included in the condensed Consolidated Statements of Operations and Comprehensive Income (Loss) was overstated by $1.0 million, resulting in an understated “Net loss”. The Company corrected these errors in the quarterly period ended June 30, 2021, which increased net loss by $3.9 million and $2.9 million for the three and six months then ended, respectively. Management evaluated the effects of these out-of-period adjustments, both qualitatively and quantitatively, and concluded that the errors and the related correction were not material both individually and in the aggregate to the current period or prior periods.

Investments in Real Estate-Related Securities

The Company holds investments in real estate-related securities, which consist of common equities, preferred equities and debt investments of publicly traded REITs. The Company has elected to classify these investments as trading securities and carry such investments at fair value. These assets are valued on a recurring basis. The Company earns interest and dividend income monthly related to these securities, which is recorded in interest and other income in the Company’s Condensed Consolidated Statements of Operations and Comprehensive Income (Loss). The table below presents the effects of the changes in fair value of the Company’s real estate-related securities in the Company’s Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) for the three and six months ended June 30, 2021 and 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gain (Loss) Recorded on Investments in Real Estate-Related Securities |

| | Three months ended June 30, | | Six months ended June 30, |

| | | 2021 | | 2020 | | 2021 | | 2020 |

| Unrealized gain (loss) | | $ | 3,091 | | | $ | 4,548 | | | $ | 5,541 | | | $ | (2,839) | |

| Realized gain (loss) | | 2,659 | | | (1,412) | | | 3,548 | | | (1,762) | |

| Total gain (loss) on real estate-related securities | | $ | 5,750 | | | $ | 3,136 | | | $ | 9,089 | | | $ | (4,601) | |

Tenant and Other Receivables

Tenant and other receivables consists primarily of base rents, tenant reimbursements and receivables attributable to straight-line rent, and are carried at cost. As of June 30, 2021 and December 31, 2020, the Company had receivables related to base rents and tenant reimbursements of $5.4 million and $4.6 million, respectively. Additionally, as of June 30, 2021, approximately $0.8 million of these receivables relate to rent that has been deferred at the Company’s retail properties and is expected to be repaid at a later date. As of June 30, 2021 and December 31, 2020, the Company had an allowance of approximately $0.4 million and $0.5 million related to these deferred rents, respectively.

Straight-line rent receivable consists of the difference between the tenants’ rents calculated on a straight-line basis from the date of acquisition or lease commencement over the remaining terms of the related leases and the tenants’ actual rents due under the lease agreements. Straight-line rent receivables were $11.1 million and $9.1 million as of June 30, 2021 and December 31, 2020, respectively.

Other Assets

Other assets included the following (in thousands):

| | | | | | | | | | | | | | |

| | | June 30, 2021 | | December 31, 2020 |

| | | | |

| | | | |

| Prepaid insurance | | $ | 1,506 | | | $ | 1,133 | |

| Prepaid property taxes | | 2,403 | | | 1,845 | |

| | | | |

Deferred tax assets (1) | | 8,681 | | | 9,478 | |

| Other | | 3,133 | | | 2,231 | |

| Other assets | | $ | 15,723 | | | $ | 14,687 | |

(1)Includes the effects of a valuation allowance of $9.5 million and $3.3 million as of June 30, 2021 and December 31, 2020, respectively.

3. INVESTMENT PROPERTY

Investment property consisted of the following amounts as of June 30, 2021 and December 31, 2020 (in thousands):

| | | | | | | | | | | |

| | June 30, 2021 | | December 31, 2020 |

| Buildings and improvements | $ | 1,478,563 | | | $ | 1,216,004 | |

| Less: accumulated depreciation | (76,738) | | | (60,019) | |

| Buildings and improvements, net | 1,401,825 | | | 1,155,985 | |

| Land | 479,135 | | | 402,075 | |

| Investment property, net | $ | 1,880,960 | | | $ | 1,558,060 | |

The Company proactively closed the residential accommodations at Montrose Student Residences in August 2020 to more efficiently perform renovations including the replacement of certain building safety equipment systems. In conjunction with the renovation, the Company determined that an additional €4.7 million (approximately $5.5 million assuming a rate of $1.17 per EUR as of March 31, 2021) of the building assets, which were included in Investment property, net on the Condensed Consolidated Balance Sheets with an offset to Depreciation and amortization on the Condensed Consolidated Statements of Operations and Comprehensive Income (Loss), were taken out of service and written off as of March 31, 2021. During the three months ended June 30, 2021, the Company increased the scope of the renovations from the previous estimates and determined that an additional write off of €4.7 million (approximately $5.5 million assuming a rate of $1.19 per EUR as of June 30, 2021) was necessary, which was included in Investment property, net on the Condensed Consolidated Balance Sheets with an offset to Depreciation and amortization on the Condensed Consolidated Statements of Operations and Comprehensive Income (Loss). The Company expects the renovation to be completed by May 2022.

Recent Acquisitions of Investment Property

In February 2021, the Company acquired 5301 Patrick Henry Drive, a manufacturing research and development campus located in Santa Clara, California. The net purchase price for 5301 Patrick Henry Drive was $68.0 million, exclusive of transaction costs and working capital reserves.

In April 2021, the Company acquired an additional building at ABC Westland, the industrial property located in The Hague, Netherlands. The net purchase price for the additional building, ABC Westland A3.2, was €7.3 million (approximately $8.9 million, assuming a rate of $1.22 per EUR as of the acquisition date), exclusive of transaction costs and working capital reserves.

In May 2021, the Company acquired 900 Patrol Road, an industrial logistics property located in Jeffersonville, Indiana. The net purchase price for 900 Patrol Road was $98.7 million, exclusive of transaction costs and working capital reserves.

In May 2021, the Company acquired 1015 Half Street, an office property located in Washington, D.C. The net purchase price for 1015 Half Street was $223.3 million, exclusive of transaction costs and working capital reserves.

In June 2021, the Company acquired Miramar Activity Business Center, an industrial logistics property located in San Diego, California. The net purchase price for Miramar Activity Business Center was $41.0 million, exclusive of transaction costs and working capital reserves.

The amounts recognized for the asset acquisitions as of the acquisition dates were determined by allocating the net purchase price as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Name | | Acquisition Date | | Building and

Improvements | | Land | | In-place Lease Intangibles | | Out-of-Market Lease Intangibles, Net | | Total |

| 5301 Patrick Henry Drive | | 2/10/2021 | | $ | 36,651 | | | $ | 19,089 | | | $ | 15,136 | | | $ | (2,711) | | | $ | 68,165 | |

| ABC Westland A3.2 | | 4/30/2021 | | $ | 8,400 | | | $ | — | | | $ | 678 | | | $ | — | | | $ | 9,078 | |

| 900 Patrol Road | | 5/17/2021 | | $ | 79,242 | | | $ | 7,977 | | | $ | 11,656 | | | $ | — | | | $ | 98,875 | |

| 1015 Half Street | | 5/19/2021 | | $ | 131,745 | | | $ | 32,884 | | | $ | 81,861 | | | $ | (17,391) | | | $ | 229,099 | |

| Miramar Activity Business Center | | 6/30/2021 | | $ | 17,007 | | | $ | 19,573 | | | $ | 4,411 | | | $ | 34 | | | $ | 41,025 | |

| | | | | | | | | | | | |

As of June 30, 2021, the cost basis and accumulated amortization related to lease intangibles are as follows (in thousands):

| | | | | | | | | | | | | | | | | |

| | Lease Intangibles |

| | In-Place Leases | | Out-of-Market

Lease Assets | | Out-of-Market

Lease Liabilities |

| | | |

| Cost | $ | 258,308 | | | $ | 12,309 | | | $ | (47,841) | |

| Less: accumulated amortization | (49,604) | | | (2,646) | | | 8,413 | |

| Net | $ | 208,704 | | | $ | 9,663 | | | $ | (39,428) | |

As of December 31, 2020, the cost basis and accumulated amortization related to lease intangibles were as follows (in thousands):

| | | | | | | | | | | | | | | | | |

| | Lease Intangibles |

| | In-Place Leases | | Out-of-Market

Lease Assets | | Out-of-Market

Lease Liabilities |

| | | |

| Cost | $ | 153,358 | | | $ | 12,362 | | | $ | (27,792) | |

| Less: accumulated amortization | (41,998) | | | (1,892) | | | 6,399 | |

| Net | $ | 111,360 | | | $ | 10,470 | | | $ | (21,393) | |

Amortization expense of in-place leases was $8.9 million and $7.5 million for the three months ended June 30, 2021 and 2020, respectively. Net amortization of out-of-market leases resulted in an increase to rental revenue of $0.7 million and $0.3 million for the three months ended June 30, 2021 and 2020, respectively.

Amortization expense of in-place leases was $16.1 million and $16.5 million for the six months ended June 30, 2021 and 2020, respectively. Net amortization of out-of-market leases resulted in an increase to rental revenue of $1.1 million and $0.9 million for the six months ended June 30, 2021 and 2020, respectively.

Anticipated amortization of the Company’s in-place leases and out-of-market leases, net for the period from July 1, 2021 through December 31, 2021 and for each of the years ending December 31, 2022 through December 31, 2026 are as follows (in thousands):

| | | | | | | | | | | |

| In-Place Lease | | Out-of-Market

Leases, Net |

| July 1, 2021 through December 31, 2021 | $ | 22,036 | | | $ | (2,486) | |

| 2022 | $ | 40,808 | | | $ | (5,432) | |

| 2023 | $ | 35,439 | | | $ | (5,106) | |

| 2024 | $ | 28,945 | | | $ | (4,195) | |

| 2025 | $ | 23,298 | | | $ | (2,973) | |

| 2026 | $ | 16,181 | | | $ | (1,288) | |

Commercial Leases

The Company’s commercial leases are generally for terms of 15 years or less and may include multiple options to extend the lease term upon tenant election. The Company’s leases typically do not include an option to purchase. Generally, the Company does not expect the value of its real estate assets to be impacted materially at the end of any individual lease term, as the Company is typically able to re-lease the space and real estate assets tend to hold their value over a long period of time. Tenant terminations prior to the lease end date occasionally result in a one-time termination fee based on the remaining unpaid lease payments including variable payments and could be material to the tenant. Many of the Company’s leases have increasing minimum rental rates during the terms of the leases through escalation provisions. In addition, the majority of the Company’s leases provide for separate billings for variable rent, such as, reimbursements of real estate taxes, maintenance and insurance and may include an amount based on a percentage of the tenants’ sales. Total billings related to expense reimbursements from tenants for the three and six months ended June 30, 2021 were $5.9 million and $11.6 million, respectively, and for the three and six months ended June 30, 2020 were $3.8 million and $8.7 million, respectively, which are included in rental revenue on the Condensed Consolidated Statements of Operations and Comprehensive Income (Loss).

The Company has entered into non-cancelable lease agreements with tenants for space. As of June 30, 2021, the approximate fixed future minimum rentals for the period from July 1, 2021 through December 31, 2021, for each of the years ending December 31, 2022 through 2026 and thereafter related to the Company’s commercial properties are as follows (in thousands):

| | | | | |

| | Fixed Future Minimum Rentals |

| July 1, 2021 through December 31, 2021 | $ | 59,669 | |

| 2022 | 115,457 | |

| 2023 | 104,117 | |

| 2024 | 92,098 | |

| 2025 | 82,505 | |

| 2026 | 66,131 | |

| Thereafter | 229,240 | |

| Total | $ | 749,217 | |

During the six months ended June 30, 2021 and 2020, the Company did not earn more than 10% of its revenue from any individual tenant.

The Company also enters into leases with tenants at its student housing properties and multi-family properties. These leases generally have terms less than one year and do not contain options to extend, terminate or purchase, escalation clauses, or other such terms, which are common in the Company’s commercial leases.

4. DEBT FINANCING

As of June 30, 2021 and December 31, 2020, the Company had approximately $1.1 billion and $885.5 million of debt outstanding, with weighted average years to maturity of 1.7 years and 2.4 years, respectively, and a weighted average interest rate of 1.99% and 2.08%, respectively. The following table provides additional information regarding the Company’s debt outstanding at June 30, 2021 and December 31, 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Origination or Assumption Date | | Maturity Date | | Maximum Capacity in Functional Currency | | Interest Rate Description | | Interest Rate as of June 30, 2021 | | Principal Outstanding at June 30, 2021 | | Principal Outstanding at December 31, 2020 |

| Secured Mortgage Debt | | | | | | | | | | | | | | |

| Cottonwood Corporate Center | | 7/5/2016 | | 8/1/2023 | | $ | 78,000 | | | Fixed | | 2.98% | | $ | 69,632 | | | $ | 70,555 | |

| Rookwood Commons | | 1/6/2017 | | 7/1/2023 | | $ | 67,000 | | | Fixed | | 4.25% | | 54,500 | | | 54,500 | |

| Rookwood Pavilion | | 1/6/2017 | | 7/1/2023 | | $ | 29,000 | | | Fixed | | 4.25% | | 29,000 | | | 29,000 | |

| Montrose Student Residences | | 3/24/2017 | | 3/23/2022 | | € | 22,605 | | | Euribor + 2.00% (1) | | 2.00% | | 26,850 | | | 27,723 | |

| Queen's Court Student Residences | | 12/18/2017 | | 12/18/2022 | | £ | 29,500 | | | Libor + 2.10% (1) | | 2.16% | | 40,813 | | | 40,265 | |

| Venue Museum District | | 9/21/2018 | | 10/9/2021 | | $ | 45,000 | | | Libor + 1.95% (1) | | 4.02% | | 27,601 | | | 27,601 | |

| Fresh Park Venlo | | 10/3/2018 | | 8/15/2023 | | € | 80,197 | | | Euribor + 1.55% (1) | | 1.55% | | 95,258 | | (2) | 91,958 | |

| Maintal Logistics | | 2/21/2019 | | 2/28/2024 | | € | 23,500 | | | Euribor + 1.10% (1) | | 1.10% | | 27,262 | | | 28,292 | |

| ABC Westland | | 5/3/2019 | | 2/15/2024 | | € | 82,830 | | | Euribor + 1.55% (1) | | 1.55% | | 93,753 | | (2) | 87,197 | |

| Łódź Urban Logistics | | 9/20/2019 | | 9/20/2024 | | € | 13,600 | | | Fixed (3) | | 1.05% | | 15,881 | | | 16,492 | |

| Glasgow West End | | 9/26/2019 | | 9/26/2024 | | £ | 43,200 | | | Libor + 1.80% (1) | | 1.86% | | 59,767 | | | 58,964 | |

| Gdańsk PL II | | 10/4/2019 | | 9/20/2024 | | € | 16,800 | | | Fixed (3) | | 1.05% | | 19,618 | | | 20,372 | |

| Madrid Airport Complex | | 6/19/2020 | | 6/19/2023 | | € | 15,150 | | | Fixed | | 2.80% | | 15,629 | | | 17,358 | |

| UK Logistics | | 7/7/2020 | | 7/7/2023 | | £ | 55,138 | | (4) | Libor + 1.75% (1) | | 1.84% | | 76,283 | | | 75,257 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other Notes Payable | | | | | | | | | | | | | | |

| JPMorgan Chase Revolving Credit Facility | | 9/13/2019 | | 11/15/2022 | | $ | 275,000 | | | Variable | | 1.60% | | 238,000 | | | 140,000 | |

| JPMorgan Chase Revolving Credit Facility - Term Loan | | 9/13/2019 | | 11/15/2022 | | $ | 150,000 | | | Variable | | 1.53% | | 150,000 | | | 100,000 | |

| JPMorgan Chase Bridge Loan | | 5/14/2021 | | 8/12/2021 | | $ | 108,000 | | | Variable | | 1.85% | | 108,000 | | (5) | — | |

| Notes Payable | | | | | | | | | | $ | 1,147,847 | | | $ | 885,534 | |

| Affiliate Note Payable | | | | | | | | | | | | | | |

| Credit Facility with Hines | | 10/2/2017 | | 12/31/2021 | | $ | 75,000 | | | Variable | | N/A | | — | | | — | |

| Total Note Payable to Affiliate | | | | | | | | | | $ | — | | | $ | — | |

| Total Principal Outstanding | | | | | | | | | | $ | 1,147,847 | | | $ | 885,534 | |

| Unamortized discount | | | | | | | | | | — | | | — | |

| Unamortized financing fees | | | | | | | | | | (3,900) | | | (4,738) | |

| Total | | | | | | | | | | $ | 1,143,947 | | | $ | 880,796 | |

(1)On the loan origination date, the Company entered into an interest rate cap agreement as an economic hedge against the variability of future interest rates on this borrowing. See Note 5—Derivative Instruments for further details. (2)The Company entered into amendments to increase the capacity of the secured mortgage loans for Fresh Park Venlo and ABC Westland in 2021 and made additional borrowings on these loans during the three months ended June 30, 2021.

(3)On the loan origination date, the Company entered into an interest rate swap contract effectively fixing the interest rate for the full term of the facility. See Note 5—Derivative Instruments for further details. (4)This credit facility is collateralized by the following four industrial logistics properties: Charles Tyrwhitt DC, DSG Bristol, Royal Mail and Wakefield Logistics.

(5)The Company entered into a $108.0 million bridge loan facility with JPMorgan in May 2021, to provide funding for the Company’s May 2021 acquisitions. This bridge loan was fully repaid in July 2021 using proceeds from the amended credit facility described below, and the bridge loan facility was terminated in accordance with its terms.

JPMorgan Chase Revolving Credit Facility

During the six months ended June 30, 2021, the Company made draws of approximately $253.0 million and made payments of $105.0 million on its revolving loan commitment with JPMorgan Chase, N.A., (the “Revolving Credit Facility”), resulting in an outstanding balance of $388.0 million on June 30, 2021.

On July 30, 2021, the Company entered into an Amended and Restated Credit Facility (the “Amended Revolving Credit Facility”) with JP Morgan Chase Bank, N.A. as administrative agent for itself and the various lenders named in the credit agreement. The Amended Revolving Credit Facility increased the total capacity of the original credit agreement dated November 15, 2019, and amended as of November 13, 2020 from $425.0 million to $725.0 million. The Amended Revolving Credit Facility provides for borrowings of up to $425.0 million under a senior, unsecured revolving credit facility and $300.0 million under a senior, unsecured term loan. Additionally, the Amended Revolving Credit Facility provides options for the Company to increase the total capacity up to $1.25 billion, subject to certain requirements. The maturity date was also extended to November 15, 2023, subject to two one-year extensions options that the Company may exercise if it meets certain conditions.

As of July 30, 2021, the Company had outstanding amounts of $300.0 million on the Term Loan, $173.0 million on the Amended Revolving Credit Facility, and retired the $108.0 million bridge loan. From August 1, 2021 through August 16, 2021, the Company made $33.0 million in additional payments under the Amended Revolving Credit Facility.

Financial Covenants

The Company’s mortgage agreements and other loan documents for the debt described in the table above contain customary events of default, with corresponding grace periods, including payment defaults, bankruptcy-related defaults, and customary covenants, including limitations on liens and indebtedness and maintenance of certain financial ratios. The Company is not aware of any instances of noncompliance with financial covenants on any of its loans as of June 30, 2021. The Company’s continued compliance with these and other covenants depends on many factors and could be impacted by current or future economic conditions associated with the Coronavirus pandemic. Failure to comply with any covenants would result in a default which, if the Company were unable to cure or obtain a waiver from the lenders, could accelerate the repayment obligations and impact the liquidity of the Company.

Principal Payments on Debt

The Company is required to make the following principal payments on its outstanding notes payable for the period from July 1, 2021 through December 31, 2021, for each of the years ending December 31, 2022 through December 31, 2025 and for the period thereafter (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Payments Due by Year |

| | July 1, 2021 through December 31, 2021 | | 2022 | | 2023 | | 2024 | | 2025 | | Thereafter |

| Principal payments | $ | 143,081 | | | $ | 460,572 | | | $ | 329,514 | | | $ | 214,680 | | | $ | — | | | $ | — | |

LIBOR is expected to be phased out or modified by June 2023, and the writing of contracts using LIBOR is expected to stop by the end of 2021. As of June 30, 2021, $700.5 million of the Company’s outstanding debt had a variable interest rate tied to LIBOR. The loan agreements provide procedures for determining a replacement or alternative rate in the event that LIBOR is unavailable. However, there can be no assurances as to whether such replacement or alternative rate will be more or less favorable than LIBOR. The Company intends to monitor the developments with respect to the potential phasing out of LIBOR and work with its lenders to ensure any transition away from LIBOR will have minimal impact on its financial condition, but can provide no assurances regarding the impact of the discontinuation of LIBOR.

5. DERIVATIVE INSTRUMENTS

The Company has entered into several interest rate swap contracts and interest rate cap contracts in connection with certain of its secured mortgage loans in order to limit its exposure against the variability of future interest rates on its variable interest rate borrowings. The Company’s interest rate swaps effectively fixed the interest rates on each of the loans to which they relate and the interest rate cap agreements have limited the interest rate on each of the loan to which they relate. The Company has not designated any of these derivatives as hedges for accounting purposes. The Company has not entered into a master netting arrangement with its third-party counterparty and does not offset on its Condensed Consolidated Balance Sheets the fair value amount recorded for its derivative instruments.

The Company has also entered into foreign currency forward contracts as economic hedges against the variability of foreign exchange rates related to certain cash flows of some of its international investments. These forward contracts fixed the currency exchange rates on each of the investments to which they related. The Company did not designate any of these contracts as fair value or cash flow hedges for accounting purposes.

The table below provides additional information regarding the Company’s interest rate contracts as of June 30, 2021 (in thousands, except percentages).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Rate Contracts | | | | | | | | | | | | |

| Type | | Property | | Effective Date | | Expiration Date | | Maximum Capacity of Debt in Functional Currency | | Notional Amount | | Interest Rate Received | | Pay Rate /Strike Rate |

| | | | | | | | | | | | | | |

| Interest rate cap | | Montrose Student Residences | | March 24, 2017 | | March 23, 2022 | | € | 22,605 | | | € | 16,954 | | | Euribor | | 1.25 | % |

| Interest rate cap | | Fresh Park Venlo | | October 8, 2018 | | August 15, 2023 | | € | 80,197 | | | € | 52,487 | | | Euribor | | 2.00 | % |

| Interest rate cap | | Fresh Park Venlo | | May 27, 2021 | | August 15, 2023 | | € | — | | (2) | € | 5,215 | | | Euribor | | 1.00 | % |

| Interest rate cap | | Maintal Logistics | | February 28, 2019 | | February 28, 2024 | | € | 23,500 | | | € | 16,450 | | | Euribor | | 2.00 | % |

| Interest rate cap | | ABC Westland | | May 3, 2019 | | February 15, 2024 | | € | 82,830 | | | € | 52,500 | | | Euribor | | 1.00 | % |

| Interest rate cap | | ABC Westland | | May 27, 2021 | | February 15, 2024 | | € | — | | (2) | € | 7,830 | | | Euribor | | 1.00 | % |

| Interest rate cap | | Glasgow West End | | September 27, 2019 | | September 24, 2024 | | € | 43,200 | | | € | 32,400 | | | LIBOR | | 2.00 | % |

| Interest rate swap | | Łódź Urban Logistics | | October 10, 2019 | | September 20, 2024 | | € | 13,600 | | | € | 13,600 | | | Euribor | | (0.36) | % |

| Interest rate swap | | Gdańsk PL II | | October 10, 2019 | | September 20, 2024 | | € | 16,800 | | | € | 16,800 | | | Euribor | | (0.36) | % |

| Interest rate cap | | Charles Tyrwhitt | | July 2, 2020 | | July 2, 2023 | | £ | 9,598 | | (1) | £ | 9,598 | | | LIBOR | | 1.50 | % |

| Interest rate cap | | DSG Bristol | | July 2, 2020 | | July 2, 2023 | | £ | 20,240 | | (1) | £ | 20,240 | | | LIBOR | | 1.50 | % |

| Interest rate cap | | Royal Mail | | July 2, 2020 | | July 2, 2023 | | £ | 13,970 | | (1) | £ | 13,970 | | | LIBOR | | 1.50 | % |

| Interest rate cap | | Wakefield Logistics | | July 2, 2020 | | July 2, 2023 | | £ | 11,330 | | (1) | £ | 11,330 | | | LIBOR | | 1.50 | % |

| Interest rate cap | | Venue Museum District | | October 9, 2020 | | October 9, 2022 | | $ | 45,000 | | | $ | 27,601 | | | LIBOR | | 2.00 | % |

(1)Represents an allocation of a total maximum capacity of £55.1 million borrowed under one facility agreement. See Note 4—Debt Financing for more information on the borrowing. (2)The notional amount for these interest rate caps are in addition to the already existing caps for the corresponding maximum capacity of debt in functional currency for the property listed above in this table.

The table below provides additional information regarding the Company’s foreign currency forward contracts that were active during the three and six months ended June 30, 2021 (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign Currency Forward Contracts | | | | | | |

| Effective Date | | Expiration Date | | Notional Amount | | Buy/Sell | | Traded Currency Rate |

| December 17, 2020 | | March 31, 2021 | | £ | 9,000 | | | USD/GBP | | $ | 1.36 | |

| March 30, 2021 | | June 30, 2021 | | £ | 9,000 | | | USD/GBP | | $ | 1.37 | |

| June 25, 2021 | | September 30, 2021 | | £ | 9,000 | | | USD/GBP | | $ | 1.39 | |

The table below presents the effects of the changes in fair value of the Company’s derivative instruments in the Company’s Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) for the three and six months ended June 30, 2021 and 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gain (Loss) Recorded on Derivative Instruments |

| | Three months ended June 30, | | Six months ended June 30, |

| | | 2021 | | 2020 | | 2021 | | 2020 |

| Derivatives not designated as hedging instruments: | | | | | | | | |

| Interest rate swaps | | $ | (86) | | | $ | 165 | | | $ | (157) | | | $ | 348 | |

| Interest rate caps | | (38) | | | 14 | | | 45 | | | (73) | |

| Foreign currency forward contracts | | (61) | | | 1,335 | | | (164) | | | 8,195 | |

| Total gain (loss) on derivatives | | $ | (185) | | | $ | 1,514 | | | $ | (276) | | | $ | 8,470 | |

6. STOCKHOLDERS’ EQUITY

Public Offering

The Company raises capital for its investments primarily through public offerings of its common stock. In connection with the Restructuring and the Second Offering, on November 30, 2017, the Company (i) redesignated its issued and outstanding Class A shares of common stock, Class T shares of common stock, Class I shares of common stock and Class J shares of common stock as “Class AX shares,” “Class TX shares,” “Class IX shares” and “Class JX shares,” (collectively, the “IPO Shares”) respectively, and (ii) reclassified the authorized but unissued portion of its common stock into four additional classes of shares of common stock: “Class T shares,” “Class S shares,” “Class D shares,” and “Class I shares.” The Company is offering its shares of common stock in the Second Offering in any combination of Class T shares, Class S shares, Class D shares and Class I shares. All shares of the Company’s common stock have the same voting rights and rights upon liquidation, although distributions received by the Company’s stockholders are expected to differ due to the distribution and stockholder servicing fees payable with respect to the applicable share classes, which reduce distributions.

The Company complies with the FASB ASC 480 “Distinguishing Liabilities from Equity” which requires, among other things, that financial instruments that represent a mandatory obligation of the Company to repurchase shares be classified as liabilities and reported at settlement value. When shares are tendered for redemption and approved by the board of directors, the Company will reclassify such obligations from equity to an accrued liability based upon their respective settlement values and redeem those shares in the subsequent month pursuant to the Company’s current share redemption program.

Common Stock

As of June 30, 2021 and December 31, 2020, the Company had the following classes of shares of common stock authorized, issued and outstanding (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2021 | | December 31, 2020 |

| Shares Authorized | | Shares Issued and Outstanding | | Shares Authorized | | Shares Issued and Outstanding |

| Class AX common stock, $0.001 par value per share | 40,000 | | 24,281 | | 40,000 | | 19,990 |

| Class TX common stock, $0.001 par value per share | 40,000 | | 12,979 | | 40,000 | | 18,152 |

| Class IX common stock, $0.001 par value per share | 10,000 | | 90 | | 10,000 | | 95 |

| Class JX common stock, $0.001 par value per share | 10,000 | | — | | 10,000 | | — |

| Class T common stock, $0.001 par value per share | 350,000 | | 45,766 | | 350,000 | | 40,036 |

| Class S common stock, $0.001 par value per share | 350,000 | | — | | 350,000 | | — |

| Class D common stock, $0.001 par value per share | 350,000 | | 13,844 | | 350,000 | | 10,217 |

| Class I common stock, $0.001 par value per share | 350,000 | | 27,892 | | 350,000 | | 15,291 |

The tables below provide information regarding the issuances and redemptions of each class of the Company’s common stock during the six months ended June 30, 2021 and 2020 (in thousands). There were no Class JX and S shares issued, redeemed or outstanding during the six months ended June 30, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class AX | | Class TX | | Class IX | | Class T | | Class D | | Class I | | Total |

| Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount |

| Balance as of January 1, 2021 | 19,990 | | | $ | 20 | | | 18,152 | | | $ | 21 | | | 95 | | | $ | — | | | 40,036 | | | $ | 39 | | | 10,217 | | | $ | 9 | | | 15,291 | | | $ | 15 | | | 103,781 | | | $ | 104 | |

| Issuance of common shares | 181 | | | — | | | 87 | | | — | | | 1 | | | — | | | 2,668 | | | 3 | | | 1,170 | | | 1 | | | 6,317 | | | 6 | | | 10,424 | | | 10 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Conversion of common shares (1) | 2,260 | | | 2 | | | (2,260) | | | (2) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Redemption of common shares | (402) | | | — | | | (356) | | | — | | | (3) | | | — | | | (431) | | | (1) | | | (64) | | | — | | | (98) | | | — | | | (1,354) | | | (1) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2021 | 22,029 | | | $ | 22 | | | 15,623 | | | $ | 19 | | | 93 | | | $ | — | | | 42,273 | | | $ | 41 | | | 11,323 | | | $ | 10 | | | 21,510 | | | $ | 21 | | | 112,851 | | | $ | 113 | |

| Issuance of common shares | 170 | | | — | | | 95 | | | — | | | 1 | | | — | | | 3,827 | | | 4 | | | 2,578 | | | 3 | | | 6,626 | | | 6 | | | 13,297 | | | 13 | |

| Redemption of common shares | (493) | | | (1) | | | (164) | | | — | | | (4) | | | — | | | (334) | | | — | | | (57) | | | — | | | (244) | | | — | | | (1,296) | | | (1) | |

Conversion of common shares (1) | 2,575 | | | 3 | | | (2,575) | | | (3) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Balance as of June 30, 2021 | 24,281 | | | $ | 24 | | | 12,979 | | | $ | 16 | | | 90 | | | $ | — | | | 45,766 | | | $ | 45 | | | 13,844 | | | $ | 13 | | | 27,892 | | | $ | 27 | | | 124,852 | | | $ | 125 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1)The Company will cease paying distribution and stockholder servicing fees with respect to Class TX shares when the total of such fees reach certain thresholds. Once these thresholds are reached, Class TX shares are converted into Class AX shares, as indicated in the table above.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class AX | | Class TX | | Class IX | | Class T | | Class D | | Class I | | Total |

| Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount |

| Balance as of January 1, 2020 | 18,885 | | | $ | 19 | | | 19,901 | | | $ | 22 | | | 91 | | | $ | — | | | 28,837 | | | $ | 29 | | | 6,927 | | | $ | 6 | | | 7,206 | | | $ | 7 | | | 81,847 | | | $ | 83 | |

| Issuance of common shares | 126 | | | — | | | 146 | | | 1 | | | 1 | | | — | | | 5,809 | | | 6 | | | 1,696 | | | 2 | | | 2,957 | | | 3 | | | 10,735 | | | 12 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Redemption of common shares | (159) | | | — | | | (183) | | | — | | | — | | | — | | | (86) | | | — | | | (20) | | | — | | | (16) | | | — | | | (464) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of March 31, 2020 | 18,852 | | | $ | 19 | | | 19,864 | | | $ | 23 | | | 92 | | | $ | — | | | 34,560 | | | $ | 35 | | | 8,603 | | | $ | 8 | | | 10,147 | | | $ | 10 | | | 92,118 | | | $ | 95 | |

| Issuance of common shares | 150 | | | — | | | 127 | | | — | | | 1 | | | — | | | 2,528 | | | 2 | | | 702 | | | — | | | 1,314 | | | 1 | | | 4,822 | | | 3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Redemption of common shares | (383) | | | (1) | | | (211) | | | — | | | — | | | — | | | (319) | | | — | | | (68) | | | — | | | (56) | | | — | | | (1,037) | | | (1) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance as of June 30, 2020 | 18,619 | | | $ | 18 | | | 19,780 | | | $ | 23 | | | 93 | | | $ | — | | | 36,769 | | | $ | 37 | | | 9,237 | | | $ | 8 | | | 11,405 | | | $ | 11 | | | 95,903 | | | $ | 97 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions

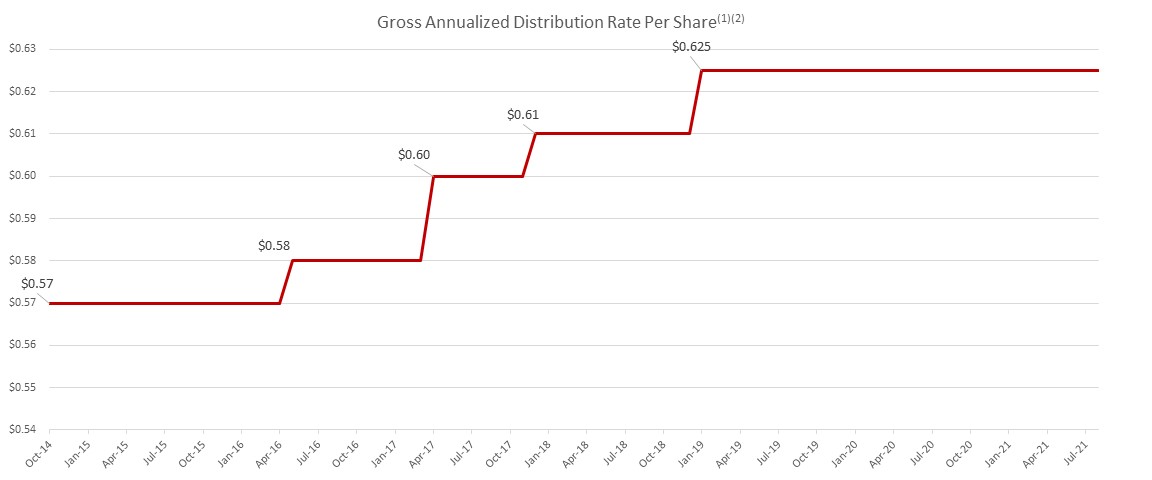

With the authorization of the Company’s board of directors, the Company declared distributions monthly from January 2020 through August 2021 at a gross distribution rate of $0.05208 per month for each share class (represents an annualized rate of $0.625 per share per year if this rate is declared for an entire year), less any applicable distribution and stockholder servicing fees.

Distributions were made on all classes of the Company’s common stock at the same time. All distributions were paid in cash or reinvested in shares of the Company’s common stock for those participating in the Company’s distribution reinvestment plan and have been paid or issued, respectively, on the first business day following the completion of the month to which they relate. Distributions reinvested pursuant to the Company’s distribution reinvestment plan were reinvested in shares of the same class as the shares on which the distributions were made. Some or all of the cash distributions may be paid from sources other than cash flows from operations.

The following table outlines the Company’s total distributions declared to stockholders for each of the quarters ended during 2021 and 2020, including the breakout between the distributions declared in cash and those reinvested pursuant to the Company’s distribution reinvestment plan (in thousands).

| | | | | | | | | | | | | | | | | | | | | | |

| | | Stockholders | | |

| Distributions for the Three Months Ended | | Cash Distributions | | Distributions Reinvested | | Total Declared | | |

| 2021 | | | | | | | | |

| June 30, 2021 | | $ | 8,378 | | | $ | 8,915 | | | $ | 17,293 | | | |

| March 31, 2021 | | 7,615 | | | 7,978 | | | 15,593 | | | |

| Total | | $ | 15,993 | | | $ | 16,893 | | | $ | 32,886 | | | |

| 2020 | | | | | | | | |

| December 31, 2020 | | $ | 6,981 | | | $ | 7,531 | | | $ | 14,513 | | | |

| September 30, 2020 | | 6,486 | | | 7,309 | | | 13,795 | | | |

| June 30, 2020 | | 6,262 | | | 7,190 | | | 13,452 | | | |

| March 31, 2020 | | 5,669 | | | 6,732 | | | 12,401 | | | |

| Total | | $ | 25,398 | | | $ | 28,762 | | | $ | 54,161 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

The table below outlines the net distributions declared for each class of shares for the three and six months ended June 30, 2021 and 2020. The net distributions presented below are representative of the gross distribution rate declared by the Company’s board of directors, less any applicable ongoing distribution and stockholder servicing fees.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | | |

| | 2021 | | 2020 | | 2021 | | 2020 | | | | |

| Distributions declared per Class AX share, net | | $ | 0.16 | | | $ | 0.16 | | | $ | 0.31 | | | $ | 0.31 | | | | | |

| Distributions declared per Class TX share, net | | $ | 0.13 | | | $ | 0.13 | | | $ | 0.26 | | | $ | 0.26 | | | | | |

| Distributions declared per Class IX share, net | | $ | 0.15 | | | $ | 0.15 | | | $ | 0.30 | | | $ | 0.30 | | | | | |

| Distributions declared per Class T share, net | | $ | 0.13 | | | $ | 0.13 | | | $ | 0.26 | | | $ | 0.26 | | | | | |

| Distributions declared per Class S share, net | | $ | 0.13 | | | $ | 0.13 | | | $ | 0.26 | | | $ | 0.26 | | | | | |

| Distributions declared per Class D share, net | | $ | 0.15 | | | $ | 0.15 | | | $ | 0.30 | | | $ | 0.30 | | | | | |

| Distributions declared per Class I share, net | | $ | 0.16 | | | $ | 0.16 | | | $ | 0.31 | | | $ | 0.31 | | | | | |

7. RELATED PARTY TRANSACTIONS

The table below outlines fees and expense reimbursements incurred that are payable by the Company to the Advisor and the Hines Securities, Inc. (the "Dealer Manager"), Hines and its affiliates for the periods indicated below (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Incurred | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, | | Unpaid as of |

| Type and Recipient | | 2021 | | 2020 | | 2021 | | 2020 | | June 30, 2021 | | December 31, 2020 |

Selling Commissions- Dealer Manager (1) | | $ | 1,030 | | | $ | 658 | | | $ | 1,660 | | | $ | 2,304 | | | $ | — | | | $ | — | |

| Dealer Manager Fee- Dealer Manager | | 190 | | | 117 | | | 312 | | | 413 | | | — | | | — | |

| Distribution & Stockholder Servicing Fees- Dealer Manager | | 4,018 | | | 3,234 | | | 5,983 | | | 7,532 | | | 29,267 | | | 26,271 | |

| Organization and Offering Costs- the Advisor | | 1,586 | | | 987 | | | 2,359 | | | 1,850 | | | 5,493 | | | 6,263 | |

| | | | | | | | | | | | |

| Asset Management Fees- the Advisor | | 3,845 | | | 2,747 | | | 7,306 | | | 5,538 | | | 841 | | | 2,672 | |

Other- the Advisor (2) | | 1,497 | | | 692 | | | 866 | | | 1,054 | | | 720 | | | 1,249 | |

Performance Participation Allocation- the Advisor (3) | | 5,249 | | | — | | | 7,483 | | | — | | | 7,483 | | | — | |

Interest expense- Hines and its affiliates (4) | | — | | | 2 | | | — | | | 362 | | | — | | | — | |

| Property Management Fees- Hines and its affiliates | | 749 | | | 513 | | | 1,393 | | | 1,195 | | | 203 | | | 91 | |

| Development and Construction Management Fees- Hines and its affiliates | | 229 | | | 27 | | | 276 | | | 90 | | | 579 | | | 650 | |

| Leasing Fees- Hines and its affiliates | | 382 | | | 126 | | | 795 | | | 219 | | | 455 | | | 230 | |

| | | | | | | | | | | | |

Expense Reimbursement- Hines and its affiliates (with respect to management and operations of the Company's properties) (5) | | 2,050 | | | 1,843 | | | 4,175 | | | 3,759 | | | (4,953) | | (6) | 1,869 | |

| Total | | $ | 20,825 | | | $ | 10,946 | | | $ | 32,608 | | | $ | 24,316 | | | $ | 40,088 | | | $ | 39,295 | |

(1)Some or all of these fees may be reallowed to participating broker dealers rather than being retained by the Dealer Manager.

(2)Includes amounts the Advisor paid on behalf of the Company such as general and administrative expenses and acquisition-related expenses. These amounts are generally reimbursed to the Advisor during the month following the period in which they are incurred.

(3)Through its ownership of the special limited partner interest in the Operating Partnership, the Advisor is entitled to an annual performance participation allocation of 12.5% of the Operating Partnership’s total return. Total return is defined as distributions paid or accrued plus the change in net asset value of the Company’s shares of common stock for the applicable period. This performance participation allocation is subject to the Company earning a 5% total return annually (as defined above), after considering the effect of any losses carried forward from the prior period (as defined in the Operating Partnership’s agreement of limited partnership (the "Operating Partnership Agreement"). The performance participation allocation accrues monthly and is payable after the completion of each calendar year.

(4)Includes amounts paid related to the Company’s credit facility with Hines (the “Hines Credit Facility”).

(5)Includes amounts with respect to the management and operation of the Company’s properties. These amounts are generally reimbursed to Hines and its affiliates during the month following the period in which they are incurred. Reimbursement of third party costs are not included in the incurred amounts.

(6)As of June 30, 2021, the balance included $5.5 million in receivables related to rents collected by the Hines-affiliated property manager at the international student housing properties, which were being held in the property manager controlled bank accounts.

8. FAIR VALUE MEASUREMENTS

Fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities the Company has the ability to access. Fair values determined by Level 2 inputs utilize inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs include quoted prices for similar assets and liabilities in active markets and inputs other than quoted prices observable for the asset or liability, such as interest rates and yield curves observable at commonly quoted intervals. Level 3 inputs are unobservable inputs for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability. In instances in which the inputs used to measure fair value may fall into different levels of the fair value hierarchy, the level in the fair value hierarchy within which the fair value measurement in its entirety has been determined is based on the lowest level

input significant to the fair value measurement in its entirety. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the asset or liability.

Financial Instruments Measured on a Recurring Basis

As described in Note 5—Derivative Instruments, the Company entered into several interest rate contracts as hedges against the variability of future interest rates on its variable interest rate borrowings. The valuation of these derivative instruments is determined based on assumptions that management believes market participants would use in pricing, using widely accepted valuation techniques including discounted cash flow analysis on the expected cash flows of each derivative. This analysis reflects the contractual terms of the derivatives, including the period to maturity, and uses observable market-based inputs, including interest rate curves and implied volatilities. The fair values of interest rate contracts have been determined using the market standard methodology of netting the discounted future fixed cash receipts (or payments) and the discounted expected variable cash payments (or receipts). The variable cash payments (or receipts) are based on an expectation of future interest rates (forward curves) derived from observable market interest rate curves.