|

Exhibit 99.1

|

Self Storage Real Estate

Income Opportunity*

April 22, 2015

* | | There is no guarantee we will meet our objectives. |

Disclaimer and Risk Factors

Disclaimers

CAUTIONARY NOTE REGARDINGFORWARD--LOOKING STATEMENTS Certain statements contained in this material, other than historical facts, may be consideredforward--looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We intend for all such forward looking statements to be covered by the applicable safe harbor provisions forforward--looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such statements include, in particular, statements about our plans, strategies, and prospects and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to dier materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Suchforward--looking statements can generally be identied by our use offorward--looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Readers are cautioned not to place undue reliance on theseforward--looking statements, which speak only as of the date of this material. We cannot guarantee the accuracy of any such forward looking statements contained in this material, and we do not intend to publicly update or revise anyforward--looking statements, whether as a result of new information, future events, or otherwise. Any suchforward--looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are dicult or impossible to predict accurately. To the extent that our assumptions dier from actual results, our ability to meet suchforward--looking statements, including our ability to generate positive cash ow from operations and provide distributions to stockholders, and our ability to nd suitable investment properties, may be signicantly hindered. Allforward--looking statements should be read in light of the risks identied in our prospectus.

Continue to next page

Disclaimer and Risk Factors

Risk Factors – Strategic Storage Trust II, Inc. (SST II)

• | | As of December 31, 2014, our accumulated decit was approximately $2.4 million, and we anticipate that our operations will not be protable in 2015. |

• | | We have paid distributions from sources other then our cash ows from operations, including from the net proceeds of this oering. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributitions. Until we generate cash flows sucient to pay distributions to you, we may pay distributions from the net proceeds of this opering or from borrowings in anticipation of future cash ows. |

• | | No public market currently exists for shares of our common stock and we may not list our shares on a national securities exchange before three to ve years after completion of this opering, if at all; therefore, it may be dicult to sell your shares. If you sell your shares, it will likely be at a substantial discount. Our charter does not require us to pursue a liquidity transacCon at any time. |

• | | This is an initial public opering; we have little prior operating history, and the prior performance of real estate programs sponsored by aliates of our sponsor may not be indicative of our future results. |

• | | This is a “best eorts” opering. If we are unable to raise substantial funds in this oering, we may not be able to invest in a diverse portfolio of real estate and realestate--related investments, and the value of your investment may puctuate more widely with the performance of specic investments. |

• | | We are a “blind pool” because we have not identied any properties to acquire with the net proceeds from this opering. As a result, you will not be able to evaluate the economic merits of our future investments prior to their purchase. We may be unable to invest the net proceeds from this oering on acceptable terms to investors, or at all. |

• | | There are substantial conicts of interest among us and our sponsor, advisor, property manager and dealer manager. |

• | | Our advisor will face conicts of interest relating to the purchase of properties, including conicts with our sponsor and Strategic Storage Growth Trust, Inc., and such conicts may not be resolved in our favor, which could adversely aect our investment opportunities. |

• | | We have no employees and must depend on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor will devote adequate time or resources to us. |

• | | We will pay substantial fees and expenses to our advisor, its aliates and participatingbroker--dealers, which will reduce cash available for investment and distribution. We may be required to pay our advisor a signicant distribution if our advisor agreement is involuntarily terminated. |

• | | We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment. |

• | | We may fail to qualify as a REIT, which could adversely aect our operations and our ability to make distributions. |

• | | Our board of directors may change any of our investment objectives without your consent. |

Other Information – SST II

• | | An investment in shares of SST II is not suitable for all investors. An investment in shares of SST II involves signicant risks and is only suitable for persons who have adequate nancial means, desire a relativelylong--term investment and will not need immediate liquidity from their investment. Investors should only purchase shares if they can aord a complete loss of their investment. Generally, a purchaser of shares must have, excluding the value of a purchaser’s home, furnishings and automobiles, either: |

• | | a net worth of at least $250,000, or |

• | | a gross annual income of at least $70,000 and a net worth of at least $70,000. |

• | | Please see the prospectus for a full description of suitability standards. Residents of Alabama, Iowa, Kansas, Kentucky, Massachuse`s, Maine, Nebraska, New Jersey, New Mexico, North Dakota, Ohio, Oregon, Pennsylvania and Tennessee should consult the prospectus for details regarding the more stringent suitability standards that apply to them based on their states of residence. |

Self Storage

• | | Fastest--growing sector of the U.S. commercial real estate industry over the last 35 years(1) |

• | | Self storage properties historically produce stable revenue streams(2) |

(1) Self Storage Association “Industry Fact Sheet” (6/13). Although self storage is the fastest–growing sector in U.S. commercial real estate, there is no guarantee that SST2 will experience similar growth.

(2) “Demand for storage is driven by major demographic trends which are going to happen regardless of GDP growth rates, unemployment or what the S&P 500 is doing. . . accordingly, [self] storage is recession resistant.” Source: “Gates:Recession--resistant property is best for investors”-- Austin Business Journal by Cody Lyon, Sta Writer, September 2011. Past performance is no indication of future results. It is possible to lose money on this investment. While the self storage industry may be resistant to recessions, there is no guarantee that a related investment will realize a prot or prevent against loss. Distributions are not guaranteed. Diversication does not ensure a prot or guarantee against a loss.

Self Storage

Driven by People in Transition

• | | Change in marital status |

• | | Business expansion or contraction |

Nearly 10% of U.S. households, currently rent a self storage unit, up from 1 in 17 in 1995.*

* | | Self Storage Association “Industry Fact Sheet” (6/13) |

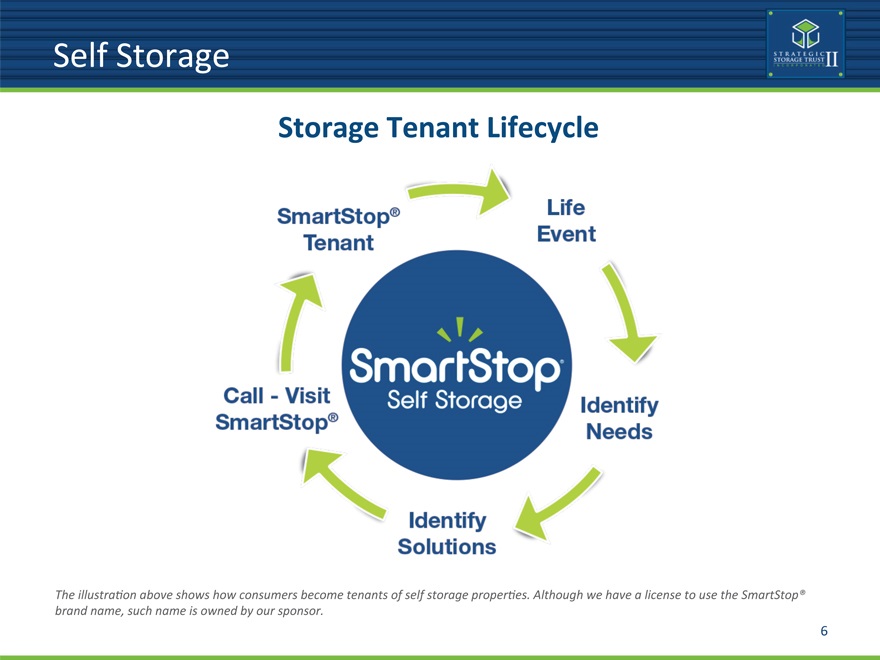

Self Storage

Storage Tenant Lifecycle

The illustration above shows how consumers become tenants of self storage properties. Although we have a license to use the SmartStop®

brand name, such name is owned by our sponsor.

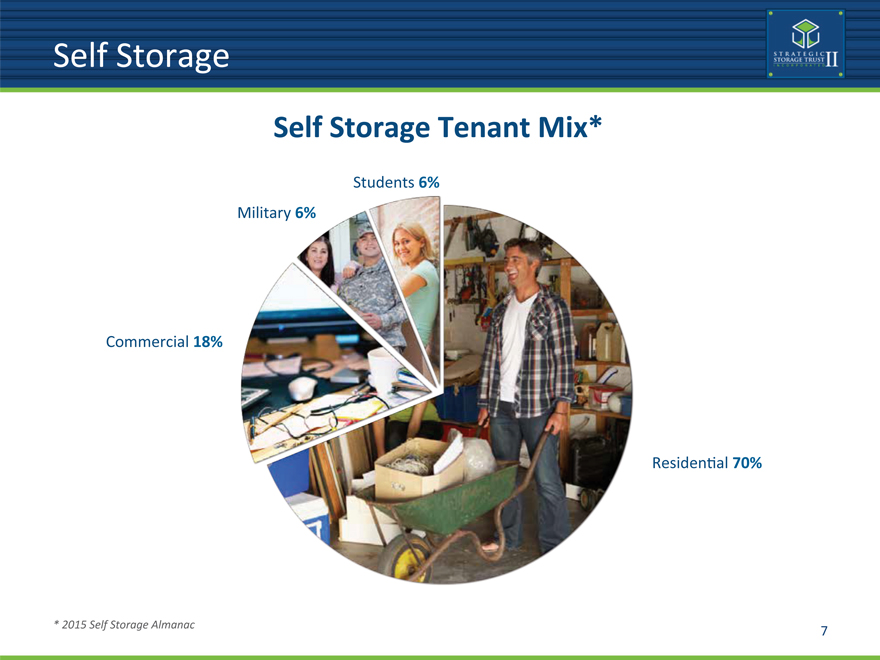

Self Storage

Self Storage Tenant Mix*

Military 6%

Students 6%

Commercial 18%

Residential 70%

* | | 2015 Self Storage Almanac 7 |

Strategic Storage Trust II, Inc.

Investment Strategy

• | | Stabilized – 75% or greater occupancy |

• | | Geographic area – High Density |

* We intend to use less than 50% leverage. Our charter limits borrowing to 75% of the cost of our assets. At times our leverage may be greater than 50%. See page 65 of our prospectus for details of our borrowing policy.

These properties are not owned by Strategic Storage Trust II, Inc. These properties were acquired by another program sponsored by our sponsor or its aliates. The properties are only shown to indicate what we expect our acquisitions to look like after we have converted them to the SmartStop® brand.

Target Markets

This map depicts the locations of properties purchased by the sponsor.

9

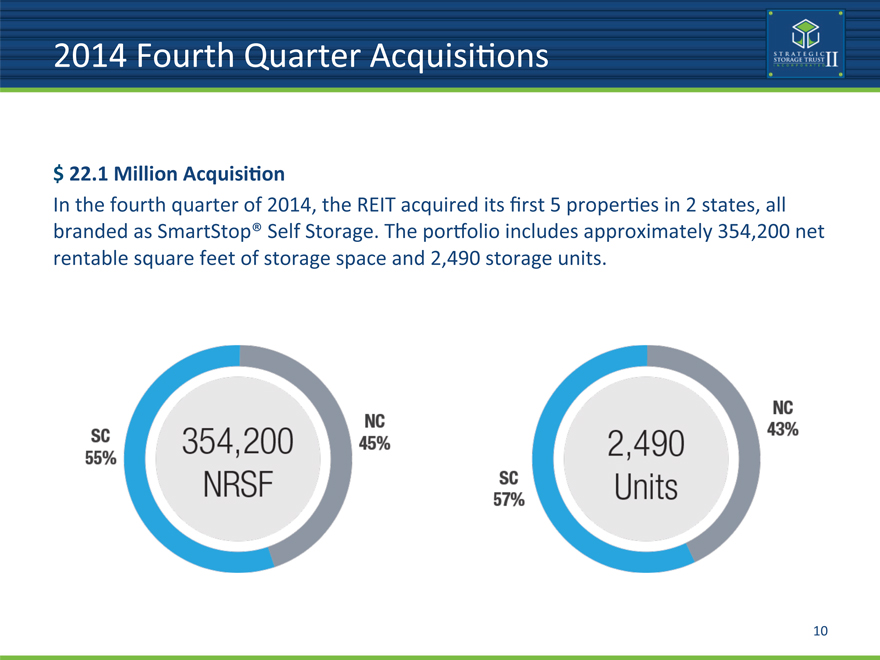

2014 Fourth Quarter Acquisitions

$ 22.1 Million Acquisition

In the fourth quarter of 2014, the REIT acquired its rst 5 properties in 2 states, all branded as SmartStop® Self Storage. The portfolio includes approximately 354,200 net rentable square feet of storage space and 2,490 storage units.

10

Fourth Quarter Acquisitions

Morrisville, NC

320 Units

36,900 NRSF

Cary, NC

310 Units

62,100 NRSF

Raleigh, NC

440 Units

60,600 NRSF

Myrtle Beach I, SC

760 Units

100,100 NRSF

Myrtle Beach II, SC

660 Units

94,500 NRSF

11

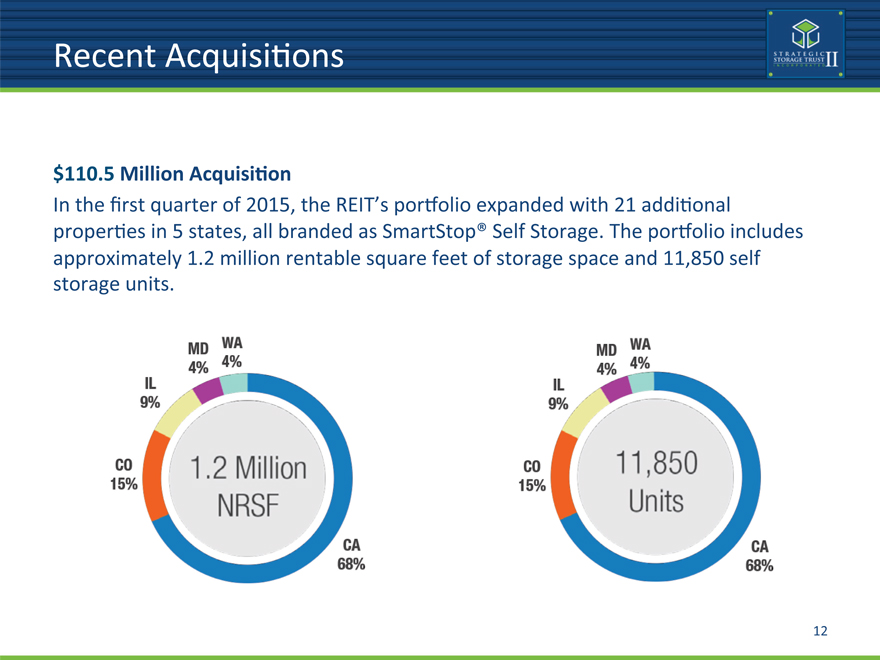

Recent Acquisitions

$110.5 Million Acquisition

In the rst quarter of 2015, the REIT’s portfolio expanded with 21 additional properties in 5 states, all branded as SmartStop® Self Storage. The portfolio includes approximately 1.2 million rentable square feet of storage space and 11,850 self storage units.

12

Recent Acquisitions

Chico, CA

360 Units

38,800 NRSF

Faireld, CA

440 Units

41,000 NRSF

La Verne, CA

520 Units

49,800 NRSF

Riverside, CA

570 Units

61,000 NRSF

Upland, CA

610 Units

56,500 NRSF

Lancaster, CA

700 Units

64,700 NRSF

Santa Rosa, CA

1,150 Units

116,400 NRSF

Lompoc, CA

430 Units

46,500 NRSF

13

Recent Acquisitions

Santa Ana, CA

840 Units

84,500 NRSF

La Habra, CA

420 Units

51,400 NRSF

Monterey Park, CA

390 Units

31,200 NRSF

HunCngton Beach, CA

610 Units

61,000 NRSF

Vallejo, CA

510 Units

54,400 NRSF

Whiter, CA

510 Units

58,600 NRSF

Aurora, CO

890 Units

87,400 NRSF

Li`leton, CO

400 Units

45,800 NRSF

14

Recent Acquisitions

Federal Heights, CO

450 Units

40,600 NRSF

Crestwood, IL

460 Units

49,300 NRSF

Bloomingdale, IL

570 Units

58,200 NRSF

Forestville, MD

530 Units

55,200 NRSF

Everett, WA

490 Units

48,100 NRSF

15

Portfolio

$132.6 Million Portfolio

Since the launch of SST2 in 2014, the REIT’s portfolio has expanded to 26 properties in 7 states all branded as SmartStop® Self Storage. The portfolio includes approximately 1.6 million rentable square feet and 14,340 storage units.

16

$17.7 Million in Pending Acquisitions

In

Contract

Address

Purchase

Price

Year

Built

Approx. Sq. Ft. (net)

Approx. Units

Warren—MI

27203 Groesbeck Hwy, Warren MI 48089

$3,390,000

1996

63,100

500

Warren—MI

24623 Ryan Road, Warren MI 48091

$3,590,000

1987

52,100

490

Sterling Heights—MI

42557 Van Dyke Avenue, Sterling Heights MI 48314

$3,810,000

1977

57,900

460

Troy—MI

262 E. Maple Road, Troy MI 48083

$4,770,000

1988

82,200

730

Beverly—NJ

4233 Route 130 South, Beverly NJ 08010

$2,130,000

1988

51,000

460

Property Totals $17,690,000

306,300

2,640

17

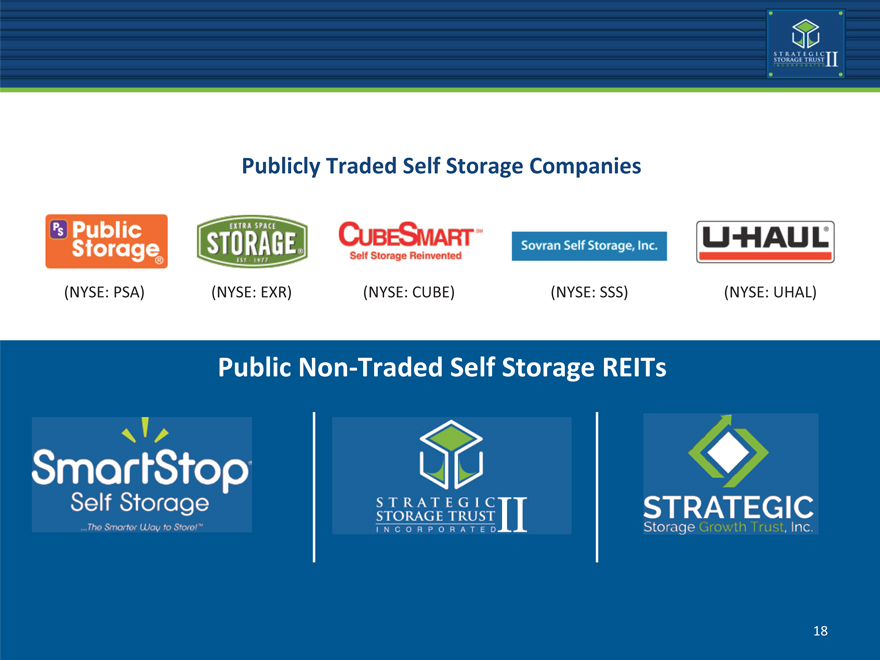

Publicly Traded Self Storage Companies

(NYSE: PSA) (NYSE: EXR) (NYSE: CUBE) (NYSE: SSS) (NYSE: UHAL)

PublicNon--Traded Self Storage REITs

18

Questions?